Abstract

This paper examines the impact of perceived unethical behavior by entrepreneurs, angel investors and venture capitalists on their conflict process. For this purpose, we use an embedded case study design to provide a diversity of perspectives on the topic at hand. From the eye of the beholder, i.e. investor, entrepreneur or both, 11 conflict situations were analyzed for any perceived unethical behavior. Based on findings from within- and cross-case analysis, we propose that perceived unethical behavior among venture partners triggers conflicts between them through increased fault attribution or blaming. Further, we propose that perceived unethical behavior affects venture partners’ choice of conflict management strategy and increases the likelihood of conflict escalation and of conflict having a negative partnership outcome such as failure or another form of involuntary exit. As such, this paper contributes to the entrepreneurship literature by addressing calls for more research on the darker sides of investor–investee relationships.

Similar content being viewed by others

1 Introduction

The importance of angel and venture capital (VC) investors as a financing source for entrepreneurial ventures is well documented (e.g., Mason and Harrison 1995; Sohl 2003; Vanacker and Manigart 2010). Unfortunately, risk capital markets are inherently inefficient due to reputation effects, knowledge specialization and high search and negotiation costs (Cable and Shane 1997; Sohl 1999). Because this makes replacement of either investor or entrepreneur both hard and expensive, an ongoing cooperative relationship between these two parties is desirable (Cable and Shane 1997; Sapienza et al. 1996). However, previous research indicates that investor-entrepreneur conflicts are rather common instead and, as such, cooperation is far from self-evident (Parhankangas and Landström 2006). Further corroborating conflicts' importance, investor–entrepreneur conflicts have been shown to substantially affect their partnership’s life span and success (e.g., Higashide and Birley 2002). Despite this, empirical work on conflicts between and among angel investors, VCs and entrepreneurs is still scant. To address this gap in the literature, this article seeks to extend our theoretical understanding of conflicts between entrepreneurs and investors. Given that conflict is a process that unfolds over time, scholars have previously suggested that more insight is needed into conflict’s inputs and outputs “to clarify how and why its process unfolds as it does” (Forbes et al. 2010, p. 579). As such, we aim to examine how perceived unethical behavior by entrepreneurs, angel investors or VCs affects the emergence of conflict, reaction to conflict as well as conflict’s effects on their partnership.

The focus on perceived unethical behavior is motivated by the fact that it has been previously suggested to engender conflict (e.g., Viswesvaran and Deshpande 1996; Weeks and Nantel 1992), yet the relationship between these two concepts has hitherto not been examined. As such, studying the impact of perceived unethical behavior on how investors and entrepreneurs make sense out of and react to their conflicts should help unravel the complex relationships between unethical behavior and conflict. Additionally, by examining the role of perceived unethical behavior in investor–entrepreneur relationships, this article helps move research connecting ethics and entrepreneurship beyond its “embryonic” state (Harris et al. 2009, p. 407). While scholars have acknowledged the importance of ethical behavior in investor-entrepreneur partnerships (e.g., Boatright 1999; Fassin 1993), they are yet to study its effects explicitly. Taken together, we thus believe this study to make several contributions to the entrepreneurship literature.

2 Literature review

Conflict refers to disagreements about the work that should be done or how it should be doneFootnote 1 as well as to disagreements that arise due to differences in personalities (Jehn 1995; Jehn and Bendersky 2003). A long tradition of research on conflict in work groups has revealed that conflicts may substantially affect both the well-being of the individuals involved and the performance of their work units (e.g., Jehn and Bendersky 2003). The relevance of this body of literature for the relationship between investors and entrepreneurs is clear given that, like individuals in work groups, investors and entrepreneurs depend on each other to achieve company value maximization (Collewaert 2011). With the goal of building and maintaining a cooperative working relationship (Cable and Shane 1997; Sapienza et al. 1996), exchanges among investors and entrepreneurs are required that facilitate a deeper understanding of each other’s goals and viewpoints. In such settings, conflicts tend to be unavoidable (Yitshaki 2008). Previous research has confirmed conflict’s relevance in investor–entrepreneur settings given that conflicts reduce an entrepreneur’s value assessment of investor involvement (Sapienza 1992) and increase both investors’ and entrepreneurs’ intentions to exit the venture (Collewaert 2011). Investor–entrepreneur conflicts have also been shown to affect venture performance (Higashide and Birley 2002). Only one study to date has examined investors’ reactions to disagreements with their entrepreneurs; Parhankangas and Landström (2006) found that VCs with stronger ties and more managerial experience will use more active and constructive approaches to dealing with conflicts. With regard to their emergence, investor–entrepreneur conflicts have been shown to be stimulated by investors’ involvement (Yitshaki 2008) and have been associated with more technologically innovative ventures (Sapienza and Amason 1993).

