Abstract

Inspired by empirical evidence from the oil market, we build a model of an oligopoly facing a fringe as well as competition from renewable resources. We explore different subclasses of HARA utility functions (Cobb–Douglas, power and quadratic utility) to check the robustness of results found in the previous literature. For isoelastic demand, we characterize the equilibrium extraction rates of the fringe and the oligopolists. There always exists a phase of simultaneous supply of the oligopolists and the fringe, implying an inefficient order of use of resources since the oligopolists have smaller unit extraction costs and carbon emissions than the fringe. We calibrate our model to the oil market to quantify this sequence effect. In our benchmark calibration, we find for the three HARA subclasses that the sequence effect is responsible for almost all of the welfare loss compared to the first-best. It becomes smaller as market power decreases. Furthermore, we show that climate damage and Green Paradox effects depend non-monotonically on the degree of market power.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, we setup an oligopoly-fringe model of a non-renewable resource market to assess the implications of imperfect competition in markets for fossil fuel on (i) welfare and climate damages and (ii) the occurrence of the so-called Green Paradox.

We build upon Benchekroun et al. [5, 6] in which we have developed a dynamic game of the oil market. The main ingredients are the following. Demand is met by OPEC, an entity which market power can be that of a cohesive cartel [6], or can be proxied by the outcome of an oligopoly [5]. In addition, there is a competitive fringe and there are producers of a perfect renewable substitute, also supplied competitively. It is shown for linear demand schedules that in the open-loop Nash equilibrium, where players choose extraction paths, there is always a phase with simultaneous supply of oil by the fringe and the oligopolists. If the marginal costs of extraction (including climate damages from carbon emissions) by these two types of suppliers differ, as assumed, this feature gives rise to an inefficiency since an expensive resource is exploited before the cheaper resource is depleted [12]. This is in addition to the two well-known sources of inefficiency stemming from undersupply due to market power and oversupply due to the climate externality. A calibrated version of the model with a cohesive cartel [6] revealed that the former source of inefficiency, called the sequence effect, dwarfs the combined effect of the latter two to a large degree. This is an important result that has repercussions on the type of policies that should be considered when dealing with fossil fuels and the role they play in climate change.

The aim of the present paper is to investigate the robustness of this conclusion with respect to the specification of demand. In particular, we will characterize qualitatively the equilibrium for isoelastic demand and examine quantitatively the inefficiencies for different subclasses of HARA (hyperbolic absolute risk aversion) utility functions. We also check that the sequence effect and its relative importance are due to market power by allowing for OPEC’s degree of market power to vary. Empirical work has shown that OPEC does not act cohesively but rather as a group of oligopolists [1, p. 144].

Our main findings are threefold. First, it appears that the equilibrium with isoelastic demand qualitatively closely resembles the linear demand case. Second, we find that there might be substantial quantitative differences between the different subclasses of demand functions when it comes to inefficiencies, but what is preserved from the earlier studies is the prevalence of the sequence effect as a cause of the inefficiency. Third, although the sequence effect is robust with respect to changes in the utility function, it depends negatively on the degree of market power and it vanishes if the number of oligopolists becomes large.

The numerical analysis also indicates that the effect of market power on climate damage may be non-monotonic, due to the counteracting sequence effect (causing front-loading of dirty extraction) and conservation effect (causing undersupply of the non-renewable resource) of imperfect competition. Furthermore, we numerically examine Green Paradox effects of an increase in the subsidy on renewable energy. A Green Paradox is said to occur if (announced) climate policies lead to an increase in current carbon emissions [e.g., 9, 19, 21, 24, 20]. Under perfect competition with constant unit extraction cost, constant unit production cost of renewables and perfect substitution between the resource and renewables, a subsidy on renewable energy typically causes a Green Paradox. On the contrary, under similar conditions such a subsidy may cause a decrease in initial extraction under monopolistic resource supply [e.g., 23]. In terms of market power, the situation in our model is somewhere in between these extreme cases of perfect competition and monopoly. In our benchmark calibration, we find a modest Green Paradox effect. The relationship between the strength of this Green Paradox effect and the degree of market power is U-shaped.

This paper contributes to the literature on the extraction of non-renewable resources under imperfect competition [cf. 15, 16] and in particular the dominant firm framework [cf. 14, Withagen2013]. Like Groot et al. [11], Benchekroun et al. [3], Benchekroun et al. [4] and Benchekroun and Withagen [7], we build on the seminal framework of Salant [17]. We incorporate an important feature of the oil market and energy sector in general: the existence of renewables that provide perfect substitutes for oil and that can be produced in unlimited amounts. This implies that an equilibrium may include a phase of limit pricing by oil cartel members (see, e.g., Van der Meijden et al. [22], Andrade de Sá and Daubanes [2] and Van der Meijden and Withagen [23] for recent work and Hoel [13], Salant [18] and Gilbert and Goldman [10] for early contributions), where the price is maintained at a level that precludes entry of suppliers using the backstop technology.

Our model has shortcomings. First, there is no uncertainty, with regard to extraction cost nor with regard to climate change. Second, we opt for the open-loop Nash equilibrium, whereas feedback Nash would be an option as well. Third, we assume a constant technology, with linear constant marginal extraction cost. Fourth, energy types are perfect substitutes. Fifth, we abstract from geopolitical motives. Finally, we assume that agents maximize profits over an infinite horizon discounting the future at a constant interest rate. These restrictions also limit the policy relevance of our findings. However, we think we still make a useful contribution. The framework we consider is particularly relevant for the oil market. Indeed, in practice oil is supplied by a large number of small producers, such as the UK, Norway and Canada, and by a group of large suppliers, think of OPEC members. Moreover, there exist close substitutes like solar and wind energy and biofuels that are produced in a competitive way. The equilibrium we characterize therefore constitutes a useful framework to examine the important market failures associated with the oil market: imperfect competition and a significant contribution to carbon emissions and therefore to climate change.

The remainder of the paper is structured as follows. Section 2 describes the model and defines the Nash–Cournot equilibrium of the game. Section 3 provides an analytical characterization of the Nash–Cournot equilibrium in the case of isoelastic demand. Section 4 contains a welfare analysis for varying degrees of market power and different subclasses of HARA utility functions. Section 5 discusses Green Paradox effects. Finally, Sect. 6 concludes.

2 The Model

We consider a market for renewable and non-renewable resources. Both resources are assumed to be perfect substitutes in generating energy. Renewable energy can be produced at unit cost b. The non-renewable resource is supplied by a price-taking fringe and a group of \(n<\infty \) suppliers with market power, referred to as oligopolists. The superscripts o and f indicate the oligopolists and the fringe, respectively. The fringe owns an aggregate initial stock \(S_{0}^{f}\) and extracts at constant per unit extraction cost \(k^{f}\). All oligopolists have identical initial stocks \(S_{0i}^{o}=S_{0}^{o}/n=\sum _{j=1}^{n}S_{0j}^{o}/n\). The per unit extraction cost of each oligopolist is constant as well and denoted by \( k^{o} \). We assume throughout that \(k^{o}<k^{f}<b\). This is the empirically most relevant case. Extraction rates at time \(t\ge 0\) for the fringe and oligopolist i are \(q^{f}(t)\) and \(q_{i}^{o}(t)\), respectively. We write aggregate supply by the oligopolists as \(q^{o}(t)\equiv \sum _{i}q_{i}^{o}(t)\). Consumer demand for energy follows from a HARA utility function

Demand readsFootnote 1

If \(p<b\), then only non-renewables are used, because producing renewables yields negative profits. Quadratic utility yielding linear demand as in Benchekroun et al. [5, 6] corresponds to \(\varphi =2\) and positive \(\psi \) and \(\chi \). In the analytical part of this paper, we shall deal with Cobb–Douglas utility, yielding isoelastic demand: \(\varphi <1\) and \(\chi =0\) . When we compare equilibria numerically, attention will also be paid to the so-called power utility function defined by \(\varphi <1\), \(\chi >0\) and \(\psi =1-\varphi \) [see 14].

