Abstract

This study examines the impact of the COVID-19 pandemic on the income, inequality, and poverty levels among Colombian children between 2019 and 2020, using data from the Luxembourg Income Study Database. The income distribution and changes among Colombian children are analyzed using the probability density function and growth incidence curve. The paper utilizes the Foster–Greer–Thorbecke methodology to measure child poverty in Colombia, decomposes the contributions of different subgroups to child poverty and its changes, and conducts a growth-distribution decomposition of changes in child poverty. The study also employs income-source decomposition to examine the contributions of different income sources to child inequality and its changes. The results show that Colombian children experienced a decline in income, an increase in inequality, and higher levels of poverty during the COVID-19 pandemic. Children from households with higher dependency ratios and those living in rural areas were more likely to experience poverty. The main driver of increased poverty among Colombian children was decreased income, and there was a significant worsening of inequality for ultra-poor children. Labor income emerged as the primary source of inequality and its changes, whereas capital income and private transfers played a role in reducing poverty. However, public social benefits slightly increased inequality levels. Overall, the recession caused by the COVID-19 pandemic is antipoor but pro-ultra-poor. To address similar recessions in the future, the government should expand public transfer payments especially programs targeting children to reduce income inequality and alleviate poverty among children, and bolster the provision of public services essential for children’s development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Historically, recessions tend to lead to increases in income poverty and inequality (Hoynes et al., 2006; Majid, 2011; Mood & Jonsson, 2016; Perri & Steinberg, 2012). For instance, the recessions that occurred in Greece (Matsaganis & Leventi, 2014), Spain (Mínguez, 2017), Central and Eastern Europe (Brzezinski, 2018) all led to increase in poverty levels or income inequality in those nations or regions. Similarly, the COVID-19 recession has demonstrably increased income poverty (Moyer et al., 2022; Pieper et al., 2021; Schulten, 2020; Sumner et al., 2020) and income inequality (Elgar et al., 2020; Francis et al., 2022; Goldin & Muggah, 2020; Lakner et al., 2022; Stiglitz & Development, 2020) compared to a scenario without the pandemic. However, Clark et al. (2021) suggests a more nuanced picture in their study of four European countries (France, Germany, Italy, and Spain). While they observed an initial rise in inequality from January to May 2020, they also reveal a subsequent hump-shaped change in inequality in equivalent household disposable income. This highlights the need for further research to understand the diverse and potentially evolving impacts of recessions on income distribution.

Compared to other social groups, children are significantly more vulnerable to the effects of recessions, with a higher risk of falling into poverty and suffering long-term consequences (Blofield et al., 2022; Fanjul, 2014; Sinha et al., 2020). For instance, in Ireland during the 2008 Great Recession, children’s material deprivation increased from 16 to 32%, resulting in higher child poverty rates than those for adults and older individuals (Regan & Maître, 2020).

In the context of COVID-19 pandemic, the increasing trend in child poverty level had been confirmed by some scholars (Fiala et al., 2022; UNICEF, 2020). For instance, in Ireland, child income poverty rates could increase substantially at most 6 percentage points relative to the no pandemic baseline, marking a one-third increase (Regan & Maître, 2020). In Morocco, the pandemic disproportionately impacts children, and over half a million children under the age of 18 would fall into poverty as a result of the pandemic (Abdelkhalek et al., 2022). In Turkey, expenditure-based child poverty might increase by 4.9–9.3 percentage points (depending on shock severity) from a base level of 15.4% due to the reduction in household expenditure caused by the labor income loss during the pandemic (Aran et al., 2022). The European Union saw a 19% increase in poor children, equivalent to nearly 1 million in 2020 (Hallaert et al., 2023).

In particular, as households with more children are more vulnerable to macroeconomic shocks (Glewwe & Hall, 1995; Glewwe et al., 1998) and children living in household with more children appeared to have less income and face higher risk of poverty (Tai et al., 2009; Wan & Wan, 2008), inequality among children has also increased in some countries during recessions (Fanjul, 2014), such as Argentina during the COVID-19 pandemic (Argentina, 2020). Moreover, inequalities in mental health, education, nutrition had also been exacerbated (Alaba et al., 2022; Bessell, 2022; Li et al., 2021; Murray-Garcia et al., 2023; Thanh et al., 2024). These experiences would contribute to poorer health outcomes, limited learning experiences, lower education quality, fewer job opportunities, lower income and less social participation in adulthood (Duncan et al., 2012; Li & Chen, 2007; Yu et al., 2011; Zhang et al., 2014). So it is essential to analyze the impact of COVID-19 pandemic on children income poverty and inequality.

Despite existing literatures, comprehensive research examining the COVID-19 pandemic's impact on child poverty and inequality using extensive income data remains scarce. Some studies primarily project potential changes rather than definitively confirming actual shifts in child poverty and inequality (Regan & Maître, 2020). Within literatures measuring such changes, a lack of comprehensive analysis on the underlying drivers of shifts in child poverty and inequality is evident. For instance, how do income fluctuations and distributional variations influence shifts in child poverty? Additionally, a more detailed understanding of income sources contributing to inequality shifts is required. Ultimately, was the recession triggered by the COVID-19 pandemic pro-poor or anti-poor? Regrettably, these questions remain unanswered, leading to deficiencies in policy implications. Although the COVID-19 pandemic has concluded, its effects will continue to linger, and a similar pandemic may occur in the future. Thus, it is essential to evaluate the dynamics of child poverty and inequality during the COVID-19 recession as well as the factors influencing these change. Such understanding is crucial, as suffering from poverty and inequality contributes to poorer health outcomes, limited learning experiences, lower education quality, fewer job opportunities, lower income and less social participation in adulthood (Duncan et al., 2012; Li & Chen, 2007; Yu et al., 2011; Zhang et al., 2014).

To address the COVID-19 pandemic’s impact on income, different countries implemented diverse policy measures. Some, like France, Germany, Italy and Spain (Clark et al., 2021), Brazil and Argentina (Pereira & Oliveira, 2020), the US (Fox & Burns, 2021), and the U.K. (Blundell et al., 2022), significantly expanded social assistance, particularly for the poorest. This mitigated the recession’s effects and even reversed inequality and poverty increase. However, many countries, like Mexico (Lustig et al., 2021) and Bangladesh (Parekh & Bandiera, 2020), where economic inequality was substantial, the pandemic exacerbated the inequality and exposed the vulnerability of the poor due to inadequate interventions (Parekh & Bandiera, 2020; Pereira & Oliveira, 2020). This resulted in increased inequality and poverty.

Unlike developed countries which mitigated the shock of the COVID-19 pandemic on income inequality and poverty through comprehensive social assistance programs, like the US and the UK, with the supplemental poverty measure rates declining from 11.8 percent in 2019 to 9.1 percent in 2020 (Fox & Burns, 2021), and the absolute poverty falling from 17.9% to 16.8% between 2019–20 to 2020–21 (Ray-Chaudhuri & Wernham, 2023), respectively, Colombia allocated fewer fiscal resources towards targeted pandemic programs for the poor (Lustig et al., 2021). This resulted in declining incomes and rising poverty for Colombians. The World Bank reported that 71.7% of Colombian households saw their total income decrease in 2020 (Lustig et al., 2022). Moreover, Colombia’s Administrative Department of National Statistics (Dane) found that the pandemic pushing 3.6 million Colombians into poverty that year, with the poverty rate jumping to 42.5%, a 6.8-point increase from 2019. This stark contrast to countries whose social assistance programs buffered pandemic impacts, makes Colombia a compelling case study of how child income poverty and inequality shift when a pandemic exacerbates pre-existing disparities. Accordingly, this article delves into the dynamics of child income inequality and poverty in Colombia during the COVID-19 recession, seeking to expose the underlying factors driving these changes.

To comprehend the impact of the COVID-19 pandemic on child poverty and inequality, it is essential to uncover the underlying factors driving these phenomena and their dynamics in order to formulate effective policies that can appropriately address the pandemic's shocks. Several frameworks exist in the literature for decomposing poverty changes. One such approach is the Shapley-type decomposition described by (Shorrocks, 2013), while another is the integral-based approach developed by (Muller, 2006). A more recent method, proposed by (Aristondo et al., 2023), decomposes poverty indices by evaluating the effects of both the poverty line and the distribution of income. In this article, we employ the Shapley-type method to decompose the growth and distribution components that contribute to poverty changes while maintaining a fixed poverty line.

