Abstract

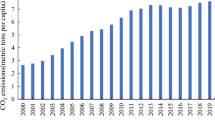

Green financial investment and privatization have been widely used as policy tools to promote economic growth and efficiency in many countries. However, their effects on environmental sustainability have been less explored. This study utilizes autoregressive distributed lag (ARDL) and quantile autoregressive distributed lag (QARDL) techniques to explore the effects of green financial investment and privatization on economic and environmental performance in China. Using data from 1995 to 2021, we analyze the impact of green financial investment and privatization on economic performance, measured by GDP per capita, and environmental performance, measured by CO2 emissions based on green finance and privatization theories. Our findings reveal that green financial investment has a beneficial effect on both economic and environmental performance. On the other hand, privatization has a positive impact on long-term economic performance, while also having negative consequences on environmental performance. These findings can inform evidence-based policies and strategies that promote both economic and environmental performance.

Similar content being viewed by others

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Ahmed M, Hafeez M, Kaium MA, Ullah S, Ahmad H (2023) Do environmental technology and banking sector development matter for green growth? Evidence from top-polluted economies. Environ Sci Pollut Res 30(6):14760–14769

Alsagr N (2023) Financial efficiency and its impact on renewable energy investment: empirical evidence from advanced and emerging economies. J Clean Prod 401:136738

Altiparmakov N, Nedeljković M (2018) Does pension privatization increase economic growth? Evidence from Latin America and Eastern Europe. J Pension Econ Financ 17(1):46–84

Beladi H, Chao CC (2006) Does privatization improve the environment? Econ Lett 93(3):343–347

Bellakhal R, Kheder SB, Haffoudhi H (2019) Governance and renewable energy investment in MENA countries: how does trade matter? Energy Econ 84:104541

Cavaliere A, Scabrosetti S (2008) Privatization and efficiency: from principals and agents to political economy. J Econ Surv 22(4):685–710

Chen Y, Feng J (2019) Do corporate green investments improve environmental performance? Evidence from the perspective of efficiency. China J Account Stud 7(1):62–92

Chen Y, Ma Y (2021) Does green investment improve energy firm performance? Energy Policy 153:112252

Chen Y, Igami M, Sawada M, Xiao M (2021) Privatization and productivity in China. Rand J Econ 52(4):884–916

Chen J, Lee SH, Muminov TK (2022) R&D spillovers, output subsidies, and privatization in a mixed duopoly: flexible versus irreversible R&D investments. Bull Econ Res 74(3):879–899

Cuervo-Cazurra A, Inkpen A, Musacchio A, Ramaswamy K (2014) Governments as owners: state-owned multinational companies. J Int Bus Stud 45:919–942

Ding Q, Xiao X, Kong D (2023) Estimating energy-related CO2 emissions using a novel multivariable fuzzy grey model with time-delay and interaction effect characteristics. Energy 263:126005

Dong H, Xue M, Xiao Y, Liu Y (2021) Do carbon emissions impact the health of residents? Considering China’s industrialization and urbanization. Sci Total Environ 758:143688

Falcone PM (2020) Environmental regulation and green investments: The role of green finance. Int J Green Econ 14(2):159–173

Fang Z, Razzaq A, Mohsin M, Irfan M (2022) Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol Soc 68:101844

Ganda F (2019) The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J Clean Prod 217:469–483

He J, Iqbal W, Su F (2023) Nexus between renewable energy investment, green finance, and sustainable development: role of industrial structure and technical innovations. Renew Energy 210:715–724

Huang SZ (2022) Do green financing and industrial structure matter for green economic recovery? Fresh empirical insights from Vietnam. Econ Anal Policy 75:61–73

IRENA (2021) Renewable capacity statistics 2021. Available: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Apr/IRENARECapacityStatistics2021.pdf

Jafri MAH, Liu H, Majeed MT, Ahmad W, Ullah S, Xue R (2021) Physical infrastructure, energy consumption, economic growth, and environmental pollution in Pakistan: an asymmetry analysis. Environ Sci Pollut Res 28:16129–16139

Jiang F, Kim KA (2015) Corporate governance in China: a modern perspective. J Corp Finan 32:190–216

Kang J, Huang D (2023) Examining the effect of privatization on renewable energy consumption in the digital economy under economic patriotism: a nonlinear perspective. Sustainability 15(7):5864

