Abstract

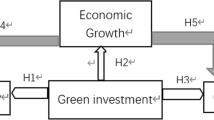

Previous studies examined the impact of finance on CO2 emissions; however, relatively few studies have explored the role of green investment in carbon reduction. In this study, we assessed the relationship between green investment, high-quality economic development, and carbon emissions in China. Based on the evaluation of three first-level indicators of economic development, social life, and ecological environment from 2001 to 2020, the index of China’s high-quality economic development level was calculated and performed analysis using an autoregression-distributed lag error-correction model. The results confirmed a long-term cointegration relationship between the three variables in China. In the long term, green investment is conducive to high-quality economic development and carbon-emissions reduction. During the process of high-quality economic development, carbon emissions will be reduced, and high-quality economic development and carbon emission reduction are also conducive to the increase of green investment. Second, in the short term, high-quality economic development and green investment demonstrate different mechanisms of influence on carbon emissions during the lag period. These findings suggest that investment in green energy should be strengthened, and the concept of green development should be adhered to in order to promote green economy to help improve China's environmental quality.

Similar content being viewed by others

Data availability

All data generated or analysed during this study are included in its supplementary information files.

References

Abbas, M., Wang, Z., Bashir, S., Iqbal, W., & Ullah, H. (2021). Nexus between energy policy and environmental performance in China, The moderating role of green finance adopted firms. Environmental Science and Pollution Research., 28, 63263–63277.

Ali, H., Law, S., Lin, W., Yusop, Z., Abdulahi, U., & Bare, A. (2018). Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. GeoJournal, 78(4), 641–655.

Amir, B., Robert, H., & Alan, K. (2005). Green investors and corporate investment. Structural Change and Economic Dynamics, 16(3), 332–346.

An, S., Li, B., Song, D., & Chen, X. (2020). Green credit financing versus trade credit financing in a supply chain with carbon emission limits. European Journal of Operational Research, 291(1), 125–142.

Capasso, M., Hansen, T., Heiberg, J., Klitkou, A., & Steen, M. (2019). Green growth–asynthesis of scientific findings. Technological Forecasting and Social Change., 146, 390–402.

Charfeddine, L. (2017). The impact of energy consumption and economic development on ecological footprint and CO2 emissions: Evidence from a Markov switching equilibrium correction model. Energy Economics, 65, 355–374.

Daniel, M., & Orestis, S. (2019). Fuzzy real options and shared savings: Investment appraisal for green shipping technologies. Transportation Research Part d: Transport and Environment, 77, 1–10.

Danish, & Recep, U. (2021). A revisit to the relationship between financial development and energy consumption: Is globalization paramount? Energy, 227, 120337.

Datta, T. K., & Lin, Y. (2020). A new green efficiency-based carbon taxing policy and its effects on a production-inventory system with random carbon emissions and green investment. Advances in Operations Research, 10, 1–13.

Dikau, S., Volz, U. (2019). Central banking, climate change, and green finance. Handbook of Green Finance, Energy Security and Sustainable Development, 1–23.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Eyraud, L., Clements, B., & Wane, A. (2013). Green investment: Trends and determinants. Energy Policy, 60, 852–865.

Falcone, P. M., Morone, P., & Sica, E. (2018). Greening of thefinancial system and fuelling a sustainability transition: A discursive approach to assess landscape pressures on the Italianfinancial system. Technological Forecasting and Social Change, 127, 23–37.

Fu, W., & Irfan, M. (2022). Does green financing develop a cleaner environment for environmental sustainability: empirical insights from association of southeast asian nations economies. Frontiers in Psychology, 13, 904768–904768.

Gan, C., Voda, M. (2022). Can green finance reduce carbon emission intensity? Mechanism and threshold effect. Environmental science and pollution research international.

Gerlach, H., & Zheng, X. (2018). Preferences for green electricity, investment and regulatory incentives. Energy Economics, 69, 430–441.

Ghorashi, N., & Rad, A. (2018). Impact of financial development on CO2 emissions: panel data evidence from iran’s economic sectors. Journal of Community Health Research, 7(2), 127–133.

Grossman, G.M., Krueger, A.B. (1994). Economic growth and the environment NBER. Working Paper No. 4634. Cambridge, UK: National Bureau of Economic Research.

