Abstract

This study measures the impact of the implementation of the Regional Greenhouse Gas Initiative (RGGI) on firms’ green innovation initiatives. We used 20 years of panel data from the Fortune 500 list of the US largest companies. Based on DID, a benchmark regression, the RGGI has a significant adverse effect on the green innovation of Fortune 500 companies, and we verified these findings with multiple robustness tests. As we investigate how energy-intensive industries were affected by RGGI, we found that it slowed down green innovation, but it was not statistically significant. This study provides a novel perspective on how the RGGI influences green innovation in firms and how different types of sectors respond to the policy. The findings indicate that the “weak” Porter Hypothesis has not been confirmed in the present carbon trading market (particularly the RGGI) for Fortune 500 firms in the USA. In terms of policy, we believe that a well-covered and differentiated legislation that fosters green innovation while being realistic about the policy’s goal and the firm’s environmental attitude, like emissions reduction through green innovation, is essential.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental regulation (ER) that is well managed can help companies become more committed to green innovation. Green innovation refers to technical advances incorporated into ecological management techniques to reduce pollution, hazardous waste, and energy consumption (Chen 2008; Zhang et al. 2020a). Governments implement environmental regulations to lessen firms’ negative externalities and increase their ecological consciousness. Scholars categorized these regulations into different dimensions. For instance, Liu et al. (2018) differentiated Chinese environmental regulations into three types, i.e., economic, legal, and supervised environmental regulations. Also, these ecological regulations are grouped into formal and informal environmental regulations (Song et al. 2019). Others are classified based on their obligatory nature, such as mandatory, participatory, and voluntary environmental regulation.Footnote 1 This study considers market-based regulation, which is economical, formal, and mandatory. The Regional Greenhouse Gas Initiative (RGGI) was established in 2009 in 10 northeastern US states. It aims to cut down on GHG emissions from the power sector. By investing proceeds from the RGGI allowance auction, the RGGI participating states have more power to increase energy efficiency, low-carbon fuel switching, and green technology innovation (ICAP. 2021). Also, green innovation is a commonly accepted way to reduce CO2 emissions, and research suggests that market-based schemes are better at doing so.

This study aims to measure the effect of the RGGI on US firms’ green innovation. Empirical literature documents that environmental regulation and green innovation motivate firms’ environmental attitudes (Yang 2022). However, different authors have concluded diverse effects. For instance, adverse effects have been found in the work of Li et al. (2018b), Tang et al. (2020b), and Chen et al. (2021), while positive and negative effects were found in the work of Fang et al. (2020) and Liu et al. (2022). Also, Fang et al. (2020) revealed that ER failed to improve green innovation efficiency. Hence, previous results are inconclusive. Meanwhile, various issues have been investigated to measure the impact of the RGGI. For instance, it significantly reduced emissions from CO2, and SO2 (Chan and Morrow 2019), accelerated the coal-to-gas switching, and reduced coal-fired and increased natural gas cycle generation (Fell and Maniloff 2018). Also, the RGGI moderately shows some indirect child health benefits and reduces overall infant mortality by mitigating air pollutant concentrations (Lee and Park 2019; Perera et al. 2020). Regarding CO2 reduction from power plants, RGGI was found significant in the short-term but not in the long-term within regulated states (Shawhan et al. 2014). Also, the RGGI has neither had a significant effect on carbon emission from electricity production (Lee and Melstrom 2018) nor failed to improve technical efficiency (Zhou and Huang 2016). However, previous studies investigated at the states/province level, but the firm-level effect of RGGI implementation remains unexplored.

Industrial operations are considered a primary factor for excessive CO2 emissions, and firms’ environmental attitudes play a vital part in escalating toxic gases. Moreover, green innovation is one of the most acceptable ways to keep hazardous emissions and environmental regulations accountable by providing regulatory pressure for corporate innovation (Tang et al. 2020a). The empirical literature has established that any ecological law should increase firms’ environmental concerns. Therefore, we believe that a firm-level investigation is vital. To fill this gap, we collected the financial and economic data of the US Fortune 500 (hereafter F500) ranked companies (headquartered in the US) from 2000 to 2019. We consider 20 years because it is a usual patent life cycle, which is 20 years from the date of filing a regular patent application (Purvis 2022) and we limit our periodical coverage in 2019 to avoid the COVID-19 effects. Our selection of the Fortune 500 US companies provides us with several benefits. For instance, F500 companies were categorized based on their business success (revenue performance). Firms’ green inventions are a costly endeavor for a firm. Practically, a strong connection between a firm’s business performance and innovation activities was established in the “Derwent Innovation Index,” where most of the F500 companies were included in the index as top innovating companies (Derwent-Index 2019). We identified green patents from the firm’s total patents using the WIPO’s IPC green inventory (Cecere and Corrocher 2016; Kesidou and Wu 2020). Previous literature documented that apart from induced policy (RGGI in this study), a firm’s green innovation may be affected by other policies or firm’s actions, which makes the results estimation of this study biased. To determine the true impact of RGGI, we employ “Difference-in-Difference” (DID) as a benchmark regression to make the empirical results more robust.

Previous studies have shown that energy-intensive industries are more responsible for high CO2 emissions, and most market-based policies are imposed to curb emissions from energy-intensive industries. For instance, RGGI was also deployed to reduce emissions from the electric power sector, one of the US’s highest emitting individual sectors in the last 40 years. Also, we separated the firms into energy-intensive industries (EI) and less energy-intensive (LEI). We employed the “Difference-in-Difference-in-Difference (DDD)” to measure the effect of RGGI on the energy-intensive industry. Subsequently, we conduct a series of robustness tests to ensure the results’ validity. Also, we examine the sector-wise heterogeneity of firms’ green innovation.

Based on benchmark DID regression, our empirical investigation established a significant relationship between the green innovation of F500 companies and the RGGI implementation. The green innovation for carbon abatement was also found insignificant in the firms of energy-intensive industries compared to less energy-intensive industries. Specifically, we found significant sector-wise heterogeneity, i.e., only five out of fifteen sectors including the manufacturing industry positively impacted. In other words, the RGGI has a different effect on the FGI in their respective production line.

After applying several robustness tests, these results hold up, including (i) alternative measures of green innovation, i.e., sector-adjusted green innovation and proportion of green-to-total patents; (ii) hysteresis effects text to perceive the effect of the global financial crisis; and (iii) introduced the “Pro-State Feature,” to control the state’s characteristics. To address the issue of endogeneity, we utilize three additional tests. To begin, we use a DID analysis based on Propensity Score Matching (PSM) to address the dual problem of selection bias due to firm-specific and functional misspecification. Second, we correct for endogeneity biases brought on by sample selection using the Heckman Selection Model. Thirdly, we use the two-step Generalized Method of Moments (GMM) method, which takes into account reverse causality and dynamic endogeneity. All three methods, which more explicitly address endogeneity issues, provide results that are consistent with our original findings.

Based on our findings showing a negative relation between RGGI deployment and firms’ green innovation, we hypothesized that energy-intensive firms would respond favorably and conducted an empirical investigation to verify this hypothesis. Firstly, we created subsamples by separating energy-intensive sectors and less-energy-intensive sectors and used the triple DID concept (called DDD). Further, we categorize the subsamples to the individual sector-wise and re-run the benchmark model. Our findings indicate no significant difference in the impact of RGGI on energy-intensive sectors compared to less-energy-intensive sectors. However, most of the sector’s green innovations are negatively influenced by RGGI. Secondly, we consider alternative specifications such as sector-adjusted firm’s R&D expenditures as input for the firm’s innovation activities. The underlying assumption we test here is that allocating inputs leads to achieving the desired output. We consider winsorized (1% level) sector-adjusted R&D expenditures as a dependent variable by keeping remain same as the other inclusions like the benchmark model and found a significant negative effect. We found evidence that offers a possible explanation for the negative correlation between RGGI's adoption and green innovation: decreased R&D spending by firms.