We will show that the characteristics of the equilibrium depend on the market power of the oligopolists, as measured by the so-called Lerner index. The Lerner index is defined as the negative inverse of the price elasticity of demand perceived by individual oligopolists.

Without supply from the fringe, the Lerner index for the isoelastic demand case is given by \(\Lambda =\frac{1-\varphi }{n}\).Footnote 2 Marginal revenue of the oligopolists in case the fringe does not supply can be written as

Hence, given the price, marginal revenue depends negatively on the Lerner index. We will make a distinction between cases with strong, intermediate and weak market power.

Strong market power corresponds to the case in which marginal revenue at \( p=b\) is lower than marginal extraction cost, i.e., \(b\left( 1-\frac{1-\varphi }{ n}\right) <k^o\). In the absence of supply by the fringe, the oligopolists will then always set the limit price. Intermediate market power corresponds to the case where marginal revenue exceeds marginal extraction cost at the limit price, but falls short of marginal costs at \(p=k^f\), i.e., \(b\left( 1- \frac{1-\varphi }{n}\right)>k^o>k^f\left( 1-\frac{1-\varphi }{n}\right) \). In the absence of supply by the fringe, the oligopolists set \(p\in (k^f,b]\). Weak market power corresponds to the case where marginal revenue exceeds marginal cost at \(p=k^f\), i.e., \(k^f\left( 1-\frac{1-\varphi }{n}\right) >k^o\). In the absence of supply by the fringe, the oligopolists may set a price below \(k^f\) (as long as the scarcity rent on their resource is small enough).

By defining \(\Lambda _b\equiv 1-\frac{k^o}{b}\) and \(\Lambda _f\equiv 1-\frac{k^o}{k^f}\), we get

Hence, the cases with strong, intermediate and weak market power correspond to \(\Lambda >\Lambda _b, \Lambda _f<\Lambda <\Lambda _b\) and \(\Lambda <\Lambda _f\), respectively.

In the rest of this section, we define the game that is played among the agents, and we define the equilibrium and discuss its associated necessary conditions for the players, who maximize their objective functions subject to constraints. We also characterize the equilibrium for specific knife-edge cases that will be instrumental to describe the full equilibrium of the game, which will be provided in Sect. 3.

2.1 Definition of the Equilibrium

For the convenience of the reader, we here reproduce the objectives of the players, the definition of the equilibrium of the game and the corresponding necessary conditions as used in Benchekroun et al. [5]. In an equilibrium, the fringe maximizes its discounted profits, taking the price path and the constant interest rate r as given:

subject to its resource constraint

This constraint describes the time path of the fringe’s resource stock and requires the stock and the extraction rate to be nonnegative.

For the oligopolists, we consider an open-loop Nash equilibrium where each oligopolist i takes the time paths of \(q^{f}\) and \(q_{j}^{o}\) (\( j\ne i\)) as given and maximizes

subject to the following constraints

The former constraint describes the evolution of the resource stocks. The latter one states that oligopolist i must make sure that the price is never higher than b because otherwise non-renewable resource supply would be (infinitely) higher than demand.

An equilibrium of the dynamic game is defined as follows.

Definition 1

A vector of functions \((q_{1}^{o},...,q_{n}^{o},q^{f})\) is an open-loop oligopoly-fringe equilibrium (OL-OFE) if

-

(i)

each element of \((q_{1}^{o},...,q_{n}^{o},q^{f})\) satisfies the corresponding resource constraint,

-

(ii)

for all \(i=1,2,...,n\)

$$\begin{aligned}&\ \int _{0}^{\infty }e^{-rs}\left[ p\left( q^{f}(s)+\sum _{j\ne i}q_{j}^{o}(s)+q_{i}^{o}(s)\right) -k^{o}\right] q_{i}^{o}(s)ds \\&\ \ge \int _{0}^{\infty }e^{-rs}\left[ p\left( q^{f}(s)+\sum _{j\ne i}q_{j}^{o}(s)+\hat{q}_{i}^{o}(s)\right) -k^{o}\right] \hat{q}_{i}^{o}(s)ds, \end{aligned}$$for all \(\hat{q}_{i}^{o}\) satisfying the resource constraint, and

-

(iii)

$$\begin{aligned} \int _{0}^{\infty }e^{-rs}\left[ p\left( s\right) -k^{f}\right] q^{f}(s)ds\ge \int _{0}^{\infty }e^{-rs}\left[ p\left( s\right) -k^{f}\right] \hat{q}^{f}(s)ds, \end{aligned}$$

where \(p\left( s\right) =p\left( q^{f}(s)+\sum _{j=1}^{n}q_{j}^{o}(s)\right) \), for all \(\hat{q}^{f}\) satisfying the resource constraint.

2.2 Necessary Conditions

The Hamiltonian associated with the fringe’s problem reads

with \(\lambda ^{f}\) the co-state of its resource stock. We omit the time argument where there is no danger of confusion. The necessary conditions then include

Here, complementary slackness (c.s.) means that \(q^{f}=0\) if the first inequality is strict. We observe that in an equilibrium with positive supply of the fringe, the net price, \(p-k^{f}\), increases over time at a rate equal to the rate of interest. This is Hotelling’s rule.

The Hamiltonian and the Lagrangian associated with oligopolist i read, respectively,

Here, \(\lambda _{i}^{o}\) is the co-state of the resource stock of oligopolist i, and \(\mu _{i}^{o}\) is the Lagrange multiplier corresponding to the price constraint. When taking account of the fact that the oligopolists are identical (so that in an equilibrium we may write \(q_{i}^{o}=q^{o}/n= \sum _{j=1}^{n}q_{j}^{o}/n\), \(\lambda _{i}^{o}=\lambda ^{o}\), \( \mu _{i}^{o}=\mu ^{o}\)), the necessary conditions read

The final condition is associated with a free choice of the time horizon T, i.e., the moment of depletion of the stock by an oligopolist: In a symmetric equilibrium, the Hamiltonian associated with each oligopolist’s problem vanishes at that same date.

3 Equilibrium of the Game

In the OL-OFE, different phases of resource extraction and sequences thereof exist. By F, O, S and L, we denote phases with only the fringe supplying, only the oligopolists supplying at a consumer price strictly below b, simultaneous supply and supply by the oligopolists at a consumer price b (i.e., limit pricing), respectively. The moments \(T^{F}\), \(T^{O}\), \(T^{S}\) and \(T^{L}\) indicate at which instants of time each of these phases comes to an end. For a variable x, we write \(x(t^{+})=\lim _{\tau \downarrow t}x(\tau )\) and \(x(t^{-})=\lim _{\tau \uparrow t}x(\tau )\).

