Abstract

This paper examines whether corporate environmental responsibility is influenced by regional differences in climate change denial. While there is an overwhelming consensus among scientists that climate change is happening, recent surveys still indicate widespread climate change denial across societies. Given that corporate activity causing climate change is fundamentally rooted in individual beliefs and societal institutions, we examine whether local perceptions about climate change matter for firms’ engagement in environmental responsibility. We use climate change perception surveys conducted in the U.S. to compute a novel measure of climate change denial for each U.S. county. We find that firms located in counties with higher levels of climate change denial have weaker environmental performance ratings, are more likely to commit environmental violations, and impose greater environmental costs on society. Regional differences in religiosity, social capital, political leaning, or county-level demographic characteristics cannot explain these results. Furthermore, we document that strong corporate governance mechanisms and corporate culture moderate the negative relationship between climate change denial and corporate environmental responsibility. Overall, our findings offer new insights into how local beliefs and perceptions about climate change may influence firm-level sustainability practices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Climate scientists unanimously agree that human-caused climate change is an existing threat to our planet (for reviews, see Cook et al., 2013, 2016). Nevertheless, recent survey evidence suggests that climate change denial is still widespread in societies, and nearly 30 percent of American adults, for instance, do not believe that climate change is happening as suggested by scientific research (Tyson et al., 2021). Given that corporate decisions and activities that inflict climate change and global warming are likely to be influenced by societal views and values, widespread climate change denial in the local society can create severe negative externalities for sustainable development and initiatives related to environmental responsibility. In this paper, we aim to empirically examine the impact of climate change denial on corporate environmental responsibility.

Building on the institutional theory, previous studies have acknowledged the role of local communities and local socio-political norms in influencing corporate decisions and outcomes (see, e.g., Powell & DiMaggio, 1991; Campbell, 2007; Marquis & Battilana, 2009; Caprar & Neville, 2012; Burdon & Sorour, 2020). A vast body of research has documented that attributes related to firms’ operating environment and geographical location, such as civic engagement, local culture, social capital and trust, religiosity, and political leanings, are reflected in firms’ strategic decisions, financial policies, governance mechanisms, and various other corporate outcomes (e.g., Hilary & Hui, 2009; El Ghoul et al., 2012; McGuire et al., 2012; Callen & Fang, 2015; Hasan et al., 2017; Hoi et al., 2019; Hasan et al., 2020; Colak et al., 2021; Afzali et al., 2022; Gupta & Minnick, 2022). Most closely related to our study, Di Giuli and Kostovetsky (2014), Du et al. (2014), Jha and Cox (2015), Cui et al. (2015), Attig and Brockman (2017), Cahan et al. (2017), Hoi et al. (2018), Zolotoy et al. (2019), and Ucar and Staer (2020) have documented that local norms and beliefs permeate engagement in corporate social responsibility (CSR) and environmental responsibility. We intend to extend the existing literature by investigating whether local beliefs and perceptions about climate change influence corporate environmental performance.

Given that corporate policies and decisions related to environmental threats and opportunities boil down to individual beliefs and societal institutions (Hoffman, 2010), it is likely that local perceptions regarding climate change influence such decisions and permeate the concomitant firm-level environmental outcomes. The institutional theory predicts that organizations seek the need to “fit” their social environment through their activities, and local social norms and values may discipline firms to enact certain policies and decisions (Kitzmueller & Shimshack, 2012; Scott, 2001). Following Hoepner et al. (2021), we rely on the institutional theory as an analytical framework in our study.

The formal rules, laws, and regulations—often linked to the regulative pillar of the institutional theory—form the foundational framework for guiding organizational behavior. Prior research documents country-specific regulation as a key determinant of the emergence of socially responsible investing (e.g., Sandberg et al., 2009; Scholtens & Sievänen, 2013). In the context of climate change and environmental responsibility, in regions where climate change denial is more prevalent, there may be weaker support for stringent environmental regulations or resistance to implementing new environmental policies. As a result, firms operating in these regions may face fewer external pressures to adopt sustainable practices, which can lead to weaker corporate environmental performance.

Similarly, social norms and values constitute another important pillar of the institutional theory and influence the expectations and behavior of individuals as well as organizations. In regions where climate change denial is widespread, there might be a cultural acceptance or even endorsement of environmentally harmful practices. Experimental evidence, for instance, shows that climate change denialism at the individual level is associated with self-interested choices at the expense of environmental harm (Berger & Wyss, 2021). This phenomenon could create a social norm that downplays the significance of climate change and devalues corporate environmental responsibility. Furthermore, in regions with higher levels of climate change denialism, corporate executives, employees, investors, and decision-makers may also hold more skeptical views regarding the importance of climate change and its impact on their business operations. These cognitive biases can influence strategic decisions, investment choices, and resource allocation, leading to a reduced focus on corporate environmental responsibility. Collectively, the different elements of institutional theory suggest that firms may be less likely to take measures that reduce their environmental impact in communities where local perceptions about climate change are more incredulous and skeptical. Therefore, we hypothesize that corporate environmental performance is negatively associated with the level of climate change denial in the firms’ social environment.

Our empirical analysis uses data on publicly traded U.S. firms to test the hypothesis that climate change denial influences corporate environmental responsibility. Specifically, we utilize a novel measure of climate change denial for each county in the U.S. estimated from survey data collected as part of the Climate Change in the American Mind project (see, Leiserowitz et al., 2013). The climate change perception survey comprises several questions that measure public opinion on climate change beliefs, risk perceptions, and policy support. Regarding “beliefs,” survey respondents are asked, for instance, whether climate change is happening and whether humans are causing climate change. Concerning “risk perceptions,” the respondents are asked whether they are worried about climate change and whether climate change will harm people in the U.S. Finally, the survey questions related to “policy support” aim to measure support for regulating carbon dioxide emissions and imposing a carbon tax on fossil fuel companies. Based on the survey responses, we construct a single county-level measure of climate change denial using principal component analysis. We employ the Environmental (E) pillar score of the MSCI’s environmental, social, and governance (ESG) ratings to measure firm-level environmental responsibility. The E score encompasses firm-level policies, outcomes, and risks related to climate change, natural resource use, waste management, and carbon emissions. In addition to the MSCI E score, we use five different E score subcomponents, Refinitiv’s Environmental pillar score, federal environmental compliance violations, and environmental costs as alternative measures to gauge environmental responsibility.

Consistent with our research hypothesis, we document that corporate environmental responsibility is negatively influenced by climate change denial. Specifically, our empirical findings demonstrate that firms located in counties with higher levels of climate change denial have weaker environmental performance ratings after controlling for firm characteristics and various county-level attributes such as social capital, religiosity, and political leaning. In terms of economic magnitude, our estimates suggest that a one standard deviation increase in local climate change denial is associated with an almost 5 percent decrease in the firms’ environmental scores. Our results also indicate that firms headquartered in high climate change denial counties are more likely to commit federal environmental compliance violations and impose more environmental costs on society.

We perform several additional tests to mitigate endogeneity concerns and rule out alternative explanations. First, we use instrumental variable regressions and entropy balancing to address endogeneity biases and facilitate causal inferences. Regardless of the approach, our tests provide support for the hypothesis that corporate environmental responsibility is negatively influenced by local climate change denial. We further utilize corporate headquarters relocations as a quasi-natural experiment to assess the causal linkage between local climate change perceptions and environmental performance. The results suggest that environmental performance decreases after a firm relocates its corporate headquarters to a county with a higher level of climate change denial.

