Abstract

Operating on electricity markets requires accurately identifying, quantifying, and measuring risk coupled with their corresponding return: this appears as a crucial point, particularly during and after the COVID-19 pandemic. The aim of the present paper is twofold. First, we propose a novel econometric approach to identifying relevant market factors that capture several elements of the risk transmission mechanism inherent in energy systems. The proposed model extends Bayesian graphical models with change points to a multiple-layer set-up. Multilayer graphs encompass the two relevant channels of shock transmission: volatility and price contagion effects. The choice of these two layers seems natural because electricity prices and their spiky nature, coupled with inherent volatility, constitute essential influential elements for market players to maximize their profits. The change-point specification allows for detecting relevant changes in the electricity market. Second, we apply the proposed econometric framework to the Italian zonal markets analyzing the effects of returns and volatility contagion in several periods detected by the model. The last time intervals identified by the change-point methodology overlap the COVID-19 pandemic period. The model captures relevant abrupt changes in prices and volatility in the zonal electricity market and provides new evidence of interconnections in the zones of the Italian market related to the risk alone, price process alone, and risk versus price process relationship and their interactions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The global economic system has endured extraordinarily turbulent periods that have major repercussions on lives and livelihoods because of the novel COVID-19, which has unleashed a crisis of exceptional ferocity on the global front, with severe impact worldwide. This is manifested in extensive financial burden and cost (Amankwah-Amoah et al., 2021; Zheng & Zhang, 2021). Siddique et al. (2021) mentioned that the viral wave of COVID-19 could set a pace for a crisis in the energy sector. In other words, the COVID-19 pandemic has caused more disruption to the energy sector in comparison with any other event in recent history, leaving impacts that will be felt for years to come (Fezzi & Fanghella, 2020). The sudden emergence of COVID-19 has brought to focus a tremendous near-term uncertainty about the future of energy. There is a critical need to accelerate clean energy transitions putting emissions on a structural downward trend (Zeppini & Van Den Bergh, 2020).

Change-point analysis presents a unique tool to detect relevant changes in the market structure. It is particularly useful in market distress periods and during events, such as the recent prolonged pandemics, that can cause lasting damage to various economic prospects. For instance, lower energy demand will put downward pressure on oil and gas prices, with the likelihood of corresponding falls in investment offers and market volatility increases.

Understanding volatility spill-over effects and profitability linkages among energy markets is essential because transmission and distribution entail losses that increase with distance. Network analysis provides effective tools for investigating the market connectivity structure, particularly when markets are organized through interconnected areas/zones. This is a situation of network externality from the viewpoint of David (1987) in relation to technical inter-relatedness and economies of system scale, the so-called network integration benefits. Therefore, a combination of technical and policy innovation should be designed to realize the full potential of renewable energy sources (RES). The innovation should accommodate the specific features of RES and maintain the overall grid stability, even with high RES penetration.

In this paper, we propose a novel statistical framework based on Vector Autoregression (VAR) for detecting change points, extracting network structures, and measuring the impact of RES, particularly during the COVID-19 pandemic, with an application to the Italian zonal electricity market. We contribute to various strands of literature. Since the ground-breaking seminal works of Sims (1980) and Blanchard and Watson (2007), VAR and Structural VAR (SVAR) models have gained attention in the economic literature. The SVAR approach accounts for the partially overlapping directions and the identification of the influence of the various policies (Amisano & Giannini, 2012). It provides an instantaneous basis for the correlation among variables, normally buried in the variance-covariance matrix of the innovation terms. Bayesian SVAR analysis has proven successful over the years because data is combined with prior beliefs, which constitute an additional source of information. The simple Bayesian VAR model has been extended to account for non-linear and non-Gaussian effects, as in Bayesian non-parametric VARs (Bassetti et al., 2014; Kalli, 2018; Billio et al., 2019), for instabilities, as in change-point VARs (Koop & Potter, 2007) and Markov-switching VARs (Sims & Sha, 2006, Casarin et al., 2018, e.g., see), for over parametrization issues, as in high-dimensional VARs (e.g., see Gefang, 2008; George et al., 2014; Koop et al.,2019), and for multiple observation units, as expressed in panel VARs (e.g., see Canova and Ciccarelli, 2004, 2009; Korobilis, 2016) and Markov-switching panel VARs (e.g., see Billio et al., 2016; Casarin et al., 2018). This paper focuses on Graphical VAR extensions, as discussed in the subsequent sections.

Building on the literature on Gaussian graphical models (e.g., see Carvalho & West, 2007; Dawid & Lauritzen, 1993; Gruber & West, 2017; Jones et al., 2005; Jones & West, 2005; Lauritzen, 1996; Wang, 2010; Wang et al., 2011; Wang & West, 2009; Whittaker, 2009) SVAR models have been extended to Graphical SVAR (G-SVAR) where unobservable graphs encode the lagged and contemporaneous dependence structures (e.g., see Ahelegbey et al., 2016a, b; Casarin et al., 2020; Corander & Villani, 2006; Paci & Consonni, 2020). The Bayesian G-SVAR (BG-SVAR) of Ahelegbey et al. (2016a, 2016b) has been extended in different directions. Fianu et al. (2022) and Ahelegbey et al. (2021) proposed Bayesian Graphical Panel SVAR (BG-PSVAR) to account for multiple observation units. Casarin et al. (2020) introduced Bayesian SVARs with Multilayer Graphs (BMG-SVAR) to account for different groups of variables in the dependence structure. In this paper, we extend Fianu et al. (2022) and Ahelegbey et al. (2021) in two directions. Multiple layers are introduced to account for different types of variables in the panel, and change points account for breaks in the dependence structure. The multilayer network introduces a variable selection mechanism to overcome the over-parameterization issue of panel VAR modeling. The network change points identify the structural breaks in SVAR models.

Our novel modeling approach consists of a Bayesian Multilayer Graphical Panel SVAR with Change Points (CP-BMG-PSVAR). It helps to investigate two relevant channels of shock transmission among electricity market zones: volatility and price. This choice of the network layers seems natural because electricity prices and their spiky nature coupled with inherent volatility constitute essential elements for market players to maximize their profits (Imani et al., 2021). Accounting for equation-specific and overall change points, we detect sub-periods of the initial time domain. The detected time intervals are explored in light of economic events that have influenced the Italian electricity market and its zonal structure. Congestion events are accounted for, and an analysis of congestion costs allows us to characterize the transmission of risks among the macro-zones of the market. The two-layer contagion model allows for disentangling connections among the market zones in terms of returns and volatility transmission. Among other events, the impact of COVID-19 on the Italian zonal market is carefully analyzed.

The rest of the paper is organized as follows. Section 2 reviews the literature on layer propagation and interconnections in the Italian zonal markets and provides an overview of congestion events responsible for major changes in the market risk. Section 3 introduces an original multiple-layer graphical framework for analyzing market interconnections. The empirical results are presented and discussed in Sect. 4. We conclude the paper in Sect. 5 by presenting some remarks related to the impact of COVID-19.

2 The Italian zonal electricity market

2.1 Literature review

The interconnections among transmission networks play an essential role in terms of risk and return for market participants. Given this, Fang and Hill (2003), for instance, mentioned that it is essential to develop a transmission network capable of handling future generation and load patterns in a deregulated, unbundled, and competitive electricity market. Joskow (2006) highlighted that evidence from the US and some other countries reveal that organized markets for electrical energy and operating reserves do not provide adequate incentives to stimulate the proper quantity or mix of generating capacity with mandatory reliability; a concern mostly occurring because of full utilization of the generating capacity. In effect, Joskow (2006), for instance, designed a policy program to improve the efficiency of the spot wholesale electricity markets. Because of different regulatory and structural transformations in the energy markets, all firms now compete to provide generation services at the market price. Electricity firms are now significantly exposed to higher risks, and the need for suitable, actionable decision support models has increased (Ventosa et al., 2005). This implies a paradigm shift from the traditional supply and demand approach that requires energy to be supplied only when demand occurs. The new paradigm, however, places high value on efficient supply, reliability as well security of energy supply. Therefore, reliable operations of energy systems require a real-time balance between demand and supply, which is not easily attainable (Joskow & Tirole, 2005). Papaioannou et al. (2015) exploit the notions of co-evolution of co-movement to study the Italian and Greek electricity markets, focusing on wholesale day-ahead prices and a time-frequency domain. In financial economics, co-movement is generally linked to market integration, and it is ideal for exploring these occurrences in the electricity market. A key understanding in this framework is that markets are integrated if the reward for risks is identical across markets.

