Abstract

Standard climate economics considers damages of climate change to utility, total factor productivity, and capital. Highlighting that air pollution and climate change affect human health and labor productivity significantly, we complement this literature by including human health in a theoretical climate economic framework. Our macroeconomic approach incorporates a separate health sector and provides closed-form analytical solutions for the main model variables. Economic growth is endogenously driven by innovations, which depend on labor availability and productivity. These aspects of the labor force are directly linked to human health, which is harmed by burning fossil fuels. We calculate growth in the decentralized equilibrium and derive optimal climate policy. Calibrating the model by taking standard parameter values we show the economic growth rate to be higher for the planner solution compared to the market outcome. For an optimal climate policy, we find that 44% of total resource stock should be extracted when considering damages to capital, but only 1% of the stock should be extracted in an “all inclusive” approach where health damages are included. The health perspective requires optimal environmental policies that are much more stringent than those normally advocated in climate economics, since harm to human health has negative effects on economic growth, which makes the overall impact of climate change very large.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

How much of earth’s fossil resources should we extract? According to McGlade and Ekins (2015), 1/3 of oil, 1/2 of gas, and 80% of coal need to remain in the ground to meet the internationally agreed temperature goal of below \(2^\circ\) Celsius warming.Footnote 1 From an economic perspective, we have to ask whether this result corresponds to a social optimum.Footnote 2 For the design of optimal climate policies, the economic valuation of climate damages is crucial. The use of accurate climate damage functions thus lies “at the heart” of the economic analysis of climate change (Farmer et al. 2015, p. 332). In their seminal contributions, Nordhaus and Boyer (2000) and Weitzman (2010) admit that the task is very demanding. The survey of Auffhammer (2018) sets out the difficulties of finding an objective, globally-acceptable single estimate of climate change damages. The aggregate global function has to be based on the evaluation of many different ecosystems and of current and future economic losses in very heterogeneous world regions.Footnote 3 However, the global challenge of climate change requires that optimal policies be formulated at the global level.

Adequate modeling of climate damages is absolutely necessary to derive the optimal policy. We need to include all relevant kinds of climate damages, even if the used functions are only an approximation of the real relationships. Part of the literature assumes damages to utility and productivity (Nordhaus and Boyer 2000; Weitzman 2010; Golosov et al. 2014), while more recent dynamic approaches have highlighted the importance of damages to capital (Moore and Diaz 2015; Bretschger and Karydas 2019).Footnote 4 Yet, climate economic models have mostly disregarded an important effect of burning fossil fuels and of climate change: the damages to human health. This is quite surprising, as both regional air pollution and climate change affect human health and labor productivity significantly (Pörtner et al. 2022, p. SPM-52). Notable exceptions are the contributions by Aloi and Tournemaine (2011) and Scovronick et al. (2019), where the former disregards damages to capital and does not provide policy recommendations due to the absence of a calibration, while the latter provides a meticulous calibration but disregards the importance of labor for economic innovation and growth.Footnote 5 Dugan et al. (2022) surveys the literature of overlapping-generations models where the survival probability of agents is endogenous but climate considerations are absent. By adding a specific health sector, including the whole range of climate damages and by deriving policy conclusions using a quantitative model version is how this paper aims to make a contribution to the literature. Our theoretical contribution relies on the insights from applied work where the health issue has been treated more prominently, see e.g. Ščasnỳ et al. (2015), Roson and Sartori (2016), and the references in Scovronick et al. (2019) such as Markandya et al. (2018).

Extreme weather events (heatwaves, storms, and floods) cause death and illness. They reduce the quality of air and drinking water, disrupt food systems, and accelerate food-, water- and vector-borne diseases. Regional and local air quality is an additional concern; outdoor air pollution caused by fossil-driven motor vehicles and industrial facilities is an important source of morbidity and mortality. The World Health Organization (WHO 2021) estimates that between 2030 and 2050, global warming will cause approximately 250 000 additional deaths per year and that the direct damage costs to health will be between USD 2–4 billion/year by 2030.Footnote 6 The combined effects of ambient air pollution and household air pollution is associated with 7 million premature deaths annually (WHO 2022).Footnote 7 For China, the damages associated with outdoor air pollution have been estimated to be 3.8 percent of GDP (World Bank 2007, p. viii).Footnote 8

The significant impact of climate change on human health is mirrored in the great estimated impact of climate policy on welfare.Footnote 9 Models of health co-benefits show that a \(1.5^\circ\)C warming pathway could result in around 152 million fewer premature deaths worldwide between 2020 and 2100, compared to a business-as-usual scenario, particularly due to reductions in exposure to PM2.5 (Pörtner et al. 2022 p. 3-106). The avoided health impacts associated with climate change mitigation can substantially offset mitigation costs at the societal level (Ščasnỳ et al. 2015; Markandya et al. 2018). It has even been stated prominently that the economic benefits from air quality improvement with climate mitigation policy on human health can be of the “same order of magnitude as mitigation costs, and potentially even larger” (Pörtner et al. 2022, p. TS 48). This leads to our approach of an “all inclusive” climate policy.

In the present paper we include human health in an integrated theoretical climate economic framework policy, which differentiates the presented approach from previous contributions (Nordhaus and Boyer 2000; Weitzman 2010; Golosov et al. 2014; Bretschger and Karydas 2019). We assume that economic growth is endogenous, driven by innovations and knowledge accumulation, following the seminal contribution of Romer (1990). Papers dealing with the effects of pollution on human health and growth are scant, with the exception of Bretschger and Vinogradova (2017) where it is shown how the uncertainty of environmental shocks affect health and economic growth. That paper deals with flow pollution, while—with the present topic of climate change—we have to analyse stock pollution. We believe that growth adds an important channel for exploring the economic effects of climate change, because—in particular in the research sector—the availability and productivity of labor are key. These labor aspects are directly linked to human health. In addition to Aloi and Tournemaine (2011), we include a separate health sector, consider climate damages to capital, and provide a quantitative analysis. We calculate growth in the decentralized equilibrium and then derive optimal climate policy. Taking standard parameter values we show the economic growth rate to be higher for the planner solution compared to the market outcome. Building a model for the world economy, we calculate the resource stock that is available for extraction in the social optimum in closed analytical form. We calibrate the model and find that, when only considering climate damages to the capital stock, in the optimum the stock of resources available for extraction is about 44% of total available fossil resources, i.e., coal, gas, and oil. If we add health damages, however, this value shrinks to the very low value of 2.45% or even 1.09% of the available stock. These results are due to the fact that reduced human health affects the economic growth rate negatively which makes the overall impact of climate change very large. Thus, taking the health effects into account calls for an “all inclusive” i.e., much more stringent climate policy than advocated by standard climate economic literature.

By deriving an explicit quantitative policy goal in terms of aggregate resource extraction, the paper is close to the literature suggesting that climate policy could be achieved by supply-side measures, e.g. through the decommissioning of resource stock, prominently proposed by Harstad (2012). Despite the theoretical appeal of this policy approach, demand-side policies like carbon taxes and permit markets are more likely to be implemented successfully in real politics. The current paper provides a guideline for the required stringency of such policies, but does not deal with the question which policies and projects should be prioritised in terms of efficiency and welfare. The paper of Fabra and Reguant (2024) presents an excellent survey highlighting that successful policies must not only be economically efficient but also feasible, fair, effective, and credible. In a model with many substitution possibilities between clean and dirty energies, Hart (2019) shows that for a successful decarbonization, emissions taxes are far more important than research subsidies. This literature complements our analysis.

The remainder of the paper is organized as follows. Section 2 develops the model and derives the balanced growth path. In Sect. 3, we show the social planner solution. Section 4 derives the optimal climate policy in terms of resource stocks that are available for extraction. Section 5 present the calibration and Sect. 6 provides a discussion and an extensive sensitivity analysis. Section 7 deals with the impact of asset stranding, and Sect. 8 concludes.

2 The Model

We develop our framework and motivate the model assumptions starting with the firms and proceeding with the environment, health, and households in turn.

