Abstract

This paper studies how interaction between economic decision-making and environmental awareness affects US business cycle and GHG emissions in a two-sector DSGE model. We emphasize the mechanisms that relate carbon emissions dynamics, consumer behavior, and environmental awareness in a framework incorporating two classes of goods (i.e., “clean” and “dirty”). This paper offers three main results. First, green consumption preferences play a key role in emissions reduction when they internalize emissions concentrations. Second, a green preference shock is the second source of fluctuation in many sectoral variables and stabilizes the business cycle. Third, a pollutant supply shock leads to sustainable consumption procyclicality documented in US data, only if households are environmentally aware.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The adverse effects of a rapid increase in Greenhouse Gases (GHGs) concentration on global warming are nowadays one of the most critical concerns of policymakers worldwide. In order to avoid the dangerous consequence of climate change, the Paris Agreement established a global framework to limit global warming below 1.5 °C within 2050. To keep the average global temperature below this critical threshold, we need an ambitious emissions reduction effort from all agents.

Therefore, world economies will need social and technological changes. In this context, households play a crucial role, contributing to \(72\%\) of global greenhouse gas emissions (Hertwich & Peters, 2009; Duarte et al., 2015). The direct and indirect pollution makes the share of carbon emissions from households a substantial part of its total volume (Jakučionytė-Skodienė et al., 2020). Households make pollution directly through cooking, heating, and transportation and indirectly through the consumption of goods produced by pollutant technologies. Several studies show that residential energy use accounts for almost \(24\%\) of GHG emissions in Europe.

In the USA, Bin and Dowlatabadi (2005) report that households’ activities directly influence more than \(40\%\) of the total CO\(_{2}\) (carbon dioxide) emissions. Baiocchi et al. (2010) show that households’ consumption indirectly affects around \(52\%\) or 358 million tons of carbon dioxide emissions in the UK.

These findings suggest that household behavior is a crucial component in climate policies since individuals can save immense amounts of carbon (the so-called behavioral mitigation wedge) simply by changing their diet to avoid meat or forgoing air travel. In this connection, McKinsey and Company (2009) and Farber (2012) find that behavioral change contributes to removing between \(4\%\) and \(8\%\) of the overall emissions. Hence, academic and policy discourses considered behavioral change among households as an essential strategy to curb carbon emissions and prevent climate change (Niamir et al., 2020).

However, consumer behavior is complex, and it does not follow purely rational choices (Frederiks et al., 2015). The key determinants of green consumption behavior include the socioeconomic framework, culture, and knowledge of environmental issues. A large body of literature in this research field reports that household consumption is closely related to knowledge and awareness about CO\(_{2}\) emissions impacts on climate change (Alfredsson, 2004). Among these, Polonsky et al. (2012) find a positive relationship between general and carbon-specific knowledge, attitude towards the environment, and general and carbon-specific behaviors. Joshi and Rahman (2015) demonstrate that the consumers’ environmental concern and product functionality are two significant determinants of consumer green purchase behavior.

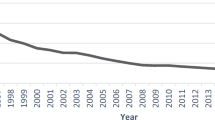

Furthermore, public concerns about climate change and energy-related behaviors are slowly growing (Niamir et al., 2020). People are paying more attention to potential effects in their daily lives and their role in protecting the environment nowadays (Gadenne et al., 2011). Households are getting a greater awareness of the value and the need for sustainable actions. According to the Nielsen Company, sales of sustainable fast-moving consumer goods in the USA have risen nearly \(20\%\) since 2014, with a compound annual growth rate of \(3.5\%\)Footnote 1. In this direction, the GfK (2011) report finds many US citizens are buying products made from packaged or recycled materials (\(29\%\)) and cutting down on their automobile usage by taking mass transit (\(18\%\)), which is twice compared to 1990 (Johnson, 2011).

Nevertheless, in the last decades, the international climate policy debate has been fixated on economic incentives. It has often relegated behavioral change to an afterthought rather than having it join the center stage (Dubois et al., 2019).

Only a small part of macroeconomic modeling research considers the diversity of behavior and various psychological and social factors beyond purely economic considerations to assess environmental issues in a dynamic context. In a general equilibrium framework, several contributions analyze the adverse effects of GHGs growth focusing on the supply side (e.g., Acemoglu et al., 2012; Brock & Taylor, 2010; Nordhaus, 2008 and Heutel, 2012), while relatively less on the demand side (i.e., Llavador et al. (2011)) of the economy. Therefore, analyzing the impact of environmental concerns and green preferences on the business cycle is crucial to achieve climate goals, denoting an interesting research avenue that we pursue in this paper.

Empirical evidence indicates that environmental concerns are time-varying and procyclical. In detail, several studies demonstrate the public is less concerned with global warming when the unemployment rate is high. Among this, Elliott et al. (1995) demonstrate that changes influence environmental expenditures to support actual economic conditions. Kahn and Kotchen (2010) show a decrease in the probability that residents think global warming is happening when the state’s unemployment rate increases. Reporting on survey data from the Gallup organization, Jacobe (2012) finds a change in the respondents’ behavior before and after the 2007 crisis. Before the crisis, a higher priority was given to the environment over the economy.

Starting in 2009, Americans’ priorities appear to have changed, with more respondents indicating that they believe economic growth should be given priority over the environment and by as much as an 18-point gap (Conroy and Emerson, 2014). Scruggs and Benegal (2012) find that public opinion about global warming is variable and driven by the business cycle and economic insecurity.

This preliminary but strong evidence suggests the importance of understanding the economic mechanisms in a dynamic context where households’ environmental awareness cannot be neglected. This relationship suggests that macroeconomic shocks inducing cyclical fluctuations in output should also account for the cyclical behavior of environmental awareness and sustainable consumption. Therefore, policymakers require supporting decision tools, exploring the interplay of economic decision-making and ecological behavior when testing common climate mitigation policies and socioeconomic pathways in a world with a changing climate (Niamir et al., 2020).

In light of that, this paper studies how interaction between economic decision-making and environmental awareness to affects the US business cycle and emissions in a two-sector DSGE model. Its innovative contribution to the literature is threefold.

First, our setup augments (Heutel, 2012) and Angelopoulos et al. (2010, 2013) by adding green and dirty firms and allowing the households to change preferences about green products. Our model allows environmentally friendly behavior, which consists of purchasing and consuming products and services that are benign toward the environment; for instance, we refer to fast-moving consumer goods, such as sustainable non-durable products. The representative economy consists of many identical infinite lived private agents whose utility depends on private consumption, labor, and the stock of environmental quality. Two classes of goods (i.e., “clean” and “dirty”) are produced, respectively, by an environmentally friendly technology and dirty technology, entailing high-carbon growthFootnote 2. Second, to the best of our knowledge, no other study examines the impact of a green preference shock on the macroeconomic dynamics. Third, this is the first study aiming to analyze the impact and the importance of green behavioral change on the business cycle using DSGE modeling.

Our model is deliberately based on several simplifying assumptions to stress the intuition behind environmental awareness on some common shocks’ transmission mechanism in the literature. Alternative formulations include the damages from pollution directly in the production function. In a decentralized economy, like the one we consider, the two modeling choices are equivalent. However, this study exclusively examines how damages from pollution affect households’ utility function and their choices toward sustainable products.

This document is motivated by the recent rise in awareness about climate change issues and their consequences (e.g., “Fridays for Future” Climate Strike implications). However, most of the existing literature on environmental policy analysis (e.g., Fischer and Springborn (2011); Heutel (2012); Annicchiarico and Di Dio (2015)) neglects the role of the household in this story. This study allows exploring other channels in which environmental policies may affect macroeconomic dynamics, focusing on consumers preferences and sectoral interactions between sustainable and pollutant production sectors.

