Abstract

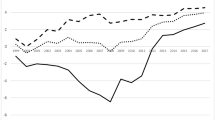

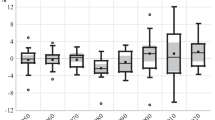

We analyze current account imbalances through the lens of the two largest surplus countries; China and Germany. We observe two striking patterns visible since the 2007/8 Global Financial Crisis. First, while China has been gradually reducing its current account surplus, Germany’s surplus has continued to increase throughout and after the crisis. Second, for these two countries, there is a remarkable reversal in the patterns of exchange rate misalignment: China’s currency has turned from being undervalued to overvalued, Germany’s currency has erased its level of overvaluation and become undervalued. Our empirical analyses show that the current account balances of these two countries are quite well explained by currency misalignment, common economic factors, and country-specific factors. Furthermore, we highlight the global financial crisis effects and, for Germany, the importance of differentiating balances against euro and non-euro countries.

Similar content being viewed by others

Notes

In 2018, Christine Lagarde specifically addressed Germany’s role in reducing global imbalances in the post-crisis period: “We need to ask why German households and companies save so much and invest so little, and what policies can resolve this tension” (Speech at the joint IMF-BBk conference “Germany-Current Economic Policy Debates”, January 2018).

In 2015, China’s surplus was USD 304.2 bn., while that of Germany was USD 288.2 bn. The US deficit in the same year was USD 434.6 bn., accounting for 35% of the world’s current account deficits.

Since China’s current account surplus started bourgeoning at the beginning of the twenty-first century, its foreign exchange policy has been scrutinized and criticized. The US is arguably the most vocal critic and threatens to impose various retaliation measures including the 2005 Schumer–Graham bipartisan bill that proposes to impose an across the board tariff on all imports from China to force China to stop currency manipulation. More recently, also Germany has been in the focus of criticism, both vis-a-vis the US and its European trading partners.

Ma and McCauley (2014) compares the evolution processes of the Chinese and German imbalances.

For China, Giannellis and Koukouritakis (2018) is an exception.

Currency undervaluation and the resulting misalignment lead to contentious policy debate and academic discussions (Mattoo and Subramanian 2009; Staiger and Sykes 2010; Marchetti et al. 2012; Engel 2011; Corsetti et al. 2018). Engel (2011), for example, argues that maintaining the exchange rate at its fundamental equilibrium level should be an additional independent policy objective of central banks.

For instance, Hans-Jürgen Schmahl, the former member of the German Council of Economic Experts criticized the German overvaluation (“Die teure D-Mark behindert deutsche Exporteure – vor allem in Europa”, Die Zeit, April 16th, 1993).

“Why Germany’s current-account surplus is bad for the world economy”, The Economist, July 8th, 2017.

Some studies examine the real effective exchange rate effect on current account balances; see, for example, Khan and Knight (1983), Edwards (1989), Lee and Chinn (2006), and Arghyrou and Chortareas (2008). Some studies consider currency misalignment instead of real effective exchange rate; see, for example, Freund and Pierola (2012), Algieri and Bracke (2011), Di Nino et al. (2011), and Haddad and Pancaro (2010). Gnimassoun and Mignon (2015) and Gnimassoun (2017) suggest that the use of currency misalignment measures alleviates endogeneity concerns.

In 2005, China modified its exchange rate policy from a de facto dollar peg to a “managed floating exchange rate regime,” which put the RMB on a gradual appreciation path. China replaced the managed float with a stable RMB/dollar rate policy in the midst of the global financial crisis, reestablished the managed float and allowed the RMB to appreciate in 2011. In 2015, China revamped its RMB central parity formation mechanism to enhance the role of market forces. In the same year, the IMF indeed stated that the RMB is at a level that is no longer undervalued in its Article IV consultation mission press release. Over time, China, either because of domestic or external considerations, has loosened its grip on the RMB and led to changes in the misalignment pattern.