2.1 Production and Innovation

We assume the production function in the final goods sector takes the form

where labor \(l_{p,t}\), natural fossil resources \(R_{t}\), physical capital \(K_t\) and knowledge \(B_t\) are the inputs.Footnote 10 The production of the consumption good operates under perfect competition and is conducted by a single representative firm with the following profits

where \(w_{p,t},p_{r,t}, r_t, p_{b,t}\) are the factor prices for labor, resources, capital and knowledge respectively. Since we use output as the numeraire all prices are represented in terms of the consumption good. Maximizing profits with respect to inputs we obtain the standard demand functions

Knowledge stock can be increased by employing labor in a research sector with \(B_t\) taking the following law of motion

The representative firm in the research sector operates under perfect competition, maximizing its profits

where \(w_{r,t}\) stands for the wage in the research sector. Thus, we obtain \(w_{r,t}=p_{b,t}\kappa B_{t}\) and \(\Pi _{r,t}=0\).

2.2 Natural Environment

In our model, climate change and pollution have adverse effects on the accumulation of physical capital via their impact on depreciation, on human mortality via their impact on the survival probability, on human morbidity via their impact on labor supply and on utility via their impact on the utility function, and we lay these mechanisms out in the following. First, let us begin by describing the resource and pollution dynamics. The economy owns a finite stock of non-renewable fossil resources like coal, oil, and gas, \(S_{0}\), which decreases due to extraction and burning of fossil fuels, given by \(R_{t}\), so that \(\dot{ S}_{t}=-R_{t}\). Resource use is polluting, entailing the accumulation of pollution stock \(P_{t}\) in a linear wayFootnote 11

with \(\iota >0\). The stock of pollution in period t is then given by

where \(P_{0}\) is the pre-industrial stock of pollution and \(S_{t}\) is the remaining stock of the non-renewable resource at time t. We assume that pollution entails damages to existing capital stock which are captured by the damage function \(D(P_{t})\) so that the evolution of capital reads

where \(\chi\) is the depreciation rate of capital due to use in production and \(I_{t}\) are the household’s investment that are described below. The assumption reflects that carbon emissions entail global warming which causes increasing frequency of extreme weather events like hurricanes, landslides and flooding that destroy part of existing capital stock, i.e. buildings, roads, and infrastructure. For the damage function \(D(P_{t})\) we follow the structure of Bretschger (2020) by assuming for simplicity that \(P_{0}=0\) and environmental impact is given by \(\tilde{v}_{K}\)

Assuming that resources reflect fossil fuels with a transition from coal to oil and to cleaner resources such as gas, \(\tilde{v}_{K}\) is not constant over time but inversely related to used resource stock, \(S_{0}-S_{t}\) or, in percentage changes, \(\left( S_{0}-S_{t}\right) /S_{0}.\) Hence, we have we have \(\tilde{v}_{K}=\frac{v_{K}S_{0}}{\iota (S_{0}-S_{t})}\) and arrive at a law of motion for capital reading

where the pollution induced depreciation rate is constant over time but depends positively on the total stock of resources in the ground, \(S_{0}\).

2.3 Labor and Health

We assume that pollution has two effects on the labor force. First, by raising morbidity it reduces the current available stock of labor that can be used as an input in production. Second, it leads to increased mortality, which affects intertemporal optimization. To allow for mortality with a constant labor force we build on the perpetual youth model by Blanchard-Yaari-Model, see Blanchard (1985) and Yaari (1965), where one child is born when an individual dies, leading to a constant population.Footnote 12 Turning to the first effect, we have \(\overline{L}\) denoting total labor stock, so that the effective supply of labor \(L_{t}\), becomes

where the function H captures the damages to human health stemming from pollution, similar to the function D for the damages to physical capital. The negative health impacts from pollution can be mitigated by using health services though. We let \(G_{t}\) stand for the amount of health goods, i.e., medicine and medical services, that are purchased by the household from the health sector. For the function H we assume the following formFootnote 13

where we use a simplified version of the function for health in Aloi and Tournemaine (2011). They consider a production function for health, while we consider a function for health damages so that we include the inverse of their equation. Like in the case of capital we posit that the damage intensity of emissions is inversely related to used resource stock, \(S_{0}-S_{t},\)Footnote 14 so that \(\tilde{v }_{H}=v_{H}S_{0}/(S_{0}-S_{t})\) and

An obvious yet important feature of (8) is that a larger \(S_{0}\) will require more health goods in order to maintain the same level of labor. We assume that medicine and medical services are produced competitively by infinitely many competitive firms of measure 1 and denoted by index i. They use labor \(l_{h,i,t}\) as the sole input. We will use the terms medicine, medical services and health goods interchangeably in the following. These health goods are produced in the health sector of the economy with the following production function:

where \(\eta >0,\) measures productivity, \(0<\xi <1\) is some measure of concavity, and \(Q_t\) stands for spillovers in the health sector that occur between firms and depend on the aggregate employment in the health sector \(\overline{l}_{h,t}\).Footnote 15 The spillovers are of the form \(Q_t=\overline{l}_{h,t}^{1-\xi }\), which are taken as given by each firm so that an individual firm maximizes the following profit function

Since all firms are identical, we can rewrite the demand function for a representative firm that hires labor \(l_{h,t}\) as

Turning to the second effect of pollution, we write the probability of an agent, i.e., cohort, to die by \(p(S_0)\) which is a non-decreasing function of \(S_0\) by the logic described above. We make the assumption that there are no health goods to reduce p. Intuitively, we claim that the first type of pollution effects make agents sick but health goods can cure him to some extent, whereas there is no medicine that can bring back anyone from the dead.

2.4 Household Optimization

We assume a representative households that owns the stocks of physical capital and non-renewable resource. It rents out the former and sell the latter to the final good firms, earning \(r_{t}\) and \(p_{r,t}\) per unit of stock. The household maximizes utility U over an infinite time horizon. Hereby, the household receives utility from consumption and disutility from health damages that arises due to pollution and climate change. We let \(\rho\) stand for the discount rate, \(\tilde{p}(S_0)\) for the probability of dying and c for consumption. By making analogous assumptions as for damages to capital and health, \(v_U S_0\) with \(v_U>0\) stands for the aforementioned damages to utility. Hence, we write the lifetime utility of the household as

As in the aforementioned model by Yaari (1965) and Blanchard (1985) the probability of dying increases the discount rate, which reads \(\rho +\tilde{p}(S_0)\). For convenience, we will write it as \(p(S_0)\) in the following. Hence, our model includes effects of pollution and climate change on physical capital, mortality, morbidity and utility, rendering the mitigating policies “all-inclusive”. The agent maximizes this expression subject to Equation (6), its budget-constraintFootnote 16

and its constraint on labor supply \(L_{t}(S_0,G_{t})=l_{h,t}+l_{r,t}+l_{p,t}\), which says that labor demand of all three sectors has to add up to the effectively available labor supply. We posit the following utility function:

where \(\sigma\) is the constant elasticity of substitution in consumption and b is the weight that the household assigns to utility that arise from other sources than consumption, with \(0<\phi <1\). Setting up the appropriate Hamiltonian and Transversality conditions in the Appendix, we derive the following optimality conditions:

which are the Keynes-Ramsey rule and the Hotelling rule for the model at hand; the net return to capital is given by \(r-\chi -v_{K}S_{0}\). For the demand for health goods, we find that the price of medicine has to be equal to the marginal earnings that follow from improved health and increased labor supply, i.e.,

2.5 Equilibrium

We define an equilibrium for the market economy as a sequence of prices \(\{p_{h,t},p_{r,t},p_{b,t},r_t,w_{h,t}, w_{p,t}, w_{r,t}\}_{t=0}^\infty\) and allocations \(\{B_t, c_t, G_t, K_t, l_{h,t}, l_{p,t}, l_{r,t}, R_t, Y_t\}_{t=0}^\infty\)

such that the household maximizes utility, firms in the final good, the health and the research sector maximize profits and the markets for all inputs and outputs clear. That includes the markets for the final good, capital, resources, knowledge and labor, whereby labor demand and supply has to equate in the health, final good and research sector. These conditions imply that

To obtain the market clearing condition for health goods, we equate demand and supply for health goods by substituting the price for health goods \(p_{h,t}\) from (14) into (10). This yields

We note that this equation yields a value for \(l_{h}\), which is constant over time and linearly increasing in \(S_0\) and \(v_H\). It decreases in labor productivity in the health sector, \(\eta\).

