Abstract

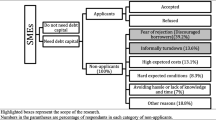

The availability of credit to entrepreneurs with good investment opportunities is an important facilitator of economic growth. Under normal economic conditions, most entrepreneurs who requested loans receive them. In a global financial crisis, popular opinion is that banks are severely restricting lending to smaller businesses. This assumes that low levels of investment are caused by supply-side restrictions in the credit market. Little is said about potential changes in the demand for credit and how it is influenced by entrepreneurs’ perceptions about supply-side restrictions. One particularly interesting, and under-researched, group of small businesses is that who have potentially good investment opportunities, but are discouraged from applying for external funding as they fear rejection. In this study, we question whether these entrepreneurs were correct in their assumptions. We find that levels of discouragement are quite low in general at 2.7 % of the total smaller business population. Further analysis implies that 55.6 % of discouraged borrowers would have got loans had they applied.

Similar content being viewed by others

Notes

Results available upon request.

References

Acs, Z., & Storey, D. (2004). Introduction: entrepreneurship and economic development. Regional Studies, 38(8), 871–877. doi:10.1080/0034340042000280901.

Alsos, G. A., Isaksen, E. J., & Ljunggren, E. (2006). New venture financing and subsequent business growth in men- and women-led businesses. Entrepreneurship Theory and Practice, 30(5), 667–686. doi:10.1111/j.1540-6520.2006.00141.x.

Bascle, G. (2008). Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization, 6(3), 285–327. doi:10.1177/1476127008094339.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931–2943. doi:10.1016/j.jbankfin.2006.05.009.

Behr, P., & Guttler, A. (2007). Credit risk assessment and relationship lending: An empirical analysis of German small and medium-sized enterprises. Journal of Small Business Management, 45(2), 194–213. doi:10.1111/j.1540-627X.2007.00209.x.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6), 613–673. doi:10.1016/S0378-4266(98)00038-7.

Blinder, A. (1987). Credit rationing and effective supply failures. Economic Journal, 97(386), 327–352. doi:10.2307/2232882.

Butchart, R. (1987). A new UK definition of high-technology industries. Economic Trends, 400, 82–88.

Carter, S., Shaw, E., Lam, W., & Wilson, F. (2007). Gender, entrepreneurship, and bank lending: The criteria and processes used by bank loan officers in assessing applications. Entrepreneurship Theory and Practice, 31(3), 427–444. doi:10.1111/j.1540-6520.2007.00181.x.

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261–283. doi:10.1016/S0883-9026(03)00029-6.

Cavalluzzo, K., Cavalluzzo, L., & Wolken, J. (2002). Competition, small business financing, and discrimination: Evidence from a new survey. Journal of Business, 75(4), 641–680. doi:10.2139/ssrn.171733.

Chakravarty, S., & Xiang, M. (2013). The international evidence on discouraged small businesses. Journal of Empirical Finance, 20, 63–82. doi:10.1016/j.jempfin.2012.09.001.

Chandler, V. (2010). An Interpretation of discouraged borrowers based on relationship lending. Industry Canada: Small Business Tourism Branch.

Chua, J. H., Chrisman, J. J., Kellermanns, F., & Wu, Z. (2011). Family involvement and new venture debt financing. Journal of Business Venturing, 26(4), 472–488. doi:10.1016/j.jbusvent.2009.11.002.

Cieply, S., & Dejardin, M. (2010). Entrepreneurial finance in France: The persistent role of banks. In J. Bonnet (Ed.), How to fill the gap between knowledge and innovation. Cheltenham: Edward Elgar. doi:10.2139/ssrn.534483.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37(4), 633–648. doi:10.1016/j.respol.2008.01.003.

Coco, G. (2000). On the use of collateral. Journal of Economic Surveys, 14(2), 191–214. doi:10.1111/1467-6419.00109.

Cole, R. (2013). What do we know about the capital structure of privately held US firms? Evidence from the surveys of small business finance. Financial Management, 42(4), 777–813. doi:10.1111/fima.12015.

