Abstract

This study examines the link between the strictness of environmental policies and carbon leakage in the European Union (EU). It utilizes an econometric model to analyse how carbon leakage is influenced by environmental policies and other factors. A comprehensive dataset spanning from 1995 to 2020 for 20 EU member nations is employed. This study is ground-breaking, as it is the first to comprehensively assess the effect of aggregated environmental policies on carbon leakages in the EU. This study employs a range of econometric techniques to ensure the reliability of its findings, including the continuously updated fully modified approach, bias-adjusted ordinary least squares method, and bootstrap panel causality testing. The findings confirm that stringent environmental policies cause greater carbon leakage by increasing the quantity of foreign carbon emissions embodied in EU’s domestic final demand. Specifically, carbon leakage increases within the range 0.051–0.111% as environmental policy stringency rises by 1%. This outcome confirms that direct carbon leakage occurs through the international trade channel as domestic carbon emissions reduction is continuously being offset by greater emissions abroad. Country-specific reactions captured through causality tests further reveal that the predictive powers between environmental policy stringency and carbon leakage is widespread among the sampled EU countries. Thus, our conclusion is that stringent environmental policies put the region at a disadvantage in the international markets. The main recommendation therefore is that ample justification exists for the introduction of carbon border adjustment mechanism, as the positives associated with its imposition are likely to outweigh the negatives.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The fundamental challenge in global environmental protection stems from the absence of a universally agreed upon set of environmental policies (Grubb et al., 2022). According to Nordhaus (2015), without a ‘Climate Club’ consisting of countries committed to pursuing uniform environmental policies, environmental protection efforts will be ineffective except penalties are imposed on non-participating nations. Another important consequence of adopting unilateral and heterogeneous climate policies is that countries with more stringent environmental policies are likely to suffer carbon leakages (Misch & Wingender, 2021). The fragmentation of global carbon policies is at the root of the leakage problem. If all countries were to adopt comparable environmental policies, carbon leakage would be eliminated. Unfortunately, the current reality is that the world has so far not been able to coalesce into a global climate club, and only select regions, the European Union (EU) being a notable example, are willing to undertake sufficiently stringent environmental policies (Felbermayr et al., 2020).

Given the pressing imperative to curtail greenhouse gas emissions and avert the potential for catastrophic climate impacts, the EU has established ambitious goals through the recently unveiled Fit-for-55 package (Riechmann et al., 2022). The EU aims to achieve a 55% reduction in emissions by 2030, relative to 1990 levels, and ultimately reach net zero emissions by 2050. A pivotal strategy employed by the EU to attain the primary objectives of the Fit-for-55 package is the introduction of more stringent environmental policies (see Schlacke et al., 2022). Stringent environmental policies mitigate environmental degradation (Adebayo, 2022, 2023; Adebayo et al., 2023; Liu et al., 2023).

By imposing more stringent environmental policies, the EU compels stakeholders to incorporate the environmental repercussions of their actions into their decision-making processes. For example, the EU, as key components of the Fit-for-55 package, is raising carbon emissions standards for vehicles and increasing removals in the land use and forestry sectors. The region is also exploring the options of sustainable aviation fuels and decarbonized fuels for shipping, improving energy efficiency and renewable energy use, increasing energy performance of buildings, and raising energy taxes as part of the scheme (see Fetting, 2020; Siddi, 2020; Schlacke et al., 2022; Adebayo & Alola, 2023; Saint Akadiri et al., 2019; Usman et al., 2022). Stringent environmental policies such as those being adopted in the EU can influence trade dynamics. Stringent regulations may result in higher production costs in a particular region, making imported goods from less regulated areas more attractive due to their lower production costs. This can lead to carbon leakage as industries move to or invest in regions with laxer environmental standards to remain competitive (Copeland & Taylor, 2004).

As it is, the EU holds the distinction of being the top global importer of CO2 emissions. The EU acquires over 700 million tons of CO2 emissions through goods and services imported from outside its borders (Felbermayr et al., 2020). This figure surpasses 20% of the EU's own territorial CO2 emissions. The question that begs an answer therefore is whether this excessive net importation of embodied carbon (direct carbon leakage) through international trade is tied to the stringent environmental policies within the EU. If this were to be the case, then the redirection of policy focus from the EU’s territorial emissions to the EU’s carbon footprint through carbon border adjustments would be the best option. This policy direction will not only improve the impact of the region’s environmental policy initiatives but also improve global efforts aimed at reducing carbon emissions.

Arguments such as those introduced in the preceding paragraph have pushed the EU towards considering the use of a Carbon Border Adjustment Mechanism (CBAM). The EU is currently working on the implementation of a CBAM which will take effect in 2026, through the implementation of carbon pricing on imports as part of its European Green Deal. The CBAM is a policy tool aimed at preventing carbon leakage by imposing a carbon price on imported products based on their carbon footprint. It ensures that imported goods meet similar environmental standards as domestically produced goods (Pycroft et al., 2021). This would also reduce the competitive advantage of products produced in countries with lax environmental regulations, and it would incentivize global partners to adopt more stringent environmental policies (Carraro et al., 2020).

Issues regarding carbon leakage and the proposed implementation of a CBAM sparked significant debate during the recently concluded climate change conference (COP28). The imposition of a CBAM is however being criticized on several grounds.

There are several claims that the CBAM comes with its own set of challenges and implications (Pycroft et al., 2021). The CBAM can strain international trade relations, as it imposes a carbon cost on imports. This means that the EU must navigate potential disputes and conflicts with trading partners, particularly those with less stringent environmental regulations. For instance, countries such as China and the United States have expressed concerns about the CBAM's potential trade-distorting effects. Also, the less developed countries within the EU may be disproportionately affected by the CBAM, as they often have less advanced and less energy-efficient industries. Furthermore, implementing the CBAM without proper safeguards could exacerbate global inequality and hinder sustainable development.

Erring on the side of caution with regards to the imposition of the CBAM becomes quite important as extant empirical literature predominantly implies that carbon leakage in the EU is limited (see Joltreau & Sommerfeld, 2019; Naegele & Zaklan, 2019; Venmans et al., 2020; Verde, 2020; Garnadt et al., 2021; Akadiri et al., 2021). Our theoretical argument is that if the excessive net importation of embodied carbon being witnessed in the EU is significantly associated with the stringent environmental policies, then the positives associated with the imposition of the CBAM would outweigh the negatives. A case could thus be made in support of the use of the CBAM in the region. If, however, carbon leakage in the EU is not significantly caused by the stringent environmental policies, then there would be no strong reason to follow through with the CBAM. This is the main issue this study seeks to address.

