Abstract

We study the relationships between the input and network additionalities prompted by public support for innovation and entrepreneurial orientation and whether being a family business moderates these relationships. The results, based on a dataset of 115 Mexican firms, show that the changes generated by public support for innovation programmes encourage entrepreneurial orientation. Additionally, family firms have a differential ability to transform input and network additionalities into entrepreneurial orientation. This study contributes theoretically and practically by highlighting the positive effects of research and development support programmes on a firm’s entrepreneurial orientation. It also points out the need to consider family status when designing public policies, since our results reveal that family and non-family firms are not equally efficient in transforming resources into entrepreneurial orientation and that family firms that drive networking through the rules of the subsidy do not trigger the expected potential benefits.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The increasing interest in promoting public policies that support research and development (R&D) in the private sector (e.g. IMF, 2016; Szczygielsk et al., 2017) leads to the need to know their impact on companies (e.g. Catozzella & Vivarelli, 2016; Heijs et al., 2022). Literature postulates that public subsidies may modify firms’ R&D expenditure (input), behavior, and/or output (Kim et al., 2021; Yaghi & Tomaszewski, 2023). “A key question for any R&D subsidy is related to how the results differ from a situation without the subsidy, which is referred to as the additionality of the subsidy” (Steinmo et al., 2022, p. 381). Many studies relying on the additionality framework focus on input additionality (e.g. Taş & Erdil, 2023), that is, the increase in business expenditure on R&D caused by the support (Heijs et al., 2022). However, this formulation of additionality does not capture the effects of the programmes well (Buisseret et al., 1995), given that government aid generates effects that last beyond project completion (OECD, 2006). To overcome this limitation, a limited set of studies focus on the behavioral additionality, defined as the differences that public R&D support make in the behavior of firms receiving support (Falk, 2007; Ghazinoory & Hashemi, 2023). Behavioral additionality provides the long-term effect from a subsidy (Georghiou et al., 2002) being considered a complementary measure of short-term measures (Busom & Fernández-Ribas, 2008).

The individual impact of input and behavioral additionalities generated by public R&D support on firms remains scarcely researched beyond performance (Bellucci et al., 2019) or innovation (e.g. Falk, 2007). However, the literature points to a possible influence of additionalities generated by public R&D support in entrepreneurial orientation (EO), defined as the “entrepreneurial processes, that is, the methods, practices and decision-making styles managers use to act entrepreneurially” (Lumpkin & Dess, 1996, p. 136). The adoption of a high EO requires complementary or different resources (e.g. financial and human) and capabilities (e.g. networking) (Covin & Slevin, 1991; Miao et al., 2017) to develop new routines, competencies and technologies. These resources and capabilities can potentially be enhanced by publicly supported R&D and the additionalities thereof. Public R&D supported programmes may encourage companies to invest more in R&D activities (Clarysse et al., 2009; Falk, 2007; Petrin & Radicic, 2023), which, in turn, can influence EO, as they can foster innovation, proactivity and risk-taking (Block, 2012), which are its core dimensions (Covin & Slevin, 1989). Literature also suggests that R&D subsidies can promote intrapreneurship (Mennens et al., 2022). Receiving an R&D subsidy increases the financial resources of firms which promotes employees’ venture behavior for the implementation of ideas which can create new business for the organization (Hornsby et al., 2002; Mennens et al., 2022; Menzel et al., 2007). In addition, public R&D support and their additionalities can improve firms’ networking which will foster their internal endowment of resources and capabilities (i.e. Guisado-González et al., 2018). As a result, firms will increase their innovative capacities, and then its EO (Covin & Slevin, 1991). Notably, this phenomenon has been recognised by the State Council of Science and Technology of the State of Jalisco (COECYTJAL) as a legal foundation and motivation for the public programmes included in our analysis, as its strategic vision includes “the launch of a programme that promotes and fosters a culture of innovation and entrepreneurship” (COECYTJAL, 2015).

Besides, the literature typically assumes that companies have the same capacity to benefit from the R&D supported programmes, which implies that the impact of this intervention is homogeneous across firms (Afcha & Lucena, 2022). However, growing evidence reveals that the impact of R&D in terms of additionality differs between industries, countries, and firm characteristics (Afcha & Lucena, 2022; Gelabert et al., 2009; Lewandowska et al., 2022; Wanzenböck et al., 2013). Consequently, and in line with Afcha and Lucena (2022), we explore the idea that firm context plays a key role in how firms exploit R&D subsidies to promote EO. Specifically, we focus on the family business context because family influence affects firms’ resources and capabilities (Habbershon & Williams, 1999; Habbershon et al., 2003; Sirmon & Hitt, 2003) and the way resources are utilized and strategies are established (Arregle et al., 2007; Chrisman et al., 2009). Indeed, family businesses have a singular behavior in aspects such as its innovation patterns (Carney et al., 2015; Cucculelli et al., 2022; De Massis et al., 2013; Duran et al., 2016; Jalilvand et al., 2019; Flores-Rivera et al., 2024), its EO (Hernández-Linares & López-Fernández, 2018; Jalilvand et al., 2019) and the way they take advantage of networks (Pucci et al., 2020). Although to our knowledge, research is lacking on how the family business context affects the relationships between additionalities generated by the R&D subsidies and EO, there are empirical evidence that being a family business moderates the relationship between EO and some of their antecedents, such as chief executive officer’s tenure (Boling et al., 2016) or learning orientation (Hernández-Linares et al., 2018). Consequently, we posit that the relationship between a firm’s additionalities and its EO may also be moderated by the family business context.

Drawing on Theory of Market Failure (TMF; Arrow, 1972), Evolutionary Theory (ET; Kim et al., 2021), Transaction Costs Theory (TCT, Williamson, 1981), and Resource-Based View (RBV; Barney, 1991), this study analyses how input additionality and behavioral additionality are related to the EO of companies receiving such support. Subsequently, this study explores whether these relationships are moderated by a firm’s family status. For this purpose, survey data from 115 Mexican companies were analysed. Mexico was chosen as the study setting because of weaknesses around Mexican companies’ capacity for spending on R&D are significant (De Fuentes et al., 2020), which makes them quite dependent on public subsidies to innovate (Andrade Rojas et al., 2018), but also because Mexican firms are largely family owned and they contribute 60% of jobs and half of the gross domestic product in (Ramírez-Solís et al., 2016). Besides, Mexico is the second largest country transitioning from an efficiency-driven to an innovation-driven economy (Schwab, 2015) and is a representative example of the Latin American region (Ramírez-Solís et al., 2016). Therefore, it can be good illustration of other emerging markets where governments play a key role as a fundamental source of resources (Hoskisson et al., 2000; Ring et al., 2005).

Our study makes four contributions to the literature. First, we address calls to evaluate public support going beyond the examination of its effectiveness on innovation inputs (Petrin & Radicic, 2023). In this way, we contribute to the policy evaluation literature and specifically to the debate on public R&D support’s impact on private firms by for the first-time providing empirical support for the positive effects on companies’ EO. Second, we contribute to R&D literature by challenging the assumption that the impact of public support to R&D would be homogeneous across firms (Afcha & Lucena, 2022) and addressing the need to analyse the moderating effect of being a family firm on the relationship between additionalities and EO (Feranita et al., 2017). Third, we contribute to entrepreneurship literature by identifying additionalities as key factors underlying EO development (Lumpkin et al., 2010; Wales et al., 2013, 2021), which is important “because EO does not exist automatically” (Ling et al., 2020, p. 710). Finally, literature on additionalities is mostly concentrated in developed countries (e.g. Freitas et al., 2017; Holt et al., 2021; Marino et al., 2016), making the results difficult to be generalized to emerging economies, which present a series of specific characteristics make it more difficult to take advantages from the R&D subsidies and their additionalities (Hoskisson et al., 2000; Ring et al., 2005; Wei et al., 2020). However, studying behavioral additionalities in developing countries is of interest as in these contexts public policies for support on R&D are incipient and aim to “change innovation patterns in the medium and long terms” (Berrutti & Bianchi, 2020, p. 2). Therefore, we contribute to management literature by addressing the various calls for additional insights into the innovation management (Heredia-Pérez et al., 2019) in an under-researched context where additionalities are more complex than in developed countries (Berrutti & Bianchi, 2020; Hoskisson et al., 2000; Ring et al., 2005; Wei et al., 2020).

