Abstract

Economists acknowledge that technical progress and growth in capital inputs increase labour productivity (LP). However, less focus is given to the realization that changes in labour input alone could also affect LP. Because this effect disappears when the short-run technology exhibits constant returns to scale, we call it the returns to scale effect. We decompose growth in LP into three contributing factors: (1) technical progress, (2) capital input growth and the (3) returns to scale effect. We propose theoretical measures for these three components and show that they coincide with the index number formulae consisting of prices and quantities of inputs and outputs. Subsequently, we apply the results of our decomposition to US industry data for 1987–2009. LP in the services sector is shown to grow much slower than that in the goods sector during the 1987–1995 productivity slowdown period. We conclude that the returns to scale effect can considerably explain the gap in LP growth between the two industry groups.

Similar content being viewed by others

1 Introduction

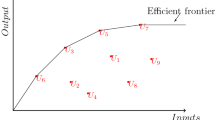

Economists broadly regard productivity as measuring the current state of the technology used in producing a firm’s goods and services. The production frontier, consisting of inputs and the maximum output attainable from them, characterises the prevailing state of the technology. Productivity growth is often identified by a shift in the production frontier, reflecting changes in production technology.Footnote 1 However, movement along the production frontier also can derive productivity growth.Footnote 2

Even in the absence of changes in the production frontier, changes in production inputs can yield productivity growth, moving along the production frontier and making use of its curvature. Productivity growth induced by movement along the production frontier is called the returns to scale effect. This effect does not reflect changes in the production frontier. Thus, to properly evaluate improvements in the underlying production technology reflecting a shift in the production frontier, we must disentangle the returns to scale effect from overall productivity growth.

Productivity measures can be classified into total factor productivity (TFP) and partial factor productivity (PFP). The former relates a bundle of total inputs to outputs; the latter relates a portion of total inputs to outputs. This study deals with labour productivity (LP) among several measures of PFP. LP is output per labour input in the simple one-output, one-labour-input case. Economy-wide LP is the critical long-run determinant of a country’s standard of living. For example, throughout US economic history, increases in LP have translated to nearly one-for-one increases in per capita income over long periods.Footnote 3 The importance of LP for the advancement of economic wellbeing prompts researchers to investigate the determinants of its growth. Technical progress and growth in capital inputs have been emphasised as primary determinants of a country’s LP growth over long periods (Jorgenson and Stiroh 2000; Jorgenson et al. 2008) and of variations in LP across countries (Hall and Jones 1999; Kumar and Russell 2002; Henderson and Russell 2005).Footnote 4 This paper adds another explanatory factor to LP growth.

LP relates labour input to outputs. The short-run production frontier, which consists of labour input and the maximum output attainable from it, represents the capacity of current technology to translate labour input into outputs. Both technical progress and capital input growth induce LP growth throughout the shift in the short-run production frontier. Their role for enhancing LP growth is widely discussed, as mentioned above. However, the returns to scale effect—LP growth induced by movement along the short-run production frontier—has never been exposed.

We decompose LP growth into three contributing factors: (1) technical progress, (2) capital input growth and the (3) returns to scale effect.Footnote 5 First, we propose theoretical measures representing the three factors using the output distance functions. Second, we derive index number formulae consisting of prices and quantities and show that they coincide with theoretical measures, assuming the translog functional form for the output distance function and the firm’s profit-maximising behaviour.

Our approach to implementing theoretical measures is drawn from Caves, Christensen and Diewert (1982). Using distance functions, they formulated the (theoretical) Malmquist productivity index that measures the shift in the production frontier. They show that the Malmquist and Törnqvist productivity indexes coincide, assuming the translog functional form for the distance functions and the firm’s profit-maximising behaviour.Footnote 6

The Törnqvist productivity index is a measure of TFP growth calculated by the Törnqvist quantity indexes. It is an index number formula consisting of prices and quantities of inputs and outputs. Equivalence between the Malmquist and Törnqvist productivity indexes breaks down if the underlying technology does not exhibit constant returns to scale. Caves et al. showed that the difference in these productivity indexes depends on the degree of returns to scale in underlying technology, which captures the curvature of the production frontier. Thus, following Diewert and Nakamura (2007) and Diewert and Fox (2010), we interpret that Caves et al. decomposed TFP growth calculated by the Törnqvist productivity index into the Malmquist productivity index and the returns to scale effect.Footnote 7 The former component captures TFP growth induced by the shift in the production frontier. The latter component, which is the difference between the Malmquist and Törnqvist productivity indexes, captures TFP growth induced by movement along the production frontier, exploiting its curvature.

Caves et al.’s formula for the returns to scale effect appeared as the residual of two indexes, and they did not explicitly model the effect using the underlying production frontier. However, other studies model the growth in TFP induced by movement along the underlying production frontier, but they adopt different approaches to estimating the modelled returns to scale effect rather than rely on index number formulae. Lovell (2003) modelled the returns to scale effect using the input and output distance functions, and designated this as the scale effect or activity effect. In Balk’s (2001) decomposition of TFP growth, the product of scale efficiency change and input mix effect, or that of scale efficiency change and output mix effect, summarised TFP growth induced by movement along the production frontier, thus it can be interpreted as the returns to scale effect.Footnote 8

Although scholars have recognised the significance of the returns to scale effect for TFP growth, its effect on LP growth has never been addressed even though it is more important to explain LP growth than it is to explain TFP growth. When the underlying technology exhibits constant returns to scale, the returns to scale effect disappears from the TFP growth. However, it still influences LP growth because the short-run production frontier is unlikely to exhibit constant returns to scale even if the underlying technology does exhibit constant returns to scale.

Triplett and Bosworth (2004, 2006) and Bosworth and Triplett (2007) observed that LP growth in the US services sector has lagged behind the goods sector since the early 1970 s. Because there are three underlying factors to LP growth, as discussed above, different explanations might account for stagnated LP growth, depending on the factor emphasised. We apply our decomposition result to US industry data to compare relative contributions of the three contributing factors.

Section 2 discusses how to measure the joint effect of technical progress and capital input growth and derives an index number formula for measuring it. Section 3 discusses how to measure the returns to scale effect and derives an index number formula for measuring it. Subsequently, we show that the product of the joint effect of technical progress and capital input growth, and the returns to scale effect coincides with LP growth. Section 4 further decomposes the joint effect of technical progress and capital input growth into two components. It leads to the complete decomposition of the LP growth into three components. Section 5 includes the application to US industry data. Section 6 presents conclusions.

2 Joint Effect of Technical Progress and Capital Input Growth

We begin by considering the joint effect of technical progress and capital input growth on LP growth. Both technical progress and capital input growth positively affect the productive capacity of labour, raising LP. The short-run production frontier indicates maximum output, using a specified quantity of labour given currently available capital input and technology. Thus, both technical progress and capital input growth shift the short-run production frontier outward by increasing the output attainable from a given labour input. The greater the outward shift of the short-run production frontier, the greater the LP growth. Thus, the joint effect of technical progress and capital input growth is captured throughout by measuring the distance between the short-run production frontiers of two periods.

