Abstract

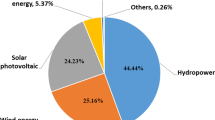

Development of domestic energy sources is a central pillar of national policies for energy independence. In Italy, renewable-energy plants have attained important profit margins under incentivizing policies. The yields and risks for the various sources of biomass, wind, photovoltaic and hydro vary according to the size of the specific plant. The use of mean variance portfolio (MVP) methodology to define efficient portfolios of such energy sources has been established in previous studies. Such methodology defines and quantifies the benefits associated with diversification. In this paper we apply MVP, using net present value and Sharpe ratio criteria, to identify not only the source selection but also its optimal dimensioning, which will achieve the objectives set by decision-makers. The study considers plant capacities from 10 kW up to 100 MW.

Similar content being viewed by others

References

Allan, G., Eromenko, I., McGregor, P., Swales, K.: The regional electricity generation mix in Scotland: a portfolio selection approach incorporating marine technologies. Energy Policy 39, 6–22 (2011)

Amjady, N., Vahidinasab, V.: Security-constrained self-scheduling of generation companies in day-ahead electricity markets considering financial risk. Energy Convers. Manag. 65, 164–172 (2013)

Awerbuch, S., Berger, M.: Applying portfolio theory to EU electricity planning and policy-making. IEA/EET working paper, p. 72 (2003)

Awerbuch, S., Yang, S.: Efficient electricity generating portfolios for Europe: maximising energy security and climate change mitigation. EIB Pap. 12, 8–37 (2007)

Bhattacharya, A., Kojima, S.: Power sector investment risk and renewable energy: a Japanese case study using portfolio risk optimization method. Energy Policy 40, 69–80 (2012)

Blum, H., Legey, L.F.L.: The challenging economics of energy security: ensuring energy benefits in support to sustainable development. Energy Econ. 34, 1982–1989 (2012)

Brounen, D., De Jong, A., Koedijk, C.G.: Corporate finance in Europe confronting theory with practice. ERIM Report Series Research in Management (2004)

Chen, T.-Y., Yu, O.S., Hsu, GJy, Hsu, F.-M., Sung, W.-N.: Renewable Energy technology portfolio planning with scenario analysis: a case study for Taiwan. Energy Policy 37, 2900–2906 (2009)

Chiaroni, D., Chiesa, V., Colasanti, L., Cucchiella, F., D’Adamo, I., Frattini, F.: Evaluating solar energy profitability: a focus on the role of self-consumption. Energy Convers. Manag. 88, 317–331 (2014)

Cucchiella, F., D’Adamo, I., Gastaldi, M.: Sustainable management of waste to energy facilities. Renew. Sustain. Energy Rev. 33, 719–728 (2014a)

Cucchiella, F., D’Adamo, I., Lenny Koh, S.C.: Environmental and economic analysis of building integrated photovoltaic systems in Italian regions. J. Clean. Prod. (2013a). doi:10.1016/j.jclepro.2013.10.043

Cucchiella, F., D’Adamo, I.: Feasibility study of developing photovoltaic power projects in Italy: an integrated approach. Renew. Sustain. Energy Rev. 16, 1562–1576 (2012)

Cucchiella, F., D’Adamo, I.: Issue on supply chain of renewable energy. Energy Convers. Manag. 76, 774–780 (2013)

Cucchiella, F., D’Adamo, I.: Residential photovoltaic plant: environmental and economical implications from renewable support policies. Clean Technol. Environ. Policy (2015a). doi:10.1007/s10098-015-0913-1

Cucchiella, F., D’Adamo, I., Gastaldi, M.: Modeling optimal investments with portfolio analysis in electricity markets. Energy Educ. Sci. Technol. Part A Energy Sci. Res. 30, 673–692 (2012)

Cucchiella, F., D’Adamo, I., Gastaldi, M.: Italian energy portfolio analysis: an interactive renewable investments tool. Adv. Mater. Res. 739, 768–776 (2013b)

Cucchiella, F., D’Adamo, I., Gastaldi, M.: Financial analysis for investment and policy decisions in the renewable energy sector. Clean Technol. Environ. Policy 17, 887–904 (2014b)

Cucchiella, F., D’Adamo, I., Rosa, P.: End-of-life of used photovoltaic modules: a financial analysis. Renew. Sustain. Energy Rev. 47, 552–561 (2015)

Cucchiella, F., D’Adamo, I.: A Multicriteria analysis of photovoltaic systems: energetic, environmental, and economic assessments. Int J Photoenergy 1–8 (2015b)

Dunlop, J.: Modern portfolio theory meets wind farms. J. Priv. Equity 7, 83–95 (2004)

Elbannan, M.A.: The capital asset pricing model: an overview of the theory. Int. J. Econ. Financ. 7, p216 (2014)

