Abstract

Recently, the complex dependence patterns among various stocks gained more importance. Measuring the dependency structure is critical for investors to manage their portfolio risks. Since the global financial crisis, researchers have been more interested in studying the dynamics of dependency within stock markets by using novel methodologies. This study aims to investigate a Regular-Vine copula approach to estimate the interdependence structure of the Istanbul Stock Exchange index (ISE100). For this purpose, we consider 32 stocks related to 6 sectors belonging to ISE100. To reflect the time-varying impacts of the 2008–2009 global financial crisis, the dependence analysis is conducted over pre-, during-, and post-global financial crisis periods. Portfolio analysis is considered via a rolling window approach to capture the changes in the dependence. We compare the Regular-Vine-based generalized autoregressive conditional heteroskedasticity (GARCH) against the conventional GARCH model with different innovations. Value at risk and expected shortfall risk measures are used to validate the models. Additionally, for the constructed portfolios, return performance is summarized using both Sharpe and Sortino ratios. To test the ability of the considered Regular-Vine approach on ISE100, another evaluation has been done during the COVID-19 pandemic crisis with various parameter settings. The main findings across different risky periods illustrate the suitability of using the Regular-vine GARCH approach to model the complex dependence among stocks in emerging market conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the past decade, financial markets experienced many crises due to underestimation of risk (MacKenzie & Spears, 2014; Jickling, 2009). Since the global financial crisis (GFC), researchers and practitioners have increasingly sought to develop new methods to predict and control market risks. Understanding the dynamic of interdependence between stocks is vital for investors to manage their portfolio’s risk and forecast returns (Liu et al., 2017). Copulas are a popular tool for modeling dependence and risk in finance. They offer a flexible way to model the joint distribution of two or more random variables, which is especially common in stock markets. Besides, copula modeling can be beneficial when detecting the symmetric and asymmetric dependence patterns for financial data in times of stress.

Correlation is a traditionally used measure of dependence, applicable only in the elliptical world, for example, when the returns follow a multivariate Gaussian or Student’s t-distribution. When there are non-linear relationships between returns, the correlation may not adequately describe the type of dependency, thus leading to an underestimation of the joint risk of extreme events (Junker et al., 2005). Copulas ask a different question, such as “How do two variables act together and how strong is this simultaneous movement at various points in the distribution” (Vuolo, 2015), rather than how variable X affects variable Y. In this context, the advantage of using copula in the co-movement analysis is multifaceted (Ning, 2010). The motivation behind the copula is that it allows a separation of the dependence structure from its margins and captures the non-linear dependency patterns. Copula also allows for asymmetric dependence, which has important implications when calculating portfolio risks (Nelsen, 2007; Patton, 2013; Prince & Anokye, 2020). Therefore, copula adapts well to the dependency of financial data, making it a good choice for incorporating dependence into the model (Embrechts et al., 1999).

Although copulas are widely-used in finance and economics, they are not practical for high-dimensional data. Vine copulas (or Vines) are tree-based models to overcome such limitations of multivariate copulas (Cooke, 1997; Bedford & Cooke, 2001, 2002). Vines, also called as pair copula construction (PCCs), rely on the use of bivariate copulas. Each pair captures the dependence between two variables sequantially. Vine copulas offer better flexibility than standard multivariate copula models due to the wide selection of bivariate copula models (Heinen & Valdesogo, 2008; Kurowicka & Joe, 2010). Additionally, Vines can overcome the limiting features of alternative measures of dependency and correlation, such as Pearson, Spearman, and Kendall (Hernandez, 2015). Bedford and Cooke (2001) and Bedford and Cooke (2002) graphically explored the pair-copula constructions, regular vines (R-Vines), and developed two main sub-classes, called canonical vines (C-Vines) and drawable vines (D-Vines). C- and D-Vines are beneficial for specific tree structures whereas R-Vines are more flexible framework.

The 2008-2009 financial crisis provides an example of how financial institutions and their markets are interconnected and how shocks in one industry can threaten the stability of the other sectors or the entire system. In Turkey, there is a gap in the dependence analysis of stocks, covering both the financial and other sectors. In this direction, the contributions of this study are two-fold. First, we examine the co-dependencies of 32 stocks with the R-Vine copula model. The duration of data is selected as 01.01.2005-31.12.2013 to investigate the effects of the pre-, during, and post-GFC periods. Within the 32 stocks of ISE100, we study the sub-sector varying dependencies by focusing on R-Vines. A general understanding of the structure of co-dependency between sectors is critical in measuring a portfolio’s risk. Secondly, we construct an equally weighted portfolio from the selected leaders of each sector by an R-Vine-based GARCH model. Thereafter, the dynamic Value-at-Risk (VaR) and Expected Shortfall (ES) risk measures are computed over the constructed portfolio. For the reliability of risk measures, we employ backtesting methods to provide further insight to the policymakers with more reliable information to avoid potential losses, especially during periods of financial stress. During 2020, the COVID-19 pandemic has left global financial markets considerably vulnerable for the first time since the 2008. In this challenging period, ISE100, as an emerging stock market, has experienced a real collapse, based on a quick jump in market volatility during the COVID-19 epidemic, including other economic issues such as a weakened currency, elevated inflation, and unemployment as well as certain political decisions. For that reason, to test the considered R-Vine model under different market conditions, similar computations have been made to bring further evidences for the model suitability on Turkish market.

This study is the first comprehensive R-Vine copula dependence analysis on various sectors traded in ISE100 in certain time periods regarding the 2008–2009 global financial crisis, and COVID-19 pandemic crisis with significant events and shocks. The second period is examined to support the suitability of considered model under different economic characteristics. In the first financial crisis period, we discuss not only the results of dependence analysis but also two crucial risk measures, VaR and ES, which are carefully investigated and compared under various scenarios. The main findings show that the R-Vine copula is a suitable model for the complex dependence structures of the ISE100 stock market. Results show that dependence structure varies with time, and Survival Gumbel copula occurs in maximum numbers, especially during the GFC period, and plays a crucial role in the dependence structure of sectors. Especially the finance sector has the highest dependence risk during times of turbulence. The dynamic R-Vine GARCH portfolio analysis, with VaR and ES risk measures, is studied for different periods. In addition, we also compute only GARCH-based portfolio risk measures for comparison and show that the R-Vine GARCH model performs better in capturing data variability. The computations demonstrate the suitability of the R-Vine GARCH model for portfolio analysis. In addition to the calculated risk measures, it is important to highlight the portfolio return performance with suitable indicators. There are numerous performance measurement strategies for measuring portfolio return performance mainly including Sharpe Ratio (reward to variance), and Sortino Ratio (corrected version of Sharpe). Briefly, Sharpe ratio (ShR) evaluates an investment’s performance compared to a risk-free asset (Sharpe, 1964). It is the investment return minus the risk-free return divided by the investment return standard deviation. Investors gain more return per unit of risk. On the other hand, risk-adjusted return is measured via the Sortino ratio (SoR). Unlike the ShR ratio, it penalizes only returns below a user-specified target or required rate of return (Sortino & Price, 1994). For that purpose, Sharpe and Sortino ratios are summarized similar to the calculated risk measures over different time intervals. Additionally, the impact of risk free rate graphically displayed and discussed for the GFC period for the same equally weighted portfolio setting. The calculated ratios support the main finding that it is better to rely on R-Vine GARCH framework rather than relying on classical GARCH models. For the second crisis period, similar stocks and their relationships have been examined under the COVID-19 pandemic crisis that had certain shock economic waves through different channels towards the Turkish financial market.

The rest of the paper is organized as follows: Sect. 2 briefly summarizes the literature regarding the application of Vine copulas for stock markets. In Sect. 3, we give a brief review on the methodology of ARMA-GARCH and Vines. Section 4 presents the application of the R-Vine for sub-sector dependence analysis and the constructed portfolio. Finally, Sect. 5 summarizes the results, including the benefits and limitations of the study.

2 Literature Review

The popularity of copula models in the last few decades increased significantly. In particular, there is a growing interest to do research on the co-dependence of stock markets during periods of extreme fluctuations. It is demonstrated in the literature that stock markets are more dependent on one another during financial crises (Chesters, 2011; Jansen & Nahuis, 2003; David, 1997). For example, the R-Vine copula model is used to measure and analyze the co-dependency of stocks from the Dow Jones Industrial Average (DJIA) index (Allen et al., 2013). Hernandez (2015) models the portfolio interdependencies using a copula counting technique to assess the multivariate dependent risk. Heinen and Valdesogo (2008); Dismann et al. (2013); Brechmann and Czado (2013) and Geidosch and Fischer (2016) employed vine copulas to assess co-dependency of financial time series. Heinen and Valdesogo (2008) proposed a dynamic model called canonical vine autoregressive (CAVA) to estimate the dependence between stocks, the sector and stocks, and the sector and market. Dismann et al. (2013) considered the R-Vine framework for European financial data, using 11 stock indices to model the change of dependence structure during periods of GFC.