Our study also offers practical implications especially valuable for policy makers. On the one hand, as it evidences how the increase of the recipient firm’s R&D investment and the extension of its networking behavior resulting from the aid received lead to boosting its EO, our study offers insights about how to design effective public policies in supporting of innovation and fostering firm’s EO. On the other hand, policy makers can also consider our results to improve the impact of their policies in specific contexts. Along this line, recognising the different effects of their programmes on different types of enterprises, and on family businesses, can guide policy makers to design and implement R&D subsidies focused on supporting innovative activities on these specific contexts.

Theoretical Framework

Governments favour R&D activities because of the potential benefits to businesses and the overall technological and economic development of society (Wanzenböck et al., 2013). The funding of business sector R&D activities either employ direct (such as grants or subsidies) and indirect (R&D tax incentives) funding mechanisms (Taş & Erdil, 2023). The rationale for these public investment grounds in the TMF (Arrow, 1972), which suggests that public intervention supporting private R&D occurs due to the gap between its social and private returns because of the existence of a wide range of market failures (Yaghi & Tomaszewski, 2023). According to TMF, market failures prevent companies from investing in R&D to undertake innovative activities and “government intervention is thus needed to compensate for the underinvestment in R&D that would occur if left to the private sector” (Clarysse et al., 2009; p. 1517). The widespread implementation of publicly supported R&D programmes results in an increased need to evaluate their efficacy (Dimos et al., 2022). The additionality framework, which comes from the TMF (Clausen & Rasmussen, 2011), assesses public programmes by identifying their additional effects produced in companies (Luukkonen, 2000; OECD, 2006).

Although literature has been mainly based upon input and output additionalities (Wu, 2017), to explore both short-term and long-term effects from a subsidy (Busom & Fernández-Ribas, 2008; Georghiou et al., 2002), this study focuses on input and behavioral additionalities. Input additionality is broadly understood as “the effect of public R&D support on the private R&D efforts of the recipient company” (Clarysse et al., 2009, p. 1521). This concept, that has its roots on the TMF (Clarysse et al., 2009), is broadly related to the debate between the crowding-out (substitute internal R&D investments with the public financial resources received) (Marino et al., 2016) and the crowding-in (additionality) effects of R&D subsidies (Clarysse et al., 2009). Input additionality deals with the question of whether “the firm itself spends at least one additional Euro on the research project for every Euro received in subsidy” (Falk, 2007, p. 667). In contrast to input additionality, behavioral additionality is inherently intangible (Falk, 2007) and refers to behavioral changes of a firm following a policy stimulus (Buchmann & Kaiser, 2019; Georghiou, 2002). Although there not exist a generalized agreement about its operationalization, in line with most of the literature (Autio et al., 2008; Busom & Fernández-Ribas, 2008; Falk, 2007; Steinmo et al., 2022; Wanzenböck et al., 2013), we focus on network additionality, which is “the extent to which a firm extends its network of external sources to the innovation process” (Knockaert et al., 2014, p. 378).

From a theoretical point of view, TMF suggests that R&D subsidies mitigate market failures, while at the same time allow firms to increase their expectations about the returns of their R&D investments, in this way incentivising their own R&D expenditures (Dimos et al., 2022), that is, promoting input additionality. Furthermore, ET, which emphasizes interaction and learning among innovation actors (Kim et al., 2021), suggests that R&D public support may facilitate the formation of links among innovation players, thus changing and adapting firms behavior in an evolutionary process (Kim et al., 2021; Nelson & Nelson, 2002; Oh et al., 2022). Furthermore, TCT (Williamson, 1981) postulates that the firm will decide to perform the innovative activities internally or cooperating with other market actors for the development of R&D activities based upon the costs associated with this kind of activities (Williamson, 1993). Receiving financial support for R&D reduces the financial costs of firm R&D activities but also the costs related to long-term collaboration contracts of firms (Soltanzadeh et al., 2020), thus making firms more collaborative.

Hypothesis Development

Impact of Additionalities on EO

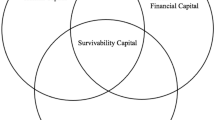

According to RBV, firms’ competitive advantages are related to their ability to successfully use (Eisenhardt & Martin, 2000; Teece et al., 1997) or integrate (Grant, 1991; Sirmon & Hitt, 2003; Sirmon et al., 2007) their resources and capabilities. Therefore, managers face the challenge of not only accumulating resources and developing capabilities, but also combining and using them to improve their potential for value generation (Sirmon et al., 2007). These resources and capabilities can potentially be enhanced by publicly supported R&D, for example encouraging companies to invest more in R&D activities (Clarysse et al., 2009; Falk, 2007; Petrin & Radicic, 2023). For this reason, research on the effectiveness of public R&D support on firms has broadly analysed its effect on performance or innovation (Bellucci et al., 2019; Falk, 2007). However, its link with EO remains as a research gap, despite “EO is the conduit through which managers […] direct how resources are used” (Miao et al., 2017, p. 69), and despite EO represents a strategic position (Wales, 2016; Wales et al., 2021) that can permeate all levels of the organisation (Covin & Slevin, 1991). To contribute to fill this gap, we propose the research model showed in Fig. 1. Specifically, we propose that input and network additionalities are associated to a firm’s EO and that these relationships are moderated by the company’s family status, such as we study with detail following.

Input Additionality and EO

Public R&D support programmes are known to encourage companies to dedicate more private resources to R&D activities (Clarysse et al., 2009; Falk, 2007; Petrin & Radicic, 2023), which, in turn, can influence EO, because the investments may encourage innovation, proactivity and risk-taking (Block, 2012), which are its three classic dimensions (Covin & Slevin, 1989; Miller, 1983). From the RBV, a firm’s resources and capabilities will determine the “firm’s ability to engage in entrepreneurial behavior” (Covin & Slevin, 1991, p. 15), because EO is a strategic approach that requires the intensive use of resources and capabilities (Miao et al., 2017; Wales et al., 2021). Different types of resources and capabilities (e.g. financial resources, technological capabilities or knowledge-based dynamic capabilities) promote the EO of a firm (e.g. Filser et al., 2014; Hernández-Linares et al., 2023b; Miao et al., 2017). However, not all resources have a similar value for boosting a company’s EO, with “financial resources devoted towards R&D” being critical for doing it (Covin & Slevin, 1991, p. 16). Besides, the additional financing resources that come from the R&D subsidy foster intrapreneurship (Mennens et al., 2022). R&D subsidies promote employees’ venture behavior for the implementation of ideas which can create new business for the organization (Hornsby et al., 2002; Mennens et al., 2022; Menzel et al., 2007). Therefore, a firm’s EO is expected to improve when the company allocates more resources to R&D activities after receiving public support for that purpose. Formally, we hypothesise the following:

Hypothesis 1

Input additionality is positively associated with EO.

Network Additionality and EO

Network additionality “denotes the impact of public R&D support on the collaboration and networking behavior of firms” (Wanzenböck et al., 2013, p. 71). It occurs when the probability of cooperating with other organisations for innovation increases owing to the receipt of public support (Busom & Fernández-Ribas, 2008; Guisado-González et al., 2018). RBV highlights the role of networking capability in facilitating access to scarce resources and improving learning processes (Ozer & Zhang, 2015). Companies improving their networking capability may be able to complement their internal endowment of resources and capabilities (Guisado-González et al., 2018; Lavie, 2006; Miao et al., 2017), with novel and diverse knowledge from external sources (Chen et al., 2015; García-Piqueres et al., 2016). It is not surprising, therefore, that research in entrepreneurship has increasingly embraced a ‘network-based approach’ (e.g. Hoang & Antoncic, 2003; Slotte-Kock & Coviello, 2010), emphasizing the importance of network-based constructs for EO (Ozcan & Eisenhardt, 2009). Business networking allows firms to get information about market trends as emerging technologies or demands changes, among others, all of which generates opportunities for the implementation of entrepreneurial activities (Su et al., 2015). Networking capability allows the acquisition of resources from outside the organization and helps firms meet the large resource requirement of EO (Covin & Slevin, 1991; Keh et al., 2007; Su et al., 2015), being a key factor for long-term EO (Jiang et al., 2018). Moreover, because entrepreneurial behaviors require a mix of knowledge to mitigate risks and help identify development opportunities (Covin & Miller, 2014), a firm with a strong networking capability has a greater capacity to undertake creative, innovative and proactive initiatives (Chen et al., 2015; Covin & Slevin, 1991). Finally, research has also suggested that network organizations facilitates the development of collaborative routines that offer opportunities for firms “to engage in joint endeavours commonly associated with innovation, risk-taking, and proactiveness for the network’s firms” (Wincent et al., 2014, p. 329). These opportunities are the basis for the development of an effective firm EO (Gunawan et al., 2016; Liu, 2021).This is especially relevant in emerging markets, such as Mexico (Andrade Rojas et al., 2018; Guerrero et al., 2019), in which barriers to innovation derived from financial limitations and unpredictable market conditions (Nanda & Rhodes-Kropf, 2013; Parker, 2009) could be diminished through collaborations (Guerrero et al., 2019; Laursen & Salter, 2006). Considering all above arguments, we think that if public support for R&D improves a firm’s networking capabilities, we can expect that its EO will be improved. Therefore, we posit the following:

Hypothesis 2

Network additionality is positively associated with EO.