Regarding inequality, two primary approaches exist for decomposing its overall level and dynamics: the first focuses on disaggregating income inequality levels and their evolution across subgroups, while the second makes decomposition by income components (Fortin et al., 2011; Montes-Rojas et al., 2017). Since this paper primarily centers on the dynamics of income inequality among children during the COVID-19 recession and whether government social assistance programs have mitigated this inequality or not, we utilize an approach that partitions children's equivalent income into various components and assesses their contributions.

This paper makes four key contributions. First, it delves into the levels and shifts in child income inequality and poverty in Colombia between 2019 and 2020. This fills a gap in existing studies that lack statistical evaluation of child poverty and inequality dynamics during pandemics. By focusing on Colombia, a developing country, this study sheds light on the specific impacts of such crises in lower-income contexts.. Second, the paper employs subgroup and growth-distribution decompositions to dissect child poverty and its fluctuations. This sheds light on the underlying factors driving these changes and enables an evaluation of the pro-poorness of the recession. Third, the paper decomposes income inequality and its dynamics by income sources to reveal the primary drivers of inequality shifts. Finally, the study’s findings offer implications for designing policies to prevent the deterioration of inequality and poverty during future recessions caused by epidemics like COVID-19.

The rest of this paper is structured as follows. Section 2 introduces the data and methods used. Section 3 analyzes child income inequality and poverty dynamics in Colombia. It then explores the poverty dynamics and pro-poorness of the COVID-19 recession through decomposition, followed by decomposing income inequality and its changes. Section 4 discusses the main findings and draws some policy implications. Finally, Section 5 acknowledges some limitations and putting forward some sug- gestions for future studies.

2 Data and Methodology

2.1 Data

In this paper, we utilize data derived from the Luxembourg Income Study Database (LIS), which is the largest available income database of harmonized microdata collected from approximately 50 countries in Europe, North America, Latin America, Africa, Asia, and Australasia since 1963 when the first dataset was collected for the US. While the LIS is confined to cross-sectional data, its extended temporal coverage spanning several decades has facilitated numerous scholars in assessing both the levels and dynamics in income poverty and inequality across various countries or regions at multiple time points (Förster & Vleminckx, 2004; Förster et al., 2002; Gornick & Jäntti, 2010).

In our study, we specifically choose data collected in Colombia for 2019 and 2020, which were acquired by the LIS, based on the Great Integrated Household Survey carried out by the National Administrative Department of Statistics of Colombia. The sample household sizes for 2019 and 2020 comprise 231,831 and 134,399 observations, representing weighted populations of 48.8 million and 49.4 million individuals, constituting 97.24% and 96.99% of the total population in Colombia, respectively. In our research, the household units are weighted by household weight and the number of household members.

Regarding the definition of child, we adhere to the definition outlined in the 1989 U.N. Convention on the Rights of the Child, which states that "a child means every human being below the age of 18 years, unless, under the law applicable to the child, majority is attained earlier" (United Nations, 1989). In this paper, we select household members aged 0–17 years as the research subjects.

In this paper, we define poor children as those residing in households with income below the poverty threshold, consistent with previous research on child poverty (Bárcena-Martín et al., 2018; Bradshaw, 2003). This definition is supported by several considerations. Firstly, most children do not have their own income and rely on their households. Secondly, although 2.5% of children in Colombia (approximately 210,431) engage in child labor, data on their individual income remains limited. Thirdly, our primary focus lies in examining the levels and dynamics of poverty and income inequality among children during the COVID-19 recession, rather than their personal income. Whether children earn income independently or the income originates from adults, the overall financial resources are distributed within the household. This aligns with the prevalent methodology of poverty research based on household income (Obermeier, 2022; Department of Work and Pensions, 2017). Moreover, and of paramount importance, the aim of addressing child poverty and inequality during the COVID-19 recession is not to mitigate the impact of the recession on child labor income, a practice that should be eradicated. Nevertheless, it's crucial to reiterate that estimates of child income refer to their share of the household income, offering an indirect but valuable indicator of their well-being. In Colombia, the official poverty line and extreme poverty line in 2020 were set at $331,688 and $145,004 Colombian pesos (COP) per capita per month, respectively. To facilitate analysis in this paper, we convert these monthly poverty lines to annual poverty lines of $3,980,256 and $1,740,048 COP, respectively.

Given the cross-sectional nature of the LIS dataset, the estimations concerning shifts in child poverty and inequality do not extend to encapsulating the variations within individual or household’s poverty status or their respective positions within the distribution. Instead, our attention converges on levels and temporal dynamics of poverty and inequality specifically among the cohort of children in Colombia.

2.2 Adjusting Household Income

Several researchers have found that young children consume less than adults (Deaton & Paxson, 1995; Desai & Potter, 2013; Lee & Mason, 2011) and that larger households can benefit from economies of scale because household members share certain goods (Bütikofer & Gerfin, 2009; Deaton, 2003; Pashardes, 2007). For these reasons, some scholars employ equivalization methods to adjust for differences in household size and composition to obtain the equivalent income when conducting research related to household income (Anyaegbu, 2010; Atkinson et al., 1995; Deaton, 2003; Deaton & Muellbauer, 1986; Regier et al., 2015).

The most commonly used equivalence scales include the “Oxford” scale (old OECD scale), the OECD-modified scale, the McClements scale, and the square root scale. While no single equivalence scale perfectly captures all household differences, any scale offers an improvement over no adjustment. As economies develop, economies of scale within households likely magnify. Reflecting this trend, Zhou and Sun (2017) opted for the Oxford equivalence scale when examining poverty in China 2012, where per capita GDP approached OECD levels of the 1980s. Following this logic, given Colombia's 2021 per capita GDP of $6,104 (similar to China's 2012 level of $6,300), this paper also utilizes the Oxford equivalence scale, which assigns a weight of 1.0 for the first member in a household, 0.7 for each additional member aged 14 and over, and 0.5 for each member aged under 14 to calculate the household equivalence scale.

According to the LIS, disposable household income is defined as the sum of income from labor, capital, pensions (both private and public), non-pension public social benefits and non-cash private transfers, less income taxes and social contributions paid. Equivalent income is calculated by adjusting disposable household income by the equivalence scale. All 2019 income figures are inflation-adjusted to the 2020 price level using the consumer price index.

2.3 Measurement Framework

This paper begins by employing the probability density function and growth incidence curve methodologies to present the distribution patterns and dynamics of income among Colombian children, thereby furnishing a comprehension of the income distribution among children and the changes. Subsequent to this, a quantitative analysis is undertaken to estimate the levels of income inequality and poverty among children. Building upon these results, we decompose child poverty and its changes, revealing the contributions of different groups, as well as the growth and distribution components. Then we made income source decomposition to examine the contribution of different income sources to child inequality and its changes. Ultimately, this study measures two pro-poorness indices, providing statistical evidence to accurately assess the pro-poorness of the recession caused by the pandemic.

2.3.1 Examining the Distribution Patterns and Dynamics of Income Among Children

To begin with, We examine the distributive effect of the recession across different percentiles of children using the growth incidence curve (GIC) proposed by Ravallion and Chen (2003), which reveals the distributional impact of the COVID-19 recession that not readily detectable through traditional metrics like inequality and poverty measures (Bárcena-Martín et al., 2016). The growth incidence curve is a graphical representation of the growth rates for various ranks in the distribution from the lowest to the highest during a period (Ravallion & Chen, 2003), i.e., \(g_{t1 - t2} (p) = \frac{{y_{t2} (p)}}{{y_{t1} (p)}} - 1 = \frac{{L_{t2}{'} (p)}}{{L_{t1}{'} (p)}}(\gamma_{t1 - t2} + 1) - 1\). where \(y_{t} (p)\) is the income of the \(p\) th percentile at time \(t\); \(L_{t} (p)\) is the Lorenz curve, and \(L_{t}{'} (p)\) is the slope of the curve; \(\gamma_{t1 - t2}\) is the growth rate in mean income for all children from time \(t1\) to \(t2\). It can be shown that the distribution is becoming more unequal if the GIC curve is upward sloping, whereas if the GIC curve is downward sloping, the distribution is becoming more equal (Ravallion & Chen, 2003).