We use the demand equation for knowledge from (3) and substitute it into the labor market clearing \(w_{p,t}=w_{r,t}\) to obtain

It is noteworthy that the labor input in production is independent of the total stock of labor and pollution and actually a constant that depends on factor shares and the productivity of labor in research. Having solved for labor input in two out of three sectors, i.e. \(l_h\) and \(l_p\), we can determine the equilibrium for labor in research by using \(L_t=l_h+l_p+l_{r,t}\) so that we have

In contrast to labor in the final good sector \(l_p\), labor input in research \(l_r\) is influenced by pollution, via the impact of \(S_0\) on \(L_t\) and \(l_h\). First, pollution reduces the total available stock of labor \(L_t\):

since the effects of pollution cannot be perfectly offset by the health sector. Alternatively, we can write \(L_t=L-\frac{\theta S_0}{\xi }\). To mitigate some of the effects of pollution it is necessary to employ labor \(l_h\) in the health sector so that the pool of labor that could be employed in research is further reduced. This is the second effect so that the total amount of available labor net of employment in the health sector is

which we can use in (17) to express \(l_r\) only in terms of \(S_0\)

The remaining dynamics are found by combining the Keynes-Ramsey rule and the Hotelling rule. Hence, from (13) we obtain

We use this expression together with the logarithmic version of (3), i.e. \(\hat{p}_{r,t}=\hat{Y}_{t}-\hat{R}_{t}\) to arrive at

2.6 Balanced Growth Path

We now consider a balanced growth path (BGP) along which output, consumption, and capital grow at the same rate. We proove existence of the BGP in the Appendix. We have seen that labor input in all sectors is constant in any equilibrium. Logarithmic differentiation of the production function for consumption goods given \(\hat{l}_{p}=0\) yields

which gives

Substituting \(\hat{B}=\kappa l_r\) from (4) and (19) yields the following proposition:

Proposition 1

The growth rate of consumption along a balanced growth path is given by

Note that this is also the growth rate of consumption per capita, since the population remains constant. We find that available resource stock \(S_0\) decreases the growth rate in two ways: First, it reduces the labor stock that could be used in research, as is shown by \(\theta S_0\). The reason is that with higher pollution the household supplies more labor to the health sector which reduces the remaining pool of labor for research. Additionally, \(l_r\) suffers from the health damages that remain unmitigated of magnitude \(\theta S_0/\xi\) even with health goods. Second, pollution increases the probability of dying and renders the household more impatient.

In order to find the optimal amount of labor in the health sector, we maximize the growth rate of consumption per capita \(\hat{c}\) with respect to \(l_{h}\), taking into account that \(L_t=\overline{L}-(v_H S_0)^2/(\eta l_h)\) and we obtain the following lemma

Lemma 1

The growth maximizing input of labor in the health sector is given by the following condition:

which is larger than the market outcome in (15), since the firms in the health sector do not internalize the spillovers that occur between them.

We find that the economy would attain a higher growth rate if labor input in the research sector was reduced and labor input in the health sector increased, as such a reallocation would decrease health damages and increase the total available labor supply. To see, compare the labor input in the research sector in the market outcome from (19) to the labor input when the growth rate is maximized and \(l_h\) is set to \(l_h^*\) as defined in the lemma above:

This term is larger than \(l_r\) from (19) if \(2<(1+\xi )/(\sqrt{\xi })\) which holds for all \(\xi <1\).

However, it is clear that the economy would grow faster if pollution had no impact on health. In this case, one could emit \(l_{h}\) from the growth rate equation as supplying labor to the health sector would be pointless.

By rewriting (13) and using (20) we find that pollution also affects the accumulation of capital:

Note that along a steady state the values of \(L_t, l_r\), and \(l_h\) are fixed independently of r. Hence, we find that pollution impacts the long-term ratio of output to capital in three ways: First, a larger value of \(S_0\) reduces the total amount of labor and hence labor employed in research. This reduces the economy’s growth rate and makes output comparatively small to physical capital in the long-run. Second, \(S_0\) increases the depreciation rate of capital, slowing down its accumulation and leading to higher output-capital ratio. Third, the probability of dying increases with pollution and also reduces the incentives to invest into capital, also increasing the ratio of \(Y_t\) to \(K_t\).

3 Social Planner Solution

The social planner maximizes the following expression

subject to the following constraints

with respect to the choice variables \(c_t, l_{r,t}, l_{h,t}, l_{p,t}\) and \(R_t\), as well as the state variables \(K_t, S_t\) and \(B_t\). The values of \(K_0, S_0\) and \(B_0\) are given. We provide the Hamiltonian and the first order conditions in the Appendix.

Combining Eqs. (43) and (49) from the Appendix yields the Keynes-Ramsey rule

Next, we turn to a balanced growth path—analogously to the market economy—and define such a path as one along which consumption, output and capital grow at the same rate, while the total stock of labor is constant and so is employment in all three sectors. Thus, we obtain

Combining this with the time derivative of the production function, i.e. \(\hat{c}=\frac{\beta \hat{R}}{1-\alpha }+\frac{\gamma \hat{B}}{1-\alpha }\) yields

which is the same expression as in the decentralized model. In the Appendix, we derive another equation that relates the growth rate of consumption \(\hat{c}\) to employment in the productive sector

Hence, the balanced growth path of the social planner solution is fully characterized by (25), (26), (46) and the labor constraint. We can solve for the growth rate of consumption by using that \(l_p=L_t-l_r-l_h\) in (26) and then substituting \(l_r\) from (25) into (26). Thus, we have

where we also use the optimal labor input in the health sector

so that the available labor supply net of employment in the health sector is

Note that the social planner employs the amount of labor in the health sector that maximizes the economy’s growth rate so that she unambiguously hires more labor in the health sector than the market economy does. We find that the growth rate of consumption is unaffected by resource use and the depreciation of capital due to pollution. However, we find that health effects play a crucial role in determining the growth rate.

Comparing the optimal growth rate in (27) to the one obtained in (21) we find three differences. First, the social planner hires the amount of labor that increases the total available supply of labor, as she internalizes the spill-over effects in the health sector. Maximizing labor supply is optimal since it allows for more labor to be employed in the final good as well as in the health sector, maximizing output today and tomorrow via the impact on the growth rate. Therefore the expression \(\overline{L}-\epsilon S_0\) in (27) is larger than the respective term \(\overline{L}-\nu S_0\) in the market solution from (21). Second, we find that in the social optimum in the numerator of the growth rate \(\delta\) is multiplied with \(p(S_0)\) which increases the growth rate in the optimal solution. Third, in the optimal solution the factor share of labor \(\delta\) is multiplied in the denominator by the preference parameter \(\sigma\) while it is not in the market solution so that the socially optimal growth rate might be smaller for \(\sigma\) sufficiently high. However, only this third difference might decrease the socially optimal growth rate relative to the market outcome, and only if \(\sigma\) is substantially larger than one which seems unlikely under reasonable parameter values.

In order to compare the labor input in research between the market economy and the social optimum we solve for \(l_r\) and obtain

where we use the superscript S to denote the social planner solution. The input of labor in production is given by

In contrast to the decentralized economy the input of labor in production, \(l_p^S\) depends on health effects as is shown by \(\overline{L}-\epsilon S_0\). The impact of pollution on labor is not only born by the research sector but also by the productive sector. Moreover, pollution has two opposing effects on labor in the productive sector. On the one hand, \(S_0\) decreases the total stock of labor and therefore also \(l_p^S\), as can be seen by \(\epsilon S_0\). On the other hand, \(S_0\) increases \(p(\cdot )\) and therefore raises the labor input into production. The first one can be seen as a form of income effect while the second one is a substitution effect away from research to production. This explains why we observe the term \(\delta p(S_0)\) in the equation for the per capita growth rate of the economy (27).

