Abstract

Size-dependent tax enforcement is quite widespread worldwide, but the literature on its effects over firms’ behaviour is very scarce. By assuming different audit probabilities for small and large firms, we propose a dynamic model to study the consequences of size-dependent monitoring level on a firm’ fiscal compliance and its decision to invest and grow in a single-firm perspective. By combining analytical findings and simulation results, we show that: (1) under certain conditions, a dimensional trap may emerge, as small firms have no advantage in growing and prefer to remain small to avoid stronger enforcement; (2) audit activity and fine levels are important tools available to the State to fight evasion, but a careful calibration is required not to incur undesired effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Taxes on personal and corporate incomes remain the most important source of revenues used to finance public spending in 17 OECD countries OECD (2022). On average in 2020, OECD countries collected 33.7% of tax revenues through taxes on income and profits. Therefore, firms contribute to a substantial fraction of governments’ income, not only because they are legally obliged to pay corporate income, payroll, property, or consumption taxes, but also because they act as withholding agents. As a consequence, firms also have an ample scope for tax evasion (Jung and Jung, 2022), a plague of worrying dimension in many countries. In the United States, the relative difference between the amount of taxes paid and the amount due is estimated to be about \(15\%\) for the period 2014-2016 (Kaoru et al., 2019). The VAT compliance gap in the European Union is around \(11\%\) (Poniatowski et al., 2021) and, according to a study of 2015, Rose-Ackerman and Palifka (2016) estimates the tax gap to be around 825 billion euros each year. If we consider, for example, the Italian case, the tax gap stands at \(23.28\%\), meaning that about 23 cents are lost due to tax evasion for each euro collected by the Revenue Agency.

Since almost all modern societies use taxes to finance the provision of collective public goods and services, putting in place effective tools to reduce tax evasion is one of the main objectives of all countries, both developing and developed. Starting from the pioneer paper by Allingham and Sandmo (1972), the “classical” tools for contrasting tax evasion are identified in enforcement and sanctioning of the evaders. To this end, the International Monetary Fund (and more specifically the Fiscal Affairs Department) guarantees technical assistance to member countries to improve revenue collection and enforcement. One proposed strategy consists of implementing different procedures in relation to different segments of the taxpaying population, with particular attention often paid to large taxpayers. These tools could ensure greater stability in tax flows and increase the effectiveness and efficiency of the tax system. In fact, as Benon et al. (2002) stress, “beginning in the 1980s, the IMF has recommended that member countries facing revenue crises and looking to strengthen tax administration establish large taxpayer units (LTUs) to increase control over the largest taxpayers and improve large taxpayers’ compliance in the short and medium term. [...] Case analysis indicates that countries may gain significant benefits from setting up special operations to control the compliance of the largest taxpayers.”

The expected advantages of the establishment of LTUs are mainly identified in a greater ability to obtain tax revenues and, more generally, in an efficiency enhancement of the tax system. Their creation concerns both developing and developed countries, albeit in different ways. Regarding developed countries, some of them focus almost exclusively on the verification of large taxpayers, with the initial aim of improving their audit programs, especially after the introduction of the value added tax (VAT) in the \(1960s-70s\). Some other countries (for example, Australia, the Netherlands, New Zealand and the United States) have a more structured tax administration system, based on a segmentation of the taxpayer population, and focus mainly on large or large and medium-sized taxpayers (Benon et al., 2002). Typically, governments provide more resources to the LTU so this unit has a higher endowment of auditors per taxpayer than the rest of the tax authorities, and on average the auditors of this unit have better experience and training so as to deal with the most complex target. Therefore, in order to segment taxpaying firms, the tax authority generally sets arbitrary thresholds. Although firms above and below the threshold often face very similar tax structures, the probability of undergoing an audit procedure changes discretely across this arbitrary threshold.

Size-dependent use of fiscal policies has increased over time, as international institutions have encouraged tax administrations to segment taxpayers (Lowe et al., 2019). In fact, as Bachas et al. (2019) stress, over the past 20 years, more than 70 countries have adopted special enforcement units for large taxpayers, aiming for stringent enforcement at the top of the firm-size distribution, although countries have also adopted enforcement policies for small and medium firms. These types of size-dependent regulations emerge in many forms and are now present in many debates around the world. For example, the US Affordable Care Act provides penalties for large firms (more than 50 employees) who fail to provide health insurance to their employees. In addition, alongside countries that have officially created LTUs, there are other countries that, even without having explicitly foreseen such taxpayer segmentation, in practice fix different auditing probabilities for firms of different sizes. For example, on the basis of the report of the Goerke (2019), in Italy micro and small firms face a \(3\%\) probability of being inspected, compared with a \(14\%\) and a \(32\%\) probability for medium and large firms, respectively.Footnote 1

Despite the widespread adoption of these size-dependent tax enforcement strategies around the world, there is very little micro-level evidence of the effects of LTUs on firm behavior (Almunia and Lopez-Rodriguez, 2018). Intuitively, some firms might deliberately decide to remain small in order to escape major monitoring, so that size-dependent enforcement may have the undesirable side effect of stimulating under-reporting of revenues or even stunting growth.Footnote 2 An empirical evidence of this can be found in Almunia and Lopez-Rodriguez (2018), where it is analyzed how firms respond to the increased monitoring effort created by the eligibility cutoff of the Spanish LTU: firms react to avoid being under stricter tax enforcement by reducing their reported revenue to bunch just below the LTU eligibility threshold. Similarly, Bachas et al. (2019) argue that the risk of such regulations could be that of generating a misallocation of resources, as the most efficient firms would not have an incentive to grow, with a consequent substantial decline in average firm size and a reduction in innovation. Using a general equilibrium model, they show that removing size dependent taxation may lead to gains in Total Factor Productivity of 1-2%. They conclude that the application of size-dependent enforcement policies provides clear evidence of the kind of bias conceptually studied in the misallocation literature. This bias in resource allocation can result from any government policy that becomes more stringent as firms get larger, such as labor regulations, tax rates, audit probability, and accounting requirements (see e.g. Kamps, 2006). Along a similar line, Murphy (2019) consider the case of Japan, where a size-dependent tax policy gives firms an exemption from filing a consumption tax report and remitting tax to the tax authority if their sales are at or below a certain threshold. In this situation, they show that firms are likely to restrain their sales at the threshold, in particular if they are middle range and when the compliance cost is higher. Gupta et al. (2014) focus on a set of regulations that are applicable to firms with 20 or more formal employees in Peru. Firms tend to adjust to these regulations by reducing their size, shifting employment composition, or splitting into subunits that fall below the regulatory threshold. Klimsa and Ullmann (2022) demonstrate how firms in Korea manipulate size reports in order to seem as if they have not grown, due to size-dependent policies. Ramaswamy (2021) show that size-based tax rules incentives firms to reorganise their production structure in order to stay below the threshold. A key strategy followed by Indian firms to stay small has been product subcontracting or capacity subcontracting. A different perspective is instead offered by Ando (2021), who studies the welfare implications of size-dependent firm regulation policies in the presence of entrepreneurial risks, in France. Although these policies have been considered sources of misallocation, he shows that they can improve efficiency once entrepreneurial risks are taken into account. In an analogous spirit, also Basri et al. (2021) endorse size-dependent policies and show that when Indonesia moved top regional firms into “medium taxpayer offices”, with high staff-to-taxpayer ratios, tax revenue more than doubled. Similarly, OECD (2022) investigate German firms’ responses to threshold-dependent intensity of tax enforcement, and find no evidence of a bunching-below-the-threshold effect.

