Abstract

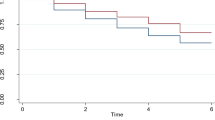

Business groups dominate the economic landscape in many economies around the world. While business groups overcome the institutional voids arising due to inefficiencies of external markets, they also possess market power, which could be economically and socially counterproductive, especially for unaffiliated firms. Drawing on the transaction cost and industrial organization economics, we examine whether the presence of business group affiliated firms in industries restricts the entry of unaffiliated firms or firms affiliated with small- and medium-size business groups. Findings based on Indian firms suggest that investments by business group affiliated firms in an industry have an inverted U-shaped relationship with the investment by unaffiliated firms. However, investments by firms affiliated with large-sized business groups have a U-shaped relationship with the investment by affiliates of small and medium business groups. These findings suggest that the market power of business groups and entry barrier relationship is contingent on the size of the business groups.

Similar content being viewed by others

References

Amsden, A. (1989). Asia’s next giant: South Korea and late industrialization. Oxford: Oxford University Press.

Bain, J. S. (1956). Barriers to new competition. Boston, MA: Harvard University Press.

Belenzon, S., & Berkovitz, T. (2010). Innovation in business groups. Management Science, 56(3), 519–535.

Belenzon, S., Berkovitz, T., & Rios, L. A. (2013). Capital markets and firm organization: How financial development shapes European corporate groups. Management Science, 59, 1326–1343.

Bernheim, B., & Whinston, M. D. (1990). Multimarket contract and collusive behavior. Rand Journal of Economics, 21, 1–26.

Bertrand, M., Mehta, P., & Mullainathan, S. (2002). Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics, 117(1), 121–148.

Bhagwati, J. N. (1982). Directly unproductive, profit-seeking (DUP) activities. Journal of Political Economy, 90, 988–1002.

Boatright, J. (1999). Does business ethics rest on a mistake? Business Ethics Quarterly, 9(4), 583–591.

Boutin, X., Cestone, G., Fumagalli, C., Pica, G., & Nicolas, S. (2013). The deep-pocket effect of internal capital markets. Journal of Financial Economics Volume, 109(1), 122–145.

Carney, M., Gedajlovic, E. R., Heugens, P., Van Essen, M., & Van Oosterhout, J. (2011). Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3), 437–460.

Caves, R. (1989). International differences in industrial organization. In R. Schmalensee & R. Willig (Eds.), Handbook of industrial organization. Amsterdam: North-Holland; pp. 1226–1249.

Caves, R. E., & Porter, M. (1977). From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. Quarterly Journal of Economics, 91, 241–262.

Chang, S., & Choi, U. (1988). Structure, strategy and performance of Korean Business Groups: A transactions cost approach. Journal of Industrial Economics, 37, 141–158.

Chang, S. J., & Hong, J. (2000). Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3), 429–448.

Chari, A., & Gupta, N. (2008). Incumbents and protectionism: The political economy of foreign entry liberalisation. Journal of Financial Economics, 88(3), 633–656.

Cottrill, M. T. (1990). Corporate social responsibility and the marketplace. Journal of Business Ethics, 9, 723–729.

Cuervo-Cazurra, A., Gaur, A. S., & Singh, D. (2018). Pro-market institutions and global strategy: The pendulum of pro-market reforms and reversals. Authors’ manuscript.

Delios, A., Gaur, A. S., & Kamal, S. (2009). International acquisitions and the globalization of firms from India. In J. Chaisse & P. Gugler (Eds.), Expansion of Trade and FDI in Asia: Strategic and Policy Challenges. New York, NY: Routledge.

Demsetz, H. (1968). The cost of transacting. The Quarterly Journal of Economics, 82(1), 33–53.

Dieleman, M., & Sachs, W. M. (2008). Coevolution of institutions and corporations in emerging economies: How the Salim Group morphed into an institution of Suharto’s crony regime. Journal of Management Studies, 45(7), 1274–1300.

Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: A study of Indian firms. Journal of International Business Studies, 38(4), 541–555.

Encarnation, D. (1989). Dislodging multinationals: India’s comparative perspective. Cornell University Press: Ithaca, NY.

Feenstra, R., Hamilton, G., & Lim, E. M. (2002). Chaebol and catastrophe: A new view of business groups and their role in the Korean financial crisis. Asian Economic Papers, 1(2), 1–45.

