Abstract

In this paper, we study the dynamic relationship between the public debt ratio and the inflation rate. Using a non-linear macroeconomic model of difference equations, we analyze the role of monetary and fiscal policy in influencing the stability of the debt ratio and inflation. We get three main results. First, we find that, in a low inflation scenario, money finance can be helpful in stabilizing the debt ratio. Second, we show that in a dynamic setting, standard Taylor rules may not be sufficient to control inflation. The Central Bank’s credibility in driving inflation expectations is indeed crucial to control price developments and to achieve macroeconomic stability. Finally, an active budget adjustment rule has a stabilizing effect on the debt ratio, even if it may not be enough to avoid explosive patterns. Notably, the stability of the steady state depends on the fine-tuning of the policy mix. One of the novelties of our analysis is the presence of a threshold level for the debt ratio and inflation, beyond which the debt ratio becomes unsustainable following an explosive path. The distance between this threshold and the steady state can be considered a proxy of the robustness of the economy to exogenous shocks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Covid-19 crisis shaped the conduct of monetary and fiscal policies in an unprecedented way. Governments launched massive debt-financed spending programs to counteract the negative consequences of the pandemic shock (Baldwin & Weder Di Mauro, 2020). Further, major Central Banks (CBs) implemented a coordinated reduction in policy interest rates, in an attempt to provide a global monetary easing (Unsal & Garbers, 2021; Cantú et al., 2021).

As it is well known, in a context of a high public debt burden, the space for further increases in government spending financed by fiscal deficit is limited (European Commission, 2023). In addition, in the Eurozone, there is a widespread fear of a return to stricter fiscal rules in 2024, despite the activation of the General Escape Clause (GEC) of the Stability and Growth Pact (SGP) (Amato & Saraceno, 2022).

Besides, the falling of real interest rates towards the zero-lower-bound, in many OECD countries until 2022, made interest-rate based policies less effective. Therefore, major CBs continued to draw upon alternative policies to spur economic activity during and after the Covid-19 shock, expanding their toolkit of unconventional monetary policies, particularly in the form of large-scale asset purchase of government bonds, i.e. quantitative easing (Akovali & Kamil, 2021). For instance, while the FED bought an unprecedented amount of public and private debt to flatten the yield curve, the ECB collected the equivalent of about 2.590 billion euros in bonds, mainly as collateral in refinancing facilities (ECB, 2022).Footnote 1 The UK went even a step further, with the Treasury and Bank of England jointly announcing the temporary reactivation of a scheme that allows the CB to finance public spending directly (Blanchard & Pisani-Ferry, 2020). This led some economists to argue that the age of CBs ‘independence’ from fiscal policy and of monetary policy isolationism was over (see (Taylor, 2013)).

These developments have raised concerns about the reappearance of large-scale ‘monetization’ programmes which might result in major inflation episodes and/or the threat of fiscal dominance of monetary policy (Menuet et al., 2016). Yet, other commentators would have liked the CBs to do even more and embark on some form of ‘helicopter money’ (e.g. (Gali, 2020)). Therefore, the issue of monetizing government debts returns to the forefront of both academic and political debate, fuelled by the concrete question of how monetary authorities can, at least indirectly, reduce the burden and cost of government bonds.

Even if debt ratios are expected to stabilize in future years (IMF, 2021) as the real growth rate of economies is currently higher than the real interest rate paid on new debt issues, there are concerns about the ability of governments to continue servicing their debt, particularly in a context of low economic growth, high uncertainty, and rising inflation following Russia’s invasion of Ukraine (Blanchard, 2022).

As stressed by monetary authorities, Quantitative Easing (QE) programmes do not qualify as debt monetization operations.Footnote 2 Indeed, while QE has led to a growth of the monetary base in recent decades, it had limited effect on the money supply (Papadamou et al., 2021). Above all, the nature of QE is only temporary, as it is conceived as a non-conventional tool used by the CB to achieve its medium-term inflation target. However, although there appears to be little current interest among CBs for abandoning their policy-making objectives in favor of debt monetization, this could change down the road as pressures mount and the appeal of monetization grows (Shahid, 2020).

In this perspective, Paris and Wyplosz (2014) argued that the only (politically acceptable) way for fiscally sunk Eurozone countries to escape default might be to sell the monetized debt to the ECB. Similarly, according to De Grauwe (2013): “Ideally, the Eurozone would combine a symmetrical budget policy with debt monetization by the ECB”, so that low-deficit countries like Germany would implement a more expansionary fiscal policy and share the burden of adjustment in the Eurozone periphery. Further, the main argument against debt monetization, namely the additional inflation it may create (Sargent & Wallace, 1981), does not seem to be very relevant in depressed economies and in the presence of liquidity traps that disconnect inflation from the money stock. As such, a moderate debt monetization could affect inflation only marginally and would allow avoiding deflation and its possible harmful effects on growth (Aron & Muellbauer, 2008; Blanchard, 2014).

What relationship does, therefore, exist between debt sustainability and monetization? And how to describe these ‘dangerous relations’? In this paper, we attempt to address these questions by considering the crucial issues that have emerged from this recent debate. Specifically, we study the impact of money finance on the debt ratio and the inflation rate, focusing on the endogenous relationships between these variables and their potential non-linearities.

To this aim, we develop a macroeconomic model of public debt sustainability formalized through a dynamic system of two first-order difference equations, one for the public debt ratio and the other for the inflation rate. Importantly, in order not to stray too far from the standard linear model, we look at the first-order difference equation of the debt ratio as a benchmark. In our model, the government can, on the one hand, generate public deficits financed by issuing new debt. However, on the other hand, the CB can set a target for the interest rate and use monetization to finance the public debt, if the (relative) magnitude of the latter undermines the financial stability of the economy. To simplify our analysis, we consider the existence of only one nominal interest rate on government bonds, i.e. the rate on the composite bond. The nominal interest rate is determined by a standard Taylor rule from the CB plus a financial market component, the risk premium on government bonds. Lastly, the dynamics of inflation affects the debt ratio through the real interest rate, that is the cost in real terms of government debt. The evolution of inflation is captured by referring to a variant of the Phillips curve, in which agents’ inflation expectations are implemented by considering the presence of both ‘fundamentalist’ and ‘trend-follower’ economic agents in the markets. This assumption makes it possible to describe complex inflation dynamics that fluctuate around the equilibrium value without ever reaching a steady state.

We get three main results. First, in a low inflation scenario, debt monetization can be helpful in stabilizing debt evolution and the resulting effect on inflation rise is generally limited. Then, we show that in a non-linear dynamic setting, standard Taylor rules may not be enough to control inflation. In fact, the CB’s credibility in guiding inflation expectations is crucial to control price dynamics and to achieve macroeconomic stability. Third, an active budget adjustment rule has a stabilizing effect on the debt ratio, even if, in some critical circumstances, it may not be enough to avoid explosive patterns. Notably, the stability of the steady state(s) depends, to a large extent, on the fine-tuning of the policy mix. Lastly, one of the novelties of our analysis, compared to the benchmark linear model of the debt ratio, is the presence of some ‘threshold values’ beyond which the debt ratio becomes unsustainable, following an explosive path (default). The distance between the threshold boundary and the steady state can be seen as a proxy of the robustness of the economy to exogenous shocks.

The paper is organized as follows. Section 2 discusses the relevant literature on the topic. Section 3 describes the dynamics of both the debt ratio and the inflation rate. The main properties of the non-linear dynamic model are presented in Sect. 4. In Sect. 4.1, we provide the analysis of the system with the description of the fixed points and their stability. Section 4.2 studies a few benchmark cases on the effect of different policy rules. Section 5 uses simulations to provide some relevant policy insights. Section 6 concludes the paper.

2 Literature

For a long time, the issue of debt sustainability was addressed in terms of the effects of public debt on the economy. According to Hume (1777), public debt could lead to harmful tax increases in the short run and possibly to default in the long run. Adam Smith also considered that debt financing would eventually lead to default. The common view was that debt financing should only be used in exceptional cases. At the beginning of the 1920s, when writing about the public debt problem faced by France, Keynes (1923) mentioned the need for the French government to conduct a sustainable fiscal policy in order to respect its budget constraint. Keynes stated that the absence of sustainability would be evident when “the State’s contractual liabilities [...] have reached an excessive proportion of the national income”.

In the literature, there is a large debate and a lack of consensus among economists about the definition of public finance sustainability. In fact, many contributions in the field introduce their own—similar but not identical—criteria (Balassone & Franco, 2000; Wyplosz, 2011; Ghosh et al., 2013). According to Blanchard (1990), sustainability is about whether, based on current fiscal policy, a government heads towards excessive debt accumulation. To give effect to this general statement, Blanchard defines a sustainable fiscal policy as the strategy that ensures the convergence of the debt ratio towards its initial level. A similar definition is provided by Buiter (1985), who defines a fiscal policy as sustainable if it maintains the ratio of government net worth to GDP at its current level.

