Abstract

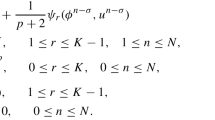

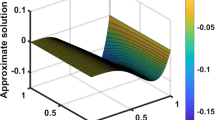

In this paper, we propose a collocation scheme for efficiently solving the mixed time-fractional Black-Scholes (MTF-BS) model and obtaining the option price. Our approach involves deriving the mixed fractional Black-Scholes (MF-BS) partial differential equation (PDE) considering the delta hedging strategy and the mixed fractional Geometric Brownian motion (MFGBM) model. To simplify the problem, we transform the MTF-BS PDE into a modified Riemann-Liouville derivative form. Subsequently, a collocation method is employed to numerically solve the transformed equation, where the solution is represented as a series of fractional Jaiswal functions with unknown coefficients. By utilizing operational matrices and collocation points, we convert the problem into a linear system of equations, allowing for the examination of convergence and stability in the Sobolev spaces. Finally, we present four examples to demonstrate the method’s effectiveness and accuracy.

Similar content being viewed by others

Data availability

The datasets generated during the current study are available.

References

Haug, E.G.: The history of option pricing and hedging. In Vinzenz Bronzin’s Option Pricing Models: Exposition and Appraisal. Berlin, Heidelberg: Springer Berlin Heidelberg (2009)

Black, F., Scholes, M.S.: The pricing of options and corporate liabilities. Journal of Political Economy, University of Chicago Press. 81, 637–654 (1993)

Benninga, S.: Financial modeling. MIT press (2014)

Rachev, S.T., Kim, Y.S., Bianchi, M.L., Fabozzi, F.J.: Financial models with Levy processes and volatility clustering. John Wiley & Sons (2011)

Gardiner, C.: Stochastic models. Springer, Berlin (2009)

Bass, R.F.: Stochastic processes. Cambridge University Press (2011)

Kolmogorov, A.N.: Wienersche spiralen und einige andere interessante kurven in hilbertscen raum, cr (doklady). Acad. Sci. URSS (NS) 26, 115–118 (1940)

Rostek, S.: Option pricing in fractional Brownian markets. Springer (2009)

Rogers, L.C.G.: Arbitrage with fractional Brownian motion. Math Financ. 7, 95–105 (1997)

Shiryaev, A. N.: On arbitrage and replication for fractal models (1998)

Willinger, W., Taqqu, M.S., Teverovsky, V.: Stock market prices and long-range dependence. Finance Stoch. 3, 1–13 (1999)

Cheridito, P.: Arbitrage in fractional Brownian motion models. Finance Stoch. 7, 533–553 (2003)

Cheridito, P.: Mixed fractional Brownian motion. Bernoulli. 913-934 (2001)

Zili, M.: On the mixed fractional Brownian motion. International Journal of stochastic analysis. (2006)

Cai, C., Cheng, X., Xiao, W., Wu, X.: Parameter identification for mixed fractional Brownian motions with the drift parameter. Phys. A: Stat. Mech. 536, 120942 (2019)

Zhang, P., Sun, Q., Xiao, W.L.: Parameter identification in mixed Brownian-fractional Brownian motions using Powell’s optimization algorithm. Econ. Model. 40, 314–319 (2014)

Xiao, W.L., Zhang, W.G., Zhang, X., Zhang, X.: Pricing model for equity warrants in a mixed fractional Brownian environment and its algorithm. Phys. A: Stat. Mech. 391, 6418–6431 (2012)

Najafi, A., Mehrdoust, F.: Conditional expectation strategy under the long memory Heston stochastic volatility model. Commun. Stat. Simul. Comput. 1-21 (2023)

Leland, H.E.: Option pricing and replication with transactions costs. J. Finance. 40, 1283–1301 (1985)

Kabanov, Y.M., Safarian, M.M.: On Leland’s strategy of option pricing with transactions costs. Finance Stoch. 1, 239–250 (1997)

Zhang, M., Jia, J., Hendy, A.S., Zaky, M.A., Zheng, X.: Fast numerical scheme for the time-fractional option pricing model with asset-price-dependent variable order. Appl. Numer, Math (2023)

Soleymani, F., Zhu, S.: Error and stability estimates of a time-fractional option pricing model under fully spatial-temporal graded meshes. J. Comput. Appl. Math. 425, 115075 (2023)

Kazmi, K.: A second order numerical method for the time-fractional Black-Scholes European option pricing model. J. Comput. Appl. Math. 418, 114647 (2023)

Zhang, M., Jia, J., Zheng, X.: Numerical approximation and fast implementation to a generalized distributed-order time-fractional option pricing model. Chaos Solit. Fractals. 170, 113353 (2023)

An, X., Wang, Q., Liu, F., Anh, V.V., Turner, I.W.: Parameter estimation for time-fractional Black-Scholes equation with S &P 500 index option. Numer. Algorithms. 1-30 (2023)

Rahimkhani, P., Ordokhani, Y., Sabermahani, S.: Hahn hybrid functions for solving distributed order fractional Black-Scholes European option pricing problem arising in financial market. Math. Methods Appl. Sci. 46, 6558–6577 (2023)