Khan FU, Zhang J, Dong N, Usman M, Ullah S, Ali S (2021) Does privatization matter for corporate social responsibility? Evidence from China. Eurasian Bus Rev 11:497–515

Khan MA, Riaz H, Ahmed M, Saeed A (2022) Does green finance really deliver what is expected? An empirical perspective. Borsa Istanbul Rev 22(3):586–593

King RG, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5, Part 2):S126–S150

Kirkpatrick C (2020) Privatisation in developing countries: an evolving relationship between state and markets. In Economic neoliberalism and international development (pp 43–61). Routledge

Lan J, Wei Y, Guo J, Li Q, Liu Z (2023) The effect of green finance on industrial pollution emissions: evidence from China. Resour Policy 80:103156

Lee SH, Park CH (2021) Environmental regulations in private and mixed duopolies: taxes on emissions versus green R&D subsidies. Econ Syst 45(1):100852

Lei W, Ozturk I, Muhammad H, Ullah S (2022) On the asymmetric effects of financial deepening on renewable and non-renewable energy consumption: insights from China. Econ Res-Ekon Istraz 35(1):3961–3978

Li J, Jiang T, Ullah S, Majeed MT (2022a) The dynamic linkage between financial inflow and environmental quality: evidence from China and policy options. Environ Sci Pollut Res 29(1):1051–1059

Li X, Shaikh PA, Ullah S (2022b) Exploring the potential role of higher education and ICT in China on green growth. Environ Sci Pollut Res 29(43):64560–64567

Lieberherr E, Truffer B (2015) The impact of privatization on sustainability transitions: a comparative analysis of dynamic capabilities in three water utilities. Environ Innov Soc Trans 15:101–122

Lin JY (2021) State-owned enterprise reform in China: the new structural economics perspective. Struct Chang Econ Dyn 58:106–111

Liu T, Zhang Y, Liang D (2019) Can ownership structure improve environmental performance in Chinese manufacturing firms? The moderating effect of financial performance. J Clean Prod 225:58–71

Mansell S (2013) Shareholder theory and Kant’s ‘duty of beneficence.’ J Bus Ethics 117:583–599

Marcelin I, Mathur I (2015) Privatization, financial development, property rights and growth. J Bank Finance 50:528–546

Maulidia M, Dargusch P, Ashworth P, Ardiansyah F (2019) Rethinking renewable energy targets and electricity sector reform in Indonesia: a private sector perspective. Renew Sustain Energy Rev 101:231–247

Mawdsley E (2015) DFID, the private sector and the re-centring of an economic growth agenda in international development. Glob Soc 29(3):339–358

Megginson WL, Netter JM (2001) From state to market: a survey of empirical studies on privatization. J Econ Lit 39(2):321–389

Meyer A, Pac G (2013) Environmental performance of state-owned and privatized eastern European energy utilities. Energy Econ 36:205–214

Nassiry D (2019) The role of fintech in unlocking green finance. Handbook of Green Finance 545:315–336

Newbold J (2006) Chile’s environmental momentum: ISO 14001 and the large-scale mining industry–Case studies from the state and private sector. J Clean Prod 14(3–4):248–261

North DC (1992) Privatization, incentives, and economic performance. In Privatization–Symposium in Honour of Herbert Giersch, Kiel (pp 3–16)

Pan X, Cheng W, Gao Y (2022) The impact of privatization of state-owned enterprises on innovation in China: a tale of privatization degree. Technovation 118:102587

Park SH, Li S, Tse DK (2006) Market liberalization and firm performance during China’s economic transition. J Int Bus Stud 37:127–147

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Plane P (1997) Privatization and economic growth: an empirical investigation from a sample of developing market economies. Appl Econ 29(2):161–178

Rashed AH, Shah A (2021) The role of private sector in the implementation of sustainable development goals. Environ Dev Sustain 23:2931–2948

Ren S, Hao Y, Wu H (2022) How does green investment affect environmental pollution? Evidence from China. Environ Resour Econ 81:25–51

Semieniuk G, Mazzucato M (2019) Financing green growth. Handbook on green growth, 240–259

Sharma GD, Verma M, Shahbaz M, Gupta M, Chopra R (2022) Transitioning green finance from theory to practice for renewable energy development. Renewable Energy 195:554–565

