Abstract

The promotion of a more stable European banking system has become a priority which, not doubt, will bring important benefits to firms. However, bank stability comes with stronger regulations that could harm the access to finance of small and medium-sized enterprises (SMEs), which are highly dependent on bank financing. We provide new evidence on the association between the stability of a country’s banking system and SMEs access to finance through the study of borrower discouragement. We analyze 20,207 observations gathered among 16,382 firms operating in the EU-28 during the period 2011–2018. Applying multilevel methodology, our results show that SMEs operating in countries with more stable banking systems are less likely to be discouraged from applying for a loan. Working to achieve a more stable banking system does not seem to harm the access to finance of SMEs.

Similar content being viewed by others

Notes

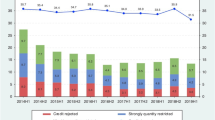

The percentage of rejected firms decreases from 8.21 to 6.70% if we compute it over the whole sample, as we do with the percentage of discouraged firms, instead of using just those firms that did apply for a loan. Data provided by the Survey on the Access to Finance of Enterprises (SAFE) carried out by the European Commission and the European Central Bank between 2011 and 2018.

For more information about the fieldwork, sample selection and weighting of the survey, see https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.html - Annex 3 to the methodological information on the survey and user guide for the anonymized micro dataset.

ECB rounds include the following countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, and Spain. Since 2014, Slovakia has been included in the sample in each survey round, while initially it was only included every 2 years (2009H1, 2011H1, and 2013H1). ECB rounds exclude the smallest countries (Cyprus, Estonia, Latvia, Lithuania, Luxembourg, Malta, and Slovenia) which represent less than 3% of the total number of employees in the euro area because, as ECB states, the inclusion of the above countries had only a very marginal impact on the results for the euro area as a whole.

The list of the countries included in Common rounds consists in those included in the ECB rounds plus the smallest euro area countries plus Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, Sweden, and United Kingdom plus some neighboring countries (i.e., Albania, Bosnia Herzegovina, Iceland, Israel, Kosovo, Liechtenstein, Macedonia, Montenegro, Norway, Serbia, Switzerland, and Turkey).

We do not include all the countries covered in Common rounds because of the unavailability of some key variables. We leave out for our analyses the first Common round (wave 1) because of the particular settings of this round in which not all the questions were asked to all firms.

In the interest of brevity, the industry dummies are not shown in the tables and their results are not discussed.

Due to data limitations, we do not have the ideal measure of firm risk in order to make a distinction between good and bad borrowers.

Following Mayordomo and Rodríguez-Moreno (2018), we drop observations from Spain because the SME SF was implemented 4 months earlier than the other EU countries.

An increase in the number of zombies also reduces the collateral value of good firms in the industry, and hence tightens any financial constraints (Caballero et al. 2008).

Introducing the first lag already reduces the sample size to 2320 observations, and 1803 firms, which leads to the large reduction in the interclass correlation, and an LR test that accepts the null hypothesis that the single-level model could be used instead of the two-level model. Since running a single-level logistic regression does not qualitatively change our results and conclusions, we decide to keep the same estimation method as in the previous regressions to make our results comparable.

References

Acharya, V. V., Eisert, T., Eufinger, C., & Hirsch, C. (2019). Whatever it takes: the real effects of unconventional monetary policy. The Review of Financial Studies, 32(9), 3366–3411. https://doi.org/10.1093/rfs/hhz005.

Andrews, D., & Petroulakis, F. (2019). Breaking the shackles: zombie firms , weak banks and depressed restructuring in Europe. Working paper series No 2240 European Central Bank. https://ssrn.com/abstract=3334840.

Barth, J. R., Caprio, G., & Levine, R. (2004). Bank regulation and supervision: what works best? Journal of Financial Intermediation, 13, 205–248. https://doi.org/10.1016/j.jfi.2003.06.002.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: are small firms different? Journal of Financial Economics, 89(3), 467–487. https://doi.org/10.1016/j.jfineco.2007.10.005.

Berger, A. N., Klapper, L. F., & Udell, G. F. (2001). The ability of banks to lend to informationally opaque small businesses. Journal of Banking & Finance, 25, 2127–2167. https://doi.org/10.1596/1813-9450-2656.

BIC. (2017). Basel Committee on Banking Supervision Basel III: finalising post-crisis reforms. https://www.bis.org/bcbs/publ/d424.htm. .

BIS. (2010). An assessment of the long-term economic impact of stronger capital and liquidity requirements. https://www.bis.org/publ/bcbs173.pdf.

