Abstract

This research seeks to enhance the current literature by exploring the nexus among environmental contamination, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African nations for a time of 34 years (1980–2014). By applying panel unit root (CADF and CIPS, cross-sectional independence test), panel cointegration (Pedroni and Kao cointegration test, panel PP, panel ADF), Hausman poolability test, and an auto-regressive distributed lag procedure in view of the pooled mean group estimation (ARDL/PMG), experimental findings disclose that alluding to the related probability values, the null hypothesis of cross-sectional independence for all variables is rejected because they are not stationary at levels but rather stationary at their first difference. The variables are altogether integrated at the same order I(1). Findings revealed that there is a confirmation of a bidirectional causality between energy use and CO2 in the short-run and one-way causality running from energy use to CO2 in the long run. There is additionally a significant positive outcome and unidirectional causality from CO2 to foreign direct investment in the long run yet no causal relationship in the short run. An increase in energy use by 1% causes an increase in CO2 by 49%. An increase in economic growth by 1% causes an increment in CO2 by 16% and an increase in economic growth squared by 1% diminishes CO2 by 46%. The positive and negative impacts of economic growth and its square approve the EKC theory. To guarantee sustainable economic development goal, more strict laws like sequestration ought to be worked out, use of sustainable power source ought to be stressed, and GDP ought to be multiplied to diminish CO2 by the utilization of eco-technology for instance carbon capturing, to save lives and also to maintain a green environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Economic growth in sub-Saharan Africa is projected to have improved slowly from 1.3% in 2016 to 2.4% in 2017. This gradual change is witnessed in countries like Angola, Nigeria, and South Africa which are considered to be the largest economies in the region due to the price stabilities and economic environment. Economic growth in sub-Saharan Africa is predicted to increase to 3.2% in 2018 and to 3.5% in 2019 but the progress will be gradually slow (World Bank 2018b). To hasten and maintain a comprehensive growth indication, policymakers should continuously invest in human capital as supported by Ndambiri et al. (2012), minimize resource wastage, and enhance production in the region. Zeufack (2018) reported that policymakers in sub-Saharan Africa should be empowered to manage the challenges that arise during the process of economic development. Not only that, they should also consider boosting the energy systems for sustainable economic development. There is no way economic growth and development can advance without the use of energy. Energy is one of the required variables for economic growth in sub-Saharan Africa as well as in the entire world. Bazilian et al. (2012) reported that accessibility to energy services are very important because of the abilities they have to handle the present global economic and social oppositions such as poverty, disparity, food security, environmental challenges, welfare, and education. Africa is rich in terms of energy resources which are capable of transforming Africa. Energy use is needed for economic growth, and access to cheap and reliable energy is a vital objective for economic activities. They stated that it is unfortunate to generate energy from fossil fuel. For economic activities to be effective and hazard-free, there is a need for de-carbonization (decoupling) from energy globally for low carbon and zero carbon emissions (Fankhauser and Jotzo 2018).

According to Avila et al. (2017) and Ispy (2018), Africa is prosperous in terms of energy resources, but on the other hand, Africa is faced with the challenge of equal distribution. That over 130 million people depend on kerosene, charcoal, lantern, candles, and fossil fuels, and on top of that, around 620 million cannot access electricity. However, with the great resource of energy, Africa has not been able to meet the demand for energy by her citizens. It was indicated by World Economic Forum WEF (2016) that the need for energy in Africa is huge and that only 24% of the sub-Saharan African region has access to electricity and yet the capacity of the generated energy is 28% gigawatts.

Avila et al. (2017) revealed that the ongoing scarcity of electricity has incapacitated the economic growth of sub-Saharan Africa and stopped it from achieving the sustainable standards of living because of the absence of the capacity to generate enough energy, lack of suitable and proper infrastructure for energy supply, and lack of stable financial resources to sustain and invest in renewable energies. These setbacks have affected the progression of the sub-Saharan African development and growth. They have also led to the great use of fossil energy in sub-Saharan Africa. Lack of accessibility to constant and affordable energy supply presents a huge hindrance to the rapid economic growth and development of Africa. For these challenges to be solved, the World Bank (2018a) reported that technical innovation for instance investing in solar power will grant Africa with enough supply of electricity which will boost. That when Africa embraces technology, it will not only boost the economy, but it will also improve the lives of the citizens once they get access to energy supply.

Africa as a slow-growing economy will need to boost her energy sector by encouraging foreign investors to come and invest in Africa. According to the World Bank (2014), foreign direct investment (FDI) is the greatest form of capital crossing borders into emerging economies. FDI in sub-Saharan Africa went up from US$6.3 billion in 2000 to US$35 billion in 2012. Rodríguez-Pose and Cols (2017) reiterated that internationally, FDI is considered to be a tool for global economic amalgamation which has got the proclivity to deliver monetary support as it promotes economic improvement for sustainable living of the citizens.

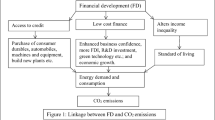

As much as sub-Saharan African region desires to develop economically, the recent economic development, demand for energy, and attraction of foreign investors have posed a huge concern about environmental pollution especially carbon emissions (Bekhet et al. 2017). On top of that, Zaman and Moemen (2017) reiterated that economic development, in the midst of environment degradation, is something that should bring shame upon everyone. The effects of economic growth on the environment are more evident in nations where industrialization is growing at a high speed inducing carbon emissions, affecting human health on a daily basis as a result of economic activities. It is also confirmed by Nazeer et al. (2016) that industrialization, urbanization, mechanization, fertilizer, pesticides, and poor management of wastes particularly in developing economies have had a great deadly impact on the environment where policies and regulations are not tight and strict. In light to what is stated above, Huisingh et al. (2015) also revealed that the main factor responsible for climate change and global warming is the ever increasing global carbon emissions engineered by human activities for instance cutting down of trees and burning of fossil fuels. Asumadu-Sarkodie and Owusu (2016) also reiterated that economic growth, population, foreign direct investments, and energy use have contributed greatly to environmental pollution.

This has made policymakers and analysts to investigate the connection between the responsible variables. The questions in the minds of several researchers have been, “how can this challenge of environmental pollution be brought to an end without interfering with the economy?” This is the question economists and environmentalists are asking. The world today is in a dilemma because of climate change as a result of environmental degradation due to human activities which has made climate change to become a global concern (Arbuckle et al. 2015; Bonan 2015; Frumhoff et al. 2015; Goldstone 2018; Meyer 2017; Wang et al. 2017). Wang et al. (2017) posted that international governments on climate change stated that global warming with an increase in temperature ushered in atmospheric extremes. That these extremes have affected nature, ecological system, and community debasement, and the practical advancement of the economy has driven individuals to economic poverty.

On top of that, it has been affirmed that energy utilization and the economic activities are thought to be the most producers of greenhouse gas discharges (Zhu et al. 2016) which have increased in the past years due to population increase, high demand of energy, increase in economic growth, and increase in agriculture (Asumadu-Sarkodie and Owusu 2017; Kofi Adom et al. 2012; McAusland 2010; Shahbaz et al. 2017). Based on the research conducted by researchers, carbon emissions is considered to be the highest pollutant and more deadly in emerging economies (Khan et al. 2011). It has greatly contributed to respiratory and cardiovascular illness. The evidence from World Health Organization stated that air pollution claims 7,000,000 lives annually (WHO 2018).

The prospective consequences of global warming are so severe that researchers and policy practitioners have devoted much time and a lot of resources to investigate the solution to environmental pollution (Chai et al. 2016; Gergel et al. 2017; Matthews et al. 2017; Pittock 2017; Schuur et al. 2015; Vogel and Henstra 2015).