The present work is part of this research strand and aims at identifying the consequences of size-dependent regulations on firms’ fiscal compliance and their decision to invest and grow. Considering different audit probabilities for small and large firms, we develop a dynamic model to systematically evaluate the effects of this specific type of size-dependent enforcement. In particular, in a similar way to Almunia and Lopez-Rodriguez (2018), we assume that monitoring effort jumps up discretely at a given level of the firm’s capital per capita, and we study the way in which audit probabilities and the level of fine interact in determining evasion and firms’ growth dynamics. We pay particular attention to the conditions determining a situation of dimensional trap, that is the circumstance in which the firm has no advantage in growing and prefers to remain small to avoid stronger enforcement. Using a single-firm and an expected pay-off maximization framework, we provide interesting outcomes from a policy perspective: i) according to the levels of fine and auditing probabilities three different long term dynamics may arise, namely, tax compliance, tax evasion without dimensional trap, or tax evasion and dimensional trap; ii) the way in which levels of fine and auditing probabilities interact to determine one of these different situations is quite complex; iii) increasing fines without careful calibration of the auditing probabilities may lead to an opposite result to the desired one, i.e. a situation of evasion and dimensional trap; iv) the same situation may arise as a consequence of increasing the auditing probability for large firms without properly adapting that of small firms and the fine.

The paper is organized as follows. Section 2 is dedicated to setting up the model description and construction. The necessary conditions for a dimensional trap to occur are given in Sect. 3. Section 4 describes the main findings through analytical results and numerical evidences. Section 5 concludes and suggests possible further developments.

2 One-Firm Model

2.1 General Set Up

Consider one representative firm endowed with a capital per capita level at time \(t\in {\mathbb {N}}\) to be invested and denoted by \(k_t\ge 0\). During production, the firm can face a bad or a good State of Nature, i.e. \(SN_t=\{0,1\}\) where \(SN_t\) is a Bernoulli variable taking values 0 and 1, respectively when the bad or good State of Nature occurs, with success probability given by \(\text{ Prob }(SN_t=1)=\theta \in (0,1)\). As a consequence, the output that the firm could realize is equal to

-

\(y_{h,t}=f_h(k_t)\) if \(SN_t=1\),

-

\(y_{l,t}=f_l(k_t)\) if \(SN_t=0\)

with \(f_h(k_t)>f_l(k_t)>0\), \(\forall k_t>0\), being continuous and differentiable functions. At time t, the initial level of capital per capita to be invested is given, production takes place, profits are realized and the firm must pay taxes on declared production at a constant and exogenous tax rate \(\tau \in (0,1)\). Without loss of generality, following Almunia and Lopez-Rodriguez (2018), we assume that the firm sells its output at the market price p, which is normalized to unity. In addition, following Guner et al. (2008), we assume that the cost of production is equal to zero. The payoff (after taxation) deriving from production in a good or in a bad State of Nature, is denoted by \(\pi _{h,t}\) and \(\pi _{l,t}\), respectively.

The firm has to decide how much profit to declare to the authorities, and hence whether to evade or be honest. We let \(e_t=\{0,1\}\) be a variable assuming value 1 if the firm at time t evades and 0 otherwise. On the other side, the State fights tax evasion through audit activity which is implemented by tax inspectors. Thus, the firm faces a positive probability of being detected in case it undertakes tax evasion. Obviously, at time t, the firm knows the State of Nature occurred, and hence its production function, while the tax inspector can discover evasion only by auditing the firm. In fact, prior to the audit, the tax inspector knows the capital level of the firm but not the State of Nature it faced. As a consequence, the tax inspector does not check the entrepreneur if a high level of profit, which derives from a high productivity function, is reported because he knows that, in this case, no evasion has taken place. On the other hand, he can check the entrepreneur’s declaration if a level of profit corresponding to an adverse State of Nature is reported: auditing is the only way in which the tax inspector can find out whether the low profit declared is indeed due to a bad State of Nature or, rather, to under-reporting and evasion. We let \(c_t=\{0,1\}\) be a variable assuming value 1 if the firm at time t is monitored and 0 otherwise.

The evasion decision is modeled by the following game tree (see also Fig. 1) to be solved by backward induction method.

-

(a)

If \(SN_t=0\), a bad State of Nature occurs and \(e_t=0\). Two cases may emerge:

(a.1) The firm is monitored, no evasion is found, and the payoff is given by \(\pi _{l,t}=(1-\tau )f_l(k_t)\);

(a.2) the firm is not monitored and the payoff is given by \(\pi _{l,t}=(1-\tau )f_l(k_t)\), as in the previous case.

-

(b)

If \(SN_t=1\), then a good State of Nature occurs and two cases may emerge:

(b.1) no evasion takes place, so that \(e_t=0\), and the payoff is given by \(\pi _{h0,t}=(1-\tau )f_h(k_t)\);

(b.2) evasion takes place, so that \(e_t=1\), and the firm may or may not be monitored:

(b.2.1) if the firm is monitored, then discovered and punished,Footnote 3 the payoff will be given by the correct amount to be paid \( (1 - \tau )f_{h} (k_{t} ) \) reduced by the fine, \(m(k_t)\), which is a strictly increasing continuous and differentiable function of the capital level.Footnote 4 The final payoff is then \((1-\tau )f_h(k_t)-m(k_t)\);

(b.2.2) if the firm is not monitored, then the payoff is given by \(f_h(k_t)-\tau f_l(k_t)\).

Since at time t the evading firm does not know if it will be monitored, detected and punished or not, we denote by \(E(q_t)\in [0,1]\) the expectation of the firm regarding the monitoring level \(q_t\in [0,1]\) put in place by the State. The expected payoff for an evading firm is then given by

$$\begin{aligned} E(\pi _{h1,t})=(1-E(q_t))[f_h(k_t)-\tau f_l(k_t)]+E(q_t)[(1-\tau )f_h(k_t)-m(k_t)]. \end{aligned}$$

The game tree is solved by backward induction and the following Proposition holds.

Proposition 2.1

Assume \(SN_t=1\) and let

Then

-

if \(E(q_t)\ge q_t^\star \), it is not profitable for the firm to evade,

-

if \(E(q_t)< q_t^\star \), it is profitable for the firm to evade.

Proof

If \(SN_t=0\), the firm will not evade. Therefore, consider \(SN_t=1\) and define \(b(k_t)=f_h(k_t)-\tau f_l(k_t)\) and \(a(k_t)=(1-\tau )f_h(k_t)-m(k_t)\). Since \(b(k_t)>a(k_t)\), \(\forall k_t>0\), then \(E(\pi _{h1,t})\in [a(k_t),b(k_t)]\). Furthermore, since \(a(k_t)\le \pi _{h0,t}\le b(k_t)\), \(\forall k_t>0\), and as \(E(\pi _{h1,t})\) is a strictly decreasing function w.r.t. \(E(q_t)\), for all fixed \(k_t>0\), then \(\exists ! q^\star _t\), given by (1), such that:

-

if \(E(q_t)\ge q^\star _t\), then \(E(\pi _{h1,t})\le \pi _{h0,t}\) and evasion is not convenient;

-

if \(E(q_t)< q^\star _t\), then \(E(\pi _{h1,t})> \pi _{h0,t}\) and evasion is convenient.