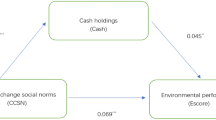

We then proceed by investigating whether corporate governance practices and corporate culture influence the negative linkage between climate change denial and corporate environmental responsibility. As documented in the prior literature, effective governance mechanisms and corporate culture may promote ethical behavior and engagement in CSR (e.g., Chen et al., 1997; Jo & Harjoto, 2011, 2012; Biggerstaff et al., 2015; Davidson et al., 2015; Baselga-Pascual et al., 2018; Chen et al., 2020; Döring et al., 2023; Drobetz et al., 2023). Our empirical findings suggest that the negative relationship between corporate environmental responsibility and local climate change denial is moderated by strong governance and culture.

To the best of our knowledge, this paper is the first to examine the effects of climate change denialism on corporate environmental responsibility as measured by various environmental performance indicators, environmental compliance violations, and the environmental costs firms impose on society. A growing body of research suggests that local socio-political norms and beliefs may influence firm-level CSR practices and environmental performance (e.g., Attig & Brockman, 2017; Cahan et al., 2017; Cui et al., 2015; Di Giuli & Kostovetsky, 2014; Hoi et al., 2018; Jha & Cox, 2015; Ucar & Staer, 2020). Closely related to but distinct from our study, Zhang et al. (2023) document that county-level social norms regarding climate change may influence corporate cash holdings, while the findings of Huang and Lin (2022) suggest that local climate risk perceptions are associated with firms’ CSR policies. Similarly, Baldauf et al. (2020) find that properties expected to be underwater in areas where residents believe in climate change sell at lower prices than houses in areas in which climate change denialism is more prevalent, suggesting that real estate prices are influenced by differing beliefs about long-term climate risks.

By utilizing a novel measure of climate change denial and employing rigorous methodologies to reduce endogeneity concerns, we contribute to the existing literature by documenting that corporate environmental responsibility is negatively influenced by climate change denialism in the surrounding society. In doing so, our study fills a gap in the understanding of the interplay between local climate change perceptions and corporate behavior, and moreover, of how this linkage is affected by the strength and efficacy of corporate governance mechanisms and corporate culture. Our results also underline the importance of societal beliefs in shaping corporate actions and emphasize the need for a multi-faceted approach to address environmental challenges. Given these findings, we hope to spur further research in this area and advocate policymakers and corporate leaders to consider the broader societal context in their efforts towards sustainability.

The remainder of this paper proceeds as follows. The next section introduces the theoretical framework and presents our research hypothesis. The third section describes the data and the variables and presents our empirical setup. Our empirical findings on the influence of local climate change denial on corporate environmental performance are presented and discussed in the fourth section. In the fifth section, we discuss the implications of our results from corporate, public policy, and ethical perspectives. Finally, the last section provides concluding remarks.

Theoretical Framework and Hypothesis Development

Recent studies demonstrate that the community is a salient stakeholder with powerful influence over corporate decisions and outcomes (for a review, see Habib et al., 2023). Community-level civic norms and social capital, for instance, mitigate agency problems related to managerial opportunism and compensation (Gupta & Minnick, 2022; Hoi et al., 2019) and positively influence managers’ use of resources (Gao et al., 2021). More importantly, such social norms may also pressure firms to behave more responsibly by engaging in positive CSR practices that benefit stakeholders and by curbing negative CSR activities that harm stakeholders (e.g., Attig & Brockman, 2017; Cahan et al., 2017; Hoi et al., 2018; Jha & Cox, 2015; Ucar & Staer, 2020).

In our setting, the institutional theory (see e.g., Meyer and Rowan, 1977; North, 1990; Scott, 2001) provides a coherent theoretical framework to understand how local perception regarding climate change may influence firms’ engagement in environmental responsibility. Prior research draws on institutional theory to emphasize the role of local communities in influencing corporate decisions and outcomes. According to Scott (2001) and Marquis and Battilana (2009), local communities can influence organizational processes through regulative, social-normative, and cultural-cognitive influences. Communities can enact rules, review others’ compliance with those rules, and establish mechanisms that punish deviance from such rules (Scott, 2001). In his seminal study, Carroll (1991) argues that CSR should be framed in a way that encompasses the entire range of business responsibilities, including economic, legal, ethical, and philanthropic considerations. Carroll (1991) further contends that ethical responsibilities stem from standards, norms, and expectations of what society deems fair and just. Such norms can also be a driving force behind regulatory reforms that guide ethical responsibility. We use the institutional theory as an analytical framework to illustrate how local climate change perceptions may potentially influence local firms’ environmental responsibility. Several prior studies rely on institutional theory to derive conceptual frameworks for a comparative understanding of corporate social responsibility (e.g., Campbell, 2007; Matten & Moon, 2008).

While our theorization heavily relies on the different pillars of the institutional theory, we are also cognizant of the overlap between the institutional theory, legitimacy theory, and stakeholder theory in explaining social and environmental responsibility (Chen & Roberts, 2010). The legitimacy theory, developed by Dowling and Pfeffer (1975), suggests that firms seek to ensure that they are perceived as operating within the bounds and norms of their respective societies or environment. This theory has been widely used to analyze corporate behavior, especially in the context of corporate social and environmental sustainability. According to the theory, organizations are more likely to engage in socially responsible behavior, such as investing in green technologies or fair labor practices, if they believe that such behavior will enhance their legitimacy in the eyes of key stakeholders (Bebbington et al., 2008; Magness, 2006). In the context of our study, firms located in areas with higher levels of climate change denial may feel less pressure to engage in environmentally responsible behaviors due to the lower perceived need for legitimacy obtained through climate actions.

Similarly, our analysis can also be motivated by the stakeholder theory which posits that instead of focusing solely on maximizing shareholder value, companies also need to consider how they can create value for their broader set of stakeholders, where stakeholders are defined as anyone who can affect or is affected by the actions, decisions, policies, practices, or goals of the organization (Freeman, 1984). A vast body of literature has adopted the stakeholder theory to study the antecedents of CSR practices (Herremans et al., 2016; Yang & Rivers, 2009). In the context of environmental responsibility, Kassinis and Vafeas (2006) use stakeholder theory to find that several stakeholder pressures correspond to expected (dis)engagement in environmental responsibility. The stakeholder theory predicts that firms located in areas with high climate change denial may be responding to the attitudes and beliefs of important local stakeholders. Because these firms perceive less demand or value from these stakeholders for environmental responsibility, they may be less likely to invest in environmentally sustainable practices.

The institutional theory is particularly expedient for our study as it allows for a more granular understanding of the complex influences shaping corporate environmental responsibility in the face of prevalent climate change denial in the vicinity of the firm’s headquarters. Whereas the legitimacy theory could explain firms’ behavior as a response to the perceived need to conform to societal expectations, and the stakeholder theory may help to understand the diverse pressures from different groups, the institutional theory provides a more comprehensive view of the institutional landscape. As we illustrate in the following, different elements within institutional theory can influence firms’ (dis)engagement in environmentally responsible behavior, allowing for a more nuanced exploration of their multifaceted impacts on firms’ environmental responsibilities. In contrast, the legitimacy theory does not specify how alignment with societal values can be achieved (Chen & Roberts, 2010) and the stakeholder theory, in turn, is more pertained to the relationships and interactions between organizations and their stakeholders, which is not the primary focus of our study.

