Abstract

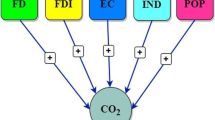

The purpose of this research is to explore the connection of financial development, sustainable environmental-economic growth, and energy consumption among the South Asian Nations. This research examines a combine influence on energy consumption, financial development on sustainable environmental economic growth regarding south Asian economies. This study has used autoregressive distributive lag (ARDL) and panel data set from World Development Indicators (WDI) start from 1980 to 2018. The findings of this study indicate a significant and positive effect of financial development toward economic growth of selected south Asian economies. However, energy consumption has also positive impact toward sustainable environmental-economic growth, which further leads toward sustainable environmental agenda progress. Finally, energy consumption results have positive effect on sustainable economic growth among mean group (MG), pooled mean group (PMG), and common correlated effect mean group (CMEMG) results.

Similar content being viewed by others

Change history

12 February 2022

A Correction to this paper has been published: https://doi.org/10.1007/s11356-022-19198-8

References

Agosin MR, Machado R (2005) Foreign investment in developing countries: does it crowd in domestic investment? Oxford Development Studies 33(2):149–162

Agustia D, Muhammad NPA, Permatasari Y (2020) Earnings management, business strategy, and bankruptcy risk: evidence from Indonesia. Heliyon 6:1–9

Anatasia V (2015) The Causal Relationship Between GDP, Exports, Energy Consumption, And CO 2 in Thailand and Malaysia. International Journal of Economic Perspectives 9(4)

Anser, M. K., Usman, M., Sharif, M., Bashir, S., Shabbir, M. S., Yahya Khan, G., & Lopez, L. B. (2021a). The dynamic impact of renewable energy sources on environmental economic growth: evidence from selected Asian economies. Environmental Science and Pollution Research, 1-13.

Arslan Z, Kausar S, Kannaiah D, Shabbir MS, Khan GY, Zamir A (2021) The mediating role of green creativity and the moderating role of green mindfulness in the relationship among clean environment, clean production, and sustainable growth. Environmental Science and Pollution Research:1–15

Anser, M. K., Usman, M., Godil, D. I., Shabbir, M. S., Tabash, M., Ahmad, M., & Lopez, L. B. (2021b). Does air pollution affect clean production of sustainable environmental agenda through low carbon energy financing? evidence from ASEAN countries. Energy & Environment, 0958305X211007854.

Anwar S, Sun S (2011) Financial development, foreign investment and economic growth in Malaysia. Journal of Asian Economics 22(4):335–342

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. Journal of econometrics 68(1):29–51

Arif A, Shabbir MS (2019) Common currency for Islamic countries: is it viable? Transnational Corporations Review 11(3):222–234

Asghar Z (2008) Energy-GDP relationship: a causal analysis for the five countries of South Asia. Applied Econometrics and International Development 8(1)

Bai J, Ng S, (2004) A PANIC attack on unit roots and cointegration. Econometrica 72,1127–1177.

Baloch MA, Danish KSUD, Ulucak ZŞ (2020a) Poverty and vulnerability of environmental degradation in Sub-Saharan African countries: what causes what? Struct. Chang. Econ. Dyn. 54:143–149. https://doi.org/10.1016/j.strueco.2020.04.007

Baloch MA, Danish KSUD, Ulucak ZŞ, Ahmad A (2020b) Analyzing the relationship between poverty, income inequality, and CO2 emission in Sub-Saharan African countries. Sci. Total Environ. 740:139867. https://doi.org/10.1016/j.scitotenv.2020.139867

Baloch MA, Danish MF (2019) Modeling the non-linear relationship between financial development and energy consumption: statistical experience from OECD countries. Environ. Sci. Pollut. Res. 26:8838–8846. https://doi.org/10.1007/s11356-019-04317-9

Baloch MA, Danish MF, Zhang J, Xu Z (2018) Financial instability and CO2 emissions: the case of Saudi Arabia. Environ. Sci. Pollut. Res. 25:26030–26045. https://doi.org/10.1007/s11356-018-2654-2

Baloch, M.A., Ozturk, I., Bekun, F.V., Khan, D., 2020c. Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus. Strateg. Environ. bse.2615. doi: 10.1002/bse.2615

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ. Sci. Pollut. Res. 26. https://doi.org/10.1007/s11356-018-3992-9

Blackburn K, Hung VTY (1998) A theory of growth, financial development and trade. Economica 65 (257), 107–124.