Secondly, we employed weighted Gaussian kernel density estimation (KDE) (Araar & Duclos, 2013) to explore the distribution pattern of children's equivalent income before and during the COVID-19 recession. Unlike traditional inequality measures like Gini and Theil indices, which only summarize income dispersion, KDE unveils the entire distribution through its frequency density function. This method reveals the distribution's level, modality, and changes over time, providing a more nuanced picture than single-value indices (Burkhauser et al., 1999).

2.3.2 Estimating and Decomposing Poverty and Changes

This paper estimated the income poverty level among children in Colombia using the Foster-Greer-Thorbecke (FGT) indices \(P_{0}\), \(P_{1}\), \(P_{2}\) (Foster et al., 1984): These indices calculate, respectively, the poverty headcount (PH), poverty gap (PG), and poverty severity (SPG) among children.

Dividing the population into \(m\) subgroups with populations \(n_{i}\) (\(i\) = 1,…,\(m\)), the contribution of subgroup \(i\) to the total poverty is \(C_{\alpha i} = \frac{{\left( {P_{\alpha i} n_{i} /N} \right)}}{{P_{\alpha } }} = \frac{{P_{\alpha i} n_{i} }}{{P_{\alpha } N}}\), where \(P_{\alpha i}\) measures poverty in subgroup \(i\). Then, according to Duclos and Araar (2007), the changes in the total poverty level can be decomposed into “within-group effect” defined as \(\sum\limits_{i = 1}^{m} {\frac{{\left( {\phi_{i}^{2019} + \phi_{i}^{2020} } \right)}}{2}} \left( {P_{\alpha i}^{2020} - P_{\alpha i}^{2019} } \right)\), which expresses the change in total poverty resulting from changes in poverty within subgroups and "population effect" calculated by \(\sum\limits_{i = 1}^{m} {\frac{{\left( {P_{\alpha i}^{2019} + P_{\alpha i}^{2020} } \right)}}{2}} \left( {\phi_{i}^{2020} - \phi_{i}^{2019} } \right)\), reflecting the change in total poverty resulting from the changes in each subgroup's population share \(\phi (i)\).

During the recession, different groups are affected differently. If income inequality worsens (poorer groups experience faster income decline), poverty increase will be faster, while if it improves (poor groups experience slower income decline), poverty increase will be slower (Khan, 2009). To better understand how and why child poverty changed in Colombia during the COVID-19 recession, we decomposed the change between 2019 and 2020 into growth and distribution components, following Kakwani (2000):

The first term in the above equation is the growth effect, which captures the change in poverty resulting from the change in the mean income with the distribution unchanged. The second term is the distribution effect which measures the change in poverty that occurs owing to the change in distribution, keeping the mean income constant, where \(\mu\), \(L\) and \(z\) represent the mean equivalent income, the Lorenz curve and the poverty line.

2.3.3 Decomposing Inequality and Changes

This paper uses the component decomposition method developed by Lerman and Yitzhaki (1985) to analyze how different income sources contribute to the Gini coefficient of inequality and its changes. The percentage contribution of a component \(i\) to total income inequality is \(P_{i} = \frac{{S_{i} R_{i} G_{i} }}{G}*100\), where \(m\) is the number of income components; \(S_{i}\) is the share of component \(i\) in total income; \(G_{i}\) is the Gini coefficient of component \(i\); and \(R_{i}\) is the Gini correlation between component \(i\) and total income.

In addition to estimating the relative contributions of distinct components to overall inequality, we also examine how a marginal increase in one component would affect overall inequality, holding all other components constant (Lerman & Yitzhaki, 1994). The marginal effect of income component i is defined as \(M_{i} = S_{i} R_{i} G_{i} - S_{i} G\). Further, to gain deeper insights, we decompose the absolute change in the overall Gini coefficient by source. This decomposition illustrates how changes in each component's share of total income, its own inequality, and its correlation with the rank of the total income affected the overall change in the Gini coefficient from 2019 to 2020: \(\Delta G_{00 - 19} = \sum\limits_{i = 1}^{n} {\left( {\left( {S_{i} R_{i} G_{i} } \right)_{2020} - \left( {S_{i} R_{i} G_{i} } \right)_{2019} } \right)}\).

2.3.4 Measuring the Pro-Poorness of the Recession

While the above measurements reveal changes in child poverty level and inequality during the COVID-19 recession, they lack the power to quantitatively assess its pro-poorness or anti-poorness (i.e., whether it disproportionately impacted poor children). To quantitatively address this pro-poorness question, we introduce two indicators:

The Pro-Poor Growth Index (PPGI) by Kakwani and Pernia (2000) measures the relative change in poverty compared to a distribution-neutral scenario, defined as \(PPGI{ = }\frac{\delta }{\eta }\), where \(\delta\) represents the ratio of poverty change to mean income change, and \(\eta\) denotes the distribution-neutral relative growth elasticity of poverty. Kakwani and Son (2003) further consider the actual growth rate with the Poverty Equivalent Growth Rate (PEGR), defined as \(PEGR = \left( {\frac{\delta }{\eta }} \right)\gamma\), where \(\gamma\) is the growth rate of all children.

During a recession (\(\gamma\) < 0), if PPGI < 1, the poor's income declines proportionally less than the non-poor's (favoring the poor). If PPGI > 1, the recession favors the non-poor. Within the PEGR framework, PEGR > 0 indicates a strictly pro-poor recession with potential poverty reduction; \(\gamma\) < PEGR < 0 signifies the poor losing proportionally less but poverty still increasing; and PEGR < \(\gamma\) < 0 suggests a highly unfavorable recession where the poor lose more than the non-poor and poverty worsens (Kakwani et al., 2003).

3 Results

3.1 Level and Dynamics of Equivalent Income Among Children in Colombia

Figure 1 depicts the dynamics of mean equivalent income among children aged 0–13 and 0–17. Between 2014 and 2019, the average equivalent income of children in Colombia fluctuated between 7.2 million and 7.4 million COP. However, in 2020, it experienced a sharp decline to approximately 6.6 million COP with a decrease rate of 10%. Additionally, in each year, the income of children aged 0–13 was slightly higher than that of children aged 0–17.

The largest decrease in the equivalent income of children occurred in cities and metropolises (Fig. 2), where the equivalent income of children aged 0–17 decreased from 10.3 million to 8.97 million, representing a decrease of 12.91%. The next significant decrease was observed in other urban areas, with a decrease of 7.28%. On the other hand, children in rural areas saw the smallest decrease at approximately 0.79%. Although the income gap among children in these three types of regions has narrowed, it still remains significant. In 2020, the income of children in cities and metropolises was approximately 0.47 times higher than that of children in other urban areas and 1.37 times higher than that of children living in rural areas.

Even in the same context of an economic recession, the income decrease may vary among individuals. This can lead to dynamics of inequality and impact the changing pattern of poverty. Figure 3 shows the GIC curve for Colombian children from 2019 to 2020. The curve is entirely situated below 0, indicating that the income of all children has decreased. Notably, the curve exhibits a steep upward slope between the 0–20 percentile, suggesting that low-income children below the 20th percentile experienced a significant decrease in income. After that, the GIC curve fluctuates around -0.1, indicating a similar decline in income for children above the 20th percentile.

Considering different regions (Fig. 4), the GIC curve for children in cities and metropolitan areas is located at the bottom, while the curve for rural children is located at the top. This indicates that the income decrease is most pronounced for children in cities and metropolitan areas and lowest for rural children, which is consistent with the findings obtained from Fig. 2. From the shape of the curves, it can be seen that across all three types of regions, the income decrease is particularly significant for children in the bottom 20 percentiles of the distribution. Particularly in cities and metropolitan areas, the start of the curve is very steep, illustrating a substantial decrease of up to 60% in income for the poorest children.

3.2 Income Distribution and Inequality Among Children

Due to disparities in the growth rates, the shape of the PDF curve undergoes changes. Figure 5 illustrates that the income distribution among children in Colombia exhibited a right-skewed pattern in both 2019 and 2020, with the majority being located in the low part of the distribution, while a minority enjoyed higher income. A noticeable observation is that the PDF curve shifted slightly leftward and upward from 2019 (with a peak of income = 3.6 million and density = 0.00000012) to 2020 (with a peak of income = 3.0 million and density = 0. 00000013), indicating a decrease in children's equivalent income levels.

