Abstract

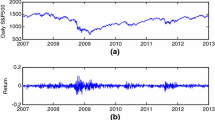

We propose a logistic smooth transition autoregressive fractionally integrated [STARFI (p, d)] process for modeling and forecasting US housing price volatility. We discuss the statistical properties of the model and investigate its forecasting performance by assuming various specifications for the dynamics underlying the variance process in the model. Using a unique database of daily data on price indices from ten major US cities, and the corresponding daily Composite 10 Housing Price Index, and also a housing futures price index, we find that using the Markov-switching multifractal (MSM) and FIGARCH frameworks for modeling the variance process helps improving the gains in forecast accuracy.

Similar content being viewed by others

Notes

For example, consider the following case: if low-valued houses’ values are relatively volatile, then policies that encourage low-income renter households to become homeowners should be evaluated in light of the house price risk that they would bear.

It must be realized that, the features of market efficiency, long-memory, nonlinearity, and non-normality, as observed traditionally for other asset markets, are however not likely due to the usage of high-frequency data of the housing market. In fact, these features have also been reported for low- frequency (monthly, quarterly, and annual) data for the US by studies such as Canarella et al. (2012, 2019), Barros et al. (2015), Balcilar et al. (2015), Gupta and Majumdar (2015).

Liu et al. (2007) find that assuming other base distributions, such as lognormal and gamma, makes little difference in empirical applications.

As mentioned by Granger (1999) the issue associated with the non-differentiability may be just a technicality due to the fact that it should always be possible to find a smooth function which is arbitrarily close to the non-smooth one.

We would like to thank an anonymous referee for pointing this out to us.

References

Ajmi, A. H., Babalos, V., Economou, F., Gupta, R. (2014). Real estate market and uncertainty shocks: a novel variance causality approach. Frontiers in Finance and Economics, 2, 56–85.

André, C., Bonga-Bonga, L., Gupta, R., Mwamba, J. W. M. (2017). Economic policy uncertainty, us real housing returns and their volatility: a nonparametric approach. Journal of Real Estate Research, 39, 493–513.

Andreou, E., Ghysels, E., Kourtellos, A. (2010). Regression models with mixed sampling frequencies. Journal of Econometrics, 158, 246–261.

Apergis, N., & Payne, J. E. (2012). Convergence in U.S. housing prices by state: Evidence from the club convergence and clustering procedure. Letters in Spatial and Resource Sciences, 5, 103–111.

Baillie, R. T., Bollerslev, T., Mikkelsen, H. O. (1996). Fractionally integrated generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 74, 3–30.

Balcilar, M., Gupta, R., Miller, S. M. (2015). The out-of-sample forecasting performance of nonlinear models of regional housing prices in the US. Applied Economics, 47, 2259–2277.

Banbura, M., Giannone, D., Reichlin, L. (2011). Oxford Handbook on Economic Forecasting, chap. nowcasting, (pp. 63–90). Oxford: Oxford University Press.

Barros, C. P., Gil-Alana, L. A., Payne, J. E. (2014). Tests of convergence and long memory behavior in u.s. housing prices by state. Journal of Housing Research, 23, 73–88.

Barros, C. P., GilAlana, L. A., Payne, J. E. (2015). Modeling the long memory behavior in U.S. housing price volatility. Journal of Housing Research, 24, 87–106.

Barros, P. C., Gil-Alana, L. A., Payne, J. E. (2015). Modeling the long memory behavior in U.S. housing price volatility. Journal of Housing Research, 24, 87–106.

Beran, J. (1994). Statistics for Long-memory Processes. New York: Chapman and Hall.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bollerslev, T., Engle, R. F., Nelson, D. (1994). Handbook of econometrics, vol. 4, chap. ARCH models, (pp. 2961–3038). Amsterdam: Elsevier Science BV.

Bollerslev, T., Patton, A., Wang, W. (2016). Daily house price index: Construction modelling and longer-run predictions. Journal of Applied Econometrics, 31, 1005–1025.

Bork, L., & Møller, S.V. (2015). Forecasting house prices in the 50 states using dynamic model averaging and dynamic model selection. International Journal of Forecasting, 31, 63–78.