The requirement of convergence of the debt ratio towards its initial level is only the special case of a more general definition, according to which fiscal policy is sustainable if the present value of future primary surpluses is equal to the current level of debt (Chibi et al., 2019). These ambiguities led some authors to distinguish between solvency and sustainability (Artis & Marcellino, 2000; IMF, 2002). A government is said to be solvent if it is able, over an infinite time horizon, to repay its debt through future primary surpluses. In other words, the government is solvent if its inter-temporal budget constraint (IBC) is fulfilled. On the other hand, sustainability is a more imprecise concept that refers to the possibility that the government, under current policies, will reach a pre-determined debt/GDP ratio in a finite time horizon. As it turns out, the latter definition implies the former.

The easiest way to assess a government’s fiscal sustainability position is to start with its IBC. The implementation of the one-period IBC requires the use of the net market value of government debt. Net debt is defined as gross debt minus financial assets. Dividing each term by nominal GDP, the budget constraint can be rewritten as \(\Delta b_{t}=d_{t}+(r_t-g_t)b_{t-1}\). \(d_{t}\) is the government primary deficit, \(b_{t}\) is the government debt ratio at the end of period t, \(r_t\) is the real interest rate on government debt and \(g_t\) is the growth rate of the economy. This equation is an identity that holds ex-post in time t and says that the interest-inclusive government deficit (right-hand side) is financed by new bond issues (left-hand side). If \((r_t-g_t)<0\) for all t, the result is a stable difference equation that can be solved backward. This implies that the debt-GDP ratio \(b_{t}\) remains finite for any sequence of finite primary deficits. In contrast, if \((r_t-g_t)>0\) for all t, the debt-GDP ratio will eventually explode for \(d_{t}>0\).

A standard metric for judging debt sustainability has become the gap between the real interest rate on government debt r and the growth rate of real GDP g (Checherita-Westphal & Semeano, 2020). For the US and most advanced economies, the cost of servicing public debt \((r-g)\) is currently negative. In this case, the government can run a primary deficit of any size in perpetuity without incurring debt explosive patterns or, equivalently, a government running a primary balance would see its debt-to-GDP ratio shrink to zero (Blanchard, 2022).

However, interest and growth rates are not constant and, as emphasized in Ball et al. (1998), a Ponzi strategy of continuous rolling over the public debt is risky. A sudden rise in interest rates relative to growth with a large stock of debt could quickly result in explosive debt dynamics (Mauro & Zhou, 2020; Weicheng et al., 2020).

In this regard, more recent works have emphasized the importance of non-linearity in the debt-growth relationship (Eberhardt & Presbitero, 2015). These non-linearities may arise if we expect fiscal authorities to react differently depending on whether the deficit has reached a certain threshold deemed unacceptable or unsustainable. Bertola and Drazen (1993) develop a framework that considers trigger points in the process of fiscal adjustment, such that significant adjustments in budget deficits may take place only when the ratio of deficit to output reaches a certain threshold. This may reflect the existence of political constraints that block deficit cuts, which are relaxed only when the budget deficit reaches a sufficiently high level deemed to be unsustainable (Alesina & Drazen, 1993). Nevertheless, the presence of a tipping point does not mean that it has to be common across countries. For instance, Ghosh et al. (2013) define the ‘debt limit’ as the level of debt beyond which fiscal solvency fails and show that this debt limit is a function of countries’ structural characteristics and GDP growth rate. This argument resembles the idea of country-specific debt ‘vulnerability regions’, which would be consistent with country-specific non-linearities (Reinhart & Rogoff, 2009; Bischi et al., 2022).

Another debate, triggered by the economic challenges posed by the global financial crisis and, more recently, the Covid-19 pandemic, concerns whether CBs should expand their unconventional monetary policy toolbox to include money finance (Unsal & Garbers, 2021). Money finance is often associated with Milton Friedman’s metaphor of a helicopter dropping money from the sky (Friedman, 1948). In fact, it is argued that a permanent increase in the monetary base could stimulate aggregate demand even in a severe liquidity trap, that is when interest rates are at zero and prices are stagnant or declining (Gali, 2020; De Grauwe, 2020; De Grauwe & Diessner, 2020; Gürkaynak & Lucas, 2020; Kapoor & Buiter, 2020; Martin et al., 2021).

Proponents of money finance argue that it has a stronger effect on aggregate demand than a debt-financed fiscal stimulus (Agur et al., 2022). It could also prevent self-fulfilling runs on government debt should investors suddenly lose confidence in debt sustainability (Corsetti & Dedola, 2016; Bacchetta et al., 2018; Camous & Cooper, 2019). Yet, calls for CBs to engage in money finance are often seen with skepticism, if not outright rejection. Skeptics argue that money finance involves swapping government debt with CB liabilities and, thus, it does not carry tangible benefits in terms of economic stimulus and debt sustainability (Cecchetti & Schoenholtz, 2016; Borio & Zabai, 2018; Blanchard & Pisani-Ferry, 2020). Money finance may also fail to fend off self-fulfilling runs in the sovereign market if it instills concerns about systematic actions of debt monetization. Indeed, a permanent debt monetization fuels fears about fiscal dominance, loss of CB independence and run-away inflation (Adrian et al., 2021).

However, as shown by Turner (2015), in some cases, fiscal monetization is a safer way to stimulate the economy because it does not involve an increase in debt. From this perspective, fiscal policy does have an effect on inflation, but if the stimulus is properly calibrated, “there is no knife edge non-linearity which makes dangerously high inflation inevitable” (Turner, 2015, p. 1).

This paper contributes to the debate on debt sustainability in two ways. First, we introduce debt monetization into the standard model of public debt, thus relaxing an important assumption of this literature, namely that public spending is financed by the government through net debt issuance and the CB may under no circumstances intervene permanently in the bond market. Second, we study the effectiveness of fiscal and monetary policy to control the debt ratio and inflation rate in the presence of endogeneity and potential non-linearities. As a first anticipation, in this scenario, the issue of debt sustainability becomes much more slippery and the role of the CB much more complex.

3 Public debt and inflation

3.1 The (augmented) government budget constraint

We start our analysis with the government intertemporal budget constraint. It states that the total public deficit \(D_{t}\) at any time t (i.e. any year) is equal to:Footnote 3

where \(G_{t}\) denotes government spending on goods and services during year t, \(T_{t}\) taxes minus transfers in the same year, r is the real interest rate, and \(B_{t-1}\) is the amount of government debt at the end of year \(t-1\). Thus, \(rB_{t-1}\) represents the real interest payments on outstanding government debt. In other words, the total budget deficit in a given year equals spending minus taxes net of transfers (i.e. the primary deficit), plus interest payments on outstanding debt.

When a deficit is budgeted, the government has only one option to finance it, namely issuing new public debt on the bond market \(\Delta B_{t} = B_{t}-B_{t-1}>0\). Once the bonds have been issued, the CB may eventually decide to buy them (typically on the secondary market) in exchange for real money \(\Delta M_{t} = M_{t}-M_{t-1}>0\), where \(M_t\) is the real stock of money at time t. This process is called money finance or debt monetization. It differs from outright monetization of the deficit, since the CB is not mandated by the government to buy or sell these securities and the amount eventually exchanged derives only from monetary policy strategy and not from fiscal policy considerations (Bénassy-Quéré et al., 2010). Putting resources and means of financing together, we rewrite Eq. (1) as:

The budget constraint in (2) is an extension of those in Barro (1990), and Bischi et al. (2022). While Barro (1990) considers balanced-budget-rules, Bischi et al. (2022) introduce public debt, but without money. By means of simple algebraic operations, Eq. (2) can be restated as:

The government budget constraint in (3) links the change in government debt in a given year to the level of debt in the previous year (which affects interest payments), current government spending, and current taxes (i.e. the primary deficit). However, in this ‘augmented’ version, the final effects on the change in the stock of government debt also depend on CB’s monetization actions (\(\Delta M_{t}\)). If the government runs a deficit (\(G_{t}+r B_{t-1}>T_{t}\)), which is not covered by ex-post CB’s monetization (i.e., \(\Delta M_t=0\)), the government debt increases as the government borrows on the market to fund the part of spending (including the interest rate on debt) in excess of revenues. If, on the other hand, the government runs a surplus (\(G_{t}+r B_{t-1}<T_{t}\)), the government debt decreases as the government uses the budget surplus to repay part of its outstanding debt.

