Abstract

Background

High prices of anticancer medicines have increased the economic burden for both patients and health insurance systems. Since 2017, China has implemented national price negotiations for medicines, relying on evidence from health technology assessments. We aim to assess the relation between negotiated price and value of anticancer medicines listed in China’s National Reimbursement Drug List (NRDL).

Methods

For all price-negotiated anticancer medicines and corresponding indications listed in the latest NRDL between 2017 and 2020, we collected their clinical outcomes data, including overall survival (OS) and progression-free survival (PFS), in supporting trials. Pearson correlation coefficient was calculated to estimate the association between the daily cost and clinical benefit of each indication.

Results

In total, 75 indications of 46 branded anticancer medicines were included for analysis. The median daily costs for the anticancer therapies that had gone through negotiation in 2017–2020 were US$87.6, US$71.8, US$58.9, and US$39.7, respectively. For indications supported by randomized trials, no correlation between daily costs and OS and PFS benefit of the price-negotiated cancer therapies was observed (N = 41, r = −0.05, and N = 49, r = 0.04, respectively). For cancer indications newly listed in NRDL in 2020, the association between their daily cost and OS benefit was −0.78 (N = 4, p = 0.221) and 0.01 (N = 8, p = 0.986) before and after the price negotiation.

Conclusion

Though the negotiation policy decreased prices of anticancer medicines in China, no statistically significant correlation was observed between their daily costs and clinical benefits. A more transparent and credible pricing approach needs to be established to promote value-based anticancer medicines and healthcare system efficiency.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The role of cost-effectiveness assessment is to help payers determine the value-based prices of branded medicine. It has been broadly used to regulate prices of expensive anticancer medicines pricing by various health systems. |

Price negotiation based on cost-effectiveness evidence was seen as an effective strategy to curb medicine prices in China. However, the negotiated prices of cancer therapies remained poorly aligned with their efficacy, which is similar to results from other countries. |

The heterogeneity of value frameworks for cancer drugs used in different regions and their failure to reflect true clinical benefits calls for a consistent and rigorous pricing approach worldwide. |

1 Introduction

High prices and increasing costs of anticancer medicines result in heavy financial burdens for patients and health systems [1,2,3,4,5]. Globally, with the increase of newly diagnosed cancer patients and launch of new therapies, the expenditure on oncologic treatments rose to US$164 billion in 2020 and is estimated to reach up to US$260 billion in 2025, representing a 9–12% growth [6]. To improve system efficiencies and access to cancer medicines [7], authorities have deployed various strategies, among which health insurance proved an effective focal point to relieve patients’ financial burden through price-setting [8, 9]. Value-Based Pricing has been proposed as a strategy to price drugs or even indications [10], ideally with price reflecting its benefits [11,12,13].

Previous studies examined correlations between the price of anticancer medicines and their clinical benefits [14]. Overall survival (OS, i.e., the time from randomization to death from any cause) gain, the survival differences between new therapy and the comparator in oncology trials, was commonly recognized as the primary measure of clinical benefit [15]. Literature showed that in the United States, the average wholesale price of anticancer medicines was independent of percentage improvement in OS [16]. In Japan, health insurance drug price was not related to treatment outcomes measured by OS or progression-free survival (PFS, the most commonly used surrogate endpoint in oncology trials, defined as the time from randomization to tumor progression or death) [17]. In an evaluation that spanned five countries, costs for new anticancer medicines wereonly weakly associated with their summarized clinical benefits measure based on OS, quality of life and safety [18,19,20]. Despite incorporating cost-effectiveness analysis into price regulations, the negotiated price of anticancer medicines in Italy did not reflect their OS benefit [21].

