Abstract

The characteristics book-to-market equity ratio, size and momentum are highly correlated with the average returns of common stocks. Fama and French (J Financ Econ 33(1):3–56, 1993), (J Finance 50(1):131–155, 1995) and (J Finance 51(1):55–84, 1996) argue (for size and the book-to-market equity ratio) that the relation between returns and characteristics arises because the characteristics are proxies for exposures to common risk factors. We examine the question whether the characteristics or the covariance structure of returns explain the cross-sectional dispersion in German stock market returns. Our results suggest that widely accepted factors SMB, HML or WML are not priced.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Executive summary

Traditional finance models suggest that investors can do no better than holding a combination of factor portfolios (e.g. Fama and French 1993 or Carhart 1997). Any deviation from this combination would increase the portfolio’s variance without increasing its expected return (Daniel and Titman 1998: 31). This is because traditional finance theory is based on the idea of no-arbitrage which implies that only systematic risk matters. Several researchers find that firms exhibiting certain characteristics like small size, high book-to-market equity ratio or high momentum (“weak” firms) have unusual high returns. According to traditional finance theory this can only be due to higher systematic risk. We examine this hypothesis in that we test whether the commonly used risk factors (SMB, HML or WML) that are build on these characteristics are priced. Our results suggest that it is more likely the characteristics rather than the exposures to the risk factors which explain the cross-sectional dispersion in average stock returns for the German stock market. These findings are consistent to the findings of Daniel and Titman (1997) or Daniel et al. (2001). Our results also suggest, in line with Daniel and Titman (1998), that investors should form portfolios that are long in stocks with “weak” firm characteristics and short in stocks with “strong” firm characteristics.

2 Introduction

The aim of the paper is to empirically analyze if the exposures from the four-factor model proposed by Carhart (1997) or the respective characteristics explain the dispersion in the average German stock returns. Over the past decades investors in stocks of small, high book-to-market equity ratio and high momentum firms (“weak” firms) have outperformed investors in stocks of big, low book-to-market equity ratio and low momentum firms (“strong” firms). The persistent performance advantage of the former stocks over the latter ones can arise either because of differences in systematic risk (covariances, exposures) or as a result of mispricing. The distinction between these two hypotheses is at the core of modern asset pricing research (Lin and Zhang 2013: 351) and has important implications for how investors should form portfolios (Daniel and Titman 1998: 24). If the return premium associated with stocks of weak firms arises due to higher systematic risk, investors can do no better than holding a combination of risk factors. For example, if expected returns are consistent with the three-factor model of Fama and French (1993) or the four-factor model of Carhart (1997), investors should hold a combination of the respective model factors. But, in contrast, if differences in stock returns are not related to differences in systematic risk (but in characteristics), investors should hold portfolios that are long in weak firms’ stocks and short in strong firms’ stocks.

There is, to the best of our knowledge, no study trying to distinguish between covariances and characteristics for the German stock market. The overall aim of this paper is to close this gap. For this purpose we apply the Daniel and Titman (1997) test which has become the workhorse for “disentangling” risk versus mispricing in asset pricing (Lin and Zhang 2013: 352). The test of Daniel and Titman (1997) is based on sorting stocks on characteristics like the book-to-market equity ratio and covariances like the exposure to HML. Following the traditional asset pricing theory portfolios of stocks with similar characteristics, but different risk factor exposures should exhibit different returns while portfolios of stocks with similar risk factor exposures but different characteristics should not. This testing procedure requires to maximize the spread in characteristics and exposures to distinguish between an asset pricing model and mispricing. Furthermore, to find variation in factor loadings that is unrelated to other characteristics multiple sorts on characteristics might be necessary. For example, Daniel and Titman (1997) and Davis et al. (2000) triple sort the stocks based on two characteristics (size and book-to-market equity) and the exposure to HML to control for the influence of size on the returns when analyzing the HML factor. These two issues require to choose the number of test portfolios as high as possible. However, the number of portfolios used is restricted by the number of firms available. In the case of Germany the number of firms is way lower than for the U.S. stock market. Instead of raw returns we therefore use “characteristic-adjust” returns to circumvent these issues. For example, when testing whether or not HML is a priced factor for the book-to-market equity ratio effect we use size-adjusted returns to control properly for the influence of firm size on returns.

Our results suggest that the factors SMB, HML and WML from the Carhart (1997) four-factor model are not priced. This finding is different to the recent literature which indicates that these factors are priced, conducting however a different empirical approach (Fama-McBeth-regression) which potentially suffers from the high correlation between characteristics and exposures (e.g. Artmann et al. 2012a). The characteristics book-to-market equity ratio and momentum explain in our analysis the cross-sectional differences in stock returns confirming the findings of, among others, Schrimpf et al. (2007), Schiereck et al. (1999), and Glaser and Weber (2003). Furthermore, we find no empirical evidence that SMB is priced or that the firm size explains the cross-sectional returns. The lack of the size effect supports the recent literature which does not find a size anomaly for Germany (e.g. Artmann et al. 2012a, b; Schrimpf et al. 2007; Ziegler et al. 2007). Our empirical results suggest that German stock market investors can do better than holding a combination of commonly used risk factor portfolios SMB, HML and WML.

