Abstract

We consider the Bachelier model with linear price impact. Exponential utility indifference prices are studied for vanilla European options in the case where the investor is required to liquidate her position. Our main result is establishing a non-trivial scaling limit for a vanishing price impact which is inversely proportional to the risk aversion. We compute the limit of the corresponding utility indifference prices and find explicitly a family of portfolios which are asymptotically optimal.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

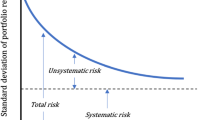

In financial markets, trading moves prices against the trader: buying faster increases execution prices, and selling faster decreases them. This aspect of liquidity, known as market depth (see Black (1986)) or price-impact, has received large attention in optimal liquidation problems, see, for instance, Almgren and Chriss (2001), Schied et al. (2010), Gatheral and Schied (2011), Bayrakatar and Ludkovski (2014), Bank and Voß (2019), Fruth et al. (2019), and the references therein.

It is well known that in the presence of price impact, super–replication is prohibitively costly, see Guasoni and Rásonyi (2015). Namely, in the presence of price impact, even in market models such as the Bachelier model or the Black–Scholes model (which are complete in the frictionless setup) there is no practical way to construct a hedging strategy which eliminates all risk from a financial position. This brings us to introducing preferences. We assume that the preferences of the agent are given by an exponential utility. Then, the optimal hedging strategy is determined by maximizing the expected exponential utility of the terminal wealth generated by the dynamic trading in the underlying asset minus the liability of the investor which is equal to the payoff of the option. A natural notion of option pricing, in this setting, is the utility indifference price (which we define in Sect. 2).

In this paper we consider the problem of optimal liquidation for the exponential utility function in a model with temporary linear price impact. Formally, we study exponential utility maximization in the presence of quadratic transaction costs and the constraints that the number of shares at the maturity date is zero. The motivation for the later constraint is that in real market conditions many of the derivative securities (such as European options) are cash settled.

We compute the asymptotic behavior of the exponential utility indifference prices where the risk aversion goes to infinity at a rate which is inversely proportional to the linear price impact which goes to zero. In addition we provide a family of asymptotically optimal hedging strategies. We divide the proof of our main result (Theorem 2.1) into two main steps: the proof of the lower bound and the proof of the upper bound. In the proof of the lower bound we apply Theorem 2.2 from Dolinsky (2022) which gives a dual representation of the certainty equivalent for the case where the investor has to liquidate her position. This dual representation together with the Brownian structure allows us to compute the scaling limit of the utility indifference prices. The proof of the upper bound is done by an explicit construction of a family of portfolios which are asymptotically optimal.

The above type of scaling limits goes back to the seminal work of Barles and Soner (1998) which determines the scaling limit of utility indifference prices of vanilla options for small proportional transaction costs and high risk aversion. The present paper provides an analogous analysis for the case of quadratic transaction costs, albeit using convex duality and martingale techniques rather than taking a PDE approach as pursued in Barles and Soner (1998). The financial idea behind this approach is to produce reasonable option prices which in the presence of small friction allow to "almost" super–hedge the derivative security (this corresponds to large risk aversion).

The current work is also closely related to the recent paper Ekren and Nadtochiy (2022) where the authors considered utility–based hedging with quadratic transaction costs and Bachelier dynamics for the unaffected stock price. For a given risk aversion the authors apply the Hamilton–Jacobi-Bellman (HJB) methodology and obtain a representation of the value function and the optimal strategy. For technical reasons, instead of requiring that the number of shares at the maturity date be zero, they penalize the square of the number of shares at the maturity date.

The rest of the paper is organized as follows. In the next section we introduce the setup and formulate the main results. In Sect. 3 we prove the lower bound. In Sect. 4 we prove the upper bound. In Sect. 5 we derive an auxiliary result from the field of deterministic variational analysis.

