Abstract

Stochastic reserving models used in the insurance industry are usually based on an assumed distribution of claim amounts. Despite their popularity, such models may unavoidably be affected by the misspecification issue given that it is likely that the underlying distribution will be different from that assumed. In this paper, we incorporate monotone splines to ensure the expected monotonically increasing pattern of cumulative development factors (CDFs) to develop a new semi-parametric reserving model that does not require a density assumption. To allow the maximum utilization of available information, we also propose an enhanced sampling approach that greatly increases the size of unbiased CDFs, particularly in later development periods. Based on the enhanced samples, a bootstrap technique is employed in the estimation of monotone splines, from which incurred-but-not-reported (IBNR) reserves and prediction errors can be obtained. Associated technical features, such as the consistency of estimator, are discussed and demonstrated. Our simulation studies suggest that the new model improves the accuracy of IBNR reserving, compared with a range of classic competing models. A real data analysis produces many consistent findings, thus supporting the usefulness of the monotone spline model in actuarial and insurance practice.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The outstanding claims reserve is usually the largest liability faced by an insurer. This provides information for both investors and regulators, and it is associated with ratemaking and solvency monitoring. Therefore, accurate estimation of an outstanding claims reserve, also known as the incurred-but-not-reported (IBNR) reserving, is critical in actuarial practice. This is particularly important for property and casualty insurers because their claims can develop over periods of more than one decade. It is worth noting that outstanding claims of an insurer include both IBNR and reported-but-not-settled (RBNS) claims. In this paper, we focus on cumulative claim amounts, rather than on counts, with only one run-off triangle. Consequently, IBNR and RBNS claims cannot be distinguished from each other, and the term (generalized) IBNR claims is used to indicate all the outstanding claim amounts.

In existing studies, relevant IBNR reserving models can be categorized into three areas. First, univariate multiplicative reserving models, which include the classic chain ladder (CL) method and its stochastic extensions, such as the overdispersed Poisson model (Renshaw & Verrall, 1998). Second, multivariate reserving models, which work with more than one run-off triangle (Wüthrich, 2003; Miranda et al., 2012). Third, micro-level reserving models, which, rather than working with run-off triangles as do the other two categories, investigate the development of individual claims (Antonio & Plat, 2014; Gabrielli & Wüthrich, 2018).

This paper contributes to developing univariate multiplicative reserving models, which constitute the most studied area of reserving modeling in the literature. As implied by the name, a common feature of such models is that the mean of cumulative paid claims until the next development period is assumed to be a multiplication of the development factor (DF) and the most recent cumulative claim. Over the past several decades, various parametric models have been developed as stochastic extensions of the classic CL method (e.g., Wright, 1990; Mack & Venter, 2000; England & Verrall, 2002; Wüthrich & Merz, 2008; Kuang et al., 2015; Kuang & Nielsen, 2020; Gao et al., 2021). Many of these extensions are based on a generalized linear model (GLM) framework with a Poisson family distribution. To allow more complicated features, such as tail factor extrapolation, parametric curves (Clark, 2003) or non-parametric splines (Gao & Meng, 2018) are fitted to the development pattern of the outstanding claims.

Despite the popularity in existing research, there are several inherent issues. First, all the parametric and Bayesian models depend on the reliableness of assumed distributions and/or associated parameters. Thus, if a model is misspecified, the estimated IBNR reserves and/or its prediction error might be unreliable. Second, most Bayesian models employ a complicated modeling structure. This can cause problems because the computational cost could be considerably high due to the employed MCMC algorithm. Further, the complicated parametric frameworks may reduce their applicability in actuarial practice. As Gisler (2019) argues, “A methodology whose mechanism is understood and which is sufficiently accurate is mostly preferred to a highly sophisticated methodology whose mechanism is difficult to understand and to see through.”

To resolve this, we adopt assumptions and technical findings in the seminal works of Mack (1993, 1999) and explore a semi-parametric reserving model. Compared with a distribution-based parametric model, our model does not require an assumed density for the underlying variables, and it is usually more robust against the misspecification issue in the assumed distribution. In addition, this less complicated model is easy to follow and understand, and it has a much lower computational cost than Bayesian models.

Based on three fundamental assumptions, Mack (1993, 1999) derives closed-form formula for both the prediction errors of IBNR reserves obtained by the classic CL method. Unlike modeling the (incremental) claims as in GLM, Mack’s model estimates the cumulative development factor (CDF) and age-to-age DF. Subsequent influential research has focused on revisiting the proposed prediction errors. For example, Diers et al. (2016) estimate the prediction error using bootstrap techniques. Röhr (2016) rewrites the prediction error of ultimate run-off risks as a function of the individual future CL DFs. Gisler (2019) provides simplified uncertainty estimators and compares them with those of Mack’s model and the model of Merz and Wuthrich (2015). Lindholm et al. (2020) use Akaike’s final prediction error in the uncertainty estimator, which is claimed to nest Mack’s model as a special case.

Unlike existing research, this study presents a framework that directly estimates forward-factors in the diagonal direction of a run-off triangle. This enables one to make the best use of the available information about CDFs/DFs and of the reliable “prior” belief using monotone splines. Specifically, in actuarial practice, negative incremental claims in a subsequent development period may inevitably arise as a result of salvage recoveries; payments from third parties; total or partial cancellation of outstanding claims due to initial overestimation of the loss or a jury decision in favor of the insurer; rejection by the insurer; or simply errors (De Alba, 2006). Despite the possibility of such occurrences, these negative values are believed to be rare/random events, and the mean development would usually be positive. That is, the CDFs are expected to monotonically increase with the development periods. Therefore, this belief strongly motivates the application of monotone splines on the modeling of CDFs.

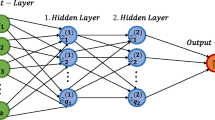

Monotone splines belong to the popular spline functions. The application of spline functions has become an influential method in statistical regression analysis, particularly since the seminal work of Hastie and Tibshirani (1986). To ensure the monotone shapes, we employ the I-spline function (also known as an integrated B-spline) basis. As introduced by De Boor (1978), the B-spline basis is one of the most popular spline functions and is commonly associated with a special parametrization of cubic splines. Given the number of knots, the I-spline basis is fully determined for a regressor, and the estimation can be easily performed in a usual linear regression fashion, and this does not require an assumed density. To ensure the (increasing) monotonicity, we need to impose only the inequality constraints of the coefficients, which are expected to be non-negative. The estimation can be efficiently completed via sophisticated algorithms, as discussed in Gill et al. (2019).

However, applying the monotone splines to the original sample of CDFs is not optimal. As is illustrated in Fig. 1 and will be discussed in Sect. 3.2, the original sample has fewer observations in the later development periods. This “unbalanced” structure will make observations at the tails unnecessarily influential in introducing large uncertainty. To resolve this issue, based on the fundamental assumptions of Mack (1993, 1999), we first demonstrate that DFs across all accident periods are unbiased and uncorrelated. Consequently, a compound multiplication of DFs sampled from associated development periods will naturally produce a large unbiased sample of CDFs at later development periods. We name this new and (much) larger sample the “enhanced sample”. In particular, following Mack (1993), the sampling procedure may use probabilities that depend on the cumulative claim amounts. Under certain conditions, we prove that the sample mean of such CDFs in the enhanced sample will coincide with the classic CL estimates. Working with the enhanced sample, a bootstrap technique is employed to obtain the mean and standard errors of estimated DFs on the diagonal of a run-off triangle. The final IBNR reserve and prediction error can then be produced following the principles of Mack (1993, 1999).

To demonstrate the effectiveness of our proposed model, we conduct systematically designed simulation studies. Apart from the monotone spline model, we consider four popular and classic competitors: GLM (based on CL); Mack’s model; bootstrap CL (England & Verrall, 2002); and Clark’s loss DF model (Clark, 2003). Using the simulation machine proposed in Gabrielli and Wüthrich (2018), we demonstrate that our model consistently outperforms all competitors. Specifically, our model results in the smallest estimate of prediction error, averaged over all simulated replicates. More importantly, this prediction error comes close to the root mean square prediction error (RMSPE) by contrasting point estimates and true values. Thus, the produced small prediction error is reliable and does not come at the cost of overfitting. To demonstrate its practical usefulness, the classic dataset of Taylor and Ashe (1983) is further investigated using all five models. Our findings are consistent with those obtained from the simulation study.