Due to the different parameter constellations determining \(l_r^S\) and \(l_p^S\) it is not clear whether these variables are greater or smaller than their conterparts from the market economy. Though, the case with logarithmic utility \(\sigma =1\) yields some clarity, as \(l_p^S\) becomes \(l_p^S(\sigma =1)=\frac{\delta p(S_0)}{\kappa \gamma },\) since \(1-\alpha =\beta +\gamma +\delta\). Hence, in this case the labor input in production is just the fraction \(p(S_0)\) of what it is in the market economy and the freed labor is employed in research, with \(l^S_r(\sigma =1)=\overline{L}-\epsilon S_0-\frac{\delta p(S_0)}{\kappa \gamma }\). By continuity, this also holds in a reasonable proximity of \(\sigma =1\).

We also study the impact of pollution on the accumulation of capital in the social optimum. As we show in the Appendix, the long-run return to capital reads

which looks similar to (23). Hereby, we let \(r^s\) stand for \(\alpha Y/K\), i.e. the long run marginal product of capital in the social optimum. We find that the social planner internalizes the depreciation of capital—natural and due to pollution—when determining the relationship between labor and the return to capital. As in the decentralized economy, \(r^s\) does not determine the input of labor but \(l_p\) determines r, since \(l_h\) and \(l_r\) are chosen independently and thus fix \(l_p\). Hence, higher values of depreciation are not reflected in the long run level of \(l_p\) but in \(r^s\), which the social planner adjusts accordingly. He does so by changing the long-run ratio of Y to K which is only possible by influencing the transitional path of K to the steady state, since Y and K have to grow at the same rate along the balanced growth path. We find that damages to capital \(v_K S_0\) have the same level effect as in the decentralized economy. The level effect stemming from health deterioration might be larger or smaller depending on whether \(\sigma /(\sigma -1)\) is larger or smaller than \(\alpha\) given that \(l_p\) in the social optimum is smaller than in the market outcome. We summarize our results in the following proposition:

Proposition 2

In the social planner solution, the growth rate of consumption per capita along a balanced growth rate is given by (27). The labor input in the health, research and final good sector are provided in (28), (29), (30). The condition \(\sigma <1\) is sufficient for the economy to grow faster in the social optimum than in the decentralized economy.

4 Maximizing Utility Along a Balanced Growth Path

In the following, we study how \(S_0\) should be set by the social planner to maximize utility of the household along a BGP, i.e.

where we assume \(\hat{c}(1-\sigma )-p(S_0)<0\). Conceptually, we first determine the balanced growth path, with \(S_0\) fixed. In addition to the dynamic equations that we derived above, a growth path is defined by the initial values of the stock variables, i.e. \(K_0, B_0\) and \(S_0\). Therefore each \(S_0\) might lead to a different path with different utility for the household and we let the social planner choose among all the paths the one that maximizes discounted utility.

In order to do so, we express the household’s utility only in terms of \(S_0\), given the values of \(K_0\) and \(B_0\). We know that \(\hat{c}\) is given by (27) and turn to \(c_0\) next. Along a balanced growth path we can write the aggregate budget constraint as

where \(Y_0\) depends on the given values \(K_0\) and \(B_0\) but also on \(l_p\) and \(R_0\) which we need to express as functions of \(S_0\). From (30) we have \(l_p^S\). In order to examine \(R_0\) we denote the socially optimal level of \(S_0\) as \(S_0^*\) while the total endowment of the economy is simply \(\overline{S}_0\). Ex ante one can be larger than the other and we define the social planner’s optimal choice of \(S_0^*\) as the amount of resources that is taken out of the ground over time, i.e.

where \(R_t^* \, \forall t\) is the optimal path of extraction determined by \(S_0^*\). If \(S_0^*<\overline{S}_0\) then the social planner will leave some resources in the ground and not use them in production. Concerning the sequence of \(R_t\) we recall, that we are looking at a balanced growth path on which extractions grow at a constant rate given by (24). Hence,

where we find two effects of \(S_0\) on \(R_0\): First, extractions increase linearly in the total available stock as is shown by the linear term for \(S_0\). Second, detrimental health effects slow down economic growth and therefore reduce extractions as is shown by \(-\epsilon S_0\). This expression reflects the conflict between the present and the future: Increasing \(S_0\) leads to immediate benefits but to costs that accumulate in the future.

Finally, we can maximize (32) over \(S_0\) subject to (27), (30), (33), and (34). Before we do so, we make some simplifying assumptions in order to arrive at an analytical solution. First, we assume logarithmic utility, as in Golosov et al. (2014). Second, we borrow the assumption that the savings rate in the long run is independent of pollution and we consider \(c_t=(1-s)Y_t\), with \(\partial s/\partial S_0=0\) and third, we omit the probability of dying \(\tilde{p}(S_0)\). These assumptions reduce the maximization problem of the social planner to the following expression:

which leads to:

In line with our specification of damages to capital, we consider the following sequence of events: First, the social planner chooses \(S_0\). Afterwards the amount \(v_K S_0 K_0\) of capital is destroyed and only then production takes place. Hence, the relevant derivatives for the case \(\sigma =1\)Footnote 17 are

Let us discuss them in turn. The impact of the resource endowment \(S_0\) on the initial level of consumption, i.e. \(\partial c_0/\partial S_0\), depends on its influence on output \(Y_0\) via damages to capital, labor supply, and resource useFootnote 18. We find that with logarithmic preferences the impact of \(S_0\) on labor and resources is constant and specifically zero in the case for labor supply. The amount of labor that the social planner hires in the final good sector is thus independent of pollution and all health damages will be reflected in less employment in the research sector. In the case of resource use, the impact of \(S_0\) is clearly positive which was to be expected.

The reduction of labor in the research sector through resource use \(S_0\) is also reflected in the negative sign of the derivative of the consumption growth rate \(\partial \hat{c}/\partial S_0\). With less employment in the research sector the advancement of technology occurs at a slower rate, reducing the potential for consumption to grow. This effect is particularly strong with logarithmic preferences since, in this case, health effects only lead to less employment in the research sector.

Substituting everything yields

so that the optimal \(S_0\) balances the benefit of the resource against the sum of damages to capital, health and utility. Setting \(\epsilon =0\) and \(b=0\), we obtain the optimal level of \(S_0\) with capital damages only \(S_0^1=\beta /\alpha v_K\). Solving for \(S_0\) if capital and utility damages are absent, yields \(S_0^2=\left( \frac{(1-\alpha )\beta \rho }{\kappa \gamma \epsilon }\right)\). When all types of damages are present we have

Proposition 3

The optimal stock of resources is

It is the ratio of the net benefits, i.e. the economic benefits of the resource minus the impact on utility, divided by the sum of the damages to capital and health.

From the calculations from above we know that the optimal amount of resources under both types of damages must be smaller than when only one type is relevant, hence \(S_0^*<\text {min}(S_0^1,S_0^2)\). However, whether damages to health or damages to capital are stronger is a question of calibration and we cannot analytically determine whether \(S_0^1\) or \(S_0^2\) is larger.

5 Calibration

Determining \(S_0^*\) from Proposition 3 requires a careful calibration of the model parameters whereby \(v_K\) and \(\epsilon\) play an important role. We discuss in turn how we choose their respective values and note that we consider a single economy that represents the world in our model.

5.1 Calibrating Damages to Capital

First, we turn to the damages from climate change to physical capital. Since in reality these damages are highly heterogeneous across countries (by magnitude of \(10^2\)) and non-linear in pollution stock and temperature, we have to linearize parts of the damage function and form averages. Also, It requires some projection about the possible climate scenarios.