Cole, R. A., & Sokolyk, T. (2016). Who needs credit and who gets credit? Evidence from the surveys of small business finances. Journal of Financial Stability, 24, 40–60. doi: 10.1016/j.jfs.2016.04.002

Colombo, M. G., Croce, A., & Murtinu, S. (2014). Ownership structure, horizontal agency costs and the performance of high-tech entrepreneurial firms. Small Business Economics, 42(2), 265–282. doi:10.1007/s11187-013-9483-y.

Colombo, M., & Grilli, L. (2007). Funding gaps? Access to bank loans by high-tech start-ups. Small Business Economics, 29(1), 25–46. doi:10.1007/s11187-005-4067-0.

Colombo, M. G., & Grilli, L. (2010). On growth drivers of high-tech start-ups: Exploring the role of founders’ human capital and venture capital. Journal of Business Venturing, 25(6), 610–626. doi:10.1016/j.jbusvent.2009.01.005.

Colombo, M. G., Grilli, L., & Murtinu, S. (2011). R&D subsidies and the performance of high-tech start-ups. Economics Letters, 112(1), 97–99. doi:10.1016/j.econlet.2011.03.007.

Cosh, A., Cumming, D., & Hughes, A. (2009). Outside enterpreneurial capital. The Economic Journal, 119(540), 1494–1533. doi:10.1111/j.1468-0297.2009.02270.x.

Cowling, M. (1997). Small business loan requests: Who gets the cash? (SME Centre Working Paper, No.53). England: Warwick Business School, Coventry.

Cowling, M. (1999). The incidence of loan collateralisation in small business lending contracts: Evidence from the UK. Applied Economics Letters, 6(5), 291–293. doi:10.1080/135048599353258.

Cowling, M. (2010). The role of loan guarantee schemes in alleviating credit rationing in the UK. Journal of Financial Stability, 6(1), 36–44. doi:10.1016/j.jfs.2009.05.007.

Cowling, M., & Clay, N. (1994). An assessment of the loan guarantee scheme. Small Business and Enterprise Development, 1(3), 7–13. doi:10.1108/eb020940.

Cowling, M., Liu, W., & Ledger, A. (2012). Small business financing in the UK before and during the current financial crisis. International Small Business Journal, 30(7), 778–800. doi:10.1177/0266242611435516.

Cowling, M., & Mitchell, P. (2003). Is the small firms loan guarantee scheme hazardous for banks or helpful to small business? Small Business Economics, 21(1), 63–71. doi:10.1023/A:1024408932156.

Cragg, J. G., & Donald, S. G. (1993). Testing identifiability and specification in instrumental variable models. Econometric Theory, 9(2), 222–240. doi:10.1017/S0266466600007519.

Cumming, D. J., Grilli, L., & Murtinu, S. (2014). Governmental and independent venture capital investments in Europe: A firm-level performance analysis. Journal of Corporate Finance,. doi:10.1016/j.jcorpfin.2014.10.016.

de Bettignies, J.-E., & Brander, J. A. (2007). Financing entrepreneurship: Bank finance versus venture capital. Journal of Business Venturing, 22(6), 808–832. doi:10.1016/j.jbusvent.2006.07.005.

de Meza, D., & Southey, C. (1996). The borrower’s curse: Optimism, finance and entrepreneurship. Economic Journal, 106(435), 375–386. doi:10.2307/2235253.

Fairlie, R., & Robb, A. (2007). Why are black-owned businesses less successful than white-owned businesses: The role of families, inheritances, and business human capital. Journal of Labor Economics, 25(2), 289–323. doi:10.1086/510763.

Fraser, S. (2009). Is there ethnic discrimination in the UK market for small business credit? International Small Business Journal, 27(5), 583–607. doi:10.1177/0266242609338756.

Fraser, S. (2014). The impact of the late 2000s financial crisis on the supply of bank credit to small businesses: Evidence from the UK. International Review of Entrepreneurship, 12(4), 163–190.

Freel, M., Carter, S., Tagg, S., & Mason, C. (2012). The latent demand for bank debt: characterizing “discouraged borrowers”. Small Business Economics, 38(4), 399–418. doi:10.1007/s11187-010-9283-6.