Blackburne EF, Frank MW (2007) Estimation of non-stationary heterogeneous panels. Stata Journal 7:197–208

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. Journal of econometrics 87(1):115–143

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its application to model specifications in econometrics. Rev. Econ. Stud. 47:239–253

Cetin M, Ecevit E, Yucel AG (2018) Structural breaks, urbanization and CO2 emissions: evidence from Turkey. J Appl Econ Bus Res 8(2):122–139

Cioca LI, Ivascu L, Rada EC, Torretta V, Ionescu G (2015) Sustainable development and technological impact on CO2 reducing conditions in Romania. Sustainability 7(2):1637–1650

Catao LAV, Terrones ME (2005) Fiscal deficits and inflation. J. Monet. Econ. 52:529–554

Calderón C, Liu L (2003) The direction of causality between financial development and economic growth. Journal of development economics 72(1):321–334

Chen GS, Yao Y, Malizard J (2017) Does foreign direct investment crowd in or crowd out private domestic investment in China? The effect of entry mode. Economic Modelling 61:409–419

Christopoulos DK, Tsionas EG (2004) Financial development and economic growth: evidence from panel unit root and cointegration tests. Journal of development Economics 73(1):55–74

Cooray A, Paradiso A, Truglia FG (2013) Do countries belonging to the same region suggest the same growth enhancing variables? Evidence from selected South Asian countries. Economic Modelling 33:772–779

Dinda S, Coondoo D (2006) Income and emission: a panel data-based cointegration analysis. Ecological Economics 57(2):167–181

Dheerasinghe KGDD(2012). Recent trends in the emerging economy of Sri Lanka.60th Anniversary Commemorative Volume of the Central Bank of Sri Lanka: 1950 – 2010.

Eaton J, Kortum S, (1996) Trade in ideas patenting and productivity in OECD. J. Int. Econ.40, 251–278.

Fase MM, Abma RCN (2003) Financial environment and economic growth in selected Asian countries. Journal of Asian economics 14(1):11–21

Gardini, S., & Grossi, G. (2018). What is known and what should be known about factors affecting financial sustainability in the public sector: a literature review. In Financial sustainability and intergenerational equity in local governments (pp. 179-205): IGI Global.

Grossman GM, Krueger AB (1995). Economic growth and the environment. The quarterly journal of economics, 110(2), 353-377.

Gökmenoğlu K, Taspinar N (2016) The relationship between CO2 emissions, energy consumption, economic growth and FDI: the case of Turkey. The Journal of International Trade & Economic Development 25(5):706–723

Goh SK, Sam CY, McNown R (2017) Re-examining foreign direct investment, exports, and economic growth in Asian economies using a bootstrap ARDL test for cointegration. Journal of Asian Economics 51:12–22

Gries T, Kraft M, Meierrieks D (2009) Linkages between financial deepening, trade openness and economic development: causality evidence from sub-Saharan Africa. World Dev. 37(12):1849–1860

Heidari H, Katircioğlu ST, Saeidpour L (2015) Economic growth, CO2 emissions, and energy consumption in the five ASEAN countries. International Journal of Electrical Power & Energy Systems 64:785–791

Habibullah MS, Eng YK (2006) Does financial development cause economic growth? A panel data dynamic analysis for the Asian developing countries. Journal of the Asia Pacific Economy 11(4):377–393

Hall R, Jones C (1999) Why do some countries produce so much more output per worker than others? Q. J. Econ. 114:83–116

