Abstract

In many R&D-intensive consumer product categories, firms deliver value to consumers through the quality enhancements provided by new and improved versions of existing products. Therefore, important marketing decisions relate to a firm’s strategy for developing quality enhancements and releasing new versions. This paper explores this type of product development using a dynamic duopoly model that endogenizes each firm’s decisions over how much to invest in R&D and when to release new versions. Specifically, I explore how two key industry fundamentals—the degree of horizontal differentiation and the cost of releasing a new version—affect firms’ product development strategies and, accordingly, the evolution of industry structure. I find that varying the degree of horizontal differentiation gives rise to three distinctly different types of competitive dynamics: preemption races when the degree of horizontal differentiation is low; phases of accommodation when it is moderate; and asymmetric R&D wars when it is high. Furthermore, I find that an increase in the cost of releasing a new version can induce firms to compete more aggressively for the lead and, in doing so, release new versions more frequently despite the higher cost.

Similar content being viewed by others

Notes

P&G (Crest) and Colgate-Palmolive (Colgate) have invested heavily in developing innovations relating to the active ingredient (which fights tooth decay), other therapeutic benefits (e.g., tartar prevention), and packaging, and have introduced these innovations via periodic version releases (McCoy 2001; Parry 2001; Dyer et al. 2004).

Goettler & Gordon (2011) incorporate product durability into a quality ladder model in the Ericson & Pakes (1995) framework and use it to study competition between Intel and AMD. While their model endogenizes firms’ R&D spending decisions, it does not endogenize the timing of version releases; rather, it assumes that a firm releases a new product after each successful innovation.

Hitsch (2006) devises and estimates a model of a firm’s decisions on whether to launch—and subsequently whether to scrap—new products in the face of demand uncertainty that resolves itself over time (post-launch) as sales are realized. The model differs from the one in this paper in that it (i) focuses on new products with unchanging quality and therefore incorporates neither R&D investment nor repeated releases (but does incorporate advertising); and (ii) does not incorporate strategic interaction between firms.

Aoki (1991), Harris (1991), Budd et al. (1993), and Hörner (2004) explore R&D competition using analytically tractable dynamic stochastic games. To achieve analytic tractability, each assumes that there is a one-dimensional state space that reflects the size of one firm’s lead. While I too restrict attention to the size of a firm’s lead in the product market, my research question cannot be explored using an analytically tractable model because I require two additional states that track the firms’ respective R&D stocks.

Ofek & Sarvary (2003) devise an analytic model (with a one-dimensional state indicating whether a firm is leader or follower) to study dynamic competition in markets in which firms invest in R&D to develop next-generation products. They explore the implications of different advantages that a leader might possess in terms of innovative ability, reputation, and advertising effectiveness. This paper differs from Ofek & Sarvary (2003) in that it focuses on the strategic role of R&D stockpiling and (endogenous) version releases.

This approach is common in the theoretical literature on dynamic quality ladder models; see the papers cited in footnote 5.

I assume that the cost of releasing a new version is private and random because it guarantees the existence of a Markov perfect equilibrium in pure strategies (Doraszelski & Satterthwaite 2010).

The assumption that there is no outside option has two noteworthy implications. First, the model admits an equilibrium in which each firm sets an infinite price and sells to half the market. I rule this out by assuming that prices are finite. Second, the Caplin & Nalebuff (1991) proof of existence and uniqueness does not apply. However, I have succeeded in computing a Nash equilibrium for every value of ω m at every parameterization explored in this paper. Moreover, I have not encountered multiple equilibria.

I have assumed that if a firm fails to incorporate a unit of R&D stock into a new version, then that unit of R&D stock is lost. The reasoning and the examples that I provide in Section 2.2 suggest that this assumption is reasonable for CPG and consumer electronics categories, among others. Alternatively, one could assume that if a firm fails to incorporate a unit of R&D stock, it retains it and can try again in the future. This entails assuming that when a firm releases a new version, its R&D stock transitions from \({\omega ^{R}_{i}}\) to \({\omega ^{R}_{i}} - \bar {\omega }^{R}_{i} \) instead of zero; the rest of the model is unchanged. I thank Referee 1 for this suggestion.

See the papers cited in footnotes 5 and 6.

In Section 3, I set L m = 20 and L R = 10. It follows that the number of industry states is 41 × 112 = 4961. However, had I not reduced the dimensionality of the state space (from four to three), then there would have been 212 × 112 = 53, 361 industry states.

First, some uncertainty exists irrespective of how much test marketing a firm does. Furthermore, CPG firms often elect to do relatively little test marketing because it is “slow, expensive, and open to spying and sabotage” (Baker et al. 2000). Second, the presence of such uncertainty relates to the idea that firms sometimes inadvertently focus on improving products from a technical standpoint—instead of focusing on satisfying customers’ needs and wants—and therefore may make improvements that customers do not value (Levitt 1960). Finally, although Coke is not characterized by frequent version releases, the infamous 1985 release of a new version of Coke—which replaced the previous version—provides an excellent example of this phenomenon. The new version of Coke failed because of tremendous public backlash despite much market research suggesting that it would be a success (Prendergrast 2000).

For example, Pakes & McGuire (1994), Gowrisankaran & Town (1997), and Borkovsky et al. (2012) assume that a consumer’s utility is characterized by diminishing returns to quality that set in very quickly beyond some quality threshold. I am unable to take this particular approach because in order to reduce the dimensionality of the state space, I have assumed that a consumer’s utility is linear in quality.

Additionally, allowing for a wide range of possible release costs yields equilibria with a wide range of release probabilities (across industry states), which makes it easier to discern the different equilibrium behaviors that arise. I have verified that qualitatively similar behaviors arise for narrower ranges of release costs. However, narrower ranges of release costs tend to give rise to greater convergence problems for the algorithm described below. Finally, Section 6.2 explores the effects of changes in the range of release costs by computing equilibria for higher values of G l and G u .

Because firms are symmetric, firm 2’s equilibrium price and profit functions are symmetric to firm 1’s, i.e., p 2(ω m ) = p 1(−ω m ) and π 2(ω m ) = π 1(−ω m ).

One derives the simplified model from the model in Section 2 by setting the release cost to zero (G l = G u = 0) and the probability that a firm successfully incorporates its entire R&D stock (when releasing a new version) to one—i.e., \(s\left ({\omega ^{R}_{i}} | {\omega ^{R}_{i}}\right )=1\).

Because firms are symmetric, firm 2’s R&D investment policy function is symmetric to firm 1’s, i.e., x 2(ω m) = x 1(−ω m).

I also compute equilibria for fine discretization of a wide range of σ values and present the equilibrium correspondence in the Appendix.

In this case, the matrices graphed in the bottom row are transposes of the corresponding matrices in the top row; this is because I restrict attention to symmetric equilibria and because firms are tied in the product market. However, this will not be the case for cross-sections for which ω m ≠ 0.

The bottom panels in Fig. 3 show that there is a roughly triangular region in the \(({\omega ^{R}_{1}},{\omega ^{R}_{2}})\) grid—where \({\omega ^{R}_{1}}\) is sufficiently high and \({\omega ^{R}_{2}}\) is sufficiently low—in which firm 2 gives up. The upper panels show that there is an analogous region in which firm 1 gives up.

