Abstract

The objective of this study is to endorse the driving factors behind total factor productivity (TFP) and economic growth in Pakistan. Pakistan’s average growth rate is 5% for last few decades, and although this growth level is satisfactory, Pakistan faced several formidable challenges yet. The economic growth has been determined mainly through labor-intensive technology and export-oriented manufacturing activities. However, TFP is assessed from the aggregate production function using the Cobb–Douglas production function that permits for the simultaneous expansion of outputs and contraction of inputs. The annual timer series data have been extracted from 1972–2016 World development Indicator (WDI) for this study. The overall results reveal that almost all variables are statistical significant. Moreover, innovation significantly contributes to economic growth and production level in Pakistan. This analysis may have significant suggestions to policy makers in Pakistan and other emerging economies when framing sustainable growth policy.

Similar content being viewed by others

1 Introduction

Recent economic growth theories draw devotion toward endogenous technological change, which describes the growth patterns of world economies. Romer (1986) established an endogenous growth model in which technological innovation was formed in the research and development (R&D) areas including human capital and the existing knowledge stock. Then, it was used in the production of all final goods and led to permanent rises in the output growth rate.

Innovation is a significant factor of economic growth in the mind of various experts especially the policy makers. Moreover, innovation is not directly related to the amount of productive resources; therefore, it affects growth of the economy mostly through TFP. Technological innovation and non-technological factors are two main divisions of innovation, where new production and services are related to the technological innovation and non-technological innovations in the form of organizational or marketing modifications. However, growth level in itself can be attained by putting more inputs for process of production and through attaining higher levels of output with the same quantity of resources. There is no clear indication determining whether there is a casual association between innovations and economic growth through productivity or whether these both procedures occur at a time in developing countries such as Pakistan. Answering this query has critical relevance for Pakistan since unconventional answers lead toward different policy recommendations regarding innovation and technology policies.

The objective of this study is to investigate how innovation and economic growth are interrelated to each other in Pakistan. How has the enrollment of TFP to economic growth changed over time in the expectation that shedding some light on the significance of innovation and showing a clearer picture of Pakistan’s economic growth? Using patent data (residential and non-residential) as a proxy for innovation, this paper gives support in the view that a growth in patents leads to rise in economic growth for long run. Moreover, at what extent, enrollment of TFP to economic growth changed over the time period and potential determinants of TFP?

This study is employing annual time series data to fill the gap by providing up-to-date estimates of TFP and exploring the determinants of TFP (this study follows the traditional approach of estimating TFP growth using a production function) and contribution of innovation, in this manner detecting future growth engines for the long-run sustainable development in Pakistan. A significant conclusion points out the relationship between innovative capabilities, TFPG and economic development. This study has recommended some of important findings for policy makers such as, the combination of innovational activities, TFPG moving toward sustainable economic growth are essential and simulated policies are the best practice for significant contributions in economic development.

The study is organized as follows: Sect. 2 introduces the research methodology and data. The crucial point of this analysis is the decisive prediction that total factor productivity (TFP) growth has contributed significantly to economic growth. Finding from the prior literature, it can be found that these analyses give only indirect evidence of the role played by innovation on economic growth. Section 3 describes the empirical results and discussion. Section 4 finally draws conclusions and discussion with their implication.

2 Literature review

Many studies have revealed the presence of positive relationship between innovation and productivity. The theoretical argument has converged to realize that the growth of productivity is infused by the innovation based on enterprises. However, several economists have been concerned in the contribution of economic growth from traditional neoclassical model (Solow 1957). Furthermore, evidence of productivity growth has been discussed by pioneer studies that capital and labor inputs illuminate less than half of the variation in productivity.

The unexplained portion, which is called “residual,” is usually reflected by the influence of the technological change on the level of productivity. For this purpose, these empirical analyses try to find different measures for technological change (R&D activities, quality of work and improvement in capital) in order to describe the residual productivity growth (Cassiman and Golovko 2011; Griliches 1979, 2000; Huergo and Jaumandreu 2004; Ortega-Argilés et al. 2005; Tsai and Wang 2004; Wakelin 2001).

According to Christensen (1997) that sustaining technological change than it’s reinforce the technological model and business routines; they do not lead to the creation of new products, but rather the development of the existing ones. In order for Pakistan’s to catch up and reach up to the levels of per capita similar to advanced countries, productivity is essential. The most important challenge for Pakistan is improving the level of productivity and growth. As supported in the studies (IDB 2010a, b), low productivity growth was the main cause of the poor economic performance of region in the last few decades, whereas innovation is playing an important role for development of growing productivity.

Meanwhile, several studies determine a virtuous circle in which innovation, productivity and per capita income jointly reinforce each other and lead countries to long-term sustained growth rates (Hall and Jones 1999; Rouvinen 2002). At the firm level, there was resounding evidence for advanced countries showing the positive links between innovation, R&D and productivity (Griffth et al. 2006; Griffth et al. 2004; Mairesse and Mohnen 2010; Mairesse et al. 2006; Shabbir 2016).

