Abstract

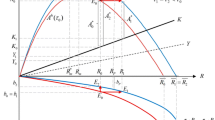

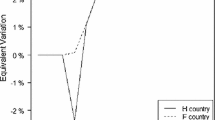

This study employs a two-country overlapping generations (OLG) model to examine how the pay-as-you-go (PAYG) pension system affects national welfare through changes in capital accumulation. In a closed economy, increase in per capita pension reduces individual savings, and the decrease in capital weakens welfare under dynamic efficiency. However, when a two-country model with capital mobility is considered, the increase in pension plan in a country may increase the welfare of the capital-exporting country. Employing a two-country model in which capital accumulates and moves between two countries, we present the marginal effect of pension plans on countries’ welfare for the steady-state generations and initial and transitional generations. We demonstrate that a paradoxical result occurs when the increase in pension plans in a country improves the country’s welfare because a higher interest rate improves the capital-exporting country’s intertemporal terms of trade. However, we show that the marginal change in a country’s PAYG pension plan cannot simultaneously improve both countries’ welfare in the steady state.

Similar content being viewed by others

Data availability

No datasets were generated or analyzed during the current study.

Notes

The PAYG pension system is common in developed countries, such as Japan, the UK, Germany, and Canada, and even in emerging countries such as China, where the PAYG pension system was adopted in cities. For example, in Japan, pension benefits are about 0.5 trillion US dollars and exceeds 10% of GDP. However, in recent decades, the continuous decline in the total fertility rate has raised significant concerns regarding the sustainability of the PAYG pension system. For an ideal pension system, refer to The World Bank (1994) and Orszag and Stiglitz (2001).

The issues examined by Casarico (2001) relate closely to the ones we examine because both studies focus on the international effect of pension systems on welfare through capital markets. However, there are three differences. First, Casarico (2001) focuses only on the transition from a closed economy to an open one and qualitatively compares the different economic situations, whereas this study examines how the marginal increase in pension benefit affects the welfare of both countries. Second, Casarico (2001) assumes that when a country adopts the PAYG pension system, it becomes a net borrower on the capital market. However, we consider a general situation wherein a country is a capital borrower or lender. Third, although not an essential difference, in Casarico’s (2001) analysis, one country adopts the PAYG pension system, whereas another adopts the funded pension system. In our study, both countries adopt PAYG pension systems.

Notably, in the log-linear utility function setting, savings do not depend on the interest rate. However, in our setting, where the PAYG pension system is considered, savings depend on the interest rate even if the utility function is log-linear. To avoid the complexity of analysis, we limit the argument to the log-linear utility function. Hamada et al. (2017) deal with the PAYG pension system when utility is a general functional form.

The first-order partial derivatives of \(\widetilde{w}_{t}^{i}\) are as follows: \(\partial \widetilde{w}_{t}^{i}/\partial p_{t}^{i} =-1\), \(\partial \widetilde{w}_{t}^{i}/\partial p_{t+1}^{i} =(1+n)/(1+r_{t+1})\), and \(\partial \widetilde{w}_{t}^{i}/\partial r_{t+1} =-(1+n)p_{t+1}^{i}/(1+r_{t+1})^{2}<0\).

Haaparanta (1989) considers a general setting on utility function and assumes that savings increase with the interest rate, that is, \(s_{r}\ge 0\). Although the study focuses on a log-linear utility function, savings increase with the interest rate when the PAYG pension system is considered.

Although the substitution effect and the income effect cancel each other out when the utility function is log-linear, a substantial decrease in pension benefits due to an increase in the interest rate increases the savings.

Since \(\Gamma =\Delta +(s_{w}^{A}+s_{w}^{B})k\), an additional assumption is required to guarantee the dynamic stability in addition to Walrasian stability.

In the steady state, we omit the time variable.

Note that this result is obtained even under the assumption that the utility function is log-linear because the PAYG pension system exists.

For a similar analysis on the impact of pension on welfare in a transitional process, refer to Hu (2019).

However, the opposite result does not necessarily hold. If capital exports are sufficiently large even when the country is a net capital exporter, curve \(UU'\) exhibits a gentler slope than curve \(FF'\).

A substantial increase in pension contributions reduces utility under dynamic efficiency for any combination of r and w. However, in this subsection, because we consider a marginal increase in the pension contributions from no pension policy, we focus only on the transitional processes caused by the changes in capital accumulation while ignoring the income effect of pension contributions.

Broadly, using an OLG model to examine two countries with different population growth rates has complicated the analysis considerably. However, a few exceptions, such as Hamada et al. (2019), examine the impact of international transfer in an OLG model when population growth rates contrast between two countries.