We first prove a lemma on the impossibility of certain transitions from one regime to another. The lemma is proved in Benchekroun et al. [5], for the case of linear demand. Here, we show that the lemma holds true for isoelastic demand. It even holds for a more general class as we do not exploit the specific HARA properties.

Lemma 1

-

(i)

L can only prevail in a final stage of resource extraction.

-

(ii)

F can only prevail in a final stage of resource extraction.

-

(iii)

A transition from O to F is excluded.

-

(iv)

O cannot prevail in a final stage of resource extraction unless \(n=\infty \).

Proof

(i). Along L the price equals b. Along all other phases the price is smaller than b. Along S, F and O the price is increasing. For S and F, this is immediate. For O, this follows from differentiating the necessary condition

with respect to time and taking into account that \((p(q^{o})-k^{o})q_{i}^{o}\) must be concave to have a maximum. Moreover, at a direct transition, if any, the price is continuous. This implies that L cannot be followed immediately by S or F or O, because this would require a downward price jump at the moment of the transition.

(ii). If F would be followed by S or O at \(T^{F}\), then it follows from price continuity that

But \(k^{f}+\lambda ^{f}e^{rT^{F}}<k^{o}+\lambda ^{o}e^{rT^{F}}\). Indeed, along F we have \(p<b\) so that \(\mu ^{o}=0\) and \(q^{o}=0\) so that (6) and \(p^{\prime }<0\) yield this inequality. Hence, we obtain a contradiction. If F would be followed by L, then at the transition date \( T^{F}\) we would still have \(k^{f}+\lambda ^{F}e^{rT^{F}}=b<k^{o}+\lambda ^{o}e^{rT^{F}}\), which violates the transversality condition (9).

(iii). At a transition time \(T^{O}\) from O to F, we have

so that \(k^{f}+\lambda ^{f}e^{rT^{O}}>k^{o}+\lambda ^{o}e^{rT^{O}}\). This contradicts that \(k^{f}+\lambda ^{f}e^{rt}<k^{o}+\lambda ^{o}e^{rt}\) for \( t\in F\).

(iv). If O would be a final phase, then at the transition date \(T^{O}\) to renewables we would have \(p(T^{O})=b\). Because of transversality (9), we also have \(b=k^{o}+\lambda ^{o}e^{rT^{O}}\). That would imply \( p^{\prime }(q(T^{O-}))\frac{q(T^{O-})}{n}=0\), which cannot be an equilibrium if \( n<\infty \) because there is demand at \(T^{O-}\). \(\square \)

3.1 Special Cases

It is our intention to sketch the equilibrium outcomes in (\(S_{0}^{f},S_{0}^{o})-\)space and to also highlight the impact of other relevant parameters. Therefore, we first consider the loci of initial stocks that give rise to three particular regimes: only F, which corresponds to the case where \(S_{0}^{o}=0;\) only \(O\rightarrow L\), which correspond to the case where \(S_{0}^{o}=0;\) and, finally, only S. Although those loci represent knife-edge combinations of resource stocks, they are nevertheless instrumental to determine the equilibrium sequences over the whole state space.

3.1.1 Only F

For any initial endowment on the \(S_{0}^{f}-\)axis regime F prevails. Since \(b>k^{f}\) by assumption, the fringe\(^{\prime }\)s stock will be fully depleted. The price follows the Hotelling rule: The growth rate of the net price, \(p-k^{f}\), is equal to the rate of interest.

3.1.2 Only \(O\rightarrow L\)

Suppose the initial endowment is on the \(S_{0}^{o}-\)axis. Since O cannot be a final stage of resource extraction unless \(n=\infty \), the typical equilibrium is \(O\rightarrow L\) with O possibly degenerate. Because of discounting, we have \(p(q^{o}(t))=b\) for all \(T^{O}\le t\le T^{L}\). Hence, the oligopolists keep the producers of renewables from the market. Moreover, due to (6) and (9) it holds that

To have an \(O-\)phase, the initial stock must be large enough in order not to deplete the stock along the \(L-\)phase:

The following lemma sketches the equilibrium.

Lemma 2

-

(i)

Suppose \(\Lambda <\Lambda _b\) and (14) holds. Then, the equilibrium is \(O\rightarrow L\) with the transition times satisfying (13). If \(\Lambda <\Lambda _b\) and (14) does not hold, then the interval O is degenerate.

-

(ii)

If \(\Lambda >\Lambda _b\), then the equilibrium reads L.

3.1.3 Only S

Consider the possibility of S throughout, meaning regime S holding from time zero till some \(T^{S}\), where \(T^{S}\) is the moment at which all non-renewable resources are exhausted. Along S we have \( p-k^{f}=\lambda ^{f}e^{rt}\), \(\mu ^o=0\) and \(q_i^o>0\) so that (6) turns into an equality. Also, from price continuity at the final instant of time \(T^{S}\) and the transversality condition (9):

Using these conditions, we can write

Solving for \(q^{f}\) gives

Profit maximization for an oligopolist requires that \(q^{o}(t)\ge 0\) for all \(t\le T^{S}\). This condition is satisfied because it is assumed that \(k^{f}>k^{o}\). Moreover, \(q^{o}(T^{S})=0\). Fringe supply is positive before \(T^{S}\) if and only if it is positive at time zero. So, we consider \(t=0\). The sign of \( q^{f}(0)\) equals the sign of

So, we see that \(q^{f}(0)>0\) for any \(T^{S}\) if \(\Lambda >\Lambda _f\) and \(\varphi <1\), as assumed. This gives the following lemma.

Lemma 3

There exists an increasing \(g(S_0^f)-\)curve in the space of initial endowments, starting at the origin, such that if the actual initial endowments are on the curve, the equilibrium consists of S throughout. If \(\Lambda <\Lambda ^f\), then the curve has a finite endpoint defined by \((S_{M}^{f},S_{M}^{o})\). If \(\Lambda >\Lambda ^f\), then the curve extends to infinity.

3.2 Full Characterization

We now build on the results derived in the preceding subsection to construct the OL-OFE. We proceed by examining where in the state space some given sequences arise as part of an equilibrium.

3.2.1 \(S\rightarrow F\) and \(O\rightarrow S\rightarrow F\)

Assume the equilibrium regime is of the type \(S\rightarrow F\) with transition times \(T^{S}\) and \(T^{F}\). The price is \(p(t)=k^{f}+\lambda ^{f}e^{rt}\) until \(T^{F}\) and \(b=k^{f}+\lambda ^{f}e^{rT^{F}}\) so that

Continuity requires \(q^{o}(T^{S})=0\). Hence, from (9) we have \(k^{f}+\lambda ^{f}e^{rT^{S}}=k^{o}+\lambda ^{o}e^{rT^{S}}\), so that \(\lambda ^{o}=(k^{f}-k^{o})e^{-rT^{S}}+(b-k^{f})e^{-rT^{F}}\). We now use these findings in (6) to arrive at:

Also,

Hence, after some straightforward calculations:

The expression

is increasing in t. The sign of \(q^{f}(0)\) equals the sign of

For \(\Lambda >\Lambda _f\) and \(\varphi <1\), initial extraction by the fringe is positive. This condition also guarantees that the \(S-\)curve extends to infinity, as shown before. Hence, if \(\Lambda >\Lambda _f\), the equilibrium sequence reads \(S\rightarrow F\) for all initial stocks below the \(S-\)curve.

