Abstract

In a series of experiments, we provide evidence that people pay special attention to the probability of losing. We first analyze this behavior in the typically used one-shot choice tasks. We then extend our analysis to repeated decisions in choice tasks, as well as allocation and investment tasks. Additionally, we test both decision making under risk and under gradually removed uncertainty, as with decisions from experience. Our findings of explicit attention to loss probabilities contradict the predictions of normative and descriptive decision theories, such as Expected Utility Theory and (Cumulative) Prospect Theory. We suggest a value function with a jump rather than a kink at the reference point, which separates gains and losses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

To some extent, people try to avoid failures under nearly all circumstances. As a consequence, decision makers pay explicit attention to the probability of such failures. (Cumulative) Prospect Theory (CPT) provides a possible explanation with loss aversion in the form of a kink in the value function or extreme risk aversion by strong curvature. An alternative explanation is that decision makers pay explicit attention to losses and their probabilities, irrespective of the loss sizes, which is neither fully captured by loss or risk aversion in CPT.

The contribution of the current paper is testing whether people have an aversion to the probability of unwanted events (failure) such as financial losses; this is done by using various different settings, including typically analyzed choice tasks, but also allocation and investment tasks, with and without prior information about the outcome probabilities in repeated decisions. To illustrate our main idea, consider, for example, two similar prospects (lotteries) or financial assets—A and B—that differ in only one small outcome ε, which is negative (–ε) for A and positive (ε) for B. For a very small ε, all major decision theories (e.g., expected utility theory or CPT) would predict that A and B will become equally attractive. If, however, decision makers pay explicit attention to the overall probability of losing, B is valued higher than A, and the magnitude of this difference depends on the probability of that outcome occurring. Such preferences are not part of the traditional decision theories, such as mean–variance, or even descriptively powerful ones, such as CPT, at least not for the typically elicited preference parameters and functional forms (and as we show later on, not even for the more extreme cases).

Despite the potentially consequential effects of explicit attention to loss probabilities, it is extremely difficult to analyze such preferences using field data. Even in finance, in which there is a lot of data available, for example, in the form of individual trading data, there is hardly any case in which there are objective, known, and/or stable probabilities. Such a setting, however, is necessary to differentiate between competing explanations based on preferences, in particular, to separate our hypothesis from the pure effect of loss aversion. As an aggravating factor, it is challenging to disentangle the effects of beliefs (e.g., investors’ forecasts about future return distributions, including probabilities) and preferences (e.g., loss, or risk aversion). Similar arguments hold true outside the finance domain, maybe except for casino gambling. Therefore, we use a series of experiments that allow us to control for beliefs by holding outcome distributions constant over time.

Roy (1952) was the first to propose the idea that decision makers try to maximize the likelihood of success (hence minimizing the probability of failure).Footnote 1 Some implicit experimental evidence for an aversion to loss probabilities in one-shot tasks has been presented by Payne et al. (1980, 1981), Lopes and Oden (1999), Payne (2005), Sokolowska (2006), Levy and Levy (2009), and Qiu and Weitzel (2012). Many of these tasks can be interpreted as relatively complex, which might be a driver for the observed behavior.Footnote 2 Zeisberger (2022) and Holzmeister et al. (2020) provide evidence that investor risk perception in multi-outcome return distributions is linked to loss probabilities. It can be argued that experimental results lack external validity because of low incentives, but Levy and Levy (2009) demonstrate that this preference pattern also holds true if relatively large real stakes of up to $1,500 are involved, as well as for financial professionals, such as mutual fund managers and financial analysts. Some broader field evidence for preferences that are consistent with our hypothesis (but not allowing for a clear distinction with other hypotheses) has been provided by Camerer et al. (1997), who show that New York cab drivers try to achieve a daily income target, Lopes (1987) for farmers, and Payne et al. (1980, 1981) for investment managers. Shefrin and Statman (2000) provide a “behavioral portfolio theory” based on these insights. However, the literature is not as conclusive as what it may seem to be. Diecidue et al. (2015) do not find evidence for loss probability aversion in a task of certainty equivalent elicitation, even for complex lotteries. Complexity might promote the use of heuristics in decision making, and the studies manipulated it by the number of outcomes and use of round versus nonround probabilities. Generally, previous studies have often used rather complex decision situations with, for example, two options and five different outcomes and probabilities each.

In the current paper, we present a series of experiments with different decision tasks and rather low complexity. To explore the generalization and boundaries of our findings, we investigate choice, allocation, and investment tasks. In the choice tasks, the participants make choices between two lotteries. In the allocation tasks, the participants are required to allocate a monetary endowment between prospects. In the investment tasks, the participants must decide how much to invest in a lottery. We begin with choice tasks in a one-shot setting, as is often used in the literature. We then explore repeated decisions because choice behavior has been found to differ substantially between one-shot and repeated decisions (see, e.g., Erev et al., 2010; Hoffmann et al., 2013; Klos et al., 2005; Lopes, 1996; Wulff et al., 2015). In particular, when it comes to repeated decisions, decision makers are acting more according to Expected Utility Theory (Wedell, 2011), and they also show a greater preference for options with higher expected values (e.g., Montgomery & Adelbratt, 1982); both effects work against our hypothesis. Probability judgments are improved for repeated decisions (Fox & Hadar, 2006). We also address the question of whether the results are transferable to a situation of (gradually resolved) uncertainty as opposed to pure risk. In the case of uncertainty, people must infer probabilities and outcomes from feedback rather than receive full distributional information beforehand.

The latter case resembles the tasks that are typically used in the decisions from experience (DfE) literature. In the DfE paradigm, decision makers experience outcome distributions rather than having them described, and in most studies, they make choices between binary risky options (see, e.g., Erev & Barron, 2005; Wulff et al., 2018; Kaufmann et al., 2013). Importantly, the DfE literature has documented considerable deviations from tasks with descriptive decision problems. Much attention has been given to the overweighting of rare events, which is lowered or turns into the underweighting of rare events (e.g., Abdellaoui et al., 2011; Hertwig et al., 2004). Although part of the effect is driven by a sampling error in the DfE paradigm, the effect does not completely vanish if controlling for it (e.g., Camilleri & Newell, 2010). Interesting for our analysis is the finding that when only experiencing the outcomes in choice tasks, decision makers tend to prefer the option providing a higher frequency of better outcomes, the option that minimizes the likelihood of losing (e.g., probability matching), or the options that have a lower recalled loss frequency (Hertwig & Erev, 2006; Erev et al., 2017), which is consistent with our loss probability aversion hypothesis.

In a number of aspects, our study differs from DfE tasks and goes beyond them to more broadly explore possible aversion to loss probabilities, thus also extending the findings of the DfE paradigm. First, as outlined above, next to classically analyzed choice tasks, we additionally analyze investment and allocation tasks and find support for our hypothesis in all these settings. Second, although we analyze situations in which the outcomes and probabilities must be experienced over time as in DfE, in many of our settings, the outcome distribution is clearly communicated beforehand (decisions under risk). Furthermore, we focus on the tasks in which there are no rare events, and by this, we circumvent the discussion on the over- and underweighting of probabilities (and differences therein between different settings) by design.