The present study is useful in various ways to the existing literature. First, this is the first-ever attempt to assess the impact of RGGI designed as market-based regulation on firms’ green innovation for the USA by using the most recent available data and treatment effect econometrics techniques. Prior studies focused on the consequences of the RGGI fuel switching or emission leakage (Zhou and Huang 2021), emissions and health co-benefits (Yang et al. 2021), fossil fuel consumption (Yan 2021), co-benefits to children’s health (Perera et al. 2020), and infant mortality (Lee and Park 2019). A few studies also applied the ‘difference-in-difference’ methods (Lee and Park 2019; Yan 2021). However, none of these studies has captured the nuances of a firm’s green innovation. We have provided a departure from the literature by focusing on the firms’ green innovation through novel yet new measures of green innovation. The subtlety of a firm’s green innovation has not been captured by any of these studies. We have contributed to this body of knowledge by concentrating on firms’ green innovation and developing new ways of measuring green innovation. We examine nuances associated with the RGGI deployment and firms’ green innovation nexus. We also explore the sector-wise heterogeneity through which regulatory agencies can stimulate firms’ green innovation.

Second, this study used the latest DID methodology as proposed by Wooldridge (2021), which enables the separation of two groups using a time-constant treatment qualification/eligibility dummy. (1 for the treated and 0 for the control group). Also, it helps to distinguish between before and after the policy/treatment intervention, and the two groups are given a time-intervening dichotomous variable which helps to identify differences in outcomes between groups. Since it controls other variables that may vary by location and examines variation among firms within the same region or state, the DID assessment of matched data could generate a more conservative estimate (O’Neill et al. 2016). Despite the popularity of DID, which offers various benefits in policy evaluation research, it suffers from endogeneity issues. Also, this study considers 20-year study periods, precisely 9 years before and 10 years after policy intervention. Although panel data can deal with various treatment endogeneity issues better than repeated cross-sections, it created a methodological dilemma in this study. One the one hand, PSM performs better in tackling endogeneity issues than DID. On the other hand, PSM is not well-suited to take advantage of long time series and while DID can, it relies on parallel pre-intervention trends between the treated and comparison groups. To solve this dilemma, we applied both DID and PSM-DID, which helped us reveal the actual effect of RGGI deployment on firms’ green innovation.

Third, our study contributes to the regulatory debate about the effectiveness of regulatory push-pull effects on green innovation at the firm level. It also helps us learn more about the effects of regulatory reform on green innovation at firms. Finally, given the statistically significant negative relationship between the implementation of RGGI and the firm’s green innovation, this disclosed relationship helps government environmental agencies identify additional regulatory measures that would encourage firms to engage in green innovation in addition to pre-existing regulations. This paper invites regulatory bodies to reconsider the rationale for RGGI implementation and its impact on firm-level green innovation, including a US economic sectoral analysis.

The rest of the study is organized as follows: The “Literature review” section presents the related literature while the “Variable, data, and research methods” section describes the hypothesis and measurement, and the “Results analysis and discussion” section explains the study’s variable, data, and research methods. The results of the benchmark regression, robustness tests, and discussion are evaluated in the “Possible reasons for detrimental effects” section, and the “Conclusion and policy implications” section provides the concluding remarks.

Literature review

The US RGGI, a market-based GHG emission policy

Among all other types of environmental regulations, ETS is the fastest growing. So far, around 80 jurisdictions worldwide employ 23 market-based systems, covering approximately 9% of global emissions (Luca et al. 2020). Except for the Korean ETS, all these policies are experimental. The EU-ETS, followed by the RGGI, California and Quebec cap-and-trade, and Chinese provincial ETS pilots (CN-ETS), are prominent and similar due to floor auction reserve prices. (Flachsland et al. 2020). Only the Quebec cap-and-trade has distinct features like reshaping and merging nature with other similar policies (ICAP. 2021). Unlike other ETS programs, Korea ETS (KETS) and New Zealand ETS (NZ ETS) are unique due to national coverage. The NZ ETS has a broader sectoral range, but revenues are assigned to the general budget without allotting for specific purposes (ICAP. 2021). In contrast, RGGI and CN-ETS covered only selected states and provinces, and EU-ETS was implemented in E.U. regions.

Primarily to rein in CO2 emissions from the electric power industry, the single largest cumulative source of US CO2 emissions for the last 40 years, in 2009, the US RGGI became the first mandatory market-based regional regulation in the US that relies only on auctions to allocate emissions permits. However, the RGGI has been operational in only ten northeastern states since January 2009, namely Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, Vermont, and New Jersey. RGGI was explicitly introduced to reduce yearly CO2 emissions from the electric power industry by 45% below 2005 levels by 2020 and an additional 30% by 2030 in regulated jurisdictions (C2ES 2019; RGGI Inc. 2020). Participating states met their target for CO2 emissions from fossil fuel consumption in the electric power sector by reducing them by more than 49% from 2005 levels in 2018 (EIA 2021). Additionally, RGGI adjusts the cap on emissions of less than 21.9 Mt (million tons) annually across participating states. However, various factors contribute to this so-called emissions decline. It could occur due to reduced natural gas costs, decreased demand, or increased renewable capacity (Huang and Zhou 2019).Footnote 2

The RGGI differs from the EU-ETS in that it has a fully functional auction, whereas the EU-ETS allows free grandfathering of allowances to former emitters (Borghesi and Montini 2016; Haapala 2017). RGGI has successfully conducted 50 auctions, selling 1.11 billion CO2 allowances for a total of $3.78 billion (RGGI Inc. 2020). The current CO2 emission cap was increased to 119.8 million tons from 96.2 million tons for the 11 participating states in 2021 (Virginia is participating for the first time). However, RGGI is continuously reducing the state-wise CO2 emission budget each year to reach 86.9 million tons by 2030 (RGGI Inc. 2020). The auction proceeds are distributed to member states for energy efficiency, renewable energy, direct energy bill assistance, agriculture and home technological innovation, and other GHG reduction programs (RGGI Inc. 2020). With over 10 years of deployment, RGGI provides enough data for researchers to conduct an in-depth investigation of its emissions from the electricity sector (Chan and Morrow 2019). In addition, RGGI significantly reduces spillover CO2 and SO2 emissions, resulting in significant societal benefits for both RGGI member states and neighboring non-member states (Chan and Morrow 2019). RGGI has completed its three-year compliance phase in 2020 and reimbursed billions of dollars from emission budgets to consumers, primarily to assure low-carbon power generation. Thus, we assume that RGGI impacts firms’ green innovation, ensuring energy efficiency and ultimately lowering CO2.

Green innovation (GI)

Nearly a quarter-century has passed since Fussler and James (1996) initially defined green innovation as new goods and processes that add value to customers and businesses while having a negligible environmental impact. Some researchers have described green innovation as focused only on ecological considerations. For example, the primary objective of green innovation is not always to alleviate environmental burdens but to provide some environmental advantages (Driessen and Hillebrand 2002). Likewise, Bernauer et al. (2007) and Dangelico and Pujari (2010) claimed that GI should comprise new or modified processes, practices, methods, and environmentally conscious products and contribute to product life-cycle sustainability.

Recently, authors added the economic success of a green innovation with an environmental benefit. For instance, GI refers to technology innovations in environmental management practices, pollution prevention, waste reduction, and energy-saving (Chen 2008; Zhang et al. 2020a). Lee and Kim (2011) defined GI as integrating producer and supplier’s innovation efforts that enhance compliance with environmental regulatory requirements and achieve target economic success. In the extended literature, many authors aligned GI with multiple dimensions. For instance, green design is an initiative carried out during the design and product development phase to lessen adverse environmental effects in the whole product life cycle (Tseng et al. 2013). Every firm has combined strategies for green innovation, which will optimize the firm’s revenue and environmental legitimacy (Wang et al. 2020). Practically, a business entity would not spend on activities that do not value the firm. Due to the high cost of inclusion, we feel that the firm’s innovation must provide economic value for the organization. As a result, this research views GI as an activity that assists enterprises in promoting manufacturing, operating, and managing processes that result in economic gains and minimize environmental harm.

Nexus between emissions trading schemes-RGGI and firms’ green innovation

The relationship between climate change issues, environmental regulations, and technological innovation has become a hot topic in academic research in the last few years. From the broader perspective, the recent empirical studies are divided into two facets, such as regulatory and non-regulatory impact analysis. From a non-regulatory perspective, recent few studies emphasized various aspects such as globalization and environmental performance (Anser et al. 2021; Chien et al. 2021; Huo et al. 2022; Sun et al. 2021; Uzuner et al. 2020), renewable energy, technology or eco-innovation, CO2 emissions (Anwar et al. 2022; Chien et al. 2021; Chien et al. 2022; Sharif et al. 2021; Suki et al. 2022; Sun et al. 2022), and the asymmetric relationship with the CO2 emissions (Li et al. 2022; Uzuner et al. 2020). However, our study is different from these recent works and unified with regulatory impact analysis. From the perspective of regulatory impact analysis, scholars investigate ETS’s impact on ecological topics, including GHG emissions, carbon leakage, energy efficiency, and energy switching (from fossil fuel to low carbon), while R&D investment, financial performance, and market competitiveness lead to economic issues.

