Abstract

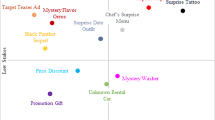

Bundling in this era of eCommerce and high technology is a potent and widespread selling tool. The literature has focused on three static bundling strategies under which the products are sold separately (pure components or PC) or only in a bundled form (pure bundling or PB) or both (mixed bundling or MB). In a generalization, and motivated by real world examples, this paper examines the relative effectiveness of temporal bundling. We consider a firm that sells to a market of myopic and strategic consumers, and a selling season consisting of two stages. We compare four strategies – PC-PC (i.e., pure components in each of two stages), PB-PB, PB-PC and PC-PB – relative to MB. Our results show that PB-PB maximizes profits under low marginal costs; PC-PC prevails under high marginal costs given a large proportion of myopic consumers; and PB-PC is profit maximizing under moderate marginal costs when most consumers are strategic. These temporal strategies dominate MB except when the market is comprised entirely of strategic consumers. Finally, while temporal mixed bundling – MB-MB – is weakly superior to other temporal strategies, the latter are much easier to implement, as shown by real-world uses, and suffice to capture most of the profits. Related interesting pricing implications are discussed. Three extensions to the main model are also proposed.

Similar content being viewed by others

Notes

Amazon.com follows PC-PC in its offering of Blu-ray versions of “Argo” and “Life of Pi.” Both were released at a price of $30 and later discounted by over 33%. By contrast, certain music bands such as AC/DC have adopted PB-PB. A price tracker of their album “Black Ice” reveals a launch price of about $11 and a subsequent drop to half that price in six months.

Our conceptualization echoes with Bulow (1982, p.316) who notes that durable goods can be broadly defined and writes, “A ticket to a first-run movie has the durable quality that once someone has seen the film that person is unlikely to buy a second ticket. … Similarly, the expectation that a viewing will be available at a cheaper price on a second-run affects demand for the first-run film. (The market for hardcover and paperbacks works this way also.)”

The empirical analysis by Li et al. (2014) suggests that less than 20% of consumers are strategic in the air-travel industry.

Both the first and second stage bundle prices show a non-linear increase in marginal costs with a kink at c = c ∗ = 0.25 + α/9. The kink per se is not a major result and is consistent with extant findings under static pure bundling PB (e.g., Venkatesh and Kamakura 2003, p. 222). Further, there is no discontinuity in the trajectory of optimal prices and in the profit function. The non-linear rise in optimal bundle prices as a function of marginal cost is attributable to the unimodal distribution of the reservation prices for the bundle (a point that resonates with Schmalensee’s 1984 work with the normal distribution).

Specifically, either c ≤ 0.108 or [c ∈ (0.108, 0.261) and \( \alpha \ge \frac{7{c}^2-10c+1}{14{c}^2-8c} \)].

The function (7c2-10c + 1)/(14c2-8c) in the interval of c = 0.108 to 0.261, is a slightly curved line from 0 to 1. Thus at some point between c = 0.108 to 0.261 it must intersect with the value of α (the proportion of myopic consumers) and the transition between cases occurs.

There are four scenarios because in Fig. 5(b), panels (i) and (iii) are analytically equivalent, as are (ii) and (iv). To illustrate, we expand one case: From Fig. 5(a) (i) where 2P 2 ≤ P B1 ≤ 1, a total of α(1 − P B1)2/2 myopic consumers buy the first stage bundle, providing a profit of α(P B1 − 2c)(1 − P B1)2/2. Then, in the second stage, α(P B1 − P 2)2 myopic consumers buy components, yielding a profit of α(P 2 − c)(P B1 − P 2)2. For Fig. 5(b) (i) for strategic consumers, the demand occurs only in the second stage and is 2(1 − α)(1 − P 2) and their profit contribution is 2(1 − α)(1 − P 2)(P 2 − c). Thus the total profit for the case 2P 2 ≤ P B1 ≤ 1 is given by α(P B1 − 2c)(1 − P B1)2/2 + 2(1 − α)(1 − P 2)(P 2 − c). Similar expressions for the remaining three cases can be derived.