The contributions of this paper to the existing reserving methodology are threefold. First, we propose a framework that incorporates reliable beliefs and allows maximum utilization of available information.Footnote 1 The adopted monotone spline can easily deal with negative incremental values and does not require adjustment in the estimation iteration, which is often needed for parametric approaches with log transformation (e.g., GLM).Footnote 2 More importantly, the spline method ensures the monotone increasing shape of CDFs and thus reduces the influence of unavoidable random errors and improves credibility. In addition, the enhanced sample consists of CDFs naturally composed of the actual DFs. This greatly increases the sample space of CDFs than the original data, and thus may effectively reduce the uncertainty. Second, we present the technical properties of the enhanced sample and estimators of monotone splines. Without imposing additional assumptions, the unbiasedness of CDFs in the enhanced sample validates its applicability to being modeled compared with the original scarce CDFs. This means that the employed bootstrap technique can provide consistent estimators of both IBNR reserves and the prediction errors. Third, our model exhibits desirable technical features that are superior to those of existing models. Compared with parametric approaches, our model retains the property of a distribution-free framework to be robust against the misspecification issue. Compared with Bayesian models, the computation based on the monotone spline can be efficiently completed at a much lower cost. In addition, the monotone spline can be easily and reliably interpolated/extrapolated. This can be used to estimate claim developments at intermediate steps (e.g., for a development quarter whereas yearly data are modeled) and tail factors. Such features significantly complement Mack’s model and related extensions. Note that a continuous CL model developed by Miranda et al. (2013) also enables DFs to be estimated at continuous time points. As will be detailed in Sect. 3, our model complements such in-sample density forecasting models by ensuring the monotone increasing shape of estimated CDFs and ease of calculation of prediction errors.

The remainder of this paper is structured as follows. Section 2 introduces existing claims reserving models. Section 3 proposes the monotone spline model and discusses the technical properties. Section 4 presents the simulations studies. Section 5 performs a real data analysis. Section 6 concludes the paper.

2 Existing claims reserving methods

Most existing IBNR claims reserving models focus on the aggregated paid claims organized in a so-called run-off triangle. In this triangle, claims are grouped into cohorts by their accident years (AY). Each cohort is then subsequently settled by development years (DY), which are usually organized in calendar years. However, months and quarters are also popular units of temporal periods. A claims cohort with the earliest AY has the longest development history, while that with the latest AY has only one DY of the last AY. Such a run-off triangle with an incremental claim in each DY is presented below, where \(Y_{i,j}\) is the claims paid in AY i and settled in DY j, with \(i,j\in \{1,2,...,I\}\). Note that the numbers of AY and DY can be different, in which case all the methods examined in this paper still apply. In this section, we briefly introduce the classic CL method and its parametric GLM specification, as well as a distribution-free model developed in Mack (1993).

2.1 Classic CL method and GLM

The classic CL method calculates DFs to estimate the IBNR claims of each AY. The CL method employs the cumulative claims to compute DFs and CDFs. Let \(C_{i,j}\) denote the cumulative claims corresponding to AY i and DY j, which gives \(C_{i,j}=\sum _{l=1}^{j}Y_{i,l}\). In addition, the claims on the diagonal with the suffix \(c=i+j-1\) represent the claims paid in the calendar year c. For example, \(C_{1,2}\) defines the paid cumulative claims in the second DY, that is, one year after the second AY from which the claim arises. Hence, it is clear that the claims in the upper triangle with \(i+j-1\le I\), as presented in the Table 1, are observed historical claims. The claims in the lower triangle with \(i+j-1> I\) are IBNR claims to be predicted.

Without considering a risk margin, the total of the incremental IBNR claims in the lower triangle is then the overall reserve that an insurer must hold. Specifically, the outstanding incremental IBNR reserve for each AY \(i=2, 3, \ldots , I\) is defined as:

The sum of all outstanding incremental IBNR reserve is therefore:

To estimate R, one of the most commonly used models is the CL method, which estimates DFs derived from historical data for the calculation. Using the same notations as in Mack (1993) and Mack (1999), the DF corresponding to DY k is estimated here:

Future cumulative claims can be predicted by multiplying these DFs with the latest observed cumulative claims in each AY, such that:

Then, \(R_i\) defined in (1) can be estimated by \({\widehat{C}}_{i,I}-C_{i,I-i+1}=C_{i,I-i+1}(\prod ^{I-1}_{k=I-i+1}{\hat{f}}_k-1)\) for \(i=1,2,...,I\).

Remark 1

It can be shown that the above estimators of the classic CL model are unbiased, under the assumptions adopted in Mack (1993). However, apart from the estimated IBNR reserve, the associated uncertainty or prediction error is usually required to determine the risk margin for prudence (England & Verrall, 2002). Unfortunately, the deterministic CL method as presented in (4) cannot be used for this purpose without additional assumptions.

To derive the uncertainty measure for CL, there are two popular approaches in the literature. The first (detailed in Sect. 2.2) is discussed in the seminal works of Mack (1993, 1999), which employ the same distribution-free assumption as the classic CL. The second is embedded within a GLM framework, which requires an assumption for the density of claims. For the GLM approach, since stochastic errors are allowed, the prediction error can then be obtained. To enable a GLM estimation of IBNR reserves, we consider a multiplicative model for the incremental claims as follows:

where \({c_i}\) is the expected claims amounts for AY i, and \(b_j\) is the proportion of claims paid in DY j for a given accident year. Note that the mean of \(Y_{i,j}\) is structured in a multiplicative fashion, such that \(E[Y_{i,j}]= {c_i}b_j\). Consequently, applying a logarithmic transformation would enable (5) to be estimated in an additive fashion that can be accommodated via a GLM. The associated log-linear specification of such a GLM is then as follows:

where \(\mu \) is the intercept, \(\alpha _i\) is a parameter for each AY i and \(\beta _j\) is the associated coefficient for each DY j. As a convention, we impose the corner constraint, such that \(\alpha _1=\beta _1=0\) to achieve the aim of identification.Footnote 3 The predictor vector, or \({\varvec{x}}_{i,j}\in 1\times \{0,1\}^{2I-2}\), includes the constant 1 (the intercept) and the indicators of each AY and DY starting from 2. The parameter vector \(\varvec{\theta }\) then consists of \((\mu , \alpha _2, \ldots , \alpha _I, \beta _2, \ldots , \beta _I)\).

Remark 2

With an estimated parameter vector \(\widehat{\varvec{\theta }}\), the outstanding IBNR claims can be predicted as \(\exp {({\varvec{x}}^\top _{i,j}\widehat{\varvec{\theta }})}\). The GLM specification (6) can therefore be viewed as a stochastic CL. One of the most desirable features of the above GLM framework is that the predicted claims exactly coincide with those obtained from (4), or the deterministic counterpart (see Renshaw & Verrall, 1998; England & Verrall, 2002, for proofs).

However, due to the employed Poisson distribution, the original GLM specified in (6) assumes that the variance of the response variable is equal to its mean. In actuarial literature, it is widely acknowledged that this assumption is too strong, and the variance of the claim is usually (much) greater than the mean. Within the same parametric framework, To allow for a more flexible mean-variance relationship, overdispersed Poisson models are examined. An additional parameter known as the dispersion is employed to estimate more accurately the prediction error in the stochastic claims reserving. More details regarding those parametric extensions can be found in Renshaw and Verrall (1998), England and Verrall (2002), Wüthrich and Merz (2008) and Gao et al. (2021).

2.2 Mack’s distribution-free model

Unlike the density-based GLM extensions, the classic CL model does not assume a distribution for the claims. To derive an associated uncertainty measure of the reserves estimate, in his seminal works, Mack (1993, 1999) makes two major contributions by demonstrating the following: 1) the classic CL estimators of the DFs are standard weighted least squares estimators; and 2) an estimator of the conditional mean squared error (MSE) of predicted reserves.

Consistent with the classic CL model, no distribution assumption is required, and the following three fundamental assumptions are neededFootnote 4:

where \(F_{i,k}=C_{i,k+1}/C_{i,k}\) is the AY-specific DF in AY i and DY k, \(i=1,...,I\) and \(k=1,...,I-1\).

Mack’s model focuses on the estimation of DFs directly, rather than on modeling claims as in a GLM framework. The first contribution of Mack (1993, 1999) means that \(f_k\) as estimated by (3) for the CL method is performed in a standard weighted-average fashion. Using Assumption (II), it is further demonstrated that the estimator of (3) is the minimum variance unbiased linear estimator of \(f_k\). Unlike in a deterministic approach such as the classic CL, by proposing Assumptions (I)–(III), the second contribution details how a prediction error can be estimated following usual statistical principles. Specifically, using Assumption (III), it is first shown which \({\hat{f}}_k\) obtained via (3) is unbiased and uncorrelated (Mack, 1993). Based on this, together with Assumptions (I)–(III), the following estimators are developed (Mack, 1999):

For the last four equations, we have \(i,k=1,...,I-1\). The (estimated) uncertainty measured by \({\widehat{Var}}({\hat{R}}_i)\) is also known as the (estimated) MSE of predicted outstanding claims in AY i to indicate the prediction error of the model, accounting for both process and parameter risks. The total prediction error is therefore measured by \({\widehat{Var}}({\hat{R}})\).

Remark 3

Note that for the Mack’s estimators to be valid, we need to test for the so-called calendar year effect (for AYs) and the correlation between DFs (Mack, 1994). These effects/correlations are not claimed to be underlying assumptions of the classic CL method.