Our results are as follows: In all tasks—choice, allocation, and investment—we find evidence for decision makers paying explicit attention to loss probability. In choice tasks, the participants tend to prefer options with lower loss likelihoods, even if these are less attractive under other measures. In the allocation and investment tasks, the participants allocate or invest significantly more in lotteries with low probabilities of losing, even though these lotteries are dominated in a mean–variance framework and are also less attractive in a CPT evaluation for the typically assumed preference parameters. To guarantee the robustness of our results, we allow for large variations of typically assumed preference parameters in the CPT framework. We find our hypothesized effects are independent of whether the participants are informed about the outcome distribution (“risk”) or whether they have to infer it from the outcome feedback/experience (“ambiguity”). A “classical” loss aversion explanation (kink at the reference point of the value function or elevated weighting function for losses) does not provide a convincing alternative explanation, nor do the different shapes of the probability weighting functions in CPT.

We therefore suggest to have an adaptation of CPT to capture explicit attention toward gain and loss probabilities. Diecidue and Van De Ven (2008)Footnote 3 propose a model in which the value of a prospect X is calculated according to

where the probabilities pi are associated with the outcomes xi. The important terms of Eq. (1) are the latter two, with \({\mu }^{+}\ge 0\) and \({\mu }^{-}\ge 0\) as additional decision weights to account for the overall gain and loss probabilities, P(\({x}^{+}\)) and P(\({x}^{-}\)). The parameters \({\mu }^{+}\) and \({\mu }^{-}\) determine the degree to which decision makers take gain and loss probabilities into account. A higher value \({\mu }^{-}\) compared with \({\mu }^{+}\) implies an aversion to the overall loss probability. v(xi) can take, for example, the form of the Prospect Theory value function but is not restricted to just taking this function. In the current study, we test the hypothesis that \({\mu }^{-}\) is larger than \({\mu }^{+}\), that is, that decision makers are averse to the overall loss probability.

2 Setup of analysis and general procedure

2.1 Underlying principle of experiments

The underlying principle of our study is to use a pair of prospects (named LOW and HIGH), for which the relative attractiveness according to the classical utility measures, on the one hand, and overall loss probability, on the other hand, are negatively correlated. Some studies have found complexity favoring heuristics, such as a focus on gain and loss probabilities (e.g., Erev et al., 2010; Payne, 2005; Venkatraman et al., 2009, 2014), and many related studies use relatively complex settings (e.g., a choice between five outcome lotteries with odd numbers for each outcome and probability). Therefore, we aim to reduce this level of complexity where possible. We focus on prospects with four outcomes, and in all settings, all outcomes are equally likely. Therefore, the minimum outcome probabilities are 25%. This also prevents the challenges of possible over- or underweighting of rare events (Hertwig et al., 2004; Tversky & Kahneman, 1992).

For the prospect LOW, one of the four outcomes is negative; for HIGH, three are negative. As a result, LOW possesses a low 25% overall loss probability compared with HIGH, with a high loss probability of 75%. At the same time, we calibrate the outcomes of the lotteries in a way that HIGH is more attractive based on classical measures and theories, as outlined in the following paragraph. We achieve this by having two small outcomes (compared with ε in the introduction) that are both negative for HIGH and both positive for LOW and by having the two remaining larger outcomes overcompensating this imbalance (see Table 1).

To guarantee the robustness of our analysis, we measure the lotteries’ attractiveness in three ways. First, we compare the expected value, variance, and skewness. Second, we calculate the CPT utility, thus taking into account the loss aversion, diminishing value sensitivity, and probability weighting. We use functional forms for the value function v and probability weighing functions w+ and w–, as proposed by Kahneman and Tversky (1979) and then respecified in Tversky and Kahneman (1992):

In addition, we use their parameter estimates α+ = α– = 0.88 for the value function curvature (the signs + and – indicate the gain and loss domain), γ+ = 0.61 and γ – = 0.69 for the probability weighting, and \(\lambda\) = 2.25 for the loss aversion coefficient. Our results are, however, independent of the exact functional forms of Eqs. (2) and (3). Additionally, we allow for several deviations from these parameters throughout our analysis by using a parameter sensitivity analysis. Third, we allow for individual heterogeneity in the preferences and use a set of experimentally elicited individual CPT preference parameters provided by Zeisberger et al. (2012b). This dataset consists of 73 parameter combinations (participants) with median parameters: \({\alpha }^{+}\) = 0.98, \({\alpha }^{-}\) = 0.88, \({\delta }^{+}\) = 0.90, \({\delta }^{-}\) = 0.76, and \(\lambda\) = 1.38. These values are in a similar range as those reported in other studies (for an overview on elicited CPT parameter values, see Fox & Poldrack, 2013). For each of these 73 preference parameter combinations, we calculate the CPT value. This method provides us with a prediction of attractiveness for LOW and HIGH based on CPT, here taking into account preference heterogeneity. According to all measures–except for the loss probability–HIGH is more attractive than LOW.

2.2 General procedure

We conducted all experiments with undergraduate and graduate students from the University of Zurich, ETH Zurich (Switzerland), and Radboud University (Netherlands) in a clean laboratory setting using classical experimental economics procedures (private cubicles, no cell phones, written instructions, individual performance-based payoffs, etc.) or in an online setting.Footnote 4 The participants were recruited from a database containing a few thousand students enrolled in a variety of major study courses, mainly in economics and business administration. In all experiments, almost half of the participants were female.

Each experiment lasted between approximately 5 and 20 min. To provide real monetary incentives, a fraction of the participants were randomly chosen to be paid in real money, and they earned exactly the amount they realized in the experiment (variable payoff).Footnote 5 We paid the participants individually and after the experiment had ended. The total expected hourly payoff was always equivalent to or above the hourly student wage. For all experiments, we communicated all details, including the payoff mechanism, clearly to each participant at the beginning of the experiment. No person participated twice in any of our experiments. We randomized the critical elements per subject–for example, which option is displayed on the left and right on a screen–to be equally distributed. We kept this order constant for each subject in the case of repeated decision tasks to avoid confusion and noise. Before the main part of the experiment, all participants had to answer some demographic and risk attitude questions (all our qualitative results hold, even when controlling for demographic factors). We also invited the participants in the lab to ask any questions individually if they did not understand the experimental task.

3 Choice tasks

3.1 Experiment 1: One-shot choice task

In Experiment 1 (n = 141), we set up a choice task with single decisions using our basic experimental idea. We used one main choice task, as explained below in more detail, and two choice tasks as robustness checks. Each participant was shown all three decisions in a random order. The variable payment was based on a single choice (Hey & Lee, 2005). The subjects’ tasks were to choose either option in each of the three tasks, and we measured the choice behavior. Table 2 displays several relevant measures of the main choice task and compares the attractiveness of both lotteries. As outlined above, we constructed HIGH to have both a higher expected value and lower variance. Furthermore, we guaranteed that the skewness would be higher for HIGH because decision makers have been found to have a preference for high or positive skewness (for field evidence, see Kraus & Litzenberger, 1976; Golec & Maurry, 1998; for laboratory evidence, see Ebert & Wiesen, 2011).Footnote 6

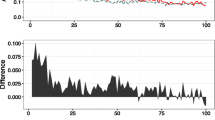

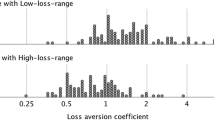

HIGH is more attractive in a CPT evaluation, given the widely used median preference parameters by Tversky and Kahneman (1992)–henceforth TK. We use a sensitivity analysis to check that our results hold qualitatively true for variations of the preference parameters (see the left panel of Fig. 1). For most of the parameter combinations, for the diminishing value sensitivity α (0.5 to 1) and loss aversion parameter \(\lambda\) (1 to 5), a CPT decision maker prefers HIGH over LOW (holding probability weighting constant at γ+ = 0.61 and γ– = 0.69). The degree of loss aversion has only a very limited impact on the relative attractiveness between LOW and HIGH. Only a relatively strong curvature (i.e., diminishing value sensitivity in the value function) of approx. α = 0.65 can make LOW and HIGH equally attractive (not more attractive). The right panel of Fig. 1 shows that CPT would predict most participants choosing HIGH over LOW.