When one firm gains a lead of 20 in the product market, both firms neither invest nor release new versions, i.e., the industry reaches an absorbing state. It does however take a very long time until this occurs—approximately 60 periods, which is twice the industry’s expected lifespan. The standard approach to addressing this issue in Ericson & Pakes (1995) models is to assume that a firm experiences decreasing returns as it approaches the upper edge of the state space. I have verified that a version of the model in which the effectiveness of investment, α, decreases in the size of a firm’s lead yields equilibria that are qualitatively similar to those presented in Section 6, the only difference being that firms never stop investing or releasing new versions and accordingly neither firm ever achieves a maximal product market lead of 20. These equilibria are available upon request.

For example, in industry state (0, 6, 2)—in which firm 2 gives up—firm 1 is the likely product market leader not only because of its R&D stock advantage, but also because it updates with much higher probability (0.4272) than firm 2 (0.0395).

A version release has a direct effect and a strategic effect. The direct effect is that a version release enhances a firm’s product quality and accordingly its profits. The larger a firm’s R&D stock, the more it enhances the firm’s (expected) profits when the firm releases a new version, and accordingly the higher the firm’s release probability should be. Hence, if one considers only the direct effect, one would expect a firm’s release probability to be strictly increasing in its R&D stock, as is the case in a monopolistic version of the model. The fact that a firm’s release probability is not strictly increasing in its R&D stock can be attributed to the strategic effect, i.e., the impact of a version release on a rival firm’s behavior.

Some preemption in terms of version releases still remains because of the uncertain nature of the release cost; see the Appendix for details.

In multistage patent races, if R&D investment has a deterministic impact on innovation (Fudenberg et al. 1983; Harris & Vickers 1985; Lippman & McCardle 1988), then ε -preemption arises, i.e., once a firm gains an arbitrarily small lead, it induces its rival to immediately drop out of the race. If R&D investment has a stochastic impact on innovation (Grossman & Shapiro 1987; Harris & Vickers 1987; Lippman & McCardle 1987), then the leader invests more than the follower and is therefore likely to expand its lead until it ultimately induces its rival to drop out.

Similarly, because this is a symmetric equilibrium and in the ω m = 0 cross-section, firms are tied in the product market, there are identical trenches along \({\omega _{1}^{R}}=1\) for \({\omega _{2}^{R}}\geq 3\) and along \({\omega _{1}^{R}}=4\) for \({\omega _{2}^{R}}\geq 8\), in which the roles of the firms are reversed.

The probability that firm 2 is the product market leader (ω m < 0) 100 periods after the industry enters state ω = (0, 3, 1) is 1.88%.

In fact, for ω1R ≥ 5, firm 2 does not invest at all while in this trench. Therefore, its R&D stock remains fixed at \({\omega _{2}^{R}}=1\) as long as long as neither firm releases a new version.

The panel in the middle row and middle column of Fig. 7 shows that when a firm gains a large R&D stock lead, it updates with high probability. Hence, a follower invests heavily in R&D in hopes of preventing the leader from gaining such a large lead. Because the follower updates with low probability, the leader faces no similar incentive.

The equilibria in the middle and lower panels of Fig. 7 are also characterized by accommodation. While the ω m = 0 cross sections in the lower panels do not include any accommodative trenches and the ones in the middle panels include only one (at \({\omega _{2}^{R}}=0\) for \({\omega _{1}^{R}}\geq 9\)), there are several prominent accommodative trenches in other cross-sections for both equilibria.

The bottom panels of Fig. 2 show that in the benchmark model, when the degree of horizontal differentiation is high, as the laggard falls behind it simply reduces its R&D investment and the leader increases its R&D investment (for ω m ≤ 10), making it extremely unlikely that the laggard narrows the leader’s lead; accordingly, an asymmetric industry structure arises.

Besanko et al. (2010) explain why their model of dynamic price competition admits multiple equilibria and, specifically, how different equilibria are underpinned by different beliefs about the future (see pp. 492–493). The same explanation applies to my model.

The relatively small non-monotonicities in the left panel of Fig. 8 arise because of slight qualitative changes in the equilibrium policy functions.

Indirect network effects existed because web content developers preferred to produce content for browsers with large user bases and users preferred browsers for which much compatible content was available (Bresnahan 2001).

To incorporate product durability into the model, in addition to including forward-looking consumers and dynamic pricing, one would augment the state space to include the ownership distribution across products (Goettler & Gordon 2011).

Incorporating entry and exit into the model would be theoretically straightforward. However, it would increase computational burden because one would not be able to restrict attention to the difference between firms’ respective product qualities. If one firm exits, the remaining incumbent firm would have to be characterized by its product’s absolute quality. Therefore, it would be necessary to retain absolute as opposed to relative product qualities in the state space.

The notion of learning about uncertain demand from observed sales is explored in Hitsch (2006).

In the diaper category, several innovations have been introduced via product line extensions, e.g., gel technology (Pampers 1986), Velcro tabs (Huggies 1993, Pampers 1994), and stretchable side panels (Pampers 1994) (Parry & Jones 2001). These innovations were later broadly incorporated into the firms’ respective product lines. Both P&G and Kimberly-Clark have also introduced many innovations directly into new versions of existing products, e.g, tape closures (Pampers 1971), stay-dry lining (Pampers 1976), a waist shield (Pampers 1985), and contoured elastic leg bands (Huggies 1992) (Dyer et al. 2004; Parry & Jones 2001).

The literature on analytically tractable quality ladder models (see footnote 5) assumes that an exogenous profit function is (weakly) increasing in the size of a firm’s lead. In the empirical (Gowrisankaran & Town 1997; Goettler & Gordon 2011; Borkovsky et al. 2017) and computational applied theory (Pakes & McGuire 1994; Markovich 2008; Markovich & Moenius 2009; Borkovsky et al. 2012; Goettler & Gordon 2014) literatures, the (endogenous) static profit function is strictly increasing in a firm’s quality because—as in my model—the marginal utility of quality is constant across consumers.

The literature on endogenous quality choice explores the decisions that firms face in positioning new products relative to their competitors (see p. 141 of Moorthy1988). The literature on quality ladder models explores competition amongst firms that repeatedly invest in R&D to incrementally enhance (or sustain) the quality of existing products while also repeatedly engaging in product market competition.

This insight stems from Referee 2’s comments, for which I am extremely grateful.

The version release decision in this model is analogous to the entry and exit decisions in Doraszelski & Satterthwaite (2010); by assuming that the release cost is random and privately known, I “purify” the mixed strategy equilibria that the model would admit were the release cost fixed (Harsanyi 1973).

Because I restrict attention to symmetric equilibria, all relevant differences between firms are reflected in the industry state ω. Accordingly each firm’s behavior is a function of only the size of its product market advantage/disadvantage and the status of the R&D stock race. For example, firm 1’s behavior in industry state (7,4,2) is identical to firm 2’s behavior in industry state (-7,2,4); in each case, the firm in question has a product market lead of 7 and has an R&D stock lead of 4 to 2.

For this specification, I have found that setting ρ = 0.95 mitigates the effect of the edge of the state space. Alternatively, one could assume s(⋅|ω i R) is binomial, i.e., each unit of R&D stock is successfully incorporated with the same probability (q n = ρ for all n). However, if one uses the binomial specification, then one must assume a much lower success probability in order to successfully mitigate the effects of the edge of the state space. This lower success probability weakens investment incentives on the interior of the state space much more than the generalized binomial specification described above. In this respect, the generalized binomial specification is similar in spirit to the approach taken in Pakes & McGuire (1994), Gowrisankaran & Town (1997), and Borkovsky et al. (2012); see footnote 15.

