Abstract

Despite the lack of electoral accountability, China has built an expanding welfare system that is set to include most citizens. Why does China defy the conventional prediction of an exclusive authoritarian welfare state? This paper looks at the critical time when China first established its social security system in the 1990s and argues that the state adopts a “threat-driven strategy” where the redistribution effort varies with the expected collective action of economic losers. Analyzing an original granular county-level dataset of China’s laid-off workers and social security taxation, the paper finds that a group of newly emerged economic losers, precipitated by state policy, drives the local states’ efforts to redistribute. In particular, the number of laid-off state-owned enterprise workers explains 46% of the variations in social security collection among non-state-owned enterprises. Instrumental variable estimation, with legacy state-owned enterprises established in historical contingencies as the instrument for laid-off workers, shows consistent results. Further analysis on mechanisms demonstrates that layoffs lead to an increase in SOE protests, which in turn foster greater redistribution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Economic change is disruptive. Inevitably, there are “losers” in these structural changes, such as laid-off state-owned enterprise (SOE) workers in former socialist countries in Eastern Europe and unemployed workers in deindustrialized countries (Iversen and Cusack 2000). In democracies, economic losers demanded state compensation and risk-sharing by converting their preferences into social welfare policies by winning elections (Deacon 2000). More inclusive political regimes are more likely to avoid “winner-take-all” partial reforms, as losers can exert more influence on policy outcomes (Hellman, 1998, 230).

However, heightened economic competition does not always come hand-in-hand with political competition. Former socialist countries like China and Vietnam underwent radical shocks from economic liberalization and globalization without democratization. Like Eastern Europe, the Chinese state has introduced a redistributive social security system in response to the grievances of losers. Lacking inclusive political institutions, the Chinese state still integrated the losers’ preferences into social policies.

It is not uncommon for autocracies to develop an exclusive welfare state that co-opts crucial supporting groups (Knutsen and Rasmussen 2018). Given that these groups tend to represent a small segment of the population, this body of literature suggests a limit on the expansion of authoritarian social protection, positing that comprehensive social protection in authoritarian states is improbable. However, this is at odds with the ever-expanding social security system in China that includes 1.05 billion people in pension and 1.34 billion people in medical insurance by 2022, albeit with unequal coverage. On the other hand, studies about contentious politics in contemporary China among laid-off workers (Hurst 2004), pensioners (Hurst and O’Brien 2002), and peasants (Bernstein and Lü 2003) provide significant insights into how the collective action of the masses can catalyze state concessions. This paper bridges these two bodies of literature on autocratic welfare states, examining the contentious politics during the critical period of China’s welfare state establishment. I argue that the state adopts a “threat-driven” appeasement strategy, whereby the potential collective action of individuals adversely affected by economic liberalization stimulates the expansion of a social security system to populations outside the crucial supporting group. The state assesses the potential for collective action by monitoring both the size of the aggrieved population and the actual collective actions, which reflect the mobilization capabilities of these aggrieved groups.

Autocrats’ concessions to the masses are studied closely in the literature on government responsiveness. Przeworski et al. (1999, 9) define a state as “responsive” if it adopts policies signaled as preferred by citizens. An array of robust empirical studies document authoritarian responsiveness that reflects local concerns to the center through representatives (Malesky and Schuler 2010) and claims to take account of citizens’ inputs (Meng et al. 2017) or gives information to satisfy citizens’ requests (Distelhorst and Hou 2017; Chen et al. 2016). However, these recent studies in responsiveness take the form of particularistic and piecemeal transactions that address individual grievances, deviating from an earlier focus on programmatic responsiveness (Tsai 2007). More importantly, the literature is usually not concerned with the redistributive effect of responsiveness. What other party’s interest is harmed, and from where are the resources systematically taken away? Using China as a case, the paper finds that an authoritarian state can make programmatic changes that harm other interest groups, including itself. The state is willing to pay a real price for responsiveness for fear of collective action.

The paper also makes a substantive contribution to historical political economy on the establishment of the Chinese social security system. I find that, due to the fiscal crisis that forced the state to lay off millions of SOE workers, the state shifted most of the burden of financing social security to cover economic losers to private firms through their contributions. These new contributors then became future claimants of these benefits. This self-reproducing dynamic explains why China’s social security system continues to expand to include most of the population instead of remaining exclusive, as autocratic welfare states usually do.

The case is studied at the subnational level in China, where the social security system is decentralized, and the large-scale dismantling of SOEs has produced enormous variation in the size of the displaced workforce. State commitment to redistribution is operationalized as the enforcement of social security collection because the latter can only be used to provide welfare and crowds out other extractable fiscal resources. The level of expected collective action is measured as the number of laid-off workers. The paper finds that greater expected collective action leads to greater social security collection, suggesting more government commitment to the welfare state.

The rest of the paper is organized as follows. “Theory” lays out the theoretical arguments. “Background” introduces the background of the dismantling of SOEs and the social security system in China. “Research Design” introduces the research design that exploits an instrumental variable. “Results” presents and discusses the results.

Theory

Threat-Driven Appeasement

Establishing a welfare system is a formidable task for the state and requires a sustained commitment of resources. In an authoritarian state that lacks the mechanisms of accountability to citizens, a welfare system is especially expensive for ruling elites in terms of opportunity costs, as it carves away the state extraction that could otherwise be used to advance their private goals. More importantly, due to the loss aversion of beneficiaries, any reduction or reneging of welfare promises is likely to result in widespread public grievances. Once established, the state must continuously supplement the welfare system with extractions to sustain social stability. Therefore, the state is more likely to use targeted welfare programs to solve credible commitment problems to win over crucial supporting groups (Knutsen and Rasmussen 2018).Footnote 1 Who constitutes the crucial supporting group for the regime? Knutsen and Rasmussen (2018, 664) define it as “individuals who support the regime and, if they were to retract their support, would substantially increase the probability of the regime ending.” Huang (2020) also finds that China’s central and local states frequently increase health insurance reimbursement rates for the privileged groups of state employees, retirees, and urban formal workers to maintain support.

I diverge from the elitist perspective on authoritarian redistribution, proposing that autocracies extend welfare benefits not only to elites but also to dissidents. This concept aligns with the findings of Pan (2020), who has shown that states grant particularistic concessions to individuals who may pose a threat to social stability. However, unlike the individual-level compensation highlighted by Pan (2020), my argument is that the state also implements programmatic concessions aimed at specific groups, such as the millions of laid-off SOE workers.

The mechanism that channels programmatic redistribution to dissents is through the threat of collective action. Protests and strikes not only disrupt economic activities but also necessitate either fiscal or coercive resources for containment. Even under the minimalist assumption that the state aims to maximize discretionary revenues, it is expected that the state would address social unrest to minimize both economic disruption and revenue consumption. The state’s inclination to offer social welfare arises in response to the threat of social instability. In essence, it is a threat-driven strategy. The authoritarian state aims to preemptively address burgeoning grievances by fulfilling citizens’ demands, offering just enough redistribution to maintain stability before potential protesters take to the streets. Should protests occur, the state seeks to resolve them with sustainable commitments that both disband the crowds and effectively dissuade their future demonstrations.

The threat of collective action is a function of both the size of the aggrieved group and their mobilization potential. This threat can manifest as either realized protests or potential of protests. The theory is agnostic regarding the form of the threat, recognizing that realized protests and a large organized crowd that has not yet protested can both be seen as clear indicators of mobilization potential. The state, focused on long-term social stability, must address both realized and potential collective actions.

Under authoritarianism, collective action is analogous to voting in electoral democracies, where the ability to organize collective action mirrors the expected voter turnout of a social group in a democratic election. Compliance without assertiveness in autocracies is akin to disenfranchisement in democracies. If an aggrieved group has a large population but is scattered and disorganized, reducing their mobilization power, the authoritarian state’s inclination to redistribute towards them would be less pronounced.