The remainder of this paper proceeds as follows. In Sect. 2 we introduce into the covariances versus characteristics debate and the factor model considered in our paper. In Sect. 3 we derive some empirically testable hypotheses to distinguish between the rational pricing story and the mispricing story. In Sect. 4 we present the data and describe the firm characteristics. Then in Sect. 5 we provide empirical evidence on the central test of the null hypothesis of a risk factor model against the alternative hypothesis of a characteristics model for the German stock market. Section 6 summarizes and concludes.

3 Literature and model review

One of the central questions in finance is why different assets earn vastly different returns on average. Rational asset pricing models agree on the central insight that assets that have riskier payoffs should earn higher returns on average to compensate investors for bearing that increased (systematic) risk. What rational asset pricing models differ on is what constitutes systematic risk (Jagannathan et al. 2010: 50; Goyal 2012: 3).

The capital asset pricing model (CAPM) states that the expected returns on assets are a positive linear function of their betas (systematic risk), which are measured relative to a comprehensive market portfolio (Fama and French 1992: 427, 2004: 25). Several empirical findings challenge the central statements of the CAPM (e.g. Fama and French 1992, 1996 or 2008). The size effect (Banz 1981), the book-to-market equity ratio (BE/ME) effect (Stattman 1980; Rosenberg et al. 1985) and the momentum effect (Jegadeesh and Titman 1993) are among the most prominent contradictions of the CAPM. For the German stock market empirical evidence is provided for the BE/ME effect by, among others, Artmann et al. (2012a, b), Wallmeier (2000) and for the momentum effect by Glaser and Weber (2003), Artmann et al. (2012a, b), Schiereck et al. (1999). The empirical evidence on the existence of a possible size anomaly, weakly persistent in studies on U.S. stock returns, is mixed for the German stock market (Artmann et al. 2012a, b; Schrimpf et al. 2007; Ziegler et al. 2007).

There is considerable disagreement about the question why a high percentage of the cross-sectional dispersion in average stock returns is captured by characteristics like size, BE/ME and momentum while left unexplained by the CAPM. There are different stories for explaining the empirical findings. These stories are based on the covariances versus characteristics debate.

The first (rational pricing) story is the need for a new rational asset pricing model. In line with this story Fama and French (1993, 1995, 1996) suggest that the higher average returns on high BE/ME and small stocks are a compensation for (distress) risk in a multifactor version of Merton (1973)’s intertemporal capital asset pricing model (ICAPM) or Ross (1976)’s arbitrage pricing theory (APT) (Daniel and Titman 1997: 2; Davis et al. 2000: 389). Based on this idea Fama and French (1993) propose a three-factor asset pricing model (FF-model) that contains in addition to the market factor a size and a BE/ME effect based factor. Carhart (1997) proposes a four-factor model (FFC-model) that contains additionally a momentum effect based factor.

According to the FFC-model the expected returns conform to a four-factor model,

where \(R_{i}\) is return on asset i, \(R_\text{f}\) is the risk-free interest rate, \(R_\text{M}\) is the return on the market portfolio, SMB captures the size effects, HML is the difference between the returns on portfolios of high BE/ME stocks and portfolios of low BE/ME stocks and WML is created to capture the momentum effect.

Our construction of the risk factors SMB and HML is in line with the approach of Fama and French (1993). In June of each year t, we use two independent sorts to allocate stocks in our sample to two size groups and three BE/ME groups. Big stocks (B) are above the median market equity of all firms at the end of June and small stocks (S) are below. High BE/ME stocks (H) are above the 70th percentile of BE/ME for all firms at the end of December of year t − 1, medium BE/ME (M) stocks are in the middle 40 percent, and low BE/ME (L) stocks are in the bottom 30 percent. We form six value-weight portfolios, S / L, S / M, S / H, B / L, B / M, B / H, as the intersections of the size and BE/ME groups. SMB is the difference between the equal-weight averages of the returns on the three small stock portfolios and the three big stock portfolios:

HML is the difference between the equal-weight averages of the returns on the two high BE/ME stock portfolios and the two low BE/ME stock portfolios:

When constructing the WML factor we follow Fama and French (2012) and use two independent sorts to allocate stocks in our sample to two size groups and three momentum groups in each month m of each year t. Big stocks (B) are above the median market equity of all firms at the end of month m and small stocks (S) are below. High momentum (or winner) stocks (W) are above the 70th percentile of monthly prior (2–12) returns for all firms at the end of month m, medium momentum stocks are in the middle 40 percent, and low momentum (or loser) stocks (L) are in the bottom 30 percent. We form four value-weight portfolios, S / W, S / L, B / W, B / L as the intersections of the size and momentum groups. WML is the difference between the equal-weight averages of the returns on the two short-term winner stock portfolios and the two short-term loser stock portfolios:

If the FFC-model is a rational asset pricing model then the expected stock returns are a compensation for exposures (\(b_{i}, s_{i}, h_{i}, m_{i}\)) on risk factors created as described (\(R_\text{M}\), SMB, HML, WML), regardless of characteristics. For the German stock market, empirical evidence in favor of the FFC-model is provided by, among others, Artmann et al. (2012a, b), Ziegler et al. (2007), or Koch and Westheide (2012). Obviously, in the rational pricing story there might be other than the FFC-model risk factors or factors differently created on the same characteristics that are able to capture the behavior of the returns.

The second (characteristics) story is a characteristics-based explanation of the size effect and the BE/ME effect. The characteristics story covers anything that produces a premium for the high BE/ME (and small) stocks relative to the low BE/ME (and big) stocks (Davis et al. 2000: 390). The behavioral overreaction story can be regarded as the most prominent variant of the characteristics story. Proponents of the behavioral overreaction story (De Bondt and Thaler 1987 or Lakonishok et al. 1994) argue that small and high BE/ME stocks (value firms) tend to have poor past earnings growth while big and low BE/ME stocks (growth firms) tend to have strong past earnings growth. Investors overreact to past earnings growth, resulting in stock prices that are too high for growth and too low for value firms. The correction of the overreaction results in high returns for value stocks and low returns for growth stocks. The behaviorists do not dispute the possibility that there may be priced factors associated with high BE/ME (and small) stocks relative to low BE/ME (and big) stocks. Instead they argue that the premium associated with the risk factors is simply too large to be rationally justified as a compensation for bearing systematic risk. The high risk premium is itself the result of investor overreactions which happens to be correlated across firms in a way that just looks like a rational pricing story (Fama and French 2004: 40).

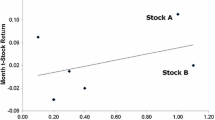

Because the behavioral overreaction story does not address the more fundamental question of whether the SMB and HML factors are priced at all, Daniel and Titman (1997) suggest an approach to distinguish between the rational pricing story and the characteristics story. The characteristics story states that value (small) firms have high returns due to characteristics of weak firms and growth (big) firms have low returns due to characteristics of strong firms regardless of their exposures to HML or SMB (Davis et al. 2000: 391). In contrast, the rational pricing story states that returns compensate risk factor exposures, regardless of characteristics (Davis et al. 2000: 391). To identify independent variation in characteristics and risk factor exposures Fama and French (1992) and Jegadeesh (1992) form portfolios by double-sorting stocks on firms’ size (characteristic) and market factor exposures while Daniel and Titman (1997) and Davis et al. (2000) form portfolios mainly by triple-sorting stocks on firms’ size, BE/ME (characteristics) and exposure to HML.

Daniel and Titman (1997) analyze if HML and SMB are priced and provide evidence in favor of the characteristics story. Davis et al. (2000) argue that this evidence is special to their rather short sample period and show in long return time series that HML and SMB are priced. Since the results of Daniel and Titman (1997) and Davis et al. (2000) do not provide a clear picture on the question whether the rational pricing story or the characteristics story explains the cross-sectional dispersion of average stock returns there is need for studies that provide further empirical research. First evidence outside the USA is provided by Daniel et al. (2001) for the Japanese stock market and by Lajili-Jarjir (2007) for the French stock market. Daniel et al. (2001) find evidence in favor of the characteristics story while Lajili-Jarjir (2007) finds evidence in favor of the rational pricing story.

4 Null hypothesis and its empirically testable implications

To test the null hypothesis of the true asset pricing model (FFC-model) it is necessary to form portfolios of stocks that have similar characteristics but different risk factor exposures. They are referred to as characteristics-balanced (CB) portfolios (Daniel and Titman 1998). A CB portfolio goes long (short) in a portfolio of stocks with high (low) factor loadings while the characteristics of both portfolios are nearly equal. If there is a linear relation between risk exposures and returns (and the risk premium is positive) then a CB portfolio should have a positive average return. A positive average return of a CB portfolio cannot be due to differences in the characteristics as there should be no differences in the firm characteristics in a CB portfolio. In contrast, if the average return on a CB portfolio is zero we should reject the FFC-model because there is no linear relation between exposures and asset returns.

An alternative to test the null hypothesis is to form portfolios of stocks that have similar risk factor loadings but different characteristics. They are referred to as factor-balanced (FB) portfolios (Daniel and Titman 1998). A FB portfolio goes long in a portfolio of stocks with “weak” firm characteristics and short in a portfolio of stocks with “strong” firm characteristics while both portfolios exhibit similar factor loadings. The null hypothesis is rejected in favor of a characteristics-based explanation if a FB portfolio exhibits a positive average return because then the positive return difference is caused by firm characteristics.

