Abstract

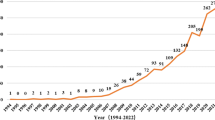

Climate change and climate finance continue to attract substantial research interest in several dimensions and categories through COVID-19 breakout and resulting disruptions were crucial. An in-depth scientometric analysis was undertaken to gain concise insights on evolution and publication trends of this multi-dimensional field. Corpus of 657 articles, extracted from Web of Science from 1995 to 2020, were used to identify networks of co-authorship, keywords, subject categories, institutions, and countries engaged in publishing on climate finance along with co-citation and cluster analysis. Networks and interactive visualizations created using CiteSpace revealed new research areas where climate finance may be beneficial along with potential directions of development for climate finance discipline. We identify carbon neutrality, accounting for sustainability, planetary boundaries framework, sustainable finance, managing climate risk for third pole, financial innovation and green finance, green swans, COVID pandemic and corporate law and governance in climate finance as emerging domains of climate finance research, seeking overwhelming research attention globally.

Similar content being viewed by others

Data availability

The datasets generated and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Environment needs to be safeguarded and developed as a result of economic development (Gilbert and Zhou 2017).

Climate adaptation could be funded through a range of creative financial options like catastrophe bonds; environmental impact bonds and (the more-nascent) resilience bonds.

Climate-related mitigation strategies could result in lower financial valuation or declined credit ratings for enterprises that broke rules.

Decisions for reducing emissions from deforestation and forest degradation in developing countries.

Bracking and Leffel (2020) provided critical evaluation of conceptual framework on climate finance governance, as well as outlined institutional arrangements and governance logics that enabled climate finance.

Specifically, strategic and operational planning, emphasizing accounting scholars' societal responsibility to increasingly incorporate climate change mitigation into accounting.

International Sustainability Standards Board.

Government, financial institutions, businesses, and consumers.

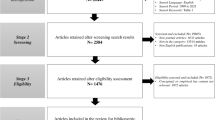

PRISMA is the minimum set of elements for systematic reviews and meta-analyses that is based on evidence.

Bhandary et al. (2021) examined working of climate financing policy practically by analyzing performance of nine types of climate finance policies: target lending, green bond policies, loan guarantee programs, weather indexed insurance, feed-in-tariffs, tax credits, national development banks, disclosure policies, and national climate funds.

References

Afionis S, Sakai M, Scott K, Barrett J, Gouldson A (2017) Consumption‐based carbon accounting: does it have a future? Wiley Interdiscip Rev Clim Change 8(1):e438

Atterdge A, Savvidou G (2019) Development aid for energy in small island developing states. Energy, Sustain Soc 9(1):1–16. https://doi.org/10.1186/s13705-019-0194-3

Baboukardos D (2017) Market valuation of greenhouse gas emissions under a mandatory reporting regime: evidence from the UK. Account Forum 41(3):221–233. https://doi.org/10.1016/j.accfor.2017.02.003

Battiston S, Mandel A, Monasterolo I, Schütze F, Visentin G (2017) A climate stress-test of the financial system. Nat Clim Chang 7(4):283–288. https://doi.org/10.1038/nclimate3255

Bebbington J, Larrinaga-Gonzalez C (2008) Carbon trading: accounting and reporting issues. Eur Account Rev 17(4):697–717. https://doi.org/10.1080/09638180802489162

Bebbington J, Österblom H, Crona B, Jouffray JB, Larrinaga C, Russell S, Scholtens B (2019) Accounting and accountability in the Anthropocene. Account Audit Account J 33(1):152–177. https://doi.org/10.1108/AAAJ-11-2018-3745

Bhandary RR, Gallagher KS, Zhang F (2021) Climate finance policy in practice: a review of the evidence. Clim Pol 21(4):529–545. https://doi.org/10.1080/14693062.2020.1871313

Biagini B, Bierbaum R, Stults M, Dobardzic S, McNeeley SM (2014) A typology of adaptation actions: a global look at climate adaptation actions financed through the Global Environment Facility. Glob Environ Chang 25(1):97–108. https://doi.org/10.1016/j.gloenvcha.2014.01.003

Bosetti V, Carraro C, Tavoni M (2009) Climate change mitigation strategies in fast-growing countries: the benefits of early action. Energy Econ 31(1):S144–S151. https://doi.org/10.1016/j.eneco.2009.06.011

Bouwer LM, Alerts JC (2006) Financing climate change adaptation. Disasters 30(1):49–63. https://doi.org/10.1111/j.1467-9523.2006.00306.x

