Abstract

Following the European Debt Crisis, there was a significant push for greater fiscal discipline across the EU member states. This began with the revitalization of the Stability and Growth Pact in 2011 and continued with the adoption of the Fiscal Stability Treaty of 2013. The measures were designed to maintain or achieve both government debt-to-GDP ratios of below 60% and government budget deficits of below 3%. This paper investigates whether the fiscal discipline measures had an impact on the relationship between fiscal and current account balances. Using the synthetic control method, we examine current account balances in each EU member state that implemented the fiscal provisions in the treaty (Title III), compared to a synthetic counterfactual economy. We find that countries most impacted by the European Debt Crisis experienced the greatest improvement in their current account deficits from the fiscal discipline measures. Several other EU member states also experienced stabilization in their current account balances compared to their synthetic counterfactuals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the aftermath of the European Debt Crisis, several measures were adopted to reform and unify fiscal policy across the European Union (EU). Notably, starting with the revival of the Stability and Growth Pact (SGP) in 2011 and continuing with the adoption of the Fiscal Stability Treaty in 2013, the measures aimed to ensure greater fiscal unity and transparency across EU member states. They were designed to maintain or achieve both government debt-to-GDP ratios of below 60% and government budget deficits of no more than 3% of GDP.

The revived commitment to fiscal discipline and policy coordination across the EU member states after the European Debt Crisis may have important implications for current account imbalances in the region. According to the twin deficits hypothesis, there is a causal link between a country’s government budget balance and its current account balance. Various studies have investigated the linkages between fiscal and current account balances across advanced and emerging economies, finding that improvement (deterioration) in fiscal balances corresponds to improvement (deterioration) in current account balances as well (Abbas et al. 2011; Vansteenkiste and Nickel 2008).

The research presented in this paper aims to contribute to the literature by examining what effect the reformed policies on fiscal discipline in Europe may have on the relationship between fiscal and current account balances across EU member states. Specifically, we assess whether the adoption of fiscal discipline commitments through the Stability and Growth Pact, and eventually through the fiscal provisions of Title III in the Fiscal Stability Treaty, has an effect on current account balances in the participating countries. We expect the fiscal measures taken in Europe to have a limiting effect on budget deficits of member countries thereby leading to smaller current account deficits. We use the synthetic control method and construct a counterfactual economy from a donor pool for each country to test whether the current account balance would have been different if the fiscal restrictions were not in place, while implicitly controlling for other factors. Using the synthetic control method has been found to provide substantial advantages in empirical modeling for out-of-sample predictions and analysis (Abadie 2021a).Footnote 1 For example, with this method, we are able to model the current account balances from 2012 to 2019 for a country that implemented fiscal discipline measures, such as Finland, based on characteristics that determine current account balances to create a “counterfactual Finland”, where the balances before the policy change match up very closely. We can then compare the current account balances of the “counterfactual Finland”, which represents the case if the fiscal discipline measures were not adopted, to the actual current account balances after the adoption and implementation of the measures. By comparing the current account balances from the actual data and the counterfactual estimation, we can determine whether the fiscal discipline measures impacted current account balances.

We find a significant impact of the fiscal discipline measures on current account balances in countries that were most affected by the European Debt Crisis. Specifically, Greece, Italy, Portugal, and Spain all experience improvement and stabilization of their current account balances upon commitment to the fiscal discipline measures compared to the synthetic counterfactual estimates. Several other EU countries experience a stabilization in their current account balances as well after the start of these measures, including Bulgaria, Estonia, Latvia, Lithuania, Luxembourg, Romania, and Slovakia. Moreover, the impact of the more stringent rules in the 2011 reforms of the Stability and Growth Pact had a more significant effect on current account balance improvement than the eventual adoption, ratification, and implementation of Title III of the Fiscal Stability Treaty. This signifies the success of the early measures of fiscal discipline enacted in 2011, which ultimately led to the 2013 Fiscal Stability Treaty.

The remainder of the paper is structured as follows. “Section 2” presents a review of the literature on linkages between fiscal and current account balances, current account imbalances in Europe, and the European fiscal discipline efforts. “Section 3” presents the methodology, and “Section 4” the empirical results. “Section 5” concludes the study.

2 Literature review

2.1 European fiscal policy coordination

At the start of the European Monetary Union (EMU) in 1999, there was a consolidated effort to coordinate fiscal policy by bringing down public debt ratios and improving fiscal deficits. Once the euro had been introduced, these efforts diminished, fiscal policies were relaxed, and lower interest rates fueled increases in primary spending. As the 2008–2009 Global Financial Crisis spread across Europe, there was further deterioration of public finances across the euro area (Schuknecht et al. 2011). Furthermore, the sovereign debt crisis that beset the euro area in 2010 was a symptom of the failure to coordinate fiscal policy measures among member countries. The spillover effects of the financial and economic crisis of 2009 added to the existing fiscal disparities in several member states.

The drastic deterioration in fiscal balances in individual countries risked undermining stability, growth, and employment across the EU.

The EU-wide Stability and Growth Pact (SGP) was first agreed to in 1997 to strengthen the monitoring and coordination of national fiscal and economic policies. The goal was to enforce deficit and debt limits established by the Maastricht Treaty. However, there were several instances where the terms of the agreement were breached by Greece, Portugal, Italy, France, and Germany when fiscal deficits exceeded the 3% threshold. The enforcement of the initial SGP was lenient, with lengthy extensions granted to the excessive deficit procedures and limited adjustment efforts required of member states (Schuknecht et al. 2011).

After the fallout of the European Debt Crisis in 2010, there was an effort to resurrect the SGP, by making it more comprehensive and predictable. The new laws included regulation on public accounting systems covering all areas of income and expenditure; requirements to make fiscal data publicly available; ensuring fiscal planning is based on the most accurate macroeconomic and budgetary forecasts available; specific fiscal rules to ensure government budgets align with European rules; establishing a credible and effective medium-term budgetary framework; and ensuring consistency and coordination of all accounting rules and procedures.Footnote 2 These rules have been termed the “Six Pack”. The 2011 SGP reforms included enhancements to the EU’s governance rules. The monitoring of budgetary and economic policies was organized under the European Semester, which provides a framework for the coordination of economic policies across the EU. Most importantly, an automatic procedure for imposing penalties for violations was introduced. This made the SGP of 2011 more stringent than the original version.