Analyzing behavioral changes in rational expectation framework allow to address the following research question: (i) How do green preferences affect U.S. business cycle and emissions’ reduction? (ii) To what extent supply shocks influence environmental awareness? In a nutshell, our answers can be summarized as follows. First, green preferences play a key role in shaping macroeconomic fluctuations and reducing emissions. A green preference shock is the second source of fluctuation in many sectoral variables (i.e., green consumption and investment) and stabilizes the business cycle. When productivity shocks hit the economy entailing an increase in emissions concentration, a strong substitution effect works, prevailing on the perception of negative externality deriving from a reduction in environmental quality. However, a pollutant supply shock leads to sustainable consumption procyclicality documented in US data, only if households are environmentally aware. In detail, the environmental awareness allows for a cross-sectoral exchange in favor of the green sector after pollutant and clean shocks. Unlike prior contributions, we find that a pollutant technology shock activates households’ environmental concerns, affecting their consumption decisions in favor of sustainable consumption. Since households’ behavioral changes are key factors of sustainable economic development, failing their preferences could result in a biased calculation of environmental policies ranking.

The remainder of the paper is organized as follows. Section 2 reviews the environmental dynamic general equilibrium literature related to this topic. Section 3 describes the model. Section 4 discusses the calibration and steady-state properties of the model. Section 5 shows results in terms of impulse response analysis and variance decomposition. Section 6 examine how environmental policies interact with a green preference shock. Section 7 provides sensitivity analysis. Section 8 concludes and discusses the future research agenda.

2 Literature review

Climate change is significantly connected to macroeconomic phenomena. As a result of these connections, macroeconomics research to examine issues linked to climate change is growing. Over the past decades, the main tools to evaluate the benefits and costs of several climate change reduction strategies have been the Computable General Equilibrium (CGE) models and Integrated Assessment Models (IAMs). However, a large body of recent research models environmental issues in a DSGE framework, focusing mainly on environmental policy evaluation.

Accordingly, a significant part of E-DSGE literature has examined several questions related to climate change, focusing on the relationship between the supply side of the economy and the emissions dynamics. In that context, the first contributions are Angelopoulos et al. (2010), Fischer and Springborn (2011), and Heutel (2012). These papers augment the standard RBC framework considering pollution dynamics (e.g., carbon emissions). The rest of the literature emerged as a comparative framework of these first studies. Angelopoulos et al. (2010) extend a basic stochastic neoclassical growth model to compare the performance of alternative environmental policy rules. Fischer and Springborn (2011) provide a different definition of the interplay between economic activity and pollution dynamics. The authors explore the macroeconomic performance of different environmental policies in an RBC model in which production requires a polluting input. Heutel (2012) develops an E-DSGE model in the spirit of Nordhaus’s (2008) DICE model to evaluate how the optimal environmental policy should respond to business cycle volatility. Starting from these studies, very heterogeneous literature has been produced in this field. Angelopoulos et al. (2013) extend (Angelopoulos et al., 2010), developing an E-DSGE model to compare the second-best optimal environmental policy and the first-best allocation in the Ramsey model. Annicchiarico and Di Dio (2015) build an NK E-DSGE to assess how different degrees of price stickiness affect the economy’s dynamic under a carbon tax, cap-and-trade, and intensity target policies.

A prominent part of E-DSGE literature has focused on evaluating different environmental policy recipes in the energy sector. The first contribution to this research topic is Golosov et al. (2014) . The authors assess the role of economic policy for dealing with climate change in an E-DSGE model embedding the energy sector. Dissou and Karnizova (2016) extend the previous contribution in order to capture some results in the short term, including investments and unemployment, in a multi-sector model. Argentiero et al. (2017) explore the role of the energy policy in an RBC model augmented with the energy sector, which considers both renewable (RES) and fossil energy sources. As in Golosov et al. (2014), the authors consider the energy inputs in the aggregate production function. However, they extend the previous analysis assuming that renewable and fossil fuel energy inputs are substitutable. In detail, fossil fuel intermediate input is produced by combing capital, labor, and exhaustible fossil fuel resources. The study is completed with a Bayesian Estimation for three specific countries: the USA, European Union 15, and China. The same model set-up is employed by Argentiero et al. (2018) to assess the cost-effectiveness of technology-push measures and demand-pull measures to promote RES in the E.U. 15.

A recent strand of research has employed E-DSGE models to examine the relationship between financial systems and climate change risks. Among these, Wang et al. (2021) provide insights into the interaction between borrowing constraints and environmental policies and the combined effect on the real economy . Huang et al. (2021) investigate the risk arising from transition toward a low-emission economy and examine its transmission channels within the financial system. Liu and He (2021) contribute to this debate demonstrating that both price-based and quantity-based incentive green credit have obvious economic, environmental, and health effects and can achieve a win-win situation between output and environment.

Although the analysis of the impact of supply shock on the environment is the main topic in the DSGE literature, some recent papers address this issue from another perspective, focusing on the economy’s demand side. Chan (2019) explores the optimal environmental tax rate in an open economy with labor migration. His study is motivated by the idea that poor environmental quality could dissuade professional workers from immigrating to a city. His model’s key mechanism is related to work’s disutility that increases when air pollutant emission levels rise, forcing the local workers to move out. The author demonstrates that the optimal environmental tax rate volatility and procyclicality are underestimated in the previous literature because a higher environmental tax rate could stimulate output, deter labor outflow, and attract labor inflow. Another recent study in this field is Chan (2020).The author focuses on behavioral anomalies on the demand side of the economy, considering bounded rational households. The author’s DSGE model features households with habit formation (internal habits) and social comparisons (external habits). The author finds that the household bounded rationality affects the optimal model response in different ways. First, the model with external habits amplifies consumption volatility but produces a similar response to pollutant emissions than the benchmark model without consumption externality. Second, the model with internal habits decreases the volatility of both consumption and pollutant emissions. From the environmental policy perspective, the social comparisons model mitigates the procyclicality of optimal emissions tax rates. In contrast, the optimal emissions tax rates under the habit formation model remain constant in response to all shocks. Annicchiarico et al. (2021) contribute to this discussion suggesting that bounded rationality and behavioral biases, associated with business cycle fluctuations, may prevent agents from fully internalizing the impact of climate policies, conditioning the policy effectiveness and the achievement of climate targets. The authors explicitly discuss the role of monetary policy in the face of climate actions when considering short-run uncertainty and agents that are not fully rational.

This paper is closely related to previous studies in this research area. Starting from these contributions, we extend the investigation of the relationship between economic fluctuations and emissions in a framework that incorporates two kinds of goods and with a greater focus on pro-environmental consumption effects. More precisely, our model includes environmental awareness in household behavior as in Chan (2019) . However, we differ from this latter by not focusing on labor migration. On the contrary, we investigate the role of environmental awareness in determining “green buying preferences.”

3 The model

This section introduces and discusses a DSGE model, emphasizing the mechanism that relates carbon emissions dynamics, consumer behavior, and environmental awareness. The economy is populated by homogeneous households and firms that operate in two different productive sectors: clean and dirtyFootnote 3. In each sector, firms produce final output using two different technologies: a clean firms with low-carbon emissions technology and dirty firms employing high-carbon emissions technology. Each firm solves the profit maximization problem subject to a technological constraint, and each sector produces an identical and homogenous consumption good. Households are infinitely lived, environmentally aware, and maximize their discounted utility, which is a function of consumption and labor. All markets are perfectly competitive.

3.1 Firms

The economy presents two representative firms: clean and dirty. Firms in the clean sector use mainly renewable resources and emit a low quantity of carbon dioxide in the atmosphere. In contrast, firms in the dirty sector employ pollutant technology (e.g., fossil fuel) and produce a high amount of carbon emissions. As in Apostolakis (1990), we consider the complementarity between capital and energy. Hence, we assume that dirty capital is linked to fossil fuel energy, and clean capital is connected to renewable energy.