Conflict is, however, a process which unfolds over time (Pondy 1967; Korsgaard et al. 2008). Despite the contributions of previous studies on investor–entrepreneur conflicts, they provide little insight into “specific events that intervene between the structural “inputs” and decision “outputs” to clarify how and why the process unfolds as it does” (Forbes et al. 2010, p. 579). According to process theory, one of the dominant conflict theories (De Dreu and Gelfand 2007), conflict originates with latent conditions such as goal incompatibilities, scarce resources, personal differences, interference in reaching goals, inefficient communication and interdependency (Bartos and Wehr 2002; Pondy 1967). These latent conditions, representing the context in which conflicts occur, evoke events which in turn trigger a sense-making process and turn latent conflict into overt conflict. The latter may in turn elicit several affective and behavioral reactions (conflict manifestation) and may affect both the individuals and company involved (conflict outcome). Critical to note is that latent conflict may hence not necessarily transform into overt conflict, but instead requires some kind of event or behavior that will trigger this transformation. Forbes et al. (2010), for instance, suggested that financing decisions involving venture devaluation represent such an event and showed that such decisions do indeed cause conflict. Clearly though, much remains to be learned about conflict-triggering events.

With this study, we aim to extend this research stream by examining the impact of perceived unethical behavior as a potential conflict-triggering event. Unethical behavior pertains to conduct “that is either illegal or morally unacceptable to the larger community”, while ethical behavior refers to conduct “that is both legal and morally acceptable to the larger community” (Jones 1991, p. 367). Although scholars have previously suggested that unethical behavior may engender conflict (e.g., Viswesvaran and Deshpande 1996; Weeks and Nantel 1992), no research to date—to our knowledge—has examined how this process works nor has it unpacked the nature and implications of conflicts where unethical behavior was perceived.

A commonly encountered difficulty in determining which acts are (un)ethical is whose perception defines what is morally acceptable (Baker et al. 2006; Fraedrich 1993). In this research, the perception of the entrepreneur, VC and/or angel investor is used to define unethical behavior. Ethics scholars acknowledge strong individual differences in notions of fairness and equity (Huseman et al. 1987). The unique sensitivity of individuals to fair and unfair situations further influences their attitudes and reactions (Huseman et al. 1987; Kickul et al. 2005). Given these individual differences, what may be perceived as an unfair and unethical treatment by an entrepreneur (or investor) will not necessarily be seen in the same manner by their venture partner, who in fact may see their own behavior as common business practice. In this paper, behavior is labeled as perceived unethical behavior when at least one of the parties involved perceives an unethical treatment. While this perception may not be shared by the other parties’ involved, and not necessarily reflect the authors’ view, we argue that this will nonetheless affect their dyadic interactions and hence serve as a conflict-triggering event.

3 Method

For this study, we use an embedded case study design to provide diverse perspectives, i.e. of investors and entrepreneurs, on the topic at hand (Eisenhardt and Graebner 2007). Eleven companies that received financing from angel investors and/or VCs were selected using a theoretical sampling procedure (Eisenhardt 1989). Based on data collected through a previous research project (as in Ucbasaran et al. 2003) on the nature of conflicts between investors and entrepreneurs, cases were selected to represent a wide range in conflicts between angel investors, VCs and/or entrepreneurs. Table 1 provides an overview of the companies selected and illustrates the variety in and complexity of their conflicts.

Each of the aforementioned latent conflict conditions is represented at least once in the cases. Even though most cases represent examples of investor–entrepreneur conflicts, one case also included disputes among investors (case I). Further, of the 11 cases used, three were from the United States (California) and eight were from Continental Europe (Belgium). Variation is also present in terms of the industries these companies operate in, ranging from basic consumer goods and retailing to high-tech activities. Of the 11 cases studied, four had failed prior to and two during the study (cases B and D). All others were active during the study and remained so afterwards. For those who had already ceased operations, failure took place less than six months prior to data collection. Further, the active ventures had received risk capital financing at a maximum of five years prior to the first interview. Together this should limit the risk of recall bias. Combining these cases also allows for combining retrospective and real-time data (Eisenhardt and Graebner 2007). While the former allows for efficient data collection, the latter enhances our understanding of how perceived unethical behavior affects the conflict process.

We used several data sources including (1) semi-structured interviews conducted face-to-face, by telephone or through email with investor(s), entrepreneur(s) or both, (2) emails and phone calls to follow up initial interviews and (3) additional information including investor–entrepreneur email correspondence (provided by the informant), survey data regarding the investor–entrepreneur relationship for previous research project respondents (6 out of 11 cases)Footnote 2 and/or statutory required publications for the Belgian companies on capital increases, shareholder structure and composition of board of directors and company status.

