Abstract

This study provides an empirical analysis of the impact of the disaster on technological innovation by employing the instrumental variable (2SLS) method and instrumental variable fixed-effect method in a panel of 45 African economies from 1990 to 2019. The empirical results confirm disaster’s negative and significant impact on innovation. A 1% increase in a disaster will lead to about − 13.750% decrease in scientific journals, − 3.302% decrease in R&D, and − 3.644% decrease in the TFP, respectively. These findings are supported by panel quantile regression. The study identifies four possible channels through which disaster lowers innovation in African economies: (i) reducing trade, (ii) total investment opportunities, and (iii) human capital. Various robustness tests support our findings. Finally, the study bolsters historical capital models for the adoption of cutting-edge technology in the building, provides critical policy recommendations on environmental laws, and advocates for disaster-response policies; decentralization of the energy industry away from disaster-affected areas for greater private sector participation; financial incentives for start-ups to facilitate trade and investment; creating a culture of prevention, preparation, and resilience at all levels via knowledge and innovation; and reconstruction as a method of establishing disaster-resistant structures and habitat to offer a safer living environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The invention of new items, equipment, and technological processes that lower the cost of extracting or creating raw materials and energy and turning those inputs into completed products are typically associated with technological innovation. Increased efficiency and improved products and services may lead to increased demand and cheaper production costs for innovative countries. Therefore, innovation is influenced by the institutional and macroeconomic environment where the firms and businesses function, possibly leading to substantial differences across countries and regions. However, growth and development economists and economic historians agree on the relevance of technical innovation for long-term economic growth. According to Cooper and Helpman (2004), total factor productivity (TFP) has significantly explained differences in income per worker and growth patterns among countries; hence, technological development is an essential predictor of TFP. According to Acemoglu (2012), “sustainable economic development necessitates innovation, and innovation cannot be divorced from creative destruction, which replaces the old with the new in the economic sphere while simultaneously destabilizing established power relations in politics.” In 2020, the World Economic Forum’s annual gathering of political and corporate leaders focused on innovation and the worldwide discussion concentrated on countries’ ability to innovate in changing circumstances. How an economy responds to megatrends like technological advancements and the dangers of climate change can determine its long-term success. This long-term success can be actualized using the following innovative metric; “R&D intensity, patent activity, tertiary efficiency, manufacturing value-added, productivity, high-tech density, researcher concentration” (Benz 2018).

The influencing factors of technological progress are mainly divided into two categories. First, the input factors of innovation, such as human development, research intensity (R&D), housing price, FDI, and financial services development, are concluded to play a significant role in innovation accomplishment (Brown et al. 2017; Perri and Peruffo 2016; Rong et al. 2016; Roper and Hewitt-Dundas 2015). Second, further studies (Lehmann and Seitz 2017; Wang et al. 2019; Wen et al. 2018, 2022) engrossed in the country’s internal atmosphere, such as “socio-cultural and political factors” promoting technical innovation. Additionally, it is well known that achieving technological progress is somewhat multifaceted. Some unpredictable influences, such as life-threatening proceedings (like disasters), may affect technological innovation and productivity in an economy such as Africa. For instance, the most serious occurrence can undermine investor trust and reduces predicted investment returns (Almeida and Montes 2020). As a result, investors shift their investments to another country. Consequently, it lessens the productive capital stock and the flow of innovations that increase productivity in a nation (Bandyopadhyay et al. 2015). These unpredictably damaging occurrences directly impact FDI (Almeida and Montes 2020). As a result, foreign nations’ capacity to produce high-quality technology is threatened, and eventually, there may be a shortage of productive foreign capital. These uncontrollable factors might boost the cost of innovation by raising transaction fees, interest rates, and lost opportunities for businesses. Therefore, a drag on the global economy might be caused by epidemics, excessive heat, droughts, extreme terrorism, and other unfavourable events (Lee et al. 2021). However, the current study examines the link between disaster and technological innovation systematically and empirically, especially in African nations, and the mediating role of trade, investment and human development. Through this research, a vacuum in the literature will be filled.

Africa’s economy comprises industry, agriculture, commerce, and human resources. Mlambo (2018) claims that the African economy has undergone numerous stages. The Stone Age gave way to the Iron Age, which witnessed the birth of agriculture. Greater political complexity and commercial activities accompany sedentary people in emerging countries. According to Coulibaly et al. (2019), the African economy expanded 3.5% in 2018. However, some major African countries have had reduced development (Singh 2019). Some studies attributed macroeconomic instability, particularly poor debt management, political and regulatory uncertainty, and fragility, to subpar growth in many African nations (World Bank 2020a). Between 2000 and 2018, the sub-Saharan African economy’s GDP averaged $1.3 trillion. According to Fig. 1, Europe and Central Asia’s GDP averaged $20.79 trillion, whereas Latin America’s averaged $5.08 trillion. This represents sub-Saharan Africa’s large yet impoverished economy. An area plagued by natural disasters, poverty, unemployment, and sickness, nevertheless working to meet the UN’s Sustainable Development Goals (SDGs). Increasing GDP cannot be overstated since it helps other development outcomes. China, for example, expanded by about 10% over four decades (World Bank 2020b).

Gross domestic product (GDP) constant trillion US$, 2000 to 2018 averaged. “ECA is Europe and Central Asia, LAC is Latin America and the Caribbean, MENA is the Middle East and North America, SA is South Asia, and SSA is Sub Saharan Africa.” Source: World Bank (2020b)

FDI has also been low in Africa compared to other worldwide areas. Figure 2 shows that from 2000 to 2018, sub-Saharan Africa received the least FDI. Latin America and the Caribbean (LAC) receive more FDI than sub-Saharan Africa, the Middle East, and North Africa combined (MENA). The low level of FDI in Africa is due to the more significant risk premium associated with the continent. Foreign investors will not invest in countries prone to natural catastrophes or political unrest, and various African nations have had low human capital development. Africa has the lowest levels of human development, such as school enrollment (UNDP 2020). As a result, Africa’s economy is doing poorly. African countries have developed various policies and programs to boost economic growth. Policies that promote education and health via social intervention include budgetary growth and regional integration. Unfortunately, the policies have been tarnished by political, economic, and natural calamities. Therefore, disasters and other politically unstable events may erode economic growth and development, reducing African countries’ wealth. Figure 3 depicts the disaster that significantly impacts the most people in each African country, with the top 10 countries by total disaster death toll in Fig. 4. Drought has wreaked havoc in southern Africa, the Horn of Africa, and the Sahel, while floods have wreaked havoc throughout central and western Africa. However, not enough academic attention has been devoted to the influence of disaster on African technical advancement.

Foreign direct investment, FDI inflow (BoP, current billion US$), 2000–2018. “ECA is Europe and Central Asia, LAC is Latin America and the Caribbean, MENA is the Middle East and North America, SA is South Asia, and SSA is sub-Saharan Africa.” Source: World Bank (2020b)

Disaster type affecting highest number of people by country (2000–2019). Source: UNISDR (2019)

Top 10 countries by total disaster death toll (2000–2019). Source: EM-DAT (2020)

Why does natural disasters are regarded as one of Africa’s most significant concerns for innovative activity? First, the most severe incident stifles investor confidence and lowers the projected investment return (Almeida and Montes 2020; Bandyopadhyay et al. 2015; Desouza et al. 2007). As a result, investors shift their investments to another country. Consequently, it reduces a country’s productive capital stock and the flow of productivity-boosting innovations (Bandyopadhyay et al. 2015). Second, severe events directly influence FDI (Almeida and Montes 2020). This eventually leads to a scarcity of productive foreign capital and jeopardizes the ability of foreign countries to provide high-quality technology. Third, an extreme event might raise the cost of innovation by increasing corporate transaction costs, borrowing rates, and opportunity costs. Therefore, epidemics, high heat, droughts, extreme terrorism, and other severe occurrences may contribute to the global economy’s drag (Albala-Bertrand 1993; Lee et al. 2021). Many studies have demonstrated the predictive potential of uncommon occurrences in predicting excess returns and volatility in financial markets (Farhi and Gabaix 2016; Gabaix 2012; Manela and Moreira 2017; Nakamura et al. 2013; Prabheesh et al. 2020). Hundreds of calamities (including earthquakes, floods, typhoons, and hurricanes) strike Africa, causing widespread devastation and detrimental to the African economy. Natural disasters distress a company’s material assets, such as buildings, equipment, and human capital, reducing its production capacity. Businesses may be forced to shut down due to these unfavourable outcomes.