A firm is considered to be a productive entity, transforming inputs into outputs. We assume there are M (net) outputs, y ≡ (y 1,…,y M ), N types of capital inputs, x K ≡ (x K,1,…,x K,N ), and one type of labour input, x L Outputs include intermediate inputs. If output m is an intermediate input, then y m < 0. If the output is not an intermediate input but a (gross) output, then y m > 0. We assume that outputs and inputs are non-zero, such that y m ≠ 0 for all m, x K,n ≠ 0 for all n and x L ≠ 0.Footnote 9 The technology at period t is represented by the period t technology set S t defined as

It consists of all feasible combinations of inputs and outputs. We assume S t satisfies convexity and Färe and Primont’s (1995) axioms that guarantee the existence of distance functions.

The period t output distance function for t = 0 and 1 is defined as follows:

Given capital inputs \(\varvec{x}_{K}\) and labour input x L , \(D^{t} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\) is the minimum contraction of outputs \(\varvec{y}\) enabling the contracted outputs \(\varvec{y}/D^{t} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\), capital inputs \(\varvec{x}_{K}\) and labour input x L to fall on the period t production frontier. If \(\left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\) is on the period t production frontier, then \(D^{t} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right) = 1\). Note that \(D^{t} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\) is linearly homogeneous in \(\varvec{y}\).

While the period t output distance function is constructed to relate to the period t production frontier, we can relate it to the period t short-run production frontier. Given a labour input x L , \(D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L} } \right)\) is the minimum contraction of outputs \(\varvec{y}\) causing contracted outputs \(\varvec{y}/D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L} } \right)\) and labour input x L to fall on the period t short-run production frontier. Thus, \(D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L} } \right)\) provides a radial measure of the distance from \(\varvec{y}\) to the period t short-run production frontier. We measure the shift in the short-run production frontier by comparing the radial distances from \(\varvec{y}\) to the short-run production frontiers of periods 0 and 1, defined asFootnote 10

If technical progress and capital input growth affirmatively affect the productive capacity of labour between periods 0 and 1, then the short-run production frontier shifts outward. Given labour input x L , more outputs can be produced. Thus, the minimum contraction factor for given outputs \(\varvec{y}\) declines such that \(D^{1} \left( {\varvec{y},\varvec{x}_{K}^{1} ,x_{L} } \right) \le D^{0} \left( {\varvec{y},\varvec{x}_{K}^{0} ,x_{L} } \right)\), thereby leading to \(SHIFT\left( {\varvec{y},x_{L} } \right) \ge 1\). Similarly, the negative joint effect of technical progress and capital input growth leads to \(SHIFT\left( {\varvec{y},x_{L} } \right) \le 1\).

Each choice of reference vectors \(\left( {\varvec{y},x_{L} } \right)\) might generate a different measure of the shift in the short-run production frontier from periods 0 to 1. We calculate two measures using different reference vectors \(\left( {\varvec{y}^{0} ,x_{L}^{0} } \right)\) and \(\left( {\varvec{y}^{1} ,x_{L}^{1} } \right)\). Because these reference outputs and labour inputs are, in fact, chosen in each period, they are equally reasonable. Following Fisher (1922) and Caves et al. (1982), we use the geometric mean of these measures as a theoretical measure of the joint effect of technical progress and capital input growth SHIFT as followsFootnote 11:

Given a quantity of labour input, the ratio of output attainable from such a labour input at period 1 to output attainable at period 0 represents the extent to which the short-run production frontier expands. SHIFT is the geometric mean of those ratios conditional on x 0 L and x 1 L .

SHIFT is a theoretical measure defined by the unknown distance functions, and there are several methods of implementing them. We show that the theoretical measure coincides with a formula of price and quantity observations under the assumption of the firm’s profit-maximising behaviour and the translog functional form for the output distance function.Footnote 12 This is the way that Caves et al. demonstrated the equivalence between the Malmquist and Törnqvist productivity indices.Footnote 13 Our result can be considered to be a corollary of Caves et al.’s findings. However, since we apply the same strategy throughout the paper, we outline below how to compute SHIFT under two assumptions for completeness of the discussion.

First, we assume the firm’s profit-maximising behaviour. Thus, \(\left( {\varvec{y}^{t} ,\varvec{x}_{K}^{t} ,x_{L}^{t} } \right)\) is a solution to the following period t profit-maximisation problem for \(t = 0\) and 1:

Outputs are sold at positive producer prices \(\varvec{p } \equiv \varvec{ }\left( {p_{1} , \ldots ,p_{M} } \right) \in {\Re }_{ + + }^{M}\) and capital inputs and labour input are purchased at positive rental prices \(\varvec{r } \equiv \varvec{ }\left( {r_{1} , \ldots ,r_{N} } \right) \in {\Re }_{ + + }^{N}\) and at positive wage \(w \in {\Re }_{ + + }\). The period t profit-maximisation problem yields the following first-order conditions for t = 0 and 1Footnote 14:

Equations (6)–(8) allow us to compute derivatives of the output distance function without knowing the output distance function itself. Information concerning the derivatives is useful for calculating values of the output distance function.

Second, we assume the translog functional form with time-invariant second-order coefficients for the period t output distance function for \(t = 0\) and 1, defined as follows:

with the usual restrictions to ensure linear homogeneity in output quantities.Footnote 15

The translog functional form characterised in (9), is a flexible functional form, enabling it to approximate an arbitrary output distance function to the second order at an arbitrary point. Thus, the assumption of this functional form does not harm the generality of the output distance function. Note that the coefficients for the linear terms and the constant term are allowed to vary across periods. Technical progress under the translog distance function is by no means limited to Hicks neutral, and various types of technical progress are allowed.

The translog functional form allows us to represent a theoretical measure SHIFT by the derivatives of output distance functions, which are computable from Eq. (6) and (8). Thus, under the assumptions of profit-maximising behaviour and the translog functional form, we can compute a theoretical measure SHIFT from price and quantity observations, as shown by the following proposition. Its proof is sketched in “Appendix 1”.

Proposition 1 (Corollary of Caves et al. 1982)

Footnote 16 Assume that a firm follows profit-maximising behaviour in periods \(t = 0\) and 1, as in Eq. ( 5 ). Also, assume that output distance functions D 0 and D 1 have the translog functional form with time-invariant second-order coefficients, as defined by Eq. ( 9 ). Then the joint effect of technical progress and capital input growth SHIFT can be computed from observed prices and quantities as follows Footnote 17:

where s m is the average value-added shares of output m and s L is the average value-added shares of labour compensation between periods 0 and 1, such that

The index number formula in Eq. (10) can be interpreted as the ratio of a quantity index of output to that of labour input. No data for price and quantity of capital inputs appear in this formula. Although the shift in the short-run production frontier reflects technical progress as well as the change in capital input, we can measure its shift without explicitly resorting to capital input data.

