Abstract

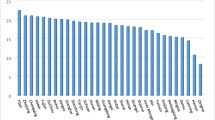

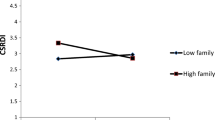

Previous research has provided contingent results on the relationship between geographic diversification and corporate social responsibility. We revisit this relationship by studying the different levels of corporate social responsibility (CSR) disclosure of the largest US multinationals, using a more rigorous research design. We improve on the previous literature by focusing on geographic segment information under Financial Accounting Standards Statement No. 131 (SFAS 131) and by developing two reliable measures of geographic diversification (Geographic Diversification Depth, Geographic Diversification Breadth). These new measures capture the level information of geographic diversification that the measures used by previous studies. From a sample of 1108 multinationals in 22 countries encompassing 11,080 observations over a period spanning from 2009 to 2018, we find that the geographical diversification of multinationals is negatively associated with CSR scores, which is consistent with the explanation of social interaction. A DID approach shows that the results hold when controlling for endogeneity between geographic diversification and CSR. Moreover, the overall effect of associating higher levels of CSR disclosure with higher levels of geographic diversification is stronger in countries with more democracy, more government effectiveness, and better regulatory quality. Therefore, host country-level characteristics affect the social and environmental behavior of geographically diversified and cross-listed multinationals in the USA.

Similar content being viewed by others

Data availability

Data supporting the conclusions of this study are available from the author, upon reasonable request. Ethical clearance: Research tools and procedures for data collection, analysis, management, and sharing have been reviewed by University.

Notes

World Federation of Stock Exchanges. (2016), available at: http://info.worldbank.org/governance/wgi/ index.aspx#home (accessed January 2016).

An SEC panel investigated several of their most pressing concerns regarding accounting and financial reporting in 2014. Luisi (2015), the leader of the panel, highlighted that issues still exist in current segment reporting, including inappropriate identification of the “chief operating decision maker” and unclear definition for operating segment and aggregation.

Psychic distance refers to the uncertainty associated with factors such as ‘‘differences in language, culture, political systems, level of education, or level of industrial development’’ that adversely affect the flow of information between a firm and the market (Johanson and Vahlne 1977, p. 24).

References

Aggarwal, R., Berrill, J., Hutson, E., & Kearney, C. (2011). What is a multinational corporation? Classifying the degree of firm-level multinationality. International Business Review, 20(5), 557–577.

Aguilera-Caracuel, J., Guerrero-Villegas, J., & Morales-Raya, M. (2015). Corporate citizenship of multinational enterprises & financial performance: The moderating effect of operating in developing countries”. Ethical Perspectives, 22, 437–467. https://doi.org/10.2143/EP.22.3.3108216

Alfonso, E., Hollie, D., & Yu, S. (2012). Managers’ segment financial reporting choice: An analysis of firms’ segment reconciliations. Journal of Applied Business Research, 28(6), 1413–1444.

Attig, N., Boubakri, N., El Ghoul, S., & Guedhami, O. (2016). Firm internationalization and corporate social responsibility. Journal of Business Ethics, 134, 171–197.

Attig, N., Cleary, S., El Ghoul, S., & Guedhami, O. (2013). Institutional investment horizons and the cost of equity capital. Financial Management, 42, 441–477.

Bens, D., Monahan, S. J., & Steele, L. B. (2018). The effect of aggregation of accounting information via segment reporting on accounting conservatism. European Accounting Review, 27(2), 237–262. https://doi.org/10.1080/09638180.2016.1260488

Black, D. E., Dikolli, S. S., & Dyreng, S. D. (2014). CEO pay-forcomplexity and the risk of managerial diversion from multinational diversification. Contemporary Accounting Research, 31, 103–135.

Blanco, B., Lara, J., & Tribo, J. (2015). Segment disclosure and cost of capital. Journal of Business Finance and Accounting, 42(3/4), 367–411.

