Abstract

We used a Bayesian dynamic factor model (BDFM) to examine the share of variance explained by the European and country factors for 59 regions in Eurozone countries in the period from 1992 to 2020. The BDFM output facilitated the construction of a criterion that enables the assessment of the cost of participation in the European Monetary Union, which is directly related to the optimum currency area theory. Over the examined period, we observed business cycle divergence, with 46 regions experiencing a drop in the share of variance explained by the European factor from 1992–2005 to 2006–2020. However, the analysis over shorter time spans demonstrated that all the regions decoupled from the European business cycle. The results contradict the predictions of "The European Commission View". On the one hand, two predictions stemming from "The Krugman View" are supported by the results: the European regions experienced a slight increase in sectoral specialization, and they experienced business cycle divergence. On the other hand, the data does not support the notion that the ongoing specialization was the underlying cause of this divergence.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The efficient operation of the European Monetary Union is one of the main issues on the European economic research agenda. The optimum currency area (OCA) theory has served as the main guide for delimiting the borders of a domain in which a single central bank can implement a common monetary policy effectively. Contemporary research has departed from the original criteria proposed in Mundell (1961), McKinnon (1963), and Kenen (1969) to focus on business cycle synchronization at the country level (Frankel and Rose 1998; Alfonso and Furceri 2008; Ductor and Leiva-Leon 2016; Matesanz Gomez et al. 2017).

The shift in focus from the original OCA criteria toward the synchronization of business cycles has placed significant emphasis on research at the country level. In contrast to the original concept proposed in Mundell (1961), the implicit assumptions that a given country is an OCA and that international comparisons are adequate have become the standard in the literature. The literature mostly focuses on measuring the degree of synchronization of business cycles and examining its determinants. Approaches to measurement have evolved from those based on the bilateral correlation of cyclical components of GDP to more modern approaches based on Markov-switching regimes or dynamic factor models.

Most research at the regional level still utilizes approaches based on bilateral correlations with a minority of papers utilizing alternatives (e.g., Leiva-Leon (2017)). Therefore, we have attempted to fill a gap in the literature by applying a Bayesian dynamic factor model (BDFM) using data on the real GDP of 59 regions in 10 Euro area countries over the 1992 to 2020 period. We estimated the share of variance attributable to the European factor and the country factors. Within this framework, we constructed a synchronization criterion that is directly related to the OCA theory. We define a region as part of an OCA if the share of variance explained by the European factor is above \(50\%\), indicating a region in which the monetary policy designed at the European level is more appropriate than the monetary policy designed at the country level.

We found that European regions experience significant business cycle divergence with the share of variance explained by the European factor declining in 46 out of 59 regions from 1992–2005 to 2006–2020. Moreover, the analysis using rolling windows demonstrated that all 59 Eurozone regions experienced decoupling from the European business cycle. There is no evidence supporting the hypothesis of convergence into clubs as the countries that are the most in line with the European business cycle have experienced the greatest fall in the share of variance explained by the European factor. Furthermore, the change in the share of variance explained by the European factor is not related to the level of regional development measured by GDP per capita. The results we obtained contradict the predictions of "The European Commission View”, that progressing economic integration is associated with tighter synchronization of business cycles. On the one hand, two predictions stemming from "The Krugman View" are supported by the results. Firstly, the European regions experienced a slight increase in the degree of sectoral specialization. Secondly, the Eurozone regions experienced business cycle divergence. On the other hand, the data does not support the notion that the ongoing specialization was the underlying cause of this divergence.

The remainder of this paper is organized as follows. Section 2 presents a literature review. Section 3 describes the data and methods used in this study. Section 4 presents our empirical results and Section 5 concludes this paper.

2 Literature Review

2.1 Synchronization of Business Cycles at the Country Level

The publication of the seminal work of Frankel and Rose (1998) and popularization of endogeneity of the OCA criteria hypothesis sparked increased interest in research on business cycle correlations. The analysis of business cycle synchronization based on the bilateral correlation of the cyclical components of real GDP has become a standard practice in the field. Below, we summarize a sample of research that assesses the degree of business cycle comovement based on bilateral correlations.

A significant number of studies have addressed the effects of establishing the Economic and Monetary Union (EMU) on the bilateral business cycle synchronization or degree of business cycle synchronization among EMU members, including Darvas and Szapáry (2007) and Oman (2019). Both of these studies used the Hodrick-Prescott (HP) filter (or the Christiano-Fitzgerald (CF) filter, e.g. Oman (2019)) to extract cyclical components of quarterly GDP. All of these studies used various bilateral correlation measures to assess the degree of business cycle synchronization. For example, Darvas and Szapáry (2007) analyzed five measures of business cycle synchronization, namely correlation, leads or lags, volatility of the cycle, persistence, and impulse-response function. Oman (2019) estimated cycle comovement by using concordance statistics (i.e., a bivariate synchronization index computed for each pair of countries) to represent the period of time in which two series were synchronized.

Most studies consider EMU establishment as a significant factor contributing to business cycles synchronization, although the estimated magnitude of this effect is not uniform. Darvas and Szapáry (2007) pointed out a greater effect of synchronization in core EMU members compared to periphery members. Belke et al. (2017) reported the desynchronizing effect of the recent global financial crisis, particularly on the periphery. Similarly, Oman (2019) indicated the positive (and heterogeneous) effect of a common currency on business cycle synchronization in the Euro area.

Some studies have examined the determinants of business cycle synchronization by investigating the factors contributing to business cycle comovement. Jagric and Ovin (2004) analyzed the monthly indexes of industrial production for Slovenia and Germany for the period of January, 1992 to March, 2002 and identified international trade as a factor fostering business cycle synchronization. Dées and Zorell (2012) assessed the links between business cycle synchronization, financial markets, and markets of goods integration, as well as similarities in production structures based on a sample of OECD and EU countries from the period of 1993 to 2007. The study also reported the positive effects of international trade intensity on business cycle synchronization, and underlined the role of production structure similarity. Delgado and Pino (2020) assessed the effects of inflation targeting credibility in the business cycle synchronization of G7 countries and found that greater inflation targeting credibility facilitates business cycle synchronization. Following a common trend, all of the studies reviewed in this paragraph used an HP or CF filter for cyclical component extraction and pairwise correlation to assess the degree of bilateral business cycle synchronization.