We form CB and FB portfolios from double sorts on a characteristic and its related risk factor exposure. A detailed description how the portfolios are formed is given in the Sect. 5. Our testing approach differs from the Daniel and Titman (1997) procedure in one crucial point regarding the construction of the CB (and FB) portfolios. Daniel and Titman (1997) sort stocks on size and the book-to-market equity ratio before sorting them on their factor loadings. Consequently, to find variation in factor loadings that is unrelated to the characteristics multiple sorts on characteristics might be necessary before sorting stocks on their factor loadings. Furthermore, the Daniel and Titman (1997) testing procedure requires to maximize the spread in characteristics and exposures in order to test the null hypothesis. Both, multiple sorts and a high spread, require to choose the number of test portfolios as high as possible. However, the potential number of portfolios is restricted by the number of firms under consideration, which is rather low in the case of Germany. For the Daniel and Titman (1997) test not to lack statistic power we calculate characteristic-adjusted returns (in addition to the raw returns). E.g., when testing whether or not HML is priced we use returns which are size-adjusted and when testing the SMB we adjust the returns for book-to-market equity ratio. We follow Glaser and Weber (2003) and calculate each firm’s monthly characteristic-adjusted return by subtracting the monthly return of the appropriate benchmark portfolio return. The benchmark portfolio is the portfolio that corresponds to the size- or book-to-market equity ratio grouping of the stock at the respective portfolio formation date from a single sort. In our opinion the use of characteristic-adjusted returns is a useful recommendation for further research as it allows to reduce the loss in testing power which might be caused by small cross sections.

To our knowledge the distinction between the hypothesis of rational pricing and the alternative hypothesis of a characteristics-based explanation for the FFC-model has so far been only conducted based on CB portfolios by Daniel and Titman (1997) and Davis et al. (2000). A contribution of our paper is that we provide an alternative approach for the distinction between the two hypotheses taking also FB portfolios into consideration.

5 Data

We use Thomson Reuters Datastream and Thomson Reuters Worldscope data to construct our sample for the German stock market. As shown by Ince and Porter (2006) and others, the naive use of Thomson Reuters Datastream data can have a large impact on economic inferences. To achieve an adequate data quality for the construction of test assets and risk factors they therefore recommend to conduct some corrections. We follow the screening procedure of Ince and Porter (2006) in order to reduce errors in Thomson Reuters Datastream data. Our sample is based on the Thomson Reuters Datastream research lists (FGER1, FGER2, FGERDOM, FGKURS) and dead lists (DEADBD1 to DEADBD6) and the Thomson Reuters Worldscope list (WSCOPEBD). Ince and Porter (2006) report that the U.S. research lists are incomplete which we can confirm for the German stock market. Additionally, we search Datastream for all German equities using the following filters: status = all, market = Germany, instrument type = equity. After the screening procedure as proposed by Ince and Porter (2006) is finished we are left with 2359 common shares for the German stock market. For these firms, we extract time-series data for the time period from January 1975 to December 2014. To be consistent with the empirical asset pricing literature we exclude financial firms. Fama and French (1992) exclude financial firms because the high leverage that is normal for financial firms must not have the same meaning for non-financial firms, where high leverage is likely to indicate near-bankruptcy. Furthermore financial firms are often excluded from empirical studies since they are subject to special accounting standards and risk factors as noted by Viale et al. (2009). We exclude financial firms using the one digit SIC-code ‘6’.

Table 1 reports the average number of firms for different time periods for which the end-of-month stock prices are available in our data sample. Due to Thomson Reuters Datastream market coverage issues before 1990 and numerous IPOs in the 1990s, our sample size more than doubles after 1990 and reaches a maximum of 631 firms on average in the time period from 1999 to 2001. Compared to a comprehensive hand-collected data sample used in related studies of Artmann et al. (2012a) and (b) our time-series and cross-sectional dimensions are smaller in the time period before 1990 but they are considerably larger in the time period after 1990.

We calculate simple monthly stock returns from the total return index which is provided by Thomson Reuters Datastream and adjusted for dividends, splits and equity offerings. Then, we exclude 1 % of the smallest and largest monthly return observations from the sample to reduce the impact of outliers. We measure size by the market value of equity at the end of June of year t. The book-to-market equity ratio (BE/ME) is calculated as the book value of equity divided by the market value of equity, both as of the end of December of year t − 1. Firm-years exhibiting negative book values are excluded since from a firm’s limited liability structure it follows that shareholder’s equity cannot have a negative value. A lag of 6 month is imposed for BE/ME to ensure that the accounting data used to calculate these variables are known by the market when the stocks are ranked and no ex-ante information is used in portfolio formation. BE/ME is winsorized to avoid outliers. The bottom (top) 1 % values are set equal to the value corresponding to the first (99th) percentile of the empirical distribution. Finally, the momentum characteristic is calculated monthly based on the cumulative past return from month m − 12 to month m − 2. We consider a lag of one month to avoid the short-term reversal effect as documented by Jegadeesh (1990). Table 2 shows summary statistics for firm characteristics.