3 Returns to Scale Effect and Decomposition of LP Growth

The shift in the short-run production frontier is not the only factor contributing to growth in LP. Even when there is no change in the short-run production frontier, movement along the short-run frontier could raise LP, exploiting the curvature of the short-run production frontier. LP growth induced by movement along the short-run production frontier is the returns to scale effect. In the simple model, featuring one output and one labour input, LP is deemed as output per one unit of labour input. Therefore, LP growth, the growth rate of LP from the previous to the current period, coincides with the ratio of the growth rate of output to the growth rate of labour input. Because the returns to scale effect is LP growth induced by movement along the short-run production frontier, it is computed by the growth rates of output and labour input between the two endpoints of the movement.

We generalise the growth rate of outputs between two points on the period t short-run production frontier. In the multiple-outputs case, outputs attainable from a given labour input x L are not uniquely determined by the short-run production frontier. Output isoquant \(ISOQ\ P^{t} \left( {x_{L} } \right)\) is the portion of the period t short-run production frontier conditional on labour input x L and it consists of the set of outputs \(\varvec{y}\) attainable from x L using capital inputs and technology available at period t. It is defined as

Because \(D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L} } \right)\) provides a radial measure of the distance between \(\varvec{y}\) and the period t short-run production frontier conditional on x L , it also can be interpreted as a radial measure of the distance between \(\varvec{y}\) and \(ISOQ\ P^{t} \left( {x_{L} } \right)\). We construct the counterpart of the growth rate of outputs between two points on the period t short-run production frontier by measuring the distance between \(ISOQ\ P^{t} \left( {x_{L}^{0} } \right)\) and \(ISOQ\ P^{t} \left( {x_{L}^{1} } \right)\). We begin with the reference outputs vector \(\varvec{y}\). We measure the distance between \(ISOQ\ P^{t} \left( {x_{L}^{0} } \right)\) and \(ISOQ\ P^{t} \left( {x_{L}^{1} } \right)\), comparing the radial distance from \(\varvec{y}\) to \(ISOQ\ P^{t} \left( {x_{L}^{0} } \right)\) and the radial distance from \(\varvec{y}\) to \(ISOQ\ P^{t} \left( {x_{L}^{1} } \right)\). This is defined as

If labour input growth allows a firm to produce more outputs while holding capital input fixed and using the same technology, then the set of outputs attainable from x 1 L , \(ISOQ\ P^{t} \left( {x_{L}^{1} } \right)\) shifts outwards to that of outputs attainable from x 0 L , \(ISOQ\ P^{t} \left( {x_{L}^{0} } \right)\). Thus, the minimum contraction factor for given outputs \(\varvec{y}\) declines, such that \(D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L}^{1} } \right) \le D^{t} \left( {\varvec{y},\varvec{x}_{K}^{t} ,x_{L}^{0} } \right)\), leading to \(OUTPUT\left( {t,\varvec{y}} \right) \ge 1\). Similarly, if the change in labour input allows a firm to produce less output while holding capital input fixed and using the same technology \(ISOQ\ P^{t} \left( {x_{L}^{1} } \right)\), shifts inward to \(ISOQ\ P^{t} \left( {x_{L}^{0} } \right)\) leading to \(OUTPUT\left( {t,\varvec{y}} \right) \le 1\).

Using the counterparts of the growth rate of outputs between two points on the period t short-run production frontier, we can propose a measure for LP growth between these two points. When we consider movement along the period t short-run production frontier and use outputs \(\varvec{y}\) as reference, the returns to scale effect is defined as followsFootnote 18:

Each choice of reference short-run production frontier and reference output vector \(\varvec{y}\) may generate a different measure of the returns to scale effect between two periods 0 and 1. We calculate two measures using short-run production frontiers and output vectors available at the same period. The first is the period 0 short-run production frontier and period 0 output vector \(\varvec{y}^{0}\); the second is the period 1 short-run production frontier and period 1 output vector \(\varvec{y}^{1}\). Because these sets of short-run production frontiers and output vectors are equally reasonable, we use the geometric mean of these measures as a theoretical measure of the returns to scale effect SCALE as follows:

Given the period t short-run production frontier, the ratio of the LP associated with x 1 L to the LP associated with x 0 L represents LP growth induced by movement along the period t short-run production frontier. SCALE is the geometric mean of those ratios conditional on the period 0 and 1 short-run production frontiers.

SCALE is also a theoretical measure defined by the unknown distance functions like SHIFT, and there are several methods of implementing them. As we do for implementing SHIFT, we can compute SCALE from price and quantity observations under the assumption of the firm’s profit-maximising behaviour and the translog functional form, as shown by the following proposition.Footnote 19 Translog functional form allows us to represent the theoretical measure SCALE by the derivatives of output distance functions, which are computable from Eq. (8), under the assumption of profit-maximising behaviour. Its proof is sketched in “Appendix 1”.

Proposition 2

Assume that a firm follows profit-maximising behaviour in periods \(t = 0\) and 1, as in Eq. ( 5 ). Also, assume that output distance functions D 0 and D 1 have the translog functional form with time-invariant second-order coefficients, as defined by Eq. ( 9 ). Then the returns to scale effect SCALE can be computed from observed prices and quantities as follows:

where s L is the average value-added shares of labour compensation between periods 0 and 1.

The index number formula on the right-hand side of Eq. (15) can be interpreted as the growth rate of labour input adjusted by the ratio of labour compensation to the total value added, minus one: s L - 1. The fact that s L - 1 < 0 means that increases in labour input alone always decreases LP, holding capital input fixed and using the same technology. It reflects the diminishing marginal product of labour that we observe as we move along the short-run production frontier. A large change in labour input is likely to raise the magnitude of the returns to scale effect. However, if the share of labour compensation is large, or the share of capital compensation is small, its impact is mitigated. In other words, even if labour input changes a little, when the share of labour compensation is small or the share of capital compensation is large, the magnitude of the returns to scale effect is exacerbated.

Beginning from the understanding that the two contributing factors SHIFT and SCALE exist for LP growth, we independently reached the index number formula for these factors. However, our result does not deny that other unknown factors might also explain LP growth. Fortunately, the two factors SHIFT and SCALE can fully explain LP growth. The product of SHIFT and SCALE coincides with the index of LP growth, as follows:

The right-hand side of Eq. (16) represents growth in LP. Since its numerator coincides with the Törnqvist output quantity index, we refer to the right-hand side of Eq. (16) as the Törnqvist LP index. This equation allows us to completely decompose LP growth into two components, SHIFT and SCALE.