In addition, portfolio risk measures can be improved with the use of Vines. Guegan and Maugis (2010) compared the Vine-GARCH method with the regular GARCH model and concluded that vines offer a significant improvement in the portfolio VaR predictions. Guegan and Maugis (2010) applies vine copulas in 5-dimensional stocks for VaR estimation. Brechmann and Czado (2013) stressed the usefulness of vine copulas in portfolio management. They developed a method called the Regular Vine Market Sector (RVMS) model to measure and understand the dependence structure of the Euro Stoxx 50, which includes 46 stocks and 5 national indices. The fitted R-Vine copula model can adequately capture the asymmetric dependence between the stocks, sectors, and the market. In the same vein, Kurowicka and Joe (2010) showed the capability of the R-Vine copulas to capture a high-dimensional asymmetric relationship of financial returns. Dismann et al. (2013) suggest an algorithm to make R-Vine estimation feasible, showing the high flexibility of the R-Vines compared to C- and D-Vines. Geidosch and Fischer (2016) confirmed the advantages of vine copulas over conventional copulas when modeling the dependence structure of a portfolio.

Recently, the literature on the effects of COVID-19 on financial markets increased rapidly, especially in the second quarter of 2020, when the epidemic began to spread worldwide. Among different studies, there are some research papers focused on stock dependencies between countries using copula framework. To illustrate, Aslam et al. (2021), the dependence structure of global stock markets in the COVID-19 period has been examined using the C-vine Copula approach. The dynamic tail dependence risk between the BRICS economies and the world energy market was studied by Muteba Mwamba and Mwambi (2021), during the COVID-19 financial crisis. They used the vector autoregressive (VAR), Markov-switching GJR-GARCH, and vine copula methods. For a specific stock market, Eita and Tchuinkam Djemo (2022) applied an EVT-based pairwise copula method for modeling risk interaction between foreign exchange rates and equity indices of the Johannesburg Stock Exchange (JSE) by using some selected listed stock indices. By combining different tools, Alqaralleh and Canepa (2021) considered the wavelet-copula-GARCH procedure to investigate the occurrence of cross-market linkages during the COVID-19 pandemic using six major stock indices. In another recent work, Sahamkhadam and Stephan (2023) examined vine copulas in modeling symmetric and asymmetric dependency structures and forecasting financial returns from 2001 to 2022, including the COVID-19 pandemic crisis.

As noted above, while there is a vast literature on modeling the co-dependency between stock returns via Vine copula, the literature on modeling the dependency structure of ISE100 stock returns is limited. Examples of the research on the co-dependence of the financial markets of Turkey can be found in Binici et al. (2013); Talasli (2013). These studies are along the line of correlations, and conditional correlations. The application example closest to our study belongs to the work of Özgür and Sarıkovanlık (2021). They analyzed the co-dependency of 12 stocks traded in ISE30 but did not include a crisis period in their study. Understanding the impacts of the financial crises on individual stocks, as well as on a portfolio, is one of the main objectives of this study. It fails to examine asymmetric dependence between stock returns since they assume that innovations follow a symmetric multivariate normal or Student’s t-distribution. In this regard, we extend the above-mentioned studies by using a wide range of stocks and presenting an examination of the dependency structures over three different sample periods involving the GFC. In light of the available literature, we employ and study the R-Vine GARCH model for portfolio risk modeling over different sub-periods. To the best of our knowledge, within the same modeling framework, this study is the first one that focuses on COVID-19 pandemic period for ISE100 stock market.

For Turkey stock market, the implementations of Sharpe (ShR) and Sortino (SoR) ratios are limited similar to the VaR and ES investigations. Generally, many empirical studies are focused on the pension funds and banking sector rather looking at the different sector leaders jointly. In one of the studies, the stability of mutual fund performance was investigated in the short and long term using monthly returns including Sharpe ratio calculation (Akel, 2007). Other studies, such as (Korkmaz & Uygurturk, 2008), (Dagli & Er, 2008), and (Eken & Pehlivan, 2009), also calculated Sharpe ratio values in mutual fund analysis. (Uyar & Gokce, 2008) measured the daily returns of equity funds using the Sharpe ratio and Jensen Alpha, while (Kok & Erikci, 2015) compared the performance of different types of mutual funds to the performance of the BIST100 index using various performance indices. There are also more specific studies, such as (Atmaca, 2022) considered the electricity market in Turkey, and (Ocal & Kamil, 2021) compared the BIST100 data with the Indonesian Stock Exchange market without any dependence modeling. In another banking-sector focused study, (Bagci, 2022) investigated the performance of the stocks of 7 banks registered at the Borsa Istanbul Liquid Bank Index by calculating both Sharpe and Sortino ratios, for the years 2017-2021. Overall, up to the authors knowledge, there is no study that investigated the return performances tied to vine copulas. In that respect, our work contributes to the existing literature in a unique and comprehensive way.

3 Methodology

This section explains the methods combined in analyzing the several characteristics of financial assets. The first aspect is time series modeling to incorporate mean and volatility trends of stocks. The second part is about the Vines to model the dependency between the assets, that can create a systemic risk if it is ignored. We explain the portfolio construction and risk measure estimations. Lastly, we present the validation of risk measures using backtesting methods at the end of this section.

3.1 ARMA-GARCH Model

To model the standardized residuals via copula, one first needs to undertake a univariate time series analysis (Patton, 2012; Zhang & Singh, 2019). To model both the trend and non-constant volatility inherent in financial time series data, we opt to use an ARMA-GARCH model. The return series is described as an autoregressive moving average model, ARMA(p, q), as follows

where, \(r_t\) is return at time t, \(\varepsilon _t\) is a white noise series, c is a constant, \(\alpha _i \ne 0\) and \(\beta _j \ne 0\) are AR(p) and MA(q) parameters.

As a generalized version of autoregressive conditional heteroscedasticity (ARCH), a GARCH model is used for modeling the volatility and focuses on the error term \(\varepsilon _t\). GARCH(m, n) model is expressed as

where \(z_{t} \sim D(0,1)\) are iid, w is a constant, \(a_{i} \ge 0\), \(b_{j} \ge 0\), and \(\sum a_{i} + \sum b_{j} \le 0\) are GARCH parameters.

Here, \(z_{t}\) can be taken as any distribution to correctly reflect the features of the data modelled. By using the guidance of the literature in this subject, we compare standard normal (norm), Student’s t (std), and skewed Student’s t-distributions (sstd) for \(z_{t}\) in the portfolio analysis part.

3.2 Vine Copula

A d-dimensional copula is a multivariate joint distribution function that connects number of d marginal distributions. As introduced by Sklar (1959), the multivariate distribution function F of d random variables \(X_{1}, \dots , X_d\) with marginal distribution functions \(F_1(x_1) = u_1,\dots ,F_d(x_d) = u_d\) can be described by a copula function, \(C: [0,1]^d \rightarrow [0,1]\) such that

Based on the dependence structure, there are two main types of copulas: (i) The elliptical copula is suitable for modeling symmetric dependence, and (ii) The Archimedean copula is suitable for asymmetrical dependence. For multivariate cases, especially with the increased dimension, Archimedean copula models become more complex, challenging to use, and exhibit some parameter limitations although they are more suitable for non-normal financial data. As an alternative, the complexity of a d-dimensional distribution can be expressed easily with the help of PCCs, namely Vines. First proposed by Joe (1996) and later developed by Aas et al. (2009), vine copulas offer a flexible graphical model for describing complex multivariate dependence by a rich variety of pair-copulas. Pair-copulas can be arranged and analyzed in a graphic tree structure to facilitate the analysis of multiple dependencies.

A Vine denoted as V on d variables consists of connected trees \(V=\{T_{1},\dots ,T_{d-1}\}\), and the edges of tree j are the nodes of tree \(j+1\), \(j=1,\dots ,d-2\). An R-Vine copula on d variables is a vine in which two edges in tree j are joined by an edge in tree \(j=1\) only if these edges share a common node, \(j=1, \dots , d-2\). Hence, it provides a single optimal PCC. In a d dimensional case, \(d(d-1)/2\) bivariate pair copulas are selected for \((d-1)\) number of trees. The first root-node models the dependence with respect to a selected variable. Conditional on the selected variable, the second root-node models the dependence with respect to another variable. Following the same structure, all pair-copulas are selected conditionally on the selected variables.