3 A semi-parametric model using monotone splines

Past research has developed many extensions of Mack’s model (e.g., Merz & Wuthrich, 2015; Röhr, 2016; Gisler, 2019; Lindholm et al., 2020). Most of these studies focus on developing new MSE formulas based on different statistical principles. In this section, using Assumptions (I)–(III) and findings of (8), we aim to utilize more information from the historical data and reliable “prior” beliefs. For example, although incremental claims could be negative for reasons such as salvage recoveries, cumulative claims would increase under “normal” circumstances. Thus, while no distribution is assumed, CDFs might be fitted using monotone splines for this belief.

3.1 Monotone splines

The application of spline functions has become an influential and popular tool in statistical regression analysis, stemming from the seminal work of Hastie and Tibshirani (1986). Simply speaking, the spline function employs piecewise polynomials, which are continuously differentiable at the knots, to model a sequence of data. In addition, splines can be spanned using different basis functions. Introduced by De Boor (1978) and other scholars, B-spline basis is one of the most popular basis functions, and a common practice is associated with a special parametrization of cubic splines (i.e., piecewise polynomials up to cubic order).

To restrict fitted splines to being monotone increasing, we employ the integrated B-splines, also known as the I-splines. For a quadratic I-spline with three consecutive knots \(t_j\), \(t_{j+1}\) and \(t_{j+2}\), with \(t_j<t_{j+1}<{t_{j+2}}\), the I-spline basis for a given value x is described belowFootnote 5:

To fit I-splines of a regressor X to a response variable Y, a linear regression can be fitted by replacing original values of X by its corresponding I-spline basis, given all predetermined knots.

Remark 4

As defined in an integrated form, it can be shown that the I-spline basis is non-negative (e.g., the above quadratic case). In addition, with the increasing value of inputs, each corresponding basis of a partition will be monotone increasing, with lower limit 0 and upper limit 1. For example (this is the same I-spline to be used in Section 4), for DY 1-11 with 4 knots (evenly located), the cubic I-spline basis is displayed in Table 2. Consequently, to ensure fitted piecewise polynomials are monotone increasing (decreasing) with the regressor values, it is sufficient to impose non-negative (non-positive) constraints on each coefficient in the linear regression. In the usual case of a squared loss, the estimation is equivalent to a quadratic optimization issue with inequality constraints. This can be solved via efficient iteration-based algorithms (Gill et al., 2019).

3.2 Modeling claim DFs using monotone splines: preliminary analyses

We now explore how monotone splines can be employed to obtain claim DFs. To facilitate the exploration, we employ an illustrative example for the remainder of this section. The historical cumulative claims and associated AY-specific CDFs (denoted by \(A_{i,k}\)=\(C_{i,k+1}/C_{i,1}=\prod _{j=1}^{k}F_{i,j}\) for AY i and DY k) are presented in Table 3. The incremental claims and AY-specific DFs (denoted by \(F_{i,k}\) for AY i and DY k) are presented in Table 4. To perform the simulation, we implement the individual claims history simulation machine proposed by Gabrielli and Wüthrich (2018) to create 1,000 run-off rectangles with 12 accident years and 12 development years. Specifically, a synthetic insurance portfolio of features, including the claims code, AY, age of injured, and injured body part, is first generated. Please see Appendix B of Gabrielli and Wüthrich (2018) for the detailed procedure of generating this synthetic portfolio. Then, based on this synthetic portfolio of claims features, individual claims cash flows are simulated 1,000 times using neural networks. The design and calibration of these neural networks can be found in Sections 2 and 3 of Gabrielli and Wüthrich (2018), respectively. Finally, those individual claims cash flows are aggregated into 1,000 run-off rectangles with 12 AYs and 12 DYs, and each triangle is an aggregation of 50,000 individual claims.

Following common practices, such as the GLM, we now fit monotone splines to the “unbalanced” raw data of CDFs. Specifically, we have \(I-k\) observations for DY \(k=1,...,I-1\). Note that unlike with the GLM (accounting for both AY and DY), the spline function would be applied to DYs only. This is due to the inference that \(F_{i,k}\) and \(A_{i,k}\) should be independent across AYs, which is demonstrated below:

Lemma 1

Under Assumptions (I) and (III) described in (7), AY-specific \(F_{i,k}\)’s (\(F_{i,k}=C_{i,k+1}/C_{i,k}\)) are unbiased estimators of \(f_k\), and are uncorrelated for \(i=1,...,I\) and \(k=1,...,I-1\).

Proof

See Appendix B.1. \(\square \)

Theorem 1

Under Assumptions (I) and (III) described in (7), AY-specific CDFs, or \(A_{i,k}\)’s (\(A_{i,k}=C_{i,k+1}/C_{i,1}\)), are unbiased estimators of \(a_k\), and are uncorrelated across AYs, regardless of k being the same or not.

Proof

This stems straightforwardly using Lemma 1 and from the fact that \(A_{i,k}=\prod _{j=1}^{k}F_{i,j}\). \(\square \)

The last issue to consider when fitting monotone splines is the selection of knots. As briefly explained in Remark 4, m knots will create \(m+1\) partitions in one regressor. In a usual linear regression case, the monotone spline model to fit \(A_{i,j}\) is specified below:

where \(c_j\) is the intercept of DY j, \({\varvec{I}}^\top _m(j)\) is the \(1 \times (m+1)\) I-spline basis of DY j with m knots, \(\varvec{\beta }\) is the corresponding \((m+1) \times 1\) coefficient vector, and \(\varepsilon _{i,j}\) is the error term. To ensure the monotonicity of fitted CDFs, as stated in Remark 4, we require that \(\varvec{\beta }\) is non-negative.Footnote 6 The estimation is performed via quadratic optimization with no other constraints. The range of m is from 2 to I. To avoid the overfitting (i.e., choosing the largest m), the selection of knots number can follow a cross-validation principle. Specifically, m is selected in the following steps, where all knots are evenly located:

-

1.

For a given value of m, fit all \(\{A_{i,j}\}\) excluding \(j=2\) in (9);

-

2.

Use the fitted model in 1, backcast the CDF in DY 2, or \(\widehat{a^s_{2}}\);

-

3.

Calculate the mean squared error in DY 2, or \(e^2_2=\sum _{i=1}^{I-2}(A_{i,2}-\widehat{a^s_{2}})^2\);

-

4.

Repeat steps 1–3, until all \(e^2_i\) for \(i=2,...,I-2\) are producedFootnote 7; and

-

5.

Select m such that the root of mean squared error (RMSPE) \(\sqrt{\sum _{i=2}^{I-2}e^2_i}\) is minimized.

To explore the appropriateness of this “naive” modeling approach, we fit monotone splinesFootnote 8 to the raw dataset of AY-specific CDFs. According to the steps described above, six knots are selected in the monotone spline basis. All raw data points, together with fitted monotone splines, are plotted in Fig. 1. For comparison, we also present the fitted CDFs of Mack’s model (identical to those of a classic CL or a GLM approach) and fitted values using cubic splines without monotone constraint. First, we compare the two curves resulting from splines. The cubic splines lead to undesirable fitted CDFs, which are decreasing from DY 8. This is due to the relatively small AY-specific CDFs of the first two AYs. For example, \(A_{1,11}\) is only 1.935, which is even smaller than the \(A_{8,4}\) of 2.197. After imposing the monotone constraint, the resulting curve is more desirable and closer to that of Mack’s model. However, because of the unbalanced feature, the small AY-specific CDFs at larger DYs still significantly affect the fitted curve, which causes distinct differences from Mack’s model.Footnote 9

Illustrative example: fitted DFs. Solid back dots are the DFs of the actual data. Red curve is the estimated DFs of the Mack method. Black curve is the estimated DFs of natural splines. Green curve is the estimated DFs of monotone splines. Note that both Figs. 1 and 2 concern the data presented in Table 4. (Color figure online)

Many similar observations are made if AY-specific DFs (\(F_{i,k}\)) are examined instead of the results that are plotted in Fig. 2. In this case, although the prior belief of the monotone trend is not as strong as it is for the CDFs, we employ monotone decreasing splines for illustration. Consequently, although supported by Theorem 1, fitting monotone splines to raw CDFs or DFs may lead to drastically different results from the classic CL approach. This may indicate that the associated uncertainty would be (much) larger, therefore leading to greater prediction error than the CL and/or Mack models.

3.3 Modeling claim DFs using enhanced samples

We now explore the possibility of enhancing the credibility using limited historical observations. As can be inferred from Lemma 1, AY-specific \(F_{i,k}\) would be uncorrelated and have an identical mean.Footnote 10 Therefore, the following result can be obtained.

Theorem 2

A total of \(I-k\) distinct samples can be randomly drawn from the set \(\{F_{i,k}:i=1,\ldots ,I-k+1\}\) for each \(k=1,...,I-1\). Denote \(F^*_{k_n}\) as the nth distinct sample drawn for the set of DY k, and \(A^*_{k_n}\) as the corresponding nth distinct CDF sample, with \(k=1,...,I-1\).Footnote 11\(A^*_{k_n}\) is then a CDF consisting of the product of corresponding DFs not necessarily of the same AY. Under Assumptions (I) and (III) described in (7), such \(A^*_{k_n}\)’s are all unbiased estimators of the true CDFs \(a_k=\prod _{j=1}^{k}f_j\).