4 Technical Progress and Capital Input Growth

As a theoretical measure of the joint effect of technical progress and capital input growth, SHIFT captures the part of LP growth driven by shifts in short-run production and corresponds to the distance between the short-run production frontiers of periods 0 and 1. In this subsection, we differentiate two contributions of technical progress and capital input growth. As for SHIFT and SCALE, we take two steps: First, we propose the theoretical measure of each effect, respectively. Second, under the assumption of the firm’s profit-maximising behaviour, as well as the translog functional form for the output distance function, we derive index number formulae computable from prices and quantities that coincide with these theoretical measures.

Given \(,\varvec{x}_{K}\), the shift in the short-run production frontier induced only by technical progress between periods 0 and 1 is measured by the ratio \(D^{0} \left( {\varvec{y},\varvec{x}_{K} , x_{L} } \right)/D^{1} \left( {\varvec{y},\varvec{x}_{K} , x_{L} } \right)\). Each choice of reference vector \(\left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\) might generate a different measure of technical progress. We calculate two measures using two equally reasonable reference vectors \(\left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} ,x_{L}^{0} } \right)\) and \(\left( {\varvec{y}^{1} ,\varvec{x}_{K}^{1} ,x_{L}^{1} } \right)\). Then, we use the geometric mean of these measures as a theoretical measure of technical progress, TFP, as follows:

Similarly, given the period t production frontier, the shift in the short-run production frontier induced by capital input growth between the periods 0 and 1 is measured by the ratio \(D^{t} \left( {\varvec{y},\varvec{x}_{K}^{0} , x_{L} } \right)/D^{t} \left( {\varvec{y},\varvec{x}_{K}^{1} , x_{L} } \right)\). Each choice of reference short-run production frontier and reference vector \(\left( {\varvec{y},x_{L} } \right)\) might generate a different measure of capital input growth. We calculate two measures using short-run production frontiers and output–labour input vectors available at the same period. The first is the period 0 short-run production frontier and period 0 output–labour input vector \(\left( {\varvec{y}^{0} ,x_{L}^{0} } \right)\); the second is the period 1 short-run production frontier and period 1 output–labour input vector \(\left( {\varvec{y}^{1} ,x_{L}^{1} } \right)\). Because these sets of short-run production frontiers and output–labour input vectors are equally reasonable, we use the geometric mean of these measures as a theoretical measure of capital input growth, CAPITAL, as follows:

TFP and CAPITAL are theoretical measures that Caves et al. (1982) have already introduced.Footnote 20 As for implementing SHIFT and SCALE, they show that theoretical measures of TFP and CAPITAL coincide with the following index number formulae of price and quantity observations under the same assumptions of the firm’s profit-maximising behaviour and the translog functional form for the output distance function as Propositions 1 and 2:

where s m , s K,p and s L are the average value-added shares of output m, capital input n and labour input, respectively, between periods 0 and 1, such that

The index number formula in Eq. (19) can be interpreted as the ratio of a quantity index of total output to a quantity index of total input.Footnote 21 On the other hand, the index number formula in (20) can be interpreted as the quantity index of capital input, as constructed by the weighted geometric mean of the growth rates for capital input. The ratio of capital income for a particular type of capital input to the total value added is used as weighting.Footnote 22

Equations (10), (19) and (20) show that two factors TFP and CAPITAL can fully explain the LP growth induced by the shift in the short-run production frontier, as follows:

Finally, applying (21)–(16), we can decompose the LP growth into the three contributing factors: (1) technical progress, (2) capital input growth and the (3) returns to scale effect under the assumptions of the firm’s profit-maximising behaviour, and the translog functional form for output distance function, as follows:

where s m is the average value-added shares of output m between periods 0 and 1.

Balk (2005) provided a general framework for decomposing productivity indexes, arguing that each factor in the decomposition should be independent of other factors for the decomposition to be meaningful.Footnote 23 Several decomposition results dealing with the Malmquist productivity index are criticised from this viewpoint. The difficulty with these decompositions of the Malmquist productivity index is attributed to the Malmquist productivity index itself not being transitive in input and output quantities. On the other hand, although our theoretical measures of SHIFT and SCALE, as well as TFP and CAPITAL, are defined by the same output distance function, their definitions do not depend on each other.Footnote 24 Thus, our decomposition result is immune from Balk’s criticism of the Malmquist productivity index. We emphasise that the Törnqvist LP index, which appears on the right-hand side of Eqs. (16) and (22), satisfies transitivity in labour input and output quantities for fixed value-added shares.

How can we relate our decomposition in Eq. (22) to the past studies on the sources of LP growth? We explain its relationship with Kumar and Russell (2002), which is the most related study based on the distance functions.Footnote 25 As shown in Eq. (22), we decompose LP growth into three contributing factors: (1) technical progress, (2) capital input growth and the (3) returns to scale effect. On the other hand, Kumar and Russell (2002) decompose LP growth into two contributing factors in the two-input (one capital input and one labour input) and one-output case: (1) technical progress and (2) the change in capital–labour ratio.Footnote 26 We adopt the same theoretical measure of technical progress as Kumar and Russell (2002). Note that the measure of the LP growth is also the same in the two-input and one-output case. Therefore, we can say that the contribution of the change in capital–labour ratio in Kumar and Russell (2002) comprises the returns to scale effect and the contribution of capital input growth. Our decomposition has the advantage of allowing us to investigate the origin of LP growth in further detail. An increase in labour input definitely decreases LP, reflecting the diminishing marginal productivity of labour. However, as long as capital input increases alongside labour input, the capital–labour ratio does not change. Thus, Kumar and Russell (2002) never capture the negative impact of labour input on LP in their decomposition.

5 An Application to US Industry Data

Having discussed the theory underlying our decomposition, we now explore its empirical significance with industry data. Industry data for 1987–2009 are from the US Bureau of Labor Statistics multifactor productivity data. We use gross output, three intermediate inputs (energy, materials and purchased services) and a labour input at current and constant prices for the 59 industries that constitute the US non-farm business sector. Labour input at constant prices measures the number of hours worked.Footnote 27 These industries are categorised as goods-producing (goods sector) or services-providing (services sector). Considering gross outputs and intermediate inputs of each industry within each sector as distinct products, we decompose sectoral LP growth into three components, based on Eq. (22).Footnote 28 Table 1 compares LP growth and its contributing factors for the goods and services sectors.Footnote 29 Dividing the sample period into three parts is useful: the ‘productivity slowdown’ 1987–1995, the ‘productivity resurgence’ 1995–2007 and the ‘great recession’ 2007–2009.

Triplett and Bosworth (2004, 2006) and Bosworth and Triplett (2007) found that LP growth in the services sector was stagnant and lower than LP growth in the goods sector in US industry data.Footnote 30 Our dataset also documented this difference. Services sector LP averaged 1.19 % annual growth during 1985–1995, much lower than the average annual 1.97 % for the goods sector. However, once we control the returns to scale effect and consider only the joint effect of technical progress and capital input growth, the services sector’s average annual rate of 1.82 % approximates the goods sector’s average annual 2.04 %. Thus, although services sector LP grew far slower during 1987–1995 than in the goods sector, the productive capacity of labour in the services sector (output attainable from a given labour input) grew at a pace comparable with the goods sector. The fact that services sector LP grew less than goods sector LP reflects that the greater increase in labour input in the services sector restrained LP from significantly increasing. The relative contributions of technical progress and capital input growth are opposite between the two sectors. More than two-thirds of the joint effect of technical progress and capital input growth is attributed to technical progress for the goods sector, and capital input growth for the services sector.

