Abstract

The surge in online grocery shopping amid the COVID-19 pandemic has significantly altered the balance between offline and online purchases, influencing consumer attitudes toward these channels. Given the anticipated continued growth of online grocery shopping in the coming years, research on this topic becomes increasingly crucial for retailers, manufacturers, and consumers. Particularly, brand managers and retailers find themselves uncertain about the implications for their consumer segments and products, including national versus private label brands, organic products, and fair-trade products. Against this backdrop, our study delves into consumer characteristics and purchase behavior to explore the distinctions between offline-only and also-online grocery shoppers. Additionally, we examine whether consumer behavior varies across offline and online channels. Specifically, we analyze extensive household panel data encompassing 4,142,485 purchases and diverse consumer characteristics (such as demographics and attitudes) from an average of 21,428 households spanning the years 2016–2020. It is noteworthy that also-online shoppers, despite their preference for convenience, tend to be younger, reside in larger cities, and exhibit more positive attitudes toward buying local and environmental responsibilities. These consumers, characterized by lower price consciousness and higher brand preferences, display a greater inclination toward national brands online compared to offline. Furthermore, they express more favorable attitudes toward organic and fair-trade products and exhibit relatively higher purchasing of these items. Our extensive empirical analyses reveal that these cross-sectional differences are attributable, in part, to demand-driven factors and, in part, to supply-side effects. Through this research, we provide valuable insights to brand managers, retailers, and researchers, facilitating a better understanding of the evolving retail landscape, particularly within the dynamic realm of online grocery shopping.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

E-commerce and online retailing are experiencing steady growth, particularly driven by digitalization. Despite the previously sluggish adoption of online grocery shopping (OGS) before the COVID-19 pandemic [1,2,3], there has been a substantial surge in OGS since then [4]. Illustrated in Fig. 1 is the monthly revenue generated by OGS across four product categories in relation to the total revenue of these categories from 2016 to 2020. The figure signifies a noteworthy increase in the popularity of OGS post-COVID-19, aligning with recent statistics [4, 5] and research findings [6,7,8,9,10]. Sheth [11] also observed a considerable shift in consumer behavior due to the pandemic, prompting more retailers, such as Rewe or Edeka in Germany, to offer OGS. However, this expansion of distribution channels introduces complexities and new challenges, including data access, integration, and privacy protection [12]. Consequently, there is a growing imperative to gather precise information about online and offline consumers to align the respective channels closely with consumer demand.

Volume-based share of OGS from 2016 to 2020 [13]

As established retailers extend their OGS offerings, and new business models like Flink, Gorillas, and Picnic emerge, the knowledge of (potential) consumers becomes critical for differentiation from offline-only shoppers and targeted communication. In the face of these significant transformations, brand managers and retailers must understand how the evolving retail landscape will impact their businesses.

Despite numerous studies comparing online retailing and OGS to brick-and-mortar retailing [14,15,16,17,18,19,20,21], there is a surprising dearth of research comparatively analyzing consumer characteristics (including demographics and attitudes) and purchase behavior between online and offline grocery shoppers. This gap is noteworthy, given that practitioners and researchers require insights into the distinctions in consumer characteristics and actual purchase behavior between also-online and offline-only shoppers [22, 23]. In light of this, our investigation focuses on the following aspects, which we deem most relevant for understanding online and offline grocery shoppers.

To investigate the fundamental distinctions between online and offline shoppers, we consider several consumer demographics, including the age of the household head, household size, and the number of children. Given the greater availability of OGS in urban areas [24, 25], we conduct an examination of differences in consumers’ city size. Furthermore, in light of previous research indicating that convenience is a key motivator for online shopping [26], we undertake an analysis of disparities in consumers’ attitudes toward convenience between online and offline grocery shoppers. Against the backdrop of global warming and the increasing emphasis on climate protection, the study explores variations in environmental responsibility and preferences for locally sourced products. Given the positive impact of attitudes toward innovation and technology on the ability to shop online in general [27], a similar importance is anticipated for OGS. The utilization of loyalty cards [28, 29] and the competition between national brands and private labels are pertinent topics in grocery shopping, with rich research in the offline setting [30,31,32] and growing work in online settings [e.g., 17, 33,34,35,36. This research complements existing studies by considering price consciousness and brand preference in both online and offline contexts. Moreover, considering the ongoing trend toward organic and fair-trade products, particularly in the food sector [37, 38], the study analyzes OGS with a specific focus on both organic and fair-trade consumer attitudes and purchases.

The overarching objective of this research is to elucidate the consumer segment that engages more in OGS. Consequently, the focus is on the following research question: What are the differences in consumer characteristics and purchase behavior between also-online and offline-only grocery shoppers?

By addressing this research question, the study contributes new insights into how consumer characteristics and purchase behavior differ between offline grocery shopping and OGS. Specifically, a comparative analysis is conducted on also-online and offline-only grocery shoppers in different settings to uncover potential disparities in household behavior and channel usage. The aim is to enable brand managers and retailers to better characterize and address online and offline grocery shoppers, especially in times of changing retail landscapes and global uncertainty [39,40,41].

In prior research on OGS, thorough analyses of online and offline shopping behavior and the acceptance of OGS have been conducted [e.g., 15, 16, 42, 43. Chu et al. [15] observed that consumers exhibit lower price sensitivity in the online channel of the studied grocery retailer. Further empirical investigations by Chu et al. [16] revealed that households tend to demonstrate greater brand loyalty and product size preferences in the online channel, while being less price-sensitive. Hand et al. [42] focused on situational factors, finding that constraints related to issues such as childcare or health problems can incentivize OGS. Interestingly, some individuals discontinue OGS when the initial triggering situation is absent. Anesbury et al. [43] examined the behavior of 40 first-time online grocery shoppers, noting a desire among consumers to save time when shopping for groceries online. Notably, for groceries, the authors concluded that online shopping appears to be very similar to in-store shopping.

Subsequent research delved into the impact of OGS on stockpiling [44], explored OGS in different countries such as China [45], the United Kingdom [46, 47], the Czech Republic [48], Portugal [49], and Germany [9], and addressed the evolving landscape of online and offline grocery shopping due to the pandemic [8, 9, 13, 50,51,52]. Additionally, research streams investigated the effects of OGS on private labels [53] and national brands [54]. However, certain aspects have been overlooked in previous OGS research. First, some studies relying on consumer attitudes toward OGS using survey data [2, 55,56,57,58,59] may have limited implications for actual purchase behavior. The implicit assumption that consumers “do what they say” has been criticized (e.g., OgilvyFootnote 1) and should be validated by comparing it with actual purchase behavior. Second, empirical studies face the risk of outdated findings, especially given the rapid development of OGS in recent years. Third, prior research has often focused on specific aspects of OGS (e.g., price sensitivity, brands, time saving, specific countries, COVID-19), lacking a holistic comparative analysis of online and offline grocery shoppers.

To address these significant research gaps, Brüggemann and Pauwels [60] differentiated consumers into also-online and offline-only grocery shoppers based on purchase data. Subsequently, the authors analyzed consumer characteristics and purchase behavior, concluding that further research is needed with a strong hypothetical foundation, additional variables, and more granular comparisons of online and offline purchases. Responding to this call, we formulate a set of hypotheses, considering additional aspects of OGS, and conduct in-depth cross-sectional analyses to gain a deeper understanding of various facets of also-online and offline-only shoppers.

2 Theoretical background and research hypotheses

Given the virtual absence of households exclusively engaged in OGS, we differentiate between offline-only grocery shoppers and also-online grocery shoppers to formulate hypotheses regarding consumer characteristics and attitudes. We initiate our exploration with consumer demographics (i.e., demographics and attitudes) (H1a-H1d) before delving into technology, innovation, and the use of loyalty cards (H2). Subsequently, we investigate aspects related to price consciousness, brand preference, and the shares of purchased (national) brands (H3a and H3b). Finally, we scrutinize attitudes and purchase behavior concerning organic (H4a and H4b) and fair-trade (H5a and H5b) products.