Proof

This follows straightforwardly using Lemma 1. \(\square \)

Theorem 2 implies that using the samples randomly drawn from the raw dataset can substantially increase the size of distinctive CDFs. To see this, at DY k, instead of observing \(I-k+1\) distinct \(A_{i,k}\), we now have \(\prod _{j=1}^{k}(I-j+1)\) distinct and unbiased \(A^*_{k_n}\) that can be used. This drastically increased sample size, together with the reliable belief of monotone increasing trend, can improve estimation accuracy for IBNR reserves. Moreover, unlike working with the raw \(A_{i,k}\) dataset, modeling such \(A^*_{k_n}\) will result in the desirable identical mean IBNR reserves as in the classic CL model. This is discussed below.

Remark 5

Note that the enhancement to increase available and reliable (unbiased) sample size is only possible for CDFs. This is a natural result because CDFs are products of associated DFs. Apart from the stronger belief that CDFs would usually be monotone increasing with DYs, this is another and more important reason to work with CDFs rather than incremental DFs (as per most existing studies) in this study.

With the following additional assumptions, we discuss important features of the estimators based on the enhanced samples.

Essentially, Assumption (IV) indicates that \(F^*_{k_n}\) is sampled from \(F_{i,k}\) corresponding to AY i and DY k with a probability of \(C_{i,k}/\sum _{i=1}C_{i,k}\), for \(i=1,...,I-k\). Assumption (V) means that for DY k, the enhanced sample \(\{A^*_{k_n}\}\) consists of all distinct DFs over DYs 1 to k, or \(\{F_{i,j}\}\) with \(i=1,...,I-j\) and \(j=1,...,k\). In other words, \(\{A^*_{k_n}\}\) is the CDF set of all distinct samples.

Lemma 2

Under Assumptions (I) and (III)–(V) described in (7) and (10), the mean in the empirical distribution of \(\{A^*_{k_n}\}\) with sample size \(N_k=(I-1)!/(I-k-1)!\), denoted by \(\overline{A_k^*}\), is identical to \(\prod _{j=1}^{k}{\widehat{f}}_j\), where \({\widehat{f}}_j\) is defined as in (3).

Proof

See Appendix B.2. \(\square \)

With a sufficiently large size, rather than modeling the raw AY-specific CDFs directly as in Sect. 3.2, Lemma 2 supports that the enhanced sample of \(\{A^*_{k_n}\}\) may be modeled to improve the estimation. This is because its mean in the empirical distribution \(\overline{A^*_k}\) coincides with the classic CL estimate of CDFs, which is clearly not true for the raw AY-specific CDFs. Therefore, we will apply monotone splines to this enhanced sample for the remainder of this study.

As seen in Mack (1993), eventually, incremental DFs are needed to perform the IBNR reserving and produce the prediction error. Using the enhanced sample of CDFs with monotone splines, the estimated DFs can be then obtained. Specifically, suppose that the enhanced sample \(\{A^*_{k_n}\}\) as described in Assumption (V) is collected, monotone splines defined in (9) is then employed to model those \(A^*_{k_n}\)’s as in a usual linear regression, or

where \(\widehat{A^*_{k}}=c_k+{\varvec{I}}^\top _m(k)\varvec{\beta }\) is the fitted CDF in DY k, and \(\varepsilon _{n,k}\) is the corresponding residual. Our estimated DF in DY k is then \(\widehat{f^*_1}=\widehat{A^*_1}\) for \(k=1\) and \(\widehat{f^*_k}=\widehat{A^*_k}/\widehat{A^*_{k-1}}\) for \(k>1\). Features of estimators \(\widehat{f^*_k}\) are discussed below, which requires a final assumption of the residual.Footnote 12

Theorem 3

Under Assumptions (I) and (III)–(VI) described in (7), (10) and (12), the monotone splines estimators \(\widehat{f^*_k}\) are unbiased estimators of \(f_k\)’s for all \(k=1,...,I-1\).

Proof

See Appendix B.3. \(\square \)

Remark 6

It is worth noting that the distinct number of \(\{A^*_{k_n}\}\) increases quickly with k. For instance, if the DY is limited to 10 years, the distinct number for the last CDF is up to 9!=362,880. Given that insurance claims can develop over a long period, it might not be computationally practical to consider all distinct samples in each AY.

Alternative to using all distinct samples in \(\{A^*_{k_n}\}\), we sample a fixed number of N observations in each DY. Under Assumptions (I), (III) and (IV), when \(N \rightarrow \infty \), the corresponding estimator of DF in DY k is expected to converge to \(\widehat{f^*_k}=\widehat{A^*_k}/\widehat{A^*_{k-1}}\), the estimator when all distinct \(A^*_{k_n}\)’s are used. Further, when \(I \rightarrow \infty \),Footnote 13\(\overline{A^*_k}\), the mean of the empirical distribution of \(\{A^*_{k_n}\}\), is expected to converge in probability to \(a_k\), the population CDF in DY k.

With Assumption (VI) and as proved in Appendix B.3, we have that \(\widehat{A^*_k}=\overline{A^*_k}-\overline{\varepsilon _k}\) and \(E(\overline{\varepsilon _k})=0\). Thus, we would expect the monotone spline estimator of DF in DY k with N samples will converge in probability to \(f_k=a_k/a_{k-1}\), when both N and I go to infinity. In other words, our estimator is asymptotically consistent, when \(N,I \rightarrow \infty \). Although a rigorous proof is beyond the scope of this paper, we provide simulation results in Appendix C. Also see Sect. 4.2 for discussions related to estimated claims amounts.

Illustrative example: fitted CDFs with an enhanced sample. Solid back dots are the sampled CDFs. Solid red dots are the CDFs of the actual data. Red curve is the estimated CDFs of the Mack method. Green curve is the estimated CDFs of monotone splines. Note that although visually identically, estimates of Mack and monotone splines differ slightly for each DY. (Color figure online)

We now illustrate the effectiveness of the enhanced sample using the same example discussed in Sect. 3.2. Simply speaking, we sample a total of 1000 AY-specific DFs for each DY, the product of which then composes the sampled CDFs. The specific sampling procedure follows that described in Sect. 3.4 when the bootstrap replicate is introduced. Our monotone spline method is then fitted to this sample, with six knots as explained in Sect. 3.2, and the estimated CDFs are plotted in Fig. 3. For comparison, the estimated CDFs of Mack’s model (identical to the classic CL estimates) are also presented. Clearly, the enhanced sample effectively complements the scarcity of raw CDFs and “balances” the distribution, which have “dragged down” the estimated curve of monotone splines. The fitted curve using this enhanced sample is highly identical to the Mack model, which preliminarily supports its reliability. Thus, the corresponding IBNR reserves would be obtained following (4), with \({\widehat{f}}_k\) replaced by \(\widehat{f^*_k}\), or the fitted DFs of monotone splines.

3.4 Estimation of prediction errors via bootstrap replicates and the final model

Finally, we need to estimate prediction errors of the IBNR reserve. As discussed in Mack (1993), estimators of \(\sigma _{k}^2\) and \(Var(\widehat{f^*_{k}})\) are needed, as presented in (8). We now discuss the estimator of \(Var(\widehat{f^*_{k}})\), or the uncertainty in the estimated DFs. Note that as \(\widehat{f^*_{k}}\) is obtained using the monotone spline model rather than the dataset itself, Mack’s estimator in (8), or \({\hat{\sigma }}_k^2/\sum _{j=1}^{I-k}C_{j,k}\), is not directly applicable. In our case, given that \(\widehat{f^*_k}=\widehat{A^*_k}/\widehat{A^*_{k-1}}\), the covariance matrix of the fitted CDFs (\(\widehat{A^*_{k}}\)) is then needed to estimate the variance of \(\widehat{f^*_k}\). This covariance matrix is based on the enhanced sample using monotone splines. However, unlike a usual linear regression, the algorithm to solve the constrained quadratic optimization (Gill et al., 2019) cannot produce a standard error for prediction. Therefore, an alternative estimation method is needed.

The bootstrap technique, as employed in related literature such as England and Verrall (2002), is an effective approach for obtaining the covariance matrix of \(\widehat{A^*_{k}}\). Nevertheless, bootstrap replicates can also be naturally employed to produce the enhanced sample. Simply speaking, with a predetermined number of observations for each DY, we can first resample the corresponding DFs. Those realizations are then multiplied together to produce the bootstrap replicates of CDFs. However, to resample DF from \(\{F_{i,j}\}\), it is important to note that Assumption (II) suggests that DFs of the same DY are heteroskedastic across different AYs. Since bootstrap replicates need to be drawn from an identically distributed dataset, standardization is required before resampling. Specifically, suppose that there are N observations to be sampled for each of the I DYs, the resampling steps are described below.

-

1.