\(\square \)

Note that \(q_t^\star \) depends on \(k_t\) and that the type of relation is determined by the analytical form of the production functions and the fine function. After the decision about evasion has been taken (according to the State of Nature, the capital per capita level invested at time t, and the expected monitoring level), the control activities by the State take place and, depending on whether the firm is monitored or not, the realized payoff is determined.

As far as the monitoring activity is concerned, \(q_t\) represents the probability the firm faces to be monitored by the State. Similarly to Guner et al. (2008), and following the evidences in Sect. 1 and the related stylized facts (see e.g. Bachas et al., 2019), who find a robust positive correlation between an industry’s average firm-size and its tax audit probability, we assume that the monitoring level by the State increases as the capital per capita level of the monitored firm does, and express it as \(q_t=\phi (k_t)\), with \(\phi : {\mathbb {R}}_+\rightarrow [0\;\;1]\). Thus, we let \(c_t=\{0,1\}\) be a Bernoulli variable, taking value 1 in case the firm is monitored, and value 0 otherwise, with \(\text{ Prob }(c_t=1)=q_t\). Then, the realized profits are summarized in the following Remark.

Remark 2.2

Depending on the State of Nature \(SN_t\), the evasion decision \(e_t\), and the potential control undergone \(c_t\), the realized profit is as follows:

-

if \(SN_t=0\) and \(c_t=1\) or \(c_t=0\), then \(e_t=0\), so that \(\pi _t=\pi _{l,t}=(1-\tau )f_l(k_t)\);

-

if \(SN_t=1\) and \(E(q_t)\ge q^\star _t\), then \(e_t=0\) and \(c_t=0\), so that \(\pi _t=\pi _{h0,t}=(1-\tau )f_h(k_t)\);

-

if \(SN_t=1\) and \(E(q_t)< q^\star _t\), then \(e_t=1\); in case \(c_t=1\), then \(\pi _t=a(k_t)=(1-\tau )f_h(k_t)-m(k_t)\);

-

if \(SN_t=1\) and \(E(q_t)< q^\star _t\), then \(e_t=1\); in case \(c_t=0\), then \(\pi _t=b(k_t)=f_h(k_t)-\tau f_l(k_t)\).

The capital per capita disposable for production at time \(t+1\) is thus obtained by decreasing the capital available at time t according to a certain depreciation rate \(\delta \in [0,1]\), and by increasing it by the portion of profit \(\pi _t\) that the firm decides to invest. The introduction of this investment decision is a key novelty of the present work. Given \(k_t\) and \(\pi _t\), the firm needs to choose how much profits to invest, taking into account that future expected profits do not necessarily increase with capital per capita. In fact, increasing capital per capita, on the one hand increases production, but on the other hand also increases the likelihood of being caught in case of evasion and the amount of the consequent fine. Therefore, the firm may be better off not reinvesting the entire profit realised, but just a portion of it. Let \(\mu _t\in [0,1]\) be the fraction of realized profits \(\pi _t\) that the firm decides to invest. Then at time \(t+1\), the new capital per capita level is given by

and the following Remark holds.

Remark 2.3

The capital per capita level available for production at time \(t+1\) is bounded, i.e.

After the investment decision is taken, the updated level of capital per capita, \(k_{t+1}\), is obtained and the story repeats itself. In a dynamic setting, in which the probability of being audited depends on the size of the firm, we describe how capital per capita evolves over time, according to the ex-ante convenience of evading, and the consequent endogenous monitoring level evolution. The outcome is a discrete time dynamical system, with state variables \(k_t\) and \(q_t\). We underline that this model is not deterministic as, at any time t, both \(SN_t\) and \(c_t\) are random variables. In particular, they are Bernoulli variables with success probability given respectively by \(\text{ Prob }(SN_t=1)=\theta \) and \(\text{ Prob }(c_t=1)=q_t\). Hence, the standard instruments from discrete time deterministic dynamical systems cannot be used and we study the model making use of both analytical and numerical tools.

In order to describe how investment and evasion decisions are taken, in the next section we need to specify the ingredients of the model.

2.2 Ingredients

The general model built in the previous section, needs the specification of some functions that determine its dynamical evolution. For this purpose we make specific assumptions on the production functions, the fine level and the monitoring level.

Remark 2.4

Production functions and fine level are defined as follows.

-

The production function is of the Cobb-Douglas type, given by \(f_h(k_t)=A_h k_t^{\alpha }\) and \(f_l(k_t)=A_l k_t^{\alpha }\), with \(A_h>A_l>0\) and \(\alpha \in (0,1)\).

-

The fine is assumed to be proportional to the profit realized in case of undetected evasion and given by \(m(k_t)=m_0(f_h(k_t)-\tau f_l(k_t))\), where the positive constant \(m_0\) is the fine strength.Footnote 5 We assume that the fine to be paid cannot exceed the total amount of realized profit, so that the profit cannot become negative. Hence \((1-\tau )A_hk_{t}^{\alpha }-m_0(A_h k_{t}^{\alpha }-\tau A_l k_{t}^{\alpha })\ge 0\), so that the following relation holds

$$\begin{aligned} 0<m_0\le \frac{(1-\tau )A_h}{A_h-\tau A_l}=m_0^M. \end{aligned}$$(3)

Taking into account Remark 2.4 and Proposition 2.1 the following result trivially holds.

Proposition 2.5

Let \(f_h(k_t)=A_h k_t^{\alpha }\), \(f_l(k_t)=A_l k_t^{\alpha }\) and \(m(k_t)=m_0(A_h k_t^{\alpha }-\tau A_l k_t^{\alpha })\). Then, the threshold level is

which is constant for all \(k_t\ge 0\).

From Eq. (4), it is evident that, under the assumptions in Remark 2.4, the threshold level \(q^\star \) does not change over time and it is a decreasing function of the fine strength \(m_0\). In addition, \(q^\star \) is also a decreasing function of the tax rate and an increasing function of the distance between \(A_h\) and \(A_l\).

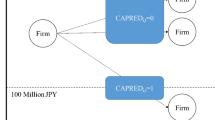

With regard to the monitoring activity put in place by the State, we define

with \(k^{\star }>0\) and \(0<q_l<q_h<1\) as it emerges from stylized facts discussed in Sect. 1, i.e. small firms are subject to a lower level of monitoring than large firms. In particular, in defining \(q_t\) as in Eq. (5), we follow Almunia and Lopez-Rodriguez (2018) and assume that the probability of audit jumps up discretely at a given level of declared profits, which we approximate by capital level. In this work, such a relationship is specified in a single-firm perspective, assuming that the monitoring level attached by the State to each firm only depends on the capital per capita level of that firm, regardless of the dimension of other firms and the industrial structureFootnote 6. Finally, complete information is assumed, i.e. the firm knows the monitoring level function used by the State, and hence \(E(q_{t+1})=q_{t+1}\).

3 Investment Choice and Dimensional Trap

In this section we describe the mechanism according to which the firm defines the proportion \(\mu _t\) of profits to reinvest in production. Note that this decision is taken before the new State of Nature \(SN_{t+1}\) occurs, and, hence, before making the choice of evading or not. The firm chooses the level of \(\mu _t\) or, equivalently, the level of \(k_{t+1}\), which maximizes the expected payoff at time \(t+1\). Hence, the objective function to maximize depends on the probability \(\theta \) of facing a good State of Nature, and on the expected monitoring level \(E(q_{t+1})\), while \(k_t\) and \(\pi _t\) are given. Furthermore, as \(\mu _t \in [0,1]\), the firm can choose a capital per capita level that is bounded in \([k_{t+1}^m, k_{t+1}^M]\) (see Remark 2.3).