Overall, investigating the link between environmental policy stringency and carbon leakages in the EU is important for several reasons. First, carbon leakage refers to the situation where stricter environmental policies in one region led to increased emissions in another region with weaker regulations. By studying this phenomenon in the EU, policymakers can better understand the effectiveness of their climate policies and make needed adjustments to mitigate carbon leakage. This is crucial for achieving global climate change mitigation goals, as emissions reduction in one region can be offset by increased emissions in another, undermining overall efforts to combat climate change. Second, analyzing environmental policy stringency allows policymakers to assess the impact of existing regulations and make informed decisions regarding future policy development. Third, the EU, like any other region, needs to balance environmental goals with economic competitiveness. Understanding carbon leakage helps policymakers strike a balance between stringent environmental policies and the risk of industries relocating to regions with less stringent regulations, which can lead to economic challenges and job losses. Finally, this study is critical for achieving climate change mitigation goals, assessing policy effectiveness, balancing economic and environmental objectives, and promoting international cooperation. It helps ensure that the region's environmental policies are both effective and equitable, which is essential in the global effort to combat climate change.

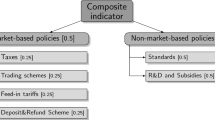

This study makes a major contribution to empirical literature on the consequences of environmental policy by being the very first to consider the aggregate carbon leakage effect of stringent environmental policies in the EU. Many other studies have considered this issue within a relatively limited scope. For instance, most existing related studies are narrowly focused on carbon leakage effects of carbon pricing systems such as the EU ETS (see Joltreau & Sommerfeld, 2019; Naegele & Zaklan, 2019; Perino et al., 2019; Garnadt et al., 2020; Venmans et al., 2020). This paper improves on the previous ones by considering instead the composite environmental policy stringency index of Botta and Koźluk (2014). This composite index is currently the most comprehensive measure of environmental policy toughness as it quite effectively captures the extent to which the aggregate of environmental policies place prices (implicit or explicit) on actions that harm the environment. This study further contributes to the debate on the use of the CBAM in the EU. This study argues that an empirically proven existence of a significant association between stringent environmental policies and carbon leakage serves as an important justification for the enforcement of the CBAM in the EU. Finally, on the empirical front, a battery of econometric techniques—continuously-updated fully modified approach, bias-adjusted ordinary least squares method, and bootstrap panel causality testing—is employed. As such, findings from the study are reliable and useful for policymaking.

The organization of this study is as follows: Sect. 2 encompasses a comprehensive review of the literature, with specific focus on environmental policy stringency and carbon leakages, elucidating their core concepts. In Sect. 3, we delve deeply into our model specification, detail our data sources, and elaborate on the methodology employed for empirical analysis. Section 4 is dedicated to unveiling our empirical results and engaging in a comprehensive discussion of our findings. Lastly, in Sect. 5, we conclude our study by offering final remarks and workable policy recommendations.

2 Literature review

2.1 Overview of environmental policies in the EU

The Eurozone, comprising 19 of the 27 EU member states that use the euro as their common currency, has been actively pursuing a range of environmental policies to address various sustainability challenges. The EU's environmental policies within the Eurozone are primarily established through the European Commission (EC). The European Green Deal, launched in 2019, is a key policy initiative aiming to make the Eurozone climate-neutral by 2050. It encompasses various regulations, directives, and strategies to combat climate change and protect the environment (European Commission, 2019a). This region is committed to the Paris Agreement's goal of limiting global warming to well below 2 °C. The EU has set ambitious targets to reduce greenhouse gas emissions, aiming for a 55% reduction by 2030, compared to 1990 levels. This includes the "Fit for 55" package, which seeks to update and expand climate and energy laws (European Commission, 2021a).

The region has also prioritized renewable energy sources. The European Commission has established the Renewable Energy Directive (RED), which requires a 32% share of renewable energy in the EU by 2030. Furthermore, the European Investment Bank (EIB) is supporting green investments, including renewable energy projects, within the Eurozone (European Investment Bank, 2020). Preserving biodiversity is another crucial aspect of the Eurozone's environmental policy. The EU Biodiversity Strategy for 2030 aims to protect and restore ecosystems and species, including the allocation of funds for nature conservation and restoration projects (European Commission, 2020a, 2020b). The Eurozone is actively promoting a circular economy by reducing waste and enhancing resource efficiency. The Circular Economy Action Plan (CEAP) outlines measures for sustainable product design, waste reduction, and recycling (European Commission, 2020a, 2020b). Lastly, improving air quality is a significant concern within the Eurozone. The EU has established air quality standards and implemented measures to reduce air pollution, aiming to protect human health and the environment (European Commission, 2021b).

2.2 Stringency assessment

Stringency assessment in environmental policies within the Eurozone, like in many regions, involves evaluating the comprehensiveness, effectiveness, and rigor of regulations and measures aimed at addressing environmental challenges (Gulbrandsen, 2010). The Eurozone, which comprises 19 of the 27 EU member states that use the euro as their official currency, has a framework of environmental policies and regulations developed at both the EU and national levels (Bulmer, 2020). Some key aspects of stringency assessment in environmental policies in the Eurozone is via assessing the legal framework governing environmental policies, with a focus on EU directives and regulations. They evaluate the alignment of national laws with EU legislation and the enforcement mechanisms in place, and examine the specific targets and objectives set by both the EU and individual Eurozone countries. This includes targets related to emissions reduction, renewable energy adoption, waste management, and biodiversity conservation.

In addition, they evaluate the monitoring and reporting mechanisms in place to track progress toward environmental goals. This involves reviewing data on emissions, pollution levels, and other relevant indicators. The European Environment Agency (EEA) is a key institution responsible for collecting and disseminating such data, the agency assesses the range of policy instruments used, including economic instruments (such as carbon pricing and subsidies), regulatory measures (such as emissions standards), and voluntary initiatives (Waterton & Wynne, 2004). The EEA determines the effectiveness of these instruments in achieving environmental objectives, while examining the mechanisms for ensuring compliance with environmental regulations and the enforcement actions taken when violations occur. These include penalties and fines for non-compliance. Lastly, via stringency assessment, the EEA examines how well Eurozone countries are meeting their international commitments, such as those under the Paris Agreement, and whether they are on track to achieve their climate and environmental goals among others. Stringency assessment in environmental policies is an ongoing process that requires a multidimensional analysis of policies, regulations, and their actual impacts on the environment (Botta & Koźluk, 2014). It often involves collaboration between governmental bodies, research institutions, environmental NGOs, and experts in various fields.