Reframing the timing of the game does not change the model. Because the model is infinitely repeated, one can define the value function and accordingly derive the Bellman equation from the perspective of any step in the timing of a period—as long as one applies the discount factor β at the beginning of the actual period. Therefore, when deriving the Bellman equation, I apply the discount factor β at the beginning of subperiod 1.

While I have succeeded in computing at least one equilibrium for each parameterization, there is no guarantee that all equilibria have been found.

This simply entails setting \(s(\omega _{i}^{R}|\omega _{i}^{R})=1\) for all \(\omega _{i}^{R}\in \Omega ^{R}\).

This raises the question of why the release probabilities in the top row of Fig. 14 are characterized by any preemption whatsoever. The reason is that there is also uncertainty over the cost of releasing a new version. (Recall that this uncertainty is required to guarantee the existence of an equilibrium in pure strategies.) Hence, a firm that releases a new version can gain a strategic advantage over a rival because to catch up the rival would need to draw a release cost that is low enough to make updating optimal.

Recall that the ω = 0 cross-sections of firm 2’s policy functions are the transposes of those presented for firm 1.

References

Aguirregabiria, V., & Nevo, A. (2013). Recent developments in empirical IO: dynamic demand and dynamic games. In D. Acemoglu, M. Arellano, & E. Dekel (Eds.) Advances in economics and econometrics, 10th world congress (Vol. 3, pp. 53–122). Cambridge: Cambridge University Press.

Aizcorbe, A. (2005). Moore’s Law, competition, and Intel’s productivity in the mid-1990s. American Economic Review Papers and Proceedings, 95(2), 305–308.

Alfonsi, S., Fahy, U., & Brown, K. (2010). Battle for baby’s bottom: diaper wars heat up. ABC News.

Anderson, S., de Palma, A., & Thisse, J. (1992). Discrete choice theory of product differentiation. Cambridge: MIT Press.

Aoki, R. (1991). R&D competition for product innovation: an endless race. American Economic Review, 81(2), 252–256.

Bajari, P., Hong, H., & Nekipelov, D. (2013). Game theory and econometrics: a survey of some recent research. In D. Acemoglu, M. Arellano, & E. Dekel (Eds.) Advances in economics and econometrics, 10th world congress (Vol. 3, pp. 3–52). Cambridge: Cambridge University Press.

Baker, M., Graham, P., Harker, D., & Harker, M. (2000). Marketing: managerial foundations. South Yara: Macmillan Publishers.

Besanko, D., Doraszelski, U., Kryukov, Y., & Satterthwaite, M. (2010). Learning-by-doing, organizational forgetting, and industry dynamics. Econometrica, 78(2), 453–508.

Bhaskaran, S., & Ramachandran, K. (2011). Managing technology selection and development risk in competitive environments. Production & Operations Management, 20(4), 541–555.

Borkovsky, R., Doraszelski, U., & Kryukov, S. (2012). A dynamic quality ladder duopoly with entry and exit: exploring the equilibrium correspondence using the homotopy method. Quantitative Marketing and Economics, 10(2), 197–229.

Borkovsky, R., Goldfarb, A., Haviv, A., & Moorthy, S. (2017). Measuring and understanding brand value in a dynamic model of brand management. Marketing Science, 36(4), 471–499.

Bradsher, K. (2010). China drawing high-tech research from USA. The New York Times.

Bresnahan, T. (2001). Network effects and microsoft, stanford institute for economic policy research discussion paper No. 00-51. Stanford: Stanford University.

Budd, C., Harris, C., & Vickers, J. (1993). A model of the evolution of duopoly: does the asymmetry between firms tend to increase or decrease? Review of Economic Studies, 60(3), 543–573.

Caplin, A., & Nalebuff, B. (1991). Aggregation and imperfect competition: on the existence of equilibrium. Econometrica, 59(1), 26–59.

Chain Drug Review (2010). It’s dueling shavers as Gillette, Schick launches catch on.

Dahremoller, C., & Fels, M. (2015). Product lines, product design, and limited attention. Journal of Economic Behavior and Organization, 119, 437–456.

Doraszelski, U., & Markovich, S. (2007). Advertising dynamics and competitive advantage. RAND Journal of Economics, 38(3), 1–36.

Doraszelski, U., & Pakes, A. (2007). A framework for applied dynamic analysis in IO. In M. Armstrong, & R. Porter (Eds.) Handbook of industrial organization (Vol. 3 pp. 1887–1966). North-Holland, Amsterdam.

Doraszelski, U., & Satterthwaite, M. (2010). Computable Markov-perfect industry dynamics. RAND Journal of Economics, 41(2), 215–243.

Dubé, J., Hitsch, G., & Chintagunta, P. (2010). Tipping and concentration in markets with indirect network effects. Marketing Science, 29(2), 216–249.

Dyer, D., Dalzell, F., & Olegario, R. (2004). Rising tide: lessons from 165 years of brand building at procter & gamble. Boston: Harvard Business School Press.

Elzinga, K., & Mills, D. (1996). Innovation and entry in the US disposable diaper industry. Industrial and Corporate Change, 5(3), 791–812.

Ericson, R., & Pakes, A. (1995). Markov-perfect industry dynamics: a framework for empirical work. Review of Economic Studies, 62, 53–82.

Fried, I. (2009). Microsoft launches IE8 with a smile. CNET News.

Fudenberg, D., Gilbert, R., Stiglitz, J., & Tirole, J. (1983). Preemption, leapfrogging and competition in patent races. European Economic Review, 22, 3–31.

Goettler, R., & Gordon, B. (2011). Does AMD spur Intel to innovate more? Journal of Political Economy, 119(6), 1141–1200.

Goettler, R., & Gordon, B. (2014). Competition and product innovation in dynamic oligopoly. Quantitative Marketing and Economics, 12(1), 1–42.

Gordon, B. (2009). A dynamic model of consumer replacement cycles in the PC processor industry. Marketing Science, 28(5), 846–867.

Gowrisankaran, G., & Town, R. (1997). Dynamic equilibrium in the hospital industry. RAND Journal of Economics, 6(1), 45–74.

Grossman, G., & Shapiro, C. (1987). Dynamic R&D competition. Economic Journal, 97(386), 372–387.

Hansen, E. (2003). Microsoft to abandon standalone IE. CNET News.

Harris, C. (1991). Dynamic competition for market share: an undiscounted model. Working paper, Nuffield College, Oxford University: Oxford.

Harris, C., & Vickers, J. (1985). Perfect equilibrium in a model of a race. Review of Economic Studies, 52(2), 193–209.

Harris, C., & Vickers, J. (1987). Racing with uncertainty. Review of Economic Studies, 54(1), 1–21.

Harsanyi, J. (1973). Games with randomly disturbed payoffs: a new rationale for mixed-strategy equilibrium points. International Journal of Game Theory, 2(1), 1–23.

Hartmann, W., & Nair, H. (2010). Retail competition and the dynamics of demand for tied goods. Marketing Science, 29(2), 366–386.

Hitsch, G. (2006). An empirical model of optimal dynamic product launch and exit under demand uncertainty. Marketing Science, 25(1), 25–50.

Hoover, N. (2006). The fight is on; Internet Explorer 7.0 takes on Firefox 2.0 in a face-off that’s reminiscent of the browser battle of the ’90s. This time, it’s Microsoft’s fight to lose. Information Week.

