Abstract

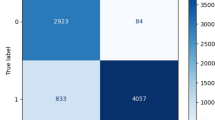

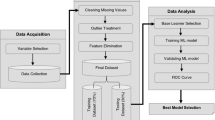

In recent years, experts and academics in the environmental management field have developed an interest in the factors and evaluation techniques that influence corporate environmental investment decisions. However, there are substantial differences between studies employing the most recent evaluation methodologies and those that use indicator systems. To explore the mechanisms that influence corporate environmental investment, this study investigated the determinants of environmental investment through the perspectives of firm, board, chair, and chief executive officer (CEO) characteristics using a machine learning approach. Based on a large-scale data sample from Chinese-listed companies, the results indicated that the extreme gradient boosting (XGBoost) model had an accuracy of up to 97.63%, thus performing the best. Additionally, the model that used SHapley Additive exPlanations (SHAP) to interpret XGBoost showed that a company’s sales performance was the most important factor that influenced environmental investment, followed by CEO tenure, board independence, board gender diversity, chair academic experience, and the company’s level of internationalization. Furthermore, when examining the sample of heavily polluting enterprises, sales, board gender diversity, CEO tenure, chair academic experience, board independence, and chair–CEO duality, all were found to play crucial roles in predicting environmental investment. Overall, this study aids in evaluating the factors that influence corporate environmental investment decisions and provides policymakers and practitioners with a machine learning approach for use when assessing these factors.

Similar content being viewed by others

Data Availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Notes

More detailed information can be found at https://www.mee.gov.cn/hjzl/dqhj/qgkqzlzk/201701/t20170123_395142.shtml.

References

Akbar A, Jiang X, Qureshi MA, Akbar M (2021) Does corporate environmental investment impede financial performance of Chinese enterprises? The moderating role of financial constraints. Environ Sci Pollut Res 28(41):58007–58017

Banerjee A, Nordqvist M, Hellerstedt K (2020) The role of the board chair—a literature review and suggestions for future research. Corp Gov: An Int Rev 28(6):372–405

Bhuiyan MBU, Huang HJ, de Villiers C (2021) Determinants of environmental investment: evidence from Europe. J Clean Prod 292:125990

Booth JR, Deli DN (1996) Factors affecting the number of outside directorships held by CEOs. J Financ Econ 40(1):81–104

Burkart N, Huber MF (2021) A survey on the explainability of supervised machine learning. J Artif Intell Res 70:245–317

Canepa A, Stoneman P (2008) Financial constraints to innovation in the UK: evidence from CIS2 and CIS3. Oxf Econ Pap 60(4):711–730

Chen WT, Zhou GS, Zhu XK (2019) CEO tenure and corporate social responsibility performance. J Bus Res 95:292–302

Chin MK, Hambrick DC, Treviño LK (2013) Political ideologies of CEOs: the influence of executives’ values on corporate social responsibility. Adm Sci Q 58(2):197–232

Cho E, Okafor C, Ujah N, Zhang L (2021) Executives’ gender-diversity, education, and firm’s bankruptcy risk: evidence from China. J Behav Exp Financ 30:100500

Crossland C, Hambrick DC (2011) Differences in managerial discretion across countries: how nation-level institutions affect the degree to which CEOs matter. Strateg Manag J 32(8):797–819

De Villiers C, Naiker V, Van Staden CJ (2011) The effect of board characteristics on firm environmental performance. J Manag 37(6):1636–1663

Dianova A, Nahumury J (2019) Investigating the effect of liquidity, leverage, sales growth and good corporate governance on financial distress. J Account Strat Finance 2(2):143–156

Dočekalová MP, Kocmanová A (2016) Composite indicator for measuring corporate sustainability. Ecol Ind 61:612–623

Dong Z, He Y, Wang H, Wang L (2020) Is there a ripple effect in environmental regulation in China?–evidence from the local-neighborhood green technology innovation perspective. Ecol Ind 118:106773

Eyraud L, Clements B, Wane A (2013) Green investment: trends and determinants. Energy Policy 60:852–865