2.3 Key industries affected by stringent policies

Stringent policies in the Eurozone can be aimed at addressing issues such as economic stability, environmental concerns, and consumer protection, among others. The Eurozone has implemented strict regulations on financial institutions, particularly in the wake of the 2008 financial crisis. These regulations impact banks, insurance companies, and other financial service providers (Dermine, 2015; European Central Bank, 2021), as well as aggressive environmental policies to combat climate change and promote sustainability. This affects industries such as renewable energy, traditional energy, and manufacturing. Regulations on emissions and safety standards impact the automotive industry. The Eurozone has stringent emissions targets that affect car manufacturers. Regulations on drug approval, pricing, and safety standards impact pharmaceutical companies (European Commission, 2018, 2019b, 2021b; European Parliament, 2020).

The healthcare sector is also subject to regulatory oversight in terms of patient data protection and quality of care. The Eurozone has strict data protection regulations, such as the General Data Protection Regulation (GDPR), which impacts technology companies, especially those dealing with data and privacy. The Eurozone's commitment to reducing carbon emissions drives investment and regulations in the renewable energy sector, including wind, solar, and hydroelectric power. It is important to note that these industries are not limited to the Eurozone, and many of the regulations are part of broader EU policies. The specific impact of stringent policies within the Eurozone can vary depending on the industry and the nature of the regulations in place. Companies operating in these sectors need to comply with these regulations and adapt their strategies to navigate the regulatory landscape effectively (European Commission, ).

2.4 Causes and mechanisms of carbon leakage

Some of the factors that cause leakages in the Eurozone are not farfetched. For instance, when this region imposes stricter carbon pricing mechanisms or taxes on domestic industries, it can lead to increased production costs (Burniaux & Oliveira Martins, 2012; Yu et al., 2021). This can incentivize some industries to relocate their operations to regions with less stringent carbon pricing, thus causing carbon leakage. The Eurozone's emissions reduction efforts may encourage some industries to shift their production to countries with lower environmental regulations and emissions standards, resulting in emissions increases outside the Eurozone. Energy-intensive industries, such as steel and cement production, are more susceptible to carbon leakages due to their high carbon emissions. These industries may move their production to regions with less stringent environmental regulations. The Eurozone may import goods and products from countries with less stringent emissions regulations, effectively ‘importing’ carbon emissions, contributing to leakage costs (Burniaux & Oliveira Martins, 2012; Yu et al., 2021).

In terms of mechanism of carbon leakage, industries facing higher carbon costs in the Eurozone may choose to relocate their production facilities to countries with lower carbon costs, effectively moving their emissions abroad. Companies may alter their production processes or sourcing strategies to minimize emissions within the Eurozone; however, this can result in increased emissions outside the region as they produce or source from less environmentally friendly locations. As the Eurozone imports goods and products from countries with lower emissions standards, it indirectly contributes to emissions outside its borders. In some cases, higher carbon prices within the Eurozone can lead to reduced competitiveness for domestic industries, potentially leading to decreased production and increased imports of carbon-intensive goods from non-compliant regions (Wagner & Timilsina, 2003; Ellerman et al., 2013; Aichele & Felbermayr, 2015; Tovar & Martin-Moreno, 2015).

2.5 Previous research on the topic

Policies aimed at mitigating climate change take various forms, encompassing regulations, subsidies, carbon taxes, and emissions trading systems (ETS). However, when it comes to evaluating carbon leakage, the focus has primarily been on ETS and carbon taxes. There exists a substantial body of literature that assesses ex ante carbon leakage in response to hypothetical carbon taxes or ETS, with roots that can be traced back to the work of Felder and Rutherford (1993). Many of these studies make use of Computable General Equilibrium (CGE) models, as seen in the works of Peterson and Schleich (2007), Mattoo et al. (2009), Dissou and Eyland (2011), Balistreri and Rutherford (2012), Böhringer et al. (2012), Fischer and Fox (2012), and Lanzi et al. (2013). Some studies however employ partial equilibrium models, as demonstrated by Gielen and Moriguchi (2002), Mathiesen and Maestad (2004), Demailly and Quirion (2006), and Monjon and Quirion (2011).

CGE models, known for simulating the behavior of entire economies, are highly relevant for studying the impact of policies on trade across various sectors. However, they often rely on more aggregated data, typically drawing from the Global Trade Analysis Project database, which might obscure the effects on specific sectors. Notably, most CGE models incorporate a zero-profit condition, limiting their ability to assess competitiveness as the capacity to earn profits. An exception to this is the work of Goulder et al. (2010), whose model incorporates capital adjustment costs, thereby acknowledging that capital is not perfectly mobile across sectors. This unique feature allows the model to capture the diverse impacts of policy interventions on the profitability of different industries. Their assessment of a hypothetical federal ETS in the United States led to the conclusion that freely allocating fewer than 15% of the emissions allowances is generally sufficient to prevent profit losses in the most vulnerable industries.

These models offer a wide spectrum of estimations regarding leakage and competitiveness losses. Several key factors influence these results. The outcomes are heavily contingent on the scenario assumptions made. For instance, the size of the abating coalition plays a crucial role. A larger abating coalition tends to result in a lower leakage rate, while more ambitious emission reduction targets tend to increase leakage. Some other studies however conclude that linking carbon markets within the abating coalition (Lanzi et al., 2013), authorizing offset credits (Böhringer et al., 2012), or extending carbon pricing to cover all greenhouse gases (Ghosh et al., 2012) can enhance economic efficiency and subsequently reduce leakage.

In addition, these models exhibit sensitivity to two sets of parameters. The first set includes fossil fuel supply elasticities, which influence the international fossil fuel price channel. These elasticities indicate the extent to which a decrease in fossil fuel demand affects the fuel price. The second set of parameters concerns Armington elasticities, which are essential for the competitiveness channel. These elasticities represent the substitutability of domestic and foreign products. Notable studies such as Monjon and Quirion (2011), Alexeeva-Talebi et al. (2012), and Balistreri and Rutherford (2012) highlight the significance of these parameters in influencing the model outcomes.

Numerous empirical studies focusing on the assessment of the effects of the EU ETS on firms (as demonstrated by the European Commission in 2015 and Martin et al. in 2016) consistently present a unified narrative. Firms, in response to carbon pricing, have taken measures such as emission reduction (Costantini & Mazzanti, 2012), fuel source diversification (Ellerman & McGuinness, 2008), and innovation (Dechezleprêtre et al., 2008). Remarkably, these actions have not led to declines in employment, reduced profits (Martin et al., 2012), or diminished productivity. Notably, certain industries, such as power generators, have even thrived under the EU ETS, capitalizing on free allowances and passing the carbon pricing costs on to consumers.