Moderating Role of Family Business Status on the Relationship between Additionalities and EO

A family business is “one in which the family, as broadly defined, either has significant ownership or management control” (Lee, 2006, p. 104). Family involvement provides the firm with a differential configuration of resources and capabilities (Habbershon & Williams, 1999; Habbershon et al., 2003; Sirmon & Hitt, 2003). This singular configuration of resources and capabilities of family firms, or familiness, has its origins in “the systems interaction between the family, its individual members, and the business” (Habbershon & Williams, 1999; p.11). This idiosyncratic bundle of family specific resources and capabilities has the potential to explain the nature of family influence on firm behavior (Habbershon et al., 2003). Therefore has implications for business goals, planning horizons, resource allocations, strategic and innovative behaviors (Arregle et al., 2007; Boling et al., 2016; Chrisman et al., 2009), as well as for EO and its relationships to various antecedents (Hernández-Linares & López-Fernández, 2018). Being a family business moderates the relationship between EO and some of its antecedents, such as the tenure of the chief executive officer (Boling et al., 2016) or the firm’s learning orientation (Hernández-Linares et al., 2018). Hence, although to our knowledge, the influence of being a family business in the link between additionalities generated by the R&D subsidies and firm’s EO remains nonresearched, it seems reasonable to posit that the unique configuration of resources and capabilities of family businesses (Habbershon & Williams, 1999; Habbershon et al., 2003) and their ability to act in a unique way (Carney et al., 2015; Duran et al., 2016), may also influence how they extract value from the received subsidies in terms of EO. Specifically, we consider that being a family business may have a dual influence on the way companies take advantage of additionalities generated by R&D subsidies and utilize them in entrepreneurial efforts, such as we explain with detail below.

Input Additionality, EO and Family Business Status

Family firms are often considered less risk-taking (Boling et al., 2016; Ceipek et al., 2021; Short et al., 2009) because of the family’s wealth concentration in its business (Schulze et al., 2001). In similar view, there are abundant evidence that family businesses are less likely to invest in R&D than no family firms (Block, 2012; Brinkerink & Bammens, 2018; Carney et al., 2015; Duran et al., 2016; Munari et al., 2010), which often is attributed to their interest to protect their socioemotional wealth, understood as the “non-financial aspects of the firm that meet the family’s affective needs, such as identity, the ability to exercise family influence and the perpetuation of the family dynasty” (Gómez-Mejía et al., 2007, p. 106). These characteristics (less risk-taking and less investment in R&D) as well as their lesser proactiveness (Short et al., 2009) are expected to limit family businesses ability to transform their resources in terms of EO (Boling et al., 2016; Covin, 2016; De Massis et al., 2014).

Nevertheless, the family status of a company has also been found to provide a context in which managers overcome conservative limitations and support R&D investments (Boling et al., 2016; Kraiczy et al., 2015) due to the existence of a “compensatory mechanism” (Carney et al., 2015). This mechanism drives family firms to be more efficient in the transformation of their resources as they engage in more innovation (Carney et al., 2015; Duran et al., 2016) so that they may become more relevant to the market and. Notably, “innovation is a core element of entrepreneurial behavior”, and “innovativeness is inherent to the exhibition of EO” (Boling et al., 2016, p. 896). Specifically, a long-term orientation (Lumpkin et al., 2010) and a desire to preserve the business for future generations (Le Breton-Miller & Miller, 2011) seem to play a key role in this improved efficiency of family firms. Moreover, long-term orientation (Chrisman & Patel, 2012; Lumpkin et al., 2010) and the fall of performance below acceptable expectations (Patel & Chrisman, 2014) tend to lead to riskier R&D investments in family firms. Additionally, the long tenure of family members in key management positions is related to higher EO levels (Boling et al., 2016). In line with these arguments and considering that literature (e.g. Ceipek et al., 2021; De Massis et al., 2014; Patel & Chrisman, 2014) suggests that the family status of a firm may boost its ability to transform additional financial resources devoted to R&D and lead to higher EO, we formally propose:

Hypothesis 3

Family firm status positively moderates the relationship between input additionality and EO, such that the positive association between input additionality and EO will be stronger for family firms than for nonfamily firms.

Network Additionality, EO and Family Business Status

As EO demands recourses (Covin & Slevin, 1991; Miao et al., 2017; Wales et al., 2021) and resources may be obtained from internal and external sources (Zahra & Nielsen, 2002), network additionality contributes to overcoming a paucity of resources (e.g. human and financial) faced by companies pursuing an EO strategy (Covin & Slevin, 1991; Miao et al., 2017). It does so by promoting new knowledge acquisition and recognising entrepreneurial opportunities (Song et al., 2017). However, the relationship between network additionality and EO may be influenced by the uniqueness of the family business in two ways.

On the one hand, owing to their transgenerational horizons (Habbershon et al., 2003), family firms tend to be more community oriented, building long-lasting and trust-based reciprocal relationships with external parties and stakeholders (Cabrera-Suárez et al., 2011; Chrisman et al., 2009; De Massis et al., 2015; Miller & Le Breton-Miller, 2005). Furthermore, collaborative network orientation is positively associated with innovativeness (an EO dimension) in family firms (Sorenson et al., 2008). Indeed, Pucci and colleagues (2020, p. 207) report that “family firms are particularly able to take advantage of the combination of local and distant relationships in order to produce innovation outcomes”. Above arguments and findings support the idea that the family business context strengthens the positive relationship between network additionality and EO.

On the other hand, the relationships among family members strengthen communications and trust within organization and provide access to human, physical, and financial resources (Yates et al., 2023). A key resource for recognising and taking advantage of networks and entrepreneurial opportunities is the knowledge (Randolph et al., 2017) and family businesses are unique in the way of sharing and transfer of knowledge (Chirico, 2008; Zahra et al., 2007) due to the family relationships. However, when taken to excess these relationships can deny family members in the firm access to external knowledge and resources (Yates et al., 2023). For this reason, family firms are less prone to using external sources to acquire knowledge and/or collaborate (De Massis et al., 2013; Nieto et al., 2015; Serrano-Bedia et al., 2016). Additionally, even when family firms are willing to network, they use a less diversified set of collaboration partners than nonfamily firms (Classen et al., 2012). Serrano-Bedia et al. (2016, p. 18) found that family involvement leads to higher transaction costs in collaborations because the family involvement negatively moderates “the relationship between the use of knowledge obtained via contractual collaborations and innovation performance”. The combination of these propositions leads us to propose a less pronounced relationship between network additionality and EO in the family firm context. Formally stated:

Hypothesis 4

Family firm status negatively moderates the relationship between network additionality and EO, such that the positive association between network additionality and EO will be weaker for family firms than for nonfamily firms.

Methods

Study Setting and Data

The dataset used for this study were obtained from an ad hoc questionnaire applied to Mexican firms’ beneficiaries of a government innovation support programme and presented to those having an adequate company overview and a good knowledge of projects and their effects. The participants were also responsible for officially monitoring projects and answering surveys. As is common in the literature (e.g. Hernández-Linares et al., 2023c), the questionnaire was translated into Spanish from English and was subsequently back-translated to English to check consistency. The pre-test involved presenting the questionnaire to two technical project managers benefiting from the Innovation Stimulus Programme (Programa de Estímulos a la Innovación, PEI), a key public R&D support programme designed to foster innovative activities in Mexico (Guerrero & Link, 2022). Thereafter, between October 2015 and February 2017, the questionnaire was distributed to all the firms located in the State of Jalisco (i.e. the second biggest economy in Mexico) that had received grants from three government programmes to support innovation (PEI, Alberta and Prosoft programmesFootnote 1). As a best practice, the inclusion of various programmes was ensured to identify the impact of support programmes (Autio et al., 2008; Huergo & Moreno, 2017). To collect complementary data for triangulation, the questionnaire was also sent to all the companies located within the Entrepreneurship and Innovation Park of Tecnológico de Monterrey University, Guadalajara, which has received government support for R&D activities over the past five years (2012–2016). These 154 firms make up a suitable population for providing information that would lead to an improved understanding of the effects of R&D activities in Mexico (Andrade Rojas et al., 2018). The questionnaire yielded 115 responses. The support of COECYTJAL and the Tecnológico de Monterrey ensured a high response rate (74%) (Table 1).

