Abstract

This article examines the impact of market restructuring on retail prices, using the restructuring of the electricity industry as a case study. Utilizing synthetic control as an estimation strategy, this paper finds retail competition reduced retail prices across all sectors by an average of $1.5/MWh, relative to their counterfactual outcome. On average, prices fell for residential and commercial users and rose for industrial users. The price differential is consistent with the enactment of price ceilings and increased pass-through of changes in the price of natural gas.

Source: EIA (2021)

Source: EIA (2021)

Source: EIA (2021) and Author’s calculations

Source: Authors’ calculations

Similar content being viewed by others

Notes

For a further review of the literature, see Bushnell et al (2017).

Rose et al. (2023) employs a synthetic control strategy to answer this question but with different explanatory factors, a different outcome variable and the inclusion of the Northeast. The pre-treatment match and similarity in explanatory factor values pre-restructuring of this paper provide evidence that this paper has generated more accurate estimates of the counterfactual.

For example, a coal-intensive state would create a poor counterfactual for a gas-intensive one.

Vermont is the only regulated Northeast state and its capacity mix and pre-trend price do not match other states.

See Abadie (2021) for a review of the synthetic control method and literature.

Full restructuring here is defined as the introduction of retail competition.

For example, Act 286 in Michigan caps electric choice participation at 10%.

While electricity is traded across state borders, transmission constraints makes plant location relevant.

For a technical understanding of the synthetic control methodology, see Abadie et al. (2010).

For internal consistency, multiple states were excluded due to partial restructuring, remoteness, and unique traits. This selection is covered in more detail later in this section.

Endogeneity concerns, typically the highest hurdle in empirical papers, are reduced by creating a synthetic state that is similar in the most important determinants of electricity prices except market regulation.

Factors such as construction costs (CC), labor differences (w), and plant age do not vary widely enough between states to significantly impact prices, relative to the generation mix.

Demand variance can be estimated at the balancing authority level, but these do not match state boundaries.

Heating degree days are not used due to limited use of electricity for heating in the Northeast and Midwest.

For example, Michigan’s reliance on coal impacts its electricity price, not its oil sector, which is excluded.

Taking the change from 1990 is similar to papers selecting comparison regions with similar pre-treatment slopes.

Generation is chosen instead of capacity as it more closely approximates what states use.

Oregon only opened its commercial and industrial sectors to competition, so its residential sector is excluded.

Section 5.5 explains further why Iowa and Wisconsin are outliers as donor states.

See Appendix D for more details on the Northeast common support problem.

See Appendix B for the state factors and Appendix C for which states were used to construct the counterfactual.

For further details, see Appendix A.

The large utilities Connecticut Light & Power and Baltimore Gas & Electric filed for rate increases of more than 70% once the freezes were lifted (Kwoka 2008).

This is especially true once you eliminate the period from 1998 to 2002, when many restructured states cut and capped their prices.

For example, it is unlikely that generators in fully-restructured states were less cost effective than those in regulated states from 2003 to 2008 and then more cost effective after.

The primary funding mechanism for stranded assets were either bonds or special fixed charges, such as the wire charge in New Jersey (FERC 2006).

References

Abadie, A. (2021). Using synthetic controls: Feasibility, data requirements, and methodological aspects. Journal of Economic Literature, 59(2), 391–425.

Abadie, A., Diamond, A., & Hainmueller, J. (2010). Synthetic control methods for comparative case studies: Estimating the effect of California’s Tobacco Control Program. Journal of the American Statistical Association, 105(490), 493–505.

Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: A case study of the Basque country. American Economic Review, 93(1), 113–132.

Anderson, L., & Erman, M. (2005). Calpine files for bankruptcy. USA Today (December 21).

Apt, J. (2005). Competition has not lowered U.S. industrial electricity prices. Electricity Journal, 18(2), 52–61.

Borenstein, S. (1989). Hubs and high fares: Dominance and market power in the U.S. Airline Industry. RAND Journal of Economics, 20(3), 344–365.

Borenstein, S., & Bushnell, J. (2015). The US electricity industry after 20 years of restructuring. Annual Review of Economics, 7(1), 437–463.

Borenstein, S., Bushnell, J., & Wolak, F. (2002). Measuring market inefficiencies in California’s restructured wholesale electricity market. American Economic Review, 92(2), 1376–1405.

Brown, M. (2001). Restructuring in retrospect National conference of State Legislatures Brown, Stephen and Yucel, Mine. 2008. What drives natural gas prices? The Energy Journal, 29(2), 45–60.

Bushnell, J., Mansur, E., & Novan, K. (2017). Review of the economics literature on US electricity restructuring. Working Paper.

Chan, H. R., Fell, H., Lange, I., & Shanjun, L. (2017). Efficiency and environmental impacts of electricity restructuring on coal-fired power plants. Journal of Environmental Economics and Management, 81, 1–18.

Chu, Y., Halladay, S., & LaRiviere, J. (2017). Opportunity cost pass-through from fossil fuel market prices to procurement costs of the U.S. power producers. Journal of Industrial Economics, 65(4), 842–871.