Feenstra, R., Huang, D., & Hamilton, G. (2003). A market-power based model of business groups. Journal of Economic Behavior and Organizations, 51, 459–485.

Fisman, R. (2001). Estimating the value of political connections. American Economic Review, 91, 1095–1102.

Fisman, R., & Khanna, T. (2004). Facilitating development: The role of business groups. World Development, 32(4), 609–628.

Gaur, A. S., & Delios, A. (2015). International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2), 235–253.

Gaur, A. S., & Kumar, M. (2018). A systematic approach to conducting review studies: An assessment of content analysis in 25 years of IB research. Journal of World Business. https://doi.org/10.1016/j.jwb.2017.11.003.

Gaur, A. S., & Kumar, V. (2009). International diversification, firm performance and business group affiliation: Empirical evidence from India. British Journal of Management, 20, 172–186.

Gaur, A. S., Kumar, V., & Singh, D. (2014). Institutions, resources, and internationalization of emerging economy firms. Journal of World Business, 49(1), 12–20.

Gaur, A. S., Ma, X., & Ding, Z. (2018). Perceived home country supportiveness/unfavorableness and Outward Foreign Direct Investment from China. Journal of International Business Studies. https://doi.org/10.1057/s41267-017-0136-2.

Ghemawat, P., & Khanna, T. (1998). The nature of diversified oups: A research design and two case studies. Journal of Industrial Economics, XLVI(1), 35–62.

Gopalan, R., Nanda, V. K., & Seru, A. (2007). Affiliated firms and financial support: Evidence from Indian Business Groups. Journal of Financial Economics, 86, 759–795.

Granovetter, M. (1994). Business groups. In N. J. Smelser & R. Swedberg (Eds.), In: Handbook of Economic Sociology. Princeton, NJ: Princeton University Press.

Guillén, M. F. (2000). Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3), 362–380. 47.

Haans, R. F., Pieters, C., & He, Z. L. (2016). Thinking about U: Theorizing and testing U-and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37, 1177–1195.

Hamilton, G., & Biggart, N. (1988). Market, culture, and authority. American Journal of Sociology, 94, S52–S94.

Harrigan, K. R. (1985). Vertical integration and corporate strategy. Academy of Management Journal, 28, 397–425.

Hemphill, T. A. (2004). Antitrust, dynamic competition and business ethics. Journal of Business Ethics, 50, 127–135.

Hendry, J. (2001). Morality and markets: A response to boatright. Business Ethics Quarterly, 11(3), 537–545.

Hobday, M., & Colpan, A. M. (2010). Technological innovation and business groups. In A. M. Colpan, T. Hikino & J. R. Lincoln (Eds.), The Oxford handbook of business groups: 763–782. Oxford: Oxford University Press.

Kant, K. (2016). India, 15 of the top 20 business groups are family-owned! Retrieved 01 February, 2018 from http://www.rediff.com/money/report/special-in-india-15-of-the-top-20-business-groups-are-family-owned/20160818.htm.

Kedia, B. L., Mukherjee, D., & Lahiri, S. (2006). Indian business groups: Evolution and transformation. Asia Pacific Journal of Management, 23(4), 559–577.

Keister, L. A. (2000). Chinese business groups: The structure and impact of interfirm relations during economic development. New York: Oxford University Press.

Khanna, T. (2000). Business groups and social welfare in emerging markets: Existing evidence and unanswered questions. European Economic Review, 44, 748–761.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Khanna, T., & Palepu, K. (2000). Is group affiliation profitable in emerging markets? Ananalysis of diversified Indian business groups. Journal of Finance, 55(2), 867–891.

Khanna, T., & Rivkin, J. W. (2001). Estimating the performance effects of business groups inemerging markets. Strategic Management Journal, 22(1), 45–74.

Khanna, T., & Yafeh, Y. (2007). Business groups in emerging markets: Paragons or parasites? Journal of Economic Literature, 45(2), 331–372.

Kumar, V., Gaur, A. S., & Pattnaik, C. (2012). Product diversification and international expansion of business groups: Evidence from India. Management International Review, 52, 175–192.

Lawrence, R. (1993). Japan’s different trade regime: An analysis with particular reference to keiretsu. Journal of Economic Perspectives, 7, 3–19.

Lee, C.-Y., Lee, J.-H., & Gaur, A. S. (2017). Are large business groups conducive to industry innovation? The moderating role of technological appropriability. Asia Pacific Journal of Management, 34(2), 313–337.