Hörner, J. (2004). A perpetual race to stay ahead. Review of Economic Studies, 71(4), 1065–1088.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–58.

Hout, T., & Ghemawat, P. (2010). China vs the world: whose technology is it? Harvard Business Review, 88(12), 94–103.

Jansen, J. (2010). Strategic information disclosure and competition for an imperfectly protected innovation. Journal of Industrial Economics, 58(2), 349–372.

Judd, K. (1998). Numerical methods in economics. Cambridge: MIT Press.

Kamien, M., & Schwartz, N. (1972). Timing of innovations under rivalry. Econometrica, 40(1), 43–60.

Lee, R. (2013). Vertical integration and exclusivity in platform and two-sided markets. American Economic Review, 103(7), 2960–3000.

Levitt, T. (1960). Marketing myopia. Harvard Business Review, 38(4), 45–56.

Lippman, S., & McCardle, K. (1987). Dropout behavior in R&D races with learning. RAND Journal of Economics, 18(2), 287–295.

Lippman, S., & McCardle, K. (1988). Preemption in R&D races. European Economic Review, 32, 1661–1669.

Markoff, J. (2001). USA vs. Microsoft: news analysis; making a judgement on a moving target. The New York Times.

Markovich, S. (2008). Snowball: a dynamic oligopoly model with network externalities. Journal of Economic Dynamics and Control, 32(3), 909–938.

Markovich, S., & Moenius, J. (2009). Winning while losing: competition dynamics in the presence of indirect network effects. International Journal of Industrial Organization, 27(3), 346–357.

McCoy, M. (2001). What’s that stuff? Fluoride. Science & Technology, 79(16), 42.

Moorthy, S. (1988). Product and price competition in a duopoly. Marketing Science, 7(2), 141–168.

Moorthy, S., & Png, P. (1992). Market segmentation, cannibalization, and the timing of product introductions. Management Science, 38(3), 345–359.

Morgan, L., Morgan, R., & Moore, W. (2001). Quality and time-to-market trade-offs when there are multiple product generations. Manufacturing & Service Operations Management, 3(2), 89–104.

Nair, H., Chintagunta, P., & Dubé, J. (2004). Empirical analysis of indirect network effects in the market for personal digital assistants. Quantitative Marketing and Economics, 2(1), 23–58.

Neven, D., & Thisse, J. (1990). On quality and variety competition. In J. Gabszewicz, J. Richard, & L. Wolsey (Eds.) Economic decision-making: games, econometrics and optimisation (pp. 175–199). Amsterdam: Elsevier.

Ofek, E., & Sarvary, M. (2003). R&D, marketing and the success of next-generation products. Marketing Science, 2(3), 355–370.

Pakes, A., & McGuire, P. (1994). Computing Markov-perfect Nash equilibria: numerical implications of a dynamic differentiated product model. RAND Journal of Economics, 25(4), 555–589.

Parry, M. (2001). Crest toothpaste: the innovation challenge. Darden Business Publishing.

Parry, M., & Jones, M. (2001). Pampers: the disposable diaper war (A). Darden Business Publishing.

Prendergrast, M. (2000). For God, Country & Coca-Cola: the definitive history of the great American soft drink and the company that makes it. New York: Basic Books.

Qi, S. (2013). The impact of advertising regulation on industry: the cigarette advertising ban of 1971. RAND Journal of Economics, 44(2), 215–248.

Ramachandran, K., & Krishnan, V. (2008). Design architecture and introduction timing for rapidly improving industrial products. Manufacturing & Service Operations Management, 10(1), 149–171.

Richardson, A. (2010). Innovation X: why a company’s toughest problems are its greatest advantage. San Francisco: Jossey Bass.

Rietschel, R., & Fowler, J. (2008). Fisher’s contact dermatitis 6. Hamilton: BC Decker Inc.

Rivkin, S., & Sutherland, F. (2004). The making of a name: the inside story of the brands we buy. New York: Oxford University Press.

Scherer, F. (1967). Research and development allocation under rivalry. Quarterly Journal of Economics, 81, 351–394.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. Review of Economic Studies, 49(1), 3–13.

Sutton, J. (1991). Sunk costs and market structure. Cambridge: MIT Press.

Tirole, J. (1988). The theory of industrial organization. Cambridge: MIT Press.

West, C. (2001). Competitive intelligence. Basingstoke: Palgrave Macmillan.

Wildstrom, S. (2003). On beyond microsoft explorer. Business Week.

Wilson, L., & Norton, J. (1989). Optimal entry timing for a product line extension. Marketing Science, 8(1), 1–17.

Acknowledgments

I am extremely grateful to Mark Satterthwaite, David Besanko, Ulrich Doraszelski, Sarit Markovich, Andrew Ching and Avi Goldfarb for their guidance and feedback. I also thank Guy Arie, Allan Collard-Wexler, J.P. Dubé, Ron Goettler, Paul Grieco, Delaine Hampton, Dan Horsky, Yaroslav Kryukov, Mitch Lovett, Lauren Lu, Karl Schmedders, audiences at numerous conferences and universities, and especially the editor and reviewers for very helpful comments. I gratefully acknowledge financial support from the General Motors Center for Strategy in Management at Northwestern’s Kellogg School of Management and SSHRC Grant 410-2011-0356. I thank Marina Milenkovic for superb research assistance.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In Sections A.1 and A.2, I present details on the dynamic model and on computation that have been omitted from the paper. In Section A.3, I present the equilibrium of the static product market game, including the equilibrium market share functions that have been omitted from Fig. 1 in the paper. In Section A.4, I present a detailed version of the benchmark model that is described in Section 5 of the paper. In Section A.5, I summarize all of the equilibria that I have computed for a fine discretization of a wide range of σ (i.e., degree of horizontal differentiation) values. In Section A.6, I present an alternative version of the static model of product market competition that is based on the Hotelling (1929) “linear city” model. I discuss the benefits of using the Logit model presented in Section 2, as opposed to the Hotelling model, in the baseline specification. I then show that a version of the dynamic model that includes the Hotelling model as its period game admits equilibria that are qualitatively similar to those of the baseline model in Section 2. In Section A.7, I present equilibria of two alternative versions of the dynamic model; each alternative version “turns off” one key feature of the dynamic model so as to help readers better understand its role. In Section A.8, I discuss an example that shows how introducing uncertainty into the version release process mitigates the effects of the edge of the state space.

1.1 A.1 The model: deriving the optimality conditions

In this section, I present the optimization problems that firms face and derive the optimality conditions. An abridged version of this material appears in Sections 2.1 and 2.3.