Recently, there has been much penetration of RES in the electricity markets, which has led to various regulatory transformations across the globe in energy markets. Some of these transformations exhibit structural effects. Ritzenhofen et al. (2016) highlighted that the RES growth has been tremendous across the globe, deriving benefits from various support schemes such as renewable portfolio standards (RPS), feed-in tariffs (FITs), and market premia (MP). These authors found that each support scheme increases RES penetration, curbing carbon dioxide emissions. Hirth (2013) provides a detailed analysis of the market value of variable renewable energy and shows that (i) the variability of solar and wind power affects their market value, and (ii) the market value of variable renewables falls with higher penetration rates.

The analysis of structural changes in energy markets is a crucial issue for both market participants and policymakers (e.g., see Ali et al., 2020). Among the potential sources of structural changes, COVID-19 has been considered by many authors to investigate transitory and permanent effects on the energy market (Bento et al., 2021; Lazo et al., 2022; Norouzi, 2022; Norouzi et al., 2021). For the Italian market, there is strong evidence of multiple structural changes motivated by crisis periods coupled with other developmental, regulatory, and transitional changes in the evolution of COVID-19 and its influence on the energy sector.Footnote 1 Bigerna et al. (2022) found that the Italian electricity market was characterized by a remarkable decrease in demand during the COVID-19 lockdown. The impact of the penetration of RES is explored in a similar spirit by Amusat et al. (2018), Matos et al. (2019), Zeppini and Van Den Bergh (2020), Amankwah-Amoah et al. (2021), Zheng and Zhang (2021), among others. Compared to other global pandemics, the novel coronavirus outbreak has various significant impacts on energy markets and other sectors across the globe. Queiroz et al. (2020) provide a systematic literature review and the details of operation framework and supply chain management during the COVID-19 pandemic, encompassing six perspectives: adaptation, digitalization, preparedness, recovery, ripple effect, and sustainability. Ivanov (2020) focused on the viability of the supply chain and considered three viewpoints: agility, resilience, and sustainability. The author pointed out that the principal ideas of the viable supply chain are adaptable designs for supply–demand allocations and provide a useful framework for ecosystem dynamic analysis. Since the energy sector represents an evolving complex system, these notions can be readily applied. We contribute to this literature with a new dynamic modeling framework that allows for automatically detecting periods of significant changes in market activity and structure. We investigate the absorption of negative disturbances, recovery, and resilience to short-term disruptions and long-term global shocks.

The complexity of the energy market structure calls naturally for multilayer graph models, which can provide insight into the analysis of such systems (Kurant & Thiran, 2006). While most studies assume observable interaction layers among complex systems, Valles-Catala et al. (2016) address the issue of uncovering latent interaction layers from aggregate data. Yu et al. (2020) show that information spreading on multilayer networks exhibits a crossover phenomenon between the information outbreak size and the transmission probability. Fianu et al. (2022) develop and estimate graphical models to uncover the connectivity structure of the Italian electricity market. They explore risk transmission in the zonal markets, thereby identifying the most influential zones in terms of hub and authority centrality. This paper extends Fianu et al. (2022) to a multiple-layer and nonlinear setup. Two layers of shock transmission will help to explore further the various pathways relevant to policy design mechanisms and policy decisions. Change points introduce nonlinearities in the model and help to detect abrupt changes in the interconnections of the risk (volatility) alone, return alone, and risk-return relationship.

2.2 Structure and congestion analysis

The Italian electricity market has experienced a new paradigm shift among European countries. Since January 2021, the map of the Italian electricity market zones has gone through some transformation, which aims at improving the functioning of the zonal market (see Terna, 2021 for an overview).

A brief insight into the changes that have taken place in the zonal configuration of the Italian power market shows that there are currently seven market zones. Starting from ten market zones, four production hubs have been eliminated (Priolo, Foggia, Brindisi, and Rossano), and a new geographical zone has been incorporated, which reflects the renewable generation on power flows. On the other hand, the Umbria region has been moved from the Center-North zone to the Centre-South zone to reflect better the impact of negotiations within this region on grid congestions. All in all, the new physical zones in this new horizon, since January 2021, include North, Center-North, Centre-South, South, Calabria, Sicily, and Sardinia, disparate from the old configuration by the addition of the Calabria region. Figure 1 provides an overview of the changes that have taken place in the electricity market. Hence, the sample data used in our analysis is limited to 2020 because it is not possible to compare data from 2021 onward with past data for some zones (e.g., South, Centre-South and Centre-North).

Map of the Italian electricity zonal market in force up to 31 December 2020 (with the production hub of Rossano in the province of Catanzaro), on the left, and the new zonal configuration, on the right. Source: Authors’ preprocessing of figure from Terna (2021)

The goal of the old physical zones was only geared toward ensuring grid security. Like almost every other liberalized wholesale electricity market, there is an allowance for significantly improved efficiency through enhanced pricing of customers connected to the distribution network. The physical interconnections between the Italian zonal market and the neighboring European countries include the following: the North relates to France, Switzerland, Austria, and Slovenia, the Centre-North and Sardinia have a connection with Corsica, the Center-South with Montenegro, the South with Greece, Sicily with Malta. These interconnections are essential to maximizing the efficiency of the electricity markets. It is always crucial that the power flows among the physical zones follow the demand and supply conditions in the grid transmission that are compatible with the security of the national electrical system. The new configuration will likely reveal the grids’ uniqueness so operators can optimize and improve negotiations. In this vein, grid security problems are eradicated, and there is more stability and uniformity, which will give rise to lower prices as this will reflect cases of scarcity and excess in the electricity supply. The objective of the restructuring is to give a correct interpretation of the trends observed on the electricity flows among geographical zones accounting for the supply and demand conditions which can be described as “bottlenecks” in the grid transmission, compatible with the security of the national electrical system (Bigerna et al., 2016). The Italian energy market is organized in several sessions: the day-ahead market (in Italian, Mercato del Giorno Prima, MGP) and the intra-day market (ID). They are the main segments where producers, wholesalers, and end customers buy and sell wholesale quantities of electricity that must be delivered the next day. Although injection and withdrawal schedules accepted in the MGP account for interconnection capacity among physical zones, they do not consider intra-zonal congestion or any other network security constraint, which could make physical energy delivery unfeasible. When congestions happen, the national area is split into market zones where auctions provide different prices. The general rule is that prices are higher in zones with lower supply.

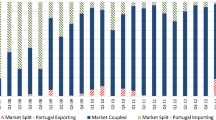

Table 1 shows, for each year and for the whole time horizon, the average price, the standard deviation, and the percentages of hours for each market configuration. In case of no congestion in the grid, the one-market case occurs. The grid’s security has improved in the observed period: the percentage of one-market hours (no congestions) has increased from 8.2% in 2014 to 44.1% in 2020. Congestion events create several market zones from two to six. It is worth noticing that the two-market case is the most frequent, and the extreme six-market case never happens. Table 2 analyzes some of the most interesting two- and three-market configurations. Due to supply imbalances, Sicily is the physical zone most frequently separated from the others. In 22,932 h, Sicily has a price different from the common price observed in the remaining zones, and in 5284 h (4414 + 870), it is separated within the three-market configuration. This fact is confirmed by the average zonal price observed in Sicily, which is on average higher than that observed in the remaining geographical zones.Footnote 2

3 A change-point graphical vector autoregression

This section introduces the three main components of our Change Points Bayesian Multilayer Graphical Panel SVAR (CP-BMG-PSVAR): change points, the multilayer graph, and exogenous variables. The CP-BMG-PSVAR model is presented both in expanded and compact forms. The inference procedure used for the electricity market analysis is then briefly described.