Age, household size and number of children. Concerning consumer characteristics, aligning with previous research, we anticipate that younger, well-educated consumers are more inclined to engage in OGS [9, 48, 49, 61, 62]. This expectation is grounded in the observation that younger individuals tend to be more adept at using (new) technology [63]. Consequently, due to their younger age, we anticipate that also-online grocery shoppers will have smaller households with fewer children compared to their offline-only counterparts. Recognizing substantial disparities in OGS between large cities and rural regions, we find it pertinent to consider city size in addition to the aforementioned consumer demographics. Previous research has underscored the significant variation in OGS availability between large cities and rural areas [24, 25]. Hence, we posit the following hypothesis:

H1a

Also-online grocery shoppers are younger, have smaller households with fewer children, and reside in larger cities compared to offline-only grocery shoppers.

Convenience orientation. Consumers who prioritize convenience, as evidenced by a tendency to favor online shopping [26, 64], are motivated by the reduced time and energy demands associated with online transactions [65]. This inclination is further underscored by the liberation from time and place restrictions [66, 67], as online shopping offers the flexibility to browse and make purchases at one’s convenience. Additionally, the appeal is enhanced by the convenience of home delivery options [68], providing consumers with the seamless experience of having their groceries brought directly to their doorstep. Therefore:

H1b

Also-online grocery shoppers are more convenience-oriented than offline-only grocery shoppers.

Environmental responsibility. As previously discussed, our expectation is that also-online grocery shoppers are characterized by a younger demographic profile [H1a, 61, 62]. This anticipation is grounded in the observation that younger generations tend to exhibit a greater awareness of and concern for environmental issues [69,70,71]. Moreover, there is evidence suggesting that OGS can be perceived as a more environmentally friendly option due to potential reductions in transportation-related emissions and packaging waste [72].

Given these considerations, we expect that also-online grocery shoppers, influenced by their younger age and the perceived environmental advantages of OGS, are more likely to demonstrate a heightened sense of environmental responsibility compared to their offline-only counterparts. Therefore:

H1c

Also-online grocery shoppers show greater environmental responsibility than offline-only grocery shoppers.

Buying local. The burgeoning food trend of locally produced food, particularly prevalent in Europe and North America [27], has gained prominence in the food industry. Eriksen [27, p.51] specifies that local food is primarily defined as “geographical proximity frequently in combination with relational proximity and less often in combination with values of proximity”. The importance of local food is further highlighted by its potential to reduce the carbon footprint in retail, in particular by saving resources through shorter transport distances [73]. According to Barska and Wojciechowska-Solis [74], e-consumers have higher shares of local food products. However, the question of whether offline-only and also-online grocery shoppers differ in terms of attitudes toward buying local has not yet been investigated. The exploration of this distinction is crucial, as it can provide insights to retailers and brand managers on potential disparities in the value placed on buying local between these consumer segments. Addressing this research gap, we hypothesize the following:

H1d

Also-online grocery shoppers have more positive attitudes toward buying local than offline-only grocery shoppers.

Technology, innovation, and consumer’s use of loyalty cards. Technology, innovation, and the utilization of consumer loyalty cards are critical facets influencing OGS behaviors. Maat and Konings [75] underscore the intrinsic association between online shopping and consumers who demonstrate a predisposition towards openness to technology and innovation. Schultz and Brüggemann [76] contribute to this understanding by revealing a negative correlation between technology anxiety and the perceived ease of adopting digital voice assistants in the context of OGS. Given these insights, a logical inference is the anticipation of a positive association between attitudes toward technology and innovation and the acceptance of OGS, particularly acknowledging OGS as an innovative technology within the retail landscape.

In light of the heightened attitude toward technology and innovations among also-online shoppers, we expect an inclination towards greater openness to loyalty cards. Loyalty cards, encompassing all customer loyalty programs enabling consumers to enroll for benefits, constitute integral elements in both online and offline grocery retailing [e.g., 77,78,79]. Notably, Lim and Lee [80] assert that the likelihood of success for loyalty programs is higher in the online domain compared to offline channels. The authors argue that redeeming loyalty rewards is more convenient online due to the absence of physical transportation costs.

Consequently, we posit the expectation that the potentially positive effects associated with attitudes toward technology and innovation will extend to the utilization of specific technologies, such as loyalty cards, in the OGS context. Therefore:

H2

Also-online grocery shoppers are more open to technology and innovation and therefore more likely to use loyalty cards than offline-only grocery shoppers.

Price consciousness, brand preference, and national brand purchases. When households opt for either also-online or offline-only grocery shopping, variations in price consciousness and brand preference are expected to arise. Consequently, these differences will impact their purchases of (national) brands, underscoring the need to consider these factors when comparing also-online and offline-only shoppers.

Price consciousness refers to the inclination of individuals to seek the best price for each purchase, emphasizing the pursuit of lower prices [81]. In the grocery retailing context, research has explored price sensitivity in online and offline grocery shopping. Gan et al. [82] assert, based on their empirical findings, that online grocery shoppers exhibit lower price sensitivity due to the convenience afforded by the internet. This conclusion is supported by subsequent grocery retailing-specific research. Chu et al. [15] and Chu et al. [16] contend that households display even lower price sensitivities when shopping for groceries online compared to offline. Aligned with these recent findings, we expect that also-online grocery shoppers will demonstrate diminished levels of price consciousness in contrast to their offline-only counterparts.

In tandem with price consciousness, brand preference significantly influences purchasing behavior [34, 83], particularly in the competition between national brands and private labels [84,85,86,87,88]. Brüggemann and Schultz [54] found, in the context of OGS, that the share of national brands increases among households after they commence OGS. This result leads us to expect that both brand preference and the share of national brands will be higher among also-online grocery shoppers compared to offline-only grocery shoppers.

Drawing from the depicted findings, we expect that also-online grocery shoppers exhibit a propensity towards a higher share of comparatively pricier national brands. This inclination is expected to be driven by a diminished emphasis on price consciousness, alongside an elevated brand preference. With this in mind, we posit the following hypothesis:

H3a

Also-online grocery shoppers have lower price consciousness and higher brand preference and therefore purchase relatively more national brands online than offline-only grocery shoppers.

If there is a lower level of price consciousness and a higher inclination towards brand preferences among consumers who shop also-online compared to those who exclusively shop offline, it follows that the share of national brands should be relatively higher in the online sphere. This scenario suggests that the elevated share of national brands online may stem from differing consumer attitudes between also-online and offline-only grocery shoppers, indicating a demand-driven effect. However, if the share of national brands is higher in online environments without corresponding differences in consumer attitudes, the effect may lean towards being supply-sided. As noted by Basu and Sondhi [89], online retailing is particularly cost-efficient for well-established premium brands with a reputation for trustworthiness. Conversely, newer online retailers may not yet offer their own private labels and may therefore focus on stocking well-known national brands. As such, we anticipate the presence of both demand-driven and supply-side effects. Hence:

H3b

The difference in share of national brands between online and offline channels is both demand-driven (i.e., due to different purchase habits of also-online and offline-only consumers) and supply-sided (i.e., due to online and offline channel specifics).

Purchase behavior and attitudes toward organic products. The escalating significance of organic products in food retailing emphasizes the necessity of comparing consumer attitudes and purchases in online and offline grocery shopping. According to the European Union, “organic production means a sustainable agricultural system respecting the environment and animal welfare, but also includes all other stages of the food supply chain” [90]. Recent statistics indicate a rising trend in both attitudes toward organic products and purchases of organic items [37, 38]. Additionally, Bezawada and Pauwels [91] have asserted that expanding the assortment of organic products and associated promotional activities can enhance the profitability of an entire category, underscoring the significant role of organic products in food retailing.

In the realm of online retailing, prior research suggests that younger consumers demonstrate a greater propensity to engage in online shopping [74, 92,93,94,95,96]. Onyango et al. [97] report that young consumers frequently purchase organic food products. Similarly, Bryła [98] highlights that online purchasers of organic goods in Poland tend to be younger. Synthesizing these findings, an expectation arises that both attitudes toward organic products and actual purchases of organic items are more pronounced among online grocery shoppers. Surprisingly, this aspect remains unexplored, despite the ongoing escalation in the significance of both OGS [4, 5] and organic products [30]. Thus:

H4a

Also-online grocery shoppers have more positive attitudes toward organic products than offline-only shoppers, while the share of organic products online is substantially higher.