References

Bruce N, Turnovsky SJ (2013) Social security, growth, and welfare in overlapping generations economies with or without annuities. J Public Econ 101:12–24. https://doi.org/10.1016/j.jpubeco.2013.02.007

Casarico A (2001) Pension systems in integrated capital markets. BE J Econ Anal Policy 1:1–19. https://doi.org/10.2202/1538-0653.1017

Cipriani GP (2014) Population aging and PAYG pensions in the OLG model. J Popul Econ 27:251–256. https://doi.org/10.1007/s00148-013-0465-9

Eugeni S (2015) An OLG model of global imbalances. J Int Econ 95:83–97. https://doi.org/10.1016/j.jinteco.2014.10.003

Fanti L, Gori L (2012) Fertility and PAYG pensions in the overlapping generations model. J Popul Econ 25:955–961. https://doi.org/10.1007/s00148-011-0359-7

Haaparanta P (1989) The intertemporal effects of international transfers. J Int Econ 26:371–382. https://doi.org/10.1016/0022-1996(89)90010-X

Hamada K, Kaneko A, Yanagihara M (2016) The transfer problem and intergenerational allocation in an overlapping generations model. Int Econ J 30:599–615. https://doi.org/10.1080/10168737.2016.1204345

Hamada K, Kaneko A, Yanagihara M (2017) The transfer paradox in a pay-as-you-go pension system. Int Econ Econ Policy 14:221–238. https://doi.org/10.1007/s10368-016-0338-2

Hamada K, Shinozaki T, Yanagihara M (2019) Population growth and the transfer paradox in an overlapping generations model. Rev Dev Econ 23:331–347. https://doi.org/10.1111/rode.12541

Hamada K, Yanagihara M (2014) Donor altruism and the transfer paradox in an overlapping generations model. Rev Int Econ 22:905–922. https://doi.org/10.1111/roie.12142

Hu W (2019) Policy effects on transitional welfare in an overlapping generations model: a pay-as-you-go pension reconsidered. Econ Model 81:40–48. https://doi.org/10.1016/j.econmod.2018.12.005

Iwata K (1997) Public pension reform in Japan and the U.S.: privatization and economic welfare. Q Soc Security Res 25:338–401 (in Japanese)

Iwata K, Saruyama S (2013) Growth-friendly tax and pension reform: estimated effect based on macroeconomic model. RIETI Discuss Pap 13:1–28 (in Japanese)

Kaganovich M, Zilcha I (2012) Pay-as-you-go or funded social security? A general equilibrium comparison. J Econ Dyn Control 36:455–467. https://doi.org/10.1016/j.jedc.2011.03.015

Matsuyama K (1991) Immiserizing growth in Diamond’s overlapping generation model: a geometrical exposure. Int Econ Rev 32:251–262. https://doi.org/10.2307/2526943

Orszag PR, Stiglitz JE (2001) Rethinking pension reforms: ten myths about social security systems. In: Holzmann R, Stiglitz JE (eds) New ideas about old age security: toward sustainable pension systems in the 21st century. The World Bank, Washington, DC, pp 17–56

Pestieau P, Piaser G, Sato M (2006) PAYG pension systems with capital mobility. Int Tax Public Finance 13:587–599. https://doi.org/10.1007/s10797-006-6079-3

Roberts MA (2003) Can pay-as-you-go pensions raise the capital stock? Manch Sch 71:1–20. https://doi.org/10.1111/1467-9957.71.s.1

Sadahiro A, Shimasawa M (2003) A simulation analysis on aging and international capital movement. Waseda Univ Working Pap 0304:1–32 (in Japanese)

The World Bank (1994) Averting the old age crisis: policies to protect the old and promote growth. Oxford University Press, Oxford, UK

Yanagihara M (1998) Public goods and the transfer paradox in an overlapping generations model. J Int Trade Econ Dev 7:175–205. https://doi.org/10.1080/09638199800000010

Acknowledgements

We thank Tsuyoshi Shinozaki and Hideya Kato for their valuable suggestions. The authors are solely responsible for any remaining errors.

Funding

This study was supported by JSPS KAKENHI (grant numbers 19K01679 (Hamada, Kaneko, and Yanagihara); 20K01629 (Hamada); 17K03762, 19H01505 (Yanagihara)).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hamada, K., Kaneko, A. & Yanagihara, M. Impact of PAYG pensions on country welfare through capital accumulation. Int Econ Econ Policy 21, 207–226 (2024). https://doi.org/10.1007/s10368-024-00585-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-024-00585-0