Additionally, the two curves intersect, with the 2020 curve situated higher on the left side of the intersection point (the lower-income range) and lower on the right side of the intersection point (the higher-income range) compared to the 2019 curve. This implies that the probability density of the low-income group increased from 2019 to 2020, while the probability density of the high-income group decreased, aligning with previous findings.

Based on Fig. 3 and Fig. 5, it can be inferred that income inequality among Colombian children changed between 2019 and 2020. Table 1 presents several inequality indices, including percentile ratios, generalized entropy inequality indices and the Gini coefficient. First, these indices indicate a fairly inequitable distribution among Colombian children, with Gini coefficients close to 0.5. Second, all indices show an increasing trend, suggesting that inequality among Colombian children worsened during the period. Third, comparing the changes in different indices, the percentile ratio of p90/p10 increased from 8.91 to 9.85, with a growth rate of 10.6 percent, larger than the other three percentile ratios, indicating a more substantial expansion of the gap between children with low and high income.

Furthermore, among the generalized entropy inequality indices developed by Shorrocks (1980), GE (-1) increased sharply from 0.80 to 0.97, with the largest growth rate of 21.3%. In contrast, GE (0) only increased by 7.47%, and the changes in GE (1) and GE (2) were not statistically significant. Since the smaller the parameter value for GE, the more sensitive it is to differences at the bottom of the distribution, these results further support the previous conclusion that the inequality among low-income children is worsening more severely.

3.3 Level, Trends and Decomposition of Child Poverty

3.3.1 Level and Trends of Child Poverty

As a result of the decrease in income and worsening inequality, the child poverty level in Colombia increased between 2019 and 2020. Referring to the official poverty line, the PH index for children reached 43.7%, meaning that nearly half of the children live below the official poverty line. This represents an increase of 0.053 (approximately 13.8%) compared to 2019. Furthermore, the PG and SPG indices increased by 20.0% and 25.3%, respectively, both higher than the increase in the PH index, indicating that the economic status of ultra-poor children has deteriorated more severely, as the PG and SPG indices place more weight on the poorest. Additionally, the PH, PG, and SPG indices based on the extreme poverty line increased by 26.0%, 38.4%, and 47.5%, respectively, all exceeding the corresponding increase based on the official poverty line, suggesting that in 2020, Colombian children became increasingly concentrated below the extreme poverty line.

In comparison to adults and elderly individuals, all three poverty indices for children are the highest in 2019 and 2020. Moreover, during the study period, except for the PH index based on the official poverty line, where children experienced a comparatively lower increase rate compared to adults, in all other indices, children exhibited the highest increase rate. In other words, child poverty levels were the highest and deteriorated most sharply from 2019 to 2020.

When comparing different areas, both in 2019 and 2020 and across both poverty lines, the poverty level among children living in rural areas was higher than that of urban children, which in turn was still higher than the child poverty level in cities and metropolitan areas. For instance, in 2019, the poverty headcount among rural children reached 65.5%, nearly 30 percentage points higher than that of urban and metropolitan areas. Moreover, the extreme poverty incidence for rural children was nearly twice as high as that of children living in cities and metropolitan areas. However, it is worth noting that during the period, poverty indices for rural children exhibited the smallest increase, thus narrowing the poverty gap between them and children living in other areas. This could be attributed to the fact that rural children initially had lower incomes and were potentially less affected by the COVID-19 pandemic, while urban children and their households faced greater challenges and hardships (Table 2).

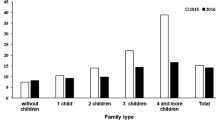

3.3.2 Decomposition of Child Poverty and Changes

What contributed to the changes in child poverty in Colombia? In this paper, we examine the main sources of child poverty and its changes in Colombia through subgroup decomposition and growth (income)-distribution. Table 3 shows the poverty levels of different types of households. In both 2019 and 2020, the poverty level of households with children were higher than those of households without children, whether based on the official poverty line or the extreme poverty line. For example, based on the official poverty line, in 2019, 31.3% of households with children had an equivalent income below the poverty line, which was 14 percentage points higher than that of households without children. In addition, from 2019 to 2020, the increase in all poverty indices in households with children was greater than that in households without children. For example, based on the extreme poverty line, the PH index of households with children increased from 10% to 13.1%, an increase of 3.1 percentage points, while that of households without children increased by 1.9 percentage points. This shows that households with children face a greater risk of poverty and are more severely affected by the recession caused by COVID-19.

Based on the child dependency ratio, children are categorized into five subgroups: G1-G5, representing children living in households with dependency ratios of less than 1, 1–1.5, 1.5–2, 2–3, and above 3, respectively. These subgroups account for population shares of 35.7%, 34.4%, 12.4%, 11.7%, and 5.7%, respectively.

From Table 4, it can be seen that as the dependency ratio rises, child poverty levels increase. In 2020, when using the official poverty line, the PH index for children belonging to the G5 group reached as high as 75.7%, 45 percentage points higher than the PH index for children in the G1 group.

In terms of contribution rates, although the G5 group exhibits a higher level of poverty, its contribution to overall poverty is relatively small due to its smaller population share. For instance, in 2020, when employing the official poverty line, the G5 group contributed only 9.9% to the overall PH index. However, both the G4 and G5 groups have higher contribution rates to the three overall poverty indices based on the extreme poverty line compared to their contribution rates based on the official poverty line. Additionally, as the parameter of FGT indices increases, placing greater weight on the poorest individuals, the contribution of G4 and G5 groups to overall poverty slightly increases, while the contribution of the other three groups slightly decreases. This indicates that among extremely poor children, the proportion of children belonging to the G4 and G5 groups is relatively higher than their population proportion among all children.

Dividing children by their residential areas, the proportions of children in cities and metropolitan areas, other urban areas, and rural areas in 2020 were 39.2%, 34.6%, and 26.2%, respectively. However, due to the significantly higher poverty level among rural children, their contribution to overall poverty exceeds their population share. For instance, in 2019, rural children contributed 46.0% and 56.9% to the overall PH index based on the official poverty line and the extreme poverty line, respectively. These contribution percentages were 20 and 30 percentage points larger than their population share, respectively. Nonetheless, as there were minimal changes in rural child poverty from 2019 to 2020, while other children experienced a larger increase in poverty, rural children’s contribution rate decreased, while their counterparts’ contribution slightly increased.

Table 5 presents the results of subgroup decomposition of the changes in child poverty. Except for the negative contribution from the within-group effect of rural children to the overall PH index based on the extreme poverty line, all other within-group effects are positive. This is because the poverty indices within these subgroups have increased during this period. The population effects of G3, G4, G5 groups, and rural children are all negative, indicating a decrease in the proportion of these children.

In terms of overall contribution, the G5 group has negative contributions to the changes in the PH and PG indices based on the official poverty line but a positive contribution to the change in the SPG index. The other groups have positive contributions to the changes in all poverty indices using both poverty lines. This suggests that although some groups have negative population effects, the within-group effects completely offset the reducing effect as their own poverty level has increased so much.

Based on regional divisions, rural children contribute negatively to the changes in the three poverty indices based on the official poverty line and the PH index based on the extreme poverty line but increase the overall PG and SPG indices based on the extreme poverty line. On the other hand, children in cities or metropolitan areas and other urban areas have positive contributions to the changes in all poverty indices. This is due to a significant increase in poverty levels among them.

Table 6 provides the growth-distribution decomposition results for changes in child poverty. Both the growth and distribution components contribute positively to the changes, indicating that the decreasing income and worsening distribution have exacerbated child poverty. Based on the official poverty line, the contributions of the growth components are greater than those of the distribution components. However, when using the extreme poverty line, the distribution components’ contributions to the changes in the PG and SPG indices are greater than the contributions of the growth components. This suggests that the income decline for the extremely poor group among children below the extreme poverty line is relatively small (as their income is already extremely low, there is limited room for further decline), while the deterioration of income distribution is relatively significant. This finding aligns with the conclusions drawn from the analysis of the changes in GE indices that GE (-1) decreased more significantly compared to other GE indices.