Chu et al. (2011) show via numerical and empirical work that the profitability of mixed bundle pricing for a large number of products can be approximated by pricing the bundles based solely on the number of items in the bundle.”

In the parallel universe of static bundling, there are contexts where MB is more common than the simpler PB or PC, such as sales of video games and video game consoles. In an empirical study, Derdenger and Kumar (2013) note that the profitability of MB could exceed that of PB by over 30%. However, the utility structure is different from the present study as video game buyers might want to buy new games but not necessarily new consoles on a purchase, and complementarity is a factor. For the music industry where complementarity is less of a factor, Elberse (2010) finds that MB reduces revenues and profits compared to PB.

With perfect positive correlation, PC and PB will yield similar profits as MB, a point noted by Schmalensee (1984, p. S227).

References

Adams, W. J., & Yellen, J. L. (1976). Commodity bundling and the burden of monopoly. Quarterly Journal of Economics, 90(3), 475–498.

Bakos, Y., & Brynjolfsson, E. (1999). Bundling information goods: pricing, profits and efficiency. Management Science, 45(12), 1613–1630.

Besanko, D. and Winston, W. L. (1990). Optimal price skimming by a monopolist facing rational consumers. Management Science, 36(5), 555–567.

Bhargava, H. K. (2012). Retailer-driven product bundling in a distribution channel. Marketing Science, 31(6), 1014–1021.

Bhargava, H. K. (2013). Mixed bundling of two independently valued goods. Management Science, 59(9), 2170–2185.

Bulow, J. I. (1982). Durable-goods monopolists. Journal of Political Economy, 90(2), 314–332.

Carbajo, J., de Meza, D., and Seidmann, D. J. (1990). A strategic motivation for bundling. Journal of Industrial Economics, 38(3), 283–298.

Chu, S., Leslie, P., & Sorensen, A. (2011). Bundle-size pricing as an approximation to mixed bundling. American Economic Review, 101(1), 263–303.

Coase, R. (1972). Durability and monopoly. Journal of Law and Economics, 15(1), 143–149.

Crawford, G. S. (2008). The discriminatory incentives to bundle in the cable television industry. Quantitative Marketing and Economics, 6(1), 41–78.

DeGraba, P., & Mohammed, R. (1999). Intertemporal mixed bundling and buying frenzies. RAND Journal of Economics, 30(4), 694–718.

Derdenger, T., & Kumar, V. (2013). The dynamic effects of bundling as a product strategy. Marketing Science, 32(6), 827–859.

Elberse, A. (2010). Bye-bye bundles: the unbundling of music in digital channels. Journal of Marketing, 74(3), 107–123.

Elmaghraby, W., & Keskinocak, P. (2003). Dynamic pricing in the presence of inventory considerations: research overview, current practices, and future directions. Management Science, 49(10), 1287–1309.

Ghosh, B., Balachander, S. (2007). Research note—competitive bundling and counterbundling with generalist and specialist firms. Marketing Science, 53(1), 159–168.

Goh, K. H., & Bockstedt, J. C. (2013). The framing effects of multipart pricing on consumer purchasing behavior of customized information goods bundles. Information Systems Research, 24(2), 334–351.

Guiltinan, J. P. (1987). The price bundling of services: A normative framework. Journal of Marketing, 51(2), 74–85.

Hitt, L. M., & Chen, P. (2005). Bundling with customer self-selection: a simple approach to bundling low-marginal-cost goods. Management Science, 51(10), 1481–1493.

Lazear, E. P. (1986). Retail pricing and clearance sales. American Economic Review, 76(1), 14–32.

Li, J., Granados, A., & Netessine, S. (2014). Are consumers strategic? Structural estimation from the air-travel industry. Management Science, 60(9), 2114–2137.

Matutes, C., & Regibeau, P. (1992). Compatibility and bundling of complementary goods in a duopoly. Journal of Industrial Economics, 40(1), 37–54.

McAfee, R. P. (2002). Coarse matching. Econometrica, 70(5), 2025–2034.

McAfee, R. P., McMillan, J., & Whinston, M. D. (1989). Multiproduct monopoly, commodity bundling, and correlation of values. Quarterly Journal of Economics, 104(2), 371–383.