2 Preliminaries and main results

Let \(T<\infty \) be the time horizon and let \(W=(W_t)_{t \in [0,T]}\) be a standard one dimensional Brownian motion defined on the filtered probability space \((\Omega , \mathcal {F},(\mathcal F_t)_{t\in [0,T]}, \mathbb P)\) where the filtration \((\mathcal F_t)_{t\in [0,T]}\) satisfies the usual assumptions (right continuity and completeness). We consider a simple financial market with a riskless savings account bearing zero interest (for simplicity) and with a risky asset \(S=\left( S_t\right) _{t \in [0,T]}\) with Bachelier price dynamics

where \(S_0\in \mathbb R\) is the initial position of the risky asset, \(\mu \in \mathbb R\) is the constant drift and \(\sigma >0\) is the constant volatility.

Following Almgren and Chriss (2001), we model the investor’s market impact, in a temporary linear form and, thus, when at time t the investor turns over her position \(\Phi _t\) at the rate \(\dot{\Phi }_t:=\frac{d\Phi _t}{dt}\) the execution price is \(S_t+\frac{\Lambda }{2}\dot{\Phi }_t\) for some constant \(\Lambda >0\). The portfolio value at the maturity date is given by

In our setup the investor has to liquidate her position. Thus, the natural class of admissible strategies which we denote by \(\mathcal A\) is the set of all progressively measurable processes \(\Phi =(\Phi _t)_{t\in [0,T]}\) with differentiable trajectories such that \(\int _{0}^T \dot{\Phi }^2_t dt<\infty \) and \(\Phi _T=0\) almost surely. We assume that the initial number of shares \(\Phi _0\) is fixed.

Consider a vanilla European option with the payoff \(X=f(S_T)\) where f is of the form

for some constants \(\Theta ,K\in \mathbb R\). Observe that this form includes call/put options.

The investor will assess the quality of a hedge by the resulting expected utility. Namely, we follow the approach proposed in Hodges and Neuberger (1989) which says that the price of the contingent claim (from the seller’s point of view) is the amount leading the investor to be indifferent between the following two actions:

(i) Selling the option and hedging it. (ii) Hedging with no option. Thus, assuming exponential utility with constant absolute risk aversion \(\alpha >0\), the utility indifference price \(\pi =\pi (\Lambda ,\alpha ,\Phi _0,X)\) satisfies

We obtain the definition

The certainty equivalent of the claim X is given by

Namely, \(c:=c(\Lambda ,\alpha ,\Phi _0,X)\) satisfies

Economically speaking, the term c is the amount leading the investor to be indifferent between the following: (i) Selling the option and hedging it. (ii) Doing nothing \((-1=-e^{-\alpha 0})\). From the economics point of view, the certainty equivalent is a more appropriate term for the buyer of the option. Hence, in our setup (we treat the seller) we are mainly interested in the utility indifference price \(\pi (\Lambda ,\alpha ,\Phi _0,X)\). The certainty equivalent \(c(\Lambda ,\alpha ,\Phi _0,X)\) can be viewed as the logarithmic scale for the value of the utility maximization problem \(\sup _{\Phi \in \mathcal A}\mathbb E_{\mathbb P}\left[ -\exp \left( \alpha \left( X-V^{\Phi }_T\right) \right) \right] \). Moreover, the certainty equivalent term appears naturally in the dual representation from Dolinsky (2022). For more details on utility indifference pricing see Carmona (2009).

We notice that if the risk aversion \(\alpha >0\) is fixed, then by applying standard density arguments we obtain that for \(\Lambda \downarrow 0\), the above indifference price converges to the unique price of the continuous time complete (frictionless) market given by (2.1). A more interesting limit emerges, however, if we re-scale the investor’s risk-aversion in the form \(\alpha :=A/\Lambda \). Hence, we fix \(A>0\) and consider the case where the risk aversion is \(\alpha (\Lambda ):=\frac{A}{\Lambda }\).