Let \(\mu ^{\star }_t\in [0,1]\) be the solution of the above constrained maximization problem, i.e. the fraction of profits the firm invests at time t to contribute to production at time \(t+1\). Then, if \(\mu ^{\star }_t<1\), a situation in which the firm finds it convenient not to invest all realized profits, called a dimensional trap, emerges. The following Proposition establishes a necessary condition for a dimensional trap to emerge.

Proposition 3.1

If \(q^{\star }>q_l\) and \(k^{\star }\in [k_{t+1}^m,k_{t+1}^M)\) a dimensional trap may arise.

Proof

Consider \(q^\star \) as defined in (4) and \(q_{t+1}=\phi (k_{t+1})\) as specified in (5). The following cases may occur.

-

1.

Suppose \(q^\star \in (q_h,1]\), then \(E(q_{t+1})<q^\star \) and according to Proposition 2.1 evasion is (ex-ante) expected to be convenient for all \(k_{t+1}\). The expected profit under evasion is given by

$$\begin{aligned} E(\pi _{E,t+1})= & {} (1-\theta )(1-\tau )f_l(k_{t+1})+\theta \{\phi (k_{t+1})[(1-\tau )f_h(k_{t+1})-m(k_{t+1})]+\\{} & {} +(1-\phi (k_{t+1}))(f_h(k_{t+1})-\tau f_l(k_{t+1}))\}. \end{aligned}$$Define

$$\begin{aligned} H=(1-\tau )A_l+\theta (A_h-A_l) \end{aligned}$$and

$$\begin{aligned} J(m_0)=\theta [(1-\tau )A_h-(A_h-\tau A_l)(m_0+1)], \end{aligned}$$then

$$\begin{aligned} E(\pi _{E,t+1})=k_{t+1}^{\alpha }(H+J(m_0)\phi (k_{t+1})), \end{aligned}$$so that \(E(\pi _{E,t+1})=g_1(k_{t+1})\), where:

$$\begin{aligned} g_1(k_{t+1}):=\left\{ \begin{array}{ll} g_{1l}(k_{t+1})=k_{t+1}^{\alpha }(H+J(m_0)q_l) \hbox { if } k_{t+1}\in [0, k^{\star }]\\ \\ g_{1h}(k_{t+1})=k_{t+1}^{\alpha }(H+J(m_0)q_h) \hbox { if } k_{t+1}> k^{\star } \end{array}\right. . \end{aligned}$$(6)Consider \(q_j\in (0,1)\), \(j=\{l,q\}\), and assume condition (3) holds. Then

$$ \begin{aligned} H + J(m_{0} )q_{j} = & (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) + \theta q_{j} [(1 - \tau )A_{h} - (A_{h} - \tau A_{l} )(m_{0} + 1)] \\ & > (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) + \theta q_{j} \left[ {(1 - \tau )A_{h} - (A_{h} - \tau A_{l} )\left( {\frac{{(1 - \tau )A_{h} }}{{A_{h} - \tau A_{l} }} + 1} \right)} \right] \\ & = (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) + \theta q_{j} \left[ {(1 - \tau )A_{h} - (A_{h} - \tau A_{l} )\frac{{(1 - \tau )A_{h} + (A_{h} - \tau A_{l} )}}{{A_{h} - \tau A_{l} }}} \right] \\ & = (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) + \theta q_{j} \left[ {(1 - \tau )A_{h} - (1 - \tau )A_{h} } \right.\left. { - (A_{h} - \tau A_{l} )} \right] \\ & = (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) - \theta q_{j} (A_{h} - \tau A_{l} ) \\ & > (1 - \tau )A_{l} + \theta (A_{h} - A_{l} ) - \theta (A_{h} - \tau A_{l} ) \\ & = A_{l} (1 - \tau )(1 - \theta ) > 0 \\ \end{aligned} $$so that both \(g_{1l}\) and \(g_{1h}\) are strictly increasing functions and the following cases may occur.

-

1.1.

If \(k_{t+1}^M\le k^{\star }\) then \(\max \{E(\pi _{E,t+1})\}=g_{1l}(k_{t+1}^M)\) and \(\mu ^{\star }_t=1\), that is all profits are invested.

-

1.2.

If \(k_{t+1}^m\le k^{\star } <k_{t+1}^M\) then, being \(g_{1l}(k^{\star })>\lim _{k_{t+1}\rightarrow k^{\star +} }g_{1h}(k_{t+1})\), the constrained expected payoff maximization implies \(\max \{E(\pi _{E,t+1})\}=\max \{g_{1l}(k^{\star }),g_{1h}(k_{t+1}^M)\}\), so that the dimensional trap occurs whenever \(g_{1l}(k^{\star })>g_{1h}(k_{t+1}^M)\).

-

1.3.

If \(k^{\star }<k_{t+1}^m\) then \(\max \{E(\pi _{E,t+1})\}=g_{1h}(k_{t+1}^M)\) and \(\mu ^{\star }_t=1\), that is all profits are invested.

-

1.1.

-

2.

Let \(q^\star \in (q_l,q_h]\), and define

$$\begin{aligned} L=(1-\theta )(1-\tau )A_l+\theta (1-\tau )A_h, \end{aligned}$$so that the expected payoff, under evasion or not depending on \(k_{t+1}\), can be written as \(E(\pi _{ENE,t+1})=g_2(k_{t+1})\), with

$$\begin{aligned} g_2(k_{t+1}):=\left\{ \begin{array}{ll} g_{2l}(k_{t+1})=k_{t+1}^{\alpha }(H+J(m_0)q_l) \hbox { if } k_{t+1}\in [0, k^{\star }]\\ \\ g_{2h}(k_{t+1})=k_{t+1}^{\alpha }L \hbox { if } k_{t+1}> k^{\star } \end{array}\right. . \end{aligned}$$(7)Then, we can distinguish between the following cases:

-

2.1.

If \(k_{t+1}^M\le k^{\star }\), according to Proposition 2.1, evasion is ex-ante convenient for all \(k_{t+1}\) and, similar to case 1.1, the maximum expected payoff corresponds to \(\mu ^{\star }_t=1\).

-

2.2.

If \(k_{t+1}^m\le k^{\star } <k_{t+1}^M\), evasion could be convenient or not. As it has been previously showed, both \(g_{2l}\) and \(g_{2h}\) are strictly increasing functions in their domain, so that the constrained maximization problem solution is the one associated with the higher value between \(g_{2l}(k^\star )\) and \(g_{2h}(k_{t+1}^M)\), similar to case 1.2.

-

2.3.

If \(k^{\star }<k_{t+1}^m\), according to Proposition 2.1, evasion is not convenient for any \(k_{t+1}\). As \(g_{2h}\) is continuous and strictly increasing, the maximum expected payoff corresponds to \(\mu _t^\star =1\) and it is given by \(g_{2h}(k_{t+1}^M)\).

-

2.1.

-

3.