Despite the acceptability of ETS, researchers are also keen to investigate their effects ranging on various direct and spillover (indirect) issues related to environmental and economic issues. Theoretical literature argues that environmental policies increase firms’ innovation and bring long-term benefits (Porter and Van der Linde 1995), commonly identified as a ‘weak’ version of the Porter Hypothesis (Ambec et al. 2013; Jaffe and Palmer 1997). Distinct ERs motivate firms’ environmental initiatives differently (Jaffe and Palmer 1997; Kemp 1997). Regulatory pressure creates innovative technological push (Lahteenmaki-Uutela et al. 2019) and market pull (Horbach et al. 2012), which forces to change the innovative activities to low-carbon technologies (Acemoglu et al. 2012; Zhang et al. 2022b). This push-pull pressure could help the firm reduce environmental compliance costs and improve its ability to lessen ecological damages in the long run (Fan et al. 2022).

Some recent studies investigated the ‘weak’ version of the Porter Hypothesis (PH) and show that market-based instruments influence firms’ green innovation (Chen et al. 2021; Fang et al. 2021; Hu et al. 2021; Lyu et al. 2020; Ning et al. 2022; Ren et al. 2020; Wei et al. 2021). However, the findings related to the PH remain inconclusive; although most works found supportive evidence of the PH, Chen et al. (2021) did not find corroborating evidence of the PH in the Chinese listed enterprises. However, most of the recent works emphasized either CN-ETS or EU-ETS. In contrast, the RGGI designed as a market-based trading scheme is initiated to lessen emissions in the power sector through fuel switching from high to low carbon, improve energy efficiency, promote renewable energy, and low-carbon technological development. According to WIPO’s IPC green inventory, firms filing applications for a patent with these attributes can be considered green patents. We used these green patents to measure a firm’s green innovation. To the best of our knowledge, based on the PH, the relationship between the RGGI deployment and firms’ green innovation has not yet been explored empirically. To fill up this gap, we aim to investigate the relationship between the US RGGI implementation and the firm’s green innovation.

The theory of innovation economics acknowledges that the ambitious motives of firm-level GIs are not entirely encompassed by market and technological factors but require regulatory aspects for revision. Thus, ER has a dual effect by directly addressing the environmental externalities and, indirectly, encouraging FGI (regulatory push-pull hypothesis) (Rennings 2000). The legislative push-pull can improve the firm’s resource efficiency, effectively controlling environmental hazards, encouraging FGI, and transforming the industry towards green innovation. At this point, we combined the narrow and weak version of Eco-efficiency theory with the “Porter Hypothesis” framework that ER stimulates firms’ innovation and stringency of ER promotes innovation (Porter 1991). Therefore, we construct a research question: “To what extent is the US RGGI promoting the firm’s green innovation initiatives?” We focus on the US RGGI instead of the other environmental regulations. We used FGI as a replacement for innovation initially considered in PH, extending PH, and providing empirical evidence from the F500 companies like all other ETS.

Past empirical studies on market-based carbon schemes and green innovation

Many regulations (national or regional) have been enacted to limit the use of fossil fuels in the production process, encourage the use of renewable energy, and assure environmentally friendly technology development or adoption. Regarding ERs, flexible regulations provide businesses with more flexibility and effectiveness (Ramanathan et al. 2018). Along with flexibility, ETS is one of the politically viable programs due to cash rebates (or “carbon dividends”), which help reimburse proceeds for public benefits while meeting low GHG emission goals (Raymond 2019). The ETS programs covered the power sector (except Tokyo and Saitama), aiming to reduce GHG emissions from fossil fuels in the power generation and transmission process. In principle, the cost of ETS allowances offers many incentives for the power industry to reduce emissions through investment in less carbon-intensive power generation, demand reduction, or transmission switching to a low-carbon power source (Luca et al. 2020). To accomplish this, all key ETS initiatives, including the RGGI, aim to promote energy efficiency, renewable energy, low-carbon innovation, direct energy bill assistance, and other greenhouse gas reduction programs (RGGI Inc. 2022).

The impact of the EU-ETS and the CN-ETS on green innovation was emphasized in the recent literature, and they focused on macro and micro levels with innovations. In the case of the micro (firm)-level, Calel and Dechezlepretre (2016) found a positive relation between EU-ETS and green innovation. However, green innovation was also found to have no connection with EU-ETS (Lofgren et al. 2014). In the case of the CN-ETS, authors also found similar inconclusive findings, for instance, positive (Ning et al. 2022; Zhu et al. 2019a), negative (Chen et al. 2022; Zhang et al. 2019b), mixed or inverted-U and U-shaped (Peneder et al. 2022; Song et al. 2020; Zhang et al. 2022a; Zhuge et al. 2020), no effect or not significant (Shen et al. 2020b; Wu and Lin 2022). Thus, the impact of ETSs on green innovation remains inconclusive and varies in terms of geographical and sectoral heterogeneity.

Researchers also attempt to measure ETS’s direct and indirect (spillover) impact on CO2 emissions and environmentally friendly technology development. In this vein, proactive firms’ participation in GI helps meet the regulatory burdens, improve energy efficiency, and reduce waste (Li et al. 2018a). The legislative enforcement of economic and social pressure is also driven to pursue sustainable growth FGI (Saunila et al. 2018), which helps improve the firm’s ecological performance (Guoyou et al. 2013). Besides the firm’s internal and external resources, market-based mechanisms also play a vital role in promoting FGI (Cai and Li 2018). Also, the market-based policy has spillover effects on the green innovation of neighboring provinces in China (Liu et al. 2022). Thus, the impact of ETS is not limited to the regulated states and sectors but is also found to be effective in stimulating green innovation in the non-regulated regions and sectors.

The RGGI has been examined regarding sulfur dioxide (SO2) or nitrogen oxides (NOx) emissions, social benefits, carbon leakage, infant mortality, merger incentives, and political advantages. For instance, Chen (2009) and Chan and Morrow (2019) identified the undesirable consequences of RGGI implementation and concluded that CO2 leakage and SO2, NOx, is associated with carbon allowance price. Along with meeting short-term emissions targets, the ETS creates economic incentives that shift long-term production capacity toward low-CO2-intensive technologies (Chen 2009). Additionally, lowering the expense of regulation enables regulated enterprises to have greater discretion in doing business (Huber 2013). As a spillover of RGGI, Creti and Sanin (2017) investigated merger incentives and found a new insight for understanding many mergers in the presence of a tradable emission permit market. In addition, RGGI significantly reduces child mortality by lessening air pollutant concentrations (Lee and Park 2019). Cap-and-trade programs provide a political advantage, thus, widely accepted by many constituents due to their ‘double dividend’ scope. It creates opportunities to redistribute the carbon revenue to citizens and enhance investment ability for low carbon technologies, helping achieve climate change or emission goals (Raymond 2019). Also, a theoretical foundation assuring that market-based regulation has a significant relationship with an FGI. Therefore, we presume that RGGI must encourage green innovation in the US F500 companies within the regulated states. Thus, based on the above analysis, the first hypothesis is stated as follows:

-

Hypothesis (H1): The US Regional Greenhouse Gas Initiative (RGGI) affects firms’ Green Innovation.

ETS-energy intensive industries and GI nexus

This study considers energy-intensive industries consuming the bulk of energy in production activities and energy expenditures proportionately related to the total output. In the post-industrial era, industrial activities are the critical basis of economic prosperity, and energy is the lifeblood of industry (Michielsen 2013). For instance, the production processes and manufacturing actions significantly consume almost 90% of the total industrial energy consumption (Salahi and Jafari 2016). The transportation, electric power, and industrial sectors consume more than 91% of total annual energy in the US (EIA U 2019). Consequently, these sectors are responsible for around 72% of total yearly GHG emissions in the USA (EPA 2020). As discussed above, the RGGI was implemented to lessen GHG emissions from the electric power sector. However, fossil fuels are the most significant energy source for electricity generation, and almost two-thirds of electric generation (63%) depend on fossil fuels (EIA US 2019). Usually, the effect of large quantity production is high-energy consumption, which leads to heavy pollution (Bai et al. 2019). Green innovation is a well-accepted alternative approach to solving this problem (Huang et al. 2019). As discussed above, the P.H. states that stringent ER promotes firms’ innovation. The impact of EU-ETS on technological innovation is significant in the energy-intensive industries compared to less energy-intensive industries (Ajayi and Reiner 2020). However, green innovation is significantly different from traditional innovation because of its double externality characteristics such as negative and positive externalitiesFootnote 3. Therefore, considering the emission effects of energy-intensive industries, this study considers another hypothesis which is stated below:

-

H2: The US RGGI does affect firms’ green innovation more in the energy-intensive sectors than the less energy-intensive firms.