Gelos, R. G., & Werner, A. M. (2002). Financial liberalization, credit constraints, and collateral: Investment in the Mexican manufacturing sector. Journal of Development Economics, 67(1), 1–27. doi:10.1016/S0304-3878(01)00175-4.

Grilli, L. (2011). When the going gets tough, do the tough get going? The pre-entry work experience of founders and high-tech start-up survival during an industry crisis. International Small Business Journal, 29(6), 626–647. doi:10.1177/0266242610372845.

Grilli, L., & Murtinu, S. (2014). Government, venture capital and the growth of European high-tech entrepreneurial firms. Research Policy, 43(9), 1523–1543. doi:10.1016/j.respol.2014.04.002.

Grilli, L., & Murtinu, S. (2015). New technology-based firms in Europe: Market penetration, public venture capital, and timing of investment. Industrial and Corporate Change, 24(5), 1109–1148. doi:10.1093/icc/dtu025.

Han, L., Fraser, S., & Storey, D. J. (2009). Are good or bad borrowers discouraged from applying for loans? Evidence from US small business credit markets. Journal of Banking & Finance, 33(2), 415–424. doi:10.1016/j.jbankfin.2008.08.014.

Hanousek, J., & Filer, R. K. (2004). Investment, credit rationing, and the soft budget constraint: What would a well-functioning credit market look like? Economics Letters, 82(3), 385–390. doi:10.1016/j.econlet.2003.09.017.

Hyytinen, A., & Pajarinen, M. (2007). Is the cost of debt capital higher for younger firms? Scottish Journal of Political Economy, 54(1), 55–71. doi:10.1111/j.1467-9485.2007.00404.x.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323–329. doi:10.2139/ssrn.99580.

Keeton, W. R. (1979). Equilibrium credit rationing. Hamden: Garland.

Kon, Y., & Storey, D. J. (2003). A theory of discouraged borrowers. Small Business Economics, 21(1), 37–49. doi:10.1023/A:1024447603600.

La Rocca, M., La Rocca, T., & Cariola, A. (2011). Capital structure decisions during a firm’s life cycle. Small Business Economics, 37(1), 107–130. doi:10.1007/s11187-009-9229-z.

Laeven, L. (2003). Does financial liberalization reduce financing constraints? Financial Management, 32(1), 5–34. doi:10.2307/3666202.

Le, N. T. B., & Nguyen, T. V. (2009). The impact of networking on bank financing: The case of small and medium-sized enterprises in Vietnam. Entrepreneurship Theory and Practice, 33(4), 867–887. doi:10.1111/j.1540-6520.2009.00330.x.

Levenson, A. R., & Willard, K. L. (2000). Do firms get the financing they want? Measuring credit rationing experienced by small business in the US. Small Business Economics, 14(2), 83–94. doi:10.1023/A:1008196002780.

Lown, C., & Morgan, D. P. (2006). The credit cycle and the business cycle: New findings using the loan officer opinion survey. Journal of Money, Credit and Banking, 38(6), 1575–1597. doi:10.1353/mcb.2006.0086.

Marlow, S., & Patton, D. (2005). All credit to men? Entrepreneurship, finance, and gender. Entrepreneurship Theory and Practice, 29(6), 717–735. doi:10.1111/j.1540-6520.2005.00105.x.

Mazzucato, M. (2013). Financing innovation: Creative destruction vs. destructive cre-ation. Industrial and Corporate Change, 22(4), 851–867. doi:10.1093/icc/dtt025.

Michaelas, N., Chittenden, F., & Poutziouris, P. (1999). Financial policy and capital structure choice in UK SME: Empirical evidence from company panel data. Small Business Economics, 12(2), 113–130. doi:10.1023/A:1008010724051.

Mina, A., Lahr, H., & Hughes, A. (2013). The demand and supply of external finance forinnovative firms. Industrial and Corporate Change, 22(4), 869–901. doi:10.1093/icc/dtt020.

Murray, M. P. (2006). Avoiding invalid instruments and coping with weak instruments. Journal of Economic Perspectives, 20(4), 111–132. doi:10.1257/jep.20.4.111.

Orser, B. J., Riding, A. L., & Manley, K. (2006). Women entrepreneurs and financial capital. Entrepreneurship Theory and Practice, 30(5), 643–665. doi:10.1111/j.1540-6520.2006.00140.x.