State-to-state transitions

In each period, the firms’ respective updating and R&D investment decisions determine the industry state that arises in the next period. As explained above, a firm is able to enhance the quality of its product by releasing a new version, which incorporates each unit of the firm’s R&D stock with some probability. Specifically, if firm i possesses \({\omega _{i}^{R}}\) units of R&D stock and it releases a new version, its product quality improves by \(\bar {\omega }_{i}^{R}\in \left \{0,1,...,{\omega _{i}^{R}}\right \} \) units with probability \(s(\bar {\omega }_{i}^{R}|{\omega _{i}^{R}})\). This resets firm i’s R&D stock, \({\omega _{i}^{R}},\) to zero. It follows that:

-

1.

if firm 1 releases a new version and firm 2 does not, the industry state transitions from \(\left (\omega ^{m},{\omega _{1}^{R}},{\omega _{2}^{R}}\right )\) to \(\left (\min \left (\omega ^{m}+\bar {\omega }_{1}^{R},L^{m}\right ),0,{\omega _{2}^{R}}\right )\) with probability \(s\left (\bar {\omega }_{1}^{R}|{\omega _{1}^{R}}\right );\)

-

2.

if firm 2 releases a new version and firm 1 does not, the industry state transitions from \(\left (\omega ^{m},{\omega _{1}^{R}},{\omega _{2}^{R}}\right )\) to \(\left (\max \left (\omega ^{m}-\bar {\omega }_{2}^{R},-L^{m}\right ),{\omega _{1}^{R}},0\right )\) with probability \(s\left (\bar {\omega }_{2}^{R}|{\omega _{2}^{R}}\right );\) and

-

3.

if each firm releases a new version, the industry state transitions from \(\left (\omega ^{m},{\omega _{1}^{R}},{\omega _{2}^{R}}\right )\) to \(\left (\min \left (\max \left (\omega ^{m}+\bar {\omega }_{1}^{R}-\bar {\omega }_{2}^{R},-L^{m}\right ),L^{m}\right ),0,0\right )\) with probability \(s\left (\bar {\omega }_{1}^{R}|{\omega _{1}^{R}}\right )\times s\left (\bar {\omega }_{2}^{R}|{\omega _{2}^{R}}\right ).\)

The max and min functions are included above simply to ensure that transitions are confined to the state space.

In subperiod 2, the industry is initially in state ω ′. Firm i’s R&D stock for the subsequent period, \(\omega _{i}^{R^{\prime \prime }}\), is determined by the stochastic outcome of its investment decision:

where ν i ∈{0, 1} is a random variable governed by firm i’s investment x i ≥ 0. If ν i = 1, the investment is successful and the firm i’s R&D stock increases by one. The probability of success is \(\frac {\alpha x_{i}}{1+\alpha x_{i}}\), where α > 0 is a measure of the effectiveness of investment. To simplify exposition, I define

if \({\omega _{i}^{R}}\in \{0,1,...,L^{R}-1\}\), and q(ν i = 0|x i ,L R) = 1, which simply enforces the bounds of the state space.

Bellman equation

To derive the Bellman equation, I first consider the investment decisions that firms make in subperiod 2 and then the updating decisions that they make in subperiod 1. I let V i (ω,ϕ i ) denote the expected net present value of all future cash flows to firm i in state ω in subperiod 1, immediately after it has drawn release cost ϕ i . Because I solve for a symmetric equilibrium (as explained in Section 2.3), I restrict attention to firm 1’s problem.

Investment decision

At the beginning of subperiod 2, the industry is in state ω ′. The expected net present value of cash flows to firm 1 is

The continuation value is

where

is the expectation of firm 1’s value conditional on an investment success (ν 1 = 1) or failure (ν 1 = 0), and x 2(ω ′) is firm 2’s R&D investment in industry state ω ′. Firm 1 chooses investment x 1 ≥ 0 that maximizes the expected net present value of its future cash flows. Solving firm 1’s optimization problem on the right-hand side of Eq. 2, I find that

if W 1(1|ω ′) ≥ W 1(0|ω ′), and x 1(ω ′) = 0 otherwise, for all ω ′ such that \({\omega _{1}^{R}}\neq L^{R};\) and x(ω ′) = 0 for all ω ′ such that ω1R = L R.

Version release decision

Having solved for firm 1’s optimal investment in subperiod 2, I can now solve for firm 1’s optimal updating decision in subperiod 1. Consider an industry that is in state ω in subperiod 1, after firms have drawn their respective costs of updating. Let \({Y_{1}^{1}}(\boldsymbol {\omega })\) be the expected net present value of all future cash flows to firm 1 in state ω if it decides to update and firm 2 does not; the period profits that firm 1 earns in state ω and the release cost it incurs are not incorporated into \({Y_{1}^{1}}(\boldsymbol {\omega }),\) but are included below in Bellman Eq. 7. Define \({Y_{1}^{2}}(\boldsymbol {\omega })\) similarly, and let \(Y_{1}^{12}(\boldsymbol {\omega })\) be defined analogously for the case in which both firms choose to update. It follows that

Let firm 1’s perceived probability that firm 2 releases a new version of its product, conditional on the current industry state ω be r 2(ω). Firm 1’s value function \(\boldsymbol {V}_{1} : \Omega \times \Phi \rightarrow \mathbb {R}\) is implicitly defined by the Bellman equation

Substituting x 1(ω ′) from Eq. 3 into Eq. 2; U 1(ω ′) from Eq. 2 into Eqs. 4–6; and \({Y_{1}^{1}}(\boldsymbol {\omega })\), \({Y_{1}^{2}}(\boldsymbol {\omega }),\) and \(Y_{1}^{12}(\boldsymbol {\omega })\) from Eqs. 4–6 into Bellman Eq. 7, I determine whether firm 1 chooses to update the good being sold in the product market in industry state ω when it draws release cost ϕ 1. Letting χ 1(ω,ϕ 1) be the indicator function that takes the value of one if firm 1 chooses to update, and zero otherwise, yields

The probability of drawing a ϕ 1 such that χ 1(ω,ϕ 1) = 1 determines the probability of updating or

I can now restate the Bellman equation in terms of firm 1’s expected value function

The expected value function \(\boldsymbol {V}_{1}:\Omega \rightarrow \mathbb {R}\) is implicitly defined by the Bellman equation

where ϕ 1(ω) is the expectation of ϕ 1 conditional on updating in state ω.

Equilibrium

I restrict attention to symmetric Markov perfect equilibria in pure strategies. Theorem 1 in Doraszelski & Satterthwaite (2010) establishes that such an equilibrium always exists.Footnote 50 In a symmetric equilibrium, the investment decision taken by firm 2 in state ω is identical to the investment decision taken by firm 1 in state ω [2] ≡ (−ω m,ω2R,ω1R), i.e., x 2(ω) = x 1(ω [2]). A similar relationship holds for the probability of releasing a new version and the value function: r 2(ω) = r 1(ω [2]) and V 2(ω) = V 1(ω [2]).Footnote 51 It therefore suffices to determine the value and policy functions of firm 1. Solving for an equilibrium for a particular parameterization of the model amounts to finding a value function V 1(⋅) and policy functions x 1(⋅) and r 1(⋅) that satisfy the Bellman Eq. 9 and the optimality conditions 3 and 8.

1.2 A.2 Computation

This section complements Section 3. I present the formal specification of the distribution that determines how many units of R&D stock are successfully incorporated into a new version. I also present additional detail on the algorithm used to compute equilibria.