The Stability and Growth Pact criteria apply to both euro area and non-euro area member states and require, as mentioned earlier, the fiscal budget deficit to not exceed 3% of GDP, and the debt-to-GDP ratios to remain below 60%. These criteria are part of the Medium-Term Budgetary Objective (MTO), which originally required all EU member states to aim at meeting these minimum standards in the medium term. If a country does not reach the MTO, it is required to implement annual improvements for its structural balance in the subsequent years.

In 2012, the Fiscal Stability Treaty was introduced as a stricter version of the 2011 Stability and Growth Pact. It was implemented starting January 2013 for 16 member states, with others beginning implementation in 2015. The Fiscal Stability Treaty has three titles (III–V) which establish rules regarding fiscal discipline, coordination, and governance. Of these, Title III sets out the specific limitations on debt and deficit ratios in the member countries, the details of which are presented in Table 1.Footnote 3

Title III, also known as the Fiscal Compact, binds the euro area member states plus Bulgaria, Denmark, and Romania to specific fiscal discipline rules and measures. National budgets must be in balance or surplus, and an automatic correction mechanism must be in place to correct potential deviations in the budget. Fiscal surveillance by an independent monitoring institution is required. The requirements on fiscal budget balances and debt ratios mirror those established in the SGP. However, the treaty also contains strict rules on breach or noncompliance of the fiscal criteria, requiring states to rectify the issue and show sufficient annual progress toward the debt and deficit limits (European Commission 2012).

2.2 Current account imbalances in Europe

Recent literature on current account imbalances in Europe focuses primarily on the imbalances within the European Monetary Union that arose prior to the 2008–2009 Global Financial Crisis and contributed to the subsequent sovereign debt crisis in Europe. These imbalances, with large, persistent deficits in the southern economies and large, persistent surpluses in the northern economies, have been viewed as a major symptom of the problems of incomplete coordination in financial regulation and fiscal policy within the monetary union (Eichengreen 2010).

One of the contributing factors to the imbalances across the European Monetary Union countries was the decrease in private savings relative to investment in countries that were poorer and less developed. Greater access to financial markets and increased growth prospects upon entering the EMU were primarily responsible for these increased imbalances. Blanchard and Giavazzi (2002) show that savings investment correlations fell both immediately before and at the time of the introduction of the euro due to the financial integration that occurred with the adoption of the single currency. Moreover, current account imbalances across the EMU were fueled by capital flows from more advanced, capital-rich member countries to the less advanced, capital-scarce member countries. Both Schmitz and von Hagen (2011) and Lane (2010) provide additional evidence to support the “good” imbalances of capital and investment flowing into the lower income-per-capita countries from higher income-per-capita countries after the introduction of the euro. However, the “good” imbalances turned out to be not so great, as countries with the largest domestic distortions attracted the most intra-EMU capital, leading to asset booms, excessive budget deficits, and unrealistic expectations of future growth (Berger and Nitsch 2010; Zemanek et al. 2009).

Similar to Blanchard and Giavazzi (2002), Hope (2016) finds that the introduction of the euro was responsible for divergence in current account balances across the euro area leading up to the European Debt Crisis. The current account imbalances across the euro area saw growing deficits in the lower income-per-capita southern economies (and Ireland) and growing surpluses in the higher income-per-capita northern economies. In the fallout of the Global Financial Crisis, investors were hesitant to lend to the indebted southern euro-area economies, which were running large current account deficits. With the lack of a credible lender of last resort and the lack of a banking union, the EMU got pushed into a sovereign debt crisis (DeGrauwe 2013; Iversen et al. 2016; Moro 2014). Moreover, countries that ran the greatest current account deficits—Italy, Ireland, Spain, Greece, and Portugal were the ones most deeply affected by the sovereign debt crisis (Brancaccio 2012; Carlin 2013).

Other factors driving current account imbalances in the euro area include declining export competition and asymmetric trade developments vis-a-vis non-EU countries (Chen et al. 2013). The growing deficits in the euro area against the rest of the world were financed primarily through cheap intra-EMU capital flows, which contributed to the growth of these imbalances over time.

2.3 Fiscal and current account balances

Bringing fiscal and current account imbalances together, Eichengreen (2010) argues that one potential factor driving “bad [current account] imbalances” is “excessive budget deficits” in individual member states together with a lack of EU-wide fiscal policy coordination. Our emphasis is on the effects of fiscal policy coordination on the relationship between the fiscal and current account balances, which has long been of interest to policymakers and academics alike. There have been numerous studies examining the linkage between these two variables to test the “twin deficits” hypothesis, which suggests a causal link between the government budget balance and the current account balance in an economy. Therefore, we make the simplifying assumption that changes in government consumption or taxation will yield changes in the fiscal balance, and we analyze the impact on the current account balance through that channel. Although imperfect, it allows for the analysis of the fiscal policy coordination across the participating EU members and the subsequent potential impact on current account balances. We recognize that this simplification may not fully reflect changes in tax policy or shifts in government consumption spending, which may not impact the fiscal balance but may affect the current account, such as a VAT tax or substitution of domestic goods for imported goods. However, from the perspective of assessing fiscal policy coordination’s impact on overall fiscal balances that may correspond to changing current account balances, this simplification allows us to proceed with our analysis through the proposed methodology.