Disasters may also increase poverty and reduce economic output in Africa. Destroying or damaging natural or human resources may reduce productivity. Suppose the production possibilities frontier (PPF) represents an economy’s output and that all resources are fully used. A drop in the PPF occurs when catastrophes reduce the availability of resources. With contemporary technology, all resources are entirely used. New resources or technological advances allow for more production; Given the model’s reliance on resource usage, disaster-related resource damage must affect an economy’s ability to produce goods and services. Labour force abilities, skills, buildings, equipment, and technology accessible to workers affect productivity. The amount of physical capital available to employees affects labour productivity (output per man-hour). Regardless of other conditions, workers will be more productive if they access more capital. Those with access to tools and equipment produce more than those without. Disasters change the balance of human and physical capital. The disaster’s influence on the capital-labor ratio depends on the degree of the waning and its influence on the output. For instance, a pandemic affects labor-intensive production more than capital-intensive output (information processing or industrial manufacturing). Hurricanes and tornadoes influence capital-intensive production more than labor-intensive output. When big earthquakes, floods, or volcanic eruptions inflict death and destruction, they reduce the production possibilities border. Floods, landslides, drought, and cyclones ravaged east and southern Africa areas in 2019, leaving at least 33 million people facing extreme food insecurity or worse (OCHA 2019). Southern Africa is warming twice as fast as the rest of the world (Engelbrecht et al. 2015). Multiple shocks have hit many nations, with Mozambique witnessing two powerful cyclones in the same season for the first time in recorded history. Compared to 1,021,600 at the end of 2018, these disasters displaced at least an extra 1.1 million people (Hamer et al. 2017).

To preview our findings, we find strong evidence to support that extreme events (natural disasters) have a detrimental influence on technological innovation in Africa and are in line with similar findings from developed nations (Chen et al. 2022, 2021a; Zhao et al. 2022). They offer theoretical support to predict that natural disasters may affect long-run growth through various channels and is essential to innovative activity. Our study provides the results by investigating different channels (the trade channel, the investment channel, and the human development channel) to technological innovations by showing that African countries with strong trade, investment, and HDI tend to withstand the drastic effects of disasters. For instance, African nations with a high level of open trade can withstand disaster shocks, so an increase in disaster risk from the findings has little or no effect on their level of technological innovation; conversely, African countries with a low level of trade see a significant decline in innovation as a result of an increase shocks from disaster. Natural disasters do have an impact on FDI flows (Anuchitworawong and Thampanishvong 2015). In particular, average temperature increases for manufactured and agricultural items appear to negatively impact export values (less so on imports) (Osberghaus 2019). From the investment channel, the stronger the disaster condition, the higher the cost of production and the less investment is made in information technology, physical assets, infrastructure, and human capital, which eventually results in lower innovative performance, especially in nations with a low investment plan. It also discourages saving and values of investment returns. As a result, more disasters might affect overall investment. The “risk factor” of investing in afflicted regions may be permanently increased as a result of natural catastrophes (Toner-Rodgers and Friedt 2020), and internal financing elements can have a bigger impact than external funding sources, which suggests that strengthening internal finance skills might help these governments make better use of their financial resources and increase their ability to withstand disasters (Zhang and Managi 2020). Human development channels indicate that nations with higher HDI tend to withstand natural disasters’ effects on innovation performance. But nations with low HDI get affected more by disaster shocks on technological innovativeness. Disasters seem to cause significant harm to human capital, including death and devastation, and negatively affect things like nutrition, education, health, and many activities that generate money (Baez et al. 2010). Rich- and low-income nations’ investments in human capital are vulnerable to the unequal effects of natural catastrophes, which change decisions at the household and national levels and expose them to short- and long-term losses (Onigbinde 2018). These findings contribute to the literature by empirically developing a crucial determinant of innovation in Africa and also becomes a point of reference to academics, researchers, and policymakers. This research aims to encourage the African nation to increase the investment in human capital, look for favorable conditions to attract foreign investors, and raise trade and businesses with other nations to attract R&D and technology.

Therefore, the research seeks to respond to the following questions; what is the influence of natural disasters on technological innovation, and what are the possible channels and mechanisms for the relationship between natural disasters and innovations in Africa? This research question leads to the main objective of the research, to investigate the influence of natural disasters on technical innovations in African nations and the possible channels. This is the first study empirically addresses the issue of natural disasters and innovation in Africa and finds different channels for it. The following is the framework of the analysis. The literature and hypotheses development are discussed in the “Literature review and hypothesis development” section . The “Materials and methods” section defines materials and methods and outlines the data sources and econometric methodology. Following the estimation techniques, the “Presentation and analysis of results” section discusses the results/findings, robustness checks, and the research mechanisms. Finally, the conclusion and a few policy considerations are presented in the “Conclusions and policy implications” section.

Literature review and hypothesis development

Worldwide interest in promoting commercial and technological innovations seeks to maintain or increase national competitiveness. New production and consumption patterns are necessitated by a growing understanding of the impacts of economic activity on resource use and environmental damage. The endogenous growth model emanated from the deficiencies in the Solow growth model and was pioneered by Romer (1986). In Solow’s model, only technological progress affects economic growth, which is exogenous to the model. According to Onyimadu (2015), the classical Cobb Douglas type production function exhibits a constant return to scale, leaving no incentive for economic agents in activities encouraging technological progress. Technological progress cannot be in an environment of competitive equilibrium where the factors to production are rewarded with their marginal product. The theory argues that economic growth would be propelled when a nation’s human capital is improved upon by developing new modes of technology accompanied by efficient and effective means of production. This study will discuss the endogenous growth model based on research and development models. The endogenous growth model presented is based on models developed by Aghion and Howitt (1992), Grossman and Helpman (1991), and Romer (1990). Howitt and Aghion (1998) reveal valid reasons to believe technological progress depends on economic agents’ decisions. In the Solow model, technological progress is the core of long-run economic growth, which the model cannot determine. In the endogenous growth model, technological progress becomes endogenous.

Disaster models use geographic information systems (GIS) to recreate hypothetical physical attributes of natural disasters. The hazard features are then used to assess exposed property harm, often expressed by land use or building values. These models usually measure the intensity and probability of natural disaster damage from which expected annual damage is generated, and the geographical scales ranging from small (e.g., town) to global (de Moel et al. 2015). The bulk of investigation on the indirect impacts of natural catastrophes is based on input-output (I-O) and computational general equilibrium (CGE) model projections (Koks and Thissen 2016). Like social accounting, they identify all financial flows across all economic sectors. The I-O models estimate how damages in one industry affect trade and related production output in other sectors. Conversely, CGE models estimate how natural disasters influence demand, supply, and price in varied markets in equilibrium (Koks et al. 2016). Both models say natural disasters hurt the economy (Rose 2004). These models have been used to examine the indirect economic effects of critical infrastructure failures (e.g., ports) and disruptions in a wide range of sectors (e.g., manufacturing, construction, and services) (Galbusera and Giannopoulos 2018; Koks et al. 2016; Okuyama 2007). Neoclassical Growth theory posits constant returns to scale for capital and labor, a constant savings and depreciation rate, and diminishing returns to capital. Theoretically, any capital stock or labor supply shock will gradually return to pre-disaster levels. Natural disasters’ savings, depreciation, and productivity growth are long-term economic effects (Berlemann et al. 2015). Contrarily, exogenous growth models assume rather than explain technological development entirely differently from neoclassical growth models. For example, historical capital models assume capital always adopts the latest technologies during construction (Whitaker 1966). In addition, these models assume that higher capital depreciation due to a catastrophic shock would improve productivity because technology will be updated. This is known as the “build-better” idea (Klomp and Valckx 2014).