Blum, J. (1999). Do capital adequacy requirements reduce risks in banking? Journal of Banking & Finance, 23, 755–771. https://doi.org/10.1016/S0378-4266(98)00113-7.

Brown, M., Popov, A., Steven, O., & Pinar, Y. (2011). Who needs credit and who gets credit in Eastern Europe? Economic Policy, 26(65), 93–130. https://doi.org/10.1111/j.1468-0327.2010.00259.x.

Caballero, R. J., Hoshi, T., & Kashyap, A. K. (2008). Zombie lending and depressed restructuring in Japan. American Economic Review, 98(5), 1943–1977. https://doi.org/10.1257/aer.98.5.1943.

Calem, P., & Rob, R. (1999). The impact of capital-based regulation on bank risk-taking. Journal of Financial Intermediation, 8(4), 317–352. https://doi.org/10.1006/jfin.1999.0276.

Chakravarty, S., & Xiang, M. (2013). The international evidence on discouraged small businesses. Journal of Empirical Finance, 20(1), 63–82. https://doi.org/10.1016/j.jempfin.2012.09.001.

Cole, R. A., & Sokolyk, T. (2016). Who needs credit and who gets credit? Evidence from the surveys of small business finances. Journal of Financial Stability, 24, 40–60. https://doi.org/10.1016/j.jfs.2016.04.002.

Constâncio, V. (2017). Synergies between banking union and capital markets union. Brussels: Keynote speech at Conference of the European Commission and European Central Bank on European Financial Integration https://bit.ly/2JXDCbL. .

Cowling, M., Liu, W., Minniti, M., & Zhang, N. (2016). UK credit and discouragement during the GFC. Small Business Economics, 47(4), 1049–1074. https://doi.org/10.1007/s11187-016-9745-6.

de Guindos, L. (2020). The euro area financial sector in the pandemic crisis. ECB Speech. https://bit.ly/389kwHp. Accessed 16 December 2020.

Dietsch, M., Fraisse, H., Lé, M., & Lecarpentier, S. (2019). Lower bank capital requirements as a policy tool to support credit to SMEs: evidence from a policy experiment. In EconomiX Working Papers 2019-12. EconomiX: University of Paris Nanterre https://bit.ly/34hmhRL.

EBA. (2016). EBA report on SMEs and SME supporting factor. https://bit.ly/2K0uEum. Accessed 16 December 2020.

EBA. (2018). Basel III monitoring exercise-results based on data as of 31 December 2017. https://bit.ly/3lJ81rY. .

EBA. (2019). Basel III reforms: impact study and key recomendations - macroeconomic assessment, CVA and market risk and corresponding policy advice on Basel III reforms on CVA and market risks. https://bit.ly/37lGXtR. .

ECB. (2015). The impact of the CRR and CRD IV on bank financing - eurosystem response to the DG FISMA consultation paper. https://bit.ly/3nsH7pa. .

European Commission. (2017a). Communication to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions on completing the Banking Union. https://bit.ly/3nmojYD.

European Commission. (2017b). Completing the banking union by 2018. https://ec.europa.eu/commission/presscorner/detail/en/MEMO_17_3722.

Feridun, M., & Özün, A. (2020). Basel IV implementation: a review of the case of the European Union. Journal of Capital Markets Studies, 4(1), 7–24. https://doi.org/10.1108/JCMS-04-2020-0006.

Fraisse, H., Lé, M., & Thesmar, D. (2020). The real effects of bank capital requirements. Management Science, 66(1), 5–23. https://doi.org/10.1287/mnsc.2018.3222.

Freel, M., Carter, S., Tagg, S., & Mason, C. (2012). The latent demand for bank debt: characterizing discouraged borrowers. Small Business Economics, 38(4), 399–418. https://doi.org/10.1007/s11187-010-9283-6.

Gama, A. P. M., Duarte, F. D., & Esperança, J. P. (2017). Why discouraged borrowers exist? An empirical (re)examination from less developed countries. Emerging Markets Review, 33, 19–41. https://doi.org/10.1016/j.ememar.2017.08.003.

Han, L., Fraser, S., & Storey, D. J. (2009). Are good or bad borrowers discouraged from applying for loans? Evidence from US small business credit markets. Journal of Banking & Finance, 33(2), 415–424. https://doi.org/10.1016/j.jbankfin.2008.08.014.

Han, L., Zhang, S., & Greene, F. J. (2017). Bank market concentration, relationship banking, and small business liquidity. International Small Business Journal: Researching Entrepreneurship, 35(4), 365–384. https://doi.org/10.1177/0266242615618733.