The threat-driven strategy generates a testable implication: social security is collected and distributed to address actual and potential collective action. Subsequently, more active and organized citizens can push the state to devote more to providing social welfare. Note that this implication does not necessarily contradict the elitist arguments raised by Knutsen and Rasmussen (2018) and Huang (2020). Privileged groups, such as urban formal workers, retirees, and state employees, are better organized and more active, for the same reasons that laid-off SOE workers possess greater bargaining power. In contrast, migrant workers, who are often less organized and typically lack a “rightful” grievance against the government (most grievances are against private employers), have historically been overlooked in their integration into the welfare state.

Snowballing of Authoritarian Social Protection

The literature has made associations between the inclusiveness of the welfare state with regime type. In democracies, the median voter is poorer than the average voter; their preference is redistributive and supports a more comprehensive welfare state (Meltzer and Richard 1981). In autocracies, the winning coalition is a minority of the population (Bueno De Mesquita et al. 2005). Hence, its preference for the welfare state is more exclusive and benefits the crucial supporting group at the expense of “other citizens” (Knutsen and Rasmussen 2018). We should expect the autocratic welfare state to be self-limiting in size instead of expanding to include more people.

However, my argument is that the extent of inclusiveness in an autocratic welfare state depends significantly on its approach to funding. The parallel between collective action in autocracies and voting in democracies extends beyond their capacity to extract concessions. The principle of threat-driven appeasement suggests that social protection under autocracy may inherently possess a self-expanding characteristic, paralleling how the right to vote gradually broadened in modern democracies (Acemoglu and Robinson 2000; Lizzeri and Persico 2004). An exclusive system might struggle to sustain itself if the autocracy lacks adequate fiscal resources, consequently needing to secure funding from new participants by promising them future benefits, such as social security tax. Unlike discretionary tax revenue with no strings attached, social security tax creates clear expectations among the state’s subjects regarding the public goods provisions they should receive in return. Similar to legal codes that standardize expectations for workers (Gallagher 2017), social security tax serves as a focal point for citizens contributing to it, ensuring their claim to future benefits and mobilizing them in cases of underpayment. The logic of threat-driven appeasement should compel the state to continue fulfilling its promises. In turn, to fund these new benefits, the state must further expand its participation in the welfare system, broadening the tax base to include more citizens. Eventually, the state will need to extend the limited welfare state to encompass all productive labor. This implies that the lasting effects of a surge in organized economic losers can be observed in future social security collection efforts.

Background

This paper tests these hypotheses in the establishment and expansion of the social security system in China, a strong authoritarian state. China is a suitable case not only for its regime type; several aspects of its social security system also lay the foundation for an ideal setting: (1) the dismantling of the state-owned-enterprises-centered welfare system created legitimate claims for a sizable group of dissidents to pose a threat to the government; (2) the lack of fiscal capacity of the state necessitates a new stream of revenue, like a participatory social security system; (3) the decentralized social security system allows for local autonomy and generates local variations that can be exploited for empirical testing; (4) the competition between social security tax and discretionary tax revenue, coupled with the fungibility of the latter, compels local governments to adjust their social security collections based on the perceived level of threat rather than focusing solely on maximizing social security tax revenue.

Replacement of the Welfare State

Before the 1990s, China’s welfare provision was a classic club good, as expected in authoritarian states. As Dillon (2015, 36) argues in his account of China’s pre-reform welfare state, the founding of the Chinese welfare state in the early 1950s was marked by a coalition that integrated urban labor but excluded capital. This political constraint and economic constraints imposed by low development level resulted in a welfare system that was resistant to expanding benefits to new groups, focusing instead on enhancing benefits for insiders. Until the 1990s, this exclusivity was predominantly evident in the state sector, where benefits were restricted to individuals with state affiliations, such as workers in state-owned enterprises (SOEs), civil servants, teachers, doctors, and military personnel. This unequal provision of welfare also created perverse incentives for insiders to increase their benefits to unsustainable levels at the expense of outsiders under the soft budget constraints for state sectors.

The old welfare regime was also highly fragmented: each work unit provided its own package of benefits, including housing, healthcare, pensions, and lifetime employment to its employees (Frazier 2011). Rapid market-oriented reforms leading to China’s entry into the World Trade Organization in 2001 ended lifetime employment for tens of millions of SOE workers and deprived them of SOE-provided benefits. Most of these workers were laid off, while others were pushed into “early retirement” and designated as pensioners. From 1998 to 2003, 29.7 million workers were laid off, while pensioners on pension payrolls increased from 27.3 to 38.6 million.Footnote 2 Meanwhile, the central government expanded the old micro-welfare state into a national social safety net that included pensions, health insurance, and unemployment insurance. The new system replaced the fragmented firm-level welfare state with a more unified welfare state administered by city and county governments. It also eliminated participation barriers and made the system accessible to all urban workers.

Privatization and social welfare provision are usually perceived as being on opposite sides of the political spectrum. Counterintuitively, the two policies overlapped in the late 1990s in China. The co-occurrence of the two events was not a coincidence. Indeed, Frazier (2011, 40) argues that the creation of China’s welfare regime directly responded to the looming threat of labor unrest that emerged because of labor liberalization. At its root, the effort to build a comprehensive welfare state was a way to appease unemployed SOE workers during a period of economic upheaval and liberalization.

The intention was clear from then Premier Zhu Rongji’s keynote speech titled “Accelerate the Improvement of the Social Security System to Ensure the Country’s Long-term Stability and Peace”: “Only by establishing a comprehensive social security system and properly addressing the basic livelihood issues [of laid-off SOE workers] can we prevent shocks to social stability.”Footnote 3 In the same speech, he targeted the new economy: “The current problem is that laws are not adhered to and law enforcement is not strict. For example, many localities do not levy social insurance fees on foreign-funded enterprises and private enterprises as stipulated, and are not strict in pursuing those who are in arrears. We need to intensify law enforcement and at the same time accelerate the legislative process for social security.”

Beyond the statements of the government head, there is a robust body of literature that portrays redistribution measures in China as strategies to forestall social unrest (e.g., Hurst 2009; Frazier 2011; Wallace 2014; Heurlin 2016). This provides a compelling historical basis for the argument linking SOE layoffs to the inception of the contemporary social security system.

The urgent need for liberalization came from large-scale financial losses among the SOEs that had survived only through consuming credit provided by state-owned banks. SOEs’ fiscal and debt burden forced the state to privatize most SOEs and downsize the rest. Laid-off workers lost their salaries and the micro-welfare system, from schooling to healthcare, supplied by SOEs. These measures reneged on the cradle-to-grave promise given to SOE employees.

Laid-off workers from downsized SOEs led to a steep rise in unemployment (Solinger 2002). Despite the state’s efforts at reemployment, according to a survey by the Chinese Federation of Labor Unions, only 18% found new jobs (Lee 2000, 928). The number of laid-off workers translates into the expected scale of collective action for two reasons. First, former SOE workers are specifically able to organize collective action such as labor protests. They represent a more cohesive group than non-SOE workers because they share a working relationship and common community from factory neighborhoods to children’s factory schools (Cai 2002, 341). Second, as these workers were once promised lifetime care by the state and were recognized as “the ruling class,” they have a political mandate to claim compensation from the state, similar to the “rightful resistance” found by O’Brien and Li (2006) among Chinese peasant protests. Of the 156 documented labor protests between 2004 and 2007, 58 were SOE-related and 39 demanded better compensation in SOE restructuring (Elfstrom and van der Velden 2016).