According to Kompas et al. (2018) total GDP losses for a global mean temperature increase of \(3^\circ\) C are \(3\%\), while for an increase of \(4^\circ\) C they amount to \(7.5\%\), an increase by the factor 2.5. Bretschger (2012) finds that for the case that under the best possible climate scenario that can be realistically achieved, i.e., a mean temperature increase of \(2^\circ\) C, the global costs of climate policy will be 0.2% of GDP. The highest increase in temperature considered by the IPCC are \(5^\circ\) C. We will consider that this increase will occur if all remaining fossil fuels are burnt in the future. Due to the non-convexity of the damage function, we assume that this increase leads to damages of \(30\%\) of GDP, so that damages increase by a factor of 4 compared to the \(4^\circ\) C scenario.

Since we maximize utility along a balanced growth path with a constant GDP to capital ratio, we posit that damages to GDP in percentage translate into the same amount of damages to capital in percentage. Hence, our climate induced depreciation rate \(v_K S_0\) measures the loss of capital in percentage and depends on the total available stock of fossil resources for which we rely on BP Statistical Review of World Energy by BP (2020). This review contains the data shown in Table 1.

To express the three quantities in a single unit, we use “tonnes of oil equivalent”, which means that we express gas and coal in the amount of tonnes of oil that contain the same energy. We have the following conversion rates

-

1 barrel of oil \(\equiv\) 0.1364 metric tonnes of oil

-

1 tonne of oil \(\equiv\) 1.4286 tonnes of coal. (This is based on energy equivalency, i.e., a tonne of oil contains the same amount of energy as a 1.4286 tonnes of coal.)

-

1 billion \(\text {m}^3\) of natural gas \(\equiv\) 0.860 million tonnes of oil (also based on energy equivalency).

Applying these conversion rates and summing yields a total of roughly \(1.156\cdot 10^{12}\) tonnes of oil equivalent. With this number and the assumption that climate damages for a temperature increase of \(5^\circ\) C are equal to \(30\%\) we use the following simple equation

to set \(v_K\) equal to \(2.5952\cdot 10^{-13}\). Furthermore, we rely on Bretschger (2022) for the factor shares for capital and resources \(\alpha\) and \(\beta\) and set them to 0.265 and 0.035. Considering only damages to capital, the optimal stock is \(S_0^1=\beta /\alpha v_K\), which yields the optimal stock to be \(44.02\%\) of the total available stock.

5.2 Calibrating Damages to Health

In the following, we focus on calibrating the parameter \(\epsilon\) but not b because the estimation of the economic effects of pollution often rely on the value of statistical life (VSL). This approach builds on agent’s willingness to pay to reduce the risk of a specific illness that might arise due to pollution. Since this approach already includes considerations of preference, we consider it difficult to measure \(\epsilon\) and b separately. Therefore we omit b and assume that impacts of pollution through health and the appreciation of health enter both through \(\epsilon\).

In order to calibrate the health impacts, we use data for the two different mechanisms: First, the reduction in GDP due to increased mortality and morbidity from heat. Second, the reduction in GDP due to increased pollution and subsequent mortality and morbidity. For the first mechanism, Roson and Sartori (2016) provide country specific impacts arising from heat itself but also from diseases whose incidences increase with heat-when the global temperature increases by \(3^\circ\) C. For our calibration, we rely on Carleton et al. (2022), where the authors estimate the impact of health from climate change on the world economy, accounting for abatement. They find that in a high emission scenario \(3.2\%\) of world GDP is lost. Such a scenario would entail a temperature increase of \(3.75^\circ\) C.

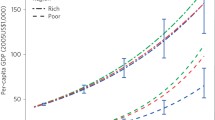

For the second mechanism, Shindell et al. (2018) and OECD (2016) provide the following estimates: The former find that reducing the goal for climate policy from \(2^\circ\) to \(1.5^\circ\) might yield gains of \(0.5\%\) to \(0.6\%\) of world GDP in terms of reduced mortality and morbidity from pollution. The latter argue that the health damages from pollution will reach \(1\%\) of world GDP in 2060, using own projections for the development of different pollutants. The point estimate of \(1\%\) is corroborated by Crawford-Brown (2022). He studies the impact when no climate policy is undertaken and the temperature increase is unbounded. In contrast to that, the World Bank (2007) provide a contrasting study with a significantly higher impact, i.e., of \(5.78\%\) of GDP in China in 2006, while Landrigan et al. (2018) find that productivity losses for the whole world amount to \(0.16\%\) of GDP, whereby there is significant heterogeneity, i.e. the damages amount to \(1.9\%\) in low income countries and to \(0.054\%\) in high income countries. In total, they find that global welfare damages are \(5.6\%\) of GDP. Taking these findings together we find it necessary to distinguish between a high damage and a low damage case. For high damages we will use the \(5.6\%\) estimate and for low damages \(1\%\).

As a first step, we make the same assumption as for capital damages: Percentage damages to GDP are equal to percentage damages to the total labor supply, as their ratio is constant along a BGP. In the next step, we turn to the labor supply equation in the social optimum and write

Given the estimates for the reductions in labor supply that arise from heat and pollution we have \(L_t(5^\circ )=\overline{L}(1-0.032-0.0)\) in the high damage case; and plugging into (38) yields

where we normalize the population \(\overline{L}\) to 1.Footnote 19 Using the estimate of low damages to health from pollution, i.e., \(1\%\), we obtain \(\epsilon _l= 3.6332\cdot 10^{-14}\).

5.3 Calibrating the Remaining Parameters

The last step to determine \(S_0^*\) is to find the value for the productivity of research \(\kappa\) and spillovers in the health sector \(1-\xi\), as well as the factor shares for innovation and labor \(\gamma\) and \(\delta\). As our calibration target, we use a growth rate of \(2\%\) for per capita consumption in the competitive economy. For the spillovers in the health sector, we rely on the literature on cost reduction due to an expansion of Medicare Advanced (MA). Baicker et al. (2013) find that a an increase of \(10\%\) in the penetration of Medicare Advanced leads to fall in hospitalization costs of \(4.7\%\). Chernew et al. (2008) estimate that an increase in MA of one percentage point yields a reduction of one percentage point in Traditional Medicare (TM) spending. Reexamining the relationship between MA penetration and TA spending after the introduction of the Affordable care act, Feyman et al. (2021) estimate that a one percentage point increase in MA penetration leads to a cost reduction for TM of 0.7 percentage points. We refer to the authors’ work for a comprehensive overview of the literature on the spillovers between MA and TA.

We note that these estimates stem from the health system of the United States, which is well known outlier in terms of health care spending; with its share of GDP devoted to health care being significantly larger, as well as growing substantially faster than in other countries (Chandra and Skinner 2012). Additionally, Garber and Skinner (2008), Muennig and Glied (2010), and Papanicolas et al. (2018) document the absence of superior health outcomes. Together with Laugesen and Glied (2011), these studies indicate that the driving forces behind the high spending are administrative costs, pharmaceutical costs, and wages of physicians and nurses. To our knowledge there is has not been an attempt to measure health sector spillovers outside of the US so that the question whether spillover in other countries are smaller or larger remains open. Theoretically, both is possible; considering the health care system in the US as rather inefficient, spillovers can be large as a marginal improvement in efficiency will have large effects. At the same time, one could argue that the spillovers are small in the US because the inefficient system does not allow the spillovers to spread throughout the health care system. Therefore, we will use the estimate from Baicker et al. (2013) in our baseline calibration, addressing this issue further below in the sensitivity analysis. Concerning the application of this estimate we make the following assumption: An increase of \(10\%\) in the average labor supply to the health sector leads to an increase in productivity of \(4.7\%\) for an individual health firm so that

From (21) we see that the growth rate of consumption depends on the parameter \(\nu\), which is an amalgamation of parameters according to

where we can express \(\frac{v_H}{\eta ^{\frac{1}{2}}}\) as \(\epsilon /2\) to obtain \(\nu _h=1.1381\cdot 10^{-13}\), where we again differentiate between high and low damages from pollution to health, with \(\nu _l\) being \(5.3228\cdot 10^{-14}\). Finally, we set the parameter \(\delta\) to 0.65, i.e., smaller than the more standard value of 0.7 in order to account for a decrease in the labor share as is observed in Autor and Salomons (2018) and Autor et al. (2020). This leaves \(\gamma\) to be 0.05. Hence, we have for \(\kappa\)

where we increase the discount rate \(p(S_0)\) from its common value of \(2\%\) to \(3\%\) to reflect increased mortality from climate change. Accordingly \(\kappa _l\) is equal to 14.1731.