A simple and rough intuition for this type of scaling is done by applying Schied and Schöneborn (2007). Indeed, consider the simple case where \(\sigma =1\) and \(\mu =0\). Then, from Theorem 2.1 in Schied and Schöneborn (2007) we have

Hence, if we are looking for a scaling such that

will converge as \(\Lambda \downarrow 0\) and \(\alpha \rightarrow \infty \) (for any \(\Phi _0\)), then the right scaling is \(\alpha (\Lambda ):=\frac{A}{\Lambda }\).

Before we formulate the main result we need some preparations. Introduce the functions

and

The term \(u(t,S_t)\) represents the price at time t of a European option with the payoff \(g(S_T)\) in the complete market given by (2.1). It is well known that \(u\in C^{1,2}([0,T)\times \mathbb R)\) solves the PDE

Next, let \(\Lambda >0\) and let

be the risk-liquidity ratio. Consider the (random) ODE on the interval [0, T]

From the linear growth of g it follows that for any \(\epsilon >0\) the functions \(\frac{\partial u}{\partial x},\frac{\partial ^2 u}{\partial x^2}\) are uniformly bounded in the domain \([0,T-\epsilon ]\times \mathbb R\). In particular \(\frac{\partial u}{\partial x}\) is Lipschitz continuous with respect to x in the domain \([0,T-\epsilon ]\times \mathbb R\). Observe that the functions \(\frac{\cosh (\sqrt{\rho }(T-t))}{2 \cosh ^2\left( \frac{\sqrt{\rho }(T-t)}{2}\right) }, \tanh (\sqrt{\rho }(T-t))\) are bounded. Hence, from the standard theory of ODE (see Walter (1998), Chapter II, Section 6) we obtain that there exists a unique solution to (2.7) which we denote by \(F^{\Lambda }=(F^{\Lambda }_t)_{t\in [0,T)}\) and the solution is Lipschitz continuous, and so \(\lim _{t\rightarrow T-}F^{\Lambda }_t\) exists. Set \(F^{\Lambda }_T:=\lim _{t\rightarrow T-}F^{\Lambda }_t\) and define

Theorem 2.1

For vanishing linear price impact \(\Lambda \downarrow 0\) and re-scaled high risk-aversion \(A/\Lambda \) with \(A>0\) fixed, the certainty equivalent of \(X=\max \left( 0, \Theta \left( S_T-K\right) \right) \) has the scaling limit

Moreover, the trading strategies given by (2.8) are asymptotically optimal, i.e.

From Theorem 2.1 we obtain immediately the following corollary which says that the asymptotic value of the utility indifference prices is equal to the price of the vanilla European option with the payoff \(g(S_T)\) and the shifted initial stock price \(S_0-\sigma \sqrt{A}\Phi _0\).

Corollary 2.2

For vanishing linear price impact \(\Lambda \downarrow 0\) and re-scaled high risk-aversion \(A/\Lambda \) with \(A>0\) fixed, the utility indifference price of X given by (2.4) has the scaling limit

Proof

Apply (2.9) and take \(X\equiv 0\) for the denominator of (2.4). \(\square \)

Remark 2.3

In the proof of the lower bound (given in the next section) we only assume that the payoff function f is Lipschitz continuous. By a more careful analysis we can prove that in fact there is an equality, namely (2.9) holds true for any payoff function \(X=f(S_T)\) with a Lipschitz continuous f. Unfortunately, the proof of (2.10) (given in Sect. 4) uses the specific structure of the payoff given by (2.3). This together with the fact that the most common vanilla options in real markets are of the form (2.3) led us to assume from the beginning that the payoff is of this form.

Let us emphasize that our results can be extended to the multi–asset case with a similar proof. In the multi asset case the volatility \(\sigma \) is replaced with a positive definite matrix and the functions \(\coth \) and \(\tanh \) are viewed as matrix valued functions.