Cicala, S. (2015). When does regulation distort costs? Lessons from fuel procurement in U.S. electricity generation. American Economic Review, 105(1), 411–444.

Cicala, S. (2022). Imperfect markets versus imperfect regulation in US electricity generation. American Economic Review, 112(2), 409–441.

Craig, J. D., & Savage, S. (2013). Market restructuring, competition and the efficiency of electricity generation: Plant-level evidence from the United States 1996 to 2006. The Energy Journal, 34(1), 1–31.

Davis, L., & Wolfram, C. (2012). Deregulation, consolidation, and efficiency: Evidence from US nuclear power. American Economic Journal: Applied Economics, 4(4), 194–225.

Energy Information Administration (EIA). (2021). www.eia.gov

Fabrizio, K., Rose, N., & Wolfram, C. (2007). Do markets reduce costs? Assessing the impact of regulatory restructuring on US electric generation efficiency. American Economic Review, 97, 1250–1277.

Fagan, M. (2006). Measuring and explaining electricity price changes in restructured states. Electricity Journal, 19(5), 35–42.

FERC. (2005). Report to congress on competition in wholesale and retail markets for electric energy. The Electric Energy Market Competition Task Force.

Hausman, C. (2014). Corporate incentives and nuclear safety. American Economic Journal: Economic Policy, 6(3), 178–206.

Hill, A. (2021). Excessive entry and investment in deregulated markets: Evidence from the electricity sector. Journal of Environmental Economics and Management, 110(C), 66.

Hortacsu, A., Madanizadeh, S., & Puller, S. (2017). Power to choose? An analysis of consumer inertia in the residential electricity market. American Economic Journal: Economic Policy, 9(4), 192–226.

Hortacsu, A., & Puller, S. (2008). Understanding strategic bidding in multi-unit auctions: A case study of the Texas Electricity Spot Market. RAND Journal of Economics, 39(1), 86–114.

Joskow, P. (1997). Restructuring, competition and regulatory reform in the U.S. electricity sector. Journal of Economic Perspectives, 11(3), 119–138.

Joskow, P. (2006). Markets for power in the United States: An interim assessment. The Energy Journal, 27(1), 1–37.

Joskow, P., & Kahn, E. (2002). A quantitative analysis of pricing behavior in California’s wholesale electricity market during summer 2000. The Energy Journal, 23(4), 1–35.

Knittel, C., Metaxolgou, K., & Trindade, A. (2019). Environmental implications of market structure: Shale gas and electricity markets. International Journal of Industrial Organization, 63, 511–550.

Kwoka, J. (2008). Restructuring the U.S. electric power sector: A review of recent studies. Review of Industrial Organization, 32, 165–196.

Mansur, E. (2008). Measuring welfare in restructured markets. The Review of Economics and Statistics, 90(2), 369–386.

National Oceanic and Atmospheric Administration (NOAA). (2019). www.noaa.gov

Rose, K., Tarufelli, B., & Upton, G. (2023). Retail electricity market restructuring and retail rates. USAEE Working Paper.

Sperduto, D. (2019). Florida, Nevada among states with notable power price declines from 2009–2019. S&P Global Market Intelligence.

Su, X. (2015). Have customers benefited from electricity retail competition? Journal of Regulatory Economics, 47(2), 146–182.

Wharton, A. (2006). Continuing turmoil in the power industry: What it means for the major players. Knowledge@Wharton.

Winston C 1998 U.S. industry adjustment to economic deregulation. Journal of Economic Perspectives 12 (3): 89–110

Wolfram, C. (1999). Measuring duopoly power in the British electricity spot market. American Economic Review, 89(4), 805–826.

Woo, C. K., & Zarnikau, J. (2009). Will electricity market reform likely reduce retail rates? The Electricity Journal, 22(2), 40–45.

Zhang, F. (2007). Does electricity restructuring work? Evidence from the U.S. nuclear energy industry. Journal of Industrial Economics, 55(3), 397–418.

Author information

Authors and Affiliations

Contributions

There was one author for this paper who wrote and reviewed the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: State restructuring and price freeze information

When states began the process of restructuring their electricity markets, there was concern that consumers may have difficulty navigating the transition from one regional retailer to many. To ease the transition, the majority of state electricity regulatory commissions froze electricity prices for a varying number of years and, in many cases, reduced them (Kwoka, 2008). These freezes largely applied to the residential sector, although they were extended in some states to the other sectors (see Table

10 for details on each state in this study). This had the potential to create a financial problem for retailers if the cost of production rose during the price freeze period, as retailers would be subject to variable wholesale prices without the ability to pass on those costs to consumers. However, as Kwoka (2008) notes, it was expected that prices would fall, with the price freezes providing some funding for utilities’ stranded assets.Footnote 27

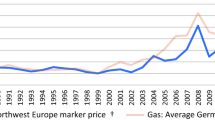

Due to an increase in natural gas prices and a failure of restructuring to reduce the cost of electricity provision, a gap formed between the rising cost of electricity provision and consumer prices that had been cut and frozen. This occurred first in California in 2001, as a surge in the cost of electricity provision left the three large utilities in California (Pacific Gas & Electric, San Diego Gas & Electric and Southern California Edison) either bankrupt or near bankruptcy. By 2006, all price freezes had been removed and a number of major electricity providers and retailers were in dire straits.Footnote 28 To address the imbalance, utilities were allowed by state commissions to book “deferred balances,” which could then be charged to ratepayers after the price freeze ended. The combination of rising natural gas prices, deferred balances, and prices that had been artificially held below market value for years led to a substantial rise in rates across states for several years.