Bougerol, P., & Picard, N. (1992). Stationarity of GARCH processes and of some nonnegative time series. Journal of Econometrics, 52, 115–127.

Calvet, L., & Fisher, A. (2001). Forecasting multifractal volatility. Journal of Econometrics, 105, 27–58.

Calvet, L., & Fisher, A. (2004). Regime-switching and the estimation of multifractal processes. Journal of Financial Econometrics, 2, 44–83.

Canarella, G., Gil-Alana, L.A., Payne, R., Miller, S.M. (2019). Persistence and cyclical dynamics of US and UK house prices: Evidence from over 150 years of data. Urban Studies. https://doi.org/10.1177/0042098019872691.

Canarella, G., Miller, S. M., Pollard, S. K. (2012). Unit roots and structural change: an application to US house-price indices. Urban Studies, 49, 757–776.

Case, K. E., Quigley, J. M., Shiller, R. J. (2013). Wealth effects revisited 1975-2012. Critical Finance Review, 2, 101–128.

Chan, F., & McAleer, M. (2002). Maximum likelihood estimation of STAR and STAR-GARCH models: Theory and monthe carlo evidence. Journal of Applied Econometrics, 17, 509–534.

Chen, H. (2017). Real estate transfer taxes and housing price volatility in the United States. International real Estate Review, 20, 207–219.

Conrad, C., & Haag, B. R. (2006). Inequality constraints in the fractionally integrated GARCH model. Journal of Financial Econometrics, 4, 413–449.

Crawford, F. W., & Fratantoni, M. C. (2003). Assessing the forecasting performance of regime switching ARIMA and GARCH models of home prices. Real Estate Economics, 31, 223–243.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Ding, Z., Granger, C., Engle, R. (1993). A long memory property of stock market returns and a new model. Journal of Empirical Finance, 1, 83–106.

Dolde, W., & Tirtiroglu, D. (2002). House price volatility changes and their effects. Real Estate Economics, 30, 41–66.

Douc, R., Roueff, F., Soulier, P. (2008). On the existence of some ARCH\((\infty )\) processes. Stochastic Processes and Applications, 118, 755–761.

Elder, J., & Villupuram, S. (2012). Persistence in the return and volatility of home price indices. Applied Financial Economics, 22, 1855–1868.

Engsted, T., & Pedersen, T. Q. (2014). Housing market volatility in the OECD area: Evidence from VAR based return decompositions. Journal of Macroeconomics, 42, 91–103.

Fairchild, J., Ma, J., Wu, S. (2015). Understanding housing market volatility. Journal of Money Credit and Banking, 47, 1309–1337.

Giraitis, L., Kokoszka, P., Leipus, R. (2000). Stationarity ARCH models: Dependence structure and central limit theorem. Econometric Theory, 16, 3–22.

Glosten, L., Jagannathan, R., Runkle, D. E. (1993). On the relation between the expected value and volatility of the nominal excess return on stocks. Journal of Finance, 46, 1779–1801.

Granger, C. W. (1999). Outline of forecast theory using generalized cost functions. Spanish Economic Review, 1, 161–173.

Gupta, R., & Majumdar, A. (2015). Forecasting US real house price returns over 1831-2013: evidence from copula models. Applied Economics, 47, 5204–5213.

Hansen, P. R., Lunde, A., Nason, J. M. (2011). The model confidence set. Econometrica, 79, 453–497.

Henderson, J. V., & Ioannides, Y. (1987). Owner occupancy: Consumption vs. investment demand. Journal of Urban Economics, 21, 228–241.

Hentschel, L. (1995). All in the family nesting symmetric and asymmetric GARCH models. Journal of Financial Economics, 39, 71–104.

Hill, B. M. (1975). A simple general approach to inference the tail of a distribution. Annals of Statistics, 3, 1163–1174.

Hosking, J. R. (1981). Fractional differencing. Biometrika, 68, 165–176.

Kazakevicius, V., & Leipus, R. (2002). On stationarity in the ARCH\((\infty )\) model. Econometric Theory, 18, 1–16.

Lee, T. H., White, H., Granger, C. W. J. (1993). Testing for neglected nonlinearity in time series models. Journal of Econometrics, 56, 269–290.