Remark 2.4

The current setup without the liquidation requirement \(\Phi _T=0\) was studied in Dolinsky and Moshe (2022). In both cases (with or without liquidation) the scaling limit of the utility indifference prices (with the same scaling \(\alpha (\Lambda )=\frac{A}{\Lambda }\)) is equal to \(\mathbb E_{\mathbb P} \left[ h\left( S_0-\sigma \sqrt{A}\Phi _0+\sigma W_T\right) \right] \) for a modified function h. In the present paper

while in Dolinsky and Moshe (2022) the modified payoff is smaller and given by

In both cases the function h is strictly larger (provided that \(A>0\)) than the original payoff function f. The term \(\mathbb E_{\mathbb P} \left[ h\left( S_0-\sigma \sqrt{A}\Phi _0+\sigma W_T\right) \right] \) represents the option price of the modified claim \(h(S_T)\) in the complete (frictionless) Bachelier model with volatility \(\sigma \) and shifted initial stock price \(S_0-\sigma \sqrt{A}\Phi _0\).

Observe that if the risk aversion \(\alpha \) is constant and \(\Lambda =0\) (i.e. no friction) then formally \(A=\alpha \Lambda =0\) and so, in this case the function h coincides with the original payoff f and there is no shift in the initial stock price \(S_0\). Namely, we recover the price for the complete (frictionless) Bachelier model given by (2.1).

Next, we discuss briefly the difference between the asymptotically optimal portfolios which are given by Theorem 2.1 and those given in Dolinsky and Moshe (2022). From (2.8) we have

where \(\rho (\Lambda ):=\frac{\sigma ^2 A}{\Lambda ^2}\) and \(\Upsilon ^{\Lambda }_t:=\frac{\partial u}{\partial x}(t,S_t-\sigma \sqrt{A} F^{\Lambda }_t)\), \(t\in [0,T)\).

Thus, we have a mean reverting structure which combines tracking the \(\Delta \)–hedging strategy \((\Upsilon ^{\Lambda }_t)_{t\in [0,T]}\) of a modified claim g and liquidating the position up to the maturity date. As time t approaches maturity the weight \(\sqrt{\rho (\Lambda )}\tanh \left( \frac{\sqrt{\rho (\Lambda )}\left( T-t\right) }{2} \right) \)of the \(\Delta \)–hedging strategy vanishes and due to the term \(\sqrt{\rho (\Lambda )}\coth \left( \sqrt{\rho (\Lambda )} \left( T-t\right) \right) \) (goes to \(\infty \) for \(t\uparrow T\)) the investor trading is mainly towards liquidation. This is in contrast to the asymptotically optimal portfolios in Dolinsky and Moshe (2022) which are just based on tracking the appropriate \(\Delta \)–hedging strategy.

In broad terms the methods of the proof in this paper are close to those in Dolinsky and Moshe (2022) and based on duality and explicit construction of asymptotically optimal portfolios. However, the additional constraint that the number of shares at the maturity date is zero (i.e. liquidation), makes the mathematical analysis more challenging. In particular it requires a dual representation which was obtained recently in Dolinsky (2022) and treats the liquidation case.

3 Proof of the lower bound

In this section we prove the following statement.

Proposition 3.1

For vanishing linear price impact \(\Lambda \downarrow 0\) and re-scaled high risk-aversion \(A/\Lambda \) with \(A>0\) fixed, we have the following lower bound

We start with the following Lemma.

Lemma 3.2

Denote by \(\Gamma \) the set of all progressively measurable processes \(\theta =(\theta _t)_{t\in [0,T]}\) such that \(\theta \in L^2(dt\otimes \mathbb P)\) and let \(\mathcal M\) be the set of all \(\mathbb P\)–martingales \(M=(M_t)_{t\in [0,T)}\) which are defined on the half-open interval [0, T) and satisfy \(||M||_{L^2(dt\otimes \mathbb P)}:=\mathbb E_{\mathbb P}\left[ \int _{0}^T M^2_t dt\right] <\infty \). Then, for any \(\Lambda ,\alpha >0\) we have