Fowlie et al. (2016) and Fowlie and Reguant (2018) conduct researches to gauge the elasticity of production, imports, and exports concerning energy prices, considering variations among industries. They harness these estimates to model the impact of a $10/tCO2 carbon price on these economic variables. Saussay and Sato (2018), on the other hand, utilize comprehensive data related to mergers and acquisitions involving multinational corporations to investigate how such transactions are influenced by disparities in a country's energy price index. Lanzi et al. (2013) commence their study by building upon the global mitigation scenarios outlined by the Organisation for Economic Co-operation and Development (OECD, 2012) in the OECD Environmental Outlook to 2050. They highlight two major challenges faced by countries implementing ambitious mitigation policies in isolation: carbon leakages and issues related to maintaining competitiveness. Importantly, they argue that these challenges cannot be entirely mitigated through border carbon compensation.

Aichele and Felbermayr (2015) conduct an econometric assessment of the effects of adopting emission targets under the Kyoto Protocol, which is indicative of being a developed country that has ratified the Protocol. They examine how this impacted CO2 emissions, the CO2 footprint, and CO2 net imports using a differences-in-differences approach across a panel of 40 countries. To address the potential bias arising from endogeneity (the situation where countries with expected low or negative emissions growth might be more inclined to ratify the Protocol), they employ participation in the International Criminal Court as an instrumental variable for Kyoto ratification. Their findings indicate that countries with Kyoto targets reduced their domestic emissions by approximately 7% between 1997 and 2000 and 2004–2007 in comparison to countries without such targets. However, there was no significant change in their CO2 footprint, and CO2 net imports increased by roughly 14%. These results suggest that any reductions in domestic emissions were fully counteracted by carbon leakage.

The current literature review reveals that a limited number of studies investigating the carbon leakage effects of environmental policies currently exist, especially for the EU. Moreover, most of these studies concentrate on the carbon leakage effects of specific environmental policies, most especially carbon taxes and emissions trading schemes. Furthermore, cross-country comparisons of the link between environmental policy stringency and carbon leakage are non-existent. These gaps are what this study seeks to fill. This paper improves on the previous ones by considering instead the composite environmental policy stringency index, which is currently the most comprehensive measure of environmental policy toughness as it quite effectively captures the extent to which the aggregate of environmental policies place prices (implicit or explicit) on actions that harm the environment. Also, by conducting country-specific panel causality tests, this study provides an avenue to observe cross-country differences in the link between environmental policy stringency and carbon leakage in the EU.

3 Data, model and methodology

3.1 Data and model

The empirical analysis of the connection between environmental policy stringency and carbon leakages in the EU begins with the specification of an econometric model. To this end, a model which treats carbon leakage as a function of environmental policy alongside other control variables is introduced. As such, a structured yearly panel dataset on the variables included in the model is constructed over the period 1995–2020 for 20 EU member nations. The nations included in the empirical analysis are Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland. These countries are chosen based on data availability, as they are the only ones with data on environmental policy stringency.

Drawing upon the insights of scholars such as Naegele and Zaklan (2019) and Garnadt et al. (2021), this study's empirical analysis hinges on the concept that carbon leakage can be gauged through trade flows in embodied carbon. Naegele and Zaklan (2019) elaborate that this concept finds its roots in both classical and contemporary trade theories. In this context, carbon leakage, serving as the dependent variable in the research, is proxied by the volume of foreign carbon emissions incorporated into the domestic final demand of the sampled EU nations. This metric signifies the interconnectedness of foreign industries and local consumers in the EU nations, even in the absence of direct trade relationships. Consequently, it serves as an indicator of imported carbon emissions, showcasing the degree to which reductions in domestic emissions are counteracted by increased emissions elsewhere. The OECD's Trade in Embodied CO2 Database (TECO2) serves as the data source, with the methodology for variable construction detailed in Wiebe and Yamano (2016).

Environmental policy stringency is measured using the composite index approach of Botta and Koźluk (2014). This composite index remains the most comprehensive measure of environmental policy toughness as it quite effectively captures the extent to which environmental policies place prices (implicit or explicit) on actions that harm the environment (Akram et al., 2023; Olasehinde-Williams & Folorunsho, 2023). The composite index has therefore become a popularly employed tool in policy analysis.

Additional variables that generally operate as determinants of carbon leakage are also included as controls in the specified models. Specifically, exchange rate is included in the model to control for relative price differences between the importing EU country and the rest of the world. The stronger the domestic currency, the cheaper it becomes to import products with high amount of carbon embedded in their production. Per-capita GDP is also added to the model to control for the impact of domestic purchasing power. The greater the purchasing power of domestic consumers in the EU countries, the greater is likely to be the level of their consumption of imported products with high amount of carbon embodied in their production. Finally, trade openness is included to control for trade policy flexibility. Generally, EU countries that are more open to trade are likely to also import relatively larger quantities of products that have large amounts of carbon embedded in their production. Data on exchange rate, per-capita GDP, and trade openness are all collected from the World Development Indicators database of the World Bank. Stemming from the above, the model employed for empirical analysis takes the following form:

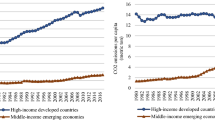

Where LCL refers to the logarithmic form of carbon leakage. LEPS represents the logarithmic form of environmental policy stringency. LEXR stands for the logarithmic form of exchange rate. LTO is the logarithmic form of trade openness. \({\beta }_{1},{\beta }_{2},\dots ,{\beta }_{4}\) are the parameter estimates of interest, subscripts i and t refer to cross section and time dimensions respectively, and \({\upvarepsilon }_{{\text{it}}}\) is the error term. To minimize the probability of heteroscedasticity and convert estimates into elasticities, all variables are converted to their logarithmic forms. The summary statistics and plots of both variables of interest are presented in Table 1 and Fig. 1 respectively.

3.2 Methodology

3.2.1 Long-run estimation techniques

Two different panel estimation techniques are utilized to extract long-term coefficients that signify the influence of environmental policy stringency and the controls on carbon leakage in the EU. The first method, known as the Continuously Updated Fully Modified (CUP-FM) estimator by Bai and Kao (2006) and Bai et al. (2009), is favored for its ability to produce results that are robust against cross-sectional dependence. This technique achieves this by uncovering co-movements responsible for the dependence using factor models. Additionally, this approach demonstrates resilience to endogeneity, varying variance, autocorrelation, fractional integration, and small sample sizes (Ahmed & Le, 2021). Bai and Kao (2006) propose an equation with a matrix of common factors that account for cross-sectional dependencies as follows:

In Eq. (2), y is the dependent variable, x is a matrix of regressors, α denotes the intercept or drift parameter, β signifies the matrix of elasticity parameters, and \({\varepsilon }_{it}\) denotes the error term. The error term (\({\varepsilon }_{it}\)) is further divided into its factor loading component (π) and an unobservable factor component (ϑ) as expressed below:

The Phillips and Hansen (1990) fully modified ordinary least squares method, as employed by Bai and Kao (2006), is instrumental in identifying the presence of common factors, as demonstrated by the equation below:

The estimation of these parameters follows an iterative process until convergence is achieved, addressing issues related to serial correlation and endogeneity during the iterations.