As is well known, in an economy where output grows over time, it makes more sense to focus on the debt-to-GDP ratio. Therefore, we divide both sides of Eq. (3) by real output \(Y_{t}\) and rewrite \(B_{t-1}/Y_{t}= (B_{t-1}/Y_{t-1})(Y_{t-1}/Y_{t})\). To simplify the final result, we assume that the output growth rate is constant and denoted by g, so that \(Y_{t-1}/Y_{t}\) can be written as \(1/(1+g)\). Finally we use the approximation \((1+r)/(1+g) \approx 1+r-g\). This requires some steps, but the final relationship in Eq. (4) has a simple interpretation.

where \(b_{t}=B_{t}/Y_{t}, \, b_{t-1}=B_{t-1}/Y_{t-1}, \, d_{t}=(G_{t}-T_{t})/Y_{t}, \, \Delta m_{t}=\Delta M_{t}/Y_{t}\). The change in the government debt ratio-to-GDP over time (the left side of (4)) is equal to the sum of two terms: (1) the difference between the real interest rate and the growth rate times the initial debt ratio \((r-g) \, b_{t-1}\), (2) the primary deficit-to-GDP minus the ratio of money growth-to-GDP related to CB’s monetization operations \((d_{t} - \Delta m_{t})\).

Each period t, the CB independently from government deficit decisions, through its debt monetization programme, chooses a constant share of government debt ratio (i.e. government bonds) to be purchased on the secondary market. We call this share \(\eta \), so that \(\eta \) by definition is strictly lower than one (\(0\le \eta \le 1\)). The CB expands its portfolio with the acquisition of public debt, injecting real monetary base into the economy, \(\Delta m_{t}>0\). This means that the net real money-to-GDP created must be sufficient to cover the share of outstanding public debt ratio that the CB decides to purchase (i.e. the extent of the debt monetization programme): \(\Delta m_{t}=\eta \, b_{t-1}\). By substituting this condition into (4), we obtain the following ‘augmented’ budget constraintFootnote 4:

It is worth noting that Eq. (5) can be seen as a first-order linear difference equation in \(b_{t}\) if r, g, \(\eta \) and d are considered exogenous parameters (Blanchard, 2022).

Assuming no monetary financing by the CB (i.e. \(\eta = 0\)), the standard discussion of public debt dynamics has typically concerned the term \((r-g)\). If the latter is negative, so \(g>r\), as is currently the case for many advanced OECD economies, the government can run a primary deficit (\(d > 0\)) without compromising debt sustainability (IMF, 2021). If, however, \(g<r\), to stabilize the debt ratio, the government must inevitably run a primary surplus (\(d<0\)). Therefore, a sudden surge in \(r-g\) is a source of serious concern as it can generate large economic costs (Born et al., 2020) and eventually lead to sovereign debt distress (Mauro & Zhou, 2020).

However, when \(\eta \) is greater than zero, i.e. the CB employs debt monetization, the relevant factor for the dynamics of public debt becomes \(r-g-\eta \). It is indeed its value that determines the long-run dynamics of the linear model in (5), whose equilibrium point \(d/(g-r+\eta )\) is asymptotically stable whenever \(r<(g+\eta )\) with either a lender (\(d<0\)) or borrower (\(d>0\)) government.Footnote 5 The solutions of (5) are, instead, unstable whenever \(r>(g+\eta )\).

The literature on the sustainability of the debt ratio has provided numerous empirical studies to assess the effectiveness of fiscal policies in controlling the evolution of the debt ratio (Balassone & Franco, 2000; Chalk & Hemming, 2000; Collignon, 2012; Beqiraj et al., 2018; Bischi et al., 2022). Still, these quantitative analyses do not consider the role of monetary policy and/or the issue of non-linearities in the relationship between the debt ratio, the real interest rate, and the inflation rate. In fact, as shown by Weicheng et al. (2020) high public debts can lead to adverse future \((r-g)\) dynamics. In this scenario, monetary policy can be used to stabilize debt and control inflation expectations.

3.2 The central bank and inflation dynamics

Traditional prescriptions for monetary policy focus on the money stock (Romer, 2012). For instance, Friedman (1960) famously argued that the CB should keep the money stock growing steadily at an annual rate of k-percent and renounce stabilizing the economy. However, despite many economists’ impassioned advocacy of money-stock rules, CBs have rarely given the behavior of the money stock more than a minor role in policy. In addition, in many countries, the relationship between measures of the money stock and aggregate demand has broken down in recent decades, further weakening the case for money-stock rules (Eggertsson, 2010). Because of these difficulties, modern CBs almost universally conduct policy by adjusting the short-term interest rate in response to various disturbances (Barro, 1989).

A key fact about conducting policy in terms of interest rates is that interest-rate policies, in contrast to money-supply policies, cannot be passive. Taylor (1993) and Bryan et al. (1993) therefore argued that we should think about the conduct of monetary policy in terms of rules for the short-term nominal interest rate. That is, we should neither think of the CB as choosing a path for the nominal rate that is unresponsive to economic conditions, nor think of it as adjusting the nominal rate on an ad-hoc basis. Instead, we should think of the CB as following a policy of adjusting the nominal rate in a predictable way to economic developments. Therefore, interest-rate rules may provide a reasonable approximation to actual CBs behavior and can be analyzed formally (Orphanides, 2010).

Following a simple Taylor rule, we assume that the CB adjusts its interest rate policy instrument in a systematic manner in response to inflation developments, see Eq. (6). Specifically, the nominal interest rate \(i_t\) responds to divergences of the actual inflation rate from a target inflation rate \((\pi _{t}-{\bar{\pi }})\). The idea is that when inflationary (dis-inflationary) pressures develop, a monetary restriction (expansion) can restore the CB’s price stability objective. Therefore, the nominal interest rate must rise when inflation exceeds the CB’s current target \({\bar{\pi }}\) and reduce when inflation lies below it.Footnote 6

The parameter \(\alpha \ge 0\) measures the responsiveness (i.e., the elasticity) of changes in the nominal interest rate to inflation deviations from the target, usually defined at \(2\%\) (Krugman, 2014). Note that \(\alpha \) could be both smaller than 1, less than proportional response, or greater than 1, more than proportional response (Davies, 2013). The original Taylor rule assumes that the funds’ rate responds by a half-percentage point to a one-percentage-point change in either inflation or the output gap (that is, the coefficient \(\alpha \approx 1.5\)). Likewise, the CB should decrease the real funds’ rate by the same amount for deviations below either target or potential. Empirical evidence suggests that CBs typically respond to inflation deviations (at least since 1983) a little less than Taylor assumed (Carlstrom & Fuerst, 2007).

To simplify the analysis we focus exclusively on pure inflation targeting without considering the output gap in the objective function of the CB. We do this mainly for two reasons: first, the problems associated with measuring the output gap and hence implementing rules of the ‘Taylor’ type; second, because the primary objective of any modern CB is to regulate inflation (Bacchiocchi & Giombini, 2021). Note, however, that adding the output gap to the CB’s objective function does not change the main implications of the analysis.Footnote 7

The nominal interest rate \(i_t\) relevant for the calculation of the public debt is also determined by the market. Indeed, it depends on both the short-term interest rate set by the CB (from the Taylor rule) and a risk premium required by investors to hold public bonds in their portfolio, measured by \(\beta \) (with \(\beta \ge 0\)). The idea is that the spread between the actual indebtedness of an economy and the level of it considered as ‘sustainable’ by investors can be seen as a proxy of the risk premium (Von Hagen et al., 2011; Bernoth et al., 2012). This is consistent with the IMF rule of thumb that the interest rate is given by the riskless rate plus a risk premium, which increases by 3.5 basis points for every one percentage point increase in the debt ratio above 90% of GDP (IMF, 2017; Alcidi & Gros, 2019). This would imply that the interest rate of a country with a debt-to-GDP ratio of 150% would be 2.1 percentage points above the riskless rate (e.g. 10-year German government bonds). If the country had a lower debt ratio (130%), the interest rate would be only 1.4% above the riskless rate. The risk premium may eventually be negative for very virtuous countries, which have lower debt ratios with respect to the benchmark country. Equation (6) represents the market-determined nominal interest rate and Fig. 1 shows the relationship between the real interest rate and the risk premium.