China’s cancer drug spending has more than doubled in the past 5 years, mainly driven by existing branded medicines (i.e. patented originator medicines) [6]. To temper growing costs and improve the affordability of anticancer medicines, the Chinese government has implemented centralized price negotiation since 2017 [22, 23]. Taking a value-based pricing approach that required evidence of comparative outcomes and budget impact analyses, medicine price negotiation was a criterion for inclusion in the National Reimbursement Drug List (NRDL) [24]. The policy was reported to have reduced drug prices by half [22], yet little is known about the relation between anticancer medicines’ clinical benefit and their negotiated prices in China. Therefore, in this paper, we assess the correlation between the daily cost and clinical benefit of anticancer therapies listed in the NRDL through national price negotiations between 2017 and 2020. Using price-negotiated anticancer medicines in 2020, we further investigate whether the negotiation led to better alignment of anticancer therapy prices and their benefits.

2 Methods

2.1 Sample Identification

Using publicly available NRDL issued by the National Health Security Administration, we constructed a dataset of price-negotiated anticancer medicine–indication pairs (i.e., cancer therapies) between 2017 and 2020 [25,26,27,28]. We reviewed the latest labels posted on the China National Medical Product Administration or manufacturer’s official website and excluded medicines only for adjuvant or neoadjuvant therapy, cancer supportive care, and pediatric use. Medicines without a ‘Clinical Trials’ section in their labels were also excluded. For price-negotiated anticancer medicines indicated for malignancies and non-malignant tumors, their indications listed in the NRDL for malignancies were included in the analysis [25,26,27,28]. The study was considered not to be human subjects research by the institutional review board of Peking University.

2.2 Daily Costs Calculation

According to the national negotiation policy, after policy implementation, public hospitals in China can purchase anticancer medicines on provincial platforms of medical product procurement at national negotiated prices. As negotiated prices were mandated to be implemented nationwide since March 1, 2021, we collected negotiated prices of all authorized doses for each branded medicine from Beijing Medicine Sunshine Purchasing, the official hospital procurement website run by Beijing municipality, China [29, 30]. When the website indicated that price was “subject to hospital pricing”, we obtained data from the website for drug price inquiries of Peking University-affiliated hospitals [31,32,33]. All prices were collected on February 1, 2021 and on April 1, 2021, one month before and after the policy implementation [28].

We calculated the daily cost of each cancer therapy based on negotiated price and dosage regimens recommended in the latest approved label. For treatment doses determined by weight or body surface area, we assumed an average adult patient weighing 70 kg with a body surface area of 1.70 m2 [34, 35]. For therapies administered on specific days in a treatment cycle, we calculated the average daily dose in one cycle. A dose was classified as a maintenance dose when there was an initial dose as well as maintenance doses in a treatment cycle. For medicines with multiple approved doses (e.g., 5 mg per pill and 1 mg per pill; 250 mg per capsule and 200 mg per capsule), we applied the dosage with the lowest costs per unit, in line with the previous study [36]. All prices were converted into and reported in US dollars (US$) using the exchange rate on March 1, 2021 (US$1 = 6.4754 CNY) [37].

2.3 Clinical Outcome Extraction

To assess the clinical outcome of sample indications, we collected results of their supporting clinical trials disclosed in the latest product label obtained from the publicly available data provided by the Centre for Drug Evaluation, National Medical Products Administration [38, 39], When a cancer therapy has multiple trials disclosed, we selected studies of the Chinese or Asian population for data extraction. Phase III studies were preferred when there was more than one pre-marketing study. When more than one trial meets the aforementioned criteria, we focused on the best treatment outcome, in concordance with previous research [36]. When the efficacy data of an indication was not fully disclosed in the label, we extracted its clinical outcome data from peer-reviewed publications of the trials. Using trial name and registration number, we searched PubMed for publications reporting original results of each study published before March 1, 2021. Two investigators (Y.C. and Y.G.) independently reviewed the title and abstract of all records to identify publications reporting trial results and brought disagreements to another investigator (Y. Z.) for settlement.

For therapies supported by randomized controlled trials (RCTs), we extracted median OS and median PFS of the treatment and comparison groups. We then calculated OS and PFS gains in percentage given by differences in median OS and PFS between the two groups as the measure of clinical benefits. As for indications approved based on single-arm trials, we extracted objective response rate (ORR, endpoint in single-arm cancer trials acknowledged by authorization agencies, defined as the percentage of patients who have complete response or partial response) from the treatment arm [15].