Measures

All multi-item measures were reflective and perceptual and based on a seven-point Likert-type scale with responses ranging from 1 = “strongly disagree” to 7 = “strongly agree”, unless otherwise noted. The scores were then averaged (see Appendix 1).

Dependent Variable

EO (Cronbach’s alpha = 0.90). The study applied the three-component (i.e. innovativeness, proactiveness and risk-taking) unidimensional conceptualisation of EO proposed by Miller (1983), improved by Covin and Slevin (1989) and perfected for our use by Kellermanns and Eddleston (2006).

Independent Variables

Input additionality (Cronbach’s alpha = 0.80). Given that an archival measure of the impact of policy support was not available, the present study used the perceptual four-item scale developed by Clarysse et al. (2009).

Network additionality (Cronbach’s alpha = 0.82). The three-item scale developed by Knockaert et al. (2014), which is based on the work of Clarysse et al. (2009), was used. However, before calculating the reported Cronbach’s alpha, the second item was excluded, owing to low loading on this factor.

Moderating Variable

Family business status. Given the lack of a database on family firms in Mexico and in line with other scholars (e.g. Stanley et al., 2019), we identified family firms based on a subjective criterion: their self-perception as a family business. Specifically, the questionnaire included an item asking whether the respondents perceived their firm as a family business. As a result, 40 of the 115 firms included in the study sample were identified as family businesses (34.80%). This is a lower percentage than expected in the Mexican economy, but it is consistent with the proportion of family businesses engaged in innovation activities that were potential participants in the support programmes (López-Fernández et al., 2011).

Controls

To ensure appropriate model specification and to consider possible alternative explanations of variations (Arzubiaga et al., 2018) of additionalities and EO, three control variables were included. First, and in line with Rostain (2021), we controlled for firm size using a dichotomous variable (1 = firms with more than 250 employees and 0 = otherwise). This variable was included because larger firms may be slow in engaging in entrepreneurial activities (Kellermanns & Eddleston, 2006), whereas smaller firms may be quicker and more successful (Rauch et al., 2009). Next, we controlled by sector (1 = manufacturing sector, and 0 = otherwise), as sectors may imply different competitive contexts (Wiklund & Shepherd, 2005). Finally, because “organisations develop and improve skills to perform a certain task as experience is accumulated” (Clarysse et al., 2009, p. 1,518), we controlled for experiential learning, which was measured by the number of projects financed by the company using public support for innovation over the past five years (Clarysse et al., 2009).

To ensure the validity and reliability of our measures, scales previously validated in the literature were used. The composite reliability for our dependent and independent variables was higher than 0.766, exceeding the 0.70 benchmark (Nunnally, 1978; Nunnally & Bernstein, 1994). Therefore, internal consistency was confirmed.

All items of the three constructs showed high loadings (Appendix 1) in the confirmatory factor analyses (CFA), apart from the second item (i.e. network additionality), which was excluded owing to its low loading. This suggests that the items in each construct were empirically related and constituted distinct unidimensional constructs.

To test the measures for discriminant validity, and in line with recent studies (e.g. Fultz & Hmieleski, 2021), the square roots of the average variances extracted (AVEs) for the dependent and independent variables were calculated (Table 2). The results indicate that the measured constructs differed significantly (Bagozzi & Phillips, 1982), and they especially apply (Fornell & Larcker, 1981) to the two types of additionalities.

We performed a CFA, specifying that each item was allowed to only load onto the construct it was designed to measure. Item loadings were significant (all at p < 0.001), and all indicators were acceptable (X2 = 106.43, df = 58, p < 0.001, CFI = 0.94, IFI = 0.94, TLI = 0.92, GFI = 0.87, AGFI = 0.80 and RMSEA = 0.09), except for RMSEA, which was above the 0.08 threshold. However, this can be considered acceptable (Schumacker & Lomax, 2010), given the small size of the sample and the small number of variables in the model (Kenny & McCoach, 2003).

Results

Table 3 presents the descriptive statistics and zero-order correlations (see Appendix 2 for a description of the sample). The largest correlation coefficient was smaller than the rule-of-thumb cut-off of 0.65 (Tabachnick & Fidell, 2012), and the variance inflation factors were smaller than 1.94, far below the suggested cut-off value of 5 (O’Brien, 2007). This suggests that multicollinearity was not a problem (Hair et al., 1998). Finally, the variables were converted to z-scores before creating the interaction terms (Aiken & West, 1991) to reduce any remaining risk of multicollinearity.

To check for the adequacy of the linear regression model, the assumptions of the linear models were analysed for their validity with respect to the study sample. No heteroskedasticity was reported in the analyses (White, 1980), suggesting the normality of residuals and the equality of variances. Thus, no violations of the linear model assumptions were found (Greene, 2003).

Furthermore, as the present study relies on single informants, a series of procedures were applied to minimise the risk of common method variance (CMV). The anonymity of the respondents was protected (Arend, 2014; Fuetsch, 2022), and the survey was pre-tested (Oliveira & Pinheiro, 2021; Tourangeau et al., 2000) to ensure minimum ambiguity using the correct wording of the questions. The independent and dependent scale items were separated to prevent respondents from intuiting relationships between variables (Arend, 2014). When the questionnaire was applied, Harman’s (1967) single-factor test was performed, following the method of Podsakoff and Organ (1986). Four factors with eigenvalues greater than 1.0 were identified, accounting for 63.70% of the variance. Although no single-method factor emerged, a stronger test was used (Podsakoff et al., 2003), and three competing confirmatory factor models were tested. In the first model, all items were loaded on a common method factor (Akaike’s information criterion [AIC] = 361.84); in the second model, items were loaded on their theoretically assigned latent variables (AIC = 172.43); and in the third model, items were loaded on both their theoretical latent variables and an additional method factor (AIC = 179.77). The second model showed a better fit. Subsequently, a chi-squared difference test was performed to compare the second and third models (ΔX2 = 4.66, Δdf = 6, p < 0.001). The addition of the method factor to the second model reduced the model fit; hence, CMV does not seem to have been a problem in the measurement model (Williams et al., 1989).

Finally, because the literature suggests that additionality and EO may be endogenous (Catozzella & Vivarelli, 2016), we adequately addressed the issue to ensure unbiased results. Following recent studies (Gillis et al., 2020), we ran a two-step least square (2SLS) regression and performed a Durbin and Wu-Hausman test. In the first step of 2SLS, the potentially endogenous variables were regressed on the instrumental variables. In the second step, the dependent variable was regressed on the predictors using the predicted values obtained in the first step for those that were endogenous (Gillis et al., 2020). The instrumental variables must be correlated with the independent variables they represent and uncorrelated with the error term in the primary regression (Gould & Gruben, 1996). Based on the purpose of this study, we selected both “Research” and “Ownership Structure” as instrumental variables. “Research” represents the extent to which a firm’s employees carried out research activities to gain new advanced knowledge. “Ownership structure” indicates whether the ownership structure of the firm was national, foreign or public. In the second step, the results of the Durbin and Wu-Hausman chi-square and Wu-Hausman F tests (Hamilton & Nickerson, 2003) indicated the nonexistence of endogeneity (Davidson & Mackinnon, 1983) (input additionality: F = 0.00, p = 0.93 and Chi-square = 0.00, p = 0.97; network additionality: F = 0.01, p = 0.931 and Chi-square = 0.01, p = 0.92).

The proposed model was tested by hierarchical regression analysis (Table 4). In Model 1, the control variables were included, but none were significantly related to EO. The two independent variables were included in Model 2. A significant change in R2 was observed (ΔR2 = 0.30, p < 0.001). The significant and positive association between input additionality (β = 0.31, p < 0.05) and network additionality (β = 0.55, p < 0.001) and firm’s EO supports Hypotheses 1 and 2. Next, the family business variable was entered into Model 3, and the two interaction terms were entered into Model 4. Although the change observed in R2 was not significant in Model 3 (ΔR2 = 0.000, n.s.), the change was significant in Model 4 (ΔR2 = 0.08, p < 0.05). Family business status had a significant effect on the relationship between input additionality and firm EO (β = 0.48, p < 0.01), supporting hypothesis 3. Hypothesis 4 was also supported, given the significant negative effect of family business status on the network additionality–EO relationship (β = − 0.43, p < 0.05).