However, using correlation coefficients for business cycle synchronization analysis has been criticized for several reasons (Kose et al. 2003a; Lehwald 2013). First, correlations facilitate only a bilateral analysis of business cycle dependence and do not allow for common business cycles in many countries simultaneously. Second, they only account for temporal comovement while disregarding inter-temporal comovement, which makes correlation-based models very sensitive to phase shifts introduced in the filtration process (Christiano and Fitzgerald 2001). Therefore, dynamic factor models have become increasingly popular in business cycle synchronization research, particularly following the development of the methodological approach of Otrok and Whiteman (1998).

Kose et al. (2003b) designed a BDFM and decomposed time series of real GDP, consumption, and investment into global, regional (supranational), and country factors for a sample of 60 countries over the 1960 to 1990 period. Strong evidence in favor of a global business cycle was reported, and only a small portion of the observed comovement could be attributed to regional factors. Kose et al. (2003a) examined annual data on per capita GDP and private consumption for 76 countries for the period of 1960 to 1999. Dynamic unobserved factor models were used to decompose fluctuations in the aforementioned indicators into country-specific and common factors. It was reported that the weight of the common factor was more significant in industrial economies than in developing countries.

Kose et al. (2008) applied a BDFM to quarterly time series from 1960 to 2003 for G-7 countries. They documented an increase in the degree of business cycle comovement during the period of globalization (after 1986). Kose et al. (2012) estimated a BDFM for 106 countries over the 1960 to 2008 period. The business cycle converged between industrial and emerging economies, but only within groups. However, divergence was observed between groups of countries.

Kim (2021) analyzed the process of globalization using a DFM that included an unobserved country factor and global factor. The corresponding dataset included annual observations collected from 71 countries between 1970 and 2018. The range of macroeconomic indicators analyzed included real GDP, real imports, real exports, real exchange rate, private consumption, government consumption, and investments. Similarly to Kose et al. (2003a), the study demonstrated that global factors account for a more significant share of the analyzed indicator variance for developed countries compared to developing countries.

In the European context, Lee (2012) estimated a DFM with time-varying parameters for a sample of real GDP data from 25 OECD countries over the 1970 to 2010 period. This model distinguished between global and regional factors (EMU factor for 17 countries). The author reported that business cycle convergence was present during the run-up to the Euro period, but ceased following the introduction of the Euro. Lee (2013) designed a BDFM for a sample of 25 OECD countries using quarterly data from the 1970 to 2010 period on real GDP and inflation. The study demonstrated that in the majority of EU and EMU countries, the degree of business cycle synchronization increased prior to 1999 and remained stable thereafter.

Lehwald (2013) applied a BDFM to time series of real GDP data from Euro area countries for the period before (1991 to 1998) and after (2000 to 2010) the adoption of the Euro. The author found that the role of the common factor increased only for Euro area core countries, whereas it decreased for most peripheral economies. Ferroni and Klaus (2015) examined four European economies using a DFM and found evidence of business cycle decoupling following the financial crisis. Beck (2020) reached similar conclusions when applying a BDFM to time series of real GDP and inflation data from 20 European Union countries. In contrast, de Lucas and Delgado Rodríguez (2016) found evidence of tighter business cycle synchronization following the introduction of the Euro in core and peripheral countries.

Until recently, there have been only a few attempts to examine sectoral sources of business cycles at both the national (Long and Plosser 1983; Norrbin and Schlagenhauf 1991) and international (Backus et al. 1992; Norrbin and Schlagenhauf 1996) level. However, BDFMs have become increasingly popular in the literature devoted to the topic. Karadimitropoulou and León-Ledesma (2013) demonstrated that the national factor dominates the industry factor in terms of explaining the variation of sectoral value added of G7 countries. Karadimitropoulou (2018) reported similar results for a sample of emerging countries. Beck (2021c) demonstrated that the business cycle divergence observed in the European Union could be attributed to the declining share of manufacturing in GDP.

2.2 Synchronization of Business Cycles at the Regional Level

The approach of measuring the synchronization of business cycles based on correlations has been widely applied to regional data. Clark and van Wincoop (2001) investigated the existence of the so-called "border effect" by comparing the degree of integration between EU regions and the US states. The authors confirmed their hypothesis regarding the European border effect by concluding that the degree of within-country synchronization was lower compared to cross-country correlation. Montoya and de Haan (2008) analyzed business cycle synchronization in EMU regions (NUTS1) based on real gross value added (GVA) data. The correlation coefficients between cyclical components obtained using the HP filter served as a measure of business cycle synchronization. This study reported an increasing degree of regional business cycle synchronization based on the Eurozone benchmark. Panteladis et al. (2011) investigated regional business cycle synchronization in Greek regions at the NUTS2 level. The authors extracted cyclical components using an HP filter and assessed synchronization using correlation coefficients. The study reported a greater degree of synchronization at the NUTS2 level compared to the national level, suggesting the existence of an intra-country border effect.

Poncet and Barthélemy (2008) addressed the question of whether Chinese provinces fulfil the OCA criterion by examining the degree of business cycle synchronization (measured as the pairwise correlation between regional cyclical components obtained from an HP filter) across the country. The authors reported a higher degree of synchronization in the interior regions than in the coastal regions. They also emphasized the role of trade integration and policy coordination in facilitating integration at the regional level.

Artis and Okubo (2009) examined the degree of regional synchronization between UK NUTS1 regions. The degree of regional synchronization was assessed based on the cross-correlations of HP-filtered GVA series for a specific sector. The authors reported a significant degree of synchronization between UK regions and concluded that the UK fulfils the OCA criterion. Beck (2016) considered a sample of NUTS1, NUTS2, and NUTS3 European Union regions over the 1998 to 2010 period. The author reported that within-country correlations were higher than the correlations between regions from different countries, as well as the correlation of national aggregates. Artis and Kholodilin (2011) compared the degree of regional cycle synchronization in the EMU and the US. The correlation between regional and national cycles was found to be stable during the 20 years prior to the study.

Gianelle and Salotti (2017) measured the degree of business cycle synchronization between the EMU regions (NUTS2) as the bilateral correlation between cyclical GDP components obtained from HP filter. Regions with more intensive bilateral trade and a higher degree of production structure similarity exhibited a higher degree of business cycle synchronization. Gadea-Rivas and Leiva-Leon (2018) used dynamic model averaging to assess the degree of business cycle synchronization in EU regions (NUTS2). This study reported that during the great recession of 2008, the degree of economic cohesion between EU regions increased.