Relationship between real interest rate and risk premium. Real interest rate (GDP deflator) and General government gross debt (% of GDP). Countries included: Austria, Germany, Spain, France, UK, Greece, Ireland, Italy, Japan, Portugal, Sweden, US. Observations for different countries are identified by rhombs with different colors. The interest rate ‘spread’ is calculated as the excess over the annual average value for the panel of countries considered. The benchmark value of public debt is taken at 90% (countries’ average). Measures are average growth rates over five-year periods (from 1990 to 2022). Source: Authors’ calculations on OECD data

The dynamics of inflation \(\pi _{t}\) is defined by an augmented Phillips Curve (PC), which relates the next-period inflation to the actual inflation, the output gap, and a ‘cost-push’ effect influenced by expected inflation (Clarida et al., 2000; Roberts, 1995; Blanchard & Gali, 2007). Practical modern formulations of pricing behavior generally do not assume that price and wage-setters are rational in forming their expectations since this has strong implications that do not appear to be supported by the data. Alternatively, if one assumes that workers and firms do not form their expectations rationally, this would rest on the theory of irrationality (Romer, 2012). A natural compromise is to assume that core inflation is a weighted average of current inflation (\(\pi _{t}\)) and expected inflation (\(E_{t+1} [\pi _{t}]\)), as in Eq. (7) where, for the sake of simplicity, these weights are not specified and thus are equal to 1.

When prices are sticky, there is a positive relationship between the rate of inflation and a proxy of real economic activity. In practice, the output gap, or a measure of real marginal cost is used as a proxy of real economic activity. Here, we rely on Roberts (1995) and use the real interest rate.Footnote 8 Therefore, a reduction in the real interest rate can increase output temporarily (if \(r_{t}<{\bar{r}}\)), but cannot increase it permanently, since in the long-run \({\bar{r}}\) would prevail. On the other hand, an increase in the real interest rate can decrease output temporarily (if \(r_{t}>{\bar{r}}\)), but in the long-run again \({\bar{r}}\) prevails. The magnitude of the effect of the real interest gap (\(r_{t}-{\bar{r}}\)) on next period inflation \(\pi _{t+1}\) is given by the parameter \(\gamma > 0\) in Eq. (7). The idea is that inflation is a forward-looking phenomenon caused by staggered nominal price setting as developed by Taylor (1979, 1980) and Calvo (1983) or quadratic price adjustment cost (Rotemberg, 1982). With these assumptions, we obtain a hybrid Phillips curve (7):

More specifically, the expectations of the next period’s inflation are formulated on the basis of the actual observable inflation, i.e. \(E_{t+1} [\pi _{t}]\). We postulate that heterogeneous economic agents form their subjective beliefs (i.e., forecasts) by making some corrections to this value (i.e. \(\pi _{t}\)), taking into account whether inflation over the period is currently above or below the target value \({\bar{\pi }}\) (Hommes, 2011; Hommes & Lustenhouwer, 2019). Two types of economic agents are included in our model. The trend-follower which have a trend-following expectation strategy: they believe that when inflation is over the target or the reference value of the CB, i.e. \(\pi _t>{\bar{\pi }}\), it will continue to increase in the next period, while if it is currently under the target \(\pi _t<{\bar{\pi }}\), it will also reduce in \(t+1\). For this reason, these agents are defined trend-follower, and their share in the economy is equal to the parameter \(0 \le \mu \le 1\). The fundamentalists, who , on the contrary, base their expectations strategy on the existence of a fundamental value for inflation, consistent with the objective pursued by the CB (i.e. \({\bar{\pi }}\)), thus behaving oppositely to trend-follower agents. Indeed, in each period, they bet on inflation returning to its fundamental value. Therefore, when \(\pi _t>{\bar{\pi }}\) fundamentalists think that inflation will drop in the next period, approaching the CB target, whereas if \(\pi _t<{\bar{\pi }}\) they expect inflation to rise in \(t+1\), so as to reach the CB objective. In other words, fundamentalists fully trust the ability of the CB to bring back inflation to its target \({\bar{\pi }}\) by clearing out any possible shocks or deviations from the fundamental/target. The share of fundamentalist agents in the economy is complementary to the share of trend-follower agents, and therefore equal to \(1-\mu \). Consequently, the overall effect on inflation expectations in each period t is a weighted average (i.e., a convex combination) of these two effects: \(E_{t+1} [\pi _{t}] = \mu (\pi _{t}-{\bar{\pi }}) + (1-\mu ) ({\bar{\pi }}-\pi _{t})\).

If inflation shocks are not persistent (i.e. transitory phenomenon), this year’s inflation is not a good predictor of inflation next year. Therefore, under the rational agents’ hypothesis, fundamentalists prevail (i.e., \(\mu \) reduces) by driving inflation, in the next periods, to the reference level \({\bar{\pi }}\). On the contrary, if inflation shocks become more persistent, agents start to take into account this persistence when forming their expectations, and trend-following behavior would prevail (\(\mu \) increases). Hence, a high level of inflation in one year becomes likely to be followed by high inflation values also in the next periods. In the macroeconomic jargon, expectations that were previously anchored (i.e., roughly constant around the reference or CB target value \({\bar{\pi }}\)) suddenly become de-anchored (Baumann et al., 2021). Different from Hommes and Lustenhouwer (2019), we do not assume a heuristic switching model which would allow for endogenous credibility of CB targeting. Rather in Sect. 4.2.4, we exploit this setting to simulate how the equilibrium of the system changes when \(\mu \) varies.

Finally, to complete our inflation equation we also consider a ‘monetarist effect’. As is well known, the Quantity Theory of Money (QTM) predicts a positive relationship between the money supply and the general price level of goods and services. Therefore, monetarists contend that “inflation is always and everywhere a monetary phenomenon” (Friedman, 1989). Thus, at any given time, the actual rate of inflation is seen as a function of monetary expansion. In line with the success of Neo-Keynesian models of monetary policy, the importance of monetary aggregates has declined in CB modeling (Rotemberg & Woodford, 1997; Goodfriend & King, 1997; Woodford, 2003). However, since its establishment, the ECB has conducted a ‘two-pillar’ monetary policy with a ‘leading role’ for the growth rate of monetary aggregates and the output gap (ECB, 1999; Assenmacher-Wesche & Gerlach, 2008). Recently, several authors have presented empirical models that provide a formal interpretation of the two pillars by incorporating money growth in a reduced-form Phillips-curve model for inflation (Assenmacher-Wesche & Gerlach, 2007). The monetary and the economic pillars of the ECB’s framework are in these models viewed as reflecting different time perspectives in the determination of inflation. While money growth impacts inflation in the long run, real economic indicators such as the output gap and cost-push factors influence inflation mainly in the short run.Footnote 9 Considering this additional long-term effect, the corresponding inflation equation, under the usual assumption that \(\Delta m = \eta b_{t}\) (i.e., monetary financing of public debt), takes the following form (8):

Where the term \(\eta b_{t}\) reflects the extent to which the next-period inflation rate is affected by the new issue of real money used to buy government bonds at time t, and the parameter \(\delta > 0\) measures the intensity of this relationship (Gerlach, 2003, 2004).

As a cross-country long-run regularity, the link between money growth and inflation raises little discussion (McCandless & Weber, 1995; Lucas, 1996). In a short horizon and low-inflation context, there is little relationship between these two variables (Bénassy-Quéré et al., 2010). However, it is important to add that the strength of the relationship between money growth and inflation mostly comes in the long run. Indeed, as shown in Fig. 2, the annual inflation rate (measured by the GDP deflator) (vertical axis) roughly tracked the average excess growth in the broad real money supply (M3/GDP) (horizontal axis) during the period 1990–2022. Although, in the Euro Area, the high growth rate of M3 in the 2000s was accompanied by subdued headline inflation—hardly more than 2% per year (Assenmacher-Wesche & Gerlach, 2007).

Inflation rate versus broad money (M3) growth. Price deflator of gross domestic product at market prices and Broad money (M3). Countries included: Austria, Germany, Spain, France, UK, Greece, Ireland, Italy, Japan, Portugal, Sweden, US. Observations for different countries are identified as rhombs with different colors. Total growth rate over five-year periods (from 1990 to 2022). Source: Authors’ calculations on OECD data

3.3 The government budget adjustment rule

In many countries, fiscal policy decisions are increasingly conditioned by rules and institutions that contribute to limiting the scope for discretionary choices (Wyplosz, 2012). The design of rules and the choice of a mandate for institutions determine a country’s fiscal regime and contribute to the quality of its policy. The Euro Area has been at the forefront of this trend toward rules-based fiscal policy, but it is by no means the only region of the world where such a move was apparent.Footnote 10

Fiscal rules are legal provisions that impose constraints on fiscal policy through numerical limits on budgetary aggregates. They can target the deficit, the debt, or the public expenditures. They can be couched in nominal terms (such as absolute limits for the fiscal deficit or the primary deficit), in real terms (such as benchmarks for the real growth rate of public spending), or in structural terms (such as thresholds and minimum annual improvements of the cyclically adjusted budget balance). They can be applied ex-ante or ex-post, to the general government as a whole or to sub-entities. Finally, they can, as in the EU, result from an international treaty and secondary supranational legislation, as well as be part of the national constitution, or simply national law (Schuknecht, 2004).