The second technique employed for long-term estimation is the Bias-Adjusted Ordinary Least Squares (BA-OLS) method introduced by Westerlund (2007). A limitation of the CUP-FM method is its requirement for knowing the number of common factors, which is often impractical. Westerlund (2007) offers a solution by proposing the estimation of common factors using information criteria, expressed as follows:

Here, \(C\left(k\right)\) represents the information criteria. In this study, the number of common factors is determined using the Bayesian Information Criterion (BIC), formulated as follows:

where V(k) represents the estimated variance of the scalar idiosyncratic error based on k factors, and \(\widehat{k}\) is obtained through the minimization of BIC. It is worth noting that both methods necessitate cointegrated variables in the long run.

3.2.2 Causality testing technique

In addition to the long-run estimations, country-specific causal relations are also examined in this study using the Kónya (2006) causality test since it effectively addresses cross-sectional dependence. The procedure is based on estimating a specified system using the seemingly unrelated regression (SUR) method to impose zero restrictions for causality through the Wald test principle. Notably, the Wald tests do not necessitate a joint hypothesis for all countries in the panel, as the causality method employs country-specific Wald tests with corresponding bootstrap critical values. Furthermore, this approach eliminates the need for pretesting panel unit root and cointegration. The equation system for the Kónya (2006) method consists of two sets of equations specified as follows:

And

where: Yi,t, i = 1,…,N represents carbon leakage and Xi,t, i = 1,…,N denotes environmental policy stringency. N is the number of cross sections (nations) present in the panel (j = 1,…, N), t is the time frame (t = 1,…,T) and l is the lag length.

To overcome potential challenges associated with lag structure, following Kónya (2006), maximal lags are permitted to vary across variables but be the same across equations.

4 Empirical findings

4.1 Pre-estimation test results

To begin with, tests for correlation between the variables studied are conducted and reported in Fig. 2. This is done for two reasons. The first is to determine the standalone nature, strength and significance of the relationship between carbon leakage and environmental policy stringency. The second reason is to check for possible multicollinearity among the regressors. Very high correlation values (greater than 0.8) are indicative of multicollinearity and will need to be dealt with to prevent the generation of unreliable estimates. As shown in Fig. 2, there is a statistically significant positive correlation between environmental policy stringency and carbon leakage. This is the first confirmation of the assertion being made by this study that more stringent environmental policies can instigate greater carbon leakage in Europe. The results further show that while per-capita GDP has a significant positive correlation with carbon leakage, both exchange rate and trade openness have significant negative correlations with it. With regards to multicollinearity, there are no coefficients reflecting the correlation between the regressors that are large enough to suggest that this problem exists in the data series.

As a next step, the presence of cross-sectional dependence is checked via the Pesaran (2021) scaled LM cross-sectional dependence test. Given that the sampled EU nations are not randomly chosen, and that common climate policy shocks can affect them simultaneously, there is the likelihood that some degree of dependence will exist between them. It is thus crucial to test for such dependence through the cross-sectional dependence test. The test results are reported in Table 2. The results confirm our suspicion that cross-sectional dependence is a challenge in this study as statistically significant values lead to the rejection of the null of no cross-sectional dependence.

The stationarity properties of the variables are further checked via unit root testing. Due to the detection of cross-sectional dependence in the data, the assessment of stationarity is specifically done using the cross-sectionally augmented IPS (Im et al., 2003) panel unit root test. The results obtained from the test are reported in Table 3. For both the constant and constant & trend specifications, the outcomes show that carbon leakage, exchange rate, per-capita GDP, and trade openness are nonstationary in their level form but become stationary when differenced once. With regard to environmental policy stringency, the constant specification shows that is integrated of order one whereas the constant & trend specification shows that it is integrated of order zero.

Upon stationarity testing, possible long-run connection between carbon leakage and environmental policy stringency along with the other regressors in the specified model is also checked through cointegration testing. The Westerlund and Edgerton (2007) panel bootstrap cointegration test is performed to achieve this objective. This test is chosen due to its unique ability to accommodate cross-sectional dependence within or between cross sections. It also has small size distortions and superior power when compared with available alternatives. The cointegration test outcomes are provided in Table 4. The rejection of the null of no cointegration inferred from the significant asymptotic and bootstrap p-values is indicative of the presence of cointegration among the variables. With this finding, the necessary condition for the adoption of the CUP-FM and BA-OLS long-run estimation techniques is satisfied.

4.2 Panel-level long-run impacts

The long-run effect of environmental policy stringency and the controls on carbon leakage in the EU are summarized in Table 5. The top part of the table reports the results generated via the CUP-FM estimator. The lower half of the table, on the other hand, displays the results generated using BA-OLS. The coefficients generated for environmental policy stringency from both methods show that environmental policy stringency has a positive and significant marginal impact on carbon leakage in the EU. Carbon leakage increases within the range of 0.051% and 0.111% as environmental policy stringency rises by 1%. This finding is indicative of the fact that stringent environmental policies, by causing domestic carbon emissions reductions to be offset by greater emissions abroad, create carbon leakage in the EU. This conclusion broadly supports theoretical claim that carbon leakage occurs through the ‘international trade’ channel (see Yu et al., 2021). This suggests that due to more stringent environmental policies in the EU, investments and production are being shifted to regions with relatively lax environmental policies (see Santamaria et al., 2014; Branger et al., 2016; Duscha et al., 2019; Yu et al., 2021).

Results from both CUP-FM and BA-OLS also show that per-capita GDP and trade openness increase carbon leakage in the EU. A percentage rise in per-capita GDP raises carbon leakage in the EU between the range of 0.005 and 0.079%, a percentage increase in trade openness raises carbon leakage by an amount ranging between 0.001 and 0.004%, and a percentage rise in exchange rates lowers carbon leakage into the EU between 0.017 and 0.045%. These are in line with a priori expectations. Firstly, increased per-capita income is indicative of increased purchasing power and increased purchasing power generally increases imports (see Vacu & Odhiambo, 2020). Thus, the greater the purchasing power of domestic consumers in the EU countries, the greater will be the level of their consumption of imported products with high amount of carbon embodied in their production. Secondly, trade openness is a reflection of trade policy flexibility. In general, greater openness to trade is associated with greater imports (see Zakaria, 2014). As such, the more open the EU countries are to trade, the higher the quantity of products with large amounts of carbon embedded in their production will be. Thirdly, the significantly negative coefficients on exchange rate indicates that currency appreciation in the EU aggravates carbon leakage. This is a confirmation that a stronger domestic currency encourages increase in the volume of products with high amount of carbon embedded in their production.