Brandes U (2001) A faster algorithm for betweenness centrality. J Math Sociol 25(2):163–177. https://doi.org/10.1080/0022250X.2001.9990249

Bumpus AG, Liverman DM (2008) Accumulation by decarbonization and the governance of carbon offsets. Econ Geogr 84(2):127–155. https://doi.org/10.1111/j.1944-8287.2008.tb00401.x

Burke M, Hsiang SM, Miguel E (2015) Global non-linear effect of temperature on economic production. Nature 527(7577):235–239. https://doi.org/10.1038/nature15725

Busch T, Hoffmann VH (2007) Emerging carbon constraints for corporate risk management. Ecol Econ 62(3–4):518–528. https://doi.org/10.1016/j.ecolecon.2006.05.022

Campiglio E (2016) Beyond carbon pricing: the role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol Econ 121:220–230. https://doi.org/10.1016/j.ecolecon.2015.03.020

Campiglio E, Dafermos Y, Monnin P, Ryan-Collins J, Schotten G, Tanaka M (2018) Climate change challenges for central banks and financial regulators. Nat Clim Chang 8(6):462–468. https://doi.org/10.1038/s41558-018-0175-0

Cetin M (2019) The effect of urban planning on urban formations determining bioclimatic comfort area’s effect using satellitia imagines on air quality: a case study of Bursa city. Air Qual Atmos Health 12:1237–1249. https://doi.org/10.1007/s11869-019-00742-4

Cetin M (2020) Climate comfort depending on different altitudes and land use in the urban areas in Kahramanmaras City. Air Qual Atmos Health 13:991–999. https://doi.org/10.1007/s11869-020-00858-y

Cetin M, Isik Pekkan Ö, Ozenen Kavlak M et al (2022) GIS-based forest fire risk determination for Milas district. Turkey. Nat Hazards. https://doi.org/10.1007/s11069-022-05601-7

Chan G, Stavins R, Ji Z (2018) International climate change policy. Annu Rev Resour Econ 10(1):335–360. https://doi.org/10.1146/annurev-resource-100517-023321

Chawla K, Ghosh A (2019) Greening new pastures for green investments. Issue Brief. Council on Energy, Environment and Water. https://www.ceew.in/sites/default/files/CEEW-Greener-Pastures-for-Green-Investments-20Sep19.pdf. Accessed Jan–Feb 2022

Chen C (2006) CiteSpace II: detecting and visualizing emerging trends and transient patterns in scientific literature. J Am Soc Inf Sci Technol 57(3):359–377. https://doi.org/10.1002/asi.20317

Chen C (2014) The CiteSpace manual. In The CiteSpace Manual. http://cluster.ischool.drexel.edu/~cchen/citespace/CiteSpaceManual.pdf

Chen PY, Welsh C, Hamann A (2010) Geographic variation in growth response of Douglas-fir to interannual climate variability and projected climate change. Glob Change Biol 16(12):3374–3385. https://doi.org/10.1111/j.1365-2486.2010.02166.x

Chen C, Qian C, Deng A, Zhang W (2012) Progressive and active adaptations of cropping system to climate change in Northeast China. Eur J Agron 38(1):94–103. https://doi.org/10.1016/j.eja.2011.07.003

Chen L, Zadek S, Sun T (2017) Scaling citizen action on climate: Ant Financial’s efforts towards a digital finance solution. http://hdl.handle.net/20.500.11822/22279. Accessed Jan–Feb 2022

Clark SS, Chester MV, Seager TP, Eisenberg DA (2019) The vulnerability of interdependent urban infrastructure systems to climate change: could Phoenix experience a Katrina of extreme heat? Sustain Resilient Infrastruct 4(1):21–35. https://doi.org/10.1080/23789689.2018.1448668

Colenbrander S, Dodman D, Mitlin D (2018) Using climate finance to advance climate justice: the politics and practice of channelling resources to the local level. Clim Pol 18(7):902–915. https://doi.org/10.1080/14693062.2017.1388212

Copenhagen Accord (2009) Draft decision-/CP. 15. In Conference of the parties to the L NFCC, fifteenth session. Copenhagen 7(1):18

Coulson AB, Monks V (1999) Corporate environmental performance considerations within bank lending decisions. Eco-Manag Audit J Corp Environ Manage 6(1):1–10. https://doi.org/10.1002/(SICI)1099-0925(199903)6:1%3C1::AID-EMA93%3E3.0.CO;2-M