The innovation and economic development based on small and medium enterprises in Pakistan is studied by Subhan et al. (2014). This study adds new contribution in the existing literature to develop an efficient relationship among innovation, TFPG and economic growth in Pakistan. Moreover, the results of ARDL model and the Toda–Yamamoto–Dolado–Lutkepohl (TYDL) approach showed that there is the casual relationship found among innovation, TFPG and economic growth.

3 Research methodology and data

This study gauges the potential drivers of TFP in two-stage process. First, TFP is calculated using a neoclassical production function which describes the relationship between inputs and output of production function. In second stage, the significant potential drivers of TFP are tested applying the fixed effect estimator.

3.1 Macroeconomic model: theoretical framework

However, growth accounting methods traditionally depend upon a decomposition on output rely on an aggregate production function (with constant returns to scale) that explains accumulated factors of production (physical capital (K) and human capital, denoted by (H) into output (Y is real GDP)). The traditional theory is also deliberated in detail and depends on prior work by Diewert and Morrison (1986).

In precise, study assumes a Cobb–Douglas production function approach that takes the following form:

Following the literature of Hall and Jones (1999) it is described that the stock of human capital (H) can be estimated through the labor force and the product of the quality from labor force (h). The TFP is denoted by the parameter A, which shows the efficiency and factors of production are jointly used in the economy.

Based on the existing literature (Klenow and Rodri´guez-Claire 2005), this study assumes that the capital share (a = 1/3) is almost the same across the countries and also constant over the time. Literature shows this standard assumption which is mainly based on the evidence for the USA. While there is a significant variation across different economies in this parameter described by Gollin (2002), this deviation does not follow any specific pattern. In precise, once informality and entrepreneurship are taken into account, and it is not associated with the level of growth (GDP per capita).

This study uses time series data of physical and human capital to estimate measure of TFP by:

The study from a development perspective is concerned in decomposing GDP per capita (y). Moreover, Eq. (1) can be written in following form with reference to growth level perspective

where the term (f) is the contribution of the labor force in the total population, whereas the population ages consist of 15–64 years. However, physical capital (kt) investment has a visibly based on the level of TFP. The indirect effect of TFP following the literature of Klenow and Rodriguez-Claire (1997) and production function mentioned in (3) can be rewritten in intensive form as:

where “κ” is defines as the capital-output ratio (K/Y).

The growth decomposition input and the contribution of TFP do not detect policy suggestions because it only explains the significant factors behind the projected TFP growth rates. A complementary query at that time is the consequence of a policy outcome like fiscal deficit and the inflation or on the capital accumulation (TFP growth). In finding for a stable relationship between the actual growth rates of output and numerous variables recommended by the ancient and new economic concepts, various studies have complemented exercises of growth accounting with growth regressions for an economy or different group of countries. The traditional (neoclassical) model indicates that steady-state growth and hence the probability of improving living standards over time are due to the growth of TFP. The Solow–Swan model assumes that the key parameter capital-input ratio is stable over time.

3.2 The total factor production and its potential drivers

This paper describes the direct sources of TFP by modeling TFPG as a function (f) along with a set of potential variables. The possible endogeneity between some variables and TFP can be controlled by applying the 2SLS model with 1-year lagged explanatory variables as instruments. The dynamic data model is also used for the same purpose by (Arellano and Bover 1995; Blundell and Bond 1998).

All the variables are converted into logarithm form.

where TFP is a total factor productivity, GDP is real gross domestic product, LPT is number of patents, TRD is trade openness, INF is inflation, PRL is private credit, EDU is education, IMM is imported machinery, FDI is foreign direct investment and \( e_{\text{t}} \) is error term. Moreover, TFPG is related to total factor productivity growth; X is vector of all determinants; and \( \mu \) is related to error term.

3.3 Variables description

Klenow and Rodri´guez-Claire (2005) developed a model to examine the relationship between TFP and human capital augmented through Cobb–Douglas production function. This paper develops TFP measure using information from the Penn World Tables, version 9.0 (followed by Heston et al. 2009 who used version 6.3).

This study uses a perpetual inventory method to construct capital stock, following the methodology explained in Easterly and Levine (2002). Precisely, the total capital formation equation states that

where Kt is the capital stock l in period t, I is investment and \( \varvec{\delta} \) is the rate of depreciation. The data have been taken from the World Development Indicators (WDI) databases and Penn World Tables 9.0 version. Whereas capital stock estimation is computed using the perpetual inventory method, data of a depreciation rate (delta) are also taken from Penn world table (version 9.0). The delta is based on average depreciation rate of the capital stock. The data of capital stock are used at constant 2011 national prices (in million 2011US$). Finally, gross fixed capital formation in real terms is taken from WDI statistics.