To the best of our knowledge, there has been only one application of a DFM to regional data in the context of the synchronization of business cycles. Song and Xia (2018) combined a DFM with a clustering algorithm and applied it to the Chinese provinces data. This procedure was initiated by defining the regional structure of the Chinese economy. Instead of relying on the traditional geographical division of regions, Song and Xia (2018) defined regions by determining the optimal number of clusters based on business fluctuation data. Based on four identified regions (leading, coincident, lagging, and overshooting), the authors performed variance decomposition analysis based on a multilevel factor model. The proportion of variance explained by the model based on the cluster-defined regional nomenclature was significantly higher than the proportion of variance explained by the model based on the official Chinese regional division.

In summary, the business cycle synchronization literature is dominated by papers examining the degree of correlation between two series of extracted cyclical GDP components. However, based on the extensive criticism of approaches based on correlation (see Section 3), other approaches to measuring the synchronization of business cycles have been developed. BDFM models have become particularly popular for examining the macroeconomic and structural sources of business cycle comovement. On the other hand, the approach based on correlation is dominating the regional literature on business cycle synchronization. DFM model has been only applied once in the context of regional data. Therefore, in this study, we attempted to fill a gap in the literature by applying a BDFM for the Eurozone regions.

3 Data and Methods

3.1 Data

In our analysis, we used time series of real GDP calculated at the NUTS1 level for 10 Eurozone countries, namely Austria, Belgium, Finland, France, Greece, Germany, Italy, the Netherlands, Portugal, and Spain. We excluded countries that were too small to be divided into NUTS1 regions. This sample covers 59 NUTS1 regions, as shown in Fig. 1. The full list of regions is available in Appendix A. The time series are annual and cover the 1991 to 2020 period. The data were obtained from the Cambridge Econometrics European Regional Database.

3.2 Bayesian Dynamic Latent Factor Model

Prior to estimation, all time series were logarithmized, first-differentiated, and demeaned. Our analysis of regional data was conducted using the BDFM proposed by Otrok and Whiteman (1998) and developed by Kose et al. (2008). The panel of demeaned regional real GDP growth time series is denoted as \(Y_{t}^{i,k}\), where \(i=1,\dots ,59\) represents the region, \(k=1,\dots ,10\) represents the country, and \(t=1,\dots ,29\) represents time. We assume that \(Y_{t}^{i,k}\) is described by the following DFM:

where \(F_{t}^{E}\) denotes the European factor (common to all time series) and \(F_{t}^{C,k}\) denotes the country factor (common to all time series within country i). \(\varepsilon _{t}^{i,k}\) is the idiosyncratic term (specific to developments in a specific region plus measurement error) and \(E[ \varepsilon _{t}^{ij}, \varepsilon _{t-s}^{i',k'}]=0\) for \(i\ne i'\) \(\vee\) \(k\ne k'\), while \(\beta _{m}^{i,k}\), \(m(=E,C)=1,2,...,1+K=11\) are the factor loadings. The unobservable factors and idiosyncratic term follow an autoregression of order p.Footnote 1

The order of the autoregression process is equal to three; accordingly, the model captures the degree of temporal and intertemporal comovement within 3 years. All innovations \(e_{t}^{ij}\) and \(\upsilon _{t}^{m}\) are assumed to be mutually orthogonal.

The model described by Eqs. (1-3) suffers from rotational indeterminacy, meaning it is impossible to identify the signs and scales of factors and factor loadings separately. To overcome this limitation, signs were identified based on the requirement that one factor loading is positive for each factor. Specifically, the European factor is positive for the aggregate growth of Germany, which is the largest economy under scrutiny. The country factor loading is positive for the aggregate of all regions within one country (i.e., real country value added). Scale identification follows Stock and Watson (1993) based on the assumption that each \(\sigma _{i}^{2}\) and \(\sigma _{m}^{2}\) are constant.

The model defined in Eqs. (1-3) is estimated using the approach proposed by Otrok and Whiteman (1998). It utilizes Gibbs sampling, which is a Markov chain Monte Carlo (MCMC) method for the approximation of marginal and joint distributions based on sampling from conditional distributions. Because all conditional distributions are known (parameters given data and factors, and factors given data and parameters), MCMC can be applied to generate random samples from the joint posterior distribution of unknown parameters and unobserved factors. This algorithm is summarized in the following three steps.

-

1.

Simulation of AR coefficients and the variance innovation of shocks to (2-3) conditional on a draw of factors;

-

2.

Draw of factor loadings conditional on the draw of factors;

-

3.

Simulation of factors conditional on all of the above parameters.

These steps were repeated 220,000 times to ensure the convergence of the chains with the first 20,000 Gibbs sampling replications being discarded.

The prior for all factor loadings is N(0, 1), whereas for the autoregressive parameters, the prior is \(N(0,\Sigma )\), where

The prior for the innovation variances in the observable equation is given by inverted Gamma (6,0.001), which is relatively diffuse (Kose et al. 2012).

Most of our results focus on the relative importance of the European and the country factors. Their assessment relies on variance decomposition. With orthogonal factors, the variance of an observable variable \(Y_{t}^{i,k}\) can be defined as follows:

Consequently, the share of volatility attributable to factor m is given by \(\frac{(\beta _{m}^{i,k})^{2}var(F_{t}^{m})}{var(Y_{t}^{i,k})}\).

3.3 Interpretation of the Results

With 59 regions considered, we obtained 59 individual variance decompositions. It is therefore not feasible for a single study to provide a detailed description of each variance decomposition. Instead, we provided a summary of the results using a series of EU regional maps. The construction of these maps utilized criteria based on the relative variance shares attributable the European factor.

The conventional method for assessing the degree of business cycle synchronization based on bilateral correlation coefficients is associated with several issues. First, correlation coefficients are calculated for a particular pair of regions, which disregards more complex relationships within the overall group of regions, especially the possibility of a common international business cycles. Second, correlations measure the degree of temporal comovement, meaning they do not account for intertemporal comovement that could be present in macroeconomic time series. Finally, correlations do not provide any critical values that can be used to distinguish between regions (or countries) that should join the monetary union. As a result, analysis that relies on correlation coefficients does not directly correspond to the OCA theory.

The prior research aimed at circumventing the first of the aforementioned issues by incorporating correlations into complex networks analysis (Caraiani 2013; Matesanz Gomez and Ortega 2016; Matesanz Gomez et al. 2017). However, these networks are still based on distances between bilateral correlations or Granger causality test between the examined pairs (see Caraiani (2013)); consequently, the analysis within this framework does not allow for the possibility of a single common business cycle among the examined countries. To address the second issue, the authors employ pairwise correlations with lag shifts or conduct Granger causality tests on pairs of the examined time series (Matesanz Gomez and Ortega 2016; Matesanz Gomez et al. 2017). These approaches maintain the bilateral nature of the analysis. Moreover, if a phase shift is present, the analysis conducted within this framework does not allow for identification of the comovment within the same international business cycles (which could result from lags in shocks propagation).

The application of a BDFM facilitates solutions to the three key issues listed above. Firstly, a BDFM allows distinction between the portion of the variation in the real GVA attributable to a factor common to all series, to all the series within the same country, and to a given region. Moreover, the same factor can have various impacts on specific regions through region-specific factor loadings. Therefore, the model accounts for variations in the experiences of international or national business cycles in the regions under examination. Second, the autoregressive nature of idiosyncratic terms and factors (see Eqs. 2 and 3) facilitates the examination of both temporal and intertemporal comovement between time series. In other words, international or national shocks can propagate and affect regions with varying intensity over time. Therefore, a BDFM offers a highly flexible framework for examining international business cycles.

Finally, the application of a BDFM facilitates the introduction of the direct correspondence between the OCA theory and measurement of the degree of synchronization of business cycles. In the original work on OCAs, Mundell (1961) proposed an examination of regions. His approach stands in contrast to most of the literature that assumes (ex ante) that countries are OCAs (e.g., Belke et al. (2017); Beck (2021b, 2022b)). McKinnon (1963) defined an OCA as a domain in which common monetary policy and flexible exchange rates can maintain macroeconomic stability. According to the insights provided by Mundell and McKinnon, monetary policy implemented at the country level does not need to be optimal for all individual regions within a country. The ability of a national central bank to design an optimal monetary policy relies on the degree of business cycle synchronization between the regions in a country. If the regional business cycles within a country are not synchronized, then the cost of renouncing independent monetary policy is relatively low as the central bank is not able to construct a monetary policy that is optimal for all regions. Therefore, the assumption that a given country is an OCA leads to the overestimation of the cost of joining a monetary union.

The application of a BDFM to regional data alleviates these issues by providing information regarding the relative shares of the European factor, country factors, and idiosyncratic factors. Within this framework, we can distinguish the percentage of variation in real GVA that can be attributed to each of these factors for each individual region. Consequently, we can identify regions in which the European factor dominates and the adoption of a common monetary policy is the optimal choice. Similarly, we can identify regions in which the country factor dominates, implying that maintaining monetary policy at the national level is the optimal choice. Furthermore, because results are provided at the regional level, it is possible for a country to have certain regions that should optimally abandon independent monetary policy at the national level, while other regions should not.

The OCA criterion utilized in this research classifies a region as follows.

-

1.

Part of an OCA if the European factor accounts for more than \(50\%\) of the variance in real GVC;

-

2.

not part of an OCA if the country factor accounts for more than \(50\%\) of the variance in real GVC.

This criterion is directly related to the OCA theory and identifies regions in which (1) the common monetary policy is optimal and in which (2) the national monetary policy is optimal. It should be noted that in our results, there are no intermediate cases and the role of the idiosyncratic factor is marginal (below \(5\%\) of the total variance in each case). Therefore, our results provide a clear indication of regions that benefit from participation in the Eurozone. As the criterion we have adopted is very strict, there is a possibility of misrepresentation of the result on the graph, for example, in the case of regions that are slightly below or slightly above the established threshold value. Therefore, we opted for adopting continuous scale on the maps presenting the results, to better depict the nuances in the share of variance explained by the European factor across countries and regions.

Our results exhibit a high degree of heterogeneity in terms of the extent of relative prevalence of the European and country factors in the analyzed sample. Therefore, we added additional maps depicting the share of variance explained by the European factor at a country level calculated in three different ways. In the main text we present the version of the maps using simple averages of the share of variance explained by the European factor at the regional level in a given country. To ensure the robustness of our results, we used two different methods of constructing additional country maps. In the first version, we weighted the share of variance explained by the European by region share in country’s Gross Domestic Products. In the second version, we used the shares of the regional populations among the total population as weights. In other words, we examined a hypothetical voting process for joining the monetary union that is conducted in a manner that allows individuals to vote or money to vote. However, for all three approaches, we obtained results very similar to those of the first version presented in the main text. Appendix B presents the results of these robustness checks.

3.4 Measurement of Regional Specialization

In the empirical section, we explore one of the possible explanations of the results we obtained on the basis of the Krugman View on the relationship between economic integration and synchronization of business cycles (see Section 4 for a detailed explanation). This view connects the prevalence of idiosyncratic shocks to the degree of specialization at the regional level. Therefore, we calculated three alternative measure of specialization for each of the examined regions.

We collected the data on sectoral composition of each regions from the European Commission database. Data covers all 59 examined regions over the 1995–2019 period. The data set is not very detailed and presents division of regional GDP into six NACE (Nomenclature of Economic Activities) sectors: agriculture (A), industry (B-E), construction (F), non-financial services (G-J), financial and business services (K-N), and non-market services (O-S). More detailed description of the sectors is depicted in Table 1.

We calculated three alternative measures of sectoral specialization for each of the 59 examined regions. The first two are based on the so called Krugman specialization index. (Krugman 1992). KSI1 measure is defined as:

where i indices the region \((i=1,\dots ,59)\), s indices the sector \((s=1,\dots ,6)\). \(y_{s,i}\) denotes sector s share in the GDP of region i, while \(y_{\text {EA}}\) denotes denotes sector s share in the GDP of the Eurozone (all 10 countries under examination). KSI1 compares structural shares to shares for the entire examined area, and consequently, it is a relative measure of specialization - a comparison between a region i and an entire analyzed group of countries as a whole. To safeguard against the bias coming from the changes in the sectoral composition of the entire examined area the next two measures we calculate two additional measures. The second variation on the KSI we adopt is based on the differences between the actual shares and the ideal share, the one we would obtain if all the sectors had equal contribution to GDP (\(\frac{1}{S}=\frac{1}{6}\)):

Both KSI1 and KSI2 take values from the range between 0 and 2, where 0 represents complete diversification, while 2 complete specialization within one sector. The final measure of specialization is based on the Herfindahl-Hirschman index (Herfindahl 1950):

The HHI measure takes the values from the range between \(\frac{1}{6}\) and 1. \(HHI=\frac{1}{6}\) implies complete diversification with equal shares of each sector accounting for GDP of a given region, \(HHI=1\) represents complete specialization within one sector.

4 Empirical Results

The estimation results for the 1992 to 2020 period are presented in panel a) of Fig. 2. Overall, 27 of the 59 examined regions are characterized by a variance share explained by the European factor above \(50\%\). However, Spain was the only country in the case of which all the regions where characterized by the shares of variance explained by the European factor above the \(50\%\) threshold. Therefore, it was the only examined country that could determine that joining the Eurozone was associated with net benefits from the perspective of every single region.

To assess whether a given country should join the Euro area, we examined the relative prevalence of the European factor in the regions within that country. The results obtained using average regional value of the share of variance explained by the European factor (in line with the description in Section 3.3) are depicted in panel a) Fig. 3. Spain, with \(61\%\), is the country with the highest average share of variance explained by the European factor. Austria, Finland, France, the Netherlands, and Portugal are all above the \(50\%\) threshold. Therefore, over the entire examined period, those countries would benefit from common monetary policy and that the Eurozone can be considered as an OCA. Italy recorded the lowest results, almost \(41\%\), while Belgium, Germany, and Greece had between \(43\%\) and \(49\%\) of variance explained by the European factor. Even though, those countries are below the threshold value, the analysis indicates relatively high degree of comovement of real gross value added among all examined countries.

Figures 6 and 7 (in Appendix B) present even stronger results in favour of the common European business cycle in the Euro area. However, regardless of the used averaging procedure, Italy comes out as a the the country that is the least aligned with the European business cycle. The results from Figs. 6 and 7 also indicate that regional economies with the highest populations and gross domestic product are the most in line with the European business cycle.

The results presented in panel a) of Fig. 2 and panel a) of Fig. 2 cover a period of 29 years. Over this period European economies experienced the introduction of the Euro, three major crises (the global financial crisis, sovereign debt crisis, and COVID pandemic), and various enlargements of both the Eurozone and the European Union. Furthermore, within this period, European economies went through significant changes that could have contributed to alterations in the pattern of business cycle comovement within the Euro area. Therefore, in the second stage of our analysis, we split the sample into two sub-periods from 1992 to 2005 and 2006 to 2020, and applied our model to each sub-period. The results at the regional level are presented in panel b) and c) of Fig. 2, whereas those from the perspective of countries are presented in panel b) and c) of Fig. 3.

During the 1992 to 2005 period, 40 of the 59 examined regions were characterized by the share of variance explained by the European factor being above \(50\%\). The only country with the average share of variance explained by the European factor below the threshold was France with \(42\%\). This outcome could be explained by relatively mild response of France to the dot-com burst in comparison with other European countries (Aviat et al. 2021). Nevertheless, this result for France is rather close to the threshold value. The share of variance attributable to the European factor was between \(50\%\) and \(60\%\) for Belgium, Germany, and Italy, while above \(60\%\) for the remaining countries (Austria, Greece, Finland, Italy, the Netherlands, and Portugal). This group of nine European countries could be considered an OCA with the minimal costs stemming from the loss of independent monetary policy. Moreover, in the case of Austria, Belgium, Finland, Greece, Italy, the Netherlands, and Portugal, all the regions where above the \(50\%\) threshold, which indicates net benefits of a common monetary policy for those countries. The results depicted in panel b) of Fig. 3 are corroborated by the results obtained using weighted averages in Figs. 6 and 7 (in Appendix B).

The results are vastly different for the 2006 to 2020 period. There are only 8 of 59 regions in which \(50\%\) of the variance could be attributed to the European factor. There is no country with all the regions meeting the \(50\%\) threshold. Spain is the only country in which the European factor dominated in the case of the simple average, and Finland in the instances of weighted averages. Therefore, only those two countries could benefit from common monetary policy. The share of variance explained by the European factor is especially low in the regions of Austria (on average \(36\%\)), Belgium (on average \(33\%\)), Netherlands (on average \(29\%\)), and Italy (on average around \(24\%\)). Consequently, there was no group of countries within the Eurozone that could be considered an OCA.

The case of Spain is especially interesting as it features the highest degree of synchronization with the European business cycle in all the examined periods. This can be explained by the fact that factor loadings for Spanish regions are higher than those of regions in other countries. Therefore, the special standing of Spain can be attributed to its higher sensitivity to international shocks compared to other Eurozone countries. Alvarez et al. (2021) explain this by the pro-cyclical behavior of Spanish government spending.

The results described above indicate a significant business cycle divergence in the Euro area. Furthermore, there was a widespread increase in the share of variance attributable to the country factor at the expense of the European factor. The share of variance explained by the European factor decreased in 46 out of 59 regions. Panel a) of Fig. 4 presents regions in which the share of variance explained by the European factor increased and those in which it decreased. Panel b) of Fig. 4 presents the countries in which most of the regions experienced an increase in the share of the European factor (the graphs obtained using GDP and population weighted averages are identical to panel b) of Fig. 4). The increase in the share of variance explained by the European factor was experienced in five regions in Spain (on average by \(2\%\)), seven in France (on average by \(2\%\)), and one in Germany (by \(1\%\)). However, other regions in those countries experienced drop in the share of variance attributable to the European factor. On the other hand, decrease in the European factor’s share was substantial in Austria (on average by \(28\%\)), Belgium (on average by \(25\%\)), Finland (on average by \(25\%\)), Greece (on average by \(32\%\)), Italy (on average by \(35\%\)), the Netherlands (on average by \(38\%\)), and Portugal (on average by \(26\%\). Therefore, there has been extensive business cycle divergence in the Eurozone over the examined period, and particularly strong in the smaller European economies.

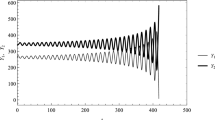

In the next stage of the analysis, we have estimated BDFM over the examined period using 13-years rolling window. The results for all the examined regions are depicted in Figs. 8 to 12 in Appendix C. Interestingly, all the regions ended up with lower share of the European factor than they started with. However, there is high level of heterogeneity in the extent of the drop. The highest decline in the share of variance explained by the European factor taken place in the Netherlands (on average by 40 percentage points), Italy (on average by 39 percentage points), Austria (on average by 38 percentage points), Portugal (on average by 32 percentage points), and Greece (on average by 31 percentage points). Fall in the share of variance was milder in Belgium (on average by 26 percentage points), Finland (on average by 29 percentage points), and Germany (on average by 21 percentage points). Finally, the degree of synchronization with the European cycle was the most stable in France and Spain, where the share of the European factor dropped by 6 and 7 percentage points, respectively. Despite, such heterogeneity in the degree of change, the results demonstrate that the Eurozone regions have decoupled form the European business cycle over the examined period. This conclusion is further corroborated with the results for countries aggregated using simple averages, in Fig. 5, as well as using GDP weights, in Fig. 13, and population weights, in Fig. 14 in Appendix C.

There are two major views regarding the behavior of business cycle synchronization and the constituency of an OCA over time. The first view, which is known as the "European Commission View" and described in the Report of the EU Commision (1990), states that economic integration reduces barriers to trade through removal of tariffs, improved harmonization and recognition of standards, and elimination of exchange rate risk. Consequently, deeper economic integration facilitates international trade, and especially intra-industry trade. In turn, trade in general, and intra-industry trade in particular promotes a more symmetrical distribution of economic shocks and facilitates tighter business cycle synchronization. Therefore, the European Commission View predicts that tighter economic integration will bring economies closer to an OCA. This view is strongly supported by the endogeneity of the OCA criteria hypothesis proposed by Frankel and Rose (1998) - an empirical finding demonstrating close association between trade and synchronization of business cycles that has been corroborated in further research (Baxtera and Kouparitsas 2005; Beck 2019; Fidrmuc 2008). One of the main implications is that countries can fulfill the OCA conditions ex post. Ergo, after joining the monetary union, the elimination of the exchange rate risk facilitates higher trade, and through trade, business cycle convergence, which brings a new member closer to fulfilment of the OCA criteria.

The second view is known as the "Krugman View" and was developed by Krugman (1993). The Krugman View, starts with a similar observation as the European Commission View. The economic integration is associated with elimination of barriers to trade, as well as capital and labor. As he notes, elimination of these barriers facilitates location of industries in places where they can benefit the most from comparative advantage and external economies of scale. This, in turn, results in progressing specialization of regions in the integrating countries. Krugman (1993), following Kenen (1969), argues that specialization is making regional economies more prone to asymmetric shocks. Consequently, the degree of business cycle synchronization at the regional level will decline.

The results reported above do not provide support for the the European Commission View. The decreasing role of the European factor indicates business cycle divergence, which stands in contrast to the predictions made in the Report of the Commission. However, the results do not provide unequivocal support for the Krugman View. On one hand, the declining share of variance explained by the European factor is in line with the Krugman View. On the other hand, the Krugman View predicts intensification of regional specialization, which should be reflected in the increasing role of the idiosyncratic factor, which is region-specific. However, the idiosyncratic factor does not play a major role in driving the behavior of real value added. Therefore, the results presented in this paper cannot be interpreted as providing a strong support for the Krugman View.

In order to investigate justification of the Krugman View further, we examined sectoral composition of individual regions, as well as the their degree of structural specialization. The structural composition of the examined regions over the 1995–2019 period is depicted in Figs. 15 to 19 in Appendix D, while the measures of sectoral specialization are illustrated in Figs. 20 to 24 in Appendix E. The results demonstrate that structural composition of the regions was very stable over the examined period. However, this conclusion should be taken with one reservation. Data on regional composition includes only six sectors, and there exist a possibility, that there has been ongoing specialization within those sectors.

Nevertheless, the three measures point to some changes. Firstly, there has been at least some small degree of specialization. This specialization took place in 50 and 53 regions according to KSI2 and HHI measure, respectively. Using KSI1 measure we find only 18 instances of specialization. However, this result can be attributed to slowly progressing specialization of the entire examined Eurozone, that is taken as a reference point in the case of this measure. On average, the increase in specialization was relatively mild with KSI2 and HHI increasing by \(13\%\) and \(5\%\), respectively. Those outcomes should be interpreted cautiously because regional composition of the Eurozone regions was very diversified to begin with, so we can one can expect strong influence of small base effect. On the other hand, KSI1 on average declined by \(13\%\), indicating progressing diversification. Again, this outcome can be attributed to the overall progress in specialization in the Eurozone as a whole. Summarizing, there has been a slight increase in the degree of specialization in the Eurozone regions, in line with the predictions of the Krugman View.

In the final stage of our analysis, we examined the role of the drivers of the change in the share of variance attributable to the European factor. This approach can allow to examine whether this change can be attributed to the changes in the degree of sectoral specialization of the Eurozone regions. The results of regressions for changes in the impact of the European factor on the initial share of variance explained by the European factor (Initial EF), GDP per capita (GDPpc), population (POP), and the changes in the values of the three measures of specialization in a given region (dKSI2, dKSI2 and dHHI)Footnote 2 are presented in Table 2.Footnote 3 The coefficient of the initial share of variance explained by the European factor is statistically significant in all specifications. It has a negative sign and its absolute value is approximately 1.2. Therefore, regions with initially high shares explained by the European factor experienced the highest drop in value. An additional percentage point of variance explained by the European factor is associated with an approximately 1.2 percentage point decrease in the value of the factor from period to period.

The estimated coefficients on population and GDP per capita are close to zero and not significant at any conventional level in all specifications. Inclusion of one of these variables has minor impact on \(R^{2}\), while at the same time is associated with the drop in the adjusted \(R^{2}\). Because GDP per capita does not influence the phase of business cycle synchronization, the hypothesis of business cycle club convergence cannot be accepted, particularly in light of the fact that the regions with the highest share of variance attributable to the European factor experienced the greatest decline.

Finally, none of the measures of structural specialization is statistically significant. The inclusion of any of the measures into the model has marginal impact on \(R^{2}\), and leads to a decline in adjusted \(R^{2}\). Therefore, we find no evidence that the fall in the degree of business cycle synchronization could be attributed to specialization within sectors. One the one hand, ongoing economic integration in the Eurozone is associated with slowly progressing specialization and business cycle divergence, in line with the prediction of the Krugman View. On the other hand, we do not find evidence on the link between specialization and synchronization of business cycles. In other words, the data shows that the prediction is correct, however, the channel proposed in the Krugman View is not the cause of business cycle divergence in the Eurozone.

5 Conclusions

In this study, we estimated a BDFM for a group of NUTS1 regions in the Euro area countries for the 1992 to 2020 period to fill a gap in the literature, where a DFM has only been applied once to regional data in the context of business cycle synchronization. Our application of a BDFM solves the problems associated with the application of pairwise business cycle comovement indicators as a measure of business cycle synchronization. Furthermore, within the BDFM framework, we developed a criterion directly related to OCAs. Specifically, regions with a variance share explained by the European factor above \(50\%\) will benefit from participation in the Eurozone.

The results of our model indicated that when considering the entire examined period, nearly half of the regions fulfilled this criterion (27 of 59). The result indicates that those regions have benefited from participation in a monetary union. However, Spain was the only country in case of which all the regions where above the \(50\%\) threshold; therefore, it was the only country in the sample that could determine that joining the Eurozone was associated with net benefits from the perspective of every single region.

The examination of the results in sub-periods shed new light on this issue. Specifically, we observed a significant drop in the degree of business cycle synchronization. From 1992 to 2005, 40 regions were characterized by a share of variance attributable to the European factor above \(50\%\), whereas only 8 regions were characterized in this manner in the 2006 to 2020 period. In the latter period, there was no single country in case of which the share of variance explained by the European factor was above \(50\%\) threshold. Moreover, the share of variance explained by the European factor decreased in 46 regions. Furthermore, the analysis conducted using the rolling windows demonstrated that all the regions experienced a drop in the relative share of the European factor. Therefore, our results indicate that over the examined period, Euro area experienced business cycle divergence. This result confirms the findings of a growing body of research on ongoing business cycle divergence in the Eurozone and the European Union (Ferroni and Klaus 2015; Belke et al. 2017; Beck 2021a, c, 2022a, b).

The greatest drop in the share of variance explained by the European factor was experienced by countries that were characterized by the highest initial values. Additionally, changes in the degree of business cycle synchronization are not related to the level of development as measured by the regional real GDP per capita. Taken together, these two results indicate that there is no convergence into clubs for countries in terms of core-periphery or rich-poor regions.

Finally, ongoing business cycle divergence at both the national and regional levels contradicts the predictions of the European Commission View. However, our results do not provide strong support for the Krugman View either. The divergence predicted by the Krugman View should result from the increasing role of the regional factor. However, we found that divergence is a result of the growing importance of the country factor. On the one hand, two predictions stemming from the Krugman View are supported by the results. Firstly, the European regions experienced a slight increase in the degree of sectoral specialization. Secondly, the Eurozone regions experienced business cycle divergence. On the other hand, the data does not support the notion that the ongoing specialization was the underlying cause of this divergence.

Data Availability

This research utilizes data available in the dataset titled ‘Replication Data for: Optimum Currency Area in the Eurozone. The regional origins of the European business cycle. Open Economies Review’ deposited by Krzysztof Beck in 2024, accessible at the Harvard Dataverse (DOI: https://doi.org/10.7910/DVN/H2LWOX). All data necessary to replicate the findings and analyses presented in this paper are openly accessible at the provided link. Researchers interested in further exploring or verifying the results are encouraged to refer to this dataset.

Notes

We experimented with different values of the order of autoregression. Values of \(p=1,2,3,4\) lead to similar results. The results of these robustness checks are not reported for brevity, but are available upon request from the authors.

Those changes are calculated as differences in mean values for the 1995–2005 and the 2006–2019 period. We experimented with different periods, as well as values for individual years (e.g., 1995 and 2019), however, none of these changes had any bearing on the results reported in the main text. The results of these robustness checks are not reported for brevity but available upon request from the authors.

In another robustness check we tried to estimated the impact of KSI1, KSI2, and HHI in levels on the share of variance explained by the European and country factors. In all the considered specifications KSI1, KSI2, and HHI turned out to be not statistically significant. We do not report these results here for brevity, but they are available upon request from the authors.

References

Alfonso A, Furceri D (2008) EMU enlargement, stabilizations costs and insurance mechanisms. J Int Money Financ 27(2):169–187

Alvarez L, Gadea M, Gómez Loscos A (2021) Cyclical patterns of the spanish economy in europe. Documentos Ocasionales 2103, Banco de España

Artis DCM, Kholodilin K (2011) What drives regional business cycles? The role of common and spatial components. Manch Sch 79(5):1035–1044

Artis MJ, Okubo T (2009) The UK Intranational Trade Cycle

Aviat A, Bec F, Diebolt C, Doz C, Ferrand D, Ferrara L, Heyer E, Mignon V, Pionnier PA (2021) Dating business cycles in france: A reference chronology. Working paper, French Economic Association

Backus DK, Kehoe PJ, Kydland FE (1992) International real business cycles. J Polit Econ 100(4):745–775

Baxtera M, Kouparitsas MA (2005) Determinants of business cycle comovement: a robust analysis. J Monet Econ 52(1):360–369

Beck K (2016) Business cycle synchronization in European Union: regional perspective. Equilibrium 11(4):785–815

Beck K (2019) What drives business cycle synchronization? BMA results from the European Union. Baltic Journal of Economics 19(2):248–275

Beck K (2020) Decoupling after the crisis: western and eastern business cycles in the European Union. East Eur Econ 58(1):68–82

Beck K (2021a) Capital mobility and the synchronization of business cycles: evidence from the European Union. Rev Int Econ

Beck K (2021b) Migration and business cycles: testing the OCA theory predictions in the European Union. Appl Econ Lett 28(13):1087–1091

Beck K (2021c) Why business cycles diverge? Structural evidence from the European Union. J Econ Dyn Control 133(104263)

Beck K (2022a) Macroeconomic policy coordination and the European business cycle: Accounting for model uncertainty and reverse causality. Bull Econ Res 74(4):1095–1114

Beck K (2022b) Synchronization without similarity. The effects of COVID-19 pandemic on GDP growth and inflation in the Eurozone. Appl Econ Lett

Belke A, Domnick C, Gros D (2017) Business cycle synchronization in the EMU: core vs periphery. Open Econ Rev 28:863–892

Caraiani P (2013) Using complex networks to characterize international business cycles. PLoS ONE 8(3):e58109

Christiano LJ, Fitzgerald TJ (2001) The band pass filter. Int Econ Rev 44(2):435–465

Clark TE, van Wincoop E (2001) Borders and business cycles. J Int Econ 55(1):59–85

Commision E (1990) One market, one money. An evaluation of the potential benefits and costs of forming an economic and monetary union. Tech Rep 44

Darvas Z, Szapáry G (2007) Business cycle synchronization in the enlarged EU. Open Econ Rev 19(1):1–19

Delgado AIC, Pino G (2020) Business cycle synchronization: is it affected by inflation targeting credibility? SERIEs 11:157–177

Dées S, Zorell N (2012) Business cycle synchronisation: disentangling trade and financial linkages. Open Econ Rev 23:623–643

de Lucas Santos S, Delgado Rodríguez MJ (2016) Core-periphery business cycle synchronization in Europe and the great recession. East Eur Econ 54(6):521–556

Ductor L, Leiva-Leon D (2016) Dynamics of global business cycles interdependence. J Int Econ 102:1109–1127

Ferroni F, Klaus B (2015) Euro area business cycles in turbulent times: convergence or decoupling? Appl Econ 47(34–35):3791–3815

Fidrmuc J (2008) The endogeneity of the optimum currency area criteria, intra-industry trade, and EMU enlargement. Contemp Econ Policy 22(1):1–12

Frankel JA, Rose AK (1998) The Endogenity of the optimum currency area criteria. Econ J 108(449):1009–1025

Gadea-Rivas GLAMD, Leiva-Leon D (2018) Increasing linkages among European regions. The role of sectoral composition. Econ Model 80:222–243

Gianelle MLC, Salotti S (2017) Interregional trade, specialization, and the business cycle: policy implications for the EMU. J Bus Cycle Res 13:1–27

Herfindahl OC (1950) Concentration in the u.s. steel industry. PhD thesis, Columbia University, New York

Jagric T, Ovin R (2004) Method of analyzing business cycle in a transition economy: the case of Slovenia. Dev Econ 42(1):42–62

Karadimitropoulou A (2018) Advanced economies and emerging markets: dissecting the drivers of business cycle synchronization. J Econ Dyn Control 93(4):115–130

Karadimitropoulou A, León-Ledesma M (2013) World, country, and sector factors in international business cycles. J Econ Dyn Control 37(12):2913–2927

Kenen PB (1969) The optimum currency area: an eclectic view. In: Monetary Problems of the International Economy, University of Chicago Press

Kim Y (2021) Global or country business cycles: developed versus developing countries. Seoul J Econ 34(1):81–98

Kose M, Prasad E, Terrones M (2003a) How does globalization affect the synchronization of business cycles? Am Econ Rev 93(2):57–62

Kose MA, Otrok C, Whiteman CH (2003b) International business cycles: world, region, and country-specific factors. Am Econ Rev 93(4):1216–1239

Kose MA, Otrok C, Whiteman CH (2008) Understanding the evolution of world business cycles. J Int Econ 75(1):110–130

Kose MA, Otrok C, Prasad E (2012) Global business cycles: convergence or decoupling? Int Econ Rev 53(2):511–538

Krugman P (1992) Geography and Trade. The MIT Press, Cambridge, Massachusetts

Krugman PR (1993) Lessons of Massachusetts for EMU. In: Torres F, F G (eds) Adjustment and Growth in the European Monetary Union, Cambridge University Press, Cambridge, pp 241–266

Lee J (2012) Measuring business cycle comovement in Europe: evidence from a dynamic factor model with time-varying parameters. Econ Lett 115(3):438–440

Lee J (2013) Business cycle synchronization in Europe: evidence from a dynamic factor model. Int Econ J 27(3):347–364

Lehwald S (2013) Has the Euro changed business cycle synchronization? Evidence from the core and the periphery. Empirica 40(4):655–684

Leiva-Leon D (2017) Measuring business cycles intra-synchronization in US: a regime-switching interdependence framework. Oxford Bull Econ Stat 79(4):513–545

Long JB, Plosser CI (1983) Real business cycles. J Polit Econ 91(1):39–69

Matesanz Gomez D, Ortega GJ (2016) On business cycles synchronization in europe: A note on network analysis. Physica A 462:287–296

Matesanz Gomez D, Ferrari HJ, Torgler B, Ortega GJ (2017) Synchronization and diversity in business cycles: a network analysis of the European Union. Appl Econ 49(10):972–986

McKinnon R (1963) Optimum currency areas. Am Econ Rev 53(4):717–725

Montoya LA, de Haan J (2008) Regional business cycle synchronization in Europe? IEEP 5(1–2):123–137

Mundell R (1961) A theory of optimum currency areas. Am Econ Rev 51(4):657–665

Norrbin SC, Schlagenhauf DE (1991) The importance of sectoral and aggregate shocks in business cycles. Economic Inquiery 29(2):317–335

Norrbin SC, Schlagenhauf DE (1996) The role of international factors in the business cycle: A multi-country study. J Int Econ 40(1–2):85–104

Oman W (2019) The synchronization of business cycles and financial cycles in the Euro area. Int J Cent Bank 15(1):327–362

Otrok C, Whiteman CH (1998) Bayesian leading indicators: measuring and predicting economic conditions in Iowa. Int Econ Rev 39(4):997–1014

Panteladis I, Tsiapa M, Duran HE (2011) Business cycle synchronisation in the Greek regions. J Urban Reg Anal 3(2):143–158

Poncet S, Barthélemy J (2008) China as an Integrated Area? J Econ Integr 23(4):896–926

Song ZTT, Xia K (2018) Regional business cycle synchronization in Europe? Chin Geogra Sci 28(4):571–583

Stock JH, Watson MW (1993) A procedure for predicting recessions with leading indicators: Econometric issues and recent experience. In: Business cycles, indicators and forecasting, University of Chicago Press, pp 95–156

Funding

This article was prepared under the research project “Structural and regional aspects of international business cycles,” which is funded by the Polish National Science Centre on the basis of decision No. DEC-2019/35/D/HS4/03636

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Beck, K., Okhrimenko, I. Optimum Currency Area in the Eurozone. Open Econ Rev (2024). https://doi.org/10.1007/s11079-024-09750-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s11079-024-09750-z