Taking all this together yields an optimal stock of resources, \(S_0\) that is equal to \(2.45\%\) of the total available stock under low damages to health from pollution and just \(1.09\%\) of the total available stock of fossil resources under high damages to health from pollution. Setting \(v_K\) equal to zero yields optimal stocks that are equal to \(2.59\%\) and \(1.12\%\) of the total stock under the low and high damages scenario respectively. This is a drastic difference, whereby the impact of damages to capital only accounts for a difference of 0.14 and 0.03 percentage points. We address these findings in the next section.

6 Discussion and Sensitivity Analysis

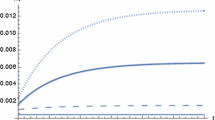

In this section, we further explore our finding that damages to health reduce the optimal resource stock of \(S_0\) so strongly. The first reason lies in the model structure where we assume that labor is the only input that matters for long-run growth and the innovative sector entails dynamic externalities. Hence, a lower labor input leads to less innovations today and fewer innovations today lead to slower growth in all following periods. If, however, the research sector required resources as an input, reducing the total available amount \(S_0\) would have an impact on long-run growth. This question is outside the scope of this study and we leave it to future research. The accumulated effect of slower GDP growth becomes very large when added over all future periods and Eq. (36) accounts for this slower growth in the future by dividing the health impact \(\kappa \gamma \epsilon /(1-\alpha )\) by \(\rho\). Thus the term \(\kappa \gamma \epsilon /(1-\alpha )\rho\) is larger than the term for capital damages \(\alpha v_K\) by the factor 100. Having the stock of resources affect growth positively would increase the optimal stock of resources to be extracted. In the following, we vary parameter values and study how that impacts the optimal policy recommendation.

6.1 The Discount Rate

The choice of the appropriate discount is crucial in the sustainability context. Hence, we let \(\rho\) vary and provide the results in Table 2, with all values being in percentages. Hereby, we distinguish between the cases of low and high damages to health and write \(S_{0\,l}/S_0\) and \(S_{0\,h}/S_0\) for the ratio of the optimal stock to the total available stock respectively. We will call these ratios optimal ratios. As expected, higher impatience increases the optimal stock of resources. When \(\rho\) takes its largest possible value of 100% we arrive at ratios of \(28.66\%\) and \(19.67\%\). With such a high discount rate, the relative importance of damages to capital increases as we see by setting \(v_K=0\). Doing so yields values of \(82.15\%\) and \(35.56\%\) for \(\rho =1\). The contribution of capital damages to the optimal stock is the difference between \(S_{0\,l}/S_0\) and \(S_{0\,l}/S_0(v_K=0)\) for low health damages and analogously for high health damages. When \(\rho =1\), the contribution of capital damages becomes 53.49 and 15.89 percentage points, instead of almost zero when \(\rho\) is equal to \(3\%\) or less. Overall, we find that damages to capital do not impact the optimal stock significantly unless the discount rate exceeds \(30\%\), and we can show that the impact of \(\rho\) almost solely comes through Eq. (36) by removing \(\rho\) from this equation. Then, the optimal ratios are \(28.66\%\) and \(19.67\%\) which are the values we have for \(\rho =1\).

6.2 The Impact on Labor

In our calibration we assume that the relative loss of output is equal to the loss of labor. In this section, we loosen this assumption and investigate the possibility that the relative loss of labor is less than the relative loss of output. This might be the case for the following reasons: First, the damages to GDP from the impact of pollution on health rely partially on the value of statistical life approach. As mentioned above, this approach captures households’ willingness to pay and not directly their reduced labor supply. Second, increased pollution might lead to higher health spending and costs which shift resources in the economy but do not imply reduces labor supply. Hence, we introduce a scaling parameter \(\tau <1\) with which we multiply \(\epsilon\) in (39) to allow for smaller labor losses in the economy. Note that \(\kappa\) also depends on labor losses and thus \(\epsilon\). Hence, varying \(\epsilon\) is not equivalent as varying \(\rho ^{-1}\), as one might suspect from observing (36).

We find that even when we consider labor losses that are significantly smaller than those in the calibration section, a more drastic climate policy is warranted than one based on damages to capital alone. Setting \(\tau =5\%\), so that labor losses are \(0.21\%\) and \(0.449\%\) under the low and high damage scenario, the optimal stock amounts to 55.03 and 25.65, i.e., half or a quarter of total available stock in absence of damages to capital. Introducing damages to capital in this case further reduces the optimal stock to 24.46 and 16.21 percent of the total stock respectively. For larger values of \(\tau\) this effect becomes stronger and once yearly labor losses exceed \(2.1\%\), which is the product of \(\tau =0.5\) and the losses in the low damage scenario \(4.2\%\), health damages dominate the optimal stock of resources, with the effect of capital on the optimal stock becoming marginal. Only for values of \(\tau \%\) below \(2.5\%\) we find that health effects become irrelevant as the optimal stock in absence of capital damages exceeds the available stock.

6.3 Health Spillovers

The last sensitivity analysis that we undertake relates to the spillovers in the health sector; and instead of relying on the estimates by Baicker et al. (2013), we will use the findings from Feyman et al. (2021), which yields

This value implies a lower productivity in the health sector, but larger spillovers, and we will use this value to repeat the calculation behind Tables 2 and 3; providing the results in Tables 4 and 5. In Table 4, we see that the lower productivity of the health sector translates into a lower optimal stock of resources for all values of \(\rho\), irrespectively of the presence of damages to capital. Comparing \(S_{0l}/S_0\) and \(S_{0h}/S_0\) for our baseline case of \(\rho =0.03\) we find that the value of 2.45 falls to 2.37 when health damages are low and from 1.09 to 1.02 when damages are high. Expressed in ratios this reads \(2.45/2.37=1.0338\) and \(1.09/1.02=1.0686\), and we observe that these ratios are falling with \(\rho\), being at most 1.0789 for the case of \(\rho =1\) and under high health damages.

In Table 5, we reconsider how the sensitivity of labor to health and pollution damages impacts the optimal resource stock when labor losses affect GDP less severely. We find that, as before, the optimal stocks are smaller across all configurations, i.e., all values in 5 are smaller than in 3. The largest relative difference between optimal stocks arises for \(\tau =100\) with high damages to health and no damages to capital, that is \(S_{0h}(v_K=0)/S_0\), where we find \(1.12/1.04=1.0789\). As in Table 4 this ratio falls when \(\tau\) decreases. Thus, we conclude that our calibration is relatively robust to the calibration of the health spillovers and the productivity of the health sector, with the optimal resource share being at most \(8\%\) larger when we rely on the estimate of Baicker et al. (2013).

7 Stranded Assets

Our findings prescribe a fairly small stock of fossil fuels that the world economy should extract in the optimum. This assumes that households do not assign a positive value to the stock of resources in their utility function, which applies for the vast majority of the world’s population who do not own resource stock. These households will not suffer from a politically induced stranding of resource wealth. However, resource-rich countries will put a value on owning these stocks and assert a welfare loss with stringent climate policy. To include this perspective in our model, we introduce the resource stock as a positive argument in the utility function. Hence, the social planner maximizes the following utility function along the balanced growth path:

where \(\eta\) measures the intensity of preference for the stock. Accordingly (36) is replaced by

Since \(\eta\) is a measure of preferences there are some liberties in choosing its value. We find that the values 0.01, 0.02, 0.05, 0.1, 0.50 and 1 offer insight into how such a stranded assets thought can shape the results.

Table 6 provides the ratios of the optimal stock divided by the total stock. When \(\eta\) takes the value of 0.01 we only find a very small change in the optimal ratio compared to our baseline calibration, especially in the case of high health damages where the optimal ratio moves up from \(1.09\%\) to \(1.41\%\). Increasing \(\eta\) leads to larger ratios and the optimal ratio reaches roughly \(72\%\) when \(\eta\) is one and damages to health are low. However, for high health damages this number is significantly smaller, taking a value of \(32\%\).