Settlements for Laid-off Workers

The state partially appeased laid-off workers by promising that they would be covered by the newly founded social security system. Even though pre-reform SOE workers had never contributed to social security, their tenure in the SOE was recognized as though they had contributed. Subsequently, they could make additional contributions to the fund, either as individuals or as employees elsewhere. After retirement, if they had contributed for 15 years, they would be eligible to receive pensions. This commitment was termed “historical debt” within the social security system, signifying an unfunded obligation to accommodate pre-reform SOE workers. However, if a laid-off worker’s tenure was shorter than 15 years, they would not qualify for the pension. Such workers would be ineligible for the employee’s pension and would have to collect basic resident’s pension, resulting in a substantial pay reduction. Given the widespread unemployment post-layoff, the state permitted workers who joined the pension scheme before 2011 (which effectively includes all laid-off workers) to make a one-time out-of-pocket contribution to account for the missed years.Footnote 4

A similar arrangement applies to medical insurance: the tenure of laid-off workers in the SOE was treated as if they had contributed. However, to enjoy employee medical insurance after reaching retirement age, they needed to have contributed to the medical insurance consecutively for the required number of years. The “consecutive” requirement posed challenges for many, as their employment after being laid off was often unstable.

A third aspect of the settlement entails the provision of regularized, low-level cash payments to laid-off workers, distinct from the lump-sum payment made at the time of their layoffs. These regular payments comprise two components: unemployment insurance benefits and a basic living allowance. The unemployment insurance benefits should be disbursed from the local unemployment insurance fund. The basic living allowance for laid-off workers will be shared equally among the SOE, unemployment insurance, and the local government’s treasury, adhering to the “one-third principle.”Footnote 5 A document outlining Yunnan province’s standard in 2002 stipulates a payment of 252 yuan per month for unemployment benefits and 302 yuan per year for the basic living allowance at its highest level.Footnote 6

The imperfect prospects of social protection helped stabilize the expectations of many laid-off workers, deterring them from engaging in collective action against local governments, as they aimed to remain in good standing with the government. An indirect manifestation of this is that the majority of the documented petitions and protests from laid-off workers aimed to compel local states to fulfill their social security obligations, rather than to get their jobs back.

Since each of the pension fund, health insurance, and unemployment insurance is effectively pay-as-you-go and pooling all contributions at county or prefectural level in our period of analysis,Footnote 7 remaining SOE and non-SOE contributions effectively funded the payments and medical expenses. The replacement of SOE’s welfare systems with the new social security system externalized the massive welfare burden from decentralized provisions within SOEs to local governments. Local states provided partial coverage for laid-off workers by adding unfunded liabilities to their balance sheets.

Promising future welfare is not the only option to quell the protests of economic losers. Hurst (2004) documents two alternatives: regions badly hit by the economic reform, like the Northeast, could only afford to forcefully suppress protests, while fiscally resourceful regions chose to use one-time payments to buy off protesters. The first tactic is politically unsustainable when protests have massive crowds and rightful mandates; the second tactic adds immediate fiscal pressure to local states. One-time payments came from local discretionary revenue, central transfers, and the unemployment insurance fund.Footnote 8 More importantly, the central state prohibits the one-time payment method to absolve the SOE’s responsibility to laid-off workers’ previous social security entitlement.Footnote 9

To be sure, most of the laid-off workers were in their 40s and 50s and had not yet reached retirement age. They would not be able to collect pensions or reimburse medical bills for at least another decade. Consequently, millions of workers were pushed into poverty, and one-time, piecemeal compensations were insufficient to alleviate their situation (Hurst 2004; Frazier 2011). Many had to participate in the informal economy or migrated to economically vibrant regions. But if not for the future promise of a stable income from pension and healthcare, these laid-off workers would have much more desperate prospects and deeper grievances.

The accumulated monetary value of these income flows (including pensions) over 20 years surpasses any single compensation that local states could afford then, making such a promise appear fiscally imprudent. However, the new social security system introduces a revenue stream for local states to bridge the gap between worker demands and fiscal capacity. This can be achieved if they extend the collection efforts to the growing number of private and foreign firms. Notably, the young employees of these firms will not claim benefits for several decades. Moreover, the remaining SOEs and their employees are also required to contribute to the social security funds. Given that the social security system operates on a pay-as-you-go basis, pensions and medical expenses for workers forced into retirement, along with those laid-off workers nearing retirement age, can be funded using these new contributions rather than relying on the local states’ discretionary revenue. Younger laid-off workers can look forward to being supported by the expanding social security contributions upon their retirement. In essence, by implementing a contribution-based social security system that acknowledges past contributions and assures regular future payments, the immediate fiscal responsibility is transferred to external stakeholders (current employers and employees) and future administrations.

Moreover, local social security bureaus’ surging administrative capacity and budgets create momentum for future welfare state expansion. As Frazier (2011, 80) recounts, the staff and offices of China’s local social insurance bureaucracy nearly doubled between 1998 and 2004.

In sum, the nationalization of various work units’ micro-welfare states created immense pressure on government finance. Social unrest threatened by laid-off workers forced local states to find new sources of revenue to fund the nascent and limited welfare state. Surviving firms and their employees who never enjoyed the welfare state became an untapped pool of potential contributors. The self-reproducing dynamic of seeking future claimants as contributors positioned the SOE reforms in 1998–2003 as a critical juncture that kickstarted the massive expansion of the social security system in the two decades after 1998.

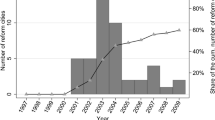

Figure 1 depicts a decline in urban worker pension participation during the 1990s, with a notable increase beginning only after 1998. From that point onward, its growth consistently outpaced China’s rapid industrialization, eventually encompassing the majority of non-agricultural workers. The number of workers enrolled in the urban worker pension scheme—which is the most widely participated-in form of social security—rose from 84.8 million in 1998 (primarily covering the 88 million SOE workers and a small portion of non-SOE workers) to 349 million in 2021, which constitutes 60.7% of non-agricultural workers.Footnote 10 This significant expansion took place even though many of the 291 million migrant workers in informal jobs remain without access to the system. This suggests a self-reinforcing dynamic within the autocratic welfare state.

A Decentralized Pay-As-You-Go Social Security System

Even after the reforms in the 1990s, China’s social policy regime is regarded in the literature as fragmented and decentralized (Ratigan 2017; Hurst 2004; Lin and Tussing 2017; Huang 2020). Figure 2 illustrates the variation in the county-level de facto social security rate (SSR) (pension + health insurance + unemployment insurance) across the 31 provinces of China as of 2005. Note that variation within provinces is as significant as that across provinces.Footnote 11 Despite the national guideline of 28%, the SSR in almost all counties falls well below that level.

Most social security accounts are decentralized, used, and managed at the county level in the early 2000s. Despite the effort to pool pensionFootnote 12 and medical insuranceFootnote 13 funds at higher levels, such as in prefectures and provinces, progress is slow and incomplete as of 2019.

Decentralized social security system also leaves room for local variations in enforcement. Before 2015, the national nominal rate required Chinese firms to contribute 28% of an employee’s salary to the social security bureau (pension 20%, medical insurance 6%, unemployment insurance 2%). Individual prefectures had discretion regarding the designated contribution rate, but most prefectures set it above 20%. Social security authorities ask firms to contribute using their employees’ gross salary as the base from which they calculate the social security contribution.Footnote 14 However, according to data at the industrial firm level from 2004 to 2007, the participation rate (non-zero contribution) was 62.9%. Many firms used the minimum base (60% of the local average wage) instead of the real salary to indicate participation while minimizing their contribution. Among participating firms, the median contribution rate was 9.2% of gross salary, far below the national nominal rate of 28%.