The sectoral output is the result of capital (\(K_{j,t}\)) and market labor\(\ (L_{j,t})\) combination applied to a Cobb–Douglas technology, where \(\alpha _{j}\) is the usual capital share used in production activitiesFootnote 4. Each sector presents a specific total factor productivity shock. This kind of modeling allows defining the Adjusted-TFP for the pollution abatement. According to OECD data, in most countries, emissions have decreased over the last two decades, and their GDP growth rates should be thus adjusted upwards to reflect their growth performance correctly. Emission reductions can occur for various reasons, including investing in cleaner technologies, switching to cleaner fuels, or changes in economies’ industrial structure. Such adjustments shed light on countries’ (green) growth performance, including those where significant pollution abatement efforts might otherwise lead to undervaluing their economic growth (OECD, 2016). According to these premises, the standard TFP shock (\(A_{t})\) in this paper is the following:

\(A_{D,t}\) is the standard pollutant TFP and \(A_{C,t}\) represents part of the economic growth achieved from using fewer pollutant inputs. Both shocks evolve according to the following AR (1) process:

where \(0<\rho _{j}<1\) is the shock persistence and \(\varepsilon _{j,t}\) is normally distributed with mean zero and standard deviation \(\sigma _{j.}\) The aim of the two representative firms is to choose capital and labor in order to maximize profits (\(\Pi _{j,t}\)) given as:

where \(P_{jt}\) is the price,\(W_{j,t}\) is the wage level, \(L_{j,t}\) denotes the labor factor and \(R_{j,t}\) is the rate of rent for capital.

For each sector, the first-order conditions for capital and labor are given, respectively, as:

Equations (6) and (7) show the optimality conditions: firms choose input levels so that the marginal product of these inputs equals their real marginal costs. In equilibrium, profit is zero ( \(\Pi _{j,t}=0\)), and each input is priced according to its marginal product.

3.2 Environmental sector

In this model, each sector produces carbon emissions in the production process. Hence, the standard carbon emission function is augmented to consider emissions from both sectors:

where \(\upsilon\) determines the elasticity of emissions with respect to output equal to \(0<\upsilon <1;\) \(\xi _{d}\) and \(\ \xi _{c}\) denote the emissions intensity for the high-carbon and low-carbon technology, respectively. In order to clarify the definition of clean and dirty good, we use a threshold parameter \(\xi _{0}\), which refers to the level of emissions intensity that does not jeopardize the regular dynamics of the carbon cycle. In detail, \(\xi _{0}\) is the level of emission that allows reaching carbon neutralityFootnote 5.

Condition 1

Let \(\xi _{0}\in {\mathbb {R}} ^{+}\), \(\xi _{C}\in {\mathbb {R}} ^{+},\)and \(\xi _{D}\in (\xi _{0},+\infty )\) , the good is defined clean if and only if \(\xi _{C}<\xi _{0}.\)

The dynamic accumulation process of carbon emissions evolves according to a natural decay rate \(\delta _{m}\) , emissions flow \(EM_{t},\) as in Heutel (2012) and Nordhaus (2008):

As in previous literature in this field, for simplicity, the model does not embody some aspects of climate change, such as long delays between changes in the stock of pollution and temperature changes, ultimately affecting total factor productivity. As in Angelopoulos et al. (2013), the stock of environmental quality evolves according to the following law of motion:

The environmental quality is treated as an accumulation process that takes values on the interval [0, Q]. In particular, the environmental quality steady state is at its maximum when carbon emissions do not appear \((f(Q)=Q)\) and \(f(0)>0\), which guarantees the existence of a non-negative solution for environmental quality. In particular, the term \(\lambda _{1}\) is an indicator of the environment’s capacity to absorb the rise in emissions. If \(\lambda _{1}=0\), the absorption capacity is complete, and the economy reaches the maximum level of environmental quality because nature has absorbed any negative impact of emissions from the preceding period. If \(\lambda _{1}=1\), the absorption capacity is non-existent, and environmental quality is reducing in each period.

3.3 Households

The economy is assumed to be populated by representative households supplying capital and labor in the dirty and clean sectors. The typical infinitely lived household derives utility from consumption \(C_{t}\) ( function of green and dirty consumption) and disutility from hours worked in the dirty sector \((L_{D,t})\) and in the clean one \((L_{C,t})\). Indirectly, the environmental quality affects households’ welfare influencing the utility from the green and dirty consumption. The representative infinite-lived households maximize the following intertemporal utility function:

where \({\mathbb {E}}_{t}\) is the expectation operator, \(\beta \in (0,1)\) is the subjective discount factor, q denotes risk aversion parameter, \(\theta _{c}\) and \(\theta _{d}\) are the disutility parameter from clean and dirty labor, \(\psi _{d}\) and \(\psi _{c}\) are the Frish elasticity parameters. Households consumption basket \(C_{t}\) is described by a constant elasticity of substitution (CES) aggregate consumption bundle defined over the two sectors, clean (C) and dirty (D), respectively:

where \(\varepsilon\) is the constant elasticity of substitution parameter between the two sectors and \(\gamma _{t}\) measures households pro-environmental consumption. Throughout, we say that the two sectors are (gross) substitutes when \(\varepsilon >1\) and (gross) complements when \(\varepsilon\) \(<1\). In particular, when \(\gamma _{t}\) is high, consumers are environmentally conscious and derive higher utility levels from low-carbon emission goods. Here, the definition of clean consumption is used as a label for consumption patterns that have a low-carbon intensity (e.g., sustainable and organic goods), and dirty consumption refers to high-carbon intensity consumption:

Furthermore, the households capital accumulation process satisfies the following equation:

where \(\delta j\) is the depreciation rate of capital, \(I_{j,t}\) is household sectoral investment, and \(K_{j,t}\). is the capital stock.

The representative household maximizes the utility function for \(C_{C,t},C_{D,t},K_{C,t+1}\) and \(K_{D,t+1}\) subject to the following inter-temporal budget constraint:

The first-order conditions for this problem are the following :

Equations (19) and (20) define the Euler equations for green and dirty capital, respectively. It tells us that along an optimal path, the marginal utility from dirty and clean consumption at any point in time is equal to the opportunity cost of consumption. The solution to the typical household’s problem is described in Appendix.

Moreover, from the FOCs , we obtain the following relationship between dirty and clean price:

This equation implies that the relative price of dirty goods (compared to clean goods) is decreasing in their relative demand and the elasticity of the relative price response is the inverse of the elasticity of substitution between the two goodsFootnote 6.

3.3.1 Environmental awareness and green preferences

Since the consumers’ environmental awareness strongly and increasingly guides the decision to consume, this study considers that carbon emissions directly affect green goods’ preferences through environmental qualityFootnote 7. This model defines green preferences as follows:

where \({\bar{\gamma }}\) is initial value of the clean consumption preferences, and \(\phi _{t}\) is a term capturing the environmental awareness, \(V_{t}\) is a shock affecting environmental concern. According to Delis and Iosifidi (2020), the environmental awareness is function of the environmental quality:

where \(\chi\) captures the intensity of environmental awareness in changing consumption behavior, \(Q_{t}\) is the environmental quality and \(Q_{ss}\) is the steady-state environmental quality level.

Equation (23) allows environmental awareness to influence consumer behavior and change household consumption habits. The reasoning is relatively straightforward: the individuals react to a variation in carbon emissions amount, becoming more careful about the environmental issues after an increase in \(CO_{2}\) concentration. In particular, households link environmental degradation to producing dirty goods, determining a change in consumption habits in favor of green goods. The presence of \(\phi _{t}\) makes it possible to create a circularity in the consumption decision-making process. At the impact of the shock, the consumers choose their optimal consumption level. Still, in the following quarters, they adjust the optimal consumption path according to the atmosphere’s carbon emissions level.

Environmental issues are receiving widespread media coverage affecting public opinion and capturing consumer attention. To this end, this study simulates a shock that affects public opinion about environmental issues and makes consumers more sensitive to environmental problems. We can think of such a shock as a change in consumer preferences following a policy intervention, for example, development at the national level of information and awareness-raising policies about the environmental issues; or a natural disaster that increases concern about environmental issues; or a change in consumer sentiment, e.g., following a Greta Thunberg speech. In other words, it is a standard preference shock that influences the intertemporal elasticity between green and dirty consumption and investments. In particular, the green preference shock evolves according to the following AR(1) process:

where \(0<\rho _{V}<1\) is the shock persistence and \(\varepsilon _{V,t}\) is the exogenous preference shock that is normally distributed with mean zero and standard deviation \(\sigma _{V.}\)

3.4 Equilibrium and aggregation

This study explores the economy in a decentralized contest. The decentralize competitive equilibrium for a given process followed by technology, preferences \(\left\{ A_{C,t},A_{D,t},V_{t}\right\} _{t=0}^{\infty }\), initial green and dirty capital stock, initial environmental quality, and carbon emissions stock is a list of sequences \(\left\{ Y_{C,t},Y_{D,t},C_{C,t},C_{D,t},,K_{C,t+1},I_{D,t+1},L_{C,t},L_{D,t}\right\} _{t=0}^{\infty }\) for the households, and input prices \(\left\{ W_{C,t},W_{D,t},R_{C,t},R_{D,t}\right\} _{t=0}^{\infty }\) such that : (i) the household maximizes its utility function subject to its budget constraint and its environmental awareness; (ii) the representative firms maximize their profits; (iii) environmental quality, and sectoral capital follow their law of motion; (iv) all markets clear. Market clearing condition is given by:

where \(Y_{t},C_{t},\) and \(I_{t}\) are the sum of the sectoral output, consumption and investments, respectively.

