Abstract

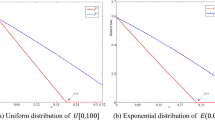

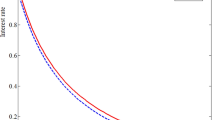

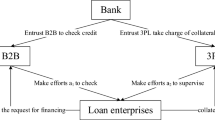

E-commerce platform financing is a new service pattern of supply chain finance. However, this pattern may bring some new issues when considering the problem of cash flow shortage and financing difficulties of small and medium-sized enterprises. When enterprises use this service, they worry about the leakage of preferential wholesale price when applying the full loan amount and providing the true transaction information. Based on the model consisting of a supplier, a retailer and a cross-border e-commerce platform, the authors design a price masking strategy to prevent the retailer’s preferential wholesale price information from leakage. The authors analyze the profit of the retailer and the platform before and after adopting the price masking strategy. The authors find that the price masking strategy always benefits the retailer. Besides, the optimal profit of the retailer and the platform are both affected by the loan interest rate. Moreover, there exists a range of loan interest rates that can benefit both the retailer and the platform if the price masking strategy is adopted. The research emphasizes that platform can expand the total business volume by allowing retailers to use price masking strategy. In other words, there will be more and more retailers attracted by the strategy, which benefits the long-term growth of cross-border e-commerce platform financing.

Similar content being viewed by others

References

Albert R, Economic aspects of inventory and receivable financing, Law and Contemporary Problems, 1948, 13(4): 566–578.

Mathis F J and Cavinato J, Financing the global supply chain: Growing need for management action, Thunderbird International Business Review, 2010, 52(6): 467–474.

Walters D, Effectiveness and efficiency: The role of demand chain management, The International Journal of Logistics Management, 2006, 17(1): 75–94.

Bemabucci R J, Supply chain gains from integration, Financial Executive, 2008, 24(3): 46–48.

He X and Tang L, Exploration on building of visualization platform to innovate business operation pattern of supply chain finance, Physics Procedia, 2012, 33: 1886–1893.

Zhang W, Yan S, Li J, et al., Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data, Transportation Research Part E: Logistics and Transportation Review, 2022, 158: 102611.

Guo L, Chen J, Li S, et al., A blockchain and IoT based lightweight framework for enabling information transparency in supply chain finance, Digital Communications and Networks, 2022, 8(4): 576–587.

Soni G, Kumar S, Mahto R V, et al., A decision-making framework for Industry 4.0 technology implementation: The case of FinTech and sustainable supply chain finance for SMEs, Technological Forecasting and Social Change, 2022, 180: 121686.

Klapper L, The role of factoring for financing small and medium enterprises, Journal of Banking and Finance, 2006, 30(11): 3111–3130.

Soufani K, On the determinants of factoring as a financing choice: Evidence from the UK, Journal of Economics and Business, 2002, 54(2): 239–252.

Tunca T I and Zhu W, Buyer intermediation in supplier finance, Management Science, 2018, 64(12): 5631–5650.

Tanrisever F, Cetinay H, Reindorp M, et al., Value of reverse factoring in multi-stage supply chains, Innovation & Management Science eJournal, 2015, DOI: https://doi.org/10.2139/ssrn.2183991.

Van der Vliet K, Reindorp M J, and Fransoo J C, The price of reverse factoring: Financing rates vs. payment delays, European Journal of Operational Research, 2015, 242(3): 842–853.

Kouvelis P and Xu F, A supply chain theory of factoring and reverse factoring, Management Science, 2021, 67(10): 6071–6088.

Tang C S, Yang S A, and Wu J, Sourcing from suppliers with financial constraints and performance risk, Manufacturing and Service Operations Management, 2017, 20(1): 70–84.

Reindorp M, Tanrisever F, and Lange A, Purchase order financing: Credit, commitment, and supply chain consequences, Operations Research, 2018, 66(5): 1287–1303.

Li J, Luo X, Wang Q, et al., Supply chain coordination through capacity reservation contract and quantity flexibility contract, Omega, 2021, 99: 102195.

Chen Y, Essays on supply chain finance, Dototor’s degree thesis, University of Minnesota, Minneapolis, 2016.

Fu J, Cao B, Wang X, et al., BFS: A blockchain-based financing scheme for logistics company in supply chain finance, Connection Science, 2022, 34(1): 1929–1955.

Yi X, Sheng K, Yu T, et al., RD investment and financing efficiency in Chinese environmental protection enterprises: Pperspectives of COVID-19 and supply chain financial regulation, International Journal of Logistics Research and Applications, 2022, 25(4–5): 569–590.

Wang L and Wang Y, Supply chain financial service management system based on block chain IoT data sharing and edge computing, Alexandria Engineering Journal, 2022, 61(1): 147–158.

Deshpande V, Schwarz L B, Atallah M J, et al., Outsourcing manufacturing: Secure price-masking mechanisms for purchasing component parts, Production and Operations Management, 2011, 20(2): 165–180.

Chen Y J, Shum S, and Xiao W, Should an OEM retain component procurement when the CM produces competing products? Production and Operations Management, 2012, 21(5): 907–922.

Rubinstein A, Perfect equilibrium in a bargaining model, Econometrica, 1982, 50(1): 97–109.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors declare no conflict of interest.

Additional information

This paper was supported by the Key Program of National Natural Science Foundation of China under Grant No. 71831007, the General Program of National Natural Science Foundation of China under Grant Nos. 72071085 and 71871166, High-End Foreign Expert Recruitment Plan under Grant No. G2022154004L and Huazhong University of Science and Technology Double First-Class Funds for Humanities and Social Sciences under Grant No. 2021WKFZZX008.

Rights and permissions

About this article

Cite this article

Li, J., Hang, Z., Chen, Z. et al. Price Masking Strategy of Cross-Border E-Commerce Platform Financing. J Syst Sci Complex 37, 668–691 (2024). https://doi.org/10.1007/s11424-024-2164-x

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-024-2164-x