Abstract

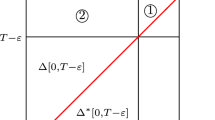

This paper is mainly a survey of recent research developments regarding methods for risk minimization in financial markets modeled by Itô-Lévy processes, but it also contains some new results on the underlying stochastic maximum principle. The concept of a convex risk measure is introduced, and two representations of such measures are given, namely: (i) the dual representation and (ii) the representation by means of backward stochastic differential equations (BSDEs) with jumps. Depending on the representation, the corresponding risk minimal portfolio problem is studied, either in the context of stochastic differential games or optimal control of forward-backward SDEs. The related concept of recursive utility is also introduced, and corresponding recursive utility maximization problems are studied. In either case the maximum principle for optimal stochastic control plays a crucial role, and in the paper we prove a version of this principle which is stronger than what was previously known. The theory is illustrated by examples, showing explicitly the risk minimizing portfolio in some cases.

Similar content being viewed by others

References

Aase, K.: Recursive utility and jump-diffusions. Manuscript, Norwegian School of Economics (NHH), 11 Dec 2013

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Duffie, D., Epstein, L.: Stochastic differential utility. Econometrica 60, 353–394 (1992)

Di Nunno, G., Øksendal, B., Proske, F.: Malliavin Calculus for Lévy Processes with Applications to Finance. Springer, New York (2009)

Epstein, L., Zin, S.: Substitution, risk aversion, and the temporal behavior of consumption and asset returns: an empirical analysis. J. Polit. Econ. 99, 263–286 (1991)

Frittelli, M., Rosazza-Gianin, E.: Putting order in risk measures. J. Bank. Financ. 26, 1473–1486 (2002)

Föllmer, H., Schied, A.: Convex measures of risk and trading constraints. Financ. Stoch. 6, 429–447 (2002)

Föllmer, H., Schied, A.: Stochastic Finance. De Gruyter, Berlin (2010)

Hu, Y., Peng, S.: Solution of forward-backward stochastic differential equations. Probab. Theory Relat. Fields 103, 273–283 (1995)

Jacod, J., Shiryaev, A.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, New York (2003)

Kreps, D., Porteus, E.: Temporal resolution of uncertainty and dynamic choice theory. Econometrica 46, 185–200 (1978)

Løkka, A.: Martingale representation of functionals of Lévy processes. Stoch. Anal. Appl. 22, 867–892 (2005)

Mataramvura, S., Øksendal, B.: Risk minimizing portfolios and HJBI equations for stochastic differential games. Stochastics 80, 317–337 (2008)

Øksendal, B., Sandal, L., Ubøe, J.: Stochastic Stackelberg equilibria and applications to time-dependent investor models. J. Econ. Dyn. Control. doi:10.1016/j.jedc2013.02.010 (2013)

Øksendal, B., Sulem, A.: Applied Stochastic Control of Jump Diffusions. 2nd edn. Springer (2007)

Øksendal, B., Sulem, A.: Forward-backward stochastic differential games and stochastic control under model uncertainty. J. Optim. Theory Appl. (2012). doi:10.1007/s10957-012-0166-7

Øksendal, B., Sulem, A., Zhang, T.: A stochastic HJB equation for optimal control of forward-backward SDEs (13 pages). arXiv 1312.1472 (Dec. 2013)

Quenez, M.-C.: Backward Stochastic Differential Equations, Encyclopedia of Quantitative Finance, pp. 134–145 (2010)

Quenez, M.-C., Sulem, A.: BSDEs with jumps, optimization and applications to dynamic risk measures. Stoch. Proc. Appl. 123, 3328–3357 (2013)

Rockafellar, R.T.: Convex Analysis. Princeton University Press (1997)

Royer, M.: Backward stochastic differential equations with jumps and related non-linear expectations. Stoch. Proc. Appl. 116, 1358–1376 (2006)

Tang, S.H., Li, X.: Necessary conditions for optimal control of stochastic systems with random jumps. SIAM J. Control Optim. 32, 1447–1475 (1994)

Acknowledgments

These lecture notes are based on our earlier works and lectures given on this topic, and on a course on risk minimization that B.Ø. gave at NHH, in 2013. We are grateful to K. Aase, J. Haug, S.-A. Persson and J. Ubøe for valuable comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

The research leading to these results has received funding from the European Research Council under the European Community’s Seventh Framework Programme (FP7/2007-2013)/ERC grant agreement no [228087].

Rights and permissions

About this article

Cite this article

Øksendal, B., Sulem, A. Risk minimization in financial markets modeled by Itô-Lévy processes. Afr. Mat. 26, 939–979 (2015). https://doi.org/10.1007/s13370-014-0248-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13370-014-0248-9

Keywords

- Convex risk measure

- Risk minimization

- Recursive utility

- Utility optimization

- Itô-Lévy process

- Backward stochastic differential equation

- The maximum principle for stochastic control of FBSDE’s

- Stochastic differential game

- HJBI equation