Li, K. W. (2012). A study on the volatility forecast of the US housing market in the 2008 crisis. Applied Financial Economics, 22, 1869–1880.

Ling, S., & McAleer, M. (2002). Necessary and sufficient moment conditions for the GARCH(r,s) and asymmetric power GARCH(r,s) models. Econometric Theory, 18, 722–729.

Liu, R., di Matteo, T., Lux, T. (2007). True and apparent scaling: The proximity of the Markov-switching multifractal model to long-range dependence. Physica A, 383, 35–42.

Lundbergh, S., & Terasvirta, T. (1999). Modelling economic high frequency time series with STAR-STGARCH models. SSE/EFI Working Paper Series in Economics and Finance, No. 291.

Lux, T. (2008). The Markov-switching multifractal model of asset returns: GMM estimation and linear forecasting of volatility. Journal of Business and Economic Statistics, 26, 194–210.

Lux, T., & Ausloos, M. (2002). Market fluctuations I: scaling, multi-scaling and their possible origins. In Bunde, A., Kropp, J., Schellnhuber, H. J. (Eds.) Science of disasters: Climate disruptions, heart attacks and market crashes (pp. 372–409). Berlin: Springer.

Mandelbrot, B. B., Fisher, A., Calvet, L. (1997). A multifractal model of asset returns. Cowles Foundation Discussion Papers 1164, Cowles Foundation for Research in Economics, Yale University.

Miles, W. (2008a). Boom-bust cycles and the forecasting performance of linear and non-linear models of house prices. Journal of Real Estate Finance and Economics, 36, 249–264.

Miles, W. (2008b). Volatility clustering in U.S. home prices. Journal of Real Estate Research, 30, 73–90.

Miles, W. (2011). Long range dependence in U.S. house prices volatility. Journal of Real Estate Finance and Economics, 42, 214–240.

Miles, W. (2015). Regional house price segmentation and convergence in the US: a new approach. Journal of Real Estate Finance and Economics, 50, 113–128.

Miller, N. G., & Peng, L. (2006). Exploring metropolitan price volatility. Journal of Real Estate Finance and Economics, 33, 5–18.

Montañés, A., & Olmos, L. (2013). Convergence in US house prices. Economics Letters, 121, 152–155.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 59, 347–370.

Nyakabawo, W., Gupta, R., Marfatia, H. A. (2018). High frequency impact of monetary policy and macroeconomic surprises on US MSAs, aggregate US housing returns and asymmetric volatility. Advances in Decision Sciences, 22, 1–26.

Phillips, P., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75, 335–346.

Shiller, R. (1998). Macro markets: Creating institutions for managing society’s largest economic risks. New York: Oxford University Press.

Shiryaev, A. (1995). Probability (Graduate Texts in Mathematics), 2nd edn. Berlin: Springer.

Teraesvirta, T., Liu, C. F., Granger, C. W. J. (1993). Power of the neural network linearity test. Journal of Time Series Analysis, 14, 209–220.

Wang, W. (2014). Daily house price indexes: Volatility dynamics and longer-run predictions. Ph.D. thesis, Duke University. Available for download from: https://dukespace.lib.duke.edu/dspace/handle/10161/8694.

Weron, R. (2002). Estimating long-range dependence: finite sample properties and confidence intervals. Physica A: Statistical Mechanics and its Applications, 312, 285–299.

White, H. (2000). A reality check for data snooping. Econometrica, 68, 1097–1126.

Wooldridge, J. (1994). Aspects of modelling nonlinear time series, chap. estimation and inference for dependent processes, (pp. 2639–2738). Amsterdam: Elsevier Science.

Zhou, Y., & Haurin, D. R. (2010). On the determinants of house value volatility. The Journal of Real Estate Research, 32, 377–396.

Acknowledgments

We would like to thank an anonymous referee for many helpful comments. However, any remaining errors are solely ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Segnon, M., Gupta, R., Lesame, K. et al. High-Frequency Volatility Forecasting of US Housing Markets. J Real Estate Finan Econ 62, 283–317 (2021). https://doi.org/10.1007/s11146-020-09745-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09745-w