In spite of the distinctions of sentiment, a few activities have been put together to check the antagonistic impacts of environmental change (Anderson et al. 2017; Melillo et al. 2017). For instance, the Kyoto convention which placed an official instruction among developed and developing nations, with the goal to lessen GHG emanations (Sethi and Gupte 2017; Weitzman 2017). To achieve the sustainable development goals, the Kyoto protocol was linked to UNFCCC (United Nations Framework Convention on Climate Change) which was adopted in December 1997, in Kyoto, Japan. It came into action in 2005 to influence government Presidents to task their ministers to start working toward sustainability and also to remind them of the future deadly effects of global warming if nothing is done about it (Aldy 2017; Böhringer et al. 2018; Nanda 2018; Sethi and Gupte 2017). From the result of the convention, several treaties were signed to encourage countries to vow to reduce their carbon emissions out of a good will to a temperature of 2 °C. Unfortunately, most developing countries have not fully paid attention to the request which has led to extreme global warming (de Alegría et al. 2017). During the conventions, techniques like bio-filtration for cleaning ambient gas were suggested and more research on these techniques were encouraged (Ben Jaber et al. 2016; Devinny et al. 2017).

As nations commence to address economic challenges, discussions have taken place to whether economic growth can exist alongside stabilized climate or vice versa (Aden 2016). As discussions about the relationship between economic growth and environmental pollution, Hanley Wood Data Studio (2016) carried out a study and they found that 21 countries globally have managed to enhance their economy as they downsize their carbon footprint. Their findings confirmed that nations can reduce carbon emissions without interfering with the economic growth. They stated that at least 1 billion metric tons annually was reduced between 2000 and 2014 by nations like the USA, UK, Australia, Bulgaria, and Uzbekistan. For instance, Slovakia downsized her greenhouse gas by 22% at the same time achieving a high GDP growth by 75%. The leading nation in the business of carbon emission reduction globally is USA. Hanley Wood Data Studio (2016) indicated that based on the findings of World Resource Institute, USA is considered to be the largest nation with a continuous GDP growth with a huge decline in emissions for several years. For instance, from 2010 to 2012, carbon emissions dropped by 6% from 5.58 to 5.23 billion metric tons and the GDP increased by 4% from $14.8 trillion to $15.4 trillion. Aden (2016) reported that in 2014 and 2015, global carbon emissions remained leveled as the GDP continued to grow among the 21 nations and they managed to reduce GHG emissions. Unlike in Canada, it has been the opposite. Hughes and Herian (2017) posited that right from 1956, both the GDPs and emissions of Canada have frequently increased rapidly. They stated that Canada must decouple GDP from carbon emissions to meet Canada’s emission reduction target of 2030.

In regard to the above environmental distress, this study investigates the nexus among environmental pollution, economic growth energy use, and foreign direct investment in 6 selected sub-Saharan African countries for over the period of 1980–2014. The selected countries are Ghana, Kenya, Botswana, Mauritius, Togo, and Benin. Even though several researchers have done studies in connection to the variables used in this study using time series or panel data associations (Begum et al. 2015; Bekhet et al. 2017; Ghosh and Kanjilal 2014; Lin and Ouyang 2014; Ozcan 2013; Salahuddin et al. 2018), to the best of our knowledge, no research has yet been carried out to determine the nexus among the 6 selected sub-Saharan African countries.

The research aims to provide more consistent estimates of the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in the 6 selected sub-Saharan African countries during the period of 1980–2014. The results of the study will help governments to formulate policies that will be useful in terms of governing the environment for a sustainable standard of living and even to find out the kind of technology suitable for environmental protection. It will also add value to the existing literature about sub-Saharan African and other parts of the world.

The remaining structure of the study is structured as follows: “Theoretical literature review” discusses the theoretical evidences from literature review, “Methodology” is devoted to methods and data, “Empirical results and discussions” focuses on the empirical results and discussion of the study, and “Conclusion and policy implications” details the conclusion and policy implications or recommendation.

Theoretical literature review

For the past two decades, the causal nexus among carbon discharges, economic growth, energy use, and FDI have been a subject of discussion (Achour and Belloumi 2016). As indicated by various researchers like Chai et al. (2016) and Gergel et al. (2017), the prospective consequences of environmental destruction are so severe that researchers and policy practitioners have devoted much time to investigate the solutions to this challenge.

It is imperative to understand the variables involved in this study. When we discuss carbon outflows (dependent variable), we are concentrating particularly on carbon dioxide, or CO2 discharges into the air in an enormous amount of ways (Jones 2016; Schreier 2017). In the area of research, some of the indicators that have been engaged as proxies for ecological pollution are CO2 (carbon dioxide) and SO2 (sulfur dioxide) emissions and methane. The other variables are economic growth, foreign direct investment inflow, and energy use as the independent variables.

The nexus among economic growth and carbon emission

Economic growth is an extension in the production of goods and services execution over a specific period. To be correct, the estimation must oust the effects of inflation. Economic growth or development makes more advantage for organizations and a nation in general. Hence, stock cost rise gives firms resources to remain in business. They contribute and contract more laborers and as greater work opportunities are made accessible as well as compensation rise. Be that as it may, as much as nations would need to see their income enhances, this comes with consequences like carbon emissions. This makes it very important to understand the nexus between this economic growth and carbon emissions. According to Han et al. (2018), they reveal that it is imperative to have a decent comprehension about the relationship between carbon emissions and economic growth to disclose the interfaces between human activities and the natural ecology to reduce greenhouse gases.

The nexus between environmental defilement and economic growth can be shown by EKC (Environmental Kuznets Curve) presented by Simon Kuznets in the 1960s. He revealed that environmental contamination rises correspondently as one with economic growth. That when there is an increase in the income level and when the income ascends to a particular level, at the defining moment, CO2 begins to decrease. Accordingly, an inverted U-shaped correlation between environmental defilement and economic growth is made. Ahmed and Azam (2016) exhibited that the current literature displays the connection between energy usage and economic progression is extensively examined. However, the experimental discoveries are yet not made clear and irreconcilable with respect to the trend of causality, basing on their research using cross-country time-series unidirectional causality runs from gross national product (GNP) to energy utilization, for both Chile and Argentina.

Begum et al. (2015) examined the impact of dynamic impacts of economic growth, energy consumption, and population growth on CO2 emissions. They used econometric methodologies such ARDL bound testing in Malaysia from 1970 to 1980. Their results indicated that as the carbon emissions reduced, economic growth increased. But again, from 1980 to 2009, carbon emissions increased abnormally as the economic growth increased at the same time. Their result also indicated that both energy consumption and economic growth have a long-term positive effect on carbon emissions. They suggested the use of low-carbon innovations such green energy to reduce carbon emissions for sustainable economic growth. Kasman and Duman (2015) investigated the causal nexus among energy consumption, economic growth carbon emissions, urbanization, and trade openness for a panel of EU countries over the period 1992–2010. They exerted panel causality tests, panel unit root test, and panel cointegration methodologies. According to their results, the evidence of Environmental Kuznets Curve hypothesis is supported. This proved that there is an inverted U-shaped correlation between environment pollution and economic growth for the selected countries. Salahuddin et al. (2017) scrutinized the empirical effects of economic growth, electricity consumption, foreign direct investment (FDI), and financial development on carbon dioxide (CO2) emissions in Kuwait using time-series data for over the period of 1980–2013. They exerted ARDL bound testing method, and their report indicated that economic growth, electricity consumption, and FDI stimulate CO2 emissions in Kuwait. The results from the VECM exposed that FDI, economic growth, and electricity consumption toughly Granger-cause CO2 emissions. According to these results, the study indorsed that carbon emissions should be reduced by increasing its present carbon capture and use of renewable energy like solar and wind energy. Cai et al. (2018) explored the causal relationship among renewable energy consumption, economic growth, and carbon emissions. They exerted bootstrap ARDL bounds alongside structural break to investigate cointegration and causality for G7 nations. Their findings of causality test revealed that renewable energy use causes real GDP per capita for countries like Canada, Germany, and the USA and CO2 emissions cause renewable energy use for Germany. They also revealed that their findings have got significant policy implications for G7 nations steering effective energy-use approach to decrease CO2 emissions. They also concluded by stating that clean energy has the capability to bridge the gap between economic growth and environmental management in G7 and the demerging economies.