CPI–Climate Policy Initiative (2019) Global landscape of climate finance 2019

Cui H, Wang R, Wang H (2020) An evolutionary analysis of green finance sustainability based on multi-agent game. J Clean Prod 269:121799. https://doi.org/10.1016/j.jclepro.2020.121799

Degerli B, Çetin M (2022) Using the remote sensing method to simulate the land change in the year 2030. Turkish Journal of Agriculture - Food Science and Technology 10(12):2453–2466. https://doi.org/10.24925/turjaf.v10i12.2453-2466.5555

Delina LL (2011) Mitigating climate change via clean energy financing: an assessment of the Asian development bank’s mitigation efforts in Southeast Asia. Springer, Berlin Heidelberg, pp 51–68. https://doi.org/10.1007/978-3-642-14776-0_4

Delina L (2017) Multilateral development banking in a fragmented climate system: shifting priorities in energy finance at the Asian Development Bank. Int Environ Agreem Politics Law Econ 17:73–88. https://doi.org/10.1007/s10784-016-9344-7

Ebeling J, Yasué M (2008) Generating carbon finance through avoided deforestation and its potential to create climatic, conservation and human development benefits. Philos Trans R Soc B Biol Sci 363(1498):1917–1924. https://doi.org/10.1098/rstb.2007.0029

Elkington J (2020) Green swans: the coming boom in regenerative capitalism. Greenleaf Book Group

Engels A, Hüther O, Schäfer M, Held H (2013) Public climate-change skepticism, energy preferences and political participation. Glob Environ Chang 23(5):1018–1027. https://doi.org/10.1016/j.gloenvcha.2013.05.008

Fisher-Vanden K, Thorburn K (2011) Voluntary corporate environmental initiatives and shareholder wealth. J Environ Econ Manage 62(3):430–445

Fortunato S, Bergstrom CT, Börner K, Evans JA, Helbing D, Milojević S, ... Barabási AL (2018) Science of science. Science 359(6379):eaao0185

Ghisetti C, Mancinelli S, Mazzanti M, Zoli M (2017) Financial barriers and environmental innovations: evidence from EU manufacturing firms. Clim Policy 17(sup1):S131–S147. https://doi.org/10.1080/14693062.2016.1242057

Gilbert S, Zhou L (2017) The knowns and unknowns of China’s green finance. The new climate economy. Retrieved from: http://admin.indiaenvironmentportal.org.in/files/file/ChinaGreenFinance.pdf. Accessed Jan–Feb 2022

Gond JP, Piani V (2013) Organizing the collective action of institutional investors: three case studies from the principles for responsible investment initiative. In Institutional Investors’ Power to Change Corporate Behavior: International Perspectives 5(1):19-59. https://doi.org/10.1108/S2043-9059(2013)0000005010

Gouldson A, Colenbrander S, Sudmant A, McAnulla F, Kerr N, Sakai P, …, Kuylenstierna J (2015) Exploring the economic case for climate action in cities. Glob Environ Chang 35:93–105. https://doi.org/10.1016/j.gloenvcha.2015.07.009

Granoff I, Hogarth JR, Miller A (2016) Nested barriers to low-carbon infrastructure investment. Nat Clim Chang 6(12):1065–1071. https://doi.org/10.1038/nclimate3142

Greene DL (2011) What is greener than a VMT tax? The case for an indexed energy user fee to finance us surface transportation. Transp Res Part D: Transp Environ 16(6):451–458. https://doi.org/10.1016/j.trd.2011.05.003

Guertler P (2012) Can the Green Deal be fair too? Exploring new possibilities for alleviating fuel poverty. Energy Policy 49(1):91–97. https://doi.org/10.1016/j.enpol.2011.11.059

Gulluscio C, Puntillo P, Luciani V, Huisingh D (2020) Climate change accounting and reporting: a systematic literature review. Sustainability 12(13):5455. https://doi.org/10.3390/su12135455

Guo R, Lin Z, Mo X, Yang C (2010) Responses of crop yield and water use efficiency to climate change in the North China Plain. Agric Water Manag 97(8):1185–1194. https://doi.org/10.1016/j.agwat.2009.07.006

Hafner S, Jones A, Anger-Kraavi A, Pohl J (2020) Closing the green finance gap–a systems perspective. Environ Innov Soc Trans 34(1):26–60. https://doi.org/10.1016/j.eist.2019.11.007