Guariglia A, Liu P (2014) To what extent do financing constraints affect Chinese firms’ innovation activities? Int Rev Financ Anal 36:223–240

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manag Rev 9:193–206

Han SR, Li P, Xiang JJ, Luo XH, Chen CY (2020) Does the institutional environment influence corporate social responsibility? Consideration of green investment of enterprises—evidence from China. Environ Sci Pollut Res 29:12722–12739

Hashemizadeh A, Ashraf RU, Khan I, Zaidi SAH (2023) Digital financial inclusion, environmental quality, and economic development: the contributions of financial development and investments in OECD countries. Environ Sci Pollut Res 30:1–12

Hu L, Yang D (2021) Female board directors and corporate environmental investment: a contingent view. Sustainability 13(4):1975

Huang J, Zhao J, Cao J (2021) Environmental regulation and corporate R&D investment—evidence from a quasi-natural experiment. Int Rev Econ Financ 72:154–174

Ikram M, Qayyum A, Mehmood O, Haider J (2020) Assessment of the effectiveness and the adaption of CSR management system in food industry: the case of the South Asian versus the Western food companies. SAGE Open 10(1):2158244019901250

Işik C, Kasımatı E, Ongan S (2017) Analyzing the causalities between economic growth, financial development, international trade, tourism expenditure and/on the CO2 emissions in Greece. Energy Sources Part B 12(7):665–673

Işik C, Dogru T, Turk ES (2018) A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: theory and evidence. Int J Tour Res 20(1):38–49

Işık C, Sirakaya-Turk E, Ongan S (2020) Testing the efficacy of the economic policy uncertainty index on tourism demand in USMCA: theory and evidence. Tour Econ 26(8):1344–1357

Jia F, Li G, Lu X, Xie S (2021) CEO given names and corporate green investment. Emerg Mark Rev 48:100808

Jiang X, Akbar A (2018) Does increased representation of female executives improve corporate environmental investment? Evidence from China. Sustainability 10(12):4750

Jin Z, Xu J (2020) Impact of environmental investment on financial performance: evidence from Chinese listed companies. Pol J Environ Stud 29(3):2235–2245

Jun C, Qiyuan L, Ma X, Zhang FF (2023) Board gender diversity and cost of equity: evidence from mandatory female board representation. Int Rev Econ Finance 88:501–515

Khan TM, Gang B, Fareed Z, Yasmeen R (2020) The impact of CEO tenure on corporate social and environmental performance: an emerging country’s analysis. Environ Sci Pollut Res 27:19314–19326

Kock CJ, Santaló J (2005) Are shareholders environmental laggards? Corporate governance and environmental firm performance. Corporate Governance and Environmental Firm Performance (January 19, 2005). Instituto de Empresa Business School Working Paper No. WP05–05

Konrad AM, Kramer V, Erkut S (2008) The impact of three or more women on corporate boards. Organ Dyn 37(2):145–164

Krause R, Withers MC, Semadeni M (2017) Compromise on the board: investigating the antecedents and consequences of lead independent director appointment. Acad Manag J 60(6):2239–2265

Krause R, Li W, Ma X, Bruton GD (2019) The board chair effect across countries: an institutional view. Strateg Manag J 40(10):1570–1592

Lewis BW, Walls JL, Dowell GW (2014) Difference in degrees: CEO characteristics and firm environmental disclosure. Strateg Manag J 35(5):712–722

Li J, Zhao F, Chen S, Jiang W, Liu T, Shi S (2017) Gender diversity on boards and firms’ environmental policy. Bus Strateg Environ 26(3):306–315

Li S, Niu J, Tsai SB (2018) Opportunism motivation of environmental protection activism and corporate governance: an empirical study from China. Sustainability 10(6):1725

Li L, Fei C, Fei W (2023) Research on investment incorporating both environmental performance and long (short) term financial performance of firms. Int J Syst Sci 1–27

Lin J, Zhang R (2021) The influence of political connection on environmental investment: evidence from China tourism-related listed companies. J Policy Res Tour Leis Events, Ahead of Print. https://doi.org/10.1080/19407963.2021.1949329