For some observers, the limited role of currency misalignment in China in the pre-crisis period may appear surprising, as there is an abundance of news reports on the alleged use of currency misalignment to stimulate exports. However, it is not uncommon that academic studies reported the Chinese exports and imports do not follow the textbook exchange rate effects and do not empirically satisfy the Marshall-Lerner condition (Cheung et al. 2012; Devereux and Genberg 2007; Marquez and Schindler 2007), and that the Renminbi misalignment estimate can span a wide range that covers both under- and overvaluation (Bineau 2010; Cheung and He 2019).

Compared to the Aizenman and Sengupta (2011) specification, there are several contributions. First, we extend the sample period beyond the global financial crisis and obtain additional insight about the evolution of current account balances after the crisis. Secondly, the use of currency misalignment instead of real exchange rates as an important explanatory factor alleviates endogeneity concerns. Third, we include additional controls (e.g. China- and Germany-specific factors), and, fourth, we consider a full multivariate specification.

The beginning of the sample period is mainly determined by the availability of Chinese data. We consider the same sample period for both China and Germany to facilitate the joint estimation and comparison.

See Couharde et al. (2017) for a detailed discussion of the database.

The literature covers a diverse set of determinants of current account balances. Our choices are based on existing studies including Ca’Zorzi et al. (2012), Algieri and Bracke (2011), Karunaratne (1988), Calderon et al. (2002), Chinn and Prasad (2003), Gruber and Kamin (2007), Liesenfeld et al. (2010), Aizenman and Sengupta (2011), Duarte and Schnabl (2015), Unger (2017).

Results obtained from alternative choices of crisis years for the dummy variable are available upon request. Among the alternative crisis variables, the Crisis07 dummy variable yields the highest R-squares and, thus, is used in all subsequent regressions.

Analytically, Devereux and Genberg (2007), for example, show that an RMB depreciation will have an immediate reverse effect and little short-run effect on the current account balance.

The (total) age dependency variable, which is the sum of the young and old age dependency variables is not included to avoid multicollinearity.

Other empirical studies on the determinants of the current account came up with similarly mixed results. While, for example, Gruber and Kamin (2007) mostly found negative coefficients for both, the young and old age dependency ratio, Aizenman and Sengupta (2011) report heterogeneous results across the two countries and their age profiles.

Similarly, Horioka et al. (2007) report a positive old-age dependency effect in Chinese saving data.

For Germany, the statistically insignificant old-age dependency ratio is not surprising given the well-documented non-standard saving behavior of Germans. Börsch-Supan et al. (2001), for instance, document the “German savings puzzle” of relatively flat saving rates across age profiles in Germany. A recent study by the Deutsche Bank even finds the savings rate to increase in the second half of retirement. According to survey data, two motives stand out in explaining this finding: i) German retirees are eager to hedge longevity risk and ii) more than half of them would prefer passing their savings to descendants rather than consuming it by themselves (Kaya and Mai 2019).

To account for the effect of a slowdown in global growth after the GFC, we considered adding an interaction term of the global growth variable with our crisis dummy. For both countries, the interaction term is insignificant, and its inclusion does not change our main results. These results are not reported for brevity but are available upon request.

The theoretical effects of these variables are mostly ambiguous. Expansionary monetary policy may exert expenditure-switching and opposing income-absorption effects. Monetary aggregates are, furthermore, often considered to be proxies of financial depth. Empirically, Kim (2001) finds positive short-term effects on the trade balance (of small open) economies. The coefficients of the inflation and real interest rate variables are in line with what the savings literature surmises (Loayza et al. 2000; Masson et al. 1998).

In passing, we note that the residual estimates of these specifications a) pass the stationarity test; that is, we cannot reject the hypothesis that they are stationary, and b) pass the serial correlation test; that is, we cannot reject the hypothesis that these residuals are not serially correlated. The results are available upon request.

In addition to the two robustness exercises reported below, we assessed whether trade barriers play a marginal effect. However, as reported in Table B1 of Appendix B, neither the average tariff rates nor the accession to the WTO help to explain these two countries’ current account balances.