One might conclude that the argument of stranded resource assets has the potential to weaken our results on the stock to be extracted significantly. Yet, this does actually not apply. We include preferences for the stock above in the form of \(\eta \cdot \log (S_0)\) and since \(S_0\) is a number of magnitude of \(10^{12}\), the utility from this term can be large, especially when \(\eta\) is close to 1. Since the GDP of developed countries is of the same magnitude, i.e., \(10^{12}\), setting \(\eta =1\) would mean that the household evaluates the resource stock the same way it evaluates consumption. Clearly, this is a drastic assumption, given the huge uncertainties of future resource revenues. We see that when \(\eta\) falls to 0.2 and therefore the weight on the resource stock is only a fifth of the weight on consumption, the optimal ratio drops to below \(10\%\) when climate damages are high, which is much closer to our main results.

8 Conclusions

We have developed a model with endogenous climate change and knowledge-driven economic growth, which adds to the existing literature by highlighting the central role of human health. Our framework includes a separate health sector and considers the externalities of burning fossil fuels to both physical capital and the health of the labor force. We have shown that economic growth is typically lower in the decentralized equilibrium compared to social optimum. We have calculated the resource stock that is available for extraction in the social optimum in closed-form. When calibrating the model we have found that, when only considering climate damages to the capital stock, in the optimum the stock of resources available for extraction is about 44% of total total available fossil resources, i.e., coal, gas, and oil. If we add health damages, however, this value is reduced to 1.09% - 2.45% of available stock. These results reflect that human health has not only a static effects but is also positively related to the economic growth rate, so that reducing its size has a large negative effect on welfare. Results are robust against various model and parameter variations. We conclude that, taking the health effects of fossil fuel emissions into account, calls for a significantly more stringent climate policy compared to the standard climate economic literature.

We are aware that our conclusions for an optimal environmental policy appear quite radical. However, the results are less surprising when considering that health effects of regional air pollution have been misconceived for a long time and treated separately from climate damages. Hence, combining the two effects and highlighting the dynamic effects of a healthy labor force provides abundant intuition for the results. One may want to analyse the health sector in more detail in order to explain differences between the countries. Or it may be instructive to look deeper into the education of the labor force. These and related topics are left for further research.

Notes

These percentages refer to the currently known resource stocks, which are also used for the present paper.

The optimum concerns resource supply, in the spirit of Harstad (2012), rather than the carbon price, which is more frequently used in the literature; we will follow the supply side approach in this paper.

Roson and Sartori (2016) provide a summary of meta-analyses and estimate specific damage functions for different sectors and 140 countries.

For a theoretical treatment of pollution effects on health and productivity in a static model see Williams (2002).

Deaths are mainly caused by malnutrition, malaria, diarrhoea and heat stress; the cost figure excludes costs in health-determining sectors such as agriculture, water, and sanitation. Climate-sensitive health risks are disproportionately felt by the most vulnerable and disadvantaged (WHO 2021).

A sector that is especially important for mitigation of health risks is the transport sector, see Pörtner et al. (2022) p. SPM-41.

Using the approach of the value of a statistical life, total cost of air and water pollution in China were about 5.78 percent of GDP in 2003 (World Bank 2007, p. xvii).

Kompas et al. (2018) use a large intertemporal CGE trade model to account for the various effects of global warming on income and growth for 139 countries and find considerable global economic gains from complying with the Paris Climate Accord. Guo et al. (2021) finds that the global economy could be impacted by an additional 10% loss in GDP by mid-century under the baseline \(2-2.6^\circ\)C temperature-rise scenario compared to if the Paris Agreement and net-zero emissions targets are achieved.

We deliberately deviate from the richer (Romer 1990) setup where knowledge takes the form of patents or blueprints that are used to produce intermediate goods; the implied monopolistic distortions in the intermediates’ sector are not the focus of our attention.

We abstract from natural decay for simplicity; our assumptions follow the approach of Bretschger and Karydas (2019).

For a model of climate change where health is an argument in the utility function see Bretschger and Vinogradova (2017).

We do not explicitly model the fact that regional pollution stock has a different decay rate than global pollution stock, the difference is captured by the impact intensities which we calibrate in the quantitative section.

There is a large literature on the relevance of social network effects between doctors when it comes to the adoption of new drugs and an increasing literature about the prevalence of spillovers in the health sector. See Chandra and Staiger (2007), Callison (2016), and Baicker et al. (2013) and the references therein.

We abstract from life-insurance in our model. Implicitly we assume that the capital stock of a dying cohort is distributed among the remaining cohorts so that the aggregate budget constraint is given by the above expression.

For interest, we provide the derivatives of key variables with respect to \(S_0\) for the case \(\sigma \ne 1\) in the Appendix.

Damages to capital should be \(v_K K_{-1}\), however we assume without loss of generality that the stocks of capital \(K_{-1}\) and \(K_0\) are the same.

We could also use the world population but this is not of relevance, because a higher value of \(\overline{L}\) leads to a lower value of \(\kappa\).

References

Ackerman F, Stanton EA, Bueno R (2013) Epstein-zin utility in dice: Is risk aversion irrelevant to climate policy? Environ Resource Econ 56:73–84

Aloi M, Tournemaine F (2011) Growth effects of environmental policy when pollution affects health. Econ Model 28(4):1683–1695

Auffhammer M (2018) Quantifying economic damages from climate change. J Econ Perspect 32(4):33–52

Augier L, Yaly A (2013) Economic growth and disease in the OLG model: the HIV/AIDS case. Econ Model 33:471–481

Autor D, Dorn D, Katz LF, Patterson C, Van Reenen J (2020) The fall of the labor share and the rise of superstar firms. Q J Econ 135(2):645–709

Autor D, Salomons A (2018) Is automation labor-displacing? Productivity growth, employment, and the labor share. Technical report, National Bureau of Economic Research

Baicker K, Chernew ME, Robbins JA (2013) The spillover effects of medicare managed care: medicare advantage and hospital utilization. J Health Econ 32(6):1289–1300

Blanchard OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93(2):223–247

BP (2020) Statistical review of the world economy

Bretschger L (2022) Green road is open: Economic pathway with a carbon price escalator. Economics Working Paper Series

Bretschger L, Karydas C (2019) Economics of climate change: introducing the basic climate economic (BCE) model. Environ Dev Econ 24(6):560–582

Bretschger L, Pattakou A (2019) As bad as it gets: how climate damage functions affect growth and the social cost of carbon. Environ Resource Econ 72:5–26

Bretschger L, Vinogradova A (2017) Human development at risk: economic growth with pollution-induced health shocks. Environ Resource Econ 66(3):481–495

Callison K (2016) Medicare managed care spillovers and treatment intensity. Health Econ 25(7):873–887

Carleton T, Jina A, Delgado M, Greenstone M, Houser T, Hsiang S, Hultgren A, Kopp RE, McCusker KE, Nath I et al (2022) Valuing the global mortality consequences of climate change accounting for adaptation costs and benefits. Quart J Econ 137(4):2037–2105

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116(1):119–137

Chandra A, Skinner J (2012) Technology growth and expenditure growth in health care. J Econ Lit 50(3):645–80

Chandra A, Staiger DO (2007) Productivity spillovers in health care: evidence from the treatment of heart attacks. J Polit Econ 115(1):103–140

Chernew M, DeCicca P, Town R (2008) Managed care and medical expenditures of Medicare beneficiaries. J Health Econ 27(6):1451–1461

Crawford-Brown D (2022) Analysis of the co-benefits of climate change mitigation. In: Handbook of climate change mitigation and adaptation. Springer, pp 3723–3738

Dietz S, Stern N (2015) Endogenous growth, convexity of damage and climate risk: how Nordhaus’ framework supports deep cuts in carbon emissions. Econ J 125(583):574–620