Result

We observe that 68.8% of the participants in our Experiment 1 preferred option LOW, which is significantly different from random choice at 50% (binomial test, p < 0.001). Hence, despite the fact that HIGH is more attractive in all the presented measures, there is a strong preference for LOW. If the participants were not focusing on loss probabilities but were CPT decision makers instead, then the curvature of most of the subjects would need to be below 0.65 to explain our observed preference pattern. Thus, in contrast to all predictions from Table 2, most preferred LOW, giving evidence for particular attention to the loss probability.

We use the two robustness choice tasks presented in Table 3 to exclude the CPT value function curvature driving our main result. Task 1 presents our baseline task. In Task 2, we made both lotteries LOW and HIGH less attractive to a similar extent in a CPT evaluation. We achieved this by decreasing the two middle outcomes by a small amount. We made sure that the relative attractiveness would not change between the two options for all measures presented in Table 2. Although we still call the two options LOW and HIGH, they share the same loss probability of 75% in Task 2 because our adjustment of the two middle outcomes affects the outcome signs of LOW. In Task 3, we shifted the middle outcomes upwards when compared with the baseline Task 1 so that both lotteries would have a loss probability of only 25%. Table 4 demonstrates that the relative CPT evaluation between LOW and HIGH does not change. HIGH is more attractive in a CPT framework with \(\alpha =0.88\) (this also holds true for the expected value, variance, and skewness). We also tested the case of stronger curvature (\(\alpha =0.60\)). Here, a strong curvature CPT decision maker would prefer LOW in all three tasks. Hence, if curvature drives our findings exclusively, Tasks 2 and 3 should lead to equal results as Task 1. Furthermore, because we deal with one-shot decisions under risk, our assumption of probability weighting, as in Tversky and Kahneman (1992), seems appropriate. However, our results do not depend on this assumption.

Result

For Tasks 2 and 3, we can observe a strong difference in choice behavior compared with Task 1 (see right column of Table 3). In Task 2, only 41.8% of participants preferred LOW over HIGH, which is significantly less than the 68.8% in Task 1 (p < 0.001). Hence, once the loss probability advantage of LOW is eliminated, the preference for LOW does not exist anymore. Although our findings for Task 1 might be explained by strong curvature, the results for Task 2 rule out this possibility as an exclusive explanation. For Task 3, only 51.1% of the participants preferred LOW, which is also significantly less than in Task 1 (p < 0.001). This finding confirms the one from Task 2, now for the case of 25% loss probability instead of 75% for both lotteries. Taken together, we find support for our hypothesis that people focus on loss probabilities in one-shot choice tasks. This result does not seem to be explainable by CPT value function curvature alone.

3.2 Experiment 2: Repeated choice task with known return distributions

Previous studies have reported substantial differences in choice behavior between one-shot and repeated decisions (see, e.g., Erev et al., 2010; Hoffmann et al., 2013; Klos et al., 2005; Lopes, 1996; Wulff et al., 2015). In particular, with repeated decisions, decision makers act more according to Expected Utility Theory (Wedell, 2011), and they show a more pronounced preference for options with higher expected values (e.g., Montgomery & Adelbratt, 1982). Both effects work against our hypothesis. Additionally, individuals’ probability judgments are superior in repeated decisions (Fox & Hadar, 2006). Against this background, it is not straightforward to transfer the findings from the one-shot tasks to repeated decision making. Therefore, we aim to explore the generalizability of our baseline findings using repeated decisions.

In Experiment 2 (n = 47), we applied a choice task with repeated decisions. We informed the participants about the outcomes and associated probabilities before they made their choices (decisions under risk), hence making the two options easily comparable. The decision screen displayed the two options for each choice. We used a similar lottery setting as in Experiment 1 but adapted it to the repeated choice task. We displayed the outcomes in monetary terms, and they amounted to –1.30, +0.05, +0.10, and +1.30 EUR for LOW and –0.80, –0.05, –0.10, and +1.60 EUR for HIGH.

The experiment consisted of 50 periods with repeated decisions (a typical number in DfE tasks), allowing the participants to have a substantial amount of feedback (this feedback is more important in later tasks where we did not communicate the outcome distribution). As in all experiments with repeated decisions, we informed the participants about the independence of periods and the fact that the options would remain constant over all periods (see Appendix A for a screenshot and Appendix B for instructions). After each choice, the software informed the participants about the actual random outcome of the option they took (the “minimal info paradigm” in the DfE literature).

Result

The results of the choice task are in line with our findings for the one-shot choices. The ratio of choices for LOW is significantly higher over all periods, starting with the first ones. The first 10-period average is as follows: \({ratio}_{LOW}^{first\_10}=74.3\%\) (binomial test p < 0.01). This also holds for the last 10 periods, hence after some feedback has been received: \({ratio}_{LOW}^{last\_10}=72.9\%\) (p < 0.01). Therefore, we qualitatively observe the same results as in Experiment 1 and provide evidence that one-shot our results regarding a loss probability focus also hold in a repeated choice setting with known outcome distributions.

3.3 Experiment 3: Repeated choice task with unknown return distributions

In Experiment 3 (n = 54), we replicated Experiment 2, but we did not inform the participants about the outcomes and probabilities of the two prospects beforehand. As a result, they had to learn the outcome distribution through experience. This made the two options of LOW and HIGH more difficult to compare. For decisions by experience, choice behavior can differ substantially from the behavior observed for single choices when outcomes are described. Decision makers might pay more attention to the actual outcomes. The natural question arises if the above observed results hold in this setting. Some evidence exists that in DfE tasks, decision makers focus on recalled frequencies (Hertwig & Erev, 2006; Erev et al., 2017). To test this, we used the same outcome distribution as in Experiment 2. Again, in each of 50 periods, the subjects had to choose one of the two options, and after they made their choice, they were shown the outcome of their chosen option (“minimum info paradigm”).

Result

We observe similar findings as in the previous experiments. Because the participants could not know the distribution, there is an almost equal split between LOW and HIGH at the beginning appeared: \({ratio}_{LOW}^{first\_10}=53.0\%\). After gaining experience, however, most participants showed a choice preference for LOW: \({ratio}_{LOW}^{last\_10}=61.8\%\) (p = 0.057).