A more complicated situation occurs if \(\Lambda <\Lambda _f\). We show that there is a curve, \(l_{2}\), defined by the initial endowments in the space of stocks, starting at the point \((S_{M}^{f},S_{M}^{o})\), such that if the initial endowments are on the curve, the equilibrium sequence is \(S\rightarrow F\) and \( q^{f}(0)=0\). By construction, the point \((S_{M}^{f},S_{M}^{o})\) is on the curve \(l_{2}\) because there \(q^{f}(0)=0\). Let \(S_{0}^{f}\) be increased to, say, \(S_{M}^{f}+\delta \) with \(\delta >0\), and keep \(S_{0}^{o}\) constant at \( S_{M}^{o}\). Assume the new equilibrium reads \(S\rightarrow F\) with \( q^{f}(0)=0\). This gives a new \(T^{F}\) as well as a new \(T^{S}\) following from (19) put equal to zero. This then gives \(\tilde{S} _{0}^{o}\) to achieve the new equilibrium. It would be a coincidence if \( \tilde{S}_{0}^{o}=S_{M}^{o}\). Hence, the curve is typically not a constant. The curve is either monotonically increasing or monotonically decreasing starting from \((S_{M}^{f},S_{M}^{o})\). In the next section, we provide numerical examples where the curve is monotonically increasing and another one where it is monotonically decreasing. The intuition is as follows. An increase in the cost advantage of the oligopolists enlarges the regions of stocks where an O phase precedes the \(S-F\) regime. On the one hand, if the cost advantage of the oligopolists is substantial enough (i.e., \( k^{o}<k^{f}(1-\frac{1-\varphi }{n})\)), then starting on the \(l_{2}-\)curve and increasing \(S_{0}^{f}\) result in the oligopolists increasing their initial extraction and delaying the supply from the fringe: The increase in \( S_{0}^{f}\) leads to an \(O\rightarrow S\rightarrow F\) regime, and the curve \(l_{2}\) is then monotonically decreasing. On the other hand, if the cost advantage of the oligopolists, \(k^{o}-k^{f}(1-\frac{1-\varphi }{n})\), is small enough, then starting on the \(l_{2}-\)curve, where \(q^{f}(0)=0\), and increasing \(S_{0}^{f}\) result in the fringe increasing its output; hence, \( q^{f}(0)>0\): The increase in \(S_{0}^{f}\) leads to the interior of the \( S\rightarrow F\) regime (where initial extraction rates of the oligopolists and the fringe are positive), and the curve \(l_{2}\) is then monotonically increasing.

It is also clear now that if we start from \((S_{M}^{f},S_{M}^{o})\) and increase \(S_{0}^{o}\), the new equilibrium should be \(O\rightarrow S\). Above the locus \(S\rightarrow F\) with \(q^{f}(0)=0\), the equilibrium reads \( O\rightarrow S\rightarrow F\).

The results are summarized in

Lemma 4

-

(i)

Suppose \(\Lambda >\Lambda _f\). Then to the right of the \(S-\)curve, the equilibrium reads \(S\rightarrow F\).

-

(ii)

Suppose \(\Lambda <\Lambda _f\). Then, there exists a curve \(l_{2}(S_{0}^{f})\) starting in \((S_{M}^{f},S_{M}^{o})\) such that on and below the curve the equilibrium reads \(S\rightarrow F\). To the northeast of (\(S_{M}^{f},S_{M}^{o})\), the equilibrium reads \(O\rightarrow S\rightarrow F\) with \(q^{f}(0)=0\) at the start of S.

3.2.2 \(S\rightarrow L\), \(S\rightarrow O\rightarrow \hat{L}\) and \(O\rightarrow S\rightarrow L\)

Three cases with different degrees of market power are to be considered.

Case 1: Strong market power, \(\Lambda >\Lambda _b\). On the \(S_{0}^{o}-\)axis, an O phase (with \(p\left( q^{o}\right) <b\)) does not exist, since it would imply that marginal revenue of an oligopolist is smaller than its marginal cost. Hence, we only have L on the \(S_{0}^{o}-\)axis. Also, there cannot be a phase O of the \(S_{0}^{o}-\)axis. Moreover, if \(\Lambda >\Lambda _b\), we have \(\Lambda >\Lambda _f\), which implies, from Lemma 3, that the \(S-\)curve extends to infinity. Hence, for points to the left of the \(S-\)curve the equilibrium reads \(S\rightarrow L\).

Case 2: Intermediate market power, \(\Lambda _b>\Lambda >\Lambda _f\). Now, the \(S-\)curve still extends to infinity, and for \(S_{0}^{o}\) larger (smaller) than some threshold \(\hat{S}_{0}^{o}\), the equilibrium on the \( S_{0}^{o}-\)axis is of the type \(O\rightarrow \hat{L}\) (L), where \(\hat{L}\) denotes a limit-pricing phase of a specific duration \(T_L-T_S\), corresponding to \(q^o(T^S)=\hat{q}\equiv \frac{1-\varphi }{\psi }(\frac{b}{ \psi })^{\frac{1}{1-\varphi }}\). From (6) and (9), this duration is given by

This yields \(T^{S}\) as a function of \(T^{L}\). We address the question when \( S\rightarrow \hat{L}\) is the equilibrium. We show that in the space of initial stocks (\(S_{0}^{f},S_{0}^{o}\)), there exists an increasing curve \( h(S_{0}^{f})\) such that if the initial stocks are on the curve, the equilibrium consists of an \(S-\)phase for an initial interval of time and ends in that interval at \((0,\hat{S}_{0}^{o})\). Let \(T^{L}\) be given for the moment. We must end up in \((0,\hat{S}_{0}^{o})\) at \(T^{S}\). During the \(\hat{L}-\)phase, we have \(p(t)=b\); hence, \(q^o(t)=q(t)=\hat{q}\) and \(\int _{T^{S}}^{T^{L}}q^{o}(t)dt=\hat{S}_{0}^{o}\). This yields \(\hat{S} _{0}^{o} \). We also have \(p(t)=k^{f}+\lambda ^{f}e^{rt}\) for \(0\le t\le T^{S}\) with \(k^{f}+\lambda ^{f}e^{rT^{S}}=b\). This gives \(p\left( t\right) \) as a function of \(T^{L}\) for \(0\le t\le T^{s}\). Moreover, due to transversality, \(\lambda ^{o}=(b-k^{o})e^{rT^{L}}\), the condition

for \(0\le t\le T^{S}\), yields \(q^{o}\left( t\right) \) as a function of \(T^{L}\). So, \(T^{L}\) uniquely follows from the resource constraint \( \int _{0}^{T^{L}}q^{o}(t)dt=S_{0}^{o}\). Consequently, to the initial resource stock of the oligopolists corresponds to a unique initial stock of the fringe such that the equilibrium reads \(S\rightarrow \hat{L}\) with the \(\hat{L}-\)phase starting at the vector of stocks \((0,\hat{S}_{0}^{o})\). The curve \( h(S_{0}^{f})\) is indeed upward sloping: Observe that any equilibrium is unique, given the initial vector of stocks. If the curve were backward bending, then from a point with the same initial stock of the oligopolists and a higher initial stock of the fringe we would never end up in \(\hat{S} _{0}^{o}\).