2.4 Data Analysis and Sensitivity Analysis

To evaluate the correlation between price and clinical benefit of sample cancer therapies, we estimated Pearson correlation coefficients using their daily cost and relative OS or PFS benefit. For indications supported by single-arm trials only, we evaluated the relation between costs and ORR. Subgroup analyses were performed for the most common type of solid tumor (lung cancer) and blood cancer (lymphoma) in our dataset [40].

To test the robustness of results, we varied the identified efficacy sizes or measures in different scenarios. In the first scenario, we removed data with the 5% highest and lowest clinical benefits and estimated the correlation between daily cost and clinical outcome of the remaining 90% of samples. In the second scenario, we replaced clinical benefit data with quality-adjusted life-years (QALY) data obtained from cost-effectiveness analysis. For each cancer drug, we searched its generic name in combination with ‘QALY’ in PubMed, CNKI, and WanFang databases on May 21, 2021. QALYs for the Chinese or Asian population in specific therapies were identified for analysis.

All statistical analyses were performed in Microsoft Excel for plots using ordinary least squares linear regression. Software STATA/MP 14.0 was also used for coefficient estimation, with two-side p < 0.05 as the statistically significant threshold.

3 Results

3.1 Characteristics of Sample Anticancer Medicines and Indications

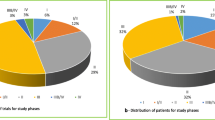

Between 2017 and 2020, 53 anticancer medicines were incorporated into NRDL after price negotiation, including two medicines rejected by the NRDL in the subsequent negotiation. Among them, three were not for adult malignancy therapeutic use; one did not disclose clinical trials in their label; and one did not have a procurement record in Beijing. We finally included 46 anticancer medicines corresponding to 75 indications for data analysis (see eFig. 1 for the detailed procedure in the electronic supplementary material [ESM]). Of all sample medicines, 27 (58.7%) launched in China after 2017 (Table 1). For the 75 indications, the most common malignancies were lung cancer (n = 16, 21.3%) and lymphoma (n = 13, 17.3%). According to clinical trials described in their product labels, 58 indications (77.3%) were supported by at least one RCT, while 17 (22.7%) others only presented results from single-arm trials (eFig. 1, see ESM).

Overall, the median daily costs of all sample indications were US$61.2, ranging from US$12.5 to US$281.6 (see eTable 1 in the ESM for further detail) after price negotiation. The price of six medicines varied by indication due to multiple recommended regimens. Stratified by year of initial price negotiation, the median daily costs for the anticancer therapies that went through negotiation in 2017–2020 were US$87.6, US$71.8, US$58.9, and US$39.7, respectively (eFig. 2).

3.2 Correlation Between Daily Cost and Clinical Outcome

Of the 58 cancer therapies supported by RCTs, 41 indications (70.7%) have mature OS data and 49 (84.5%) have PFS data available. OS gain of the 41 therapies ranged from − 16.2 to 63.3% and improvement in PFS of the 49 therapies ranged from 0 to 485.7%. No correlation was observed between either OS or PFS gain and daily costs, with a Pearson correlation coefficient of − 0.05 (p = 0.767) and 0.04 (p = 0.808), respectively. For the 17 therapies supported only by single-arm trials, we found no relation between their ORR and daily costs (r = 0.00, p = 0.998, Fig. 1).

For 12 medicines that first went through price negotiation in 2020, 17 indications were listed in the latest NRDL, with nine (52.9%) indications supported by RCTs and the other eight by single-arm trials. Of the therapies supported by RCTs, four (44.4%) and seven (77.8%) indications have matured OS and PFS data reported in their latest label, respectively. Fig. 2 illustrates the relation between cancer therapy daily costs before and after policy implementation and their OS, PFS gain, and ORR. The incremental cost per PFS gain decreased considerably from US$59.4/∆PFS% pre-negotiation to US$12.7/∆PFS% after policy implementation, though no correlation was observed between costs and survival gain (all p > 0.05). For therapies supported by single-arm trials, the Pearson correlation coefficient between their daily costs and ORR was 0.313 pre- (p = 0.450) and 0.667 (p = 0.071) post-negotiation.