Let \(q^{\star }\in [0,q_l]\), then \(E(q_{t+1})\ge q^\star \) and, according to Proposition 2.1, evasion is not convenient for any \(k_{t+1}\). The expected profit without evasion is given by

$$\begin{aligned} E(\pi _{NE,t+1})=g_3(k_{t+1}) =(1-\theta )(1-\tau )f_l(k_{t+1})+\theta (1-\tau )f_h(k_{t+1})=k_{t+1}^{\alpha }L, \end{aligned}$$which is continuous, strictly increasing and independent of the monitoring level. As a consequence \(\max \{E(\pi _{NE,t+1})\}=g_3(k_{t+1}^M)\) and \(\mu ^{\star }_t=1\).

\(\square \)

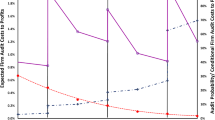

Qualitative description of the possible situations arising according to Proposition 3.1: (a) no dimensional trap, (b) no dimensional trap and (c) dimensional trap. The black star identifies the amount of disposable capital per capita the firm decides to invest, and the corresponding expected profit

Figure 2 represents the expected profit as a function of the capital per capita level, and illustrates different scenarios, in which the dimensional trap can or cannot occur. Panel (a) provides a representation of case 3., in which evasion is never convenient, so that the expected payoff does not depend on the monitoring level and it is a continuous, increasing function for any \(k_{t+1}\). Thus, the maximum expected payoff can be achieved by investing the whole amount of profits. A similar situation arises in cases 1.1, 1.3, 2.1 and 2.3, in which the monitoring level is constant for all attainable values of capital per capita, so that the expected payoff does not experience any discontinuity with respect to \(k_{t+1}\). On the other hand, panels (b) and (c) show a situation in which the monitoring level changes within the interval of attainable values of \(k_{t+1}\), thus determining a discontinuity point in the expected profit for \(k_{t+1}=k^\star \). The existence of such a discontinuity is a necessary but not sufficient condition for the dimensional trap to occur, and panel (b) provides evidence of this: there is no dimensional trap despite the discontinuity in expected profit. On the contrary, panel (c) shows a situation in which the discontinuity in the expected profit makes it convenient for the firm to only invest a fraction of disposable capital per capita. Note that any of the two panels (b) and (c) can arise in both cases 1.2 and 2.2. The cases described in the proof of Proposition 3.1 are also summarized in Table 1, where the term “evasion” is to be intended as “potential evasion”, since it refers to the decision taken by the firm before knowing the State of Nature at time \(t+1\). Once the State of Nature emerges, if it is good, the potential evasion turns into actual evasion, if it is bad, the evasion remains only potential and the company declares the profit realised in full.

4 Numerical Experiments

As we have underlined, the dynamical system describing the behaviour of \(k_t\) and \(q_t\) is not deterministic, since the evolution of these two quantities depends on the realization of the random variables \(SN_t\) and \(c_t\). Thus, in this section, we propose a simulation study to explore the possible trajectories of the system.

To better specify the iterated mechanism applied to the non-deterministic dynamical system previously described, we summarize the main steps used to construct the algorithm. We can distinguish between two steps: (1) profit determination, (2) investment choice and capital level updating.

With regard to profit determination at time t, consider \(q_t\) as given by (5). Then, the following system is used:

With regard to investment choice and capital level updating, consider \(k_{t+1}^M\) and \(k_{t+1}^m\), as defined in Remark 2.3 and depending on \(k_t\) and \(\pi _t\). Recalling the definitions

and

given in (6) and (7), the capital per capita updating mechanisms is as follows:

By investigating the dynamics produced by (8) and (9), our main goal is to understand whether any relationship exists between capital per capita evolution, the emergence of a dimensional trap, and the instruments available to the State to tackle evasion, namely (i) the fine level, whose spread is increasing with \(m_0\), and (ii) the monitoring levels attached to small and large firms, \(q_l\) and \(q_h\), respectively. For this reason, we leave these three policy parameters free to vary and we explore the different dynamics determined by their values.

On the contrary, the values of the remaining parameters are fixed. Following the literature, we choose the following values: the marginal product of capital is \(\alpha =0.2\),Footnote 7 the tax coefficient is \(\tau =0.3\),Footnote 8 while the capital depreciation rate is \(\delta =0.05\).Footnote 9 Furthermore, we consider \(A_l=4\) and \(A_h=8\) (several numerical experiments show that they only have an effect on the speed of capital per capita growth but not on its dynamics or on the choice to evade taxes, in the long term), while we assume \(\theta =0.5\) (other values can be considered, to take into account different economic situations). Finally, we fix \(k^{\star }=50\) and consider \(k_0=10\). Different values of \(k^\star \) and \(k_0\) would simply affect the timing of the system dynamics but not its long term extent. Obviously, choosing \(k^\star \le k_0\) is of no interest as the outcome of a dimensional trap would be a priori ruled out. A temporal horizon of \(N=500\) iterations is considered to simulate the trajectories.

4.1 Capital Per Capita and Evasion Dynamics

We first consider different combinations of \(m_0\), \(q_l\) and \(q_h\), and show the results in Figs. 3 to 7. In particular, we provide the evolution of capital per capita \(k_t\) and evasion index \(e_t\) over time, respectively in panels (a) and (b), while the levels of \(q^\star \), \(q_l\) and \(q_h\) are plotted in panel (c). In order to consider reasonable and truly observable values for \(q_l\) and \(q_h\), we refer to the current situation in Italy, where the monitoring probability is about 0.03 for micro and small firms, 0.14 for medium firms and 0.3 for large firms (Goerke, 2019).

In Fig. 3, we set \(q_l=0.14\) and \(q_h=0.3\), with \(m_0=0.1\), which gives \(q^\star =0.6383\), so that \(q^\star \in (q_h,1]\). It can be seen that, as the good State of Nature occurs, the firm always evades but no dimensional trap emerges. In Fig. 4, the value of \(m_0\) is increased to 0.2, so that \(q^\star =0.4688\). In this situation, we still have \(q^\star \in (q_h,1]\), but the prize to be paid in case of detected evasion and the probabilities of detection are such that the firm finds it convenient to evade and stay small to avoid being controlled and punished. Thus, we observe not only evasion but also a dimensional trap, so that \(k_t<k^\star ,\; \forall t\). In Fig. 5, we further increase the value of \(m_0\) and let \(m_0=0.7\), so that \(q^\star =0.2013\) and \(q^\star \in (q_l,q_h]\). Now the punishment in case of detection is so strong to be effective in fighting evasion: the threshold \(q^\star \) is small enough that tax compliance is convenient and the firm maximizes its expected payoff under tax compliance by investing all the profit, so that no dimensional trap arises.

When considering \(q_l=0.03\) and \(q_h=0.14\), setting \(m_0=0.1\) (Fig. 6) or increasing it to \(m_0=0.4\) (Fig. 7) produce results similar to those already seen in Fig. 3 and Fig. 4: evasion without a dimensional trap in the first case and evasion with a dimensional trap in the second case. However, with these values of \(q_l\) and \(q_h\), further increasing \(m_0\) produces no improvement: in the long term the system remains stuck in a no-growth and evasion situation. Even setting \(m_0=0.8235\), its maximum possible value, does not help. Therefore, according to our model, it would seem that in Italy, the monitoring levels are such that they favour evasion of micro-small firms and, for insufficiently high fines, also of medium and large enterprises. In addition, depending on the value of the fine, the dimensional trap may also occur, both at the level of the micro-small and at the level of the medium-sized firms.