4 Calibration

This section presents model calibration between parameters drawn from typical macroeconomic literature and environmental parameters extracted from selected studies on emission and global temperature dynamics. The model is calibrated for the US economy, and the GHG considered is carbon dioxide, the main gas leading to global warming. Table 1 lists the parameter values for the base model. Parameters characterizing the dirty economy and household preferences are reasonably standard. The values are chosen for the household subjective discount factor \(\beta\). The risk aversion parameter q is calibrated as in most dynamic stochastic general equilibrium studies (see, e.g., Chang and Kim (2007); Stern (2008)). According to Acemoglu et al. (2012), the base calibration considers a substitution elasticity parameter greater than one because it appears as the more empirically relevant benchmark. For this reason, throughout the article, we assume that \(\varepsilon\) is equal to 1.5. The parameters in the motion for environmental quality are set as in Angelopoulos et al. (2013). The persistence of the environmental quality process is equal to 0.9, and we normalize its constant term (i.e., the level of environmental quality without economic activity) to unity. To calibrate dirty and clean technologies, this study follows (Argentiero et al., 2017) that employs the Bayesian estimation technique to estimate renewable and fossil production. This latter reports a larger capital share in the dirty sector concerning the clean one (\(\alpha _{c}=0.36\) and \(\alpha _{d}=0.39\)), the lower depreciation rate for clean capital than the dirty one (\(\delta _{c}=0.004\) and \(\delta _{d}=0.0225\)). Moreover, this study estimates a greater persistence of the dirty technology shock than the clean one (\(\rho _{d}=0.97\),\(\rho _{c}=0.82\)). The persistence parameter for a preference shock is equal to 0.81, following (Argentiero et al., 2017). Labor disutility parameters in each sector are defined endogenously.

To calibrate the initial weight of green goods in the CES function, this study refer to the Nielsen Company study. This latter defines sustainable consumption by combining sustainability into free-from, clean, simple, sustainable, and organic labels. In 2018, the sales of sustainable products in the USA amounted to approximately 128.5 billion US dollars, make up \(22\%\) of total store salesFootnote 8. The intensity of environmental awareness in changing consumption behavior \(\chi\) is set equal to 0.4 as in Delis and Iosifidi (2020) and Angelopoulos et al. (2013), which is at the higher bound of the values given usually to public goods in utility functions.

Table 2 reports the deterministic steady-state ratio for the key variables in accord with the discussed calibration. At the initial state, households invest and consume more in the dirty sector than in the clean sector. The capital depreciation rate plays a crucial role in choosing the sector to invest in, making the green investment less profitable. As a result, the clean sector size is smaller than the dirty, in line with the US economy’s actual characteristics. The above economic conditions imply the reasonable requirement that the green sector is backward relative to the dirty sector.

5 Results

In order to assess the impact of environmental awareness on carbon emissions and the business cycle, we analyze the dynamic properties of the model considering two alternative calibrations: environmentally indifferent (\(\chi =0\)) and environmentally aware consumers (\(\chi =0.4\)). When households are indifferent about environmental quality degradation, green preferences are constant and equal to their steady-state value. In this scenario, only a green preference shock allows changing their consumption attitude. On the contrary, in the case of environmentally aware consumers, green preferences are time-varying, and they are affected by the environmental quality dynamics. The goal is to understand a twofold causal nexus: first how green preferences drive macroeconomic and emissions dynamics and second how supply shocks, entailing different degrees of environmental quality degradation, incentivize sustainable actions. We present and discuss impulse response functions (IRFs) of macroeconomic and environmental variables to technology and preference shocks, examining the role of green preferences within the economic mechanism operating in our economy. Moreover, we employ variance decomposition to examine the influence of a green preference shock in model variables fluctuations.

5.1 Impulse response analysis

This subsection shows simulation results of preference shock in the green sector and technology shocks (in dirty and clean sectors). The simulations have been obtained using numerical analysis and perturbation methods to simulate the economy and compute the equilibrium conditions outside the steady state. We solve the model using a second-order Taylor approximation around its steady stateFootnote 9. All results are reported as percentage deviations from the steady state.

5.1.1 Green preference shock

Assessing the effects of a demand shock turns out to be interesting (and innovative) since the demand side may affect the supply of clean versus dirty goods. Therefore, we simulate a preference shock in the clean sector, to quantify the economic and environmental impacts of environmental preference shocks (Fig. 1). After a green preference shock, the agents’ response is similar in both calibrations for the environmental awareness degree. A green preference shock makes households more sensitive to environmental issues, shifting the demand from polluting consumption goods towards sustainable goods. This shock increases the household’s current utility from green goods relatively more than the future utility. The opposite mechanism occurs for the dirty consumption utility.

Meanwhile, this shock induces factor reallocations between two sectors. First, a green preference shock shifts labor hours’ demand from the dirty sectors to the green ones. The entire labor supply’s interior shift along a stable labor demand curve in the dirty sector leads to increased wages and a fall in hours. In the green sector, green preference shock has a positive impact on sustainable output production. This, in turn, pushes up green labor demand, and the new equilibrium occurs with lower wages in the green sector. A different picture appears for investments. This kind of shock makes households more focused on current issues, neglecting long-term goals. As a result, households prefer to disinvest in the clean sector to devote all resources to consumption. However, this mechanism makes dirty investment more profitable. The entire process has a positive impact on sustainable goods production, increasing the green sector market share.

At the aggregate level, a green preference shock acts as a standard preference shock: aggregate consumption rises, but aggregate output, investment, and labor decline immediately. The increase in green preferences is effectively like a decrease in the discount factor: households value current utility relatively more than the future utility. They want to consume more in the present and work less, increasing consumption and decline in labor. The interior shift of labor supply along a stable labor demand curve leads to increased wages—falling hours with no direct change capital or productivity decrease the aggregate output. Aggregate output falling with consumption increasing triggers a reduction in investment. The environmental awareness influence at the aggregate level is significant, dampening the aggregate output slowdown; however, it stabilizes the business cycle in the long-run. This section demonstrates that a green preference shock has two crucial impacts in the short run. First, it allows increasing the market share of green products over the dirty ones. However, a green preference shock slows down the economy at the shock impact. Finally, the emissions dynamics result is positive in the short run, and environmental awareness curbs its rising (Fig. 2).

5.1.2 Dirty technology shock

Figure 3 displays the economy’s response to a one percent increase in dirty technology. A TFP shock in the dirty sector increases productivity only for the pollutant firms. Dirty output rises, reducing their marginal cost of production, encouraging labor and capital demand. This, in turn, pushes up dirty consumption via an income effect. Note that in the case of “environmentally indifferent” consumers, an inter-sectoral substitution of capital from clean to dirty sectors operates since households find it convenient to disinvest resources from the clean sector and invest in the dirty sector that results to be more productivity. The same dynamics occur for labor choices. The dirty productivity shock affects emissions dynamics, worsening environmental quality. Environmental awareness plays a crucial role in changing the green consumption attitude after a dirty technology shock. This latter has two implications for the households. First, it allows rising the income disposal for the households. Second, the rise in emissions due to the dirty sector growth worries households. In our rational expectation model, households expect that carbon emissions will rise and that the environmental quality will worsen (negative externality). Households respond to environmental issues by changing their consumption basket composition. On impact, the green preference has a slight rise but reaches an increase of 4.5% after 10 quarters. However, since the households are myopic in the environmental sense, the environmental concern does not act immediately but after one period after shock. Therefore, green consumption rise in the short run, smoothing dirty consumption rise. While dirty consumption increases because of the income effect, clean consumption grows up because households are also sensitive to environmental concerns. Households use a part of the resources dedicated to dirty investments towards the green sector. Further, labor in the green sector increase, supported by higher marginal productivity than the dirty sector. Dirty output increases after the shock, as in the indifferent households scenario, but relatively less. Surprisingly, at the impact of “dirty shock,” clean output increases when households are careful about environmental issues. In this scenario, household behavior depends on various factors, influencing it beyond purely economic considerations. In turn, behavioral factors affect the dynamic of some macroeconomics variables. Importantly our results show that the environmental concern curb emission rise. In other words, if household consumption preferences are sensitive to environmental quality variations, the worsening of environmental quality due to economic growth is limited. However, this is not enough to change significantly households’ green attitudes since the economic dimension is relatively more robust.

