Abstract

A picture fuzzy regression function approach is a fuzzy inference system method that uses as input the lagged variables of a time series and the positive, negative and neutral membership values obtained by picture fuzzy clustering method. In a picture fuzzy regression functions method, the parameter estimation is also obtained by ordinary least squares method. Since the picture fuzzy regression functions approach is based on the ordinary least squares method, the forecasting performance decreases when there are outliers in the time series. In this study, a picture fuzzy regression function approach that can be used even in the presence of outliers in a time series is proposed. In the proposed method, the parameter estimation for the picture fuzzy regression function approach is performed based on robust regression with Bisquare, Cauchy, Fair, Huber, Logistic, Talwar and Welsch functions. The forecasting performance of the proposed method is evaluated on the time series of the Spanish and the London stock exchange time series. The forecasting performance of these time series are evaluated separately for both the original and outlier cases. Besides, the proposed method is compared with several different fuzzy regression function approaches and a neural network method. Based on the results of the analysis, it is concluded that the proposed method outperforms the other methods even when the time series contains both original and outliers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the literature, fuzzy, intuitionistic, and picture sets are used for different purposes. In recent years, forecasting, image segmentation, multiple criteria decision-making and pattern recognition problems have been solved by using intuitionistic and picture fuzzy sets. Hung et al. (2008), Hwang et al. (2012), Boran et al. (2014), and Chen et al. (2016) used intuitionistic fuzzy sets for solving pattern recognition problems. Chen (2014), Kumar and Chen (2021), Kumar and Chen (2022), Chai et al. (2023), Priyanka and Kalia (2023), and Kumar and Tyagi (2023) used intuitionistic fuzzy sets for multiple criteria decision-making. He and Wang (2023) used picture fuzzy sets for energy analysis with sentiment analysis. Haktanır and Kahraman (2023) used picture fuzzy sets for a defender-challenger comparison application. Fuzzy set theory plays an important role in the development of inference systems. Intuitionistic and picture fuzzy sets developed in recent years have paved the way for fuzzy inference systems, especially for solving forecasting problems. Another area where intuitionistic and picture fuzzy sets have started to be used is the solution of forecasting problems.

Joshi and Kumar (2012) proposed a method using intuitionistic fuzzy sets for fuzzy time series forecasting. Hung and Lin (2013) proposed a forecasting method for long-term business cycle forecasting based on intuitionistic fuzzy sets and a support vector regression approach. Gangwar and Kumar (2014) proposed a forecasting method based on both probabilistic and intuitionistic fuzzy sets. An intuitionistic fuzzy time series forecasting model based on intuitionistic fuzzy reasoning was proposed by Wang et al. (2016). In Fan et al. (2016), an intuitionistic fuzzy time series method based on similarity measures is proposed. A forecasting method is proposed for solving the high-order intuitionistic fuzzy time series forecasting model by Gautam and Singh (2018). Fan et al. (2020), Chen et al. (2021), Pant and Kumar (2022), Wang et al. (2023), and Dixit and Jain (2023) are other recent studies of forecasting methods using intuitionistic fuzzy sets. One of the most well-known fuzzy inference systems is the fuzzy regression functions approach, which in recent years has been able to produce successful results in solving the forecasting problem.

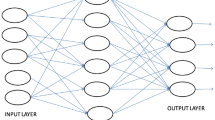

The fuzzy regression functions approach was first proposed in Türksen (2008). In the fuzzy regression functions approach, the inputs of the system are fuzzified by the fuzzy c-means method first proposed by Bezdek et al. (1984). The memberships obtained from fuzzy sets are used in the construction of the models used in the fuzzy inference system. In the fuzzy regression functions approach in Celikyilmaz and Turksen (2009), the multiple linear regression method is used to construct fuzzy functions. In Atanassov (1986), intuitionistic fuzzy sets, which are a more generalized form of fuzzy functions and also utilize the degree of hesitation, are proposed. With intuitionistic fuzzy sets, it is possible to create an inference system just like fuzzy sets. The intuitionistic fuzzy regression functions approach using intuitionistic fuzzy sets was first introduced to the literature by Bas et al. (2021). In the intuitionistic fuzzy regression functions approach proposed by Bas et al. (2021), the fuzzification process is performed by the intuitionistic fuzzy c-means method proposed in Chaira (2011) instead of fuzzy c-means.

The fuzzy regression functions approach was first generalized as picture fuzzy regression functions for picture fuzzy sets by Bas et al. (2020). Picture fuzzy sets were defined for the first time in Cường (2014) and in this study, the basic operations of picture fuzzy sets are presented. In Bas et al. (2020), picture fuzzy sets are used instead of fuzzy sets in the fuzzy regression functions approach. In the picture fuzzy regression functions method, the picture fuzzy clustering method proposed by Thong and Son (2016) is used to obtain positive, negative, and neutral memberships of picture fuzzy sets. According to Bas et al. (2020), three different outputs of the system are formed according to positive, negative, and neutral memberships. In combining these outputs, an optimization process based on a genetic algorithm was carried out. The number of forecasting methods utilizing picture fuzzy sets is quite limited in the literature. Some researchers have used picture fuzzy sets to obtain forecasts from picture fuzzy inference systems.

Thong and Son (2015a) used picture fuzzy clustering and picture fuzzy rule interpolation methods for forecasting. Thong and Son (2015b) proposed hybrid forecasting methods based on picture fuzzy clustering. Son et al. (2017) proposed a picture fuzzy inference system and made an application for control theory. Fuzzy regression function approaches continue to be developed in the literature. In Kizilaslan et al. (2020), an intuitionistic fuzzy function approach is improved using ridge regression. In Tak (2020a, 2020b) and Egrioglu et al. (2022), recurrent fuzzy and intuitionistic fuzzy regression function approaches are proposed. In Bas (2022), the fuzzy regression functions approach is made robust by using M estimators. In Tak and Inan (2022), the fuzzy regression functions method was improved by using elastic net regularisation. The meta-fuzzy functions method is proposed by Tak (2018) and Tak (2021) to realize a type of forecasting combination that exploits fuzzy function approaches. An approach of fuzzy regression functions based on probabilistic fuzzy sets was proposed in Tak (2020a, 2020b) and Tak (2022).

A picture fuzzy regression function approach works based on the picture fuzzy clustering method. Therefore, it contains more information than fuzzy regression and intuitionistic fuzzy regression function approaches. One reason for this is that the picture fuzzy set is a generalization of both fuzzy and intuitionistic fuzzy sets. Since the fuzzy and intuitionistic fuzzy regression function approaches are inevitably affected by outliers in the time series, the picture fuzzy regression function approach is also affected by outliers. In this paper, an approach to a picture fuzzy regression function that can be utilized even in the presence of outliers in a time series is proposed. In a picture fuzzy regression function approach, the parameter estimation is done by ordinary least squares, while in the proposed method, the parameter estimation is done by robust regression with Bisquare, Cauchy, Fair, Huber, Logistic, Talwar, and Welsch functions.

Thus, with the proposed method, a picture fuzzy regression method is proposed that can be less affected when there are outliers in the time series. The forecasting performance of the proposed method is evaluated on the London and Spain time series. The analysis is performed for both cases where these time series contain both original and outliers. Other parts of the paper are as follows. Section 2 summarizes the picture fuzzy clustering method. Section 3 gives the steps of the proposed method. Section 4 presents the results of the application on real-life data with tables and graphs to evaluate the performance of the proposed method. Section 5 is on the conclusions and discussion of the study.

2 Picture Fuzzy Clustering Method

Since the fuzzy clustering method (FCM) method works only on membership values, it is inadequate when real life problems are evaluated on positive, negative, neutral and refusal decisions. From this point of view, the picture fuzzy clustering (PFC) method, which is a clustering method that has both positive, negative, neutral and refusal membership values, is used as a generalisation of the FCM method, which has many limitations. PFC method proposed by Thong and Son (2016) is based on updating the positive membership values, neutral membership values, and refusal membership values and therefore the negative membership values in the structure of the picture fuzzy sets during iterations. The flow chart of PFC method is given in Fig. 1.

Besides, in order to make the algorithm more understandable, the algorithm of PFC method is given step by step with Algorithm 1.

Algorithm 1. The steps of PFC method.

Step 1 The initial values are generated.

The number of observations \(\left( n \right)\), the number of picture fuzzy sets \(\left( c \right)\), \(m\) is the fuzziness index and ε is an error value determined by the researcher; firstly, positive membership values \(\left( {u_{kj} { };\left( {k{ } = { }1,{ }2, \ldots ,{ }n{ };{ }j{ } = { }1,{ }2, \ldots ,c} \right)} \right)\), neutral membership values \(\left( {\eta_{kj} ;\left( {k{ } = { }1,{ }2, \ldots ,{ }n{ };{ }j{ } = { }1,{ }2, \ldots ,c} \right)} \right)\) and refusal membership values \(\left( {\xi_{kj} ;\left( {k{ } = { }1,{ }2, \ldots ,{ }n{ };{ }j{ } = { }1,{ }2, \ldots ,c} \right)} \right)\) are randomly generated and stored in matrices \(U,{ }{\rm N},{\rm K}\) respectively.

Step 2 The cluster centres \(\left( {V_{j} } \right)\) are updated at each iteration using Eq. (1). According to the updated cluster centres, updated positive membership values \((u_{kj}^{*} )\), updated neutral membership values \(\left( {\eta_{kj}^{*} } \right)\) and updated refusal membership values \(\left( {\xi_{kj}^{*} } \right)\) are obtained by Eqs. (2)-(4) and stored in the matrices \(U^{*} ,{ }{\rm N}^{*} ,{\rm K}^{*}\) respectively.

Step 3 The stopping condition is checked.

If the condition \(\left\| {U^{*} - U} \right\| + \left\| {{\rm N}^{*} - {\text{\rm N}}} \right\| + \left\| {{\rm K}^{*} - {\text{\rm K}}} \right\| < \varepsilon\) is met or the maximum number of iterations is reached, the process is terminated, otherwise the process is continued by returning to Step 2.

3 The Proposed Method

Fuzzy regression function approaches can exhibit superior performance in solving the forecasting problem. The picture fuzzy regression function approach, introduced by Bas et al. (30), is a method with superior forecasting performance based on the dynamic combination of more linear models, which provides a different treatment of uncertainty compared to classical fuzzy regression function approaches. In the proposed method, diversity is provided by using each of the methods based on Bisquare, Cauchy, Fair, Huber, Logistic, Talwar, and Welsch weight functions as M estimators. The flow chart for the proposed method is given in Fig. 2.

The steps of the proposed robust picture fuzzy regression function approach (R-PFRF) method are introduced in Algorithm 2.

Algorithm 2. The steps of R-PFRF method.

Step 1 Determine the parameters of the proposed method.

The parameters of the R-PFRF method are determined by the researcher by the applied data. These parameters are the number of lags \({ }\left( p \right)\), the length of the training set \(\left( {ntrain} \right)\), the length of the test set \(\left( {ntest} \right)\), the number of picture fuzzy sets (\(c)\).

Step 2 Applied PFC method.

According to the number of picture fuzzy sets given in Step 1, the PFC method is applied using PFC. The PFC method is applied for the data set (DX) consisting of the inputs and targets of the training data. The DX data set consists of \(p\) lagged variables and simultaneous variables of the time series. The time series is \(\left\{ {x_{1} ,x_{2} , \ldots ,x_{n} } \right\}\), the training time series is \(\left\{ {x_{1} ,x_{2} , \ldots ,x_{n - ntest} } \right\}\), \(ntarin = n - ntest\) and the test time series is \(\left\{ {x_{n - ntest + 1} ,x_{n - ntest + 2} , \ldots ,x_{n} } \right\}\). The DX matrix given in Eq. (5) is formed from the lagged and simultaneous variables of the training time series. By applying the PFC method, positive, neutral, negative, and refusal membership values are obtained for each picture fuzzy set.

Step 3 Obtain picture fuzzy functions and the forecasts for each picture fuzzy set.

For each picture fuzzy set, picture fuzzy functions are created by applying robust regression for the training set. If \(u\) is positive, \(\eta\) is neutral and \(\nu\) is a negative membership value, the matrix of explanatory variables is given in Eq. (6).

Response vector \(\left( Y \right)\) is constituted in Eq. (7) and the parameter estimations are calculated by using Eq. (8).

The forecasts for each picture fuzzy set are calculated as in Eq. (9).

In Eq. (8), \(W_{f}\) is any of Bisquare, Cauchy, Fair, Huber, Logistic, Talwar, and Welsch weight functions. Weight functions are a nonlinear transformation of adjusted residuals (\(r\)) calculated as a function of the residuals from classical multiple regression (\(e_{i}\)) and are generally based on the idea of suppressing or masking very large and very small residuals. Adjusted residual is calculated by Eq. (10). In robust regression based on M-estimators, the aim is to minimize the least squares calculated with adjusted residuals instead of ordinary least squares.

The tune parameter value varies according to the M-estimator applied and the tune parameter value used for each method is presented in Table 1. \(h\) is the vector of leverage values from an ordinary least-squares fit.

Formulas of Bisquare, Cauchy, Fair, Huber, Logistic, Talwar, and Welsch weight functions are given in Eqs. (11), (12), (13), (14), (15), (16), and (17).

Step 4 Calculate the forecasts for each membership type.

For the training data, forecasts are calculated separately for each membership type as given in Eqs. (18) to (20).

Step 5 Obtain optimal weight values for each membership type.

The forecasts of the R-PFRF method for the training data are the weighted average of the forecasts obtained according to positive, neutral, and negative memberships as given in Eq. (21).

In determining the weights, an optimization based on a genetic algorithm is performed for the training data. For optimization, the genetic algorithm is applied under the condition that the weights are between 0 and 1 and the sum is one. The applied optimization problem can be represented as in Eq. (22).

Step 6 Calculate the forecasts for the test data.

Forecasts are calculated for the test data. For this purpose, the matrix of explanatory variables given in Eq. (6) is reconstructed for the test set with the membership values calculated according to the cluster centers obtained for the training data. Forecasts for the test data are obtained using Eqs. (8), (9), (18), (19), (20) and (23) respectively.

Besides, a Pseudo-code of the R-PFRF method is given in Algorithm 3. Moreover, the codes of the R-PFRF method are uploaded to GitHub by name “https://github.com/erole1977/RPFF”.

4 Applications

To investigate the performance of the proposed method, applications are performed for a time series of Spain and London stock markets. The original time series are analyzed by the fuzzy time series network (FTS-N) proposed by Bas et al. (2020), the FRF method proposed by Turksen (2008), the IFRF method proposed by Egrioglu et al. (2022), and the PFRF method proposed by Bas et al. (2020) and compared with the proposed method in terms of forecasting performance. In addition, the superiority of the proposed method over other methods in terms of forecasting performance in case of outliers is investigated by artificially adding outlier observations to the original series. In the comparison of each method, the root of mean square error (RMSE) and mean absolute percentage error (MAPE) are used as evaluation criteria. The formulas of RMSE and MAPE criteria are given in Eqs. (24) and (25).

In Eqs. (24) and (25); \(ntest,\) \({\text{X}}_{{\text{t}}} { }\) and \(\hat{X}_{t}\) shows the length of the test set, the observed value, and the forecasting value, respectively. In the analysis process, the data set is primarily divided into training, validation, and test sets. The validation and test set lengths are determined as 30 in the analysis of the Spanish stock market time series. The validation and test set lengths are determined as 45 in the analysis of the London stock market time series. The number of inputs is tried between one and five and the number of fuzzy clusters is tried between two and five for each of these methods. The optimal number of inputs and fuzzy clusters giving the lowest RMSE value is determined for each method over the validation set. The forecasting performances of the methods are compared on the test data for the best hyperparameters.

4.1 Comparison of the Original Time Series

In this first part of the analysis phase, the closing prices of the Spanish stock market (IBEX) are analyzed. While analyzing the IBEX time series, five-time series with 250 observations are randomly generated within the entire time series between the years 2015–2022. The start and end dates of these five randomly generated IBEX time series are given in Table 2. The graphs of each IBEX time series are also given in Fig. 3.

The number of optimal input and fuzzy clusters for each method of Series 1–5 are given in Table 3. These optimal numbers of input and fuzzy clusters are used for the calculations on the test set. Considering that each method will give different results for different starting values, various statistics are calculated for each method. For this purpose, each method is run ten times, and minimum, maximum, standard deviation, and mean statistics for each method are calculated for both RMSE and MAPE criteria.

Some statistics for RMSE and MAPE values obtained from methods other than the proposed R-PFRF methods for the original Series 1 to 5 are given in Table 4. These RMSE and MAPE values are calculated over the test set of the original Series 1 to 5. Besides, some statistics for RMSE and MAPE values are given in Table 5 for the proposed R-PFRF methods.

For Series 1, 4, and 5, each R-PFRF method has better results than the other compared methods in Table 5 to the mean and minimum RMSE and MAPE statistics. For Series 2, the best method is the R-PFRF-CAUCHY method according to both RMSE and MAPE criteria. Again, better RMSE and MAPE results are obtained with a robust method than other methods. For Series 3, the best method according to both RMSE and MAPE statistics is the R-PFRF-WELSCH method. As a result, it can be said that the best results are obtained from the R-PFRF methods in the analysis of the original IBEX time series.

The graphs of the forecasts obtained from the best method obtained as a result of the analysis for the original Series 1 to 5 together with the test set are given in Fig. 4. The best method for each time series is determined by considering the mean statistics. Figure 4 shows that the forecasts obtained by the proposed method are highly consistent with the test sets of each original IBEX time series.

Second and lastly, the closing prices of the London Stock Exchange (FTSE) are analyzed. Again, for the FTSE time series, five different series with 250 observations are randomly obtained between the years 2015–2022. The start and end dates of these five randomly generated FTSE time series are given in Table 6. The graphs of each FTSE time series are also given in Fig. 5.

Table 7 shows the optimal hyperparameter values for Series 6 to 10, while Table 8 shows the statistics for the RMSE and MAPE results for the methods other than the proposed method. Table 9 shows some statistics for RMSE and MAPE results of each R-PFRF method for the test set of original time Series 6–10.

When the results in Tables 8 and 9 are analyzed, it is seen that the proposed method produces more successful forecasting results for the FTSE time series than all other methods in the analyses for the original time series.

The graphs of the forecasts obtained from the best method obtained as a result of the analysis for the original Series 6 to 10 together with the test set are given in Fig. 6. The best method for each time series is determined by considering the mean statistics. Figure 6 shows that the forecasts obtained by the proposed method are highly consistent with the test sets of each original FTSE time series.

4.2 Analysis of Time Series with Outlier Cases

In the second part of the application studies, outlier data was artificially generated by adding an observation 10 times the maximum observation value to the training data. Table 10 shows the optimal hyperparameter values obtained for all methods in the IBEX time series. Tables 11 and 12 summarise the forecasting results obtained from the application of alternative methods and the proposed method, respectively.

The forecasts obtained from the best method for the Series from 1 to 5, which have outliers along with the test set, are shown in Fig. 7. The best method for each time series is determined by considering the mean statistics. Figure 7 shows that the forecasts obtained with the proposed method are highly consistent with the test sets of each IBEX time series with outliers.

In Table 13, the RMSE and MAPE values and the percentage variation of these RMSE and MAPE values of some methods other than R-PFRF methods are given over the mean statistics for the case where Series 1–5 contains original and outlier values.

According to Table 13, the result of the RMSE value obtained by the FTS-N method of Series 1 in the case of the outlier has increased by 990% compared to the original case. The result of the RMSE value obtained by the FRF method of Series 3 in the case of the outlier has increased by 928% compared to the original case. The result of the RMSE value obtained by the PFRF method of Series 5 in the case of the outlier has increased by 2405% compared to the original case. Besides, the result of the MAPE value obtained by the PFRF method of Series 5 in the case of outlier has increased by 2868% compared to the original case.

Table 14 shows how R-PFRF methods are not affected by outliers. In Table 14, the RMSE and MAPE values and the percentage variation of these RMSE and MAPE values of R-PFRF methods are given over the mean statistics for the case where Series 1–5 contains original and outlier values.

As can be seen from Table 14, lower RMSE and MAPE values can be calculated with any proposed R-PFRF methods. The result of the RMSE value obtained by the R-PFRF- FAIR method of Series 1 in the case of the outlier has just increased by 2.94% compared to the original case. The result of the MAPE value obtained by the R-PFRF-WELSCH method of Series 4 in the case of the outlier has decreased by 2.05% compared to the original case. The result of the MAPE value obtained by the R-PFRF-CAUCHY method of Series 5 in the case of the outlier has decreased by 0.90% compared to the original case. The result of the RMSE value obtained by the R-PFRF- TALWAR method of Series 3 in the case of the outlier has decreased by 1.02% compared to the original case.

Finally, the analysis results obtained from all methods for Series 6–10 are given for the case where these series contain outliers. In Table 15, the optimal number of input and fuzzy clusters of each method for Series 6–10 in the outlier case. Some statistics of RMSE and MAPE results obtained from alternative methods and the R-PFRF method belonging to Series 6–10 in outlier cases are given in Tables 16 and 17 respectively.

The forecasts obtained from the best method for the Series from 6 to 10, which have outliers along with the test set, are shown in Fig. 8. The best method for each time series is determined by considering the mean statistics. Figure 8 shows that the forecasts obtained with the proposed method are highly consistent with the test sets of each FTSE time series with outliers.

In Table 18, the RMSE and MAPE values and the percentage variation of these RMSE and MAPE values of some methods other than R-PFRF methods are given over the mean statistics for the case where Series 6–10 contains original and outlier values.

According to Table 18, the result of the RMSE value obtained by the FTS-N method of Series 1 in the case of the outlier has increased by 1317% compared to the original case. The result of the RMSE value obtained by the FRF method of Series 4 in the case of the outlier has increased by 1559% compared to the original case. The result of the RMSE value obtained by the PFRF method of Series 5 in the case of the outlier has increased by 2356% compared to the original case. Besides, the result of the MAPE value obtained by the PFRF method of Series 5 in the case of outlier has increased by 3099% compared to the original case. Table 19 shows how R-PFRF methods are not affected by outliers. In Table 19, the RMSE and MAPE values and the percentage variation of these RMSE and MAPE values of R-PFRF methods are given over the mean statistics for the case where Series 6–10 contains original and outlier values.

As can be seen from Table 19, lower RMSE and MAPE values can be calculated with any proposed R-PFRF methods. The result of the RMSE value obtained by the R-PFRF- LOGISTIC method of Series 1 in the case of the outlier has just increased by 1.50% compared to the original case. The result of the MAPE value obtained by the R-PFRF- WELSCH method of Series 2 in the case of the outlier has decreased by 1.31% compared to the original case. The result of the MAPE value obtained by the R-PFRF-FAIR method of Series 3 in the case of the outlier has just increased by 2.19% compared to the original case. The result of the RMSE value obtained by the R-PFRF-BISQUARE method of Series 4 in the case of the outlier has decreased by 1.14% compared to the original case.

5 Conclusions and Discussion

In this study, a new forecasting method based on picture fuzzy sets that is less affected by outliers is proposed. Since the proposed forecasting method is based on picture fuzzy sets, it can handle different dimensions of uncertainty. For this reason, a data augmentation process, which can be considered as some nonlinear transformations of the original data, can be operated thanks to different membership values such as positive, negative, and neutral. In addition, since the proposed method is a kind of fuzzy function approach, it leads to a kind of forecast combination method in which more than one linear model is combined with weights that vary from observation to observation. In addition, this forecast combination is a dynamic approach in which weights can be determined automatically through memberships. Since the proposed method uses robust regression instead of the OLS method in parameter estimation, the problem of being affected by outliers encountered by existing approaches is avoided.

When the performance of the proposed method is investigated on real-life stock market time series, it is observed that it is quite successful compared to its current competitors in the literature and can provide useful forecasting results for the closing futures of the Spanish and London stock markets. In particular, it is clear from the application results that the performance of the proposed method is not affected by artificially added outliers. In addition, in the proposed method, the selection of different weight functions does not have much effect on the results, and the selection of any weight function among the weight functions used in this study will be sufficient to obtain successful forecasting performance. In future studies, it is planned to improve the performance of the R-PFRF method using robust artificial neural networks.

Data Availability

Data will be made available on request.

References

Atanassov, K. (1986). Intuitionistic fuzzy sets. Fuzzy Sets Systems, 20, 87–96.

Bas, E. (2022). Robust fuzzy regression functions approaches. Information Sciences, 613, 419–434.

Bas, E., Yolcu, U., & Egrioglu, E. (2020). Picture fuzzy regression functions approach for financial time series based on ridge regression and genetic algorithm. Journal of Computational and Applied Mathematics, 370, 112656.

Bas, E., Yolcu, U., & Egrioglu, E. (2021). Intuitionistic fuzzy time series functions approach for time series forecasting. Granular Computing, 6(3), 619–629.

Bezdek, J. C., Ehrlich, R., & Full, W. (1984). FCM, The fuzzy c-means clustering algorithm. Computers & Geosciences, 10(2–3), 191–203.

Boran, F. E., & Akay, D. (2014). A biparametric similarity measure on intuitionistic fuzzy sets with applications to pattern recognition. Information Sciences, 255, 45–57.

Celikyilmaz, A., & Turksen, I. B. (2009). Modeling uncertainty with fuzzy logic. Studies in Fuzziness and Soft Computing, 240, 149–215.

Chai, N., Zhou, W., & Jiang, Z. (2023). Sustainable supplier selection using an intuitionistic and interval-valued fuzzy MCDM approach based on cumulative prospect theory. Information Sciences, 626, 710–737.

Chaira, T. (2011). A novel intuitionistic fuzzy C means clustering algorithm and its application to medical images. Applied Soft Computing, 11, 1711–1717.

Chen, L. S., Chen, M. Y., Chang, J. R., & Yu, P. Y. (2021). An intuitionistic fuzzy time series model based on new data transformation method. International Journal of Computational Intelligence Systems, 14(1), 550–559.

Chen, S. M., Cheng, S. H., & Lan, T. C. (2016). A novel similarity measure between intuitionistic fuzzy sets based on the centroid points of transformed fuzzy numbers with applications to pattern recognition. Information Sciences, 343, 15–40.

Chen, T. Y. (2014). Multiple criteria decision analysis using a likelihood-based outranking method based on interval-valued intuitionistic fuzzy sets. Information Sciences, 286, 188–208.

Cường, B. C. (2014). Picture fuzzy sets. Journal of Computer Science and Cybernetics, 30(4), 409–420.

Dixit, A., & Jain, S. (2023). Intuitionistic fuzzy time series forecasting method for non-stationary time series data with suitable number of clusters and different window size for fuzzy rule generation. Information Sciences, 623, 132–145.

Egrioglu, E., Fildes, R., & Bas, E. (2022). Recurrent fuzzy time series functions approaches for forecasting. Granular Computing, 7(1), 163–170.

Fan, X., Lei, Y., Wang, Y., & Lu, Y. (2016). Long-term intuitionistic fuzzy time series forecasting model based on vector quantisation and curve similarity measure. IET Signal Processing, 10(7), 805–814.

Fan, X., Wang, Y., & Zhang, M. (2020). Network traffic forecasting model based on long-term intuitionistic fuzzy time series. Information Sciences, 506, 131–147.

Gangwar, S. S., & Kumar, S. (2014). Probabilistic and intuitionistic fuzzy sets–based method for fuzzy time series forecasting. Cybernetics and Systems, 45(4), 349–361.

Gautam, S. S., & Singh, S. R. (2018). A refined method of forecasting based on high-order intuitionistic fuzzy time series data. Progress in Artificial Intelligence, 7(4), 339–350.

Haktanır, E., & Kahraman, C. (2023). Intelligent replacement analysis using picture fuzzy sets, Defender-challenger comparison application. Engineering Applications of Artificial Intelligence, 121, 106018.

He, S., & Wang, Y. (2023). Evaluating new energy vehicles by picture fuzzy sets based on sentiment analysis from online reviews. Artificial Intelligence Review, 56(3), 2171–2192.

Hung, K. C., & Lin, K. P. (2013). Long-term business cycle forecasting through a potential intuitionistic fuzzy least-squares support vector regression approach. Information Sciences, 224, 37–48.

Hung, W. L., & Yang, M. S. (2008). On the J-divergence of intuitionistic fuzzy sets with its application to pattern recognition. Information Sciences, 178(6), 1641–1650.

Hwang, C. M., Yang, M. S., Hung, W. L., & Lee, M. G. (2012). A similarity measure of intuitionistic fuzzy sets based on the Sugeno integral with its application to pattern recognition. Information Sciences, 189, 93–109.

Joshi, B. P., & Kumar, S. (2012). Intuitionistic fuzzy sets based method for fuzzy time series forecasting. Cybernetics and Systems, 43(1), 34–47.

Kizilaslan, B., Egrioglu, E., & Evren, A. A. (2020). Intuitionistic fuzzy ridge regression functions. Communications in Statistics-Simulation and Computation, 49(3), 699–708.

Kumar, K., & Chen, S. M. (2021). Multiattribute decision making based on the improved intuitionistic fuzzy Einstein weighted averaging operator of intuitionistic fuzzy values. Information Sciences, 568, 69–383.

Kumar, K., & Chen, S. M. (2022). Group decision making based on weighted distance measure of linguistic intuitionistic fuzzy sets and the TOPSIS method. Information Sciences, 611, 660–676.

Kumar, S., & Tyagi, R. (2023). A novel score function for picture fuzzy numbers and its based entropy method to multiple attribute decision-making. Lecture Notes in Networks and Systems, 547, 719–729.

Pant, M., & Kumar, S. (2022). Particle swarm optimization and intuitionistic fuzzy set-based novel method for fuzzy time series forecasting. Granular Computing, 7(2), 285–303.

Priyanka, S. K., & Kalia, S. (2023). MULTIMOORA-based MCDM model for sustainable ranking of wastewater treatment technologies under picture fuzzy environment. Expert Systems, e13286.

Son, L. H., Viet, P. V., & Hai, P. V. (2017). Picture inference system, a new fuzzy inference system on picture fuzzy set. Applied Intelligence, 46, 652–669.

Tak, N. (2020a). Type-1 possibilistic fuzzy forecasting functions. Journal of Computational and Applied Mathematics, 370, 112653.

Tak, N. (2021). Meta fuzzy functions based feed-forward neural networks with a single hidden layer for forecasting. Journal of Statistical Computation and Simulation, 91(13), 2800–2816.

Tak, N. (2022). A novel ARMA type possibilistic fuzzy forecasting functions based on grey-wolf optimizer (ARMA-PFFs). Computational Economics, 59(4), 1539–1556.

Tak, N. (2018). Meta fuzzy functions, Application of recurrent type-1 fuzzy functions. Applied Soft Computing, 73, 1–13.

Tak, N. (2020b). Type-1 recurrent intuitionistic fuzzy functions for forecasting. Expert Systems with Applications, 140, 112913.

Tak, N., & Inan, D. (2022). Type-1 fuzzy forecasting functions with elastic net regularization. Expert Systems with Applications, 199, 116916.

Thong, P. H., & Son, L. H. (2015a). A new approach to multivariable fuzzy forecasting using picture fuzzy clustering and picture fuzzy rule interpolation method. In Knowlegde and systems Engineering (pp 679–690).

Thong, P. H., & Son, L. H. (2015b). HIFCF, An effective hybrid model between picture fuzzy clustering and intuitionistic fuzzy recommender systems for medical diagnosis. Expert System with Applications, 42(7), 3682–3701.

Thong, P. H., & Son, L. H. (2016). Picture fuzzy clustering, a new computational intelligence method. Soft Computing, 20(9), 3549–3562.

Türksen, I. B. (2008). Fuzzy functions with LSE. Applied Soft Computing, 8(3), 1178–1188.

Wang, W., Lin, W., Wen, Y., Lai, X., Peng, P., Zhang, Y., & Li, K. (2023). An interpretable intuitionistic fuzzy inference model for stock prediction. Expert Systems with Applications, 213, 118908.

Wang, Y. N., Lei, Y., Fan, X., & Wang, Y. (2016). Intuitionistic fuzzy time series forecasting model based on intuitionistic fuzzy reasoning. Mathematical Problems in Engineering, 2016, 5035160.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK). The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Contributions

EB: Writing, Modelling, Software. EE: Writing, Modelling, Software.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bas, E., Egrioglu, E. Robust Picture Fuzzy Regression Functions Approach Based on M-Estimators for the Forecasting Problem. Comput Econ (2024). https://doi.org/10.1007/s10614-024-10647-9

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-024-10647-9