3.4 Income Source Decomposition of Income Inequality and Changes Among Children

The previous analysis revealed a rising trend in inequality among Colombian children. This shift, accompanied by a decline in average equivalent income, played a role in increasing child poverty levels during the recession. This prompts the question of how different income sources contribute to the overall inequality and its dynamics. In this regard, Table 7 provides the composition of Colombian children’s equivalent income. It is important to note that, since children do not have their own income sources, the equivalent income for children is calculated by dividing household income by an equivalence scale, i.e., children’s share of household income, rather than their own income. Labor income is the main source, accounting for nearly 90% of children’s equivalent income. From 2019 to 2020, except for public transfer income, which increased by 7.69% (P = 0.0593), all other income sources decreased. The largest decrease was observed in capital income, which declined by 29.36%, followed by a 26.78% decrease in private transfer income. Additionally, during this period, equivalent income taxes and contributions also decreased by approximately 10.41% (P = 0.0948). In terms of the proportion of various income sources, although labor income experienced a decrease, its share in total equivalent income increased by around 1 percentage point. At the same time, the share of public transfer income increased by 0.74 percentage point, while the other three sources experienced decrease in their share. However, public transfers only increased by 22,691 COP, which is only 3.35% of the total decline in other types of income (676,521 COP). As a result, it did not effectively prevent the worsening of poverty.

The changes in the proportions of various income sources and their distribution inequality have brought changes in the overall inequality. Table 8 provides the results of income source decomposition of inequality among children and its changes using the Gini coefficient as an example. Labor income, with the largest share in total income, contributes the most to the overall Gini coefficient, accounting for nearly 50%. Pension income and capital income are the second and third largest sources, respectively, in both 2019 and 2020. In 2019, private transfer income accounted for 1.95% of the overall Gini, higher than the contribution of public social benefits (1.22%), and decreased to 0.99% in 2020, primarily due to its reduced proportion in total income.

In terms of marginal effects, labor income, capital income, and pension income all have positive values, indicating that slight increases in these income sources will raise the Gini coefficient. In contrast, public social benefits, private transfer income, and taxes have negative marginal effects, meaning that slight increases in these incomes will narrow income disparities, promoting a more equal distribution of income.

Looking at the contributions of different income sources to changes in the Gini coefficient, labor income remains as the dominant driver with a contribution rate of 232.17%. This is because labor income is the primary source of income, and its Gini coefficient increased from 0.5236 to 0.5465 during this period. The contributions of pension income and public social benefits are also positive, albeit relatively small (less than 1%), indicating that these public transfers did not effectively reduce but rather increased income inequality among children. Consequently, combined with a decline in the average equivalent income, this likely contributed to an increase in child poverty levels. On the other hand, capital income and private transfers play a role in reducing income inequalities, as they tend to be concentrated among high-income groups and decrease between 2019 and 2020. Additionally, the decrease in income taxes has also contributed to narrowing the gap, possibly because tax reductions during the period have alleviated the burden of low-income households with children.

3.5 Pro-Poorness Analysis of the Recession

Based on the analysis conducted above, it can be concluded that during the recession caused by the COVID-19 pandemic, children's income generally decreased in Colombia, with impoverished children facing a more severe decline, thereby exacerbating income inequality among children. To quantitatively evaluate the pro-poorness of the recession, PPGI and PEGR are evaluated as shown in Table 9.

Throughout the period, the average income of Colombian children decreased by 9%. For the PH index, regardless of whether the official poverty line or the extreme poverty line is used, the PEGR is smaller than g, and the PPGI is greater than 1, suggesting that the recession is anti-poor, i.e., poor children suffered a larger decline.

However, for the PG and SPG indices, different conclusions arise when using different poverty lines. When using the official poverty line, two PPGI indices are less than 1, and two PEGR are greater than g, indicating a pro-ultra-poor recession, given that PG and SPG indices assign greater weights to the poorest group. On the other hand, when using the extreme poverty line, both the PPGI and PEGR for the PG and SPG indices indicate that the recession is anti-ultra-poor. Nevertheless, regardless of the poverty line used, the PPGI (PEGR) for the SPG index is smaller (greater) than the PPGI (PEGR) for the PG index, indicating that the income for the ultra-poor decreased less than that for the not-so-poor. Overall, the findings demonstrate that the recession caused by the COVID-19 pandemic had an adverse impact on children's income in Colombia, particularly for impoverished children, thereby intensifying income inequality and poverty.

4 Discussion and Policy Implications

Based on the income data of Colombia in 2019 and 2020 derived from the LIS database, this paper estimates the levels and changes in income, poverty and inequality among children, performs subgroup decomposition of child poverty and changes, makes growth-distribution decomposition of child poverty changes, and decomposes income inequality and changes by income sources to reveal the impact of the COVID-19 pandemic-induced recession on income inequality and poverty among children in Colombia. This study represents an improvement over existing studies that lacked such quantitative measurements. It also helps us understand the potential changes in child inequality and poverty during the recession caused by shocks like the COVID-19 pandemic when there is insufficient government assistance, especially in developing and poor countries.

There was a notable decline in the equivalent income of Colombian children during 2019 to 2020, compared to the minor fluctuations observed from 2014 to 2019, reflecting the impact of the recession caused by the COVID-19 pandemic. Furthermore, the decline among the low-income groups was greater than that of the high-income groups. This shift has altered the distribution pattern of Colombian children's equivalent income, and in turn, has exacerbated child poverty. These findings align with the officially reported upward trend in Colombia's national poverty levels that the poverty rate in 2020 was up 6.8 points compared to 2019. Notably, children from households with a high child dependency ratio experienced higher levels of poverty, contributed more to the overall poverty relative to their proportion in population and played a role in exacerbating the overall poverty dynamics. This underscores that children in households with high child dependency ratios face higher risk of poverty because a high dependency ratio is associated with bigger household vulnerability to shocks, such as losing job during the epidemic. This finding is consistent with the previous studies (Bigsten et al., 2003; Hashmi et al., 2008; Naudé et al., 2008; Wang et al., 2021).

Children living in rural areas contributed the most to overall child poverty, but their contribution to poverty changes was less pronounced due to smaller changes. On the other hand, child poverty levels significantly increased in city or metropolitan areas, emerging as the primary driver behind the overall increase in child poverty in Colombia. This contradicts the general assumption that low-income rural children are more vulnerable to economic shocks (Chuta, 2014; Woldehanna, 2010) and the fact that they contribute more to overall poverty. The reason maybe that rural households are more dependent on agricultural income than urban households (Palacios & Pérez-Uribe, 2021) and the agricultural sector is somewhat less compared to other sectors of the economy, as a result of the constant demand for food (Goshu et al., 2020; Kyfyak et al., 2022; Pienaar, 2020; Purwantini, 2023). Conversely, urban households derive their income mainly from formal employment. In light of the influence of the COVID-19 pandemic, numerous enterprises have either shuttered or encountered a decline in orders, leading to a higher risk of unemployment or income reduction for urban dwellers in contrast to their rural counterparts (Headey et al., 2020; Kang et al., 2021). These circumstances collectively contribute to a more substantial economic impact of the pandemic on urban children's economic status.

Poverty is responsive to both growth and distribution components (Ali & Elbadewi, 1999; Canagarajah et al., 1998). While declining income is the main reason for increasing child poverty in Colombia, the distribution inequality has further worsened during this period, and contribute more to the changes in poverty. Among the six sources of income for Colombian children, labor income contributes the most to the level and increase in overall inequality. This is attributed to the fact that the low-income group tends to experience a higher risk of losing job and wage reduction during a recession (Cortes & Forsythe, 2020), thereby widening the income gap. On the other hand, capital income and private transfer income reduce the overall level of inequality. This is because these two sources of income are predominantly concentrated among high-income groups who are more likely to face capital income losses during the recession (Kang & Sawada, 2003; Wu et al., 2022), thus narrowing the income gap.

It is particularly noteworthy that, in contrast to countries like the United States (Fox & Burns, 2021), the United Kingdom (Blundell et al., 2022), Brazil and Argentina (Pereira & Oliveira, 2020), which have successfully reduced income inequality and poverty levels through public transfers during the COVID-19 pandemic, in Colombia, public social benefits not only failed to reduce income inequality and poverty among children but actually widened them, despite its contribution rate being only 0.87%. This suggests that the government’s assistance during the COVID-19 pandemic did not effectively target the low-income population.

Consequently, in terms of pro-poorness, during the period from 2019 to 2020, impoverished children in Colombia experienced greater income losses, indicating an anti-poor recession. However, among these poor children, those in extreme poverty experienced a smaller decline in income compared to those who were not-so-poor, implying that the recession caused by the COVID-19 pandemic was pro-ultra-poor. This does not imply that the ultra-poor have any advantageous that they are less affected than those who are not so poor. Rather, it is because they are “so poor that they can scarcely be worse off” (Mill, 2022).