From a theoretical perspective, there are two channels through which changes in fiscal balances can affect current account balances. First, when there is an increase in government consumption of tradable goods or, alternatively, a tax reduction, there is a direct effect on the demand for imports. All else equal, this will increase current account deficits. Second, if the increase in government consumption or private consumption (due to a tax reduction) corresponds to increased demand for non-tradable goods, their relative price increases and yields appreciation pressure on the real exchange rate. As the real exchange rate appreciates, the overall consumption of tradable goods increases while production declines, leading to an increase in current account deficits. Both channels are represented in Mundell (1960) as effects of fiscal balances on intratemporal trade through relative price changes.Footnote 4

From an empirical perspective, several studies have found that fiscal expansion increases current account deficits, while improvements in government budget balances correspond to improvements in the current account balance. However, this relationship is not one-for-one and has been found to be significant in both advanced and emerging economies. Normandin (2006) studies the effect in USA and Canada using a vector autoregression model and finds that tax cuts which lead to increases in budget deficits deteriorate the current account balance. For each 1% increase in the budget deficit, the current account balance deteriorates by less than 1%. Boileau and Normandin (2012) perform an empirical analysis of the effects of tax cuts on the current account in 16 industrialized economies. They conclude that budget and current account deficits move in the same direction in all sample countries. Similarly, in a more recent work, Klein and Linnemann (2019) find that exogenous tax reductions increase the US current account balance via the import channel. Furthermore, they find that increased government consumption amplifies this effect. Hayo and Mierzwa (2021) study the effect of tax policy changes on the trade balance in the US, UK, and Germany, finding that reductions in various taxes, either direct and indirect changes, yield a rise in imports without a notable change in exports. They conclude that while tax cuts lead to increased trade deficits in Germany and the US, the magnitudes are not economically meaningful. Dewald and Ulan (1990), Miller and Russek (1989), and Summers (1986) come to similar conclusions regarding the relationship between fiscal deficits and a deterioration in the current account balance for the US, and Beetsma et al. (2007) for select EU countries. In conducting a panel regression analysis for 63 advanced and developing economies, Mohammadi (2004) finds that if an increase in government spending is bond-financed, the impact on increasing the current account deficit is larger than if the spending was tax-financed.

Abiad et al. (2009) find that across 135 countries, improvements in budget balances as a share of GDP by 1% correspond to improvements in the current account by 0.3% of GDP. Kennedy and Sløk (2005) and Piersanti (2000) focus on OECD countries and conclude a similar relationship between improving government budget balances and the current account. Chinn and Prasad (2003) find that the impact of budget balances on the current account is larger in developing economies than in advanced ones. This finding is also supported by Abbas et al. (2011) where the impact was most significant in emerging rather than advanced economies. The size of the impact may depend not only on the level of development but also on the degree of trade integration. Corsetti and Mu¨ller (2006) and Corsetti and Mu¨ller (2008) find that fiscal shocks have a greater and longer-lasting impact on the current account in economies where total trade is higher as a share of GDP.

3 Methodology

In this paper, we focus on estimating the effects of the fiscal discipline policies established in the 2011 Reforms of the Stability and Growth Pact and the 2013 Fiscal Stability Treaty on the relationship between fiscal and current account balances. We analyze the effects in countries that have formally adopted and implemented Title III of the Fiscal Stability Treaty, which establishes limits on the fiscal budget balance and government debt-to-GDP ratios in each country and was ratified by each participating country’s government. Title III of the Fiscal Stability Treaty, implemented by most countries in 2013, is the culmination of efforts started in 2011 through the reforms of and re-commitment to the Stability and Growth Pact, as discussed in “Section 2.3”. We use the synthetic control method to test whether the adoption of these fiscal discipline measures has impacted current account balances.

In the synthetic control method, the countries that are affected by the policy change of interest are considered the “treatment” countries. In our analysis, the policy treatment is the implementation of fiscal discipline measures that are part of the 2011 update of the Stability and Growth Pact, and, alternatively, the ratification of Title III of the Fiscal Stability Treaty in 2013.Footnote 5 The goal is to estimate the impact of the policy implementation on current account balances by comparing the actual current account balance after adoption and implementation to a synthetic counterfactual country, which presents an estimation of the current account balances if the policies were never implemented.

The synthetic control method uses a donor pool of countries to construct a counterfactual economy for each treatment country. The counterfactual economy is created as a weighted combination of “nontreatment” countries from the donor pool that are not affected by the policy change displaying similar characteristics as the treatment country in the pre-treatment period.Footnote 6 The characteristics used to select the donor weights which create the counterfactual economy are based on factors that determine changes in current account balances.

The identification assumption of the synthetic control method is that if the synthetic, counterfactual economy can closely approximate the data on current account balances prior to the policy change, then the subsequent difference between the synthetic and actual data in the post-treatment period is attributed to the effect of the policy.Footnote 7 If the effect of the fiscal measures is not significant, then the synthetic data will not diverge notably from the actual data in the post-treatment period. However, if there is a significant effect on current account balances from the policy implementation, then the treatment and synthetic data will differ substantially in the post-treatment period.Footnote 8

For each country estimation, there are J + 1 countries in the data set in periods 1 to T. Country A is exposed to the policy treatment during periods T0 to T, with 1 < T0 < T. The policy treatment occurs at T0, and (1 to T0 − 1) is the pre-treatment period. The J “non-treatment” countries, i.e., the donor pool, are used to create the synthetic estimation of country A.

Assume YitN represents the outcomes that would be observed for country i at time t in the absence of the policy treatment, and YitI represents the outcome that is observed for country i in time t if exposed to the policy treatment in periods T0 to T. Let α1t represent the effect of the policy treatment for unit 1 (country A) at time t where α1t = YitI − YitN. Note that only YitI can be observed, and therefore α1t can only be measured by estimating YitN. The policy treatment effect, α1t, can therefore be estimated by modeling YitN as follows (Abadie et al. 2010):

where δt is an unobserved common time-dependent factor, \({X}_{it}\) is a vector of observed covariates that are not affected by the intervention, \({\Theta }_{t}\) is a vector of unknown parameters, \({\lambda }_{t}\) is a vector of unknown common factors, \({\mu }_{i}\) is a vector of unknown factor loadings, and it is a vector of unobserved transitory shocks.

Abadie et al. (2015) find that Xit and pre-treatment Yit of unit 1 (country A) can often be more accurately approximated using a weighted combination of untreated units, rather than by a single untreated unit. The synthetic control method assigns different weights to the untreated units in the donor pool in a way that minimizes the root mean squared prediction error (RMSPE), a measure of the goodness of fit of the synthetic control. Therefore, the synthetic controls represent the weighted average of the non-treated units in the donor pool.

The weights for the non-treated countries are chosen to minimize the difference between the values predicted by the model, known as the counterfactual values, and the values actually observed in the data. Assume W = (w2 + … + wJ+1) is a vector of weights, where wj ≥ 0 for j = 2,…,J + 1 and w2 + … + wJ+1 = 1. Each value of W represents a potential synthetic control. The model assigns weights to each non-treatment country to match the counterfactual values to the real data in the pretreatment period.