Petersen, M. A., & Rajan, R. G. (1994). The benefits of lending relationships: Evidence from small business data. Journal of Finance, 49(1), 3–37. doi:10.1111/j.1540-6261.1994.tb04418.x.

Petersen, M. A., & Rajan, R. G. (2002). Does distance still matter? The information revolution in small business lending. Journal of Finance, 57(6), 2533–2570. doi:10.1111/1540-6261.00505.

Psillaki, M., & Daskalakis, N. (2008). Are the determinants of capital structure country or firm specific? Small Business Economics, 33(3), 319–333. doi:10.1007/s11187-008-9103-4.

Rao, M. T. (2004). Key issues for global IT sourcing: Country and individual factors. Information Systems Management, 21(3), 16–21. doi:10.1201/1078/44432.21.3.20040601/82472.3.

Revest, V., & Sapio, A. (2012). Financing technology-based small firms in Europe: What do we know? Small Business Economics, 39(1), 179–205. doi:10.1007/s11187-010-9291-6.

Riding, A. (1997). On the care and nurture of loan guarantee programs. In P. Halpern (Ed.), Financing Growth in Canada. Calgary: University of Calgary Press.

Sargan, J. D. (1958). The estimation of economic relationships using instrumental variables. Econometrica, 26(3), 393–415. doi:10.2307/1907619.

Serrasqueiro, Z., & Nunes, P. (2011). Is age a determinant of SMEs’ financing decisions? Empirical evidence using panel data models. Entrepreneurship Theory and Practice, 36(4), 627–654. doi:10.1111/j.1540-6520.2010.00433.x.

Shen, C. (2002). Credit rationing for bad companies in bad years: Evidence from bank loan transaction data. International Journal of Finance and Economics, 7(3), 261–278. doi:10.1002/ijfe.188.

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65(3), 557–586. doi:10.2307/2171753.

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71(3), 393–410.

Stiglitz, J. E., & Weiss, A. (1983). Incentive effects of terminations: Applications to the credit and labor markets. American Economic Review, 73(5), 912–927.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In: W. K. A. Donald (Ed.), Identification and inference for econometric models (pp. 80–108). New York: Cambridge University Press. doi:10.1017/CBO9780511614491.006.

Thakor, A. V. (1989). Competitive equilibrium with type convergence in an asymmetrically informed market. Review of Financial Studies, 2(1), 49–71. doi:10.1093/rfs/2.1.49.

Van de Ven, W. P. M. M., & Van Pragg, B. M. S. (1981). The demand for deductibles in private health insurance: a probit model with sample selection. Journal of Econometrics, 17(2), 229–252. doi:10.1016/0304-4076(81)90028-2.

Vanacker, T., & Manigart, S. (2010). Pecking order and debt capacity considerations for high-growth companies seeking financing. Small Business Economics, 35(1), 53–69. doi:10.1007/s11187-008-9150-x.

Vermoesen, V., Deloof, M., & Laveren, E. (2013). Long-term debt maturity and financing constraints of SMEs during the global financial crisis. Small Business Economics, 41(2), 433–448. doi:10.1007/s11187-012-9435-y.

Author information

Authors and Affiliations

Corresponding author

Appendix: Testing for over- and weak-identifying instruments in the conditional probit models

Appendix: Testing for over- and weak-identifying instruments in the conditional probit models

In order for the Heckman selection model to be properly identified, the selection equation must contain at least one variable (exclusion restriction, or instrument) that is not in the outcome (main) equation. Ideally in instrumental variable (IV) estimations, a valid instrument must be uncorrelated with the regression’s disturbances, i.e. exogenous. Moreover, a good instrument needs to be strongly correlated with the endogenous explanatory variable. If the partial correlations between the instruments and the endogenous variable are weak, the coefficient estimates can be biased and hypothesis tests distorted even with a very large sample size (Murray 2006).