Figure 2 plots the significant interactions. The interaction between input additionality and EO reveals that at low levels of input additionality, family businesses generate less EO than their nonfamily peers. However, at high levels of input additionality, family businesses implement more EO than nonfamily businesses. When the effects of the gradients are tested, the results reveal that the positive association between input additionality and EO is significant and positive for both family (t = 4.08, p < 0.001) and nonfamily businesses (t = 2.27, p < 0.05), although the association is stronger for family businesses.

The interaction effect between network additionality and family business status (see Fig. 2) shows that, at low levels of network additionality, family businesses promote higher levels of EO than nonfamily firms, whereas at high levels of network additionality, nonfamily businesses generate less EO than family businesses. The gradient test reveals that the positive slope between network additionality and EO is significant for nonfamily firms (t = 3.73, p < 0.000) but not for family businesses (t = 0.48, n.s.), suggesting that family firms’ EO is not influenced by the increase in network additionality.

Robustness Tests

We performed an analysis of variance (ANOVA) to determine whether significant differences in mean values between family and nonfamily firms existed for both additionalities. We did not find significant differences between the groups (Table 5). Moreover, we performed an analysis of covariance employing the three control variables used in our study, and the same non-significant results were yielded. These results offer support to our hypotheses of the family nature of the company serving as a moderator and not as an antecedent.

Discussion

Drawing on TMF, ET, TCT, and RBV, the present study advances the existing knowledge on how input and network additionalities generated by public support for firm innovation improve the EO of Mexican companies. The results confirm the positive effect of firms applying more resources to R&D activities (Covin & Slevin, 1991; Filser et al., 2014; Miao et al., 2017) and specifically the positive influence of the R&D investments in EO (Block, 2012). They also reveal that the “boundary expansions of a firm’s knowledge sources and resource networks” (Andrade Rojas et al., 2018, p. 118) constitute a key resource for recognising, pursuing and leveraging entrepreneurial opportunities (Randolph et al., 2017), that is, to be an entrepreneurially oriented firm (Covin & Slevin, 1991; Miao et al., 2017). Both input and network additionalities boost the EO of companies that have received subsidies to support innovation. This result highlights how R&D public support programmes in the Mexican context have a positive impact on companies, enabling them to be more entrepreneurially oriented. The present analysis adds to the evidence regarding the positive effects of public policies that support innovation to foster EO (e.g. Kim et al., 2021).

Second, this study confirms that the family business status of companies matters and determines the relationship between EO and their antecedents (e.g. Boling et al., 2016; Hernández-Linares et al., 2018), revealing the differential ability of family firms to transform input and network additionalities into EO. Although both family and nonfamily firms can convert more input additionality into more EO, family businesses generate more EO for the same input, but only when there is a substantial increase in the company’s innovation efforts arising from public support. Thus, only if family firms make an important innovation effort while devoting resources and deploying an active strategy for identifying and developing opportunities will they be able to transform the input additionality more efficiently into EO than nonfamily firms. However, if family firms generate a low-input additionality while showing a limited commitment to innovation strategies, their results are poorer than those of nonfamily businesses. This result corroborates the transformative efficiency of family firms (Duran et al., 2016). However, for transformative efficiency to exist, the family firm must be ready to invest in and deploy all their abilities.

Moreover, family firms do not appear to be sensitive to changes in the levels of network additionality, whereas nonfamily firms can transform higher networking into more EO. This result is not aligned with Pucci and colleagues (2020), which can be explained by the different context of the research. In the one hand, Pucci and colleagues researched companies involved in a regional life science cluster, which means that there is a close relationship between the local partners and voluntary collaboration with distant partners. In the other hand, in Mexico (Guerrero et al., 2019), and specifically in both PEI and Alberta programs, cooperation is encouraged. Our finding suggests that, in our case, network additionality compels family businesses to become involved with other actors more intensively than desired, thus highlighting their limitations to leveraging networking (Sirmon & Hitt, 2003). This may origin negative perceptions among family firms about external collaborative agreements and their view that they are an option only in controlled and safe contexts (De Massis et al., 2013; Nieto et al., 2015; Serrano-Bedia et al., 2016). Thus, when any level of network additionality is derived from a received subsidy, family firms may perceive that situation could result in a loss of control, posing a threat to their socioemotional wealth (Gómez-Mejía et al., 2011). The result is that family firms are involved in networks to some extent, but they are unable to extract the value of participation in terms of EO.

Conclusions

This article deepens our collective knowledge about the consequences of the additionalities generated by R&D subsidies on businesses. It provides empirical evidence that input and network additionalities affect Mexican firms’ EO. Moreover, the positive results on the moderating effects of family business status on the relationship between input additionality and EO emphasize that this feature must be considered in the design of R&D policies due to the economic relevance of family firms (Sharma et al., 2012), even in the Mexican context (Ramírez-Solís et al., 2016), the singular way in which they use and extract value from their resources (Habbershon & Williams, 1999; Sirmon & Hitt, 2003) and the their singular behavior in aspects such as its innovation patterns, EO or the way they take advantage of networks (e.g. De Massis et al., 2013; Hernández-Linares & López-Fernández, 2018; Pucci et al., 2020; Cucculelli et al., 2022; Flores-Rivera et al., 2024). The results indicate that family firms require higher levels of input additionality to generate greater EO than nonfamily companies, hence, it may be assumed that they require real commitment to entrepreneurial strategies via a significant increase in their R&D effort. Finally, when family businesses establish a network that is perceived to be a threat, they will not be able to leverage the potential benefits of networks, offering further insights into the ability and willingness paradox in family firm innovation (Chrisman et al., 2015).

Contributions to the Literature

This study makes at least four contributions to the literature regarding the evaluation of R&D policies as well as to the entrepreneurship literature. First, although the positive effect of R&D support programmes on firm-level innovation has been acknowledged in literature (e.g. Autio et al., 2008), this study is pioneering in its provision of empirical evidence of the positive effects of input and network additionalities on the EO of firms that avail of subsidies helping to close the yet scarce knowledge about EO antecedents (Ling et al., 2020). Therefore, the RBV is demonstrated as an appropriate approach to understanding how the input and network additionalities generated by public support of firm innovations improve EO, which has not previously been addressed theoretically or empirically. Second, this study provides a novel conclusion in which the family status of a firm moderates the aforementioned relationships, contradicting the general notion that the impact of public intervention via R&D subsidy programmes is homogeneous across firms, such has been pointed by Afcha and Lucena (2022), for instance. The moderating effect of family business context is found to be positive in the relationship between input additionality and EO, but it is negative in the relationship between network additionality and EO. This is the first work to empirically explore how family firms leverage public R&D subsidies effects on networking (Feranita et al., 2017). Third, our study is pioneering in providing empirical evidence of the influence of additionalities in company’s EO enlarging our still limited knowledge about EO antecedents (Lumpkin et al., 2010; Wales et al., 2013, 2021), which is especially important since the positive association between EO and performance (Bellucci et al., 2019; Falk, 2007) and the call for further research on the antecedents of EO in management literature in general (Hernández-Linares et al., 2023a; Ling et al., 2020) and within family firms literature in particular (Hernández-Linares & López-Fernández, 2018). Finally, the additionality approach of this study was previously applied restrictively in the case of Mexico and Latin America (e.g. Vergara & Heijs, 2013), hence, our study supposes a contribution to literature because our results may be extended to other emerging countries that may face specific challenges when applying R&D supporting programmes (Hoskisson et al., 2000; Ring et al., 2005; Wei et al., 2020).

Practical Implications

This work has two important practical implications. On the one hand, our results corroborate the positive effects of R&D support programmes on the entrepreneurial posture of the receiving company, which was claimed to be the motivation of one of the programmes included in the analysis, thus reinforcing the value of such programmes. To the extent that policymakers associate entrepreneurial activity with economic growth and development in their countries (i.e. those with emerging economies such as Mexico), our results could lead them to view public policies that support innovation as a key element of their growth strategy. Specifically, our results show that the support programmes not only generate an increase in the investment in R&D and a change in the networking activity of the firm supported, but also these two changes positively impact firm’s EO, being the later effect stronger than the former. Therefore, the objective claimed by COECYTJAL of promoting and fostering “a culture of innovation and entrepreneurship” is fully achieved. This is especially relevant for emerging countries such as Mexico in which governments are key funders (Hoskisson et al., 2000; Ring et al., 2005). Our results can help those countries that face the need to decide about efficient assignment of rather scarce resources, by offering them empirical evidence of the positive returns of this type of programmes.