This study examines the total factor productivity and economic growth in Pakistan with its potential drivers using time series data for the period 1972–2016. This paper follows the Hall and Jones (1999) study for estimation of human capital efficiency, which established the index (h) as a function of the average years of schooling. Moreover, to find the contribution of labor in output with its efficiency, this study used the data on years of schooling and returns to education. Furthermore, human capital indexes are used as a proxy for human capital accumulation from Penn world 9.0 tables, and labor input is estimated by number of total persons engaged (in millions) from Penn world 9.0 tables.Footnote 1 The data of total working age population (15–64 years’ ages) are taken from WDI statistics, and the rate of its contribution in the labor force. The output (Y) is measured as real GDP at constant 2011 national prices (in mil. 2011US$) from the Penn world 9.0 tables. The explanatory variables (potential drivers) of TFP are taken from the WDI data bases. The innovative capability is used as proxy to measure the number of certified patent per thousand head. The patent applications data work as an appreciable resource for estimating innovative activity and have been comprehensively used in the literature of patent as measures of technological change (Kortum1997). Also, Griliches (1989) and Joutz and Gardner (1996) discussed that patent applications are a significant measure of technological output. Followed the information of Bravo-Ortega and Marin (2011), this study constructs an unbalanced data with observations averaged of 2 years. There are two important causes for using data averaged over relatively long periods. First, patent data are missing for many years, and thus, averaging over longer periods provides more successive observations. This is predominantly helpful for estimating dynamic specifications. Similarly, applying long time periods, we evade cyclical factors that may have influenced innovations.

However, foreign direct investment (FDI) and import of machinery capture the influence of knowledge transmission. The data of FDI and import of machinery are taken from WDI databases. However, FDI has a significant effect on TFPG via new efficient production processes, the knowledge spillovers from transfer of technology and superior managerial skills (Borensztein et al. 1998). Moreover (imports may bring machinery/equipment embodied advanced technology from a small number of innovative countries into domestic production), economies have high chance of getting an advantage from technology diffusion (Grossman and Helpman 1991), and Miller and Upadhyay (2000), Dollar and Kraay (2002) and Loko and Diouf (2009) also consider it as an important determinant of TFP.

The data on inflation (inflation rate) have also been taken from WDI. The purpose of inflation rate is to check the regulatory quality, macro-instability and uncertainty (Daude and Fernández-Arias 2010). A set of human capital variables is used to measure the impact of education and its indirect impact via improving the knowledge absorptive capacity. According to Loko and Diouf (2009), inflation also has effects on TFPG, whereas human capital is significant determinant of TFPG and proxy by years of schooling in the population. Moreover, human capital index, based on years of schooling and returns to education, is used as a proxy for the human capital. The share of number of graduates from primary, secondary, high and higher education in the total population (Pakistan) is not considered due to non-availability of data. The basic level of education shows labor effectiveness in the process of production, and higher education is essential for technological innovation. Furthermore, human capital is a significant factor of the research and development projects, for instance (Romer 1990; Daude and Fernández-Arias 2010; Zhang et al. 2014) and play an important role in facilitating TFP catch-up and driving innovation (Benhabib and Spiegel 2005).

This study depicts the effect of structural changes in the country with reference to two variables: manufacturing output industry in GDP (secondary sector), and services sector (tertiary industry) output in GDP taken from WDI statistics. However, higher value-added contribution of countries with high productivity growth sectors is related to greater aggregate productivity growth (Jaumotte and Spatafora 2007; Loko and Diouf 2009; Shabbir 2015). The domestic credit to financial sector as a percentage of GDP is used as proxy of financial development, reflecting the depth of financial markets (WDI statistics). Moreover, TFP growth through financial development is positively affected by efficiency of banks loan; Mastromarco and Zago (2012) and King and Levine (1993) found a positive connection between financial development and physical capital accumulation, successive rates of economic and productivity growth (Nigeria). The trade openness is measured as the ratio of exports to GDP. Prior studies reveal that institutions and geography, along with integration (openness), have strong effects on TPFG (Isaksson 2007).

The study uses annual time series to observe the granger causality between variables, and data are taken from World Development Indicators (WDI) for Pakistan (1972–2016). This paper also uses different indicators for number of patents application by nonresidents (per thousand population) and number of patents by residents (per thousand population) as the proxies of innovation. These two proxies for innovation have been applied previously by Galindo and Mendez (2014), Pradhan et al. (2016) in their analysis.

4 Results and discussion

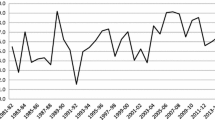

It is important to discuss here that the evolutionary highlights are important phase of TFP: Whereas literature of standard growth is assumed to estimate technological progress, absolute deteriorations are not easy to interpret in this way. Consequently, a more common interpretation of TFP is required. In particular, the accurate interpretation measured the degree of proficiency for TFP and institutions and market work together for allocation of productive factor in the economy. Remarkably, under this wider interpretation, efficiency can deteriorate in absolute terms for a long period of time, as we detect for the case of Pakistan. This study analyzes Pakistan’s sources of growth (in Table 1) for different periods between 1970–1974, 1975–1979, 1980–1984, 1985–1989, 1990–1994, 1995–2000, 2001–2005, 2006–2010 and 2011–2014 showing the different economic growth in TFP growth. The higher Pakistan coincided with the rate of growth due to TFPG in different time periods and gradually increased.