Isik et al. (2018), in another exploration, observed the interrelationship between energy consumption, environmental pollution, urbanization, and economic growth in China considering provincial panels. They used a heterogeneous panel analysis technique. In this technique, they included heterogeneous panel estimation which is based on (DOLS), fully modified least squares (FMOLS). They exerted heterogeneous panel Granger test focusing on Dumitrescu and Hurlin. Their findings revealed that carbon emissions, GDP, energy consumption structure, and urbanization contain a long-run equilibrium correlations. Their findings further revealed that GDP and energy consumption have a significant impact on carbon emission in all provincial panels. But urbanization has a significant effect on carbon emissions within national and medium-developed regions. Based on the findings, they proposed policy implications to reduce carbon emissions. Koçak and Şarkgüneşi (2018) investigated the effect of foreign direct investment on carbon emissions in Turkey over the period from 1974 to 2013. Using the structural break cointegration test bootstrap test for causal testing and ordinary least square estimator, their study reiterated that economic growth procedures reduce CO2 emissions. Khobai and Le Roux (2017) examined the relations among energy consumption, carbon dioxide emission, economic growth, trade openness, and urbanization for South Africa from 1971 to 2013. Based on the findings of Johansen test of cointegration and vector error correction model Granger causality, their study indicated that there is a long-run relationship between the variables and there is bidirectional causality running among energy use and GDP in the long run. Their study suggested that South African government should impose energy polices for the enhancement economic growth.

The nexus among foreign direct investment and carbon emission

The link between FDI inflows and CO2 emissions are broadly discussed in the literature to do with environmental behaviors. This connection has ignited debate among scholars and policymakers about the positive and the negative impact of both variables. The truth of the matter is that FDI inflows is capable of providing direct capital for investment, and motivate economic development by the means of knowledge transfer, technology transfer, and spillover effects to enhance production (Lee 2013; Ning and Wang 2017). On the other comes with carbon emissions especially in regions where there are tighter policies and regulation. Jain (2016) states that there is a great deal of confirmation recommending that through foreign direct investment, international multi-national corporations tend to move pollution to developing countries with thoughtless ecological controls as opposed to developed countries with incredibly strict ecological policies. In this way, contingent upon the idea of and the intentions behind the multinational companies, FDI can cause more emanations in the host nations (Li et al. 2018). The impact of FDI on greenhouse gas discharges specifically has likewise been a subject of level-headed discussion in the existing literature (Rafindadi et al. 2018).

Salahuddin et al. (2017) analyzed the effects of economic growth, electricity consumption, and foreign direct investment (FDI) on carbon dioxide (CO2) emissions in Kuwait using time-series data for over the period of 1980–2013. Exerting ARDL, their report showed that FDI motivates CO2 emissions. Their other result from the VECM exposed that FDI, economic growth, and electricity consumption toughly Granger-cause CO2 emissions. Bekhet et al. (2017) investigated dynamic causal relationships among, financial development, economic growth, energy use, and carbon emissions for Gulf Cooperation Council nations over the period of 1980 to 2011. When they employed ARDL model, their study revealed that there is an existence of long-run and causal relationships among the variables in all countries unlike in United Arab Emirates (UAE); within UAE, Oman, and Kuwait, one-way causal relationship from financial development to carbon emissions was found. In another study, Tang and Tan (2015) examined the connection between carbon emissions, energy consumption, (foreign direct investment), and economic growth in Vietnam from 1976 to 2009. They employed cointegration test and Granger causality test. Their report inveterate the presence of long-run equilibrium within the variables. Their other findings revealed that there is an existence of two-way causalities among carbon emissions and income, and between FDI and carbon emissions. They were able to single out energy use, FDI, and GDP as the key factors of carbon emissions in Vietnam. They also suggested that foreign direct investment is vital in the mitigation of carbon emission through clean technologies in terms of technology transfer.

Koçak and Şarkgüneşi (2018) exerted structural break cointegration test bootstrap test for causal testing and ordinary least square estimator to investigate the potential impact of foreign direct investment on carbon emissions in Turkey over the period from 1974 to 2013. Their results indicated that there is an existence of long-term balance relationship among FDI, GDP, energy use, and carbon emissions. The study also revealed that FDI has a potential impact on carbon emissions. They also found that the impact of FDI on carbon emissions is positive with a two-way relationship. Sarkodie and Strezov (2019) examined the significant impact of foreign direct investment (FDI) inflows, economic growth, and energy use on carbon emissions from 1982 to 2016 considering China, India, Iran, Indonesia, and South Africa as the leading carbon emitters in the emerging economies. They discovered that the impact of energy use on carbon dioxide emissions is significantly positive. Their final findings reported that foreign direct investment inflows can boost eco-technological transfer, upgrading in labor and eco-friendly management in emerging economies.

Another study by Ojewumi and Akinlo (2017) investigated the dynamic relations between foreign direct investment, economic growth, and environmental quality in sub-Saharan Africa (SSA). They used panel vector error correction (PVEC) and panel vector autoregressive (PVAR) methods. They indicated that vibrant relationships are evident among economic growth, foreign direct investment, and carbon emissions. They advised that sub-Saharan African governments ought to make an equilibrium between policies which are suitable for the protection of the environment. Behera and Dash (2017) explored the interrelationship between urbanization, energy consumption, foreign direct investment (FDI), and carbon emissions of 17 countries in the South and Southeast Asian (SSEA) region over the period of 1980–2012. When they used Pedroni cointegration, they found that both fossil fuel energy consumption, primary energy consumption, and FDI significantly affect carbon emission in the SSEA province. Sung et al. (2018) investigated how foreign direct investment (FDI) affect the level of carbon emissions of a nation. They used panel data for a period of 2002–2015 considering 28 industrial sectors in China. Based on their findings, they reported that FDI is a positive prognosticator of environmental quality in the hosting nation. This proves that FDI reduces the intensities of carbon emissions.

The nexus among energy use and carbon emission

The relationship between CO2 emissions and energy consumption is one of the present debates in the energy environment literature since the last two decades. Alshehry and Belloumi (2015) examined the causal connection between energy cost, economic exercises, and energy utilization in Saudi Arabia. Their findings exhibited that a long-run unidirectional causality from energy consumption to financial development and CO2 outflows. They also found a bidirectional causality between carbon dioxide discharges and financial development, and a long-run unidirectional causality keeps running from energy cost to economic growth and CO2 emanations, and a short-run, unidirectional causality running from CO2 outflows to energy utilization and monetary yield and from energy cost to CO2 emanations. In Tunisia, Ben Jebli and Belloumi (2017) utilized (ARDL) methodology and Granger causality tests and their examination revealed that a bidirectional short-run causality between sea transport and CO2 transmissions and a unidirectional short-run causality which runs from real GDP, burnable renewables and waste depletion, railroad transport to CO2 radiations, and the long-run estimates revealed that real (GDP) contributes to the abatement of CO2 emissions, while burnable renewables, waste depletion, sea, and railroad transport positively encourages emissions. A study by Mirza and Kanwal (2017) revealed that there is bidirectional causalities among energy use, economic growth, and carbon emanations in both the long and short run.