We also experimented with other CEPII estimates based on i) a smaller set of fundamental variables (i.e. relative sectoral productivity alone, or relative sectoral productivity and net foreign assets), ii) a smaller set of trade partners (top-30), and iii) time-varying trade weights based on a rolling 5-year window. Regarding the estimates by Cheung et al. (2017), we alternatively included pooled estimates over all income groups and quadratic regression equations (instead of linear regressions, separately estimated for developing and developed countries). The results are remarkably robust across these choices (with minor exceptions) and are available upon request.

China established the export tax rebate policy in 1985 and implemented the “full refund” in 1988. See Liu (2013) and references therein for the evolution of China’s export VAT rebate policies.

The insignificant financial liberalization effect is likely attributed to the fact that the Chinn-Ito index is an aggregate measure of financial openness. Different aspects of financial regulations can have opposing effects on the current account (Moral-Benito and Roehn 2016).

On the development of misalignment within the euro area see, for example, Coudert et al. (2013).

References

Aizenman J, Sengupta R (2011) Global imbalances: is Germany the new China? A skeptical view. Open Econ Rev 22(3):387–400

Algieri B, Bracke T (2011) Patterns of current account adjustment—insights from past experience. Open Econ Rev 22(3):401–425

Almås I, Grewal M, Hvide M, Ugurlu S (2017) The PPP approach revisited: a study of RMB valuation against the USD. J Int Money Financ 77:18–38

Arghyrou MG, Chortareas G (2008) Current account imbalances and real exchange rates in the euro area. Rev Int Econ 16:747–764

Auer, RA (2014) What drives TARGET2 balances? Evidence from a panel analysis. Econ Policy 29(77):139–197

Bagnai A, Manzocchi S (1999) Current-account reversals in developing countries: the role of fundamentals. Open Econ Rev 10(2):143–163

Bineau Y (2010) Renminbi's misalignment: a meta-analysis. Econ Syst 34(3):259–269

Börsch-Supan A, Reil-Held A, Rodepeter R, Schnabel R, Winter J (2001) The German savings puzzle. Res Econ 55(1):15–38

Bussière M, Fratzscher M, Müller GJ (2006) Current account dynamics in OECD countries and in the new EU member states: an intertemporal approach. J Econ Integr 21:593–618

Ca’Zorzi M, Chudik A, Dieppe A (2012) Thousands of models, one story: current account imbalances in the global economy. J Int Money Financ 31(6):1319–1338

Calderon CA, Chong A, Loayza NV (2002) Determinants of current account deficits in developing countries. BE J Macroeconomics: Contributions to Macroeconomics 2:1

Cavallo E, Eichengreen B, Panizza U (2017) Can countries rely on foreign saving for investment and economic development? Rev World Econ:1–30

Cheung Y-W, Fujii E (2014) Exchange rate misalignment estimates—sources of differences. Int J Financ Econ 19(2):91–121

Cheung Y-W, He S (2019) Truths and myths about RMB misalignment: a meta-analysis. Comp Econ Stud forthcoming

Cheung Y-W, Chinn MD, Fujii E (2007) The overvaluation of renminbi undervaluation. J Int Money Financ 26(5):762–785

Cheung Y-W, Chinn MD, Fujii E (2009) Pitfalls in measuring exchange rate misalignment. Open Econ Rev 20(2):183–206

Cheung Y-W, Chinn MD, Qian XW (2012) Are Chinese trade flows different? J Int Money Financ 31(8):2127–2146

Cheung, Y-W, Aizenman J, and Ito H (2016) The interest rate effect on private saving: alternative perspectives. NBER Working Paper #22872

Cheung Y-W, Chinn MD, Nong X (2017) Estimating currency misalignment using the Penn effect: it is not as simple as it looks. International Finance 20(3):222–242

Chinn MD, Ito H (2006) What matters for financial development? Capital controls, institutions, and interactions. J Dev Econ 81(1):163–192

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59(1):47–76

Cooper, RN (2008) Global imbalances: globalization, demography, and sustainability. J Econ Perspect 22(3): 93–112