The traditional neoclassical model indicates that steady-state growth and therefore the possibility of improving living standards over time are due to TFP growth. Indeed, suppose that the important parameter (a) of the model of Solow–Swan is stable over the time period. Table 2 shows the results of growth accounting approach by alternative method, where results showed that average TFPG is increasing gradually. Since the beginning, the average (per worker) labor productivity growth shows improvement, but in column three, it is shown that in 2008–2012 the average%age TFPG was found to be negative.

4.1 Results of potential drivers of TFP

Table 3 reports the estimation for two-stage least squared method (2SLS). The results of diagnostic test show that data have no problem of heteroskedasticity (applied ARCH test), and no serial correlation (Breusch–Godfrey LM test is used). The \( H_{0} \) of Ramsey RESET test designates that model is correctly specified; further, we also accept \( H_{0} \) in case of Jarque–Bera (JB test) which shows that data are normally distributed. Null hypothesis indicates that the values are greater than 5% level of significance. The TFP is used as a wide range of potential drivers along with main three dimensions, for instance, innovation and its spillover effects, supply of factors and efficient allocation and integration factors.

-

Innovation and its spillover effects

Patent has a significant and positive effect on TFP growth. However, innovation and knowledge creation tend to be more relevant to advanced countries. The results of (Benhabib and Spiegel 2005; Zhang et al. 2014) describe a positive significant impact of TFP, but the magnitude of the influence is rather small. The results of import of machinery (IMM) are positive and statistically significant at 10% and 1% levels, signifying that imported machinery as carriers of knowledge induces TFP growth, consistent with literature. However, those countries with more imported machinery have more chance to get advantage from technology diffusion (Grossman and Helpman 1991), as imports may bring machinery/equipment embodied advanced technology from a small number of innovative countries into domestic production. The result of foreign direct investment (FDI) found negative and significant relationship with TFP in models (2, 3 and 4). Moreover, FDI usually brings key technology superior managerial skills and proficient organizational forms from advanced countries to developing ones, but we find no evidence for the spillover effect of FDI on productivity. The results have also revealed consistent with prior literature that the positive impact of FDI on TFP is hardly detected in developing countries (Isaksson 2007). But FDI became positive in our study, when we add variable of import machinery. Furthermore, same results are found in the study of Zhang et al. (2014), and in some models, the coefficient of FDI was found to be positive as well as negative in case of China.

-

Supply of factor and efficient allocation

The influence of human capital, in terms of education, is found to be positive and significant. The degree of impact rises with the level of education, endorsing the significance of higher education in stimulating productivity. The findings of this study give evidence that human capital (education) plays a key and positive role in determining technological innovation (Romer 1990; Black and Lynch 1995; Loko and Diouf 2009).

The results of financial development are found to have a positive effect on TFP, signifying that Pakistan’s has less-developed financial markets, and for private credit, in our study, we do not find a significant effect. The manifestation of market imperfection and distortion in the Pakistani banking system leads to the unproductive allocation of capital, which in turn adversely affects productivity. Finally, results are consistent with (Daude and Fernández-Arias 2010; Mastromarco and Zago 2012).

-

Integration and other variables

The coefficients on trade openness are positive and significant in our study model. Moreover, several prior empirical analyses that commonly find an economically significant and positive effect of trade on productivity (Alcalá and Ciccone 2004) revealed that the causation runs from trade to productivity. The case of the macro-instability, regulatory quality and uncertainty (proxy by the inflation). The result indicates that inflation is negative with significantly related to productivity, and some studies are supported by (Daude and Fernández-Arias 2010). A stable monetary condition is the substance for the efficient operation of a market economy. Barro (1995) recommended for those economies, where inflation exceeds from 15% or a 10% rise in inflation leads to a decrease in GDP growth per year of 0.2–0.3% and a drop in the investment-to-GDP ratio of about 0.4–0.6%. The real GDP growth is also positive and significantly related to TFP.

This study incorporates the following empirical model to test possible directions of causality among all these variables. The data set of time series requires special care before the empirical analysis, because data are non-stationary in nature. So it is crucial to find the potential unit root problem in the first instance and to detect the order of integration of each factor. Moreover, if ignoring non-stationary issue, it would lead to cause of spurious regression. Numerous econometric methods like method of Johansen multivariate co-integration, Engle Granger and the recently developed ARDL method (Pesaran et al. (2001)) for evaluating the time series data, can be used.

The long-run as well as the short-run correlation between endogenous and exogenous variables can be analyzed by several econometric models, which are available in the several published literatures. The auto-regressive distributed lags (ARDL) are designed by Pesaran et al. (2001) to observe the long-run and short-run analysis, and similarly, Pesaran and Shin (1999); Laurenceson and Chai (2003) and Shabbir (2018) also preferred ARDL model because of its several advantages. The study of Monte Carlo demonstrates that ARDL approach is significantly important and generates consistent results even for small sample (Pesaran and Shin 1999). The technique of ARDL is used to observe the relationship between innovation, total factor productivity and GDP growth for the following reasons. This method solves the problem of most restrictive assumptions, for instance, specific model with its variables must have the same order of integration, if order of integration is not different{(I(0) or I(1)}, and still this technique can be used (Pesaran and Pesaran 1997). The ARDL approach diminishes the problem of endogeneity because it is free of residual relationship and it takes proper lags which are adjusted for the problem of serial correlation and endogeneity.