3.3 Subgroup Analysis

The same analyses were performed for indications for lung cancer and lymphoma in China and we observed no significant correlation between daily costs and clinical benefit (see Fig. 3). Among 16 lung cancer therapies, 13 were supported by RCTs and the correlation coefficients between their daily costs and OS or PFS gain were − 0.20 (p = 0.578) and −0.17 (p = 0.583), respectively. For 13 lymphoma therapies, nine were authorized based on single-arm trials. No relation between their cost and ORR was observed (r = − 0.56, p = 0.11, Fig. 3).

3.4 Sensitivity Analysis

Results of sensitivity analyses showed our findings were robust in different scenarios. When removing the 5% samples showing the most and least clinical benefits, there was no relation between daily costs and OS or PFS gain of the remaining cancer therapies (all p > 0.05, eFig. 3, see ESM). In scenario 2, among 230 English publications and 31 Chinese publications involving sample medicines and their QALY benefits, we identified 19 cost-effectiveness analysis studies for 23 sample therapies in a Chinese or Asian population. These treatments yielded a median of 1.80 QALYs, ranging from 0.44 to 9.72 QALYs. No correlation was observed between anticancer therapy daily costs and their QALYs (r = −0.14, p = 0.533, eFig. 4 see ESM).

4 Discussion

4.1 Summary of Main Findings

Between 2017 and 2020, 53 anticancer medicines were listed in China’s NRDL after price negotiation. In this study, we found no statistically significant correlation between the negotiated price of sample anticancer therapies and their clinical benefits measured by OS, PFS, and ORR gain in China. No correlation between medicine prices and clinical benefit was observed even after controlling for specific cancer sites and negotiation policy implementation.

4.2 Comparison with Other Studies

The past decade witnessed great efforts in regulating anticancer medicines pricing by various health systems [8]. The association between treatment costs and clinical effects, however, varied across countries [1, 18, 41]. To the best of our knowledge, this is the first study investigating the correlation between negotiated price and the clinical benefit of cancer therapies in China. We found no association between daily costs and clinical efficacy of anticancer medicines listed in NRDL, which is similar to results from other countries [17, 21]. Multiple frameworks have been developed to quantify cancer therapies’ clinical values due to the high-price of new anticancer medicines. However, concerns are raised worldwide about aligning price with values, especially for expensive anticancer medicines [42]. Based on survival gains, the American Society of Clinical Oncology–Value Framework and the European Society for Medical Oncology–Magnitude of Clinical Benefit Scale were used to quantifyclinically meaningful benefits [36, 43]. Other weighted methods incorporating considerations of safety and unmet medical needs were also developed to facilitate the delivery of affordable cancer care [18, 44]. Despite varying approaches to value measurement, the association between prices and value of anticancer medicines, regardless of an innovation in mechanism or superior trial outcomes, appeared weak [16, 17, 45]. The heterogeneity of value frameworks for anticancer medicines used in different regions and their failure to reflect true clinical benefits call for a consistent and rigorous pricing approach worldwide [46,47,48,49].

4.3 Policy Implications

Price negotiation based on cost-effectiveness evidence was seen as an effective strategy for curbing medicine prices in China. Besides, increasing pricing transparency for anticancer medicines in China also played an important role in addressing the heterogeneity of medicine prices between provinces and enhancing the sustainability of the healthcare systems [50, 51]. Since 2017, new anticancer medicines were listed in NRDL simultaneously with each round of annual centralized price negotiation. Compared with treatment costs before policy implementation, drug prices dropped sharply, leading to increased affordability of expensive cancer therapies [22]. Though health technology assessments were a key aspect during NRDL negotiations, our results showed no association between daily costs of cancer treatment and their QALY, an essential factor in technical assessments supporting decisions in setting reimbursement and pricing [52].