While existing research has explored variances in attitudes and behaviors towards organic products in brick-and-mortar retail settings [e.g., 99,100,101], as well as disparities in the attitude-behavior gap for online and offline grocery shopping [102], there remains a gap in the literature concerning whether potential distinctions between online and offline grocery shoppers are primarily demand-driven or supply-sided. Despite numerous publications addressing discrepancies between supply-side and demand-based factors [103,104,105], to our knowledge, no research has investigated such effects specifically for organic products in offline and online food retailing. However, it is paramount for retailers and brand managers to ascertain the extent to which the potential differences in attitudes and behaviors between also-online and offline-only grocery shoppers stem from demand-driven or supply-side factors. Should the effect predominantly be demand-driven, brand managers and retailers must adapt accordingly, such as by endeavoring to influence consumer preferences through advertising or promotions. Conversely, in the case of supply-side effects, adjustments to product assortment or portfolio may be warranted. Given this rationale, we anticipate that disparities between online and offline purchases of organic products arise from both the distinct purchasing habits of also-online and offline-only consumers and the specific characteristics of online and offline channels. Thus:

H4b

The difference in the share of organic products between online and offline channels is both demand-driven (i.e., due to different purchase habits of also-online and offline-only consumers) and supply-sided (i.e., due to online and offline channel specifics).

Purchase behavior and attitudes toward fair-trade products. In the current dynamic of grocery retailing, where there is a growing emphasis on ethical consumption and consumer preferences, the understanding of purchase behavior and attitudes towards fair-trade products becomes increasingly significant, both in online and offline retail settings. In accordance with the Fair Trade Federation’s definition [106], “Fair Trade means a safe and healthy working environment free of forced, exploitative, or underpaid labor. Throughout the trading chain, members cultivate inclusive workplaces that encourage individuals to participate in the decisions that affect them”, the global turnover and relevance of fair-trade products are steadily increasing. However, there is limited understanding of how consumers’ attitudes and purchasing behavior towards fair-trade products in OGS differ from brick-and-mortar retailing. To address this research gap, we focus on fair-trade products and extend the previous hypotheses’ rationale. Given the demographic trends suggesting that online consumers tend to be younger [H1a,61,62] and exhibit greater environmental consciousness [H1c, 69,70,71], we anticipate that also-online shoppers have higher attitudes towards fair-trade products and purchase a greater share of them, indicating that online grocery shoppers are predisposed to fair-trade products. Consequently, we hypothesize the following:

H5a

Also-online grocery shoppers have more positive attitudes toward fair-trade products than offline-only grocery shoppers, while the share of fair-trade products online is substantially higher.

In parallel with the dynamics observed in the organic products sector, we hypothesize that the rationales underpinning the online procurement of fair-trade goods are shaped by a blend of demand-driven demand and supply-side effects. This implies that the disparity in the fair-trade product adoption rates between online and offline-only grocery shoppers is likely attributable to both an increased consumer demand for fair-trade products [107] and a greater availability of such products in online grocery shops [108]. Thus:

H5b

The difference in share of fair-trade products between online and offline channels is both demand-driven (i.e., due to different purchase habits of also-online and offline-only consumers) and supply-sided (i.e., due to online and offline channel specifics).

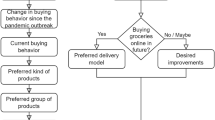

Figure 2 furnishes a systematic overview of the hypotheses.

3 Empirical analysis

3.1 Data, operationalization, and descriptive statistics

3.1.1 Data and operationalization

For our empirical analysis, we utilize German household panel data spanning from 2016 to 2020, sourced from GfK Consumer Panels & Services. This dataset comprises 4,142,485 instances of both online and offline purchases across product categories including chocolate, coffee, hair shampoo, and laundry detergent, reported by an average of 21,428 households. We augment this data with annual questionnaires completed by the same households, detailing their purchases as well as providing insights into consumer characteristics such as demographics and attitudes (refer to Table 6 in the appendix). All survey items were selected by GfK Consumer Panels & Services.

An exemplar of the raw data is presented in Table 1, illustrating, for instance, that household coded as ID1 made a purchase of 100 g of chocolate from a national brand on December 5, 2016, in a brick-and-mortar store. This chocolate product was marked as organic and fair-trade, and a loyalty card was utilized for the transaction. Furthermore, the accompanying annual survey data indicate that the purchased household is single-person with a relatively high level of price consciousness (see Table 6 in the appendix for specific questions and scales). Subsequently, in January 2017, the same household (ID1) made additional purchases, offline for chocolate and online for hair shampoo. Notably, there has been an increase in the household’s level of price consciousness.

To facilitate our empirical analysis, we aggregate the data on a monthly basis, distinguishing between also-online and offline-only shoppers across online and offline channels. It is important to note that when computing average monthly attitudes, we exclusively consider households that made at least one purchase within a given month. This methodology allows for the comparison of annually collected survey data with monthly purchase data.

In the computation of consumer characteristics and attitudes, each household that participated in both online and offline shopping, or made multiple purchases within a given month, is considered only once. This method is implemented to alleviate potential bias in the aggregated data stemming from households characterized by frequent shopping activities. As a result, this approach reveals unique average consumer characteristics and attitudes across households for each month. Additionally, we employ weighting techniques based on the representativeness of households for the German population, as provided by GfK Consumer Panels & Services. The purchase variables are quantified in terms of volume (kilograms). The operational definitions of all variables used are outlined in Table 7 of the appendix.

For the empirical analysis, we establish various comparisons concerning consumer characteristics (i.e., demographics and attitudes) and purchases (see Fig. 3). Initially, we delineate two groups for comparison: (A) consumer characteristics of also-online and offline-only grocery shoppers. Subsequently, we construct additional partial datasets to compare purchases made by online and offline shoppers, enabling the identification of evidence for supply-based and demand-driven effects. Proceeding, we segregate the dataset into two groups: (B) offline purchases of offline-only shoppers and offline and online purchases of also-online grocery shoppers. The latter group is then further subdivided into (C) online purchases of also-online grocery shoppers and (D) offline purchases of also-online grocery shoppers. This systematic approach aims to analyze disparities between also-online and offline-only consumers concerning various consumer characteristics and purchases. Additionally, this methodology facilitates the identification of evidence for demand-driven and supply-side effects across different channels. The group comparisons are summarized in Fig. 3.

3.1.2 Descriptive statistics

Table 2 presents key performance indicators related to the groups under analysis. Consistent with trends observed in the grocery market [8], a significantly larger number of households engage in offline-only grocery shopping (73,009) compared to also-online shopping (2,509). The average value per kilogram is notably lower among offline-only shoppers (€6.46). Interestingly, even the value per kilogram is higher for offline purchases made by also-online shoppers (€7.09) than for those made by offline-only shoppers (€6.46). The highest value per kilogram is observed for online purchases made by also-online shoppers (€14.25). Similar trends are observed in terms of the value per quantity.

Table 3 provides insights into the value-based distribution of product categories. Except for the online channel, the revenue distribution among the four product groups varies only slightly. Coffee emerges as the dominant product category in online purchases made by also-online grocery shoppers. Conversely, chocolate is proportionately less purchased online compared to offline. This partly accounts for the considerably higher average revenue per kilogram observed in the online channel. Nevertheless, the results indicate that the distribution between online and offline purchases among also-online shoppers and offline-only grocery shoppers is largely similar across all product categories. Overall, we conclude that there is a solid degree of comparability between the groups, although the higher proportion of coffee purchases must be taken into consideration when interpreting results related to the online channel.

The descriptive statistics in Table 4 (depicted in the “Mean” column) indicate that consumers engaging in also-online purchases typically exhibit a younger age demographic, reside in smaller households with fewer children, and are situated in larger urban centers compared to offline-only grocery shoppers. Furthermore, also-online purchasing consumers demonstrate more favorable attitudes towards convenience and environmental responsibility.