Heidari et al. (2015) applied the panel smooth transition regression (PSTR) model as a second-generation econometric technique to investigate the link between economic growth, carbon dioxide (CO2) emissions, and energy consumption in five ASEAN. Their study showed that energy consumption increase CO2. Mirza and Kanwal (2017) examined the existence of causality presence between economic growth, energy consumption, and environmental pollution for Pakistan. Using ARDL to examine the robustness of the long-run connection and the existence of Grangers’ causality results using VECM, they indicated that there is bidirectional causalities among economic growth, energy consumption, and carbon emissions. Based on their results, they suggested that the Pakistan government should increase on renewable energy. Another study conducted by Isik et al. (2018) revealed that a long-run equilibrium correlations exited among carbon emissions, GDP, energy consumption structure, and urbanization. Their study also revealed that GDP and energy consumption have a significant impact on carbon emission in all the provinces of China. Ahmad et al. (2018) used ARDL model to examine the effect of energy consumption, total population, and economic growth on carbon emissions over the period of 1971 to 2013 in China. They were able to identify a linkage among economic growth and carbon emissions which confirmed the existence of long run connection. When they used Granger causality test, they found the existence of one-way causality between economic growth and carbon emissions. Their final results divulged that the energy use and economic growth have got great potential to encourage carbon productions in the long run. The researchers suggested that the government should pay attention on the promotion of sustainable energy for sustainable economic development and living.

Another study by Balcilar et al. (2018) explored the connection between economic growth energy consumption and carbon dioxide emissions in the G-7 countries. They used historical decomposition method, and their findings provided proof that countries like Canada, Italy, Japan, and the USA needed to give up on most economic activities to diminish CO2 emissions by banning the use of nonrenewable energy use. But on the other hand, their results displayed contradiction of EKC hypothesis for Canada, Germany, Japan, the UK, and the US which indicated that economic growth does not affect the quality of the environmental quality because the EKC hypothesis is not valid for Germany and the UK.

Topcu and Payne (2018) estimated trade and energy use nexus in OECD countries for over the period of 1990–2015.They applied panel structure with approval for heterogeneity and cross-sectional dependence. Their study revealed that the influence of trade on energy use displayed an inverted U-shaped pattern which indicated that the impact of carbon emission on energy use is more than economic growth. Behera and Dash (2017) examined the interrelationship between urbanization, energy consumption, foreign direct investment (FDI), and carbon emissions of 17 countries in the South and Southeast Asian (SSEA) region over the period of 1980–2012. They used Pedroni cointegration and their outcome reported that both the primary energy consumption and fossil fuel energy consumption significantly increasing the carbon emission in the SSEA province.

Methodology

This paper explores the relationship amidst carbon emissions, economic growth, energy use, and foreign direct investment. Variables were converted into natural logarithm forms to address the issue of heteroskedasticity; every one of the factors are changed over into common logarithm shapes. The log-linear quadratic form is utilized to analyze the connection between carbon emissions, economic growth, energy consumption, and foreign direct investment using the following regression model;

where lYit represents the natural logarithm of economic growth (GPD constant price of 2010), lECit is the natural logarithm of energy consumption (kg of oil equivalent per capita), lFDIit denotes the natural logarithm of foreign direct investment net inflows (BoP, current US$), and \( l{CO}_{2_{it}} \)is the natural logarithm of carbon emissions. βo and εit, further represents the constant and error terms, respectively.

Econometric approach

To detect the stationarity of carbon-emissions, economic growth, energy consumption, and foreign direct investment, the panel data characteristics should further be elaborated in order to utilize appropriate and robust panel unit root tests. In the case where the panel time-series data is cross-sectionally independent, the use of traditional panel unit root test such as IPS, LLC, and Hadri tests gives inconsistent and erroneous results. Hence, in order to check whether the panel time-series data for the study is cross-sectionally independent, the study employed a cross-sectional independence test developed by Pesaran (2004). Under the null hypothesis of Pesaran CD test, the error terms of individual series within the panel are uncorrelated (cross-sectional independence), while under the alternative hypothesis, errors terms of individual series within the panel are correlated (cross-sectional independence). The study later analyzed the stationarity properties of the variables. Considering potential cross-sectional independences within the panel time-series data, we employed second-generation panel unit roots test developed by Pesaran (2007) which include the cross-sectional IPS (CIPS) (an extension IPS panel unit root test developed by Im et al. (2003) and cross-sectional augmented Dickey-Fuller (CADF) panel unit root tests. The CIPS and CADF panel unit root tests are based on the null hypothesis that all individual series within the panel are stationary against the alternative hypothesis that at least an individual series in the panel is stationary.

Aside the Pesaran CD test, CIPS, and CADF panel unit root tests, the study went on to investigate the long-run relationship amid carbon emissions, economic growth, energy consumption, and foreign and direct investment with Pedroni panel cointegration test and Kao panel cointegration test developed by Pedroni (2004) and Kao (1999), respectively.

Further, the study utilized the Pooled Mean Group (PMG) estimator through a panel Autoregressive Distributed Lag (ARDL) model in order to show both the long-run and short-run estimates of carbon emissions, economic growth, energy use, and foreign and direct investment. Recently, the ARDL has been used more due to some useful advantages which include (i) regardless of whether the series is I(1) or I(0) this technique can be applied (ii) both short-term and long-term estimates can be simultaneously made (Pesaran and Shin 1999). The ARDL (p, q) model consists of lag p on the response variable and lag q for the explanatory variables. The ARDL (p, q) model as developed can be formulated as:

wherei = 1, 2, 3, … , N represents the number of countries used in the study; t = 1, 2, 3, . . , T denotes the period in years, yit is the response variable, xit − j represents a m × n vector consisting of the natural logarithm of the explanatory variables, μij is a scalar vector, \( {\Omega}_{ij}^{,} \) represents the m × 1 coefficient vector, whereas εit is the error term with zero mean and a finite variance. Considering a maximum of one lag for all the variables, the autoregressive distributed lag, ARDL (1,1,1,1) model developed by Pesaran and Shin (1999) is formulated as follows:

Generally, the error correction representation of Eq. (4) can be written as:

where \( {\psi}_i=-\left(1-\sum \limits_{j-1}^p{\mu}_{ij}\right) \), and \( \Theta =\frac{\sum \limits_{j=0}^q{\Omega}_{ij}}{\psi_i} \).Θ represents the long-run relationship among the response and explanatory variables (yit and xit) whereas \( {\Omega}_{ij}^{\ast } \), on the other hand, signifies the short-run effect in the xit’s on the yit’s. The ψi again denotes the error correction term which is used from measuring the speed of convergence of the response variables in moving to its long-run equilibrium as the explanatory variable changes. The error correction term is expected to be negative and significant so as to show the existence of stability in the long-run relationship.

In this study, our modified model with carbon emission as the response variable from (1) can, therefore, be written in the ARDL format as:

The remaining equations in similar mode can be formulated as follows:

Equations (5), (5.1), (5.2), (5.3), and (5.4) are estimated respectively using the PMG estimator. As compared to other estimators, the PMG has several merits. For instances, this estimator restricts the long-run estimates to be constant across all cross sections with a panel but allows the intercepts as well as the short-run coefficients and error variances to vary across countries. Also, it can be used irrespective of whether the series is I(1) or I(0) and inference of long- and short-run causalities can be drawn even if the presence of cointegration is not officially detected.

Finally, an important diagnostic test known as the Hausman poolability test was finally performed in the study to attest whether the pooling coefficients are appropriate and efficient. This diagnostic test tests the null hypothesis of pooling long-run coefficients that are identical for all cross sections (Ho : δi = δ ∀ i) against the alternative hypothesis that pooling long-run coefficients are not identical for all cross sections.

Data source and description

This study utilizes an annual panel time-series data for 7 sub-Saharan African countries covering the period of 1980 to 2014. The data with respect to the variables (carbon emissions, economic growth, energy consumption, and foreign direct investment) were obtained from the World Bank Development Indicators (WDI) which as access from https://data.worldbank.org/indicator. The data per variable was transformed into natural logarithm so as to interpret the coefficient estimates as the elasticities of the dependent variable (carbon emissions). Sampled sub-Saharan African countries for the study include Ghana, Kenya, Botswana, Mauritius, Togo, and Benin.

With respect to the dependent variable and as the main determinant of the time frame, we could not go past the frame as data for carbon dioxide before 1980 were missing while observations after 2014 for energy consumption and carbon emissions were missing as well, and for most countries like Uganda, South Soudan, and D.R. Congo, data were also missing. The fact that several countries had large missing data observations; this left us to sample the 6 aforementioned nations.