Our summary statistics for momentum and BE/ME are very close to the summary statistics of the characteristics presented in a recent study of Artmann et al. (2012a). However, the firms used in our sample are on average somewhat larger which might be due to the fact that our time period begins later and ends later. Another possible explanation is that the exclusion of penny stocks which is due to our screening procedure as proposed by Ince and Porter (2006) increases average firm size. Artmann et al. (2012a) do not exclude penny stocks. The table also reports the correlations between the characteristics. The low correlation coefficients make it unlikely that the raw returns on CB and FB portfolios from our double sorts are driven mainly by the characteristics we are not controlling for. Our later results will confirm that it makes no difference when we use raw or adjusted returns for accepting or rejecting the null hypothesis.

To conduct further comparisons of our data sample to the data samples used in related studies we form portfolios from single sorts on characteristics. In June of each year t we sort stocks into ten portfolios on size and BE/ME. Monthly equal-weight returns on the portfolios are calculated from July of year t to June of year t + 1 and the portfolios are reformed in June of year t + 1. We also sort stocks monthly into ten portfolios on momentum. Table 3 shows the monthly average returns of the ten portfolios for the sorts on size, BE/ME and momentum. The last column of Table 3 shows monthly average returns for long-short or zero net-investment portfolios that go long in portfolio 10 (“High”) and short in portfolio 1 (“Low”). For the long-short portfolio we find that there is a statistically significant effect for BE/ME and momentum while there is no statistically significant size effect. Since our findings are of similar order of magnitude as reported by related studies (e.g. Artmann et al. 2012a, b) we conclude that our data sample is not unusual.

We estimate the factor loadings for the factors of the FFC-model for each stock at the end of June of each year t using 5-year time-series regressions based on monthly returns. Specifically, we regress each stock’s returns on factor mimicking portfolios (as described in Sect. 2) for the period m = −59 to m = 0 relative to the portfolio formation date. The risk factor exposures are not estimated if a stock does not have at least 24 monthly return observations. The return on the market \(R_\text{M}\) is the return on the value-weighted portfolio of all sample stocks. The risk-free rate \(R_\text{f}\) is the average of the 3-months FIBOR rates. Table 4 shows summary statistics and pair-wise correlations for the factors from the Carhart (1997) four-factor model.

We find the highest premium for WML while the premium for SMB is negative but statistically insignificant. The market risk premium is 0.59 and exhibits the highest standard deviation. Thereby, HML exhibits the lowest standard deviation. As in related German studies we find a strong negative correlation between \(R_\text{m}-R_\text{f}\) and SMB.

6 Empirical results

Our null hypothesis is that the FFC-model explains the cross section of stock returns while the alternative hypothesis is a characteristics model for the German stock market. Distinguishing between these two hypotheses can be difficult since characteristics and risk factor loadings are likely to be cross sectionally correlated causing multicollinearity problems in Fama and MacBeth (1973) regressions (Daniel et al. 2001: 745). These problems can be avoided by the Daniel and Titman (1997) test procedure that forms portfolios of stocks exhibiting a low correlation between their factor loadings and their characteristics. In our analysis we will focus on the CB (FB) portfolios that have similar (different) characteristics but different (similar) factor loadings. We will not discuss the question whether the market factor is priced since there is no obvious characteristic on which the market factor is constructed. This circumstance does not allow us to distinguish between a characteristic and a risk factor explanation as it is possible for SMB, HML or WML. However, like Daniel and Titman (1997) and Davis et al. (2000) we find (in unreported results) that the market factor does not seem to be priced for the German stock market.

In the FFC-model the construction of the factors SMB, HML and WML is based on characteristics. To test whether SMB, HML and/or WML are priced factors on the German stock market we use two independent sorts to allocate stocks in our sample to four characteristic groups and four factor loading groups. We use 25th percentile breakpoints for the formation of the groups. For size (book-to-market equity ratio) firms are sorted by their market capitalization at the end of June of year t (BE/ME at the end of year t − 1) and their factor loadings on SMB (HML) at the end of June of year t and remain in these portfolios from July of year t to June of year t + 1. We form 16 equal-weight portfolios as the intersections of the four characteristic groups and the four factor loading groups. We proceed analogously for WML but sort stocks monthly. We use the characteristic-adjusted stock returns to calculate the portfolio returns.

Tables 5, 6 and 7 summarize the results for our 16 double-sorted portfolios on size (BE/ME, momentum) and SMB (HML, WML) loadings and the CB and FB portfolios for the full sample period. In Sect. 3 we described that if the SMB (HML, WML) factor is priced we would expect the average returns of the CB portfolios to be positive and the average returns of the FB portfolios to be undistinguishable from zero. If the portfolio returns are related to the characteristics then we expect to see non-zero average returns on FB portfolios and zero average returns on CB portfolios.