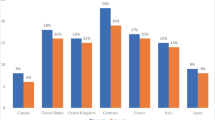

4.3 Causality results

Lastly, to corroborate the findings based on the long-run estimates of the impact of environmental policy stringency on carbon leakage, the country-specific nexus between both variables is further investigated through the Kónya (2006) bootstrap causality test. The results are reported in Table 6, where it can be observed that feedback causal relations between environmental policy stringency and carbon leakage exist in Greece, Italy, Poland, and Sweden. The null hypothesis of non-causality only from environmental policy stringency to carbon leakage is rejected in Belgium, Czech, Denmark, Finland, France, Greece, Italy, Poland, Slovakia, Sweden, and Switzerland. The null hypothesis of non-causality in the opposite direction is detected in Austria, Germany, Greece, Ireland, Italy, Netherlands, Norway, Poland, Slovenia, and Sweden. We are however unable to reject the null of non-causality in either direction in Hungary, Portugal, and Spain. In summary, environmental policy stringency is able to significantly predict carbon leakage in 11 EU countries, carbon leakage is able to predict environmental policy stringency in 10 EU countries, and there is no predictive power in either direction in 3 EU countries.

5 Conclusion, policy recommendation and limitations

5.1 Conclusion and policy recommendations

The primary challenge within climate policy stems from the unequal commitment of countries around the world to the enactment of robust carbon emission reduction measures. This discrepancy could be attributed to a lack of shared responsibility or a tendency to exploit the system. Unfortunately, without complete global engagement, there is a strong likelihood that direct carbon leakages will place countries or regions with relatively more stringent environmental policies at a disadvantage in the international markets. To protect against the disadvantages associated with carbon leakages, the EU views the imposition of the CBAM as a key instrument. However, although carbon leakage is generally regarded as a necessary condition for implementing the CBAM, the associated legal, design and administrative constraints, among others have raised strong opposition against the use of the CBAM. This argument against the use of the CBAM has been further boosted by the limited availability of empirical evidence confirming carbon leakage as a consequence of stricter environmental policy measures in the EU. In this paper, through the empirical assessment of the relationship between environmental policy stringency and carbon leakage, we make a case for the imposition of the CBAM in the EU.

Specifically, this study analyzes the aggregate impact of stringent environmental policies on carbon leakage in the EU after controlling for the effects of exchange rate, GDP and trade openness. Both Continuously Updated Fully Modified and Bias-Adjusted Ordinary Least Squares methods are employed in analyzing panel data for a sample of 20 EU nations over the period 1995–2020. The findings confirm that stringent environmental policies, by causing domestic carbon emissions reductions to be offset by greater emissions abroad, create carbon leakage in the EU. This outcome is indicative of the fact that direct carbon leakage in the EU occurs through the international trade channel. Country-specific reactions captured through causality tests further reveal that the predictive powers between environmental policy stringency and carbon leakage is widespread among the sampled EU countries. Thus, our conclusion is that the relatively more stringent environmental policies in the EU put the region at a disadvantage in the international markets, which needs to be addressed through the imposition of the CBAM.

To sum it up, this study finds that the excessive net importation of embodied carbon being witnessed in the EU is significantly associated with the stringent environmental policies. This is contrary to the conclusions of several previous studies that by focusing on specific types of environmental policies have predominantly claimed that carbon leakage is limited in the EU. The main recommendation of this study therefore is that ample justification exists for the introduction of the CBAM, as the positives associated with its imposition are likely to outweigh the negatives.

5.2 Limitation of the study and area for future reserves

It is important to mention some caveats. The first is that this study focuses solely on direct carbon leakages. Indirect carbon leakages that occur through global markets for fossil fuels are not considered in this study. Research extension in this direction could be quite revealing as it has been suggested that indirect carbon leakage might be quantitatively more important than direct carbon leakage (see Felbermayr et al., 2020). The second is that although a case is made for the imposition of the CBAM, the estimation of the aggregate trade effect of the use of this tool is not covered in this study. As such, a cost–benefit analysis of the net effect of CBAM in the EU may be useful.

Data availability

Corresponding authors can provide data used in the study on appropriate request.

References

Adebayo, T. S. (2022). Environmental consequences of fossil fuel in Spain amidst renewable energy consumption: A new insights from the wavelet-based Granger causality approach. International Journal of Sustainable Development & World Ecology, 29(7), 579–592.

Adebayo, T. S. (2023). Do uncertainties moderate the influence of renewable energy consumption on electric power CO2 emissions? A new policy insights. International Journal of Sustainable Development & World Ecology, 1–16, 314–329.

Adebayo, T. S., & Alola, A. A. (2023). Drivers of natural gas and renewable energy utilization in the USA: How about household energy efficiency-energy expenditure and retail electricity prices? Energy, 283, 129022.

Adebayo, T. S., Kartal, M. T., Ağa, M., & Al-Faryan, M. A. S. (2023). Role of country risks and renewable energy consumption on environmental quality: Evidence from MINT countries. Journal of Environmental Management, 327, 116884.

Ahmed, Z., & Le, H. P. (2021). Linking information communication technology, trade globalization index, and CO2 emissions: Evidence from advanced panel techniques. Environmental Science and Pollution Research, 28, 8770–8781.

Aichele, R., & Felbermayr, G. (2015). Kyoto and the carbon footprint of nations. Journal of Environmental Economics and Management, 69, 1–18.

Akram, R., Ibrahim, R. L., Wang, Z., Adebayo, T. S., & Irfan, M. (2023). Neutralizing the surging emissions amidst natural resource dependence, eco-innovation, and green energy in G7 countries: Insights for global environmental sustainability. Journal of Environmental Management, 344, 118560.

Alexeeva-Talebi, V., Böhringer, C., Löschel, A., & Voigt, S. (2012). The value-added of sectoral disaggregation: Implications on competitive consequences of climate change policies. Energy Economics, 34, S127–S142.

Alola, A. A., Akadiri, S. S., & Usman, O. (2021). Domestic material consumption and greenhouse gas emissions in the EU-28 countries: Implications for environmental sustainability targets. Sustainable Development, 29(2), 388–397.