Therefore, countries with a high public debt often choose to target the primary deficit, which is more directly under the control of the government as interest payments on public debt depend on market-determined interest rates. The adjustment program that IMF negotiates with countries in financial stress also includes primary balance targets (Caselli & Wingender, 2018).

Following these general considerations, to close the model, let us define the dynamics of the government budget balance. To this end, we rely on an active budget adjustment rule in Eq. (9) that aims to target the primary deficit \(d_t\) to deviations of the public debt ratio from the value of debt perceived as sustainable (i.e. \({\bar{b}}\)):

where \(\lambda \) is the constant value of the government deficit (if \(\lambda > 0\)) or surplus (if \(\lambda < 0\)), which is independent of the current debt ratio, while \(\epsilon > 0\) measures the elasticity of adjustment of the primary deficit to debt ratio deviations from the sustainable value. Note how, for virtuous governments (\(b_{t}<{\bar{b}}\)), it is possible to increase the primary deficit \(d_t\), whereas more indebted governments (\(b_{t}>{\bar{b}}\)) are forced to reduce the primary deficit \(d_t\) up to potential negative values (i.e. primary surplus).

In Fig. 3, we show this adjustment process for Euro Area economies from 1990 to 2022: on the y-axis, we plot the country’s primary budget balance to GDP (expressed in terms of surplus), while on the x-axis we plot deviations from the sustainable level of debt ratio (set at the average debt ratio over the period, i.e., 90%). The relationship is positive and the slope measures the intensity of the adjustment (i.e. parameter \(\epsilon \)).

Primary budget balance and debt ratios in the Euro Area. Net lending/ borrowing excluding interest (% of GDP) and General government gross debt (% of GDP). Total percentage change from 1990 to 2022. We have excluded the economic crisis periods (2009-2013) and (2020-2022) in which the budget balance was determined by the economic downturn rather than by fiscal rules. Source: Authors’ calculations on AMECO data

4 The model

The model is composed of the two dynamic equations (5) and (8) and the auxiliary equations (6) and (9) which express, respectively, the Taylor rule (i.e. the monetary policy rule of the CB) and the budget adjustment rule (i.e. the fiscal policy rule of the government). The relationship between nominal and real interest rates is given by the Fisher identity (\(r_t \approx i_t-\pi _t\)) (Fisher & Barber, 1907).

After the substitution of the auxiliary equations (6) and (9) into the dynamic equations (5) and (8), and re-arranging the latter for the variables \(b_{t}\) and \(\pi _{t}\), we get the complete map T in (10). The time evolution of both the debt ratio and the inflation rate is expressed by the iteration of the following two-dimensional discrete non-linear map T: (\(b_{t}\),\(\pi _{t}\))\(\rightarrow \)(\(b_{t+1}\),\(\pi _{t+1}\)).

We study the dynamic properties of the map (10), and explore the behavior of the model for economically meaningful values of the parameters. Since we are interested in the sustainability of the debt ratio, we will focus on the case \(b_{t}\ge 0\), even if the dynamic model (10) is feasible for \(b_{t}< 0\) as well. We will highlight the role of some local and global bifurcations that explain the qualitative changes and evolution of the economic system in Sect. 5, including the occurrence of different kinds of instability in the debt ratio and fluctuations in the real interest rate, with worrying default scenarios. Moreover, benchmark cases with \(\beta =0\) (no risk-premium/spread); \(\eta =0\) (no debt monetization by the CB), \(\epsilon =0\) (no government budget adjustment rule) and \(\mu =0\) (no population of trend-follower agents) will be studied in Sect. 4.2. These cases provide some basic mathematical structures of our model and may constitute useful economic scenarios for comparison.

4.1 Fixed points and local stability analysis

Equilibrium (or stationary) situations are obtained by setting \(b_{t+1}=b_{t}=b\) and \(\pi _{t+1}=\pi _{t}=\pi \) in map (10). Solving both equations for the variable \(\pi \), we get \(\pi _{1}(b)\) in (11), and \(\pi _{2}(b)\) in (12) with k, v, z which are aggregations of the model parameters.

Equilibrium points are located at the intersections of the two curves: the hyperbola (11) and the line (12).Footnote 11 The graphical representation of these two curves is shown in Figs. 4 (\(\alpha >1\)) and 5 (\(\alpha <1\)). The condition of existence (C.E.) for the hyperbola are \(\alpha \ne 1\) and \(b \ne 0\). (11) has a vertical asymptote \(b = 0\) and an oblique asymptote \(\pi = 1/(1-\alpha ) [\beta (b-{\bar{b}}) + {\bar{i}} -g-\epsilon -\mu -\alpha {\bar{\pi }}]\). In addition, for \(\alpha >1\) the hyperbola (11) becomes concave, while for \(\alpha <1\) is convex, as demonstrated in the Mathematical Appendix (A.1). On the other hand, the C.E. for the line (12) is simply \(\mu \ne [1-\gamma (1-\alpha )]/2\).

A typical scenario (Figs. 4, 5) is characterized by the presence of two equilibrium points: a lower equilibrium \(E_{L}=(b_{L},\pi _{L})\) and an upper equilibrium \(E_{U}=(b_{U},\pi _{U})\) characterized by a low and a high level of public debt respectively, i.e. \(b_{L}<b_{U}\). Analytically, the equations of the two equilibrium points \(E_{L}(b_{L};\pi _{L})\) and \(E_{U}(b_{U};\pi _{U})\) are:

Depending on the C.E. of the curves, cases with one or no equilibria may exist. Specifically, for the condition \(W =(1-\alpha )^{2}(k-z)^{2}-4\left[ \beta -v ( 1-\alpha )\right] (\lambda +\epsilon {\bar{b}}) = 0\) only one (stable/unstable) equilibrium appears, while for \(W<0\), the two curves (11) and (12) do not intersect, hence no equilibrium can be found.

Public debt and the coexistence of two equilibria with \(\alpha >1\). Two equilibria may exist \(E_{L}\) and \(E_{U}\), characterized by low and high levels of public debt ratio. Parameters of the model. a \(\alpha =1.5, \beta =0.035, \gamma =0.4, \delta =0.7, \epsilon =0.05, \eta =0.01, \lambda =0.01, \mu =0.1, {\bar{b}}=0.9, {\bar{i}}=0.02, {\bar{\pi }}=0.02, g=0.015\); b same parameters of a, except for \(\eta =0.03\); c same parameters of a, except for \(\beta =0.055, \epsilon =0.09, \lambda =0.06\) and \(\mu =0.45\)

Public debt and the coexistence of two equilibria with \(\alpha <1\). Two equilibria may exist \(E_{L}\) and \(E_{U}\), characterized by low and high levels of public debt ratio. Parameters of the model. a Same parameters of Fig. 4a, except for \(\alpha =0.9\); b same parameters of Fig. 4b, except for \(\alpha =0.9\)

As already stated, in Figs. 4 and 5 we only focused on situations of positive debt ratio for equilibrium points (positive part of the hyperbolic branch). These fixed points can be associated with either positive or negative values for inflation, i.e. \(\pi ^{*}>0\) or \(\pi ^{*}<0\). All the panels in Fig. 4 are characterized by \(\alpha > 1\), thus representing scenarios in which the CB adjusts the interest rate more than proportionally to deviations from its target. In contrasts the panels in Fig. 5 show scenarios in which the CB’s interest rate responses to inflation deviations are less than proportional (\(\alpha < 1\)). The remaining structural parameters were set to the average values identified in the literature.

In particular, Fig. 4a depicts a two-equilibrium situation in which public debt ratios are \(b_{L}<{\bar{b}}<b_{U}\) and the inflation rates are \(\pi _{U}<{\bar{\pi }}<\pi _{L}\). Indeed, the two equilibrium points \(E_{L} (0.71; 0.028)\) and \(E_{U} (2.48;0.015)\) are characterized, respectively, by low and high debt ratios and, vice versa, high and low inflation rates. In Fig. 4b (higher \(\eta \) with respect to Fig. 4a), the two fixed points \(E_{L} (0.56; 0.037)\) and \(E_{U} (2.57; 0.051)\) are more distant from each other in terms of public debt ratios with respect to Fig. 4a, \(b_{L}<{\bar{b}}<b_{U}\), but they show higher rates of inflation: both \(E_{L}\) and \(E_{U}\) have an inflation value greater than \({\bar{\pi }}\), i.e. \({\bar{\pi }}<\pi _{L}<\pi _{U}\). Lastly, in Fig. 4c (higher \(\eta ,\epsilon \) and \(\mu \) with respect to Fig. 4a), the two equilibrium points \(E_{L} (1.87;-0.008)\) and \(E_{U} (2.51;-0.04)\) are both characterized by debt ratios greater than \({\bar{b}}\) (i.e. \({\bar{b}}<b_{L}<b_{U}\)), but closer to each other, along with negative inflation (a slight deflation), \(\pi _{U}<\pi _{L}<{\bar{\pi }}\).

