Abstract

We experimentally compare collusive behaviors in first-price sealed-bid auctions without and with a reserve price. Before the auction begins, a bidder may offer a bribe to the other bidder, in exchange for a commitment not to participate in the auction. We find that the average offer and the rate of successful bribes are significantly lower in the treatment with a reserve price. These results are largely due to responding bidders who demand a greater share of the benefit from collusion. Although imposing a reserve price reduces efficiency, its optimality and bribe deterrence shift the surplus from the bidders to the seller.

Similar content being viewed by others

Notes

For example, Graham and Marshall (1987) argue that the optimal response of the auctioneer to the formation of coalitions is to establish a reserve price.

Gonçalves (2013) offers three alternative explanations for the results: (1) valuations may be private, but correlated; (2) entry may be endogenous; and (3) there may be a common value component in valuations.

Llorente-Saguer and Zultan (2017) use the same game as in our paper, while Agranov and Yariv (2018) have one treatment with communication and the other with communication and transfer after the auction (no enforceable commitment). In both auction mechanisms, they observe a significant increase in collusion in the latter treatment, as compared to the former.

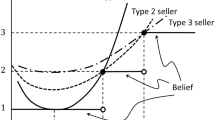

The difference in equilibrium predictions between the two mechanisms arises because bidding the true value is always a weakly dominant strategy for second-price auctions; learning the other bidder’s value does not change the bidding strategy. However, in first-price auctions, the optimal bid depends on the bid of the other bidder. If an equilibrium with positive bribes existed, the responders could infer the proposer’s value from his bribe and bid accordingly. Revealing this information creates an incentive for the proposer to mimic a smaller type (by offering a lower bribe). Therefore, the equilibrium with positive bribes does not exist..

Their main focus is to compare the results of first-price and second-price auctions without a reserve price. They observe no significant difference in terms of the levels of collusion. Despite a similar rate of collusion, the first-price auction is less efficient than the second-price auction.

This equilibrium also requires the assumption that no player bids above her true value. If this assumption is relaxed, there exist other equilibria. However, we rarely observed such behavior in any treatments. See the further discussion and formal proof in Rachmilevitch (2013a).

This equilibrium assumes that after the rejection of a positive bribe, the responder will bid slightly below her value less the bribe and win the item..

We randomized a role in each period because of two main reasons. First, this may ensure that each subject understands the information available for each role. Second, it can hinder subjects from maximizing payoffs across periods by using multi-period strategies; for example, a responder may reject the offers in the early periods in the hope to receive better offers in the later periods.

The exchange rate at the time of the experiments was about 35 THB/USD, and the minimum wage in Thailand was 300 THB per day.

There are two exceptions. First, the average accepted offer amount of cohort 3 in the treatment with a reserve price is greater than that of all other cohorts in both treatments due to an outlier. In this cohort, one subject made sizable offers of 524.8 on average, and hence received large negative payoffs. If we exclude this subject, the average offer amount and the accepted offer amount of this cohort will become 31.7 and 105.3, respectively, in line with other cohorts. Second, the smallest acceptance rate across cohorts in the treatment without a reserve price is exactly equal to the largest one in the treatment with a reserve price.

Given our sample size of eight observations in each treatment, the two-sided rank-sum test requires a minimum detectable effect (MDE) of 1.55 for an 80% power and a 5% significant level. Since we already observe larger treatment effects than MDE, we conclude that no additional sample is necessary.

In the treatment with a reserve price, a proposer may choose not to make any offer. No offer and an offer of zero have different implications. The former eliminates the possibility that the offer is accepted, while the latter does not. The offer of zero is accepted if the responder’s minimum acceptable offer is zero.

If each bidder does not update her belief about the other bidder’s valuation based on the outcome of the bribing stage, the MAO function is then

$$MAO(v_{i} ) = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {v_{i} \in [0,R)} \hfill \\ {\frac{{v_{i}^{2} }}{2000} - \frac{{R^{2} }}{4000},} \hfill & {v_{i} \in [R,1000]} \hfill \\ \end{array} } \right.$$.