Boulding, K.E. (1978). The management of decline Change, pp. 8–9; 64.

Brammer, S. J., Pavelin, S., & Porter, L. A. (2006). Corporate social performance and geographical diversification. Journal of Business Research, 59, 1025–1034.

Brammer, S. J., Pavelin, S., & Porter, L. A. (2009). Corporate charitable giving, multinational companies and countries of concern. Journal of Management Studies., 46, 575–596.

Campbell, J. L. (2007). Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Academy of Management Review, 32, 946–967. https://doi.org/10.5465/AMR.2007.25275684

Changjiang, W. (2020). International diversification, SFAS 131, and debt maturity structure. Journal of Accounting. Auditing & Finance, 35(2), 438–468.

Ciocirlan, C., & Pettersson, C. (2012). Does workforce diversity matter in the fight against climate change? An analysis of fortune 500 companies. Corporate Social Responsibility and Environmental Management, 19, 47–62.

Chen, T. K., & Liao, Y. P. (2015). The economic consequences of disclosure quality under SFAS no. 131. Accounting Horizons, 29(1), 1–22.

Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32, 639–647.

Cho, E., Chun, S. B., & Choi, D. (2015). International diversification, CSR, and corporate governance: Evidence from Korea. Journal of Applied Business Research, 31(2), 743–762.

Clarkson, P., Li, Y., Richardson, G., & Vasvari, F. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting. Organizations and Society, 33(4–5), 303–327.

Cuadrado-Ballesteros, B., Rodríguez-Ariza, L., & García-Sánchez, I. M. (2015). The role of independent directors at family firms in relation to corporate social responsibility disclosures. International Business Review, 24(5), 890–901. https://doi.org/10.1016/j.ibusrev.2015.04.002

Darnall, N., Henriques, I., & Sadorsky, P. (2010). Adopting proactive environmental strategy: The influence of stakeholders and firm size. Journal of Management Studies, 47, 1072–1094.

da Silva Monteiro, S. M., & Aibar-Guzmán, B. (2010). Determinants of environmental disclosure in the annual reports of large companies operating in Portugal. Corporate Social Responsibility and Environmental Management, 17(4), 185–204.

De Villiers, C., Naiker, V., Staden, V. A. N., & C. J. (2011). The effect of board characteristics on firm environmental performance. Journal of Management, 37(6), 1636–1663. https://doi.org/10.1177/0149206311411506

Denis, D. J., Denis, D. K., & Yost, K. (2002). Global diversification, industrial diversification, and firm value. J. Finance, 57, 1951–1979.

Delmas, M. A., & Burbano, V. C. (2011). The drivers of greenwashing. California Management Review, 54, 64–87. https://doi.org/10.1525/cmr.2011.54.1.64.

Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., & Yang, Y. G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Accounting Review, 87(3), 723–759.

Di Giuli, A., & Kostovetsky, L. (2014). Are red or blue companies more likely to go green? Politics and corporate social responsibility. Journal of Financial Economics, 111(1), 158–180.

Doukas, J., & Pantzalis, C. (2003). Geographic diversification and the agency costs of debt of multinational firms. Journal of Corporate Finance, 9, 59–92.

Duru, A., & Reeb, D. M. (2002). International diversification and analysts’ forecast accuracy and bias. The Accounting Review, 77, 415–433.

Dyreng, S. D., Lindsey, B. P., & Thornock, J. R. (2013). Exploring the role Delaware plays as a domestic tax haven. Journal of Financial Economics, 108(3), 751–772.

Dyreng, S., Hanlon, M., & Maydew, E. (2012). Where do firms manage earnings? Review of Accounting Studies, 17, 649–687.

Engle. (2007). Corporate social responsibility in host countries: A perspective from American managers. Corporate Social Responsibility and Environmental, 14, 16–27.

Ettredge, M., Kwon, S., Smith, D., & Stone, M. (2006). The effect of SFAS no. 131 on the cross-segment variability of profits reported by multiple segment firms. Review of Accounting Studies, 17, 91–117.