Contentious politics in localities further differentiates their social security policies. Local officials are held accountable for social unrest in their jurisdictions.Footnote 15 Analyzing collective action of laid-off workers, Hurst (2004, 111) argues that regional fragmentation is “probably the single most important variable” in understanding the working class’s role in contemporary Chinese politics and calls for a comparative subnational approach. Local governments design their social programs according to local socioeconomic conditions. Using provincial-level data, Huang (2020) finds that provinces with more migrants and a higher dependency ratio expand health insurance coverage to pool social risks. Therefore, the divergence of the central-local trends observed in Fig. 2 is by design. As expected, the national policy does not always reflect the true situation if subnational units control the policy process on the ground (Snyder 2001). Building a social security system represents the center’s immediate response to the broken promise of the “iron rice bowl,” with local states granted the political leeway to customize the policy without causing a public backlash. Gallagher (2017, 108) uses “high standards, self-enforcement” to describe the central state’s strategy: by passing a high-standard labor protection legislation lacking enforcement mechanisms, it can claim credit for protecting workers and shift the blame of poor implementation and enforcement to the local state.

The decentralization of the social security system makes it ineffective in reducing inter-regional inequality as the funds collected in rich regions cannot be shared with poor regions. Moreover, the social security system is fragmented along sectoral boundaries: during the period studied in this paper, social security only covered urban workers; the central state later set up separate systems to cover rural residents (2009) and urban residents (2012) The fragmentation hinders the system’s ability to alleviate inter-sector inequality, although the systems demonstrate mildly redistributive effects within sectors (Gao 2010; Gao et al. 2019).

Social Security vs. Taxation

Local leaders are often characterized as lacking incentives to collect social security when they are not under pressure from social security spending (Nyland et al. 2006, 199) and are incentivized to outperform in interjurisdictional competitions (Zhang and Zhang 2023). Social security revenue is earmarked for exclusive use, and misuse of it is considered a severe transgression. So much so that powerful officials, such as Chen Liangyu, Shanghai’s party secretary and a Politburo member, were purged for misappropriating the city’s $4.8 billion social security fund in 2008. Unlike tax revenue, social security funds are not fiscal resources that the local state can use to invest in projects or improve the welfare of officials. By contrast, tax revenue can be used for social security expenditure if necessary. In essence, social security is non-fungible, and tax revenue is fungible. Hence, if given a choice during times of surplus, local states would likely favor one yuan of tax revenue over one yuan of social security revenue.

This incentive structure is reversed if a locality faces mounting social spending pressure. Due to the compulsory and fixed nature of taxation, tax collection is less flexible and better enforced than social security collection; there is much less room to introduce new sources of revenue. Instead of pouring constrained discretionary revenue to replenish a social security deficit, local leaders would collect more social security tax by expanding participation among non-SOEs. With forbearance measures like allowing a minimum instead of a total contribution, county leaders can calibrate the priority of social security collection. Social security contributions and taxation are collected through separate channels and usually by different bureaus, so it is not difficult to differentiate enforcement.

Applying the theoretical arguments of threat-driven redistribution to China, I propose two hypotheses:

Hypothesis 1: Higher collective action threat by SOE laid-off workers would lead to higher social security collection level by county governments from non-SOE firms.

Hypothesis 2: Past SOE protests would lead to higher social security collection from non-SOE firms.

Research Design

Data

I construct an original dataset aggregating firm-level social security and SOE downsizing information to the county level from 2004 to 2007, the only years for which firm-level social security contribution data are published. The firm-level data are from the China Industrial Enterprise Dataset (CIED), which surveys all SOE industrial enterprises and large (annual revenue exceeding $650,000) non-SOE industrial enterprises. Using state-assigned county IDs, these firm data are matched with the (Landry et al. 2018) county-level administrative data. County governments do not systematically report social welfare spending as late as 2020. To our knowledge, this is the first dataset that systematically measures China’s county-level social welfare commitment. Due to data availability restrictions, the dataset only covers the first term of the Hu Jintao and Wen Jiabao administration (2003–2007) when the central government was characterized as prioritizing social welfare (Zuo 2015). This may impact the external validity of the analyses beyond the Hu-Wen era (2003–2012). However, it also increases the internal validity by unifying the central policy preference and incentives across the period, so ideology variations among officials are less of a concern. Figure 3 shows the geographical distribution of relative scale of layoff during 1998–2003, measured as multiples of total employees of large firms in 2003.

I obtained social unrest data from the International Institute of Social History’s Micro Labor Conflicts Dataverse. The data are based on the Strike Map project at the China Labour Bulletin (Elfstrom and van der Velden 2016). Only protests waged by SOE workers are included. The dataset covers 2004–2015 and geo-locates SOE-related protests to the county level, for which the period 2004–2007 is used here.Footnote 16 Given the notification system of mass incidents within the party, protests can have spillover effects on local leaders in other localities, but such effects are biased against this study’s results.

Operationalization

The unit of analysis of the paper is county-year because the county is the lowest administration level responsible for collecting, supervising, and managing the social security tax.Footnote 17 There are directives to centralize management of social security to higher levels. Centralization would allow prefectures and provinces to redistribute funding from affluent localities to insolvent localities. This would weaken the connection between the county’s social security collection and its spending ability. This effort had not yielded substantive success by 2007. Even if some counties’ social security funds were centralized to higher levels in 2004–2007, the weakened incentive for county leaders to collect social security should be a bias against my results.

The dependent variable is the local state’s commitment to redistribution. To construct the dependent variable, both de facto Social Security Rate (SSR) across local, large non-SOE industrial firms and all local large industrial firms are used.Footnote 18 Local states exercise discretion in social security collection to balance social spending and business costs (Nyland et al. 2006). I argue that this is a superior measurement of local state commitment than social spending because frequent upper-level transfers make social spending more of a national commitment than a local commitment. In addition, China’s county governments do not systematically report social spending. For each firm’s de facto SSR, the sum of its overall contribution to “pensions and healthcare” and unemployment insurances is calculated, then divided by gross salary. Pension and healthcare are listed as an aggregated term for each firm in the CIED. To determine the county-level SSR, the simple average of the SSRs of surveyed firms is taken.

This study focuses specifically on non-SOE firms for two primary research design reasons. Firstly, to more accurately gauge state commitment, we should measure social security collection from contributors that are less voluntary and necessitate stricter enforcement. It is presumed that non-SOE owners, driven by a desire to minimize costs, would default to offering the minimal social security contribution for their employees. In contrast, managers at SOEs lack the same profit-driven incentives to deviate from mandated social security policies and risk drawing complaints from their employees.

Secondly, from the state’s vantage point, extracting social security from SOEs essentially amounts to an internal transfer between different state entities. On the other hand, contributions from non-SOE firms represent external funds, potentially offsetting the state’s fiscal outlays for social welfare. Consequently, the de facto non-SOE SSR provides a more genuine reflection of a local state’s commitment to the welfare state. This underlying assumption anticipates that SOEs would typically contribute more towards social security. Supporting this, the data reveals that the median county-level SSR for SOEs stands at 19.7%, while for non-SOEs, it is significantly lower at 5.3%. Put differently, if there were to be a notable effect, it would most likely be observed in non-SOEs.

However, many localities lack sufficient non-SOEs to shoulder the financial burden of insuring laid-off workers. Notably, some regions with the highest numbers of laid-off workers, such as Northeastern China, also have a less robust private economy. As such, focusing solely on non-SOE contributions might overlook key contributors to the social security system. Consequently, the same hypotheses are tested across the entire set of industrial firms within the locality.

The independent variable is the number of laid-off SOE workers in the county during the period of SOE reform (1998–2003). The cumulative year-to-year net decreases of the county’s total SOE workers are added. Admittedly, this measure underestimates the true number of laid-off SOE workers because new hiring in some local SOEs cancels out the downsizing of other SOEs in the calculation of net contraction of the state economy. However, when SOE industrial firms faced a predominantly negative economic outlook in 1998–2003, the disparity of fortunes was muted if not minimal. As SOE development became more unbalanced post-reform, the net downsizing of SOEs became less representative of the true scale of layoffs. Therefore, the measurement is limited in 1998–2003 to avoid possible measurement errors.