LP growth in the goods sector still surpassed the services sector during 1995–2007. The gap in LP growth between the two sectors is much smaller than that during 1987–1995. However, the order is reversed once we control for the returns to scale effect, resulting in LP growth explained by technical progress and capital input growth at an average annual 3.18 % for the services sector, higher than the goods sector’s 2.81 %. This suggests that the productive capacity of labour increased more in the services sector than in the goods sector during this period. This is mainly attributed to the increased contribution of technical progress in the services sector at an average annual 1.61 %, which is three-fold the average 0.55 % during 1987–1995. Although technical progress in the goods sector still surpassed the services sector, this difference had narrowed considerably from the previous period 1987–1995.

The pattern that Triplett and Bosworth (2004, 2006) and Bosworth and Triplett (2007) indicated dissolved after 2008. Services sector LP grew at an average annual 2.09 %, exceeding the goods sector’s average 1.42 % annually during 2007–2009. During this period, declining labour input lead to positive returns to scale effects in both sectors. The goods sector shows a particularly large returns to scale effect, averaging a 3.69 % rate annually, which is more than three-fold the average 1.02 % for the services sector. However, this significantly large effect cannot offset the annual 2.27 % decline in the joint effect of technical progress and capital input growth in the goods sector, leading LP growth lower than that for the services sector.Footnote 31

Equation (15) reveals that the returns to scale effect depends on labour income share as well as growth in labour input. The returns to scale effect will apparently diminish under a large labour income share. While labour income shares of the two industry groups are similar and the difference in the returns to scale effect is solely attributable to the difference in the growth rate of labour input, the detailed industry study reveals cases where the large labour income share suppressed the returns to scale effect induced by labour input growth.Footnote 32

6 Conclusion

This study has examined the short-run production frontier and decomposes the Törnqvist LP index into three contributing factors: (1) technical progress, (2) growth in capital inputs and (3) the returns to scale effect. The former two factors appear as growth induced by a shift in the short-run production frontier, and the last factor as growth induced by movement along that frontier. When this decomposition result is applied to US industry data for 1987–2009, a large part of the difference in LP growth between the goods and services sectors can be attributed to differences in the returns to scale effect.

It is noteworthy that while we deal with the value-added based LP, our decomposition is applicable to the gross output based LP, with some modification (Balk 2009). Under the framework of the present paper, we deal with the net outputs and primary inputs of capital and labour. Thus, all intermediate inputs such as energy, materials and services are considered as negative outputs, y m < 0. In a gross output framework, net outputs must be split into gross outputs and intermediate inputs. The productive capacity of labour is represented by the outputs attainable from a given labour input while holding capital inputs and intermediate inputs fixed and using the same technology. Thus, theoretical measures are formulated by the output distance function that is also conditional on intermediate inputs. Let \(\tilde{\varvec{y}}\) be the gross outputs and every element be nonnegative so that \(\tilde{y}_{m} \ge 0\) for all m. Let \(\varvec{x}_{M} = \left( {x_{M,1} , \ldots ,x_{M,P} } \right)\) be the intermediate inputs. Then, all the theoretical measures discussed so far are formulated as follows:

It is clear that all intermediate inputs are treated like capital inputs in the above theoretical measures. Thus, replacing net outputs \(\varvec{y}\) by gross outputs \(\tilde{\varvec{y}}\) and capital inputs \(\varvec{x}_{K}\) by the vector of capital and intermediate inputs \(\tilde{\varvec{x}}_{K} = \left( {\varvec{x}_{K} ,\varvec{x}_{M} } \right)\), Propositions 1 and 2, and the corresponding decomposition results become associated with the gross output based LP growth.Footnote 33

This study assumed that a firm undertakes profit-maximising behaviour and ruled out inefficient production processes. If we relax the assumption of profit-maximising behaviour, then another factor—technical efficiency change—appears in the decomposition of LP growth. Even with no change in the short-run production frontier and no change in labour input, a firm can approach closer to the short-run production frontier by improving technical efficiency and raise LP. For implementing the decomposition of LP growth without assuming the firm’s profit-maximising behaviour, we must estimate the output distance function using econometric or linear programming techniques. This exercise remains for future research.

We assume one type of labour input and one type of wage exist throughout this paper. In reality, labour inputs have different characteristics in aspects such as education, skill, experience, industry and occupation. Moreover, different types of labour inputs often have different wages. Thus, the assumption of a single type of labour input and wage is a shortcoming of this paper. Although it is possible to define a theoretical measure SCALE in the case of multiple labour inputs using the labour input distance function, we are unable to derive index number formulae corresponding to them. Thus, the decomposition results of either (16) or (22) do not hold in such a case. Extending the results of the present paper so as to deal with multiple labour inputs is also a topic for future research.

Notes

In principle, productivity improvement also occurs through gains in technical efficiency—i.e. the distance between the production plan and the production frontier. This study assumes the firm’s profit-maximising behaviour; in its model, the current production plan is always on the current production frontier. Assuming profit maximisation is common in economic approaches to index numbers. See Caves, Christensen and Diewert (1982) and Diewert and Morrison (1986).

See Council of Economic Advisors (2010).

Some authors such as Hall and Jones (1999) found that improvements in the quality of labour input (human capital accumulation) significantly explain changes in LP. While we adopt hours worked as a measure of labour input only in the empirical application, it is possible to use the compensation-weighted index of labour input, which is the quality-adjusted index of labour input as well. It allows us to capture the contribution of labour quality on changes in LP along with utilising the Dutot labour input quantity index, as suggested in Balk (2010). Such a consideration just complicates our decomposition; change in labour quality itself does not affect the returns to scale effect, which is the main concern of this paper. Thus, we ignore the role of the improvement in labour quality in explaining LP growth here. See footnote 5 for where it appears in our decomposition.

When we define labour input by hours worked, the improvement in labour quality shifts the short-run production frontier. Thus, its effect on LP growth is considered part of the contribution of technical progress.

Because Caves et al. (1982) are concerned with measuring TFP growth, they deal with the underlying production frontier that consists of total inputs (capital and labour) and the maximum output attainable from them, indicating the capacity of current technology to translate total inputs into outputs. From this point forward, ‘the underlying production frontier’ or simply ‘the production frontier’ refers to this type of underlying production frontier as distinguished from the short-run production frontier.

Caves et al. used the term ‘scale factor’ for the returns to scale effect.