Proof

Denote by \(\mathcal Q\) the set of all equivalent probability measures \(\mathbb Q\sim \mathbb P\) with finite entropy \(\mathbb E_{\mathbb Q}\left[ \log \left( \frac{d\mathbb Q}{d\mathbb P}\right) \right] <\infty \) relative to \(\mathbb P\). For any \(\mathbb Q\in \mathcal Q\) let \(\mathcal M^{\mathbb Q}\) be the set of all \(\mathbb Q\)–martingales \(M^{\mathbb Q}=(M^{\mathbb Q}_t)_{t\in [0,T)}\) which are defined on the half-open interval [0, T) and satisfy \(||M^{\mathbb Q}||_{L^2(dt\otimes \mathbb Q)}:=\mathbb E_{\mathbb Q}\left[ \int _{0}^T |M^{\mathbb Q}_t|^2 dt\right] <\infty \).

From the linear growth of f it follows that \(\mathbb E_{\mathbb P}\left[ e^{\alpha X}\right] <\infty \). Thus, define the probability measure \(\tilde{\mathbb P}\) by \(\frac{d\tilde{\mathbb P}}{d\mathbb P}:=\frac{e^{\alpha X}}{\mathbb E_{\mathbb P}\left[ e^{\alpha X}\right] }.\) The Cauchy–Schwarz inequality yields that there exists \(a>0\) such that \(\mathbb E_{\tilde{\mathbb P}}\left[ \exp \left( a\sup _{0 \le t\le T} S^2_t\right) \right] <\infty .\) Hence, Assumption 2.1 in Dolinsky (2022) holds true. Thus, by applying Theorem 2.2 in Dolinsky (2022) for the probability measure \(\tilde{\mathbb P}\) and the simple equality

we obtain

Next, let C[0, T] be the space of continuous functions \(z:[0,T]\rightarrow \mathbb R\) equipped with the uniform norm \(||z||:=\sup _{0\le t \le T} |z_t|\). Denote by \(\hat{\Gamma }\subset \Gamma \) the set of all continuous and bounded processes \(\theta =(\theta _t)_{t\in [0,T]}\) of the form \(\theta =\tau (W)\) where \(\tau : C[0,T]\rightarrow C[0,T]\) is Lipschitz continuous and non-anticipative (i.e. \(\tau _t(x)=\tau _t(y)\) if \(x_{[0,t]}=y_{[0,t]}\)). From standard density arguments and the Lipschitz continuity of f it follows that in order to complete the proof of the Lemma it is sufficient to show that for any \((\theta ,M)\in \hat{\Gamma }\times \mathcal M\) we have

To this end let \((\theta ,M)\in \hat{\Gamma }\times \mathcal M\) such that \(\theta =\tau (W)\) where \(\tau \) as above. Consider the stochastic differential equation (SDE)

with the initial condition \(Y_0=0\). Theorem 2.1 from Chapter IX in Revuz and Yor (1999) yields that there exists a unique strong solution to the above SDE. From the Girsanov theorem it follows that there exists a probability measure \(\mathbb Q\in \mathcal Q\) such that \(W^{\mathbb Q}:=Y\) is a Brownian motion with respect to \(\mathbb Q\).

From (2.1) and (3.3) we obtain that the distribution of \((S_t)_{t\in [0,T]}\) under \(\mathbb Q\) is equal to the distribution of \(\left( S_t+\sigma \int _{0}^t\theta _s ds\right) _{t\in [0,T]}\) under \(\mathbb P\). Moreover,

Finally, choose \(M^{\mathbb Q}\in \mathcal M^{\mathbb Q}\) such that the law of \((W^{\mathbb Q}, M^{\mathbb Q})\) under \(\mathbb Q\) is equal to the law of \((W,M+\sigma W)\) under \(\mathbb P\). We conclude,

This together with (3.1) gives (3.2) as required.