Economic growth in the endogenous growth model is generated by enhancing a nation’s human capital by developing new forms of technology and an efficient and effective means of production. On this basis, the plethora of empirical studies, for instance (Cavallo et al. 2013; Dallmann 2019; Hsiang and Jina 2014), among others, examine the relationship between disaster and economic growth, which holds that disaster reduces long-run economic growth and as a source of firms operational cost, disaster hinders technological innovation and improvement of innovation efficiency. Catastrophes influence the economy, albeit the effects differ depending on the type of disaster and the sector of the economy. Natural disasters can have a greater influence on more sectors of the economy and have more serious economic ramifications in developing countries than in industrialized ones (Loayza et al. 2012; Porcelli and Trezzi 2019; Shabnam 2014). McDermott et al. (2014) discovered that over the medium run, natural catastrophes had persistently negative effects on economic growth in nations with low levels of financial sector development. The frequency and magnitude of disasters in the exporting country appear to have a detrimental impact on exports (Osberghaus 2019). Based on the preceding contributions, we infer that three elements influence innovation: labor, capital, and technology. According to Helderop and Grubesic (2019), hurricanes kill people and ruin infrastructure, necessitating government assistance. Destruction of infrastructure may hinder the growth of innovation and alter company innovation decisions or behavior. Furthermore, natural disasters may affect capital and R&D investment. Due to the external economic environment being affected by natural disasters, businesses may choose a cautious business strategy and not conduct new product R&D, which inhibits technological innovation. As part of extreme events, Zheng et al. (2021) examined “the effect of terrorism on green technological innovation in renewable energy technologies with a panel of 87 economies between 1991 and 2017.” They discovered that when economies face serious terrorist attacks, they respond with less green innovation in renewable energy technology, particularly in OECD nations. As a result, when confronted with potential terrorist attacks, wind energy green innovation suffers the worst setback. Terrorist attacks, they added, primarily stifle green innovation in renewable energy technologies in economies with poor green innovation performance while having minimal influence on nations with high green innovation performance. Terrorism disrupts economic performance and arms one of the drivers of long-term prosperity–green innovation (Zheng et al. 2021). This further motivated the research interest in finding the impacts of extreme natural events on African technological innovation through certain mechanisms.

The relationship between natural catastrophes and energy technology innovation is crucial in energy technological innovation theory and associated literature. Zhao et al. (2022) investigated “the influence of natural disasters on energy technology innovation by using panel data technology from 1975 to 2018 for the samples of 29 OECD countries.” Natural catastrophes, they discovered, may have a considerable detrimental influence on energy technology innovation. However, increased economic growth, trade openness, financial openness, interpersonal globalization, and political stability mitigate the consequences of natural shocks on energy innovation. Additionally, the pandemic has had the greatest detrimental effect on energy innovation. The empirical results provide compelling evidence that natural disasters have a negative impact on energy innovation, resulting in a decline in the number of patents related to energy technology, a decrease in overall R&D spending on energy technology, and a reduction in the effectiveness of energy innovation (Zhao et al. 2022). Chen et al. (2021a) studied “the influence of natural disasters on technological innovation for a panel of 49 countries.” They discovered that natural catastrophes negatively impacted technological innovation, with earthquakes, harsh weather, floods, and storms having the most impacts. Zheng et al. (2022) offer significant value for decision-makers and businesses to suggest a successful strategy to promote green innovation and raise ESG (“environmental, social, and governance”) scores as they investigated the causal relationship between ESG performance and corporate green innovation. Therefore, it is crucial to understand the factors that influence innovation. The current study determines how natural catastrophes affect Africans’ ability to innovate in the technology realm. Chen et al. (2022) conducted a study that indicated less innovation in companies with CEOs who experience natural disasters. They identified two potential pathways—CEO short-sightedness and risk-averseness—by which CEO experience with natural disasters may hinder company innovation. Extreme social and environmental occurrences have impacted Africa, which has a detrimental impact on the economy’s capacity for innovation.

The socioeconomic progress of society has benefited from technological innovation, but this development has also brought with it certain possible environmental risks. Ullah et al. (2021) investigated the symmetric and asymmetric effects of technological innovation on carbon emissions in Pakistan and discovered a short-run symmetric influence on carbon emissions. Overall, the findings indicated asymmetric impacts between technological innovation and carbon emissions from technological innovation in the long term. Their study differs from the existing work in that it attempts to establish a link between natural catastrophes and technological innovation in Africa through multiple approaches. Adewale Alola et al. (2021) showed a long-run equilibrium link between the human development index (HDI), economic growth, access to renewable energy, and technological innovation. The conclusion showed that economic growth, energy availability, and technological innovation in the studied nations lead to better HDI indices. One crucial measure of technological innovation is the HDI, which can be negatively impacted in nations where natural disasters have occurred. In the chosen blocs, having access to clean energy temporarily dampens the HDI index, but over the long term, the effect is statistically favourable (desirable) (Adewale Alola et al. 2021). Nwamaka and Orhewere (2022) promoted improving energy quality, increasing government spending on energy supply, and maximizing energy use per person to achieve economic growth. Energy-efficient nations may tend to counteract the negative impacts of environmental disruptions and advance in terms of innovation.

The economic implication of natural disasters on energy use has been proven to be negative by different researchers. However, this is mostly attributed to the adverse effect of natural disasters on energy supply infrastructures, directly affecting their use and endangering innovation and long-term growth (Miao and Popp 2014). Lee et al. (2021) drew “global evidence on the natural disaster-energy consumption nexus” and found natural disasters significantly negatively impact oil, renewables, and nuclear energy consumption. Additionally, natural calamities can disrupt the supply of electricity and cause power outages, which can cause accidents and deaths, thus reducing the country’s labor force and human capital and negatively impacting innovation performance. Rakshit (2021) explained further that the influence of natural disasters on energy use is commonly associated with power outages. This brings some economic activities such as production, transportation (movement of goods and services), banking, communication, and other activities to a halt and negatively affects the nation’s innovativeness and long-term growth. With empirical evidence, India’s GDP declined by 0.46% due to natural disasters between 1980 and 2011 (Parida 2019). The immensity of flood occurrence shows a negative and significant impact on per capita energy consumption. This reoccurrence of natural disasters destroys energy-generating infrastructures and power grids and affects energy use. He states, “such a situation can reduce both renewable and nonrenewable energy consumption and could cause India to face greater economic damage that could exceed the country’s capacity for reconstruction.” Hanif et al. (2019) discovered that consumption of nonrenewable energy in growing Asian nations increases carbon emissions, but the use of renewable energy helps limit them. They show that the exhaustion of natural resources and the strains of an expanding population are both causes of carbon emissions in emerging nations. One of Africa’s biggest problems is carbon emissions, which may be a catastrophe that prevents advancements, expansion, and development. Technology innovation may be boosted, and emissions can be decreased using renewable and efficient energy. The regional collaboration (to quicken the switch from nonrenewable to renewable energy sources and to allow the extension of green bond markets to developing countries) may prove useful for reducing carbon emissions and for boosting investment in clean energy projects (Hanif et al. 2019). Hanif and Gago-de-Santos (2017) added to the literature that limiting population growth and preserving macroeconomic stability might reduce the likelihood of economic expansion, negatively influencing circumstances of environmental degradation in emerging countries.