Nalebuff, B. (2004). Bundling as an entry barrier. Quarterly Journal of Economics, 119(1), 159–187.

Pang, M.-S., & Etzion, H. (2012). Research note: analyzing pricing strategies for online services with network effects. Information Systems Research, 23(4), 1364–1377.

Pashigian, B. P. (1988). Demand uncertainty and sales: a study of fashion and markdown pricing. American Economic Review, 78(5), 936–953.

Prasad, A., Venkatesh, R., & Mahajan, V. (2010). Optimal bundling of technological products with network externality. Management Science, 56(12), 2224–2236.

Prasad, A., Venkatesh, R., and Mahajan, V. (2015). Product bundling or reserved product pricing? Price discrimination with myopic and strategic consumers. International Journal of Research in Marketing, 32(1), 1–8.

Rao, A. (2015). Online content pricing: purchase and rental markets. Marketing Science, 34(3), 430-451.

Rao, V. R., Russell, G., Bhargava, H., Cooke, A., Derdenger, T., Kim, H., Kumar, N., Levin, I., Ma, Y., Mehta, N., Pracejus, J., and Venkatesh, R. (2017). Emerging trends in product bundling: Investigating consumer choice and firm behavior. Customer Needs and Solutions. https://doi.org/10.1007/s40547-017-0075-x

Schmalensee, R. (1984). Gaussian demand and commodity bundling. Journal of Business, 57(1), S211–S230.

Seidmann, D. J. (1991). Bundling as a facilitating device: A reinterpretation of leverage theory. Economica, 58, 491–499.

Shen, Z.-J., & Su, X. (2007). Customer behavior modeling in revenue management and auctions. Production and Operations Management, 16(6), 713–728.

Stremersch, S. and Tellis, G. (2002). Strategic bundling of products and prices: A new synthesis for marketing. Journal of Marketing, 66(1), 55–72.

Varian, H. (1980). A model of sales. American Economic Review, 70(4), 651–659.

Venkatesh, R., & Kamakura, W. (2003). Optimal bundling and pricing under a monopoly: contrasting complements and substitutes from independently valued products. Journal of Business, 76(2), 211–231.

Venkatesh, R. and Mahajan, V. (2009). The design and pricing of bundles: A review of normative guidelines and practical approaches. In Rao, V. R. (Ed.) Handbook of Pricing Research in Marketing. Northampton, Edward Elgar Publishing. pp. 232–257.

Wilson, R. (1993). Nonlinear pricing. New York: Oxford University Press.

Yalcin, T., Ofek, E., Koenigsberg, O., & Biyalogorsky, E. (2013). Complementary goods: creating, capturing, and competing for value. Marketing Science, 32(4), 554–569.

Acknowledgements

The authors thank the Editor, Wesley Hartmann, and two anonymous reviewers for their helpful comments, as well as seminar participants at the bundle choice workshop held as part of the Tenth Choice Symposium in Banff, Canada, Marketing Academic Research Colloquium at the University of Maryland, University of California Riverside, and the Marketing Science Conference in Istanbul.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 Proofs of propositions 1, 2 and 3

Proof of proposition 1

The maximization problem is,

The objective function is separable in the two products and it is globally concave. The necessary conditions for maximum yield:

Inserting the first into the second, we get δ = (1 − c)/(4 − α). The optimal profit expression can be obtained by substituting these back into the objective function.

The prices in the two stages can be put in a simplified form as \( {P}_1=\frac{1+c}{2}+\frac{\left(2-\upalpha \right)\left(1-c\right)}{2\left(4-\upalpha \right)} \) for the regular price and \( {P}_2=\frac{1+c}{2}-\frac{\upalpha \left(1-c\right)}{2\left(4-\upalpha \right)} \) after substituting for the discount.