Bai, J., & Kao, C. (2006). On the estimation and inference of a panel cointegration model with cross-sectional dependence. Contributions to Economic Analysis, 274, 3–30.

Bai, J., Kao, C., & Ng, S. (2009). Panel cointegration with global stochastic trends. Journal of Econometrics, 149(1), 82–99.

Balistreri, E. J., & Rutherford, T. F. (2012). Subglobal carbon policy and the competitive selection of heterogeneous firms. Energy Economics, 34, S190–S197.

Böhringer, C., Balistreri, E. J., & Rutherford, T. F. (2012). The role of border carbon adjustment in unilateral climate policy: Overview of an energy modeling forum study (EMF 29). Energy Economics, 34, S97–S110.

Botta, E., & Koźluk, T. (2014). Measuring environmental policy stringency in OECD countries: A composite index approach.

Branger, F., Quirion, P., & Chevallier, J. (2016). Carbon leakage and competitiveness of cement and steel industries under the EU ETS: Much ado about nothing. The Energy Journal, 37(3), 109–136.

Bulmer, S. (2020). The member states of the European Union. Oxford University Press.

Burniaux, J. M., & Oliveira Martins, J. (2012). Carbon leakages: A general equilibrium view. Economic Theory, 49, 473–495.

Carraro, C., Hafner, M., Tavoni, M., Massetti, E., & Ricci, E. (2020). Border carbon adjustments: Addressing emissions embodied in trade. FEEM Working Paper.

Copeland, B. R., & Taylor, M. S. (2004). Trade, growth, and the environment. Journal of Economic Literature, 42(1), 7–71.

Costantini, V., & Mazzanti, M. (2012). On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Research Policy, 41(1), 132–153.

Dechezleprêtre, A., Glachant, M., & Ménière, Y. (2008). The clean development mechanism and the international diffusion of technologies: An empirical study. Energy Policy, 36(4), 1273–1283.

Demailly, D., & Quirion, P. (2006). CO2 abatement, competitiveness and leakage in the European cement industry under the EU ETS: Grandfathering versus output-based allocation. Climate Policy, 6(1), 93–113.

Dermine, J. (2015). Basel III and European banking. CEPS working document No. 410.

Dissou, Y., & Eyland, T. (2011). Carbon control policies, competitiveness, and border tax adjustments. Energy Economics, 33(3), 556–564.

Duscha, V., Peterson, E. B., Schleich, J., & Schumacher, K. (2019). Sectoral targets to address competitiveness: A CGE analysis with focus on the global steel sector. Climate Change Economics, 10(01), 1950001.

Ellerman, A. D., & McGuinness, M. (2008). CO2 abatement in the UK power sector: evidence from the EU ETS trial period. CEEPR working Paper No. 2008–010, Center for energy and environmental policy research, Massachusetts Institute of Technology (2008).

Ellerman, A. D., Buchner, B. K., & Carraro, C. (2013). The European Union emissions trading system: Will it survive? Review of Environmental Economics and Policy, 7(1), 45–65.

European Commission. (2018). Environmental Policy in the European Union.

European Commission. (2019). The European green deal.

European Commission. (2019). CO2 emissions from cars and vans. Retrieved from https://ec.europa.eu/clima/policies/transport/vehicles_en

European Commission. (2020). EU biodiversity strategy for 2030.

European Investment Bank. (2020). Climate bank roadmap for 2021–2025.

European Commission. (2020). A new circular economy action plan. Retrieved from https://ec.europa.eu/environment/circular-economy/index_en.htm

European Commission. (2020). A European green deal for a sustainable future.

European Commission. (2020). A new circular economy action plan for a cleaner and more competitive Europe.

European Central Bank. (2021). Banking supervision. Retrieved from https://www.bankingsupervision.europa.eu/home/html/index.en.html

European Commission. (2021). Fit for 55: The European Green Deal Package.

European Commission. (2021). Common agricultural policy. Retrieved from https://ec.europa.eu/info/food-farming-fisheries/key-policies/common-agricultural-policy_en

European Commission. (2021). Proposal for a carbon border adjustment mechanism (CBAM).

European Parliament. (2020). COVID-19: Tourism and transport. Retrieved from https://www.europarl.europa.eu/news/en/headlines/society/20200304STO74329/covid-19-tourism-and-transport

Felbermayr, G., Peterson, S., & Kiel, I. (2020). Economic assessment of carbon leakage and carbon border adjustment. European parliament: Brussels, Belgium, 2020; ISBN 978–92–846–6753–6.

Felder, S., & Rutherford, T. F. (1993). Unilateral CO2 reductions and carbon leakage: The consequences of international trade in oil and basic materials. Journal of Environmental Economics and Management, 25(2), 162–176.

Fetting, C. (2020). The European green deal. ESDN report, 53.

Fischer, C., & Fox, A. K. (2012). Comparing policies to combat emissions leakage: Border carbon adjustments versus rebates. Journal of Environmental Economics and Management, 64(2), 199–216.

Fowlie, M., & Reguant, M. (2018). Challenges in the measurement of leakage risk. In AEA Papers and Proceedings (Vol. 108, pp. 124–129). 2014 Broadway, Suite 305, Nashville, TN 37203: American Economic Association.

Fowlie, M., Reguant, M., & Ryan, S. P. (2016). Market-based emissions regulation and industry dynamics. Journal of Political Economy, 124(1), 249–302.

Garnadt, N., Grimm, V., & Reuter, W. H. (2021). Carbon adjustment mechanisms: Empirics, design and caveats. Design and Caveats. German council of economic experts working Paper No. 11 (Wiesbaden, Germany).

Ghosh, M., Luo, D., Siddiqui, M. S., & Zhu, Y. (2012). Border tax adjustments in the climate policy context: CO2 versus broad-based GHG emission targeting. Energy Economics, 34, S154–S167.

Gielen, D., & Moriguchi, Y. (2002). CO2 in the iron and steel industry: An analysis of Japanese emission reduction potentials. Energy Policy, 30(10), 849–863.

Goulder, L. H., Hafstead, M. A., & Dworsky, M. (2010). Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. Journal of Environmental Economics and Management, 60(3), 161–181.

Grubb, M., Jordan, N. D., Hertwich, E., Neuhoff, K., Das, K., Bandyopadhyay, K. R., & Oh, H. (2022). Carbon leakage, consumption, and trade. Annual Review of Environment and Resources, 47, 753–795.

Gulbrandsen, L. H. (2010). Transnational environmental governance: the emergence and effects of the certification of forest and fisheries. Edward Elgar Publishing.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74.

Joltreau, E., & Sommerfeld, K. (2019). Why does emissions trading under the EU emissions trading system (ETS) not affect firms’ competitiveness? Empirical findings from the literature. Climate Policy, 19(4), 453–471.