Figure 4 demonstrates that TFP shocks could lead to sustainable consumption’s procyclicality documented in US data, only if households are environmentally aware. A rise in dirty sector productivity acts as a standard technology shock, increasing the economy’s total output, pushing up total labor and investment demand. The income effect has positive effects on consumption, which increases with a standard hump-shaped dynamic. Note that environmental concern positively affects consumption but reduces the beneficial effects on investment and labor. Intuitively, households decide to consume more sustainable even if productivity shock occurs in the dirty one. This mechanism affects the total output dynamics, increasing at an inferior rate than the environmentally indifferent scenario. The mechanism discussed above allows capturing the recent trend behavior in sustainable consumption.

5.1.3 Green technology shock

Figure 5 shows the economy’s response to a one percent increase in clean technology. In response to a positive shock on the TFP in the green sector, green consumption, investment, labor, and output immediately increase. The marginal productivity of labor and capital goes up, so green firms are induced to expand production. Households’ lifetime wealth increases, and therefore, consumption expands. In the dirty sector, consumption decreases because clean good becomes more convenient after the shock.

The dirty sector negatively suffers a green technology shock for two reasons. First, dirty labor’s marginal productivity increases less than the green one. This in turn push up labor supply in the green sector. Second, households prefer to consume sustainable goods. Moreover, investment in the dirty firm becomes less profitable. Green preferences increase in the short run. Still, in the long considering the better quality of the environment, households become less concerned about global warming.

Consequently, the awareness about environmental issues allows the amplification of the beneficial effects of the TFP shock on the clean sector, determining a temporary downturn in the dirty sector. However, in the long run, households’ environmental awareness allows faster recovery of the polluting sector. In the short run, the adverse effects of the increase in emission concentration are mitigated when the households are environmentally aware. By contrast, if the behavioral change is not permanent, the environmental quality improvement pushes households to review their long-term priorities, smoothening low-carbon technology shock benefits on the environmental quality.

Figure 6 shows the IRFs to a green technology shock of 1% on the aggregate variables. As in the case of dirty TFP shock, aggregate output, consumption, investment, and labor rise. However, it is important to highlight that a green technology shock determines an increase significantly inferior at the aggregate level than the dirty one. It is important to highlight that green preferences and sustainable consumption are procyclical after a green technology shock. In this case, the procyclicality derives from increasing productivity in the green sector. On the contrary, this dynamic depends less on public opinion about environmental issues.

5.2 Variance decomposition

This section analyzes the contributions of the three shocks to the fluctuation of each variable in the case of “environmentally indifferent” and “environmentally aware” consumers. This section aims are: define the importance of a green preference shock in economic and environmental variables fluctuations and understand how environmental awareness affects these shocks’ ranking. Table 3 displays the impact of green preference shocks on all aggregate macroeconomic variables is offset or covered by the two productivity shocks’ impact. Specifically, the dirty technology shock is the primary source of fluctuation. The impact of clean technology shock in aggregate variables is much lower, and there is almost no contribution from the shock of preferences. Note that the sources of aggregate variables volatility are similar in both calibrations.

Although the preference shock’s importance is scant at the aggregate level, it is the second source of fluctuation in many sectoral variables. However, sectoral technology shock is the primary source of variability in the shocked sector variables. Second, if the households are environmentally aware, the green preference shock reduces its importance in the model variables volatility. If consumers have insufficient knowledge about environmental issues, they are more susceptible to an event that affects public opinion about the adverse effects of a rapid increase in greenhouse gases. By contrast, conscious consumers are not driven by external opinion but by the dynamics of the emissions: green preference shock reduces its importance in explaining the model variables’ fluctuations.

6 Environmental policies and green preferences

This section aims to understand the importance of different environmental policy regimes as a further conditioning factor for the dynamic response of the economy to a green preference shock. To this end, we extend the previous DSGE model, including alternative environmental policy regimes and the ability of dirty firms to abate carbon emissions from their production process.

6.1 Extended model

The basic model of the previous section assumes that dirty firms are not subjected to any penalty for the carbon emissions produced. Consequently, polluting firms have no incentive to improve the production process and reduce the negative impact on environmental quality. Specifically, emissions and firms’ abatement activities depend on the class of environmental regime adopted: cap-and-trade (i.e., an exogenous limit on aggregate emissions) and tax policy (e.g., a carbon tax).This section extends the basic model by overcoming the assumptions above. Relative to the model of the previous section, we extend the dirty firms section and consider the government budget constraint.

6.1.1 Main model features

For the sake of brevity, in this section, we describe only the adding features of the model. The complete set of model equations can be found in appendix B.

Dirty Firms The representative dirty firm produces a dirty output employing high-carbon inputs according to the following technology:

According to Nordhaus (2008) and Heutel (2012), this relationship is affected by the abatement effort \(\mu _{t}\) :

We define measure emissions per unit of output in the absence of abatement effort as \(\xi _{D}\) and \(\upsilon\) determines the elasticity of emissions with respect to output equal to \(0<\upsilon <1\). The cost of emissions abatement \(CA_{t}\) is, in turn, a function of the firm’s abatement effort and output:

where \(\theta _{1}>0\) and \(\theta _{2}>1\) are technological parameters. We set the parameter of the abatement cost function \(\theta _{1}\) at 2.8 as in Nordhaus (2008), and \(\theta _{2}\) is normalized to 1.

The aim of the dirty representative firms is to choose capital, labor and abatement effort in order to maximize profits (\(\Pi _{D,t}\) ) given as:

where \(P_{e,t}\) is the price of carbon emissions. The first-order conditions for capital, labor and abatement effort are given, respectively, as:

where Eqs. (30) and (31) are the demands for capital and labor and Eq. (32) is the optimal abatement choice: firms choose input levels so that the marginal product of these inputs equals their real marginal costs. In equilibrium, profit is zero ( \(\Pi _{D,t}=0\)), and each input is priced according to its marginal product.

Government We consider two possible environmental policies: a carbon tax and cap-and-trade. In particular, only polluting firms are subject to environmental policies. To define the two instruments’ dynamics, we refer to Annicchiarico and Di Dio (2014) and Fisher and Springborn (2011). Specifically, under a carbon tax regime, the government imposes a tax rate per unit of emission, whereas, under a cap-and-trade regime, the government chooses the level of cumulative emissions that can be released \((E_{t}=E^{*})\) . The environmental policy revenues are distributed to domestic households as lump-sum transfers:

Equation 33 represents the case of the cap-and-trade regime, and Eq. 34 shows the government budget constraint under a carbon tax policy. In particular, the firms’ choice to abate emissions is linked to the significant abatement effort cost and the price they have to pay for each emission unit. Under a cap-and-trade regime, this price is variable and increases whit the dirty output. On the contrary, a carbon tax leaves the emissions to cost constant. Moreover, the carbon tax triggers a greater awareness of environmental problems by households.

As consequence, the market clearing condition is given by:

where \(G_{t}\) defines public consumption.

6.2 Impulse response functions

This section explores the dynamic properties of economic and environmental variables after a green preferences shock under two alternative environmental regimes: carbon tax and cap-and-trade. The IRFs depicted in Figs. 7 and 8 aim to answer the following question: How green preferences interact with a specific environmental policy?