The empirical evidence in the literature on the role of SMB for explaining the cross section of German stock market returns and on the existence of a size effect is mixed. Previous studies by Schlag and Wohlschieß (1997), Breig and Elsas (2009), Artmann et al. (2012a) and (b) reject the existence of a size effect. Furthermore, Schrimpf et al. (2007) and Artmann et al. (2012b) show that SMB only plays, if any, a minor role for explaining the German cross section of stock returns. In contrast, Stehle (1997) and Wallmeier (2000) find evidence in favor of a size-related characteristic and Ziegler et al. (2007) find that SMB has some explanatory power for the cross section of German stock market returns. Artmann et al. (2012b) argue that these different findings are most likely caused by different sample periods. Our results in Table 5 do not provide evidence for a size anomaly in Germany. The average BE/ME-adjusted returns of the CB and FB portfolios provide neither evidence in favor of the characteristics hypothesis nor in favor of the rational pricing hypothesis. Our results do therefore suggest that for the German stock market neither the SMB factor is priced nor are the returns related to a size characteristic.

Virtually all German studies provide empirical evidence that a BE/ME anomaly exists and that HML helps to explain the differences in the cross section of the German stock market returns. In various previous studies (e.g. Schlag and Wohlschieß 1997; Wallmeier 2000; Artmann et al. 2012a, b) a BE/ME effect is shown. Furthermore, previous results (e.g. Schrimpf et al. 2007; Ziegler et al. 2007; Artmann et al. 2012a, b) indicate that HML plays a major role for explaining the cross section of the German stock market returns. Davis et al. (2000) find a rational explanation for the HML factor for the U.S. stock market which is rejected by Daniel et al. (2001) for the Japanese stock market. Our results in Table 6 show that the average size-adjusted returns on the CB portfolios are undistinguishable from zero indicating that HML is not priced. The hypothesis of a characteristics-based explanation is supported by the average size-adjusted returns of the FB portfolios which are statistically significant and positive. The dispersion in the cross section of German stock market returns seems to be related to BE/ME rather than to the exposure to HML. These results are in line with previous findings by Daniel and Titman (1997) and Daniel et al. (2001) but are contrary to Davis et al. (2000) and the above mentioned German studies.

Momentum is one of the most puzzling anomalies because it suggests that the market is not even weak-form efficient. Consequently, the momentum effect is one of the most intensively debated topics in finance. Similarly to the BE/ME effect, there is a large body of literature documenting the momentum effect for the German stock market (among others, Schrimpf et al. 2007; Artmann et al. 2012b; Schiereck et al. 1999; Glaser and Weber 2003). In a recent study, Artmann et al. (2012a) provide evidence by the means of Fama-McBeth regressions that WML is priced. However, they only include the factor returns in the cross-sectional regression which is probably due to the high correlation between factor loadings and characteristics. Consequently, their study cannot answer the question whether the returns are related to factor loadings or to characteristics which is our main interest. To the best of our knowledge we are the first to perform the (Daniel and Titman 1997) test for the WML factor from the FFC-model. Unlike SMB and HML firms are sorted by their momentum at the end of month m and their factor loadings at the end of month m and remain in these portfolios for month m + 1. This is due to the fact that the portfolios used to construct the WML factor are also rebalanced monthly. Table 7 summarizes the results for our sixteen double-sorted portfolios on momentum and WML loadings and the CB and FB portfolios for the full sample period. We find that the average size-adjusted returns of all FB portfolios are positive and statistically significant while the CB portfolios are undistinguishable from zero. Our results provide evidence in favor of the characteristics story indicating that the momentum effect is due to mispricing rather than due to rational pricing as suggested by the FFC-model.

A final test which is commonly applied to distinguish between rational pricing and mispricing is to calculate the equal-weight average of the CB portfolios (see for example Daniel and Titman 1997; Davis et al. 2000; Daniel et al. 2001). The CB portfolio can be viewed as a “high minus low exposure” portfolio that is neutral in characteristics and has a spread between high and low factor loadings. We extend previous research and calculate the equal-weight average of our FB portfolios. We refer to the equal-weight average of the CB/FB portfolios as to “final” CB/FB portfolios. Columns one and two of Table 8 show the average characteristic-adjusted monthly returns, their standard deviations and their significance levels of the final portfolios. These figures confirm our earlier findings according to which SMB, HML and WML are not priced and that returns are related to the characteristics book-to-market equity ratio and momentum instead.

The remaining columns of the Table 8 present the coefficients, their t-statistics and \(R^2\) from a time-series regression of the four factors from the FFC-model on the returns of the final portfolios. Our formal inference is based on the intercepts of the time-series regressions, which is in line with the Black et al. (1972)—test. When analyzing final CB and FB portfolios then the covariances story is true for the FFC-model if the regression intercepts are undistinguishable from zero. If the final CB portfolio returns are related to the characteristics rather than exposures then the intercepts are expected to take on negative values because the returns on the CB portfolios are overestimated due to the multiplication of a positive (estimated) factor loading and the positive expected return on risk factor. Analogously, a positive intercept on the final FB portfolio indicates a characteristic-based explanation.