Kónya, L. (2006). Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Economic Modelling, 23(6), 978–992.

Lanzi, E., Mullaly, D., Château, J., & Dellink, R. (2013). Addressing competitiveness and carbon leakage impacts arising from multiple carbon markets: A modelling assessment.

Liu, X., Adebayo, T. S., Ramzan, M., Ullah, S., Abbas, S., & Olanrewaju, V. O. (2023). Do coal efficiency, climate policy uncertainty and green energy consumption promote environmental sustainability in the United States? An application of novel wavelet tools. Journal of Cleaner Production, 417, 137851.

Martin, R., Muûls, M., de Preux, L. B., & Wagner, U. J. (2012). CEP Discussion Paper No 1150 June 2012 industry compensation under relocation risk: A firm-level analysis of the EU emissions trading scheme.

Martin, R., Muûls, M., & Wagner, U. J. (2016). The impact of the European Union emissions trading scheme on regulated firms: what is the evidence after ten years? Review of environmental economics and policy.

Mathiesen, L., & Mæstad, O. (2004). Climate policy and the steel industry: Achieving global emission reductions by an incomplete climate agreement. The Energy Journal, 25(4), 91–114.

Mattoo, A., Subramanian, A., Van Der Mensbrugghe, D., & He, J. (2009). Reconciling climate change and trade policy. Center for Global Development Working Paper, (189).

Misch, F., & Wingender, P. (2021). Revisiting carbon leakage. IMF Working Papers, (207).

Monjon, S., & Quirion, P. (2011). Addressing leakage in the EU ETS: Border adjustment or output-based allocation? Ecological Economics, 70(11), 1957–1971.

Naegele, H., & Zaklan, A. (2019). Does the EU ETS cause carbon leakage in European manufacturing? Journal of Environmental Economics and Management, 93, 125–147.

Nordhaus, W. (2015). Climate clubs: Overcoming free-riding in international climate policy. The American Economic Review, 105(4), 1339–1370.

Olasehinde-Williams, G., & Folorunsho, A. (2023). Environmental policy, green trade and sustainable development in Europe: New perspective on the Porter hypothesis. Energy & Environment, 0958305X231193870.

Organisation for Economic Co-Operation and Development. (2012). OECD environmental outlook to 2050, p. 350

Perino, G., Ritz, R. A., & Van Benthem, A. (2019). Understanding overlapping policies: Internal carbon leakage and the punctured waterbed. National Bureau of Economic Research.

Pesaran, M. H. (2021). General diagnostic tests for cross-sectional dependence in panels. Empirical Economics, 60(1), 13–50.

Peterson, E. B., & Schleich, J. (2007). Economic and environmental effects of border tax adjustments (No. S1/2007). Working paper sustainability and innovation.

Phillips, P. C., & Hansen, B. E. (1990). Statistical inference in instrumental variables regression with I (1) processes. The Review of Economic Studies, 57(1), 99–125.

Pycroft, J., Tran, M., Muller, B., Chen, C., Sartor, O. (2021). Carbon border adjustment mechanisms: Measuring the impact on value chains. European commission joint research centre report.

Riechmann, C., Perner, J., & Peichert, P. (2022). Levelling up the EU ETS-The EU Fit-For-55 package and its implications for emission trading in Europe. Oil, Gas & Energy Law, 20(1).

Saint Akadiri, S., Alola, A. A., Akadiri, A. C., & Alola, U. V. (2019). Renewable energy consumption in EU-28 countries: Policy toward pollution mitigation and economic sustainability. Energy Policy, 132, 803–810.

Santamaría, A., Linares, P., & Pintos, P. (2014). The effects of carbon prices and anti-leakage policies on selected industrial sectors in Spain-cement, steel and oil refining. Energy Policy, 65, 708–717.

Saussay, A., & Sato, M. (2018). The impacts of energy prices on industrial foreign investment location: Evidence from global firm level data (No. hal-03475473). HAL.

Schlacke, S., Wentzien, H., Thierjung, E. M., & Köster, M. (2022). Implementing the EU climate law via the ‘Fit for 55’package. Oxford Open Energy, 1, oiab002.

Siddi, M. (2020). The European green deal: Asseasing its current state and future implementation. UPI REPORT, 114.

Tovar, R. J., & Martín-Moreno, J. M. (2015). Carbon leakage: Emissions under the EU ETS. Energy Policy, 82, 258–269.

Usman, O., Alola, A. A., & Saint Akadiri, S. (2022). Effects of domestic material consumption, renewable energy, and financial development on environmental sustainability in the EU-28: Evidence from a GMM panel-VAR. Renewable Energy, 184, 239–251.

Vacu, N., & Odhiambo, N. M. (2020). The determinants of import demand: A review of international literature. Acta Universitatis Danubius. Œconomica, 16(5).

Venmans, F., Ellis, J., & Nachtigall, D. (2020). Carbon pricing and competitiveness: Are they at odds? Climate Policy, 20(9), 1070–1091.

Verde, S. F. (2020). The impact of the EU emissions trading system on competitiveness and carbon leakage: The econometric evidence. Journal of Economic Surveys, 34(2), 320–343.

Wagner, U. J., & Timilsina, G. R. (2003). What really causes carbon leakage? Research in Transportation Economics, 45, 2–10.

Waterton, C., & Wynne, B. (2004). Knowledge and political order in the European environment agency. States of knowledge (pp. 87–108). UK: Routledge.

Westerlund, J. (2007). Estimating cointegrated panels with common factors and the forward rate unbiasedness hypothesis. Journal of Financial Econometrics, 5(3), 491–522.

Westerlund, J., & Edgerton, D. L. (2007). A panel bootstrap cointegration test. Economics Letters, 97(3), 185–190.

Wiebe, K. S., Yamano, N. (2016). Estimating CO2 emissions embodied in final demand and trade using the OECD ICIO 2015: Methodology and results. OECD Science, technology and industry working papers, No. 2016/05 (Paris, France: Organisation for economic co-operation and development).

Yu, B., Zhao, Q., & Wei, Y. M. (2021). Review of carbon leakage under regionally differentiated climate policies. Science of the Total Environment, 782, 146765.

Zakaria, M. (2014). Effects of trade liberalization on exports, imports and trade balance in Pakistan: A time series analysis. Prague Economic Papers, 23(1), 121–139.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK). This research does not receive any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors confirm that, there is no conflict of interest for this paper submission.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Olasehinde-Williams, G., Akadiri, S.S. Environmental policy stringency and carbon leakages: a case for carbon border adjustment mechanism in the European Union. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-04941-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-04941-7