Hernández-Cánovas, G., & Koëter-Kant, J. (2010). The institutional environment and the number of bank relationships: an empirical analysis of European SMEs. Small Business Economics, 34(4), 375–390. https://doi.org/10.1007/s11187-008-9140-z.

Hyun, J. S., & Rhee, B. K. (2011). Bank capital regulation and credit supply. Journal of Banking & Finance, 35, 323–330. https://doi.org/10.1016/j.jbankfin.2010.08.018.

Ijtsma, P., Spierdijk, L., & Shaffer, S. (2017). The concentration–stability controversy in banking: new evidence from the EU-25. Journal of Financial Stability, 33, 273–284. https://doi.org/10.1016/j.jfs.2017.06.003.

Kalmi, P. (2017). The role of stakeholder banks in European banking sector, In: Miklaszewska, E. (ed.) Institutional diversity in banking: small country, small bank perspectives. Palgrave Macmillan, Cham. Cham: Palgrave Macmillan. https://doi.org/10.1007/978-3-319.

Kon, Y., & Storey, D. J. (2003). A theory of discouraged borrowers. Small Business Economics, 21, 37–49. https://doi.org/10.1023/A:1024447603600.

Mac an Bhaird, C., Vidal, J. S., & Lucey, B. (2016). Discouraged borrowers: evidence for Eurozone SMEs. Journal of International Financial Markets Institutions and Money, 44, 46–55. https://doi.org/10.1016/j.intfin.2016.04.009.

Mahrt-Smith, J. (2006). Should banks own equity stakes in their borrowers? A contractual solution to hold-up problems. Journal of Banking & Finance, 30(10), 2911–2929. https://doi.org/10.1016/j.jbankfin.2005.12.003.

Mayordomo, S., & Rodríguez-Moreno, M. (2018). Did the bank capital relief induced by the supporting factor enhance SME lending? Journal of Financial Intermediation, 36, 45–57. https://doi.org/10.1016/j.jfi.2018.05.002.

Mishkin, F. S. (1999). Global financial instability: framework, events, issues. Journal of Economic Perspectives, 13(4), 3–20. https://doi.org/10.1257/jep.13.4.3.

Mol-Gómez-Vázquez, A., Hernández-Cánovas, G., & Koëter-Kant, J. (2019). Bank market power and the intensity of borrower discouragement: analysis of SMEs across developed and developing European countries. Small Business Economics, 53(1), 211–225. https://doi.org/10.1007/s11187-018-0056-y.

Peek, J., & Rosengren, E. S. (2005). Unnatural selection: perverse incentives and the misallocation of credit in Japan. American Economic Review, 95(4), 1144–1166. https://doi.org/10.1257/0002828054825691.

Rahman, A., Rahman, M. T., & Belas, J. (2017). Determinants of SME finance: evidence from three central European countries. Review of Economic Perspectives, 17(3), 263–285. https://doi.org/10.1515/revecp-2017-0014.

Romano, C. A., Tanewski, G. A., & Smyrnios, K. X. (2001). Capital structure decision making: a model for family business. Journal of Business Venturing, 16(3), 285–310. https://doi.org/10.1016/S0883-9026(99)00053-1.

Rostamkalaei, A., Nitani, M., & Riding, A. (2020). Borrower discouragement: the role of informal turndowns. Small Business Economics, 54(1), 173–188. https://doi.org/10.1007/s11187-018-0086-5.

Steele, F. (2010). Module 5: Introduction to multilevel modelling concepts. LEMMA VLE, University of Bristol, Centre for Multilevel Modelling. Accessed at https://www.cmm.bris.ac.uk/lemma/.

Taylor, A., & Goodhart, C. (2006). Procyclicality and volatility in the financial system: the implementation of Basel II and IAS 39. Procyclicality of financial systems in Asia. London: Palgrave Macmillan. https://doi.org/10.1057/9781137001535_2.

Uhde, A., & Heimeshoff, U. (2009). Consolidation in banking and financial stability in Europe: empirical evidence. Journal of Banking & Finance, 33, 1299–1311. https://doi.org/10.1016/j.jbankfin.2009.01.006.

Acknowledgements

The authors acknowledge financial support from Agencia Estatal de Investigación (https://doi.org/10.13039/501100011033), research project PID2019-106314GB-I00/AEI/10.13039/501100011033. We also acknowledge financial support from Fundación UCEIF and Santander Financial Institute (SANFI).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mol-Gómez-Vázquez, A., Hernández-Cánovas, G. & Koëter-Kant, J. Banking stability and borrower discouragement: a multilevel analysis for SMEs in the EU-28. Small Bus Econ 58, 1579–1593 (2022). https://doi.org/10.1007/s11187-021-00457-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-021-00457-w