On average, attitudes toward buying local are higher among also-online grocery shoppers compared to offline-only counterparts. Similarly, attitudes toward technology and innovation exhibit a higher average among also-online purchasing consumers. The descriptive statistics suggest a greater prevalence of purchases made with loyalty cards among also-online grocery shoppers (0.5025) than among offline-only grocery shoppers (0.3265). When comparing across different channels (i.e., online versus offline), the average disparity in the share of purchases made with loyalty cards is even more pronounced between online (0.6843) and offline (0.5025) channels.

Furthermore, the descriptive statistics in Table 4 indicate that also-online shoppers tend to display lower levels of price consciousness and higher levels of brand preference. Regarding channel usage, the share of national brands is on average higher online (0.8704) than offline (0.6796). Moreover, the descriptive statistics reveal that also-online shoppers proportionately purchase more national brands in both online and offline channels (0.7151) than offline-only shoppers (0.6796). Although the difference between also-online grocery shoppers (across online and offline purchases) and offline-only grocery shoppers (limited to offline purchases) is comparatively smaller than the channel usage effect (i.e., between online and offline purchases), it is nonetheless evident.

The attitudes toward organic products among both also-online and offline-only grocery shoppers exhibit minimal disparity, with consumers who also purchase online displaying marginally more favorable attitudes. However, notable differences emerge when examining the shares of purchased organic products. On average, also-online grocery shoppers procure more than double the quantity of organic products in the online channel (0.0717) compared to offline-only shoppers in the offline channel (0.0315). Furthermore, the results also demonstrate an average difference between offline purchases of also-online grocery shoppers (0.0531) and offline purchases of offline-only shoppers (0.0315). This disparity suggests the presence of both demand-driven and supply-side effects.

Similar patterns are observed in attitudes toward and purchases of fair-trade products. While attitudes demonstrate relative parity, leaning slightly more positive for also-online grocery shoppers, the shares of fair-trade purchases notably exceed those of offline-only shoppers among both online and offline purchases of also-online shoppers (0.0527) compared to offline purchases of offline-only shoppers (0.0314). This effect is particularly pronounced in the online channel (0.0772) compared to the offline channel (0.0314), mirroring the trends observed in organic purchases.

3.2 Cross-sectional comparison and results

In this section, we conduct a cross-sectional analysis to examine our previously formulated hypotheses using both offline-only and also-online grocery shopper cohorts across various offline and online purchasing scenarios (see Fig. 3 and Table 4). The empirical analysis is conducted using IBM SPSS, with data spanning 60 months for most variables and 48 months for attitudes toward technology among both online and offline shoppers. To assess significant group differences, we employ Levene’s test to ascertain the equality of variances; if variances are unequal, Welch’s test is utilized. Additionally, we report Cohen’s d to quantify the magnitude of group differences, with values below 0.5 indicating a small effect, values between 0.5 and 0.8 signifying a medium effect, and values above 0.8 suggesting a strong effect [109]. The results of the empirical analysis are presented in Table 4.

Significant differences emerge between also-online and offline-only grocery shoppers, with the former group being notably younger, hailing from smaller households with fewer children, and residing in larger cities, thereby supporting H1a. Moreover, also-online shoppers exhibit a greater inclination toward convenience and environmental responsibility compared to their offline-only counterparts, supporting H1b and H1c, respectively. The findings also reveal higher attitudes toward buying local among also-online grocery shoppers, thereby corroborating H1d.

Attitudes toward technology and innovation are significantly more positive among also-online shoppers, alongside a higher share of purchases made with loyalty cards, thus aligning with H2.

Furthermore, also-online shoppers demonstrate lower price consciousness and a significantly higher brand preference than offline-only shoppers, with a greater prevalence of national brands in their purchases, thus supporting H3a. The difference in national brands’ market share is particularly pronounced, indicating a supply-side and demand-driven effect, with the former exerting a stronger influence than differences in attitudes, as posited by H3b.

As anticipated, attitudes toward organic products are significantly more favorable among also-online grocery shoppers, with a higher share of organic purchases online compared to offline, thereby supporting H4a. Further analysis reveals that this disparity in organic product share is attributable to both consumer demand and retailer supply, with significant differences observed between online and offline purchases of also-online households versus offline-only households, as stipulated by H4b.

Similarly, attitudes toward fair-trade products are significantly higher among also-online purchasers, with a greater share of fair-trade purchases online compared to offline, supporting H5a. The analysis further elucidates that this discrepancy in fair-trade product share is driven by both consumer demand and retailer supply, with a notable difference observed between online and offline purchases of also-online shoppers versus offline purchases of offline-only grocery shoppers, thereby confirming H5b. Table 5 provides a summary of our hypotheses and their corresponding empirical findings.

4 Discussion

4.1 Practical implications

The empirical analysis yields novel insights into demographics, attitudes, and purchasing behaviors of both offline-only and also-online grocery shoppers across offline and online channels. This study enhances our understanding of these consumer segments, offering valuable implications for retailers and brand managers, particularly within the dynamically evolving retail landscape [20, 39,40,41], where the significance of OGS continues to escalate. Specifically, we furnish brand managers and retailers with actionable insights concerning the disparities in consumer characteristics and channel preferences between offline-only and also-online grocery shoppers, thereby facilitating more targeted marketing strategies. The ensuing paragraphs elucidate the empirical findings and delineate their practical implications.

The allure of convenience and the flexibility of home delivery resonate more profoundly with also-online grocery shoppers, underscoring their penchant for convenience. Moreover, these shoppers evince more favorable attitudes toward environmental responsibility and buying local. Brand managers and retailers are advised to incorporate these insights into their online channel strategies to cater effectively to the preferences of also-online grocery shoppers. Additionally, the heightened utilization of loyalty cards among also-online shoppers warrants a review of loyalty programs to ensure seamless integration across online and offline platforms. Targeting offline-only consumers who already engage with loyalty programs presents an opportunity to foster their transition to also-online shopping, driven by the familiarity with loyalty schemes.

The pronounced disparity between the shares of national brands in also-online and offline-only purchases presents an opportunity for brand managers to leverage online distribution channels to mitigate private label encroachment [32]. Specifically, the substantial relevance of national brands online offers manufacturers a chance to diminish their often-criticized reliance on retailers [34, 110,111,112], thereby fortifying their competitive stance [112]. Furthermore, brand managers should capitalize on the online channel to promote their national brands, given that online grocery shoppers exhibit lower price consciousness and higher brand preference.

Furthermore, the findings underscore the significance of online channels for retailers’ private labels, as evidenced by the notably higher market share of national brands online compared to the anticipated levels based on price consciousness and brand preference. This suggests the presence of a supply-side effect driven by assortment composition, aligning with recent industry trends such as the inclusion of private labels in the assortment of quick commerce providers like Gorillas [113].

From a consumer perspective, the empirical findings indicate that offline-only shoppers tend to be older and reside in larger households, potentially leading to a higher familiarity with and preference for private labels [114]. Furthermore, the demand for groceries may be heightened among larger households. These factors can contribute to the elevated market share of private labels in offline retail settings. Consequently, retailers have an opportunity to strategically target online grocery shoppers with innovative private label offerings to expand their market share in the online domain. This strategic approach has the potential to mitigate the substantial disparity in market share of private labels between online and offline channels, particularly considering the relatively smaller differences in consumer attitudes. These findings underscore significant potential for retailers to leverage the online channel for the distribution of private labels.

Brand managers and retailers can leverage the insights gleaned from the higher prevalence of organic products and the more favorable attitudes towards them to target specific consumer segments across online and offline channels [115]. Our analysis reveals that the disparity in purchasing behavior between households that shop both online and offline and those that exclusively shop offline is more pronounced than the variance in their attitudes. This suggests that consumer behavior diverges more significantly than their attitudes alone would indicate. Conversely, we observe significant yet weaker disparities between online and offline purchases.