The complete set of parameters calibration can be found in Appendix B. The simulations have been obtained using numerical analysis and perturbation methods to simulate the economy and compute the equilibrium conditions outside the steady state. We solve the model using a second-order Taylor approximation around its steady stateFootnote 10 All results are reported as percentage deviations from the steady state.

6.2.1 Green preference shock

This section explores the performance of the leading environmental policy tools in the event of a shock that temporarily affects pro-environmental consumption of environmentally aware households (\(\chi =0.4)\). Figure 7 shows that following a positive green preference shock, as expected, clean consumption rise. The greater demand for goods translates into increased production, supported by increased labor. By contrast, dirty consumption, dirty output, and dirty labor fall. Moreover, households prefer to invest in the dirty sector and disinvest in the green one after a green preference shock

Turning to environmental policies analysis, we find several interesting conclusions. First, green preferences are negatively correlated with the firm’s abatement effort under a cap-and-trade policy. A green preference shock positively affects environmental quality, reducing emissions in the atmosphere. Since a cap policy fixes carbon emissions in the atmosphere at a certain level, these kinds of shocks slack the government’s budget constraint, reducing the price of allowances. This mechanism translates into a shift towards consumers of the commitment to climate change. Second, the selection of the two environmental policies impacts macroeconomic dynamics. There exist two main channels. The first channel is related to environmentally aware consumers. A carbon tax makes carbon emissions more volatile, affecting consumers’ concerns about climate issues. This latter implies that when carbon emissions rise, households become more sensitive to environmental questions and consume more green goods. The second channel is related to the allowances market. A reduction in the emission allowances price reduces costs for the dirty firms. Finally, after a green preference shock, the environmental policy message is clear: (i) a carbon tax policy allows devoting more resources to the green sector; (ii) on the contrary, a cap-and-trade policy smooths the positive impact on the clean production of such shock.

Figure 8 shows the IRFs after a green preference shock of 1% on the aggregate variables. The dynamics of selected variables are quite similar under the two environmental policies. More precisely, a carbon tax allows for a more significant increase in consumption than the cap-and-trade policy regime. In detail, a tax on carbon emission stimulates the environmental concern and the green behavioral change of families who prefer to consume green even in the long period. The shift of labor supply along a stable labor demand curve in the dirty sector leads to increased wages that households use to increase pro-environmental consumption. The environmental concern slightly smooths the aggregate labor drop, and the investments grow in the long run. A green preference shock has beneficial effects on the entire economy, allowing sustainable growth in the long run.

7 Sensitivity analysis

The results presented thus far are taken from simulations using the base case parameter values listed in Table 2. This section provides a sensitivity analysis by varying crucial parameters related to the consumption basket and seeing the effect on selected variables. We first perform sensitivity analysis on the propensity to buy green products, considering three different calibrations: \({\overline{\gamma }}=0.22\) (“base case”), \({\overline{\gamma }}=0.5\) (“indifferent”), \({\overline{\gamma }}=0.7\) (“high propensity”).

Figure 9 displays the response of green consumption, dirty consumption, and carbon emissions to a one percent increase in green preferences under the three different values of\({\overline{\gamma }}\) . Clean consumption rises in every scenario, but households willing to buy green goods amplify the positive effects of the preference shock. In the case of low propensity, clean consumption increases by up to 0.2%, about one-third than the case of high propensity. In the shock propagation, the green consumption decreases for each calibration case. In particular, the drop in clean consumption is smooth for the agents less inclined to buy green products.

The opposite occurs for dirty consumption. Also, the two phases mentioned above ( i.e., shock impact and propagation) characterize the effects on carbon emissions dynamics. At the impact, emissions drop in every calibration. However, a higher propensity to buy green allows reaching a more significant reduction. In the shock propagation, emissions tend to increase. In particular, a lower pro-environmental attitude smooths this increment.

Moreover, this section explore the role of the degree of substitution between dirty and clean goods on defining pro-environmental consumption and the relative impact on carbon emissions. The base case calibration allows exploring the model response with weak substitutability ( \(\varepsilon =1.5\)). In line with Acemoglu et al. (2012), this section briefly contrasts the initial calibration with the case where the two goods are medium (\(\varepsilon =3\)) and strongly substitutes (\(\varepsilon =10\)).

Figure 10 shows the impulse response to a green preference shock on green and dirty consumptions and the emissions under the three different calibrations. At the green preference shock impact, green consumption rise for each degree of substitutability. Greater goods substitutability associated with a low propensity to buy green goods determines a smoothing of the positive effect for the environment after a preference shock. Although this kind of shock affects households’ preferences, the forward-looking agents generally partially substitute the two goods in the short run. However, greater substitutability allows curbing green consumption reduction in the long run. The above-discussed mechanism affects carbon emissions dynamics. During the early stage of the shock impact, a low degree of substitutability between the two goods allows reducing the emissions in the environment more significantly. On the contrary, a greater degree of substitutability between the two goods allows smoothing the emissions rise more greatly.

8 Conclusions

This study investigates environmental awareness’s effects on green preferences, economic dynamics, and environmental quality. To this purpose, we have developed a parsimonious DSGE model to stress the households’ attitudes in a context where it is established that carbon emissions will rely on changing human behavior.

In detail, our theoretical contributions are summarized as follows. First, this study extends previous analysis on this topic (e.g., Heutel 2012; Angelopoulos et al. 2013 and Annicchiarico and Di Dio 2015), considering green and dirty firms and allowing the households to change preferences about green consumption. The main model novelty regards the environmentally friendly behavior, which consists of purchasing and consuming products and services that are benign toward the environment. We consider environmental awareness consumers, adjusting their preferences according to the environmental quality dynamics. Second, we examine the impact of a green preference shock on macroeconomic dynamics and relative environmental policy implications. Third, this is the first study to analyze the effects and the importance of green behavioral change on the business cycle using DSGE modeling.

This model set-up allows reaching interesting conclusions about households’ green attitude and its relationship with the business cycle. This paper concludes that environmental awareness does play a key role in business cycle fluctuation and emissions reduction by directing consumer choices towards products produced with low-carbon technologies. First, a green preferences shock increases the green production market share over the total—however, this kind of shock dampening the total output. Second, to stimulate a strong substitution effect in favor of the clean sector, stronger consumer awareness about environmental issues is necessary after a pollutant shock. Although a green preference shock is often neglected in the literature, it is the second source of fluctuation in many sectoral variables, such as green consumption and investments. This study demonstrates that the procyclicality of sustainable consumption reported in US data is not related to green preferences but is strictly correlated to the macroeconomic dynamics. Only a supply shock and environmentally aware consumers lead to sustainable consumption procyclicality documented in US data. Finally, after a green preference shock a carbon tax policy allows devoting more resources to the green sector; on the contrary, a cap-and-trade policy smooths the positive impact on the clean production of such shock.

Our results indicate that accounting for household environmental awareness provides a better insight into the possible paths to undertake to curb carbon emissions rise and reach a low-carbon economy. In this regard, several discussions may arise. First, promoting the development at the national level of information and awareness-raising policies about the environmental issues targeting households could be ineffective in the long run if the social-economic structure is not capable of internalizing them. Second, educated consumers could play a positive role to incentivize a low-carbon lifestyle. Human capital progress through improvement in education access will help to produce more aware consumers. Hence, improved social policies and increased investment in education could indirectly influence the clean sector choices and make awareness-raising policies more effective.

In light of that, this study lays the foundation to investigate other interesting aspects of consumption habits or heterogeneous preferences. As for the former, changing human behavior toward more responsible attitudes is not taken for granted, but inertia cannot be overlooked. The latter should be taken into account that the sensitiveness and awareness toward a “greener” world are not for everyone. “Brown” preferences, or some form of myopia, do play a role in this story.

Notes

Nielsen Company refers to goods with free-from, clean, simple, sustainable, and organic labels.

In the rest of the paper, “clean” and “green” and “dirty and brown” are used interchangeably.

As it is standard in DSGE model, the representative agent assumption holds.

\(j=c,d\) henceforth.