Next, denote by \(L^2_0(\mathcal F_T,\mathbb P)\) the set of all random variables of the form

for some \(\iota \in \mathbb R\) and a predictable and bounded process \(\kappa =(\kappa _t)_{t\in [0,T]}\) such that for some (deterministic) \(\epsilon >0\) the restriction of \(\kappa \) to the interval \([T-\epsilon ,T]\) satisfies \(\kappa _{[T-\epsilon ,T]}\equiv 0\).

Lemma 3.3

For any \(Z\in L^2_0(\mathcal F_T,\mathbb P)\) there exists a constant \(\hat{C}>0\) (may depend on Z) such that for any \(\Lambda \in (0,1)\)

where, as before \(\alpha (\Lambda )=\frac{A}{\Lambda }\).

Proof

Let Z given by (3.4) and let \(\Xi \) be the map from Proposition 5.1. Define the deterministic function \(\nu :[0,T]\rightarrow \mathbb R\) by \(\nu :=\Xi _T(\Lambda ,\iota ,\Phi _0)\) and for any \(s<T\) define the stochastic process \((l_{\cdot ,s})_{\cdot \in [s,T]}\) by \((l_{\cdot ,s})_{\cdot \in [s,T]}=\Xi _{T-s}(\Lambda , \kappa _s,0)\).

Next, introduce \((\theta ,M)\in \Gamma \times \mathcal M\)

Observe that from the definition of \(\Xi \) we have

This together with the Fubini theorem, the Itô Isometry, (2.1) and (3.4) gives

where

and

From Proposition 5.1 there exists a constant \(C>0\) (may depend on \(\iota \) and \(\kappa \)) such that

and for any \(s\in [0,T-\epsilon ]\)

By combining the Itô Isometry and (3.5)–(3.7) we complete the proof.

We now have all the pieces in place that we need for the completion of the proof of Proposition 3.1.

Proof

Recall the definition of g given in (2.5). From the Lipschitz continuity of f it follows that there exists a bounded (measurable) function \(\zeta :\mathbb R\rightarrow \mathbb R\) such that

Choose a sequence \(Z_n\in L^2_0(\mathcal F_T,\mathbb P)\), \(n\in \mathbb N\) such that

where the limit is in \(L^2(\mathbb P).\) From Lemmas 3.2–3.3 and (3.8) we obtain

4 Proof of the upper bound

In order to complete the proof of Theorem 2.1 it remains to establish the following result.

Proposition 4.1

Recall the trading strategies \(\Phi ^{\Lambda }\), \(\Lambda >0\) given by (2.8). Then,

Proof

The proof will be done in three steps.

Step I: In this step we use the specific structure of the payoff f given by (2.3). Let us show that for any \(\Lambda >0\)

where, as before \(\rho (\Lambda ):=\frac{\sigma ^2 A}{\Lambda ^2}\).

Fix \(\Lambda >0\). From (2.7)

where, recall that \(\Upsilon ^{\Lambda }_t:=\frac{\partial u}{\partial x}\left( t,S_t-\sigma \sqrt{A} F^{\Lambda }_t\right) \), \(t\in [0,T)\). Clearly, \(|\Upsilon ^{\Lambda }_t|\le \Theta \), and so,

This together with (2.3) and (2.5) gives (4.1).

Step II: In this step we prove that there exists a constant \(\tilde{C}>0\) such that

Fix \(\Lambda >0\). From (2.11)

We get

and so, from the Fubini theorem

This together with the simple integral

and the inequality \(|\Upsilon ^{\Lambda }_t|\le \Theta \) gives (4.2).

Step III: In this step we complete the proof. Fix \(\Lambda >0\) and introduce the process

From the Itô formula, (2.2), (2.6)–(2.8) and (2.11) we obtain

where the last equality follows from simple calculations.

Hence, from (2.1) it follows that the process

is a local–martingale, and so from the obvious inequality \(N^{\Lambda }>0\) we conclude that this process is a super–martingale.

Finally,

The first inequality follows from (4.1) and the relations \(u(T,\cdot )=g(\cdot )\), \(\Phi ^{\Lambda }_T=0\). The second inequality is due to (4.2). The super–martingale property of \(N^{\Lambda }\) gives the third inequality. The equality is due to (2.8).