Dugan A, Prskawetz A, Raffin N (2022) The environment, life expectancy and growth in overlapping generations models: a survey. Technical report, ECON WPS-Working Papers in Economic Theory and Policy

Fabra N, Reguant M (2024) The energy transition: a balancing act. Resource Energy Econ 76(24):101408

Farmer JD, Hepburn C, Mealy P, Teytelboym A (2015) A third wave in the economics of climate change. Environ Resource Econ 62:329–357

Feyman Y, Pizer SD, Frakt AB (2021) The persistence of medicare advantage spillovers in the post-Affordable Care Act era. Health Econ 30(2):311–327

Garber AM, Skinner J (2008) Is American health care uniquely inefficient? J Econ Perspect 22(4):27–50

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82(1):41–88

Guo J, Kubli D, Saner P (2021) The economics of climate change: no action not an option. Swiss Re Institute

Harstad B (2012) Buy coal! A case for supply-side environmental policy. J Polit Econ 120(1):77–115

Hart R (2019) To everything there is a season: carbon pricing, research subsidies, and the transition to fossil-free energy. J Assoc Environ Resour Econ 6(2):349–389

Kompas T, Pham VH, Che TN (2018) The effects of climate change on GDP by country and the global economic gains from complying with the Paris climate accord. Earth’s Fut 6(8):1153–1173

Landrigan PJ, Fuller R, Acosta NJ, Adeyi O, Arnold R, Baldé AB, Bertollini R, Bose-O’Reilly S, Boufford JI, Breysse PN et al (2018) The Lancet Commission on pollution and health. Lancet 391(10119):462–512

Laugesen MJ, Glied SA (2011) Higher fees paid to US physicians drive higher spending for physician services compared to other countries. Health Aff 30(9):1647–1656

Markandya A, Sampedro J, Smith SJ, Van Dingenen R, Pizarro-Irizar C, Arto I, González-Eguino M (2018) Health co-benefits from air pollution and mitigation costs of the Paris agreement: a modelling study. Lancet Planet Health 2(3):e126–e133

McGlade C, Ekins P (2015) The geographical distribution of fossil fuels unused when limiting global warming to 2°C. Nature 517(7533):187–190

Moore FC, Diaz DB (2015) Temperature impacts on economic growth warrant stringent mitigation policy. Nat Clim Chang 5(2):127–131

Muennig PA, Glied SA (2010) What changes in survival rates tell us about us health care. Health Aff 29(11):2105–2113

Nordhaus WD, Boyer J (2000) Warming the world: economic models of global warming

OECD (2016). The economic consequences of outdoor air pollution

Papanicolas I, Woskie LR, Jha AK (2018) Health care spending in the United States and other high-income countries. JAMA 319(10):1024–1039

Pörtner H-O, Roberts DC, Poloczanska E, Mintenbeck K, Tignor M, Alegría A, Craig M, Langsdorf S, Löschke S, Möller V, et al (2022) IPCC, 2022: summary for policymakers

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5):71–102

Roson R, Sartori M (2016) Estimation of climate change damage functions for 140 regions in the GTAP9 database. J Glob Econ Anal 1(2):1

Ščasnỳ M, Massetti E, Melichar J, Carrara S (2015) Quantifying the ancillary benefits of the representative concentration pathways on air quality in europe. Environ Resource Econ 62(2):383–415

Scovronick N, Budolfson M, Dennig F, Errickson F, Fleurbaey M, Peng W, Socolow RH, Spears D, Wagner F (2019) The impact of human health co-benefits on evaluations of global climate policy. Nat Commun 10(1):2095

Shindell D, Faluvegi G, Seltzer K, Shindell C (2018) Quantified, localized health benefits of accelerated carbon dioxide emissions reductions. Nat Clim Chang 8(4):291–295

Weitzman ML (2010) What is the damages function for global warming-and what difference might it make? Clim Change Econ 1(01):57–69

WHO (2021). Climate change and health, factsheet. https://www.who.int/news-room/fact-sheets/detail/climate-change-and-health. Accessed on 21 March 2023

WHO (2022). Ambient (outdoor) air pollution, factsheet. https://www.who.int/news-room/fact-sheets/detail/ambient-(outdoor)-air-quality-and-health. Accessed on 21 March 2023

Williams RC III (2002) Environmental tax interactions when pollution affects health or productivity. J Environ Econ Manag 44(2):261–270

World Bank (2007) Cost of pollution in China: Economic estimates of physical damages (english)

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32(2):137–150

Funding

Open access funding provided by Swiss Federal Institute of Technology Zurich.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no Conflict of interest. There are no financial or non-financial interests that are directly or indirectly related to this work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank Maximillian Auffhammer and Brian Wright for valuable comments. This paper is part of a project that has received funding from the European Union’s Horizon 2020 research and innovation program under the Marie Skłodowska-Curie Grant Agreement No. 870245.

Mathematical Appendix

Mathematical Appendix

1.1 Household Problem

The Hamiltonian for this problem reads

with the two transversality conditions

For the control variables \(c,G,l_{r},l_{p}\) and R we obtain

where we write \(L_{g}=\partial L_{t}/\partial G\). We thus obtain standard conditions for \(c_{t}\) and \(R_{t}\) and find that wages have to be equal across sectors, since the Hamiltonian is linear in labor. Would a sector offer a lower wage than the other sectors it could not attract any labor. For the state variables K and S we have

Substituting and using hats to denote growth rates yields the expressions in (13).

1.2 Existence of a BGP

In this model aggregate income \(Y_t\) is spent on consumption \(c_t\), investment in physical capital \(I_t\) and health goods \(p_{h,t}G_t\). Since labor input in all sectors is constant in all competitive equilibria, \(G_t\) is also constant due to (9). From (3) we see that \(w_{p,t}\) and due to the clearing of the labor market \(w_{h,t}\) grows at the rate of output. Together with (42) this implies that also \(p_h\) grows at the rate of output. Hence, an equilibrium in which consumption and investment, i.e. capital, also grow at the rate of output is feasible, since \(Y_t=c_t+I_t+p_{h,t}G_t\).

1.3 The Social Planner Problem

The current value Hamiltonian reads

The respective optimality conditions for the variables are

Taking the time derivatives of (43) and (47) and combining them with (48) yields

As the next step, we use (43) and (44) to obtain

which we substitute into (45):

Next, we turn to (50) which we write as

Here, substituting \(\mu\) from (43) and \(\lambda\) from (51) simplifies the expression to

We combine this expression with the time derivative of (51), i.e. \(\hat{\lambda }=(1-\sigma )\hat{c}-\gamma l_r\) to obtain (26).

Using \(\hat{\lambda }+\hat{B}=\hat{\mu }+\hat{Y}\), (49), and (52) we obtain

which is an expression that is very similar to the Keynes-Ramsey rule for \(\hat{c}=\hat{Y}\). By combining it with (49) after having substituted \(\mu\) by \(c^{-\sigma }\), we arrive at (31).

1.4 More General Social Planner Problem

Without logarithmic utility we obtain

where the social planner balances the effect of a richer resource endowment, \(S_0\), on current consumption \(c_0\) and the growth rate \(\hat{g}\). The relevant derivatives become

In addition to the observations from the main text, we see that due to the increase in the probability of dying \(p(S_0)\) the economy becomes less patient and thus less willing to put aside resources for the future, which decreases the economy’s growth rate. The impact on the input of labor in the final good sector \(l_p\) is not obvious though, as two opposing effects prevail. On the one hand, more resources decrease the available labor supply, which also affects all sectors including the one producing the consumption good. On the other hand, the rise in \(p(S_0)\) increases impatience, leading to more employment in the final good sector over the research sector. Finally, resource extraction benefits from impatience, since \(p(S_0)\) as well as its derivative increase in the amount of resources used in production. Substituting everything yields an expression that we cannot solve for \(S_0\) analytically.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bretschger, L., Komarov, E. All Inclusive Climate Policy in a Growing Economy: The Role of Human Health. Environ Resource Econ (2024). https://doi.org/10.1007/s10640-024-00910-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s10640-024-00910-w