In this study, the model we adopt is in essence a two-stage regression model taking into consideration the conditionality, or endogeneity of credit demand and application (prob(DEMAND) and prob(APPLY) in the conditional credit application/discouragement and credit denial equation, respectively) using exclusion restrictions in the selection equations as instruments. However, testing instrument validity and that they are not weakly identified are not so straightforward. In a linear IV regression, Sargan test of over-identifying restrictions is usually used to assess the validity of instruments (Sargan 1958) and Stock and Yogo (2005) propose a hypothesis test of weak instruments based on the Cragg and Donald (1993) F-statistic. In order to serve our purpose, we follow Grilli and Murtinu (2014) and run the following pseudo-two-stage IV regressions (2SLS) for pre- and within-recession credit application (discouragement in the pre-recession specification):

and credit supply (denial), respectively:

In the pseudo-2SLS regressions, Z D i and Z A i are vectors of exclusion restrictions used in the selection equations in Model 1 and Model 2, respectively, in Tables 3 and 4. In turn, X A i and X S i are vectors of exogenous variable used in the outcome (main) equations in Model 1 and Model 2, respectively, in Tables 3 and 4. By definition, Z D i and Z A i are the instruments chosen in the pseudo-2SLS regressions.

Table 5 reports the model diagnostics of the pseudo-two-stage IV regressions for APPLY/DISCOURAGED and DEMAND, respectively. For all four models, the Sargan tests of overidentifying restrictions for the null hypothesis that the instruments are valid cannot be rejected. However, if all the instruments share a common rationale so that one invalid instrument would invalidate all the others, the Sargan statistics could be biased and inconsistent (Murray 2006; Bascle 2008). Therefore, we also perform the difference-in-Sargan test for the specifications on the exogeneity of individual instruments, and all the tests are passed.Footnote 1 The Cragg–Donald F-statistics show that for all but the within-recession pseudo credit denial model the null hypothesis that all of the instruments are weak is rejected, where the F-statistics exceed the critical value of 10 (Staiger and Stock 1997; Stock and Yogo 2005). Since the weak instrument test for the within-recession pseudo credit denial function is not passed, we undertake further analyses by running an unconditional, multinomial logit model to check the robustness of our main results (Model 3, Table 4).

Alternative Specifications with REGION as identifying restrictions for Table 4:

Variables | Prob(DEMAND) | Prob(APPLY|DEMAND) | Prob(APPLY) | Prob(DENIED|APPLY) |