Carbon neutrality means having a balance between emitting carbon and absorbing carbon from the atmosphere in carbon sinks.

See the appendix for further information.

The experiment is similar to Chan (2019). Notably, the author assumes that an increase in the emission stock affects labor disutility sensitivity; we apply the same methodology on consumption preferences.

Source: Nielsen Product Insider, powered by Label Insight, Week ending 10/20/2018. Cited in “Was 2018 the Year of the Sustainable Consumer?” https://www.nielsen.com/us/en/insights/news/2018/was-2018-the-year-of-the-influential-sustainable-consumer.html

See Judd (1998) and . The model has been solved in Dynare. For details, see http://www.cepremap.cnrs.fr/dynare/ and Adjemian et al. (2011).

References

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2012). The environment and directed technical change. American Economic Review, 102(1), 131–66.

Ackerman, F., DeCanio, S. J., Howarth, R. B., & Sheeran, K. (2009). Limitations of integrated assessment models of climate change. Climatic Change, 95, 297–315.

Adjemian, S., Bastani, H., Juillard, M., Mihoubi, F., Perendia, G., Ratto, M., & Villemot, S. (2011). Dynare: Reference manual, version 4.

Alfredsson, E. C. (2004). “Green’’ consumption-no solution for climate change. Energy, 29(4), 513–524.

Annicchiarico, B., & Di Dio, F. (2015). Environmental policy and macroeconomic dynamics in a new Keynesian model. Journal of Environmental Economics and Management, 69, 1–21.

Annicchiarico, B., & Di Dio, F. (2017). GHG emissions control and monetary policy. Environmental and Resource Economics, 67(4), 823–851.

Annicchiarico, B., & Diluiso, F. (2019). International transmission of the business cycle and environmental policy. Resource and Energy Economics, 58, 101112.

Annicchiarico, B., Di Dio, F., & Diluiso, F. (2021). Climate Actions, Market Beliefs, and Monetary Policy. Market Beliefs, and Monetary Policy (July 29, 2021).

Angelopoulos, K., Economides, G., Philippopoulos, A., (2010).What is the Best Environmental Policy? Taxes, Permits and Rules under Economic and Environmental Uncertainty, CESifo Working Paper series 2980, CESifo Group Munich.

Angelopoulos, K., Economides, G., & Philippopoulos, A. (2013). First-and second-best allocations under economic and environmental uncertainty. International Tax and Public Finance, 20(3), 360–380.

Apostolakis, B. E. (1990). Energy–capital substitutability/complementarity: The dichotomy. Energy Economics, 12(1), 48–58.

Argentiero, A., Atalla, T., Bigerna, S., Micheli, S., & Polinori, P. (2017). Comparing Renewable Energy Policies in EU-15, US and China: A Bayesian DSGE Model. The Energy Journal, 38(KAPSARC Special Issue).

Argentiero, A., Bollino, C. A., Micheli, S., & Zopounidis, C. (2018). Renewable energy sources policies in a Bayesian DSGE model. Renewable Energy, 120, 60–68.

Backus, D., Kehoe, P. J., & Kydland, F. E. (1993). International business cycles: theory and evidence (No. w4493). National Bureau of Economic Research.

Baiocchi, G., Minx, J., & Hubacek, K. (2010). The impact of social factors and consumer behavior on carbon dioxide emissions in the United Kingdom: A regression based on input- output and geodemographic consumer segmentation data. Journal of Industrial Ecology, 14(1), 50–72.

Bin, S., & Dowlatabadi, H. (2005). Consumer lifestyle approach to US energy use and the related CO2 emissions. Energy Policy, 33(2), 197–208.

Brock, W. A., & Hommes, C. H. (1997). A rational route to randomness. Econometrica: Journal of the Econometric Society, 1059–1095.

Brock, W. A., & Taylor, M. S. (2010). The Green Solow Model. Journal of Economic Growth, 15, 127–153.

Bruninx, K. E. N. N. E. T. H., & Ovaere, M. A. R. T. E. N. (2020). Estimating the impact of COVID-19 on emissions and emission allowance prices under EU ETS. In IAEE Energy Forum, Covid-19 Issue (Vol. 2020, pp. 40–42).

Calvo, G. A. (1983). Staggered prices in a utility-maximizing framework. Journal of Monetary Economics, 12(3), 383–398.

Carroll, C. D., Overland, J., & Weil, D. N. (1997). Comparison Utility in a Growth Model. Journal of Economic Growth, 2, 339–367.

Carroll, C. D., Overland, J., & Weil, D. N. (2000). Saving and Growth with Habit Formation. American Economic Review, 90, 341–355.

Cashell, B. W., & Labonte, M. (2005). September). The macroeconomic effects of Hurricane Katrina: Congressional Research Service, the Library of Congress.

Chan, Y. T. (2019). Optimal environmental tax rate in an open economy with labor migration–An E-DSGE model approach. Sustainability, 11(19), 5147.

Chan, Y. T. (2020). Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy, 141, 111454.

Chan, Y. T. (2020). Collaborative optimal carbon tax rate under economic and energy price shocks: A dynamic stochastic general equilibrium model approach. Journal of Cleaner Production, 256, 120452.

Chan, Y. T. (2020). Optimal emissions tax rates under habit formation and social comparisons. Energy Policy, 146, 111809.

Chang, Y., & Kim, S. B. (2007). Heterogeneity and aggregation: Implications for labor-market fluctuations. American Economic Review, 97(5), 1939–1956.

Ciarli, T., & Savona, M. (2019). Modelling the evolution of economic structure and climate change: A review. Ecological Economics, 158, 51–64.

Conroy, S. J., & Emerson, T. L. (2014). A tale of trade-offs: The impact of macroeconomic factors on environmental concern. Journal of Environmental Management, 145, 88–93.

Delis, M. D., & Iosifidi, M. (2020). Environmentally aware households. Economic Modelling, 88, 263–279.

De Grauwe, P. (2012). Lectures on behavioral macroeconomics. Princeton University Press.

Dietz, T., Shwom, R. L., & Whitley, C. T. (2020). Climate change and society. Annual Review of Sociology, 46, 135–158.

Dietz, S., Bowen, A., Dixon, C., & Gradwell, P. (2016). ‘Climate value at risk’of global financial assets. Nature Climate Change, 6(7), 676–679.

Dissou, Y., & Karnizova, L. (2016). Emissions cap or emissions tax? A multi-sector business cycle analysis. Journal of Environmental Economics and Management, 79, 169–188.

Doda, B. (2014). Evidence on business cycles and CO2 emissions. Journal of Macroeconomics, 40, 214–227.

Duarte, C. M., Borja, A., Carstensen, J., Elliott, M., Krause-Jensen, D., & Marbà, N. (2015). Paradigms in the recovery of estuarine and coastal ecosystems. Estuaries and Coasts, 38(4), 1202–1212.

Dubois, G., Sovacool, B., Aall, C., Nilsson, M., Barbier, C., Herrmann, A., & Dorner, F. (2019). It starts at home? Climate policies targeting household consumption and behavioral decisions are key to low-carbon futures. Energy Research and Social Science, 52, 144–158.

Elliott, E., Regens, J. L., & Seldon, B. J. (1995). Exploring variation in public support for environmental protection. Social Science Quarterly, 41–52.

Enkvist, P., Nauclér, T., & Rosander, J. (2007). A cost curve for greenhouse gas reduction. McKinsey Quarterly, 1, 34.

Farber, D. A. (2012). Sustainable consumption, energy policy, and individual well-being. Vand. L. Rev., 65, 1479.

Faria, J. R., & McAdam, P. (2018). The green golden rule: Habit and anticipation of future consumption. Economic Letters, 172, 131–133.

Fischer, C., & Heutel, G. (2013). Environmental macroeconomics: Environmental policy, business cycles, and directed technical change. Annual Review of Resource Economics , 5(1), 197–210.

Fischer, C., & Springborn, M. (2011). Emissions targets and the real business cycle:intensity targets versus caps or taxes, Journal of Environmental Economics and Management, 62, 352–366.

Frederiks, E. R., Stenner, K., & Hobman, E. V. (2015). Household energy use: Applying behavioural economics to understand consumer decision-making and behaviour. Renewable and Sustainable Energy Reviews, 41, 1385–1394.