The few examples above show the complex relationship linking the policy parameters to the capital per capita and evasion dynamics. Depending on the values of the monitoring probabilities, increasing the fine and, thus, the punishment in case of evasion, not necessarily helps in contrasting tax fraud. On the contrary, it might result in an incentive for companies to remain small and thus inhibit growth. Therefore, a more in-depth and systematic analysis of policies’ effects is in order and is provided in the following sections.

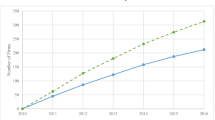

4.2 Bifurcations

In order to better understand how the final outcome changes as a function of those policy parameters that the State can use to fight evasion, we perform different experiments in which we let one parameter vary and consider all the others as fixed. We plot the asymptotic values of capital per capita (in particular the last 100 observations of \(k_t\), i.e. for \(t = 401, \ldots , 500\)), using three different colors to specify the possible final outcomes: green for the most favorable one, namely no evasion and no dimensional trap (NE-NT), yellow for the intermediate one, evasion but no dimensional trap (E-NT) and finally red for the worst one, evasion and dimensional trap (E-T).

Figures 8, 9 and 10 show the asymptotic values of \(k_t\) as a policy parameter varies, namely \(q_l\), \(q_h\) and \(m_0\) respectively, while keeping the remaining two fixed, but considering different combinations of them. It is evident that, in all the three cases, as a policy parameter increases, different situations can arise, depending on the values of the other two parameters. For example, in Fig. 8, as \(q_l\) increases, the system can remain in a E-NT condition, independently of the value of \(q_l\), as in panel (a), it can move from E-T to E-NT, as in panel (b), or it can move from E-T to NE-NT, as in panel (c). Thus, increasing the value of \(q_l\) either leaves the system unchanged or engenders an improvement of its state. On the contrary, Fig. 9 shows that as \(q_h\) increases, given the values of the other two parameters, the state of the system can improve (panel (b)), stay unchanged (panels (c) and (d)), but even worsen (panel (a)). Finally, in Fig. 10 it can be seen that as \(m_0\) increases, the system can move in plenty of different ways: it can remain in one of the three states without moving (panels (a), (c), (f)), it can move to the best condition directly (panel (e)) or after passing through the worst state (panel (d)), it can move to the worst state and remain there (panel (b)).

From Figs. 9 and 10 we can also notice that in the E-NT state, the asymptotic values of \(k_t\) decrease as \(q_h\) or \(m_0\) increases. This does not happen in Fig. 8. In fact, in the E-NT state, as no dimensional trap subsists, \(k_t\) is asymptotically larger than \(k^\star \), so that the monitoring probability for the firm is \(q_h\) and its asymptotic capital per capita does not vary as \(q_l\) increases.

We now try to determine the particular combinations of policy parameters that induce the different situations. Let us start from those involving the occurrence of the dimensional trap. Considering Proposition 3.1, it is evident that the dimensional trap can arise in just two cases. In the first case, that is when \(q^\star >q_h\) and \(k^\star \in [k_{t+1}^m,k_{t+1}^M)\), the dimensional trap at time t arises iff \(g_{1l}(k^{\star })>g_{1h}(k_{t+1}^M)\), i.e. iff

Without loss of generality, let us assume that, at time \(t-1\), \(k^\star \in [k_{t}^m,k_{t}^M)\). Then, if Eq. (10) holds at time \(t-1\), a dimensional trap arises and \(k_{t}=k^\star \), so that \(k_{t+1}^M=(1-\delta )k^\star +\pi _t\), with \(\text{ max }(k_{t+1}^M)=(1-\delta )k^\star +A_h(k^\star )^\alpha -\tau A_l(k^\star )^\alpha \). If Eq. (10) holds when substituting \(\text{ max }(k_{t+1}^M)\) to \(k_{t+1}^M\), then it will hold for any other possible \(k_{t+1}^M\) and a dimensional trap will arise also at time t as well as at any subsequent time. Therefore, substituting \(\text{ max }(k_{t+1}^M)\) with \(k_{t+1}^M\) in Eq. (10) provides a necessary and sufficient condition for the system to fall into the dimensional trap asymptotically, when \(q^\star >q_h\) and \(k^\star \in [k_{t+1}^m,k_{t+1}^M)\). If this condition does not hold, no dimensional trap occurs but the firm still evades taxes any times it faces a good state of nature, since we are considering \(q^\star >q_h\). Thus, solving the following equation

with respect to a particular policy parameter, given the values of the other two, provides the bifurcation value for that parameter, which makes the system move between the states E-T and E-NT. We denote these values as \(q_l^{bif_1}\), \(q_h^{bif_1}\) and \(m_0^{bif_1}\). Panels (b) of Fig. 8, panel (a) of Fig. 9 and panels (b) and (d) of Fig. 10 present this change of state as the respective bifurcation values of the three parameters are attained.

The second case in which a dimensional trap can arise is when \(q^\star \in (q_l,q_h]\) and \(k^\star \in [k_{t+1}^m,k_{t+1}^M)\). In this case the dimensional trap at time t occurs iff \(g_{2l}(k^{\star })>g_{2h}(k_{t+1}^M)\), i.e. iff

As before, if we substitute \(k_{t+1}^M\) with its maximum, we obtain a necessary and sufficient condition for the system to fall into the dimensional trap asymptotically, when \(q^\star \in (q_l,q_h]\) and \(k^\star \in [k_{t+1}^m,k_{t+1}^M)\). If this condition does not hold, no dimensional trap will occur and the firm will not evade taxes when facing a good state of nature. Thus, solving the following equation

with respect to \(q_l\) or \(m_0\), given the value of the other one and for any \(q_h\ge q^{\star}\), provides a further bifurcation value for these parameters, which makes the system move between the state E-T and NE-NT. We denote these values as \(q_l^{bif_2}\) and \(m_0^{bif_2}\). Panel (c) of Fig. 8 and panel (d) of Fig. 10 illustrate this change of state as the respective bifurcation values of the two parameters are attained.

Finally, consider panel (b) of Fig. 9 and panel (e) of Fig. 10, in which there is no dimensional trap and the system moves between the states E-NT and NE-NT as \(q_h\) or \(m_0\) increase. Notice that, from Proposition 3.1, for \(k^\star \in [0,k_{t+1}^m)\), when \(q^\star >q_h\) we have E-NT, while for \(q^\star \le q_h\) we have NE-NT. Therefore, using the definition of \(q^\star \) given in Eq. (4), we obtain the following equation:

whose solution with respect to \(q_h\) or \(m_0\) gives one more bifurcation value for these parameters, given the value of the other one and for any \(q_l\ge q_l^{bif_2}\). We denote these bifurcation values as \(q_h^{bif_3}\) and \(m_0^{bif_3}\), respectively.

From the previous analysis, it is evident that the policy parameters are strictly related. In order to better visualize their relationship and their role in determining evasion and dimensional traps, we consider two-dimensional diagrams, in which we let two parameters change and fix the value of the third one. We use the same color as before to describe the final asymptotic outcome of the capital per capita, and we classify an outcome as E if evasion occurs during the last 100 values of \(k_t\) (i.e. for \(t=401,\ldots ,500\)) whenever \(SN_t=1\), and we classify it as T if the last 100 values of \(k_t\) are equal to \(k^\star \).