Hawrylyshyn, O., & Maital, S. (1973). Are there Limits to Growth? Queen’s University.

He, L., Liu, R., Zhong, Z., Wang, D., & Xia, Y. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy, 143, 974–984.

Higgins, A. J., Hajkowicz, S., & Bui, E. (2008). A multi-objective model for environmental investment decision making. Computers and Operations Research, 35(1), 253–266.

Hopkins, K. G., Grimm, N. B., & York, A. M. (2018). Influence of governance structure on green stormwater infrastructure investment. Environmental Science & Policy, 84, 124–133.

IPCC(2007) Climate Change 2007: The Physical Science Basis, Summary for Policy Maker. IPCC, Geneva.

Labatt, S. (2002). Environmental finance: A guide to environmental risk assessment and financial products. Transplantation, 66(8), 405–409.

Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking and Finance, 41, 36–44.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46, 31–77.

Li, X., Lu, Y., & Huang, R. (2021). Whether foreign direct investment can promote high-quality economic development under environmental regulation: Evidence from the Yangtze River economic belt, China. Environmental Science and Pollution Research, 28, 21674–21683.

Liao, X., & Shi, X. (2018). Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy, 119, 554–562.

Liu, L., & He, L. (2021). Output and welfare effect of green credit in China: Evidence from an estimated DSGE model. Journal of Cleaner Production, 294, 126326.

Liu, L., Zhao, Z., Zhang, M., & Zhou, D. (2022). Green investment efficiency in the Chinese energy sector: Overinvestment or underinvestment? Energy Policy, 160, 112694.

Lv, P., & Xiong, H. (2022). Can FinTech improve corporate investment efficiency? Evidence from China. Research in International Business and Finance, 60, 101571.

Ma, X., & Xu, J. (2022). Impact of environmental regulation on high-quality economic development. Frontiers in Environmental Science., 10, 896892.

Madaleno, M., Dogan, E., & Taskin, D. (2022). A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Economics, 109, 105945.

Magalhes, N. (2021). The green investment paradigm: Another headlong rush. Ecological Economics, 190, 107209.

Minna, S., Juhani, U., & Tero, R. (2018). Sustainability as a driver of green innovation investment and exploitation. Journal of Cleaner Production, 179, 631–641.

Muhammad, S., & Hooi, H. (2012). Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy, 40, 473–479.

Muhammad, S., & Mohd, Z. (2021). The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Review, 22(1), 169–178.

Nie, M. H., & Xu, Y. J. (2016). Foreign direct investment, financial development and economic growth. Res. Financial Iss., 12, 13–20.

Peng, W., Yin, Y., Kuang, C., Wen, Z., & Kuang, J. (2021). Spatial spillover effect of green innovation on economic development quality in China: Evidence from a panel data of 270 prefecture-level and above cities. Sustainable Cities and Society, 69, 102863.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approches to analysis of long run relationships. Journal of Applied Econometrics, 16(3), 289–326.

Ren, X., Shao, Q., & Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production, 277, 122844.

Saud, S., Chen, S., Haseeb, A., & Sumayya. (2020). The role offinancial development and globalization in the environment: Accounting ecological footprint indicators for selected one-belt-one-road initiative countries. Journal of Cleaner Production, 250, 119518.

Schou, P. (2000). Polluting non-renewable resources and growth. Environmental and Resources Economics, 2, 211–227.

Shahbaz, M., Tiwari, A., & Nasir, M. (2013). The Effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy, 61(10), 14521459.

Shi, J., Yu, C., Li, Y., & Wang, T. (2022). Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technological Forecasting and Social Change, 179, 121678.

Sinha, A., Mishra, S., Sharif, A., & Yarovaya, L. (2021). Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. Journal of Environmental Management., 292, 112751.

Sun, H., & Chen, F. (2022). The impact of green finance on China’s regional energy consumption structure based on system GMM. Resources Policy, 76, 102588.

Tong, J., Yue, T., & Xue, J. (2022). Carbon taxes and a guidance-oriented green finance approach in China: Path to carbon peak. Journal of Cleaner Production, 367, 133050.

Vargas-Hernandez, J. (2020). Strategic transformational transition of green economy, green growth, and sustainable development: An institutional approach. International Journal of Environmental Sustainability and Green Technologies, 11, 34–56.