On the other hand, our study offers further support against the assumption of homogeneity in the effects of public R&D support argued by others (Afcha & Lucena, 2022). Conversely, our results reinforce the idea that the effects of additionality differ depending on the characteristics of the company (Gelabert et al., 2009; Lewandowska et al., 2022; Wanzenböck et al., 2013). Specifically, this work highlights the need to further consider the family or nonfamily status of companies when public policies are wielded to support innovation and/or EO, owing of their differential behaviors. We found that family firms deploy a more efficient transformation of resources into EO, implying that they are valuable recipients of public money. However, our results also inform policymakers that, in the case of family firms, driving networking through the rules of subsidies will not trigger the expected potential beneficial effects. Therefore, our results open the door to a more precise design of public policies that may include the family nature of a company as a variable when considering the effects to be obtained.

Limitations and Future Research Directions

This study has several limitations that offer opportunities for future research. First, we observed the phenomenon of firms receiving government aid, but not the amounts. This limitation has also been acknowledged by others (e.g. Szczygielski et al., 2017). Second, the cross-sectional characteristics of the study sample did not allow us to know the long-term effects and evolving collaborations of the public programs included in this study (Montes-Orozco et al., 2024). Therefore, we encourage scholars to address this issue by using panel and/or longitudinal data. Third, our empirical study was conducted in Mexico when the country only supported business R&D programmes directly. Given that the introduction of different tax and other benefits may be valid options (Dumont, 2017), the study findings may not be generalisable to other contexts. Therefore, we strongly encourage scholars to examine these relationships in other geographical areas and economic contexts. Fourth, given that only one type of behavioral additionality (i.e. network additionality) was examined, researchers are cautioned in generalising these findings to other forms of behavioral additionalities. Future research should measure other types of behaviorial additionalities and output additionalities to determine whether they are in line with the results of this study. Fifth, this study is likely to suffer from a possible sample selection bias because it empirically focused on companies availing of subsidies. However, as the survey was conducted only for this type of firms, the required information about firms not receiving R&D support was not available to control for this bias. Therefore, we strongly encourage scholars to make comparisons between both types in the future. Sixth, although the consequences of R&D support policies have been widely researched using subjective measures, future researchers must recognise that measuring the impact of policy support methods in this manner can be problematic (Georghiou, 2002). Finally, beyond the limitations of this study, our results point to the need to further explore the various contextual or internal factors (for example, the concern for developing or maintaining socioemotional wealth or the characteristics of leaders) that may alter the additional effects prompted by public support programmes. In doing so, additional frameworks are needed to deepen the understanding of the variability of the additionalities–EO link to those factors.

Notes

PEI is aimed at Mexican companies that carry out research and technological R&D activities and request support for project development. The Alberta program is directed at the small and medium enterprises (SMEs) in the State of Jalisco that develop scientific, technological, and innovation activities in collaboration with Canadian SMEs. The PROSOFT aims to promote the development and adoption of information and innovation technologies in companies, academic institutions, research centres, and specialised organisations in the information technology and digital creative media sector.

References

Afcha, S., & Lucena, A. (2022). R&D subsidies and firm innovation: Does human capital matter? Industry and Innovation. https://doi.org/10.1080/13662716.2022.2088334.

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Sage.

Andrade Rojas, M. G., Ramírez Solís, E. R., & Zhu, J. J. (2018). Innovation and network multiplexity: R&D and the concurrent effects of two collaboration networks in an emerging economy. Research Policy, 47(6), 1111–1124. https://doi.org/10.1016/j.respol.2018.03.018.

Arend, R. J. (2014). Entrepreneurship and dynamic capabilities: How firm age and size affect the capability enhancement-SME performance relationship. Small Business Economics, 42(1), 33–57. https://doi.org/10.1007/s11187-012-9461-9.

Arregle, J. L., Hitt, M. A., Sirmon, D. G., & Very, P. (2007). The development of organizational social capital: Attributes of family firms. Journal of Management Studies, 44(1), 72–95. https://doi.org/10.1111/j.1467-6486.2007.00665.x.

Arrow, K. J. (1972). Economic welfare and the allocation of resources for invention. In C. K. Rowley (Ed.), Readings in Industrial Economics (pp. 219–236). Palgrave.

Arzubiaga, U., Kotlar, J., De Massis, A., Maseda, A., & Iturralde, T. (2018). Entrepreneurial orientation and innovation in family SMEs: Unveiling the (actual) impact of the board of directors. Journal of Business Venturing, 33(4), 455–446. https://doi.org/10.1016/j.jbusvent.2018.03.002.

Autio, E., Kanninen, S., & Gustafsson, R. (2008). First- and second‐order additionality and learning outcomes in collaborative R&D programs. Research Policy, 37(1), 59–76. https://doi.org/10.1016/j.respol.2007.07.012.

Bagozzi, R. P., & Phillips, L. W. (1982). Representing and testing organizational theories: A holistic construal. Administrative Science Quarterly, 27(3), 459–489. https://doi.org/10.2307/2392322.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108.

Bellucci, A., Pennacchio, L., & Zazzaro, A. (2019). Public R&D subsidies: Collaborative versus individual place-based programs for SMEs. Small Business Economics, 52(1), 213–240. https://doi.org/10.1007/s11187-018-0017-5.

Berrutti, F., & Bianchi, C. (2020). Effects of public funding on firm innovation: Transforming or reinforcing a weak innovation pattern? Economics of Innovation and New Technology, 29(5), 522–539. https://doi.org/10.1080/10438599.2019.1636452.

Block, J. H. (2012). R&D investments in family and founder firms: An agency `perspective. Journal of Business Venturing, 27(2), 248–265. https://doi.org/10.1016/j.jbusvent.2010.09.003.

Boling, J. R., Pieper, T. M., & Covin, J. G. (2016). CEO tenure and entrepreneurial orientation within family and nonfamily firms. Entrepreneurship Theory and Practice, 40(4), 891–913. https://doi.org/10.1111/etap.12150.

Brinkerink, J., & Bammens, Y. (2018). Family influence and R&D spending in Dutch manufacturing SMEs: The role of identity and socioemotional decision considerations. Journal of Product Innovation Management, 35(4), 588–608. https://doi.org/10.1111/jpim.12428.

Buchmann, T., & Kaiser, M. (2019). The effects of R&D subsidies and network embeddedness on R&D output: Evidence from the German biotech industry. Industry and Innovation, 26(3), 269–294. https://doi.org/10.1080/13662716.2018.1438247.

Buisseret, T. J., Cameron, H., & Georghiou, L. (1995). What difference does it make? Additionality in the public support of R&D in large firms. International Journal of Technology Management, 10(4–6), 587–600. https://doi.org/10.1504/ijtm.1995.025644.

Busom, I., & Fernández-Ribas, A. (2008). The impact of firm participation in R&D programmes on R&D partnerships. Research Policy, 37(2), 240–257. https://doi.org/10.1016/j.respol.2007.11.002.

Cabrera-Suárez, M. K., Déniz-Déniz, M. C., & Martín-Santana, J. D. (2011). Familiness and market orientation: A stakeholder approach. Journal of Family Business Strategy, 2(1), 34–42. https://doi.org/10.1016/j.jfbs.2011.01.001.

Carney, M., Van Essen, M., Gedajlovich, E. R., & Heugens, P. (2015). What do we know about private family firms? A meta-analytic review. Entrepreneurship Theory and Practice, 39(3), 513–544. https://doi.org/10.1111/etap.12054

Catozzella, A., & Vivarelli, M. (2016). The possible adverse impact of innovation subsidies: Some evidence from Italy. International Entrepreneurship Management Journal, 12(2), 351–368. https://doi.org/10.1007/s11365-014-0342-3.

Ceipek, R., Hautz, J., De Massis, A., Matzler, K., & Ardito, L. (2021). Digital transformation through exploratory and exploitative internet of things innovations: The impact of family management and technological diversification. Journal of Product Innovation Management, 38(1), 142–165. https://doi.org/10.1111/jpim.12551.

Chen, M. H., Chang, Y. Y., & Chang, Y. C. (2015). Entrepreneurial orientation, social networks, and creative performance: Middle managers as corporate entrepreneurs. Creativity and Innovation Management, 24(3), 493–507. https://doi.org/10.1111/caim.12108.

Chirico, F. (2008). Knowledge accumulation in family firms evidence from four case studies. International Small Business Journal, 26(4), 433–462. https://doi.org/10.1177/0266242608091173.

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal, 55(4), 976–997. https://doi.org/10.5465/amj.2011.0211.