Variable, data, and research methods

Variable measurements and descriptive statistics

At the outset, the Pollution Abatement Costs and Expenditures (PACE) survey was used by many researchers to measure the environmental attitude or firms’ green activities. However, PACE is insufficient to measure firms’ green activities because of poor data quality (Jaffe and Palmer 1997). A few recent studies used ‘green keywords’ to separate the green patents from the total patent (Li et al. 2019; Zhang et al. 2019b). However, we believe that this keyword approach has two specific limitations: first, WIPO and OECD have classified the green patent with unique International Patent Classification (IPC) in 2010 and 2015, respectively. Second, one/two words are insufficient to reveal the identity of the whole patent. To overcome this challenge, like Ghisetti and Quatraro (2017) and Yang et al. (2020), this study quantified each sample firm's year-wise green patent application as per WIPO’s green inventory. Table 1 depicts all variables' measuring tools and methods and summary statistics.

This study considers 7780 firm-years for 389 F500 listed firms. The results show that the mean of GPAT is 2.63 with an 11.48 standard deviation, the minimum is 0.00, and the maximum value is as high as 224, signifying a difference among the firms’ green patents. Still, green patent activities are less common than patent activities by corporate entities. For instance, Zhang et al. (2019a) measured a firm’s green innovation with so-called keywords for green patents and experienced zero up to 75% (P75=0.00) of sample firms. A substantial difference in the SD of control variables indicates a significant performance gap among the firms though ranked in F500. We found all the control variables and dependent variables are stationary as per Levin, Lin, and Chu (LLC) and Phillips–Perron Fisher tests.

Data description

We select the states based on the firm’s headquarters location of the F500 companies, then classify the companies based on the RGGI implementation year and the participating states. This selection strategy provides us with three specific benefits. First, the selection of firms before states allows for avoiding self-selection bias, as we are interested in comparing the treatment effect of RGGI states and others. Secondly, invention and patent applications are costly initiatives (Zhang et al. 2019a). Hence, economic stability is positively correlated with a firm’s innovation activities. Besides, F500 companies are ranked by total revenues, which helps the firms widen patent activities and green patents. Thirdly, to select the high innovative firms viz. about 35% of global top innovators are US companies (Derwent-Index 2019), most of them ranked in F500.

Initially, we found 1007 US companies that appeared in the US Fortune 500 from 2000 to 2019 and used specific criteria for finalizing our sample companies. We excluded 151 financial companies for the high-scaled leverage difference and 371 ‘Delisted or Merged’ companies for data complexity. Meanwhile, we omitted 98 companies for another three reasons: founded after 2009, changed headquarters location, or found less than three times in the F500 list. Moreover, we exclude 38 companies established before 2009 but changed headquarters location from regulated states to non-regulated states after the implementation of RGGI in 2009. Finally, we selected 389 firms that are listed and did not change headquarters location and represent 38 US states, and 84 companies from regulated, whereas 305 companies are from non-regulated states. Besides, in terms of the ‘North American Industry Classification System (NAICS)’ sectoral classification, we found that 40% of sectors are energy-intensive (i.e., 7 out of 15 industries) compared to 8 less energy-intensive industries (for details see Table 2 in supplementary online documents). For the classification of energy and less energy-intensive sectors, we follow the high emitting sectors as per US environmental protection agency (EPA 2017; Gerres et al. 2019).

We used multiple databases for the RGGI firm’s classification and F500 companies. Firstly, the official website of RGGI, the US-EPA, and Fortune 500 used the status of RGGI, state-wise CO2 emission data, and the rank of F500, respectively. Secondly, the European Patent Office (EPO)Footnote 4 and USPTO have gathered patent information. We classified the green patents from firms’ total patents (as a proxy of GI) based on IPC’s green inventory defined by WIPO and ‘Refinitiv Eikon and Datastream’ for all control variables.

Research methods

DID model specification

Like all other market-based schemes, the ultimate target of the RGGI is to hold an upward trend in CO2 emissions. Meanwhile, as RGGI is principally induced to lower CO2, green innovation is also a commonly accepted measure to help the firm improve environmental performance. Sequentially, GI helps the firms boost their ecological consciousness, leading to energy efficiency and CO2 emission performance. Thus, the implementation of RGGI should be considered a quasi-natural experimental process. In this view, the study set ‘Green Patent (GPAT)’ as a random variable of FGI. Principally, RGGI (regulated) = 1 and RGGI (regulated) = 0, accordingly, indicating the firms whose headquarters are located within the covered RGGI states (also identified as a treatment group) and those that are not covered (the control group). Here, the notion is that only treated or regulated firms are affected by RGGI, i.e., firms located within the regulated states are affected and treated as regulated firms. Therefore, the consequence of RGGI on the FGI of the treatment group is E (Green Patent|Regulated = 1) and E(Green Patent|Regulated = 0) for the control group. Hence, the study obtains the causal relationship of the RGGI on the sample firms. That is, the pure effect of RGGI on FGI of the treatment group is:

Based on the quasi-natural experiment of RGGI, induced in January 2009, we define 2000–2008 as a ‘Pre-Treated,’ 2009–2019 as a ‘Post-Treated’ both in the treatment and control group. Then, the study estimates the pure effects of RGGI on the GI (GPAT) of F500 companies by comparing the difference between the treatment group and the control group Pre (before) and Post (after) the implementation of RGGI based on difference-in-difference concepts such as

Therefore, the study used the DID model that is specified as follows:

Where, Ynst is the firm’s total green patents in state ‘n’ in year ‘t’. RGGInt is a regulation dummy variable that equals 1 for RGGI states (10 northeastern states) and ‘0’ otherwise. Y. D.t is a year dummy variable that equals ‘1’ when YD ≥ 2009 and ‘0’ otherwise. RGGInt × Year Dummyt is the interaction term with a combination of RGGI states and the year when the policy is initiated, i.e., RGGInt × Year Dummyt = (RGGI × YD). Xnt indicates specific control variables, γn and δt are the vectors of year and sector dummy variables representing year and sector fixed effects. The coefficient β3 signifies the effect of RGGI on FGI by counting the difference before and after the implementation of RGGI between the treatment group (RGGI States) and control group (Non-RGGI States).

Parallel trend assumption and test

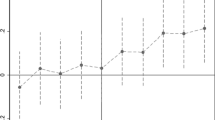

DID is one of the most used methods to evaluate specific policies and make the empirical results more robust but has some causal effects like common trend assumptions and other linear regression assumptions (Angrist &Pischke 2008). We used the parallel trend test before calculating the average treatment effects (ATE) of RGGI to confirm the common trend pre-intervention period from 2000 to 2008 (results not reported here but available in the Supplementary information, see: model 1, and model 2 in Table 3). Fig. 1 represents the average treatment effects between the treated and control group, which estimates the coefficient of β3 in Eq. (2). We found that none of the point estimates fluctuates from zero by more than two standard errors and conforms to the common trend hypothesis. Therefore, Fig. 1 shows that GI was equivalent in both treatment and control groups before the installation of RGGI.

Parallel Trend Test. Data are for 2000–2019 of 389 fortune 500 firms. Point estimates by year are of β3 in Eq. (2), illustrating average treatment effects (ATE) on firm GPAT difference between regulated and non-regulated states compared to the base year of 2009. Vertical segments capture two standard-error confidence intervals

The DID-based on Propensity Score Matching (PSM)

Despite its popularity, DID suffers from endogeneity problems in a policy or treatment (Besley and Case 2000). We calculate the DID as prescribed by Brewer et al. (2018), and Wooldridge (2021) to minimize the serial correlation and others. However, there are visible variations in the treatment and control group characteristics while conducting causal analysis through the DID method. Like CN-ETS, the RGGI is also a pilot for specific states designed within a quasi-experimental framework (Lee and Park 2019; Qu et al. 2022). Therefore, we are concerned about the chances of an unobserved treatment effect and reverse causal relationships during this research (Zhang et al. 2020b). To evade the unobserved treatment effects and change the causal relationship, we consider the Propensity Score Matching (PSM) method to estimate the propensity scores for every F500 firm and then screen out F500 companies with no systematic difference in the propensity scores (PS). Thus, we attain control of the self-selection bias goal (Zhang et al. 2020b). In line with the observable individual characteristics, self-selection bias defines as a nonrandom selection of F500 companies. It means RGGI is not a single reason but other firms’ characteristics (control variables) that influence the FGI. In this vein, we used PSM to confirm the effect of RGGI on the FGI is not disturbed because of self-selection bias.