-

Hypothesis 1: There is a significant negative effect of the disaster on technological innovation

We believe that disasters directly reduce country's trade performance of African nations, which may not be conducive to technological innovation. As a result, disasters may substantially influence trade in several ways. For example, disasters often disrupt routine economic activity by producing a loss of production, human and physical capital, and infrastructure, resulting in an immediate fall in output (Hamano and Vermeulen 2021). Furthermore, geophysical disasters and meteorological disasters damage or restrict the usage of roads, bridges, air space, telephones, and harbors, raising the logistical and transportation costs associated with the business. However, a country hit by a large natural disaster may need immediate and long-term recovery services, increasing service imports. Some scholars think natural disasters may speed up the Schumpeterian “creative destruction” process, enabling exports to recover faster following natural calamities (Crespo Cuaresma et al. 2008; Skidmore and Toya 2002). With these conflicting factors at work, determining the net impact of natural disasters and service trade is an empirical challenge. Damage to industrial capacity and infrastructure, for example, limits exports, but rehabilitation requirements and output deficits increase demand for imports. Furthermore, a vast body of evidence indicates that reducing international commerce is not favourable to technological innovation (Aghion et al. 2005a, 2018; Navas 2015). Reduced trade openness significantly impacts FDI entrance, putting local firms at risk of financing difficulties and, as a result, lowering the degree of technical innovation (Belloumi 2014; Wang and Kafouros 2009). Therefore, reduced trade openness reduces chances for domestic firms to acquire sophisticated science and technology through learning effects or technology spillovers, raising R&D costs, lowering productivity, and ultimately being unfavorable to technological innovation (Khachoo and Sharma 2016). As a result, we argue that disasters limit trade openness by lowering the country’s trade balance and undermining the degree of technical innovation.

-

Hypothesis 2: There is a significant negative effect of the disaster on technological innovation through the trade channels.

Second, disasters are the opposite of human progress; aside from death and devastation, they also pose a major threat to the recovery of both human and material assets and have detrimental effects on “nutrition, education, health, and many income-generating operations,” even if they do not result in deaths. It turns out that several of the potentially harmful effects revealed in this literature analysis are significant and long-lasting (Baez et al. 2010; McDermott 2012). While natural disasters can influence one’s human capital all over their life, it is during the early phases that such consequences are most significant if they are not appropriately and quickly addressed. Temporary illness and hunger, for example, may have long-term implications because they tend to reverberate through later human capital accumulation activities, such as school performance, cognitive development, earnings, and productivity (Okolo et al. 2021). Natural disasters have the greatest effect on human lives, physical disabilities, and the loss or destruction of public infrastructure and private, physical, and productive capital. As in urban areas, natural disasters in rural regions may result in agricultural and animal losses and damaged houses and infrastructure. Human capital encourages technological progress by absorbing information and transforming it into production. The cost of developing a novel product is proportional to the number of creative workforces hired to manufacture it, and effective innovation is thus dependent on human capital development (Coccia 2013; Dong et al. 2016; Roper and Hewitt-Dundas 2015). Therefore, disaster lowers TFP, making physical and human capital less appealing, as stated in the theoretical model above. As a result, we predicted that labor productivity would fall when natural uncertainties are large; R&D ideas would also fall as a major output component. The manner and level of technological innovation will be harmed.

-

Hypothesis 3: There is a significant negative effect of the disaster on technological innovation through the human capital channels.

Third, we think market prices are essential signals conveying relevant information required by investors and creative sectors to deploy available resources at a reduced cost. As a result, disasters can exacerbate information asymmetry and make current market pricing less efficient, reducing overall investment and undermining innovation success. This is consistent with the assertion (Berentsen et al. 2012; Malamud and Zucchi 2019) that information frictions prevent businesses from financing R&D expenditure using debt or equity. In this situation, disasters negatively impact present and future investment, particularly R&D initiatives, which are inherently hazardous and unpredictable. Furthermore, disasters can raise production costs and force businesses to postpone long-term investment choices (Pindyck and Solimano 1993; Ramírez and Tadesse 2009), which is detrimental to technological development. Disasters, in particular, present opportunities for investors since they deplete actual savings and lower investment returns. Major storms may be costly for particular companies, such as retailers and restaurants that rely only on local consumers. Natural disasters can also influence investment decisions (Ghaffarian et al. 2021).

Furthermore, because of the extended duration of rehabilitation, there may be long-term repercussions in some sectors. Affected people are compelled to seek new means of income, move, or sink deeper into poverty without such options (de Haen and Hemrich 2007). These occurrences can reverberate across many facets of everyday life and be felt in economic and noneconomic terms. For example, COVID-19 has directly influenced many workers’ short and long-term employment chances, impacting financial resources and leading to mental and physical health concerns (Banks et al. 2020). Other natural calamities have had a similar accumulative impact. Such disasters on individual assets and the broader financial markets are a key aspect of the aftermath. As a result, disasters reduce both private and governmental investments, according to the literature. A growing body of empirical evidence indicates that a reduction in investment is not favorable to technological innovation (Khachoo and Sharma 2016; Perri and Peruffo 2016; Pindyck and Solimano 1993). Moreover, a reduction in investment severely depresses schooling and, scientific investigation capacity and social infrastructure, making the development of new ideas harder hampering creative ability (Barro 1990; Marino et al. 2016; Pradhan et al. 2018; Romer 1990). Thus, reduced private venture widens the financing opening between advanced tech industries and small-scale firms, worsening the intensity of financial friction, underinvestment and, eventually, declining innovation. We offer the following hypothesis based on these reasonings:

-

Hypothesis 4: There is a significant negative effect of the disaster on technological innovation through the investment channel.

There is little research on the link between natural disasters and technological advancement. In actuality, natural disasters may have direct and indirect effects on innovation. Difficulties in energy efficiency, trade, human capital development, and investment are factors that disasters may influence. This link between natural disasters and technological innovation is vital since both are critical to long-term economic prosperity. The existing literature has three main gaps. The first is the nature of the links between disasters and technical advancement in Africa. For example, most past research has concentrated on the causal link between disasters and economic growth but not on the influence of disasters on African innovativeness or how it may accomplish this aim. An inability to assess conditional elements is another problem that may exacerbate the effect of disasters on innovation. Consequently, this research tackles this gap in 45 African countries by using disasters to inhibit trade, human development, and investment, hindering sustainable development’s economic and innovation pillars. The net benefits of innovation are then sorted between unconditional and conditional effects. The last gap is related to earlier African disasters and innovation studies. No research on this issue has been done in Africa.

Materials and methods

Data

The data ranges from 1990 to 2019 for 45 African nations for which data is available. Technological innovation efficiency variables—number of scientific journals, research and development, and total factor productivity are sourced from World Development Indicator (World Bank 2020a) and Penn World Table (Feenstra et al. 2015). Scientific papers, a kind of academic publishing, are also the most frequent consequence of R&D operations. They play an important role in conveying and disseminating new ideas and building a sound theoretical framework for R&D methods (Liu et al. 2018). This S&E (Science and Engineering) Article indicator from Science and Engineering Indicators gathers and sorts worldwide papers, books, and conference publications, principally including articles published in journals on the Science Citation Index (SCI) or Social Sciences Citation Index (SSCI) lists. Research and development measure innovation inputs. Many empirical works have widely adopted these measures of innovative activity (Aghion et al. 2005b; Wang 2013; Wen et al. 2018). Total factor productivity (TFP) reflects an increase in output without accompanying increases in the inputs due to innovative activity. TFP indicates broader measures of innovation and can be perceived as a measure of product innovations (Fracasso and Vittucci Marzetti 2015; Hall and Lerner 2010). TFP is computed as a residual, a proxy of technological change and efficiency. This variable has an advantage over patents and trademarks since it directly captures the overall impact of technological progress in all sectors of the economy in respective types of innovation. In particular, TFP is strongly correlated with trademark applications (Duygun et al. 2016). Therefore, following Cassiman et al. (2010), we also use this variable in our robust test as an alternative measure of innovation. The disaster variable is the number of deaths from natural disasters as a share of total deaths sourced from the EM-DAT dataset (Cavallo et al. 2013).