3.1 A change-point panel SVAR

Let \(Y_{jt}\in {\mathbb {R}}^{m}\) and \(Z_{jt}\in {\mathbb {R}}^{q}\), \(j=1,\ldots , N\) be two sequences of endogenous and exogenous variables, respectively, observed for the N units of a panel. In our application, there are \(N=6\) units (regions) and two endogenous variables for each unit, i.e., \(Y_{jt}=(R_{jt}, V_{jt})'\in {\mathbb {R}}^{2}\), where \(R_{jt}\) denotes the returns on energy prices and \(V_{jt}\) the daily changes in log-price volatility for the region j at time t. The vector of regional-specific exogenous variables \(Z_{jt}\in {\mathbb {R}}^{2}\) includes the electricity demand forecast and the wind generation forecast.

Assume there exist K change points and let \({\mathcal {T}}_{K} = (\tau _{1}, \tau _{2}, \ldots , \tau _{K} )\) be the vector of change times, such that \(1 = \tau _{0}<\tau _{1}< \cdots < \tau _{K+1}=T\). The change points are common to all units of the panel. They indicate the dates of possible changes in the parameter values, which include changes in the dependence structure between variables. Within each time interval \((\tau _{k-1},\tau _k]\) we assume \(Y_{jt}\), \(j=1,\ldots ,N\) satisfy a panel BG-SVAR with p lags:

for \(t\in (\tau _{k-1}, \tau _{k}]\), where the structural error terms \(\varepsilon _{jt}^{(k)}\) are i.i.d. with covariance matrix \(\Sigma ^{(k)}_{jj}\) and such that the cross-unit covariance is null, i.e. \({\mathbb {C}}ov(\varepsilon _{it}^{(k)},\varepsilon _{js}^{(k^{\prime })})=\Sigma ^{(k)}_{ij}\) \(i\ne j\), if \(s=t\) and \(k=k^{\prime }\), and null otherwise. The \((m\times m)\)-dimensional matrices \(B^{(k)}_{j\ell }\), \(\ell =1,\ldots ,p\) contain the autoregressive coefficients, and the \((q\times q)\)-dimensional matrix \(C^{(k)}_{j}\) contains the coefficients of the exogenous variables. The matrix \(B_{jj0}^{(k)}\) is full (non-symmetric) with zeroes on the main diagonal and records the contemporaneous dependence between the endogenous variables of the jth unit. The matrices \(B_{ij0}^{(k)}\) with \(i\ne j\) are full (non-symmetric) and record the contemporaneous dependence between the endogenous variables of the ith unit and the other units. We define the CP-BMG-PSVAR as the collection of BG-PSVAR over the K time intervals. In the next section, we provide the multiple-layer graph interpretation of our CP-BMG-PSVAR.

3.2 A multilayer graphical SVAR

Graphs and graphical models are a convenient framework to represent the independence structure in stochastic models. In the following, we define multilayer graphs and introduce the graphical components of the CP-BMG-PSVAR given in Eqs. (1) and (2). For each endogenous variable \(h\in \{1,\ldots ,m\}\), lag \(\ell \in \{1,\ldots ,p\}\) and period \(k\in \{1,\ldots , K\}\), we introduce the sequence of graphs \({\mathcal {G}}_{hh^{\prime },\ell }^{(k)}=(V, E_{hh^{\prime },\ell }^{(k)})\), \(h^{\prime }=1,\ldots , m\) where a graph is defined as an ordered pair of sets: the node set \(V=\{1,\ldots , N\}\) and the edge set \(E_{hh^{\prime },\ell }^{(k)}\subset V \times V\). The elements of V are the graph nodes and represent the panel units. The elements of \(E_{hh^{\prime },\ell }^{(k)}\) are the edges (i.e., pair of nodes) that describe a statistical relationship between units in the panel. The graph subscript index \((h,h^{\prime })\) indicates a type of relationship between nodes, that is, the statistical relationship between the hth and \(h^{\prime }\)th endogenous variables.

Let \({\mathcal {A}}=\{1,\ldots ,m\}\) be a collection of node features that is a set of endogenous variables in our application. The sequence of graphs \({\mathcal {G}}_{\ell }^{(k)}=\{{\mathcal {G}}_{hh^{\prime },\ell }^{(k)},(h,h^{\prime })\in {\mathcal {A}}\times {\mathcal {A}}\}\) is called a multilayer graph, where \({\mathcal {G}}_{hh,\ell }^{(k)}\) encodes the intra-layer connectivity, i.e., the statistical relationship between the same type of variable across panel units, and \({\mathcal {G}}_{hh^{\prime },\ell }^{(k)}\), \(h\ne h^{\prime }\) encodes the inter-layer connectivity, that is the relationship between different types of variables across panel units.

Equations (1) and (2) can be operationalized as a model with an underlying multilayer graphical structure, that is, a graphical model where the zero (non-zero) elements of \(B^{(k)}_{j\ell }\) indicate the absence (presence) of a statistical relationship between pairs of variables. This paper relies on conditional linear dependence between pairs of variables. Let \(Y_{ih,t}\) and \(Y_{jh^{\prime },t}\) be the hth and \(h^{\prime }\)th element of the vectors of endogenous variables \(Y_{i,t}\) and \(Y_{j,t}\), respectively. We say that \(Y_{jh,t-\ell } \not \rightarrow Y_{ih^{\prime },t}\) if \(Y_{jh}\) does not influence \(Y_{ih^{\prime }}\) at lag \(\ell \ne 0\) and that \(Y_{jh,t} \not \rightarrow Y_{ih^{\prime },t}\) when \(Y_{ih}\) and \(Y_{jh^{\prime }}\) are independent. If \(Y_{jh,t-\ell } \rightarrow Y_{ih^{\prime },t}\) then there is an edge between the nodes i in the layer h and the node j in the layer \(h^{\prime }\), that is \((i,j)\in E_{hh^{\prime }\ell }^{(k)}\) and if \(Y_{jh,t-\ell } \not \rightarrow Y_{ih^{\prime },t}\) then there is not an edge that is \((i,j)\notin E_{hh^{\prime }\ell }^{(k)}\).

The graphical structure can be encoded into a set of binary variables \(g_{hh^{\prime },ij,\ell }^{(k)}\in \{0,1\}\) such that \(g_{hh^{\prime },ij,\ell }^{(k)}=1\) if \(Y_{jh,t-\ell } ~\rightarrow ~Y_{ih^{\prime },t}\) and \(g_{hh^{\prime },ij,\ell }^{(k)}=0\) if \(Y_{jh,t-\ell } ~\not \rightarrow ~Y_{ih^{\prime },t}\). In our CP-BMG-PSVAR model the \((h,h^{\prime })\)th element \(b_{hh^{\prime },ij,\ell }^{(k)}\) of the coefficient matrix \(B_{ij\ell }^{(k)}\) is set to zero if the two units i and j are not connected in the \((h,h^{\prime })\) layer, that is:

for \(k = 1, \ldots , K\).

Our general multilayer graph model can provide information on inter-layer connectivity and connectivity dynamics at different lags. In this paper, we do not investigate these aspects further. We focus on intra-layer connectivity and collapse the lag dimension in a weighted multilayer graph. Following the coefficient restrictions in (3), we define the null-diagonal matrices \(W_h^{(k)} \in {\mathbb {R}}^{N\times N}\) and \(A_h^{(k)} \in \{0,1\}^{mN\times mN}\), whose (i, j)th elements are given by:

where \(a_{h,ij}^{(k)}\) specifies that \(Y_{hj} \rightarrow Y_{hi}\) if there is either a contemporaneous or a directed edge from j to i in the layer h at least in one of the lags. \(w_{h,ij}^{(k)}\) specifies the weights of such a relationship obtained as a sum of the contemporaneous and lagged coefficients.