Francis, B., Hunter, D., Robinson, D., et al. (2017). Auditor changes and the cost of Bank debt. The Accounting Review, 92(3), 1–24.

Franco, F., Urcan, O., & Vasvari, F. P. (2016). Corporate diversification and the cost of debt: The role of segment disclosures. The Accounting Review, 91, 1139–1165.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman.

Gallego-Alvarez, I., & Pucheta-Martínez, M. C. (2020). How cultural dimensions, legal systems, and industry affect environmental reporting? Empirical evidence from an international perspective. Business Strategy and Environment, 29, 2037–2057.

Gallego-Álvarez, I., & Quina-Custodio, A. I. (2017a). Corporate social responsibility reporting and varieties of capitalism: An international analysis of state-led and liberal market economies, corporate social responsibility and environmental management. Mgmt, 24, 478–495.

Gallego-Álvarez, I., & Quina-Custodio, I. A. (2017b). Corporate social responsibility reporting and varieties of capitalism: An international analysis of state-led and liberal market economies. Corporate Social Responsibility and Environmental Management, 24(6), 478–495.

Gao, W., Ng, L., & Wang, Q. (2008). Does geographic dispersion affect firm valuation? J. Corpor. Finance, 14, 674–687.

Garcia, D., & Norli, O. (2012). Geographic dispersion and stock returns. Journal of Financial Economics, 106, 547–565.

Gargouri, R. M., Shabou, R., & Francoeur, C. (2010). The relationship between corporate social performance and earnings management. Canadian Journal of Administrative Sciences/revue Canadienne Des Sciences De Administration, 27(4), 320–334. https://doi.org/10.1002/cjas.178

Ghoul, S. E., Guedhami, O., Kwok, C. C. Y., & Mishra, D. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35, 2388–2406.

Ghoul, S. E., Guedhami, O., Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48, 360–385.

Gong, G., Ke, B., & Yu, Y. (2013). Home country investor protection, ownership structure and crosslisted firms’ compliance with SOX-mandated internal control deficiency disclosures. Contemporary Accounting Research, 30(4), 1490–1523.

Guo, M., He, L., & Zhong, L. (2019). Business groups and CSR: Evidence from China. Emerging Mark. Rev., 2018(37), 83–97.

Hann, R., Ogneva, M., & Ozbas, O. (2013). Corporate diversification and the cost of capital. Journal of Finance, 68, 1961–1999.

Herbohn, K., Walker, J., & Loo, H. (2014). Corporate social responsibility: The link between sustainability disclosure and sustainability performance. Abacus, 50, 422–459.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40, 767–798.

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations (2nd ed.). Sage Publications.

Hollie, D., & Yu, S. (2015). A perspective on segment reporting choices and segment reconciliations”. Applied Finance and Accounting, 1(2), 88–95.

Hope, O.-K., Kang, T., & Kim, J. (2013). Voluntary disclosure practices by foreign firms cross-listed in the United States. Journal of Contemporary Accounting and Economics, 9(1), 50–66.

Hossain, M., & Reaz, M. (2007). The determinants and characteristics of voluntary disclosures by Indian banking companies. Corporate Social Responsibility and Environmental Management, 14(5), 274–288.

Huang, S. (2013). The impact of CEO characteristics on corporate sustainable development. Corp. Soc. Responsible. Environ. Manage., 20, 232–244.

Jamali, D. (2010). The CSR of MNC subsidiaries in developing countries: Global local substantive or diluted. Journal of Business Ethics, 93(2), 181–200.

Johanson, J., Vahlne, J. -E. (1977). The internationalization process of the firm: A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8, 23–32.