It is imperative for retailers and brand managers to realize that consumers who engage in OGS exhibit more positive attitudes towards organic products and demonstrate a higher propensity to purchase them, both online and offline. However, it is essential to acknowledge the influence of supply-side factors, such as the assortment of organic products offered by retailers, which significantly impacts their market share in the long term. Online retailers, in particular, have the advantage of curating their organic product selection more effectively due to the limitations of physical shelf space, potentially leading consumers with lower organic product attitudes to make purchases unintentionally.

Additionally, our findings indicate the presence of both supply-side and demand-driven effects, with the online channel still in a nascent stage, characterized by higher variability in consumer characteristics and purchasing behavior compared to the offline channel. Consequently, brand managers and retailers should maintain their focus on organic products, especially when targeting also-online shoppers, given their lower price consciousness, emphasizing the importance of organic products in the online retail landscape.

Our analysis yields similar findings regarding fair-trade products. The observation that also-online shoppers exhibit more favorable attitudes towards fair-trade products and display higher proportions of fair-trade purchases offers valuable insights into consumer behavior for retailers and brand managers. The disparities in both consumer attitudes towards fair-trade products and the offline and online purchase patterns of also-online grocery shoppers are pronounced, statistically significant, and exhibit comparable effect sizes. This alignment between consumer attitudes and behavior suggests a primary demand-driven effect between the online and offline channels, underscoring the importance for retailers and brand managers to align their assortments accordingly.

However, our results indicate the presence of additional factors beyond consumer demand. Specifically, the online channel demonstrates an even greater prevalence of fair-trade products on average, suggesting the existence of a supply-side effect. Given the dynamic nature of the online channel, brand managers and retailers must remain vigilant and continuously monitor developments to ensure alignment with consumer preferences.

Moving forward, it is imperative for brand managers and retailers to conduct ongoing analyses of evolving trends, particularly within the online channel, by scrutinizing the behavior of also-online shoppers and adjusting their assortments accordingly, encompassing considerations such as national brands, organic products, and fair-trade items.

From the consumers’ perspective, the findings unveil a distinct preference among also-online purchasing households for organic and fair-trade products. Coupled with the understanding that these households skew younger, reside in larger urban centers, exhibit higher loyalty card usage, and espouse more favorable attitudes towards environmental responsibility and local sourcing, this novel revelation furnishes retailers and brand managers with a comprehensive understanding of this consumer demographic. Moreover, this segment is poised for expansion in the foreseeable future, given the discernible trend towards the procurement of organic and fair-trade goods [37, 38]. Consequently, it is imperative for brand managers and retailers to promptly adjust to this emerging customer segment and align their offerings across both online and offline channels.

4.2 Theoretical implications

In addition to furnishing valuable insights for retailers and brand managers, our study also carries several theoretical implications. By elucidating differences in consumer characteristics and behavior between online and offline grocery shopping, we contribute to a better understanding of this evolving landscape. This holds particular significance for researchers, given the ongoing evolution of OGS [10] and its anticipated trajectory in the years to come [4, 5]. While offline-only shoppers will persist, the cohort of also-online shoppers is expected to expand. Hence, it is imperative for future research to differentiate between these consumer groups to unveil nuanced dissimilarities between online and offline grocery shoppers. Researchers may find it particularly pertinent to investigate how the distinct environmental contexts of brick-and-mortar stores versus OGS influence consumer behavior. Unlike traditional retail settings where consumers can peruse a wide array of products displayed on shelves, online grocery shoppers are constrained to viewing only a limited selection at a time. Moreover, OGS introduces novel features such as search functions, detailed product information, and recipe suggestions. The ability to customize the digital shelf and pricing online further underscores the potential impact on consumer behavior analysis and management strategies.

In addition to delineating the distinction between offline-only and also-online shoppers, our study yields novel insights into the manifestation of demand-driven and supply-side effects on both online and offline grocery shoppers. For instance, we uncover evidence suggesting that lower price consciousness, heightened brand preference, and the consequent elevated prevalence of national brands among online shoppers stem from both supply-side and demand-driven factors. On one hand, the availability of private labels may be more prevalent in traditional brick-and-mortar stores compared to OGS platforms. Conversely, our analysis of the offline and online purchases made by also-online grocery shoppers reveals robust and significant effects when compared to those of offline-only grocery shoppers. Consequently, also-online grocery shoppers exhibit a proportionally higher propensity to purchase national brands, both online and offline. In sum, this observation underscores the presence of both demand-driven and supply-side effects.

Our findings align with the conclusions drawn by Brüggemann and Schultz [54], who observed a general increase in the share of national brands per household (across both online and offline channels) upon the commencement of OGS. In light of these insights, it is imperative for researchers in the field of retailing to acknowledge and account for such demand-driven and supply-side effects in future investigations, as these distinct dynamics necessitate divergent courses of action. Strategies targeting supply-side effects may involve adjustments to product portfolios and assortments, whereas interventions aimed at influencing demand-driven effects may require initiatives such as advertising campaigns to shape consumer preferences.

5 Conclusions

5.1 Summary

The findings of this study illuminate the disparities in consumer characteristics and purchasing behaviors between online and offline grocery shopping. Specifically, also-online grocery shoppers emerge as a distinct demographic cohort, characterized by younger age, smaller household sizes, and urban residency in comparison to their offline-only counterparts. Despite displaying a stronger affinity for convenience, these individuals exhibit notably heightened inclinations towards environmental responsibility and buying local. Consistent with expectations, also-online shoppers demonstrate more favorable attitudes towards technology and innovation, alongside a greater propensity for utilizing loyalty cards in their purchases. Moreover, they manifest lower price consciousness and stronger brand preferences, resulting in a higher proportion of national brand purchases, particularly in the online domain. This disparity in national brand prevalence between online and offline channels reflects both demand-driven and supply-side influences.

Furthermore, our analysis reveals that also-online shoppers exhibit slightly elevated attitudes towards organic products compared to their offline-only counterparts, translating into a nearly twofold increase in online organic purchases. This phenomenon underscores the presence of supply-side dynamics. Similarly, the augmented share of fair-trade product purchases among also-online shoppers, both online and offline, signifies a confluence of demand-driven and supply-side factors.

5.2 Limitations and further research

This study acknowledges several limitations deserving of recognition. Primarily, the cross-sectional analysis employed herein possesses inherent constraints in delineating causal relationships. While discernible disparities were identified between also-online and offline-only grocery shoppers, gauged through Cohen’s d, causal inference remains unexplored. Subsequent investigations could endeavor to elucidate the precise variables that contribute to augmenting the turnover of OGS. Potential influencing factors, including pricing dynamics, promotional offers, and brand diversity, warrant closer scrutiny. A more nuanced examination of household demographics may yield additional insights; notably, we observed that younger consumers residing in smaller households exhibit heightened proclivities towards organic and fair-trade products. Future research endeavors could adopt a more granular approach towards household size and age demographics to elucidate the intricacies of OGS adoption. Furthermore, exploring strategies tailored towards fostering OGS adoption among older consumers residing in larger households represents a promising avenue for further inquiry.

Secondly, distinctions arise between the cohorts of offline-only and also-online grocery shoppers regarding household counts and transaction histories. This discrepancy mirrors the inherent diversity within OGS. Consequently, the outcomes hold substantive significance. However, the notable oscillations among online grocery shoppers contribute to elevated variances in the dataset. Such fluctuations necessitate cautious interpretation of Cohen’s d metrics. Consequently, future investigations should corroborate the findings of this study with supplementary datasets.

Thirdly, our empirical inquiry focuses on four product categories. While we deliberately encompass a diverse range of products (chocolate, coffee, hair shampoo, laundry detergent), alternative product classifications may yield disparate findings concerning purchases. For instance, fresh produce might exhibit distinct behaviors due to the inability to physically examine items online, which is particularly pertinent for perishable goods like fruits and vegetables. Moreover, the prominence of coffee presentation in the online realm compared to offline settings could influence outcomes. Therefore, we advocate for researchers to explore supplementary product categories and potentially incorporate context-specific considerations.