Gadenne, D., Sharma, B., Kerr, D., & Smith, T. (2011). The influence of consumers’ environmental beliefs and attitudes on energy saving behaviours. Energy Policy, 39(12), 7684–7694.

Golosov, M., Hassler, J., Krusell, P., & Tsyvinski, A. (2014). Optimal taxes on fossil fuel in general equilibrium. Econometrica, 82(1), 41–88.

Gronwald, M., & Hintermann, B. (2015). Emissions Trading as a Policy Instrument. The MIT Press.

Gust, C., Herbst, E., López-Salido, D., & Smith, M. E. (2017). The empirical implications of the interest-rate lower bound. American Economic Review, 107(7), 1971–2006.

Hertwich, E. G., & Peters, G. P. (2009). Carbon footprint of nations: A global, trade-linked analysis. Environmental Science and Technology, 43(16), 6414–6420.

Heutel, G. (2012). How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Review of Economic Dynamics, 15, 244–264.

Huang, B., Punzi, M. T., & Wu, Y. (2021). Do banks price environmental transition risks? Evidence from a quasi-natural experiment in China. Journal of Corporate Finance, 69, 101983.

Iacoviello, M. (2015). Financial business cycles. Review of Economic Dynamics, 18(1), 140–163.

Iosifidi, M. (2016). Environmental awareness, consumption, and labor supply: Empirical evidence from household survey data. Ecological Economics, 129, 1–11.

IPCC, Core Writing Team, Pachauri, R. K., & Reisinger, A. (2007). Climate Change 2007: Synthesis Report. Contribution of Working Groups I, II and III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change Intergovernmental Panel on Climate Change (IPCC).Geneva, Switzerland. pp. 30–37.

Intergovernmental Panel on Climate Change (2013) Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Stocker TF, Qin D, Plattner G-K, Tignor M, Allen SK, et al., editors Cambridge, United Kingdom and New York, NY, USA

Jacobe, D. (2012). Americans still prioritize economic growth over environment. Economy, March, 29.

Jakučionytė-Skodienė, M., Dagiliūtė, R., & Liobikienė, G. (2020). Do general pro-environmental behaviour, attitude, and knowledge contribute to energy savings and climate change mitigation in the residential sector? Energy, 193, 116784.

Johnson, S. C. (2011). The environment: Public attitudes and individual behavior—A twenty-year evolution. Online. https://www.scjohnson.com.

Jones, C. I., Taylor, J. B., & Uhlig, H. (2016). Handbook of Macroeconomics.

Joshi, Y., & Rahman, Z. (2015). Factors affecting green purchase behaviour and future research directions. International Strategic management review, 3(1–2), 128–143.

Judd, K. L., & Judd, K. L. (1998). Numerical methods in economics. MIT press.

Kahn, M., & Kotchen, M. (2010). Environmental Concern and the Business Cycle: The Chilling Effect of Recession. NBER Working Paper 16241.

Khan, H., Metaxoglou, K., Knittel, C. R., & Papineau, M. (2019). Carbon emissions and business cycles. Journal of Macroeconomics, 60, 1–19.

Kydland, F. E., & Prescott, E. C. (1982). Time to build and aggregate fluctuations. Econometrica: Journal of the Econometric Society, 1345–1370.

King, R. G., & Rebelo, S. T. (1999). Resuscitating real business cycles. Handbook of Macroeconomics, 1, 927–1007.

Leach, M., Scoones, I., & Stirling, A. (2010). Dynamic sustainabilities: Technology, environment, social justice. Routledge.

Llavador, H., Roemer, J., & Silvestere, J. (2011). A dynamic analysis of human welfare in a warming planet. Journal of Public Economics, 95(11): 1607–1620.

Liu, L., & He, L. Y. (2021). Output and welfare effect of green credit in China: Evidence from an estimated DSGE model. Journal of Cleaner Production, 294, 126326.

Mainieri, T., Barnett, E. G., Valdero, T. R., Unipan, J. B., & Oskamp, S. (1997). Green buying: The influence of environmental concern on consumer behavior. The Journal of Social Psychology, 137(2), 189–204.

Malerba, F., & Orsenigo, L. (1997). Technological regimes and sectoral patterns of innovative activities. Industrial and Corporate Change, 6(1), 83–118.

McKay, A., Nakamura, E., & Steinsson, J. (2016). The power of forward guidance revisited. American Economic Review, 106(10), 3133–58.

McKinsey & Company (2009). Pathways to a Low-carbon Economy: Version 2 of the Global Greenhouse Gas Abatement Cost Curve www.mckinsey.com/business-functions/sustainability-and-resource-productivity/our-insights/pathways-to-a-low-carbon-economy

Neumann, J. E., Willwerth, J., Martinich, J., McFarland, J., Sarofim, M. C., & Yohe, G. (2020). Climate damage functions for estimating the economic impacts of climate change in the United States. Review of Environmental Economics and Policy, 14(1), 25–43.

Niamir, L., Ivanova, O., Filatova, T., Voinov, A., & Bressers, H. (2020). Demand-side solutions for climate mitigation: Bottom-up drivers of household energy behavior change in the Netherlands and Spain. Energy Research and Social Science, 62, 101356.

Niu, T., Yao, X., Shao, S., Li, D., & Wang, W. (2018). Environmental tax shocks and carbon emissions: An estimated DSGE model. Structural Change and Economic Dynamics, 47, 9–17.

Nordhaus, W. D. (2008). A Question of Balance: Weighing the Options on Global Warming Policies. Yale University Press.

Nordhaus, W. D. (2013). The climate casino: Risk, uncertainty, and economics for a warming world. Yale University Press.

OECD, I. (2016). Energy and Air Pollution: World Energy Outlook Special Report 2016.

Polonsky, M. J., Vocino, A., Grau, S. L., Garma, R., & Ferdous, A. S. (2012). The impact of general and carbon-related environmental knowledge on attitudes and behaviour of US consumers. Journal of Marketing Management, 28(3–4), 238–263.

Schmitt-Grohé, S., & Uribe, M. (2004). Solving dynamic general equilibrium models using a second-order approximation to the policy function. Journal of economic dynamics and control, 28(4), 755–775.

Schaeffer, R., Szklo, A. S., de Lucena, A. F. P., Borba, B. S. M. C., Nogueira, L. P. P., Fleming, F. P., & Boulahya, M. S. (2012). Energy sector vulnerability to climate change: A review. Energy, 38(1), 1–12.

Scruggs, L., & Benegal, S. (2012). Declining public concern about climate change: Can we blame the great recession? Global Environmental Change, 22(2), 505–515.

Stern, N. (2006). The Economics of Climate Change: The Stern Review. Cambridge University Press.

Stern, N. (2008). The Economics of Climate Change. American Economic Review, 98(2), 1–37.

Stern, N. (2013). The structure of economic modeling of the potential impacts of climate change: grafting gross underestimation of risk onto already narrow science models. Journal of Economic Literature, 51(3), 838–59.

UNEP, W. (2001). IPCC Third Assessment Report’Climate Change 2001’.

Wang, R., Hou, J., & Jiang, Z. (2021). Environmental policies with financing constraints in China. Energy Economics, 94, 105089.

Funding

Open access funding provided by Università Parthenope di Napoli within the CRUI-CARE Agreement

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors acknowledge for helpful discussions participants to seminar at Warsaw University of Life Sciences, to the 24th EAERE Annual Conference, to the 7th International PhD Meeting at the University of Macedonia and Dr. Vincenzo Di Maro.

This article has been corrected: Funding note has been updated.

Appendices

Appendix A

1.1 Consumer’s optimization problem

The Lagrangian associated with the household’s optimization problem is:

The first-order conditions with respect to \(C_{C,t},C_{D,t},L_{D,t},L_{G,t}K_{C,t+1}\) and \(K_{D,t+1}\) are:

1.2 Firms’ optimization problem

Firms maximize instantaneous profit, renting labor services and productive capital on a period by period basis.

The first-order conditions for capital and labor are given, respectively, as:

1.3 Equilibrium conditions

-

Marginal utility—green consumption: