Abstract

The Solvency II directive has introduced a specific so-called risk-neutral framework to valuate economic accounting quantities throughout European life insurance companies. The adaptation of this theoretical notion for regulatory purposes requires the addition of a specific criterion, namely market-consistency, in order to objectify the choice of the valuation probability measure. This paper points out and fixes some of the major risk sources embedded in the current regulatory life insurance valuation scheme. We compare actuarial and financial valuation schemes. We then first address operational issues and potential market manipulation sources in life insurance, induced by both theoretical and regulatory pitfalls. For example, we show that the economic own funds of a representative French life insurance company can vary by almost 140%, as already observed by market practitioners, when the interest rate model is calibrated in October or on the 31st of December. We then propose various modifications of the current implementation, including a first product-specific valuation scheme, to limit the impact of these market-inconsistencies.

Similar content being viewed by others

Notes

In reality this is an insurance-specific use of the LIBOR Market Model. In particular it is calibrated in a standardized market fashion but the parameters of the calibration date are used for 30–60 years projections. This model is not adapted to such simulations, its first objective being to project the LIBOR forward yield on very short horizons (a few days) for hedging and not to project zero-coupon curves on very long term horizon. For this reason, we denote this model, in its insurance version, by \(LMM_{ins}\) below. The reader may consult the Appendix for further information on this model use and calibration.

See [16] for developments and justification of such treatments, used to formalize, in practice, the idea of “relevant risk-free interest rates term structure”.

In most other practical fields, when using such types of convergence algorithm, the erratic values after 40 years would be smoothed by the user, in order not to introduce any additional disturbance. It is remarkable that this is not done for the EIOPA yield curve.

The \(LMM_{ins}\) is only used here for illustration purposes. A pure finance practitioner may find many theoretical and practical issues when using this insurance adaptation of the natural LMM. This question is not developed further here, but will be addressed in subsequent papers.

We have chosen to consider a \(LMM_{ins}\) because it is currently one of the most-used models, but the results would be similar for other market interest rates models.

For the 10 randomly drawn curves shown in Fig. 4, we already have two curves capped at 70% and two close to zero.

These parameters have been chosen because the receiver swaption of maturity 5y/tenor 5y is the most liquid one.

The choice of 1000 scenarios is a typical number of simulations among European life actuaries. It would of course be desirable to use many more simulations.

To ease the comparison of the presented results, the numbers have been resized based on a 10,000 basis for 12/31/14 v2.

Through the Solvency II implementation scheme, products are grouped in ring-fences, and most economic valuations are in fact applied to ring-fenced products. We always speak of valuating products, for the sake of simplicity, but the LMCPM approach developed here, and implemented below, can easily be extended, without loss of generality, to ring-fences of products/liabilities valuations, which may be more useful to practitioners. In particular, a ring-fenced LMCPM measure still leads to a more local and well-adapted market-consistency than a standard valuation approach, where each ring-fenced group of life insurance products is valuated under the same probability measure.

This is a standard procedure among users of the LIBOR Market Model and its adaptations.

References

Abrantes-Metz RM, Kraten M, Metz AD, Seow GS (2012) LIBOR manipulation? J Bank Financ 36(1):136–150

Abrantes-Metz RM, Villas-Boas SB, Judge G (2011) Tracking the LIBOR rate. Appl Econ Lett 18(10):893–899

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Political Econ 81(3):637–654

Bonnin F, Planchet F, Juillard M (2014) Best estimate calculations of savings contracts by closed formulas: application to the ORSA. Eur Actuar J 4(1):181–196

Brigo D, Mercurio F (2006) Interest rate models-theory and practice: with smile, inflation and credit, vol. 2. Springer

CFO Forum (2009) Market consistent embedded value principles. http://www.cfoforum.nl/downloads/MCEV_Principles_and_Guidance_October_2009.pdf. Accessed 26 June 2016

Chen H, Singal V (2003) A december effect with tax-gain selling? Financ Anal J 59(4):78–90