China’s government has strong bargaining power and plays a decisive role in price negotiations and achieving favorable prices for health systems [24]. Manufacturers would thus strategically bid with low prices in order to be considered by NRDL and to secure a market share. However, value-based pricing in China remained ambiguous due to non-transparent decision making [23]. This implies that the Chinese healthcare system would pay more money for the same effectiveness, which is counterproductive with the price negotiation policy. Besides, our study showed that negotiated daily costs tended to concentrate within a specific numerical range, likely reflective of the ‘willingness to set’ of the National Healthcare Security Administration, instead of the drugs’ clinical value. Though no association was observed between anticancer medicine prices and their clinical outcomes, some disproportionately low negotiated prices were concerning due to questions on sustainability and their impacts on future drug innovations [53]. A more transparent and credible health technology assessment should be established and implemented to optimize value-based anticancer medicine pricing in China [54].

4.4 Limitations

This study has several limitations. First, price data was obtained from the Beijing Medicine Sunshine Purchasing website rather than from provinces implementing the negotiated prices. However, as negotiated prices were mandated to be implemented alike and nationwide, price should reflect prices in local implementation. Second, best practices to evaluate the value of anticancer medicines remain ambiguous and we only used OS, PFS, and ORR gain to measure the direct clinical outcomes of cancer therapies. This might have led to some biases. Third, we only extracted data from oncology trials in a Chinese or Asian population. These results may differ from international multicenter trials. Fourth, due to limited data accessibility, we only compared the association between daily costs and clinical benefits of price-negotiated anticancer medicines listed in NRDL in 2020. Further study is needed to evaluate the impacts of various rounds of negotiation on the alignment of medicine price and clinical outcomes.

5 Conclusions

No correlation between clinical benefit and costs of China’s price-negotiated cancer therapies was observed, despite the national price negotiation policy decreasing prices of anticancer medicines. As China expects an increasing number of new anticancer medicines to be launched in the near future, a more transparent and credible pricing approach needs to be established to promote value-based anticancer medicines and healthcare system efficiency.

References

Vokinger KN, Hwang TJ, Daniore P, et al. Analysis of launch and postapproval cancer drug pricing, clinical benefit, and policy implications in the US and Europe. JAMA Oncol. 2021;7(9):e212026. https://doi.org/10.1001/jamaoncol.2021.2026.

Prasad V, De Jesús K, Mailankody S. The high price of anticancer drugs: origins, implications, barriers, solutions. Nat Rev Clin Oncol. 2017;14(6):381–90. https://doi.org/10.1038/nrclinonc.2017.31.

Vogler S, Vitry A, Babar ZU. Cancer drugs in 16 European countries, Australia, and New Zealand: a cross-country price comparison study. Lancet Oncol. 2016;17(1):39–47. https://doi.org/10.1016/s1470-2045(15)00449-0.

Savage P, Mahmoud S, Patel Y, Kantarjian H. Cancer drugs: an international comparison of postlicensing price inflation. J Oncol Pract. 2017;13(6):e538–42. https://doi.org/10.1200/jop.2016.014431.

Hofmarcher T, Brådvik G, Svedman C, Lindgren P, Jönsson B, Wilking N. Comparator report on cancer in Europe 2019—disease burden, costs and access to medicines. https://ihe.se/en/publicering/comparator-report-on-cancer-in-europe-2019/. Accessed 1 May 2022.

IQVIA. Global Oncology Trends 2021. 2021. https://www.iqvia.com/insights/the-iqvia-institute/reports/global-oncology-trends-2021

Cortes J, Perez-García JM, Llombart-Cussac A, et al. Enhancing global access to cancer medicines. CA Cancer J Clin. 2020;70(2):105–24. https://doi.org/10.3322/caac.21597.