Between the \(h-\)curve and the \(S-\)curve in the (\(S_{0}^{f},S_{0}^{o})-\)space, the equilibrium is \(S\rightarrow L\), with \(q^o(T^S)<\hat{q}\) and a duration of the \(L-\)phase below the duration of \(\hat{L}\). Above the \(h-\) curve, the equilibrium is \(S\rightarrow O\rightarrow \hat{L}\), with an intermediate \(O-\)phase, as O cannot occur before the stock of the fringe is depleted.

Finally, note that at \(T^S\), the moment of the transition to L from the \( S- \)phase, the Hamiltonian is not continuous if the initial stocks are located in the region between the \(h-\)curve and the \(S-\)curve, where \(q^o(T^S)<\hat{q}\) (and hence \(q^f(T^S)>0\)). The reason is that the oligopolists’ perceived demand functions for fossil fuel increase discontinuously as the fringe’s resource stock becomes depleted and its extraction rate jumps to zero. Hence, the integrand of the oligopolists’ maximization problem (2) is discontinuous in the time at \(T^S\). This discontinuity implies that continuity of the Hamiltonian of the oligopolists cannot be invoked as a necessary condition at such a phase transition.

Case 3: Weak market power, \(\Lambda <\Lambda _f\). Now, the \(S-\)curve ends at (\(S_{M}^{f},S_{M}^{o})\), and for \(S_{0}^{o}\) larger (smaller) than some threshold \(\hat{S}_{0}^{o}\), the equilibrium on the \(S_{0}^{o}-\)axis is of the type \(O\rightarrow L\) (L). We construct a new curve, denoted by \(l_{1}\), such that if we start on the curve, the equilibrium sequence reads \(S\rightarrow L\) with \(q^{f}\left( 0\right) =0\). Both (\(0, \hat{S}_{0}^{o})\) and (\(S_{M}^{f},S_{M}^{o})\) are on the curve since for both points \(q^{f}(0)=0\), they represent the endpoints of the curve. Like before \(p(t)=k^{f}+\lambda ^{f}e^{rt}\) for \(0\le t\le T^{S}\) with \(k^{f}+\lambda ^{f}e^{rT^{S}}=b\). Moreover, due to transversality, \(\lambda ^{o}=(b-k^{o})e^{rT^{L}}\). Finally,

for \(0\le t\le T^{S}\), with \(q(0)=q^{o}(0)\). Straightforward but tedious calculations lead to the following expression:

This condition is key to obtain the \(l_{1}-\)curve. It establishes a unique relationship between \(T^{L}\) and \(T^{S}\) such that the equilibrium reads \( S\rightarrow L\) with \(q^{f}\left( 0\right) =0\). Exploiting the conditions on cumulative extraction and the maximum principle conditions along with the transversality conditions allows us to generate the \(l_{1}-\)curve. Above the \(l_{1}-\)curve, the equilibrium reads \(O\rightarrow S\rightarrow L\).

The results are summarized in

Lemma 5

-

(i)

Suppose \(\Lambda >\Lambda _b\). Then, \(S\rightarrow L\) is the equilibrium for all initial stocks above the \(S-\)curve.

-

(ii)

Suppose \(\Lambda _b>\Lambda >\Lambda _f\). Then, \(S\rightarrow L\) is the equilibrium for all initial stocks in the region between the \(S-\)curve and the \(h-\)curve. The equilibrium for all initial stocks in the region above the \(h-\)curve is \(S\rightarrow O\rightarrow \hat{L}\).

-

(iii)

Suppose \(\Lambda _b>\Lambda _f>\Lambda \). Then, \(S\rightarrow L\) is the equilibrium for all initial stocks in the region between the \(S-\)curve and the \(l_{1}-\)curve. The equilibrium for all initial stocks in the region above the \(l_{1}-\)curve reads \(O\rightarrow S\rightarrow L\).

3.3 Graphical Illustration

Figures 1 and 2 show the possible extraction sequences in \((S_{0}^{f},S_{0}^{c})-\)space for various values of the Lerner index \(\Lambda \). The figures are based on numerical simulations with parameter values in accordance with Benchekroun et al. [6], who calibrate their model to the global oil market. Specifically, we set the interest rate \( r=0.028\), marginal extraction cost by the oligopolists \(k^{o}=18\) US$/bbl, marginal extraction cost of the fringe \(k^{f}=62.5\) US$/bbl and the cost of producing renewables \(b=102.5\) US$/BOE.

The HARA parameters for the quadratic utility case are chosen to replicate the linear demand function in Benchekroun et al. [6] in the followings sense. For the Cobb–Douglas and power utility subclasses, we choose the parameters \(\varphi \) and \(\psi \) such that the demand function runs through \(p=80\) US$ and \(q=34\) billion barrels, with an initial price elasticity of demand equal to 0.56 in the case of Cobb–Douglas utility and 0.55 in the case of power utility (as in Benchekroun et al. [6]). Table 1 provides an overview of the parameters of the utility function for the three considered subclasses.Footnote 3

The OL-OFE with \(\Lambda >\Lambda _f\). Notes: Cobb–Douglas utility (giving rise to CES demand) is imposed with \(\chi =0\). In both panels, we have used \(n=1\). In panel (a), we set \(\varphi =-0.8\) and \(\psi =5.62\cdot 10^{-6}\); in Panel (b), we set \(\varphi =0.2\) and \(\psi =1.07\cdot 10^{16}\). The remaining parameter values are set at their benchmark values. The parameter values imply \(\Lambda _b=0.82\) and \(\Lambda _f=0.71\). Panel (a) shows the case with \(\Lambda =1.8\) and panel (b) with \(\Lambda =0.8\)

The OL-OFE with \(\Lambda <\Lambda _f\). Notes: Cobb–Douglas utility (giving rise to CES demand) is imposed, requiring \(\chi =0\). In Panels (a), (b) and (c), we set \(\psi =2.44\cdot 10^7\), \(\psi =248.78\) and \(\psi =0.0029\), respectively. Parameter values imply \(\Lambda _b=0.82\) and \(\Lambda _f=0.71\)

Figure 1 depicts the case of a relatively high \(\Lambda \). In panel (a), marginal profits are negative at the limit price. Hence, the oligopolists will opt for limit pricing as soon as the stock of the fringe is depleted. Apart from only S along the g -locus that extends to infinity, the possible extraction sequences are \( S\rightarrow L\) (if the initial aggregate stock of the oligopolists is large, compared to the fringe) and \(S\rightarrow F\) (if the initial aggregate stock of the oligopolists is relatively small), as indicated above and below the \(g-\)locus.