Corsetti, G, Dedola L, and Leduc S (2018) Exchange rate misalignment, capital flows, and optimal monetary policy trade-offs. CEPR discussion papers #12850, March 2018

Coudert V, Couharde C, Mignon V (2013) On currency misalignments within the euro area. Rev Int Econ 21(1):35–48

Couharde C, Delatte A-L, Grekou C, Mignon V, and Morvillier F (2017) EQCHANGE: a world database on actual and equilibrium effective exchange rates. Working paper CEPII no. 2017–14, 2017

Devereux MB, Genberg H (2007) Currency appreciation and current account adjustment. J Int Money Financ 26(4):570–586

Di Nino V, Eichengreen B, and Sbracia M (2011) Real exchange rates, trade, and growth: Italy 1861–2011. Quaderni di storia economica (Economic History Working Papers) 10. Bank of Italy.

Duarte P, Schnabl G (2015) Macroeconomic policy making, exchange rate adjustment and current account imbalances in emerging markets. Rev Dev Econ 19(3):531–544

Edwards S (1989) Real exchange rates, devaluation, and adjustment exchange rate policy in developing countries. MIT Press

Edwards S (2004) Thirty years of current account imbalances, current account reversals, and sudden stops. IMF Staff Pap 51(1):1–49

Edwards S (2008) On current account surpluses and the correction of global imbalances. In: current account and external Financing, Cowan, Kevin; Edwards, Sebastian and Valdes, Rodrigo O. Santiago: Central Bank of Chile, 2008

Engel C (2011) Currency misalignments and optimal monetary policy: a reexamination. Am Econ Rev 101(6):2796–2822

Feldstein M (2011) The role of currency realignments in eliminating the US and China current account imbalances. J Policy Model 33(5):731–736

Freund C, Pierola MD (2012) Export surges. J Dev Econ 97(2):387–395

Garroway C, Hacibedel B, Reisen H, Turkisch E (2012) The renminbi and poor-country growth. World Econ 35(3):273–294

Giannellis N, Koukouritakis M (2018) Currency misalignments in the BRIICS countries: fixed vs. floating exchange rates. Open Econ Rev 29(5):1123–1151

Gnimassoun B (2017) Exchange rate misalignments and the external balance under a pegged currency system. Rev Int Econ 25(5):949–974

Gnimassoun B, Mignon V (2015) Persistence of current-account disequilibria and real exchange-rate misalignments. Rev Int Econ 23(1):137–159

Gruber JW, Kamin SB (2007) Explaining the global pattern of current account imbalances. J Int Money Financ 26(4):500–522

Haddad M, Pancaro C (2010) Can real exchange rate undervaluation boost exports and growth in developing countries? Yes, but not for long. The World Bank, Economic Premise

Horioka CY, Junmin W (2007) The determinants of household saving in China: a dynamic panel analysis of provincial data. J Money, Credit, Bank 39(8):2077–2096

Isard P (2007) Equilibrium exchange rates: assessment methodologies. IMF Working Paper No. 7-296. International Monetary Fund, 2007

Kaldor N (1980) The foundations of free trade theory and their implications for the current world recession. In: Unemployment in Western countries, Malinvaud, Edmond and Fitoussi, Jean-Paul (Eds), International Economic Association Publications. Palgrave Macmillan, London, 1980

Karunaratne ND (1988) Macro-economic determinants of Australia’s current account, 1977–1986. Weltwirtschaftliches Archiv 124(4):713–728

Kaya O, Mai H (2019) Why do elderly Germans save? Deutsche Bank research focus, March 5, 2019

Keynes, JM (1941) Memorandum on post war currency policy, September 8, 1941. Reprinted in: the collected writings of John Maynard Keynes. Vol. 25: The Origins of the Clearing Union, 1940–1942, Johnson, Elizabeth and Moggridge, Donald (Eds.), Royal Economic Society, London 1978

Khan MS, Knight MD (1983) Determinants of current account balances of non-oil developing countries in the 1970s: an empirical analysis. Staff Papers 30(4):819–842