5 Co-integration analysis (ARDL)

The ARDL technique (bound testing) approach is lately developed technique. The method of ARDL co-integration is a stepwise procedure. The framework of ARDL method can be written as follows:

The null hypotheses are: \( H_{0} = \tau_{\text{LPR}} = \tau_{\text{GDP}} = \tau_{\text{LPN}} = \alpha_{\text{TFP}} = 0 \), \( H_{0} : = \beta_{\text{LPN}} = \beta_{\text{GDP}} = \beta_{\text{LPR}} = \beta_{\text{TFP}} = 0 \), \( H_{0} : \delta_{\text{INNO}} = \delta_{\text{LPN}} = \delta_{\text{GDP}} = \delta_{\text{LPR}} = \delta_{\text{TFP}} = 0 \), while alternative hypotheses are: \( H_{2} : \ne \tau_{\text{LPN}} \ne \tau_{\text{GDP}} \ne \tau_{\text{LPR}} \ne \tau_{\text{TFP}} \ne 0 \), \( H_{2} : = \beta_{\text{LPN}} \ne \beta_{\text{GDP}} \ne \beta_{\text{LPR}} \ne \beta_{\text{TFP}} \ne 0 \), \( H_{2} : \ne \delta_{\text{LPR}} \ne \delta_{\text{GDP}} \ne \delta_{\text{LPN}} \ne \delta_{\text{TFP}} \ne 0 \).

\( {\text{The}}\;\beta_{1} ,\delta_{1} \;{\text{and}} \;\tau_{1} \) (intercepts) are drift component, and \( \mu_{1} \) is error term and supposed to be white noise. Moreover, to detect the absence of serial correlation problem, Akaike information criterion (AIC) is chosen for optimal lag length criteria.

5.1 The Toda–Yamamoto–Dolado–Lutkepohl (TYDL) approach

The Granger causality approach in levels or in difference systems of VAR model or even in the method of ECMs is found to be risky (Toda and Yamamoto 1995; Rambaldi and Doran (1996) Zapata and Rambaldi 1997). Non-standard distributions and Nuisance parameters enter the theory of limit, when either the essential rank condition does not fulfill the requirement of VECM and also for method of the Johansen–Juselius route (for more detail see Toda and Phillips 1993, 1994). Following all studies mentioned here, testing causality with the multi-step procedure conditional on the calculating of a unit root problem, a co-integration rank and as well as co-integration vectors as frequently applied by prior studies in the context of previous literature. So, this study uses TYDL Granger causality statistics test which is a simple technique demanding the estimation of “over-fitted “or an “augmented” VAR that is valid irrespective of the co-integration or degree of integration present in the system. It applies a Wald test with some modifications called modified Wald (MWALD) test to check for constraints on the parameters of the VAR (p) model. This technique has an asymptotic Chi-squared (\( \chi^{2} \)) distribution with degrees (k) of freedom in the limit, when a value of VAR [k + dmaxi] is calculated (where dmaxi refers to the maximal order of integration for the selected series in the system). The following main steps are included in instigating this procedure. The first phase contains determination of maximal order of integration (symbolized as dmaxi in the method) and the properties of non-stationarity. In this respect, the ADF root test is conducted at 5% level of significance.

The second phase is to define the co-integration association among the variables based on time series analysis having same order of integration. The Johansen and Juselius approach for co-integration correlation with statistics of maximum eigenvalue is concluded at 5% level of significance, which investigates the null hypothesis (\( H_{0} \)) of ‘r’ co-integrating associations against the alternative (\( H_{1} \)) of ‘r + 1’ relations of co-integrating. The test is computed for ‘N’ number of observations as:

where r = 0, 1, 2, 3, 4…… k − 1.

The next procedure is to detect the proper lag length (k) of the system of VAR applying some appropriate information criteria. This study also implemented the standard vector auto-regression (VAR) approach, which is given as follows:

where \( \varepsilon_{t } \) is the residual term, \( {\text{ZE}}_{t} \) is a vector of selected endogenous variables (INNO, LPN, LPR, GDP and TFP) and \( \delta_{1} ,\delta_{2} ,\delta_{3} \ldots \delta_{j} \) are the matrices of unknown parameters. Moreover, \( {\text{DE}}_{t } \) is related to deterministic vector (with constant and as well as exogenous variables), while the term \( \gamma \) is the parameters of matrix of the deterministic vector.

6 Estimation and analysis

6.1 Unit root analysis

Although the ARDL methodology does not require the pre-testing of non-stationary (unit root) problem, it is still very important to find out the above-mentioned test to check that none of them are integrated of order more than one. The result for the ADF test is stated in Table 4.

The ADF is used to intercept as well as intercept and trend (simultaneously). The results of unit roots have confirmed that \( {\text{LPN}}_{\text{t}} \) and \( {\text{GDP }} \) of the incorporated variables are non-stationary at all levels and all of them become stationary at I(1) first difference.