For DY 1, we sample one realization \(r^b_{1,1}\) with replacement from the standardized “residuals” \(\{r_{i,1}\}\) for \(i=1,...,I-1\), where \(r_{i,1}=\sqrt{C_{i,1}}(F_{i,1}-{\hat{f}}_1)\).Footnote 14

-

2.

A realization of DF is then created by \(F^b_{1,1}=r^b_{1,1}/\sqrt{C^b_{1,1}}+{\hat{f}}_1\), where \(C^b_{1,1}\) is sampled with replacement from \(\{C_{i,1}\}\) for \(i=1,...,I-1\). The probability of selecting \(C_{i,1}\) is equal to \(C_{i,1}/\sum _{i}C_{i,1}\).

-

3.

Repeat steps 1–2 for all the \(I-1\) DYs.

-

4.

In DY k, the first sampled CDF is then \(A^b_{1,k}=\prod _{j}^kF^b_{1,j}\).

-

5.

Repeat steps 1–4 N times, a bootstrap sample then consists of \(\{A^b_{i,k}\}\) with \(i=1,...,N\) and \(k=1,...,I-1\).

Repeat the above steps B times and fit monotone splines for each bootstrap sample; we then obtain B realizations of \(\widehat{A^*_{k}}\) for each \(k=1,...,I-1\), with each fitted from (11) to model a bootstrap replicate \(\{A^b_{i,k}\}\). Their \((I-1) \times (I-1)\) covariance matrix \(\widehat{\varvec{\Sigma }_A}\) can then be estimated as the corresponding sample covariance using the B realizations.Footnote 15 Given that all AY-specific \(\{r_{i,j}\}\) will have finite variances, or \(\sigma _k<\infty \) shall hold as in Assumption (II) of (7), the estimated \(\widehat{\varvec{\Sigma }_A}\) using those bootstrap samples constructed above will produce consistent estimators of the underlying covariances of \(\{\widehat{A^*_{k}}\)}. (Bickel & Freedman, 1981). Finally, the variance of DF estimator can be straightforwardly obtained following the usual delta method.Footnote 16 To improve the performance, although DFs estimated in a single unadjusted enhanced sample could be sufficiently accurate, we use the sample mean of the B realizations produced in the bootstrap replicates. That is, this sample mean is employed as our final estimator, denoted by \(\widehat{f^s_k}\), to obtain the IBNR reserve for the proposed monotone spline reserving method.

Remark 7

Note that unlike with existing bootstrap approaches (e.g., England & Verrall, 2002; Peremans et al., 2017), an underlying distribution of claims is not needed in the resampling procedure. Therefore, the associated process error (i.e., adopting an incorrect distribution) is avoided. That is, our approach is likely to be robust against the potential misspecification issue of the density of claims.

The last estimator that remains unknown is analogous to \({\hat{\sigma }}_k\), as in (8) for Mack’s model. Note that Mack’s estimator described therein follows from Assumption (II) in (7) and the prediction of \({\hat{C}}_{i,k}\) described in (4). As discussed above, since our final estimator \(\widehat{f^s_{k}}\) using the bootstrap samples is expected to be unbiased (or at least consistent), we estimate \({\sigma }_k\) as:

For \(\widehat{\sigma ^s_{I-1}}\), the variety at the last DY, Mack (1993) adopts a simple extrapolation method displayed in (8). Given that those varieties usually exponentially decrease with DYs, we fit monotone decreasing splines on the obtained \(\widehat{\sigma ^s_{k}}\) for \(k=1,..,I-2\), and \(\widehat{\sigma ^s_{I-1}}\) is produced as the predicted value from the fitted splines. Following the reasons discussed above, it is straightforward to demonstrate that those \(\{\widehat{\sigma ^s_{k}}\}\) estimated using monotone splines and bootstrap replicates are consistent estimators of \(\{\sigma _k\}\).

The proposed reserving method using the monotone splines is summarized below.

-

1.

Select m knots of monotone splines using the original dataset \(\{A_{i,j}\}\), as discussed in Sect. 3.2;

-

2.

Produce B bootstrap replicates with N observations in individual DYs of each sample, following the procedure described in Sect. 3.4;

-

3.

Within each bootstrap replicate, fit monotone splines with m knots and obtain \(\{\widehat{A^*_{k}}\}\) and \(\{\widehat{f^*_{k}}\}\);

-

4.

The final estimator of DFs is \(\{\widehat{f^s_{k}}\}\), the sample mean of the B \(\{\widehat{f^*_{k}}\}\) for each \(k=1,...,I-1\), and calculate the sample covariance of \(\{\widehat{A^*_{k}}\}\), or \(\widehat{\varvec{\Sigma }_A}\);

-

5.

Obtain \(\widehat{\sigma ^s_k}\) as in (13) and \({\widehat{Var}}(\widehat{f^s_k})\) using the delta methodFootnote 17 and \(\widehat{\varvec{\Sigma }_A}\), i.e., \({\widehat{Var}}(\widehat{f^s_k})= \hat{{\varvec{g}}}_f' \widehat{\varvec{\Sigma }_A} \hat{{\varvec{g}}}_f\), where \(k=2,...,I-1\), \(\hat{{\varvec{g}}}_f\) is a function of estimated DF calculated from estimated CDF in vector;Footnote 18 and

-

6.

The final IBNR reserves and prediction errors are derived from the following equations.

$$\begin{aligned} {\widehat{C}}_{i,I-i+2}&= {C}_{i,I-i+1}\cdot \widehat{f^s}_{I-i+1},\quad i=2, \ldots , I,\\ {\widehat{C}}_{i,k}&= {\widehat{C}}_{i,k-1}\cdot \widehat{f^s}_{k-1},\quad i=2, \ldots , I, \quad k=I-i+1, \ldots , I-1,\\ {\widehat{SE}}(F_{i,k})&=\dfrac{\widehat{\sigma ^s_k}}{\sqrt{C_{i,k}}},\\ {\widehat{Var}}({\hat{C}}_{i,k+1})&={\hat{C}}^2_{i,k}[{\widehat{SE}}(F_{i,k})^2+{\widehat{Var}}(\widehat{f^s_k})]+{\widehat{Var}}({\hat{C}}_{i,k})\widehat{f^s_k}^2. \end{aligned}$$

Remark 8

Compared with existing models, such as the popular GLM and Mack models, there are some advantages of our approach for IBNR reserving. First, without imposing additional assumptions, we have made the best use of available information by working with enhanced samples. All additional samples of CDFs naturally consist of the AY-specific DFs, which are based on reliable actual data. Second, the monotone splines adopt the common and appropriate belief such that CDFs would usually monotonically increase with DYs. Similar to Mack’s model, our framework remains distribution free, but it has utilized reliable “prior” beliefs. Compared with the GLM, our model can incorporate the negative incremental claims without changing the iterations of estimation. In addition, the distribution-free feature avoids the issue of assuming and fitting the most appropriate dispersion as is required with the GLM (e.g., Wüthrich, 2003; Boucher & Davidov, 2011; Gao et al., 2021), and is robust against the inappropriate choice of distribution. Those two advantages enable our monotone spline model to produce more accurate IBNR reserves. This is discussed in Sect. 4 with evidence from a simulation. Third, considering the efficiency of the employed optimization algorithm, the computational cost of our model is not high. This is preferable to the reserving models based on a Bayesian approach (e.g., Gao & Meng, 2018), which require the complex Markov Chain Monte Carlo algorithm. Fourth, the fitted monotone spline can be easily interpolated and extrapolated. This is particularly useful for computing tail factors, as well as for calculating intermediate DFs (e.g., DF of a development quarter). The selection of knots effectively avoids the overfitting issue, which leads to credible extrapolation/interpolation results. Fifth, the modeling framework is flexible and extensible. For example, a general additive model (GAM) may be employed instead of linear regression. In addition, rather than assuming the usual squared loss, robust loss function could be used to prepare reserving models that are more robust to outliers.

It is worth noting that a continuous CL model developed by Miranda et al. (2013) also enables DFs to be estimated at continuous time points. The employed method is also known as in-sample density forecasting (Lee et al., 2015, 2017, 2018), which usually adopts density smoothers such as kernels (Mammen et al., 2015). Compared with this approach, there are some critical differences:

-

1.

When applied to non-life insurance reserving, the continuous CL method focuses on working with the DY and AY effects separately, similar to the GLM framework described in (6); and

-

2.

The prediction error, or an associated uncertainty measure, is not explicitly discussed therein.

In our proposed model, we focus on the CDFs, rather than on the DY and AY effects. This may be understood as working directly with forward-factors in the diagonal direction of a run-off triangle. As explained, the benefit is the ability to adopt the prior belief of non-decreasing patterns of such CDFs, which cannot be guaranteed in the continuous CL model. In addition, based on (8), the estimator of prediction error is comprehensively addressed in our model. The measure of prediction error is critical to the precision of ratemaking and the efficiency of solvency management for a property and casualty insurer.

4 Simulation evidence

In this section, we first present the fitted results of monotone splines of the illustrative example used in Sect. 3. We also discuss the accuracy of prediction errors and the relation of estimation variety with the sample sizes of bootstrap replicates. Further, with a more comprehensive collection of simulated data, we compare the prediction accuracy of the IBNR reserves of our model with several popular existing models.