Risk aversion could also explain overbidding.

We also compare the actual and theoretical bids. In the treatment without a reserve price, proposers and responders on average overbid by 45.72 and 20.59, respectively, while in the treatment with a reserve price, these numbers are 47.09 and 31.90. These results confirm our findings in Tables 7 and 8.

To calculate the expected payoff in the auction stage, one may use the responders’ actual bids instead of the optimal bids. However, we can observe the responders’ bids only when the offers were rejected. Using the actual bids to calculate the expected payoff results in a larger difference between the average and optimal MAO.

In sequential bidding in which the first bidder’s bid may be observed by the second bidder, Fischer et al. (2017) show that the second bidder gains from this leak of information. In our game, we may interpret this as an instance when the proposer partially reveals his value (and potentially his bid) to the responder. This could explain why our mechanism favors the responder.

References

Agranov, M., & Yariv, L. (2018). Collusion through communication in auctions. Games and Economic Behavior, 107, 93–108.

Aoyagi, M. (2003). Bid rotation and collusion in repeated auctions. Journal of Economic Theory, 112(1), 79–105.

Bajari, P., & Hortaçsu, A. (2003). The winner’s curse, reserve prices, and endogenous entry: Empirical insights from eBay auctions. The Rand Journal of Economics, 34, 329–355.

Bajari, P., & Summers, G. (2002). Detecting collusion in procurement auctions. Antitrust Law Journal, 70, 143.

Bajari, P., & Ye, L. (2003). Deciding between competition and collusion. Review of Economics and Statistics, 85(4), 971–989.

Baldwin, L. H., Marshall, R. C., & Richard, J. F. (1997). Bidder collusion at forest service timber sales. Journal of Political Economy, 105(4), 657–699.

Barrymore, N., & Raviv, Y. (2009). The effect of different reserve prices on auction outcomes. Mimeo.

Choi, S., Nesheim, L., & Rasul, I. (2016). Reserve price effects in auctions: Estimates from multiple regression-discontinuity designs. Economic Inquiry, 54(1), 294–314.

Correia-da-Silva, J. (2017). A survey on the theory of collusion under adverse selection in auctions and oligopolies. Mimeo.

Cramton, P., & Schwartz, J. A. (2000). Collusive bidding: Lessons from the FCC spectrum auctions. Journal of Regulatory Economics, 17(3), 229–252.

Eső, P., & Schummer, J. (2004). Bribing and signaling in second price auctions. Games and Economic Behavior, 47(2), 299–324.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Fischer, S., Guth, W., Kaplan, T. R., & Zultan, R. I. (2017). Auctions and leaks: A theoretical and experimental investigation. Mimeo.

Gonçalves, R. (2013). Empirical evidence on the impact of reserve prices in English auctions. The Journal of Industrial Economics, 61(1), 202–242.

Graham, D. A., & Marshall, R. C. (1987). Collusive bidder behavior at single-object second-price and English auctions. Journal of Political Economy, 95(6), 1217–1239.

Greenleaf, E. A., Rao, A. G., & Sinha, A. R. (1993). Guarantees in auctions: The auction house as negotiator and managerial decision maker. Management Science, 39(9), 1130–1145.

Hendricks, K., Porter, R., & Tan, G. (2008). Bidding rings and the winner’s curse. The Rand Journal of Economics, 39(4), 1018–1041.

Hinloopen, J., & Onderstal, S. (2013). Collusion and the choice of auction: An experimental study. Mimeo.

Hinloopen, J., Onderstal, S., & Treuren, L. (2020). Cartel stability in experimental first-price sealed-bid and English auctions. International Journal of Industrial Organization. https://doi.org/10.1016/j.ijindorg.2020.102642.

Hu, A., Offerman, T., & Onderstal, S. (2011). Fighting collusion in auctions: An experimental investigation. International Journal of Industrial Organization, 29(1), 84–96.

Isaac, R. M., & Walker, J. M. (1985). Information and conspiracy in sealed bid auctions. Journal of Economic Behavior & Organization, 6(2), 139–159.