Liu C, Chen Y, Huang S, Chen X, Liu F (2023a) Assessing the determinants of corporate risk-taking using machine learning algorithms. Systems 11(5):263

Liu C, Li Y, Fang M, Liu F (2023b) Using machine learning to explore the determinants of service satisfaction with online healthcare platforms during the COVID-19 pandemic. Serv Bus 17:449–476

Liu F, Wang R, Fang M (2024) Mapping green innovation with machine learning: Evidence from China. Technol Forecast Soc Chang 200:123107

Liu F, Long X, Dong L, Fang M (2023c) What makes you entrepreneurial? Using machine learning to investigate the determinants of entrepreneurship in China. China Econ Rev 102029

Mackey A (2008) The effect of CEOs on firm performance. Strateg Manag J 29(12):1357–1367

McKendall M, Sánchez C, Sicilian P (1999) Corporate governance and corporate illegality: the effects of board structure on environmental violations. Int J Organ Anal 7(3):201–223

McWilliams A, Siegel D (2001) Corporate social responsibility: a theory of the firm perspective. Acad Manag Rev 26(1):117–127

Monem R (2011) CEO quality, corporate governance, and CEO compensation. Available at SSRN 1758987. https://ssrn.com/abstract=1758987. Accessed 12 June 2023

Monks RAG (2004) Corporate State USA—2003. Corp Gov: An Int Rev 12(4):426–435. https://doi.org/10.1111/j.1467-8683.2004.00384.x

Murovec N, Erker RS, Prodan I (2012) Determinants of environmental investments: testing the structural model. J Clean Prod 37:265–277

Quigley TJ, Hambrick DC (2015) Has the “CEO effect” increased in recent decades? A new explanation for the great rise in America’s attention to corporate leaders. Strateg Manag J 36(6):821–830

Ran G, Fang Q, Luo S, Chan KC (2015) Supervisory board characteristics and accounting information quality: evidence from China. Int Rev Econ Financ 37:18–32

Reguera-Alvarado N, Bravo F (2017) The effect of independent directors’ characteristics on firm performance: tenure and multiple directorships. Res Int Bus Financ 41:590–599

Rhee SK, Lee SY (2003) Dynamic change of corporate environmental strategy: rhetoric and reality. Bus Strateg Environ 12(3):175–190

Samet M, Jarboui A (2017) How does corporate social responsibility contribute to investment efficiency? J Multinatl Financ Manag 40:33–46

Shen HB, Xie Y, Chen ZR (2012) Environmental protection, corporate social responsibility and its market response: case study based on the environmental pollution incident of Zijin Mining Group Co. China Ind Econ 1:141–151

Shome S, Hassan MK, Verma S, Panigrahi TR (2023) Impact investment for sustainable development: a bibliometric analysis. Int Rev Econ Financ 84:770–800

Shrestha YR, He VF, Puranam P, von Krogh G (2021) Algorithm supported induction for building theory: how can we use prediction models to theorize? Organ Sci 32(3):856–880

Sievänen R, Sumelius J, Islam KZ, Sell M (2013) From struggle in responsible investment to potential to improve global environmental governance through UN PRI. Int Environ Agreem: Politics, Law and Economics 13:197–217

Stanwick PA, Stanwick SD (2001) CEO compensation: does it pay to be green? Bus Strateg Environ 10(3):176–182

Tang GP, Li LH, Wu DJ (2013) Environmental control, industry attributes and enterprise environmental protection investment. Account Res 6(01):83–96

Trinh VQ, Salama A, Li T, Lyu O, Papagiannidis S (2023) Former CEOs chairing the board: does it matter to corporate social and environmental investments? Rev Quant Financ Acc 61:1277–1313

Ughetto E (2008) Does internal finance matter for R&D? New evidence from a panel of Italian firms. Camb J Econ 32(6):907–925

Walley N, Whitehead B (1994) It’s not easy being green. Reader Bus Environ 36(81):4