World Health O. Technical report: pricing of cancer medicines and its impacts: a comprehensive technical report for the World Health Assembly Resolution 70.12: operative paragraph 2.9 on pricing approaches and their impacts on availability and affordability of medicines for the prevention and treatment of cancer. World Health Organization; 2018.

Godman B, Hill A, Simoens S, et al. Potential approaches for the pricing of cancer medicines across Europe to enhance the sustainability of healthcare systems and the implications. Expert Rev Pharmacoecon Outcomes Res. 2021;21(4):527–40. https://doi.org/10.1080/14737167.2021.1884546.

Bach PB. Indication-specific pricing for cancer drugs. JAMA. 2014;312(16):1629–30. https://doi.org/10.1001/jama.2014.13235.

Robinson JC, Howell S, Pearson SD. Value-based pricing and patient access for specialty drugs. JAMA. 2018;319(21):2169–70. https://doi.org/10.1001/jama.2018.5367.

Broder MS, Ortendahl JD. Defining value-based pricing of drugs. JAMA. 2018;320(16):1710. https://doi.org/10.1001/jama.2018.11808.

Augustovski F, McClellan MB. Current policy and practice for value-based pricing. Value Health. 2019;22(6s):S4-s6. https://doi.org/10.1016/j.jval.2019.04.1918.

Howard DH, Bach PB, Berndt ER, Conti RM. Pricing in the market for anticancer drugs. J Econ Perspect. 2015;29(1):139–62. https://doi.org/10.1257/jep.29.1.139.

Wilson MK, Karakasis K, Oza AM. Outcomes and endpoints in trials of cancer treatment: the past, present, and future. Lancet Oncol. 2015;16(1):e32-42. https://doi.org/10.1016/s1470-2045(14)70375-4.

Mailankody S, Prasad V. Five years of cancer drug approvals: innovation, efficacy, and costs. JAMA Oncol. 2015;1(4):539–40. https://doi.org/10.1001/jamaoncol.2015.0373.

Satoh E, Sasaki Y, Ohkuma R, et al. Lack of correlation between the costs of anticancer drugs and clinical benefits in Japan. Cancer Sci. 2018;109(12):3896–901. https://doi.org/10.1111/cas.13831.

Salas-Vega S, Shearer E, Mossialos E. Relationship between costs and clinical benefits of new cancer medicines in Australia, France, the UK, and the US. Soc Sci Med. 2020;258: 113042. https://doi.org/10.1016/j.socscimed.2020.113042.

Cohen D. Cancer drugs: high price, uncertain value. BMJ. 2017;359:j4543. https://doi.org/10.1136/bmj.j4543.

Haycox A. Why cancer? Pharmacoeconomics. 2016;34(7):625–7. https://doi.org/10.1007/s40273-016-0413-0.

Trotta F, Mayer F, Barone-Adesi F, et al. Anticancer drug prices and clinical outcomes: a cross-sectional study in Italy. BMJ Open. 2019;9(12):e033728. https://doi.org/10.1136/bmjopen-2019-033728.

Zhang Y, Wushouer H, Han S, et al. The impacts of government reimbursement negotiation on targeted anticancer medication price, volume and spending in China. BMJ Glob Health. 2021. https://doi.org/10.1136/bmjgh-2021-006196.

Tang M, Song P, He J. Progress on drug pricing negotiations in China. Biosci Trends. 2020;13(6):464–8. https://doi.org/10.5582/bst.2019.01339.

Si L, Xu L, Chen M, Jan S. Using strategic price negotiations to contain costs and expand access to medicines in China. BMJ Glob Health. 2020;5(1): e002256. https://doi.org/10.1136/bmjgh-2019-002256.