The results in Table 8 suggest that SMB, HML or WML are not priced as the intercepts from the regressions on the final CB portfolios are significantly negative. The intercept of the momentum-based final FB portfolio is significantly positive providing further evidence for a characteristics-based explanation of the momentum effect. The intercept of the final FB portfolio from the BE/ME-sort is positive but not significant. Recalling the high positive average size-adjusted monthly return on the BE/ME-based final FB portfolio the positive intercept is more in favor of the characteristics story.

One might suspect that our main results depend on the adjustment of the stock returns for the characteristic that we would like to control for. In Sect. 4 we point to the low correlation between the characteristics which makes an additional influence of another characteristic on our double sorts unlikely. Additionally, we can report that our results do not change if we perform the analysis with raw returns. The results from the double sorts and the regression on the final CB/FB portfolios when using raw returns are presented in the Tables 9, 10, 11 and 12 in the “Appendix”. The structure of the tables and the interpretation of the results are analogous to the Tables 5, 6, 7 and 8. We can further report that other definitions of characteristic-adjusted returns do not change our main findings. For example, we also momentum-adjusted returns when testing if SMB or HML are priced and we also BE/ME-adjusted returns when testing the WML. Either way we find SMB, HML and WML are not priced.

We find (in unreported results) that our findings do not change if we use value-weighted returns instead of equally weighted returns or if we form 9 (3 × 3) or 25 (5 × 5) portfolios from the double sorts on characteristics and exposures.

7 Summary

We analyze the question if the cross-sectional dispersion in average German stock market returns is due to characteristics or the exposures to the risk factors of the FFC-model. The persistent performance advantage of some “weak” firm characteristic stocks compared to some “strong” firm characteristic stocks can either arise because they are riskier or because the differences in performance are due to mispricing (Daniel and Titman 1998: 24, 25). We find that neither there is a size effect nor that SMB is a priced risk factor. Our results indicate that HML and WML are not priced and that stock returns are related to characteristics rather than to exposures. These findings are robust to choices of the methodology. A German stock market investor is seemingly better of if she invests into firms with “weak” firm characteristics and ignores exposures to the commonly used risk factors.

References

Artmann, Sabine, Philipp Finter, and Alexander Kempf. 2012. Determinants of expected stock returns: Large sample evidence from the german market. Journal of Business Finance & Accounting 39(5–6): 758–784.

Artmann, Sabine, Philipp Finter, Alexander Kempf, Stefan Koch, and Erik Theissen. 2012. The cross-section of german stock returns: New data and new evidence. Schmalenbach Business Review 64: 20–43.

Banz, Rolf W. 1981. The relationship between return and market value of common stocks. Journal of Financial Economics 9(1): 3–18.

Black, Fisher, Michael Jensen, and Myron Scholes. 1972. The capital asset pricing model: Some empirical tests. In Jensen, Michael, editor, Studies in the theory of capital markets. New York: Praeger Publishers Inc.

Breig, Christoph M., and Ralf Elsas. 2009. Default risk and equity returns: A comparison of the bank-based german and the us financial system. Working Paper, Ludwig-Maximilians-University of Munich, 2009.

Carhart, Mark M. 1997. On persistence in mutual fund performance. The Journal of Finance 52(1): 57–82.

Daniel, Kent, and Sheridan Titman. 1997. Evidence on the characteristics of cross sectional variation in stock returns. The Journal of Finance 52(1): 1–33.

Daniel, Kent, and Sheridan Titman. 1998. Characteristics or covariances? The Journal of Portfolio Management 24(4): 24–33.

Daniel, Kent, Sheridan Titman, and K.C. Wei. 2001. Explaining the cross-section of stock returns in Japan: Factors or characteristics? The Journal of Finance 56(2): 743–766.

Davis, James L., Eugene F. Fama, and Kenneth R. French. 2000. Characteristics, covariances, and average returns: 1929 to 1997. The Journal of Finance 55(1): 389–406.

De Bondt, Werner F.M., and Richard H. Thaler. 1987. Further evidence on investor overreaction and stock market seasonality. Journal of Finance 42(3): 557–581.

Fama, Eugene F., and Kenneth R. French. 1992. The cross-section of expected stock returns. The Journal of Finance 47(2): 427–465.

Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33(1): 3–56.

Fama, Eugene F., and Kenneth R. French. 1995. Size and book-to-market factors in earnings and returns. The Journal of Finance 50(1): 131–155.

Fama, Eugene F., and Kenneth R. French. 1996. Multifactor explanations of asset pricing anomalies. The Journal of Finance 51(1): 55–84.