Overall, people focus on loss probability, and this not only holds under one-shot tasks, but also for repeated choice tasks under risk and in situations of repeated choices with (gradually removed) uncertainty about the outcome distribution.

4 Allocation tasks

In choice tasks, each participant is forced to make a decision for one option or the other. Although this provides a clear signal of preference, it does not allow an individual to state the strength of a preference. As a result, our measured effect sizes might have been inflated in the choice tasks, or they do not show a detailed result. Furthermore, not much is known about the transferability of choice task behavior to allocation tasks in general. To check the generalizability and boundaries of our findings, we performed Experiment 4 (n = 63), in which the participants had to allocate their wealth between the two risky assets of HIGH and LOW repeatedly.Footnote 7 We again relied on repeated decisions, and as in Experiment 3, the decision makers had to learn the outcome distributions from experience. All other elements, including the incentives, were the same as before. We informed the participants about both options’ actual outcomes after each period.

Result

As was expected from the setup under uncertainty in Experiment 3, the average allocations are very close to 50% in period 1: \({inv}_{LOW}^{first\_1}\) = 49.6%. In later periods, consistent with our hypothesis, the participants’ allocation to the LOW asset was found to increase over time to \({inv}_{LOW}^{last\_10}\) = 55.4%; this is statistically different from the initial allocation at the 10% level at least (paired Wilcoxon test p = 0.078). Here, 57% of the subjects increased their allocation in LOW at the end (Periods 21–25) compared with Period 1, and only 33% decreased it (see Fig. 2). The results become stronger for later periods: \({inv}_{LOW}^{last\_5}\) = 56.9%, p = 0.028. Hence, also in a direct comparison between the two assets in an allocation task, decision makers show a preference LOW over HIGH by allocating more money to LOW.

5 Investment tasks

5.1 Experiment 5: Investment task with a known outcome distribution

A further frequently used decision task besides choice tasks is an investment task such as in, for example, Gneezy and Potters (1997). A major difference regarding this task is that the subjects do not have a direct comparison between two lotteries, as in choice or allocation tasks, but only see one (either LOW or HIGH in our case) and decide about an investment amount. This investment amount can be interpreted as a measure of attractiveness or preference. In Experiment 5, we randomly assigned n = 74 to one of two treatments–either HIGH or LOW–determining the lottery that the participants were presented with and could invest in. We did not inform the subjects about the other lottery. In each period, the participants had to decide how much of their current wealth (between 0 and 100%) to invest in the lottery (see Appendix A for a screenshot of the software and Appendix B for instructions). The return distributions of both lotteries were found to be stationary over all periods, which we very clearly communicated to all the subjects. To avoid any anchoring effect, we never offered a default allocation, which reduces concerns about decision inertia. Noninvested capital was transferred to the next investment period without interest. Feedback about the lottery’s outcome was provided after each period, even if the participant did not invest. Outcomes were similar to the repeated choice task in Experiment 2 (see the first row of Table 5).Footnote 8 With these values, LOW and HIGH share the same relative characteristics as the lotteries in the previous experiments. Aggregated over all 25 periods, HIGH clearly first-order stochastically dominates LOW (see Appendix C). Measuring single periods only (based on the evidence of individuals’ myopia), Fig. 3 depicts the CPT sensitivity analysis for the lotteries LOW and HIGH in Experiment 5. The attractiveness gap is relatively large, even for a single period.

Result

The average investment amounts are substantially higher in the treatment LOW compared with HIGH: \({inv}_{HIGH}^{last\_10}\) = 38.5% vs. \({inv}_{LOW}^{last\_10}\) = 67.8% (one-sided Mann–Whitney-U test p < 0.001). Figure 8 in Appendix D presents the investment behavior over time. To have a robustness check that our results are not driven by complexity in how the task was presented, we replicated Experiment 5. In this replication (Experiment 5b, \(n\) = 64), we gave the participants some visual decision and verbal support for their decisions. Specifically, we presented the outcome distributions graphically, and we also explicitly stated the expected return and standard deviation on a one-period basis to all subjects. This support made salient that the two middle outcomes were not as important as the extreme ones. With these additional measures, we aimed at preventing the participants from overlooking important information. Despite these changes, we observe qualitatively the same results in our replication experiment: \({inv}_{HIGH}^{last\_10}\) = 40.9% and \({inv}_{LOW}^{last\_10}\) 61.2% (p < 0.01).

To gain further insights into our results, we asked the participants in Experiment 5 to fill out a questionnaire one week after they had participated in the experiment. In particular, we asked the participants about the expected wealth they would have if they had invested for 100% over all 25 periods. The median answers are 24.5 CHF for LOW and 23.0 for HIGH. The correct answers are 22.0 for LOW and 29.9 for HIGH. This misestimation provides one explanation of why the investments in LOW are higher than in HIGH, even though over 25 periods, at least, HIGH first-order stochastically dominates LOW. Although we did not expect the participants to calculate these values (they would rather use heuristics), this result demonstrates a high degree of myopia (similar to the findings of Redelmeier & Tversky, 1992), in combination with an aversion to the overall probability of losing.Footnote 9

5.2 Experiment 6: Investment task with an unknown outcome distribution

To test whether our findings also hold for an investment task with gradually reduced uncertainty rather than risk, we repeated Experiment 5 in a setting where the subjects had to infer the outcome distribution by experience.Footnote 10 All other details of the experiment were the same as in Experiment 5, including the number of periods, incentives, and general instructions, except the necessary changes for the unknown outcome distribution (see Appendix B for instructions).

Result

In the first periods, the average investments are–as expected because of the nondisclosure of the outcome distribution–very similar between LOW and HIGH: \({inv}_{HIGH}^{first\_10}\) = 26.0% and \({inv}_{LOW}^{first\_10}\) = 26.1% Over time, the difference in investment propensity increases. Figure 9 in Appendix D illustrates the results per period. In the last 10 periods, this difference amounts to 17.5 pp: \({inv}_{HIGH}^{last\_10}\) = 26.8% and \({inv}_{LOW}^{last\_10}\) = 44.3% (one-sided Mann–Whitney-U test p < 0.01). Hence, the participants invested significantly more in LOW compared with HIGH if making repeated investment decisions without prior information about the outcome distribution. Figure 9 in Appendix D displays the development of investment levels over time.

Transferring our investment task setting to a choice task, Shefrin (2015) uses the same lotteries as in Experiment 6, here with a sample of 25 MBA students. In this small (nonincentivized) survey, he reports an 80% choice ratio for LOW for a one-period decision (one-shot). The choice ratio for LOW is still 56% when the participants were asked to make a decision for a series of 25 periods ahead.

6 Discussion

Overall, our findings provide evidence that decision makers pay explicit attention to gain and loss probabilities in different settings. Although such behavior was found in some DfE tasks and one-shot choices between rather complex binary lotteries, we present evidence for such behavior for low complexity choice, allocation, and investment tasks and in both situations of risk and initial uncertainty. Our results generally hold if we control for socio-demographic variables such as gender and individually measured risk and loss aversion, which we gathered from the participants at the beginning of each experiment. We find females invest less, and individuals with a stronger value function curvature and higher loss aversion coefficients invest less, too. These variables, however, do not systematically influence the preference for LOW over HIGH.