Moving to Fig. 5, Fig. 5a is obtained with the same set of parameters of Fig. 4a with the only exception of \(\alpha = 0.9\) (i.e., less aggressive interest rate adjustment by the CB). In comparison to the latter situation, the lower equilibrium point \(E_{L} (0.65; 0.031)\) is characterized by a lower debt ratio and moderately higher inflation rate, while the upper equilibrium \(E_{U} (2.36;0.015)\) has a slightly lower debt ratio and the same inflation value. To conclude, Fig. 5b is obtained with the same set of parameters of Fig. 4b and, again, the only exception of \(\alpha = 0.9\). Compared to Fig. 4b, the lower fixed point \(E_{L} (0.49; 0.041)\) has a smaller debt ratio and moderately higher inflation, while the upper fixed point \(E_{U} (3.27;0.067)\) has both considerably larger values of debt ratio and inflation.

The local stability of each equilibrium can be determined through the usual linearization procedure based on the Jacobi matrix (J) of the map (10), given by:

In our model an analytical computation of the conditions of stability of the fixed points is possible. This is done by substituting the equilibrium values (13) and (14) into the Jacobi matrix in (15). However, due to the complexity in the mathematical tractability of the results, we refer to the numerical values of the equilibria, given the set of parameters identified in Figs. 4 and 5, to localize in the complex plane their eigenvalues (Schei, 2020). At the same time, in the next Sect. 4.2, we will employ simulations and a few benchmark cases to show the dynamical proprieties of the system when parameters change and to draw some relevant policy implications.

In all the scenarios considered, the lower equilibrium \(E_{L}\) is a stable node or a stable focus or an unstable equilibrium with a bounded attractor around it, whereas the upper equilibrium \(E_{U}\) is a saddle. The local stability analysis is included in the Mathematical Appendix at the end of the paper (A.2).

Figure 6 shows the basins of attraction for the three parameters’ set used in panels (a), (b), (c) of Fig. 4, respectively, whereas Fig. 7 represents the basins for the parameters’ set of Fig. 5. In these plots, the basin of attraction of the stable equilibrium \(E_{L}\) is represented by the red region, whereas the black region shows the basin of divergent trajectories, i.e. the set of initial conditions (\(b_{0}\), \(\pi _{0}\)) that generate time evolution leading to public default. The frontier (or watershed) that separates these two basins is formed by the stable set of the saddle point \(E_{U}\) (see e.g. Mira et al. (1996)).

The distance between the two fixed points \(E_{L}\) and \(E_{U}\) constitutes a good proxy of the extension of the basin of the stable equilibrium \(E_{L}\), thus a measure of the robustness/resilience of the latter to exogenous shocks. Indeed, one of the novelties of this analysis is the presence of a threshold level for the debt ratio and inflation, after which the debt ratio becomes unsustainable and takes an explosive path. This is different from the standard model of public debt sustainability represented by the government’s intertemporal budget constraint, where debt is always either convergent or divergent (Blanchard, 2022). On the contrary, it supports the empirical literature that suggests that the identification of a specific debt sustainability threshold should consider a number of country characteristics that might constrain government choices and influence the economy’s vulnerability to crises (Eberhardt & Presbitero, 2015). The threshold level here is represented by \(E_{U}\), while the equilibrium at which the model converges is \(E_{L}\). Thus, the distance between the two points indicates how much the system is resilient to possible perturbations from the equilibrium (i.e. \(E_{L}\)). In this regard, the basins of attraction of the stable equilibrium in Fig. 6a, b are quite similar in terms of size and behavior: a higher rate of inflation moderately reduces the stability of the system (i.e. the initial value of debt ratio at which it is possible to converge to \(E_L\)). In Fig. 6c despite the proximity of the two fixed points \(E_L\) and \(E_U\), the width of the basin continues to be almost the same for low inflation values. However, a small perturbation from the equilibrium \(E_L\) could lead the debt ratio trajectory towards the black region of default. Moreover, for higher inflation rates the basin tends to shrink very quickly and this makes the debt ratio path unsustainable for even smaller initial values of debt. In this case, the system is clearly less robust to shocks than the two previous panels.

Moving to Fig. 7, we recall that these two panels are obtained with the same parameters of Fig. 4a, b with the exception of \(\alpha = 0.9\). For this reason, the equilibrium values are fairly similar, but in terms of stability proprieties, we find an opposite behavior. As long as the inflation rate grows the system becomes more stable, so it is possible to start from higher levels of debt ratio and, nonetheless, to converge towards \(E_L\). In addition, the size of the basin of attraction of Fig. 7b is larger than Fig. 7a due to the higher level of debt ratio and inflation in \(E_U\). In this latter case, even relevant shocks from the equilibrium \(E_L\) can be borne by the system (i.e. more robust).

It is not surprising in economic terms that a higher inflation rate in equilibrium (such as in Fig. 5a, b) is associated with a lower debt ratio. In fact, inflation erodes the real value of debt, through its effect on the real interest rate. This opens up a trade-off which, depending on the weak (strong) reaction of the CB on interest rates in the face of rising inflation (i.e., \(\alpha \)), will lead to the debt ratio stabilizing at a lower (higher) level in equilibrium. The inflation rate, on the other hand, will be higher in the first case and lower in the second. The extent of this trade-off is determined by the structural parameters of the model.

Basins of attractions of equilibrium points in Fig. 4. a–c The basins of attraction for the three parameters’ set used in Fig. 4a–c, respectively. The red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories. Benchmark values for \({\bar{b}}\) and \({\bar{\pi }}\) are represented by the white dotted lines

Basins of attractions of equilibrium points in Fig. 5. a, b The basins of attraction for the two parameters’ set used in Fig. 5a, b, respectively. The red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories. Benchmark values for \({\bar{b}}\) and \({\bar{\pi }}\) are represented by the white dotted lines

By properly tuning the parameters of the model, local bifurcations can occur leading to the creation or disappearance of the equilibrium points, giving rise to several types of self-sustained oscillations and changing the stability properties of the system. These dynamic scenarios will be illustrated in Sect. 5, by means of numerical simulations, guided by some of the analytically determined conditions on the parameters. In Sect. 4.2, we will focus on a few benchmark cases, obtained by turning off some crucial parameters to explore the economic implications of the model.

4.2 Some benchmark cases

In this section, we study four benchmark cases of the dynamic model in (10). In all the cases considered hereinafter, we take as reference Fig. 4a and its parameters’ set. In every benchmark case we ‘turn off’ (i.e. set to zero) one of the parameters in order to compare the difference between the fixed points of Fig. 4a, labeled as \(E_{L0}, E_{U0}\), and the new steady states \(E_{L1}, E_{U1}\). From the comparison, it is possible to draw relevant economic insights into the effects of these parameters on the model.

4.2.1 \(\beta = 0\): absence of a spread effect (no risk-premium)

First, let us assume \(\beta = 0\). In this scenario, there is no risk-premium or spread as the nominal interest rate is simply the one set by the CB. We compare the two situations, with the risk-premia (blu curves) and without (orange curves), in Fig. 8a. A first notable consequence is that both curves shift: the hyperbolic branch \(\pi _1(b)'\) from Eq. (11) now becomes almost completely flat, while the new line \(\pi _2(b)'\), given by Eq. (12), flattens too with a slightly lower intercept.

Benchmark case No. 1, \(\beta \) = 0: no risk-premium. Parameters are the same as those used in Fig. 4a, except for the risk-premium \(\beta = 0\). In b, the red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories

For \(\beta \) = 0, the market does not apply a risk premium on the relevant interest rate for government debt issues, which means that government debt is always considered safe by the market no matter its amount. As it is possible to see from Fig. 8a, the lower stable equilibrium does not change much: from \(E_{L0} = (0.71;0.028)\) to \(E_{L1} = (0.76;0.025)\). It shows a small increase in the public debt ratio and a slightly lower inflation rate. However, the basin of attraction of the latter expands enormously, covering a much larger range of initial conditions (up to the saddle \(E_{U}\)), as depicted in Fig. 8b, where all the area is covered in red (convergent trajectories). In fact, the saddle point moves from \(E_{U0}=(2.48; 0.015)\) to \(E_{U1}=(20.67; 0.165)\). It means that from every reasonable economic value of the variables b and \(\pi \) (up to 500% of debt ratio and 50% of the inflation rate—given the structural parameters of the economy in this example), the system converges to the lower equilibrium \(E_{L1}\). This is, of course, an extreme case in which financial operators do not price in the riskiness associated with the sustainability of the debt ratio and thus the probability of a country defaulting. However, even from this extreme scenario, important policy implications can be drawn.