Identification

Instrumental Variable

The paper uses an instrumental variable strategy to identify the effect of economic losers’ size on government commitment to welfare. Ideally, social security data from the peak period of SOE layoffs (1998–2003) and a panel data structure would be used to estimate the temporal appeasement to the mounting pressure from laid-off workers. However, as the independent variable of historical layoffs does not vary across time, county-year two-way fixed effects cannot be used. Instead, I control for prefectural fixed effects. To ensure the results are not driven by one particular year, I analyze cross-county variations of the de facto SSR in each year of 2004-2007.

The obstacle to a valid identification strategy is that the scale of laid-off workers is not randomly assigned. To mitigate this concern, I use the historical contingency of “legacy SOEs” as an instrumental variable to predict laid-off SOE workers after 1998. From 1964 to 1972, fearing nuclear warfare with the Soviet Union and the United States, the Chinese state spread its industrial investment across the country.Footnote 19 Mao Zedong established the principle of “near mountains, spread out, take cover” (

) for new investments. Due to the haste in economic decision-making and the destruction wrought by the Cultural Revolution, many investment choices were made for security reasons with inadequate knowledge, and projects were deliberately dispersed to many counties to avoid invasion.

) for new investments. Due to the haste in economic decision-making and the destruction wrought by the Cultural Revolution, many investment choices were made for security reasons with inadequate knowledge, and projects were deliberately dispersed to many counties to avoid invasion.

I use the number of employees working in SOEs founded in 1964–1972 at the beginning of the massive layoffs in 1998 as an instrumental variable. I normalize the variable with the county’s total number of employees in the CIED survey.

To avoid bias introduced by the normalization term (current total employees) and SOE workforce variation introduced during 1972–1998,Footnote 20 I use, as an alternative measure, the number of SOEs founded between 1964–1972 as an instrumental variable to instrument the logged number of laid-off SOE workers (Table 1).

The model specification is as follows:

First stage model:

Second stage model:

where \(layoff_{pit}\) is the instrumented independent variable, \(legacy_{i98}\) is the instrumental variable of legacy SOE fixed in 1998 for county i, and \(SSR_{pcit}\) is the dependent variable for county i in prefecture p at year t. For each year between 2004 and 2007, the two stages are run once with pre-treatment county-level covariates \(X_{i97}\) and fixed effects of prefecture p.

Controls

The study controls for general local tax revenue per capita in 1997 to capture the local state’s fiscal capacity, which constrains social security collection and impacts the state’s inclination to lay off workers. Additionally, it controls the population and the urbanization rate to capture local economic development, which determines the county’s scales of both SOEs and non-SOEs. The “near mountains, spread out, take cover” guideline of legacy SOE investment may bias the economic endowment of SOE locations. The study controls the county seat’s distance to the prefecture capital and topographic features, such as relief amplitude, to capture selection conditions that impact economic endowment. Latitude and longitude are controlled, which captures the county’s geographical position that may affect the availability of strategic investment in 1964–1972. Local average SSR may be influenced by the proportion of migrant workers who want to contribute less, as their prospects of claiming the benefits are uncertain. To address this concern, I control the share of migrants in the county’s population using census data from 2000.

Exclusion Restriction

For four reasons, the spatial distribution of strategic investment is independent of unmeasured causes of social security collection during 2004–2007. First, there was no private economy or social security system during 1964–1972, so the decision-maker for investment did not intentionally impact non-SOEs’ SSR. Second, the requirement for diversity investment for strategic reasons made some localities industrialized for reasons independent of their endowments (Chen 2003, 160). Third, even if some investment was made for affinity to transportation hubs or resources, this is partly addressed by controlling across-prefecture variations. Summary statistics for the variables used in the analysis are reported in Table 2.

Although the dependent variable is measured after 2004, the laying-off process began in 1998. With the exception of census data off 2000, all control variables are measured for 1997 to avoid post-treatment bias. As Deuchert and Huber (2017) warn, controlling for post-treatment covariates when they are common outcomes of pre-treatment covariates and unobservables that impact the dependent variable may introduce confounding associations between unobservables and instruments. I also conduct various robustness checks in the “Results” section.

Relevance of Instruments

Legacy SOEs established between 1964 and 1972 were often founded based on strategic or political logic rather than economic rationale. Given this endowment, which was not primarily economically driven, these SOEs were predisposed to incur losses as the country transitioned towards a market economy. By 1998, regions with a higher concentration of such strategic investments had a greater number of failing SOEs, thereby facing increased pressures to downsize SOE workers. Table 3 presents the first stage of the 2SLS models for 2005. Models 3(1–2) employ the number of legacy SOEs as the instrument, using the number of laid-off workers in the county as the independent variable; the two models differ in their inclusion of controls. Models 3(3–4) and 3(5–6) utilize the share of legacy SOE employees in the current total workforce as the instrument, examining the share of laid-off workers from 1998 to 2003 in the current total employees and the share of the urban population, respectively. The robust Kleibergen-Paap rk Wald F statistic results (Table 5) alleviate potential concerns regarding weak instruments (Lal et al. 2021).

Results

Figure 4 illustrates the OLS estimation of laid-off workers as a share of total employees’ effects on non-SOE SSR and overall SSR (Table 4). Layoffs correlate with a higher SSR across all years in the data and higher collection from non-SOE accounts most of it. The significant OLS results motivate us to further examine whether they are robust to our identification strategy.

Table 5 illustrates the second-stage 2SLS estimation of three measures of the laid-off worker scale’s effects on non-SOE SSR in 2005, using their respective instruments with and without controls. Laid-off workers, instrumented by legacy SOE presence, consistently correlate with more social security extractions from non-state sectors. Note that the rural migrant share in the county is controlled, suggesting that the correlation is not driven by the lack of informal sector or migrant workers in counties with more legacy SOE presence. The same results are found among all large firms’ SSR in Table 6, showing that the results are robust even when SOEs are included. It should be noted that estimates in non-SOE SSR models are similar in value to those in SSR models. This suggests that the enforcement of social security collection among non-SOEs was the primary driver for the majority of the increase in overall SSR. All models passed the underidentification test and weak identification test with high values of LM statistics and F statistics (Stock and Yogo 2005).

What about years other than 2005? Table 7 illustrates the 2SLS estimates of the effect of laid-off SOE workers as a share of total employees on effective non-SOE SSR and overall SSR, instrumented by legacy SOE workers as a share of total industrial employees for each year during 2004–2007. Nearly all cross-sectional 2SLS models across 2004–2007 demonstrate a significant and positive effect of laid-off SOE workers on effective non-SOE SSR and overall SSR.

This result is also substantive. Take a median county in 2005 as an example, where laid-off workers comprised 56% of current employees. In this county, laid-off workers are expected to engender a 2.4 percentage-point increase in non-SOE SSR, explaining 46% of the median county’s non-SOE SSR level of 5.19%. These results demonstrate that counties with more laid-off SOE workers respond to mounting pressure from losers’ demands for a safety net by redistributing income from large non-SOEs owners to social security. For overall SSR, the impact persists. The state redistributes economic resources from private business owners and surviving SOEs to soften the impact of its broken promise to laid-off SOE workers. These firms did not get much side payments for this redistribution either: Table 8 shows that effective tax rates on surviving firms do not decrease with the scale of layoffs after 2004, supporting the premise that local states used social security tax as a new funding source.

To investigate the mechanism underlying the observed increase in social security collections, potentially due to the collective actions of laid-off workers, I examined the relationships between the key variables and the incidences of SOE protests. The findings are presented in Table 9(1–3): The size of the laid-off worker population consistently predicts the occurrences of SOE protests. Conversely, experiencing an SOE protest in the previous year significantly increases social security rates, as shown in Table 9(4). Furthermore, past protests are significant alongside layoff scales (Table 9(5–7)). These findings imply that both realized and potential collective action play a crucial role in compelling local states to increase social security collection, which reflects payments under the Pay-As-You-Go system.