6.2 Lags selection

However, to find out the co-integration among variables; this study continues the model of the unrestricted error correction model (UECM). Before applying the technique of UECM, the main concern is the selection of maximum number of lags by using Schwarz (SC) and Akaike information criterion (AIC). Then, the Wald test is used to check the existence of co-integration.

The next step is to evaluate the F statistic calculated with critical bounds value by Turner (2006) to investigate the long-run (co-integration) relationship between variables existing or not. If calculated F-statistic value is greater than upper critical bound values, then it shows that long-run (co-integration) relationship exists among variables. If computed F-statistics value is lower than lower critical bound value, then there is no co-integration. The decision of co-integration is inconclusive when the value of F statistic lies between lower and upper critical bounds.

6.3 ARDL estimation

Previous section showed that all the selected variables are co-integrated. The next stage is related to the model of ARDL and to check the long-run association existing between the entire variables. The ARDL co-integration model is estimated in the following table, where the estimation of the long-run coefficients of the independent variables is given.

The null hypothesis (\( H_{0} ) \) explained that there is no problem of heteroskedasticity (applied ARCH test), and no serial correlation (Breusch–Godfrey LM test is used). The overall results indicate that we accepted null hypothesis (which means long-run relationship exists). The \( H_{0} \) Ramsey RESET test designates that model is correctly specified. Further, this study also accept null hypothesis in case of Jarque–Bera (JB test), which shows that data are normally distributed. Moreover, null hypothesis specifies that the values are greater than 5% level of significance. Hence, the results of estimated ARDL model are consistent.

7 Empirical findings

In order to check the integration of all variable, this study applied the ADF root tests and results are revealed in Table 4. The results based on ADF tests from Table 4 show that two variables have unit root problem at level but found stationary at first difference level. The next procedure is to detect whether or not there is any long-run connection among all these variables. The next (before arranged to testing of co-integration analysis) main step is to take the optimal lag length of these variables, and the results of Table 5 indicate that AIC and SC values are taken at lag 2. Table 6 shows the projected value of Wald test (F Value) statistics is 6.87, greater than the lower and upper bound values (Narayan 2005). The results show that no longer correlation between the selected variables of (\( H_{0} ) \) is rejected at different levels of significance, when all factors are treated as response variables. Therefore, results specify that GDP, LPN, LPR and TFP are co-integrated, and there is a significant long-run relationship found between them. Furthermore, \( {\text{R}}^{2} \) and adjusted \( R^{2} \) statistics describes that ARDL technique (Table 8) for bounds test is best fitted.

7.1 Discussion on the results of long-run analysis and error correction model

The results are reported in Table 8 which exhibits that economic growth is positively related to LPN, LPR and TFP and also significant in the context of Pakistan economy. Table 7 shows the long-run relationship between economic growth and LPR, and the results are statistically significant indicating 1% change in LPR will raise GDP by 0.33% at 1% level of significance. The results of this study indicate the impact of LPR on GDP is consistent with the research of Shearmur and Bonnet (2011) and Pradhan et al. (2016). Moreover, LPN has also significant and positive impact on GDP in the long-run relationship between GDP and LPN, whereas the coefficient of LPN is estimated to be 0.18 with a positive sign, significantly indicating that 1% change in LPN will raise GDP by 0.18%. The findings of these results are supported by the studies of Pradhan et al. (2016). Finally, TFP is an important in case of GDP growth and estimated to be statistically significant at 1% level of significance as it describes 0.52% variation in GDP due to 1% change in TFP. These results are supported by Zhang et al. (2014).

This study also identifies that the one period lagged error correction terms (ECM (− 1)) are statistically significant at the 1% level or better when GDP, LPN, LPR and TFP are the variables for equation of ECM. Whereas, Table 8 shows coefficient of the ECM (− 1) identifies the speed of adjustment of all given variables to reach their long-run equilibrium position after a short-run shock. While the significance of coefficient of ECM (− 1) based on t statistics test describes the presence of a long-run causal association between variables. In the next stage, this study found the direction of causality among all these variables of interest via the Toda–Yamamoto–Dolado–Lutkepohl (TYDL) test. After the confirmation of the result of co-integration existing among variables, this test is used. This study uses the co-integration test to the model of UECM with 2 lags.

7.2 The findings of modified WALD test with the unrestricted level VAR (k + d maxi) system

The method of unrestricted level VAR (k + dmaxi) is assessed in this phase, where ‘dmaxi’ shows the maximum order of integration in the model. In this paper, VAR test is estimated where the maximum order of integration is 4. The results in Table 9 indicate that there is long-run relationship between the variables. Then, this study applies standard “Wald statistical test” to the find ‘k’ coefficient matrix of VAR only in order to apply implication on Granger causality.

Table 10 explains the main findings of Granger causality by applying MWALD statistical test. The existence of the co-integrating association among GDP, LPN, LPR and TFP specifies the long-run relationship among these variables. Results show that Granger causality running between GDP to LPN, LPN to GDP, LPR to GDP and GDP to LPR which found significant represents bidirectional causal correlation between these variables. GDP is significantly affected by TFP, LPN and LPR. The variables LPN and LPR also have bidirectional relationship. Moreover, TFP and GDP have bidirectional relationship; TFP is significantly affected by LPN having unidirectional relationship. Finally, results show that GDP is significantly affected by LPN, LPR and TFP.