A fourth limitation pertains to the absence of longitudinal analysis, which could elucidate shifts in the variables studied over time. Subsequent research endeavors could undertake longitudinal examinations to explore alterations in consumer attributes and purchasing behaviors among online and offline shoppers. For instance, future investigations could assess the impact of the COVID-19 pandemic on the enduring utilization of OGS. Particularly pertinent is the inquiry into whether the pandemic instigates enduring transformations in online and offline grocery shopping behaviors, or if individuals who adopt online shopping during the pandemic revert to their prior habits (offline-only grocery shopping) post-pandemic. Should consumers modify their behaviors due to the pandemic and an increased number of individuals continue to purchase groceries online in the long term, the demand for organic and fair-trade products, as well as national brands, is anticipated to escalate. Companies that proactively anticipate this trajectory can tailor their online assortments accordingly, thereby attaining competitive advantages.

References

Pauzi, S. F. F. B., Chin, T. A., Choon, T. L., & Sulaiman, Z. (2017). Motivational factors for online grocery shopping. Advanced Science Letters, 23(9), 9140–9144.

Frank, D. A., & Peschel, A. O. (2020). Sweetening the deal: The ingredients that drive consumer adoption of online grocery shopping. Journal of Food Products Marketing, 26(8), 535–544.

Klepek, M., & Bauerová, R. (2020). Why do retail customers hesitate for shopping grocery online? Technological and Economic Development of Economy, 26(6), 1444–1462.

Polaris (2022). Online grocery market size global report, 2022–2030, https://www.polarismarketresearch.com/industry-analysis/online-grocery-market (2023/07/28).

Statista (2022). Platform-to-consumer delivery–turnover worldwide, https://de.statista.com/outlook/dmo/eservices/online-food-delivery/platform-to-consumer-delivery/weltweit (2023/07/28).

Grashuis, J., Skevas, T., & Segovia, M. S. (2020). Grocery shopping preferences during the COVID-19 pandemic. Sustainability, 12, 1–10.

Yelamanchili, R., Wukadada, B., Jain, A., & Pathak, P. (2021). A study on consumers attitude towards online grocery shopping in Covid19 pandemic. Academy of Marketing Studies Journal, 25, 1–9.

Brüggemann, P., & Olbrich, R. (2022). The impact of COVID-19 pandemic restrictions on offline and online grocery shopping: New normal or old habits? Electronic Commerce Research, 23(4), 2051–2072.

Gruntkowski, L. M., & Martinez, L. F. (2022). Online grocery shopping in Germany: Assessing the impact of COVID-19. Journal of Theoretical and Applied Electronic Commerce Research, 17(3), 984–1002.

Shroff, A., Kumar, S., Martinez, L. M., & Pandey, N. (2024). From clicks to consequences: a multi-method review of online grocery shopping. Electronic Commerce Research, in press.

Sheth, J. (2020). Impact of Covid-19 on consumer behavior: Will the old habits return or die? Journal of Business Research, 117, 280–283.

Cui, T. H., Ghose, A., Halaburda, H., Iyengar, R., Pauwels, K., Sriram, S., Tucker, C., & Venkataraman, S. (2021). Informational challenges in omnichannel marketing: Remedies and future research. Journal of Marketing, 85(1), 103–120.

Brüggemann, P., & Olbrich, R. (2022). The impact of pandemic restrictions on offline and online grocery shopping behavior–New normal or old habits? In F. J. Martinez-Lopez & L. F. Martinez (Eds.), Advances in Digital Marketing and eCommerce (pp. 224–232). Springer.

Danaher, P. J., Wilson, I., & Davis, R. A. (2003). A comparison of online and offline consumer brand loyalty. Marketing Science, 22(4), 461–476.

Chu, J., Chintagunta, P., & Cebollada, J. (2008). Research note–a comparison of within-household price sensitivity across online and offline channels. Marketing Science, 27(2), 283–299.

Chu, J., Arce-Urriza, M., Cebollada-Calvo, J. J., & Chintagunta, P. K. (2010). An empirical analysis of shopping behavior across online and offline channels for grocery products: The moderating effects of household and product characteristics. Journal of Interactive Marketing, 24(4), 251–268.

Dawes, J., & Nenycz-Thiel, M. (2014). Comparing retailer purchase patterns and brand metrics for in-store and online grocery purchasing. Journal of Marketing Management, 30(3/4), 364–382.

Campo, K., & Breugelmans, E. (2015). Buying groceries in brick and click stores: Category allocation decisions and the moderating effect of online buying experience. Journal of Interactive Marketing, 31, 63–78.

Melis, K., Campo, K., Breugelmans, E., & Lamey, L. (2015). The impact of the multi-channel retail mix on online store choice: Does online experience matter? Journal of Retailing, 91(2), 272–288.

Prabowo, H., & Hindarwati, E. N. (2020). Online grocery shopping adoption: A systematic literature review. International Conference on Information Management and Technology (ICIMTech), 2020, 40–45.

Sheth, J. N. (2021). Future of brick and mortar retailing: How will it survive and thrive? Journal of Strategic Marketing, 29(7), 598–607.

McKinsey & Company (2020). How European shoppers will buy groceries in the next normal, https://www.mckinsey.com/industries/retail/our-insights/how-european-shoppers-will-buy-groceries-in-the-next-normal. Accessed 14 Jan 2023.

FoodNavigator (2021). Organic and Fairtrade sales soar as COVID and climate boost ethical consumerism, https://www.foodnavigator.com/Article/2021/02/11/Organic-and-Fairtrade-sales-soar-as-COVID-and-climate-boost-ethical-consumerism. Accessed 14 Jan 2023.

Verbraucherzentrale Berlin (2017). Marktcheck Online-Lebensmittelhandel–Verfügbarkeit, Lieferqualität und Alltagstauglichkeit in den Regionen Berlin und Brandenburg (im Stadt-Land-Vergleich) (Market check for online grocery shopping–availability, delivery quality and suitability for everyday use in the regions of Berlin and Brandenburg (urban-rural comparison)), https://www.verbraucherzentrale-berlin.de/sites/default/files/2018-02/18_02_02_Marktcheck_Online_LM_Web.pdf. Accessed 14 Jan 2023.

Dannenberg, P., & Dederichs, S. (2019). Online-Lebensmittelhandel in ländlichen Räumen (Online grocery retailing in rural regions). RaumPlanung, 202(3/4), 16–21.

Li, H., Kuo, C., & Rusell, M. G. (1999). The impact of perceived channel utilities, shopping orientations, and demographics on the consumer’s online buying behavior. Journal of Computer-Mediated Communication, 5(2), JMC521.

Eriksen, S. N. (2013). Defining local food: Constructing a new taxonomy–three domains of proximity. Acta Agriculturae Scandinavica, Section B-Soil & Plant Science, 63(1), 47–55.

Demoulin, N. T., & Zidda, P. (2009). Drivers of customers’ adoption and adoption timing of a new loyalty card in the grocery retail market. Journal of Retailing, 85(3), 391–405.

Demoulin, N. T., & Zidda, P. (2008). On the impact of loyalty cards on store loyalty: Does the customers’ satisfaction with the reward scheme matter? Journal of retailing and Consumer Services, 15(5), 386–398.

Pauwels, K., & Srinivasan, S. (2004). Who benefits from store brand entry? Marketing Science, 23(3), 364–390.

Sethuraman, R., & Gielens, K. (2014). Determinants of store brand share. Journal of Retailing, 90(2), 141–153.

Brüggemann, P., Olbrich, R., & Schultz, C. D. (2020). Competition between national brands and private labels: Determinants of the market share of national brands. In F. J. Martinez-Lopez, J. C. Gázquez-Abad, & E. Breugelmans (Eds.), Advances in National Brand and Private Label Marketing (pp. 39–49). Springer.

Degeratu, A. M., Rangaswamy, A., & Wu, J. (2000). Consumer choice behavior in online and traditional supermarkets: The effects of brand name, price, and other search attributes. International Journal of Research in Marketing, 17(1), 55–78.

Arce-Urriza, M., & Cebollada, J. (2012). Private labels and national brands across online and offline channels. Management Decision, 50(10), 1772–1789.