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J.Econ. 115(1):53–74

Imhanzenobe OJ (2020) Managers’ financial practices and financial sustainability of Nigerian manufacturing companies: which ratios matter most? Cogent Economics & Finance 8(1):1–23

Jalil A (2014) Energy–growth conundrum in energy exporting and importing countries: evidence from heterogeneous panel methods robust to cross-sectional dependence. Energy Economics 44:314–324. https://doi.org/10.1016/j.eneco.2014.04.015

Jun W, Mughal N, Zhao J, Shabbir MS, Niedbała G, Jain V, Anwar A (2021) Does globalization matter for environmental degradation? Nexus among energy consumption, economic growth, and carbon dioxide emission. Energy Policy 153:112230

Koçak E (2014) Türkiye’de Çevresel Kuznets Eğrisi Hipotezinin Geçerliliği: ARDL Sınır Testi Yaklaşımı. İşletme ve İktisat Çalışmaları Dergisi 2(3):62–73

Katircioglu S (2017) Investigating the role of oil prices in the conventional EKC model: evidence from Turkey. Asian Economic and Financial Review 7(5):498–508

Katircioglu S, Katircioğlu S, Altinay M (2017) Interactions between energy consumption and imports: empirical evidence from Turkey. Journal of Comparative Asian Development 16(2):161–178

Kirikkaleli D, Kalmaz DB (2020) Testing the moderating role of urbanization on the environmental Kuznets curve: empirical evidence from an emerging market. Environmental Science and Pollution Research 27(30):38169–38180

Kalai M, Zghidi N (2019) Foreign direct investment, trade, and economic growth in MENA countries: empirical analysis using ARDL bounds testing approach. Journal of the Knowledge Economy 10(1):397–421

King RG, Levine R (1993a) Finance and growth: Schumpeter might be right. The quarterly journal of economics 108(3):717–737

King RG, Levine R (1993b) Financial intermediation and economic development. Capital markets and financial intermediation:156–189

Kraft J, Kraft A (1978) On the relationship between energy and GNP. The Journal of Energy and Development:401–403

Lee CC, Lee JD (2009) Income and CO2 emissions: evidence from panel unit root and cointegration tests. Energy policy 37(2):413–423

Liu Y, Saleem S, Shabbir R, Shabbir MS, Irshad A, & Khan S (2021) The relationship between corporate social responsibility and financial performance: A moderate role of fintech technology. Environmental Science and Pollution Research, 28(16), 20174–20187.

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 631–652 (special issue).

Mancini F, Clemente C, Carbonara E, Fraioli S (2017) Energy and environmental retrofitting of the university building of Orthopaedic and Traumatological Clinic within Sapienza Città Universitaria. Energy Procedia 126:195–202

Menyah K, Nazlioglu S, & Wolde-Rufael Y (2014). Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Economic Modelling, 37, 386-394. doi: 10.1016/j.econmod.2013.11.044

McKinnon RI (1973) Money and capital in economic development. Brookings Institution, Washington

Mohan R and Ray P (2017). Indian financial sector: structure, trends and turns. IMF Working Paper,17/7.

Mughal N, Arif A, Jain V, Chupradit S, Shabbir MS, Ramos-Meza CS, Zhanbayev R (2022) The role of technological innovation in environmental pollution, energy consumption and sustainable economic growth: evidence from South Asian economies. Energy Strategy Reviews 39:100745

Muhammad I, Shabbir MS, Saleem S, Bilal K, Ulucak R (2020). Nexus between willingness to pay for renewable energy sources: evidence from Turkey. Environmental Science and Pollution Research, 1-15.