First of all, if investors in government bonds are less risk-averse about the government’s ability to repay the debt and/or perceive, on average, a lower probability of default by the country, they will tend to price the risk on government bonds less (i.e. lower \(\beta \)). As a result, the State could borrow relatively more with a lower risk of default (Von Hagen et al., 2011; Du et al., 2020). Secondly, a key finding argues that unconventional monetary policy is fundamental in stabilizing the economy thanks to the active role it can have in containing the spread/risk-premium \(\beta \). If the CB succeeds, through a program of government bond purchases (e.g. quantitative easing), to reduce financial spreads, the system becomes much more stable and shocks on both the debt ratio and the inflation rate do not alter the convergence toward \(E_L\) (Krishnamurthy & Vissing-Jorgensen, 2011; Kinateder & Wagner, 2017). This is the reason why Q.E. and similar unconventional monetary measures have been so widely used by CBs during the last years. Other than additional instruments helpful to target inflation, they have been effective in reducing spreads and interest rates on public bonds, especially for highly indebted countries, making debt ratios more sustainable as highlighted in these figures.

4.2.2 \(\eta = 0\): absence of debt monetization

Now, let us assume \(\eta = 0\). In this scenario, there is no debt monetization by the CB. It is possible to compare the two situations, with the debt monetization (curves in blue) and without (curves in orange), in Fig. 9a. The hyperbola branch \(\pi _1(b)'\) now shifts downwards, whereas the new line \(\pi _2(b)'\) is much more downward sloping with an increased intercept, shrinking the distance between the two equilibria.

Benchmark case No. 2, \(\eta \) = 0: no debt monetization. Parameters are the same as those used in Fig. 4a, except for the debt monetization parameter \(\eta =0\). In b, the red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories

For \(\eta = 0\), the CB does not implement any debt monetization measure to finance (ex-post) a specific share of the government’s outstanding debt ratio. Therefore, the dynamic equation in (5) becomes simply \(b_{t}=(1+r-g) \, b_{t-1} + d_{t} \), which is the standard model of public debt sustainability. The evolution of the debt ratio is hence determined only by (exogenous) g and (endogenous) r. In this case, the debt ratio value of the lower stable equilibrium increases from \(E_{L0} = (0.71;0.028)\) to \(E_{L1} = (0.82;0.021)\), as we can expect, since there is no longer support from the CB to finance part of it. However, in the absence of debt monetization, the inflation rate in equilibrium is quite lower. This is because a debt monetization programme generates a persistent shock in terms of inflation due to the increased money base that needs to be injected into the economy to purchase or finance part of the debt. Indeed, as long as debt monetization is in place, the equilibrium value of inflation increases, showing the trade-off of the measure: the CB is able to lower the debt ratio to preserve the financial stability of the economy, but at the expense of a persistent price increase. However, if the debt monetization measure is moderate, as in the example of Fig. 4a where \(\eta = 0.01\), the adverse effect on the inflation rate is rather limited. We have shown that a permanent government bond purchase programme/money financing of \(1\%\) of the public debt ratio leads to a moderate increase of inflation (\(0.7 \%\)) and to a non-negligible reduction in the debt ratio (\(11\%\)). From the point of view of the stability of the equilibrium, the distance between the two equilibria moderately decreases for \(\eta = 0\), because the saddle point moves to the bottom-left: from \(E_{U0}=(2.48; 0.015)\) to \(E_{U1} = (2.40;-0.001)\). Consequently, the size of the basin of attraction of the stable equilibrium (in red) becomes a little smaller, as depicted in Fig. 9b. In contrast, in the absence of debt monetization, the system is slightly less stable.

Thus, in this scenario, a moderate debt monetization might have a positive effect on the stability of the equilibrium, since it increases its basin of attraction making it easier for the government to bear unexpected public debt shocks (for instance when \(g \simeq r\)) (Agur et al., 2022). In this setting, we conclude that this measure (even if considered controversial) when implemented with caution can effectively reduce the debt burden in the long-run, as well as make the economy more resilient to perturbations with a (relatively) little sacrifice in terms of inflation cost. This may be more suitable to be carried out in periods of prolonged low inflation rates and liquidity traps such as the situation in the Eurozone in 2013–2018 (Botta et al., 2020). It is not a coincidence that the debate around a possible partial debt monetization of the most indebted member countries came to the fore precisely in those years. Nonetheless, the topic might have a comeback in the near future, as long as the situation could worsen and public debt sustainability becomes again a serious concern for the financial stability of the economy.

4.2.3 \(\epsilon = 0\): no government budget adjustment rule

Here we assume \(\epsilon = 0\). As in the standard model, in this scenario, there is no government budget adjustment to the current value of the debt ratio. In other words, it is as if the government in each period of time t (i.e., each year) set the same (constant) amount of public deficit (if \(\lambda >0\)) or surplus (if \(\lambda <0\)). It is possible to compare the two situations: without the active government budget adjustment rule (orange curves) and with (blue curves) in Fig. 10a. In the latter case, from the parameters of Fig. 4a, we have that \(\lambda = 0.02\), so it means a constant primary deficit of \(2\%\). The hyperbolic branch \(\pi _1(b)'\) now warps approaching the origin of the axes, while the line \(\pi _2(b)\) does not change as \(\epsilon \) does not enter in the dynamic equation (8), and thus in (12).

Benchmark case No. 3, \(\epsilon \) = 0: no government budget adjustment rule. Parameters are the same as those used in Fig. 4a, except for the government budget elasticity \(\epsilon = 0\). In b, the red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories

For \(\epsilon \) = 0, the government decides to set a constant (i.e. a passive) budget rule without reacting to changes in the public debt ratio. The lower equilibrium is now \(E_{L1}=(0.23;0.031)\). The level of debt ratio (sustainable in equilibrium) decreases considerably (\(-48\%\)), but the inflation rate spikes at \(3.1\%\). Further, the unstable upper equilibrium, i.e. the saddle point, considerably reduces in terms of debt ratio from \(E_{U0}=(2.48;0.015)\) to \(E_{U1}=(1.36;0.023)\). This translates into a much lower resilience or sustainability of the public debt ratio, which is less robust to perturbations/shocks and it can converge to \(E_{L1}\) only from smaller values of initial debt. This can be seen also from Fig. 10b where the basin of attraction of the stable equilibrium (in red) is very small. The result is not surprising, since if there is no budget adjustment rule to the actual level of the public debt ratio, the system is less sensitive to changes and/or shocks of public debt and, as a consequence, the stability is compromised.

For this reason, some degree of fiscal policy adjustment to the current debt ratio may be desirable (Beetsma, 2022). Governments have in fact limited control over r and g. The interest rate is under the control of the CB, while potential growth is hard to affect, and structural reforms often have uncertain effects. Thus, the policy focus is on the primary balance (Blanchard et al., 2021). As shown by Bohn (1998), as long as the primary balance reacts sufficiently to debt, any debt ratio is sustainable. However, there are economic and political limits to the size of the primary surplus a government can generate (Ghosh et al., 2013). Moreover, if this rule is not imposed on the primary current account balance, fiscal austerity has often led to a decrease in public investment rather than other forms of spending, with the consequence of worsening not only the debt ratio but also long-term economic growth (Cerniglia et al., 2020; Blanchard, 2022).

4.2.4 \(\mu = 0\): no population of trend-followers agents in inflation expectations

In the last benchmark case, we assume \(\mu = 0\). In this scenario, there is no population of agents that behave as trend-followers in forming expectations on inflation. As in the other benchmarks, we compare the two situations, with the presence of the trend-followers \(\mu =0.1\) (in blue) and without \(\mu =0\) (in orange), in Fig. 11a. The curve \(\pi _1(b)\) does not change as \(\mu \) does not enter in the dynamic equation (5), and thus in (11). The line \(\pi _2(b)'\) flattens out (i.e. less downward sloping) with a lower intercept.