3.3 Model estimation

The CP-BMG-PSVAR model defined in Eqs. (1) and (2) can be written in a more compact form stacking all unit variables in a vector. Define the \(mN\times 1\) and \(qN\times 1\) vectors \(Y_{t}=\hbox {vec}(Y_{1t},\ldots ,Y_{Nt})\) and \(Z_{t}=\hbox {vec}(Z_{1t},\ldots ,Z_{Nt})\), the \((mpN+qN)\times 1\) vector \(X_t= \hbox {vec}(Y_{t-1},\ldots ,Y_{t-p}, Z_t)\), the \(mN\times mpN\) coefficient matrices \(B_{\ell }^{(k)\prime }=(B_{1\ell }^{(k)\prime },\ldots ,B_{N\ell }^{(k)\prime })\), \(\ell =0,1,\ldots ,p\) with \(B_{j\ell }^{(k)}=(B_{j1\ell }^{(k)},\ldots ,B_{jN\ell }^{(k)})\), and the covariance matrix \((\Sigma ^{(k)})^{\prime }=(\Sigma _{1}^{(k)},\ldots ,\Sigma _{N}^{(k)})\) with \(\Sigma _{j}^{(k)}=(\Sigma _{j1}^{(k)},\ldots ,\Sigma _{jN}^{(k)})\). The definition of the binary matrices \(G_{+}^{(k)}\) and \(G_{0}^{(k)}\) follow similar arguments. The panel SVAR model can be written as

where \(~B_+^{(k)} \!=\! (B_1^{(k)},\ldots , B_p^{(k)}, C^{(k)})\) is \(mN \times (mpN+qN)\). Define \(\Upsilon ^{(k)}\!=\!\hbox {vec}(\Upsilon _{1}^{(k)},\ldots ,\Upsilon _{N}^{(k)})\) with elements \(\Upsilon _{j}^{(k)}=(\Upsilon _{j1}^{(k)},\ldots ,\Upsilon _{jN}^{(k)})\) and \(U_{t}^{(k)}=\hbox {vec}(U_{1t}^{(k)},\ldots ,U_{Nt}^{(k)})\). It can be shown that the relationship between the variance of the error terms \(U_{jt}^{(k)}\), \({\mathbb {V}}ar(U_{t}^{(k)})=\Upsilon ^{(k)}\) and the structural coefficients \(B_{0}^{(k)}\) is given by \(\Upsilon ^{(k)}=(I - B_0^{(k)})^{-1}\Sigma ^{(k)}(I - B_0^{(k)})^{-1\prime }\). The matrix \((I - B_0^{(k)})^{-1}\) records the (in)direct contemporaneous effect of \(\varepsilon _t^{(k)}\) on \(Y_t\). A shock to \(Y_{jt}\) can only affect \(Y_{it}\) if there is a contemporaneous link from \(Y_{kt}\) to \(Y_{it}\).

Following the Bayesian paradigm of Ahelegbey et al. (2021), we estimate the change-point VAR model via a collapsed Gibbs and approximate the posterior distribution by sampling sequentially from the following conditional distributions:

where \(V_{\tau ,K}=(\tau _1,\ldots ,\tau _{K})\) is the collection of change points. We sample the number of change-points and their locations \(\{K, V_{\tau ,K}\}\) following the results in Ruggieri and Antonellis (2016) and \(G_0^{(k)}\), \(G_{+}^{(k)}\), \(B_0^{(k)}\), \(B_{+}^{(k)}\), \(\Sigma ^{(k)}\), \(\Upsilon ^{(k)}\) following Ahelegbey et al. (2021). A detailed description of the posterior approximation and the sampling methods is available in Ahelegbey et al. (2021).

4 Empirical results

4.1 Data description

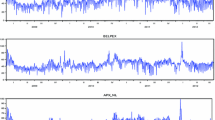

In this study, we employ hourly prices observed on the Italian electricity market collected from the managing body of the market (Gestore dei Mercati Elettrici, GME).Footnote 3 The data spans the period from March 2014 to December 2020. In addition, forecast electricity demand and wind generation in the Italian zonal electricity market, obtained from the TSO Terna,Footnote 4 have been utilized in the framework of exogenous factors. Hourly data have been aggregated daily. In this paper, following a widespread practice (see, for instance, Gianfreda & Grossi, 2012), daily prices have been computed as a simple average of the 24 h settlement prices resulting from the day-ahead auctions. As it is well known, a simple average gives the same weight to all hours of the day. The choice is motivated by adopting a neutral approach in estimating the change points. Indeed, the smoothing effect of a daily average allows moving the scale of the change detection to a large enough period while reducing the impact of intra-day movements. The choice of a different approach, such as the median or weighted average price, could introduce some noise in the data, preventing the method from detecting true change points. The focus of our analysis is on the six major physical zones, which comprise North (NORD), Centre-North (CNOR), Centre-South (CSUD), South (SUD), Sardinia (SARD) and Sicily (SICI) geographical zones. These zones are illustrated in Fig. 1. A corresponding time plot of the different zonal electricity markets in terms of the average daily price evolution and the volatility movements are displayed in Fig. 2a, b respectively. A glimpse at these figures reveals some co-movements among the prices as well as the daily log-volatilities. Furthermore, some sharp spikes can be observed during the period March 2015–March 2016 and along the second half of 2017. The period before March 2020 exhibits a downward trend until some point in July of the same year, when we see an upward trend again. Similar up and downward swings in the Italian zonal electricity market are prevalent in the log-volatility and average daily price evolution. In addition, Fig. 3a, b present the graphical display of the corresponding external factors for the different zones in relation to the forecast wind demand and the forecast electricity demand, respectively. The trend in both figures for the different zones tends to mimic each other. There are various pronounced spikes in both forecast wind demand and forecast demand, especially in the first half of 2015. Along the overall period, mild spikes are observed, with a more pronounced spike occurring in the third quarter of 2017 and 2019, respectively. The lock-down period captured in the second quarter of 2020 shows significant negative spikes in forecast electricity demand in all zones, particularly remarkable in the North and Center-North.

Breaking down these occurrences from a granular viewpoint, the year 2014 reveals the characteristics of long-term trends, which is shown by the drop in consumption and the explosion of renewables and the effects generated by the new unconventional production of crude oil and gas on the fuels market, with the collapse of coal, the undocking of gas prices on oil, and their convergence. Nonetheless, the main change, as explained by Gestore Mercati Energetici (2014), seems to come from the dramatic disruption of the balance in the world market of crude oil, which occurred only in the last quarter of 2014 with a potential impact on the power and gas markets, which saw a fall in the demand for energy by 9% in power and by 27% for natural gas, respectively.Footnote 5 It is worth noting that the purchase price of electricity (PUN) in the Power Exchange saw steep declines in the previous 2 years (16.6% in 2013; and 17.3% in 2014), which indicates a slight recovery compared to an all-time low of 2014 with a corresponding price level at 52.31 €/MWh (+ 0.4%). The monthly average levels varied between 47 and 56 €/MWh; however, an exception was observed in July when the price amounted to 67.77 €/MWh. In addition, the price dynamics also show an overall low variability of the PUN, which is reportedly changing by periodic and volatile peaks, which intensified in July because of the exceptional heat wave experienced in the summer of 2015, and thus lowered consumption to record levels, and the PUN to a monthly value among the highest in the last 3 years, pegged at 70 €/MWh (Gestore Mercati Energetici, 2015).

Notably, 2016 experienced a further step toward a full integration of European energy markets, which is increasingly characterized by common and more harmonized trends within a shared framework of standards and principles. These dynamics clear the electricity markets, depicting a unique scenario, which reflects in trends of fuels and locally shaped by regional characterizations. On the other hand, the price movements are reflected in a transitional regulatory environment toward the definition of new national energy savings targets and the approval of new guidelines for evaluating efficiency projects; the market showed this in the last quarter of 2016. This resulted in an upward and highly volatile dynamic that, in the long-run (Gestore Mercati Energetici, 2016). On the other hand, 2017 exhibited signs of a recovery in the energy markets with a positive outlook and effects of the European integration process. It showed signs of maturity in the spot market. Also, the Italian electricity markets fit well into the European Single market framework (Gestore Mercati Energetici, 2017). Furthermore, in 2018, the trends recorded in the energy markets are in line with the recent past, indicating a consolidation of the increases that emerged during 2017 and, at the same time, highlighting, on the electricity side, further steps forward in the process of European integration. The electricity market experienced further integration geared towards the single European electricity market, which saw the strengthening of the PUN, pegged at 61.31€/MWh (Gestore Mercati Energetici, 2018). In 2019 the day-ahead and intra-day electricity markets and the gas spot market was affected by the introduction of the mechanism for the integrated management of guarantees (netting). This is a tool used by the GME to promote containment of the costs incurred by operators in terms of the financial guarantees required. In addition, it simplifies the operational and management processes linked to participation in the markets (Gestore Mercati Energetici, 2019).