|---|---|---|---|---|

Coeff. | Coeff. | Coeff. | Coeff. | |

Firm characteristics | ||||

FAMOWN | 0.134** | −0.153 | −0.156 | 0.101 |

(0.058) | (0.117) | (0.178) | (0.124) | |

CORP | 0.024 | 0.302** | 0.561*** | 0.069 |

(0.080) | (0.134) | (0.212) | (0.174) | |

EMP | 0.003*** | 0.006** | 0.009*** | −0.002 |

(0.001) | (0.002) | (0.003) | (0.001) | |

AGE_11TO20 | 0.040 | 0.190 | 0.350 | −0.087 |

(0.101) | (0.171) | (0.261) | (0.205) | |

AGE_20UP | −0.096 | 0.226 | 0.359 | −0.357* |

(0.101) | (0.180) | (0.268) | (0.210) | |

SALE_DECREASE | 0.032 | −0.112 | 0.074 | −0.165 |

(0.064) | (0.146) | (0.222) | (0.132) | |

SALE_SAME | −0.109 | −0.228 | −0.242 | −0.057 |

(0.072) | (0.158) | (0.245) | (0.157) | |

PROFIT | −0.006 | 0.371** | 0.463** | −0.092 |

(0.096) | (0.164) | (0.231) | (0.203) | |

Metals Manufacturing | −0.218* | 0.187 | 0.196 | 0.423* |

(0.119) | (0.318) | (0.413) | (0.243) | |

Other Manufacturing | −0.252** | −0.290 | −0.462 | 0.200 |

(0.127) | (0.304) | (0.397) | (0.272) | |

Construction | −0.225* | −0.238 | −0.313 | 0.487** |

(0.117) | (0.288) | (0.373) | (0.245) | |

Retail & Wholesale | −0.036 | 0.085 | 0.327 | 0.199 |

(0.143) | (0.359) | (0.470) | (0.289) | |

Transport & Communication | −0.252** | −0.206 | −0.284 | 0.181 |

(0.122) | (0.295) | (0.378) | (0.255) | |

Business Services | −0.383** | −0.320 | −0.444 | −0.119 |

(0.170) | (0.374) | (0.563) | (0.420) | |

Other Services | −0.219 | 0.271 | −0.005 | 0.284 |

(0.162) | (0.397) | (0.551) | (0.337) | |

INNOVATION | 0.082 | −0.140 | −0.075 | 0.038 |

(0.066) | (0.141) | (0.193) | (0.129) | |

East | 0.128 | 0.184 | ||

(0.117) | (0.366) | |||

London | −0.073 | −0.746** | ||

(0.128) | (0.371) | |||

North East | 0.167 | −0.081 | ||

(0.144) | (0.474) | |||

North West | 0.070 | 0.141 | ||

(0.119) | (0.388) | |||

South East | 0.128 | −0.217 | ||

(0.117) | (0.343) | |||

South West | 0.090 | −0.476 | ||

(0.117) | (0.347) | |||

West Midlands | 0.009 | −0.309 | ||

(0.141) | (0.400) | |||

York & Humber | 0.197 | −0.263 | ||

(0.132) | (0.410) | |||

Wales | 0.069 | −0.131 | ||

(0.117) | (0.372) | |||

Scotland | 0.041 | −0.232 | ||

(0.159) | (0.414) | |||

Owner/Entrepreneur characteristics | ||||

WLED | −0.100 | 0.110 | 0.022 | 0.019 |

(0.090) | (0.157) | (0.247) | (0.191) | |

EXP | −0.169 | −0.908* | −1.941** | 0.284 |

(0.200) | (0.498) | (0.788) | (0.436) | |

UNIVERSITY | 0.086 | −0.323*** | −0.345** | 0.044 |

(0.055) | (0.124) | (0.170) | (0.113) | |

AIMGROW | 0.248*** | −0.038 | 0.165 | −0.095 |

(0.061) | (0.128) | (0.188) | (0.133) | |

Borrower risk indicators | ||||

SOUGHTBEFORE | −0.524*** | 0.004 | ||

(0.053) | (0.108) | |||

IBANKING | 0.197 | −0.239 | −0.242 | −0.644* |

(0.157) | (0.465) | (0.607) | (0.366) | |

RELATIO_1 | −0.477*** | 0.313** | −0.074 | −0.383** |

(0.091) | (0.147) | (0.226) | (0.160) | |

RELATIO_2 | −0.617*** | 0.491*** | 0.181 | −1.084*** |

(0.075) | (0.129) | (0.198) | (0.143) | |

MISS_1 | 0.590*** | 0.213 | 0.546 | 0.126 |

(0.116) | (0.325) | (0.397) | (0.200) | |

MISS_2 | 0.502*** | −0.364* | 0.011 | 0.126 |

(0.108) | (0.198) | (0.275) | (0.180) | |

MISS_3 | 0.775*** | −0.764*** | −0.573** | 0.244 |

(0.111) | (0.179) | (0.231) | (0.176) | |

Recessionary time indicators | ||||

WAVE2/3/4 | −0.294*** | 1.918*** | 2.394*** | 0.290 |

(0.104) | (0.392) | (0.551) | (0.227) | |

WAVE5 | −0.088 | −0.155 | −0.373 | 0.257 |

(0.093) | (0.168) | (0.232) | (0.192) | |

WAVE6 | −0.165 | 0.054 | −0.163 | −0.168 |

(0.118) | (0.200) | (0.273) | (0.243) | |

WAVE7 | −0.007 | 1.072** | 1.953** | −0.385 |

(0.227) | (0.506) | (0.830) | (0.507) | |

N | 3089 | 803 | ||

Censored N | 2286 | 82 | ||

Wald χ 2 | 114.42*** | 114.91*** | ||

Log likelihood | −1740.231 | −541.255 | ||

χ 2 (ρ = 0) | 5.17** | 3.15* | ||

Rights and permissions

About this article

Cite this article

Cowling, M., Liu, W., Minniti, M. et al. UK credit and discouragement during the GFC. Small Bus Econ 47, 1049–1074 (2016). https://doi.org/10.1007/s11187-016-9745-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9745-6