Robustness Checks

The distribution of legacy SOEs may impact current states not only through their failures but also through their successes. A higher number of legacy SOEs may lead to both more surviving SOEs and more layoffs. Increased SOE presence may also boost social security collection in non-SOEs because of competition for labor. Therefore, I have also controlled for the SOE employee share from 2004 to 2007 to account for this, as a robustness check in Table 10. The main results remain robust, especially for non-SOE SSR. It is notable that SOEs consistently had high SSR, such that the overall SSR is strongly impacted by the current SOE employee share.

Another aspect to consider is whether the explanatory variables, such as SOE layoffs, and the instrumental variables, like legacy SOEs, partially reflect local authorities’ economic statism. This question emerges because the main dependent variable centers on reallocating resources away from private and foreign firms, implying that some local governments may favor penalizing non-state sectors. This concern is particularly relevant given the prominence of the narrative ’the state advances, the private sector retreats’ since around 2005. To address this concern, I control the interaction between layoffs and current SOE employee share in Table 11 to allow for layoff size having different effects across varying levels of preponderance of the state’s role in the local economy. As the results show, neither the interaction term nor current SOE employment share has an impact on non-SOE SSR.

In a similar vein, the state can be sensitive to the moral or patriotic arguments of SOE employees in areas with high concentrations of military and/or heavy industry, even without social stability threats. Defense-related industry SOE workers, having contributed to national defense and strategic goals, have an especially “rightful” cause to resist local states, as discussed by O’Brien and Li (2006). Table 12 tests this hypothesis by controlling for the heavy industry share in the economy. The results are null when only heavy industry (which includes weaponry manufacturing) share is considered and remain so when layoff scales are included. These findings indicate that it is the scale of SOE layoffs that drives social security collections from non-SOEs and larger “patriotic economy” alone cannot explain higher redistribution.

In addition, the size of the laid-off workforce and post-1998 retirees may correlate with pre-1998 retirees of local SOEs, whose unfunded pension liability also contributes to the local states’ spending pressure and collection motive. The obligation of disbursing benefits monthly exerts direct and continual pressure on local officials to broaden coverage and/or augment social security taxes. Since the unfunded liabilities of pre-1998 retirees should strongly correlate with SOE presence before the restructuring post-1998, we control for the SOE employee share in 1998 to account for non-restructuring-related liabilities. Table 13 demonstrates that non-SOE SSR is still strongly correlated with layoffs. Also, the unfunded liabilities of pre-1998 retirees likely impacted social security collection among surviving SOEs, such that the impact of layoffs on overall SSR attenuates after including the 1998 SOE employee share.

Methods have been developed to test the robustness of instrumental variable estimates even when the exclusion restriction assumption is partially relaxed. Conley et al. (2012) replace the (exact) exclusion restriction in an instrumental variable model with an assumption related to its support or distribution. I allow the instrument to have a non-zero independent coefficient \(\gamma \) on the dependent variable. \(\gamma \) is set to be at most 0.018. To put it into perspective, 0.018 equals 55% of the instrument’s effect on the dependent variable through the independent variable (Table 7(3)’s 0.711 times Table 4(3)’s 0.046). As Table 14 shows, the results are largely robust even if we allow a significant amount of the instrument’s effects not to go through the independent variable.

Tables 15 and 16 use the other two measures of laid-off SOE workers tabulated in Table 1. The results are consistent with Table 7. The results confirm Hypothesis 1 that the state’s redistribution policy is threat-driven by the scale of economic losers and does not rely on a particular measure or instrument. To address potential biases, Table 17 includes an alternative measure of economic development, such as city light intensity, which is difficult to manipulate.

Conclusion

Using unique, granular county-level data on social security collection and laid-off workers, this paper contributes to the literature in three ways.

First, this paper contributes to the literature on autocratic welfare states. It enriches the study of why authoritarian states move beyond providing club goods and expand the welfare state. If the welfare state was established without existing fiscal resources and needed to be financed by broadening participation and unfunded liabilities, its continuing expansion is inevitable due to later surges in benefits claims. In China’s case, fiscally constrained local states relied on the non-state economy’s participation to fund the new system and continued to include more potential contributors.

Second, this paper contributes to the historical political economy study of China’s social security system and for the first time provides quantitative evidence for the causal link between laid-off workers and the establishment of a social security system at the county level. China’s reform is characterized as allowing markets to flourish outside the planned economy before merging the dual-track price systems (Weber 2021, 7). Therefore, it is unsurprising that China set up a welfare state outside the existing institutions and used the resources generated in the market to replenish the SOEs. The old exclusive social security system did not have the internal dynamism or growth potential to accommodate laid-off workers and sustain itself. The state had to seek help from the margins of the system; that is, non-SOEs whose workers were excluded from the social security system and were becoming prosperous in the marketization.

Thirdly, this paper enriches the literature on authoritarian responsiveness by offering empirical evidence of policy adjustments in response to citizen demands. Despite the absence of electoral pressures, local states effectively escalated social security collection following protests. Furthermore, this paper traces the source of the costly compensations to third parties, namely, surviving SOEs and non-SOEs. This augments the existing literature which has documented incidental compensations in response to citizen petitions and complaints, yet fallen short of identifying the respective parties and relative “loser” involved in the redistribution.

Despite the appeasing policy response observed in this paper, what should also be emphasized are the limitations of the “threat-driven” nature of the state concession. In the case in this research, the state responded to the expected threats of citizens up to the point that social stability was largely maintained. The requirement of holding expected collective action at bay is a low standard for public goods provision. Consequently, the state failed to restrain economic winners enough to stop spikes in inequality, failed to accumulate a social security fund adequate for the aging population (discussion in Appendix A.1), and failed to provide social protection to citizens who are less organized and concentrated, such as hundreds of millions of rural migrant workers. Moreover, fragmentation embedded in the centralized welfare state exacerbated these problems by building up vested interests among local urban workers to resist cross-region redistribution.

Considering the direction of redistribution analyzed in this paper, who are the true winners and losers in the SOE reform and social security system? SOEs successfully got rid of the burdens of unwanted employees and the welfare promises of retirees. Local states and investors in the SOEs enjoyed higher valuation and profitability when the surviving SOEs later grew exponentially with preferential treatment and monopolistic status. Local states shouldered some welfare responsibilities but shifted the burden to new contributors, especially non-SOEs, with the pay-as-you-go social security system. Laid-off workers lost jobs and welfare and got partial coverage under the new social security system. Non-SOE owners flourished in the market reform but faced restraint and redistribution by being required by laws to fund the welfare of current urban workers. Non-SOE employees became eligible to enjoy the once-exclusive welfare state by contributing social security tax. Subsequently, the SOEs, which seemed to be the underdogs in the late 1990s, are now the true winners of the reform at the expense of laid-off workers and non-SOE owners.

Data Availability

The datasets generated and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Knutsen and Rasmussen use “critical supporting groups.” I changed the term to avoid confusion.

Ministry of Human Resources and Social Security (MOHRSS), 1998–2003

.

.Zhu Rongji.

2000/5/26. http://www.reformdata.org/2000/0526/10016.shtml

2000/5/26. http://www.reformdata.org/2000/0526/10016.shtmlhttp://www.gov.cn/gongbao/content/2012/content_2041881.htm Admittedly, as of 2011, not every laid-off worker could afford this, and the urban employee pension scheme would not cover them.