In our model, the outcome variable Yit represents the current account balance. The set of pretreatment variables, Xit, represents predictors of changes in current account balances. Based on a survey of the literature assessing determinants that drive changes in the current account,Footnote 9 the Xit variables in Eq. 1 include real GDP growth, GDP per capita, change in the real effective exchange rate, terms of trade, trade openness10, and short-term interest rates. The predictor variables are averaged over the pre-treatment period and are augmented by including four lagged values of the current account balance (2000, 2004, 2008, and 2010). Following Abadie et al. (2010), we utilize the four lagged values of the variable that is being tested for policy impact, rather than the average over the pre-treatment period, to anchor the synthetic current account balances to existing balances while also controlling for factors that have a theoretical effect on the current account. We have tested several variations of selected lags, with the years reported here yielding the most consistent results. Results for other lag variations are available upon request.

The weights are selected to minimize the root mean squared prediction error term over the pretreatment period (Abadie et al. 2010; Abadie & Gardeazabal 2003)Footnote 10:

Once the weights are assigned in the pre-treatment period to estimate the counterfactual values, the treatment effect of the policy can be estimated as follows:

To test the significance of the results, we compare the RMSPE in the pre- and post-treatment periods. The ratio of post-RMSPE to pre-RMSPE indicates how closely the synthetic counterfactual can match up to the real data before and after the policy treatment. If the pre-RMSPE is small, and the post-RMSPE is large relative to the pre-RMSPE, this would lead to two important conclusions. First, the synthetic counterfactual was effective in replicating the real data prior to the policy change, indicated by the small pre-RMSPE. Second, the effect of the policy was significant enough in the treatment country that the donor pool was unable to effectively match up the synthetic data to the real data in the post-treatment period, indicated by the large post-RMSPE relative to the pre-RMSPE.

The analysis includes 19 EU member states which ratified and implemented Title III of the Fiscal Stability Treaty. We set the treatment period based on each country’s implementation of the treaty. We use annual data from 2000 to 2019, collected from the IMF International Financial Statistics database. The donor pool used to construct the synthetic controls includes 18 countries: 5 EU countries which did not ratify and implement Title III of the Fiscal Stability TreatyFootnote 11 and 13 OECD countries.Footnote 12 The pre-treatment period is 2000–2010 for analysis of the 2011 Reforms of the Stability and Growth Pact, and 2000–2012 for the implementation of Title III14.

There are several limitations to the empirical approach that must be pointed out. First, the estimation of the post-treatment period is contingent on the donor pool of countries, which may or may not face the same macroeconomic environment, shocks, or systemic changes that the treatment country is experiencing in the pre- and post-treatment periods. Specifically, in our analysis, the weighted synthetic country is comprised of several non-EU countries, mainly other OECD countries, that would be experiencing different economic conditions in their home country and with the rest of the world during the period of analysis than the EU-member state that is being analyzed. Most non-EU countries would not be affected as severely by the macroeconomic spillover of the European Debt Crisis, nor would respond to the changing policies of the European Central Bank and European Commission. In some cases, the countries in the donor pool are unable to match the pre-treatment conditions in the treatment country. The macroeconomic environment is fundamentally different in the treatment country compared to the donor pool, and an estimation cannot be made. This is the case for Germany in our analysis.

Due to the persistent and sizable current account surpluses in Germany, the synthetic control method was unable to construct a synthetic economy to match the experience of the German economy for the pre-treatment period sufficiently closely. Therefore, the results in the post-treatment period would not have accurately presented the impact of the fiscal discipline measures in Germany. This is due to the uncommonly large and persistent surpluses that Germany has experienced since 2000 compared to other OECD economies. Based on the countries we have utilized in the donor pool, none had current account dynamics or characteristics to match those of Germany.Footnote 13

Furthermore, there may be country-specific shocks and policy changes that impact the current account balances in the donor countries that are not found in the treatment countries, and therefore influence the current account in the post-treatment period that is unrelated to the policy change that is being analyzed. Finally, unlike time series analysis or vector autoregression analysis, that model and the estimated relationship between variables, the synthetic control method estimates a proxy of the treatment variable conditional on whether the policy occurred or not. Therefore, although it provides insight into the potential alternative scenario if the policy change had not been implemented, it does not estimate the magnitude of the impact of changes in fiscal balances on the current account that would be done in the aforementioned empirical methods.

4 Empirical results

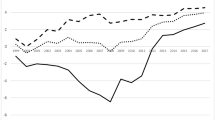

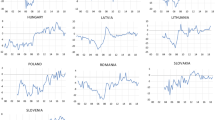

In this section, we present the results of the synthetic control method, analyzing the impact of fiscal discipline measures on current account balances. Appendix Table 4 presents the donor pool for each treatment country. Weights are assigned to donor countries to create a synthetic counterfactual which mirrors the economic characteristics that determine current account balances for each treatment country in the pretreatment period. The synthetic country presents the counterfactual estimation of the current account balance in each treatment country during the treatment period if the fiscal discipline measures were not implemented. As can be seen from Appendix Table 4, each treatment country has a different combination of weights and donors to create its counterfactual. It is important to note that the weights for the donor countries are assigned based on the ability to replicate the current account trends in the pre-treatment period, matching the determining factors that influence current account balances, such as real GDP growth, GDP per capita, short term interest rates, terms of trade, and real effective exchange rates. As can be seen in Fig. 1, the counterfactuals are able to closely match the trend in the current account balances in the pre-treatment period for most countries. Here, the solid black line depicts the actual data for the EFC countries, and the synthetic counterfactual results are depicted with the dotted line. Furthermore, in Table 2 the pre-treatment RMSPE terms are relatively low in most countries with the exception of Spain. This indicates that the counterfactual estimate is able to match the current account trends in most of the countries under study prior to the policy change.