For the decomposition of Nemoto and Goto (2005), we interpret the product of ‘scale change’ and ‘input and output mix effects’ as the returns to scale effect. Their result identified the combined effect of changes in the composition of inputs and of outputs.

Excluding zero quantities for outputs and inputs is crucial for deriving index number formulae by aggregating the growth rates of inputs and outputs. Because capital input quantities do not appear in this study’s index number formula, we do not impose the condition of non-zero quantities for capital inputs. There is an alternative approach in index number theory called the ‘difference approach’. As Diewert and Mizobuchi (2009) emphasised, it can be applied to situations in which quantities of inputs or outputs are zero.

Caves et al. (1982) and Färe et al. (1994) introduced a measure of the shift in the production frontier using the ratio of the output distance function. Given \(\left( {\varvec{y},\varvec{x}_{K} .x_{L} } \right)\), Färe et al. (1994) measured the shift in the production frontier by \(D^{0} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)/D^{1} \left( {\varvec{y},\varvec{x}_{K} ,x_{L} } \right)\).

Because the firm’s profit-maximising behaviour is assumed, we obtain \(D^{0} \left( {\varvec{y}^{0} , \varvec{x}_{K}^{0} , x_{L}^{0} } \right) = D^{1} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right) = 1\). It leads to a different formulation for the measure of the shift in the short-run production frontier:

\(SHIFT = \sqrt {\frac{{D_{O}^{0} \left( {\varvec{y}^{0} , \varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{1} , x_{L}^{0} } \right)}}\frac{{D_{O}^{0} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{0} , x_{L}^{1} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{1} ,\varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}} = \sqrt {\frac{{D_{O}^{1} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{1} , x_{L}^{0} } \right)}}\frac{{D_{O}^{0} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{0} , x_{L}^{1} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}}\).

This corresponds to the Malmquist productivity index introduced by Caves et al., which is \(\sqrt {\frac{{D_{O}^{1} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}\frac{{D_{O}^{0} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}}\).

Alternatives involve estimating the underlying output distance function by econometric or linear programming approaches. Either approach requires sufficient empirical observations. Our approach, originated by Caves et al. (1982), is applicable provided the price and quantity observations are available for the current and the reference periods. See Nishimizu and Page (1982) for application of the econometric approach and Färe et al. (1994) for the application of linear programming approach.

Caves et al. justified the use of the Törnqvist productivity index, which is the Törnqvist output quantity index divided by the Törnqvist input quantity index.

Notation: \(\nabla_{\varvec{x}} f\left( {\varvec{x},\varvec{y}} \right) \equiv \left[ {\partial f\left( {\varvec{x}, \varvec{y}} \right)/\partial x_{1} , \ldots ,\partial f\left( {\varvec{x}, \varvec{y}} \right)/\partial x_{N} } \right]^{ \top }\) is a column vector of the partial derivative of f with respect to the vector \(\varvec{x} \in {\Re }^{N}\) and \(\varvec{x} \cdot \varvec{z} = \mathop \sum \limits_{n = 1}^{N} x_{n} z_{n}\).

They are (1) \(\alpha_{i, j} = \alpha_{j, i}\) for all i and j, such as 1 ≤ i < j ≤ M; (2)\(\beta_{i, j} = \beta_{j, i}\) for all i and j, such as 1 ≤ i < j ≤ N; (3)\(\mathop \sum \limits_{n = 1}^{N} \alpha_{n}^{t} = 1\); (4)\(\mathop \sum \limits_{i = 1}^{M} \alpha_{i, m} = 0\) for \(m = 1, \ldots ,M\); (5) \(\mathop \sum \limits_{m = 1}^{M} \delta_{m, n} = 0\) for \(n = 1, \ldots ,N\); (6) \(\mathop \sum \limits_{m = 1}^{M} \varepsilon_{m} = 0\).

Once we consider the case that labour is only input being transformed into outputs, and regard changes in capital input as shifts in underlying production frontier, we can apply the equivalence result between the Malmquist and Törnqvist productivity indices to deriving an index number formula for SHIFT. Accordingly, we consider Proposition 1, as a corollary of Caves et al.

Thus, the returns to scale effect is computable from observed prices and quantities. We do not need to estimate the underlying distance function by econometric or linear programming approaches, such as SFA or DEA.

Strictly speaking, the theoretical measure of technical progress proposed by Caves et al. (1982) is \(\sqrt {\frac{{D^{1} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}{{D^{1} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}\frac{{D^{0} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right)}}{{D^{0} \left( {\varvec{y}^{0} ,\varvec{x}_{K}^{0} , x_{L}^{0} } \right)}}}\), which coincides with TFP under the assumption of the firm’s profit-maximising behaviour, because \(D^{0} \left( {\varvec{y}^{0} , \varvec{x}_{K}^{0} , x_{L}^{0} } \right) = D^{1} \left( {\varvec{y}^{1} , \varvec{x}_{K}^{1} , x_{L}^{1} } \right) = 1\) under that assumption.

If we assume the underlying technology exhibits constant returns to scale, then the value of output equals the value of total inputs, so that \(\varvec{p}^{t} \cdot \varvec{y}^{t} = \varvec{r}^{t} \cdot \varvec{x}_{K}^{t} + w^{t} \cdot x_{L}^{t}\). Under this assumption, the index number formula equals the Törnqvist productivity index..

If the ratio of capital income for a particular type of capital input to the total capital income is used as the weight, the index number formula in Eq (20) coincides with the Törnqvist quantity index.

‘Now, of course, every mathematical expression a can, given any other expression b, be decomposed as a = (a/b)a. However, not all such decompositions are meaningful’ (Balk 2005, p. 2).

The LP counterpart of the Hicks–Moorsteen productivity index (hereafter, Hicks–Moorsteen LP index) is defined as follows:

\(LP_{HM} = \sqrt {\frac{{D_{O}^{0} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{0} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{0} } \right)}} \cdot \frac{{D_{O}^{1} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{1} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{1} } \right)}}} /\left( {\frac{{x_{L}^{1} }}{{x_{L}^{0} }}} \right)\).

This is a meaningful theoretical measure of LP growth. However, neither SHIFT × SCALE nor TFP × CAPITAL × SCALE coincide with LP HM , and it is difficult to interpret them as LP growth without assuming the translog functional form for the output distance function, such as

\(SHIFT \times SCALE = \sqrt {\frac{{D_{O}^{0} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{1} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{1} } \right)}} \cdot \frac{{D_{O}^{1} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{0} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{0} } \right)}}} /\left( {\frac{{x_{L}^{1} }}{{x_{L}^{0} }}} \right)\) and \(TFP \times CAPITAL \times SCALE = \sqrt {\frac{{D_{O}^{1} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{0} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{1} } \right)}} \cdot \frac{{D_{O}^{0} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{1} } \right)}}{{D_{O}^{1} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{0} } \right)}} \cdot \frac{{D_{O}^{1} \left( {\varvec{y}^{1} ,\varvec{ x}_{K}^{0} ,\varvec{ x}_{L}^{1} } \right)}}{{D_{O}^{0} \left( {\varvec{y}^{0} , \varvec{ x}_{K}^{1} ,\varvec{ x}_{L}^{0} } \right)}}} /\left( {\frac{{x_{L}^{1} }}{{x_{L}^{0} }}} \right)\).