As an explanation for our observed behavior, we propose explicitly incorporating weights for the prospect’s gain and loss probabilities. This is not part of CPT. However, CPT is quite flexible, and a number of studies have suggested alternative solutions regarding some observed behavior. What could be some possible alternative explanations for our findings within CPT?

6.1 (Elevated) probability weighting function

A number of studies suggest that sensitivity to losses can be accounted for by an elevated probability weighting function for losses (e.g., Birnbaum, 2008; Zank, 2010). In particular, Pachur and Kellen (2013) compare the different CPT specifications for a set of lotteries. The best-performing specification was the one in which the loss aversion \(l\) was set to one and the probability weighting function was elevated for losses (δ parameters as in Eq. (4), here defined separately for gains and losses), which can account for a gain–loss asymmetry apart from the loss aversion coefficient \(l\):

Generally, for the elevated probability weighting function to explain an aversion to loss probabilities, losses (independent of the loss size) must be of increased weight. In all our experiments, the loss probabilities of the two investments were 25% and 75%. To make a difference between LOW and HIGH, the middle (small) outcomes must have a higher decision weight because they need to create the value difference between LOW and HIGH. In our settings, the two extreme outcomes are always better in HIGH than in LOW (to compensate for the middle outcomes). Crucially, however, an elevation of the weighting function for losses will mainly increase the weight of the largest loss and potentially decrease the weights of the middle outcomes (see also Fehr-Duda & Epper, 2012). This will make HIGH even more attractive, not LOW. Figure 8 demonstrates this general effect of more and less extreme weighting function elevations (\(0\le \delta \le 2\)), as shown in Eq. (4). It becomes apparent that for elevated weighting functions, that is, \(\delta\)>1, the necessary weights for the middle outcomes decrease relatively (dotted and dashed lines in Fig. 4). The key insight is that any weighting function will only redistribute the weight mass between outcomes. When one weight is increased, others will decrease. To be consistent with our findings, we would need the weighting function to have an effect mainly on larger probabilities (75% in our case), not lower ones (25%). However, the elevation has the highest effect on more extreme outcomes, not the crucial middle outcomes. Hence, it seems impossible to formally describe the observed behavior with an elevated weighting function.

Even lower \(\delta\) values (lowered weighting function) will not make LOW more attractive than HIGH because the weights for the middle outcomes do not increase sufficiently (see Table 6). Hardly any combination of \({\delta }^{+}\) and \({\delta }^{-}\) can make LOW more attractive than HIGH for \(\lambda =1\) or \(\lambda =2.25\) and \(\gamma =1\) or \(\gamma =0.65\). Even for \(\gamma =1\), the elevation parameter must be as low as 0.4 to make HIGH and LOW equally attractive (which would not be sufficient in explaining our findings). Although the DfE literature provides evidence for weighting functions that underweight rare events, even if controlling for a sampling error, our findings are robust, even when decisions are made under risk–and independent of the task being an investment, allocation, or choice one. We are not aware of any results, especially in choice tasks under risk, suggesting such an extreme weighting function. In conclusion, it is hardly possible that the elevation of the probability weighting function explains our findings.

6.2 Salience theory

A second alternative explanation for our findings might be “salience theory of choice under risk” (Bordalo et al., 2012). According to this theory, outcomes are overweighted depending on their degree of salience, that is, their relative size to other outcomes. In our experiments, the most salient outcomes are the two large ones of LOW and HIGH. They are implicitly compared with the zero outcome of not investing in our investment tasks. Because the two large outcomes are more attractive in HIGH compared with LOW, salience theory also predicts HIGH to be more attractive. Thus, it cannot explain our results either.

6.3 Risk aversion (curvature of the value function)

The potentially most promising (alternative) explanation for our results is provided by Erev et al. (2008), who argue that many experimental results supposedly driven by loss aversion might be explained by diminishing value sensitivity. Given CPT, the curvature parameter α must be as low as 0.60 or 0.65 to make both of the lotteries equally attractive in our experimental settings. Because we observe a clear preference for LOW, α would have to be substantially lower than these values to explain our results. Also, in Experiment 1, we explicitly tested for a curvature of \(\alpha =0.6\). Tasks 2 and 3 indicated together with Task 1, that curvature alone seems not able to explain our results. Besides that, the majority of studies on CPT preference parameters report higher average parameters for α (Fox & Poldrack, 2013), and there are only a few reporting a stronger curvature. All of this speaks against strong curvature being an explanation for our observed behavior.

At the same time, an extreme curvature in the value function moves in the direction of the model proposed by Diecidue and Van De Ven (2008), which we suggest above. In the most extreme case of curvature, for example, if \(\alpha\) moves toward 0 in a power function, as in Eq. (2), the value function becomes two-piece linear horizontal. This becomes consistent with an (exclusive) loss probability aversion. Importantly, it is difficult to clearly separate these cases; the way to separate them is to use very small outcomes, which is exactly what we do in the present paper. One direction of future research can be to compare the curvature parameters elicited with different lottery complexities, for example, testing more explicitly elicitation methods with multiple outcome lotteries rather than only two-outcome prospects and relating complexity to the elicited preference parameters.

7 Conclusion

Some of the literature on judgment and decision making suggests that people are very sensitive to success and failure (e.g., Diecidue & Van De Ven, 2008). Importantly, an explicit consideration of success or failure probabilities is not easily compatible with Expected Utility Theory or (Cumulative) Prospect Theory (CPT) preferences. Such behavior is, however, consistent with the suggested decision model by Diecidue and Van De Ven (2008). In this model, which can be interpreted as an extension of CPT, extra weights are put on the gain and loss probabilities. This can be modeled by a jump–rather than a kink–of the value function at the reference point. The way to test our hypothesis is using small outcomes that have a strong effect on the loss probability but only a limited effect on the prospects’ utility as measured, for example, by CPT, which is what we have done in the current paper. We present a comprehensive series of experimental studies in different settings. These include classically used choice tasks but also allocation and investment ones, with and without prior information of outcome distributions, and also in a repeated decision setting.

Overall, our results provide evidence that people explicitly take gain and loss probabilities into account when making decisions. We find behavior to be influenced by the probabilities of gaining and losing in all the tasks we tested. Also, our results do not only hold in the tasks that resemble decisions from experience where decision makers must learn about the outcome distributions and where research has shown such a behavior (see, among others, Erev & Barron, 2005), but also in tasks where the outcome distributions are clearly communicated beforehand. We can rule out a series of alternative explanations. Our results cannot be explained by the proposed “salience theory of choice under risk” (Bordalo et al., 2012). They can also not be explained by a preference for positive skewness, loss aversion in the form of a kink in the value function, or an elevated probability weighting function, as suggested by Pachur and Kellen (2013). One explanation might be the extreme curvature of the value function in a CPT framework (extremely high risk aversion). However, the more extreme this curvature is, the closer we are to a model of a jump at the reference point.