State Council. 2005.

https://www.gov.cn/govweb/zwgk/2005-05/27/content_1533.htm%7D

https://www.gov.cn/govweb/zwgk/2005-05/27/content_1533.htm%7DAs defined by the Minister of MOHRSS Yin Weimin as late as 2016: “Medical insurance operates on a pay-as-you-go system, more so than pension which requires a portion of the funds to be accumulated. Looking at the national situation, there is currently no funding gap. However, the coordination level of medical insurance is relatively low, reaching only the prefectural level.” China.com.

http://finance.china.com.cn/roll/20160229/3605926.shtml.This characterization is also corroborated by the woefully inadequate accumulation of social security funds, amounting to only 9% of GDP in 2021, despite 30 years of population dividend and massive fiscal subsidies (Balance of Social Insurance Fund, China Statistical Yearbook 2022).

http://finance.china.com.cn/roll/20160229/3605926.shtml.This characterization is also corroborated by the woefully inadequate accumulation of social security funds, amounting to only 9% of GDP in 2021, despite 30 years of population dividend and massive fiscal subsidies (Balance of Social Insurance Fund, China Statistical Yearbook 2022).MOHRSS,

“No work unit can end employee’s social security relations with ‘buy-off’ measures.” Ministry of Labor and Social Security, 1999, Document No. 10.

MOHRSS, 1998 – 2021,

In China, provinces encompass prefectures, and prefectures encompass counties. Prefectures usually comprise county-level urban districts and rural counties. At the end of 2005, there were 333 prefecture-level units and 2862 county-level units.

Xinhua, “Some provinces and cities accelerate the promotion of provincial-level coordination of pension insurance.” 2019/09/02,

http://www.xinhuanet.com/fortune/2019-09/02/c_1124948968.htm.

The central state pushed to centralize medical insurance at the prefecture-level by 2009 and to the provincial level by 2011, but by 2019, only four municipalities and several provinces achieved provincial pooling. National Healthcare Security Administration.

www.nhsa.gov.cn/art/2019/8/6/art_26_1621.html

www.nhsa.gov.cn/art/2019/8/6/art_26_1621.htmlA stipulation from 1992 (

1992.1.13.) indicates that events such as “mass petitioning to upper levels, illegal demonstrations, crowd disturbances, strikes, or school boycotts” serve as a “veto point” in career advancement.

1992.1.13.) indicates that events such as “mass petitioning to upper levels, illegal demonstrations, crowd disturbances, strikes, or school boycotts” serve as a “veto point” in career advancement.Most protests occur at a prefectural level and are not geo-located to an exact urban district. Therefore, all urban districts in a prefectural seat are treated as having experienced the protest, and counties outside the urban area as not having experienced the protest. Urban districts are at the same administrative rank as counties. The reasoning is that the urban districts of a prefectural seat represent an inter-connected built-up greater metropolitan area; county seats are usually removed from urban districts, separated by a rural expanse.

State Council. 1999/01/22,

.

.Large firms are firms with annual revenue of more than 5 million RMB. They are more “transparent” to the state because they are annually required to report their accounting information. All industrial SOEs are categorized as large firms by CIED. Any deviation from state regulations that is discovered in the data can be seen because of “forbearance,” where the state chooses not to exercise its capacity (Holland 2016).

The cut points are exogenously determined by US foreign policy. In 1964, the US started bombing North Vietnam, alerting Mao Zedong of the immediate possibility of large-scale warfare. In 1972, the US president, Nixon, visited China and normalized Sino-US relations, causing the threat of conflict to recede. Naughton (1988)

To avoid large variations caused by the division of the small values of normalization terms, I trimmed the observations with the largest 5% instruments and independent variables.

Ministry of Finance,

.

.US Social Security Administration. https://www.ssa.gov/policy/trust-funds-summary.html

References

Acemoglu, Daron, and James A. Robinson. 2000. Why did the West extend the franchise? Democracy, inequality, and growth in historical perspective. Publisher: Oxford University Press, The Quarterly Journal of Economics 115(4): 1167–1199.

Bernstein, Thomas P., and Xiaobo Lü. 2003. Taxation without representation in contemporary rural China. Cambridge Modern China Series. Cambridge: Cambridge University Press.

Bueno De Mesquita, Bruce, Alastair Smith, Randolph M. Siverson, and James D. Morrow. 2005. The logic of political survival. MIT Press, January 14.

Cai, Yongshun. 2002. The resistance of Chinese laid-off workers in the reform period. The China Quarterly 170: 327–344.

Chen, Donglin. 2003. San xian jian she: bei zhan shi qi de xi bu kai fa, 1st ed. Beijing: Zhong gong zhong yang dang xiao chu ban she.

Chen, Jidong, Jennifer Pan, and Xu. Yiqing. 2016. Sources of authoritarian responsiveness: a field experiment in China. American Journal of Political Science 60 (2): 383–400.

Conley, Timothy G., Christian B. Hansen, and Peter E. Rossi. 2012. Plausibly exogenous. Review of Economics and Statistics 94 (1): 260–272.

Deacon, Bob. 2000. Eastern European welfare states: the impact of the politics of globalization. Journal of European Social Policy 10 (2): 146–161.

Deuchert, Eva, and Martin Huber. 2017. A cautionary tale about control variables in IV estimation. Oxford Bulletin of Economics and Statistics 79 (3): 411–425.

Dillon, Nara. 2015. Radical inequalities: China’s revolutionary welfare state in comparative perspective. Harvard East Asian monographs 383. Cambridge, Massachusetts: Harvard University Asia Center.

Dimitrov, Martin K. 2015. Internal government assessments of the quality of governance in China. Studies in Comparative International Development 50 (1): 50–72.

Distelhorst, Greg, and Yue Hou. 2017. Constituency service under nondemocratic rule: evidence from China. The Journal of Politics 79 (3): 1024–1040.

Elfstrom, Manfred, and Sjaak van der Velden. 2016. China, 2004-2015. IISH data collection, datasets.iisg.amsterdam/dataset.xhtml?persistentId=hdl:10622/EAASRV (June 24).

Elfstrom, Manfred. 2021. Workers and change in China: resistance, repression, responsiveness. 1st ed. Cambridge University Press, January 21.

Elfstrom, Manfred. 2019. Two steps forward, 1–25. One Step Back: Chinese State Reactions to Labour Unrest. The China Quarterly.

Frazier, Mark W. 2011. Socialist insecurity: pensions and the politics of uneven development in China. Cornell University Press, March 15.

Gallagher, Mary E. 2017. Authoritarian legality in China: law, workers, and the state, 1st ed. Cambridge: Cambridge University Press.

Gao, Qin. 2010. Redistributive nature of the Chinese social benefit system: progressive or regressive? The China Quarterly 201: 1–19.

Gao, Qin, Sui Yang, and Fuhua Zhai. 2019. Social policy and income inequality during the Hu-Wen era: a progressive legacy? The China Quarterly 237 (March): 82–107.

Hellman, Joel S. 1998. Winners take all: the politics of partial reform in postcommunist transitions. World Politics 50 (2): 203–234.

Heurlin, Christopher. 2016. Responsive authoritarianism in China: land, protests, and policy making. New York, NY: Cambridge University Press.

Holland, Alisha C. 2016. Forbearance. American Political Science Review 110 (2): 232–246.

Huang, Xian. 2020. Social protection under authoritarianism: health politics and policy in China. Oxford, New York: Oxford University Press, August 31.

Hurst, William, and Kevin J. O’Brien. 2002. China’s contentious pensioners. Publisher: Cambridge University Press, The China Quarterly 170: 345–360.

Hurst, William. 2009. The Chinese worker after socialism. 1st ed. Cambridge University Press, March 5.

Hurst, William. 2004. Understanding contentious collective action by Chinese laid-off workers: the importance of regional political economy. Studies in Comparative International Development 39 (2): 94–120.

Iversen, Torben, and Thomas R. Cusack. 2000. The causes of welfare state expansion: deindustrialization or globalization? World Politics 52 (3): 313–349.

Jiang, Junyan, and Yu. Zeng. 2019. Countering capture: elite networks and government responsiveness in China’s land market reform. The Journal of Politics 82 (1): 13–28.