Ministry of Human Resources and Social Security. Notice of the ministry of human resources and social security on issuing the national drug catalog for basic medical insurance, work- related injury insurance, and maternity insurance. 2021. http://www.mohrss.gov.cn/SYrlzyhshbzb/shehuibaozhang/zcwj/yiliao/201707/t20170718_274153.html

National Healthcare Security Administration. Notice on including 17 anticancer medicines in "national basic medical insurance, work-related injury insurance and childbirth insurance medicine list (Category B)". http://www.nhsa.gov.cn/art/2018/10/10/art_37_1057.html

National Healthcare Security Administration. Notice on Including Year 2019 Negotiated Medicines in "National Basic Medical Insurance, Work-related Injury Insurance and Childbirth Insurance Medicine List (Category B)". 2021. http://www.nhsa.gov.cn/art/2019/11/28/art_38_2056.html

National Healthcare Security Administration. Notice on issuing the national drug catalog for basic medical insurance, work-related injury insurance, and maternity insurance (2020 edition). 2021. http://www.nhsa.gov.cn/art/2020/12/28/art_37_4220.html

Beijing Medicine Sunshine Purchasing. https://yp.bjmbc.org.cn/view/index/guide.html. Accessed 1 Apr 2021.

Beijing Medical Insurance Public Service. https://fw.ybj.beijing.gov.cn/hallEnter/#/serviceGuidelines. Accessed 1 May 2022.

Beijing Cancer Hospital. 2021. https://www.bjcancer.org

Peking University First Hospital. 2021. https://www.pkuph.cn/sufferer_services.html

Peking University Third Hospital. 2021. http://www.puh3.net.cn

Ratain MJ. Body-surface area as a basis for dosing of anticancer agents: science, myth, or habit? J Clin Oncol. 1998;16(7):2297–8. https://doi.org/10.1200/jco.1998.16.7.2297.

World Health Organization Collaborating Centre for Drug Statistics Methodology. Definition and general considerations of the defined daily dose. 2021. https://www.whocc.no/ddd/definition_and_general_considera/

Vokinger KN, Hwang TJ, Grischott T, et al. Prices and clinical benefit of cancer drugs in the USA and Europe: a cost-benefit analysis. Lancet Oncol. 2020;21(5):664–70. https://doi.org/10.1016/s1470-2045(20)30139-x.

Husereau D, Drummond M, Augustovski F, et al. Consolidated health economic evaluation reporting standards (CHEERS 2022) statement: updated reporting guidance for health economic evaluations. Pharmacoeconomics. 2022. https://doi.org/10.1007/s40273-021-01112-8.

Centre for Drug Evaluation NMPA. Launched drug information. https://www.cde.org.cn/main/xxgk/listpage/b40868b5e21c038a6aa8b4319d21b07d. Accessed 1 May 2022.

Centre for Drug Evaluation NMPA. List of launched drugs in China. https://www.cde.org.cn/hymlj/index. Accessed 1 May 2022

Chen W, Zheng R, Baade PD, et al. Cancer statistics in China, 2015. CA Cancer J Clin. 2016;66(2):115–32. https://doi.org/10.3322/caac.21338.

Lauenroth VD, Kesselheim AS, Sarpatwari A, Stern AD. Lessons from the impact of price regulation on the pricing of anticancer drugs in Germany. Health Aff (Millwood). 2020;39(7):1185–93. https://doi.org/10.1377/hlthaff.2019.01122.

Kaltenboeck A, Bach PB. Value-based pricing for drugs: theme and variations. JAMA. 2018;319(21):2165–6. https://doi.org/10.1001/jama.2018.4871.

Jiang DM, Chan KKW, Jang RW, et al. Anticancer drugs approved by the Food and Drug Administration for gastrointestinal malignancies: clinical benefit and price considerations. Cancer Med. 2019;8(4):1584–93. https://doi.org/10.1002/cam4.2058.

Ezeife DA, Dionne F, Fares AF, et al. Value assessment of oncology drugs using a weighted criterion-based approach. Cancer. 2020;126(7):1530–40. https://doi.org/10.1002/cncr.32639.