By taking \(\Lambda \downarrow 0\) we complete the proof.

5 Auxiliary result

For any \(\mathbb T\in (0,T]\) and \(x\in \mathbb R\) let \(C_{0,x}[0,\mathbb T]\) be the space of all continuous functions \(z:[0,\mathbb T]\rightarrow \mathbb R\) which satisfy \(z_0=0\) and \(z_{\mathbb T}=x\).

Proposition 5.1

For any \(\mathbb T\in (0,T]\) there exists a measurable map \(\Xi _{\mathbb T}:(0,1)\times \mathbb R^2\rightarrow C[0,\mathbb T)\) such that for any \(\Lambda \in (0,1)\) and \(x,\phi \in \mathbb R\) the continuous function \(\Xi _{\mathbb T}(\Lambda ,x,\phi )\in C_{0,x}[0,\mathbb T]\) is the unique minimizer for the optimization problem

Moreover, denote the corresponding value by \(V_{\mathbb T}(\Lambda ,x,\phi )\). Then, for any \(\epsilon >0\) and a compact set \(K\subset \mathbb R^2\) there exists a constant \(\hat{C}\) (may depend on \(\epsilon \) and K) such that

Proof

Fix \((\mathbb T,\Lambda ,x,\phi )\in [\epsilon ,T]\times (0,1)\times \mathbb R^2\). First we solve the optimization problem (5.1) under the additional constraint that \(\int _{0}^\mathbb T\delta _t dt\) is given. Then, we will find the optimal \(\int _{0}^\mathbb T \delta _t dt\).

For any \(y\in \mathbb R\) let \(C^y_{0,x}[0,\mathbb T]\subset C_{0,x}[0,\mathbb T]\) be the subset of all functions \(\delta \in C_{0,x}[0,\mathbb T]\) which satisfy \(\int _{0}^{\mathbb T}\delta _t dt=y\). Consider the minimization problem

where \(H(v_1,v_2):=\frac{\Lambda }{2\sigma ^2 A}v^2_1+\frac{1}{2\Lambda } v^2_2\) for \(v_1,v_2\in \mathbb R\). This optimization problem is convex and so it has a unique solution which has to satisfy the Euler–Lagrange equation (for details see Gelfand and Fomin (1963)) \(\frac{d}{dt}\frac{\partial H}{\partial \dot{\delta }_t}=\lambda +\frac{d}{dt}\frac{\partial H}{\partial \delta _t}\) for some constant \(\lambda >0\) (lagrange multiplier due to the constraint \(\int _{0}^{\mathbb T} \delta _t dt=y\)). Thus, the optimizer which we denote by \(\hat{\delta }\) solves the ODE \(\ddot{\hat{\delta }}_t-\rho \hat{\delta }\equiv const\) (recall the risk-liquidity ratio \(\rho =\rho (\Lambda ):=\frac{\sigma ^2 A}{\Lambda ^2}\)). From the standard theory it follows that

for some constants \(c_1,c_2,c_3\). From the three constraints \(\hat{\delta }_0=0\), \(\hat{\delta }_{\mathbb T}=x\) and \(\int _{0}^{\mathbb T} \hat{\delta }_t dt=y\) we obtain

We argue that

Indeed, the first equality is obvious. The second equality follows from (5.3) and simple computations. The third equality is due to \(c_1-c_2=\frac{x}{\sinh (\sqrt{\rho }\mathbb T)}\). The fourth equality is due to \(c_1c_2=\frac{c^2_3-xc_3}{\sinh ^2(\sqrt{\rho }\mathbb T)}\). The last equality follows from substituting \(c_3\).

From (5.5) we conclude that in order to minimize (5.1) we need to find y which minimizes the quadratic form

Observe that this quadratic form is convex in y and so has a unique minimum

Thus, define \(\Xi _{\mathbb T}(\Lambda ,x,\phi ):=\hat{\delta }\) where \(\hat{\delta }\) is given by (5.3)–(5.4) and (5.6). Clearly, \(\Xi _{\mathbb T}(\Lambda ,x,\phi )\) is the unique minimizer for (5.1).