In conclusion, during the recession caused by the COVID-19 pandemic, Colombian children experienced a decline in income, worsened inequality, and increasing poverty. However, as pointed out by Busso et al. (2021), the government did not provide sufficient social assistance to narrow the income gap among children and alleviate poverty. This may further exacerbate poor children’s deprivation in health and education (Alaba et al., 2022; Bessell, 2022; Li et al., 2021; Murray-Garcia et al., 2023; Thanh et al., 2024) and could have long-term impacts on their economic status as adults (Duncan et al., 2012; Li & Chen, 2007; Yu et al., 2011; Zhang et al., 2014).

Based on the findings above, the following policy recommendations are proposed for mitigating the exacerbated issues of child poverty and inequality during the recession caused by pandemic such as COVID-19:

Firstly, increasing government assistance. During the economic recession caused by the COVID-19 pandemic, the equivalent income of Colombian children has significantly decreased. This decline is attributed to the pervasive and widespread impact on the entire economy, which is difficult for households to cope with individually. Consequently, it is recommended that governments promptly expand the social assistance and public transfers when confronted with similar economic recessions and widespread income reductions due to pandemics like COVID-19.

Secondly, expanding specialized assistance programs for children. The higher risk of children falling into poverty, particularly during during economic recessions, emphasizes the necessity of targeted interventions. In the recession caused by the COVID-19 pandemic, the poverty level of children in Colombia has deteriorated more than that of adults and the elderly. Therefore, specialized assistance programs for children should be established. Alternatively, within existing family-targeted assistance programs, a heightened consideration for the specific needs of children is recommended.

Thirdly, improving the targeting of social assistance programs. Social assistance programs can only effectively narrow the gap and alleviate poverty when they specifically target low-income groups. However, during the the COVID-19 pandemic, Colombia's public transfer payments did not narrow the gap, but rather widened the gap, thereby increasing poverty reduction among children. Therefore, social assistance programs need to focus on children who have been severely impacted by the pandemic, such as children in families with a high dependency ratio and urban families, to prevent their income from excessively declining.

Fourthly, bolstering the provision of public services essential for children’s development. The income decline, income inequality, and even poverty during the COVID-19 pandemic not only affect the economic situation of children but also impact their access to education, healthcare, and other public services, influencing their long-term development and future economic status. These services, integral to societal functioning, cannot be comprehensively addressed through economic assistance alone. Therefore, alongside economic assistance, it is essential to enhance the supply and accessibility of fundamental public services crucial for children's holistic development.

5 Limitations and Future Directions

Compared to previous researches, this paper's strengths and contributions lie in its comprehensive assessment of changes in child poverty and inequality using Colombia as a case, which expands the research landscape on the impacts of the COVID-19 pandemic on child poverty and inequality. Moreover, it evaluates the contribution of income fluctuations and distributional changes on the changes in child poverty. The study further analyses the effects of different income sources on the inequality among children, thus yielding findings distinct from those observed in developed countries like the United States. Despite these strengths and contributions, there are still some limitations in the study that should be addressed in future research.

Firstly, the main limitation is that due to the lack of available micro-level data, this paper does not provide an in-depth analysis of the impact of micro-factors on income inequality and poverty among children, such as the employment status of household members, household composition, and even COVID-19 infection status. Unfortunately, these factors. Future studies need to analyze the impact of these factors on children's equivalent income, inequality, and poverty, thereby revealing the mechanisms behind the fluctuations in children's economic conditions during the recession caused by the pandemic.

Secondly, given that the LIS is a cross-sectional database but not longitudinal, we can only evaluate the levels and changes in child poverty and inequality in Colombia, and cannot track the longitudinal alterations in individual children or their household’s income levels, socioeconomic positioning, and poverty status. In the future, with the availability of longitudinal data, the analysis of income dynamics among children with different characteristics at the household or personal level should be conducted, facilitating the adoption of more effective policy measures.

Thirdly, in addition to the indirect effects resulting from the pandemic's impact on family finances, some children who do have to work also experience the direct impact of the recession caused by the pandemic, such as losing their job opportunities and income sources. However, due to a lack of data, the analysis in this regard has not been conducted. Future studies need to focus on the impact of recessions caused by pandemics as COVID-19 on child labor employment and income. Nevertheless, it is important to emphasize once again that our belief remains that the purpose of social policies is not to mitigate the impact of the pandemic on child labor employment and income but rather to completely eradicate child labor.

Data Availability

The income dataset for Colombia used in this paper is available by request from the Luxembourg Income Study Database here: https://www.lisdatacenter.org/our-data/lis-database/.

References

Abdelkhalek, T., Boccanfuso, D., & Savard, L. (2022). Impact of the Covid-19 pandemic on monetary child poverty in Morocco. International Journal of Microsimulation, 15(3), 15–37.

Alaba, O. A., Hongoro, C., Thulare, A., & Lukwa, A. T. J. B. P. H. (2022). Drivers of socioeconomic inequalities of child hunger during COVID-19 in South Africa: evidence from NIDS-CRAM Waves 1–5. BMC Public Health, 22(1), 1–15.

Ali, A. A., & Elbadewi, I. A. (1999). Inequality and the dynamics of poverty and growth. CID Working Paper Series No. 32, Harvard University.

Anyaegbu, G. (2010). Using the OECD equivalence scale in taxes and benefits analysis. Economic & Labour Market Review, 4(1), 49–54.

Araar, A., & Duclos, J.-Y. (2013). User manual DASP version 2.3. DASP: Distributive Analysis Stata Package, Université Laval, PEP, CIRPÉE and World Bank.

Aran, M. A., Aktakke, N., Kibar, Z. S., & Üçkardeşler, E. (2022). How to assess the child poverty and distributional impact of COVID-19 using household budget surveys: An application using Turkish data. The European Journal of Development Research, 34(4), 1997–2037.

Argentina, U. (2020). Child Poverty and Inequality in Argentina. COVID-19 Effects.

Aristondo, O., d’Ambrosio, C., & Lasso de la Vega, C. (2023). Decomposing the changes in poverty: Poverty line and distributional effects. Bulletin of Economic Research, 75(4), 1048–1063.

Atkinson, A. B., Rainwater, L., & Smeeding, T. M. (1995). Income distribution in OECD countries: evidence from the Luxembourg Income Study.

Bárcena-Martín, E., Moro-Egido, A., & Pérez-Moreno, S. (2016). How income growth differs with children in Spain: A comparative European perspective. Child Indicators Research, 9, 357–370.

Bárcena-Martín, E., Blanco-Arana, M. C., & Pérez-Moreno, S. (2018). Social transfers and child poverty in European countries: Pro-poor targeting or pro-child targeting? Journal of Social Policy, 47(4), 739–758.

Bessell, S. (2022). The impacts of COVID-19 on children in Australia: Deepening poverty and inequality. Children’s Geographies, 20(4), 448–458.

Bigsten, A., Kebede, B., Shimeles, A., & Taddesse, M. (2003). Growth and poverty reduction in Ethiopia: Evidence from household panel surveys. World Development, 31(1), 87–106.

Blofield, M., Cuartas Ricaurte, J., Filgueira, F., Martínez Franzoni, J., & Sánchez Ancochea, D. (2022). Towards a global universal basic income for children. University of Oxford.

Blundell, R., Costa Dias, M., Cribb, J., Joyce, R., Waters, T., Wernham, T., & Xu, X. (2022). Inequality and the COVID-19 Crisis in the United Kingdom. Annual Review of Economics, 14, 607–636.

Bradshaw, J. (2003). Poor children 1. Children & Society, 17(3), 162–172.

Brzezinski, M. (2018). Income inequality and the great recession in Central and Eastern Europe. Economic Systems, 42(2), 219–247.

Burkhauser, R. V., Crews Cutts, A., Daly, M. C., & Jenkins, S. P. (1999). Testing the significance of income distribution changes over the 1980s business cycle: A cross-national comparison. Journal of Applied Econometrics, 14(3), 253–272.

Busso, M., Camacho, J., Messina, J., & Montenegro, G. (2021). Social protection and informality in Latin America during the COVID-19 pandemic. Plos One, 16(11), e0259050.