The pdf of a d-dimensional rv X can be denoted as

where, \(f_i(x_i)\) \(i=1,2,\dots , d\) are the marginals. The bivariate decomposition for \(X_1\) and \(X_2\) with pair copula \(c_{1,2}\) is as follows

Linked to that, the conditional probability is

PCCs do not have a unique solution. Therefore regular vines can be used to organize simplified PCCs (Bedford & Cooke, 2001). Let there be \({\mathbb {N}}\) nodes and \(\varepsilon \) edges, such that \({\mathbb {N}}=\{N_1,\dots ,N_{d-1}\}\) and \(\varepsilon \in \{E_1,\dots ,E_{d-1}\}\). Conditioned nodes are defined as j(e) and k(e), and the conditioning set is defined as D(e). R-Vine copula is then yields as the following joint density equation

Hence, construction of a vine copula is not strict, and a large number of different pair copula models can be selected. Vine copulas can be investigated with the help of graphical representation of R-Vines. We use the sequential method (strongest dependencies) in determining the trees of R-Vine with Kendall’s \(\tau \) measure given in Eq. (9). This step-wise construction provides computational ease and effectiveness.

Akaike information criterion (AIC) and Bayesian information criterion (BIC) are the most common statistics used to select the best copula model and are computed using the following equations

where, \(p_{ei}-p_{i}\) is the difference between empirical and theoretical probabilities, N is the sample size, k is the number of parameters and L is the maximum likelihood function value for the model.

In this above setting, the full model specification requires (i) The choice of the Vine tree structure, (ii) Copula families for each pair, and (iii) Their corresponding parameters. The selection of different copula families stands for distinct dependence patterns. The well-known elliptical families are Gaussian and the Student’s t-copulas. The Gaussian copula is symmetric and has no tail dependence (Aloui et al., 2013). Student’s t copula shows symmetric tail dependence. Among all Archimedean types; Clayton, Gumbel, Frank, and Joe are primary examples of one-parameter families. The Clayton copula has higher dependence in the lower tail, while the Gumbel copula has higher dependence in the upper tail (Aloui et al., 2013). Furthermore, Joe copula captures the positive tail dependence. As combinations of these families, two-parameter copulas such as the bi-parameter bivariate (BB) class allow for different, nonzero upper and lower tail behavior (Joe, 1997).

The bivariate copula models used in this study during R-Vine copula model construction are categorized based on the number of parameters and rotation degrees as shown in Table 1. In addition to the copula function names, unique integer labels for each family are presented regarding their use in the VineCopula R package to guide the reader. The presented numbers for each copula family given in the parenthesis will appear in the fitted R-Vine copula model matrices, given in Appendix 2. For further details on Vines, the interested reader is referred to the book of Czado (2019).

3.3 Portfolio Construction

The return of the d-dimensional portfolio, \(R_t\), can be computed as

where, \(w_{i,t}\) and \(r_{i,t}\), \(i=1,\dots ,d\), denote the weight and daily returns of i’th stock at time t, respectively.

In order to manage the risk inherent in financial instruments the most popular risk measure in use is still VaR. Although it has some disadvantages (not satisfying the coherency axioms; violates the subadditivity), VaR provides a single value for the given level of risk and it is easy to interpret and compare as a quantile based risk measure. Simply, VaR at level \(\alpha \) is defined as,

VaR does not contain any information about the amount of risk and the expected loss when the quantile \(\alpha \) is exceeded. As an alternative, ES focuses on the tail portion given that the VaR level is exceeded and defined in terms of the VaR level as follows,

To test and validate the calculated VaR values, the following two backtesting methods are used: Kupiec’s proportion of failures (POF) and Christoffersen’s independence and interval forecast (IND) tests. Kupiec’s proportion of failures (POF) tests the null hypotheses defined as the probability of realized violations is equal to the risk measures confidence level. If data set has N observations, violations n has a binomial distribution with parameters (N, q). Therefore, expected number of violations n in N observations is \([(1-q)\times N]\).

Here, \(\text {LR}_\text {POF}\) distributed as as \(\chi _2^1\).

Christoffersen’s independence and interval forecast (IND) test first determines the violations by an indicator function (Christoffersen, 1998), (Christoffersen et al., 2001). For two consecutive point, four outcomes are possible, each having an \(n_{ij}\) number of observations. The subscript i represents the previous data’s state of violation and j represents the state of violation of the tested data point (Table 2).

Violation probabilities are defined as \(\pi _i\) for \(i=0,1\)

The resulting log-likelihood ratio is

whereas \(\text {LR}_\text {IND}\) distributed as as \(\chi _2^1\).

To test ES, we use the following backtesting method developed by (McNeil & Frey, 2000) based on exceedance residuals. Using the forecasted risk measure \({\hat{ES}}_{\alpha ,t}\), the realized return \(r_t\), and conditional volatility estimate \({\hat{\sigma }}_t\), the following equation shows the expected value of the exceedance residuals,

If the applied model is correct, it is expected to see that \(E\left( s_t \right) =0\). Therefore, on the backtesting interval of N, the test value is \(\sum _{t=1}^{N} s_t{\mathbb {I}}\{r_t>{\hat{VaR}}_{\alpha ,t}\}\frac{1}{{\mathbb {I}}\{r_t>{\hat{VaR}}_{\alpha ,t}\}}\).

As it was introduced earlier, in addition to the risk measures, the portfolio return performance measures, namely ShR and SoR ratios are calculated. The ShR model is the most well-known of the various single-parameter risk/return metrics used to evaluate the performance of a portfolio. Mainly, it is derived by multiplying the risk-free rate-adjusted fund return values by their standard deviation. In general, among the compared portfolios, investments are made in the portfolio with the highest Sharpe ratio (Cucchiella & Gastaldi, 2016, Gökgöz & Günel, 2012, Sharpe, 1964). Its definition is given below,

where \(E\left( R_{t} \right) \) represents the expected return of portfolio, \(R_{RF}\) denotes the risk free return, and \(\sigma _{R_{t}}\) is the standard deviation of the risk of the portfolio.

On the other hand, SoR can be considered as a corrected version of ShR ratio. Instead of the portfolio standard deviation, the denominator calculates returns below an acceptable income level. In terms of its meaning, still, the one with the highest SoR succeeds (Gökgöz & Günel, 2012, Sortino & Price, 1994). SoR calculation is briefly described below,

where only difference appears in the denominator part that \(\sigma _{R_{d}}\) stands for the standard deviation of the down-side risk of return. It simply takes into account the cases where the return is below the risk free rate as the minimum acceptable rate of return.

In this study, the portfolio representing ISE100 is constructed with the pre-selected sector leaders. To extract the risk measures and return performance indicators, new helper functions are considered relying on available R functions. Specifically, for the backtesting methods, built-in functions (VaRTest and ESTest) from rugarch package in R are applied at the the last step.

4 Numerical Results

In this study, we use the daily returns of 32 stocks trading continuously in ISE100 between 2005-2013, accessed from the Thomson Reuters Eikon financial data platform (Eikon, 2022). Stocks are grouped into sub-sectors; finance, basic materials, consumer cyclicals, consumer non-cyclicals, industrial, and others. Besides, the data set is divided into three subsets to reflect the effects of the 2008-2009 GFC such that; pre-GFC (03.01.2005-29.06.2007), GFC (02.07.2007-31.08.2009), and post-GFC (01.09.2009-31.12.2013). For each period, the daily log-returns are computed as \(r_t = 100 \times \log ({p_t}/{p_{t-1}})\) where \(p_{t}\) and \(p_{t-1}\) are prices of the stock at time t and \(t-1\), respectively.

This section investigates the effect of the R-Vine copula approach on dependent data for different periods. We implement a widely used ARMA(1,1)-GARCH(1,1) model for all the stocks, following the applications in the literature. Then a regular GARCH(1,1) model is implemented for the portfolio analysis because of the computational simplicity, since it does not cause a significant change. For all relevant computations, rugarch and VineCopula R packages are benefited (Nagler et al., 2022; Ghalanos, 2022).