Proof of proposition 2

-

Step 1: Demand and profit derivations for the three cases:

-

Case (a): P B1 > P B2 ≥ 1. From the α myopic consumers, demand in the first and second stages are α(2 − P B1)2/2 and α(2 − P B2)2/2 − α(2 − P B1)2/2 respectively, at bundle prices of P B1 and P B2 respectively (Fig. 2(a) (iii)). From the 1 − α strategic consumers, purchases only occurs in the second stage at the discounted price P B2 and demand is (1 − α)(2 − P B2)2/2 (Fig. 2(b) (iii)). Thus, the profit function is,

-

-

Case (b): P B1 ≥ 1 ≥ P B2. The demands from the myopic consumers at the bundle prices of P B1 and P B2 are α(2 − P B1)2/2 and \( \alpha \left(1-{P}_{B2}^2/2\right)-\alpha {\left(2-{P}_{B1}\right)}^2/2 \) in the first and second stages, respectively (Fig. 2(a) (ii)). The strategic segment purchases in the second stage and generates demand \( \left(1-\alpha \right)\left(1-{P}_{B2}^2/2\right) \) (Fig. 2(b) (ii)). Thus, the profit function is,

-

Case (c): 1 ≥ P B1 > P B2. Myopic consumer demands are \( \alpha \left(1-{P}_{B1}^2/2\right) \) at price P B1 in the first stage and \( \alpha \left({P}_{B1}^2-{P}_{B2}^2\right)/2 \) at price P B2 in the second stage (Fig. 2(a) (i)). The strategic consumers have demand \( \left(1-\alpha \right)\left(1-{P}_{B2}^2/2\right) \) in the second stage (Fig. 2(b) (i)). Thus, the profit function is,

-

Step 2: The next step is to examine the derived maximization problems.

First consider Case (b): P B1 ≥ 1 ≥ P B2. Its objective simplifies to:

$$ {\mathrm{max}}_{P_{B1},\kern0.5em {P}_{B2}}\kern0.5em \alpha \left({P}_{B1}-{P}_{B2}\right)\frac{{\left(2-{P}_{B1}\right)}^2}{2}+\left({P}_{B2}-2c\right)\left(1-\frac{P_{B2}^2}{2}\right). $$

The necessary conditions are:

Inserting P B1 = 2(1 + P B2)/3 into the second equation, we get,

This has the quadratic solution given in the Proposition,

and only the positive root gives a positive bundle price.

We can find the boundaries between this case and Cases (a) and (c). The former given by P B2 = 1 is given in the next part of the proof. For the latter, put P B1 = 1 which implies from P B1 = 2(1 + P B2)/3 that P B2 = 1/2. Insert these into the second necessary condition and it gives 5/4 − α + 2c = 0 which is not possible unless the parameters go out of bounds. Thus Case (c) is never optimal.

Next consider Case (a) P B1 > P B2 ≥ 1. The objective can be simplified to:

The necessary conditions are:

Thus, P B1 = 2(1 + P B2)/3. Inserting it into the second equation, \( {P}_{B2}=\frac{18\left(1+2c\right)-8\alpha }{27-4\alpha } \). Since the lowest price possible for this case is given by P B2 = 1, inserting it into the expression for P B2 gives the boundary condition, which is c = 0.25 + α/9. Finally, we verify the sufficiency conditions at the solution point.

Proof of proposition 3

-

Step 1: Demand and profit derivations for the two cases (Refer to Fig. 4):

The analysis of the strategic consumer segment (Fig. 4(b)) when the product prices are lower than the bundle price is the same as for MB: Demand is (1 − α)(1 − P)(P B − P) for each product at a margin of P − c and (1 − α)[(1 + P − P B )2 − (2P − P B )2/2] for the bundle at a margin of P B − 2c. Thus, (1 − α)[2(P − c)(1 − P)(P B − P) + (P B − 2c)((1 + P − P B )2 − (2P − P B )2/2)] is the profit from strategic consumers when P B ≥ P. If the product price is higher than the bundle price, the derivation is the same as for pure bundling: Demand is \( \left(1-\alpha \right)\left(1-{P}_B^2/2\right) \) for the bundle at a margin of P B − 2c. Thus, \( \left(1-\alpha \right)\left({P}_B-2c\right)\left(1-{P}_B^2/2\right) \) is the profit from strategic consumers when P B ≤ P.