An important aspect of the institutional theory is how regulative institutions, which encompass laws, rules, and sanctions, play a significant role in shaping corporate behavior. The degree of legal mandates in the U.S. largely varies across states based on the interpretation and implementation of the legislation. Such regional variation in implementation is shown, for instance, in the advancement of female executives and the diffusion of maternity-leave policies (Guthrie & Roth, 1999a, 1999b). As documented by Hamilton and Keim (2009) and Howe et al. (2015), the perceptions and beliefs regarding climate change vary considerably across the different geographical areas of the U.S. Given that the public perception of climate change largely shapes support or opposition to climate policies (Leiserowitz, 2005), it can be argued that different communities are likely to respond differently to climate change risks.Footnote 1 Local communities where perceptions about climate change are more skeptical are unlikely to advocate for regulations that curb local firms’ detrimental environmental impact. Regulatory and political institutions may favor climate change denying narratives, reducing the pressure on firms to adopt environmentally responsible practices.

From a social-normative perspective of the institutional theory, local norms and values serve as a platform for firms’ social engagement (Marquis et al., 2007). Campbell (2007) proposes that firms will be more likely to behave in socially responsible ways if local institutions such as nongovernmental and social movement organizations monitor their behavior effectively. In the absence of such norms and strong institutions to monitor deviance from norms, local firms are more likely to behave socially irresponsibly. Furthermore, firm-level decisions related to environmental threats and opportunities may boil down to individual beliefs and societal institutions (Hoffman, 2010). At the individual-level, recent experimental research finds that individuals denying the existence of climate change are more likely to make self-interested decisions that can harm the environment (Berger & Wyss, 2021). When local perceptions regarding climate change are more incredulous and skeptical, local socio-political norms are unlikely to play an effective role in monitoring and influencing environmentally responsible corporate behavior. Moreover, managers and employees in high climate change denial regions are likely to share local norms and may therefore be more likely to make myopic decisions causing environmental harm. Put differently, firms are less likely to take measures that reduce their environmental impact when the local demand for better environmental performance is low or nonexistent.

Furthermore, when climate change denial is deeply ingrained in the local culture, firms may not only perceive environmental responsibility as less necessary or beneficial, but they may also actively resist adopting environmentally responsible practices due to a perceived misalignment with the prevailing cultural norms. This assertion aligns with the recent findings of Hoepner et al. (2021) who document that asset owners from social backgrounds that are more culturally aligned with the values represented by the responsible investing movement are more likely to sign the United Nations Principles of Responsible Investing (PRI). However, these implications are not limited to investment choices alone. Hoepner et al. (2021) also document that corporate cultures that are harmonious with the principles of responsible investing might foster increased receptivity and commitment to sustainable practices. This implies that cultural influences play a substantial role in shaping corporate environmental responsibility by reinforcing or undermining local values associated with environmental sustainability. Collectively, these arguments lead to the following hypothesis:

H1

Corporate environmental responsibility is negatively influenced by the pervasiveness of climate change denial in the local society.

We proceed by considering the potential roles of corporate governance mechanisms and corporate culture in influencing the linkage between local climate change denial and corporate environmental responsibility. Considerable empirical evidence suggests that both internal and external corporate governance mechanisms affect the firm’s engagement in CSR activities. For instance, Jo and Harjoto (2011, 2012) study several internal and external governance mechanisms and conclude that effective monitoring and oversight by the board of directors and external monitors such as institutional investors and financial analysts is positively associated with CSR engagement. The role of institutional ownership in influencing CSR has also been studied extensively. Chen et al. (2020), for instance, document that exogenous increases in institutional ownership are positively associated with CSR performance. In a similar vein, Dyck et al. (2019) use an international setting to show that institutional investors coming from countries with stronger environmental and social norms are the primary drivers of the positive association between institutional ownership and CSR engagement. Recent studies by Döring et al. (2023) and Drobetz et al. (2023) suggest that institutional investors and their legal origin and investment horizon matter for corporate greenhouse gas emissions disclosure and environmental costs.

In a context where climate change denialism is prevalent, strong corporate governance mechanisms can mitigate the potential negative influence of local climate change denial on environmental performance through strategic commitment to CSR initiatives. Institutional shareholders, particularly those inclined towards responsible investing and sustainability, and local climate deniers may not only hold divergent beliefs about climate change but also different underlying motivations and perceptions regarding the role of corporate environmental responsibility. Institutional shareholders may be more influenced by global environmental norms and the potential financial implications of climate risks whereas local climate deniers are likely to be influenced by local cultural norms and beliefs. Therefore, the engagement of institutional shareholders may also counterbalance the adverse effects of local climate change denial on corporate environmental initiatives. Building on these arguments, we posit the following hypothesis:

H2

The negative association between climate change denial and corporate environmental responsibility is moderated by strong internal and external corporate governance mechanisms.

We further presume that corporate culture may also influence the linkage between climate change denialism and corporate environmental responsibility. Corporate culture can be considered as an informal institution that comprises firmly held values and norms within an organization (O’Reilly & Chatman, 1996). It is represented by values and norms that are widely-held and endorsed by the members of an organization, facilitating social control (Sørensen, 2002). The strength of corporate culture has been empirically linked to firm performance, efficiency, and earnings comparability (Afzali, 2023; Guiso et al., 2015; Li et al., 2021b). The culture-performance link is particularly salient during economic downturns (Li et al., 2021a). A strong corporate culture, especially one that values integrity and transparency, may discourage climate change denial and promote environmental responsibility. Such a culture is likely to foster a sense of accountability and ethical behavior among its members, leading to more responsible environmental practices. Furthermore, climate change and the firm’s engagement in environmentally responsible activities are ethical issues (Bridge, 2022; DesJardins, 1998; Markowitz, 2012) and a strong corporate culture that values integrity, transparency, accountability, and cooperation is a fundamental antecedent to ethical decision-making (Chen et al., 1997). Consequently, we posit the following hypothesis:

H3

The negative association between climate change denial and corporate environmental responsibility is less prevalent in firms with stronger corporate cultures.

Data and Methodology

Data

We test the hypothesis that climate change denial influences corporate environmental responsibility (H1) using data on publicly traded U.S. firms over the period 2012–2020. The data are collected from the following sources: (i) climate change denial data are obtained from Yale Program on Climate Change Communication, (ii) the data on firms’ environmental performance are from MSCI and Refinitiv, (iii) the data on firms’ environmental compliance violations are taken from the Violation Tracker database compiled by the Good Jobs First organization, (iv) the data on firm-level environmental costs are obtained from Freiberg et al. (2022), (v) firm headquarters locations are identified through Securities and Exchange Commission (SEC) filings, (vi) the financial statement and balance sheet data are obtained from Compustat, (vii) the county-level data on regional demographic characteristics are collected from U.S. Census Bureau, and (viii) other county-level characteristics are obtained from the Association of Religion Data Archives, the Northeast Regional Center for Rural Development, the MIT Election Data, and the National Centers for Environmental Information. To test the moderating role of internal and external corporate governance mechanisms (H2), we collect data on board characteristics from BoardEx and on institutional ownership from Thomson Reuters 13-F Institutional Holdings. Finally, to examine the role of corporate culture (H3), we use data on corporate culture obtained from Kai Li’s data library.Footnote 2

The initial sample consists of all U.S. firms included in Compustat. After excluding American Depository Receipts (ADRs),Footnote 3 limited partnerships, holding companies, and firms with missing data for environmental performance, climate change denial, firm characteristics, and county-level characteristics, we are left with a sample of 2746 individual firms and an unbalanced panel of 15,570 firm-year observations over the period 2012–2020.

