Abstract

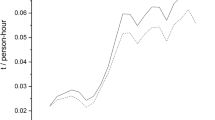

In this paper, we explore the relationship between refined and scrap copper prices, considering the possibility that this relationship may vary across various products and over time. Building upon the conjecture put forth by Phillip Crowson (Miner Econ 24(1):1-6, 2011), here referred to as the Crowson Conjecture, our study aims to investigate how the substitution between refined copper and copper scrap No. 1 and No. 2 can impact the prices of each other. To achieve this, we develop a theoretical model that allows us to understand the potential influence of substitution between refined copper and copper scrap No. 1 and No. 2 during different time periods. Additionally, we conduct an empirical test using monthly time series data spanning from January 2004 to June 2022, analyzing structural breaks in these prices. Our empirical analysis successfully identifies three distinct structural breaks: January 2004 to August 2009, September 2009 to July 2017, and August 2017 to June 2022. These breaks serve as critical time periods for measuring Granger causality between the examined prices. Interestingly, our findings indicate that the causal relationships between the refined and scrap copper prices change throughout these three analyzed breaks, providing evidence in support of Crowson Conjecture. By shedding light on the evolving nature of the relationship between refined and scrap copper prices, our study contributes to a deeper understanding of the dynamics within the copper market. These insights have implications for market participants and policymakers, enabling them to make more informed decisions regarding pricing and resource allocation strategies.

Similar content being viewed by others

Notes

It contains a minimum of 61.3% copper and a maximum of 5% iron and is made up of tin and bronze solids and chips, and alloyed and contaminated copper scrap (ISRI 2021).

There are various reasons why inertia could exist in the inverse demand function. In particular, this could be caused by the presence of inventories in the market (Williams and Wright 1991). The presence of inventories is indeed the case for refined copper (due to the presence of metal markets such as the London Metal Exchange, Shanghai, and COMEX) as well as No. 1 and No. 2 scrap copper (in this case, there are no specialized markets, but producers and consumers have private inventories). Despite this, we have decided to not explicitly model the existence of inventories in this result, so as to keep the mathematics as simple as possible, in order to demonstrate that the Crowson Conjecture is theoretically feasible and, in fact, very likely.

This condition is equivalent to requiring that the linear algebra system described below (system of equations (4)) has a non-negative determinant to ensure the existence and uniqueness of the solution.

It has been implicitly assumed that the equilibrium conditions are satisfied over the whole time period, particularly not only in t but also in t − 1.

Applying a structural break test for causality would be preferable for testing the Strong Crowson Conjecture, which, according to the authors’ knowledge, is an econometric tool that has not yet been developed. It goes without saying that having this tool could have multiple applications, not only in this case but also in different studies of interest for economics.

The Granger causality test assumes that the relevant information for predicting the respective variables analyzed is only contained in the time series information of these variables (Bhatia et al. 2018).

The null hypothesis in the Granger causality test indicates the non-existence of causality between the variables studied.

Because all the three series present a strong correlation in this period (i.e., they are parallel to a large extend), the lack of causality suggests that they all depend possibly on the same external shocks.

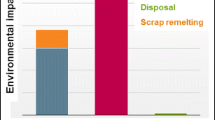

On August 29, 2008, the “Law to Promote the Circular Economy of the Popular Republic of China” was approved in the fourth session of the Xi National Popular Assembly. This is the first law of the Chinese government about the recycling industry, and it began to be implemented in 2009. The Ministry of Finance and State Tax Administration issued a new policy on adjusting VAT policy for the recovery and use of renewable resources. It meant that the VAT for recycling companies rose from 10% or VAT-exempt to 17%. The new policy was applied in 2009, reducing the recyclers’ profitability and the supply of scrap copper in 2009 (ICSG 2018).

References

Aruga K, Managi S (2011) Price linkages in the copper futures, primary, and scrap markets. Resour Conserv Recycl 56(1):43–47

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(1):47–78

Bhatia V, Das D, Tiwari AK, Shahbaz M, Hasim HM (2018) Do precious metal spot prices influence each other? Evidence from a nonparametric causality-in- quantiles approach. Res Policy 55(9):244–252

Bischofberger J (2020) Cross-hedging copper scrap: an examination of the optimal hedge ratio and market price determinants. Bachelor thesis. School of Management and Law, ZHAW Zurich University of Applied Sciences

Bonnin M, Azzaro-Pantel C, Domenech S, Villeneuve J (2015) Multicriteria optimization of copper scrap management strategy. Resour Conserv Recycl 99:48–62

Brabenec T, Montag J (2018) Criminals and the price system: evidence from Czech metal thieves. J Quant Criminol 34(2):397–430

Chilean Copper Commission (COCHILCO), 2019. Metal prices. https://www.cochilco.cl . Accessed 5 Feb 2022.