We asked informants to relate what they most frequently argue about with their partners. Such open-ended questions should increase the accuracy of retrospective reports and served as a means to elicit examples of perceived unethical behavior. Cases were analyzed by both authors independently and subsequently cross-checked using within- and cross-case analysis (Eisenhardt 1989). Through the within-case analysis we aimed to gain a thorough understanding of the conflicts in terms of its causes and participants as well as the perceived unethical behaviors (if any). Considering the sensitive nature of conflicts and unethical behavior, it was not always possible to collect data from all parties involved. For cases A and I, information could only be gathered from the angel investor(s) involved, whereas for cases C, G, H and K the CEO was the only informant. For cases B, D, E, F and J, information was retrieved from both investors and entrepreneurs. In line with our general definition of perceived (un)ethical behavior, labeling behavior as unethical was based on individual parties’ perception of right and wrong. When at least one of the informants’ perceived an unfair and unethical treatment, we subsequently coded perceived unethical practices into six generally accepted categories of unethical behavior (see below).Footnote 3 Using the findings from the within-case analysis, we then went on to conduct a cross-case analysis to examine similarities and differences between cases in terms of the effects of perceived unethical behavior on the conflict process. Cases were added to the point of saturation, i.e. where we felt we could meaningfully distinguish between the process of conflicts where no unethical behavior was perceived versus the process of conflict where unethical behavior was perceived.

4 Findings

4.1 Perceived unethical behavior by venture capitalists, angel investors and entrepreneurs

Borrowing from the business ethics literature on stakeholder relations, perceived unethical behavior may appear in many forms: unfair competition, unfair communication, abuse of power, privileging one’s own interests, non-respect of agreement and outright fraud (Crane and Matten 2004).

As shown in Table 2, our cases present various forms of perceived unfair competition: entrepreneurs felt unfairly treated by VCs investing in competitors without informing them (case H) or stealing deals away from their VC competitors using false claims regarding industry contacts towards the entrepreneur (case K). In other cases, entrepreneurs (case B) and angel investors (case I) perceived unethical behavior when (other) investors tried sidestepping and eliminating them with all means possible. Unfair communication is perceived by providing overoptimistic information (cases I and F) and withholding crucial information for reasons of hidden agenda (cases A, B and H). Entrepreneurs further felt unethically treated in case J where communication on commissions and finder fees was deliberately held vague and in case K where the investor launches rumors in the VC community about the venture’s bad shape. Examples of perceived abuse of power include investors enforcing unbalanced contracts (cases J and K) or eliminating minority shareholders through questionable methods, such as forcing them to sell their shares at reduced price or, the opposite, blocking their investment (cases I and K). Investors also cornered entrepreneurs by refusing to co-invest in replacing end-of-life materials, owned by the investor but crucial to the entrepreneur’s business (case F). In case H the investor—wanting to integrate this venture into its competitor—does everything within his power to reach that goal including draining the venture to force the entrepreneur to go along with this plan. In the end, the entrepreneur is forced to buy back his shares. Examples of privileging her/his own interests against company interests include entrepreneurs or investors billing excessive costs (cases A and F), entrepreneurs negotiating a better remuneration for themselves with new investors without the previous investors’ agreement (case I), VCs recovering their investment through excessive fees (case J) and exercising capital increases, resulting in intentionally high dilutions of the entrepreneurs’ shares which struck them as unfair (cases H, J and K). Further, the cases present illustrations of non-respect of agreements: investors refuse to provide follow-on financing without good reason (case B), entrepreneurs do not fulfil promises of bringing in assets (case A) or ensuring additional funding (case B). In case K, the entrepreneur feels unfairly treated by his VC who had promised to bring in an international partner, but subsequently refuses to do so. Outright fraud occurs in cases A and H where information is deliberately falsified or concealed to mislead the investor (case A) or entrepreneur (case H). Finally, no unethical practices were perceived in the conflicts of cases C, D, E and G.Footnote 4

4.2 The impact of perceived unethical behavior on the conflict process

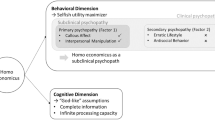

In this section, drawing on conflict process theory (Pondy 1967), we address how perceived unethical behavior may affect the conflict process between investors and entrepreneurs. As presented in Fig. 1, we propose that perceived unethical behavior enhances the chance of latent conflicts turning into overt ones through increased fault attribution (i.e. blaming).

The case evidence further suggests that perceived unethical behavior may affect the way in which these new venture partners react to their conflicts as well as the effects these conflicts may have on the partnership itself. The proposed impact of perceived unethical behavior on conflict’s outcomes is illustrated by Fig. 2. Case illustrations with selected quotes are provided in Table 2. We discuss our proposed model in more detail below.

4.2.1 Conflict sense making: naming and blaming

Cases vary in the way investors and entrepreneurs talk about their conflicts, depending on whether or not any unethical behavior was perceived. In cases of no perceived unethical behavior, there was a greater understanding of both partners having different motivations and goals. Further, there was a sense of shared responsibility for things having gone wrong. For instance, in case G the entrepreneur is upset with his investor for being too focused on the financial side of the equation, while the investor thinks the entrepreneur is too focused on the technology. These incompatible goals caused disagreements on injecting additional funds. While the entrepreneur was definitely frustrated by his angel investor, he also understood him wanting to take care of his capital and does not blame him for this. In fact, he states “He is high maintenance, but fair”. Similarly, in trying to explain what went wrong, the entrepreneur in case C notes that he “wasn’t the right man for the story” and that he, together with the investors, “probably made a wrong estimation”. He indirectly exonerates his investors for refusing to provide follow-on financing and takes up part of the responsibility for the venture going haywire by admitting he inaccurately assessed the required competencies and market potential.

When unethical practices were perceived, the storytelling turns darker. In case A where the entrepreneur provided untruthful information to the investor and embezzled money, the angel investor’s answer to the question of why it all went wrong was “you know, a real conman always goes about it cleverly” and concludes by stating that he wants “to forget that nightmare as quickly as possible”. He blames the entrepreneur and holds him responsible for his failed investment experience. Similar feelings of anger, frustration and disapproval are found in other cases where informants felt unfairly treated. The CEO of case H for instance indicates that he cannot “understand how they [the VC] think this [investing in competing companies] is reconcilable from a corporate governance perspective” and accuses them of “only being interested in their financial self-interest”.

Perceived unethical behavior seems to cause partners to look at their interaction and conflicts more negatively and to see them as a bigger hurdle to their partnership compared to when no unethical practices were perceived. Whereas understanding, exoneration and shared responsibility prevailed in the latter cases, holding the other party accountable prevailed in the former ones. This reflects what conflict literature has referred to as sense making (Korsgaard et al. 2008), which pertains to labeling events as offensive and blaming another party for deviating from norms (Felstiner et al. 1980). Also referred to as naming and blaming, it comprises the process whereby individuals perceive an injurious event, label it as such and subsequently attribute the fault to someone or something else (Felstiner et al. 1980). While all cases illustrate some degree of naming and blaming (given that all conflicts had already transgressed to the overt stage), conflict sense making does seem to turn more negative when unethical behavior was perceived. Based on the impression of being treated unfairly, attributions are made; this may increase the probability of events being classified as grievances (i.e. naming transforming into blaming) rather than as mere unfortunate events (i.e. just naming). In a process model of conflict, perceived unethical behavior may thus increase the incidence of events moving from the naming to the blaming phase, which in turn may enhance the chance of investors and entrepreneurs experiencing (more) overt conflicts. This proposition would be corroborated by previous research which has indicated that when others’ intentions are seen as high in blameworthiness, which is likely for perceived unethical behavior, the affected individual is more likely to assign blame for the event to the other party (Shaver 1985; Gilbert 1995). Additionally, conflict literature has identified the need for maintaining a positive identity as one of the main causes of conflict (De Dreu and Gelfand 2007). It is likely that when individuals perceive an unethical treatment, their self-esteem and positive view of the self are harmed, which in turn is also likely to cause conflict. Taken together, this leads to the following proposition:

Proposition 1

Perceived unethical behavior by investors or entrepreneurs may trigger conflicts through increased fault attribution to the perceived unethical party (i.e. blaming).

4.2.2 Conflict manifestation and perceived unethical behavior

Perceived unethical behavior may further impact affective and behavioral reactions that are manifested in the subsequent entrepreneur-investor relationship. Conflicts elicit a variety of affective (e.g. anger, distress) and behavioral reactions (e.g. aggression), which can all be seen as a form of conflict manifestation. In terms of affective reactions to conflict, entrepreneurs reacted with suspicion and distrust in cases of perceived unethical behavior. Feelings of suspicion and distrust peek through entrepreneurs’ pejorative appellations of their investors, such as “Trojan horses” (case H) or “having had a Machiavellian plan from the very beginning” (case K). No such examples were found in cases where no unethical behavior was perceived.

With regard to behavioral reactions to conflict, multiple options exist. One can collaborate with the other party to solve the problem, use more competitive tactics to achieve one’s goals or avoid the problem altogether (De Dreu and Gelfand 2007). In our cases, behavioral responses to conflict were markedly different depending on whether or not unethical behavior was perceived. In those cases where no unethical behavior was perceived, conflicting parties either remained silent or tried resolving the problem together. For instance, the angel investor in case D stated “I’ve given up on [company D].” After having tried several ways to find a compromise with the founder, including firing the new CEO as he could not get along with the founder and trying to make the entrepreneur focus his efforts, the angel investor finally saw no other way to deal with this problematic situation than to give up. In case E, the investors undertook no actions to change the founder’s mind. Considering the investor was actively involved in his main job, which had nothing to do with investing, he preferred to stay away from the conflict between the more professional angel investors and the entrepreneur. This rather passive approach can still be considered a constructive way of dealing with conflict as underlying it is a feeling or hope that everything will work out (Parhankangas and Landström 2006). This is not to say that when all parties behave ethically, contentious tactics are impossible. When the investor in case G “stopped funding the company and tried shutting down research programs”, the entrepreneur indicated that he “refused to play along with this strategy and kept pushing programs forward”. Even though the entrepreneur stubbornly pursued his path, he did so in a silent way. Further, he and his investor were able to work their conflicts out as soon as the entrepreneur could back his promises up with facts.

Conversely, in cases where unethical behavior was perceived, conflicts were dealt with quite differently. In case I, angel investors did not agree with the corporate investor’s strategy and refused to participate in a follow-on round financing, soon after which they were forced to exit the venture. The entrepreneurs in cases H and K immediately sought legal assistance. In case A, the investor fired the entrepreneur upon learning the latter had embezzled money. In all cases where unethical issues had arisen, the reaction to conflict was immediate and aggressive in that at least one of the parties involved reacted with aggressive voice or exit, i.e. a destructive, competing conflict-handling strategy (Parhankangas and Landström 2006).

The case evidence suggests that perceived unethical behavior may affect which strategy will be adopted by investors and entrepreneurs to manage their conflicts. This would be consistent with previous research which has indicated that the final choice of which conflict management strategy to be employed by new venture partners will depend on a combination of “actor-, relationship- and context-specific factors” (Parhankangas and Landström 2006, p. 778). Applied to perceived unethical behavior, we thus propose:

Proposition 2a

In a conflict situation between investors and entrepreneurs, perceived unethical behavior will increase the likelihood of using a destructive conflict management strategy, such as exit or aggressive voice.

Proposition 2b

In a conflict situation between investors and entrepreneurs, perceived unethical behavior will decrease the likelihood of using a constructive conflict management strategy, such as silence or considerate voice.

4.2.3 Conflict escalation and unethical behavior

Perceived unethical behavior also seemed to elicit conflict escalation, defined as “an increase in the intensity of the conflict as a whole” (Rubin et al. 1994, p. 69). It is generally characterized by an increased use of contentious tactics and a proliferation of issues (Wall and Callister 1995). An illustration is provided by venture K’s entrepreneur:

When the venture capitalist also withheld the investment plan that had been previously approved, we got legal advice. We realized that a plan had been prepared from day one and that the venture capitalist’s intention was to perpetrate a wipe-out. When the venture capitalist demanded additional cost-cutting as conditions for reinvestment in a (limited) second round, we decided to attend board meetings through a conference call from our lawyer’s office. During one of those last meetings, I said that strictly speaking I had to file for bankruptcy. Suddenly the venture capitalist wanted to abort the board meeting and told me they wanted to talk with me face-to-face. There they told me that if I couldn’t arrange an agreement with all the venture capitalists involved, they would hold me personally liable and sue me.

Similar threats of prosecution were uttered in case I. Another example of conflict escalation is found in case B. While the initial conflict focused on the investor’s representative (lawyer) sidestepping the entrepreneur by contacting an industrial partner and making him another proposal behind the entrepreneur’s back, this quickly escalated into the lawyer asking the entrepreneur to step aside, the entrepreneur removing the lawyer from the board in response and accusatory e-mails being sent back and forth. Quoting from e-mail correspondence, examples of accusations made were: “while like you he is also a scientist, he is also skilled in business dealings and you are not”, “Please don’t confuse this perceived issue control or micromanagement, with wanting to get the job done, and get it done correctly; without having to ask or explain many, many times, or stroke ad nauseam ridiculously frail egos” or “Lastly, with respect to [the representative’s] insights on fighting for control, well, again, I am confused—this seems more a statement about [the representative] fighting with his own demons, than me”. These accusations only served to intensify the already heated conversation, resulting in the investor withdrawing his funds from the venture.

Not only did perceived unethical behavior stimulate conflict escalation (as indicated by the first arrow in Fig. 2 going from unethical behavior toward conflict escalation), but this escalation also often included additional, subsequent perceived unethical behavior (as represented by the arrow in the opposite direction). For instance, in case K initial perceived unethical behavior included the VC stealing a deal away from his competitors using unfair claims toward the entrepreneur and enforcing an unbalanced contract. This helped to trigger a first conflict concerning the CEO’s replacement and acceleration of expenses. The conflict escalation process as described above, however, also included the VC starting to spread rumors about the venture’s bad shape to avoid new investors entering the venture and forcing both the minority shareholders and entrepreneurs to exit and sell their shares at reduced price. Thus, conflict escalation entailed new perceived unethical behavior from the VC. Conflict escalation was not observed in any of the cases where no unfair treatment was perceived.

These findings can be explained by conflict literature, which has shown that as conflicts persist in time and more aggressive tactics are used, conflicts have a tendency to escalate and become exceedingly difficult to undo (Rubin et al. 1994; Van de Vliert 1997). Conflicts not only intensify due to more aggressive behavior (which will likely be reciprocated by the other party), but also due to more negative perceptions of and attitudes towards the other party, weakened social ties and communication problems between conflicting parties (Friedman and Currall 2003; Rubin et al. 1994). Because perceived unethical behavior seems to provoke competitive behavior and will likely change the perception of the other party to being seen as unfair or less moral than oneself, conflict escalation is to be expected. That this may also lead to additional unethical behavior is consistent with previous research on counterproductive behaviors in work relationships. Behavioral integrity literature, for instance, suggests that an individual’s initial misbehavior may desensitize that individual to further misbehaviors on his part (Simons 2002), thereby making it more likely to occur again. Similarly, perceived unfairness in how one is treated by others and negative affect may result in spirals of unethical behavior (e.g., Gino et al. 2009). Initial unethical behavior inducing further unethical behaviour through conflict escalation is consistent with this line of research. This discussion suggests the following propositions:

Proposition 3a

Perceived unethical behavior by investors or entrepreneurs will increase the likelihood of their conflicts escalating due to an increased and reciprocated use of competitive tactics towards each other and a more unfavorable perception of the unethical party.

Proposition 3b

This conflict escalation is likely to entail additional perceived unethical behavior.

4.2.4 Conflict outcome and perceived unethical behaviour

As investors and entrepreneurs become more suspicious of each other, information barriers increase, knowledge exchange and coordination are impeded and statements and actions are more easily misunderstood (Jehn 1995; Simons and Peterson 2000). Such negative attitudes and perceptions quickly tend to be reciprocated by other parties (Gino et al. 2009; Rubin et al. 1994), leading to a breakdown of the partnership. All trust vanishes and cooperation stops, which in turn reduces the chances of conflicts getting resolved. These theoretical arguments are corroborated by our case studies given that none of the parties involved in cases where unethical behavior was perceived were able to work through their conflicts.

In all cases where some form of unethical behavior was perceived, it resulted in the end of the partnership through premature exit of one or all of the parties involved. In cases A and K the entrepreneur exits, in cases B, H, I and F the investors exited from their portfolio companies (in case J they are in exit preparation). For cases A, K and B this exit was almost immediately followed by venture failure. Even though failure and exit also occur when parties behave ethically, the chances of them working through and resolving their conflicts (cases E and G) are substantially higher because there is no breach of trust.Footnote 5 Given that (1) competitive behavior, blocked cooperation and distrust have all been suggested as factors contributing to conflict taking a turn for the bad (Rubin et al. 1994; Simons and Peterson 2000) and (2) our case study evidence suggests that perceived unethical behavior stimulates all three, we propose that perceived unethical behavior will strengthen conflict’s negative effect on the partnership involved. Thus, we propose:

Proposition 4a

Perceived unethical behavior by investors or entrepreneurs will reduce the chance of conflict resolution.

Proposition 4b

Perceived unethical behavior by investors or entrepreneurs will increase the likelihood of conflict leading to a negative partnership outcome, either by failure or another form of involuntary exit, through increased competitive behavior towards each other and increased distrust and blocked cooperation between them.

5 Conclusion

This paper sought to develop propositions regarding the impact of perceived unethical behavior on the conflict process between angel investors, venture capitalists and entrepreneurs. Using case studies, we proposed a model to help highlight the role of perceived unethical behavior in conflict emergence, conflict management, conflict escalation and conflict’s effects on investor–entrepreneur partnerships.

Future research can build on this study in several ways. First, unethical issues and their effects may vary depending on the stage of the financing partnership cycle or on the financing source used. Even though variation was clearly present in terms of unethical behavior presented by angel investors and venture capitalists, our limited sample size does not allow us to generate finer-grained insights regarding differences between the two. Second, even though our cases indicate that perceived unethical behavior is omnipresent, more research is needed to understand whether its presence varies depending on the degree of professionalization of the respective risk capital markets. In more mature markets, investors may conform more to governance and ethical guidelines to protect their reputation, while entrepreneurs may be better informed regarding the rules of the game. As such, opposed perceptions of (un)ethical behavior due to overoptimistic business plans and broken promises of added value may be tempered. Finally, future research should examine the validity of our model adopting a quantitative research approach. The aim of this article was to deepen the field of the darker sides of the relationships between angel investors, venture capitalists and entrepreneurs. As such, our objective was to raise questions and to encourage critical thinking concerning the role of ethical issues in conflicts between these parties.

This study also has practical implications: the world of entrepreneurship and venture capital is a hard one where conflicts are inevitable. Parties engaged in conflicts may have different views on what is ethically acceptable. In venture investments, ambiguous situations with different perceptions often rest upon differences between legal and ethical views. The venture capital industry has largely been influenced by its Anglo-Saxon origins with a strong emphasis on contracts and compliance. In addition to respecting legal aspects, an ethical attitude however is necessary to build trust and improve collaboration between partners. Both investors and entrepreneurs should reflect on the ethical impact of their attitude and confront their behavior with their code of conduct.Footnote 6 As in all fields, the hard thing—but also the essence—about codes is to implement them. Recognizing the ethical issues involved will help foster ethical behavior among various partners in the investment process and will increase the chances of successful collaboration.

To conclude, our study provides several important contributions. It contributes to the entrepreneurship literature by (1) addressing a call for more research on investor–investee relationships in general (Lockett et al. 2006) and their darker sides in specific (Parhankangas and Landström 2006) and (2) addressing a call for more cross-disciplinary research connecting the fields of business ethics and entrepreneurship (Harris et al. 2009). This study also informs conflict literature by more clearly disentangling the links between conflict and unethical behavior.

Notes

This mainly refers to disagreements regarding roles (who does what) and resource delegation.

Cases B, D, E, F, G and I had participated in the larger conflict research project by completing questionnaires.

For cases A and I this hence reflects perceived unethical behavior from the perspective of the angel investor(s) and for cases H and K from the perspective of the entrepreneur. In case B unethical behavior is perceived on both sides, while in cases F and J the entrepreneur perceives unethical behavior but the angel investors and venture capitalist do not.

We did not intentionally oversample conflict situations with perceived unethical behavior. Given the limited number of case studies we cannot draw any conclusions concerning the ratio of unethical to ethical conflict cases and its generalizeability.

Although exit also occurred in case C, the entrepreneur states that his exit was not related to the conflictual relations in his venture, but rather to the entrepreneur realizing that he wasn’t the right person for the job and their death valley was going to be substantially longer than initially foreseen.

See http://www.evca.eu/uploadedFiles/Home/Toolbox/Industry_Standards/evca_code_of_conduct_2009.pdf and http://www.eban.org/membership/code-of-conduct for the European Venture Capital Association’s and European Business Angel Network’s codes of conduct, respectively.

References

Baker, T., Hunt, T., & Andrews, M. (2006). Promoting ethical behavior and organizational citizenship behaviors: The influence of corporate ethical values. Journal of Business Research, 59, 849–857.

Bartos, O. J., & Wehr, P. (2002). Using conflict theory. Cambridge: Cambridge University Press.

Boatright, J. (1999). Ethics in Finance. Malden, Oxford: Blackwell Publishing.

Cable, D., & Shane, S. (1997). A prisoner’s dilemma to entrepreneur-venture capitalist relationships. Academy of Management Review, 22(1), 142–176.

Collewaert, V. (2011). Angel investors’ and entrepreneurs’ intentions to exit their ventures: A conflict perspective. Forthcoming: Entrepreneurship Theory and Practice. doi:10.1111/j.1540-6520.2011.00456.x.

Crane, A., & Matten, D. (2004). Business Ethics: A European Perspective. Oxford: Oxford University Press.

De Dreu, C. K., & Gelfand, M. (2007). Conflict in the workplace: Sources, functions, and dynamics across multiple levels of analysis. In C. De Dreu & M. Gelfand (Eds.), The Psychology of conflict and conflict management in organizations: 3–54. New York: Taylor and Francis.

Eisenhardt, K. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532–550.

Eisenhardt, K., & Graebner, M. (2007). Theory building from cases: Opportunities and challenges. Academy of Management Journal, 50(1), 25–32.

Fassin, Y. (1993). Ethics and venture capital. Business Ethics European Review, 2(3), 124–131.

Felstiner, W., Abel, R., & Sarat, A. (1980). The emergence and transformation of disputes: Naming, blaming, claiming. Law and Society Review, 15(3–4), 631–654.

Forbes, D., Korsgaard, A., & Sapienza, H. (2010). Financing decisions as a source of conflict in venture boards. Journal of Business Venturing, 25, 579–592.

Fraedrich, J. (1993). The ethical behavior of retail managers. Journal of Business Ethics, 12(3), 207–218.

Friedman, R., & Currall, S. (2003). Conflict escalation: Dispute exacerbating elements of e-mail communication. Human Relations, 56(11), 1325–1347.

Gilbert, D. (1995). Attribution and interpersonal perception. In A. Tesser (Ed.), Advanced social psychology (pp. 99–147). Boston, MA: McGraw Hill.

Gino, F., Ayal, S., & Ariely, D. (2009). Contagion and differentiation in unethical behavior: The effect of one bad apple on the barrel. Psychological Science, 20(3), 393–398.

Harris, J., Sapienza, H., & Bowie, N. (2009). Entrepreneurship and ethics. Journal of Business Venturing, 24(5), 407–418.

Higashide, H., & Birley, S. (2002). The consequences of conflict between the venture capitalist and the entrepreneurial team in the United Kingdom from the perspective of the venture capitalist. Journal of Business Venturing, 17, 59–81.

Huseman, R., Hatfield, J., & Miles, E. (1987). A new perspective on equity theory: The equity sensitivity construct. The Academy of Management Review, 12(2), 222–234.

Jehn, K. (1995). A multimethod examination of the benefits and detriments of intragroup conflict. Administrative Science Quarterly, 40, 256–282.

Jehn, K., & Bendersky, C. (2003). Intragroup conflict in organizations: A contingency perspective on the conflict-outcome relationship. Research in Organisational Behaviour, 25, 187–242.

Jones, T. M. (1991). Ethical decision making by individuals in organizations: An issue-contingent model. Academy of Management Review, 16, 366–395.

Kickul, J., Gundry, L., & Posig, M. (2005). Does trust matter? The relationship between equity and sensitivity and perceived organizational justice. Journal of Business Ethics, 56, 205–218.

Korsgaard, A., Jeong, S. S., Mahony, D., & Pitariu, A. (2008). A multilevel view of intragroup conflict. Journal of Management, 34(6), 1222–1252.

Lockett, A., Ucbasaran, D., & Butler, J. (2006). Opening up the investor-investee dyad: Syndicates, teams and networks. Entrepreneurship Theory and Practice, 25, 117–130.

Mason, C., & Harrison, R. (1995). Closing the regional equity gap: The role of informal venture capital. Small Business Economics, 7(2), 153–172.

Parhankangas, A., & Landström, H. (2006). How venture capitalists respond to unmet expectations: The role of social environment. Journal of Business Venturing, 21(6), 773–801.

Pondy, L. R. (1967). Organizational conflict: Concepts and models. Administrative Science Quarterly, 12(2), 296–320.

Rubin, J. Z., Pruitt, D. G., & Kim, S. H. (1994). Social conflict: Escalation, stalemate, and settlement (2nd ed.). New York: McGraw-Hill.

Sapienza, H. J. (1992). When do venture capitalists add value? Journal of Business Venturing, 7, 9–27.

Sapienza, H. J., & Amason, A. C. (1993). Effects of innovativeness and venture stage on venture capitalist–entrepreneur relations. Interfaces, 23(6), 38–51.

Sapienza, H. J., Manigart, S., & Vermeir, W. (1996). Venture capitalist governance and value-added in four countries. Journal of Business Venturing, 11(6), 439–470.

Shaver, K. (1985). The attribution of blame: Causality, responsibility and blameworthiness. New York: Springer.

Simons, T. (2002). Behavioral integrity: The perceived alignment between managers’ words and deeds as a research focus. Organization Science, 13, 18–35.

Simons, T., & Peterson, R. (2000). Task conflict and relationship conflict in top management teams: The pivotal role of intragroup trust. Journal of Applied Psychology, 85, 102–111.

Sohl, J. E. (1999). The early-stage equity market in the USA. Venture Capital, 1(2), 101–120.

Sohl, J. E. (2003). The U.S. angel and venture capital market: Recent trends and developments. The Journal of Private Equity, 6(2), 7–17.

Ucbasaran, D., Wright, M., & Westhead, P. (2003). A longitudinal study of habitual entrepreneurs: Starters and acquirers. Entrepreneurship & Regional Development, 15, 207–228.

Van de Vliert, E. (1997). Complex interpersonal conflict behavior: Theoretical frontiers. Hove: Psychological Press.

Vanacker, T., & Manigart, S. (2010). Pecking order and debt capacity considerations for high-growth companies seeking financing. Small Business Economics, 35, 53–69.

Viswesvaran, C., & Deshpande, S. P. (1996). Ethics, success and job satisfaction: A test of dissonance theory in India. Journal of Business Ethics, 15(10), 1065–1069.

Wall, J., & Callister, R. R. (1995). Conflict and its management. Journal of Management, 21(3), 515–558.

Weeks, W. A., & Nantel, J. (1992). Corporate codes of ethics and sales force behavior: A case study. Journal of Business Ethics, 11(10), 753–760.

Yitshaki, R. (2008). Venture capitalist-entrepreneur conflicts—an exploratory study of determinants and possible resolutions. International Journal of Conflict Management, 19, 262–292.

Acknowledgements

We would like to thank Audrey Korsgaard, Jan Lepoutre, John Boatright, Ixtaso del Palacio Aguirre, Tom Vanacker and participants of the GIMV-SBE Special Issue Workshop for their feedback and help related to this paper. A warm thank you also goes out to the entrepreneurs and investors who were willing to share their story with us. This paper also benefited from presentations at the 2010 Babson College Entrepreneurship Research Conference (Lausanne) and 2010 Academy of Management Meeting (Montréal).

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Collewaert, V., Fassin, Y. Conflicts between entrepreneurs and investors: the impact of perceived unethical behavior. Small Bus Econ 40, 635–649 (2013). https://doi.org/10.1007/s11187-011-9379-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9379-7