Chrisman, J. J., Chua, J. H., & Kellermanns, F. (2009). Priorities, resource stocks, and performance in family and nonfamily firms. Entrepreneurship Theory and Practice, 33(3), 739–760. https://doi.org/10.1111/j.1540-6520.2009.00324.x.

Chrisman, J. J., Chua, J. H., De Massis, A., Frattini, F., & Wright, M. (2015). The ability and willingness paradox in family firm innovation. Journal of Product Innovation Management, 32(3), 310–318. https://doi.org/10.1111/jpim.12207.

Clarysse, B., Wright, M., & Mustar, P. (2009). Behavioural additionality of R&D subsidies: A learning perspective. Research Policy, 38(10), 1517–1533. https://doi.org/10.1016/j.respol.2009.09.003.

Classen, N., Van Gils, A., Bammens, Y., & Carree, M. (2012). Accessing resources from innovation partners: The search breadth of family SMEs. Journal of Small Business Management, 50(2), 191–215. https://doi.org/10.1111/j.1540-627X.2012.00350.x.

Clausen, T., & Rasmussen, E. (2011). Open innovation policy through intermediaries: The industry incubator programme in Norway. Technology Analysis & Strategic Management, 23(1), 75–85. https://doi.org/10.1080/09537325.2011.537109.

COECYTJAL (2015). Programa Alberta Jalisco. Normas de Operación. Accessed December 11 2021. https://www.coecytjal.org.mx/nuevaweb/convocatorias/Alberta/Reglas%20de%20Operaci%C3%B3n%20Programa%20Alberta%20-%20Jalisco.pdf.

Covin, J. G., & Miller, D. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75–87. https://doi.org/10.1002/smj.4250100107.

Covin, J. G., & Miller, D. (2014). International entrepreneurial orientation: Conceptual considerations, research themes, measurement issues, and future research directions. Entrepreneurship Theory and Practice, 38(1), 11–44. https://doi.org/10.1111/etap.12027.

Covin, J. G., & Slevin, D. P. (1991). A conceptual model of entrepreneurship as firm behavior. Entrepreneurship Theory and Practice, 16(1), 7–25. https://doi.org/10.1177/104225879101600102.

Cucculelli, M., Dileo, I., & Pini, M. (2022). Filling the void of family leadership: Institutional support to business model changes in the Italian industry 4.0 experience. The Journal of Technology Transfer, 47, 213–241. https://doi.org/10.1007/s10961-021-09847-4.

Daspit, J. J., Chrisman, J. J., Ashton, T., & Evangelopoulos, N. (2021). Family firm heterogeneity: A definition, common themes, scholarly progress, and directions forward. Family Business Review, 34(3), 296–322. https://doi.org/10.1177/08944865211008.

Davidson, R., & Mackinnon, J. (1983). Estimation and inference in Economics. Oxford University Press.

De Fuentes, C., Santiago, F., & Temel, S. (2020). Perception of innovation barriers by successful and unsuccessful innovators in emerging economies. The Journal of Technology Transfer, 45, 1283–1307. https://doi.org/10.1007/s10961-018-9706-0.

De Massis, A., Frattini, F., & Lichtenthaler, U. (2013). Research on technological innovation in family firms: Present debates and future directions. Family Business Review, 26(1), 10–31. https://doi.org/10.1177/0894486512466258.

De Massis, A., Chirico, F., Kotlar, J., & Naldi, L. (2014). The temporal evolution of proactiveness in family firms: The horizontal S-curve hypothesis. Family Business Review, 27(1), 35–50. https://doi.org/10.1177/0894486513506114.

De Massis, A., Frattini, F., Pizzurno, E., & Cassia, L. (2015). Product innovation in family versus nonfamily firms: An exploratory analysis. Journal of Small Business Management, 53(1), 1–36. https://doi.org/10.1111/jsbm.12068.

Dimos, C., Pugh, G., Hisarciklilar, M., Talam, E., & Jackson, I. (2022). The relative effectiveness of R&D tax credits and R&D subsidies: A comparative meta-regression analysis. Technovation, 115, 102450. https://doi.org/10.1016/j.technovation.2021.102450.

Dumont, M. (2017). Assessing the policy mix of public support to business R&D. Research Policy, 46(10), 1851–1862. https://doi.org/10.1016/j.respol.2017.09.001.

Duran, P., Kammerlander, N., Van Essen, M., & Zellweger, T. (2016). Doing more with less: Innovation input and ouput in family firms. Academy of Management Journal, 59(4), 1224–1264. https://doi.org/10.5465/amj.2014.0424.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121. https://doi.org/10.1002/1097-0266(200010/11)21:10/11%3C1105::AID-SMJ133%3E3.0.CO;2-E.

Falk, R. (2007). Measuring the effects of public support schemes on firms’ innovation activities survey evidence from Austria. Research Policy, 36(5), 665–679. https://doi.org/10.1016/j.respol.2007.01.005.

Feranita, F., Kotlar, J., & De Massis, A. (2017). Collaborative innovation in family firms: Past research, current debates and agenda for future research. Journal of Family Business Strategy, 8(3), 137–156. https://doi.org/10.1016/j.jfbs.2017.07.001.

Filser, M., Eggers, F., Kraus, S., & Málovic, E. (2014). The effect of financial resource availability on entrepreneurial orientation, customer orientation and firm performance in an international context: An empirical analysis from Austria and Hungarian. Journal of East Europe Management Studies, 19, 7–30. https://doi.org/10.5771/0949-6181-2014-1-7.

Flores-Rivera, C., Serrano-Bedia, A. M., & García-Piqueres, G. (2024). Motivations and outcomes of environmental corporate sustainability in family and non-family Mexican firms: The mediating role of eco-innovation strategy. Corporate Social Responsibility and Environmental Management, 31(1), 357–374. https://doi.org/10.1002/csr.2574

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104.

Freitas, I. B., Castellacci, F., Fontana, R., Malerba, F., & Vezzulli, A. (2017). Sectors and the additionality effects of R&D tax credits: A cross-country microeconometric analysis. Research Policy, 46(1), 57–72. https://doi.org/10.1016/j.respol.2016.10.002.

Fuetsch, E. (2022). What drives innovation in family farms? The roles of socioemotional wealth and diverse information sources. European Journal of Family Business, 12(2), 184–204. https://doi.org/10.24310/ejfbejfb.v12i2.13881.

Fultz, A., & Hmieleski, K. M. (2021). The art of discovering and exploiting unexpected opportunities: The roles of organizational improvisation and serendipity in new venture performance. Journal of Business Venturing, 36(4), 106–121. https://doi.org/10.1016/j.jbusvent.2021.106121.

García-Piqueres, G., Serrano-Bedia, A. M., & López-Fernández, M. C. (2016). Sector innovation capacity determinants: Modelling and empirical evidence from Spain. R&D Management, 46(1), 80–95. https://doi.org/10.1111/radm.12125.

Gelabert, L., Fosfuri, A., & Tribó, J. (2009). Does the effect of public support for R&D depend on the degree of appropriability? The Journal of Industrial Economics, 57(4), 736–767. https://doi.org/10.1111/j.1467-6451.2009.00396.x.

Georghiou, L. (2002). Impact and additionality of innovation policy. IWT Studies, 40, 57–64. Six Countries Programme on Innovation, Brussels.

Ghazinoory, S., & Hashemi, Z. (2023). The impact of government interventions on the performance of biotechnology, information and communications technology, and electrical and electronics firms: Evidence from Iran. Journal of the Knowledge Economy, 14, 735–751. https://doi.org/10.1007/s13132-021-00882-y.

Gillis, W. E., Combs, J. G., & Yin, X. (2020). Franchise management capabilities and franchisor performance under alternative franchise ownership strategies. Journal of Business Venturing, 35(1), 105899. https://doi.org/10.1016/j.jbusvent.2018.09.004.

Gómez-Mejía, L. R., Haynes, K. T., Núñez‐Nickel, M., Jacobson, K. J. L., & Moyano‐Fuentes, J. (2007). Socioemotional wealth and business risks in family‐controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106–137. https://doi.org/10.2189/asqu.52.1.106.

Gómez-Mejía, L. R., Cruz, C., Berrone, P., & De Castro, J. (2011). The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals, 5(1), 653–707. https://doi.org/10.5465/19416520.2011.593320.

Gould, D. M., & Gruben, W. C. (1996). The role of intellectual property rights in economic growth. Journal of Development Economics, 48, 323–350. https://doi.org/10.1007/978-1-4615-6219-1_10.

Grant, R. M. (1991). The resource-based theory of competitive advantage: Implications for strategy formulation. California Management Review, 33(3), 114–135. https://doi.org/10.2307/41166664.