In panel (b), marginal profits are positive at the limit price, implying that an \(O-\)phase with a price below the limit price may occur after the fringe’s stock is depleted, if the initial stock of the oligopolists is large enough. This gives rise to an additional region with extraction sequence \(S\rightarrow O\rightarrow \hat{L}\) above the \(h-\)locus, along which the extraction sequence reads \(S\rightarrow \hat{L}\). Still, marginal profits are negative at a price equal to the unit extraction cost of the fringe \(k^{f}\). Hence, the oligopolists will never choose to extract so much as to drive the resource price below the marginal extraction cost of the fringe. As a result, there will be simultaneous use unless the stocks of the oligopolists or the stock of the cartel is depleted. The extraction sequences below the \(h-\)locus are comparable to those in panel (a).

Figure 2 shows the case of a relatively low \(\Lambda \). As the oligopolists’ marginal profits are positive at a price equal to the unit extraction cost of the fringe \(k^{f}\), it may be profitable to choose a high level of extraction that drives down the resource price below the marginal extraction cost of the fringe. As a result, an initial \(O-\)phase may occur, during which the oligopolists are the sole suppliers and the fringe keeps its stock in the ground. Intuitively, a low Lerner index implies that this case comes relatively close to the perfectly competitive equilibrium characterized by the extraction sequence \(O\rightarrow F\).

Above, we have introduced the curves \(l_{1}\) and \(l_{2} \), both characterized by zero initial extraction of the fringe and sequences \( S\rightarrow L\) for \(l_{1}\) and \(S\rightarrow F\) for \(l_{2}\). The different panels of Fig. 2 show different curvatures of \(l_{1}\) and \(l_{2}\). The \(l_{1}-\)curve can either be inverted-U-shaped (see panels (a) and (c)) or monotonically increasing (see panel (b)). The \(l_{2}-\)curve is either monotonically increasing (panels (a) and (b)) or monotonically declining (panel (c)).

When moving from panel (a) to either panel (b) or panel (c), the Lerner index goes down. A comparison of the three panels indicates that less market power results in a smaller combined surface below the \(l_{1}\) and \(l_{2}-\) curves. Note that if the initial stocks are such that the equilibrium is located within the \(S\rightarrow L\) region near a downward sloping part of one of the \(l-\)curves, an increase in the initial stock of the fringe may result in a decrease in its initial extraction, as such an increase may change the extraction sequence from \(S\rightarrow L\) to \(O\rightarrow S\rightarrow L\).

Note that panels (a) and (b) of Fig. 1 and panel (a) of Fig. 2 closely resemble Figs. 1, 2 and 3 in Benchekroun et al. [5]. They also look at different cases based upon the degree of market power, but use linear instead of isoelastic demand. Besides the quantitative differences, however, there is also a qualitative difference between the two cases. With linear demand, the \(l_{2}-\)curve is increasing, whereas with isoelastic demand, it can be decreasing as well, as shown in panel (c) of Fig. 2.

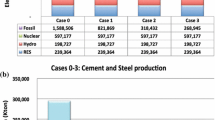

4 Welfare Analysis

In this section, we perform a welfare analysis. Our parameter values are taken from Benchekroun et al. [6]. Accordingly, we set the initial stocks equal to \( S_0^f=1212\) and \(S_0^f=619.5\) (billion barrels). Furthermore, we impose \( \varphi =-0.8\), which yields a price elasticity of resource demand of 0.56 in the case of a cohesive cartel. The remaining parameter values are set at their benchmark values, as described in Sect. 3.3. An overview is provided in Table 2.

We define welfare as the sum of consumer surplus and producer surplus minus the damages caused by the accumulation of pollution associated with resource use. We closely follow Benchekroun et al. [6], including notation. More precisely, let \(W^{G}\) denote ‘gray’ welfare, that is the discounted sum of consumer surplus and producer surplus:

where T denotes the moment at which all non-renewable resources are depleted, and x is the permanent use of renewables after T, following from \(p(x)=b\). To simplify the analysis, we assume that climate damages are linear in cumulative emissions. The discounted value of climate damage, denoted by D, can then be written as:

where \(\zeta >0\) denotes the constant marginal damage of carbon and E denotes cumulative emissions, which evolve according to

where \(\omega ^{o}\) and \(\omega ^{f}\) denote the emission factor of the cartel and the fringe, respectively. Following Benchekroun et al. [6], we set the emission factors equal to \(\omega ^{o}=0.11083\) and \(\omega ^{f}=0.1525\) (both in tC/bbl). Furthermore, we choose \(\zeta \) to get a value for the social cost of carbon (\(SCC=\frac{\zeta }{r}\)) equal to 250 US$/tC. Social welfare W is defined as the difference between gray welfare and climate damage: \(W\equiv W^{G}-D\).

We will first look at the effect of market power for the Cobb–Douglas subclass of HARA utility functions. Because of their assumption of a cohesive cartel, Benchekroun et al. [6] were not able to examine this effect. Subsequently, we will allow for quadratic and power utility to check the robustness of the results.

4.1 Effect of Market Power

We want to identify the relative importance of the welfare loss due to the inefficient order of resource use. We compare the outcome of the OL-OFE with the outcomes of two alternative scenarios: The socially optimal extraction of reserves also referred to as the first-best (FB) and a fictitious scenario that we call the ‘Herfindahl scenario.’ In the latter scenario, total extraction mimics the time path of the extraction in the OL-OFE, but we impose the efficient order of resource use, prescribed by the Herfindahl rule, namely that extraction from the fringe’s stock does not start before the oligopolists’ stock is depleted. Typically, the Herfindahl scenario is not an equilibrium of the game. But the concept allows us to decompose the inefficiency attributable to output at the industry level and the inefficiency associated with the composition of the sources of the output. We decompose the effect in the ‘conservation effect’ (i.e., the deviation of the Herfindahl scenario from the first-best) and the ‘sequence effect’ (i.e., the deviation of the OL-OFE from the Herfindahl scenario). We are particularly interested in comparing the results for the nonlinear HARA demand cases to those corresponding to linear demand.

Figure 3 depicts the effect of market power on climate damage (panel (a)), gray welfare (panel (b)) and social welfare (panel (c)), measured as a percentage deviation from the first-best. The black lines correspond to the oligopoly-fringe equilibrium and the gray lines to the Herfindahl scenario. The number of oligopolists is on the horizontal axes. When increasing the number of oligopolists, we keep the aggregate resource stock of the oligopolists unchanged. Hence, moving to the right in these figures can be interpreted as decreasing the Lerner index and, hence, decreasing market power.

Panel (a) shows that, in our calibrated model, the effect of market power on climate damage is non-monotonic. Starting from a cohesive cartel, increasing the number of oligopolists while maintaining the total stock of the oligopolists fixed at first lowers climate damage. However, increasing the number of oligopolists beyond 4 leads to higher climate damages. The intuition behind this U-shaped relationship is that increasing competition on the one hand reduces the sequence effect and hence delays the extraction of relatively carbon-intensive fossil fuel. On the other hand, increasing competition also decreases the ‘conservation effect’ and hence increases the industry-level extraction. The former effect dominates if market power is still strong, whereas the latter becomes dominant at lower levels of market power. The sequence effect is not present in the Herfindahl scenario, which explains the monotonically increasing gray line.