Nawaz S, Shabbir MS, Shaheen K, Koser M (2021a) The Role of human rights and obligations toward cross gender empowerment under the domain of Islamic laws. iRASD. Journal of Management 3(3):208–217

Nawaz S, Koser M, Boota A, Shabbir MS (2021b) The effects of cultural limitations, constitution, feminism, sexual orientation status among the women in Pakistani families. Pakistan Journal of Humanities and Social Sciences 9(3):526–534

Ndikumana L (2000) Financial determinants of domestic investment in Sub-Saharan Africa: evidence from panel data. World development 28(2):381–400

Nguyen VK, Shabbir MS, Sail MS, Thuy TH (2020) Does informal economy impede economic growth? Evidence from an emerging economy. Journal of Sustainable Finance & Investment. https://doi.org/10.1080/20430795.2020.1711501

Parente SL, Prescott EC (1994) Barriers to technology adoption and development. J.Polit. Econ. 102:298–321

Pesaran MH, 2004. General diagnostic tests for cross section dependence in panels. CESifo Working Paper No. 1229.

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74:967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross section dependence. J. Appl. Econ. 22:265–312

Pesaran HM, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J. Econ. 68:79–113

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J. Econ. 142:50–93

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94:621–634

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16:289–326

Perera A, Wickramanayake J (2012) Financial integration in selected South Asian countries. South Asian Journal of Global Business Research 1(2):210–237

Phillips PC, Moon HR (2000) Nonstationary panel data analysis: an overview of some recent developments. Econ. Rev. 19:263–286

Rjoub H, Odugbesan JA, Adebayo TS, Wong WK (2021) Sustainability of the moderating role of financial development in the determinants of environmental degradation: evidence from Turkey. Sustainability 13(4):1844

Robinson J (1952) The rate of interest and other essays. Macmillan, London.

Sacko, I. (2004). Analysis of the links between economic growth and energy consumption in Mali. CERFOD-FSJE, University of Mali.

Sadiq M, Usman M, Zamir A, Shabbir MS, Arif A (2021) Nexus between economic growth and foreign private investment: evidence from Pakistan economy. Cogent Economics & Finance 9(1):1956067

Saleem H, Khan MB & Shabbir MS (2019a) The role of financial development, energy demand, and technological change in environmental sustainability agenda: evidence from selected Asian countries. Environ Sci Pollut Res doi:10.1007/s11356-019-07039-0

Saleem H, Shabbir MS, Khan B, Aziz S, Husin MM, Abbasi BA (2020). Estimating the key determinants of foreign direct investment flows in Pakistan: new insights into the co-integration relationship. South Asian Journal of Business Studies.

Saleem H, Shahzad M, Khan MB, Khilji BA (2019b) Innovation, total factor productivity and economic growth in Pakistan: a policy perspective. Journal of Economic Structures 8(1):7

Saleem H, Shabbir MS, Shah SAR, Shah J (2021) Nexus between foreign direct investment and poverty reduction: a case of Pakistan. iRASD. Journal of Economics 3(3):280–288

Saleem H, Shabbir MS, Khan B (2019c). Re-examining multidimensional poverty in Pakistan: a new assessment of regional variations. Global Business Review, 0972150919844412.

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renewable and Sustainable Energy Reviews 70:185–192

Shan J, (2005) Does financial development “lead” economic growth? A vector autoregression appraisal. Appl. Econ. 37 (12), 1353–1367.

Shabbir MS, Wisdom O (2020) The relationship between corporate social responsibility, environmental investments and financial performance: evidence from manufacturing companies. Environmental Science and Pollution Research:1–12. https://doi.org/10.1007/s11356-020-10217-0

Shabbir MS, Aslam E, Irshad A et al (2020) Nexus between corporate social responsibility and financial and non-financial sectors’ performance: a non-linear and disaggregated approach. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-020-09972-x

Shabbir MS (2018a). The determination of money: a comparative analysis of Zakat (Alms) and income tax payers among selected ASEAN countries. Global Review of Islamic Economics and Business, 6(1), 051-061

Shabbir MS (2020) Human prosperity measurement within the gloom of Maqasid Al-Shariah. Global Review of Islamic Economics and Business 7(2):105–111

Shabbir MS (2018b) Privatization predicament and shari’ah compliant alternate solutions. Kashmir Economic Review 27(1)