Climate Change Denial

National-level climate change perception surveys in the U.S. have existed for over a decade.Footnote 4 However, such broad, national-level surveys do not capture the large variations in the beliefs and opinions across the different geographical areas of the U.S. To overcome this limitation, Howe et al. (2015) construct local estimates of climate change perception at the state, county, and congressional district level using national survey data collected as part of the Climate Change in the American Mind project (see, Leiserowitz et al., 2013). These estimates are compiled as part of the research project led by the Yale Program on Climate Change Communication and the George Mason University Center for Climate Change Communication in order to understand how climate-related opinions differ at the local levels and to provide means for policymakers and other stakeholders to better address climate change (see e.g., Leiserowitz et al., 2022).

To derive the local estimates across the U.S., Howe et al. (2015) utilize a multilevel regression and poststratification (MRP) approach in which they first model individual beliefs, opinions, and policy support as a function of demographic, geographic, and temporal effects, and then use the first-stage coefficients to derive weighted estimates for each geographic area. Unlike disaggregation which relies on pooling the responses of all respondents in each geographic region, the MRP approach produces more reliable estimates and reduces uncertainties for areas with a smaller population (Lax & Phillips, 2009). Thus, this approach expands the national-level estimates of climate change opinions to state, county, and congressional district levels with great accuracy. However, to further validate the estimates, internal cross-validations and external validations have been conducted through multiple independent surveys across different geographic areas with identical questions to the original national-level survey. The estimates obtained from these surveys are markedly similar to those produced by the MRP approach, which further reduces concerns related to measurement error (Howe et al., 2015).

The surveys comprise several questions measuring public opinion on climate change beliefs, risk perceptions, and policy support. Regarding “climate change beliefs”, survey respondents are being asked whether climate change is happening, whether humans are causing climate change, and whether scientists have a consensus on its existence. With respect to “climate change risk perceptions”, the respondents are asked whether they are worried about climate change and whether climate change will harm people in the U.S. Finally, the survey questions related to “policy support” aim to measure the respondents’ tendency to support climate-related policies such as regulating carbon dioxide emissions and imposing a carbon tax on fossil fuel companies. The local estimates are available for the years 2014, 2016, 2018, and 2021 based on the national surveys conducted in each of these years.

We rely on the estimates of Howe et al. (2015) from the Yale Program on Climate Change Communication to calculate a unique measure of climate change denial for each U.S. County. Specifically, we collect survey responses to nine questions related to climate change beliefs, risk perceptions, and policy support. We then use principal component analysis (PCA) to identify the common component with the highest eigenvalue. More details on the PCA and our climate change denial measure are provided in Table 1.

In Panel A of Table 1, we present the nine individual survey questions that comprise our measure of climate change denial as well as the national average values for each survey year. As can be seen from Panel A, the percentage of respondents who do not believe that global warming is happening (Happening Oppose) is about 20 percent in 2014, it drops to around 16–17 percent in 2016 and 2018, and then increases to 19.4 percent in 2021 while still remaining below the 2014 value. Nevertheless, both the percentages of respondents who think that global warming is caused mostly by natural changes in the environment instead of humans (Human Oppose) and who believe there is a lot of disagreement among scientists about whether or not global warming is happening (Consensus Oppose) decline over time. The survey estimates also indicate that the respondents’ risk perceptions related to climate change have changed over time as more people believe that climate change will negatively affect people in the U.S. as well as them personally. Interestingly, at the same time, the percentages of respondents who are more likely to oppose regulating carbon dioxide emissions and setting strict limits on existing coal-fired power plants have slightly increased from 2014 to 2021.Footnote 5

The results of the principal component analysis of the nine individual climate change perception variables are reported in Panel B of Table 1. Additionally, in Fig. 1, we provide a scree plot of how much variance is explained by each principal component and the eigenvalues associated with the components. The first principal component explains 75.5 percent of the variation in the nine variables and has an eigenvalue of 6.791. We use the scoring coefficients to obtain the first principal component score for each county and year. Because the estimates are available only for 2014, 2016, 2018, and 2021, we follow the prior literature (e.g., Hilary & Hui, 2009) and use the estimates from the most recent year to extend the sample period. For instance, for the years 2012 and 2013, we use the 2014 survey estimates. As an alternative approach, we create also an extrapolated version of climate change denial that accounts for the time-series variation in respondents’ perceptions. Finally, we obtain our county-level measure of climate change denial, Climate Change Denial, by normalizing the climate change denial score based on the PCA to range from 0 to 1 with higher values representing higher degrees of climate change denialism in the county.

Descriptive statistics for Climate Change Denial are presented in Panel C of Table 1. The degree of climate change denial exhibits considerable variation across the U.S. counties around the mean value of 0.571. The county with the highest climate change denial score is Loving County in Texas, followed by Cameron Parish in Louisiana and Emery County in Utah. At the other end of the spectrum, counties with the lowest climate change denial scores are Wade Hampton Census Area, Alaska, Oglala Lakota County in South Dakota, Bronx County in New York, and Suffolk County in Massachusetts. To put these scores into perspective, in Loving County, Texas, an estimated 34.5 percent of residents do not believe that global warming is happening, compared to a mere 5.5 percent of the residents of Bronx County, New York. To illustrate the regional variation in the level of climate change denial across the U.S., Fig. 2 plots the county-level climate change denial scores for the years 2014 and 2021.

Corporate Environmental Responsibility

The dependent variable in our analysis is corporate environmental responsibility. As our main measure of firm-level environmental responsibility, we use the Environmental (E) pillar score of the MSCI’s environmental, social, and governance (ESG) ratings (Environmental Score). According to MSCI (2022), their ESG ratings “aim to measure a company’s resilience to long-term, financially relevant ESG risks” and combine thousands of data points across several ESG issues that present significant risks and opportunities. The MSCI ESG ratings and their individual subcomponents have been commonly used in the prior literature to measure corporate social responsibility (see e.g., Attig et al., 2013, 2016; Harjoto et al., 2015; Arouri & Pijourlet, 2017; Attig & Brockman, 2017; Harjoto & Laksmana, 2018; Maas, 2018; Tsai & Wu, 2022; Bae et al., 2023). The MSCI ratings are also highly correlated with the holdings of ESG mutual funds in the U.S. (Berg et al., 2023).