Uncertainty in the version release process

Recall that if a firm with R&D stock \({\omega _{i}^{R}}\) updates, its product quality improves by \(\bar {\omega }_{i}^{R}\in \left \{ 0,1,...,{\omega _{i}^{R}}\right \} \) with probability \(s(\bar {\omega }_{i}^{R}|{\omega _{i}^{R}})\). I assume that \(s(\cdot |{\omega _{i}^{R}})\) is a generalized version of the binomial distribution; in particular, \(s(\bar {\omega }_{i}^{R}|\omega _{i}^{R})\) is the probability of obtaining exactly \(\bar {\omega }_{i}^{R}\) successes out of \({\omega _{i}^{R}}\) Bernoulli trials that are independent but are not identically distributed. The success probabilities of the \( {\omega _{i}^{R}}\) Bernoulli trials are q 1,\(q_{2},...,q_{\omega _{i}^{R}},\) respectively. Let \(\boldsymbol {q}_{{\omega _{i}^{R}}}\equiv \left (q_{1},q_{2},...,q_{{\omega _{i}^{R}}}\right ) \) for ω i R = 1,...,L R, and let

for \(n=1,...,{\omega _{i}^{R}},\) where ρ ∈ (0, 1). So, the probability that firm i succeeds in incorporating the first unit of its R&D stock into a new version of its product is ρ, the probability that it succeeds in incorporating the second unit is ρ 2 < ρ etc. That is, each additional unit of R&D stock is less likely to be successfully incorporated into a new version than the previous unit.Footnote 52

Algorithm

I compute equilibria using the Gauss-Jacobi version of the Pakes & McGuire (1994) algorithm. To explore the equilibrium correspondence, I nest the Pakes & McGuire (1994) algorithm in a simple continuation method (Judd 1998). The simple continuation method computes one equilibrium for each of a sequence of parameterizations of the model. For example, to compute equilibria for σ ∈{σ 1,σ 2,...,σ T } where σ t−1 ≤ σ t and σ t−1 ≈ σ t , while holding all other parameters fixed, one first solves for an equilibrium for σ = σ 1. This equilibrium serves as the starting point for the simple continuation method. The simple continuation method sequentially solves for an equilibrium for each of σ 2,...,σ T . For each σ t , it uses the equilibrium computed for σ t−1 as the starting point for the Pakes & McGuire (1994) algorithm. In this sense, the simple continuation method provides a systematic approach to selecting starting points for the Pakes & McGuire (1994) algorithm. Running the simple continuation method upward—from σ 1 to σ T —and then downward—from σ T to σ 1—can help identify multiple equilibria; if the model admits multiple equilibria for a given σ value, then the simple continuation method might compute a different equilibrium when approaching σ from the left than it does when approaching σ from the right.

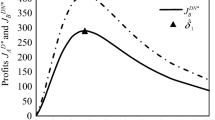

1.3 A.3 Results: product market competition

The (static) equilibrium price and profit functions for low (σ = 0.1), moderate (σ = 2), and high (σ = 4) degrees of horizontal differentiation are presented in Fig. 1 in the paper. Because Fig. 1 does not include the equilibrium market share functions—which play a central role in the discussion in Section 4—I include them in Fig. 9.

1.4 A.4 A benchmark model with no version releases

In this section, I present the benchmark model that is discussed in Section 5. The benchmark model is a simplified version of the dynamic model, in which firms cannot stockpile R&D and accordingly do not make version release decisions. Specifically, I assume that when a firm achieves an R&D success, it is immediately incorporated into its product with certainty and at no additional cost.

The benchmark model is nested in the model in Section 2; to derive the benchmark model, one simply sets the release cost to zero (G l = G u = 0) and the probability that a firm successfully incorporates its entire R&D stock when releasing a new version to one—i.e., \(s({\omega ^{R}_{i}} | {\omega ^{R}_{i}})=1\). In this section, by incorporating these assumptions, I present the benchmark model and derive the Bellman equation and optimality conditions.

In the model in Section 2, firms make version release decisions in subperiod 1 and R&D investment decisions in subperiod 2. For the purposes of the benchmark model, it is convenient to regard a period as beginning with subperiod 2 and concluding at the end of the subsequent subperiod 1.Footnote 53 It follows that firms make R&D investment decisions (in step 5) and then incorporate the successful R&D outcomes (in the subsequent step 4) within the same period. Hence, because the R&D outcomes need not be tracked from period to period, the industry state is simply the product market state ω m.

Because of this reframing, I define ω m as the industry state at the beginning of subperiod 2 and V i (ω m) as the expected net present value of all future cash flows to firm i in state ω m at the beginning of subperiod 2. I let \(\omega ^{m^{\prime }}\) be the industry state at the end of the subsequent subperiod 1. It follows that the law of motion is

where ν i = 1 if firm i’s R&D investment is successful and ν i = 0 otherwise.

As in Section 2.2, because I solve for a symmetric equilibrium, it suffices to solve for the investment optimality condition of only one firm; hence I hereafter restrict attention to firm 1. Firm 1’s value function \(\boldsymbol {V}_{1} : {\Omega ^{m}_{d}} \rightarrow \mathbb {R}\) is defined recursively by the solution to the Bellman equation

where

is firm 1’s expected value in industry state ω m conditional on an R&D investment success (ν 1 = 1) or failure (ν 1 = 0); and x 2(ω m) is the R&D investment of firm 2 in industry state ω m. The min and max operators merely enforce the bounds of the state space.

Solving the maximization problem on the right-hand side of the Bellman Eq. 10, I obtain the following optimality condition for firm 1’s R&D investment x 1(ω m):

if Z 1(1|ω m) − Z 1(0|ω m) ≥ 0, and x 1(ω m) = 0 otherwise. (Because I solve for a symmetric equilibrium, x 2(ω m) = x 1(−ω m)). Solving for an equilibrium for a particular parameterization of the model amounts to finding a value function V 1(⋅) and policy functions x 1(⋅) that satisfy the Bellman Eq. 10 and the optimality condition 11 for all industry states ω m ∈ Ωd m.

1.5 A.5 The equilibrium correspondence

I thoroughly explore the effects of horizontal product differentiation on equilibrium behavior by computing equilibria for the baseline parameterization with a wide range of σ values, in particular, σ ∈{0.1, 0.2,…, 8}. In Fig. 10, I summarize each equilibrium computed using the size of the leader’s expected lead after 30 periods (the industry’s expected lifespan), L 30. Figure 10 shows that I have found several regions in which there are multiple equilibria, including one region (around σ = 2) in which there are up to four equilibria.Footnote 54

When the degree of horizontal differentiation is sufficiently low (σ ≤ 0.7), the equilibria are qualitatively similar to the preemptive equilibrium in Fig. 3. At intermediate levels of horizontal differentiation (0.8 ≤ σ ≤ 2.6), the equilibria are qualitatively similar to the accommodative equilibrium in Fig. 5. Finally, when the degree of horizontal differentiation is sufficiently high (σ ≥ 2.7), I have found up to three qualitatively different equilibria resembling those presented in Fig. 7.

By analyzing the four equilibria computed for the σ = 2 parameterization, I am able to provide a deeper understanding of the accommodative equilibrium. Figure 5 shows that in the ω m = 0 cross-section of the accommodative equilibrium, accommodative trenches arise at R&D stock levels of 1 and 4. This raises the following question: why do accommodative trenches arise at some levels of R&D stock and not others? In this case, is there something particularly special about R&D stock levels of 1 and 4? (I will show that the answer is “no”.)

It is difficult to discern the four equilibria for the σ = 2 parameterization in Fig. 10 because the corresponding values of L 30 are very similar: 9.5293, 9.8002, 9.8421, and 9.8816. One of these equilibria (L 30 = 9.8421) is the accommodative equilibrium presented in Fig. 5. The other three equilibria are qualitatively similar, the only difference being that the accommodative trenches arise at different R&D stock levels. This shows that for a given parameterization that admits accommodative equilibria, there can be several such equilibria, differing only in the locations of the accommodative trenches.

1.6 A.6 An alternative model of product market competition: Hotelling with heterogeneous vertical qualities

The Logit demand model presented in Section 2.1 can be reinterpreted as an address model (Anderson et al. 1992); i.e., each consumer’s individual preferences are reflected by her fixed (𝜖 1,𝜖 2) values (her “location”), and the joint distribution of (𝜖 1,𝜖 2) reflects the distribution of taste heterogeneity among consumers. In this section, I present an alternative model of static price competition that incorporates both horizontal and vertical differentiation and that is rooted in a different address model—specifically, a Hotelling (1929) “linear city” model in which firms have fixed locations (at opposite ends of the Hotelling line) and different vertical qualities. I show that this model’s equilibrium profit function is qualitatively similar to the profit function of the Logit period game presented in Section 2.1. I then show that the equilibria of the corresponding dynamic model (which includes the Hotelling model as its period game) are qualitatively similar to the equilibria of the dynamic model presented in the paper.

The model

A unit mass of consumers is uniformly distributed over the unit interval [0, 1]. Firm 0 (1) is located at x = 0 (x = 1) and sells a product of quality \({\omega ^{m}_{0}}\) (ω1m). Let \(\omega ^{m}\equiv {\omega _{1}^{m}}-{\omega _{0}^{m}}\) denote the size of firm 1’s quality advantage. Each firm faces a constant marginal cost of production of c > 0. Let p 0 and p 1 denote the firms’ respective prices. A consumer incurs transportation cost t per unit of distance. I assume that the market is covered, i.e., each consumer buys one unit of one product. A consumer located at x ∈ [0, 1] receives utility \(U_{0}(x)={\omega ^{m}_{0}}-p_{0}-tx\) from consuming firm 0’s product and \(U_{1}(x)={\omega ^{m}_{1}}-p_{1}-t(1-x)\) from consuming firm 1’s product. Each firms sets price to maximize profits.

The equilibrium profit function

It is straightforward to show that the consumer who is indifferent between the products of firms 1 and 2 is located at \(\bar {x}=\frac {t - \omega ^{m} + p_{1} - p_{0}}{2t}\). It follows that the firms face demand functions

and

It is straightforward to solve each firms’ profit maximization problem and, thereafter, to solve for the equilibrium price, demand, and profit functions. Firms are symmetric, hence I will restrict attention to firm 1. Firms 1’s equilibrium price function is

Firm 1’s equilibrium demand function is

Firm 1’s equilibrium profit function is

I take the standard approach of deriving conditions on parameter values that ensure that the equilibrium prices \(p_{0}^{*}\) and \(p_{1}^{*}\) constitute an interior solution, i.e., \(D_0(p_0^*,p_1^*) \in [0,1]\) and accordingly \(D_1(p_0^*,p_1^*) \in [0,1]\). I find that assuming \(t \geq \frac {|\omega ^{m}|}{3}\) guarantees an interior solution.

The profit function 14 is qualitatively similar to the profit function of the Logit period game presented in the paper. First, profit is a function of only the difference between firms’ respective product qualities, ω m—not their absolute product qualities \({\omega ^{m}_{0}}\) and \({\omega ^{m}_{1}}\). This follows directly from the assumptions (made in both models) that there is no outside good and that utility is linear in quality.

Second, the profit function is convex in the size of a firm’s lead. This shows that the convexity of the Logit model’s profit function (see Fig. 1) is not simply an artifact of the exponential nature of the Logit model. Rather, as the Hotelling model demonstrates, the convexity reflects the fact that an increase in a firm’s quality advantage gives rise to both a higher equilibrium price (see Eq. 12) and—despite the higher price—a higher quantity demanded (see Eq. 13).

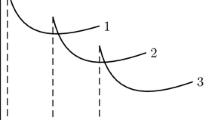

Third, an increase in the degree of horizontal differentiation (as reflected by the transportation cost t in the Hotelling model) has a qualitatively similar impact on profit in both models. To illustrate, I assume ω m ∈ [−20, 20] and present the profit functions for \(t=\frac {20}{3}\) and t = 17 in Fig. 11. Comparing these profit functions to the profit functions presented in Fig. 1, we see that in both models, an increase in the degree of horizontal differentiation tends to increase profits and makes the profit function less convex.

As explained above, because I make the standard assumption that the equilibrium prices constitute an interior solution, I impose the condition \(t \geq \frac {|\omega ^{m}|}{3}\). When ω m ∈ [−20, 20], I set \(t \geq \frac {20}{3}\) so as to ensure that this condition is satisfied for all ω m values. Because of this condition, I can reduce the degree of horizontal differentiation in the Hotelling model only so much. This is reflected in the profit function for \(t=\frac {20}{3}\) presented in Fig. 11, which is qualitatively similar to the one presented in Fig. 1 for σ = 2. It is characterized by moderate horizontal differentiation, which is reflected by the fact that the leader’s (follower’s) profit increases (declines) relatively slowly as the leader’s lead increases. Because of the \(t \geq \frac {20}{3}\) condition, the model does not admit an interior solution that gives rise to an equilibrium profit function similar to the one presented in Fig. 1 for σ = 0.1. Rather, a lower degree of horizontal differentiation can only be incorporated if one allows for corner solutions in which one firm captures the entire market (which gives rise to a kinked profit function). This highlights the benefit of using the Logit model of product market competition presented in Section 2, i.e., it is straightforward to generate wide variation in the degree of horizontal differentiation because one can easily solve for an interior solution for any σ > 0.

Equilibria of the dynamic model

As explained in Section 2, the prices firms set in the (static) product market game do not impact state-to-state transitions in the dynamic model. Hence the period game profit function can be treated as a “primitive” of the dynamic model; i.e., for the purposes of the dynamic model, it is as if the period game profit function is exogenous (see p. 1892 of Doraszelski & Pakes 2007). It follows that two different models of product market competition that give rise to qualitatively similar profit functions should yield qualitatively similar equilibria of the dynamic model. To verify this for the Hotelling model, I compute equilibria of the dynamic model for the two profit functions presented in Fig. 11 (holding all dynamic model parameters equal to their baseline values) and present them in Fig. 12.

Equilibria of dynamic model with Hotelling period game for \(t=\frac {20}{3}\) (top row) and t = 17 (bottom row). ω m = 0 cross-sections of policy functions for R&D investment x 1(ω) (left panels) and release probability r 1(ω) (middle panels). Transient distributions μ t m(ω m) for t = 30 and t = 100 (right panels)

Although they differ in terms of their scales, the profit functions for \(t=\frac {20}{3}\) and t = 17 in Fig. 11 are qualitatively similar to those for σ = 2 and σ = 4 in Fig. 1. Figure 12 shows that the corresponding equilibria of the dynamic model are similar as well. The dynamic model equilibrium for \(t=\frac {20}{3}\) in the top row of Fig. 12 is qualitatively similar to the one for σ = 2 in Fig. 5 in that they are both characterized by moderate preemption and phases of accommodation. The dynamic model equilibrium for t = 17 in the bottom row of Fig. 12 is qualitatively similar to the one for σ = 4 in second row of Fig. 7 in that they are both characterized by asymmetric R&D wars. (I present only one equilibrium for the t = 17 parameterization because I have not searched for multiplicity.) As explained above, the Hotelling model does not admit an interior solution that gives rise to an equilibrium profit function similar to the one presented in Fig. 1 for σ = 0.1; hence, the corresponding dynamic model does not admit an equilibrium characterized only by intense preemption races, like the one presented in Fig. 3.

1.7 A.7 Alternative versions of the dynamic model

In this section, I present results for two alternative versions of the dynamic model. The results and the related discussions are useful in two respects. First, they help readers understand why some of the key assumptions made in the dynamic model are needed. Second, they help readers better understand the intuitions that underly the results presented in the paper.