Synthetic control method results (2011). This figure illustrates synthetic control method results for each country that is part of the Fiscal Stability Treaty. The treatment year is set as 2011, as explained in “Section 3”

It is important to note that this estimation approach requires that the donor countries used to create the synthetic control country are not impacted by the condition that is being tested, which in this paper are the fiscal discipline policies adopted by the European nations. This is done precisely to estimate what the impact would have been on the current account balance if the policy changes had not occurred because they did not occur in the donor countries. The training period prior to the policy change (2000 to 2010) is used to create weights that match the current account balance of the given European country before the policy is enacted. Estimating the synthetic control country from a group of countries that are also affected by the policy change would not present accurate results in the post-policy period, since the variable in question in the synthetic estimation would be affected partly by the policy change. Therefore, although economic intuition may have matched the estimated country with donor countries from Europe, we have selected OECD and European nations that did not ratify or implement the EFC as part of the donor pool to ensure accurate results in the post-treatment period, which aligns with the model estimation requirements. The risk of this approach, and the estimation of the synthetic control method in general, is that because the selection of donor countries must come from those not affected by the policy change; there are macroeconomic conditions, policy changes, and shocks in the donor countries that are different from the treatment country. Therefore, the greater the distance in these conditions and trends between the treatment country and the donor country, the risk of diverging economic behavior with respect to the estimated variable may be greater.

Figure 1 presents the estimation of the current account balances based on the synthetic control method when the policy treatment occurred in 2011. This corresponds to the first round of fiscal discipline measures implemented after the European Debt Crisis as part of the reforms enacted for the Stability and Growth Pact, which created more stringent rules around fiscal discipline. The adoption of fiscal discipline measures in 2011 had a significant impact on the countries most affected by the European Debt Crisis: Greece, Italy, Portugal, and Spain. A sizable divergence between the actual and synthetic data starting at the treatment year implies that the policy change which took place at that time had a notable impact on the trajectory of the current account balance in the treatment country. It could not be replicated by the synthetic donor pool, the group of countries not affected by the policy. In Fig. 2, the synthetic counterfactual estimates that current account balances would have deteriorated further if the fiscal discipline measures were not adopted and implemented. In other words, there is a notable impact on reverting the trend of current account deficits in these countries, leading to a stabilization of the current account balance, and even a surplus in Italy. Moreover, in countries such as Bulgaria, Estonia, Latvia, Lithuania, Luxembourg, Romania, and Slovakia, the current account is more balanced than it otherwise would have been if the fiscal discipline measures were not in place. The fiscal policy measures also impacted the stabilization of the current account in these countries.

Synthetic control method placebo test. This figure illustrates the placebo test for the synthetic control method. The black line represents the difference between the treated and synthetic current account balance for each country relative to all other countries (gray lines). The red vertical line represents the treatment year of 2011

Table 2 presents the results of the synthetic control method for the EFC countries, reporting both the actual data points (treated) and counterfactual data points (synthetic) for each treatment country. From these results, it is possible to observe how closely the counterfactual is able to replicate the pretreatment country characteristics. Based on the low root mean squared prediction error term (RMSPE), the synthetic control provides a good estimation in the majority of treatment countries; however, it is relatively higher in France, Italy, the Netherlands, and Spain. Moreover, the current account balances in 2015 and 2019 are reported for the actual and synthetic data points in the table. From this, we observe a large divergence in the current account estimation in Greece, Italy, Portugal, and Spain, where the actual data shows a significant improvement in the current account deficits than would have been predicted without the fiscal policy coordination.

As an additional measure to test whether the policy effect is significant, Fig. 2 presents the difference between the actual (treated) and counterfactual (synthetic) current account balances for all countries, treated and non-treated. If the effect of the 2011 fiscal discipline measures is significant in impacting the current account balances of the treatment countries, we would expect to see a large deviation between the treated values and synthetic estimations of the current account balance. The black line presents this difference for each EFC country against the backdrop of all other countries in the analysis. The placebo test runs the synthetic control method for each country, including donor countries, to assess whether the impact of this particular event is significant. In cases where the impact is significant, we expect to see the difference to be notably larger compared to the other countries.

As is evident from Fig. 2, the fiscal discipline measures that began in 2011 had a significant effect on Greece, Italy, Portugal, and Spain. In these economies, the divergence between the actual and synthetic data is relatively large compared to the rest of the countries, indicated by the black line as an outlier in the post-treatment period. Interestingly, from the placebo test, it appears the effect is also notable in Denmark and the Netherlands, albeit smaller. Both Denmark and the Netherlands ran current account surpluses that were larger than predicted by the synthetic counterfactual.

Another important measure to test the significance of the treatment effect in the synthetic control method is to compare the root mean square prediction error (RMSPE) before and after the treatment. As discussed in “Section 3”, the RMSPE provides a goodness of fit measure for the synthetic pool, in other words, how closely the synthetic counterfactual donor pool can replicate the actual data. If the post-treatment RMSPE (post-RMSPE) is large relative to the pre-treatment RMSPE (pre-RMSPE), the counterfactual donor pool does a good job matching up the synthetic current account balance prior to the treatment year. After the treatment year, a large post-RMSPE indicates that the same donor pool predicts a different outcome for the current account if the policy change had never happened. In Fig. 3, the post-RMSPE/pre-RMSPE ratio is presented for each country, both EFC and donor pool countries. The black dots represent the ratio for the EFC countries, whereas the gray dots represent the ratio for the donor pool countries. Across the board, the post-RMSPE is large relative to the pre-RMSPE, indicating a significant divergence in the pre- and post-treatment estimations of the current account. With the exception of Bulgaria, France, and Slovakia, the post-RMSPE is more than four times greater than the pre-RMSPE.

Post-RMSPE to pre-RMSPE ratio. This figure illustrates the ratio of the post-treatment RMSPE to the pre-treatment RMSPE. A large ratio signifies that there is a significant divergence between the pre- and post-treatment estimation of the current account balance for the actual and synthetic countries. The black dots represent the ratio for the EFC countries, while the gray dots represent the ratio for the donor pool countries

During the period of the policy change, the European Debt Crisis was well underway. The crisis period occurred before and persisted beyond the 2011 adoption of the Stability and Growth Pact; however, the effect of the policy change in the model is a clear and distinct deviation of the current account balance from the synthetic estimation upon the adoption of the policy change, seen in Fig. 1. All countries in the analysis, including donor countries, were impacted by the Global Financial Crisis, which was the precursor to the European Debt Crisis. The crisis period is factored into the estimation of the model both in the pre-treatment (2007–2010) and post-treatment (2011–2015) timeframe and therefore is an underlying factor in the model, rather than a cause of the changes that are being estimated and observed. The broad base of European countries analyzed, along with a timeframe that includes the duration of the crisis both before and after the policy change supports the assumption that the model presents evidence of the impact of the Stability and Growth Pact on current account balances across the European Union. This is further supported by the comparison of pre- and post-treatment RMSPE as well.