The assumption that people pay explicit attention to loss likelihoods is not only conceivable, but it also has important implications. Overall, our findings demonstrate that the preference to avoid negative outcomes seems to be more pronounced and more widely applicable than the previous literature has suggested. It also implies that a high frequency of losses, even if these losses are only small and relatively inconsequential, might considerably lower peoples’ willingness to take risks. Decision makers seem to be willing to favorably forgo better options to minimize the likelihoods of failures. Regarding CPT, our findings suggest taking these insights into account when very small outcomes are involved and assuming that decision makers pay explicit attention to loss probabilities. One natural direction for future research is to test the boundaries and limitations of this effect with respect to the lotteries’ complexity (e.g., via the number of outcomes and whether odd numbers are used) and to explore the influence on the elicitation of preference parameters for frequently used decision theories.

Notes

Gain and loss probabilities add up to one if there is no zero outcome. For the sake of simplicity, we will focus on lotteries with a no-zero outcome, and we will limit our arguments on loss probabilities.

The typical task in these studies was to choose between two prospects with, e.g., five different outcomes and probabilities. It should be noted that in such tasks, there are 20 different numbers to consider for a single decision. The more complex the decision problem, however, the more likely it is that decision makers will apply heuristics, of which a focus on loss probabilities is an obvious one (see also Erev et al., 2010).

We conducted Experiments 1 to 3 online with students from Radboud University and Experiments 4 to 6 in a lab setting with students at the University of Zurich and ETH Zurich. We have cross-checked that the setting would not interact with our variables of interest by running one experiment in both settings.

Paying a fraction of the participants with relatively larger amounts is not uncommon, especially in experiments with professionals and online experiments. There is no evidence of an influence of the exact payment scheme. In Experiments 1 to 3 (choice tasks), each participant was endowed with 50 EUR (60 USD) for the choice task from which we added/subtracted experimental gains and losses. We paid 1 in 20 participants in real money. In all allocation and investment tasks (Experiments 4 to 6), each participant was endowed with 20 CHF (22 USD) as an initial endowment from which gains and losses were added or subtracted, and every fifth participant was paid.

In this and all following experiments, we used 25 instead of 50 periods. The differences in choice behavior between round 25 and round 50 in Experiments 2 and 3 were rather minor, so 25 periods seemed to be sufficient. Also, allocation and investment tasks come with more information on decisions than binary choice tasks.

As is often used in investment tasks, we relied on the outcomes calculated and displayed in percentages rather than monetary units such as USD or EUR. In a further robustness check with n = 42 participants from Radboud University, we analyzed if the outcome presentation format makes a difference. We find, however, that our general results hold, independently of whether we use percentage or monetary outcomes.

Zeisberger et al. (2012a) analyze whether the results of experiments on myopic loss aversion can be explained by prospect theory–as assumed in these papers–or more by “myopic loss probability aversion”, i.e., an aversion to loss probabilities under myopia. Interestingly, the authors find more evidence for prospect theory. The transferability to our experimental setting is, however, very difficult because their study mixes our research question by analyzing different levels of feedback frequency and investment flexibility.

The only other difference is that the four equally likely outcomes of LOW are –12.0%, +0.5%, +1.0%, and +14.0% and –9.0%, –0.5%, –1.0%, and +15.0% for HIGH. The outcome distribution slightly deviates from the one in Experiment 5 because we conducted Experiment 6 before Experiment 5, only afterwards adapting Experiment 6 to the outcomes that give an even larger attractiveness gap. However, in a robustness check, we also replicated Experiment 6 with known outcome distributions. The results are qualitatively similar. These outcome distributions generally share the properties of the other outcome distributions regarding the expected return, variance, and skewness differences between LOW and HIGH.

References

Abdellaoui, M., L’Haridon, O., & Paraschiv, C. (2011). Experienced vs. Described Uncertainty: Do We Need Two Prospect Theory Specifications? Management Science, 57(10), 1879–1895.

Bayrak, O., & Hey, J. (2020). Decisions under risk: Dispersion and skewness. Journal of Risk and Uncertainty, 61, 1–24.

Birnbaum, M. (2008). New paradoxes of risky decision making. Psychological Review, 115(2), 463–501.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2012). Salience Theory of Choice under Risk. Quarterly Journal of Economics, 127(3), 1243–1285.

Bougherara, D., Friesen, L., & Nauges, C. (2021). Risk Taking with Left- and Right-Skewed Lotteries. Journal of Risk and Uncertainty, 62, 89–112.

Camerer, C., Babcock, L., Loewenstein, G., & Thaler, R. (1997). Labor Supply of New York City Cabdrivers: One Day at a Time. The Quarterly Journal of Economics, 112(2), 407–441.

Camilleri, A., & Newell, B. (2010). Description- and experience-based choice: Does equivalent information equal equivalent choice? Acta Physica, 136(3), 276–284.

Diecidue, E., Levy, M., & van de Ven, J. (2015). No aspiration to win? An experimental test of the aspiration level model. Journal of Risk and Uncertainty, 51(3), 245–266.

Diecidue, E., & Van De Ven, J. (2008). Aspiration level, probability of success and failure, and expected utility. International Economic Review, 49(2), 683–700.

Ebert, S., & Wiesen, D. (2011). Testing for Prudence and Skewness Seeking. Management Science, 57(7), 1334–1349.

Erev, I., & Barron, G. (2005). On adaptation, maximization, and reinforcement learning among cognitive strategies. Psychological Science, 112(4), 912–931.

Erev, I., Ert, E., Plonsky, O., Cohen, D., & Cohen, O. (2017). From Anomalies to Forecasts: Toward a Descriptive Model of Decisions Under Risk, Under Ambiguity, and From Experience. Psychological Review, 124(4), 369–409.

Erev, I., Ert, E., Roth, A., Haruvy, E., Herzog, S., Hau, R., Hertwig, R., Lebiere, C., Stewart, T., & West, R. (2010). A Choice Prediction Competition: Choices from Experience and from Description. Journal of Behavioral Decision Making, 23(1), 15–47.

Erev, I., Ert, E., & Yechiam, E. (2008). Loss Aversion, Diminishing Sensitivity, and the Effect of Experience on Repeated Decisions. Journal of Behavioral Decision Making, 21(5), 575–597.

Fehr-Duda, H., & Epper, T. (2012). Probability and risk: Foundations and economic implications of probability-dependent risk preferences. Annual Review of Economics, 4(1), 567–593.

Fox, C., & Hadar, L. (2006). “Decisions from experience” = sampling error + prospect theory: Reconsidering Hertwig, Barron, Weber & Erev (2004). Judgment and Decision Making, 1(2), 159–161.

Fox, C., & Poldrack, R. (2013). Prospect theory and the brain. In P. Glimcher & E. Fehr (Eds.), Handbook of Neuroeconomics (2nd ed.). New York: Elsevier.

Gneezy, U., & Potters, J. (1997). An Experiment on Risk Taking and Evaluation Periods. Quarterly Journal of Economics, 112(2), 631–645.

Golec, J., & Maurry, T. (1998). Bettors Love Skewness, Not Risk, at the Horse Track. Journal of Political Economy, 106(1), 205–225.

Hertwig, R., Barron, G., Weber, E. U., & Erev, I. (2004). Decisions from Experience and the Effect of Rare Events in Risky Choice. Psychological Science, 15(8), 534–539.

Hertwig, R., & Erev, I. (2006). The description–experience gap in risky choice. Trends in Cognitive Sciences, 13(12), 517–523.

Hey, J., & Lee, J. (2005). Do subjects separate (or are they sophisticated)? Experimental Economics, 8, 233–265.

Hoffmann, A., Henry, S., & Kalogeras, N. (2013). Aspirations as reference points: An experimental investigation of risk behavior over time. Theory and Decision, 75(2), 193–210.

Holzmeister, F., Huber, J., Kirchler, M., Lindner, F., Weitzel, U., & Zeisberger, S. (2020). What Drives Risk Perception? A Global Survey with Financial Professionals and Lay People. Management Science, 66(9), 3799–4358.

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–291.

Kaufmann, C., Weber, M., & Haisley, E. (2013). The Role of Experience Sampling and Graphical Displays on One’s Investment Risk Appetite. Management Science, 59(2), 323–340.

Klos, A., Weber, E., & Weber, M. (2005). Investment Decisions and Time Horizon: Risk Perception and Risk Behavior in Repeated Gambles. Management Science, 51(12), 1777–1790.

Kraus, A., & Litzenberger, R. (1976). Skewness Preference and the Valuation of Risk Assets. The Journal of Finance, 31(4), 1085–1100.

Levy, H., & Levy, M. (2009). The safety first expected utility model: Experimental evidence and economic implications. Journal of Banking & Finance, 33(8), 1494–1506.

Lopes, L. L. (1987). Between Hope and Fear: The Psychology of Risk. Advances in Experimental Social Psychology, 20, 255–295.

Lopes, L. L. (1996). When Time is of the Essence: Averaging, Aspiration, and the Short Run. Organizational Behavior and Human Decision Processes, 65(3), 179–189.

Lopes, L. L., & Oden, G. C. (1999). The Role of Aspiration Level in Risky Choice: A Comparison of Cumulative Prospect Theory and SP/A Theory. Journal of Mathematical Psychology, 43(2), 286–313.

Montgomery, H., & Adelbratt, T. (1982). Gambling decisions and information about expected value. Organizational Behavior and Human Performance, 29(1), 39–57.

Pachur, T., & Kellen, D. (2013). Modeling gain-loss asymmetries in risky choice: The critical role of probability weighting. In M. Knauff, M. Pauen, N. Sebanz, & I. Wachsmuth (Eds.), Cooperative minds: Social interaction and group dynamics. Proceedings of the 35th Annual Conference of the Cognitive Science Society (pp. 3205–3210). Austin, TX: Cognitive Science Society.

Payne, J. (2005). It is Whether You Win or Lose: The Importance of the Overall Probabilities of Winning or Losing in Risky Choice. Journal of Risk and Uncertainty, 30(1), 5–19.

Payne, J., Laughhunn, D., & Crum, R. (1980). Translation of Gambles and Aspiration Level Effects in Risky Choice Behavior. Management Science, 26(10), 1039–1060.

Payne, J., Laughhunn, D., & Crum, R. (1981). Further Tests of Aspiration Level Effects in Risky Choice Behavior. Management Science, 27(8), 953–958.

Qiu, J., & Weitzel, U. (2012). Reference dependence and loss aversion in probabilities: theory and experiment of ambiguity attitudes. SSRN. Working Paper. Retrieved September 20, 2022, from http://ssrn.com/abstract=1972293

Redelmeier, D. A., & Tversky, A. (1992). On the Framing of Multiple Prospects. Psychological Science, 3(3), 191–193.

Rieger, M.-O. (2010). SP/A and CPT: A reconciliation of two behavioral decision theories. Economics Letters, 108(3), 327–329.

Roy, A. (1952). Safety First and the Holding of Assets. Econometrica, 20(3), 431–449.

Shefrin, H. (2015). Behavioral risk management: Managing the psychology that drives decisions and influences operational risk. Palgrave Macmillan.

Shefrin, H., & Statman, M. (2000). Behavioral Portfolio Theory. Journal of Financial and Quantitative Analysis, 35(2), 127–151.

Sokolowska, J. (2006). Risk Perception and Acceptance-One Process or Two? The Impact of Aspirations on Perceived Risk and Preferences. Experimental Psychology, 53(4), 247–259.

Trautmann, S., & van de Kuilen, G. (2018). Higher order risk attitudes: A review of experimental evidence. European Economic Review, 103, 108–124.

Tversky, A., & Kahneman, D. (1992). Advances in Prospect Theory: Cumulative Representation of Uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Venkatraman, V., Payne, J., Bettman, J., Luce, M., & Huettel, S. (2009). Separate Neural Mechanisms Underlie Choices and Strategic Preferences in Risky Decision Making. Neuron, 62(4), 593–602.

Venkatraman, V., Payne, J., & Huettel, S. (2014). An overall probability of winning heuristic for complex risky decisions: Choice and eye fixation evidence. Organizational Behavior and Human Decision Processes, 125(2), 73–87.

Wedell, D. (2011). Evaluations of single- and repeated-play gambles. Wiley Encyclopedia of Operations research and Management Science. John Wiley & Sons.

Wulff, D., Hills, T., & Hertwig, R. (2015). How short- and long-run aspirations impact search and choice in decisions from experience. Cognition, 144, 29–37.

Wulff, D., Mergenthaler-Canseco, M., & Hertwig, R. (2018). A meta-analytic review of two modes of learning and the description-experience gap. Psychological Bulletin, 144(2), 140–176.

Zank, H. (2010). On probabilities and loss aversion. Theory and Decision, 68(3), 243–261.

Zeisberger, S. (2022). What is risk? How investors perceive risk in return distributions. SSRN. Working Paper. Retrieved September 20, 2022, from https://ssrn.com/abstract=2811636

Zeisberger, S., Langer, T., & Weber, M. (2012a). Why does myopia decrease the willingness to invest? Is it myopic loss aversion or myopic loss probability aversion? Theory and Decision, 72(1), 35–50.

Zeisberger, S., Vrecko, D., & Langer, T. (2012b). Measuring the time stability of Prospect Theory preferences. Theory and Decision, 72(3), 359–386.

Acknowledgements

We are indebted to Michael Birnbaum, Peter Bossaerts, Colin Camerer, Enrico Diecidue, Maik Dierkes, Sebastian Ebert, Ido Erev, Helga Fehr-Duda, Thorsten Hens, Yuri Khoroshilov, Alexander Klos, Christine Laudenbach, Thomas Langer, John Payne, Jianying Qiu, Hersh Shefrin, Alec Smith, Peter Sokol-Hessner, Carmen Tanner, and Stefan Trautmann, as well as participants of the Experimental Finance class at the University of Zurich, for their valuable comments and suggestions. We are also grateful to the participants of the following conferences and seminars: Experimental Finance, Society for Judgment and Decision Making, SPUDM Subjective Probability, Utility, and Decision Making Conference, Annual Meeting of the Academy of Behavioral Finance and Economics; California Institute of Technology, University College London, University of Zurich, University of Nijmegen, and University of Münster. Further thanks go to Ferdinand Langnickel, Lukas Meier and Dominik Schöni for their valuable assistance with running the experiments and preliminary data analysis. We take responsibility for any remaining errors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Experiment screenshots and feedback text

1.1 Choice and allocation tasks (one-shot and repeated)

This is a sample screen of the choice task experiments for known outcome distributions (Fig. 5). For unknown distributions lotteries were not displayed. Options were displayed in random order between participants. In one-shot choice tasks the first line was “Your wealth: 50.00 EUR” and “Round [X]” was not displayed. The allocation was presented analogously without presenting the outcome distribution, but with a slider below to set the allocation.

1.1.1 Feedback text after each choice (in repeated choice task)

In round X you chose Option [A/B]. Option [A/B]’s outcome was X.XX EUR.

You made a gain [loss] of X.XX EUR.

1.2 Investment tasks

This figure shows a sample screen of the investment task experiments (translated from German) (Fig. 6).

1.2.1 Feedback text after each investment decision (analogously for allocation task)

In round X you invested [X%] (= X.XX of X.XX CHF) in the risky alternative.

The risky alternative yielded a return of X.X%.

You made a gain [loss] of X.XX CHF. / You made neither a gain nor a loss.

Appendix B: Experimental instructions

2.1 Choice tasks (repeated task version, one-shot task version was analogous and shorter)

In the following, we ask you to choose between two risky investment opportunities. You will play 50 rounds in total. In each round you will have to decide which of the two options you choose.

2.1.1 Known outcomes (only for repeated tasks)

You are informed about the outcomes and their probabilities of both options for each decision. The probabilities and the respective possible outcomes remain the same for both options over all rounds.

2.1.2 Unknown outcomes (only for repeated tasks)

You do not know the possible outcomes and their probabilities of the two options beforehand, but you have to experience them over rounds. In each round you will see the outcome of the option you chose. Importantly, the probabilities and the respective possible outcomes do not change for both options over rounds. Hence, for both options A and B the possible outcomes and their probabilities (which you do not know at the beginning but can experience over time) remain the same for all 50 rounds.

2.1.3 All experiments (cont’d)

To offer you an incentive to think seriously about your decisions, we provide you with an initial capital of 50 EUR. Depending on your decisions and your success, these 50 EUR can become more or less. In each round, you will earn the random outcome of the option you picked.

Your payment: We will select exactly one in 20 participants randomly–in particular independently of your investment decisions–and pay him/her exactly the amount he/she possesses at the end of the experiment. Therefore, you should think hard about your decisions.

The actual outcomes of the two options are randomly and individually chosen by the computer. The draws of the different rounds are independent from each other, i.e., the outcomes of previous rounds have no influence on the outcome-probabilities in later rounds (as the outcomes and their probabilities stay the same over rounds).

2.2 Investment tasks

2.2.1 The following instructions are for treatment LOW [HIGH in brackets]

In the following, we ask you to make investment decisions repeatedly. To offer you an incentive to think seriously about your decisions, we provide you with an initial capital of 20 CHF. Depending on your investment decisions and your success, these 20 CHF can become more or less.

Your payment: We will select every fifth participant randomly–in particular independently of your investment decisions–and pay him/her exactly the amount he/she possesses at the end of the experiment. Therefore, you should think hard about your decisions.

You will play 25 rounds in total. In each round you will have to decide how much of your current capital you will invest in a risky investment opportunity.

2.2.2 Experiment 5 (and 5b) only

The risk profile of this investment opportunity is identical for all 25 rounds:

The investment opportunity yields one random return out of four possible returns. The four returns are all equally likely to occur.

In 1 of 4 cases (25% probability) the investment yields a return of +13.0% [+16.0%].

In 1 of 4 cases (25% probability) the investment yields a return of +1.0% [–0.5%].

In 1 of 4 cases (25% probability) the investment yields a return of +0.5% [–1.0%].

In 1 of 4 cases (25% probability) the investment yields a return of –13.0% [–8.0%].

2.2.3 Experiment 5b only

The expected return of the risky investment opportunity is +0.375% [+1.625%] per round (the standard deviation is 9.2% [8.8%]). Hence, if you invest 10.00 CHF in the risky investment opportunity you can expect to make a gain of 0.0375 CHF [0.1625 CHF] per round on average. This gain is, however, not certain.

2.2.4 Experiment 6 only

The risk profile of this investment opportunity is identical for all 25 rounds, i.e., the possible returns and their probabilities do not change over the 25 rounds. We do not inform you about the returns and their probabilities, i.e., you will have to infer them over the course of the experiment.

2.2.5 All experiments (cont’d)

You keep your capital that you do not invest; it does not bear interest. The gains and losses are added/subtracted from your current capital and your capital is transferred to the next round. Consequently, your capital is only changed by the gains and losses of the risky investment alternative. If you do not invest anything over all 25 rounds you will keep your 20 CHF.

2.2.6 Experiments 5 (and 5b) only

The actual returns of the risky investment opportunity are randomly and individually chosen by the computer using the probabilities that you were informed about. We want to emphasize that there are no manipulations! You can rely on the fact that the returns on your investment are drawn according to these probabilities. The draws of the different rounds are independent from each other, i.e., the returns of previous rounds have no influence on the return-probabilities in later rounds.

2.2.7 Experiment 6 only

The actual returns of the risky investment opportunity are randomly and individually chosen by the computer using the probabilities that you do not know about but which are constant. We want to emphasize that there are no manipulations! You can rely on the fact that the returns on your investment are drawn according to the constant probabilities. The draws of the different rounds are independent from each other, i.e., the returns of previous rounds have no influence on the return-probabilities in later rounds.

2.2.8 All experiments (cont’d)

Let us demonstrate the principle with three examples:

1st example: You do not invest anything in the first round in the risky investment opportunity. In this case you keep the 20 CHF, i.e., you neither make a loss nor a gain, no matter how the risky investment opportunity develops. In the next round you will have your (non-invested) 20 CHF at your disposal.

2nd example: You invest 75% of your 20 CHF in the first round, i.e., 15 CHF, in the risky opportunity. Let us assume that the investment yields a return of +14%, so you achieve a gain of 14% × 15 CHF = 2.10 CHF and your 15 CHF become 17.10 CHF. Together with your non-invested capital of 5 CHF you will have 22.10 CHF in the next round at your disposal.

3rd example: You invest 75% of your 20 CHF in the first round, i.e., 15 CHF, in the risky opportunity. Let us assume that the investment yields a return of –11%, so you face a loss of 11% × 15 CHF = 1.65 CHF and your 15 CHF become 13.35 CHF. Together with your non-invested capital of 5 CHF you will have 18.35 CHF in the next round at your disposal.

Please click on “OK” to start the experiment.

2.3 Allocation task

[…] You will play 25 rounds in total. In each round you will have to decide how to allocate your current capital between two risky investment opportunities.

The risk profiles of the two investment opportunities are different from each other, but both stay constant for all 25 rounds, i.e., the possible returns and their probabilities do not change over the 25 rounds for both of the investment opportunities. We do not inform you about the returns and their probabilities, i.e., you will have to infer them over the course of the experiment. Both investment opportunities are independent of each other. […].

Appendix C: Cumulative density function for HIGH and LOW in Experiment 5

Appendix D: Investment Amounts in Investment Tasks

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zeisberger, S. Do people care about loss probabilities?. J Risk Uncertain 65, 185–213 (2022). https://doi.org/10.1007/s11166-022-09391-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-022-09391-y

Keywords

- Loss aversion

- Probability of losing

- Prospect Theory

- Repeated investing

- Aspiration level

- Investment decisions