Fama, Eugene F., and Kenneth R. French. 2004. The capital asset pricing model: Theory and evidence. Journal of Economic Perspectives 18: 25–46.

Fama, Eugene F., and Kenneth R. French. 2008. Dissecting anomalies. The Journal of Finance 63(4): 1653–1678.

Fama, Eugene F., and Kenneth R. French. 2012. Size, value, and momentum in international stock returns. Journal of Financial Economics 105(3): 457–472.

Fama, Eugene F., and James D. MacBeth. 1973. Risk, return, and equilibrium: Empirical tests. The Journal of Political Economy, 607–636.

Glaser, Markus, and Martin Weber. 2003. Momentum and turnover: Evidence from the german stock market. Schmalenbach Business Review 55: 108–135.

Goyal, Amit. 2012. Empirical cross-sectional asset pricing: A survey. Financial Markets and Portfolio Management 26(1): 3–38.

Ince, Ozgur S., and R.Burt Porter. 2006. Individual equity return data from thomson datastream: Handle with care!. Journal of Financial Research 29(4): 463–479.

Jagannathan, Ravi, Ernst Schaumburg, and Guofu Zhou. 2010. Cross-sectional asset pricing tests. Annual Review of Financial Economics 2(1): 49–74.

Jegadeesh, Narasimhan. 1990. Evidence of predictable behavior of security returns. The Journal of Finance 45(3): 881–898.

Jegadeesh, Narasimhan. 1992. Does market risk really explain the size effect? Journal of Financial and Quantitative Analysis 27(03): 337–351.

Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance 48(1): 65–91.

Koch, Stefan, and Christian Westheide. 2012. The conditional relation between Fama-French betas and return. Schmalenbach Business Review 65: 334–358.

Lajili-Jarjir, Souad. 2007. Explaining the cross-section of stock returns in france: Characteristics or risk factors? European Journal of Finance 13(2): 145–158.

Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1994. Contrarian investment, extrapolation, and risk. The Journal of Finance 49(5): 1541–1578.

Lin, Xiaoji, and Lu Zhang. 2013. The investment manifesto. Journal of Monetary Economics 60(3): 351–366.

Merton, Robert C. 1973. An intertemporal capital asset pricing model. Econometrica: Journal of the Econometric Society 867–887.

Rosenberg, Barr, Kenneth Reid, and Ronald Lanstein. 1985. Persuasive evidence of market inefficiency. The Journal of Portfolio Management 11(3): 9–16.

Ross, Stephen A. 1976. The arbitrage theory of capital asset pricing. Journal of Economic Theory 13(3): 341–360.

Schiereck, Dirk, Werner De Bondt, and Martin Weber. 1999. Contrarian and momentum strategies in Germany. Financial Analysts Journal 55(6): 104–116.

Schlag, Christian, and Volker Wohlschieß. Is ß dead? results for the German stock market. Working Paper, University of Karlsruhe, 1997.

Schrimpf, Andreas, Michael Schröder, and Richard Stehle. 2007. Cross-sectional tests of conditional asset pricing models: Evidence from the german stock market. European Financial Management 13(5): 880–907.

Stattman, Dennis. 1980. Book values and stock returns. The Chicago MBA: A Journal of Selected Papers 4(1): 25–45.

Stehle, Richard. 1997. Der size-effekt am deutschen aktienmarkt. Zeitschrift für Bankrecht und Bankwirtschaft 9: 237–260.

Viale, Ariel M., James W. Kolari, and Donald R. Fraser. 2009. Common risk factors in bank stocks. Journal of Banking & Finance 33(3): 464–472.

Wallmeier, Martin. 2000. Determinanten erwarteter renditen am deutschen aktienmarkt-eine empirische untersuchung anhand ausgewählter kennzahlen. Zeitschrift für betriebswirtschaftliche Forschung 52(2): 27–57.

Ziegler, Andreas, Michael Schröder, Anja Schulz, and Richard Stehle. Multifaktormodelle zur erklärung deutscher aktienrenditen: eine empirische analyse. Zeitschrift für betriebswirtschaftliche Forschung, 2007.

Acknowledgments

The authors thank Thomas Gehrig and Engelbert Dockner (editors) and two anonymous referees for their valuable comments. This paper has also benefited from comments from participants at the 76th Annual Meeting of the German Academic Association for Business Research (VHB) and the 4th International Conference of the Financial Engineering and Banking Society (FEBS).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The additional Tables 9, 10, 11 and 12 summarize the results analogously to the Tables 5, 6, 7 and 8, if we do not adjust the returns for characteristics, i.e. if we use the raw returns. The additional evidence confirms our previous results for the German stock market in that the factors SMB, HML and WML are not priced and that the size anomaly is not observable.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Fieberg, C., Varmaz, A. & Poddig, T. Covariances vs. characteristics: what does explain the cross section of the German stock market returns?. Bus Res 9, 27–50 (2016). https://doi.org/10.1007/s40685-016-0029-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40685-016-0029-4