4.1 Illustrative example: fitted results using the monotone spline model

We now follow the steps described in Sect. 3.4 to fit the monotone splines to the example introduced in Table 3. Note that the efficiency of linear regressions depends on the independence of error terms. To verify this for the monotone spline model using bootstrap samples, we first present the fitted autocorrelation functions (ACFs) of DY-dependent errors. Those errors are analogous to \(\varepsilon \) defined in (9). Recall that for each of B bootstrap sample, we have N observations in each DY. For the bth bootstrap sample, denote the sample mean over those N errors in DY k by \(\overline{\varepsilon ^*_{b,k}}\). We then calculate the bth realization of ACFs (up to lags of \(I-2\)) of bootstrap replicates using the sample ACFs of the \(I-1\) \(\{\overline{\varepsilon ^*_{b,k}}\}\). Thus, the point estimate and 95% confidence interval of the ACFs of error terms are estimated by the mean, and 2.5th and 97.5h percentiles, respectively, out of the B estimates. Let \(N=1,000\) and \(B=1,000\); the results corresponding to our illustrative example are presented in Fig. 4. Clearly, since 0 is covered by 95% confidence intervals at all lags, the independence of error terms across DYs is preliminarily supported.

We now present a comprehensive discussion of the estimates obtained from our monotone spline model. Our final estimates of DFs (\(\widehat{f^s_{k}}\)), their associated standard errors (\(SE(\widehat{f^s_{k}})\)), and \(\widehat{\sigma ^s_k}\) are plotted in Fig. 5a–c, respectively. The Mack’s estimates are also presented for comparison. As expected and preliminarily demonstrated in Fig. 3, the point estimates of the two models are close to each other at all DYs. This also explains the similarity of estimated \(\sigma _k\), given that the only source of difference (other than for the last DY) is the estimate of \(f_k\). Finally, there are some noticeable differences on the estimated standard errors of DFs. Those of monotone splines almost monotonically decline, which is consistent the expected exponential decay with DY (Mack, 1993). For the Mack method, we observe some “bounce-up” over DYs 6–9. As outlined in Remark 8, despite some similarities, our monotone spline model may result in more accurate IBNR reserving.

Nevertheless, it is important to understand the influence of N and B in our model. We consider three choices of N, a similar size of the raw dataset (10), an intermediate size (100), and a large size (1000). Small (100) and large (1000) numbers of bootstrap replicates B are further compared, which results in a total of six unique combinations of N and B. For each combination, we repeat the entire estimation process 1000 times. To demonstrate the variety affected by N and B, we report the average and standard deviation of the total IBNR reserve (\({\hat{R}}\)) and its prediction error (\({\widehat{Var}}({\hat{R}})\)) in Table 5. Clearly, compared with N, the number of bootstrap replicates is more influential. With \(B=1000\), the standard deviation of prediction error among all simulations is as small as 1.0 for \(N=10\). Further increasing N to 100 and 1000 will not significantly reduce this variety. For the total IBNR reserve, increasing N will more obviously improve the stability in estimation. Specifically, when \(B=1000\), standard deviations are 4.8, 1.6, and 0.6 for \(N=\)100, 100, and 1000, respectively. Nevertheless, the average of estimates is almost identical across all combinations. The average estimate of R is approximately 7370, whereas the associated average prediction error is approximately 350.

Next, we compare prediction accuracy across popular competing models via simulation studies. Apart from the proposed monotone spline method, our ensemble includes four classic models: the GLM, Mack’s model, CL based on bootstrap replicates (England & Verrall, 2002), and Clark’s loss DF method (Clark, 2003).Footnote 19 The illustrative triangle is then fitted by all the six models, and results are presented in Table 6. Considering our model and Mack’s model, the results are much consistent with those observed in Fig. 5. For instance, the estimated reserves in each AY are relatively close to each other. The predicted error of monotone splines is larger in AY 2–3 and 10–11 and smaller in the rest, compared to the error of Mack’s model. Despite the similarity, we find that our model produces the largest total estimated reserve (more conservative), and the total prediction error 351 is the smallest (most accurate). Specifically, the total prediction error of our model is around 20%, 10%, 20% and 5% smaller than those of CL, Mack’s, bootstrap CL and Clark’s models, respectively. This motivates us to perform a more comprehensive study, preferably with true values, to evaluate the monotone splines and other competing models.

4.2 Comparisons of the prediction accuracy

This section comprehensively compares the performance of models concerned in Sect. 4.1 via simulations. We firstly continue to examine the illustrative example as a preliminary analysis under an ideal scenario (true model is CL). Next, a more sophisticated analysis is carried out with simulations replicating real-life claims (true model is not one of the competitors).

We now preliminarily demonstrate the preferred performance of our monotone spline method using the same illustrative example examined. The accuracy comparison is based on 1000 simulations. Specifically, simulations are produced via the following steps:

-

1.

Fit the triangle presented in Table 3 via GLM, find the fitted Pearson residuals, and calculate their sample mean and standard deviations in each DY \(k=1,...,I-1\), denoted by \(x_k\) and \(s_k\), respectively;

-

2.

With the fitted model, collect both in- and out-of-sample incremental claims (i.e.,\({\hat{Y}}_{i,k}\) for \(i=1,...,I\) and \(k=1,...,I\));

-

3.

For each DY k, simulate I realization (or \(e_{i,k}\)) from \(N(x_k,s_k^2)\), or a normal distribution with the same sample mean and standard error of the fitted Pearson residuals in DY k from step 1;

-

4.

Simulated realizations \(e_{i,k}\) are then added to fitted \({\hat{Y}}_{i,k}\), which then forms a complete simulated triangle, with both training (upper-triangle) and test (lower-triangle) datasets; and

-

5.

Repeat steps 3–4 until 1000 triangles are produced.

In short, the simulation assumes that GLM is a true model, and Pearson residuals are normally distributed. The five competing models are then fitted to the simulated training data, with N and B both set to 1000 for the monotone splines for its lowest variety, as presented in Table 5. This is repeated for all 1000 simulations, and we compute the RMSPE of total IBNR reserve as \(\sqrt{\sum _{i=1}^{1000}(\widehat{R^i}-R^i)^2/1000}\), where \(\widehat{R^i}\) is the point estimate for the ith simulation of one model, and \(R^i\) is the true value. In addition, the average total prediction error across all 1000 simulations is produced for each model.

In Table 7, we report the RMSPE and average prediction error. These statistics enable comparison of the prediction accuracy of the total IBNR reserve across the five models. First, all RMSPEs are close to each other. This is as expected given that the principle of all models is to produce equivalent CL point estimates. Despite this, by utilizing more information, our monotone spline model results in slightly more accurate point estimates of the total IBNR reserves. More distinctive differences are observed for the prediction errors. The GLM and bootstrap CL model lead to the largest prediction errors, which are approximately 20% larger than their corresponding RMSPEs. In contrast, the average prediction error of our model is the smallest among all competitors and is also very close to the RMSPE. This result strongly supports that the small prediction error does not occur as a cost of overfitting, but rather as evidence of improved prediction accuracy. Nevertheless, it is worth noting that the prediction error of 323 of our model is somewhat different from 350, as presented in Table 5. This can be explained by the fact that GLM (with Gaussian Pearson errors) is not the actual data-generation process used to produce this illustrative example.

We now more comprehensively compare the prediction accuracy. In an ideal case, if the true test data were known, the prediction accuracy of competing reserving models can be explicitly measured as above. As outlined in Sect. 3.2 we use the simulation machine proposed in Gabrielli and Wüthrich (2018), and historical claims are simulated repeatedly until 1000 run-off rectangles (including the true test data or the lower triangle) are obtained. As was conducted above, we will focus on the prediction of total IBNR claims.

In Table 8, out of the 1000 simulated datasets, both the mean and 95th percentile of the true total data of estimated total IBNR claims are reported. Despite the similarity of the estimates, there are some noticeable differences. Of all the models, Clark’s model results in the least accurate estimates. The mean of R is below 7600, whereas the 95th percentile is approximately 8450. The estimates of the GLM/Mack’s model and bootstrap CL are largely identical, with a mean of approximately 7700 and \(Q_{95}\) of 8680. In comparison, our monotone model produces the most accurate mean and \(Q_{95}\), both of which are closest to the true values among those estimates. Hence, as measured by RMSPE, our model is the preferred approach for prediction accuracy. The same conclusion can be drawn when employing the alternative metric of the mean absolute prediction error (MAPE), which considers the absolute deviation from the true value.