MSCI’s environmental pillar score focuses on a range of factors related to a firm’s environmental impact, including carbon emissions, energy efficiency, water usage, waste management, and biodiversity. MSCI uses a data-driven approach to analyze firms’ environmental practices, relying on a combination of company-reported data, third-party data, and proprietary research. MSCI’s methodology for measuring environmental performance includes a series of quantitative and qualitative assessments that evaluate a firm’s environmental management systems, operational performance, and disclosure practices. The quantitative assessments use environmental data points, such as greenhouse gas emissions, energy consumption, and water usage, to calculate a company’s environmental performance. The qualitative assessments rely on MSCI’s research and analysis of company disclosures and management practices to evaluate a company’s environmental policies, programs, and performance. Overall, MSCI’s environmental pillar score provides a comprehensive assessment of a firm’s environmental impact.Footnote 6

MSCI’s environmental pillar score comprises five underlying subscores: Climate Change Score, Natural Resource Use Score, Waste Management Score, Carbon Emissions Score, and Toxic Emissions Score. MSCI’s Climate Change Score assesses a firm’s exposure to and management of climate-related risks and opportunities. The score is based on a range of factors, including the firm’s greenhouse gas emissions, energy efficiency, renewable energy use, and climate-related disclosure practices. The Natural Resource Use Score assesses a firm’s management of natural resource-related risks and opportunities, including water use, land use, and biodiversity. The score evaluates the firm’s resource management practices, such as water efficiency, sustainable sourcing, and land conservation efforts. The Waste Management Score assesses the management of waste-related risks and opportunities, including hazardous and non-hazardous waste generation, recycling and disposal practices, and pollution prevention efforts. The Carbon Emissions Score assesses a firm’s greenhouse gas emissions intensity, emissions reduction targets, and renewable energy use. Finally, the Toxic Emissions Score assesses the management of toxic emissions and hazardous substances, including air and water pollution, chemical spills, and other environmental releases.

Corporate Governance and Corporate Culture

For testing H2 and H3, we need empirical measures of corporate governance and corporate culture. Corporate governance is inherently a multifaceted construct, characterized by a complex interplay of various organizational mechanisms, structures, and practices. In the prior literature (see e.g., Jo & Harjoto, 2011, 2012), the conceptualization of corporate governance efficacy has often revolved around observable variables related to board characteristics and ownership structure. In our empirical analysis, we follow the approach of Colak and Liljeblom (2022) and measure the strength of corporate governance mechanisms with a composite index (Corporate Governance) constructed as the sum of the following five binary variables: (i) the firm’s Chief Executive Officer and the chairperson of the board of directors are different individuals, (ii) the average number of directorships held by board members is less than three, (iii) the number of board members is less than 12, (iv) the percentage of independent directors is above the sample median, and (v) the percentage of institutional ownership is above the sample median. By construction, this governance index can take a value between 0 and 5 with higher values indicating stronger corporate governance.

In contrast to the observable board and ownership characteristics that are commonly used to gauge corporate governance, corporate culture is a more difficult concept to define and especially to measure. To test H3, we rely on the framework of O’Reilly and Chatman (1996) which defines corporate culture as the deep-rooted values and standards informally established within an organization. Within this framework, Li et al., (2021a, 2021b) propose a machine learning technique based on word embedding to measure corporate culture from firms’ earnings call transcripts. The corporate culture measure of Li et al., (2021b) reflects five key dimensions of corporate value—innovation, integrity, quality, respect, and teamwork—based on the frequency of specific culture-reflecting words and phrases used in earnings calls. Recent studies have used this novel measure to examine how corporate culture is reflected in firm value and financial reporting practices (Graham et al., 2022; Li et al., 2021a; Afzali, 2023). Following Li et al., (2021b), we measure the strength of corporate culture (Corporate Culture) for each firm by first calculating the sum of the culture scores across the five individual corporate culture dimensions and then creating annual quartile ranks of the aggregated corporate culture scores. Firms with corporate culture scores in the top quartile are considered to have the strongest culture.

The Empirical Models

We estimate alternative versions of the following fixed-effects panel regression specification to test the hypothesis that corporate environmental responsibility is negatively influenced by local climate change denial:

where Environmental Scorei,t is the MSCI environmental pillar score for firm i in year t and Climate Change Denial is the climate change denial score for firm i’s headquarters location county j in year t. H1 predicts that the coefficient for Climate Change Denial will be negative. To test H2 and H3, we estimate modified versions of Eq. (1) in which we include interaction terms between local climate change denial and the strength of corporate governance and corporate culture, i.e., Climate Change Denial × Corporate Governance and Climate Change Denial × Corporate Culture.

Following prior literature on corporate social responsibility (e.g., Attig et al., 2016; Cai et al., 2016; Di Giuli & Kostovetsky, 2014; Jha & Cox, 2015), we control for firm size, return on assets, book-to-market ratio, the ratio of cash holdings and dividend payouts, leverage, the level of financial constraint based on the Kaplan and Zingales (1997) index, research and development expenditures, and advertisement intensity. The county-level controls included in Eq. (1) are county population, population growth, median household income, median age, and an indicator variable for whether the county is part of a metropolitan area. As documented by Kassinis and Vafeas (2006), geographic areas with greater income and population density can exert more pressure on local firms to act environmentally responsibly. Following prior research on the influence of local socio-political norms on firm-level CSR engagement, we also control for county-level differences in social capital (Hoi et al., 2018; Jha & Cox, 2015), religiosity (Du et al., 2014; Cui et al., 2015; Zolotoy et al., 2019), and political orientation (Di Giuli & Kostovetsky, 2014; Rubin, 2008). The definitions of all the variables included in Eq. (1) are provided in Appendix 1. To reduce the impact of outliers, we winsorize all control variables at the 1st and 99th percentiles.

In addition to the firm-specific and county-level controls, we include state, industry, and year fixed-effects to reduce potential biases related to omitted variables and to account for systematic variation in environmental responsibility across states and industries and over time. Finally, we cluster standard errors at the county level.Footnote 7

Descriptive Statistics

Table 2 reports descriptive statistics for the variables used in the regressions. The mean (median) values of Climate Change Denial and Happening Oppose are 0.419 (0.414) and 12.113 (11.505), respectively. It is important to note that these means and medians are different from those reported in Table 1 because the sample only includes counties in which publicly traded firms are headquartered. We identify only 375 unique such counties out of a total of over 3000 counties in the U.S. The mean, median, and standard deviation of Environmental Scoret+1 are 4.709, 4.600, and 2.197, respectively. The descriptive statistics indicate that the environmental performance of our sample firms exhibits substantial cross-sectional variation with the Environmental Score ranging from 0 to 10.

Pairwise correlation coefficients (not tabulated) indicate that Climate Change Denial and Happening Oppose are negatively correlated with Environmental Score while being positively correlated with Environmental Violations. Thus, the correlations provide support for the hypothesis that corporate environmental responsibility is negatively associated with the degree of local climate change denial. Not surprisingly, Climate Change Denial is significantly correlated with all of the county-level control variables, the strongest correlations being with median household income (r = –0.41) and county population (r = –0.35). In general, the correlation coefficients between the different independent variables used in the regressions are relatively low in magnitude, all being below 0.60 in absolute value.

Results

Univariate Analysis

To initially illustrate the correlation between climate change denial and environmental performance, we create a binned scatterplot by first segmenting climate change denial scores into percentiles and then mapping the average one-year-ahead environmental performance along these percentiles. The scatterplot is depicted in Fig. 3. The downward-sloping line indicates a trend of increasing climate change denial being associated with decreasing environmental responsibility. Thus, Fig. 3 provides preliminary support for H1.