Bütikofer, A., & Gerfin, M. (2009). The economies of scale of living together and how they are shared: estimates based on a collective household model. IZA Discussion Paper, 4327(4327). Retrieved May, 10, 2023 from http://ftp.iza.org/dp4327.pdf

Canagarajah, S., Mazumdar, D., & Ye, X. (1998). The structure and determinants of inequality and poverty reduction in Ghana, 1988–92. Available at SSRN 614963.

Chuta, N. (2014). Children’s agency in responding to shocks and adverse events in Ethiopia. Young Lives.

Clark, A. E., d’Ambrosio, C., & Lepinteur, A. (2021). The fall in income inequality during COVID-19 in four European countries. The Journal of Economic Inequality, 19, 489–507.

Cortes, G. M., & Forsythe, E. (2020). Impacts of the COVID-19 Pandemic and the CARES Act on Earnings and Inequality, Working Paper Series. No. 41, University of Waterloo.

Deaton, A. (2003). Household surveys, consumption, and the measurement of poverty. Economic Systems Research, 15(2), 135–159.

Deaton, A. S., & Muellbauer, J. (1986). On measuring child costs: With applications to poor countries. Journal of Political Economy, 94(4), 720–744.

Deaton, A. S., & Paxson, C. H. (1995). Saving, Inequality and Aging: An East Asian Perspective. Asia-Pasific Economic Review, 1(1), 7–19.

Department of Work and Pensions. (2017). Households below average income: An analysis of the UK income distribution: 1994/95‐2015/16. Available online from https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/600091/households-below-average-income-1994-1995-2015-2016.pdf.

Desai, V., & Potter, R. B. (2013). The companion to development studies. Routledge.

Duclos, J.-Y., & Araar, A. (2007). Poverty and equity: Measurement, policy and estimation with DAD. Springer.

Duncan, G. J., Magnuson, K., Kalil, A., & Ziol-Guest, K. (2012). The importance of early childhood poverty. Social Indicators Research, 108(1), 87–98.

Elgar, F. J., Stefaniak, A., & Wohl, M. J. (2020). The trouble with trust: Time-series analysis of social capital, income inequality, and COVID-19 deaths in 84 countries. Social Science & Medicine, 263, 113365.

Fanjul, G. (2014). Children of the recession: The impact of the economic crisis on child well-being in rich countries. Innocenti Report Card 12, UNICEF Office of Research.

Fiala, O., Kielem, A., Delamónica, E., Obaidy, M., Espinoza-Delgado, J., Giacoponello, M., & Martinez, I. C. (2022). Nowcasting impact of COVID-19 on multidimensional child poverty. Statistical Journal of the IAOS, 38(3), 853–859.

Förster, M., Jesuit, D., & Smeeding, T. (2002). Regional poverty and income inequality in Central and Eastern Europe: evidence from the Luxembourg income study. LIS Working Paper Series No. 324, Luxembourg Income Study (LIS).

Förster, M. F., & Vleminckx, K. (2004). International comparisons of income inequality and poverty: Findings from the Luxembourg Income Study. Socio-Economic Review, 2(2), 191–212.

Fortin, N., Lemieux, T., & Firpo, S. (2011). Decomposition methods in economics. In Handbook of labor economics (Vol. 4, pp. 1–102). Elsevier.

Foster, J., Greer, J., & Thorbecke, E. (1984). A class of decomposable poverty measures. Econometrica: journal of the econometric society, 52(3), 761–766.

Fox, L., & Burns, K. (2021). The supplemental poverty measure: 2020. Current Population Reports, US Census Bureau.

Francis, D. V., & Weller, C. E. (2022). Economic inequality, the digital divide, and remote learning during COVID-19. The Review of Black Political Economy, 49(1), 41–60.

Glewwe, P., & Hall, G. (1995). Who is most vulnerable to macroeconomic shocks? Hypotheses tests using panel data from Peru. The World Bank.

Glewwe, P., & Hall, G. (1998). Are some groups more vulnerable to macroeconomic shocks than others? Hypothesis tests based on panel data from Peru. Journal of development economics, 56(1), 181–206.

Goldin, I., & Muggah, R. (2020). COVID-19 is increasing multiple kinds of inequality. Here’s what we can do about it. In World Economic Forum (Vol. 9).

Gornick, J. C., & Jäntti, M. (2010). Child poverty in upper-income countries: Lessons from the Luxembourg Income Study. LIS Working Paper Series, No. 509, Luxembourg Income Study (LIS).

Goshu, D., Ferede, T., Diriba, G., & Ketema, M. (2020). Economic and welfare effects of COVID-19 and responses in Ethiopia: initial insights. Policy Working Paper 02/2020, Ethiopian Economic Policy Research Institute.

Hallaert, J.-J., Vassileva, I., & Chen, T. (2023). Rising Child Poverty in Europe: Mitigating the Scarring from the COVID-19 Pandemic. IMF Working Papers, No. 2023–134, International Monetary Fund.

Hashmi, A. A., Sial, M. H., Hashmi, M. H., & Anwar, T. (2008). Trends and Determinants of Rural Poverty: A Logistic Regression Analysis of Selected Districts of Punjab [with Comments]. The Pakistan Development Review, 47(4), 909–923.

Headey, D., Heidkamp, R., Osendarp, S., Ruel, M., Scott, N., Black, R., . . . Haddad, L. (2020). Impacts of COVID-19 on childhood malnutrition and nutrition-related mortality. The Lancet, 396(10250), 519–521.

Hoynes, H. W., Page, M. E., & Stevens, A. H. (2006). Poverty in America: Trends and explanations. Journal of Economic Perspectives, 20(1), 47–68.

Kakwani, N. (2000). On measuring growth and inequality components of poverty with application to Thailand. Journal of Quantitative Economics, 16(1), 67–80.

Kakwani, N., & Pernia, E. M. (2000). What is pro-poor growth? Asian Development Review, 18(1), 1–16.

Kakwani, N., & Son, H. H. (2003). Poverty equivalent growth rate: with applications to Korea and Thailand. Economic Commission for Africa.

Kakwani, N., Son, H. H., Qureshi, S. K., & Arif, G. (2003). Pro-poor growth: Concepts and measurement with country case studies [with comments]. The Pakistan Development Review, 417–444.

Kang, S. J., & Sawada, Y. (2003). Are private transfers altruistically motivated? the case of the republic of Korea before and during the financial crisis. The Developing Economies, 41(4), 484–501.

Kang, Y., Baidya, A., Aaron, A., Wang, J., Chan, C., & Wetzler, E. (2021). Differences in the early impact of COVID-19 on food security and livelihoods in rural and urban areas in the Asia Pacific Region. Global Food Security, 31, 100580.

Khan, M. H. (2009). Governance, growth and poverty reduction. Poor Poverty, 61.

Kyfyak, V., Verbivska, L., Alioshkina, L., Galunets, N., Kucher, L., & Skrypnyk, S. (2022). The influence of the social and economic situation on agribusiness. WSEAS Transactions on Environment and Development, No. 8, 1021–1035.

Lakner, C., Mahler, D. G., Negre, M., & Prydz, E. B. (2022). How much does reducing inequality matter for global poverty? The Journal of Economic Inequality, 20(3), 559–585.

Lee, R. D., & Mason, A. (2011). Population aging and the generational economy: A global perspective. Edward Elgar Publishing.

Lerman, R. I., & Yitzhaki, S. (1985). Income inequality effects by income source: A new approach and applications to the United States. The Review of Economics and Statistics, 67(1), 151–156.

Lerman, R. I., & Yitzhaki, S. (1994). Effect of marginal changes in income sources on US income inequality. Public Finance Quarterly, 22(4), 403–417.

Li, M., & Chen, W. (2007). Impact of urban poverty on children education in China. Population & Economics, 4, 40–45.

Li, W., Wang, Z., Wang, G., Ip, P., Sun, X., Jiang, Y., & Jiang, F. (2021). Socioeconomic inequality in child mental health during the COVID-19 pandemic: First evidence from China. Journal of Affective Disorders, 287, 8–14.

Lustig, N., Pabon, V. M., Sanz, F., & Younger, S. D. (2021). The Impact of COVID-19 and Expanded Social Assistance on Inequality and Poverty in Argentina, Brazil, Colombia and Mexico. Commitment to Equity (CEQ) Working Paper Series 92, Tulane University, Department of Economics.