Based on PSM, this study selects the firms from the control group (non-RGGI states) that are similar in individual characteristics to firms from the treatment group (RGGI states) instead of original comparing samples. So far, this study can keep control of the self-selection bias effect, but the time and the group-specific difference remain, for instance, firm heterogeneity between the firms from RGGI states and the non-RGGI states. Non-overlapping bias and the density weighting bias could result if such differences correlate with the dependent variables’ dynamics (Abadie and Imbens 2011). Additionally, PSM is not well-suited to take advantage of long time series, and while DID can, it relies on parallel pre-intervention trends between the treated and control groups. Panel data is a better option to minimize treatment endogeneity issues than repeated cross-sections, and PSM can better tackle endogeneity issues than DID. Like Zhang et al. (2020b), this study estimates the propensity score for RGGI regulated and unregulated firms. Finally, we use PSM-based DID with 20-year panel data to ensure the accurate and precise estimation of the pure effect of RGGI on an FGI, which can yield more robust results in the following sections.

Results analysis and discussion

The effect of RGGI on firms’ green innovation in US Fortune 500

According to Equation (2), the coefficient of β3 signifies the impact, and we run a total of 6 models with different inclusions; Table 2 illustrates the results. Model 1 is a benchmark model that does not contain any control variables and fixed effects. In contrast, Models 2, 3, 4, and 5 either add the control variables or time/sector fixed effects in turn, while model 6 considered all control variables, year, and sector fixed effects. Column (1) represents model 1 which reveals the average impact of the RGGI on FGI by controlling for individual outcomes. The results of the benchmark regression show that the expected coefficient of the policy interaction term on a firm’s green patents initiatives is −0.09241, and it is highly statistically significant, i.e., significant at a 1% level. It indicates that the implementation of RGGI does not encourage GI activities through green patents of F500 enterprises during the study period. Results remain steady in the combination of different inclusions, i.e., indicating that DID in benchmark regression is relatively robust at the primary stage. Finally, RGGI has a significant negative impact on the GI regardless of whether control variables and the fixed effects are considered.

Impact of types of economic sector with difference-in-difference-in-difference (DDD)

Empirically, some firms are less energy-intensive but recorded a high level of a green patent applications. Therefore, this study used the DDD method for analysis to remove sectoral interference that may cause an inconsistent green patent between the treatment and control group. At this point, we create another dichotomous variable, 1 for the energy-intensive sectors, 0 otherwise. Hence, the DDD model is constructed as follows:

The outcome variable is GPATitc for an individual firm i at year t in group c (treatment or control) and subgroup (s) denoting energy-intensive sector.

where the definitions of all other variables are the same as Equation (2) and our concern in the coefficient β1. Table 3 depicts a total of 5 models where models 1 to model 4 (represented in columns 1–4) illustrate the estimation of the average treatment effect of DDD with different inclusions. All the desired coefficients (β1) are negative but statistically insignificant; indicating that the RGGI has no significant influence in the energy-intensive sectors compared to less-energy-intensive sectors. Moreover, the co-efficient and sign of the interaction term (RGGI × Year Dummy) of DDD remain the same as in benchmark models, which is also another proof of the robustness of the benchmark model. Some other similar mixed findings of sectoral analysis support our result (Li and Zeng 2020; Song et al. 2020; Stoever and Weche 2018; Zhuge et al. 2020).

Robustness test

Alternative measures of firm’s green innovation

In this subsection, we retest our benchmark DID regression results and provide supporting evidence that RGGI deployment reduces the firms’ green innovation. We show evidence that our primary findings are unaffected by the addition of control variables, sector, and year-fixed effects. Also, we used correct standard errors for clustering at the firm level, as proposed by Wooldridge (2021). For brevity, the table only presents the coefficients on the variables of interest. For further cross-validation, we use alternative measures of a firm’s green innovation, such as sector-adjusted green innovation and the proportion of the total green patents to total patents. First, few studies used a firm’s industry-adjusted R&D expenditures as a proxy for innovation (Gamble 2000; Liu et al. 2019). However, R&D expenditures are considered an input for a firm’s innovation activities; thus, innovation should be measured by a firm’s registered patent activities (Lin et al. 2019). Another recent study used industry-adjusted eco-innovation scores for eco-innovation (Zaman et al. 2021). Even though the eco-innovation score shows how well a company can lower its customers' environmental costs and burdens, it is not a good way to measure a company's green innovations. Therefore, we construct an output-based sector-adjustedFootnote 5 green innovation, which captures the relative green patent activities of a firm relative to sector peers. Specifically, we calculate the sector average green patents for each sector and year and deduct this average score from the firm-level green patents for a particular year (sector adj. green innovation).

Second, another commonly used proxy is a proportion of a firm’s total to green patents (Amore and Bennedsen 2016; Chen et al. 2021; Qu et al. 2022). We calculate the ratio of the firm’s total successfully registered patents to green patents (patent-to-Green Patents) for each firm from 2000 to 2019. Table 4 summarizes the findings using alternative measures for the firm’s green innovation. The results demonstrate that our conclusions remain qualitatively unchanged when utilizing different measurements.

Joint support hypothesis test based on PSM-DID method

As discussed above, the DID method is not free from selection bias problems, serial correlation problems, and asymptotic distribution. We used bootstrapping in the Kernel ‘Probit’ and ‘Logit’ regression to overcome the asymptotic distribution problem (Angrist and Pischke 2008). We preferred PSM-DID to minimize data inconsistency, serial correlation, and self-selection bias. To reduce the data error rate after matching and enhance the validity for checking the robustness of DID, we run jointly support hypothesis tests and found all the control variables are statistically insignificant in the ‘Matched’ condition compared to the ‘Unmatched’ condition. Fig. 2 depicts SD before and after comparing all variables (DV, CV) and shows that the joint support hypothesis test is passed. We found similar results (not reported here but available in supplementary online documents in Table 7 and 8).

Before PSM-DID base regression analysis, we used kernel density propensity matching to check the treatment and control groups (shown in Fig. 4). After matching both groups, the probability density of the propensity scores has mandatorily been consistent (shown in Fig. 3), signifying that the matching effect is improved (compared to raw and matched), allowing us to apply PSM-DID as the robustness of benchmark regression.

After minimizing data error rate and improving data similarity through jointly supporting hypothesis test and Kernel Distribution of Propensity Score, we regress (both the Probit and the Logit) again based on PSM-DID, and the results are shown in Table 5. These results revealed that the estimated coefficients of the interaction term (RGGI × Year Dummy), symbols, and significance levels (in Logit) of the ‘Epanechnikov’ kernel matching method is consistent with the benchmark DID results. This result reinforced the benchmark DID regression, meaning that the RGGI has no remarkable impact on GI (GPAT) of F500 companies during the study period, which is also another evidence of the robustness of the benchmark regression results based on DID test revealed above.

Further robustness tests

Firstly, every state has legislative autonomy that may create unobservable state features and influence FGI initiatives. Hence, we introduced the “Pro-State Feature,” including state fixed effects and control variables, to control the state’s characteristics, and observed no significant difference (available in Table 10 in the supplementary material). Secondly, we noticed a global financial crisis within our study period. We tested the hysteresis effects and obtained similar results (not reported here but available in Table 10 in supplementary material). Possibly, some unobservable confounders may influence the GI of RGGI-covered F500 companies. A two-step system GMM estimator is appropriate to avoid the effects of unobservable confounders in innovation studies, especially in firm-level research (Zhang et al. 2020b). We also examined these and found no significant difference (see detail in Table 11 in the supplementary document). Based on Equation (2), we examined 15 economic sectors to estimate the impact of RGGI on FGI. We found significant sector-wise heterogeneity, i.e., the RGGI has a different effect on the FGI in their respective production line (results available in supplementary material in Table 12). Specifically, we found only five sectors positively impacted, including the manufacturing industry. Still, two-thirds of the sectors (10 out of 15) have experienced a negative trend, though insignificant. Hence, this can be evidence supporting baseline regression that the RGGI failed to encourage green innovation in F500 companies.