Lee, J. H., & Gaur, A. S. (2013). Managing multi-business firms: A comparison between Korean chaebols and diversified US firms. Journal of World Business, 48(4), 443–454.

Leff, N. (1978). Industrial organization and entrepreneurship in the developing countries: the economic groups. Economic Development and Cultural Change, 26, 661–675.

Leff, N. (1979). Entrepreneurship and economic development: The problem revisited. Journal of Economic Literature, 17, 46–64.

Mahmood, I. P., & Mitchell, W. (2004). Two faces: Effects of business groups on innovation in emerging economies. Management Science, 50(10), 1348–1365.

McGee, J., & Thomas, H. (1986). Strategic groups: Theory, research and taxonomy. Strategic Management Journal, 7, 141–160.

Mukherjee, D., Makarius, E. E., & Stevens, C. E. (2018). Business group reputation and affiliates’ internationalization strategies. Journal of World Business, 53(2), 93–103.

Nelson, J. (1994). Business ethics in a competitive market. Journal of Business Ethics, 13, 663–666.

OECD (2014). OECD Economic Surveys: Korea 2014. Paris: OECD Publishing. http://dx.doi.org/10.1787/eco_surveys-kor-2014-en.

OECD (2016). OECD economic surveys: Korea 2016. Paris: OECD Publishing. http://dx.doi.org/10.1787/eco_surveys-kor-2016-en.

Pae, P. (2018). South Korea’s chaebol, bloomberg quicktake. Retrieved 28 February, 2018. https://www.bloomberg.com/quicktake/republic-samsung.

Paine, L. S. (1990). Ideals of competition and today’s marketplace’. In C. C. Walton (Ed.), Enriching business ethics (pp. 91–112). New York: Plenum Press.

Pattnaik, C., Chang, J. J., & Shin, H. H. (2013). Business groups and corporate transparency in emerging markets: Empirical evidence from India. Asia Pacific Journal of Management, 30(4), 987–1004.

Piepenbrink, A., & Gaur, A. S. (2013). Methodological advances in the analysis of two-mode networks: An illustration using board interlocks of Indian business groups. Organizational Research Methods, 16(3), 474–496.

Popli, M., Ladkani, R. M., & Gaur, A. S. (2017). Business group affiliation and post-acquisition performance: An extended resource-based view. Journal of Business Research, 81, 21–30.

Porter, M. E. (1979). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

Posner, R. A. (1975). The social cost of monopoly and regulation. Journal of Political Economy, 83, 807–827.

Rajakumar, J. D., & Henley, J. S. (2007). Growth and persistence of Large Business Groups in India. Journal of Comparative International Management, 10(1), 3–24.

Rawls, J. (1971). A theory of justice. Cambridge, MA: Harvard University Press.

Shin, H., & Stulz, R. (1998). Are internal capital markets efficient? The Quarterly Journal of Economics, 453, 531–552.

Shin, H.-H., & Park, Y. S. (1999). Financing constraints and internal capital markets: Evidence from Korean Chaebols. Journal of Corporate Finance, 5(2), 169–191.

Singh, D. (2009). Export performance of emerging market firms. International Business Review, 18(4), 321–330.

Singh, D., & Delios, A. (2017). Corporate governance, board networks and growth in domestic and international markets: Evidence from India. Journal of World Business, 52(5), 615–627.

Singh, D., & Gaur, A. S. (2013). Governance Structure, innovation and internationalization: Evidence from India. Journal of International Management, 19(3), 300–309.

Singh, D., Pattnaik, C., Gaur, A. S., & Ketencioglu, E. (2018). Corporate expansion during pro-market reforms in emerging markets: The contingent value of group affiliation and unrelated diversification. Journal of Business Research, 82, 220–229.

Singh, D. A., & Gaur, A. S. (2009). Business group affiliation, firm governance and firm performance: Evidence from China and India. Corporate Governance, 17(4), 411–425.

Weinstein, D., & Yafeh, Y. (1995). Collusive or competitive? An empirical investigation of keiretsu behavior. Journal of Industrial Economics, 43, 359–376.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Rights and permissions

About this article

Cite this article

Pattnaik, C., Lu, Q. & Gaur, A.S. Group Affiliation and Entry Barriers: The Dark Side Of Business Groups In Emerging Markets. J Bus Ethics 153, 1051–1066 (2018). https://doi.org/10.1007/s10551-018-3914-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-018-3914-2