For the segment of myopic consumers, the first stage sales mirrors PC and hence the demand is α(1 − P) for each product at a margin of (P − c). The second stage is PB with margin (P B − 2c). Consider the case P B ≥ P. The demand for the bundle is α(2P − P B )2/2. Next, consider the case P B ≤ P. The demand for the bundle is \( \alpha \left[2\left(1-P\right)\left(P-{P}_B\right)+\left({P}^2-{P}_B^2/2\right)\right] \). Thus, the overall profit objectives are:

If P B ≥ P,

If P B ≤ P,

-

Step 2: The boundary between the cases P B ≥ P and P B ≤ P can be expressed analytically by setting P B = P in the necessary conditions. Consider the case P B ≤ P. The necessary conditions yield:

If we set P B = P in the first of these, we get P = 1 − c. If we substitute P B = P = 1 − c into the second equation, it yields,

We can obtain the condition on the marginal cost for this equation to be satisfied with α in [0, 1] by setting α first to 0 and then to 1 and solving the equation. We find that \( c\le \left(-1+2\sqrt{2}\right)/7\approx 0.261 \) for α < 1, and \( c\ge \left(5-3\sqrt{2}\right)/7\approx 0.108 \) for α > 0. Within the range [0.108, 0.261], the boundary between the solution cases P B < P and P B > P is \( \alpha =\frac{7{c}^2-10c+1}{14{c}^2-8c} \).

Appendix 2

1.1 Derivation of demand and profit under MB-MB

In this appendix we outline the derivation of MB–MB demand and profit. We assume and subsequently verify that the second stage component and bundle prices are less than their corresponding first stage prices. Then strategic consumers will postpone purchases to the second stage, and face the standard MB choices. This is also the case in the first stage for myopic consumers.

Thus, in the first stage, the α proportion of myopic consumers contributes,

where P 1 is the component price and ϕ 1 the bundle discount. The 1 − α proportion of strategic consumers in the second stage contributes

where P 2 is the component price and ϕ 2 the bundle discount.

Now consider the second stage demand calculation for myopic consumers. Those consumers who bought the bundle in the first stage have no subsequent impact, but consumers who bought one component in the first period might buy the other component if it is cheap enough in the second stage. They do so only if P 2 < P 1 − ϕ 1, i.e., it is cheap enough, and their contribution is:

Finally, we consider the segment of myopic consumers who did not buy in the first stage, but buy in the second stage. Two demand patterns occur depending on whether Δ ≡ (P 2 − ϕ 2) − (P 1 − ϕ 1) is positive or negative. The case of Δ ≤ 0 is shown schematically in the Figure. The other case is analogous.

If Δ ≤ 0 then \( 2\alpha \left({P}_2-c\right)\left({P}_1-{P}_2\right)\left({P}_2-{\phi}_2\right)+\alpha \left(2{P}_2-2c-{\phi}_2\right)\left[{\left({P}_1-{P}_2+{\phi}_2\right)}^2-\frac{\phi_1^2}{2}-\frac{\phi_1^2}{2}\right]. \)

If Δ ≥ 0 then \( 2\alpha \left({P}_2-c\right)\left[\left({P}_1-{P}_2\right)\left({P}_2-{\phi}_2\right)-\frac{\varDelta^2}{2}\left]+\alpha \left(2{P}_2-2c-{\phi}_2\right)\right[\frac{{\left({P}_1-{P}_2-\varDelta +{\phi}_2\right)}^2}{2}-\frac{\phi_2^2}{2}\right]. \)

Let P 2 < P 1 − ϕ 1 (i.e., we don’t expect much bundle discount in the first stage –we verify the conditions ex post.) Then Δ ≤ 0. We now proceed by backwards induction. The Stage 2 problem is:

We obtain necessary conditions from this. Then we maximize the first period problem, which is the sum of the profits from the first and second periods, with respect to P 1 and ϕ 1, subject to these necessary conditions. The first stage maximization problem is thus,

subject to the first order conditions from the previous stage. The Maximize function in Maple was used to obtain the numerical solution of the problem for different values of the parameters.

Rights and permissions

About this article

Cite this article

Prasad, A., Venkatesh, R. & Mahajan, V. Temporal product bundling with myopic and strategic consumers: Manifestations and relative effectiveness. Quant Mark Econ 15, 341–368 (2017). https://doi.org/10.1007/s11129-017-9189-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-017-9189-6