Kang, J. (2013). The relationship between corporate diversification and corporate social performance. Strategic Management Journal, 34, 94–109. https://doi.org/10.1002/smj.2005

Kacperczyk, A. (2009). With greater power comes greater responsibility? Takeover protection and corporate attention to stakeholders. Strategic Management Journal, 30, 261–285

Kock, C.J. & Santalo, J. (2005). Are shareholders environmental ‘laggards’? Corporate governance and environmental firm performance, Instituto de Empresa Business School working paper no. WP05–05. Retrieved Nov 2013, available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1015883.

Kumar, K., Boesso, G., Batra, R., & Yao, J. (2021). Cross-national differences in stakeholder management: Applying institutional theory and comparative capitalism framework. Business Strategy and the Environment, 30(5), 2354–2366.

Kuppuswamy, V., & Villalonga, B. (2016). Does diversification create value in the presence of external financing constraints? Evidence from the 2007–2009 financial crisis. Management Science, 62(4), 905–923.

Li, S., Qiu, J., & Wan, C. (2011). Corporate globalization and bank lending. Journal of International Business Studies, 42, 1016–1042.

LaGore, W., & Mahoney, L. (2020). An implicit-explicit examination of differences in CSR practices between the USA and Europe. Society and Business Review, 15(3), 165–187.

Landier, A., Nair, V. B., & Wulf, J. (2009). Trade-offs in staying close: Corporate decision making and geographic dispersion. The Review of Financial Studies, 22(3), 1119–1148.

LaPorta, R., Lopez-de-Silanes, F., & Shleifer, A. (2006). What works in securities laws? The Journal of Finance, 61(1), 1–32.

Lau, C. M., Lu, Y., & Liang, Q. (2014). CSR in China: A corporate governance approach. Journal of Business Ethics, 136(1), 73–87.

Lee, J. W., Kim, Y. M., & Kim, Y. E. (2018). Antecedents of adopting corporate environmental responsibility and green practices. Journal of Business Ethics, 148(2), 397–409.

Lee, E., Walker, M., & Zeng, C. (2017). Do Chinese state subsidies affect voluntary corporate social responsibility disclosure? Journal of Accounting and Public Policy, 36(3), 179–200.

Li, C. K., Luo, J. H., & Soderstrom, N. S. (2017). Market response to expected regulatory costs related to haze. Journal of Accounting and Public Policy, 36(3), 201–219.

Lindahl, F., & Schadéwitz, H. (2013). Are legal families related to financial reporting quality? Abacus, 49(2), 242–267.

Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. The Journal of Finance, 66(1), 35–65.

Ma, H., Zeng, S., Shen, G. Q., Lin, H., & Chen, H. (2016). International diversification and corporate social responsibility: An empirical study of Chinese contractors. Management Decision, 54, 750–774. https://doi.org/10.1108/MD-07-2015-0322

Marano, V., & Kostova, T. (2016). Unpacking the institutional complexity in adoption of CSR practice in multinational enterprise. Journal of Management Studies, 53, 18–54.

Marano, V., Tashman, P., & Kostova, T. (2017). Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprise. Journal of International Business Studies, 483, 386–408.

Mateo-Márquez, A. J., González-González, J. M., & Zamora-Ramírez, C. (2019). Countries’ regulatory context and voluntary carbon disclosures. Sustainability Accounting, Management and Policy Journal, 11(2), 383–408. https://doi.org/10.1108/SAMPJ-11-2018-0302

Mauri, A. J. (2009). Influence of MNC network configuration patterns on the volatility of firm performance: An empirical investigation. Management International Review, 49, 691–707.

Mauri, A. J., Lin, J., & Neiva De Figueiredo, J. (2013). The influence of strategic patterns of internationalization on the accuracy and bias of earnings forecasts by financial analysts. International Business Review, 22, 725–735.

Mauri, A. J., & Phatak, A. V. (2001). Global integration as inter-area product flows: The internalization of ownership and location factors influencing product flows across MNC units. Management International Review, 41, 233–249.

McGuire, S., Newton, N., Omer, T., Sharp, N., (2012). Does local religiosity impact corporate social responsibility? Working Paper.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 28, 117–127.