1.1 Donor states

Alabama, Arkansas, Colorado, Florida, Georgia, Idaho, Indiana, Kansas, Kentucky, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Carolina, North Dakota, Oklahoma, South Carolina, South Dakota, Tennessee, Utah, Washington, West Virginia, Wyoming.

1.2 Excluded states

Alaska, Arizona, California, Connecticut, D.C., Hawaii, Iowa, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont, Virginia, Wisconsin.

Appendix B: Factors used in state counterfactual electricity price estimation

The factors in each state’s electricity price differ based on the state. For example, oil use is more important in Delaware than it is in Ohio, where it is zero. Matching on oil use in Ohio creates an additional constraint without adding any explanatory power. Therefore, only the two most important fuel mix factors that impact a particular state’s electricity price change since 1990 and CDD are included and shown in Table

11 below.

Appendix C: Synthetic donor selection

Synthetic control selects which donor states to create the synthetic restructured state with based on two criteria: pre-treatment factor values and pre-treatment trend in electricity prices, differenced from 1990. For example, the synthetic Illinois is constructed from 77% Missouri and 23% Arkansas because, when those are combined together, they mimic Illinois’ pre-treatment price trend and the value of the three factors Illinois is matched on from Table 11 (% gas generation, % baseload generation and CDD). States were excluded as donors due to unique factors in their electricity markets, partial restructuring and their location in the Northeast (described further in Appendix D).

Donor state | DE | IL | MD | MI | NJ | OH | OR | PA | TX |

|---|---|---|---|---|---|---|---|---|---|

Alabama | 0.004 | ||||||||

Arkansas | 0.23 | 0.034 | 0.002 | ||||||

Colorado | 0.056 | 0.014 | |||||||

Florida | 0.496 | 0.323 | 0.003 | ||||||

Georgia | 0.005 | ||||||||

Idaho | 0.002 | ||||||||

Indiana | 0.595 | 0.06 | 0.019 | ||||||

Kansas | 0.018 | ||||||||

Kentucky | 0.17 | 0.012 | |||||||

Louisiana | 0.4 | ||||||||

Minnesota | 0.008 | ||||||||

Mississippi | 0.003 | 0.004 | |||||||

Missouri | 0.77 | 0.03 | 0.255 | ||||||

Montana | 0.394 | 0.002 | |||||||

Nebraska | 0.014 | ||||||||

Nevada | 0.6 | ||||||||

New Mexico | 0.368 | 0.047 | |||||||

North Carolina | 0.006 | ||||||||

North Dakota | 0.03 | 0.152 | |||||||

Oklahoma | 0.183 | 0.939 | 0.004 | ||||||

South Carolina | 0.006 | ||||||||

South Dakota | 0.002 | ||||||||

Tennessee | 0.005 | ||||||||

Utah | 0.194 | ||||||||

Washington | 0.322 | 0.005 | 0.002 | ||||||

West Virginia | 0.107 | 0.45 | 0.009 | ||||||

Wyoming | 0.176 | 0.26 | 0.212 |

Appendix D: The Northeast

A key insight of this paper is that the inclusion of the six Northeastern states that restructured (New York, Connecticut, Rhode Island, Massachusetts, New Hampshire and Maine) in the estimation creates a common support problem. Without synthetic control, it is not clearly visible that these states are a problem. However, once an attempt is made to find synthetic matches for these states, it becomes clear this is an impossible task for two reasons. First, this region experienced an increase in electricity prices in the early 1990s that other regions didn’t. Therefore, as shown in the pre-treatment period in Fig.

13, there is no synthetic match for the pre-treatment trend (Sect. 2 of this paper describes why Vermont is not a feasible candidate).

Second, the region’s generation mix, particularly its reliance on oil, throughout much of this period is unique (see Table 3). Other than Florida, there is no other state in the donor group that uses oil to generate electricity at any significant level during this time period, and Florida does not match these states on any other factors. This results in poor matching of treatment factors (Table 3), which makes it unlikely that the difference in the treated and synthetic outcomes shown in Fig. 13 represents a valid counterfactual result. The combination of these two challenges presented by the Northeast suggests the region should be excluded from the estimation.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hill, A. Price freezes and gas pass-through: an estimation of the price impact of electricity market restructuring. J Regul Econ 63, 87–116 (2023). https://doi.org/10.1007/s11149-023-09459-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-023-09459-w