Results obtained from the data were generated with the help of EVIEWS 9.0 and STATA 13.0 software. Table 1 presents the summary of the data set together with the summary statistics which includes the mean and the standard deviation of carbon emissions, energy use, economic growth, and foreign direct investment for each of the 6 selected sub-Saharan African countries. Results from the summary statistics depict that the mean of carbon emissions ranges from 8062.266 in Kenya to 1242.799 in Togo. As for energy consumption, Ghana among the 6 selected sub-Saharan African countries has the lowest energy usage, while Botswana has the highest. With respect to the gross domestic product (GDP), Mauritius has the highest GDP followed by Botswana, while Togo is the poorest country within the panel. Finally, for foreign direct investment (FDI) which is defined as net inflows (BoP, current US$), Ghana has the highest volatility and Benin has the lowest among the 6 sub-Saharan African countries.

Empirical results and discussions

Cross-sectional independence test

The CD test developed by Pesaran (2004) is utilized together with the analyzed variables in order to explore whether the panel time-series data has cross-sectional independence. Results from the various Pesaran CD tests are presented in Table 2. Referring to the related probability values, the null hypothesis of cross-sectional independence for carbon emissions, economic growth, energy use, and foreign direct investment is rejected. This results are similar to those of Omri et al. (2015) and Shahbaz et al. (2013). This, therefore, gives the indication that the panel time’s series data which includes the analyzed variables has cross-sectional independence. Given the fact that the panel time’s series data containing the variables under discussions exhibit cross-sectional independence, the study continues with panel methods that assume cross-sectional independence. Hence, this study in the next stage employs the CIPS and CADF panel unit root test.

Panel unit root test

This study as mentioned in the methodology uses the CIPS and CADF panel unit root tests instead of conventional unit root test such as Breitung, IPS, and LLC panel unit root tests (Gengenbach et al. 2009). This is due to the reason that these conventional panel unit root tests have drawbacks with respect to the presence of cross-sectional independence. Most importantly, the CADF and CIPS unit root tests yield reliable results in the presence of cross-sectional independence as supported by the results of Dogan et al. (2017). Results of the CIPS and CADF tests are therefore stated in Table 3. Both tests illustrate that the variables under investigation are not stationary at their respective levels but become stationary at their first difference. Therefore, this gives the indication that the variables CO2, GDP, EU, and FDI are all integrated at the same order (I(1)).

Since the investigated variables are non-stationary at their levels, the study used the Pedroni and Kao panel cointegration test to investigate whether long-run relationship exists among the variables or not (Fang and Chang 2016). During the test, variables are to be in a panel data to be non-stationary at their levels.

Panel cointegration test

This examination searches for cointegration connections that are conceivable between the investigated variables (CO2, Y, Y2, EU, and FDI) by most importantly using the Pedroni panel cointegration test. The Pedroni panel cointegration test from Table 4 provides results from seven diverse statistics. Generally, since the majority of these statistics which incorporates the panel PP, panel ADF, group rho, and group PP statistics are measurable, we rejected null hypothesis. This is because the analyzed variables have cointegration relationship.

Kao panel cointegration test contains coefficients that are homogeneous coefficients at the primary stage regressors over the cross section applying the same methods as the Pedroni cointegration test. As for the results of the Kao panel cointegration test exhibited in Table 5, it is detected that the investigated variables are cointegrated and subsequently have cointegration connections. This is on the grounds that there is sufficient proof to reject the null hypothesis of no cointegration for the elective speculation of cointegration at 1% noteworthiness level. In light of the results of both the Pedroni and Kao panel cointegration tests, we reach on the presence of cointegration between the investigated variables utilized in the examination.

The causality test using the Pooled Mean Group estimator

We applied the Pooled Mean Group estimator because it makes the long-run coefficients controlled to be similar for all cross section, while the short run allows it to be diverse from nation to nation. PMG also permits idiosyncratic heterogeneity to be accommodated by estimating separate equations for each country or variable and averages the parameter estimates. Finally, PMG can also be utilized when there is an integration of variables at the same order or not. This makes it possible for the short- and long-run causality interpretation to be concluded even when cointegration was identified previously or not.

Table 6 reports the results of the PMG cointegration estimation results for the 7 sub-Saharan African nations with long-run coefficients in Eq. (5) showing the elasticity of CO2 as for the different illustrative variables (EU, FDI, Y, and Y2). Apart from FDI, the rest of the variables proofed to be statistically significant at 1% level. This indicates that a 1% increase in energy use leads to 49% rise in CO2. This result confirms the findings of Acaravci and Ozturk 2010 and Wang et al. 2016. This findings recommends that increase in energy consumption encourages environmental pollution which is similar to the findings of Omri et al. (2015) who stated that an increase in energy consumption and GDP influences carbon emissions in Vietnam. To reduce the level of CO2 emission, is to increase energy efficiency, the public should be sensitized, and governments should encourage energy saving for instance switching of lights when not in use. A 1% increase in economic growth leads to 16% increase in CO2. These results support the findings of Ito (2017). Wang et al. (2016) stated that there is need to enhance and implement policies for both energy consumption and economic growth to address the issue of carbon emissions in China by encouraging low-carbon rise in the nation of China. But 1% increase in the square of economic growth triggers CO2 to reduce by 46% which was confirmed by Ben Jebli et al. (2015). They conducted an investigation of the short-run and long-run affiliations among carbon emissions, gross domestic product, renewable energy use, and international trade considering a panel of 24 sub-Saharan Africa countries for a period over 1980–2010. Their findings reported that an increase in real GDP has a great opportunity to increase carbon emissions, but an increase GPD squared is capable of reducing carbon emissions in the selected sub-Saharan African countries. This results support the findings of Anastacio (2017). Their findings also reported the existence of inverted U-shaped connection. To back up our findings, Doğan’s (2018) findings report that in the long run, an increase in GDP2 will decrease carbon emissions. As per the findings of Anastacio (2017), the positive and negative impact of economic growth and its Y2 approve the EKC theory. Concerning causalities in the midst of the investigated variables, there is a proof of a bidirectional causality between energy use and CO2 in the short run as well as a one-way causality running from energy consumption to CO2 in the long run. The bidirectional causal relationship between energy use and carbon emissions in the short term implies that energy use and carbon emissions are interconnected in the short run in the sense that increase in energy use will lead to high level of carbon emissions (Ssali et al. 2018), while the increase in carbon emissions means more consumption of energy. The unidirectional causality from former (energy consumption) to the latter (carbon emissions), on the other hand, implies that, in the long term, energy use has a significant impact on emissions of carbon in sub-Saharan countries. This further means that changes in energy consumption appear to precede changes in carbon emissions. Remarkably, there likewise exists a significant positive effect and unidirectional causality from CO2 to foreign direct investment in the long-run. In the policy context, the long-run unidirectional causal relationship from carbon emission to foreign direct investment (FDI) gives the implication that changes in carbon emissions precede changes in FDI in the long term and as well have significance influence on FDI. This means that the presence of multinationals of counties under study could either increase or even decrease the level of foreign direct investment, implying that the host countries must lay down policies to assess the environmental impact on FDI before foreign investors can be allowed into the country.

However, there is no causal relationship in the short run. With respect to carbon income nexus, the PMG results through the ARDL model from Table 6 interestingly reveal a proof of a unidirectional causality running from economic growth to carbon emanations both over the long and short run. The finding of one-way causality extending from economic growth to carbon emissions implies that the growth of sub-Saharan African economies have significant effect on carbon emissions in the sense that, with increasing carbon emissions, economic growth of the sample of sub-Saharan African countries do not decline both in the long term and short terms; thus, reduction in the increment of carbon emissions rather than minimizing the entire amount should be an attainable goal for countries under discussion. Rather than economic growth and CO2 nexus, however, unidirectional causality runs from the square of economic growth to carbon emanations over the long run and the other way around in the short run. The ECTs of carbon emanations, energy use, foreign direct investment, and economic growth and square of economic growth are highly significant and correspond to 19.6%, 21.2%, and 62.9% years. It indicates that every variable reacts quickly to deviations over the long-run equilibrium. The Hausman poolability test, on the other hand, implies that the confinement of homogenous coefficients in all cases in the long run cannot be rejected at 1% level of significance. Therefore, it indicates that the PMG estimator is effective and appropriate. Table 7 plots the rundown of principle discoveries in view of causalities.