4.1 Data Description

Table 3 illustrates the descriptive statistics for the 32 stock log-returns for the entire sample (2005–2013) under 6 different sectors (9 for finance, 4 for basic materials, 5 for consumer cyclicals, 7 for consumer non-cyclicals, 3 for industrial, and 4 for others). Not surprisingly, the overall mean returns are positive for all except DOHOL under consumer non-cyclicals. One can observe the highest and lowest values of four main statistics under each sector with bold numbers. In means of volatility, the highest attained standard deviation belongs to KOZAA (0.03550), whereas the smallest value occurs under the finance sector for ALARK (0.02043). In general, the log returns are positively skewed. The negatively skewed ones are YKBNK, ISFIN (finance); DOAS, TOASO, FROTO (consumer cyclicals); DOHOL, SISE, AEFES (consumer non-cyclicals); THYAO (industrial); and AYGAZ, TCELL, ISGYO (others). This non-normality is also supported by the large kurtosis values, and all the log returns point to the heavy-tailed distributions (leptokurtosis). For example, the largest and the smallest kurtosis belongs to MGROS (14.05958) and SISE (4.58605) stocks under consumer non-cyclicals. Overall, all of them have high kurtosis, which implies the violation of normality. This summary shows that the log returns in the collected sample have fat tails and changes in distributional characteristics meaning that those copula models are best suited to capture these properties. The rounded p-values of the Jarque-Bera (JB) test presented in the last column in Table 3 support the violation on normality of daily log returns for the entire sample data.

In addition to the summarized descriptives of the whole sample, the descriptive statistics of the three sub-periods can be seen in Tables 14, 15 and 16, given in Appendix 1. A similar pattern exists for three sub-periods with slight changes in the obtained statistics and the name of the commodities. The movements during the GFC period have negative impacts on the mean of log returns for different sectors compared to pre-GFC and post-GFC periods. During the period of GFC, more negative log returns are observed, primarily for the consumer cyclicals sector. Especially for the finance sector, the mean of log-returns is considerably lower in the GFC period compared to the pre-GFC period, a good indication of the GFC in the banking sector in Turkey. Generally, there is a certain upward trend in the standard deviations for almost all stocks from the pre-GFC to the GFC period. The higher volatility during the GFC period matches with the findings of relevant literature (Allen et al., 2017). In terms of the normality assumption, all three periods indicate violations similar to the whole sample case as supported by JB test p-values. The log returns are generally skewed in many cases including the change in the direction from positive to negative or vice versa in different time horizons. To illustrate, skewness for SAHOL from the finance sector changes from \(-\)0.11177 to 0.26207 (pre-GFC to GFC) and then from 0.26207 to \(-\)0.12612 (GFC to post-GFC). Similar to the whole sample results, the excess of high kurtosis preserves the non-normality for the stocks under three sub-periods.

4.2 Sector Analysis

In this part of the study, three periods are analyzed separately within each sector. For this aim, there are 18 different model results available since we have 3 sub-period and 6 different sectors. Firstly, each univariate time series are modeled via ARMA(1,1)-GARCH(1,1) model with the skewed Student’s t-distributed error terms. After filtering the financial time series, the obtained residuals from the fitted models are reserved for vine copula modeling. Even if C-, D- and R-Vine copulas are investigated, we only present briefly the results of the R-Vine copula. The main motivation for discussing only R-Vine is attached to the flexibility of the model compared to C- and D-Vines.

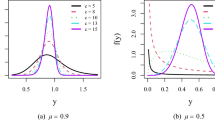

The selection of the optimal family relies on the minimum BIC among Gaussian, Student’s t, Clayton, Frank, Gumbel, Joe copula, and their variations (total of 32 candidates given in Table 1). The parameter estimation part of the above process follows the classical maximum likelihood estimation (MLE) (Nagler et al., 2022). Before fitting any vine copula model, Fig. 1 shows the correlation structure on the finance sector for pre-GFC, GFC and post-GFC periods. Among 9 different stocks from the finance sector, the level of the dependence is changing over different sub-periods. For the next sub-sections, the results are exemplified for the finance sector, whereas the detailed results for other sectors are available upon request for the interested readers.

Figure 1(a) shows that all the stocks are positively dependent with varying magnitudes in pre-GFC period. Here, the largest and the smallest attained Kendall’s \(\tau \) correlation coefficient values are 0.49 and 0.19 for the pairs (AKBNK, ISCTR) and (ECILC, SKBNK), respectively. Overall, the values are large enough to express that there exist co-dependencies among the stocks in the Finance sectors. Additionally, contour plots on the lower panel of Fig. 1a indicates that there are slight changes in the tail dependencies among the stocks so that different copula families are worth considering. Similar pattern can be seen in the Fig. 1b and 1c as well. The important difference is the increase on Kendall’s \(\tau \) values when we move from pre-GFC to GFC. Thereafter, this increasing behavior is almost preserved during the post-GFC period. In terms of the largest and smallest Kendall’s \(\tau \) value for the pairs, we have (GARAN, ISCTR) and (ALARK, SKBNK)-(ECILC, ISFIN) for the GFC period (Fig. 1b) whereas (ISCTR, YKBNK) and (ALARK, ISFIN) for post-GFC period (Fig. 1c), respectively. These differences indicate the most prominent actors in the finance sector. The fitted vine copula models present a similar tendency on different sub-periods. Log-likelihood results show that R-Vine performs the best according to the AIC and BIC in each period, which matches with the previous studies in the literature. Figures 2 and 3 shows the estimated R-Vine trees (1’st and 2’nd level) for pre-GFC period with the selected pair copulas and dependence parameters.

In Fig. 2, the edges show both the selected pair copulas with their dependence parameters in parenthesis. For many pairs, one parameter family is selected except for the pairs (AKBNK, ISCTR), (GARAN, ISCTR), (ISCTR, ALARK), and (YKBNK, SKBNK). More importantly, the selected copulas exhibit tail dependencies for the stock pairs, ie. (ISCTR, YKBNK) is modeled via survival Gumbel (SG) with \(\theta = 1.72\). In this first level, the tree structure shows that many of the stocks are directly related to ISCTR, where two exceptions are ISFIN and SKBNK. In Fig. 3, one can see the first conditional copula pairs for the second tree level. Similar to the first tree level, many of the selected copulas are Archimedean types except the pair (ISCTR, SKBNK \(\mid \) YKBNK). Similarly, the first two tree levels are visualized for the GFC and the post-GFC to highlight the changes in copula selection and dependence structure.

Figure 4 shows a different tree structure for the first level. For various unconditional copula pairs, one-parameter families are selected except for the pairs (ISCTR, SAHOL), (GARAN, YKBNK), (GARAN, ISFIN), and (GARAN, SKBNK). In many of the pairs, similar to what we obtained in Fig. 2, the selected copulas exhibit distinct tail dependencies for the stock pairs. For example, (ISCTR, ECILC) pair has Survival Gumbel (SG) copula with dependence parameter \(\theta = 1.61\). In this first level, the tree structure shows that many of the stocks are directly related to stocks GARAN and ISCTR. For the second tree level, illustrated in Fig. 5, Archimedean copulas play an important role again. In contrast to the first tree level, all of the selected copulas are one-parameter families. For the conditional copula functions, the stocks (ISCTR, YKBNK, ISFIN, and SKBNK) exhibit dependencies conditioning on (GARAN) on the upper part, whereas the pairs (AKBNK, GARAN), (AKBNK, SAHOL), (SAHOL, ECILC) and (ECILC, ALARK) are all dependent conditioning on the stock ISCTR. These two levels simply imply the importance of the stocks GARAN and ISCTR for the finance sector. To illustrate, (ECILC, ALARK \(\mid \) ISCTR) at the bottom implies that there exists a lower tail dependence (Clayton with \(\theta =0.41\)) for the (ECILC, ALARK) pairs given ISCTR.

In Fig. 6 for post-GFC, once again, ISCTR has a central role in the first tree level. In this period, all selected copula functions exhibit distinct tail dependencies including symmetric ones for the pairs (AKBNK, ISCTR) and (AKBNK, SAHOL) having Student’s t-copula with \(\theta = 0.79\) and \(\theta = 0.63\), respectively. Similar to the pre-GFC period, many of the stocks are directly related to ISCTR except SAHOL, ALARK, and ISFIN. For the second tree level, illustrated in Fig. 7, Archimedean type families appear again with different dependence patterns. In this level for the post-GFC period, all selected copulas are one-parameter families except SBB8 for the pair (AKBNK, GARAN \(\mid \) ISCTR). For the conditional copula functions, the assigned conditioning variable is much more variant compared to the results of the pre-GFC and GFC periods. For example, the pair (GARAN, YKBNK) is dependent given ISCTR (Frank, \(\theta =2.49\)) whereas (ISCTR, ALARK) is weakly dependent given the stock YKBNK (Clayton, \(\theta =0.19\)) (the middle part of Fig. 7).