Crowson PC (1988) Aspects of copper supplies for the 1990s. Res Policy 14(1):29–37

Crowson PCF (2011) Mineral reserves and future minerals availability. Miner Econ 24(1):1–6

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10(1):20–32

Fisher LA, Owen AD (1981) An economic model of the US aluminum market. Res Policy 7(3):150–160

Fleming NR (2011) Metal price volatility: a study of informative metrics and the volatility mitigating effects of recycling. Doctoral dissertation Massachusetts Institute of Technology

Fu X, Ueland SM, Olivetti E (2017) Econometric modeling of recycled copper supply. Resour Conserv Recycl 122:219–226

Gómez F, Guzmán JI, Tilton JE (2007) Copper recycling and scrap availability. Res Policy 32(4):183–190

Granger CWJ (1969) Investigating causal relations by econometric models and cross spectral methods. Econometrica 37(3):424–438

Hamilton JD (1994) Time series analysis. Princeton University press, Princeton

Institute of Scrap Recycling Industries (ISRI) (2021) Scrap specifications circular. ISRI, Inc., Washington, DC 20005-5903, 70

International Copper Study Group (ICSG) (2010) ICSG Global Copper Scrap Research Project Final Report and Statistical Annex. ICSG (Available from: https://www.icsg.org. Accessed 5 Feb 2022 )

International Copper Study Group (ICSG) (2018) Annual Recyclables Survey 2018. ICSG Available from: https://www.icsg.org . Accessed 5 Feb 2022

International Copper Study Group (ICSG) (2020) The world copper Factbook 2020. ICSG Available at: https://www.icsg.org . Accessed 5 Feb 2022

Jaunky VC (2013) A cointegration and causality analysis of copper consumption and economic growth in rich countries. Res Policy 38(4):628–639

Keković G, Sekulić S (2019) Detection of change points in time series with moving average filters and wavelet transform: application to EEG signals. Neurophysiology 51:2–8

Labys WC, Kaboudan M (1980) A short run disequilibrium model of the copper market (No. 16). Department Working Paper

Lei Y, Cui N, Pan D (2013) Economic and social effects analysis of mineral development in China and policy implications. Res Policy 38:448457

Lütkepohl H (2005) New introduction to multiple time series analysis. Springer Science & Business Media

Radetzki M, Eggert RG, Lagos G, Lima M, Tilton JE (2008) The boom in mineral markets: how long might it last? Res Policy 33(2):125–128

Rivera N, Guzmán JI, Jara JJ, Lagos G (2021) Evaluation of econometric models of secondary refined copper supply. Res Policy 73:102170

Samuelsson C, Björkman B (2014) Copper recycling. In: Handbook of recycling. Elsevier, pp 85–94

Sidebottom A, Ashby M, Johnson SD (2014) Copper cable theft: revisiting the price–theft hypothesis. J Res Crime Delinq 51(5):684–700

Slade ME (1980a) An econometric model of the US secondary copper industry recycling versus disposal. J Environ Econ Manag 7:123–141

Slade ME (1980b) The effects of higher energy prices and declining ore quality - copper-aluminium substitution and recycling in the US. Res Policy 6:223–239

Slade ME (1988) Pricing of metals (Vol. 22). Kingston, Ont.: Centre for Resource Studies. Queen’s University

Stollery KR (1983) Secondary supply of copper and ferrous metals and Canadian metal markets, Centre for Resource Studies, technical paper no. 3. Queens University, Kingston

Talbi M, De Peretti C, Belkacem L (2020) Dynamics and causality in distribution between spot and future precious metals: a copula approach. Res Policy 66:101645

Taylor CA (1979) A quarterly domestic copper industry model. Rev Econ Stat 61(3):410–422

Tilton JE (2018) Assessing the market power of mineral commodity producers. Miner Econ 31(1):71–76

Tilton JE, Guzmán JI (2016) Mineral economics and policy. Routledge

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1-2):225–250

U.S. Bureau of Labor Statistics, 2022. Producer Price Index for All Commodities [PPIACO]. Retrieved from FRED, Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/series/PPIACO. Accessed 02.05.2022.

Williams JC, Wright BD (1991) Storage and commodity markets. Cambridge University Press

Xiarchos IM, Fletcher JJ (2009) Price and volatility transmission between primary and scrap metal markets. Resour Conserv Recycl 53(12):664–673

Zhang L, Cai Z, Yang J, Yuan Z, Chen Y (2015) The future of copper in China A perspective based on analysis of copper flows and stocks. Sci Total Environ 536:142–149

Acknowledgements

We thank Cristian Foix Castillo from CODELCO for providing the No. 1 and No. 2 scrap copper price data. We also thank the reviewers for their valuable feedback and comments.

Funding

The authors did not receive support from any organization for the submitted work.

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Author information

Authors and Affiliations

Contributions

Category 1Conception and design of study:Nilza Rivera and Juan Ignacio Guzmán.

Acquisition of data:Nilza Rivera and Juan Ignacio Guzmán.

Analysis and/or interpretation of data:Nilza Rivera and Juan Ignacio Guzmán.

Category 2Drafting the manuscript:Nilza Rivera and Juan Ignacio Guzmán.

Revising the manuscript critically for important intellectual content:Nilza Rivera and Juan Ignacio Guzmán.

Category 3Approval of the version of the manuscript to be published:Nilza Rivera and Juan Ignacio Guzmán.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rivera, N., Guzmán, J.I. Dynamic relationship between refined and scrap copper prices. Miner Econ (2023). https://doi.org/10.1007/s13563-023-00401-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13563-023-00401-2