Contrasting Tables 7 and 8, one may argue that all models underperform when GLM is not the true model, and a more complicated data generation process (DGP) is employed instead. Despite the expected unbiasedness, we do observe an 5% average underestimation of the total reserves. As stated in Remark 6, the asymptotics of monotone splines will require \(I \rightarrow \infty \), and the same argument may hold for other models as well. In Appendix C, we present results using DGPs set to GLM and to the simulation machine of Gabrielli and Wüthrich (2018) with more available AYs. Two conclusions can be made in those cases. First, when DGP is different from the true model, more available data are needed to achieve a desirable level of convergence. Second, desirable asymptotics are observed for all models (i.e., prediction accuracy is improved with more AYs). This supports the common regulated actuarial practice, such that risk margins (i.e., additional capital to the estimated total reserve) need to be held to combat against the uncertainty in DGP and scarcity in historical data. Nevertheless, it is also worth pointing that in all cases, our model produces the best prediction accuracy among all competitors.

Thus, using simulation studies, we demonstrate that the proposed monotone spline model can improve the prediction accuracy of IBNR reserving. Despite the similarity, utilizing more information and the prior belief of a monotone trend, the point estimate is relatively more accurate in our model than it is in the existing models that we used for comparison. Additionally, we demonstrate that the smaller estimated prediction error of our proposed model is much close to the error produced using the true values. This supports that the proposed monotone spline model can provide more accurate point estimates of IBNR reserves with reliable prediction errors.

5 Real data study

In this section, we explore the famous dataset of Taylor and Ashe (1983) to compare the performance of the five competing models. This dataset has been frequently examined in seminal research (e.g., Mack, 1993) and recent literature (e.g., Gao et al., 2021). The run-off triangle of cumulative claims and AY-specific CDFs are presented in Table 9. The incremental claims and AY-specific DFs are presented in Table 10. As stated in Remark 3, we must test for the AY effect and correlation between DFs. Using the stats proposed in Mack (1994), at the 5% significance level, we do not reject the null hypotheses, such that those assumptions hold for the examined dataset. This validates the subsequent analyses using the five competing models.

The proposed monotone spline method is first fitted to the dataset. Let \(N=1000\) and \(B=1000\); we follow the steps described in Sect. 4.1 to obtain the point estimate and 95% confidence intervals of ACFs of DY-dependent error terms. It can be seen in Fig. 6 that the independence of those errors cannot be rejected.

Consistent with our discussion in Sect. 4.1, the related estimates of DFs produced by Mack’s model and the monotone splines are compared. Specifically, we plot \({\widehat{f}}_{k}\) and \(\widehat{f^s_{k}}\), \(SE({\widehat{f}}_{k})\) and \(SE(\widehat{f^s_{k}})\), and \({\widehat{\sigma }}_k\) and \(\widehat{\sigma ^s_k}\) in Fig. 7a–c, respectively. Most of our observations for the illustrative example made from Fig. 5 consistently hold for this real dataset. It is worth noting that DFs fitted by monotone splines in DYs 3 and 8 are relatively lower than they are in the Mack model. This is enlarged after being multiplied by the corresponding cumulative claims, which may cause the notable difference in the estimated standard errors in DYs 3 and 8.

We now compare the IBNR reserves estimated by the five competing models. The AY-specific cumulative IBNR reserves in the DY 10, the total IBNR reserve, and their associated prediction errors are reported in Table 11. For the AY-specific reserves, the GLM and Mack’s model result in identical point estimates. Those produced by the bootstrap CL model are uniformly greater, although the differences are rather small. Apart from in several cases, Clark’s model and our monotone splines lead to larger AY-specific reserves. The largest relative difference exists for AY 2. While the estimates of the GLM/Mack’s model and bootstrap CL are all below 100 (measured in thousands), the estimate of Clark’s model is approximately 210, and that of our monotone spline model is almost 250. This can be explained by the difference of estimated DF of DY 10. For example, \({\widehat{f}}_{10}\) is 1.017 using Mack’s model, and \(\widehat{f^s_{10}}\) is 1.046 using the monotone spline method.Footnote 20 Given that the Mack’s/GLM estimate of the last DF is based on one observation only, the estimate produced using our approach might be more reliable because the enhanced samples utilize much more information. Aggregating all those AY-specific results, Clark’s model produces the largest estimate of the total IBNR reserve (19682.38), followed by the monotone spline model (19317.75), with GLM and Mack’s model ranked last (18680.86).

As summarized in Sect. 4, the monotone spline approach uses more available information and is thus expected to produce a lower prediction error. The relative magnitudes of AY-specific errors are mixed across models. Roughly speaking, our model and Mack’s method have similar results and both lead to the smallest AY-specific prediction errors for all AYs excluding 6–8, for which GLM and bootstrap CL result in the smallest errors. The similarity of prediction errors of monotone spline and Mack’s models are consistent with our observations in Fig. 7. However, Clark’s model tends to cause the largest prediction errors in almost all AYs. For the coefficient of variation (CV), or the ratio of prediction error over IBNR reserve, the values of our monotone spline model are consistently small and below 0.40, suggesting a low level of dispersion. Aggregating all AY-specific values, our monotone spline model has both the smallest prediction error measured by dollar unit and as relative to the point estimate (i.e., measured by CV). Specifically, the monotone spline prediction error of total IBNR reserve is 2343.88, which is approximately 5%, 20%, 25%, and 30% smaller than the prediction errors of Mack’s model, GLM, bootstrap CL, and Clark’s method, respectively. The associated CV of our model is 0.12, close to 0.13 of Mack’s model and relatively lower than 0.16\(-\)0.17 of GLM, bootstrap CL, and Clark’s model. As evidenced in Table 7, and discussed in Sect. 4.2, such a smaller error would not be the result of overfitting. Consequently, this desirable observation supports the potential effectiveness of our proposed monotone spline model in actuarial practice. In particular, we propose that monotone splines may be a widely useful tool to improve the accuracy of IBNR reserving.

6 Concluding remarks

Following the fundamental assumptions and findings of Mack (1993, 1999), we propose a semi-parametric IBNR reserving model using monotone spline and enhanced bootstrap replicates. As with Mack’s model, we do not assume an underlying distribution, nor is any associated dispersion parameter imposed. This distribution-free approach is expected to be more robust against model misspecification of a parametric approach, including GLM and its extensions. Three key conclusions can be drawn from our research.

First, the proposed monotone spline method has desirable technical properties. By working with the enhanced sample of CDFs, we demonstrate that the fitted CDFs and DFs of our method are unbiased and/or asymptotically consistent. Under certain conditions, the estimates may coincide with those of the classic CL method. Further, the bootstrap technique provides consistent estimators of the corresponding prediction errors.

Second, without imposing additional assumptions, the proposed method makes the best use of available information and could improve the accuracy of IBNR reserving. Specifically, the enhanced sample considers much more comprehensive combinations of DFs to produce sampled CDFs, all of which are proven to be unbiased. The reliable “prior” belief, such that all CDFs would usually be monotone increasing, is further adopted. Thus, our model is expected to reduce the prediction uncertainty of the Mack model.

Third, via our simulation studies and real data analysis, the effectiveness of our model is systematically demonstrated. Compared with the four popular classic models examined in our study-GLM, Mack’s model, bootstrap CL (England & Verrall, 2002), and Clark’s model Clark (2003)-the prediction error of our model is the smallest averaged over all simulated replicates. This reduced uncertainty is highly reliable and not a result of overfitting given that its value is close to the RMSPE produced using point estimates and true values. Using the popular dataset of Taylor and Ashe (1983), the improved prediction accuracy of our proposed model is consistently demonstrated. Thus, our model could be a competitive tool to help improve IBNR reserving accuracy in actuarial practice.

There are some directions that are worth exploring for future research. First, the monotone spline method can be integrated into a GAM framework (Wood, 2017). In a general case, Pya and Wood (2015) explore a shape constrained additive model, which may incorporate monotone splines. Compared with a linear regression method, GAM enables smoothness and may further reduce the overfitting issue. Early attempts to investigate GAM for IBNR reserving can be found in Verrall (1996) and England and Verrall (2002). Second, instead of the usual squared loss, a more robust loss function (e.g., Hampel et al., 2011) could be employed in the estimation. The importance of robust techniques for IBNR reserving is discussed in Verdonck and Debruyne (2011) and Peremans et al. (2017), which reduces the estimation sensitivity to outliers, such as the recent 2021 North American winter storm. Integrating a robust method into the monotone spline framework would therefore improve this proposed model’s feasibility in more complicated conditions. Third, future analysis may be conducted to compare the effectiveness of monotone splines in estimating the tail factors. In addition, as presented in Fig. 7c, without further restrictions, \(\widehat{\sigma ^s_k}\) appears to be not strictly monotone declining. Employing the monotone decreasing spline in the estimation may help remove this irregularity. Nevertheless, a more rigorous discussion on the asymptotics of monotone splines estimators as noted in Remark 6 is worth exploration.

Notes

Note that this paper concerns the aggregated claim data, such that the individual claims are not considered there. Admittedly, if individual data are available, more information would be utilized to improve the reserving accuracy.

Since log transformation requires positive inputs, negative incremental values will need to be adjusted in the estimation iteration implemented by GLM. The corresponding estimation is known as the quasi maximum likelihood approach (Nelder & Lee, 1992) Also, it is known that GLM may incorporate individual negativity, but the estimation will fail in the case of a negative mean development. Fortunately, as can be inferred from Sect. 3, our proposed model can accommodate both single and mean negativity.