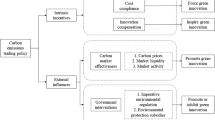

Possible reasons for detrimental effects

The implementation of RGGI significantly hampered the green innovation activities of the firms, as seen in the previous analysis, ensuring that the firms did not reduce their carbon emissions through green and low-carbon technological innovations. According to the Porter Hypothesis, strict but flexible and well-managed environmental regulation can spur a firm’s innovation (Porter and Van der Linde 1995). We investigated the effects of the US RGGI designed as market-based trading schemes, commonly recognized as efficient, effective, convenient, and politically viable over other environmental policies. RGGI is working on a cap-and-invest mechanism that helps authorities profit from carbon auctions. Leaders are committed to investing more than 85% of the proceeds in improving renewable energy and energy efficiency for less environmentally hazardous developments, technological advances, low-carbon fuel-switching, and even direct bill assistance to residents. Thus, these initiatives must help the firms to encourage green innovation.

However, the properties of market-based programs can hinder the firm’s innovation activities, such as free allocation or grandfathering; allowances are allocated in proportion to historical emissions. For instance, the free allocation of carbon permits was identified as one of the causes of the detrimental effects of EU-ETS on low-carbon investments and innovation (Teixido et al. 2019). Unlike the EU-ETS and CN-ETS (pilot), the RGGI is different due to fully auction-based programs (Borghesi &Montini 2016). Additionally, the infancy of regulation leads to the insufficiency of enforcement and market supervision which was pointed out as one of the reasons for the negative of CN-ETS (pilot) on green innovation of Chinese firms (Chen et al. 2021). However, the RGGI has passed over a decade; thus, there is no regulatory infancy problem.

Thus, we ask: which inherent issues play a role when firms are involved in green innovation within a new era of market-oriented environmental policy? We combine and explore the existing literature mainly from the following three aspects. First, one possible reason may be the narrow coverage of the economic sector. Specifically, the RGGI authorities have been strict with single sector coverage, such as the electric power sector, since 2009. For instance, the deployment of RGGI led to an increase in “electricity imports” from bordering states and a surge in power output and CO2 emissions outside the RGGI states (Lee and Melstrom 2018). Switching manufacturing operations (or electricity import) to non-regulated jurisdictions is called emission leakage, and emission reductions are achieved primarily through this leakage (Huang and Zhou 2019). Thus, the firm’s management might realize that RGGI authority is contented with the current coverage and CO2 reduction target through emission leakage, which may lead to keeping the firm away from expensive innovation attempts like green innovation. Second, another reason may be political readiness, political willingness, or political instability that reduces the consumption of clean energy (Raymond 2019; Sohail et al. 2022). For instance, the political dilemma of environmental reform may make the firm's management believe that the US federal government was ready to back away from the Paris Agreement in the middle of 2017 and rejoin it under a new government.

Third, firms’ participation in the auction on the carbon trading market may result in a drop in cash flow and anticipated earnings. Therefore, firms may have a detrimental effect on their investment in R&D, leading to a decline in the number of green patents. The "offset effect" implies that firms will move investment from innovative ventures to pollution-control programs in response to a rise in pollution costs (Chen et al. 2021). Also, a company's cash flow and expected profits are important factors in deciding whether or not to invest more in R&D (Brown and Petersen 2011). We employ sector-level standardized R&D and execute a DID regression with the same inclusions of control variables and sector and year fixed effects. Referring to Table 6, the calculated coefficient is −0.252 (with a p-value less than 10%), demonstrating that the pilot strategy (RGGI) has considerably decreased R&D spending. This research shows that firms trading in the carbon market have not yet reached the “weak” version of PH, as in the case of R&D promotions in the USA, and that market systems still need to be improved to reduce CO2 emissions through innovation activities.

Our findings do not standalone with the statistically significant negative relation, as previous studies concluded similarly with the adverse or inhibited impact of the ETS program on green initiatives. For instance, Eiadat et al. (2008) found statistically significant negative effects of ER on the adoption of environmental innovation strategy in the chemical industry of Jordan. Scholars also found adverse effects in the European energy sector (Bel and Joseph 2018), in the Chinese manufacturing industry (Li et al. 2018b), and in heavy-polluting industries (Fang et al. 2020). ER negatively affects the FGI efficiency in the short run (Tang et al. 2020b). Recently, a few studies also attempted to investigate the embedding effects of CN-ETS on enterprises’ GI and found no significant effect (Peneder et al. 2022; Shen et al. 2020a; Tang et al. 2021; Xing et al. 2019). Another recent study found a significant negative relationship between CN-ETS and green innovation (Chen et al. 2021). Thus, the RGGI regulatory agency should rethink stimulating a firm’s green innovation to keep the CO2 emissions trend at its target level.

Conclusion and policy implications

This research analyzed the effect of the RGGI on the green innovation of F500 companies from 2000 to 2019. We used DID regression as a benchmark model and performed multiple robustness tests to investigate this. We found that the RGGI influences FGI by approximately −0.09241, and the relationship is statistically significant at the 1% level. Indicating that the RGGI has a detrimental effect on firms’ green innovation in the RGGI regulated states compared to other US states, and examination of robustness tests confirms this statement. RGGI’s influence on different industrial levels, such as the EI and LEI sectors, was further examined using DDD and heterogeneity analysis to demonstrate the individual relationship between RGGI and specific sectors. Second, we have identified a small window of opportunity regarding the RGGI’s independent effect on the EI and LEI sectors. Additionally, the coefficient of the key interaction term (in DDD) of treatment, time, and industry (RGGI Year Dummy Sector) is negative (−0.0716), showing that the RGGI has no statistically significant impact on the EI sectors. However, we discovered a positive, statistically significant relationship in five economic sectors: manufacturing from energy- and carbon-intensive sectors; and another four sectors from less-energy- and carbon-intensive sectors (results available in supplementary online documents); implying that the RGGI failed to reduce CO2 emissions through firms’ green innovation.

Based on empirics, this study paves the way for policy solutions. First, to widen the RGGI's coverage; currently, it covers only electric power plants with a twenty-five megawatt or greater capacity in member states. Our specific recommendation is to cover more economic sectors, at least the energy-intensive sectors, which can help improve the situation. Second, prior studies confirmed the emissions leakage (the regulated regions’ abatement can be offset by an increase in emissions in the unregulated regions) as the RGGI is a sub-national climate policy. This emissions leakage may impact the price of CO2 allowances and the firm’s environmental compliance cost, which may restrict the firm’s green innovation attempt. The ideal solution is a national cap-and-trade program to avoid emissions leakage. However, due to relative political freedom for the policy-making power of each state, it is not easy to persuade. From this perspective, we expect that leaders of RGGI participating states can negotiate to widen the area coverage or at least the states where they are importing a high volume of energy. Third, the rationale mechanism to stimulate firms’ green innovation, our empirical results confirm significant adverse effects on firms’ sector-adjusted R&D investment (which is considered input for innovation activities) and green patenting activities (viewed as an output of innovation). RGGI authorities are committed and spending more than 85 percent of their auction proceeds on developing renewable energy, improving energy efficiency, technological progress, and direct utility bill assistance. However, policymakers should reevaluate the effectiveness of this spending and pay more attention to how firm-level green innovation can be stimulated. Finally, a reciprocal approach, such as a mix of subsidies or special fund allocations and market-based rules, can significantly impact enterprises' green actions (Bai et al. 2019; Li and Zeng 2020). Thus, when combined with present policies, subsidies for firms’ green innovation and special funds will improve firms' green efforts.

However, some limitations are inevitable in this study; we keep these for future researchers. First, the RGGI is applied in ten specific states only, and each state has legislative autonomy. Thus, we were conscious that any state’s features might influence FGI. In this context, we introduced and regressed with a “Pro-State Feature” and found no significant difference with benchmark regression. Nonetheless, specific state-level differences (e.g., incentives, voluntary initiatives) might have influenced FGI and kept it for future researchers. Second, some subsidiaries of a large company may have been involved in the innovation process or patent application (Capaldo and Petruzzelli 2014). We settled this issue by limiting the USA to an ‘innovator’s address.’ Then, we chose the listed companies in the US stock markets to confirm business activities but could not consider the proportion of industrial activities within regulated states and left this issue for future researchers.