Nenycz-Thiel, M., Romaniuk, J., & Dawes, J. (2016). Is being private better or worse online? private labels performance in online grocery channel. In F. J. Martinez-Lopez, J. C. Gázquez-Abad, & E. Gijsbrechts (Eds.), Advances in National Brand and Private Label Marketing (pp. 63–65). Springer.

Cebollada, J., Chu, Y., & Jiang, Z. (2019). Online category pricing at a multichannel grocery retailer. Journal of Interactive Marketing, 46, 52–69.

Fairtrade International (2021). Annual Reports 2018–2019, 2019–2020, and 2020–2021, https://www.fairtrade.net/search/library?fma=&fmb=annualReport. Accessed 14 Jan 2023.

Statista (2021). Umsatz mit Bio-Lebensmitteln in Deutschland in den Jahren 2000 bis 2021 (Organic food revenue in Germany from 2000 to 2021), https://de.statista.com/statistik/daten/studie/4109/umfrage/bio-lebensmittel-umsatz-zeitreihe. Accessed 14 Jan 2023.

Roggeveen, A. L., & Sethuraman, R. (2020). How the COVID-19 pandemic may change the world of retailing. Journal of Retailing, 96(2), 169–171.

Grewal, D., Gauri, D. K., Roggeveen, A. L., & Sethuraman, R. (2021). Strategizing retailing in the new technology era. Journal of Retailing, 97(1), 6–12.

Gielens, K. (2022). From one disruption to the next: How to navigate chaos? Journal of Retailing, 98(3), 373–377.

Hand, C., Riley, D. F. O., Harris, P., Singh, J., & Rettie, R. (2009). Online grocery shopping: The influence of situational factors. European journal of Marketing, 43(9/10), 1205–1219.

Anesbury, Z., Nenycz-Thiel, M., Dawes, J., & Kennedy, R. (2016). How do shoppers behave online? An observational study of online grocery shopping. Journal of Consumer Behaviour, 15(3), 261–270.

Hao, N., Wang, H. H., & Zhou, Q. (2020). The impact of online grocery shopping on stockpile behavior in Covid-19, China. Agricultural Economic Review, 12(3), 459–470.

Van Ewijk, B. J., Steenkamp, J. B. E., & Gijsbrechts, E. (2020). The rise of online grocery shopping in China: Which brands will benefit? Journal of International Marketing, 28(2), 20–39.

Robinson, H., Riley, D. O. F., Rettie, R., & Rolls-Willson, G. (2007). The role of situational variables in online grocery shopping in the UK. The Marketing Review, 7(1), 89–106.

Ramachandran, K. K., Karthick, K. K., & Kumar, M. S. (2011). Online shopping in the UK. International Business & Economics Research Journal (IBER), 10(12), 23–36.

Bartók, O., Kozák, V., & Bauerová, R. (2021). Online grocery shopping: the customers perspective in the Czech Republic. Equilibrium. Quarterly Journal of Economics and Economic Policy, 16(3), 679–695.

Gomes, S., & Lopes, J. M. (2022). Evolution of the Online Grocery Shopping Experience during the COVID-19 Pandemic: Empiric study from Portugal. Journal of Theoretical and Applied Electronic Commerce Research, 17(3), 909–923.

Tyrväinen, O., & Karjaluoto, H. (2022). Online grocery shopping before and during the COVID-19 pandemic: A meta-analytical review. Telematics and Informatics, 71, 101839.

Shen, H., Namdarpour, F., & Lin, J. (2022). Investigation of online grocery shopping and delivery preference before, during, and after COVID-19. Transportation Research Interdisciplinary Perspectives, 14, 100580.

Lu, M., Wang, R., & Li, P. (2022). Comparative analysis of online fresh food shopping behavior during normal and COVID-19 crisis periods. British Food Journal, 124(3), 968–986.

Verstraeten, J., Heeremans, E., Geuens, M., & Vermeir, I. (2023). How online grocery shopping drives private label food purchases. Journal of Business Research, 167, 114057.

Brüggemann, P., & Schultz, C. D. (2023). Shift in National Brand and Private Label Shares with Households Commencing Online Grocery Shopping. In F. J. Martinez-Lopez, J. C. Gázquez-Abad, & K. Gielens (Eds.), Advances in National Brand and Private Label Marketing (pp. 119–126). Springer.

Hansen, T. (2008). Consumer values, the theory of planned behaviour and online grocery shopping. International Journal of Consumer Studies, 32(2), 128–137.

Mortimer, G., Fazal e Hasan, S., Andrews, L., & Martin, J. (2016). Online grocery shopping: the impact of shopping frequency on perceived risk. International Review of Retail, Distribution and Consumer Research, 26(2), 202–223.

Seitz, C., Pokrivčák, J., Tóth, M., & Plevný, M. (2017). Online grocery retailing in Germany: An explorative analysis. Journal of Business Economics and Management, 18(6), 1243–1263.

Driediger, F., & Bhatiasevi, V. (2019). Online grocery shopping in Thailand: Consumer acceptance and usage behavior. Journal of Retailing and Consumer Services, 48, 224–237.

Alaimo, L. S., Fiore, M., & Galati, A. (2020). How the COVID-19 pandemic is changing online food shopping human behaviour in Italy. Sustainability, 12, 9594.

Brüggemann, P., & Pauwels, K. (2022). Consumers attitudes and purchases in online versus offline grocery shopping. In F. J. Martinez-Lopez, J. C. Gázquez-Abad, & M. Ieva (Eds.), Advances in National Brand and Private Label Marketing (pp. 39–46). Springer.

Goyal, M. M. (2014). Online shopping: A survey on consumer’s perception. International Journal of Business & Management, 2(11), 73–79.

Pant, A. (2014). An online shopping change the traditional path of consumer purchasing. International Journal of Business and Management Invention, 3(3), 39–42.

Olson, K. E., O’Brien, M. A., Rogers, W. A., & Charness, N. (2011). Diffusion of technology: Frequency of use for younger and older adults. Ageing international, 36(1), 123–145.

Swaminathan, V., Lepkowska-White, E., & Rao, B. P. (1999). Browsers or buyers in cyberspace? An investigation of factors influencing electronic exchange. Journal of Computer-Mediated Communication, 5(2), JCMC523.

Salehi, M. (2012). Consumer buying behavior towards online shopping stores in Malaysia. International Journal of Academic Research in Business and Social Sciences, 2(1), 393–403.

Yang, B., & Lester, D. (2004). Attitudes toward buying online. CyberPsychology & Behavior, 7(1), 85–91.

Salehi, F., Abdollahbeigi, B., Langroudi, A. C., & Salehi, F. (2012). The impact of website information convenience on e-commerce success of companies. Procedia Social and Behavioral Sciences, 57, 381–387.

Pechtl, H. (2003). Adoption of online shopping by German grocery shoppers. The International Review of Retail, Distribution and Consumer Research, 13(2), 145–159.

Coddington, W. (1993). Environmental marketing: Positive strategies for reaching the green consumer. McGraw-Hill.

D’Souza, C., Taghian, M., Lamb, P., & Pretiatko, R. (2007). Green decisions: Demographics and consumer understanding of environmental labels. International Journal of Consumer Studies, 31(4), 371–376.

Memery, J., Megicks, P., & Williams, J. (2005). Ethical and social responsibility issues in grocery shopping: A preliminary typology. Qualitative Market Research: An International Journal, 8(4), 399–412.

Wirecutter (2021). How to shop online more sustainably, https://www.nytimes.com/wirecutter/blog/shop-online-sustainably. Accesses 31 Jul 2023.

Young, C. (2022). Should you buy local? Journal of Business Ethics, 176(2), 265–281.

Barska, A., & Wojciechowska-Solis, J. (2020). E-consumers and local food products: A perspective for developing online shopping for local goods in Poland. Sustainability, 12, 4958.

Maat, K., & Konings, R. (2018). Accessibility or innovation? Store shopping trips versus online shopping. Transportation Research Record, 2672(50), 1–10.

Schultz, C., & Brüggemann, P. (2021). Acceptance of digital voice assistants for grocery shopping. In: Proceedings of the European Marketing Academy, vol. 50.