All three measures of LP HM , \(SHIFT \times SCALE\) and TFP × CAPITAL × SCALE become the Törnqvist LP index, and coincide with one another only under the assumption of the translog functional form for the output distance function as well as the firm’s profit-maximising behaviour. In other words, the difference among LP HM , SHIFT × SCALE, and TFP × CAPITAL × SCALE indicates the approximation error associated with these assumptions. Thus, as \((\varvec{x}_{K}^{1} ,x_{L}^{1} )\) approaches \((\varvec{x}_{K}^{0} ,x_{L}^{0} )\), the measurement error diminishes in size and all three measures come closer. I owe this point to a comment by an anonymous referee.

Jorgenson and Stiroh (2000) and Jorgenson et al. (2008) use the decomposition based on index number formulae of price and quantity observations, which are parallel to the decomposition of Kumar and Russell (2002) based on the distance functions. We adopt the same Törnqvist productivity index for technical progress as them. Thus, our decomposition disintegrates the contribution of the capital deepening in their decomposition into two parts: the returns to scale effect and the contribution of capital input growth.

The decomposition by Kumar and Russell (2002) also includes the change in technical efficiency. Because we assume the firm’s profit-maximising behaviour, we ignore its effect on LP growth.

This measure of labour input does not capture changes in labour quality. Thus, the contribution of technical progress to LP growth also includes the effect of improvements in labour quality.

Strictly speaking, we compute components in Eq (22) based on Eqs. (15), (19) and (20). Thus, we adopt the following equation for our empirical application:

\(\underbrace {{\frac{{\mathop \prod \nolimits_{m = 1}^{M} \left( {y_{m}^{1} /y_{m}^{0} } \right)^{{s_{m} }} }}{{\mathop \prod \nolimits_{n = 1}^{N} \left( {x_{K, n}^{1} /x_{K, n}^{0} } \right)^{{s_{K, n} }} \left( {x_{L}^{1} /x_{L}^{0} } \right)^{{s_{L} }} }} \times }}_{TFP}\underbrace {{\mathop \prod \limits_{n = 1}^{N} \left( {\frac{{x_{K, n}^{1} }}{{x_{K, n}^{0} }}} \right)^{{s_{K, n} }} }}_{CAPITAL} \times \underbrace {{\left( {\frac{{x_{L}^{1} }}{{x_{L}^{0} }}} \right)^{{s_{L} - 1}} }}_{SCALE} = \underbrace {{\frac{{\mathop \prod \nolimits_{m = 1}^{M} \left( {y_{m}^{1} /y_{m}^{0} } \right)^{{s_{m} }} }}{{\left( {x_{L}^{1} /x_{L}^{0} } \right)}}}}_{LP growth}\).

We treat each industry as a decision making unit and decompose industry LP growth into three components. Industry LP and its components are aggregated using value-added share.

Triplett and Bosworth (2006) used the term Baumol’s Disease to identify the situation in which services sector LP growth is likely to stagnate. They argued that this disease was cured in the mid-1990 s.

The significantly negative contribution of technical change at an average annual 3.2 % explains the large decline in the joint effect. It might be partly attributed to the under-utilization of capital or labour hoarding. The negative growth rate of technical change for the goods sector is also found in many European countries during 2007–2009 (Van Ark et al. 2013).

For example, the wood products industry shows an average 19.15 % rate of decrease in labour input during 2007–2009. However, during this period, its returns to scale effect averaged 1.73 % annually, a relatively small magnitude during this period. Its large labour income share of 91.85 % offset its large decline of labour input. All results for these 59 industries during every period are available upon request.

Different output distance functions are required for a value-added framework and a gross output framework. However, the translog functional form, as defined by Eq (9), is still a second-order approximation of the true distance functions in either framework. Therefore, Propositions 1 and 2, and the corresponding decomposition of LP growth in Eqs. (16) and (22), still hold in a gross output framework.

A notable advantage of applying it to TFP growth is the equivalence between \(SHIFT \times SCALE\) and the Malmquist productivity index. That equivalence does not hold for the Malmquist LP index.

In a strict sense, Lovell (2003) identifies the returns to scale effect on the period t production frontier by \(\left( {\frac{{D^{t} \left( {\varvec{y}^{t + 1} ,x^{t} } \right)}}{{D^{t} \left( {\varvec{y}^{t + 1} ,x^{t + 1} } \right)}}} \right)/\left( {\frac{{x^{t + 1} }}{{x^{t} }}} \right)\). This is called the activity effect. Because we consider the returns to scale effect on the TFP growth between two periods, we use the geometric mean of the period 0 and 1 activity effect so as to be comparable with SCALE. The use of the geometric mean is suggested in Lovell (2003).

References

Balk BM (1998) Industrial price, quantity, and productivity indices. Kluwer Academic Publishers, New Boston

Balk BM (2001) Scale efficiency and productivity change. J Prod Anal 15:159–183

Balk BM (2005) The many decompositions of productivity change. In: Presented at the North American Productivity Workshop, Toronto, 2004 and at the Asia-Pacific Productivity Conference, Brisbane, 2004. www.rsm.nl/bbalk

Balk BM (2009) On the relation between gross output- and value added-based productivity measures: the importance of the Domar factor. Macroecon Dyn 13(S2):241–267

Balk BM (2010) An assumption-free framework for measuring productivity change. Rev Income Wealth 56(S1):224–256

Bosworth BP, Triplett JE (2007) The early 21st century U.S. productivity expansion is still in services. Int Prod Monit 14:3–19

Caves DW, Christensen L, Diewert WE (1982) The economic theory of index numbers and the measurement of input, output, and productivity. Econometrica 50:1393–1414

Chambers RG (1988) Applied production analysis:a dualaApproach. Cambridge University Press, New York

Council of Economic Advisors (2010) Economic report of the president. U.S. Government Printing Office, Washington

Diewert WE, Fox KJ (2010) Malmquist and Törnqvist productivity indexes: returns to scale and technical progress with imperfect competition. J Econ 101:73–95

Diewert WE, Mizobuchi H (2009) Exact and superlative price and quantity indicators. Macroecon Dyn 13(S2):335–380

Diewert WE, Morrison CJ (1986) Adjusting output and productivity indexes for changes in the terms of trade. Econ J 96:659–679

Diewert WE, Nakamura AO (2007) The measurement of productivity for nations. In: Heckman JJ, Leamer EE (eds) Handbook of econometrics, vol 6, chapter 66. Elsevier, Amsterdam, pp 4501–4586