Third, as R&D is the prime input of firms’ innovation, the disclosure trend of green R&D is still not enough to conduct good academic research. Thus, the gradual development of firm-level green information will be a field of research that could be carried out in the future. Fourth, in-depth industry-wise analysis with no limits to listed and non-listed or comparative impact on private and public or ‘large firm’ and ‘small and medium firm’ or ‘state-owned’ and ‘listed’ can also enrich the empirical understanding of the relationship between this policy and firms’ green behavior. Finally, different methods can be used to study the effects of a policy with comparative effectiveness. To illustrate, consider synthetic control methods for panel data-based comparative case studies.

Notes

This study considers three types of environmental regulation such as “mandatory regulation” (i.e. ‘environmental regulation’, ‘command and control based or fiscal and taxation or carbon tax or emission tax’, ‘market-based emission scheme or cap-and-trade mechanism or emission trading schemes’ and so on), “participatory regulation” (i.e. ‘R&D subsidies’, ‘pollution incentives’), and “voluntary regulation”-agreement or commitment between regulators and polluters; see details for mandatory and voluntary regulation Ren S, Li X, Yuan B, Li D, Chen X (2018) The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. Journal of cleaner production 173: 245-255. https://doi.org/10.1016/j.jclepro.2016.08.113, Zhu Y, Wang Z, Qiu S, Zhu L (2019b) Effects of environmental regulations on technological innovation efficiency in China’s industrial enterprises: A spatial analysis. Sustainability-Basel 11: 2186. https://doi.org/10.3390/su11072186, and participatory regulation Reichardt K, Rogge KS, Negro SO (2017) Unpacking policy processes for addressing systemic problems in technological innovation systems: The case of offshore wind in Germany. Renewable and Sustainable Energy Reviews 80: 1217-1226. https://doi.org/10.1016/j.rser.2017.05.280, Shen C, Li SL, Wang XP, Liao ZJ (2020b) The effect of environmental policy tools on regional green innovation: Evidence from China. Journal of Cleaner Production 254. https://doi.org/10.1016/j.jclepro.2020.120122.

See more: Ellerman AD, Montero J-P (1998) The Declining Trend in Sulfur Dioxide Emissions: Implications for Allowance Prices. Journal of Environmental Economics and Management 36: 26-45. https://doi.org/10.1006/jeem.1998.1033.

For detail see- Bai Y, Song SY, Jiao JL, Yang RR (2019) The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. Journal of Cleaner Production 233: 819-829. https://doi.org/10.1016/j.jclepro.2019.06.107

See details about the strength of this database in www.worldwide.espacenet.com

As RGGI is a sector-based regulation and covered the electric-power sector of 11 Northeastern states.

References

Abadie A, Imbens GW (2011) Bias-corrected matching estimators for average treatment effects. J Bus Econ Stat 29:1–11. https://doi.org/10.1198/jbes.2009.07333

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102:131–166. https://doi.org/10.1257/aer.102.1.131

Ajayi V, Reiner D (2020) European industrial energy intensity: innovation, environmental regulation, and price effects. Energy J 41:105–128. https://doi.org/10.5547/01956574.41.4.vaja

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The Porter Hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Policy 7:2–22. https://doi.org/10.1093/reep/res016

Amore MD, Bennedsen M (2016) Corporate governance and green innovation. J Environ Econ Manag 75:54–72. https://doi.org/10.1016/j.jeem.2015.11.003

Angrist JD, Pischke J-S (2008) Mostly harmless econometrics: an empiricist's companion. Princeton, Princeton University Press

Anser MK, Usman M, Godil DI, Shabbir MS, Sharif A, Tabash MI, Lopez LB (2021) Does globalization affect the green economy and environment? The relationship between energy consumption, carbon dioxide emissions, and economic growth. Environ Sci Pollut R 28:51105–51118. https://doi.org/10.1007/s11356-021-14243-4

Anwar A, Sinha A, Sharif A, Siddique M, Irshad S, Anwar W, Malik S (2022) The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: evidence from selected Asian countries. Environ Dev Sustain 24:6556–6576. https://doi.org/10.1007/s10668-021-01716-2

Bai Y, Song SY, Jiao JL, Yang RR (2019) The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J Clean Prod 233:819–829. https://doi.org/10.1016/j.jclepro.2019.06.107

Bel G, Joseph S (2018) Policy stringency under the European Union Emission trading system and its impact on technological change in the energy sector. Energy Policy 117:434–444. https://doi.org/10.1016/j.enpol.2018.03.041

Bernauer T, Engel S, Kammerer D, Sejas Nogareda J (2007) Explaining green innovation: ten years after Porter's win-win proposition: how to study the effects of regulation on corporate environmental innovation? Politische Vierteljahresschrift 39:323–341 Available at SSRN: https://ssrn.com/abstract=918733

Besley T, Case A (2000) Unnatural experiments? Estimating the incidence of endogenous policies. Econ J 110:672–694. https://doi.org/10.1111/1468-0297.00578

Borghesi S, Montini M (2016) The best (and worst) of GHG emission trading systems: comparing the eU eTS with its followers. Front Energy Res 4:19. https://doi.org/10.3389/fenrg.2016.00027

Brewer M, Crossley TF, Joyce R (2018) Inference with difference-in-differences revisited. J Economet Meth 7. https://doi.org/10.1515/jem-2017-0005

Brown JR, Petersen BC (2011) Cash holdings and R&D smoothing. J Corp Finan 17:694–709. https://doi.org/10.1016/j.jcorpfin.2010.01.003

C2ES (2019) Regional Greenhouse Gas Initiative (RGGI): an emissions trading case study. Center for Climate and Energy Solutions, Arlington, Virginia

Cai WG, Li GP (2018) The drivers of eco-innovation and its impact on performance: evidence from China. J Clean Prod 176:110–118. https://doi.org/10.1016/j.jclepro.2017.12.109

Calel R, Dechezlepretre A (2016) Environmental policy and directed technological change: evidence from the European carbon market. Rev Econ Stat 98:173–191. https://doi.org/10.1162/REST_a_00470

Capaldo A, Petruzzelli AM (2014) Partner geographic and organizational proximity and the innovative performance of knowledge-creating alliances. Eur Manag Rev 11:63–84. https://doi.org/10.1111/emre.12024

Cecere G, Corrocher N (2016) Stringency of regulation and innovation in waste management: an empirical analysis on EU countries. Ind Innov 23:625–646. https://doi.org/10.1080/13662716.2016.1195253

Chan NW, Morrow JW (2019) Unintended consequences of cap-and-trade? Evidence from the Regional Greenhouse Gas Initiative. Energy Econ 80:411–422. https://doi.org/10.1016/j.eneco.2019.01.007

Chen YH (2009) Does a regional greenhouse gas policy make sense? A case study of carbon leakage and emissions spillover. Energy Econ 31:667–675. https://doi.org/10.1016/j.eneco.2009.02.003

Chen YS (2008) The driver of green innovation and green image - green core competence. J Bus Ethics 81:531–543. https://doi.org/10.1007/s10551-007-9522-1

Chen YY, Yao ZY, Zhong K (2022) Do environmental regulations of carbon emissions and air pollution foster green technology innovation: evidence from China's prefecture-level cities. J Clean Prod 350:9. https://doi.org/10.1016/j.jclepro.2022.131537

Chen ZF, Zhang X, Chen FL (2021) Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol Forecast Soc Chang 168:15. https://doi.org/10.1016/j.techfore.2021.120744

Chien F, Ajaz T, Andlib Z, Chau KY, Ahmad P, Sharif A (2021) The role of technology innovation, renewable energy and globalization in reducing environmental degradation in Pakistan: a step towards sustainable environment. Renew Energy 177:308–317. https://doi.org/10.1016/j.renene.2021.05.101

Chien F, Hsu C-C, Andlib Z, Shah MI, Ajaz T, Genie MG (2022) The role of solar energy and eco-innovation in reducing environmental degradation in China: evidence from QARDL approach. Integr Environ Assess Manag 18:555–571. https://doi.org/10.1002/ieam.4500

Creti A, Sanin ME (2017) Does environmental regulation create merger incentives? Energy Policy 105:618–630. https://doi.org/10.1016/j.enpol.2017.01.057

Dangelico RM, Pujari D (2010) Mainstreaming green product innovation: why and how companies integrate environmental sustainability. J Bus Ethics 95:471–486. https://doi.org/10.1007/s10551-010-0434-0

Derwent-Index I (2019) Derwent Top 100 Global Innovators 2018-2019. Clarivate Analytics

Driessen PH, Hillebrand B (2002) Adoption and diffusion of green innovations. In: Bartels GC, Nelissen WJA (eds) Marketing for sustainability: towards transactional policy-making. IOS Press, Amsterdam, pp 343–355

EIA U (2019) U.S. energy consumption by source and sector. In: Energy USDo (Hrsg.). U.S. Energy Information Administration, Washington DC 20585

EIA US (2019) Electricity explained - basics. In: Administration EI (Hrsg.)