Miniaoui, Z., Chibani, F., & Hussainey, K. (2019). The impact of country-level institutional differences on corporate social responsibility disclosure engagement. Corporate Social Responsibility and Environmental Management, 26(6), 1307–1320. https://doi.org/10.1002/csr.1748

Montgomery, C. A. (1985). Product-market diversification and market power. Academy of Management Journal, 28, 789–798.

Muiño, F., & Núñez-Nickel, M. (2016). Multidimensional competition and corporate disclosure. Journal of Business Finance and Accounting, 43(3/4), 298–328.

Pater, A., & Lierop, K. V. (2006). Sense and sensitivity: The roles of organisation and stakeholders in managing corporate social responsibility. Business Ethics: A European Review, 15(4), 339–351.

Patrisia, D., & Dastgir, S. (2017). Diversification and corporate social performance in manufacturing companies. Eurasian Business Review, 7, 121–139. https://doi.org/10.1007/s40821-016-0052-6

Patten, D. M. (1991). Exposure, legitimacy, and social disclosure. Journal of Accounting and Public Policy, 10, 297–308.

Pinheiro, A. B., Sampaio, T. S. L., Rodrigues, R. C., & Batistella, A. J. (2022). Democracy, corruption and civil liberties: Does national context influence corporate carbon disclosure? Revista De Administração Da UFSM, 15, 434–452.

Porter, M. E., & Kramer, M. R. (2011). How to reinvent capitalism: And unleash a wave of innovation and growth. Harvard Business Review, 891, 62–77.

Rangan, S., & Sengul, M. (2009). Information technology and transnational integration: Theory and evidence on the evolution of the modern multinational enterprise. Journal of International Business Studies, 40, 1496–1514.

Reeb, D., Kwok, C., & Baek, Y. (1998). Systematic risk in the multinational corporation. Journal of International Business Studies, 29, 263–279.

Roach, B. (2005). A primer on multinational corporations. In Chandler, A. D., and Mazlish. B. Eds. Leviathans. Multinational corporations and the new global history:19–44. Cambridge, UK: Cambridge University Press.

Sang, F., Alam, P., & Hinkel, T. (2022). Segment earnings and managerial incentives: Evidence from foreign firms cross-listed in the USA. Review of Accounting and Finance, 21(3), 130–153.

Scherer, A. G., & Palazzo, G., et al. (2008). Globalization and corporate social responsibility. In A. Crane (Ed.), The Oxford handbook of corporate social responsibility (pp. 413–431). Oxford University Press.

Serrasqueiro, R., & Oliveira, J. (2022). Risk reporting: Do country-level institutional forces really matter. Asian Review of Accounting, 30(2), 258–293.

Shi, Y., Kim, J.-B., & Magnan, M. (2015b). Voluntary disclosure, legal institutions, and firm valuation: evidence from U.S. cross-listed foreign firms”. Journal of International Accounting Research, 13(2), 57–85.

Shi, G., Sun, J., & Luo, R. (2015a). Geographic dispersion and earnings management. Journal of Accounting and Public Policy, 34(5), 490–508.

Shia, G., Sunb, J., Zhangc, L., & Jin, Y. (2017). Corporate social responsibility and geographic dispersion. Journal of Accounting and Public Policy, 36, 417–428.

Simerly, R. L., & Li, M. (2000). Corporate social performance and multinationality, a longitudinal study. B [Quest, article available at http://www.westga.edu/*bquest/2000/corporate.html

Simnett, R., Vanstraelen, A., & Chua, W. F. (2009). Assurance on sustainability reports: An international comparison. Accounting Review, 84, 937–967.

Srinivasan, S., Wahid, A., & Yu, G. (2015). Admitting mistakes: Home country effect on the reliability of restatement reporting. The Accounting Review, 90(3), 1201–1240.

Strike, M. V., Gao, J., & Bansal, P. (2006). Being good while being bad: Social responsibility and the international diversification of US firms. Journal of International Business Studies, 37, 254–280.