We next perform univariate t-tests to examine the differences between firms headquartered in high versus low climate change denial counties. For this purpose, we divide firm-year observations into two subsamples based on the top and bottom terciles of Climate Change Denial. The results of the univariate are reported in Table 3.

Consistent with our hypothesis, the t-tests indicate that firms headquartered in the high climate change denial counties have lower environmental performance than firms headquartered in the low climate change denial counties. As can be noted from Table 3, the mean difference between Environmental Score between the two subsamples is negative and statistically significant at the 1 percent level. Moreover, all the other environmental performance indicators, such as climate change, natural resource use, waste management, carbon emission, and toxic emission scores, are also statistically significantly lower for firms headquartered in high climate change denial counties. The univariate tests also demonstrate that firms located in high climate change denial counties commit significantly more federal environmental violations than firms in low climate change denial counties.

With respect to the firm-specific and county-specific control variables, the univariate tests in Table 3 suggest that firms located in the regions of high climate change denial are more profitable and have higher book-to-market and leverage ratios, while also having significantly lower cash holdings, R&D expenditures, and advertisement intensity. Furthermore, the results of the t-tests indicate that counties with high degrees of climate change denial are very different from the ones with low degrees of denial in terms of socio-political characteristics. Specifically, climate change denialism is more prevalent in smaller counties and non-metropolitan areas, more religious and decisively Republican counties, and regions with an older population and lower median household income.Footnote 8

Main Results: Test of H1

Table 4 presents the estimation results of five alternative versions of Eq. (1). We begin by estimating a parsimonious industry and year fixed-effects specification with Climate Change Denial as the only explanatory variable (Model 1). The adjusted R2 indicates that this constrained model explains about 26 percent of the cross-sectional variation in Environmental Score. As can be noted from Table 4, the coefficient estimate for Climate Change Denial in Model 1 is negative and statistically significant at the 1 percent level, indicating that corporate environmental performance decreases with increasing local climate change denial. For reference purposes, we estimate Model 2 which excludes Climate Change Denial and includes all the control variables as well as industry and year fixed-effects. In this specification, the coefficients for most of the control variables appear statistically significant, and the adjusted R2 increases to 30.9 percent after the inclusion of these controls.

Model 3 is our baseline model which includes all the control variables along with industry and year fixed-effects. Consistent with H1, the estimated coefficient for Climate Change Denial is negative and statistically significant at the 1 percent level. Given that local socio-political values and preferences are likely to influence both climate change denial and corporate environmental responsibility, we then augment the set of county-level characteristics by including region fixed-effects in Model 4 and state fixed-effects in Model 5 to control for potential biases related to systematic heterogeneity in firm-level environmental responsibility across different regions and states. Similar to the other models, the estimated coefficients for Climate Change Denial in both of these specifications are negative and statistically highly significant.

Overall, the regression results in Table 4 provide strong support for the hypothesis that corporate environmental responsibility is negatively influenced by local climate change denial (H1). In addition to being statistically significant, the results can also be considered economically meaningful. For instance, the coefficient estimate of –1.050 for Climate Change Denial in Model 3 suggests that, ceteris paribus, an increase of one standard deviation in the degree of local climate change denial is associated with a 4.92 percent [(–1.050 × 0.221) ÷ 4.709] decrease in Environmental Score.

As can be seen from Table 4, the coefficient estimates for most of the firm-level control variables in Models 2–5 are statistically significant and consistent with our expectations.Footnote 9 Specifically, the regression results demonstrate that corporate environmental performance is positively related to firm size, R&D intensity, cash holdings, dividend payout, and the level of financial constraint while being negatively associated with book-to-market ratio. Interestingly, the coefficients for county-level control variables appear statistically insignificant throughout the regressions, with the only exceptions being the negative coefficients for Republican in Models 2, 3, and 5. Broadly consistent with the findings of Di Giuli and Kostovetsky (2014), the negative coefficients for Republican suggest that firms headquartered in Republican states tend to be less environmentally responsible.Footnote 10

Endogeneity Bias

Our regression results indicate that local climate change denial has a negative influence on the firm’s environmental responsibility. However, we acknowledge that endogeneity caused by omitted variables, reverse causality, and selection biases may influence the estimates and impede causal interpretations. In our main regressions, we have included a range of firm-specific and county-specific control variables as well as industry, year, and state fixed-effects to alleviate concerns related to omitted variables. Nevertheless, it is possible that some omitted or unobservable attribute is simultaneously influencing firm-level environmental responsibility and county-level beliefs and perceptions about climate change.

It is also conceivable that the environmental responsibility of local firms influences the public perception regarding climate change in the surrounding community, which would lead to reverse causality from firm-level environmental performance to county-level climate change denial. The endogenous nature of selecting headquarters location may also bias our results if environmentally responsible firms self-select their location into the geographic areas with lower degrees of climate change denial. To address these endogeneity concerns, we next utilize entropy balancing and instrumental variable regressions in order to establish a causal linkage from local climate change denial to corporate environmental responsibility.

Entropy Balancing

Our first approach for mitigating endogeneity concerns, specifically relating to selection bias, is entropy balancing (Hainmueller, 2012). Prior research has used this technique to deal with endogeneity concerns (e.g., Chapman et al., 2019; Chahine et al., 2020). We use entropy balancing to construct a balanced sample based on firm and county-level characteristics (covariates). Entropy balancing aids us in reducing observable differences between the control and treatment groups without requiring assumptions about any relationships between the covariates and the dependent variable. We begin by dividing our sample into firms headquartered in high climate change denial (treatment) and low denial (control) counties. Entropy balancing then assigns weights for each observation in the treatment and control groups such that the weighted samples have identical means for all the pre-specified covariates, thereby addressing potential selection bias. Similar to our univariate tests, we use values above and below the median of Climate Change Denial to define the high and low climate change denial counties.Footnote 11 Untabulated univariate tests indicate that the observable differences in firm-specific and county-specific attributes observed in Table 3 become statistically insignificant in the entropy-balanced sample, suggesting that the process effectively eliminates the observable differences between the matched and the treatment firms.

The regression results based on the matched-firm sample are reported in the first numerical column of Table 5. Consistent with our main regressions, the coefficient estimate for Climate Change Denial is negative and statistically significant at the 5 percent level. Thus, the estimates suggest that local climate change denial has a negative influence on corporate environmental responsibility even after curtailing the observable differences in firm characteristics and socio-political attributes between high and low climate change denial counties. These findings provide further support for our first hypothesis.

Instrumental Variable Regressions

We proceed to address potential endogeneity concerns with two-stage instrumental variable (IV) regressions. For this purpose, we use two different instruments for Climate Change Denial, the endogenous variable of interest: (i) Average CC Denial and (ii) Temperature Anomaly. Following Zhang et al. (2023), we define Average CC Denial as the average climate change denial score in the state excluding the county in which the firm is headquartered. As our second instrument, we use “temperature anomaly” in July for each county. To calculate this measure, we obtain county-level monthly average temperatures over the period 1901–2021 from the National Centers for Environmental Information. We define Temperature Anomaly as the difference between the temperature in a given July of a county-year minus the average July temperature over the period 1901–2000. We use July because it is the hottest month of the year in most U.S. states.