Färe R, Primont D (1995) Multiple-output production and duality: theory and applications. Academic Publishers, Boston

Färe R, Grosskopf S, Norris M, Zhang Z (1994) Productivity growth, technical progress, and efficiency change in industrialized countries. Am Econc Rev 84:66–83

Fisher I (1922) The making of index numbers. Houghton-Mifflin, Boston

Griliches Z (1987) Productivity: measurement problems. In: Eatwell J, Milgate M, Newman P (eds) The new palgrave: a dictionary of economics. McMillan, New York, pp 1010–1013

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others? Q J Econ 114:83–116

Henderson DJ, Russell RR (2005) Human capital and convergence: a production-frontier approach. Int Econ Rev 46:1167–1205

Jorgenson DW, Stiroh KJ (2000) Raising the speed limit: U.S. economic growth in the information age. Brookings Pap Econ Act 2:125–211

Jorgenson DW, Ho MS, Stiroh KJ (2008) A retrospective look at the US productivity growth resurgence. J Econ Persp 22:3–24

Kumar S, Russell RR (2002) Technological change, technical catch-up, and capital deepening: relative contributions to growth and convergence. Am Econ Rev 92:527–548

Lovell CAK (2003) The decomposition of Malmquist productivity indexes”. J Prod Anal 20:437–458

Nemoto J, Goto M (2005) Productivity, efficiency, scale economies and technical change: a new decomposition analysis of TFP applied to the Japanese Prefectures. J Jpn Int Econ 19:617–634

Nishimizu M, Page JM (1982) Total factor productivity growth, technical progress and technical efficiency change: dimensions of productivity change in Yugoslavia, 1965–78. Econ J 92:920–936

Triplett JE, Bosworth BP (2004) Services productivity in the United States: new sources of economic growth. Brookings Institution Press, Washington

Triplett JE, Bosworth BP (2006) ‘Baumol’s Disease’ has been cured: IT and multi-factor productivity in U.S. services industries. In: Jansen DW (ed) The new economy and beyond: past, present, and future. Edgar Elgar, Cheltenham, pp 34–71

Van Ark B, Chen V, Jäger K (2013) European productivity growth since 2000 and future prospects. Int Prod Monit 25:65–87

Acknowledgments

Part of this paper was circulated under the title ‘New Indexes of LP Growth: Baumol’s Disease Revisited’. I am grateful to Bert Balk and two anonymous referees for helpful comments and suggestions. I thank Erwin Diewert, Jiro Nemoto, Takanobu Nakajima, Toshiyuki Matsuura, Mitsuru Sunada and seminar participants in the 12th European Workshop on Efficiency and Productivity Analysis, June 2011, Verona, Italy, and the annual meeting of the Japanese Economic Association, Kumamoto Gakuen University, May, 2011, Tohoku University, Keio University, Chuo University, Tokyo University, Kyoto University. I gratefully acknowledge the financial support provided by KAKENHI (25870922). All remaining errors are the author’s.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proofs of Propositions

The proof of propositions is obvious from that of Caves et al. (1982) and Balk (1998). We briefly sketch it below for reference. The detailed proof is available upon request.

1.1 Proof of Proposition 1

from assuming the translog functional form in Eq. (9) and applying the translog identity of Caves et al.

1.2 Proof of Proposition 2

from assuming the translog functional form of Eq. (9) and applying the translog identity of Caves et al.

from Eq. (7)

Appendix 2: Application to Decomposition of TFP Growth

The present paper measures the returns to scale effect of LP growth. We model it by LP growth induced by movement along the short-run production frontier. Lovell (2003) similarly defines the returns to scale effect of TFP growth by TFP growth induced by movement along the underlying production frontier. This appendix adopts the simple case of one input x and multiple output \(\varvec{y}\) so as to explain the relationship between two returns to scale measures.Our measure of SCALE reduces to the following measuresFootnote 34:

For the returns to scale effect on TFP growth, a variety of theoretical measures is proposed. We compare SCALE with the seemingly closely related measures proposed by Lovell (2003):

SCALE Lovell is the geometric mean of Lovell’s (2003) activity effects of periods 0 and 1.Footnote 35 The numerator of SCALE and SCALE Lovell , which is the only item of difference, measures the distance between the two output isoquants. They are production frontiers conditional x 0 and x 1, denoted by \(ISOQ\ P^{t} \left( {x^{0} } \right)\) and \(ISOQ\ P^{t} \left( {x^{1} } \right)\) for t = 0 and 1, respectively. The difference in SCALE and SCALE Lovell is considered as the difference in the choice of the direction \(\varvec{y}\) for measuring the distance between two output isoquants. SCALE measures the distance between \(ISOQ\ P^{0} \left( {x^{0} } \right)\) and \(ISOQ\ P^{0} \left( {x^{1} } \right)\) in the direction \(\varvec{y}^{0}\) and the distance between \(ISOQ\ P^{1} \left( {x^{0} } \right)\) and \(ISOQ\ P^{1} \left( {x^{1} } \right)\) in the direction \(\varvec{y}^{1}\).

On the other hand, SCALE Lovell measures the distance between \(ISOQ\ P^{0} \left( {x^{0} } \right)\) and \(ISOQ\ P^{0} \left( {x^{1} } \right)\) in the direction \(\varvec{y}^{1}\) and the distance between \(ISOQ\ P^{1} \left( {x^{0} } \right)\) and \(ISOQ\ P^{1} \left( {x^{1} } \right)\) in the direction \(\varvec{y}^{0}\). Because \(ISOQ\ P^{0} \left( {x^{0} } \right)\) and \(ISOQ\ P^{0} \left( {x^{1} } \right)\) are on the period 0 production frontier, the direction \(\varvec{y}^{0}\) is the most appropriate choice for measuring the distance between them from the viewpoint of period 0 production. Similarly, because \(ISOQ\ P^{1} \left( {x^{0} } \right)\) and \(ISOQ\ P^{1} \left( {x^{1} } \right)\) are on the period 1 production frontier, the direction of period 1 output \(\varvec{y}^{1}\) is the most appropriate choice of measuring the distance between them from the viewpoint of period 1 production. Thus, SCALE is considered more justifiable than SCALE Lovell in terms of the choice of direction.

However, this paper’s contribution to the literature of TFP growth decomposition is severely limited, since the existence of a single type of input needs to be presupposed. Thus, it is necessary for us to extend our decomposition of LP growth to the multiple-labour inputs case. Applying this extended result, we can decompose TFP growth and properly measure the returns to scale effect in more realistic case of multiple inputs.

Rights and permissions

About this article

Cite this article

Mizobuchi, H. Returns to scale effect in labour productivity growth. J Prod Anal 42, 293–304 (2014). https://doi.org/10.1007/s11123-014-0408-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-014-0408-9

Keywords

- Labour productivity

- Index numbers

- Malmquist index

- Törnqvist index

- Output distance function

- Input distance function