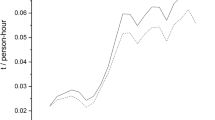

The study includes eight control variables to improve the models' goodness of fit. They include the human development index (UNDP 2020) to proxy human development, promoting technological innovation by engrossing knowledge and transforming it into productivity (Wen et al. 2022). Population rate, increase in population means more concepts and more discoverers, which can stimulate technological change (Kremer 1993; Wen et al. 2022), domestic credit to private sector % of GDP measures financial development as indicated by studies (Chen et al. 2021a; Ibrahim and Alagidede 2018; Puatwoe and Piabuo 2017; Taddese Bekele and Abebaw Degu 2021) and have found a significant influence of financial development on economic growth in African countries. Economic growth is sourced from the “World Development Indicator” (World Bank 2020a) and captured by the per capita GDP. Energy use is the GDP per unit of energy use, indicating the energy system’s possible efficiency—government effectiveness in capturing the quality of governance (Wen et al. 2021). Finally, trade is the export-import ratio to aid technology and skill transfer, fostering innovation. Investment is the total sum of gross fixed capital creation, including inventory changes and purchases, expanding the capital stock and countries’ productivity capacity (Ergashev et al. 2020). Data’s full description is given in Table 1, and Fig. 5 captures the evolution of the graph of the variables introduced in the estimation.

Econometric methodology

The instrumental variable regression is introduced. The 2SLS estimator is one of the possible IV estimators to utilize. In econometrics, it is an often-used endogenous estimator. This is due to the estimating process’s accuracy and precision. There are two phases in this process. First, we used Eq. (1) and the conventional OLS approach to regress x on z, supposing z to be a valid exogenous instrumental variable for x.

where

- z:

-

is the “exogenous instrument,”

- π1:

-

is its “coefficient,”

- π0:

-

is the “slope,” and

- ξ:

-

is” the error term” following an N(0,1) distribution

The under-identification process examines the hypothesis of no meaningful link between x and z. If there are several endogenous variables, the rank of the coefficient matrix test should be utilized (Cragg and Donald 1993). The predicted value of \({x}_i,\hat{x_i}=\hat{\pi_0}+\hat{\pi_1}{z}_i\), is then used in the proceeding stage, which agrees to the normal OLS technique of y on \(\hat{x_i}\)

when

- \({\beta}_0^{\ast }\):

-

is the “intercept,”

- \({\beta}_1^{\ast }\):

-

is the “slope,” and

- ε:

-

is “the error term” following an N (0, 1) distribution

Therefore, the regression estimator of Eq. (2) is the two-stage least square estimator:

where

- \(\hat{x}\):

-

is the “predicted regressor from the first stage, the resulting estimator of β is consistent.”

The approach may readily be extended to the case of multiple linear regression. However, given the standard normality, the OLS approach summarizes the average association between disasters and technological innovation using the conditional mean function. Secondly, the IV fixed effects model and the IV quantile regression are used in the study. IV fixed effect models are being sought because they can compensate for simultaneity/reverse causation and account for unobservable variability among African nations (Iheonu et al. 2020; Wen et al. 2022). In addition, the IV revises for endogeneity, eliminating the inconsistencies of OLS regression (Asongu 2012; Asongu and Mohamed 2013). Regressor lags may be used as instruments in the first regression in the instrumental approach. OLS regression using “heteroskedastic and autocorrelation consistent (HAC) standard errors” of the model’s regressors with their initial lags is used to construct these instruments.

This procedure is consistent with various studies (Asongu et al. 2017; Asongu and Biekpe 2018). As seen in Eq. 5, the fitted values are used as instruments for the original equations.

Innovation represents three indicators and includes the number of scientific journal papers, R&D, and total factor productivity, disaster is the total number of deaths from natural disasters as a share of total deaths, and Eq. (5) includes other covariates such as human development, population, financial development, economic growth, energy use, government effectiveness, trade, and investment. ui represents the “unobserved heterogeneity” and υi, t is the “error term.” Before estimating the IV-FE model, the cross-sectional dependence (CD) test was conducted using Ditzen (2019) procedures delineated by Pesaran (2015). This ensures the viability of the Driscoll and Kraay (1998) standard errors, which account for CD. Additionally, the IV quantile regression with fixed effects is used for robustness checks due to its ability to account for simultaneity/reverse causality, unobserved heterogeneity, and pre-existing levels of the dependent variables. The Qth quantile estimator for a dependent variable is generated by solving the optimization problem:

where 𝜃 ∈ (0, 1). The conditional quantile of the dependent variable Innovationi, t given Xi, t which is composed of the regressors is: \({Q}_{Innovation}+\left(\theta /{X}_i\right)={X}_i^{\iota}\beta \theta\). Here, each slope parameter is designed for each Qth distinct quantile (Asongu and Odhiambo 2020).

Presentation and analysis of results

Descriptive statistics

Presented in Table 2 are the descriptive statistics for each of the variables examined. It shows that the average of a scientific journal is 545.5.78. However, the standard deviation is 1560.89 among different sample countries. Also, the R&D mean and standard deviation are 0.308 and 0.195, TFP mean and standard deviation are 0.987 and 0.302, indicating less cross-country diversity, as the standard deviation value is relatively low compared to the mean values. Using the overall variables’ standard deviation, we can see that the data points are clustered closely around their respective means, showing that they are grouped close to their respective means (more reliable). The mean of the variables mirrors the actual value of the entire dataset closely, indicating a good observation. On average, the variation of the variables is well behaved. The statistics show that most variables are fairly symmetrical while others are moderately skewed, as indicated in Table 2. The kurtosis of most of the dataset is heavy-tailed relative to the normal distribution. However, Table 3 shows the association between the variables used in the study. We find no significant link between the regressors. This result reflects the absence of multicollinearity.

The study used the Pesaran (2015) CD test, which is reliable for use with imbalanced panels like the data in the study, to continue testing for CD in the modelling exercise. Table 4 shows that, with one exception, all the model variables display CD at a 1% level of statistical significance. Estimates that are CD-resistant are therefore required.

Primary findings

Table 5 presents empirical results using instrumental variable regression (2SLS). The total number of deaths as a share of total deaths from natural disasters acts as a measure of disaster. Our result presents the following major findings. Firstly, it is revealed that the unconditional effect of disaster significantly reduces all the measures of technological innovation (the number of scientific journal articles, R&D, and total factor productivity) in Africa. This result is in line with research from around the world that shows how a natural disaster hurts the development of new ideas and the economy (Abbas Khan et al. 2019). The following research results are in line with our findings, and their conclusions are pertinent: Using panel data just for the continent of Africa from 1980 to 2015, it was discovered that natural catastrophes had a considerable negative impact on economic development, growth in agricultural value-added, and growth in industrial value-added (Adjei-Mantey and Adusah-Poku 2019). Scientists have discovered that natural catastrophes (defined as “occurrences, deaths, impacted persons, and economic losses”) have a major negative impact on technological innovation, with earthquakes, scorching temperatures, floods, and storms having the biggest impact (Chen et al. 2021b). Using GeoMet data, it was discovered that catastrophes had a significant, persistent, and negative average influence on growth (Felbermayr and Gröschl 2014). Floods hurt municipal welfare and growth and local businesses’ ability to compete in domestic and global markets (Haddad and Teixeira 2015). Catastrophic disasters have a detrimental influence on the fiscal situations of the BRICS nations; however, trade openness, FDI, and economic activity improve fiscal balance in the long run (Khan et al. 2020). Major natural disasters significantly and negatively affect economic activity immediately and over time (von Peter et al. 2012). Further results show that human development, population, energy use, financial development, economic growth, and government effectiveness significantly boost the growth of technological innovation in Africa. Human development encourages innovation by engrossing knowledge and revolving it into efficiency (Wen et al. 2022). More population creates more ideas and discoverers, stimulating technical revolution (Kremer 1993). GDP per unit of energy use enables manufacturing and production processes in the areas of R&D support which is part of innovation activities (Wen et al. 2022). Financial development through financial inclusion forms a consistent attribute to innovation performance in African nations. Income and governance also facilitate innovation and productivity.