As a robustness check, we conduct the same synthetic control estimation with the treatment year of 2013, corresponding to the ratification and implementation of Title III of the Fiscal Stability Treaty,Footnote 14.Footnote 15Fig. 4 depicts the synthetic control method estimation results for this policy change. As is evident from the results, the counterfactual estimations are less aligned with the pre-treatment period current account balances than in Fig. 1. This possibly reflects the fact that the policy change on fiscal discipline already began to take effect in 2011, so the donor pool is less able to match up the pretreatment estimations with the policy change already impacting the current account balances. Moreover, as seen in Table 3, the RMSPE values are higher than in Table 2, indicating that the synthetic control estimations with treatment year 2013 are less capable of accurately matching the pre-treatment estimations of the current account balance. As mentioned previously, a sizable divergence between the actual and synthetic data starting at the treatment year implies that the policy change that took place at that time had a notably different impact on the trajectory of the current account balance in the treatment country than in the synthetic economy. This divergence is seen in 2011 but less so in 2013, implying the re-commitment to the Stability and Growth Pact and the policies implemented leading up to the 2013 Fiscal Stability Treaty had a greater effect on current account balances than the 2013 implementation of Title III itself. These results indicate that the anticipation of fiscal discipline policies becoming regulation had a notable impact on adjustments in current account balances.

This can be seen also in Fig. 5, where the post-pre RMSPE ratios in 2011 and 2013 are compared.

Post-RMSPE to pre-RMSPE ratio in 2013 vs. 2011. This figure illustrates the ratio of the post-treatment RMSPE to the pre-treatment RMSPE when the treatment year is 2013 vs. 2011. A large ratio signifies that there is a significant divergence between the pre- and post-treatment synthetic donor pool. In most cases, the post–pre RMSPE ratio is lower when the treatment year is 2013. The black and gray dots represent the post–pre ratio with the treatment year 2011, as identified in Fig. 3. The dotted line represents the difference in the ratio from 2011 to 2013, with the white square indicating the RMSPE ratio with treatment year 2013

The white box indicates the post–pre RMSPE ratio in 2013, whereas the black and gray dots indicate the RMSPE ratio in 2011, which are first seen in Fig. 3. In the countries that experienced the greatest impact of the policy change, notably Greece, Italy, Portugal, and Spain, the treatment year of 2013 produces a much smaller RMSPE ratio compared to the ratio in 2011. The same holds true across the treatment countries, with the exception of Romania, Slovenia, France, and Bulgaria. The smaller post/pre RMSPE ratio in 2013 compared to 2011 indicates that the effect of the Title III implementation in 2013 on current account balances is less significant than the 2011 reforms of the Stability and Growth Pact.

5 Conclusions

Since the inception of the European Monetary Union, the need for fiscal unity to match the monetary unity has been called for by academics and policymakers alike. Early attempts through the 1997 Stability and Growth Pact were not successful, partly due to the weak enforcement and special treatment of the largest European economies, namely France and Germany. After the European Debt Crisis, there was a renewed commitment to and a call for coordinated fiscal discipline across the EU member states. The re-commitment began with the 2011 reforms of the Stability and Growth Pact that included automatic penalties for the violation of the debt-to-GDP and deficit ratios. A renewed attempt to coordinate fiscal policy also began in 2011 and continued through the ratification and implementation of the Fiscal Stability Treaty, of which Title III fortified the commitment to fiscal provisions. With more stringent fiscal rules being adopted across the member states, it is critical to understand whether these policy changes lead to improvements in the current account balances of the most affected countries. There is ample theoretical and empirical evidence for the twin deficits hypothesis that links the improvement (deterioration) of government budget balances with the improvement (deterioration) of current account balances, although the relationship is not one-for-one. The research presented in this paper investigates whether the fiscal discipline measures enacted after the wake of the European Debt Crisis had an impact on current account balances.

Using the synthetic control method, it is clear that the countries most deeply affected by the European Debt Crisis experienced the greatest improvements in their current account balances after the adoption of the fiscal policy changes. Specifically, Greece, Italy, Portugal, and Spain experienced significant improvements in current account balances after the re-commitment to the fiscal discipline measures. The corresponding counterfactual estimations illustrate further sustained deterioration of the current account balance had the fiscal discipline policies not been enacted. The effect of the policy change is most pronounced for the 2011 reforms of the Stability and Growth Pact. Other EU member states also experienced stabilization in the current account upon implementation of the fiscal discipline measures. Through the improvements in government deficit ratios from 2011 to 2019, and the commitment to reining in debt-to-GDP ratios to below 60%, countries most at risk during the debt crisis experienced the greatest improvements in their current account balances.

The findings presented in this paper provide a novel assessment of current account imbalances in Europe with a specific focus on the European experience after the European Debt Crisis, from which a renewed commitment to fiscal discipline arose. However, as coordination continues to improve and increase across the participating EU member states, it will be critical to study how the EU as a whole will deal with the stabilization policies during the onset of crises and recessions. A critical point that needs to be addressed will focus on whether the fiscal discipline measures prevent member states from enacting fiscal expansion in times of recession, and how effective the response can be if it originates from the European Commission. A failure to appropriately address this concern will undermine the notable efforts made toward greater fiscal discipline and integration. Furthermore, the suspension of the fiscal compact during the COVID-19 pandemic will allow interesting research in the future. For example, we could ask, to what degree countries have altered their behavior after a decade of the fiscal compact? Did they go back to pre-2010 fiscal policies? It will be interesting to see how EU member states will then also react to the end of the pandemic and the reactivation of the fiscal compact.

Notes

Athey and Imbens (2017) have called the synthetic control method “arguably the most important innovation in the policy evaluation literature in the last 15 years.”.