EIA US (2021) Carbon dioxide emissions from fossil fuel consumption, energy-related CO2 emission data tables. U.S. Energy Information Administration, United States

Eiadat Y, Kelly A, Roche F, Eyadat H (2008) Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J World Bus 43:131–145. https://doi.org/10.1016/j.jwb.2007.11.012

Ellerman AD, Montero J-P (1998) The declining trend in sulfur dioxide emissions: implications for allowance prices. J Environ Econ Manag 36:26–45. https://doi.org/10.1006/jeem.1998.1033

EPA US (2017) Sources of greenhouse gas emissions. In: Agency EP (Hrsg.). EPA, USA

EPA US (2020) Inventory of U.S. greenhouse gas emissions and sinks. In: Agency EP (Hrsg.). The U.S. Environmental Protection Agency, Washington DC, United States of America

Fan M, Yang P, Li Q (2022) Impact of environmental regulation on green total factor productivity: a new perspective of green technological innovation. Environ Sci Pollut R 16. https://doi.org/10.1007/s11356-022-19576-2

Fang Z, Bai H, Bilan Y (2020) Evaluation research of green innovation efficiency in China's heavy polluting industries. Sustainability-Basel 12:21. https://doi.org/10.3390/su12010146

Fang ZM, Kong XR, Sensoy A, Cui X, Cheng FY (2021) Government's awareness of environmental protection and corporate green innovation: a natural experiment from the new environmental protection law in China. Econ Anal Policy 70:294–312. https://doi.org/10.1016/j.eap.2021.03.003

Fell H, Maniloff P (2018) Leakage in regional environmental policy: the case of the regional greenhouse gas initiative. J Environ Econ Manag 87:1–23. https://doi.org/10.1016/j.jeem.2017.10.007

Flachsland C, Pahle M, Burtraw D, Edenhofer O, Elkerbout M, Fischer C, Tietjen O, Zetterberg L (2020) How to avoid history repeating itself: the case for an EU Emissions Trading System (EU ETS) price floor revisited. Clim Pol 20:133–142. https://doi.org/10.1080/14693062.2019.1682494

Fussler C, James P (1996) Driving eco-innovation: a breakthrough discipline for innovation and sustainability. Financial Times/Prentice Hall

Gamble JE (2000) Management commitment to innovation and ESOP stock concentration. J Bus Ventur 15:433–447. https://doi.org/10.1016/s0883-9026(99)00037-3

Gerres T, Avila JPC, Llamas PL, San Roman TG (2019) A review of cross-sector decarbonisation potentials in the European energy intensive industry. J Clean Prod 210:585–601. https://doi.org/10.1016/j.jclepro.2018.11.036

Ghisetti C, Quatraro F (2017) Green technologies and environmental productivity: a cross-sectoral analysis of direct and indirect effects in Italian regions. Ecol Econ 132:1–13. https://doi.org/10.1016/j.ecolecon.2016.10.003

Guoyou Q, Saixing Z, Chiming T, Haitao Y, Hailiang Z (2013) Stakeholders' influences on corporate green innovation strategy: a case study of manufacturing firms in China. Corp Soc Resp Env Ma 20:1–14. https://doi.org/10.1002/csr.283

Haapala KM (2017) Reclaiming the atmospheric commons: the regional greenhouse gas initiative and a new model of emissions trading. Carbon Manag 8:109–110. https://doi.org/10.1080/17583004.2017.1285179

Horbach J, Rammer C, Rennings K (2012) Determinants of eco-innovations by type of environmental impact—the role of regulatory push/pull, technology push and market pull. Ecol Econ 78:112–122. https://doi.org/10.1016/j.ecolecon.2012.04.005

Hu GQ, Wang XQ, Wang Y (2021) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ 98:13. https://doi.org/10.1016/j.eneco.2021.105134

Huang L, Zhou YS (2019) Carbon prices and fuel switching: a quasi-experiment in electricity markets. Environ Resour Econ 74:53–98. https://doi.org/10.1007/s10640-018-00309-4

Huang ZH, Liao GK, Li ZH (2019) Loaning scale and government subsidy for promoting green innovation. Technol Forecast Soc Chang 144:148–156. https://doi.org/10.1016/j.techfore.2019.04.023

Huber BR (2013) How did RGGI do it? Political economy and emissions auctions. Ecol Law Q 40:59–106

Huo C, Hameed J, Sharif A, Albasher G, Alamri O, Alsultan N, Nu-a B (2022) Recent scenario and nexus of globalization to CO2 emissions: evidence from wavelet and Quantile on Quantile Regression approach. Environ Res 212:113067. https://doi.org/10.1016/j.envres.2022.113067

ICAP. 2021 Canada - Québec Cap-and-Trade System, International Carbon Action Partnership

Jaffe AB, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79:610–619. https://doi.org/10.1162/003465397557196

Kemp R (1997) Environmental policy and technical change: a comparison of the technological impact of policy instruments. Edward Elgar, Cheltenham, UK

Kesidou E, Wu LC (2020) Stringency of environmental regulation and eco-innovation: evidence from the eleventh Five-Year Plan and green patents. Econ Lett 190:5. https://doi.org/10.1016/j.econlet.2020.109090

Lahteenmaki-Uutela A, Yliskyla-Peuralahti J, Olaniyi E, Haukioja T, Repka S, Prause G, Gonzalez OD (2019) The impacts of the sulphur emission regulation on the sulphur emission abatement innovation system in the Baltic Sea region. Clean Techn Environ Policy 21:987–1000. https://doi.org/10.1007/s10098-019-01684-2

Lee J, Park T (2019) Impacts of the Regional Greenhouse Gas Initiative (RGGI) on infant mortality: a quasi-experimental study in the USA, 2003-2014. BMJ Open 9:7. https://doi.org/10.1136/bmjopen-2018-024735

Lee K, Melstrom RT (2018) Evidence of increased electricity influx following the regional greenhouse gas initiative. Energy Econ 76:127–135. https://doi.org/10.1016/j.eneco.2018.10.003

Lee KH, Kim JW (2011) Integrating suppliers into green product innovation development: an empirical case study in the semiconductor industry. Bus Strateg Environ 20:527–538. https://doi.org/10.1002/bse.714

Li D, Huang M, Ren S, Chen X, Ning L (2018a) Environmental legitimacy, green innovation, and corporate carbon disclosure: evidence from CDP China 100. J Bus Ethics 150:1089–1104. https://doi.org/10.1007/s10551-016-3187-6

Li D, Zeng T (2020) Are China's intensive pollution industries greening? An analysis based on green innovation efficiency. J Clean Prod 259:8. https://doi.org/10.1016/j.jclepro.2020.120901

Li DY, Tang F, Jiang JL (2019) Does environmental management system foster corporate green innovation? The moderating effect of environmental regulation. Tech Anal Strat Manag 31:1242–1256. https://doi.org/10.1080/09537325.2019.1602259

Li LC, Lei L, Han DR (2018b) Regional green innovation efficiency in high-end manufacturing. J. Coast. Res.: 280-287. 10.2112/si82-040.1

Li X, Ozturk I, Ullah S, Andlib Z, Hafeez M (2022) Can top-pollutant economies shift some burden through insurance sector development for sustainable development? Econ Anal Policy 74:326–336. https://doi.org/10.1016/j.eap.2022.02.006

Lin WM, Chen JL, Zheng Y, Dai YW (2019) Effects of the EU Emission Trading Scheme on the international competitiveness of pulp-and-paper industry. Forest Policy Econ 109:9. https://doi.org/10.1016/j.forpol.2019.102021

Liu BH, Huang W, Wang L (2019) Performance-based equity incentives, vesting restrictions, and corporate innovation. Nankai Bus Rev Int 10:138–164. https://doi.org/10.1108/nbri-10-2018-0061

Liu YL, Li ZH, Yin XM (2018) The effects of three types of environmental regulation on energy consumption-evidence from China. Environ Sci Pollut R 25:27334–27351. https://doi.org/10.1007/s11356-018-2769-5