Figure 11 shows the long term behaviour of the firm as \(q_l\) and \(q_h\) vary, while keeping \(m_0\) fixed at different increasing values. Notice that the line separating the red and the yellow areas is simply Eq. (11), solved with respect to \(q_h\), for \(m_0\) fixed. For each \(q_l\), it provides the bifurcation value \(q_h^{bif_1}\). Analogously, the line separating the red and the green areas is Eq. (13) solved with respect to \(q_l\), for \(m_0\) fixed, that is \(q_l=q_l^{bif_2}\). Finally, the line separating the yellow and the green areas is the solution of Eq. (14) with respect to \(q_h\), with \(m_0\) fixed, and provides the bifurcation value \(q_h=q_h^{bif_3}\equiv q^\star \).

From Fig. 11, some interesting considerations arise. For example, in the case where no fine is imposed (i.e. \(m_0=0\), as in panel (a)), the firm always finds evasion convenient. In addition, it also finds convenience in remaining small whenever the distance between \(q_h\) and \(q_l\) is large enough. More precisely, from Eq. (11), one can find the minimum distance between \(q_h\) and \(q_l\) that creates the dimensional trap, and this is a decreasing function of both \(q_l\) and \(m_0\). As \(m_0\) increases, the firm finds complying with tax payment advantageous for more and more combinations of the values \(q_l\) and \(q_h\) (i.e. the green area becomes larger and larger). In particular, even for very low \(q_l\) and \(q_h\), provided they are respectively larger than the values \(q_l^{bif_2}\) and \(q_h^{bif_3}\) computed for \(m_0=m_0^M\), it is always possible to fix a large enough value of \(m_0\) for tax compliance being convenient in the long period. In fact, increasing \(m_0\) decreases \(q^\star \), making it easier to have \(q_l\ge q^\star \), a sufficient condition for non evasion.

Previous considerations are particularly relevant from a policy perspective. In fact, while many different combinations of \(q_l\), \(q_h\) and \(m_0\) can determine the optimal long term system state NE-NT, some of them are more convenient than others for the State from an economic point of view. For example, setting a small fine (as in panel (b)) and large enough monitoring levels would result in NE-NT but at a high cost, since monitoring activity is expensive for the State. On the other side, setting a large fine (as in panel (c)) would allow one to reduce the monitoring levels, and thus the monitoring costs, but still achieve the NE-NT state.

Figure 12 illustrates the firm’s long term behaviour as \(q_h\) and \(m_0\) vary, while keeping \(q_l\) fixed at different increasing values. The lines separating the red and the yellow, the red and the green, and the yellow and the green areas, are the solutions of Eqs. (11), (13) and (14), respectively, solved with respect to \(m_0\), for \(q_l\) fixed. It is interesting to note that, as for \(m_0=0\), also for \(q_l=0\) evasion occurs, no matter what the values of the other two policy parameters are, and for most combinations of \(q_h\) and \(m_0\), provided by Eq. (10) for \(q_l=0\), a dimensional trap also occurs. As \(q_l\) increases, more and more combinations of \(q_h\) and \(m_0\) determine a NE-NT long term behaviour. In particular, NE-NT arises if \(m_0>m_0^{bif_2}\) and \(q_h\) is larger than the value obtained by equating the right-hand sides of Eqs. (11) and (13). Finally, if we solve Eq. (13) with respect to \(q_l\), letting \(m_0=0\), we find the upper bound for \(q_l\), above which the dimensional trap can never subsist. This is the situation depicted in panel (d), where \(q_l\) is fixed to a large enough value so that the system can only be in a NE-NT state or, for very small values of \(m_0\) (smaller than the value for which \(q^\star =q_h\)), in a E-NT state. Obviously, it would be quite expensive for the State to achieve tax compliance in this way, as high monitoring levels are needed. Another interesting remark, which has already been raised analyzing panel (a) of Fig. 9, but is clarified by panel (b) or (c) of Fig. 12, is that for a fixed \(q_l\) (smaller than the upper bound above which evasion cannot subsist), increasing the monitor level \(q_h\) can be counterproductive and determine an E-T situation if not supported by an adequate punishment policy, namely a large enough value of \(m_0\), larger than \(m_0^{bif_2}\). In a specular way, for a fixed \(m_0\), increasing \(q_h\) can result in E-T if \(q_l\) is not large enough, i.e. larger than \(q_l^{bif_2}\) (see also Fig. 11 panel (b) or (c)).

Finally, Fig. 13 represents the state of the system as \(q_l\) and \(m_0\) vary, while keeping \(q_h\) fixed at different increasing values. As before, the lines separating the red and the yellow, the red and the green, and the yellow and the green areas, are the solutions of Eqs. (11), (13) and (14), respectively, solved with respect to \(m_0\), but, this time, for \(q_h\) fixed. Panel (a) shows a trivial and unrealistic situation in which the monitoring level \(q_h\) is so small to be very close to \(q_l\) and always below \(q^\star \), so that the system can only converge to a E-NT behaviour. In panel (b) \(q_h\) is slightly higher but still smaller than \(q^\star \) for all \(m_0\) so that in the long run there is evasion and, if the distance between \(q_l\) and \(q_h\) is large enough, also a dimensional trap. Then, in panel (c) and (d), \(q_h\) is further increased so that, for \(m_0>m_0^{bif_3}\), it is larger than \(q^\star \). In these situations, all three cases, E-T, E-NT and NE-NT, can emerge in the long run. Finally, for \(q_h=1\) we have that \(q^\star \le q_h\) for all \(m_0\) and so, in agreement with Proposition 3.1, evasion can only arise in combination with a dimensional trap. Therefore, the system is in E-T if Eq. (12) holds and otherwise in NE-NT.

Overall, we can underline that increasing \(m_0\) (Fig. 11) or \(q_l\) (Fig. 12) has the effect of augmenting the possible combinations of the remaining two parameters that determine NE-NT, i.e. the green area. On the other hand, increasing the value of \(q_h\) (Fig. 13) augments both the combinations of the other two parameters determining NE-NT (green area) and those determining E-T (red area).

5 Conclusions and Further Development

In this paper, we have developed a dynamic model to study the effects of size-dependent fiscal policies. In particular, we have considered their consequences on firms’ decisions to evade taxes and the risk that such regulations discourage the growth of firms, making it advantageous for them to remain small sized and thus determining a dimensional trap. Assuming different audit probabilities for small and large firms, with a monitoring effort that jumps up discretely at a certain capital per capita level, and using a single-firm and an expected pay-off maximization framework, we provided necessary and sufficient conditions for evasion and dimensional trap to take place. Determining such conditions proved valuable in suggesting guidelines for an effective use of the tools available to the State to tackle evasion, namely monitoring and punishment. In particular, we showed that a complex relationship exists linking audit probabilities and fine level to the capital per capita and evasion dynamics of the firm. For example, increasing the fine without accurately calibrating the monitoring probabilities, might even have the unintended effect of incentivising evasion and pushing firms to remain small. Similar effects might be determined by augmenting the auditing probability of large firms, without consequently tuning the remaining policy parameters. In brief, the conditions we determined allow one to find all the possible combinations of the policy parameters that can foster an optimal long term situation of no evasion and no dimensional trap, so to identify the most convenient for the State, from an economic point of view.