According to the European Commission and EU Legislation.

Title IV establishes rules on economic policy coordination and convergence, specifically around competitiveness, employment, fiscal sustainability, and financial stability and coordination. Title V outlines the governance provisions which require the heads of state of euro-area countries, the President of the European Commission, and the President of the European Central Bank to meet twice yearly to discuss competitiveness and governance issues of the euro area (European Council 2012).

However, when the capital account is relatively closed, the dynamics of increased government spending yield a more enduring increase in interest rates. As a result, investment is crowded out, private savings rises, and the impact on the trade and current account balance is diminished and potentially reversed.

Most countries which adopted Title III did so in 2013, with the exception of Belgium, Bulgaria, and Latvia, which implemented the policy in 2014, and Lithuania, which implemented the policy in 2015. We set the treatment period according to the adoption and implementation in each country.

The pre-treatment period is the period prior the policy change.

Abadie et al. (2010, 2015) recommend a “good balance” in terms of both the pre-treatment outcome variable and covariates when estimating weights to achieve an unbiased estimator. “Good balance” in this context means that there is a set of weights that results in equal values of each of these variables for both the treated and the counterfactual unit. However, as pointed out by Ferman et al. (2020), the literature provides only little guidance on the choice of both predictor variables and covariates.

The robustness of the results and the reliability of the analysis depend on having a sufficiently long pre-treatment period (see, for example, Abadie (2021b)).

Kuosmanen et al. (2021) argue that this joint optimization of predictor and control unit weights typically leads to a solution assigning all weight to a single predictor and develop an alternative method to resolve this issue.

Czech Republic, Hungary, Poland, Sweden and United Kingdom.

Australia, Canada, Chile, Colombia, Iceland, Israel, Japan, Korea, Mexico, New Zealand, Norway, Switzerland, and United States. 14.

The pre-treatment period is 2000–2013 for Belgium, Bulgaria and Latvia, which implemented Title III in 2014, and 2000–2014 for Lithuania, which implemented Title III in 2015.

To address the issue of Germany, we re-estimate our model including emerging market economies that have ran current account surpluses, including China, Malaysia, Singapore, Hong Kong, Thailand and Vietnam. Details and results are in “Appendices 1 and 2”. Abadie et al. (2010) state that “… the synthetic control method safeguards against estimation of “extreme counterfactuals”, that is, those counterfactuals that fall far outside the convex hull of the data.” This may be the case for Germany, with the persistent current account surpluses that are hard to match from other countries.

We would expect weaker results here when using treatment year 2013 due to the “anticipation effect” of the treaty given preceding discussions and reforms.

This treatment year is adjusted based on the date of implementation. Belgium, Bulgaria and Latvia implemented Title III in 2014, and Lithuania implemented Title III in 2015.

References

Abadie A (2021a) Using synthetic controls: feasibility, data requirements, and methodological aspects. Journal of Economic Literature 59(2):391–425

Abadie A (2021b) Using synthetic controls: feasibility, data requirements, and methodological aspects. Journal of Economic Literature 59:391–425

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. J Am Stat Assoc 105(490):493–505

Abadie A, Diamond A, Hainmueller J (2015) Comparative politics and the synthetic control method. American Journal of Political Science 59(2):495–510

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque country. American Economic Review 93:113–132

Abbas SM, Bouhga-Hagbe J, Fatas A, Mauro P, Velloso RC (2011) Fiscal policy and the current account. IMF Economic Review 59(4):603–629

Abiad A, Leigh D, Mody A (2009) Financial integration, capital mobility, and income convergence. Economic Policy 24(58):241–305

Athey S, Imbens GW (2017) The state of applied econometrics: causality and policy evaluation. Journal of Economic Perspectives 31(2):3–32. https://doi.org/10.1257/jep.31.2.3 (Retrieved from https://www.aeaweb.org/articles?id=10.1257/jep.31.2.3)

Beetsma R, Giuliodori M, Klaassen F (2007) The effects of public spending shocks on trade balances and budget deficits in the European Union. J Eur Econ Assoc 6(2–3):414–423

Berger H, Nitsch V (2010) The Euro’s effect on trade imbalances. IMF working paper series (WP/10/226). International Monetary Fund

Blanchard O, Giavazzi F (2002) Current account deficits in the Euro area: the end of the Feldstein-Horioka puzzle? Brook Pap Econ Act 33(2):147–210

Boileau M, Normandin M (2012) Do tax cuts generate twin deficits? A multi-country analysis. Can J Econ 45:1667–1699

Brancaccio E (2012) Current account imbalances, the Eurozone crisis, and a proposal for a “European wage standard.” Int J Polit Econ 41:47–65

Calderon C, Chong A, Loayza N (1999) Determinants of current account deficits in developing countries. Working Papers Central Bank of Chile 51, Central Bank of Chile

Carlin W (2013) Real exchange rate adjustment, wage-setting institutions, and fiscal stabilization policy: lessons of the Eurozone’s first decade. Cesifo Economic Studies 59:489–519

Chen R, Milesi-Ferretti G, Tressle T (2013) Eurozone external imbalances. Economic Policy 28(73):101–142

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59:47–76

Clower E, Ito H (2012) The persistence of current account balances and its determinants: the implications for global rebalancing. Macroeconomics Working Papers 23381, East Asian Bureau of Economic Research

Commission E (2012) Common principles on national fiscal correction mechanisms. Communication from the European Commission, COM 2012:342

Corsetti G, Mu¨ller GJ (2006) Budget deficits and current accounts: openness and fiscal persistence. Economic Policy 21(48):597–638

Corsetti G, Mu¨ller GJ (2008) Twin deficits, openness, and the business cycle. J Eur Econ Assoc 6(2/3):404–413

Das D (2016) Determinants of current account imbalance in the global economy: a dynamic panel analysis. MPRA Paper 42419, University Library of Munich, Germany

DeGrauwe P (2013) The political economy of the Euro. Annu Rev Polit Sci 16:153–170

Dewald WG, Ulan M (1990) The twin-deficit illusion. Cato J 9(3):689–707

Eichengreen B (2010) Imbalances in the Euro area. European Commission Discussion paper