Kim S (2001) Effects of monetary policy shocks on the trade balance in small open European countries. Econ Lett 71(2):197–203

Lane PR, Milesi-Ferretti GM (2018) The external wealth of nations revisited: international financial integration in the aftermath of the global financial crisis. IMF Economic Review 66(1):189–222

Lee J, Chinn MD (2006) Current account and real exchange rate dynamics in the G7 countries. J Int Money Financ 25(2):257–274

Li H, Zhang J, Zhang J (2007) Effects of longevity and dependency rates on saving and growth: evidence from a panel of cross countries. J Dev Econ 84(1):138–154

Liesenfeld R, Valle Moura G, Richard J-F (2010) Determinants and dynamics of current account reversals: an empirical analysis. Oxf Bull Econ Stat 72(4):486–517

Liu X (2013) Tax avoidance through re-imports: the case of redundant trade. J Dev Econ 104:152–164

Loayza N, Schmidt-Hebbel K, Servén L (2000) What drives private saving across the world? Rev Econ Stat 82(2):165–181

Ma G, McCauley RN (2014) Global and euro imbalances: China and Germany. China & World Economy 22(1):1–29

Marchetti J, Ruta M, and Teh R (2012) Trade imbalances and multilateral trade cooperation. CESifo Working Paper #4050

Marquez J, Schindler J (2007) Exchange-rate effects on China's trade. Rev Int Econ 15(5):837–853

Masson PR, Bayoumi T, Samiei H (1998) International evidence on the determinants of private saving. World Bank Econ Rev 12(3):483–501

Mattoo A, Subramanian A (2009) Currency undervaluation and sovereign wealth funds: a new role for the World Trade Organization. World Econ 32(8):1135–1164

Moral-Benito E, Roehn O (2016) The impact of financial regulation on current account balances. Eur Econ Rev 81:148–166

Qin D, He X (2011) Is the Chinese currency substantially misaligned to warrant further appreciation? World Econ 34(8):1288–1307

Sinn, H-W (2007) Can Germany be saved? The malaise of the world's first welfare state. MIT Press: Cambridge

Sinn, H-W (2014) The euro trap: on bursting bubbles, budgets, and beliefs. Oxford University Press: Oxford

Sinn H-W, Wollmershäuser T (2012) Target loans, current account balances and capital flows: the ECB’s rescue facility. Int Tax Public Financ 19(4):468–508

Staiger RW, Sykes AO (2010) Currency manipulation’and world trade. World Trade Rev 9(4):583–627

Steinkamp S, Westermann F (2014) The role of creditor seniority in Europe's sovereign debt crisis. Econ Policy 29(79):495–552

Svensson LEO, Razin A (1983) The terms of trade and the current account: The Harberger-Laursen-Metzler effect. J Polit Econ 91(1):97–125

Unger R (2017) Asymmetric credit growth and current account imbalances in the euro area. J Int Money Financ 73:435–451

Williamson J (1983) The exchange rate system, policy analyses in international economics 5. Washington DC: Institute for International Economics

Acknowledgments

We would especially like to thank two anonymous referees and the editor for their constructive comments and suggestions, which substantially improved the paper. We also thank Joshua Aizenman, Philippe Bacchetta, Angela Capolongo, Woo Jin Choi, Paul Luk, Xingwang Qian, Kishen S. Rajan, and participants of the Bank of Finland Institute for Economies in Transition (BOFIT) Seminar in Helsinki, as well as the conference on “Current Account Balances, Capital Flows and International Reserves” in Hong Kong for their comments and suggestions. Cheung gratefully thanks The Hung Hing Ying and Leung Hau Ling Charitable Foundation for its support. Westermann thanks BOFIT for its hospitality during the research visit in 2018.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2: Additional Figures and Regression Results

Rights and permissions

About this article

Cite this article

Cheung, YW., Steinkamp, S. & Westermann, F. A Tale of Two Surplus Countries: China and Germany. Open Econ Rev 31, 131–158 (2020). https://doi.org/10.1007/s11079-019-09537-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-019-09537-7