Lustig, N., Pabon, V. M., Sanz, F., & Younger, S. (2022). The Impact of COVID-19 on Living Standards: Addressing the Challenges of Nowcasting Unprecedented Macroeconomic Shocks with Scant Data and Uncharted Economic Behavior. International Journal of Microsimulation, 16(1), 1–27.

Majid, N. (2011). The global recession of 2008–09 and developing countries. In From the Great Recession to Labour Market Recovery: Issues, Evidence and Policy Options (pp. 53–77). Palgrave Macmillan UK.

Matsaganis, M., & Leventi, C. (2014). Poverty and inequality during the Great Recession in Greece. Political Studies Review, 12(2), 209–223.

Mill, J. S. (2022). Dissertations and Discussions: Vol. II. BoD–Books on Demand.

Mínguez, A. M. (2017). Understanding the impact of economic crisis on inequality, household structure, and family support in Spain from a comparative perspective. Journal of Poverty, 21(5), 454–481.

Montes-Rojas, G., Siga, L., & Mainali, R. (2017). Mean and quantile regression Oaxaca-Blinder decompositions with an application to caste discrimination. The Journal of Economic Inequality, 15(3), 245–255.

Mood, C., & Jonsson, J. O. (2016). Trends in child poverty in Sweden: Parental and child reports. Child Indicators Research, 9, 825–854.

Moyer, J. D., Verhagen, W., Mapes, B., Bohl, D. K., Xiong, Y., Yang, V., . . . Carter, C. (2022). How many people is the COVID-19 pandemic pushing into poverty? A long-term forecast to 2050 with alternative scenarios. Plos One, 17(7), e0270846.

Muller, A. (2006). Clarifying poverty decomposition. rapport nr.: Working Papers in Economics(217).

Murray-Garcia, J., Ngo, V., & y Garcia, E. F. (2023). COVID-19′ s still-urgent lessons of structural inequality and child health in the United States. Journal of the National Medical Association, 115(3), 21–325.

Naudé, W., Santos-Paulino, A. U., & McGillivray, M. (2008). Vulnerability in developing countries. Reserach Brief, No. 2, 2008, United Nations University.

Obermeier, T. (2022). Individual welfare analysis: What's the role of intra-family preference heterogeneity? Beiträge zur Jahrestagung des Vereins für Socialpolitik 2022: Big Data in Economics, ZBW - Leibniz Information Centre for Economics, Kiel, Hamburg.

Palacios, P., & Pérez-Uribe, M. A. (2021). The Effects of Agricultural Income Shocks on Forced Migration: Evidence from Colombia. Peace Economics, Peace Science and Public Policy, 27(3), 311–340.

Parekh, N., & Bandiera, O. (2020). Poverty in the time of COVID: the effect of social assistance. LSE Public Policy Review, 1(2), 1–11.

Pashardes, P. (2007). Why Child Poverty in Cyprus is so low. Cyprus Economic Policy Review, 1(2), 3–16.

Pereira, M., & Oliveira, A. M. (2020). Poverty and food insecurity may increase as the threat of COVID-19 spreads. Public Health Nutrition, 23(17), 3236–3240.

Perri, F., & Steinberg, J. (2012). Inequality and redistribution during the Great Recession. Economic Policy Paper, 1, Federal Reserve Bank of Minneapolis.

Pienaar, L. (2020). COVID-19 Rapid Socio-Economic Impact Study: Agricultural Value Chains in the Western Cape. Working Paper, The Western Cape Department of Agriculture.

Pieper, J., Schneider, U., & Schröder, W. J. S. S. (2021). Bilanz nach einem Krisenjahr: Corona und die Armut in Deutschland. Soziale Sicherheit, 1, 37–41.

Purwantini, T. B. (2023). Human Capital Performance in the Agriculture Sector During the Era of Covid-19. 1st UMSurabaya Multidisciplinary International Conference 2021 (MICon 2021),

Ravallion, M., & Chen, S. (2003). Measuring pro-poor growth. Economics Letters, 78(1), 93–99.

Ray-Chaudhuri, S., & Wernham, X. (2023). Living standards, poverty and inequality in the UK: 2023. IFS Report R265, The Institute for Fiscal Studies.

Regan, M., & Maître, B. (2020). Child poverty in Ireland and the pandemic recession. Budget Perspectives, No. 2021/4, The Economic and Social Research Institute (ESRI), Dublin.

Regier, G., Zereyesus, Y., Dalton, T., & Amanor-Boadu, V. (2015). Do Adult Equivalence Scales Matter in Poverty Estimates? A Ghana Case Study. 2015 Conference, August 9-14, 2015, Milan, Italy.

Schulten, T. (2020). Der niedriglohnsektor in der Corona-Krise. Aus Politik und Zeitgeschichte, 70(39/40), 16–21.

Shorrocks, A. F. (2013). Decomposition procedures for distributional analysis: A unified framework based on the Shapley value. The Journal of Economic Inequality, 1(11), 99–126.

Shorrocks, A. F. (1980). The class of additively decomposable inequality measures. Econometrica: Journal of the Econometric Society, 48(3), 613–625.

Sinha, I. P., Lee, A. R., Bennett, D., McGeehan, L., Abrams, E. M., Mayell, S. J., . . . Auth, M. K. (2020). Child poverty, food insecurity, and respiratory health during the COVID-19 pandemic. The Lancet Respiratory Medicine, 8(8), 762–763.

Stiglitz, J. (2020). Conquering the great divide. Finance & Development, 57(3), 17–19.

Sumner, A., Hoy, C., & Ortiz-Juarez, E. (2020). Estimates of the Impact of COVID-19 on Global Poverty. WIDER working paper.

Tai, T. O., & Treas, J. (2009). Does household composition explain welfare regime poverty risks for older adults and other household members? Journals of Gerontology Series b: Psychological Sciences and Social Sciences, 64(6), 777–787.

Thanh, P. T., & Tram, N. H. M. (2024). Educational inequality during the COVID-19 pandemic in Vietnam: Implications for disadvantaged children. Children and Youth Services Review, 156, 107339.

UNICEF. (2020). Estimating the Impact of COVID-19 on Child Poverty in Georgia using a Micro-Simulation Model. Working Report, Prepared for UNICEF by Development Analytics.

United Nations. (1989). Convention on the Rights of the Child. Retrieved March, 18, 2023 from http://www.ohchr.org/EN/ProfessionalInterest/Pages/CRC.aspx

Wan, G., & Wan, G. H. (2008). Understanding inequality and poverty in china. Springer.

Wang, C., Zeng, B., Luo, D., Wang, Y., Tian, Y., Chen, S., & He, X. (2021). Measurements and determinants of multidimensional poverty: Evidence from mountainous areas of southeast China. Journal of Social Service Research, 47(5), 743–761.

Woldehanna, T. (2010). Do pre-natal and post-natal economic shocks have a long-lasting effect on the height of 5-year-old children? Evidence from 20 sentinel sites of rural and urban Ethiopia. Young Lives.

Wu, L., Zhang, S., & Qian, H. (2022). Distributional effects of China’s National Emissions Trading Scheme with an emphasis on sectoral coverage and revenue recycling. Energy Economics, 105, 105770.

Yu, D., Liu, A., Yu, W., Zhang, B., Zhang, J., Jia, F., Li, J., & Zhao, L. (2011). Status of malnutrition and its influencing factors in children under 5 years of age in poor areas of China in 2009. Wei sheng yan jiu= Journal of hygiene research, 40(6), 714–718.

Zhang, X., Wang, G., & He, Q. (2014). Nutritional Status of 7–14 years old students in poverty-stricken area in Anhui province. China Journal of School Health, 35(6), 816–818.

Zhou, Y., & Sun, J. (2017). Social Capital and Rural Household Poverty Reduction: An Empirical Analysis Based on CGSS Data. Economics Information(4), 16–29.

Acknowledgements

This paper is supported by“the Fundamental Research Funds for the Central Universities”(N2314009), “Liaoning Social Science Fund” (L22AGL010) and “Liaoning Economic and Social Development Research Project”(2023lslybkt-052).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wang, Z., Chen, Y., Lin, T. et al. The Dynamics of Inequality and Poverty Among Children in Colombia During the COVID-19 Recession. Child Ind Res 17, 815–843 (2024). https://doi.org/10.1007/s12187-024-10105-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12187-024-10105-w