Similarly, using the instrumental variable, fixed effect regression in Table 6, disasters reduce the growth of R&D, innovation, and TFP in African nations at a 1% level, though with different magnitudes. However, the interactive effect in Table 7 shows how disasters reinforce the impact of trade, human development, investment, and energy use on innovation. This signifies that natural disasters lower trade activities (Hamano and Vermeulen 2021), negatively tampers human capital development (Baez et al. 2010; McDermott 2012), decrease investment opportunities (Ghaffarian et al. 2021), and lower the efficiency of energy use (Lee et al. 2021) as a result to destructions and poor management of African nations and these factors in turns lowers innovation performances. The control variables follow the a priori expectations. The F-statistic probability value demonstrates that all of the model’s variables together greatly impact innovation in Africa. Additionally, we discover that multicollinearity is not a major problem in the modelling, which is consistent with the correlation matrix’s findings. In conclusion, the robustness finding aligns with the primary results using IV instrumental quantile regression results. This estimation provides evidence that the magnitude of the disaster’s impact on innovation is about the same across quantiles, demonstrating that the levels of innovation in African countries are impacted at any given quantile.

Robustness checks

To describe the given dependent variable’s (scientific journal) full distribution, Table 8 shows the estimated effect of disasters on innovation. The results in columns 1–5 indicate disaster significantly lowers innovation performance by − 21.480***, − 16.460***, − 9.189***, − 17.690***, − 22.670*** percentage points. In particular, evidence from this estimation shows that the significance of the effect is almost the same across quantiles indicating that the levels of innovation are affected in African nations at any given quantiles. These findings are in line with the preliminary results.

Mechanisms

Based on the analysis, we further explore the possible mechanisms through which natural disasters may affect innovation performance, even though we cannot rule out the possibility of other mechanisms. The previous discussion states the four mechanisms by which disasters may affect innovation performance. In this section, we verify the existence of these mechanisms empirically as follows.

Trade openness

We believe that disaster can theoretically reduce the degree of trade competitiveness by putting more pressure on the production cost, future price level and currency stability, ultimately reducing technological innovation by restricting capital flows and technology spillovers. Suppose the influence channel described above is established. In that case, we draw the following inference: in the absence of any economic shocks, countries with a high degree of trade openness have a strong ability to withstand disaster shocks, and so more increased risk of disaster may have a weak or no significant impact on their level of technological innovation; on the contrary, countries with a low degree of trade openness experience a significant decline in their level of innovation following an increase of disaster. To draw the above inferences, we split the sample into two sets according to the degree of trade openness based on the median of the Trade variable. We call it a lower degree of trade openness (LTRADE) in the first group, with a median value of less than 58.813 from the 45 African country sample. We give the second group a higher degree of trade openness (HTRADE) with a median value above 58.813.

Table 9 reports the instrumental variables (2SLS) regression results from this sub-sample using the scientific journal, R&D, and TFP as dependent variables, respectively. As column 2 in Table 9 shows, the coefficient of disaster in HTRADE economies is − 14.44, − 1.618, 1.780 and statistically insignificant, which indicates that disaster has no significant impact on the innovation capacity of countries with a high level of trade openness. However, the coefficient of disaster in LTRADE economies is significant (− 25.54**, − 5.910***, and − 2.413*), indicating that disaster significantly reduces the growth rate of innovations in African countries with a low degree of trade openness. Thus, we find that the negative effects of disaster on innovation in countries are influenced by the degree of trade openness. Specifically, higher disaster conditions further worsen the trade balance in countries with low trade openness, as these countries’ R&D activities face more obstacles, which ultimately reduce their level of technological innovation. But for those countries with high trade openness, the higher trade may have no or little significant impact on their level of innovation. In summary, the above results suggest that the effect of disaster might work through the channel of trade openness.

Investment

Following the conclusion from the endogenous growth model, we show that disaster can also adversely affect technological innovation by reducing the marginal product of capital and total investment. We utilize the total investment (%GDP) to achieve this task. We divided the sample into two groups according to the total investment level in African countries (based on the median of the INVEST variable). First, we give the first group lower values defined as LINVEST, equal to economies with low-level investments with median values less than 21.002; similarly, we provide the second group higher value as HINVEST, equal to African economies with high-level investments with median values greater than 21.002. However, the coefficient of HINVEST is not significant, which means that countries with a high level of investment can absorb shocks from natural disasters from columns 1 to 3. On the other hand, in economies with a low level of investment from Table 9, we find that the coefficient of disasters is − 7.191**, − 3.314**, − 5.880* and are statistically significant, indicating that disasters significantly reduce the growth rate of innovations in target countries of Africa with low levels of total investment consistent with our prediction. Thus, we find that the level of investment influences the negative effects of disaster on innovation. Specifically, the higher disaster condition increases the cost of production, discourages saving and values of investment returns, and decreases investment in information technology, physical assets, infrastructure, and human capital, ultimately reducing innovation performance. Thus, higher disasters might work through the channel of total investment.

Human development

We also indicate that disaster and technological innovation operate by reducing human capital. We further divide countries into two groups according to the overall human development index based on median values in countries with low human capital (below the median) and high human capital (above the median). From the Table 9 reports, we find that the coefficient of disasters is − 13.36, − 3.318, − 2.302 and statistically insignificant from columns 1 to 3, which indicates that disaster has a less impact on the innovation capacity in economies with higher human development. However, the coefficient of disaster in columns 4–6 is significant (− 14.000*, 1.453**, and 5.519***), indicating that disaster significantly reduces the innovation in African economies with less human capital development; this result further implies that a significant negative relationship is strong in countries with less human capital development. Thus, we find that the negative effects of disaster on innovation operate through its impact on the human capital channel.

Conclusions and policy implications

In this research, we examine the influence of natural disasters on African technical innovation. To assess natural disasters, we use the number of fatalities as a proportion of total deaths. The number of scientific and technical journal publications, R&D investment (% of GDP), and total factor productivity are used to assess African countries’ innovativeness. Natural disaster fatalities reduce the quantity of scientific and technical journal publications, R&D spending, and total factor productivity. Both welfare-relevant TFP and panel quantile econometric techniques get the same conclusions, implying that natural disasters contribute to the hindering determinants for African nations’ innovative progress and growth. The results also indicate that natural disasters reinforce the impact of trade, investment and human development on technological innovation performance. Our empirical results suggest that disasters decrease the innovation capacity in our sample by reducing trade openness, level of investment, and human development.

First, natural disasters may result in a significant worsening of African countries’ trade balances. Imports of food, raw materials, and rebuilding materials often increase, while exports typically drop. As a result, the public debt increases as imports strain the current account and tax income declines. Moreover, sluggish export recovery may impede recovery and exacerbate the financial gap when disaster losses exceed a disaster-affected government’s fiscal capacity. Consequently, susceptibility to recurring calamities affects the medium-term capacity for technological innovation and progress. Second, natural disasters can deprive nations of foreign direct investment, while the existing investment remains at risk due to threats of natural disasters, thereby reducing investment opportunities, which is a core determinant of technical innovation. Third, natural disasters affect human capital development due to destructions of lives and properties, decrease the quest for R&D and endanger innovation progress. Fourth, disruptions and losses in the energy industry may cascade and impact the rest of the economy. For example, how quickly power can be restored affects the recovery of other sectors, including information technology, research and development. This results in energy price inflation and a decline in hydroelectric power output due to the increased operating costs associated with droughts. Therefore, our findings also indicate that the effect of the disaster on innovation varies in African countries, such as those with different trade performances, levels of investment and human development and size of the energy sector.