The relevance criterion requires that the instrumental variables should be meaningfully correlated with Climate Change Denial. Given that norms and perceptions are likely to be relatively similar within a given geographic region, we expect counties within the same state to have similar climate change perceptions as the county of the firm’s headquarters. This presumption is based on the premise that people within a state are more likely to be influenced by common state-level factors when forming their climate change perceptions. Thus, it is reasonable to assume that Average CC Denial reflects regional climate change perceptions relevant to the county of the firm’s headquarters. With respect to our second instrument, we contend that unusually warm and rising temperatures are likely to affect local perceptions of climate change. When temperatures deviate significantly from historical averages, individuals living in these areas are more likely to notice and potentially link such anomalies to climate change through experiential processing, i.e., they learn through personal experience. This relationship between experiential processing and climate change perceptions has empirical support in the climate science literature (see e.g., Myers et al., 2013; Spence et al., 2011).

For the instrumental variables to be valid, they must also satisfy the exclusion criteria, i.e., the instrument should not affect firm-level environmental performance independently but only through the endogenous variable. It is reasonable to presume that the perceptions of individuals working in a given county are likely to be influenced by the broader climate change perceptions prevailing in their state. The impact of state-level climate change denial on firm-level environmental performance is therefore likely to be mediated through county-level climate change denial, satisfying the exclusion restriction. Similarly, anomalous local temperatures in July are expected to affect local perceptions of climate change within a county. It is unlikely that unusually warm temperatures in individual U.S. counties would have a direct, independent effect on firm-level environmental performance. The logical channel is that such temperature anomalies would influence individuals within the county to form certain climate change perceptions that, in turn, influence their engagement with environmental issues, potentially impacting firm-level environmental responsibility.Footnote 12

The second numerical column of Table 5 presents the estimates of the first-stage regression. As can be seen from the table, the average degree of climate change denial score of the counties in the state is strongly positively correlated with the endogenous variable, Climate Change Denial. Similarly, as predicted, the anomalous temperature in July is significantly negatively associated with the climate change denial score. The Craig-Donald F-statistic has a value above the thresholds suggested in Stock and Yogo (2005), indicating that our instrumental variable estimates do not suffer from a weak instrument problem. The results of the second-stage IV regressions with the instrumented Climate Change Denial are reported in the third numerical column of Table 5. Overall, the second-stage estimates are consistent with our main regressions reported in Table 4. The coefficient estimate for the instrumented Climate Change Denial is negative and statistically significant at the 5 percent level, and it is very similar in magnitude to the coefficients in Table 4. The Hansen j-statistic and the accompanying p-value indicate that the instruments do not overidentify the equation. Thus, the IV regressions facilitate the causal interpretation of our results and suggest that corporate environmental responsibility is negatively influenced by local climate change denial even after controlling for potential endogeneity.

Corporate Headquarters Relocation as a Quasi-Natural Experiment

Following the recent literature studying the effects of local socio-political norms on corporate decisions and outcomes (e.g., Hasan et al., 2017; Hoi et al., 2019), we next utilize headquarters relocation as a quasi-natural experiment to assess the causal linkage between local climate change perceptions and corporate environmental performance. In our sample, we are able to identify 185 individual firms that relocated their headquarters to another county during the sample period. We require at least 3 years of non-missing data for all the variables in our baseline model before and after the headquarters relocation. This filtering process leaves us with a sample of 62 headquarters relocations. We next identify whether the corporate headquarters relocation is from a county with lower climate change denial to a county with higher climate change denial, and vice versa. In 49 relocations, climate change denial is lower in the new headquarters location county than in the old location, and in the remaining 13 relocations corporate headquarters moves to a county with a higher degree of climate change denial. The final headquarters relocation sample for the quasi-natural experiment comprises 532 firm-year observations.

The main variable of interest in the quasi-natural experiment is the interaction term between a dummy variable CCD Increasing Relocation that equals 1 if the firm relocates from a low climate change denial county to a high climate change denial county and a dummy variable Post that equals 1 for the years after the corporate headquarters relocation and 0 before the relocation year. The regression results based on the corporate headquarters relocation sample are presented in the fourth numerical column of Table 5. As can be noted from the table, the coefficient estimate for the interaction variable CCD Increasing Relocation × Post is negative and statistically significant at the 5 percent level. This negative coefficient suggests that the environmental performance of firms that relocate their corporate headquarters to a county with a higher level of climate change denial decreases after the relocation in comparison to firms that relocate to counties with lower climate change denial. Thus, the quasi-natural experiment based on headquarters relocations provides evidence of a causal linkage from local climate change denial to corporate environmental responsibility.

An Additional Test Related to Reverse Causality

In our main regressions, Climate Change Denial and all the other independent variables are lagged by 1 year relative to Environmental Score to address potential reverse causality. Although the instrumental variable regressions and the quasi-natural experiment based on headquarters relocations should alleviate endogeneity arising from reverse causality, we perform an additional test to reduce any remaining concerns related to reverse causality. Specifically, following the approach of Hillman and Keim (2001), we use the change in local climate change denial from year t to year t + 1 as the dependent variable and corporate environmental performance in year t as the main independent variable along with the set of control variables used in Eq. (1). We estimate these cross-sectional regressions with the change in climate change denial as the dependent variable for each year in our sample. Our untabulated regression results indicate that corporate environmental performance is not associated with changes in climate change perceptions. This result further mitigates concerns related to reverse causality.

The Roles of Corporate Governance and Corporate Culture: Tests of H2 and H3

We next investigate whether the linkage between local climate change denial and corporate environmental responsibility is influenced by the strength of corporate governance mechanisms (H2) and corporate culture (H3). In order to test H2 and H3 and to assess the potential mediating effect of corporate governance and culture on the negative relation between climate change denial and corporate environmental responsibility, we estimate modified versions of Eq. (1) which include either an interaction term between climate change denial and the strength of corporate governance (Climate Change Denial × Corporate Governance) or an interaction term between climate change denial and corporate culture (Climate Change Denial × Corporate Culture). Following Colak and Liljeblom (2022), we measure the strength of corporate governance with a governance index that reflects the effectiveness of internal and external governance. To gauge the strength of corporate culture, we employ the corporate culture measure of Li et al., (2021b) which is constructed from earnings call transcripts by utilizing machine learning techniques.

The results of the interaction regressions are reported in Table 6. Models 1 and 3 are estimated without the county-level control variables, while Models 2 and 4 include the full set of controls in addition to industry and year fixed-effects. Regardless of the model specification, the coefficient estimates for the interaction variables Climate Change Denial × Governance and Climate Change Denial × Corporate Culture are positive and statistically highly significant. Thus, the estimates indicate that the negative relationship between local climate change denial and corporate environmental performance is mitigated by strong corporate governance mechanisms and corporate culture. Collectively, these results provide support for H2 and H3 and thereby highlight the importance of corporate governance mechanisms and corporate culture for socially responsible behavior. Our findings imply that strong internal and external governance mechanisms and firm-level cultural values can act as buffers against the detrimental influence of local climate change denialism on corporate environmental responsibility and strategic commitment to CSR initiatives.

Additional Tests

Subscores of Environmental Responsibility

Thus far, we have measured corporate environmental performance with the MSCI environmental score. Next, we decompose Environmental Score into the following five subscores of environmental responsibility: (i) Climate Change Score, (ii) Natural Resource Use Score, (iii) Waste Management Score, (iv) Carbon Emissions Score, and (v) Toxic Emissions Score.