Shirley MM (1999) Bureaucrats in business: the roles of privatization versus corporatization in state-owned enterprise reform. World Dev 27(1):115–136

Sineviciene L, Kubatko OV, Sotnyk IM, Lakstutiene A (2019) Economic and environmental performance of post-communist transition economies. In Eurasian Economic Perspectives: Proceedings of the 24th Eurasia Business and Economics Society Conference (pp. 125–141). Springer International Publishing

Snyman S (2017) The role of private sector ecotourism in local socio-economic development in southern Africa. J Ecotour 16(3):247–268

Szarzec K, Totleben B, Piątek D (2022) How do politicians capture a state? Evidence from state-owned enterprises. East Eur Polit Soc 36(1):141–172

Tsai TH, Wang CC, Chiou JR (2016) Can privatization be a catalyst for environmental R&D and result in a cleaner environment? Resour Energy Econ 43:1–13

Ullah S, Ozturk I, Majeed MT, Ahmad W (2021) Do technological innovations have symmetric or asymmetric effects on environmental quality? Evidence from Pakistan. J Clean Prod 316:128239

Wang H, Liu Y, Xiong W, Song J (2019) The moderating role of governance environment on the relationship between risk allocation and private investment in PPP markets: evidence from developing countries. Int J Project Manage 37(1):117–130

Wang QJ, Wang HJ, Chang CP (2022) Environmental performance, green finance and green innovation: what’s the long-run relationships among variables? Energy Econ 110:106004

Wei X, Ren H, Ullah S, Bozkurt C (2023) Does environmental entrepreneurship play a role in sustainable green development? Evidence from emerging Asian economies. Econ Res-Ekon Istraz 36(1):73–85

Wu H (2023) Evaluating the role of renewable energy investment resources and green finance on the economic performance: evidence from OECD economies. Resour Policy 80:103149

Xing M, Tan T (2021) Environmental attitudes and impacts of privatization on R&D, environment and welfare in a mixed duopoly. Econ Res-Ekon Istraz 34(1):807–827

Yang L, Hui P, Yasmeen R, Ullah S, Hafeez M (2020) Energy consumption and financial development indicators nexuses in Asian economies: a dynamic seemingly unrelated regression approach. Environ Sci Pollut Res 27:16472–16483

Yang Y, Su X, Yao S (2021) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Resour Policy 74:102445

Yarrow G (1999) A theory of privatization, or why bureaucrats are still in business. World Dev 27(1):157–168

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 26:28919–28932

Zeb R, Salar L, Awan U, Zaman K, Shahbaz M (2014) Causal links between renewable energy, environmental degradation and economic growth in selected SAARC countries: progress towards green economy. Renewable Energy 71:123–132

Zhang D, Du W, Zhuge L, Tong Z, Freeman RB (2019) Do financial constraints curb firms’ efforts to control pollution? Evidence from Chinese manufacturing firms. J Clean Prod 215:1052–1058

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang L, Saydaliev HB, Ma X (2022) Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renewable Energy 193:991–1000

Zhu C, Ning Y, Sun X et al (2023) Energy taxes, energy innovation, and green sustainability: empirical analysis from a China perspective. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27927-w

Funding

Hunan Provincial New Liberal Arts Research and Reform Practice Project in 2021, Digital Intelligence Empowerment and Cross-Chain Integration - Innovative Practice of Collaborative Education Mechanism of New Business, Science, Government, Industry and Research (Xiangjiaotong[2021]NO.94-51).

Author information

Authors and Affiliations

Contributions

Shen Zhongping: Idea, software, Methodology, Writing-Original draft preparation, Reviewing and Editing; Methodology; Guan Yongjun: Investigation, Reviewing and Editing; Xu Yunbao: Conceptualization, Methodology, Writing-Original draft preparation; Xu Qifeng & Zubaria Andlib: Methodology, Reviewing and Editing.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information

Consent to publish

Not applicable

Competing interests

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhongping, S., Yongjun, G., Yunbao, X. et al. Green financial investment and its influence on economic and environmental sustainability: does privatization matter?. Environ Sci Pollut Res 30, 91046–91059 (2023). https://doi.org/10.1007/s11356-023-28520-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28520-x