Thus, based on basic results and perceived mechanisms, the following policy implications emerge. The policymakers in African countries should pay close attention to natural disasters, given that innovation is a key driver for long-term economic growth. The government of African nations should continue to enhance trade openness to counteract the detrimental impact of disasters on innovation, including in regions not affected by disasters. Determining how to improve other production variables such as labor, capital, and technology is critical to the success of innovation by increasing physical and human capital investment. As the main body of technological innovation, enterprises should increase investment into independent innovation technology and product development, adhere to market orientation, and form a group of core technologies with independent intellectual property rights. Public awareness, education, preparation, and early warning systems may help communities cope with natural disasters. However, zoning, land-use regulations, and construction rules are required to avoid or limit real harm. Planning and zoning rules, for example, may prevent development in landslide and flood-prone regions, saving money and reducing loss of life, property, and natural resources. In addition, post-disaster studies demonstrate that community investment in mitigation yields immediate rewards. All new schools and hospitals should be built to avoid high-hazard regions and with particular precautions to limit the risk of natural disaster damage. Existing school and hospital buildings should also be surveyed to resist relevant hazards. Nonstructural mitigation measures can help reduce injuries and property damage from natural disasters. For example, furniture and equipment can be secured to prevent earthquake injuries and damage. Nonstructural techniques include managing vegetation to decrease wildfire damage and locating buildings away from high-risk locations. A culture of prevention, preparedness, and resilience should be promoted throughout the government to encourage technological, traditional, and environmental mitigation strategies. Government should incorporate disaster risk identification, assessment, and monitoring into the development planning process. The government should build modern forecasting and early warning systems with IT assistance and foster constructive media collaboration to raise awareness and build capabilities. The government should use reconstruction to build disaster-resistant structures and habitats on encourage proactive media relations in disaster management.

This study also includes certain research deficiencies that need further consideration in future studies. First, this article did not dig into more segmented sections of Africa’s energy or resource fields. For example, have droughts, floods, and extreme temperatures fostered technical innovation in Africa? How will natural disasters affect renewable or green energy technologies in African countries? Second, it is also essential to research the effects of natural catastrophes on energy price risks, financing, and innovation in various nations. Third, the study samples in this paper are restricted to African nations; we anticipate that other nations and continents might be examined in the future. Finally, we may keep researching and computing the socioeconomic effects of extreme social events, like terrorism and political unrest in Africa, on technological innovation, green innovation, etc., in African countries.

Data availability

The datasets used and/or analyzed during the current study are available in the World Bank Development Indicator (WDI) repository, https://wdi.worldbank.org/; Penn World Table 10.0 (PWT) repository, www.ggdc.net/pwt; The Emergency Events Database (EM-DAT) repository, https://www.emdat.be/; Human Development Reports (HDR) repository, https://hdr.undp.org/; World governance indicator (WGI) repository, https://databank.worldbank.org/.

References

Abbas Khan K, Zaman K, Shoukry AM, Sharkawy A, Gani S, Sasmoko, Ahmad J, Khan A, Hishan SS (2019) Natural disasters and economic losses: controlling external migration, energy and environmental resources, water demand, and financial development for global prosperity. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04755-5

Acemoglu D (2012) Introduction to economic growth. J Econ Theory 147(2):545–550. https://doi.org/10.1016/j.jet.2012.01.023

Adewale Alola A, Ozturk I, Bekun FV (2021) Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa?A myth or reality. Energy Policy 158:112520. https://doi.org/10.1016/j.enpol.2021.112520

Adjei-Mantey K, Adusah-Poku F (2019) Natural disasters and economic growth in Africa. Munich Personal RePEc Archive, Munich, p 95588

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323. https://doi.org/10.2307/2951599

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2005a) Competition and Innovation: an Inverted-U Relationship. Q J Econ 120(2):701–728. https://doi.org/10.1093/qje/120.2.701

Aghion P, Howitt P, Mayer-Foulkes D (2005b) The effect of financial development on convergence: Theory and evidence. Q J Econ 120(1):173–222. https://doi.org/10.1162/0033553053327515

Aghion P, Bechtold S, Cassar L, Herz H (2018) The causal effects of competition on innovation: Experimental evidence. J Law Econ Org 34(2):162–195. https://doi.org/10.1093/jleo/ewy004

Albala-Bertrand JM (1993) Natural disaster situations and growth: a macroeconomic model for sudden disaster impacts. World Dev 21(9):1417–1434. https://doi.org/10.1016/0305-750X(93)90122-P

Almeida AFG, Montes GC (2020) Effects of crime and violence on business confidence: evidence from Rio de Janeiro. J Econ Stud 47(7):1669. https://doi.org/10.1108/JES-07-2019-0300

Anuchitworawong C, Thampanishvong K (2015) Determinants of foreign direct investment in Thailand: does natural disaster matter? In J Disaster Risk Reduct 14:312–321. https://doi.org/10.1016/j.ijdrr.2014.09.001

Asongu SA (2012) On the effect of foreign aid on corruption. Econ Bull 32(3):2174–2180. https://doi.org/10.2139/ssrn.2493289

Asongu SA, Biekpe N (2018) Globalization and terror in Africa. Int Econ 156:86–97. https://doi.org/10.1016/j.inteco.2017.12.005

Asongu SA, Mohamed J (2013) On the channels of foreign aid to corruption. Econ Bull 33(3):2191–2201. https://doi.org/10.2139/ssrn.2493353

Asongu SA, Odhiambo NM (2020) Foreign direct investment, information technology and economic growth dynamics in sub-Saharan Africa. Telecommun Policy 44(1):101838. https://doi.org/10.1016/j.telpol.2019.101838

Asongu S, Tchamyou V, Asongu N, Tchamyou N (2017) The comparative african economics of inclusive development and military expenditure in fighting terrorism. J Afr Dev 19(2):77–91. https://doi.org/10.5325/jafrideve.19.2.0077

Baez J, de la Fuente A, Santos I (2010) Do natural disasters affect human capital? An assessment based on existing empirical evidence. IZA Discussion Paper, Bonn, p 5164

Bandyopadhyay S, Sandler T, Younas J (2015) The toll of terrorism: terrorists not only exact a direct human cost, they can cause innumerable economic problems too. Finance Dev 52(2):26–28

Banks J, Karjalainen H, Propper C (2020) Recessions and health: the long-term health consequences of responses to the coronavirus*. Fisc Stud 41(2). https://doi.org/10.1111/1475-5890.12230

Barro RJ (1990) The stock market and investment. Rev Financ Stud 3(1):115–131. https://doi.org/10.1093/rfs/3.1.115

Belloumi M (2014) The relationship between trade, FDI and economic growth in Tunisia: an application of the autoregressive distributed lag model. Econ Syst 38(2):269–287. https://doi.org/10.1016/j.ecosys.2013.09.002

Benz E (2018) The societal and cultural factors behind innovation. SSRN Electron J. https://doi.org/10.2139/ssrn.3113963

Berentsen A, Rojas Breu M, Shi S (2012) Liquidity, innovation and growth. J Monet Econ 59(8). https://doi.org/10.1016/j.jmoneco.2012.10.005

Berlemann M, Steinhardt M, Tutt J (2015) Do natural disasters stimulate individual saving? Evidence from a natural experiment in a highly developed country, IZA Discussion Paper, Bonn, p 9026

Brown JR, Martinsson G, Petersen BC (2017) What promotes R&D? Comparative evidence from around the world. Res Policy 46(2):447–462. https://doi.org/10.1016/j.respol.2016.11.010

Cassiman B, Golovko E, Martínez-Ros E (2010) Innovation, exports and productivity. Int J Ind Organ 28(4):372–376. https://doi.org/10.1016/j.ijindorg.2010.03.005

Cavallo E, Galiani S, Noy I, Pantano J (2013) Catastrophic natural disasters and economic growth. Rev Econ Stat 95(5):1549–1561. https://doi.org/10.1162/REST_a_00413

Chen M, Sinha A, Hu K, Shah MI (2021a) Impact of technological innovation on energy efficiency in industry 4.0 era: Moderation of shadow economy in sustainable development. Technol Forecast Soc Chang 164:120521. https://doi.org/10.1016/j.techfore.2020.120521

Chen YE, Li C, Chang CP, Zheng M (2021b) Identifying the influence of natural disasters on technological innovation. Econ Anal Policy 70:22–36. https://doi.org/10.1016/j.eap.2021.01.016

Chen C, He Y, Wang K, Yan S (2022) The impact of early-life natural disaster experiences on the corporate innovation by CEOs. Emerg Mark Financ Trade. https://doi.org/10.1080/1540496X.2022.2073817

Coccia M (2013) What are the likely interactions among innovation, government debt, and employment? Innovation: The European Journal of Social Science Research 26(4):456–471. https://doi.org/10.1080/13511610.2013.863704