Christensen JH, Diebold FX, Rudebusch GD (2009) An arbitrage-free generalized Nelson-Siegel term structure model. Econom J 12(3):C33–C64

Christensen JH, Diebold FX, Rudebusch GD (2011) The affine arbitrage-free class of Nelson–Siegel term structure models. J Econom 164(1):4–20

Coroneo L, Nyholm K, Vidova-Koleva R (2011) How arbitrage-free is the Nelson–Siegel model? J Empir Financ 18(3):393–407

Danielsson J, Jong F, Laux C, Laeven R, Perotti E, Wüthrich M (2011) A prudential regulatory issue at the heart of Solvency II. VOX policy note

Delcour IG (2012) On the use of risk-free rates in the discounting of insurance cash flows, PhD thesis, Katholieke Universiteit Leuven

Devineau L, Loisel S (2009) Construction d’un algorithme d’accélération de la méthode des “simulations dans les simulations” pour le calcul du capital économique Solvabilité II. Bull Franç d’Actuar 10(17):188–221

Dybvig PH, Ingersoll JE Jr, Ross SA (1996) Long forward and zero-coupon rates can never fall. J Bus 69(1):1–25

EIOPA (2010) Quantitative impact study 5—technical specifications

EIOPA (2016) Technical documentation of the methodology to derive EIOPA’s risk free interest rate term structures. https://eiopa.europa.eu/regulation-supervision/insurance/solvency-ii-technical-information/risk-free-interest-rate-term-structures. Accessed 26 June 2016

El Karoui N, Frachot A, Geman H (1997) On the behavior of long zero coupon rates in a no arbitrage framework. Rev Derivativ Res 1:351–370

Floreani A (2011) Risk margin estimation through the cost of capital approach: some conceptual issues. Geneva Pap Risk Insur Issues Pract 36(2):226–253

Glasserman P (2004) Monte Carlo methods in financial engineering. Springer

Hirt GA, Block SB (2006) Fundamentals of investment management. McGraw Hill

Hull JC, White A (2000) Forward rate volatilities, swap rate volatilities, and the implementation of the LIBOR Market Model. J Fixed Income 10(2):46–62

Kemp M (2009) Market consistency: model calibration in imperfect markets. Wiley

Kreps DM (1981) Arbitrage and equilibrium in economies with infinitely many commodities. J Math Econ 8(1):15–35

Kroese DP, Taimre T, Botev ZI (2013) Handbook of Monte Carlo methods. Wiley

Lakonishok J, Smidt S (1988) Are seasonal anomalies real? A ninety-year perspective. Rev Financ Stud 1(4):403–425

Malamud S, Trubowitz E, Wüthrich MV (2008) Market consistent pricing of insurance products. ASTIN Bull 38(2):483

Markowitz H (1952) Portfolio selection. J Financ 7(1):77–91

Martin P, Rey H (2004) Financial super-markets: size matters for asset trade. J Int Econ 64(2):335–361

Merton RC (1973) Theory of rational option pricing. Bell Jo Econ Manag Sci 4(1):141–183

Moehr C (2011) Market-consistent valuation of insurance liabilities by cost of capital. ASTIN Bull 41(2):315–341

Mukerji S, Tallon J-M (2001) Ambiguity aversion and incompleteness of financial markets. Rev Econ Stud 68(4):883–904

Rebonato R (1999) On the simultaneous calibration of multi-factor log-normal interest-rates models to Black volatilities and to the correlation matrix. J Comput Financ 2:5–27

Schubert T, Grießmann G (2004) Solvency II = Basel II+ X. Versicherungswirtschaft 18:1399–1402

Sheldon TJ, Smith AD (2004) Market consistent valuation of life assurance business. Br Actuar J 10(3):543–605

Söderlind P, Svensson L (1997) New techniques to extract market expectations from financial instruments. J Monet Econ 40(2):383–429

Sum V (2010) The january and size effects on stock returns: more evidence. Int J Appl Account Financ 1(1):47–52