Effect of market power on welfare and climate damage. Notes: The figure shows the effect of the number of oligopolists (which is negatively related to the Lerner index of market power) on the percentage deviations of climate damage (panel (a)), gray welfare (panel (b)) and social welfare (panel (c)) from their values in the first-best. The black (gray) lines correspond to the OL-OFE equilibrium (Herfindahl scenario). Cobb–Douglas utility (giving rise to CES demand) is imposed, with the parameter values shown in Table 1. The remaining parameters are set at their benchmark values

Panel (b) confirms that gray welfare increases monotonically in the number of oligopolists. Social welfare, however, depends non-monotonically on the number of oligopolists. It first increases with this number (as gray welfare goes up and climate damage goes down), but starts to decline if the number of oligopolists increases beyond 8, when the increase in climate damage as a result of more competition dominates the decrease in distortions from market power. When there are 8 oligopolists, the welfare loss compared to the first-best shrinks to only 0.5 percent, 22 percent of which is due to the inefficient order of extraction.

4.2 Quadratic and Power Utility

Welfare effects of market power and of the interest rate. Notes: The figure shows the effect of the number of oligopolists, which is negatively related to the Lerner index of market power (panels (a), (c) and (e)) and of the interest rate (panels (b), (d) and (f)) on the percentage deviations of climate damage (panels (a) and (b)), gray welfare (panels (c) and (d)) and social welfare (panel (e) and (f)) from their values in the first-best. The solid, dashed and dotted lines correspond to the cases of CES, linear and shifted CES demand, respectively. The corresponding parameter values of the utility function are shown in Table 1. The remaining parameters are set at their benchmark values

In this section, we examine the robustness of our results with respect to different subclasses of HARA utility functions. In addition to Cobb–Douglas utility, we will present results for the quadratic utility case (yielding linear demand, as in Benchekroun et al. [6]) and power utility (yielding ‘shifted CES demand’). The parameter values of the utility function are given in Table 1. Figure 4 shows the percentage welfare loss (compared to the first-best) for the number of oligopolists varying from 1 to 10 (panels (a), (c) and (e)) and interest rates varying from 0.01 to 0.05 (panels (b), (d) and (f)). The interest rate affects the welfare consequences of the timing of extraction and hence of the sequence effect. The benchmark interest rate of 0.028 is indicated by the dashed-dotted vertical line in the panels on the right. Panels (a) and (b) depict climate damage, panels (c) and (d) gray welfare and panels (e) and (f) social welfare.

Panel (a) shows that climate change depends non-monotonically on the number of oligopolists for the three HARA subclasses, due to the interaction of the conservation and the sequence effect. Gray welfare is monotonically increasing, whereas social welfare is first increasing and then slightly decreasing in the number of oligopolists. The three panels on the right show that climate damage and welfare loss (both compared to the first-best) depend positively on the rate of interest. Intuitively, a higher interest rate implies that timing becomes more important. Hence, the welfare loss from the sequence effect will be more pronounced.

The deviation of climate damages from the first-best does not differ too much among the three HARA-class functions. However, the losses in gray welfare (and hence in social welfare) can be significantly affected. Panels (e) and (f) show that in our benchmark calibration with a constant elasticity of resource demand an interest rate of 2.8 percent and a cohesive cartel, social welfare is 8.5 percent lower than in the first-best. A large share, 98 percent, of this welfare loss can be attributed to the inefficient order of extraction. In the case of power utility (yielding shifted CES demand, see the dotted curves), the welfare loss compared to the first-best amounts to 4.2 percent, of which again 98 percent is caused by the inefficient order of extraction. Although the welfare loss from market failures in our nonlinear HARA demand scenarios is significantly smaller than the 14.5 percent reported in Benchekroun et al. [6] for the linear demand case (see the dashed curves), the share of this welfare loss that is attributable to the inefficient order of extraction is comparable to the 97 percent found in Benchekroun et al. [6].

5 Green Paradox

In this section, we numerically investigate the occurrence of the so-called Green Paradox. The extensive literature on the Green Paradox (defined as an increase in current emissions upon the announcement of climate policies) typically assumes either perfectly competitive or monopolistic fossil fuel supply [cf. 19, 23]. The issue has not been addressed by Benchekroun et al. [5] nor by Benchekroun et al. [6]. We look at the effect of an increase in the subsidy on renewable energy from 10 to 20 US$ per BOE, thus lowering the unit cost of renewable energy accordingly.

Green Paradox effects of a subsidy on renewables. Notes: The figure shows the effect of an increase in the subsidy of renewables from 10 to 20 US$ per BOE. The solid, dashed and dotted lines in panel (a) correspond to extraction by the fringe, extraction by the oligopolists and total extraction, respectively. Panel (b) shows the change in initial carbon emissions, respectively. Cobb–Douglas utility (giving rise to CES demand) is imposed, with the parameter values shown in Table 1. The remaining parameters are set at their benchmark values

Figure 5 shows the effect on initial extraction (panel (a)) and initial emissions (panel (b)) for isoelastic demand case. As shown by the solid line in panel (a), extraction by the fringe increases by 0.9 GtC in the case of a cohesive cartel, whereas extraction by the cartel only goes up by 0.1 GtC (dashed). When increasing the number of oligopolists, the rise in total extraction by all oligopolists together upon the increase in the renewables subsidy becomes larger, whereas the increase in extraction by the fringe becomes smaller. Together, in our calibrated model these extraction responses imply that the effect of the number of oligopolists on the increase in total initial extraction (dotted line in panel (a)) and total initial carbon emissions (panel (b)) is U-shaped, with the smallest increase in emissions of 0.06 GtC occurring when there are 3 oligopolists. Hence, a Green Paradox materializes in our model, but the effect is rather small.

6 Conclusion

To examine the effect of imperfect competition on welfare, climate damages and Green Paradox effects, we have formulated a dynamic non-renewable resource game between a group of oligopolists, in the presence of a competitive fringe and producers of a renewable substitute. We have examined the robustness of existing results in the literature with respect to the functional form of the demand function by allowing for a general class of HARA utility functions and by analyzing the effect of changes in the degree of market power of the oligopolists, as measured by the Lerner index.

We have provided a full analytical characterization of the equilibrium for the HARA subclass with Cobb–Douglas utility, with particular attention for the different sequences of extraction phases that can occur. The equilibrium always features a phase with simultaneous supply by the oligopolists and the fringe. An initial phase in which the oligopolists are the sole suppliers is possible when the Lerner index of market power is below a certain threshold and if the oligopolists’ stocks are relatively large. However, when the resource is relatively scarce, simultaneous extraction occurs at the beginning of the game. Whether the fringe or the oligopolists exhaust the resource first depends on their relative stocks. Moreover, when the fringe exhausts its reserves first, there always exists a limit-pricing phase. For intermediate values of the Lerner index, there is a phase where the cartel members extract alone at a price below the limit-pricing level. This phase is between an initial phase of simultaneous supply and a final phase of limit pricing. If the Lerner index is high, there will be simultaneous supply initially, followed by limit pricing or sole supply by the fringe, depending on the relative initial stocks.