8 Conclusions and policy implications

Pakistan is essentially an agrarian economy, employing more than 42.3% of the economically dynamic population and generating more than 19.5% of GDP (Pakistan Economic Survey, 2016–2017). However, economic growth has consistently weakened, deteriorating far short of what is required to substantially increase living standards. The study tries to observe causal relationships between innovation, total factor productivity and economic growth in Pakistan simultaneously. The results reveal that variables are co-integrated. The study investigates the total factor productivity by first estimating a Cobb–Douglass production function over 1972–2016. Furthermore, contributing to the unsatisfactory TFPG were inappropriate macroeconomic policies, political disturbances and deterioration in the terms of trade (TOT), openness to trade, financial sector development, import of machinery, GDP growth, education, terms of trade improvements, innovation (residential plus non-residential) and financial sector development are all associated with higher TFP growth. Moreover, inflation is negative and significantly related to productivity growth.

The results of this empirical analysis suggest that to stimulate sustained economic growth in the Pakistan, policy makers may focus importance to improve educational system, control inflation and increased GDP growth. However, financial sector reforms certify the efficient allocation of financial resources to improve both productive and allocate efficiencies in the economy. The results indicate that long-term economic growth is highly dependent on the potential ability of country to move up on the innovation scale to remain globally competitive. This needs the allocation of appropriate resources for research and development (R&D) activities to push key economic sectors in the country.

Notes

For more details see Human capital PWT9.

References

Alcalá F, Ciccone A (2004) Trade and productivity. Q J Econ 119:613–646

Arellano M, Bover O (1995) Another look at the instrumental variable estimation oferror-components models. J Econ 68:29–51

Barro RJ, Sala-i-Martin X (2004) Economic growth. MIT Press, Cambridge

Benhabib J, Spiegel MM (2005) Human capital and technology diffusion. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier, Amsterdam

Black SE, Lynch LM (1995) Beyond the incidence of training: evidence from a national employers survey. NBER Working Paper No. 5231. NBER, Cambridge

Blundell R, Bond S (1998) Conditions and moments restrictions in dynamic panel data models. J Econ 87:115–143

Borensztein E, De Gregorio J, Lee JW (1998) How does foreign direct investment affect economic growth? J Int Econ 45:115–135

Bravo-Ortega C, García Marín A (2011) R&D and productivity: a two way avenue? World Dev 39(7):1090–1107. https://doi.org/10.1016/j.worlddev.2010.11.006

Cassiman B, Golovko E (2011) Innovation and internationalization through exports. J Int Bus Stud 42(1):56–75

Christensen CMCM (1997) The innovator’s Dilemma: when new technologies cause great firms to fail. Harvard Business School Press, Boston

Daude C (2010) Innovation, productivity and economic development in Latin America and the Caribbean. Development centre working papers. http://www.oecd.org/dev/wp

Daude C, Fernández-Arias E (2010) On the role of aggregate productivity and factor accumulation for economic development in Latin America and the Caribbean, IDB-WP-155. Inter American Development Bank, Washington DC

Diewert WE, Morrison CJ (1986) Adjusting output and productivity indexes for changes in the terms of trade. Econ J 96:659–679

Dollar D, Kraay A (2002) Institutions, trade, and growth. J Monet Econ 50:133–162

Easterly W, Levine R (2002) It’s not factor accumulation: stylized facts and growth models. Working Papers Central Bank of Chile 164, Central Bank of Chile

Galindo M, Mendez MT (2014) Entrepreneurship, economic growth, and innovation: are feedback effects at work? J Bus Res 67(5):825–829. https://doi.org/10.1016/j.jbusres.2013.11.052

Gollin D (2002) Getting income shares right’. J Polit Econ 110(2):458–474

Griffth R, Redding SJ, Van Reenen J (2004) Mapping the two faces of R&D: productivity growth in a panel of OECD industries. Rev Econ Stat 86(4):883–895

Griffth R, Huergo E, Mairesse J, Peters B (2006) Innovation and productivity across four European Countries. Oxf Rev Econ Policy 22(4):483–498

Griliches Z (1979) Issues in assessing the contribution of research and development to productivity growth. Bell J Econ 10:92–116

Griliches Z (1989) Patents: recent trends and puzzles. In: Brookings papers on economic activity, microeconomics, pp 291–330

Griliches Z (2000) R&D, education and productivity, vol 214. Harvard University Press, Cambridge

Grossman G, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Cambridge

Hall R, Jones C (1999) Why do some countries produce so much more output per worker than others?”. Q J Econ 114:83–116

Heston A, Summers R, Aten B (2009) Penn world table Version 6.3. In: Center for international comparisons of production, income and prices at the University of Pennsylvania (CICUP)

Huergo E, Jaumandreu J (2004) Firms’ age, process innovation and productivity growth. Int J Ind Organ 22(4):541–559