Wang M, Yu Y, Liu F (2023) Does digital transformation curb the formation of zombie firms? A machine learning approach. Technol Anal Strat Manag, Ahead of Print. https://doi.org/10.1080/09537325.2023.2296007

Wei F, Ding B, Kong Y (2017) Female directors and corporate social responsibility: evidence from the environmental investment of Chinese listed companies. Sustainability 9(12):2292

Withers MC, Fitza MA (2017) Do board chairs matter? The influence of board chairs on firm performance. Strateg Manag J 38(6):1343–1355

Wong TT, Yeh PY (2019) Reliable accuracy estimates from k-fold cross validation. IEEE Trans Knowl Data Eng 32(8):1586–1594

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ 91:104880

Wu J, Zhang Z, Zhou SX (2022) Credit rating prediction through supply chains: a machine learning approach. Prod Oper Manag 31(4):1613–1629

Xie ZH, Sun YX, Wang Y (2018) The influence of environmental regulation on corporate environmental investment of companies—a panel data study based on heavy pollution industry. J Arid Land Resour Environ 3:12–16

Xu X, Yan Y (2020) Effect of political connection on corporate environmental investment: evidence from Chinese private firms. Appl Econ Lett 27(18):1515–1521

Yan Y, Xu X (2022) Does entrepreneur invest more in environmental protection when joining the communist party? Evidence from Chinese private firms. Emerg Mark Financ Trade 58(3):754–775

Yang D, Wang Z, Lu F (2019) The influence of corporate governance and operating characteristics on corporate environmental investment: evidence from China. Sustainability 11(10):2737

Yao S, Zhang W (2020) Is private entrepreneurs’ religiosity conducive to environmental investment? Evidence from China. Sustainability 12(4):1467

Ye J, Moslehpour M, Tu YT, Ngo TQ, Nguyen SV (2023) Investment on environmental social and governance activities and its impact on achieving sustainable development goals: evidence from Chinese manufacturing firms. Econ Res-Ekonomska Istraživanja 36(1):333–356

Yu M, Song YI, Ku H, Hong M, Lee WK (2023) National-scale temporal estimation of South Korean Forest carbon stocks using a machine learning-based meta model. Environ Impact Assess Rev 98:106924

Zhang B, Bi J, Yuan Z, Ge J, Liu B, Bu M (2008) Why do firms engage in environmental management? An empirical study in China. J Clean Prod 16(10):1036–1045

Zhang Y, Sun Z, Zhou Y (2023b) Green merger and acquisition and green technology innovation: stimulating quantity or quality? Environ Impact Assess Rev 103:107265

Zhang J, Zhu M, Liu F (2023a) Find who is doing social good: using machine learning to predict corporate social responsibility performance. Oper Manag Res , Ahead of Print. https://doi.org/10.1007/s12063-023-00427-3

Zheng S, He C, Hsu SC, Sarkis J, Chen JH (2020) Corporate environmental performance prediction in China: an empirical study of energy service companies. J Clean Prod 266:121395

Funding

This work was supported by the Humanities and Social Sciences Foundation of the Ministry of Education of China [Grant No. 21YJC630076].

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, writing–original draft, review and editing, software, funding acquisition, formal analysis, data curation: F.L., R.W., and C.L. Investigation, resources, writing–review and editing: S.L. and M.S.

Corresponding author

Ethics declarations

Ethical approval

According to institutional guidelines and national laws and regulations, ethical approval was not required as there was no unethical conduct in this study. This study did not involve human clinical trials or animal experiments, no further approval from the ethics committee was required.

Consent to participate

All subjects gave written informed consent in accordance with the “Declaration of Helsinki.” Respondents were assured of confidentiality and anonymity. All participation is voluntary.

Consent for publication

Its publication has been approved by all co-authors.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Feng Liu is the first author.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liu, F., Wu, R., Liu, S. et al. Assessing the determinants of corporate environmental investment: a machine learning approach. Environ Sci Pollut Res 31, 17401–17416 (2024). https://doi.org/10.1007/s11356-024-32158-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-32158-8