Abstract

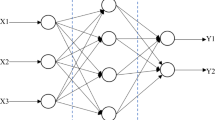

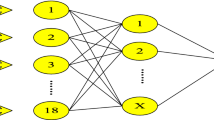

The risk assessment methods of agricultural supply chain finance (SCF) are explored to reduce agricultural SCF’s credit risks. First, the genetic algorithm (GA) is utilized to adjust and determine the initial weights and thresholds of the backpropagation neural network (BPNN), which assesses the credit risks. Second, for the problem that many factors affect the credit risks and the difficulty in selecting the characteristics, the principle of assessment indicator selection is proposed; the characteristics of these indicators are selected by principal component analysis (PCA). Finally, the case analysis method is utilized to verify the proposed risk assessment method, and an optimal credit risk assessment method is established. The results show that GA-BPNN can accelerate the convergence speed of the BPNN and improve the disadvantage in easily falling into the local minimum of BPNN. The PCA method simplifies the complexity of assessment indicator selection, and the representative indicators in agricultural SCF credit risk assessment are successfully selected. Through verification, it is found that the GA-BPNN algorithm performs well in credit risk prediction of agricultural SCF, and its prediction accuracy and prediction speed are improved. Therefore, the used GA-BPNN has performed well in the credit risk prediction of agricultural SCF, which applies to financial credit risk assessment to reduce the credit risks in agricultural SCF.

Similar content being viewed by others

References

Bergius, M., Benjaminsen, T. A., & Widgren, M. (2018). Green economy, Scandinavian investments and agricultural modernization in Tanzania. The Journal of Peasant Studies., 45(4), 825–852.

Blome, C., & Schoenherr, T. (2011). Supply chain risk management in financial crises—A multiple case-study approach. International Journal of Production Economics., 134(1), 43–57.

Crnković, D., & Vukomanović, M. (2016). Comparison of trends in risk management theory and practices within the construction industry. E-GFOS., 7(13), 1–11.

Cui, K., & Jing, X. (2019). Research on prediction model of geotechnical parameters based on BP neural network. Neural Computing and Applications, 31(12), 8205–8215.

Dong, Z., Wang, Z., & Chen, Y. (2016). A research on retailers’ decision-making and value of prepayment financing. Industrial Engineering Journal, 19(5), 99–106.

Fitó Bertran, M. À., Pla Erta, D., & Llobet, J. (2018). Usefulness of Z scoring models in the early detection of financial problems in bankrupt Spanish companies. Intangible Capital., 14(1), 162–170.

Halai, A. D., Woollams, A. M., & Ralph, M. A. L. (2017). Using principal component analysis to capture individual differences within a unified neuropsychological model of chronic post-stroke aphasia: Revealing the unique neural correlates of speech fluency, phonology and semantics. Cortex, 86, 275–289.

He, F., & Zhang, L. (2018). Mold breakout prediction in slab continuous casting based on combined method of GA-BP neural network and logic rules. The International Journal of Advanced Manufacturing Technology, 95(9), 4081–4089.

Huang Y., Xu, Q., Jiang, X., Tong, Z., & Liu, J. (2018). A comprehensive model for wind power forecast error and its application in economic analysis of energy storage systems. Journal of Electrical Engineering and Technology, 13(6), 2168–2177.

Jeong, H. J., & Ko, Y. (2016). Configuring an alliance portfolio for eco-friendly innovation in the car industry: Hyundai and Toyota. Journal of Open Innovation: Technology, Market, and Complexity, 2(1), 24–31.

Le Clainche, S., Lorente, L. S., & Vega, J. M. (2018). Wind predictions upstream wind turbines from a LiDAR database. Energies, 11(3), 543–549.

Li, J. C., Zhao, D. L., Ge, B. F., Yang, K. W., & Chen, Y. W. (2018). A link prediction method for heterogeneous networks based on BP neural network. Physica A: Statistical Mechanics and Its Applications, 495, 1–17.

Li, R. Z., Pang, S. L., & Xu, J. M. (2002). Neural network credit-risk evaluation model based on back-propagation algorithm. Proceedings International Conference on Machine Learning and Cybernetics: IEEE, 4, 1702–1706.

Li, Z., Yang, S., & Li, Z. (2016). Overview of risk management system of commercial bank data center. International Journal of Security and Its Applications., 10(3), 245–258.

Liang, X., Liang, W., & Xiong, J. (2020). Intelligent diagnosis of natural gas pipeline defects using improved flower pollination algorithm and artificial neural network. Journal of Cleaner Production, 264, 121655–121663.

Liu, X., & Zeng, M. (2017). Renewable energy investment risk evaluation model based on system dynamics. Renewable and Sustainable Energy Reviews., 73, 782–788.

Ma, D., Duan, H., Cai, X., Li, Z., Li, Q., & Zhang, Q. (2018). A global optimization-based method for the prediction of water inrush hazard from mining floor. Water, 10(11), 1618–1624.