The estimates of Eq. (1) with the alternative environmental performance subscores as the dependent variables are presented in the first five numerical columns of Table 7. Because the different subscores are not available for all firms, the number of firm-year observations used in these regressions is lower than in our main regressions, ranging from 5803 to 14,723. The adjusted R2s of the regressions vary between 38 and 46 percent. Overall, the results of these additional regressions are broadly consistent with our main analysis. Specifically, the coefficient estimates for Climate Change Denial are negative and statistically highly significant in the regressions with Climate Change Score, Natural Resource Use Score, and Carbon Emissions Score as the dependent variables, while being insignificant in the Waste Management Score and Toxic Emissions Score regressions. The magnitudes and the significance levels of the coefficient estimates indicate that local climate change denial has a particularly strong negative influence on the responsible use of natural resources. The estimates suggest that a one standard deviation increase in local climate change denial is associated with a 3.5 percent lower Natural Resource Use Score.

Alternative Measures of Environmental Responsibility

Recent studies have documented that there is substantial disagreement across different ESG rating providers regarding the environmental, social, and governance performance of individual firms (Berg et al., 2022; Chatterji et al., 2016; Christensen et al., 2022). Therefore, to ascertain that our empirical findings are robust to different assessments of corporate environmental performance, we next use Refinitiv’s Environmental Pillar Score as an alternative dependent variable. Refinitiv’s Environmental Pillar Score aims to rank firms’ environmental performance relative to their peers on a scale of 0–100 based on data related to emissions reduction, resource use, and environmental innovations. Again, the sample size is lower than in Table 4 because Refinitiv covers a smaller number of individual firms than MSCI.Footnote 13 The estimates of Eq. (1) with the Environmental Pillar Score from Refinitiv as the dependent variable are reported in the sixth numerical column of Table 6. Consistent with our main regressions, the coefficient for Climate Change Denial is negative and statistically significant at the 5 percent level.

As the next approach to measure corporate environmental responsibility, we follow the recent literature (e.g., Heese et al., 2022; Raghunandan & Rajgopal, 2021) and use the number of federal environmental compliance violations from the Violation Tracker database compiled by the nonprofit organization Good Jobs First. Unlike the environmental performance assessments constructed by different ESG rating providers, the federal environmental compliance violations reflect actual firm-level environmental outcomes rather than being subjective assessments based on the firm’s CSR disclosure, sustainability reports, and environmental policies. We estimate a Poisson regression with the number of committed environmental violations as the dependent variable. As shown in Table 7, the coefficient estimate for Climate Change Denial is positive and statistically significant at the 5 percent level. This suggests that higher levels of climate change denial in the firm’s social environment increase the number of environmental violations committed by the firm.

Our third alternative measure of corporate environmental responsibility is motivated by recent studies on environmental costs (Drobetz et al., 2023; Freiberg et al., 2022). Specifically, we use data obtained from Freiberg et al. (2022) to measure environmental intensity as the total environmental costs divided by the total revenue of the firm. The approach of Freiberg et al. (2022) allows the conversion of environmental impact estimates into scalable monetary values. These estimates are derived by applying specific characterization pathways and monetization factors to the environmental outputs of an organization, which can include carbon emissions, water usage, and various other types of emissions. The regression results with Environmental Costs as the dependent variable are reported in the eighth numerical column of Table 7. The positive and statistically significant coefficient for Climate Change Denial suggests that firms headquartered in high climate change denial counties impose more environmental costs on society than firms located in counties with lower levels of climate change denialism. Nevertheless, it should be acknowledged that the sample size in this regression is considerably lower than in our other specifications, and thus, these estimates should be approached more cautiously.

Alternative Measures of Climate Change Denial

We also conduct two additional tests related to the measurement of climate change denial. First, we acknowledge that the use of a single climate change denial score which is based on the principal component analysis of nine survey questions may also lead to a measurement bias. To address this concern, we use Happening Oppose instead of Climate Change Denial to measure local beliefs about climate change. This variable is the estimated percentage of county residents who do not believe that global warming is happening. The ninth numerical column of Table 7 presents the estimates of Eq. (1) with Happening Oppose as the test variable of interest. Consistent with the hypothesis that corporate environmental responsibility is negatively influenced by local climate change denial, the coefficient estimate for Happening Oppose is negative and statistically significant at the 1 percent level.

Second, while in our main analysis, we extrapolate the sample period to cover the years 2012–2020, the county-level climate change denial scores can only be estimated for the years 2014, 2016, 2018, and 2020. To ensure that our results are not affected by this extrapolation, we estimate Eq. (1) based on a sample constrained to the 4 years during which the climate change perception surveys were conducted. The estimation results of this specification are reported in the tenth numerical column of Table 7. As shown in the table, the coefficient for Climate Change Denial remains negative and statistically significant at the 1 percent level even after constraining the sample to the survey years.

Discussion and Ethical Implications

Our empirical findings have broad implications for firms, policy makers, and society at large regarding sustainability practices, socially responsible investing, and sustainable development. From the firm’s perspective, it is essential to acknowledge that climate change denial in the surrounding community may inflict environmental initiatives and create conflicts with the long-term interests of shareholders, other stakeholders, and the broader society. Thus, local climate change denialism can create significant reputational and financial risks for firms. In regions with a tendency towards high climate change denialism, firms may face less stringent demands from investors, financial institutions, and other external stakeholders to disclose their environmental impact and demonstrate their commitment to environmental responsibility. To mitigate these risks, firms that prioritize corporate environmental responsibility may have to consider relocating their headquarters to regions with lower levels of climate change denial.

From a public policy perspective, our findings highlight the need for governments and non-governmental organizations to shape solutions and regulations that address climate change and curb global warming. If incredulous local beliefs about climate change influence firms’ engagement in environmental responsibility, in addition to regulation, policy makers should direct efforts towards initiatives and public awareness campaigns that reduce climate change skepticism and enhance public trust in institutions and science. By enhancing public trust in environmental science, policy makers can encourage firms to prioritize corporate environmental responsibility and foster sustainable development. One approach proposed by Bain et al. (2012) would be to direct efforts toward policies that have positive societal outcomes and create societies where people are more considerate and caring. Furthermore, society as a whole should recognize the importance of sustainable development and climate change mitigation. Public opinion and beliefs about climate change may play a crucial role in shaping firms’ engagement in environmental responsibility and policy responses to climate change.

Our study also has important ethical implications. Our empirical findings emphasize the moral responsibility of firms to transcend local biases and misconceptions about climate change and to uphold rigorous environmental standards. In regions with higher levels of climate change denialism, firms face a greater ethical obligation to ensure that their operational decisions are not influenced by the prevailing local misconceptions about climate change but are instead based on scientific evidence and global ethical standards. Our results also highlight the important role of internal and external corporate governance mechanisms and corporate culture in mitigating the detrimental influence of local climate change denial on environmental responsibility. On a more general level, our findings point to the ethical imperative for organizational leadership to cultivate a culture of environmental stewardship that instills values that take into account the well-being of the planet and all its inhabitants while ensuring that corporate policies and practices align with global initiatives aimed at mitigating environmental degradation and climate change. In this broader context, corporate ethics goes beyond mere legal compliance; it entails a moral obligation to contribute positively to global efforts to combat climate change, especially in regions where climate change denialism is more prevalent.

Conclusions