European Council (2012) Fiscal compact enters into force 21/12/2012. European Council Memo

Ferman B, Pinto C, Possebom V (2020) Cherry picking with synthetic controls. J Policy Anal Manage 39:510–532

Hayo B, Mierzwa S (2021) The effect of legislated tax changes on the trade balance: Empirical evidence for the United States, Germany, and the United Kingdom. J Macroecon, Elsevier 78(C)

Hope D (2016) Estimating the effect of the EMU on current account balances: a synthetic control approach. Eur J Polit Econ 44:20–40

Iversen T, Soskice D, Hope D (2016) The Eurozone and political economic institutions: a review article. Ann Rev Pol Sci 19:163–185

Jaumotte F, Sodsriwiboon P (2010) Current account imbalances in the Southern Euro area. IMF working papers(WP/10/139). International Monetary Fund

Kennedy M, Sløk T (2005) Structural policy reforms and external imbalances. OECD Economics Department Working Papers 415, OECD Publishing

Klein M, Linnemann L (2019) Tax and spending shocks in the open economy: are the deficits twins? European Economic Review, p 120

Kuosmanen T, Zhoua X, Eskelinen J, Malo P (2021) Synthetic control methods: the good, the bad, and the ugly. EEA Conference Working Paper

Lane PR (2010) Some lessons for fiscal policy from the financial crisis. Nordic Economic Policy Review 1(1):13–34

Miller SM, Russek FS (1989) Are the twin deficits really related? Contemporary Economic Policy, Western Economic Association International 7(4):1–115

Mohammadi H (2004) Budget deficits and the current account balance: new evidence from panel data. Journal of Economics and Finance 28(1):39–45

Moro B (2014) Lessons from the European economic and financial grea crisis: a Survey. Eur J Polit Econ 34:9–24

Mundell RA (1960) The pure theory of international trade. American Economic Review 50:67–110

Normandin M (2006) Fiscal policies, external deficits, and budget deficits. Cahiers de recherche 0632. CIRPEE

Piersanti G (2000) Current account dynamics and expected future budget deficits: some international evidence. J Int Money Financ 19:255–271

Schmitz B, von Hagen J (2011) Current account imbalances and financial integration in the Euro area. J Int Money Financ 30(8):1676–1695

Schuknecht L, Moutot P, Rother P, Stark J (2011) The stability and growth pact: crisis and reform. Occasional Paper Series 129, European Central Bank

Summers LH (1986) Debt problems and macroeconomic policies. NBER Working Papers 2061, National Bureau of Economic Research, Inc

Vansteenkiste I, Nickel C (2008) Fiscal policies, the current account and Ricardian equivalence. Working Paper Series 935, European Central Bank

Zemanek H, Belke A, Schnabl G (2009) Current account imbalances and structural adjustment in the Euro area: How to rebalance competitiveness. No 895, Discussion Papers of DIW Berlin, DIW Berlin, German Institute for Economic Research

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Debt-to-GDP ratios in EFC countries from 2000 to 2019. This figure illustrates the structurally adjusted debt-to-GDP ratios in the EFC countries from 2000 to 2019. The adoption and implementation of the EFC requires governments to have debt-to-GDP ratios of no more than 60%. The shaded area marks the period when the Stability and Growth Pact was revived in 2011, which began the strengthening of the fiscal coordination measures

Government budget-to-GDP ratios in EFC countries from 2000 to 2019 This figure illustrates the government budget-to-GDP ratios in the EFC countries from 2000 to 2019. The adoption and implementation of the EFC requires governments to have deficit-to-GDP ratios of no more than 3%. The shaded area marks the period when the Stability and Growth Pact was revived in 2011, which began the strengthening of the fiscal coordination measures

Appendix 2

2.1 Addressing synthetic control method estimation for Germany

One of the drawbacks of using the synthetic control method to estimate the effects of policy changes is the ability to accurately create a synthetic country from a donor pool of countries that represents the variable in question in the pre-treatment period. We ran into this issue specifically for Germany, which has consistently run current account surpluses for decades. The pool of non-EU OECD countries and the EU members that did not ratify the policy change were unable to accurately represent the German pre-treatment period, and therefore, the post-treatment results were not reliable

In an attempt to address these concerns, we re-estimate the synthetic control method for Germany and include several emerging market economies that have historically run current account surpluses. These include China, Malaysia, Singapore, Hong Kong, Thailand, and Vietnam. We utilize these countries alongside the other countries in the initial donor pool described in “Section 3”. All control variables are the same. There are some obvious drawbacks as well in using emerging market economies to estimate the policy response in advanced economies. Primarily, when considering control variables such as GDP per capita, real GDP growth, and interest rates, alongside structural factors such as institutional quality, financial market depth, and global integration, the distance between treatment and synthetic country is once again of concern. However, the estimation process attempts to ameliorate these issues by assigning weights for countries closely matching the behavior in the pre-treatment period. Table 5 presents the weights of the donor pool for Germany which is presented below

China now makes up more than half of the weight for synthetic Germany’s current account variable, alongside Japan and Switzerland. As an economy that has also run persistent current account surpluses, this is not surprising. Table 6 presents the results for the synthetic Germany compared to the real data, based on the treatment year of 2011. This aligns with our analysis in the paper of the 2011 recommitment to the Stability and Growth Pact as a precursor to the fiscal policy coordination of the EU members. Figure 8 presents the Synthetic Control Method estimation for the current account balance. The results align with other EU member states that adopted the Stability and Growth Pact but were not at risk of crisis due to excessive government deficits. As a country that already practiced austerity in government spending, improvements in budget balances from the policy coordination and recommitment to SGP did not have a significant effect on Germany’s current account balance. The synthetic current account remains in surplus for Germany, albeit slightly below the real data.

Synthetic control estimation for Germany. This figure illustrates synthetic control method results for Germany. The treatment year is set as 2011, as explained “Section 3”

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Glebocki Keefe, H., Hepp, R. The effects of European fiscal discipline measures on current account balances. Int Econ Econ Policy 21, 251–283 (2024). https://doi.org/10.1007/s10368-024-00587-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-024-00587-y

Keywords

- Current account balance

- European fiscal stability treaty

- Fiscal policy coordination

- Synthetic control method