Georgiev, E., Mihaylov, E.: Economic growth and the environment: reassessing the environmental Kuznets Curve for air pollution emissions in OECD countries. Lett. Spat. Resou. Sci. 8, 29–47 (2014)

Gökgöz, F., Atmaca, M.E.: Financial optimization in the Turkish electricity market: Markowitz’s mean-variance approach. Renew. Sustain. Energy Rev. 16, 357–368 (2012)

Graham, J.R., Harvey, C.R.: The theory and practice of corporate finance: evidence from the field. J. Financ. Econ. 60, 187–243 (2001)

Hirth, L.: The market value of variable renewables: the effect of solar wind power variability on their relative price. Energy Econ. 38, 218–236 (2013)

Huang, X.: Portfolio selection with a new definition of risk. Eur. J. Oper. Res. 186, 351–357 (2008)

Janczura, K.: Price volatility and the efficient energy portfolio for the United States. Atl. Econ. J. 38, 239–239 (2010)

Komor, P., Bazilian, M.: Renewable energy policy goals, programs, and technologies. Energy Policy 33, 1873–1881 (2005)

Kruyt, B., van Vuuren, D.P., de Vries, H.J.M., Groenenberg, H.: Indicators for energy security. Energy Policy 37, 2166–2181 (2009)

Liu, M., Wu, F.F.: Managing price risk in a multimarket environment. IEEE Trans. Power Syst. 21, 1512–1519 (2006)

Madlener, R.: Portfolio optimization of power generation assets. In: Zheng, Q.P., Rebennack, S., Pardalos, P.M., Pereira, M.V.F., Iliadis, N.A. (eds.) Handbook of CO\(_{2}\) in Power Systems, pp. 275–296. Springer, Berlin (2012)

Magnani, N., Vaona, A.: Regional spillover effects of renewable energy generation in Italy. Energy Policy 56, 663–671 (2013)

Markowitz, H.: Portfolio selection*. J. Financ. 7, 77–91 (1952)

Marrero, G.A., Ramos-Real, F.J.: Electricity generation cost in isolated system: the complementarities of natural gas and renewables in the Canary Islands. Renew. Sustain. Energy Rev. 14, 2808–2818 (2010)

Muñoz, J.I., Sánchez de la Nieta, A.A., Contreras, J., Bernal-Agustín, J.L.: Optimal investment portfolio in renewable energy: the Spanish case. Energy Policy 37, 5273–5284 (2009)

Ozturk, I.: A literature survey on energy-growth nexus. Energy Policy 38, 340–349 (2010)

Panwar, N.L., Kaushik, S.C., Kothari, S.: Role of renewable energy sources in environmental protection: a review. Renew. Sustain. Energy Rev. 15, 1513–1524 (2011)

Ren, R.: Global status report. Renewable Energy Policy Network for the 21st Century, Paris, France (2014)

Roques, F.A., Newbery, D.M., Nuttall, W.J.: Fuel mix diversification incentives in liberalized electricity markets: a mean-variance portfolio theory approach. Energy Econ. 30, 1831–1849 (2008)

Shen, Y.-C., Chou, C.J., Lin, G.T.R.: The portfolio of renewable energy sources for achieving the three E policy goals. Energy 36, 2589–2598 (2011)

Sunderkötter, M., Weber, C.: Valuing fuel diversification in power generation capacity planning. Energy Econ. 34, 1664–1674 (2012)

van Kooten, G.C.: Wind power: the economic impact of intermittency. Lett. Spat. Resou. Sci. 3, 1–17 (2010)

Westner, G., Madlener, R.: The benefit of regional diversification of cogeneration investments in Europe: a mean-variance portfolio analysis. Energy Policy 38, 7911–7920 (2010)

Wing, L.C., Jin, Z.: Risk management methods applied to renewable and sustainable energy: a review. J. Electr. Electron. Eng. 3, 1–12 (2015)

Xin-Gang, Z., Tian-Tian, F., Yu, M., Yi-Sheng, Y., Xue-Fu, P.: Analysis on investment strategies in China: the case of biomass direct combustion power generation sector. Renew. Sustain. Energy Rev. 42, 760–772 (2015)

Xu, F., Xiang, N., Yan, J., Chen, L., Nijkamp, P., Higano, Y.: Dynamic simulation of China’s carbon emission reduction potential by 2020. Lett. Spat. Resour. Sci. 8, 15–27 (2014)

Zakamouline, V., Koekebakker, S.: Portfolio performance evaluation with generalized Sharpe ratios: beyond the mean and variance. J. Bank. Financ. 33, 1242–1254 (2009)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cucchiella, F., D’Adamo, I. & Gastaldi, M. Optimizing plant size in the planning of renewable energy portfolios. Lett Spat Resour Sci 9, 169–187 (2016). https://doi.org/10.1007/s12076-015-0150-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-015-0150-6