Let

Finally, we prove (5.2). Choose \(\epsilon >0\) and a compact set \(K\subset \mathbb R^2\). Assume that \((\mathbb T,x,\phi )\in [\epsilon ,T]\times K\). From (5.5) and the equality \(\rho =\frac{\sigma ^2 A}{\Lambda ^2}\) we get that there exists a constant \(C_1\) (may depend on \(\epsilon \) and K) such that

where y given by (5.6). From (5.6) we have \(\left| y-\frac{\mathbb T}{2}\left( x-\sigma \sqrt{A}\phi \right) \right| \le C_2 \Lambda \) for some constant \(C_2\) (may depend on \(\epsilon \) and K). This together with (5.7) gives (5.2) and completes the proof.

References

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–39 (2001)

Black, F.: Noise. J. Finance 41, 529–543 (1986)

Bayrakatar, E., Ludkovski, M.: Liquidation in limit order books with controlled intensity. Math. Financ. 24, 627–650 (2014)

Barles, G., Soner, H.M.: Option pricing with transaction costs and a nonlinear Black–Scholes equation. Finance Stochast. 2, 369–397 (1998)

Bank, P., Voß, M.: Optimal investment with transient price impact. SIAM J. Financ. Math. 10, 723–768 (2019)

Carmona, R.: Indifference Pricing: Theory and Applications. Series in Financial Engineering, Princeton University Press (2009)

Dolinsky, Y.: Duality theory for exponential utility based hedging in the Almgren–Chriss model. J. Appl. Probab. (to appear) (2022). arXiv:2210.03917

Dolinsky, Y., Moshe, S.: Utility indifference pricing with high risk aversion and small linear price impact. SIAM J. Financ. Math. 13, SC-12-SC−25 (2022)

Ekren, I., Nadtochiy, S.: Utility-based pricing and hedging of contingent claims in Almgren–Chriss model with temporary price impact. Math. Financ. 32, 172–225 (2022)

Fruth, A., Schöneborn, T., Urusov, M.: Optimal trade execution in order books with stochastic liquidity. Math. Financ. 29, 507–541 (2019)

Gelfand, I.M., Fomin, S.V.: Calculus of Variations. Prentice Hall (1963)

Guasoni, P., Rásonyi, M.: Hedging, arbitrage and optimality under superlinear friction. Ann. Appl. Probab. 25, 2066–2095 (2015)

Gatheral, J., Schied, A.: Optimal trade execution under geometric Brownian motion in the Almgren and Chriss framework. Int. J. Theor. Appl. Finance 14, 353–368 (2011)

Hodges, S., Neuberger, A.: Optimal replication of contingent claims under transaction costs. Rev. Futures Market 8, 222–239 (1989)

Revuz, D., Yor, M.: Continuous Martingales and Brownian Motion, volume 293 of Grundlehren der Mathematischen Wissenschaften [Fundamental Principles of Mathematical Sciences], 3rd edn. Springer, Berlin (1999)

Schied, A., Schöneborn, T.: Optimal portfolio liquidation for CARA in-vestors. SSRN Electron. J. (2007)

Schied, A., Schöneborn, T., Tehranchi, M.: Optimal basket liquidation for CARA investors is deterministic. Appl. Math. Finance 17, 471–489 (2010)

Walter, W.: Ordinary Differential Equations. Springer, New-York (1998)

Funding

Open access funding provided by Hebrew University of Jerusalem.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

YD Supported in part by the GIF Grant 1489-304.6/2019 and the ISF Grant 230/21.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dolinskyi, L., Dolinsky, Y. Optimal liquidation with high risk aversion and small linear price impact. Decisions Econ Finan 47, 183–198 (2024). https://doi.org/10.1007/s10203-024-00435-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-024-00435-3