Knutsen, Carl Henrik, and Magnus Rasmussen. 2018. The autocratic welfare state: old- age pensions, credible commitments, and regime survival. Comparative Political Studies 51 (5): 659–695.

Lal, Apoorva, Mackenzie William Lockhart, Yiqing Xu, and Ziwen Zu. 2021. How much should we trust instrumental variable estimates in political science? Practical advice based on over 60 replicated studies. SSRN Scholarly Paper ID 3905329. Rochester, NY: Social Science Research Network, December 21.

Landry, Pierre F., Xiaobo Lü, and Haiyan Duan. 2018. Does performance matter? Evaluating political selection along the Chinese administrative ladder. Comparative Political Studies 51 (8): 1074–1105.

Lee, Hong Yung. 2000. Xiagang, the Chinese style of laying off workers. Asian Survey 40 (6): 914–937.

Lee, Ching Kwan. 2007. Against the law: labor protests in China’s rustbelt and sunbelt. Berkeley: University of California Press.

Lieberthal, Kenneth, and Michel Oksenberg. 1988. Policy making in China: leaders, structures, and processes. Princeton University Press.

Lin, Jing, and A. Dale Tussing. 2017. Inter-regional competition in retirement benefit growth - the role of the sub-national government in authoritarian China. Journal of Contemporary China 26 (105): 434–451.

Lizzeri, Alessandro, and Nicola Persico. 2004. Why did the elites extend the suffrage? Democracy and the scope of government, with an application to Britain’s age of reform. Publisher: Oxford University Press, The Quarterly Journal of Economics 119(2): 707–765.

Malesky, Edmund, and Paul Schuler. 2010. Nodding or needling: analyzing delegate responsiveness in an authoritarian parliament. American Political Science Review 104 (3): 482–502.

McCubbins, Mathew D., and Thomas Schwartz. 1984. Congressional oversight overlooked: police patrols versus fire alarms. American Journal of Political Science 28 (1): 165.

Meltzer, Allan H., and Scott F. Richard. 1981. A rational theory of the size of government. Journal of Political Economy 89 (5): 914–927.

Meng, Tianguang, Jennifer Pan, and Ping Yang. 2017. Conditional receptivity to citizen participation: evidence from a survey experiment in China. Comparative Political Studies 50 (4): 399–433.

Naughton, Barry. 1988. The third front: defence industrialization in the Chinese interior. The China Quarterly 115: 351–386.

Nyland, Chris, Russell Smyth, and Cherrie Jiuhua Zhu. 2006. What determines the extent to which employers will comply with their social security obligations? Evidence from Chinese firm-level data. Social Policy & Administration 40 (2): 196–214.

O’Brien, Kevin J., and Lianjiang Li. 2006. Rightful resistance in rural China. Cambridge Studies in Contentious Politics. Cambridge: Cambridge University Press.

Pan, Jennifer. 2020. Welfare for autocrats: how social assistance in China cares for its rulers. Oxford: Oxford University Press.

Perry, Elizabeth. 2010. Popular Protests in China. In China today, China tomorrow: domestic politics, economy, and society, ed. Joseph Fewsmith. Lanham, Md: Rowman & Littlefield Publishers.

Przeworski, A., S.C. Stokes, and B. Manin. 1999. Democracy, accountability, and representation, vol. 2. Cambridge: Cambridge University Press.

Ratigan, Kerry. 2017. Disaggregating the developing welfare state: provincial social policy regimes in China. World Development 98: 467–484.

Snyder, Richard. 2001. Scaling down: the subnational comparative method. Studies in Comparative International Development 36 (1): 93–110.

Solinger, Dorothy J. 2002. Labour market reform and the plight of the laid-off proletariat. The China Quarterly 170: 304–326.

Steed, Ryan, Terrance Liu, Wu. Zhiwei Steven, and Alessandro Acquisti. 2022. Policy impacts of statistical uncertainty and privacy. Science 377 (6609): 928–931.

Stock, James, and Motohiro Yogo. 2005. Testing for weak instruments in linear IV regression. In Identification and Inference for Econometric Models, ed. Donald W. K. Andrews, 80–108. Backup Publisher: Cambridge University Press. New York: Cambridge University Press.

Tsai, Lily L. 2007. Accountability without democracy: solidary groups and public goods provision in rural China. 1st ed. Cambridge University Press, August 27.

Wallace, Jeremy L. 2014. Cities and stability: urbanization, redistribution, & regime survival in China. New York: Oxford University Press.

Wang, Yuhua. 2014. Coercive capacity and the durability of the Chinese communist state. Communist and Post-Communist Studies 47 (1): 13–25.

Weber, Isabella. 2021. How China escaped shock therapy: the market reform debate. Routledge studies on the Chinese economy. Abingdon, Oxon ; New York, N.Y: Routledge.

Wright, Teresa. 2018. Popular protest in China. China today. Cambridge, UK ; Medford, MA: Polity Press.

Zhang, Hao, and Ye Zhang. 2023. Strong State, weak enforcement: bureaucratic forbearance and regressive consequences of China’s social insurance policies. SSRN Electronic Journal.

Zuo, Cai. 2015. Promoting city leaders: the structure of political incentives in China*. The China Quarterly 224 (December): 955–984.

Acknowledgements

I thank Melanie Manion, Erik Wibbels, Eddy Malesky, Daniel Stegmueller, David Siegel, Haiyan Duan, Haohan Chen, Xiaoshu Gui, Zeren Li, Tim McDade, Peng Peng, Ngoc Phan, Griffin Riddler, Viola Rothschild, Pei-Yu Wei, and participants in 2023 MPSA Panel on Governance, State Capacity, and Welfare in Contemporary China for their helpful comments on the earlier drafts.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

A.1 Sustainability of China’s Social Security System

China has one of the highest social security rates (SSR) worldwide. As of 2018, it requires employers to contribute 28% of an employee’s salary to social security. In comparison, in the US, the FICA rate for employers is 7.75%. Even Sweden has a lower SSR (17.2 % in 2018). Despite the high SSR and a relatively young population, China’s social security system faces a substantial deficit (fiscal transfer to social security funds amounts for 2.49 trillion yuan in 2023, 25% of the fund’s annual expenditure of 9.9 trillion).Footnote 21 Pressure on the social security system has worsened as the labor force began to shrink in 2012. Meanwhile, the Chinese state is not perceived as fiscally incapable. The Chinese state’s overall fiscal extraction accounted for 36.7 % of GDP in 2014 and 35.7% in 2017 (including general fiscal revenue, state-managed funds revenue, state-owned capital revenue, and social security fund revenue). Even with the help of fiscal transfers, the social security accumulation is inadequate. Contextually, the US Social Security Trust has a fund asset that can support 288% of its annual outgoing payments in 2018,Footnote 22 that is 34.6 months. Its trustees estimate it to be unsustainable and to be depleted by 2035. In comparison, according to data collected in 2016, only two out of 31 of China’s provinces have sufficient funds to support periods of payment longer than 34.6 months (the national average is 17.2). In summary, China’s social security system is unprepared for long-run demographic challenges without fiscal transfers.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhu, H. Contentious Origins of Authoritarian Social Protection: China’s “Threat-Driven” Strategy in Redistribution. St Comp Int Dev (2024). https://doi.org/10.1007/s12116-024-09429-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s12116-024-09429-z

.

. 2000/5/26.

2000/5/26.

1992.1.13.) indicates that events such as “mass petitioning to upper levels, illegal demonstrations, crowd disturbances, strikes, or school boycotts” serve as a “veto point” in career advancement.

1992.1.13.) indicates that events such as “mass petitioning to upper levels, illegal demonstrations, crowd disturbances, strikes, or school boycotts” serve as a “veto point” in career advancement. .

. .

.