Taghipour, M., Aminikhah, H.: A spectral collocation method based on fractional Pell functions for solving time-fractional Black-Scholes option pricing model. Chaos Solit. Fractals. 163, 112571 (2022)

Abdi, N., Aminikhah, H., Sheikhani, A.R.: High-order compact finite difference schemes for the time-fractional Black-Scholes model governing European options. Chaos Solit. Fractals. 162, 112423 (2022)

Roul, P.: Design and analysis of a high order computational technique for time-fractional Black-Scholes model describing option pricing. Math. Methods Appl. Sci. 45, 5592–5611 (2022)

Sarboland, M., Aminataei, A.: On the numerical solution of time fractional Black-Scholes equation. Int. J. Comput. Math. 99, 1736–1753 (2022)

Mesgarani, H., Bakhshandeh, M., Aghdam, Y.E., Gómez-Aguilar, J.F.: The convergence analysis of the numerical calculation to price the time-fractional Black-Scholes model. Comput Econ. 62(4), 1845–1856 (2023)

Mesgarani, H., Aghdam, Y.E., Beiranvand, A., Gómez-Aguilar, J. F.: A novel approach to fuzzy based efficiency assessment of a financial system. Comput Econ. 1-18 (2023)

Aghdam, Y. E., Mesgarani, H., Amin, A., Gómez-Aguilar, J. F.: An efficient numerical scheme to approach the time fractional Black-Scholes model using orthogonal Gegenbauer polynomials. Comput Econ. 1-14 (2023)

Mohapatra, J., Santra, S., Ramos, H.: Analytical and numerical solution for the time fractional Black-Scholes model under jump-diffusion. Comput Econ. 1-26 (2023)

Priyadarshana, S., Mohapatra, J., Pattanaik, S.R.: A second order fractional step hybrid numerical algorithm for time delayed singularly perturbed 2D convection-diffusion problems. Appl Numer Math. 189, 107–129 (2023)

Mohapatra, J., Priyadarshana, S., Raji Reddy, N.: Uniformly convergent computational method for singularly perturbed time delayed parabolic differential-difference equations. Eng Comput. 40(3), 694–717 (2023)

Aghdam, Y.E., Mesgarani, H., Amin, A., Gómez-Aguilar, J.F.: An efficient numerical scheme to approach the time fractional Black-Scholes model using orthogonal Gegenbauer polynomials. Comput. Econ. 1-14 (2023)

Kaur, J., Natesan, S.: A novel numerical scheme for time-fractional Black-Scholes PDE governing European options in mathematical finance. Numer. Algorithms. 1-31 (2023)

Zhang, H., Liu, F., Turner, I., Yang, Q.: Numerical solution of the time fractional Black-Scholes model governing European options. Comput. Math. with Appl. 71, 1772–1783 (2016)

Jaiswal, D.V.: On polynomials related to Tchebichef polynomials of the second kind. Fibonacci Q. 12, 263–265 (1974)

Canuto, C., Hussaini, M.Y., Quarteroni, A., Zang, T.A.: Spectral methods: fundamentals in single domains. Springer Science & Business Media (2007)

Rahimkhani, P., Ordokhani, Y.: Generalized fractional-order Bernoulli-Legendre functions: an effective tool for solving two-dimensional fractional optimal control problems. IMA J. Math. Control. Inf. 36, 185–212 (2019)

Zhao, T., Li, C., Li, D.: Efficient spectral collocation method for fractional differential equation with Caputo-Hadamard derivative. Fract. Calc. Appl. Anal. 26(6), 2903–2927 (2023)

Abo-Gabal, H., Zaky, M.A., Doha, E.H.: Fractional Romanovski-Jacobi tau method for time-fractional partial differential equations with nonsmooth solutions. Appl. Numer. Math. 182, 214–34 (2022)

Dehestani, H., Ordokhani, Y.: Razzaghi, M: An improved numerical technique for distributed-order time-fractional diffusion equations. Numer. Methods Partial Differ. Equ. 37(3), 2490–2510 (2021)

Author information

Authors and Affiliations

Contributions

Dr. Alazemi and Dr. Alsenafi designed and wrote the main idea of the paper and solved the pde and wrote the paper text and Dr Najafi wrote the program section.

Corresponding author

Ethics declarations

Ethical approval

The manuscript is not submitted to more than one journal for simultaneous consideration. The manuscript is original and is not published elsewhere in any form or language. The manuscript is not divided into several parts to increase the quantity of submissions and submitted to various journals or to one journal over time. Results are presented clearly, honestly, and without fabrication, falsification, or inappropriate data manipulation (including image-based manipulation). No data, text, or theories by others are not presented without references.

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Alazemi, F., Alsenafi, A. & Najafi, A. A spectral approach using fractional Jaiswal functions to solve the mixed time-fractional Black-Scholes European option pricing model with error analysis. Numer Algor (2024). https://doi.org/10.1007/s11075-024-01797-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11075-024-01797-w