Note that since \(E[Y_{i,j}]= {c_i}b_j\), \(c_i\) and \(b_j\) have a confounding impact on the constant \(E[Y_{i,j}]\), and cannot be identified without constraints.

Note that Mack (1999) has extended Assumption (II) to allow more flexible relationships, which does not affect the new model proposed in this paper and therefore is not discussed further.

The choice of quadratic order is for the purpose of illustration. The algebraic structure of an I-spline basis with an arbitrary order can be found in Ramsay (1988).

Note that despite this imposed non-negative constraint on coefficients of regressors, for the usual least square loss, it is well known that the quadratic optimization will still lead to errors with 0 mean. This validates the relevant assumption in Theorem 3 (i.e., \(E(\varepsilon _{i,k})=0\)).

Note that CDFs of the first and last DY are excluded in the cross-validation process, such that the monotone splines are not extrapolated for prediction. The results including all CDFs are highly robust.

All monotone splines analyzed in this study are up to the cubic order, which is commonly used in practice as a balance of accurate data fitting and non-overfitting.

The same conclusion will hold even if we consider weights (i.e., \(C_{i,k}/\sum _{i}C_{i,k}\) for \(A_{i,k}\)) in the loss function to fit monotone splines, which also applies to the case if \(F_{i,k}\)s are to be fitted.

Note that those AY-specific DFs are not identically distributed given that the associated variances are dependent on \(C_{i,k}\) as per Assumption (II). However, if an unadjusted enhanced sample (introduced in this section) is to be worked with, it will not affect the unbiasedness/consistency of the estimators. To derive the standard errors of the estimator, adjustments are made in the bootstrap procedure to ensure the resampled realizations are identically distributed. This is detailed in Sect. 3.4.

In this case, the subscript \(k_n\) denotes the nth distinct sample drawn for DY k. This notation is to distinguish from the subscript (i, k), indicating the observation of AY i and DY k. It is easily seen that for the CDF, the total number of distinct samples in DY k is the number of k-combinations with \(I-1\) elements, or \((I-1)!/[k!(I-k)!]\).

Intuitively, a sufficient condition for the independence in Assumption (VI) is that \(\varepsilon _{n,k}\) is independent of \(\widehat{A^*_{k-1}}\), \(\widehat{A^*_{k}}\) and \(\widehat{A^*_{k+1}}\). In other words, residuals in DY k are independent of fitted values in DYs from \(k-1\) to \(k+1\).

Although we assume that the total numbers of AY and DY are identical, the asymptotic statement is only related to the number of AYs. This is more closely linked to actuarial practice, since a tail factor is used after a few DYs, whereas the number of AY can go large with a sufficiently long claim history.

From Assumptions (I)–(III), it can be verified that such residuals are independently and identically distributed with a (conditional) mean of 0 and a (conditional) variance of \(\sigma _k^2\). Essentially, we are assuming CL is the true model to perform the residual-based bootstrap.

Note that the degree of freedom needs to be adjusted to account for the difference between sizes of a bootstrap sample and the raw dataset. The rationale is that we have a total of \((I-1)!\) actual observations, rather than \(N\times (I-1)\) as in an enhanced (bootstrap) sample.

Note that as outlined in Remark 6, the asymptotic framework in this case requires that both N and I go to infinity. When \(N \rightarrow \infty \) only, the delta method’s estimator will converge to the estimator as if all distinct CDFs are modeled. Furthered with \(I \rightarrow \infty \) the delta method’s estimator will converge to the true variances of DFs.

See footnote 16 for the asymptotic framework and expected features of the delta method.

Note that the DF and CDF at DY 1 are identical, so will be their variances. For \(k \ge 2\), essentially the delta method implies that

$$\begin{aligned} {\widehat{Var}}(\widehat{f^s_k})=\begin{pmatrix} -\widehat{A^s_k}/(\widehat{A^s_{k-1}})^2 &{} 1/\widehat{A^s_k}\\ \end{pmatrix} (\widehat{\varvec{\Sigma }_A})_{k-1,k} \begin{pmatrix} -\widehat{A^s_k}/(\widehat{A^s_{k-1}})^2 \\ 1/\widehat{A^s_k} \end{pmatrix}, \end{aligned}$$where \(\widehat{A^s_{k}}\) is the bootstrap sample mean of CDF estimates, and \((\widehat{\varvec{\Sigma }_A})_{k-1,k}\) is the \(k-1\) to kth row and \(k-1\) to kth column elements (a \(2 \times 2\) matrix) of \(\widehat{\varvec{\Sigma }_A}\).

Given that we do not consider tail factors, the largest DY is set to 12 in Clark’s model.

Our simulation study also suggests that there is more likely for DF estimators from different models to differ at later DYs. The results are available upon request.

References

Antonio, K., & Plat, R. (2014). Micro-level stochastic loss reserving for general insurance. Scandinavian Actuarial Journal, 7, 649–669.

Bickel, P. J., & Freedman, D. A. (1981). Some asymptotic theory for the bootstrap. The Annals of Statistics, 9(6), 1196–1217.

Boucher, J. P., & Davidov, D. (2011). On the importance of dispersion modeling for claims reserving: An application with the tweedie distribution. Variance, 5(2), 158–172.

Clark, D. R. (2003). Ldf curve-fitting and stochastic reserving: A maximum likelihood approach. CAS Forum Citeseer, 3, 41–92.

De Alba, E. (2006). Claims reserving when there are negative values in the runoff triangle: Bayesian analysis using the three-parameter log-normal distribution. North American Actuarial Journal, 10(3), 45–59.

De Boor, C. (1978). A practical guide to splines. New York: Springer.

Diers, D., Linde, M., & Hahn, L. (2016). Quantification of multi-year non-life insurance risk in chain ladder reserving models. Insurance: Mathematics and Economics, 67, 187–199.

England, P. D., & Verrall, R. J. (2002). Stochastic claims reserving in general insurance. British Actuarial Journal, 8(3), 443–518.

Gabrielli, A., & Wüthrich, M. (2018). An individual claims history simulation machine. Risks, 6(2), 29.

Gao, G., & Meng, S. (2018). Stochastic claims reserving via a bayesian spline model with random loss ratio effects. ASTIN Bulletin: The Journal of the IAA, 48(1), 55–88.

Gao, G., Meng, S., & Shi, Y. (2021). Dispersion modelling of outstanding claims with double Poisson regression models. Insurance: Mathematics and Economics, 101, 572–586.

Gill, P. E., Murray, W., & Wright, M. H. (2019). Practical optimization. SIAM.

Gisler, A. (2019). The reserve uncertainties in the chain ladder model of mack revisited. ASTIN Bulletin: The Journal of the IAA, 49(3), 787–821.

Hampel, F. R., Ronchetti, E. M., Rousseeuw, P. J., & Stahel, W. A. (2011). Robust statistics: The approach based on influence functions, (Vol. 196). Wiley.

Hastie, T., & Tibshirani, R. (1986). Generalized additive models. Statistical Science, 1(3), 297–310.

Kuang, D., & Nielsen, B. (2020). Generalized log-normal chain-ladder. Scandinavian Actuarial Journal, 2020(6), 553–576.

Kuang, D., Nielsen, B., & Nielsen, J. P. (2015). The geometric chain-ladder. Scandinavian Actuarial Journal, 2015(3), 278–300.

Lee, Y., Mammen, E., Nielsen, J., & Park, B. (2018). In-sample forecasting: A brief review and new algorithms. ALEA-Latin American Journal of Probability and Mathematical Statistics, 15, 875–895.

Lee, Y. K., Mammen, E., Nielsen, J. P., & Park, B. U. (2015). Asymptotics for in-sample density forecasting. The Annals of Statistics, 43(2), 620–651.

Lee, Y. K., Mammen, E., Nielsen, J. P., & Park, B. U. (2017). Operational time and in-sample density forecasting. The Annals of Statistics, 45(3), 1312–1341.

Lindholm, M., Lindskog, F., & Wahl, F. (2020). Estimation of conditional mean squared error of prediction for claims reserving. Annals of Actuarial Science, 14(1), 93–128.

Mack, T. (1993). Distribution-free calculation of the standard error of chain ladder reserve estimates. ASTIN Bulletin: The Journal of the IAA, 23(2), 213–225.

Mack, T. (1994). Measuring the variability of chain ladder reserve estimates. Casualty Actuarial Society Forum, 1, 101–83.

Mack, T. (1999). The standard error of chain ladder reserve estimates: Recursive calculation and inclusion of a tail factor. ASTIN Bulletin: The Journal of the IAA, 29(2), 361–366.

Mack, T., & Venter, G. (2000). A comparison of stochastic models that reproduce chain ladder reserve estimates. Insurance: Mathematics and economics, 26(1), 101–107.

Mammen, E., Miranda, M. D. M., & Nielsen, J. P. (2015). In-sample forecasting applied to reserving and mesothelioma mortality. Insurance: Mathematics and Economics, 61, 76–86.