Kagel, J. H., & Levin, D. (2014). Auctions: A survey of experimental research. Mimeo.

Klemperer, P. (2002). What really matters in auction design. Journal of Economic Perspectives, 16(1), 169–189.

Kwoka, J. E., Jr. (1997). The price effects of bidding conspiracies: Evidence from real estate auction “knockouts”. The Antitrust Bulletin, 42(2), 503–516.

Llorente-Saguer, A., & Zultan, R. (2017). Collusion and information revelation in auctions. European Economic Review, 95, 84–102.

Lopomo, G., Marx, L. M., & Sun, P. (2011). Bidder collusion at first-price auctions. Review of Economic Design, 15(3), 177–211.

Lucking-Reiley, D., Bryan, D., Prasad, N., & Reeves, D. (2007). Pennies from eBay: The determinants of price in online auctions. The Journal of Industrial Economics, 55(2), 223–233.

Marshall, R. C., & Marx, L. M. (2007). Bidder collusion. Journal of Economic Theory, 133(1), 374–402.

Myerson, R. B. (1981). Optimal auction design. Mathematics of Operations Research, 6(1), 58–73.

Noussair, C. N., & Seres, G. (2020). The effect of collusion on efficiency in experimental auctions. Games and Economic Behavior, 119, 267–287.

Ostrovsky, M., & Schwarz, M. (2016). Reserve prices in internet advertising auctions: A field experiment. Mimeo.

Phillips, O. R., Menkhaus, D. J., & Coatney, K. T. (2003). Collusive practices in repeated English auctions: Experimental evidence on bidding rings. American Economic Review, 93(3), 965–979.

Porter, R. H. (2005). Detecting collusion. Review of Industrial Organization, 26(2), 147–167.

Porter, R. H., & Zona, J. D. (1993). Detection of bid rigging in procurement auctions. Journal of Political Economy, 101(3), 518–538.

Rachmilevitch, S. (2013a). Bribing in first-price auctions. Games and Economic Behavior, 77(1), 214–228.

Rachmilevitch, S. (2013b). Endogenous bid rotation in repeated auctions. Journal of Economic Theory, 148(4), 1714–1725.

Rachmilevitch, S. (2015). Bribing in second-price auctions. Games and Economic Behavior, 92, 191–205.

Riley, J. G., & Samuelson, W. F. (1981). Optimal auctions. American Economic Review, 71, 381–392.

Robinson, M. S. (1985). Collusion and the choice of auction. The Rand Journal of Economics, 16(1), 141–145.

Sherstyuk, K. (2002). Collusion in private value ascending price auctions. Journal of Economic Behavior & Organization, 48(2), 177–195.

Skrzypacz, A., & Hopenhayn, H. (2004). Tacit collusion in repeated auctions. Journal of Economic Theory, 114(1), 153–169.

Trautmann, S. T., & Traxler, C. (2010). Reserve prices as reference points—Evidence from auctions for football players at Hattrick.org. Journal of Economic Psychology, 31(2), 230–240.

Troyan, P. (2017). Collusion and signaling in auctions with interdependent values. Journal of Economic Theory, 170, 319–345.

Acknowledgements

We gratefully acknowledge financial support from the Center for Behavioral and Experimental Economics, Chulalongkorn University. We thank Nartsupon Dumchuen for his helpful research assistance. We benefit from comments by Tim Cason, Ramon Cobo-Reyes, Paan Jindapon, Ragan Petrie, Roberto Weber, two anonymous referees, and seminar participants at the American University of Sharjah; also, by participants in the 2019 Asia-Pacific Economic Science Association Conference, the 2018 Annual Meetings of the Southern Economic Association, the 2017 Asia-Pacific Economic Science Association Conference, and the 4th Joint Workshop between Chulalongkorn University and Osaka University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Sujarittanonta, P., Viriyavipart, A. Deterring collusion with a reserve price: an auction experiment. Exp Econ 24, 536–557 (2021). https://doi.org/10.1007/s10683-020-09671-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-020-09671-x