On a global scale, the energy markets have been impacted by the health emergency linked to the Covid-19 pandemic in 2020. In the European markets, this unique economic situation inevitably resulted in a convergence of European gas prices and the continental electricity markets due to their highly integrated nature. Furthermore, these markets also experienced advanced coordination mechanisms activated by market coupling. In a similar context, the Italian electricity market showed a marked reduction in demand, and the cost of gas has pushed the PUN (38.92€/MWh, \(-\)25.6%) and its differential with foreign countries to an all-time low. However, the market contained this anomaly, possibly due to an effective coupling mechanism, which partially supports national production (Gestore Mercati Energetici, 2020).

4.2 Preliminary data analysis

Let \(P_{i,l,t}\) be the observed price for the ith zone at the lth hour of day t. We construct daily standard deviations (\(\sigma _{i,t}\)) as a measure of realized volatility by:

where \({\bar{P}}_{i,t}\) is the average of \(P_i\) on the day t, and N is the total number of observations in a day, i.e., \(N =24\). This formula was used to compute standard deviations for prices.

Table 3 provides the descriptive statistics for each physical zone of the first differences applied to the log transformation of daily summaries related to prices (P), volatility (V), forecast demand (FD), forecast wind (FW). For example, the range of minimum log-prices returns is (\(-\) 2.04, \(-\) 0.86), where the extremes are observed in (SICI) and (NOR, CNOR, CSUD), respectively. On the other hand, SICI shows the highest maximum log-price return (\(+\) 2.04), whilst the lowest maximum log-price return is exhibited by CNOR (\(+\) 0.75). As expected, SICI shows the highest log-price return variation (SD = 0.20). All the zones are characterized by positive skewness except P.SICI, which shows a negative skewness of \(-\) 0.02. In addition, the distributions of log-price returns in all the zones are leptokurtic, implying a deep interest in exploring change points in the zonal market dynamics. The trends in log-volatilities and log-returns are similar. However, the wind and demand forecast dynamics differ somewhat from the log-returns and log-volatilities dynamics.

From the viewpoint of demand, the SUD zone exhibits the lowest (\(-\) 1.00) and the highest (\(+\) 0.85) levels of change in the demand forecast for electricity. It is worth noticing that the highest variation of the forecast demand is observed in the NORD zone (SD = 0.18). FD.SUD and FD.SARD exhibit negative skewness, while in the remaining zones, skewness is positive. All zones exhibit leptokurtic features, with SARD showing the highest excess kurtosis. The forecast wind shows different characteristics from the rest, with high levels of variability in the CSUD and SARD zones.

4.3 Change points in the market

Table 4 lists the change point dates with their posterior probabilities and possible electricity market events that characterize the identified dates. To achieve a better interpretation of the change points, we compute the congestion cost per year and between consecutive change points. The congestion cost is the difference between the zonal price and the National Unique Price.Footnote 6

Table 5 presents the average zonal congestion cost among the different geographical zones. The congestion cost presents some interesting signals among the different zones. For instance, CNOR, NORD, SARD, SUD show upward and downward trends. On the other hand, a clear upward trend is observed in the SICI zonal market, at least from 2016 to 2019. This is not surprising as the most frequent changes in structure were found between SICI and SUD, whose interconnections were the most congested (see Table 2).Footnote 7

All the change points identified in our modeling framework constitute periods where the national average price was quite high in comparison with the majority of the zonal prices, therefore depicting a negative cost of congestion (Table 6).Footnote 8 For example, CNOR, and SUD always show negative congestion costs during the identified change points, while congestion costs are negative in NORD, CSUD and SARD in four cases out of six. However, SICI shows positive costs of congestion throughout. Making various deductions based on the trajectories and the dynamics in the Italian zonal electricity market, the different change points identified have possible economic interpretations.

The first change point (CP #1) constitutes the market’s explosion of RES. In this respect, the GME has focused on compliance activities in relation to neutrality, transparency, objectivity, and competition among the operators, coupled with activities aimed at adapting to the European single electricity market. This requires a change in market models, as well as the harmonization of the current design of the Italian market with respect to the requirements for implementing the EU Target Model. In particular, it was necessary to make several modifications to model the Italian electricity market to fit into the EU framework. For instance, it was necessary to change the closing time of the MGP sessions and re-organize the sub-phases of the market that constitute the MPE. Furthermore, Terna, in her quest for the proper functioning of the electricity market and the green certificates, made several regulatory transformations.Footnote 9 All these amendments became effective on March 14, 2014.Footnote 10

The rise in crude oil prices, which has been stable for years at around 110$/bbl, collapsed in the last quarter of 2014 and attained a decreasing trend pegged at 50$/bbl at the start of 2015. Indeed, this has a further ripple effect on other sectors of the economy and hence contributed to the second change point (CP #2) identified by our statistical framework. A downward trend in power prices was experienced in the Italian electricity market. For instance, in this period, the PUN fell to the historical low of 52 €/MWh in just 2 years, with a decline of more than 20 €/MWh. Other contributing factors include the compression of the costs of gas-fired generation, whose impact at the zonal level was modulated locally by the different influences of renewable supply and demand. Furthermore, 2016 highlights the adequacy of investments in grids to accommodate future methods of transmitting and distributing electricity.

Alongside this, a reform of the input-based methodology has been implemented to promote extensive possible regulation, which is results-oriented and has significant consumer benefits. During the analyzed period, there was a high degree of integration in the European electricity markets. For instance, in October 2016 and February 2017, the massive unavailability of the French nuclear plants—has put the entire European electricity system under stress, causing sudden spikes in prices everywhere, which could contribute to the turning point (CP #3) in the Italian zonal market. In addition, comparing the Italian electricity demand in 2016 to the one in 2014 seems to be relative with a \(-\) 2.1 % reduction. Because of additional renewable capacity, and the simultaneous investment in new (mainly renewable) production plants, a drop in electricity consumption was observed. However, there was a reversal in this trend in 2016 and at the beginning of 2017 because of the French nuclear outages (combined with high French demand), which led to a reduction in Italian imports, with a need for strong domestic production.

The energy markets were characterized by strong and generalized bearish price dynamics in 2019, which has been favored by a significant decrease in European oil and gas prices, with subsequent large reductions in electricity prices. The Italian electricity markets saw the PUN falling to levels of around 52 €/MWh. All these events and further integration of RES contributed to the change points (CP #4) and (CP #5).

The final change points (CP #6) and (CP #7) detected relate to the COVID-19 pandemic, which put the global economy in disarray and inevitably resulted in a convergence of European gas prices and the prices expressed by the continental electricity markets. There was a marked demand reduction, and the cost of gas has pushed the PUN (38.92 €/MWh, \(-\) 25.6%) and its differential with foreign countries to an all-time low. In other words, Bigerna et al. (2022) highlight that the Italian electricity market was characterized by a remarkable decrease in demand during the COVID-19 lockdown, leading to negative peaks of over 50% and record low prices of about 20 €/MWh.

4.4 Connectedness dynamics

A preliminary analysis of the Italian electricity market provides some evidence in favor of variations and abrupt changes in market interdependence. More specifically, we measure the connectedness by estimating our panel BG-SVAR on quarterly rolling windows of 90 days. We monitor the daily changes in connectedness by setting the increments between successive rolling windows to 1 day. Thus, we set the first window of our study from 2/3/2014 to 30/5/2014, followed by 3/3/2014 to 31/5/2014; the last window is from 3/10/2020 to 31/12/2020. In total, we consider 2,408 rolling windows. To assess and compare networks, we estimate the network density measure for each day of the sample period. The rolling-window network density, the piecewise network density, and the change-point posterior probability are given in Fig. 4.

As previously recalled, the number of change points has been reduced to 5 because we merged windows with less than 30 observations with the previous ones.