Han Z, Long D, Fang Y, Hou A, Hong Y (2019) Impacts of climate change and human activities on the flow regime of the dammed Lancang River in Southwest China. J Hydrol 570(1):96–105. https://doi.org/10.1016/j.jhydrol.2018.12.048

Hepburn C, O’Callaghan B, Stern N, Stiglitz J, Zenghelis D (2020) Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxf Rev Econ Policy 36(Supplement_1):S359–S381. https://doi.org/10.1093/oxrep/graa015

Hoepner AG, Dimatteo S, Schaul J, Yu PS, Musolesi M (2017) Tweeting about sustainability: can emotional nowcasting discourage greenwashing? Forthcom Corp Finan 8. https://doi.org/10.2139/ssrn.2924088

Hu J, Zhang Y (2017) Discovering the interdisciplinary nature of Big Data research through social network analysis and visualization. Scientometrics 112(1):91–109. https://doi.org/10.1007/s11192-017-2383-1

Jaffe AB, Newell RG, Stavins RN (2005) A tale of two market failures: technology and environmental policy. Ecol Econ 54(2–3):164–174. https://doi.org/10.1016/j.ecolecon.2004.12.027

Kang M (2013) A brief analysis of low-carbon agriculture development pattern. Bus Manag Res 2(2):96. https://doi.org/10.5430/bmr.v2n2p96

Kang S, Im ES, Eltahir EA (2019) Future climate change enhances rainfall seasonality in a regional model of western Maritime Continent. Clim Dyn 52(1):747–764. https://doi.org/10.1007/s00382-018-4164-9

Keeley AR (2017) Renewable Energy in Pacific Small Island Developing States: the role of international aid and the enabling environment from donor’s perspectives. J Clean Prod 146(1):29–36. https://doi.org/10.1016/j.jclepro.2016.05.011

Kim EH, Lyon TP (2015) Greenwash vs. brownwash: exaggeration and undue modesty in corporate sustainability disclosure. Org Sci 26(3):705–723. https://doi.org/10.1287/orsc.2014.0949

Kim JE, Choi Y, Lee CH (2019) Effects of climate change on Plasmodium vivax malaria transmission dynamics: a mathematical modeling approach. Appl Math Comput 347(1):616–630. https://doi.org/10.1016/j.amc.2018.11.001

Klarin A, Suseno Y (2021) A state-of-the-art review of the sharing economy: Scientometric mapping of the scholarship. J Bus Res 126:250–262. https://doi.org/10.1016/j.jbusres.2020.12.063

Kleinberg J (2002) An impossibility theorem for clustering. Adv Neural Inf Proces Syst 15

Klenert D, Mattauch L, Combet E, Edenhofer O, Hepburn C, Rafaty R, Stern N (2018) Making carbon pricing work for citizens. Nat Clim Chang 8(8):669–677. https://doi.org/10.1038/s41558-018-0201-2

Klenert D, Funke F, Mattauch L, O’Callaghan B (2020) Five lessons from COVID-19 for advancing climate change mitigation. Environ Resour Econ 76:751–778. https://doi.org/10.1007/s10640-020-00453-w

Kolk A, Levy D, Pinkse J (2008) Corporate responses in an emerging climate regime: the institutionalization and commensuration of carbon disclosure. Eur Account Rev 17(4):719–745. https://doi.org/10.1080/09638180802489121

Kretschmer B, Hübler M, Nunnenkamp P (2013) Does foreign aid reduce energy and carbon intensities of developing economies? J Int Dev 25(1):67–91. https://doi.org/10.1002/jid.1788

Lam PT, Law AO (2016) Crowdfunding for renewable and sustainable energy projects: an exploratory case study approach. Renew Sustain Energy Rev 60(1):11–20. https://doi.org/10.1016/j.rser.2016.01.046

Liesen A, Hoepner AG, Patten DM, Figge F (2015) Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Account Audit Account J 28(7):1047–1074. https://doi.org/10.1108/AAAJ-12-2013-1547

Lin A, Dong L, Fuqiang Y (2015) How China can help lead a global transition to clean energy. https://www.cigionline.org/sites/default/files/fixing_climate_governance_policy_brief_no6.pdf. Accessed Jan–Feb 2022

Lind RC (1995) Intergenerational equity, discounting, and the role of cost-benefit analysis in evaluating global climate policy. Energy Policy 23(4–5):379–389. https://doi.org/10.1016/0301-4215(95)90162-Z

Lyon TP, Montgomery AW (2015) The means and end of greenwash. Organ Environ 28(2):223–249. https://doi.org/10.1177/1086026615575332

Marchand RD, Koh SL, Morris JC (2015) Delivering energy efficiency and carbon reduction schemes in England: lessons from Green Deal Pioneer Places. Energy Policy 84(1):96–106. https://doi.org/10.1016/j.enpol.2015.04.035

Milne MJ, Grubnic S (2011) Climate change accounting research: keeping it interesting and different. Account Audit Account J 24(8):978–999. https://doi.org/10.1108/09513571111184715

Moher D, Liberati A, Tetzlaff J, Altman DG, PRISMA Group*, T (2009) Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Ann Intern Med 151(4):264–269. https://doi.org/10.7326/0003-4819-151-4-200908180-00135

Nassani AA, Aldakhil AM, Abro MMQ, Zaman K (2017) Environmental Kuznets curve among BRICS countries: spot lightening finance, transport, energy and growth factors. J Clean Prod 154(1):474–487. https://doi.org/10.1016/j.jclepro.2017.04.025

Ngwenya N, Simatele MD (2020) Unbundling of the green bond market in the economic hubs of Africa: case study of Kenya, Nigeria and South Africa. Dev South Afr 37(6):888–903. https://doi.org/10.1080/0376835X.2020.1725446

Nugent JP (2015) Ontario’s infrastructure boom: a socioecological fix for air pollution, congestion, jobs, and profits. Environ Plan A 47(12):2465–2484. https://doi.org/10.1068/a140176p

O’Sullivan N, O’Dwyer B (2015) The structuration of issue-based fields: social accountability, social movements and the Equator Principles issue-based field. Acc Organ Soc 43(1):3–55. https://doi.org/10.1016/j.aos.2015.03.008

Okereke C, Dooley K (2010) Principles of justice in proposals and policy approaches to avoided deforestation: towards a post-Kyoto climate agreement. Glob Environ Chang 20(1):82–95. https://doi.org/10.1016/j.gloenvcha.2009.08.004

Ozcan B, Tzeremes PG, Tzeremes NG (2020) Energy consumption, economic growth and environmental degradation in OECD countries. Econ Model 84(1):203–213. https://doi.org/10.1016/j.econmod.2019.04.010

Paramati SR, Apergis N, Ummalla M (2017) Financing clean energy projects through domestic and foreign capital: the role of political cooperation among the EU, the G20 and OECD countries. Energy Econ 61:62–71

Paris Agreement (2015) Paris agreement. In: Report of the conference of the parties to the United Nations framework convention on climate change (21st Session, 2015: Paris). Retrived December, 4(1), 2017. HeinOnline

Parry IW, Williams III RC (2010) What are the costs of meeting distributional objectives for climate policy? The BE Journal of Economic Analysis & Policy 10(2)

Pellegrino C, Lodhia S (2012) Climate change accounting and the Australian mining industry: exploring the links between corporate disclosure and the generation of legitimacy. J Clean Prod 36(1):68–82. https://doi.org/10.1016/j.jclepro.2012.02.022

Petticrew M, Roberts H (2008) Systematic reviews in the social sciences: a practical guide. John Wiley & Sons

Pillay K, Aakre S, Torvanger A (2017) Mobilizing adaptation finance in developing countries. CICERO Report

Polzin F (2017) Mobilizing private finance for low-carbon innovation–a systematic review of barriers and solutions. Renew Sustain Energy Rev 77(1):525–535. https://doi.org/10.1016/j.rser.2017.04.007

Scarpellini S, Marín-Vinuesa LM, Portillo-Tarragona P, Moneva JM (2018) Defining and measuring different dimensions of financial resources for business eco-innovation and the influence of the firms’ capabilities. J Clean Prod 204(1):258–269. https://doi.org/10.1016/j.jclepro.2018.08.320

Schmidt GA, Annan JD, Bartlein PJ, Cook BI, Guilyardi É., Hargreaves J C, …, Yiou P (2014) Using palaeo-climate comparisons to constrain future projections in CMIP5. Clim Past 10(1):221–250. https://doi.org/10.5194/cp-10-221-2014

Schwerhoff G (2017) Response to the comment on: ‘The economics of leadership in climate change mitigation.’ Clim Policy 17(6):817–818. https://doi.org/10.1080/14693062.2016.1202098

Slevin A, Elliott R, Graves R, Petticrew C, Popoff A (2020) Lessons from Freire: towards a pedagogy for socio-ecological transformation. Adult Learner: The Irish Journal of Adult and Community Education 73:95

Small H (1973) Co-citation in the scientific literature: a new measure of the relationship between two documents. J Am Soc Inf Sci 24(4):265–269. https://doi.org/10.1002/asi.4630240406

Solomon BD (1995) Global CO2 emissions trading: early lessons from the U.S. acid rain program. Clim Change 30(1):75–96. https://doi.org/10.1007/BF01093226

Stadelmann M, Castro P (2014) Climate policy innovation in the South-Domestic and international determinants of renewable energy policies in developing and emerging countries. Glob Environ Chang 29(1):413–423. https://doi.org/10.1016/j.gloenvcha.2014.04.011

Steckel JC, Jakob M, Flachsland C, Kornek U, Lessmann K, Edenhofer O (2017) From climate finance toward sustainable development finance. Wiley Interdiscip Rev Clim Change 8(1):e437. https://doi.org/10.1002/wcc.437

Stern NH (2007) The economics of climate change: the Stern review. Cambridge University press

Sun Y, Xie S, Zhao S (2019) Valuing urban green spaces in mitigating climate change: a city-wide estimate of aboveground carbon stored in urban green spaces of China’s Capital. Glob Change Biol 25(5):1717–1732. https://doi.org/10.1111/gcb.14566

Taleb NN (2007) Black swans and the domains of statistics. Am Stat 61(3):198–200. https://doi.org/10.1198/000313007X219996

Tekin O, Cetin M, Varol T et al (2022) Altitudinal migration of species of fir (Abies spp.) in adaptation to climate change. Water Air Soil Pollut 233:385. https://doi.org/10.1007/s11270-022-05851-y

Tirpak D, Adams H (2008) Bilateral and multilateral financial assistance for the energy sector of developing countries. Clim Policy 8(2):135–151. https://doi.org/10.3763/cpol.2007.0443

Tolliver C, Keeley AR, Managi S (2019) Green bonds for the Paris agreement and sustainable development goals. Environ Res Lett 14(6):064009. https://doi.org/10.1088/1748-9326/ab1118

Tolliver C, Keeley AR, Managi S (2020) Drivers of green bond market growth: the importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. J Clean Prod 244(1):118643. https://doi.org/10.1016/j.jclepro.2019.118643

Varol T, Cetin M, Ozel HB et al (2022a) (2022) The effects of climate change scenarios on Carpinus betulus and Carpinus orientalis in Europe. Water Air Soil Pollut 233:45. https://doi.org/10.1007/s11270-022-05516-w

Varol T, Canturk U, Cetin M et al (2022b) Identifying the suitable habitats for Anatolian boxwood (Buxus sempervirens L.) for the future regarding the climate change. Theor Appl Climatol 150:637–647. https://doi.org/10.1007/s00704-022-04179-1

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104(1):311–316. https://doi.org/10.1016/j.egypro.2016.12.053

Watch C (2020) Historical GHG Emissions Data

Ye N, Kueh T-B, Hou L, Liu Y, Yu H (2020) A bibliometric analysis of corporate social responsibility in sustainable development. J Clean Prod 272(1):122679. https://doi.org/10.1016/j.jclepro.2020.122679

Zadek S (2011) Beyond climate finance: from accountability to productivity in addressing the climate challenge. Clim Policy 11(3):1058–1068. https://doi.org/10.1080/14693062.2011.582288

Zhang D, Zhang Z, Managi S (2019) A bibliometric analysis on green finance: current status, development, and future directions. Financ Res Lett 29(1):425–430. https://doi.org/10.1016/j.frl.2019.02.003

Zhao X (2017) A scientometric review of global BIM research: analysis and visualization. Autom Constr 80(1):37–47. https://doi.org/10.1016/j.autcon.2017.04.002

Zhao C, Yan Y, Wang C, Tang M, Wu G, Ding D, Song Y (2018) Adaptation and mitigation for combating climate change–from single to joint. Ecosyst Health Sustain 4(4):85–94. https://doi.org/10.1080/20964129.2018.1466632

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Shikha Gupta and Gurmani Chadha. The first draft of the manuscript was written by Shikha Gupta, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Singhania, M., Gupta, S., Chadha, G. et al. Mapping 26 years of climate change research in finance and accounting: a systematic scientometric analysis. Environ Sci Pollut Res 30, 83153–83179 (2023). https://doi.org/10.1007/s11356-023-27828-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27828-y