Conclusion and policy implications

The nexus among the variables was investigated in the selected sub-Saharan African countries by applying cross-sectional freedom test created by Pesaran which incorporate the cross-sectional IPS (CIPS) (an augmentation IPS board unit root test created by Im et al. (2003)), ARDL model utilizing PMG applying a board information running from 1980 to 2014. Five variables incorporated into this investigation are carbon outflows, Y, Y2, energy use, and outside direct venture. The developing nations considered for this investigation are Ghana, Kenya, Nigeria, Botswana, Mauritius, Togo, and Benin.

The present problems of climate alteration activated by ecological degradation has woken up governments to deal with this catastrophe before it destroys the whole world. Researchers around the globe have picked interest to find out the major cause and the end results of climate change globally. They have utilized distinctive variables to comprehend the impact and the reasons for environmental change today. Understanding variables is imperative since it helps in developing the right strategies. Having said that, our research is the best thing to do for the benefit of mankind. We did not utilize traditional test to avoid questionable outcomes. We utilized second-generation test, for instance, CADF and CIPS (Pesaran 2007). The cointegration test of Kao and Pedroni delineates that variables are cointegrated which implies they have long-run causality relationship.

Our empirical findings of the long-term peripheral effect of the breakdown on dependent variable for the seven nations was focused on the ARDL approach. Empirical investigation findings report that 1% increase in energy use and economic growth are destined to cause a relative increase in CO2 emission by 49% and 16% reliably. This suggests energy use and GDP add to the growth of CO2 emissions which makes them perilous to the emerging economies. The findings likewise report that an increase in Y2 by 1% diminishes CO2 by 46%. This reveals that Y2 promotes the environment of the emerging nations. This implies more accentuation ought to be put on economic growth to inspire income to invest in technologies to encourage low carbon. But the results indicate that if nothing is done, energy use and economic growth will continue, causing carbon emissions in developing countries. This is because the majority of African nations still use poor sources of energy due to lack of accessibility to clean energy. This has resulted in intense lower respiratory sickness, cerebrovascular malady, ischemic coronary illness, obstructive aspiratory ailment, and lung malignancy. Economic activities have also contributed a lot to carbon emissions in developing nations because most of them have not yet arrived at the level of using renewable energy in huge capacity according to the EKC hypothesis.

Over the long run, the Pooled Mean Group (PMG)—estimator result demonstrates that Y has a positive and significant impact on carbon emission while Y2 negatively and positively effects carbon emissions. This infers the connection between GDP growth and carbon emanation has a U-shaped but not an inverted-U-shaped relationship in the long run, which negates the Kuznets’ environmental curve. It likewise keeps up the possibility that when the economy grows, it diminishes CO2 discharges, yet as the economy grows, it prompts increased CO2 in the long run. In the long run, the coefficients of economic growth and Y2 are positively and negatively significant. Our study revealed that the error correction coefficient to environmental degradation, energy use, and foreign direct investments postulates long-run equilibrium. We notice the system runs back to equilibrium at a rate of 19.6%, 21.2%, and 62.9% for the latter three variables.

As per Table 7, it presents the long- and short-run causality inside the variables. The outcomes depict that long-run unidirectional causality runs from energy use to CO2, GDP to CO2, GDP-squared to CO2, and CO2 to FDI. In any case, the short-run unidirectional causality runs from energy use to CO2, CO2 to GDP, and CO2 to GDP-squared. Basing on Tables 6 and 7, the long-run causality correlation test findings show that unidirectionality exists between CO2 and independent variables.

There is a need to use the existing research to help combat environmental pollution to acquire sustainable economic development. Diverse methodologies have to be put in place to handle this challenge of carbon emissions in developing nations. Developing nations should have research institutions to conduct more investigations on the type of carbon emitted in the space as a result of consuming fossil energy which has become dangerous to human health.

Policy implication

Our policy implications are summarized on the fact that the policymakers of the sub-Saharan region must stimulate the economic segments to come up with new investment policies in renewable sources of energy by encouraging a tax policy incentives and establishing energy codes to reduce environmental pollution. The mix of African energy is that 23% of oil is utilized as a source of energy, 14% coal, 14% gas, 48% bio-energy, and 1% different sources like atomic, hydro, and renewable (Ispy distributing 2018). This implies less accentuation has been put on the use of renewable energy source. More accentuation ought to be put on sustainable power sources rather than non-sustainable power source. Hydropower, wind energy, atomic energy, and sun-based power ought to be advanced in emerging economies. Therefore, renewable energy supplies should be enlarged and reinforced in the selected countries and globally and as well as encouragement of energy efficiency by the governments. Green technology investments should be enhanced to reduce carbon emissions as well as venturing into carbon capture and storage. For this to happen, suitable motivational policies should be considered for example boosting FDI by governments to buttress industrial sectors in relation to renewable energy investments and production. These policies can be effective if they are made mandatory as well as creating more public awareness concerning the new green technologies and concerning their positive effectiveness on the environment.

In conclusion, as much as emerging economies would like to develop, governments should take it upon themselves to fight against this threat of environmental pollution before the number of deaths escalates globally. In this scenario, knowledge management strategies as a means of creating awareness about the dangers of climate change should be introduced in all sectors. Knowledge should be collected and then this knowledge should be shared among citizens through different means of communication.

Change history

15 March 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-32894-x

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35(12):5412–5420. https://doi.org/10.1016/j.energy.2010.07.009

Achour H, Belloumi M (2016) Investigating the causal relationship between transport infrastructure, transport energy consumption and economic growth in Tunisia. Renew Sust Energ Rev 56:988–998. https://doi.org/10.1016/j.rser.2015.12.023

Aden N (2016) The roads to decoupling: 21 countries are reducing cEmissions while gGDP. Retrieved from https://www.wri.org/blog/2016/04/roads-decoupling-21-countries-are-reducing-carbon-emissions-while-growing-gdp

Ahmad M, Hengyi H, Rahman ZU, Khan ZU, Khan S, Khan Z (2018) Carbon emissions, energy use, gross domestic product and total population in China. Ekonomia i Środowisko

Ahmed M, Azam M (2016) Causal nexus between energy consumption and economic growth for high, middle and low income countries using frequency domain analysis. Renew Sust Energ Rev 60:653–678. https://doi.org/10.1016/j.rser.2015.12.174

Aldy JE (2017) Policy surveillance in the G-20 fossil fuel subsidies agreement: lessons for climate policy. Clim Chang 144(1):97–110. https://doi.org/10.1007/s10584-015-1505-0

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Anastacio JAR (2017) Economic growth, CO2 emissions and electric consumption: Is there an environmental Kuznets curve? An empirical study for North America countries. Int J Energy Econ Policy 7(2):65–71

Anderson EP, Marengo J, Villalba R, Halloy S, Young B, Cordero D, . . . Herzog SK (2017) Consequences of climate change for ecosystems and ecosystem services in the tropical Andes

Arbuckle JG Jr, Morton LW, Hobbs J (2015) Understanding farmer perspectives on climate change adaptation and mitigation: the roles of trust in sources of climate information, climate change beliefs, and perceived risk. Environ Behav 47(2):205–234

Asumadu-Sarkodie S, Owusu PA (2016) The relationship between carbon dioxide and agriculture in Ghana: a comparison of VECM and ARDL model. Environ Sci Pollut Res 23(11):10968–10982. https://doi.org/10.1007/s11356-016-6252-x