Although we believe in the usefulness of our work in providing economic policy guidance and contributing to a currently still limited literature on size-dependent fiscal policies’ effects on firm behaviour, we are also aware of some limits, mainly concerning the assumptions used. Our choices have been driven by the need to make the model tractable and to suggest some preliminary results, providing a completely new approach to describe the link between size-dependent fiscal policies, evasion level and firms’ dimension, and to show how, under some conditions, dimensional traps are likely to emerge, thus explaining the occurrence of industrial structures characterized by many small firms. In future work, we plan to relax some of the current assumptions and assess to what extent this affects the results. In particular, we intend to consider the effects of size-dependent fiscal policies not only at a single firm level, but also on the industrial structure as a whole. We mean to envisage different firms’ expectations formation mechanisms about the monitoring level put in place by the State, for instance, assuming incomplete information. We plan to examine different functional forms for production and fine to evaluate the robustness of the results. Finally, we intend to model the probability to incur in a good State of Nature, to account for economic cycle and heterogeneity between firms.

Change history

30 May 2024

A Correction to this paper has been published: https://doi.org/10.1007/s10614-024-10595-4

Notes

This reading of the data seems to be confirmed by the words of the current Italian Prime Minister, Giorgia Meloni, during her inaugural speech in Parliament the day she was sworn-in, with regard to the will of reforming the Revenue Agency. In particular, she vowed to put up a tough fight against tax evasion (starting with total evaders, large companies and large-scale VAT frauds) accompanied by a change in the criteria for assessing the performance of the Internal Revenue Service, which she wants to anchor in the amounts actually collected.

Bachas and Soto (2021), for example, show that firms that would have had revenues slightly above the thresholds have a strong incentive to reduce their revenues just below the thresholds.

We assume \(m(k_t)<(1-\tau )f_h(k_t)\) for profits remaining positive.

In doing so, we follow the considerations of Rose-Ackerman and Palifka (2016). In fact, they argue that, for the firm, the punishment must be linked to the benefits it expects from corruption. Therefore, by analogy, we consider that the punishment must be proportionate to the firm’s expected benefit from evasion.

In future work, we intend to extend the model to consider the whole industrial structure, as discussed in Sect. 5.

For marginal products of private capital, we follow Ramaswamy (2021).

The world average corporate income tax rate (176 countries), is 24.18%. The GDP-weighted average statutory tax rate is 26.30%. The maximum average corporate tax rate is 21.77% in EU countries, 23.59% in OECD countries and 27.65% in G7 countries. See Asen (2019).

References

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3–4), 323–338.

Almunia, M., & Lopez-Rodriguez, D. (2018). Under the radar: The effects of monitoring firms on tax compliance. American Economic Journal: Economic Policy, 10(1), 1–38.

Ando, S. (2021). Size-dependent policies and risky firm creation. Journal of Public Economics, 197, 104404.

Asen, E. (2019). Corporate tax rates around the world 2019. Fiscal Fact (679).

Bachas, P., Jaef, R. N. F., & Jensen, A. (2019). Size-dependent tax enforcement and compliance: Global evidence and aggregate implications. Journal of Development Economics, 140, 203–222.

Bachas, P., & Soto, M. (2021). Corporate taxation under weak enforcement. American Economic Journal: Economic Policy, 13(4), 36–71.

Basri, M. C., Felix, M., Hanna, R., & Olken, B. A. (2021). Tax administration versus tax rates: Evidence from corporate taxation in Indonesia. American Economic Review, 111(12), 3827–71.

Benon, O. P., Baer, K., & Toro, J. (2002). Improving large taxpayers’ compliance: a review of country experience. International Monetary Fund, 47, 777.

CGIA-MESTRE. (2019). Fisco: Le grandi imprese evadono 16 volte in piú delle piccole. https://w/2019/10/Accertamentifiscali-05.10.2019.pdf

Coppier, R., Michetti, E., & Scaccia, L. (2022). Industrial structure and evasion dynamics, is there any link? Metroeconomica, 73(4), 960–986.

Dabla-Norris, E., Jaramillo, L., Lima, F., & Sollaci, A. (2018). Size Dependent Policies, Informality and Misallocation (IMF Working Papers No. 2018/179). International Monetary Fund. Retrieved from https://ideas.repec.org/p/imf/imfwpa/2018-179.html

Garoupa, N. (2007). Optimal law enforcement and criminal organization. Journal of Economic Behavior & Organization, 63(3), 461–474.

Goerke, L. (2019). Tax evasion by firms. In A. Marciano & G. B. Ramello (Eds.), Encyclopedia of law and economics (pp. 2001–2006). New York, NY: Springer, New York.

Guner, N., Ventura, G., & Xu, Y. (2008). Macroeconomic implications of size-dependent policies. Review of Economic Dynamics, 11(4), 721–744.

Gupta, S., Kangur, A., Papageorgiou, C., & Wane, A. (2014). Efficiency-adjusted public capital and growth. World Development, 57, 164–178.

IRS. (2022). Federal tax compliance research: Tax gap estimates for tax years 2014-2016. https://www.irs.gov/pub/irs-pdf/p1415.pdf

Jung, A., & Jung, D. (2022). The effects of size-dependent policy on the sales distortion reporting: Focusing on the discretionary sales management of Korean SMEs. Managerial and Decision Economics, 43(2), 301–320.

Kamps, C. (2006). New estimates of government net capital stocks for 22 OECD countries, 1960–2001. IMF Staff Papers, 53(1), 120–150.

Kanbur, R., & Keen, M. (2014). Thresholds, informality, and partitions of compliance. International Tax and Public Finance, 21(4), 536–559.

Kaoru, H., Masaki, H., & Daisuke, M. (2019). Size-dependent VAT, Compliance Costs, and Firm Growth (Discussion papers No. 19041). Research Institute of Economy, Trade and Industry (RIETI). Retrieved from https://ideas.repec.org/p/eti/dpaper/19041.html

Klimsa, D., & Ullmann, R. (2022). Threshold-dependent tax enforcement and the size distribution of firms: evidence from Germany. International Tax and Public Finance. https://doi.org/10.1007/s10797-022-09732-2

Lamantia, F., & Pezzino, M. (2021). Social norms and evolutionary tax compliance. The Manchester School, 89(4), 385–405.

Lowe, M., Papageorgiou, C., & Perez-Sebastian, F. (2019). The public and Private Marginal Product of Capital. Economica, 86(342), 336–361.

Murphy, R. (2019). The European tax gap - A report for the socialists and democrats group in the European parliament. Global policy. https://www.socialistsanddemocrats.eu/it/publications/european-tax-gap

OECD. (2022). Revenue statistics 2022. https://www.oecd-ilibrary.org/content/publication/8a691b03-en

Poniatowski, G., Bonch-Osmolovskiy, M., & Śmietanka, A. (2021). Study and reports on the VAT gap in the EU-28 member states: 2021 final report. Center for Social and Economic Research (CASE).

Ramaswamy, K. V. (2021). Do size-dependent tax incentives discourage plant size expansion? Evidence from panel data in Indian manufacturing. Margin: The Journal of Applied Economic Research, 15, 395–417.

Rose-Ackerman, S., & Palifka, B. J. (2016). Corruption and government: Causes, consequences, and reform (pp. 1–57). Cambridge: Cambridge University Press.

Funding

The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised due to retrospective openaccess.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/

About this article

Cite this article

Coppier, R., Michetti, E. & Scaccia, L. Size-Dependent Enforcement, Tax Evasion and Dimensional Trap. Comput Econ (2023). https://doi.org/10.1007/s10614-023-10399-y

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-023-10399-y