Rodwin MA, Mancini J, Duran S, et al. The use of “added benefit” to determine the price of new anti-cancer drugs in France, 2004–2017. Eur J Cancer. 2021;145:11–8. https://doi.org/10.1016/j.ejca.2020.11.031.

Drummond M, de Pouvourville G, Jones E, Haig J, Saba G, Cawston H. A comparative analysis of two contrasting European approaches for rewarding the value added by drugs for cancer: England versus France. Pharmacoeconomics. 2014;32(5):509–20. https://doi.org/10.1007/s40273-014-0144-z.

Cheng S, McDonald EJ, Cheung MC, et al. Do the American Society of Clinical Oncology Value framework and the European society of medical oncology magnitude of clinical benefit scale measure the same construct of clinical benefit? J Clin Oncol. 2017;35(24):2764–71. https://doi.org/10.1200/jco.2016.71.6894.

Shah-Manek B, Galanto JS, Nguyen H, Ignoffo R. Value frameworks for the patient-provider interaction: a comparison of the ASCO value framework versus NCCN evidence blocks in determining value in oncology. J Manag Care Spec Pharm. 2017;23(6-a Suppl):S13-s20. https://doi.org/10.18553/jmcp.2017.23.6-a.s13.

Saluja R, Everest L, Cheng S, Cheung M, Chan KKW. Assessment of whether the American Society of Clinical Oncology’s value framework and the European Society for Medical Oncology’s magnitude of clinical benefit scale measure absolute or relative clinical survival benefit: an analysis of randomized clinical trials. JAMA Oncol. 2019;5(8):1188–94. https://doi.org/10.1001/jamaoncol.2019.0818.

Godman B, Hill A, Simoens S, et al. Pricing of oral generic cancer medicines in 25 European countries; fi ndings and implications. GaBI J. 2019;8(2):49–70. https://doi.org/10.5639/gabij.2019.0802.007.

Hasan SS, Kow CS, Dawoud D, Mohamed O, Baines D, Babar ZU. Pharmaceutical policy reforms to regulate drug prices in the Asia Pacific region: the case of Australia, China, India, Malaysia, New Zealand, and South Korea. Value Health Reg Issues. 2019;18:18–23. https://doi.org/10.1016/j.vhri.2018.08.007.

MacKillop E, Sheard S. Quantifying life: understanding the history of quality-adjusted life-years (QALYs). Soc Sci Med. 2018;211:359–66. https://doi.org/10.1016/j.socscimed.2018.07.004.

Franzen N, Retèl VP, Schats W, van Harten WH. Evidence underlying policy proposals for sustainable anticancer drug prices: a systematic review. JAMA Oncol. 2020;6(6):909–16. https://doi.org/10.1001/jamaoncol.2019.6846.

Bach PB, Pearson SD. Payer and policy maker steps to support value-based pricing for drugs. JAMA. 2015;314(23):2503–4. https://doi.org/10.1001/jama.2015.16843.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

Dr Guan reported receiving grants from Research on Equitable Access and Rational Use of Medicines sponsored by Peking University Health Science Center during the study. The funding organization had no role in the design and conduct of the study; collection, management, analysis, and interpretation of the data; preparation, review, or approval of the manuscript; and decision to submit the manuscript for publication.

Competing interest

The authors declare that there are no competing interests.

Ethical approval

Not required.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Availability of data and material

All datasets presented in this study are included in the article/Supplementary Material.

Code availability

Not applicable.

Data sharing

The corresponding author had full access to all the data in the study and had final responsibility for the decision to submit for publication.

Author contribution statement

YZ and XG conceptualized and designed the study. YC and RY collected and rechecked the data. YW conducted the data analysis. YZ drafted the manuscript. XG and HL provided critical revision of the manuscript. LS supervised the study and provided administrative support.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Zhang, Y., Wei, Y., Li, H. et al. Prices and Clinical Benefit of National Price-Negotiated Anticancer Medicines in China. PharmacoEconomics 40, 715–724 (2022). https://doi.org/10.1007/s40273-022-01161-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-022-01161-7