Passingham, J. (1998). Grocery retailing and the loyalty card. Market Research Society Journal, 40(1), 1–8.

Wright, C., & Sparks, L. (1999). Loyalty saturation in retailing: Exploring the end of retail loyalty cards? International Journal of Retail & Distribution Management, 27(10), 429–440.

Mauri, C. (2003). Card loyalty. A new emerging issue in grocery retailing. Journal of Retailing and Consumer Services, 10(1), 13–25.

Lim, S., & Lee, B. (2015). Loyalty programs and dynamic consumer preference in online markets. Decision Support Systems, 78, 104–112.

Alford, B. L., & Biswas, A. (2002). The effects of discount level, price consciousness and sale proneness on consumers’ price perception and behavioral intention. Journal of Business Research, 55, 775–783.

Gan, L., He, S., Huang, T., & Tan, J. (2007). A comparative analysis of online grocery pricing in Singapore. Electronic Commerce Research and Applications, 6(4), 474–483.

Sriram, S., Chintagunta, P. K., & Neelamegham, R. (2006). Effects of brand preference, product attributes, and marketing mix variables in technology product markets. Marketing Science, 25(5), 440–456.

Hoch, S. J. (1996). How should national brands think about private labels? MIT Sloan Management Review, 37(2), 89–102.

Ailawadi, K. L., Neslin, S. A., & Gedenk, K. (2001). Pursuing the value-conscious consumer: Store brands versus national brand promotions. Journal of Marketing, 65(1), 71–89.

Sethuraman, R. (2003). Measuring national brands’ equity over store brands. Review of Marketing Science, 1(1), 1–28.

Steenkamp, J. B. E., Van Heerde, H. J., & Geyskens, I. (2010). What makes consumers willing to pay a price premium for national brands over private labels? Journal of Marketing Research, 47(6), 1011–1024.

Sinha, I., & Batra, R. (1999). The effect of consumer price consciousness on private label purchase. International Journal of Research Marketing, 16(3), 237–252.

Basu, R., & Sondhi, N. (2021). Online versus offline: Preferred retail choice for premium brand purchase. International Journal of Retail & Distribution Management, 49(10), 1447–1463.

European Union (2018). The EU’s organic food market: facts and rules (infographic), https://www.europarl.europa.eu/news/en/headlines/society/20180404STO00909/the-eu-s-organic-food-market-facts-and-rules-infographic. Accessed 15 Mar 2023.

Bezawada, R., & Pauwels, K. (2013). What is special about marketing organic products? How organic assortment, price, and promotions drive retailer performance. Journal of Marketing, 77(1), 31–51.

Farag, S., Schwanen, T., Dijst, M., & Faber, J. (2007). Shopping online and/or in-store? A structural equation model of the relationships between e-shopping and in-store shopping. Transportation Research Part A: Policy and Practice, 41(2), 125–141.

Crocco, F., Eboli, L., & Mazzulla, G. (2013). Individual attitudes and shopping mode characteristics affecting the use of e-shopping and related travel. Transport and Telecommunication, 14(1), 45–56.

Zhou, Y., & Wang, X. C. (2014). Explore the relationship between online shopping and shopping trips: An analysis with the 2009 NHTS data. Transportation Research Part A: Policy and Practice, 70, 1–9.

Ding, Y., & Lu, H. (2017). The interactions between online shopping and personal activity travel behavior: An analysis with a GPS-based activity travel diary. Transportation, 44(2), 311–324.

Nguyen, M. H., Armoogum, J., & Nguyen Thi, B. (2021). Factors affecting the growth of e-shopping over the COVID-19 era in Hanoi, Vietnam. Sustainability, 13, 9205.

Onyango, B. M., Hallman, W. K., & Bellows, A. C. (2007). Purchasing organic food in US food systems: A study of attitudes and practice. British Food Journal, 109(5), 399–411.

Bryła, P. (2018). Organic food online shopping in Poland. British Food Journal, 120(5), 1015–1027.

Tsakiridou, E., Boutsouki, C., Zotos, Y., & Mattas, K. (2008). Attitudes and behaviour towards organic products: An exploratory study. International Journal of Retail & Distribution Management, 36(2), 158–175.

Aschemann-Witzel, J., & Niebuhr Aagaard, E. M. (2014). Elaborating on the attitude–behaviour gap regarding organic products: Young Danish consumers and in-store food choice. International Journal of Consumer Studies, 38(5), 550–558.

Ermecke, K., Olbrich, R., & Brüggemann, P. (2023). They don’t do what they say–the attitude-behavior gap in online and offline grocery shopping for organic products. In F. J. Martinez-Lopez (Ed.), Advances in Digital Marketing and eCommerce (pp. 70–77). Springer.

Ermecke, K., Brüggemann, P., & Olbrich, R. (2023). Reduce the gap!–How the attitude-behavior gap for organic products impacts sales in offline versus online grocery shopping, In: Proceedings of the Society for Marketing Advances Conference 2023, in press.

Carrington, M. J., Neville, B. A., & Whitwell, G. J. (2010). Why ethical consumers don’t walk their talk: Towards a framework for understanding the gap between the ethical purchase intentions and actual buying behaviour of ethically minded consumers. Journal of Business Ethics, 97(1), 139–158.

Aschemann-Witzel, J., & Niebuhr Aagaard, E. M. (2014). Elaborating on the attitude-behaviour gap regarding organic products: Young Danish consumers and in-store food choice. International Journal of Consumer Studies, 38(5), 550–558.

Frank, P., & Brock, C. (2018). Bridging the intention-behavior gap among organic grocery customers: The crucial role of point-of-sale information. Psychology & Marketing, 35(8), 586–602.

Fair Trade Federation (2023). Fair trade federation principles–support safe & empowering working conditions, https://www.fairtradefederation.org/principles/#1548272394808-d33ee27a-b19d. Accessed 15 Mar 2023.

Zysk, W. (2020). Fair trade phenomenon and its evolution in Visegrad countries. International Entrepreneurship Review, 6(4), 81–98.

Fair Trade Deutschland (2024). Online-shoppingliste–Fairtrade einen Klick entfernt, https://www.fairtrade-deutschland.de/einkaufen/online-shoppingliste. Accessed 31 Jan 2024.

Cohen, S. (1988). Perceived stress in a probability sample of the United States. In S. Spacapan & S. Oskamp (Eds.), The Social Psychology of Health (pp. 31–67). Sage.

Quelch, J., & Harding, D. (1996). Brands versus private labels: Fighting to win. Harvard Business Review, 74(1), 99–109.

Olbrich, R., Hundt, M., & Jansen, H. C. (2016). Proliferation of private labels in food retailing: A literature overview. International Journal of Marketing Studies, 8(8), 63–76.

Brüggemann, P. (2023). Die Dekomposition von Marktanteilen–methodische Grundlagen und empirische Anwendung–am Beispiel der Marktanteile von Hersteller-und Handelsmarken sowie von Vertriebslinien im Lebensmittelhandel [The decomposition of market shares - methodical basics and empirical application-using the example of market shares of manufacturer and retailer brands as well as of distribution lines in grocery retailing]. In R. Olbrich (Ed.), Marketing und Marktorientierte Unternehmensführung [Marketing and market-oriented management] (pp. 1–208). Springer.

RetailDetail (2022). Gorillas to launch own private label brands, https://www.retaildetail.eu/news/food/gorillas-to-launch-own-private-label-brands/. Accessed 14 Jan 2023.

Gielens, K., Ma, Y., Namin, A., Sethuraman, R., Smith, R. J., Bachtel, R. C., & Jervis, S. (2021). The future of private labels: Towards a smart private label strategy. Journal of Retailing, 97(1), 99–115.

Basha, M. B., Mason, C., Shamsudin, M. F., Hussain, H. I., & Salem, M. A. (2015). Consumers attitude towards organic food. Procedia Economics and Finance, 31, 444–452.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Brüggemann, P., Pauwels, K. How attitudes and purchases differ between also-online versus offline-only grocery shoppers in online and offline grocery shopping. Electron Commer Res (2024). https://doi.org/10.1007/s10660-024-09828-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10660-024-09828-3