Greene, W. H. (2003). Econometric Analysis (5th ed.). Prentice Hall.

Guerrero, M., & Link, A. N. (2022). Public support of innovative activity in small and large firms in Mexico. Small Business Economics, 59(1), 413–422. https://doi.org/10.1007/s11187-021-00517-1.

Guerrero, M., Urbano, D., & Herrera, F. (2019). Innovation practices in emerging economies: Do university partnerships matter? The Journal of Technology Transfer, 44, 615–646. https://doi.org/10.1007/s10961-017-9578-8.

Guisado-González, M., González-Blanco, J., Coca-Pérez, J. L., & Guisado-Tato, M. (2018). Assessing the relationship between R&D subsidy, R&D cooperation and absorptive capacity: An investigation on the manufacturing Spanish case. The Journal of Technology Transfer, 43(6), 1647–1666. https://doi.org/10.1007/s10961-017-9579-7.

Gunawan, T., Jacob, J., & Duysters, G. (2016). Network ties and entrepreneurial orientation: Innovative performance of SMEs in a developing country. International Entrepreneurship and Management Journal, 12, 575–599. https://doi.org/10.1007/s11365-014-0355-y.

Habbershon, T. G., & Williams, M. L. (1999). A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12(1), 1–25. https://doi.org/10.1111/j.1741-6248.1999.00001.x.

Habbershon, T. G., Williams, M. L., & MacMillan, I. (2003). A unified systems perspective of family firm performance. Journal of Business Venturing, 1(4), 451–465. https://doi.org/10.1016/S0883-9026(03)00053-3.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1998). Multivariate Data Analysis. Prentice Hall.

Hamilton, B. H., & Nickerson, J. A. (2003). Correcting for endogeneity in strategic management research. Strategic Organizations, 1(1), 51–78. https://doi.org/10.1177/1476127003001001218.

Harman, H. H. (1967). Modern Factor Analysis. University of Chicago Press.

Heijs, J., Guerrero, A. J., & Huergo, E. (2022). Understanding the heterogeneous additionality of R&D subsidy programs of different government levels. Industry and Innovation, 29(4), 533–563. https://doi.org/10.1080/13662716.2021.1990024.

Heredia–Pérez, J. A., Geldes, C., Kunc, M. H., & Flores, A. (2019). New approach to the innovation process in emerging economies: The manufacturing sector case in Chile and Peru. Technovation, 79, 35–55. https://doi.org/10.1016/j.technovation.2018.02.012.

Hernández-Linares, R., & López-Fernández, M. C. (2018). Entrepreneurial orientation and the family firm: Mapping the field and tracing a path for future research. Family Business Review, 31(3), 318–351. https://doi.org/10.1177/0894486518781940.

Hernández-Linares, R., Kellermanns, F. W., & López-Fernández, M. C. (2018). A note on the relationships between learning, market, and entrepreneurial orientations in family and nonfamily firms. Journal of Family Business Strategy, 9(3), 192–204. https://doi.org/10.1016/j.jfbs.2018.08.001.

Hernández-Linares, R., López‐Fernández, M. C., Eddleston, K. A., & Kellermanns, F. (2023a). Learning to be entrepreneurial: Do family firms gain more from female leadership than nonfamily firms? Strategic Entrepreneurship Journal, 17(4), 971–1001. https://doi.org/10.1002/sej.1482.

Hernández-Linares, R., López-Fernández, M. C., García-Piqueres, G., Pina e Cunha, M., & Rego, A. (2023b). How knowledge-based dynamic capabilities relate to firm performance: The mediating role of entrepreneurial orientation. Review of Managerial Science. https://doi.org/10.1007/s11846-023-00691-4.

Hernández-Linares, R., López-Fernández, M. C., Memili, E., Mullins, F., & Patel, P. C. (2023c). High-performance work practices, socioemotional wealth preservation, and family firm labor productivity. BRQ Business Research Quarterly, 26(3), 237–255. https://doi.org/10.1177/23409444211002521.

Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship: A critical review. Journal of Business Venturing, 18(2), 165–187. https://doi.org/10.1016/S0883-9026(02)00081-2.

Holt, J., Skali, A., & Thomson, R. (2021). The additionality of R&D tax policy: Quasi-experimental evidence. Technovation, 107, 102293. https://doi.org/10.1016/j.technovation.2021.102293.

Hornsby, J. S., Kuratko, D. F., & Zahra, S. A. (2002). Middle managers’ perception of the internal environment for corporate entrepreneurship: Assessing a measurement scale. Journal of Business Venturing, 17(3), 253–273. https://doi.org/10.1016/S0883-9026(00)00059-8.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. (2000). Strategy in emerging economies. The Academy of Management Journal, 43(3), 249–267. https://doi.org/10.2307/1556394.

Huergo, E., & Moreno, L. (2017). Subsidies or loans? Evaluating the impact of R&D support programmes. Research Policy, 46(7), 1198–1214. https://doi.org/10.1016/j.respol.2017.05.006.

IMF (2016). Fiscal Policies for Innovation and Growth, IMF & Fiscal Monitor (Chapter 2, 29–57).

Jalilvand, M. R., Vosta, N., Khalilakbar, L., R., Pool. J. K., & Tabaeeian, R. A. (2019). The effects of internal marketing and entrepreneurial orientation on innovation in family businesses. Journal of the Knowledge Economy, 10, 1064–1079. https://doi.org/10.1007/s13132-017-0516-7.

Jiang, X., Liu, H., Fey, C., & Jiang, F. (2018). Entrepreneurial orientation, network resource acquisition, and firm performance: A network approach. Journal of Business Research, 87, 46–57. https://doi.org/10.1016/j.jbusres.2018.02.021.

Keh, H. T., Nguyen, T. T. M., & Hwei, P. N. (2007). The effects of entrepreneurial orientation and marketing information on the performance of SMEs. Journal of Business Venturing, 22, 592–611. https://doi.org/10.1016/j.jbusvent.2006.05.003.

Kellermanns, F. W., & Eddleston, K. A. (2006). Corporate entrepreneurship in family firms: A family perspective. Entrepreneurship Theory and Practice, 30(6), 809–830. https://doi.org/10.1111/j.1540-6520.2006.00153.x.

Kenny, D. A., & McCoach, D. B. (2003). Effect of the number of variables on measures of fit in structural equation modeling. Structural Equation Modeling, 10(3), 333–351. https://doi.org/10.1207/S15328007SEM1003_1.

Kim, K., Choi, S., & Lee, S. (2021). The effect of a financial support on firm innovation collaboration and output: Does policy work on the diverse nature of firm innovation? Journal of the Knowledge Economy, 12, 645–675. https://doi.org/10.1007/s13132-020-00667-9.

Knockaert, M., Spithoven, A., & Clarysse, B. (2014). The impact of technology intermediaries on firm cognitive capacity additionality. Technological Forecasting and Social Change, 81, 376–387. https://doi.org/10.1016/j.techfore.2013.05.007.

Kraiczy, N. D., Hack, A., & Kellermanns, F. W. (2015). What makes a family firm innovative? CEO risk-taking propensity and the organizational context of family firms. Journal of Product Innovation Management, 32(3), 334–348. https://doi.org/10.1111/jpim.12203.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131–150. https://doi.org/10.1002/smj.507.

Lavie, D. (2006). The competitive advantage of interconnected firms: An extension of the resource-based view. Academy of Management Review, 31(3), 638–658. https://doi.org/10.5465/amr.2006.21318922.

Le Breton-Miller, I., & Miller, D. (2011). Commentary: Family firms and the advantage of multitemporality. Entrepreneurship Theory and Practice, 35(6), 1171–1177. https://doi.org/10.1111/j.1540-6520.2011.00496.x.

Lee, J. (2006). Family firm performance: Further evidence. Family Business Review, 19(2), 103–114. https://doi.org/10.1111/j.1741-6248.2006.00060.x.

Lewandowska, M. S., Weresa, M. A., & Rószkiewicz, M. (2022). Evaluating the impact of public financial support on innovation activities of European Union enterprises: Additionality approach. International Journal of Management and Economics, 58(3), 248–266. https://doi.org/10.2478/ijme-2022-0020.

Ling, Y., López-Fernández, M. C., Serrano-Bedia, A. M., & Kellermanns, F. W. (2020). Organizational culture and entrepreneurial orientation: Examination through a new conceptualization lens. International Entrepreneurship and Management Journal, 16(2), 709–737. https://doi.org/10.1007/s11365-019-00600-w.