Mao, D., Wang, F., Hao, Z., & Li, H. (2018). Credit evaluation system based on blockchain for multiple stakeholders in the food supply chain. International Journal of Environmental Research and Public Health., 15(8), 1627–1634.

Moretto, A., Grassi, L., Caniato, F., Giorgino, M., & Ronchi, S. (2019). Supply chain finance: From traditional to supply chain credit rating. Journal of Purchasing and Supply Management., 25(2), 197–217.

Oliveira, G. D. L. (2018). Chinese land grabs in Brazil? Sinophobia and foreign investments in Brazilian soybean agribusiness. Globalizations, 15(1), 114–133.

Peng, Y., & Xiang, W. (2020). Short-term traffic volume prediction using GA-BP based on wavelet denoising and phase space reconstruction. Physica A: Statistical Mechanics and Its Applications, 549, 123913–123921.

Sheng, T. (2020). The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Finance Research Letters, 39, 101558–101565.

Shi, J., Guo, J. E., Wang, S., & Wang, Z. (2015). Credit risk evaluation of online supply chain finance based on third-party B2B e-commerce platform: an exploratory research based on China’s practice. International Journal of u-and e-Service, Science and Technology, 8(5), 93–104.

Shi, J., Zhu, Y., Khan, F., & Chen, G. (2019). Application of Bayesian Regularization Artificial Neural Network in explosion risk analysis of fixed offshore platform. Journal of Loss Prevention in the Process Industries., 57, 131–141.

Tseng, M.-L., Wu, K.-J., Hu, J., & Wang, C.-H. (2018). Decision-making model for sustainable supply chain finance under uncertainties. International Journal of Production Economics., 205, 30–63.

Wang, H., & Zhang, G. J. (2018). The Application of KMV Model in Chinese Listed Real Estate Companies Credit risk Measurement. On Economic Problems, 3, 7–12.

Woo, S. H., Kwon, M. S., Yuen, K. F. (2020). Financial determinants of credit risk in the logistics and shipping industries. Maritime Economics & Logistics 1–23.

Wu, W., Kou, G., & Peng, Y. (2018). A consensus facilitation model based on experts’ weights for investment strategy selection. Journal of the Operational Research Society., 69(9), 1435–1444.

Yang, Q., Wang, Y., & Ren, Y. (2019). Research on financial risk management model of internet supply chain based on data science. Cognitive Systems Research, 56, 50–55.

Yang, S. A., & Birge, J. R. (2018). Trade credit, risk sharing, and inventory financing portfolios. Management Science., 64(8), 3667–3689.

Yao, J., & Lian, C. (2016). A new ensemble model based support vector machine for credit assessing. International Journal of Grid and Distributed Computing., 9(6), 159–168.

Yurdakul, M., & İç, Y. T. (2004). AHP approach in the credit evaluation of the manufacturing firms in Turkey. International Journal of Production Economics, 88(3), 269–289.

Zeng, Y. R., Zeng, Y., Choi, B., & Wang, L. (2017). Multifactor-influenced energy consumption forecasting using enhanced back-propagation neural network. Energy, 127, 381–396.

Zhang, C. (2016). Small and medium-sized enterprises closed-loop supply chain finance risk based on evolutionary game theory and system dynamics. Journal of Shanghai Jiaotong University (science), 21(3), 355–364.

Zhang, Y., Li, X., & Min, Q. (2018). How to balance the relationship between conservation of Important Agricultural Heritage Systems (IAHS) and socio-economic development? A theoretical framework of sustainable industrial integration development. Journal of Cleaner Production., 204, 553–563.

Zhu, C., Zhang, J., Liu, Y., et al. (2020). Comparison of GA-BP and PSO-BP neural network models with initial BP model for rainfall-induced landslides risk assessment in regional scale: A case study in Sichuan. China. Natural Hazards, 100(1), 173–204.

Zhu, Y., Zhou, L., Xie, C., Wang, G.-J., & Nguyen, T. V. (2019). Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. International Journal of Production Economics., 211, 22–33.

Acknowledgements

The project was supported by Research on Promoting Sino-Russian Agricultural Production Capacity Cooperation with agricultural modernization advantages (Heilongjiang Provincial Planning Office of Philosophy and Social Sciences Project 17JYH48), and also supported by Heilongjiang philosophy and social science planning project “research on implementation mechanism of agricultural production capacity cooperation between China and countries along the belt and road” (18JLD310).

Author information

Authors and Affiliations

Contributions

YW: writing—original draft preparation; XL: formal analysis, data curation; QL: Conceptualization, methodology; GT: writing—review and editing, visualization, supervision. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

All Authors declare that they have no conflict of interest.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wu, Y., Li, X., Liu, Q. et al. The Analysis of Credit Risks in Agricultural Supply Chain Finance Assessment Model Based on Genetic Algorithm and Backpropagation Neural Network. Comput Econ 60, 1269–1292 (2022). https://doi.org/10.1007/s10614-021-10137-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-021-10137-2