Asumadu-Sarkodie S, Owusu PA (2017) The causal nexus between carbon dioxide emissions and agricultural ecosystem—an econometric approach. Environ Sci Pollut Res 24(2):1608–1618. https://doi.org/10.1007/s11356-016-7908-2

Avila N, Carvallo JP, Shaw B, Kammen DM (2017) The energy challenge in sub-Saharan Africa: A guide for advocates and policy makers: Part 1: Generating energy for sustainable and equitable development. Oxfam Research Backgrounder series

Balcilar M, Ozdemir ZA, Ozdemir H, Shahbaz M (2018) Carbon dioxide emissions, energy consumption and economic growth: The historical decomposition evidence from G-7 countries. Retrieved from https://ideas.repec.org/p/emu/wpaper/15-41.pdf.html. Accessed 22 Dec 2018

Bazilian M, Nussbaumer P, Rogner H-H, Brew-Hammond A, Foster V, Pachauri S et al (2012) Energy access scenarios to 2030 for the power sector in sub-Saharan Africa. Util Policy 20(1):1–16. https://doi.org/10.1016/j.jup.2011.11.002

Begum RA, Sohag K, Abdullah SMS, Jaafar M (2015) CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew Sust Energ Rev 41:594–601. https://doi.org/10.1016/j.rser.2014.07.205

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sust Energ Rev 70:96–106. https://doi.org/10.1016/j.rser.2016.11.201

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Ben Jaber M, Couvert A, Amrane A, Rouxel F, Le Cloirec P, Dumont E (2016) Biofiltration of H2S in air—experimental comparisons of original packing materials and modeling. Biochem Eng J 112:153–160. https://doi.org/10.1016/j.bej.2016.04.020

Ben Jebli M, Belloumi M (2017) Investigation of the causal relationships between combustible renewables and waste consumption and CO2 emissions in the case of Tunisian maritime and rail transport. Renew Sust Energ Rev 71:820–829. https://doi.org/10.1016/j.rser.2016.12.108

Ben Jebli M, Ben Youssef S, Ozturk I (2015) The role of renewable energy consumption and trade: environmental Kuznets curve analysis for sub-Saharan Africa countries. Afr Dev Rev 27(3):288–300. https://doi.org/10.1111/1467-8268.12147

Böhringer C, Carbone JC, Rutherford TF (2018) Embodied carbon tariffs. Scand J Econ 120(1):183–210

Bonan G (2015) Ecological climatology: concepts and applications. Cambridge University Press, Cambridge

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011. https://doi.org/10.1016/j.jclepro.2018.02.035

Chai X, Tonjes DJ, Mahajan D (2016) Methane emissions as energy reservoir: context, scope, causes and mitigation strategies. Prog Energy Combust Sci 56:33–70. https://doi.org/10.1016/j.pecs.2016.05.001

de Alegría IM, Molina G, del Río B (2017) Carbon markets: linking the international emission trading under the United Nations Framework Convention on Climate Change (UNFCCC) and the European Union Emission Trading Scheme (EU ETS). In: Chen W-Y, Suzuki T, Lackner M (eds) Handbook of Climate Change Mitigation and Adaptation. Springer International Publishing, Cham, pp 313–339

Devinny JS, Deshusses MA, Webster TS (2017) Biofiltration for air pollution control. CRC press, Boca Raton

Doğan N (2018) The impact of agriculture on CO2 emissions in China. Panoeconomicus. https://doi.org/10.2298/PAN160504030D

Dogan E, Seker F, Bulbul S (2017) Investigating the impacts of energy consumption, real GDP, tourism and trade on CO2 emissions by accounting for cross-sectional dependence: a panel study of OECD countries. Curr Issue Tour 20(16):1701–1719. https://doi.org/10.1080/13683500.2015.1119103

Fang Z, Chang Y (2016) Energy, human capital and economic growth in Asia Pacific countries — evidence from a panel cointegration and causality analysis. Energy Econ 56:177–184. https://doi.org/10.1016/j.eneco.2016.03.020

Fankhauser S, Jotzo F (2018) Economic growth and development with low-carbon energy. Wiley Interdiscip Rev Clim Chang 9(1):e495. https://doi.org/10.1002/wcc.495

Frumhoff PC, Heede R, Oreskes N (2015) The climate responsibilities of industrial carbon producers. Clim Chang 132(2):157–171

Gengenbach C, Palm FC, Urbain J-P (2009) Panel unit root tests in the presence of cross-sectional dependencies: comparison and implications for modelling. Econ Rev 29(2):111–145

Gergel DR, Nijssen B, Abatzoglou JT, Lettenmaier DP, Stumbaugh MR (2017) Effects of climate change on snowpack and fire potential in the western USA. Clim Chang 141(2):287–299. https://doi.org/10.1007/s10584-017-1899-y

Ghosh S, Kanjilal K (2014) Long-term equilibrium relationship between urbanization, energy consumption and economic activity: empirical evidence from India. Energy 66:324–331. https://doi.org/10.1016/j.energy.2013.12.052

Goldstone JA (2018) Demography, environment, and security. Environmental conflict. Routledge, London, pp 84–108

Han J, Du TY, Zhang C, Qian XP (2018) Correlation analysis of CO2 emissions, material stocks and economic growth nexus: evidence from Chinese provinces. J Clean Prod 180:395–406. https://doi.org/10.1016/j.jclepro.2018.01.168

Hanley Wood Data Studio (2016) Reducing greenhouse gas emissions and growing GDP are not mutually exclusive. Retrieved from https://www.architectmagazine.com/technology/reducing-greenhouse-gas-emissions-and-growing-gdp-are-not-mutually-exclusive_o. Accessed 19 Dec 2018

Heidari H, Katircioğlu ST, Saeidpour L (2015) Economic growth, CO2 emissions, and energy consumption in the five ASEAN countries. Int J Electr Power Energy Syst 64:785–791. https://doi.org/10.1016/j.ijepes.2014.07.081

Hughes L, Herian A (2017) The correlation between GDP and greenhouse gas emissions. Retrieved from http://policyoptions.irpp.org/magazines/september-2017/the-correlation-between-gdp-and-greenhouse-gas-emissions/. Accessed 20 Dec 2018

Huisingh D, Zhang Z, Moore JC, Qiao Q, Li Q (2015) Recent advances in carbon emissions reduction: policies, technologies, monitoring, assessment and modeling. J Clean Prod 103:1–12. https://doi.org/10.1016/j.jclepro.2015.04.098

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

Isik C, Dogru T, Turk ES (2018) A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: Theory and evidence. Int J Tour Res 20(1):38–49. https://doi.org/10.3390/su10072383

Ispy P (2018) An African energy industry report: 2018 Retrieved from https://www.futureenergyafrica.com/media/1751/1-mir-africa-mir-18-2-es_685804715-05-2018.pdf. Accessed 22 Dec 2018

Ito K (2017) CO2 emissions, renewable and non-renewable energy consumption, and economic growth: evidence from panel data for developing countries. Int Econ 151:1–6. https://doi.org/10.1016/j.inteco.2017.02.001

Jain H (2016) Trade liberalisation, economic growth and environmental externalities: an analysis of Indian manufacturing industries. Springer, Berlin

Jones RL (2016) Process or separating and enriching carbon dioxide from atmospheric gases in air or from atmospheric gases dissolved in natural water in equilibrium with air: Google Patents. From https://patents.google.com/patent/US9266057B1/en

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Khan AN, Ghauri B, Jilani R, Rahman S (2011) Climate change: emissions and sinks of greenhouse gases in Pakistan. Paper presented at the Proceedings of the Symposium on Changing Environmental Pattern and its impact with Special Focus on Pakistan

Khobai HB, Le Roux P (2017) The relationship between energy consumption, economic growth and carbon dioxide emission: The case of South Africa. Int J Energy Econ Policy 7(3):102–109

Koçak E, Şarkgüneşi A (2018) The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res 25(1):790–804. https://doi.org/10.1007/s11356-017-0468-2