First, I present results for a version of the model with a much smaller state space. The results shows that a model with a small state space is not rich enough to admit the behaviors described in Section 6. Second, I present results for a version of the model in which there is no uncertainty in the version release process; i.e., when a firm releases a new version, it always succeeds in incorporating its entire R&D stock. I use these results to explain the impact of uncertainty in the version release process on firm behavior. I then show that the equilibria of this version of the model are qualitatively similar to the corresponding equilibria presented in the paper.

1.7.1 A.7.1 A smaller state space

In this section, I explore whether the equilibrium behaviors described in Section 6 would arise in a model with a much smaller state space. I make the state space as small as possible while still allowing for the accumulation of R&D successes; i.e., I set L R = 2, which implies that \({\omega ^{R}_{i}} \in \{0,1,2\}\), and L m = 2, which implies that ω m ∈{−2,…, 2}. So, each firm can possess either 0, 1, or 2 units of R&D stock and can hold a product market lead of either 0, 1 or 2 units.

Figure 13 presents equilibria for the baseline parameterization with σ = 0.1, 2, and 4, which correspond to the equilibria presented in Figs. 3, 5 and 7. (The corresponding period profit functions are simply the profit functions in Fig. 1 confined to ω m ∈{−2,…, 2}. I present only one equilibrium for the σ = 4 parameterization because I have not searched for multiplicity.) Fig. 13 shows that the model with a small state space does not admit any of the behaviors described in Section 6: preemption races, phases of accommodation, and asymmetric R&D wars.

Model with a smaller state space. Equilibria for σ = 0.1(top row), σ = 2(middle row), and σ = 4(bottom row). ω m = 0 cross-sections of policy functions for R&D investment x 1(ω)(left panels) and release probability r 1(ω)(middle panels). Transient distributions μ t m(ω m) for t = 30 and t = 100(right panels)

The discussion of these behaviors in Section 6 suggests that they arise only if the state space is much larger because the model then provides a sufficiently rich reflection of how changes in the competitive positioning of firms impact their period profits and accordingly their investment and updating incentives. In other words, the dynamic incentives that firms face can differ drastically depending on whether the leader’s advantage is non-existent, small, moderate, large, very large etc.

Figure 13 presents equilibria for a “smaller” model. Alternatively, one could consider a “coarser” model, i.e., one with a coarser discretization of the state space. Instead of restricting attention to the product market states ω m ∈{−2,−1, 0, 1, 2}, one could restrict attention to the states ω m ∈{−20,−10, 0, 10, 20}. I have found that equilibria of a coarser model are qualitatively similar to those presented in Fig. 13 (just, expectedly, with higher investment levels and updating probabilities) and accordingly do not admit the behaviors described in Section 6. These results are available upon request.

1.7.2 A.7.2 No uncertainty in version releases

In this section, I explore a version of the model in which there is no uncertainty in the version release process. That is, whenever a firm releases a new version, it successfully incorporates its entire R&D stock.Footnote 55 Figure 14 presents equilibria for the baseline parameterization with σ = 0.1, 2, and 4, which correspond to the equilibria presented in Figs. 3, 5 and 7.

Model with no uncertainty in version releases. Five equilibria, for σ = 0.1 (top row), σ = 2 (second row), and σ = 4(rows 3-5). ω m = 0 cross-sections of policy functions for R&D investment x 1(ω)(left panels) and release probability r 1(ω) (middle panels). Transient distributions μ t m(ω m) for t = 30 and t = 100 (right panels)

I first explain the effect of uncertainty in the version release process on firm behavior. I then explain that aside from this effect, these equilibria are qualitatively similar to the corresponding equilibria presented in the paper. Finally, in Section A, I use these results to explain how this uncertainty mitigates the effect of the edge of the state space.

The top row of Fig. 14 presents the equilibrium for a low degree of horizontal differentiation (σ = 0.1). It is similar to the corresponding equilibrium in Fig. 3 in that it is characterized by preemption in terms of both R&D investment and release probabilities. However, there are two qualitative differences. First, the R&D preemption is more intense in the sense that firms invest more heavily in R&D during a preemption race and the preemption race comes to an end more quickly. Second, the preemption in terms of release probabilities is milder.

I will first explain why eliminating uncertainty from the version release process makes R&D preemption more intense. If a firm’s entire R&D stock is successfully incorporated when it releases a new version, then R&D investment becomes a more effective tool for enhancing product quality and, accordingly, for building a lead over a rival in hopes of inducing that rival to give up. This gives rise to stronger investment incentives when neither firm has too large a lead. The preemption race ends more quickly because a smaller R&D stock advantage is required to induce a rival to give up, simply because the rival recognizes that that R&D stock advantage will necessarily be translated into a quality advantage in the product market.

To understand why eliminating uncertainty from the version release process gives rise to milder preemption in terms of release probabilities, recall that firms engage in preemption for purely strategic reasons and that the strategic benefit of a version release stems directly from the fact that it is uncertain (see Section 6.1.1). In the absence of uncertainty, while a version release does allow a firm to gain a quality advantage in the product market, it compromises its ability to gain a strategic advantage.Footnote 56

Except for the effects of eliminating uncertainty that are described above, the equilibria presented in rows 2-5 of Fig. 14 are qualitatively similar to the corresponding equilibria in Section 6. The equilibria is the second and third rows of Fig. 14 are characterized by preemption and phases of accommodation just like the ones in Fig. 5 and the top row of Fig. 7. The equilibrium in the fourth row of Fig. 14 is characterized by asymmetric R&D wars (as well as some mild R&D preemption stemming from the first effect described above) just like the equilibrium in the second row of Fig. 7. The equilibrium in the bottom row of Fig. 14 is characterized by mild R&D preemption and asymmetric R&D wars just like the equilibrium in the bottom row of Fig. 7. Accordingly, the short- and long-run industry structures presented in the right column of Fig. 14 are qualitatively similar to the industry structures of the corresponding equilibria presented in Section 6.

1.8 A.8 The effect of the edge of the state space

In this section, I discuss an example that shows how introducing uncertainty into the version release process mitigates the effects of the edge of the state space. Consider the equilibrium in the third row of Fig. 14. In industry state (0, 10, 9), firm 1 holds a small R&D stock lead over firm 2, but cannot increase this lead further because it has already achieved the highest possible R&D stock level. Because its only recourse is to release a new version, it does so with very high probability (specifically, probability 1). This gives rise to perverse R&D investment incentives for firm 2; in industry states near (0, 10, 9), firm 2 invests very heavily in R&D in hopes of avoiding industry state (0, 10, 9).Footnote 57 Firm 1 best responds by investing heavily and updating with high probability in nearby states.

Comparing this equilibrium with the corresponding equilibrium in the top row of Fig. 7 shows that incorporating uncertainty into the version release process mitigates the perverse investment and updating incentives caused by the edge of the state space. Specifically, in the presence of uncertainty, the incentives that firm 1 faces in industry state (0, 10, 9) are not as different from those it faces in neighboring state (0, 9, 9) because in both states it understands that it is unlikely to successfully incorporate its entire R&D stock when it releases a new version.

Rights and permissions

About this article

Cite this article

Borkovsky, R.N. The timing of version releases: A dynamic duopoly model. Quant Mark Econ 15, 187–239 (2017). https://doi.org/10.1007/s11129-017-9186-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-017-9186-9