Isaksson A (2007) Determinants of total factor productivity: a literature review. In: United Nations industrial development organization working paper

Jaumotte F, Spatafora N (2007) Asia rising: a sectorial perspective. In: IMF Working Paper No. 07/130. International Monetary Fund, Washington

Joutz FL, Gardner TA (1996) Economic growth, energy prices and technological innovation. South Econ J 62(3):653–666

King R, Levine R (1993) Finance and growth: schumpeter might be right. Q J Econ 108:717–738

Klenow P, Rodri´guez-Claire A (2005) Externalities and Growth. In: Aghion P, Durlauf S (eds) Handbook of economic growth, vol 1, 1st edn. Elsevier, Amsterdam

Klenow P, Rodriguez-Claire A (1997) The neoclassical revival in growth economics: Has it gone too far? NBER Macroecon Annual 12:73–103

Kortum SS (1997) Research, patenting, and technological change. Econometrica 65(6):1389–1419

Laurenceson J, Chai JCH (2003) Financial reform and economic development in China. Advances in Chinese economic studies series. Edward Elgar, Cheltenham

Loko B, Diouf MA (2009) Revisiting the determinants of productivity growth: What’s new? In: IMP working paper No. 225

Mairesse J, Mohnen P (2010) Using innovation surveys for econometric analysis. In: NBER working paper 15857. National Bureau of Economic Research, Washington

Mastromarco C, Zago A (2012) On modelling the determinants of TFP growth. Struct Change Econ Dyn 23:373–382

Miller SM, Upadhyay MP (2000) The effects of openness, trade orientation, and human capital on total factor productivity. J Dev Econ 63:399–423

Narayan PN (2005) The saving and investment nexus for China: evidence from co integration tests. Appl Econ 37(17):1979–1990

Ortega-Argilés R, Potters L, Vivarelli M (2005) R&D and productivity: testing sectoral peculiarities using micro data. Empir Econ 41(3):817–839

Pesaran MH, Pesaran B (1997) Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modeling approach to co integration analysis. Chapter 11. In: Strom S (ed) Econometrics and economic theory in the 20th century: the ragnarfrisch centennial symposium. Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith R (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Pradhan RP, Arvin MB, Hall JH, Nair M (2016) Innovation, financial development and economic growth in Eurozone countries. Appl Econ Lett 23(16):1141–1144. https://doi.org/10.1080/13504851.2016.1139668

Rambaldi AN, Doran HE (1996) Testing for granger non-causality in co integrated systems made easy. In: Working paper in econometrics and applied statistics, vol 88, University of New England

Romer PL (1986) Increasing returns and long-run growth? J Polit Econ 94:1002–1037

Romer P (1990) Endogenous technological change. J Polit Econ 96:S71–S102

Rouvinen P (2002) R&D–productivity dynamics: causality, lags and dry holes. J Appl Econ 5:123–156

Shabbir MS (2015) Innovation and competitiveness lead to industrial trade. Bus Econ J 6(4):181

Shabbir MS (2016) The impact of financial development on economic growth of Pakistan economy. Am Based Res J 5(3):35–43

Shabbir MS (2018) The impact of foreign portfolio investment on domestic stock prices of Pakistan. In: MPRA

Shearmur R, Bonnet N (2011) Does local technological innovation lead to local development? A policy perspective. Reg Sci Policy Pract 3(3):249–270

Solow R (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Solow RM (1957) Technical change and the aggregate production function. Rev Econ Stat 39:312–320

Subhan QA, Mehmood T, Sattar A (2014) Innovation and economic development: a case of small and medium enterprise in Pakistan. Pak Econ Soc Rev 52(2):159–174

Toda HY, Phillips PCB (1993) Vector auto-regressions and causality. Econometrica 61:1367–1393

Toda HY, Yamamoto T (1995) Statistical inference in vector auto-regression with possibly integrated processes. J Econ 66:225–250

Tsai K, Wang J (2004) The R&D performance in taiwan’s electronics industry: a longitudinal examination. R&D Manag 34(2):179–189

Wakelin K (2001) Productivity growth and R&D expenditure in UK manufacturing firms. Res Policy 30(7):1079–1090

Zapata HO, Rambaldi AN (1997) Monte Carlo evidence on co-integration and causation. Oxf Bull Econ Stat 59(2):285–298

Zhang J, Jiang C, Wang P (2014) Total factor productivity and china’s growth miracle: An Empirical Analysis. SSRN. https://doi.org/10.2139/ssrn.2456009

Authors’ contributions

The HS is the main author of the research, other co-authors namely MS wrote the literature review, MB collected the data and BAK reviewed the paper and improved the quality of paper by qualitative and quantitative analyses. All authors read and approved the final manuscript.

Acknowledgements

Authors are thankful to their colleagues who provided expertise that greatly assisted the research.

Competing interests

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Saleem, H., Shahzad, M., Khan, M.B. et al. Innovation, total factor productivity and economic growth in Pakistan: a policy perspective. Economic Structures 8, 7 (2019). https://doi.org/10.1186/s40008-019-0134-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-019-0134-6