Su, W., & Tsang, E. W. K. (2015). Product diversification and financial performance: The moderating role of secondary stakeholders. Academy of Management Journal, 58(4), 1128–1148. https://doi.org/10.5465/amj.2013.0454

Sullivan, D. (1994). Measuring the degree of internationalization of a firm. Journal of International Business Studies, 25, 325–334.

Surroca, J., Tribo, J. A., & Zahra, S. A. (2013). Stakeholder pressure on MNEs and the transfer of socially irresponsible practices to subsidiaries. Academy of Management Journal, 56(2), 549–572.

Tinker, T., Lehman, C., & Neimark, M. (1991). Falling down the hole in the middle of the road: Political quietism in corporate social reporting. Accounting, Auditing and Accountability Journal, 4(2), 28–54.

Toukabri, M., & Jilani, F. (2022). The power of critical mass to make a difference: how gender diversity in board affect US corporate carbon performance. Society and Business Review, 18(3), pp.1–30. https://doi.org/10.1108/BR-11-2021-0224

Toukabri, M., & Kateb, I. (2022). The bidirectional relationship between corporate social responsibility and financial reporting quality: Does gender diversity matter? Evidence from US companies. Journal of Corporate Accounting & Finance, 34(1), 1–26. https://doi.org/10.1002/jcaf.2260

Toukabri, M., & Youssef, M. M. A. (2022). Climate change disclosure and sustainable development goals (SDGs) of the 2030 agenda: The moderating role of corporate governance”. Journal of Information, Communication and Ethics in Society, 21(1), 1–35.

Valenzuela-Fernández, L., Jara-Bertin, M., & Villegas-Pineaur, F. (2015). Prácticas de responsabilidad social, reputación corporativa y desempeño financiero. RAE-Revista De Administração De Empresas, 55, 329–344. https://doi.org/10.1590/S0034-759020150308

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18, 303–319.

Walden, W. D., & Schwartz, B. N. (1997). Environmental disclosures and public policy pressure. Journal of Accounting and Public Policy, 16, 125–154.

Xu, S., & Liu, D. (2016). Corporate social responsibility (CSR) and corporate diversification: Do diversified production firms invest more in CSR? Applied Economics Letters, 24(4), 254–257.

Yang, X., & Rivers, C. (2009). Antecedents of CSR practices in MNCs’ subsidiaries: A stakeholder and institutional perspective. Journal of Business Ethics, 86(2), 155–169.

Yuan, Y., Tian, G., Lu, L. Y., & Yu, Y. (2019). CEO ability and corporate social responsibility. Journal of Business Ethics, 157(2), 391–411. https://doi.org/10.1007/s10551-017-3622-3

Zahra, S. A., Neubaum, D. O., & Huse, M. (2000). Entrepreneurship in medium-size companies: Exploring the effects of ownership and governance systems. Journal of Management, 26, 947–976. https://doi.org/10.1016/S0149-2063(00)00064-

Zeng, S. X., Ma, H. Y., Lin, H., Zeng, R. C., & Tam, V. W. (2015). Social responsibility of major infrastructure projects in China. International Journal of Project Management, 33(3), 537–548.

Zhang, G., Wang, L., Guo, F., & Yang, G. (2021). Does corporate internationalization affect corporate social responsibility? Evidence from China. Emerging Markets Review, 46, 100794.

Acknowledgements

The authors extend their appreciation to the Deanship of Scientific Research at King Khalid University for funding their work through the Research Small Group Project under grant number RGP1/327/44.

Funding

The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

Both authors made substantial contributions to the conception and research design, data collection, analysis as well as to the interpretation of data in this paper. Both authors participated in drafting and revising the paper. Both authors gave the final approval of the version being submitted to this journal.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Toukabri, M., Al Adawi, M.A. Revisiting the relation between geographical diversification and corporate social responsibility: the role of segment disclosure (SFAS 131) and institutional environment. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-03390-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-03390-y