Shabbir MS (2016). Contributing factors of inland investment. Global Journal of Management and Business Research

Shabbir M (2017) Women on corporate boards and firm performance, results from Italian companies. American Based Research Journal 6(9)

Shaw ES (1973) Financial deepening in economic development. Oxford University Press, New York

Shahbaz M (2012) Does trade openness affect long run growth? Cointegration, causality and forecast error variance decomposition tests for Pakistan. Economic Modelling 29(6):2325–2339

Smarzynska Javorcik B (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American economic review, 94(3), 605-627.

State Bank of Pakistan (2002) Pakistan: financial sector assessment 1990-2000. State Bank of Pakistan, Karachi

Svirydzenka K (2016). Strategy, policy, and review department introducing a new broad-based index of financial development. IMF Working Paper 16/5

Swamy PAV (1970) Efficient inference in a random coefficient regression model. Econometrica 38:311–323

Tsai PL (1994) Determinants of foreign direct investment and its impact on economic growth. Journal of economic development 19(1):137–163

Urbain J, Westerlund J (2006) Spurious regression in nonstationary panels with cross unit cointegration. METEOR Research Memorandum No. 057

Westerlund J (2007) Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 69:709–748

Wang C, Wang F, Zhang H, Ye Y, Wu Q, Su Y (2014) Carbon emissions decomposition and environmental mitigation policy recommendations for sustainable development in Shandong province. Sustainability 6(11):8164–8179

Wolde-Rufael Y (2009) Re-examining the financial development and economic growth nexus in Kenya. Econ. Model. 26(6):1140–1146

World Bank. (2000). Is globalization causing a “race to the bottom” in environmental standard? PREM economic policy group and development Economics Group, April 2000

Xu Z, Baloch MA, Danish MF, Zhang J, Mahmood Z (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ. Sci. Pollut. Res. 25:28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yavuz NÇ (2014). CO2 emission, energy consumption, and economic growth for Turkey: evidence from a cointegration test with a structural break. Energy Sources, Part B: Economics, Planning, and Policy, 9(3), 229-235.

Yuan J, Zhao C, Yu S, Hu Z (2007). Electricity consumption and economic growth in China: cointegration and co-feature analysis. Energy Economics, 29(6), 1179-1191.

Yikun Z, Gul A, Saleem S, Shabbir MS, Bilal K, Abbasi HM. (2021). The relationship between renewable energy sources and sustainable economic growth: evidence from SAARC countries. Environmental Science and Pollution Research, 1-10.

Zhao X, Zhang Y, Liang J, Li Y, Jia R, Wang L (2018) The sustainable development of the economic-energy-environment (3E) system under the carbon trading (CT) mechanism: a Chinese case. Sustainability 10(1):98

Availability of data and materials

The data is available on request from corresponding author.

Author information

Authors and Affiliations

Contributions

Dr XingHua Cao has completed the data analysis part, Dr. Desti completed the Introduction section, Dr Ye completed the Literature review section, Miss Kanwal wrote Methodology section, Mr Malik Shabbir interpreted the data analysis section, Dr Jamal wrote conclusion and Dr. Mosab wrote abstract parts and format the paper as per journal requirements.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This study did not use any kind of human participants or human data, which require any kind of approval.

Consent for publication

Our study did not use any kind of Individual data such as video, images etc.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: The 1st Author has 2 affiliations and the correct given name of the last Author is Mosab.

Rights and permissions

About this article

Cite this article

Cao, X., Kannaiah, D., Ye, L. et al. Does sustainable environmental agenda matter in the era of globalization? The relationship among financial development, energy consumption, and sustainable environmental-economic growth. Environ Sci Pollut Res 29, 30808–30818 (2022). https://doi.org/10.1007/s11356-022-18772-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-18772-4

Keywords

- Financial development

- Energy consumption

- Sustainable environmental economic growth

- South Asian countries

- ARDL