Turc J, Ungari S (2009) Filtering the interest rate curve, the MENIR framework. Soc Gen Cross Asset Res

Vedani J, Devineau L (2013) Solvency assessment within the ORSA framework: issues and quantitative methodologies. Bull Franç d’Actuar 13(25):35–71

Wüthrich M V, Bühlmann H, Furrer H (2008) Market-consistent actuarial valuation. Springer

Acknowledgements

The authors acknowledge support from the ANR Project LoLitA (Dynamic Population Models for Human Longevity with Lifestyle Adjustments), the research chair Actuariat Durable sponsored by Milliman Paris, the research chair DAMI (Data Analytics and Models for Insurance) sponsored by BNP Paribas Cardif, and the research chair Risques Financiers sponsored by Société Générale.

Author information

Authors and Affiliations

Corresponding author

Appendix: The LIBOR market model—actuarial version (\(LMM_{ins}\))

Appendix: The LIBOR market model—actuarial version (\(LMM_{ins}\))

The LIBOR Market Model provides forward rates dynamic modeling. The following presentation assumes that the considered swaptions are options on yearly swaps. Therefore, only annual payment dates are used. This assumption is often chosen in practice when calibrations are made on yearly forward rates, which is generally the case.

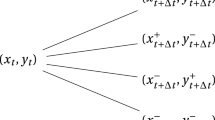

Let \(0 \le j \le J\) be a set of \(J+1\) successive dates. We get the 1 year-forward zero-coupon prices from, \(\forall j\in [\![1;J]\!] \text {, }0\le t\le j,\)

Let n be the ceiling function defined by:

Let \((g_j)_{j\in [\![1;J]\!] }\) and \(\Phi (t)\) be the following deterministic functions: \(\forall j\in [\![1;J]\!] \text {, }0\le t\le j\),

and

In a general framework, the 1 year-forward diffusion is given, under the spot LIBOR measure, by the following equation (see [5]): for \(0\le t\le j\),

with \(Z^M\) a M-dimensional Brownian motion, and \(\rho _{i,j}(t)dt=d<Z^M_i,Z^M_j>_t\).

Practitioners suppose \(Z^M\) can be decomposed through a two-dimensional standard Brownian motion:Footnote 12

In addition, the specification of the correlation structure is given by the user through a set of parameters

such that \(\rho _{i,j}(t)=\beta _{i-n(t)+1}\beta _{j-n(t)+1}\). The \(\beta\) parameters are therefore meta-parameters, often a priori assessed based on a historical forward data set.

Denoting \(\eta _j(t)=\Phi (t)g_j(t)\beta _{j-n(t)+1}\), the Forward diffusion is assumed to be, for \(0\le t\le j\),

The calibration therefore aims to estimate, in an optimal fashion, the six parameters \(P=\left( a,b,c,d,\kappa ,\theta \right)\).

Suppose a user wants to fit the at-the-money receiver swaption Black implied volatilities of maturities \((m_i)_{i \in \llbracket 1;I\rrbracket }\) and tenors \((n_i)_{i \in [\![1;I]\!] }\), denoted as \((\sigma _i)_{i \in [\![1;I]\!] }\). Using the Rebonato formula (see [32], [5, 21]), the LMM model implied volatility \(\sigma ^{LMM}_i(P)\) can be approximated by:

with

and

The parameters are estimated by:

This calibration approach is standard in day-to-day trading on the swaption market using the specific daily data. The Black implied volatilities are indeed very sensitive to the yield curve. To project the interest rates in the economic scenarios table, actuaries simply identify the spot LIBOR measure to the risk neutral measure. This \(LMM_{ins}\), used for very long term projections, is simply not justified by market standards.

Rights and permissions

About this article

Cite this article

Vedani, J., El Karoui, N., Loisel, S. et al. Market inconsistencies of market-consistent European life insurance economic valuations: pitfalls and practical solutions. Eur. Actuar. J. 7, 1–28 (2017). https://doi.org/10.1007/s13385-016-0141-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-016-0141-z