The structures of the market interconnection in the six periods are given in Fig. 5. The multilayer connectivity can be pictured as a block matrix interconnection of price and volatility. In each matrix, the coefficient estimates measure the impact of prices and volatility at time t (columns) on prices and volatility at time \(t+1\) (rows). Utilizing blocks of time series, zonal market interconnection can result in four types of shock transmission pathways: price connectedness effects in the upper-left block (log-transformed price \(\rightleftharpoons \) log-transformed price); volatility connectedness, that is, volatility persistence and volatility spill-over effects in the bottom-right block (volatility \(\rightleftharpoons \) volatility); leverage effects in the bottom-left block (log-transformed price \(\rightarrow \) volatility); inverse leverage effects in the upper-right block (volatility \(\rightarrow \) log-transformed price).

We detected structural changes in the physical zones. Overall, different co-causality characterizations can be observed between price and volatility. The transition from Fig. 5a–f indicates various structural changes experienced in the Italian electricity market in conformity with the change point windows. The changes in the macro-zones can be summarized as follows.

-

In the first and second periods (panels a and b), there is strong evidence of leverage effect (log-transformed price \(\rightarrow \) volatility) and some evidence of inverse leverage effect (volatility \(\rightarrow \) log-transformed price) with varying degrees of negative and positive associations. There is also evidence of volatility spill-over effects, particularly in the first period.

-

In the third and fourth periods (panels c and d), there is strong evidence of leverage effects with price changes at time t causing volatility at time \(t+1\) and with high intensity (red color), particularly in the fourth period. In the same periods, we find evidence of volatility persistence and volatility spill-over effects among the markets. The inverse leverage effect is no longer observed.

-

In the fifth period (panel e), the structure of the linkages is similar to the one of the first and second periods, with causal effects from price changes to volatility.

-

In the sixth period (panel f), a block structure emerged, with strong inter-dependence effects in the price layer and some volatility spill-over effects among some of the macro-zones. Prices impact volatility only in a few zones (e.g., an increase in the NO returns increases the volatility in the same zonal market and reduces volatility in the CN). There is a fading of negative connectedness during COVID-19 compared to periods before COVID-19, which could be due to more penetration of renewable geared towards net-zero emissions and low electricity demand, as mentioned earlier.

To stress the final point of the above list, Fig. 6 shows an expanded elaborated (a zoom-out) view of the last year of Fig. 4. In this plot, a new series is added representing the dynamics of the “stringency index” (Mathieu et al., 2020).Footnote 11 The restriction drop at the end of May 2020 produces a decrease in market connectedness, detected in May by the rolling-window network density and in June by the change-point network density. A simple explanation could be as follows. Consider that in normal times, the six geographical zones of the market are quite different in terms of electricity demand structure and prices, which are, of course, influenced by the demand. Demand for electricity in the NORD zone is strongly affected by the intense economic activity, while in the southern zone and islands, demand from households is prevalent. Consequently, the connectedness among zones is quite low. During the restrictions related to the first wave of COVID, the difference in demand structure among zones has reduced because many firms were forced to close. Several papers pointed out that during the first wave of restrictions, electricity demand dropped consistently in the NORD zone and the CNOR, while it remained more or less stable in the remaining zones. The reduction of demand in the NORD and CNOR has been reflected in prices too, which have become more similar to those observed in the remaining zones. When the restrictions have been relaxed, demand and prices have increased in NORD and CNOR. This reduced the similarity with the other zones, as confirmed by the drop observed 1 months later in the connectedness index (red line) in Fig. 6.

Sup-period Impact of Renewable Penetration of zonal prices and volatility. (I) 2/3/2014–17/5/2014; (II) 18/5/2014–6/10/2014; (III) 7/10/2014–21/8/2016; (IV) 22/8/2016–14/3/2019; (V) 15/3/2019–14/6/2020; (VI) 15/6/2020–31/12/2020. Dependent (explanatory) variables are on the rows (columns). Elements in red (green) represent negative (positive) coefficients and white elements for coefficients around zeros. (Color figure online)

4.5 Penetration of renewables and connectedness

The energy transition has gained momentum within the space of a few years and has therefore become a global phenomenon, which influences to a greater extent, the energy supply structures across the globe. The energy sector is a major sector that plays a significant role in this transition. For instance, the power sector is championing the transition with solar and wind power, able to replace coal, natural gas, and nuclear energy as the world’s main energy sources.

The results on shock propagation obtained with the multilayer analysis may reflect the impact of the penetration of RES, various regulatory transformations accounting for the further penetration of RES, and the impact of COVID-19 on the Italian electricity market. In this section, we examine the role of renewables (Forecast Wind, FW) and Forecast Demand (FD) in zonal market connectivity.

Figure 7 presents the graphical topological structures of these interconnections. The different windows of the change points accounted for are depicted in Fig. 7a–f. Panels (a) and (b) in Fig. 7 maintain the persistence in volatility in the first and second change point window identified in terms of the forecast demand and forecast wind with slight variations. However, there was a dramatic change in persistence in the subsequent change-point windows. For instance, Fig. 7c–f exhibit a mixed outcome.

The influence of RES (FW), shown in the second column of each panel, remains persistent for the various windows of change points in varying degrees. In all periods, except period II (panel b), we find strong evidence of the impact of renewable penetration on the zonal electricity prices and volatility (colored cells in Fig. 7). The forecast wind generation negatively influences prices to varying degrees. This is expected as the increasing RES penetration in the grid has a mitigating effect on prices: the price of wind is always set to zero and enters the supply curve with a very low merit order. The effect was more pronounced during the last two periods when the COVID spread reduced the demand and increased renewable penetration in the grid. The further integration of RES in line with the single European electricity market target model and the unavailability of French Nuclear Power, as discussed earlier in Sects. 4.1 and 4.3, resulted in negative influences on prices and partially on volatility. Indeed, it is worth noticing that, during COVID, the increase in RES has a negative impact on volatility in several zones, perhaps connected to the reduced influence of fossil fuel prices. The impact of FW on volatility and prices in the remaining periods appears somewhat negligible.

The periods before COVID-19 and during COVID-19 detail a clear-cut reflection of forecast demand on prices and volatility. For instance, while FW intensifies its negative impacts on prices, FD continues to affect prices positively in all zonal markets with varying degrees of intensity (green-colored cells). For instance, the periods during COVID incorporated the lock-down periods, where the markets were characterized by a remarkable decrease in demand leading to low prices. However, the opposite case is observed in terms of volatility.

5 Conclusion

The COVID-19-related global crisis has heightened the importance of a reliable, cheap, and secure electricity supply that can accommodate sudden changes in the behavior of the market participants and in economic activity while continuing to support vital health and information services. Efficient management of modern power systems requires accurate identification and measuring of the risk factors in the energy market.

In this paper, we develop and apply a new econometric framework that relies on Bayesian Graphical models with a two-layer network structure and a change point specification (called the CP-BMG-PSVAR model) to achieve this goal. The model allows for two shock transmission channels, log-price returns, and volatility contagion among the physical zones of the Italian electricity market. The change-point specification accounts for abrupt changes in the functioning of the market. Since our graphical model allows for identifying structural breaks and extracting contagion, it is now possible to study the relationship between the dynamics of the electricity demand and a COVID variable.

The application to the Italian zonal electricity market allows us to detect seven structural breaks (change points) in the market and the shock transmission pathways. The breaks identify specific events, such as increased renewable penetration and disruption in the crude oil markets (change points from 1 to 5), which greatly impact the congestion costs. During the COVID-19 pandemic, the global energy market has suffered significantly from the impact of the health emergency (change points 6 and 7).

If we focus on the period defined by the last change-point (06/14/2020), directly connected to the removal of the constraints of the first lockdown, positive costs can be identified in the CSUD, SARD, and SICI areas and negative costs in the remaining areas (see Table 6). Positive costs imply an advantage for generators selling energy in those areas because the selling price always equals the spot price higher than the PUN. As observed in Fig. 3, the lockdown led to a particularly sharp reduction in electricity demand in the NOR and CNOR areas, where demand from companies is very relevant. In this situation, congestion issues decreased with a consequent leveling of zonal prices and extra-profit opportunities for generating plants in areas with more transmission problems (especially SARD and SICI). Removing the lockdown led to a recovery of electricity demand to pre-COVID levels in the NOR and CNOR areas, where the economic activity resumed more strongly, with corresponding congestion costs decreasing at the expense of CSUD, SARD, and SICI, where congestion costs changed sign from negative to positive.