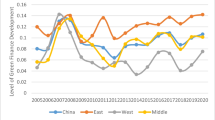

Wan, Y., & Sheng, N. (2021). Clarifying the relationship among green investment, clean energy consumption, carbon emissions, and economic growth: A provincial panel analysis of China. Environmental Science and Pollution Research International, 29(6), 9038–9052.

Wang, F., Wang, R., & He, Z. (2021b). The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resources Policy, 74, 102451.

Wang, Y., Kang, L., Wu, X., & Xiao, Y. (2013). Estimating the environmental Kuznets curve for ecological footprint at the global level: A spatial econometric approach. Ecological Indicators, 34, 15–21.

Wang, Y., Lei, X., Zhao, D., Long, R., & Wu, M. (2021a). The dual impacts of green credit on economy and environment: Evidence from China. Sustainability, 13(8), 1–13.

Wolde-Rufael, Y. (2010). Bounds test approach to cointegration and causality between nuclear energy consumption and economic growth in India. Energy Policy, 38(1), 52–58.

Wu, G. (2022). Research on the Spatial Impact of Green Finance on the Ecological Development of Chinese Economy. Frontiers in Environmental Science, 10, 887896.

Wu, X., Sadiq, M., Chien, F., Ngo, Q., Nguyen, A., & Trinh, T. (2021). Testing role of green financing on climate change mitigation: Evidences from G7 and E7 countries. Environmental Science and Pollution Research, 28, 66736–66750.

Xu, G., Dong, H., Xu, Z., & Bhattarai, N. (2022). China can reach carbon neutrality before 2050 by improving economic development quality. Energy, 243, 123087.

Yan, W., Peng, B., Wei, G., & Wan, A. (2021). Is there coupling effect between financial support and improvement of human settlement? a case study of the middle and lower regions of the Yangtze river. China. Sustainability, 13(15), 8131.

Yin, X., & Xu, Z. (2022). An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resources Policy, 75, 102476.

Zhang, D., & Kong, Q. (2022). Renewable energy policy, green investment, and sustainability of energy firms. Renewable Energy, 192, 118–133.

Zhang, M. (2022). Research on the spatial effect of green investment’s impact on economic high-quality development. Frontiers in Economics and Management, 3(2), 8–15.

Zhang, S., Wu, Z., Wang, Y., & Hao, Y. (2021). Fostering green development with green finance, an empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management, 296, 113159.

Zhang, X., Wang, Z., Zhong, X., Yang, S., & Siddik, A. (2022). Do green banking activities improve the banks’ environmental performance? The mediating effect of green financing. Sustainability, 14(2), 989–989.

Zhou, M., & Li, X. (2022). Influence of green finance and renewable energy resources over the sustainable development goal of clean energy in China. Resources Policy, 78, 102816.

Zhou, X., & Tang, X. (2022). Spatiotemporal consistency effect of green finance on pollution emissions and its geographic attenuation process. Journal of Environmental Management, 318, 115537.

Acknowledgements

This work was supported by Periodical Achievement of "Public Administration" of Guangdong Provincial Characteristic Key Discipline Construction (F2017STSZD01), Key Platform youth Innovation Project of Universities in Guangdong Province (No.2021WQNCX112), 2020 General project of Guangzhou Xinhua University (No.2020KYYB09) and The 14th Five-year Plan for the development of Philosophy and Social Sciences in Guangzhou (No: 2022GZYB16).

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

There is no conflict of interest involved in this publication.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Calculation results of high-quality economic development index.

Year | EHQ (%) | Year | EHQ (%) | Year | EHQ (%) | Year | EHQ (%) |

|---|---|---|---|---|---|---|---|

2001 | 31.13 | 2006 | 34.28 | 2011 | 40.14 | 2016 | 56.63 |

2002 | 32.27 | 2007 | 40.16 | 2012 | 46.37 | 2017 | 57.85 |

2003 | 33.52 | 2008 | 41.61 | 2013 | 47.77 | 2018 | 60.41 |

2004 | 33.59 | 2009 | 39.91 | 2014 | 48.5 | 2019 | 65.1 |

2005 | 33.15 | 2010 | 44.37 | 2015 | 50.01 | 2020 | 69.75 |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wan, Y., Su, H. The nexus of green investment, high-quality economic development, and carbon emissions in China: evidence according to an ARDL–ECM approach. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-03585-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-03585-3