For the simplicity, only first two trees are presented whereas one can do the forward trace to examine the noticeable differences on each pair copula. For finance sector, the best selected pair copula is varying throughout pre-GFC to post-GFC with different tail dependence properties. At various levels in the tree structure, the obtained pair copulas can be summarized in terms of counting/grouping method as in Table 4 (Hernandez, 2015). Based on the selected copula families, it is important to highlight the changing dependence patterns over different periods of global financial crisis. In Table 4, the most selected family in pre-GFC, survival Gumbel, indicates that there exists lower tail dependencies for the stock pairs (asymmetric type of dependence). For GFC period (bear market), the impact of Gaussian and Frank exhibits no tail dependence at various tree levels of fitted R-Vine model. The Frank family appears the most for post-GFC period whereas only one Gaussian family is selected. For periods of GFC and post-GFC (especially increased number of Frank pairs), it is obvious that the most of the dependence is concentrated in the centre of the joint distributions. This finding indicates that the stocks in the finance sector have high dependence risk when the market is not stable. Additionally, during GFC, the largest presence of Gaussian copula implies that the most of the dependence relationship are mainly linear type. Nevertheless, for pre-GFC period, most of the dependence is located in the lower tail (Clayton, survival Gumbel and BB8 families). The lower tail dependence concentration is suggesting that the finance sector have high dependence risk in bear market conditions and low dependence risk when the financial markets are stable. Overall, the dependence pattern between the stocks for three different periods encounters various changes, reflected by the tree structures, the best fitted copula and derived dependence degrees. Nevertheless, the dependence parameters always show a positive relationship between the stocks in the finance sector.

Similar to the related literature, the advantage of exploiting the R-Vines for capturing the complex patterns of dependency is easy to observe in terms of different copula pairs and corresponding tail dependence properties. As an illustration, R-Vine copula specification matrix for pre-GFC period with additional details is displayed in Tables 17, 18 and 19 in Appendix 2. Table 17 summarise how considered stocks are tied together within R-Vine copula model. For the ease of reading, the ordering of the stock names given in Figs. 2 and 3 are important. For instance, the integer numbers in the bottom row with the diagonal entries in Table 17 exhibit which pairs are connected for the unconditional copulas (first tree level), ie. (1,3) stands for the stock pair (AKBNK, ISCTR). In this matrix representation, Table 18 shows which copula family are fitted to capture dependencies between the pairs of indices. To illustrate, by following the same guideline, the first indicated integer at the bottom row of Table 18 corresponds to the Student’s t-distribution with one of the estimated parameters is presented in the same entry of the Table 19. This reading implies the stock pair (AKBNK, ISCTR) is modeled with Student’s t-copula having lower and upper tail dependencies symmetrically, for the pre-GFC period. This information basically implies the joint behavior of two stocks for small or large values before the global financial crisis. This joint co-movement is switched to the relationship without a tail dependence during GFC (Gaussian) and turned back to the one with both tail dependencies during post-GFC period (Student’s t). It is interesting to highlight that for the GFC period, the stock pairs (AKBNK, ISCTR) show greater dependence in the centre of the joint distributions.

To conserve space, the R-Vine copula model specification is just illustrated for the pre-GFC period for finance sector with the matrix representation (Further details about the GFC and pre-GFC periods of finance sector are available upon request). Herein, only the fitted pair copula families and their indications for other sectors are summarized by Tables 5, 6, 7, 8 and 9 regarding the copula counting/grouping approach. Especially, to examine whether the major financial shock caused a noticeable change in dependencies or not, the summarized copula families and tail dependence properties for each sector can give more insight about the reaction of stocks in ISE100.

Table 5 illustrates that the most selected copula families for the basic materials sector are grouped under lower tail dependence, having the Survival Gumbel as the most appeared family. With the difference of finance sector, there is no so much impact of Gaussian and Frank families for all sub-periods. Additionally, the largest presence belongs to lower tail dependence families with additional lower/upper tail dependence pattern of two parameter families (Student’s t and BB1) during GFC period. Generally, the lower tail dependence concentration is suggesting that the stocks in finance sector have high dependence risk in each sub-period for the stocks under basic materials sector. Another difference is that, as a result of limited number of stocks (\(p=4\)), independence copula did not appear for any level of fitted R-Vine tree.

Copula selections for the cons cyclicals in Table 6 shows that the most appeared families have lower tail dependence. It illustrates that the selected copula families are grouped mostly under lower tail dependence, having Clayton (4 times) for pre-GFC more frequently. There exists one upper tail dependence family (Gumbel) for the consumer cyclicals sector (at the last tree level). Similar to finance sector, for periods of GFC and post-GFC, the increased number of Gaussian copulas indicate that some part of the dependence is concentrated in the centre alongside with the lower tail dependence by selected survival Gumbel. When we have a closer look at the tree structure, the appearance of Normal and survival Gumbel families do not exhibit any pattern so that the identification of the joint behavior for the considered stocks are not easy to interpret for GFC period. On the other side, for the post-GFC period, survival Gumbel families appears mostly in the first tree level that the unconditional lower tail dependence concentration among the stocks is suggesting that still they have high dependence risk.

The dominance of the lower tail dependence is still valid for the stocks considered under the sector consumer non-cyclicals (Table 7). The most selected copula family for each sub-period is Survival Gumbel (7 for pre-GFC and GFC, 9 for post-GFC indicating that the dependence during the post-GFC period is more of asymmetric type). From GFC to post-GFC states, the central dependence is replaced by the lower tail dependence or independence regarding the inter-dependencies between the stocks. Similar to many discussed cases before, there is no upper tail dependence and primarily the dependence concentration in the lower tail indicates that any constructed portfolio with the mentioned stocks has high dependence risk in any sub-period. This information gives an important clue about how the optimum portfolio should be established when the financial stock markets do not behave smoothly. In that sense, any portfolio focused on only the stocks belonging to that sector have higher risk regardless of the existence of bear or stable market.

In Tables 8 and 9, the dominance of the lower tail dependence can be identified first. The only difference is that the stocks under the industrial sector have solely lower tail dependence (Table 8), whereas the stocks that are classified under the others have also central dependence (more Gaussian case in Table 9). Additionally, the selected families are more diversified for the case of the others sector compared to the industrial. More specifically, one of the families is Survival BB1 for post-GFC period in Table 8 that shows a joint behavior of the returns where the prices are both decreasing or increasing. In that sense, to minimize the risk of any portfolio, selection of stocks from different sectors could be useful for decision makers. From GFC to post-GFC, the more balanced lower/central dependence occurrence is replaced by the lower/upper tail dependence. There is no upper tail dependence for the dependence pattern captured for the industrial sector in any sub-period so that one can not expect see positively skewed returns in market conditions. On the other hand, the impact of survival BB1 for the others sector might result in a weak recovery of the stock markets for post-GFC period. This increases probability for the stocks to realize positive returns, a clue for recovery after the crisis, is more visible for finance sector in Table 4 with five copula families having both tail dependencies on the same market conditions (post-GFC period).

To sum up, the most frequently observed pair copula within the fitted R-Vine model is the Survival Gumbel family, which corresponds with the findings of Patton (2004), who stressed the importance of orientation of copula families before. Regarding the appearance of Gaussian copula, especially during post-GFC period, the outcomes presented for Turkish market contradict with the findings of Allen et al. (2017), having the reduction in the use of tail dependencies. This information can be exploited by the decision makers in the market so that the optimal portfolio allocation can be examined by diversifying the risk by creating a basket from different stocks. For this reason, a reasonable sector leader selection followed by the calculation of two main risk measures; VaR and ES for different market conditions are explained in the next subsection.

4.3 Portfolio Analysis

For the portfolio analysis, a reasonable selection over different stocks is the starting point. By regarding the previous studies, 8 stocks among 32 are selected for portfolio construction. For this selection, the C-Vine tree structure and the importance of the diversity among the sectors are taken into account together (Czado, 2019). Based on this selection, the obtained sector leaders are; AKBNK (finance), EREGL (basic materials), DOHOL (consumer non-cyclicals), ARCLK (consumer cyclicals), THYAO (industrial) TUPRS, TCELL, ISGYO (others). For simplicity, C-Vine model fitted over the whole sample for the sectors except others and the 3 stocks (TUPRS, TCELL, ISGYO) from the others are included since they represent different business lines.

Rolling window approach have been used for the estimation of the stock movements with the limited time intervals. Instead of analyzing the data all at once, a dynamic approximation is generated by filtering and shifting the data in a limited time window iteratively. For the window size, we use 250-days, which is widely used in literature, and its results are compared with 100-days rolling window size results. While relatively long-term portfolio risk is measured with the 250-days rolling window method, a relatively shorter-term is obtained with the 100-days rolling window approach. In each rolling window, residual decomposition of GARCH(1,1) model with sstd innovation, R-Vine copula fitting with cumulative-transformed residuals and related R-Vine simulations with 1000 iterations are executed. For comparison, classical GARCH(1,1) models with normal (norm), student-t (std) and skewed student-t (sstd) innovations are fitted and forecasted one-day ahead by using obtained parameters.

The steps for an m days dynamic method with \(p\%\) for risk measure estimations are described below:

-

(1)

Convert the data into log-return series.

-

(2)

For each moving window estimate GARCH(1,1) parameters for univariate data with different innovation distributions, extract the standardized iid residuals.

-

(3)

Convert residuals to innovation of marginal distributions.

-

(4)

Fit the R-Vine copula model to the marginals and estimate copula parameters. Generate 1000 simulations from the fitted R-Vine model.

-

(5)

Convert the simulated uniform marginals to residuals and simulate one-day ahead mean and volatility forecasts using GARCH(1,1) parameters.

-

(6)

Forecast one day ahead VaR\(_p\) and ES\(_p\). Similarly, ShR and SoR ratios are extracted for the return performance

-

(7)

Repeat Step 2 to 6 for each moving window.

-

(8)

Apply backtesting methods for the values of VaR\(_p\) and ES\(_p\)

Constructing an equally weighted portfolio allows us to compare GARCH(1,1) models with different innovations with the R-Vine GARCH model, which provides ease of interpretation. By construction of an equally-weighted portfolio, we estimate one-day ahead portfolio returns and compare VaR and ES values of these settled portfolios for three sub-periods. To examine the riskiness of the portfolio, VaR and ES are measured empirically over 1000 simulations. Both measures are obtained for \(\alpha = 0.05\) (%95 confidence) over 250 (long-term) and 100 (short term) days of rolling window size separately.

Figures 8 and 11 provide the comparisons of VaR and ES values for the pre-GFC period on the long-term. Within pre-GFC period, Vine-GARCH outperforms other candidate models based on the co-movements between riskiness of portfolio returns. Similarly, Figs. 9 and 12 exhibit the comparison of VaR and ES values for GFC period. Basic GARCH models with different innovations can be erroneous for this period, especially shown in ES values, due to the risky and structural stock movements in GFC period. These basic GARCH models are not capable of explaining portfolio movement in this period, it reveals the need for a model with an dependency structure. Lastly, Figs. 10 and 13 provide that the comparisons of VaR and ES values for the post-GFC period. For the post-GFC period, Vine-GARCH gives more consistent results by comparison with other candidate models.

Regardless of the structural differences of sub-periods, inclusion of R-Vines in all sub-periods is able to capture downfalls of portfolio better than the other candidate models. Besides, it is observed that the average portfolio return decreased more during GFC period. In this fragile period, the accurate estimation of these downfalls become more important for the sustainability of the economic system.

The backtesting for both VaR and ES risk measures in 250 and 100 days rolling windows for \(\alpha =0.05\) level are used for statistical testing. As shown in Tables 10 and 11, for 250 days, Vine-GARCH models are more capable of capturing the portfolio risk compared to other candidates. In the case of 100 days rolling windows in Table 12, although p-values for each sub-period are small, Vine-GARCH model gives the closest value to the expected exceedance count. Similarly, the backtesting results for ES values in Table 13 show that p-values of Vine-GARCH model for each sub-period are relatively higher than other models. Generally, the achieved minimal variability on the differences between the expected and actual number of exceedances support the potential benefit for the considered R-Vine GARCH model with sstd innovation (VineGARCH-sstd) for all time periods.

4.4 Return Performance

For the return performance indicators, ShR and SoR ratios, mainly the \(5 \%\) risk free rate is investigated for the three periods similar to the VaR and ES calculations. For the each day, simulated set of returns are considered for the calculation of both ShR and SoR ratios and the performance under four main approaches (VineGARCH-sstd, GARCH(1,1)-sstd, GARCH(1,1)-std and GARCH(1,1)-norm) is summarized graphically. Except some certain period of times, the obtained ShR and SoR ratios support the risk measure calculations from a different perspective.

Since the Turkey free risk rate is highly changing over time and no certain data published regularly during the selected years, four main rates (\(R_{rf} = \%5, 10, 15, 20\)) are considered to express the potential impact of \(R_{rf}\) over the values of ShR and SoR ratios. For the sake of simplicity, the impact of different risk free rates is elaborated only for 250-days rolling window and GFC sub-period.

Firstly, in many cases, R-Vine GARCH approach resulted in higher return performance indices compared to classical GARCH models. Even if the created portfolio is an equally-weighted design, still, it is better to incorporate the dependence structure among the stock returns. For 250-days rolling window case, both ShR and SoR values are higher for the R-Vine GARCH framework. Especially, during GFC period, investment return performance over downside risk and overall risk with VGARCH model is higher than other candidate models. Whereas in pre-GFC and post-GFC periods, the performance of R-Vine GARCH model can overlap with its alternatives in certain period of times in Figs. 14, 15 and 16.

In the case of 100-days, the ShR and SoR ratios became more volatile in R-Vine GARCH approach, but still higher than other GARCH models most of the time. Besides, the dominance of SoR over ShR ratios, shows us the downside volatility is less than mean volatility in risky period for pre- GFC and GFC sub-periods (as shown in Figs. 17 and 18). However, even if R-Vine GARCH model often yields higher return performance, the equally weighted approach seems a bit insufficient during post-GFC period, towards the end of 2013, in Fig. 19. Overall, the R-Vine GARCH model performance seems more adequate over classical GARCH results for certain time periods and different rolling window size, whereas both ShR and SoR have higher discrepancy when 100-days time-window is investigated.

The impact of risk free rate change is explored only during GFC period and 250-days rolling window size. For the space limitation, the results are summarized in Appendix 3. The first observation is that, for 250-days rolling window size, R-Vine GARCH model outperforms its competitors still over the changing risk free rate. During GFC period, in all Figures from 23, 24 and 25, the ShR and SoR ratios are higher for the R-Vine GARCH approach. When the risk free rate is increased, it illustrates that the ShR ratio falls above the visualized levels of SoR values, compared to the examined cases for \(\% 5\) risk free rate.

4.5 COVID-19 Pandemic Crisis

The investigations about the suitability of R-Vine GARCH for an emerging stock market, as it is mentioned before, similar calculations have been made for the COVID-19 pandemic period. For that purpose, the eight stock values (AKBNK, EREGL, DOHOL, ARCLK, TUPRS, TCELL, ISGYO, and THYAO) that we explored in the portfolio analysis are considered mainly. For the pandemic time horizon decision, we mainly relied on the announcements during the COVID-19 pandemic period, both globally and nationally. Generally, the pandemic period has been announced in Turkey starting on March 11, 2020 (the first COVID-19 case announcement). To make a decision on the ending date, April 26, 2022 is considered, as the date of mask obligation was lifted and all places came back to regular status in Turkey. Officially, the World Health Organisation (WHO) declared that COVID-19 no longer constitutes a pandemic in May 2023 but we tried to avoid using data until 2023 because of potential national-election-related impacts. Overall, this new data set covers log-returns of main stocks from March 11, 2020, to April 26, 2022 (533 daily observations). In this new examination, the same model comparison results are generated at different risk free rates (\(R_{rf} = \%5, 10, 15, 20\)) to measure its potential impact on the Sharpe and Sortino ratios. Besides, the impact of rolling window size (\(m=150, 250, 350\)) and significance level (\(p=0.01, 0.05, 0.10\)) is explored further on the risk measure calculations.

The structure of the financial market and return dynamics can vary across countries and these differences resulted in heterogeneous considerable shocks and waves in Turkey, as an emergent market. During COVID-19 time horizon, in addition to pandemic-related shocks, there were certain national news or political decisions that may exacerbate oscillations in the Turkish stock market. Specifically, there are key dates related to pandemic crisis management (varying timings and characteristics of lockdowns) and certain administrative decisions (managerial changes in the Central Bank of the Republic of Turkey). During this period, the performance of R-Vine GARCH (VGARCH with sstd) seems to be promising over classical approaches for Turkish stock market. For simplicity, only VaR and ES behavior differences are summarized graphically under different rolling window size values. Other related findings are available upon request but they were empirically discussed briefly.

Mainly, Figs. 20, 21 and 22 show the model comparison summary over the VaR and ES values, showing the suitability of R-Vine GARCH as opposed to classical GARCH models, over the changing rolling window size. Although the time horizon that we used for the one-day-ahead forecasting is slightly changed, the plausibility of the VGARCH model with sstd is preserved. Additionally, this approach seems successful in reacting to certain return drops for specific dates. For the case of \(m=250\), as a result of the first lagged COVID-19 shock over the market and further economical decisions, there is a big decline and VGARCH seems more sensitive to this change. During March 2020, two main news were the interest rate cut made by Central Bank of the Republic of Turkey (17 March, 2020) and FED asset purchase decision (24 March, 2020). Similarly, during December 2020, the accelerating impact of lockdowns in various economics including Turkey, and local market dynamics potential reasons of another large decline. Besides, sudden and political managerial changes at the Central Bank of the Republic of Turkey occurred during March 2021 with a certain negative impact on the trustworthiness of the market movement dynamics. In such movements, the sensitivity of VGARCH model seems comparatively higher than other GARCH type approaches. This general pattern can be observed under the impact of different rolling window size for both VaR and ES values. Besides, within different parameter constraints, similar pattern appeared most of the time and this empirically supports the use of VGARCH model with sstd for measuring the Turkish stock market dependencies. Regarding the VaR and ES backtesting results, the VGARCH model resulted in significant results with LR Test p-values larger than 0.05 level under different rolling window size. In that respect, the findings over COVID-19 period are aligned with the previously summarized GFC period.

5 Conclusions

This study uses the R-Vine copula framework for two main purposes: (i) To detect the inter-dependencies between stocks and (ii) To construct a more flexible portfolio over different sectors. For the first goal, the R-Vine copula is considered for the daily log returns of the ISE100 stocks in the Turkish financial market for three periods; pre-GFC, GFC, and post-GFC. Primarily, the filtered log returns are modeled via R-Vine over three sub-periods to exhibit significant changes in the dependence pattern between the stock values. In the second part, we compare the R-Vine based GARCH(1,1) model with sstd innovations against to the classical GARCH(1,1) type models with different innovations. The widely used rolling window approach allowed us to estimate one-day-ahead returns and compute dynamic VaR and ES risk measures. The backtesting methods indicate that the R-Vine based approach is more suitable for more resilient risk management for the Turkish financial market. Additionally, the risk measures calculations are supported by the Sharpe and Sortino ratio behaviors. Specifically, the potential impact of risk free rate is investigated over the GFC period. To the best of the author’s knowledge, the main findings of this study constitute the most comprehensive work on the Turkish market and extend the available literature by offering an in-depth analysis of the stock’s market dependence structure and risk dynamics attached to its performance by exploiting the use of R-Vine copulas.

The optimal pair copulas for the sectors, over three sub-periods, exhibit asymmetrical cases of dependency between stock returns in the Turkish financial market. Indicating that, stock returns are best explained by asymmetrical copulas. Another significant discovery is that, when the financial industry is excluded, there are only a few situations over a short period where the Student’s t-copula demonstrates symmetric lower and upper tail dependency. Specifically, the shifted dependence structure from the lower-tail (survival Gumbel) to the center (Frank) for the finance sector implies increased confidence in stocks attached to the high returns belonging to the finance sector (from pre- to post-GFC period). This finding can be seen as a reflection of the increasing flexibility of the developing markets, and changing regulatory environments in the post-GFC period. Regarding the fact that the Turkish financial sector is predominantly composed of banks, structural reforms starting in 2001 in the banking sector made the finance sector more resistant to the impacts of the GFC.

Overall, the most selected copula families are lower-tail copulas; Clayton, and survival Gumbel for different periods. This result supports the previous criticism of the Gaussian copulas during a crisis. The main findings show a high dependence risk between stocks under non-tranquil conditions, and a low dependence risk when the stock market moves smoothly. The varying dependence on the stocks for each sector shows the importance of the portfolio diversification. For this reason, the dynamic use of the R-Vine model instead of classical GARCH-type tools will be useful to estimate more robust VaR and ES measures. Specifically, the advantage of combining R-Vine and GARCH models is beneficial in detecting asymmetrical and fat-tailed distributions for stock returns. Herein, the equally weighted portfolio construction over the selected leaders (weight of 26.46% in ISE100) is a good indicator of the general behavior in the stock market. From this point of view, a more precise identification of the dependence structure among these sector leaders offers practical implications to investors and policymakers. Specifically, the findings of the study can serve as a generic tool for investment and hedging purposes over more volatile periods.

Importance of examining the dependence between different stocks for risk measures have been underlined with the help of empirical findings belong to the COVID-19 period. Under the impact of different economic shock waves, the use of R-Vine GARCH is shown to be promising for an emerging stock market. By considering various parameter values during the calculation, the suitability of the R-Vine GARCH has been tested and it is shown that, the calculated risk measures are performing better than the classical GARCH type models. Similar to the previously discussed return performance, Sharpe and Sortino values once again supported the findings positively. In that respect, for two different crisis period, modeling stock dependencies via R-Vine GARCH model for further risk measure calculations seem more suitable for Turkish market.

Although the main findings of the study are competent and informative about varying dependence structures in the Turkish market, there are certain directions to improve the considered approach. As an expansion of the considered R-Vine GARCH framework, the time or variable dependent approach can be incorporated for the similar setting. Specifically, through the use of non-simplified pair copulas can be considered to consider the changing dependence patterns in the Turkish stock market under globally accepted indicators such as exchange rates and liquidity conditions. Considering that the Turkish financial market is a developing one, and affected by global factors, such impacts can be included in the design. The equally weighted portfolio construction can be replaced by an optimal portfolio. Efficient frontier analysis can be considered under different constraints. From a different perspective, a wavelet-based R-Vine copula approach can be examined with non-simplified pair copulas to capture co-movements more flexibly. In a more systematic approach, phase-wise analysis can be examined over the market by considering in-sample and out-of-sample phases such as bear or bull market conditions.

To provide a clearer market analysis, the potential impacts of other financial markets in this region should be incorporated. Since the stock market in Turkey mainly vulnerable to different markets such as western or eastern financial markets, other factors can be embedded into R-Vine GARCH approach flexibly. The potential impacts of exchange or oil price shocks will be indicator to the market conditions so that the phase-level non-simplified R-Vine GARCH approach could be the next step to derive more robust and statistically significant findings over the ISE100 stocks in the Turkish financial market. Instead of empirical-based time splitting, change-point analysis oriented sub-period design empowered with the phase-level analysis lies on the top of the authors future plans.

Data Availability

The considered data set is retrieved from Thomson Reuters website and available upon request for the purpose of reproducibility.

References

Aas, K., Czado, C., Frigessi, A., & Bakken, H. (2009). Pair-copula constructions of multiple dependence. Insurance Mathematics and Economics, 44, 182–198. https://doi.org/10.1016/J.INSMATHECO.2007.02.001

Akel, V. (2007). Türkiye’deki a ve b tipi yatırım fonları performansının devamlılığının parametrik ve parametrik olmayan yöntemlerle değerlendirilmesi. Dokuz Eylül Üniversitesi İktisadi İdari Bilimler Fakültesi Dergisi, 22(2), 147–178.

Allen, D. E., Ashraf, M. A., Mcaleer, M., Powell, R. J., & Singh, A. K. (2013). Financial dependence analysis: Applications of vine copulas. Statistica Neerlandica, 67, 403–435. https://doi.org/10.1111/STAN.12015

Allen, D. E., McAleer, M., & Singh, A. K. (2017). Risk measurement and risk modelling using applications of vine copulas. Sustainability, 9(10), 1762.

Aloui, R., Aïssa, M. B. S., & Nguyen, D. K. (2013). Conditional dependence structure between oil prices and exchange rates: A copula-garch approach. Journal of International Money and Finance, 32, 719–738. https://doi.org/10.1016/J.JIMONFIN.2012.06.006

Alqaralleh, H., & Canepa, A. (2021). Evidence of stock market contagion during the COVID-19 pandemic: A wavelet-copula-GARCH approach. Journal of Risk and Financial Management, 14(7), 329. https://doi.org/10.3390/jrfm14070329

Aslam, F., Mughal, K. S., Aziz, S., Ahmad, M. F., & Trabelsi, D. (2021). Covid-19 pandemic and the dependence structure of global stock markets. Applied Economics, 54(18), 2013–2031. https://doi.org/10.1080/00036846.2021.1983148

Atmaca, M. E. (2022). Portfolio management and performance improvement with Sharpe and Treynor ratios in electricity markets. Energy Reports, 8, 192–201.

Bagci, H. (2022). Measuring stock performance in BIST liquid bank index. Global Agenda in Social Sciences Global Studies, 9, 31–47.

Bedford, T., & Cooke, R. M. (2001). Probability density decomposition for conditionally dependent random variables modeled by vines. Annals of Mathematics and Artificial Intelligence, 32, 245–268. https://doi.org/10.1023/A:1016725902970

Bedford, T., & Cooke, R. M. (2002). Vines a new graphical model for dependent random variables. The Annals of Statistics, 30, 1031–1068. https://doi.org/10.1214/AOS/1031689016

Binici, M., Koksal, B., & Orman, C. (2013). Stock return comovement and systemic risk in the turkish banking system [Working Papers]. Research and Monetary Policy Department, Central Bank of the Republic of Turkey, (1302).

Brechmann, E. C., & Czado, C. (2013). Risk management with high-dimensional vine copulas: An analysis of the euro Stoxx 50. Statistics and Risk Modeling, 30, 307–342.

Chesters, J. (2011). The global financial crisis in Australia. TASA 2010 Proceedings of the Conference: Social Causes, Private Lives.

Christoffersen, P., Hahn, J., & Inoue, A. (2001). Testing and comparing value-at-risk measures. Journal of Empirical Finance, 8, 325–342.

Christoffersen, P. F. (1998). Evaluating interval forecasts. International Economic Review, 39, 841. https://doi.org/10.2307/2527341

Cooke, R.M. (1997). Markov and entropy properties of tree-and vine-dependent variables. In Proceedings of the ASA Section of Bayesian Statistical science, 27.

Cucchiella, D. I. F., & Gastaldi, M. (2016). Optimizing plant size in the planning of renewable energy portfolios. Letters in Spatial and Resource Sciences, 9(2), 169–187.

Czado, C. (2019). Analyzing dependent data with vine copulas. Switzerland: Springer International Publishing.

Dagli, H., Semra, B. A., & Bünyamin, E. R. (2008). Türkiye’deki bireysel emeklilik yatırım fonlarının performans değerlendirmesi. Muhasebe ve Finansman Dergisi, 40, 84–95.

David, A. (1997). Fluctuating confidence in stock markets: Implications for returns and volatility. The Journal of Financial and Quantitative Analysis, 32, 427. https://doi.org/10.2307/2331232

Dismann, J., Brechmann, E. C., Czado, C., & Kurowicka, D. (2013). Selecting and estimating regular vine Copulae and application to financial returns. Computational Statistics and Data Analysis, 59, 52–69. https://doi.org/10.1016/j.csda.2012.08.010

Eikon, T. R. (2022). Teck resources ltd income statement, annual standardized in millions of us dollars, ise-100 financial data, accessed: 20 november 2021. (https://eikon.thomsonreuters.com/index.html).

Eita, J. H., & Tchuinkam Djemo, C. R. (2022). Quantifying foreign exchange risk in the selected listed sectors of the johannesburg stock exchange: An sv-evt pairwise copula approach. International Journal of Financial Studies, 10(2), 24. https://doi.org/10.3390/ijfs10020024

Eken, M. H., & Pehlivan, E. (2009). Yatirim fonlari performansı klasik performans Ölçümleri ve vza analizi. Maliye ve Finans Yazıları, 1(83), 85–114.

Embrechts, P., Mcneil, E., & Straumann, D. (1999). Correlation: Pitfalls and alternatives. RISK, 1999, 69–71.

Geidosch, M., & Fischer, M. (2016). Application of vine copulas to credit portfolio risk modeling. Journal of Risk and Financial Management, 9, 4. https://doi.org/10.3390/JRFM9020004

Ghalanos, A. (2022). rugarch: Univariate garch models. (R package version 1.4-8.).

Guegan, D., & Maugis, P. A. (2010). An econometric study of vine copulas. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1590296

Gökgöz, F., & Günel, M. O. (2012). Portfolio performance analysis of Turkish mutual funds. Ankara University Journal of Social Sciences, 3(2), 3–25.

Heinen, A., & Valdesogo, A. (2008). Asymmetric CAPM dependence for large dimensions: The canonical vine autoregressive copula model. SSRN Electronic journal. https://doi.org/10.2139/SSRN.1297506

Hernandez, J. A. (2015). Vine copula modelling of dependence and portfolio optimization with application to mining and energy stock return series from the australian market. Theses: Doctorates and Masters.

Jansen, W. J., & Nahuis, N. J. (2003). The stock market and consumer confidence: European evidence. Economics Letters, 79, 89–98. https://doi.org/10.1016/S0165-1765(02)00292-6

Jickling, M. (2009). Causes of the financial crisis. CRS Report for Congress.

Joe, H. (1996). Families of m-variate distributions with given margins and m(m-1)/2 bivariate dependence parameters on jstor. Lecture Notes-Monograph Series Vol. 28, Distributions with Fixed Marginals and Related Topics.

Joe, H. (1997). Multivariate models and dependence concepts. New York, NY: Springer.

Junker, M., Szimayer, A., & Wagner, N. (2005). Nonlinear term structure dependence: Copula functions, empirics, and risk implications. Journal of Banking and Finance, 30(4), 1171–1199.

Kok, D., & Erikci, M. E. (2015). Türkiye’de a tipi yatırım fonlarının performansı: 2004–2013 dönemi analizi. Pamukkale İşletme ve Bilişim Yönetimi Dergisi, 2, 15–26.

Korkmaz, T., & Uygurturk, H. (2008). Türkiye’deki emeklilik fonları ile yatırım fonlarının performans karşılaştırması ve fon yöneticilerinin zamanlama yetenekleri. Kocaeli Üniversitesi Sosyal Bilimler Dergisi, 15, 114–147.

Kurowicka, D., & Joe, H. (2010). Dependence modeling: Vine copula handbook. Singapore: World Scientific Publishing Co.

Liu, B., Ji, Q., & Fan, Y. (2017). A new time-varying optimal copula model identifying the dependence across markets. Quantitative Finance, 17(3), 437–453.

MacKenzie, D., & Spears, T. (2014). The formula that killed wall street: The gaussian copula and modelling practices in investment banking. Social Studies of Science, 44(3), 393–417.

McNeil, A. J., & Frey, R. (2000). Estimation of tail-related risk measures for heteroscedastic financial time series: An extreme value approach. Journal of Empirical Finance, 7(3), 271–300. https://doi.org/10.1016/S0927-5398(00)00012-8

Muteba Mwamba, J. W., & Mwambi, S. M. (2021). Assessing market risk in BRICS and oil markets: An application of Markov switching and vine copula. International Journal of Financial Studies, 9(2), 30. https://doi.org/10.3390/ijfs9020030

Nagler, T., Schepsmeier, U., Stoeber, J., Brechmann, E.C., Graeler, B., & Erhardt, T. (2022). Vinecopula: Statistical inference of vine copulas. Retrieved from https://CRAN.R-project.org/package=VineCopula (R package version 2.4.4).

Nelsen, R. B. (2007). An introduction to copulas. New York, NY: Springer.

Ning, C. (2010). Dependence structure between the equity market and the foreign exchange market a copula approach. Journal of International Money and Finance, 29(5), 743–759. https://doi.org/10.1016/j.jimonfin.2009.12.002

Ocal, H., & Kamil, A. A. (2021). Risk-return based performance evaluation of stocks in BIST 100 and KOMPAS 100 indices of Borsa Istanbul and Indonesian stock exchange. Scientific Papers of the University of Pardubice, 29, 1–13.

Patton, A. J. (2004). On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. Journal of Financial Econometrics, 2(1), 130–168. https://doi.org/10.1093/jjfinec/nbh006

Patton, A. J. (2012). A review of copula models for economic time series. Journal of Multivariate Analysis, 110, 4–18. https://doi.org/10.1016/J.JMVA.2012.02.021

Patton, A. J. (2013). Copula methods for forecasting multivariate time series. Handbook of Economic Forecasting, 2, 899–960. https://doi.org/10.1016/B978-0-444-62731-5.00016-6

Prince, M. O., & Anokye, M. A. (2020). Quantifying the information flow between Ghana stock market index and its constituents using transfer entropy. Mathematical Problems in Engineering. https://doi.org/10.1155/2020/6183421

Sahamkhadam, M., & Stephan, A. (2023). Portfolio optimization based on forecasting models using vine copulas: An empirical assessment for global financial crises. Journal of Forecasting, 42(8), 2139–2166. https://doi.org/10.1002/for.3009

Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Sklar, M. (1959). Fonctions de repartition an dimensions et leurs marges. Publ. inst. statist. univ. Paris, 8, 229–231.

Sortino, F., & Price, L. (1994). Performance measurement in a downside risk framework. Journal of Investing, 3, 59–64. https://doi.org/10.3905/joi.3.3.59