A further point that is worth analyzing regards the links of causation in the two-layer analysis (prices-volatility) shown in Fig. 5. As mentioned, during the COVID period (first and second half of 2020), the decrease in electricity demand has boosted the penetration of RES, with low merit order, as marginal plants in creating equilibrium prices/quantities. One of the effects has been the reduction of negative connectedness during COVID-19 compared to periods before COVID-19 (see, Fig. 6).

Also, RES showed a persistent impact on prices and volatility, and these effects have intensified during COVID-19. The approach is general and can find application in relation to other markets, and thus provides a valuable tool for data-driven decision-support mechanisms, which are relevant for investors, regulators, and other market participants for policy, regulatory changes, and investment decisions.

Future research could investigate the risk transmission mechanism underlying the recent energy crisis caused by sudden increases in fossil fuel prices, partially related to the Russia-Ukraine conflict. The model could be easily extended to analyze the risk transmission process among national European electricity markets. This is somewhat relevant in view of the creation of a unique European electricity market. Finally, the change point model could be used to study the pollution transmission among energy markets starting from the analysis of carbon emission time series at the European level.

Notes

See Terna (2021) for an overview.

For a previous similar analysis of the congestion events in the Italian electricity market, see Fianu et al. (2022).

Data source: https://www.mercatoelettrico.org/en/Default.aspx.

Data source: https://www.terna.it.

See Gestore Mercati Energetici (2014) for an overview.

The National Unique Price, also called PUN (Prezzo Unico Nazionale), is the weighted average of the prices observed in the physical zones.

In the calculation, we joined sample periods 4/3/2019–14/3/2019 and 4/6/2020–14/6/2020 with other periods, since they have less than 30 observations, thus reducing the number of change points from 7 to 5 and the number of periods to 6.

These regulations are aimed to standardize the provisions in their disciplinary measures and apply to operators on the electricity and green certificate markets who breach them.

This saw approval by the Decree of the Ministry for Economic Development of Economic Development (hereinafter: MiSE) of August 6, 2014, setting forth “Amendments to the Integrated Text of the Integrated Text of the Electricity Market Regulations”, having acquired the favorable opinion of the AEEGSI, expressed in Resolution 350/2014/I/eel on “Opinion of the Authority for Electricity, Gas, and Water System to the Ministry of Economic Development regarding amendments to the integrated text of the regulation of the electricity market”.

The stringency index is part of the Oxford COVID-19 Government Response Tracker (OxCGRT). This dataset includes information on policy measures related to closure and containment, health, and economic policy for more than 180 countries. Further details can be found in Hale et al. (2021).

References

Ahelegbey, D. F., Billio, M., & Casarin, R. (2016a). Bayesian graphical models for structural vector autoregressive processes. Journal of Applied Econometrics, 31(2), 357–386.

Ahelegbey, D. F., Billio, M., & Casarin, R. (2016b). Sparse graphical vector autoregression: A Bayesian approach. Annals of Economics and Statistics/Annales d’Économie et de Statistique, 123(124), 333–361.

Ahelegbey, D. F., Billio, M., & Casarin, R. (2021). Modeling turning points in the global equity market. Econometrics and Statistics.

Ali, W., Sadiq, F., Kumail, T., Li, H., Zahid, M., & Sohag, K. (2020). A cointegration analysis of structural change, international tourism and energy consumption on CO2 emission in Pakistan. Current Issues in Tourism, 23(23), 3001–3015.

Amankwah-Amoah, J., Khan, Z., & Wood, G. (2021). COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice. European Management Journal, 39(2), 179–184.

Amisano, G., & Giannini, C. (2012). Topics in structural VAR econometrics (Vol. 381). Berlin: Springer.

Amusat, O. O., Shearing, P. R., & Fraga, E. S. (2018). Optimal design of hybrid energy systems incorporating stochastic renewable resources fluctuations. Journal of Energy Storage, 15, 379–399.

Bassetti, F., Casarin, R., & Leisen, F. (2014). Beta-product dependent Pitman-Yor processes for Bayesian inference. Journal of Econometrics, 1, 49–72.

Bento, P., Mariano, S., Calado, M., & Pombo, J. (2021). Impacts of the COVID-19 pandemic on electric energy load and pricing in the Iberian electricity market. Energy Reports, 7, 4833–4849.

Bigerna, S., Bollino, C. A., D’Errico, M. C., & Polinori, P. (2022). COVID-19 lockdown and market power in the Italian electricity market. Energy Policy, 161, 112700.

Bigerna, S., Bollino, C. A., & Polinori, P. (2016). Market power and transmission congestion in the Italian electricity market. The Energy Journal, 37(2), 133–154.

Billio, M., Casarin, R., Ravazzolo, F., & Van Dijk, H. K. (2016). Interconnections between Eurozone and US booms and busts using a Bayesian panel Markov-switching VAR model. Journal of Applied Econometrics, 31(7), 1352–1370.

Billio, M., Casarin, R., & Rossini, L. (2019). Bayesian nonparametric sparse VAR models. Journal of Econometrics, 212(1), 97–115.

Blanchard, O. J., & Watson, M. W. (2007). Are business cycles all alike? (pp. 123–180). Chicago: University of Chicago Press.

Canova, F., & Ciccarelli, M. (2004). Forecasting and turning point predictions in a Bayesian panel VAR model. Journal of Econometrics, 120(2), 327–359.

Canova, F., & Ciccarelli, M. (2009). Estimating multicountry VAR models. International Economic Review, 50(3), 929–959.

Carvalho, C. M., & West, M. (2007). Dynamic matrix-variate graphical models., 2(1), 69–98.

Casarin, R., Foroni, C., Marcellino, M., & Ravazzolo, F. (2018). Uncertainty through the lenses of a mixed-frequency Bayesian panel Markov-switching model. The Annals of Applied Statistics, 12(4), 2559–2586.

Casarin, R., Iacopini, M., Molina, G., Ter Horst, E., Espinasa, R., Sucre, C., & Rigobon, R. (2020). Multilayer network analysis of oil linkages. The Econometrics Journal, 23(2), 269–296.

Casarin, R., Sartore, D., & Tronzano, M. (2018). A Bayesian Markov-switching correlation model for contagion analysis on exchange rate markets. Journal of Business & Economic Statistics, 36(1), 101–114.

Corander, J., & Villani, M. (2006). A Bayesian approach to modelling graphical vector autoregressions. Journal of Time Series Analysis, 27(1), 141–156.

David, P. A. (1987). Some new standards for the economics of standardization in the information age (pp. 206–239). Cambridge: Cambridge University Press.

Dawid, A. P., & Lauritzen, S. L. (1993). Hyper Markov laws in the statistical analysis of decomposable graphical models. The Annals of Statistics, 21, 1272–1317.

Fang, R., & Hill, D. J. (2003). A new strategy for transmission expansion in competitive electricity markets. IEEE Transactions on Power Systems, 18(1), 374–380.

Fezzi, C., & Fanghella, V. (2020). Real-time estimation of the short-run impact of COVID-19 on economic activity using electricity market data. Environmental and Resource Economics, 76(4), 885–900.

Fianu, E. S., Ahelegbey, D. F., & Grossi, L. (2022). Modeling risk contagion in the Italian zonal electricity market. European Journal of Operational Research, 298(2), 656–679.

Gefang, D. (2014). Bayesian doubly adaptive elastic-net lasso for VAR shrinkage. International Journal of Forecasting, 30(1), 1–11.

George, E. I., Sun, D., & Ni, S. (2008). Bayesian stochastic search for VAR model restrictions. Journal of Econometrics, 142(1), 553–580.

Gestore Mercati Energetici, G. (2014). Annual report 2014.

Gestore Mercati Energetici, G. (2015). Annual report 2015.

Gestore Mercati Energetici, G. (2016). Annual report 2016.

Gestore Mercati Energetici, G. (2017). Annual report 2017.

Gestore Mercati Energetici, G. (2018). Annual report 2018.

Gestore Mercati Energetici, G. (2019). Annual report 2019.

Gestore Mercati Energetici, G. (2020). Annual report 2020.