Cooper RN, Helpman E (2004) The mystery of economic growth. Foreign Affairs 83(6). https://doi.org/10.2307/20034157

Coulibaly B, Gandhi D, Senbet L (2019) Is sub-Saharan Africa facing another systemic sovereign debt crisis? Africa Growth Initiative 1–16. https://think-asia.org/handle/11540/9975

Cragg JG, Donald SG (1993) Testing identifiability and specification in instrumental variable models. Econ Theory 9(2):222–240. https://doi.org/10.1017/S0266466600007519

Crespo Cuaresma J, Hlouskova J, Obersteiner M (2008) Natural disasters as creative destruction? Evidence from developing countries. Econ Inq 46(2):214–226. https://doi.org/10.1111/j.1465-7295.2007.00063.x

Dallmann I (2019) Weather variations and international trade. Environ Resour Econ 72(1):155–206. https://doi.org/10.1007/s10640-018-0268-2

de Haen H, Hemrich G (2007) The economics of natural disasters: implications and challenges for food security. Agric Econ 37(S1):31–45. https://doi.org/10.1111/j.1574-0862.2007.00233.x

de Moel H, Jongman B, Kreibich H, Merz B, Penning-Rowsell E, Ward PJ (2015) Flood risk assessments at different spatial scales. Mitig Adapt Strateg Glob Chang 20(6):865–890. https://doi.org/10.1007/s11027-015-9654-z

Desouza KC, Koh WTH, Ouksel AM (2007) Information technology, innovation and the war on terrorism. Technol Forecast Soc Change 74(2):125–128. https://doi.org/10.1016/j.techfore.2006.07.006

Ditzen J (2019) Estimating long run effects in models with cross-sectional dependence using xtdcce 2(7):1–37. Retrieved from https://www.jan.ditzen.net

Dong J, Li W, Cao Y, Fang J (2016) How does technology and population progress relate? An empirical study of the last 10,000 years. Technol Forecast Soc Chang 103:57–70. https://doi.org/10.1016/j.techfore.2015.11.011

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560. https://doi.org/10.1162/003465398557825

Duygun M, Sena V, Shaban M (2016) Trademarking activities and total factor productivity: Some evidence for British commercial banks using a metafrontier approach. J Bank Financ 72:S70–S80. https://doi.org/10.1016/j.jbankfin.2016.04.017

EM-DAT (2020) Database | EM-DAT. Em-Dat. https://www.emdat.be/database. Accessed 30 Feb 2021

Engelbrecht F, Adegoke J, Bopape MJ, Naidoo M, Garland R, Thatcher M, McGregor J, Katzfey J, Werner M, Ichoku C, Gatebe C (2015) Projections of rapidly rising surface temperatures over Africa under low mitigation. Environ Res Lett 10(8):085004. https://doi.org/10.1088/1748-9326/10/8/085004

Ergashev I, Yuldashev S, Alibekova S, Nasimov D (2020) Venture capital financing as the source of investment-innovative activities in the field of services. J Crit Rev 7(7):43–46. https://doi.org/10.31838/jcr.07.07.08

Farhi E, Gabaix X (2016) Rare disasters and exchange rates. Q J Econ 131(1):1–52. https://doi.org/10.1093/qje/qjv040

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the Penn world table. Am Econ Rev 105(10):3150–3182. https://doi.org/10.1257/aer.20130954

Felbermayr G, Gröschl J (2014) Naturally negative: the growth effects of natural disasters. J Dev Econ 111:92–106. https://doi.org/10.1016/j.jdeveco.2014.07.004

Fracasso A, Vittucci Marzetti G (2015) International trade and R&D spillovers. J Int Econ 96(1):138–149. https://doi.org/10.1016/j.jinteco.2015.01.010

Gabaix X (2012) Variable rare disasters: an exactly solved framework for ten puzzles in macro-finance. Q J Econ 127(2):645–700. https://doi.org/10.1093/qje/qjs001

Galbusera L, Giannopoulos G (2018) On input-output economic models in disaster impact assessment. In J Disaster Risk Reduct 30:186–198. https://doi.org/10.1016/j.ijdrr.2018.04.030

Ghaffarian S, Roy D, Filatova T, Kerle N (2021) Agent-based modelling of post-disaster recovery with remote sensing data. In J Disaster Risk Reduct 60:102285. https://doi.org/10.1016/j.ijdrr.2021.102285

Grossman GM, Helpman E (1991) Trade, knowledge spillovers, and growth. Eur Econ Rev 35(2–3):517–526. https://doi.org/10.1016/0014-2921(91)90153-A

Haddad EA, Teixeira E (2015) Economic impacts of natural disasters in megacities: the case of floods in São Paulo, Brazil. Habit Int 45(P2):106–113. https://doi.org/10.1016/j.habitatint.2014.06.023

Hall BH, Lerner J (2010) The financing of R&D and innovation. In: Handbook of the Economics of Innovation 1(1):609–639. Elsevier B.V. https://doi.org/10.1016/S0169-7218(10)01014-2

Hamano M, Vermeulen WN (2021) Natural disasters and trade: the mitigating impact of port substitution. J Econ Geogr 20(3):809–856. https://doi.org/10.1093/JEG/LBZ020

Hamer MJM, Jordan JJ, Reed PL, Greulich JD, Gaye DB, Beadling CW (2017) Republic of Senegal disaster preparedness and response exercise: lessons learned and progress toward key goals. Disaster Med Public Health Prep 11(2):183–189. https://doi.org/10.1017/dmp.2016.113

Hanif I, Gago-de-Santos P (2017) The importance of population control and macroeconomic stability to reducing environmental degradation: an empirical test of the environmental Kuznets curve for developing countries. Environ Dev 23:1–9. https://doi.org/10.1016/j.envdev.2016.12.003

Hanif I, Aziz B, Chaudhry IS (2019) Carbon emissions across the spectrum of renewable and nonrenewable energy use in developing economies of Asia. Renew Energy 143:586–595. https://doi.org/10.1016/j.renene.2019.05.032

Helderop E, Grubesic TH (2019) Streets, storm surge, and the frailty of urban transport systems: a grid-based approach for identifying informal street network connections to facilitate mobility. Transp Res Part D: Transp Environ 77:337–351. https://doi.org/10.1016/j.trd.2018.12.024

Howitt P, Aghion P (1998) Capital accumulation and innovation as complementary factors in long-run growth. J Econ Growth 3(2):111–130. https://doi.org/10.1023/A:1009769717601

Hsiang SM, Jina AS (2014) The causal effect of environmental catastrophe on long-run economic growth: Evidence from 6,700 cyclones. National Bureau of Economic Research Working Paper Series, 20352, 1–70. https://www.nber.org/papers/w20352.pdf%5Cn

Ibrahim M, Alagidede P (2018) Effect of financial development on economic growth in sub-Saharan Africa. J Policy Model 40(6):1104–1125. https://doi.org/10.1016/j.jpolmod.2018.08.001

Iheonu CO, Nwodo OS, Anaduaka U, Ekpo U (2020) Inequality and female labour force participation in west Africa. Eur J Govern Econ 9(3):252–264. https://doi.org/10.17979/ejge.2020.9.3.6717

Khachoo Q, Sharma R (2016) FDI and innovation: an investigation into intra- and inter-industry effects. Glob Econ Rev 45(4):311–330. https://doi.org/10.1080/1226508X.2016.1218294

Khan A, Chenggang Y, Khan G, Muhammad F (2020) The dilemma of natural disasters: Impact on economy, fiscal position, and foreign direct investment alongside Belt and Road Initiative countries. Sci Total Environ 743:140578. https://doi.org/10.1016/j.scitotenv.2020.140578

Klomp J, Valckx K (2014) Natural disasters and economic growth: a meta-analysis. Glob Environ Chang 26(1):183–195. https://doi.org/10.1016/j.gloenvcha.2014.02.006

Koks EE, Thissen M (2016) A multiregional impact assessment model for disaster analysis. Econ Syst Res 28(4):429–449. https://doi.org/10.1080/09535314.2016.1232701