Kofi Adom P, Bekoe W, Amuakwa-Mensah F, Mensah JT, Botchway E (2012) Carbon dioxide emissions, economic growth, industrial structure, and technical efficiency: empirical evidence from Ghana, Senegal, and Morocco on the causal dynamics. Energy 47(1):314–325. https://doi.org/10.1016/j.energy.2012.09.025

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489. https://doi.org/10.1016/j.enpol.2012.12.039

Li Q, Xue Q, Truong Y, Xiong J (2018) MNCs’ industrial linkages and environmental spillovers in emerging economies: The case of China. Int J Prod Econ 196:346–355. https://doi.org/10.1016/j.ijpe.2017.12.008

Lin B, Ouyang X (2014) Energy demand in China: comparison of characteristics between the US and China in rapid urbanization stage. Energy Convers Manag 79:128–139. https://doi.org/10.1016/j.enconman.2013.12.016

Matthews TK, Wilby RL, Murphy C (2017) Communicating the deadly consequences of global warming for human heat stress. Proc Natl Acad Sci 114(15):3861–3866

McAusland C (2010) Globalisation's direct and indirect effects on the environment. Globalisation, Transport and the Environment:31–53. https://doi.org/10.1787/9789264072916-4-en

Melillo JM, Frey SD, DeAngelis KM, Werner WJ, Bernard MJ, Bowles F et al (2017) Long-term pattern and magnitude of soil carbon feedback to the climate system in a warming world. Science 358(6359):101–105

Meyer LH (ed) (2017) Intergenerational justice. Routledge, London. https://doi.org/10.4324/9781315252100

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240. https://doi.org/10.1016/j.rser.2016.10.081

Nanda SK (2018) From Rio to Doha: In Search of cooperative action for climate change. In: Nirmal BC, Singh RK (eds) Contemporary issues in international law: environment, international trade, information technology and legal education. Springer Singapore, Singapore, pp 161–171

Nazeer M, Tabassum U, Alam S (2016) Environmental pollution and sustainable development in developing countries. Pak Dev Rev 55(4 Part I &):589–604

Ndambiri H, Ritho C, Ng'ang'a S, Kubowon P, Mairura F, Nyangweso P et al (2012) Determinants of economic growth in sub-Saharan Africa: a panel data approach. International Journal of Economics and Management Sciences 2(2):18–24

Ning L, Wang F (2017) Does FDI bring environmental knowledge spillovers to developing countries? The tole of the local industrial structure. Environ Resour Econ:1–25. https://doi.org/10.1007/s10640-017-0159-y

Ojewumi SJ, Akinlo AE (2017) Foreign direct investment, economic growth and environmental quality in sub-Saharan Africa: a dynamic model analysis. African Journal of Economic Review (AJER) 5(1):48–68

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric theory 20(3):597–625. https://doi.org/10.1017/S0266466604203073

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran H, Shin Y (1999) Econometrics and economic theory in the twentieth century: the Ragnar Frisch Centennial Symposium: Cambridge University Press, Cambridge, UK, chapter An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysisin

Pittock AB (2017) Climate change: turning up the heat. Routledge, London

Rafindadi AA, Muye IM, Kaita RA (2018) The effects of FDI and energy consumption on environmental pollution in predominantly resource-based economies of the GCC. Sustainable Energy Technologies and Assessments 25:126–137. https://doi.org/10.1016/j.seta.2017.12.008

Rodríguez-Pose A, Cols G (2017) The determinants of foreign direct investment in sub-Saharan Africa: ehat role for governance? RSPP 9(2):63–81. https://doi.org/10.1111/rsp3.12093

Salahuddin M, Alam K, Ozturk I, Sohag K (2017) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev. https://doi.org/10.1016/j.rser.2017.06.009

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010. https://doi.org/10.1016/j.rser.2017.06.009

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Schreier MR (2017) Solar-driven reduction of CO2: from homogeneous to heterogeneous catalytic systems. Ecole Polytechnique Fédérale de Lausanne (Thesis)

Schuur E, McGuire AD, Schädel C, Grosse G, Harden J, Hayes D et al (2015) Climate change and the permafrost carbon feedback. Nature 520(7546):171–179

Sethi S, Gupte R (2017) Is trade openness leading to sustainable carbon emission? IJPMB 7(1):79–93

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. Singap Econ Rev 62(04):929–957

Ssali MW, Du J, Hongo DO, Mensah IA (2018) Impact of economic growth, energy use and population growth on carbon emissions in sub-Sahara Africa. JESE-B 7:178–192. https://doi.org/10.17265/2162-5263/2018.05.002

Sung B, Song W-Y, Park S-D (2018) How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: evidence from panel data. Econ Syst 42(2):320–331. https://doi.org/10.1016/j.ecosys.2017.06.002

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454. https://doi.org/10.1016/j.energy.2014.11.033

Topcu M, Payne JE (2018) Further evidence on the trade-energy consumption nexus in OECD countries. Energy Policy 117:160–165. https://doi.org/10.1016/j.enpol.2018.03.007

Vogel B, Henstra D (2015) Studying local climate adaptation: a heuristic research framework for comparative policy analysis. Glob Environ Chang 31:110–120

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371. https://doi.org/10.1016/j.scitotenv.2015.10.027

Wang X, Jiang D, Lang X (2017) Future extreme climate changes linked to global warming intensity. Sci Bull 62(24):1673–1680. https://doi.org/10.1016/j.scib.2017.11.004

WEF (2016) Understanding Africa’s energy needs. Retrieved from https://www.weforum.org/agenda/2016/11/understanding-africas-energy-needs/. Accessed 22 Dec 2018

Weitzman ML (2017) Voting on prices vs. voting on quantities in a World Climate Assembly. Res Econ 71(2):199–211. https://doi.org/10.1016/j.rie.2016.10.004

WHO (2018) Air pollution: air pollution infographics. Retrieved from https://www.who.int/airpollution/infographics/en/. Accessed 23 Dec 2018

World Bank (2014) Foreign direct investment flows into sub-Saharan Africa Retrieved from http://documents.worldbank.org/curated/en/505071468203651135/Foreign-direct-investment-flows-into-Sub-Saharan-Africa

World Bank (2018a) Boosting access to electricity in Africa through innovation, beter Regulation. Retrieved from https://www.worldbank.org/en/region/afr/publication/boosting-access-to-electricity-in-africa-through-innovation-better-regulation. Accessed 22 Dec 2018

World Bank (2018b) Global economic prospects: sub-Saharan Africa. Retrieved from https://www.worldbank.org/en/region/afr/brief/global-economic-prospects-sub-saharan-africa-2018. Accessed 22 Dec 2018

Zaman K, Moemen M A-e (2017) Energy consumption, carbon dioxide emissions and economic development: evaluating alternative and plausible environmental hypothesis for sustainable growth. Renew Sust Energ Rev 74:1119–1130. https://doi.org/10.1016/j.rser.2017.02.072

Zeufack A (2018) Growth in sub-Saharan Africa is slower than expected. Retrieved from https://www.worldbank.org/en/news/press-release/2018/10/03/growth-in-sub-saharan-africa-is-slower-than-expected. Accessed 22 Dec 2018

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ Model 58:237–248. https://doi.org/10.1016/j.econmod.2016.05.003

Acknowledgements

The authors would like to thank the reviewers who spared their time to review this paper. We would like to thank you for the positive comments which helped us to revise our manuscript. We would also like to thank Springer for publishing our paper in their fine and great scientific journal.

Funding

This work was supported in part by the National Science Foundation of China under grants 71471076, 71704066, 71671080, 71701090, and 71501084. This work was also supported by the Special Funds of the National Social Science Fund of China (18VSJ038) and by the Jiangsu Provincial Natural Science Foundation of China (grant no. BK20170542).

Author information

Authors and Affiliations

Contributions

All authors were able to contribute equally to the study as presented in this paper.

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note