Gianfreda, A., & Grossi, L. (2012). Forecasting Italian electricity zonal prices with exogenous variables. Energy Economics, 34(6), 2228–2239.

Gruber, L. F., & West, M. (2017). Bayesian online variable selection and scalable multivariate volatility forecasting in simultaneous graphical dynamic linear models. Econometrics and Statistics, 3, 3–22.

Hale, T., Angrist, N., Goldszmidt, R., Kira, B., Petherick, A., Phillips, T., Webster, S., Cameron-Blake, E., Hallas, L., Majumdar, S., et al. (2021). A global panel database of pandemic policies (Oxford COVID-19 government response tracker). Nature Human Behaviour, 5(4), 529–538.

Hirth, L. (2013). The market value of variable renewables: The effect of solar wind power variability on their relative price. Energy Economics, 38, 218–236.

Imani, M. H., Bompard, E., Colella, P., & Huang, T. (2021). Forecasting electricity price in different time horizons: An application to the Italian electricity market. IEEE Transactions on Industry Applications, 57(6), 5726–5736.

Ivanov, D. (2020). Viable supply chain model: Integrating agility, resilience and sustainability perspectives–lessons from and thinking beyond the COVID-19 pandemic. Annals of Operations Research, 319, 1–21.

Jones, B., Carvalho, C., Dobra, A., Hans, C., Carter, C., & West, M. (2005). Experiments in stochastic computation for high-dimensional graphical models.

Jones, B., & West, M. (2005). Covariance decomposition in undirected gaussian graphical models. Biometrika, 92(4), 779–786.

Joskow, P. L. (2006). Competitive electricity markets and investment in new generating capacity.

Joskow, P., & Tirole, J. (2005). Merchant transmission investment. The Journal of Industrial Economics, 53(2), 233–264.

Kalli, M. (2018). Bayesian nonparametric vector autoregressive models. Journal of Econometrics, 2, 267–282.

Koop, G., Korobilis, D., & Pettenuzzo, D. (2019). Bayesian compressed vector autoregressions. Journal of Econometrics, 210(1), 135–154.

Koop, G., & Potter, S. M. (2007). Estimation and forecasting in models with multiple breaks. The Review of Economic Studies, 74(3), 763–789.

Korobilis, D. (2016). Prior selection for panel vector autoregressions. Computational Statistics and Data Analysis, 101, 110–120.

Kurant, M., & Thiran, P. (2006). Layered complex networks. Physical Review Letters, 96(13), 138701.

Lauritzen, S. L. (1996). Graphical models (Vol. 17). Oxford: Clarendon Press.

Lazo, J., Aguirre, G., & Watts, D. (2022). An impact study of COVID-19 on the electricity sector: A comprehensive literature review and Ibero-American survey. Renewable and Sustainable Energy Reviews, 158, 112135.

Mathieu, E., Ritchie, H., Rodés-Guirao, L., Appel, C., Giattino, C., Hasell, J., Macdonald, B., Dattani, S., Beltekian, D., Ortiz-Ospina, E., & Roser, M. (2020). Coronavirus pandemic (COVID-19). Our World in Data. https://ourworldindata.org/coronavirus.

Matos, C. R., Carneiro, J. F., & Silva, P. P. (2019). Overview of large-scale underground energy storage technologies for integration of renewable energies and criteria for reservoir identification. Journal of Energy Storage, 21, 241–258.

Norouzi, N. (2022). COVID-19 and the electricity market. In C. R. G. Popescu (Ed.), Handbook of research on changing dynamics in responsible and sustainable business in the post-COVID-19 era, Chapter 6. Business Science Reference: Hershey, PA.

Norouzi, N., Zarazua de Rubens, G. Z., Enevoldsen, P., & Behzadi Forough, A. (2021). The impact of COVID-19 on the electricity sector in Spain: An econometric approach based on prices. International Journal of Energy Research, 45(4), 6320–6332.

Paci, L., & Consonni, G. (2020). Structural learning of contemporaneous dependencies in graphical VAR models. Computational Statistics and Data Analysis, 144, 12.

Papaioannou, G. P., Dikaiakos, C., Evangelidis, G., Papaioannou, P. G., & Georgiadis, D. S. (2015). Co-movement analysis of Italian and Greek electricity market wholesale prices by using a wavelet approach. Energies, 8(10), 11770–11799.

Queiroz, M. M., Ivanov, D., Dolgui, A., & Wamba, S. F. (2020). Impacts of epidemic outbreaks on supply chains: Mapping a research agenda amid the COVID-19 pandemic through a structured literature review. Annals of Operations Research, 319, 1–38.

Ritzenhofen, I., Birge, J. R., & Spinler, S. (2016). The structural impact of renewable portfolio standards and feed-in-tariffs on electricity markets. European Journal of Operational Research, 255(1), 224–242.

Ruggieri, E., & Antonellis, M. (2016). An exact approach to Bayesian sequential change point detection. Computational Statistics and Data Analysis, 97, 71–86.

Siddique, A., Shahzad, A., Lawler, J., Mahmoud, K. A., Lee, D. S., Ali, N., Bilal, M., & Rasool, K. (2021). Unprecedented environmental and energy impacts and challenges of COVID-19 pandemic. Environmental Research, 193, 110443.

Sims, C. A. (1980). Macroeconomics and reality. Econometrica, Econometric Society, 48(1), 1–48.

Sims, C. A., & Zha, T. (2006). Were there regime switches in US monetary policy? American Economic Review, 96(1), 54–81.

Terna. (2021). The new electricity market zones: What you need to know. Retrieved February 9, 2023, from https://lightbox.terna.it/en/insight/new-electricity-market-zones.

Valles-Catala, T., Massucci, F. A., Guimera, R., & Sales-Pardo, M. (2016). Multilayer stochastic block models reveal the multilayer structure of complex networks. Physical Review X, 6(1), 011036.

Ventosa, M., Baıllo, A., Ramos, A., & Rivier, M. (2005). Electricity market modeling trends. Energy Policy, 33(7), 897–913.

Wang, H. (2010). Sparse seemingly unrelated regression modelling: Applications in finance and econometrics. Computational Statistics and Data Analysis, 54, 2866–2877.

Wang, H., Reeson, C., & Carvalho, C. M. (2011). Dynamic financial index models: Modeling conditional dependencies via graphs. Bayesian Analysis, 6(4), 639–664.

Wang, H., & West, M. (2009). Bayesian analysis of matrix normal graphical models. Biometrika, 96, 821–834.

Whittaker, J. (2009). Graphical models in applied multivariate statistics. Hoboken: Wiley Publishing.

Yu, X., Yang, Q., Ai, K., Zhu, X., & Wang, W. (2020). Information spreading on two-layered multiplex networks with limited contact. IEEE Access, 8, 104316–104325.

Zeppini, P., & Van Den Bergh, J. C. (2020). Global competition dynamics of fossil fuels and renewable energy under climate policies and peak oil: A behavioural model. Energy Policy, 136, 110907.

Zheng, C., & Zhang, J. (2021). The impact of COVID-19 on the efficiency of microfinance institutions. International Review of Economics & Finance, 71, 407–423.

Acknowledgements

The authors’ research used the HPC multiprocessor systems at the Ca’ Foscari University of Venice. This work was partly funded by the MUR–PRIN projects ‘Innovative statistical tools for the analysis of large and heterogeneous customs data’ under g.a. 2022LANNKC and ‘Discrete random structures for Bayesian learning and prediction’ under g.a. n. 2022CLTYP4, the European Union’s Horizon2020 project Periscope, contract number No 101016233 and the Next Generation EU – ‘GRINS – Growing Resilient, INclusive and Sustainable’ project (PE0000018), National Recovery and Resilience Plan (NRRP) – PE9. The views and opinions expressed are only those of the authors and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the European Commission can be held responsible for them.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ahelegbey, D.F., Casarin, R., Fianu, E.S. et al. Structural changes in contagion channels: the impact of COVID-19 on the Italian electricity market. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-05893-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-05893-x

Keywords

- Bayesian inference

- Complex networks

- Electricity price returns and volatility

- OR in energy

- Returns and volatility transmission

- Systemic risk

- Zonal electricity market