We use our model to derive three additional main results. First, the occurrence of a phase with simultaneous supply is shown to be a source of inefficiency, because the fringe’s stock is assumed to be relatively more costly to extract and to generate relatively more full-cycle carbon emissions per unit of the resource. Hence, efficiency would require depletion of the oligopolists’ stocks before the fringe starts supplying. We numerically show that the inefficiency due to the extraction sequence effect in the oligopoly-fringe equilibrium with Cobb–Douglas and power utility is responsible for almost all (98 percent) of the welfare loss with respect to the first-best. This is in line with the result obtained for a quadratic utility Benchekroun et al. [6] (97 percent). However, we also show that this sequence effect depends negatively on the number of oligopolists and almost vanishes if this number is large enough. Hence, the result of Benchekroun et al. [6] is robust with respect to the specification of the demand function and is indeed due to market power.

Second, because of the interaction of the sequence effect (front-loading of dirty extraction due to market power) and the conservation effect (higher price due to market power), the effect of market power on climate damage is non-monotonic. Starting from a cartel-fringe situation, increasing the number of oligopolists (and hence lowering the degree of market power) first lowers climate damage because the weakening of the sequence effect dominates the weakening of the conservation effect. At lower levels of market power, the weakening of the conservation effect becomes dominant, implying that increasing the number of oligopolists further leads to higher climate damages.

Third, we look at Green Paradox effects. More specifically, we examine the effect of a subsidy on renewables on initial carbon emissions. We find that such a subsidy boosts initial carbon emissions, in line with the literature on the Green Paradox [e.g., 19]. The strength of this Green Paradox effect depends non-monotonically on the degree of market power. The reason is that a change in market power has different effects on the initial extraction responses of the oligopolists and the fringe. Starting from a high degree of market power, increasing the level of competition makes initial extraction of the oligopolists less responsive to a subsidy on renewables. On the contrary, initial extraction of the fringe becomes more responsive. Together, these effects imply that the relationship between market power and the Green Paradox is U-shaped.

Another potential area of application of the equilibrium that we have characterized is the examination of different climate policies, such as a tax on carbon on the extraction paths of the different players. Interesting other avenues for further research include the application of different equilibrium concepts (e.g., feedback Nash), allowing for stock-dependent extraction costs, a more realistic specification of climate damages, and introducing convex production costs of renewables.

Notes

Note that HARA utility functions are characterized by a nonnegative super-elasticity of demand \(\frac{d\varepsilon }{dq}\frac{q}{\varepsilon }\), where \(\varepsilon \) is the price elasticity of demand. This implies that in the CFE the growth rate of \(p-k^{c}\) is smaller than r. Hence, the growth rate of the oil price does not exceed the rate of interest. This prevents arbitrators from purchasing oil, hoarding it and making capital gains [cf. 14, DH1979].

For the other HARA subclasses, the Lerner index is endogenous, as it depends on the level of resource demand.

For numerical reasons, in the case of power utility we multiply all prices by a factor \(10^{-6}\), so that the demand function runs through \( (p(0),q(0))=(80\cdot 10^{-6},34)\).

References

Almoguera PA, Douglas CC, Herrera AM (2011) Testing for the cartel in OPEC: non-cooperative collusion or just non-cooperative? Oxford Rev Econom Policy 27:144–168

Andrade de Sá S, Daubanes J (2016) Limit pricing and the (in)effectiveness of the carbon tax. J Public Econom 139:28–39

Benchekroun H, Halsema A, Withagen C (2009) On nonrenewable resource oligopolies: the asymmetric case. J Econom Dynam Control 33:1867–1879

Benchekroun H, Halsema A, Withagen C (2010) When additional resource stocks reduce welfare. J Environ Econom Manag 59:109–114

Benchekroun H, van der Meijden G, Withagen C (2019) An oligopoly-fringe non-renewable resource game in the presence of a renewable substitute. J Econom Dynam Control 105:1–20

Benchekroun H, Van der Meijden G, Withagen C (2020) OPEC, unconventional oil and climate change-On the importance of the order of extraction. J Environ Econom Manag 104:102384

Benchekroun H, Withagen C (2012) On price taking behavior in a nonrenewable resource cartel-fringe game. Games and Econom Behav 76:355–374

Dasgupta P, Heal G (1979) Economic Theory and Exhaustible Resources. Cambridge Economic Handbooks, University Press, Oxford

Gerlagh R (2011) Too Much Oil. CESifo Econom Stud 57:79–102

Gilbert RJ, Goldman SM (1978) Potential competition and the monopoly price of an exhaustible resource. J Econom Theory 17:319–331

Groot F, Withagen C, de Zeeuw A (2003) Strong time-consistency in the cartel-versus-fringe model. J Econom Dynam Control 28:287–306

Herfindahl OC (1967) Depletion and economic theory. In: Gaffney M (ed) Extractive resources and taxation. University of Wisconsin Press, Madison, pp 63–90

Hoel M (1978) Resource extraction, substitute production, and monopoly. J Econom Theory 19:28–37

Kagan M, Ploeg F, Withagen C (2015) Battle for climate and scarcity rents: beyond the linear-quadratic case, Dynam Games and Appl 5

Long NV (2010) A survey of dynamic games in economics, number 7577 in World Scientific Books. World Scientific Publishing Co. Pte. Ltd

Long NV (2011) Dynamic games in the economics of natural resources: a survey. Dynam Games Appl 1:115–148

Salant SW (1976) Exhaustible resources and industrial structure: a nash-cournot approach to the World oil market. J Political Econom 84:1079–1094

Salant SW (1979) Staving Off the Backstop: Dynamic Limit Pricing with a Kinked Demand Curve. In: Pindyck R (ed) Advances in the Economics of Energy and Resources. JAI Press, Greenwich, Conn

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15:360–394

Van der Ploeg F, Withagen C (2012) Is there really a green paradox? J Environm Econom Manag 64:342–363

Van der Ploeg F, Withagen C (2015) Global warming and the green paradox: a review of adverse effects of climate policies. Rev Environ Econom Policy 9:285–303

Van der Meijden G, Ryszka K, Withagen C (2018) Double limit pricing. J Environ Econom Manag 89:153–167

Van der Meijden G, Withagen C (2019) Limit pricing, climate policies, and imperfect substitution. Resource and Energy Econom 58:101118

Van der Werf E, Di Maria C (2012) Imperfect environmental policy and polluting emissions: the green paradox and beyond. Int Rev Environ Resour Econom 6:153–194

Withagen C (2013) Cartel-versus-Fringe Models. In: Shogren JF (ed) Encyclopedia of Energy, Natural Resource, and Environmental Economics. Elsevier, Waltham, pp 260–267

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the topical collection “Dynamic Games in Environmental Economics and Management" edited by Florian Wagener and Ngo Van Long.

Hassan Benchekroun thanks the Fonds de recherche du Québec - Société et culture (FRQSC) and the Canadian Social Sciences and Humanities Research Council (SSHRC) for financial support. All data generated or analysed during this study are included in this published article and its supplementary information files.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van der Meijden, G., Withagen, C. & Benchekroun, H. An Oligopoly-Fringe Model with HARA Preferences. Dyn Games Appl 12, 954–976 (2022). https://doi.org/10.1007/s13235-022-00439-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-022-00439-x

Keywords

- Oligopoly-fringe

- Climate policy

- Non-renewable resource

- Herfindahl rule

- Limit pricing

- Oligopoly

- HARA preferences