Benchmark case No. 4, \(\mu = 0\): no population of trend-followers agents. Parameters are the same as those used in Fig. 4a, except for the share of trend-followers agents \(\mu =0\). In b, the red areas represent initial conditions that generate converging trajectories, while the black areas represent initial conditions that generate diverging trajectories

For \(\mu \) = 0 there is only the population of fundamentalist agents who believe that inflation will eventually return to its fundamental target (because of the likely intervention of the CB). In other words, there are no trend-followers agents in the economy (who, on the contrary, expect a less aggressive intervention). As it is possible to see from Fig. 11a, this has a strong effect on the value of public debt and inflation in equilibrium, which decreases to \(E_{L1} = (0.69; 0.026)\), respectively.

A growing number of agents who trust in the CB’s ability to influence and bring back inflation to the targeted level (i.e. a small increase of fundamentalist agents: from \(90\%\) to the totality of the population) does not alter significantly the stability of the lower equilibrium \(E_{L1}\). Indeed, the saddle point now moves to the left, \(E_{U1} = (2.46; 0.016)\), with respect to Fig. 4a, but the basin of attraction remains almost the same in Fig. 11b.

Inflation expectations of economic agents matter, especially for the equilibrium value of inflation. As one might expect, when the share of fundamentalist agents in the economy increases, and vice versa the share of trend-follower agents decreases (they are complementary), the long-run inflation approaches the \(2\%\) value, as more agents behave with expectations anchored to the target. On the contrary, when trend-followers beliefs prevail in the economy, inflation expectations are dis-anchored to the objective (i.e. agents simply follow the previous realized inflation value) and this contributes to moving away the equilibrium value of inflation from the target set by the central bank (i.e. \({\bar{\pi }} = 2\%\)).

Consequently, a relevant policy prescription arises and involves the credibility of the CB in guiding inflation expectations (Woodford, 2004). If the CB seems more credible in the eyes of economic agents, it follows that a higher share of economic agents will behave as fundamentalists, anchoring inflation expectations to the value pursued by the CB. If, vice versa, the CB starts to lose credibility or efficacy (for whatever reason) in the agents’ perception, the share of trend-following agents in the economy will inevitably rise, in the belief that the CB, with its monetary policy, is not able (or not as effective as before) to drive inflation to the target (Hommes & Lustenhouwer, 2019). It results that shocks on inflation are more persistent in time as inflation expectations continue to follow past realizations. This implies a longer time for the CB to adjust the inflation rate to the target value and, often, requires more effort in terms of interest rate-based policy (i.e. changes of \(i_t\)) to achieve the same result (i.e. the target \({\bar{\pi }}\)).

5 Numerical simulations

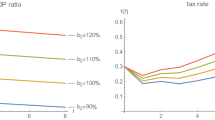

In this final section, we provide some numerical simulations to study the effects of different economic conditions and/or policies on the long-run evolution of the economic system. Let us again take Fig. 4a as a reference and let us vary one parameter at a time, ceteris paribus. In Fig. 12, we show the change of the equilibrium value \(E_L\) for both public debt ratio (Fig. 12a) and inflation rate (Fig. 12b) when varying the share of outstanding debt monetized \(\eta \) from 0 to 1 (i.e. bifurcation diagram).

Bifurcation diagram for \(\eta \). Same set of parameters of Fig. 4a. a The equilibrium value of public debt \((b_{L})\) and b that of inflation \((\pi _{L})\) as \(\eta \) changes between 0 and 1

It is evident the trade-off of the debt monetization measure: a higher level of \(\eta \) reduces the equilibrium debt ratio \((b_L)\) in the long run, but has a negative impact on the inflation rate \((\pi _L)\). In addition, due to the peculiarity of the non-linear map in (10), the effect is highly non-linear: a small variation of \(\eta \) has a large impact on both variables for lower values of debt monetization rather than for larger levels. This suggests that for the policy maker (in this case the CB), it is sufficient to monetize a relatively small amount of debt (e.g. \(\eta <0.03\) per year) to generate a beneficial effect on the debt ratio and, at the same time, to avoid strong inflationary pressure.

On the other hand, a stronger measure is not advisable due to the perverse effect it may have on the inflation rate and thus on the stability of the economic system. The CBs always face this dilemma when it comes to choosing a debt monetization instrument. For their mandate and role, CBs attribute the maximum priority to inflation targeting. For this reason, these measures have been often considered a ‘taboo’ in CBs practices. However, we claim that in particular circumstances, such as in economic periods of very low (or even negative) inflation, a moderate measure of debt monetization could be an alternative unconventional tool (in addition to interest rate-based policies). This holds especially when the interest rate has already hit the lower bound and conventional monetary levers become no longer effective in stimulating inflation. In fact, this latter measure would increase the inflation rate and simultaneously reduce the debt burden of the economy.

In Fig. 13, with the parameters set of Fig. 4a, the bifurcation diagram for \(\mu \) is represented in a relative small range between 0.58 and 0.6, for both the debt ratio (Fig. 13a) and inflation (Fig. 13b). We focus on this small range of the parameter because for \(\mu <0.5802\) the model always converges to the unique stable equilibrium \(E_L\), while for \(\mu =0.5802\) the system undergoes a Neimark–Sacker (N–S) bifurcation where \(E_L\) becomes unstable and an attracting closed orbit around \(E_L\) is created along with a quasi-periodic motion, see the phase diagram in Fig. 14b. As long as \(\mu \) increases, the attracting orbit grows in size (i.e. the area in blue in Fig. 13a, b) until, for \(\mu \approx 0.5911\), a global (or final) bifurcation occurs. This happens when the closed orbit collides with the boundary of its basin, destroying the latter and driving the system toward public default.

Bifurcation diagram for \(\mu \). Same set of parameters of Fig. 4a. a The equilibrium debt ratio \((b_{L})\) for changes of \(\mu \) between 0.58 and 0.6. b The equilibrium inflation rate \((\pi _{L})\) for changes of the same parameter over the same range

We capture the behavior of the system in this small window of instability (characterized by bounded oscillations that start at \(\mu \approx 0.5802\) and ends at \(\mu \approx 0.5911\) with the collapse of the orbit) in Fig. 14 for the value \(\mu =0.5849\). In Fig. 14a, the time series of debt ratio \(b_L\) shows a cyclical path of ups and downs between 1.24 and 2.18 on a very long period of time (90 years in this case). The phase diagram, in Fig. 14b, confirms that these cycles are generated by an attracting closed orbit located at the debt ratio values previously highlighted and at an inflation range between 0.001 \((0.1 \%)\) and 0.089 \((8.9 \%)\). In other words, the parameter \(\mu \) of the model may generate self-sustained oscillations (Baiardi et al., 2020).

The dynamics of a cycle can be described as follows. In the first instance, government debt is above the sustainability threshold (125% against 90%) and inflation is above the CB’s target level (5.79% against 2%). As a result, the government budget balance starts to improve (due to the adjustment rule on the primary deficit), inflation rises (given the push by chartist agents), and the nominal interest rate increases in turn. Notably, the response of the interest rate is stronger than that of inflation, so that the real interest rate also rises. These adjustments occur period after period until the inflation rate reaches its maximum. At this point, as a result of the Taylor Rule, the nominal interest rate starts to slow down (with an overshooting period of 4 years), until it reaches its maximum point too. It will finally take 8 more periods before the real interest rate begins its descent (from a max of 6.13%). This moment marks the turning point for the growth of public debt, which starts to slow down its growth rate (following the favorable developments in the interest rate and inflation), but will grow again for the next 15 periods (up to 218% of GDP). When the public debt reaches its maximum, the budget surplus also reaches its maximum (5.04%) and then begins to fall. It will therefore improve from now on, as will public debt until the end of the cycle. However, just 15 periods after the debt peak, inflation will reach a low of 0.29% and start to rise again, driven (now) by the fundamentalist agents, who believe it has fallen too far below its target value, thus expecting a reaction from the CB. The resumption of inflation will end the decline of the nominal interest rate (at 2.55%) after 4 periods. Therefore, the nominal interest rate will start to rise until the end of the cycle, dragging the real interest rate, which will reach a low of 1.82% in just 7 periods. After 90 years (in our example), all variables have returned to their initial value and a new cycle can hence begin. In Appendix (Fig. 25b), we report the time series of all variables when \(\mu =0.5849\), and compare them with the previous situation of \(\mu =0.1\) (Fig. 25a).

Time series and phase diagram for \(\mu =0.5849\). Same set of parameters of Fig. 4a, except for \(\mu = 0.5849\). a The public debt \((b_{t})\) as a time series, while b The phase diagram with all pairs of public debt ratios and inflation over time \((b_{t},\pi _{t})\). In both cases, a transient of 1 million iterations was removed